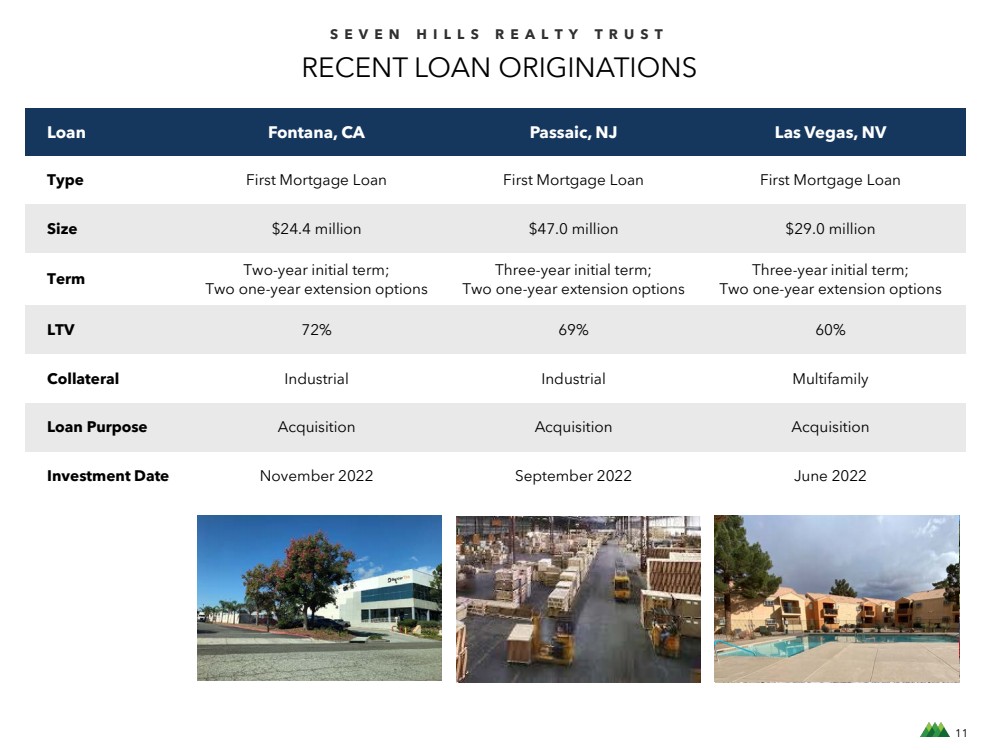

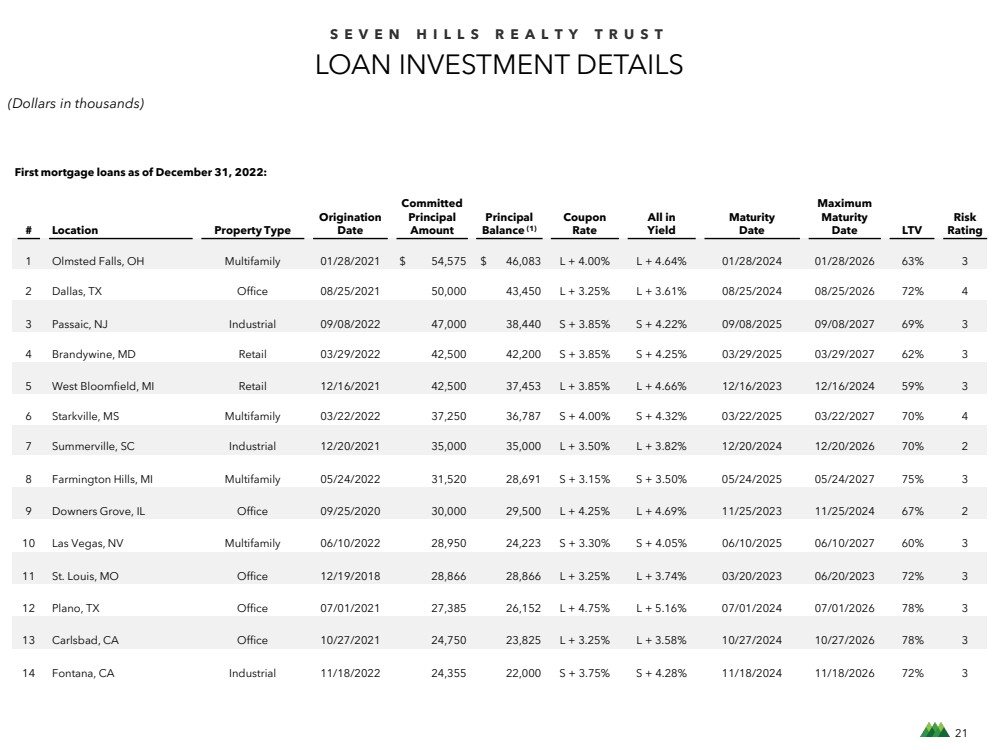

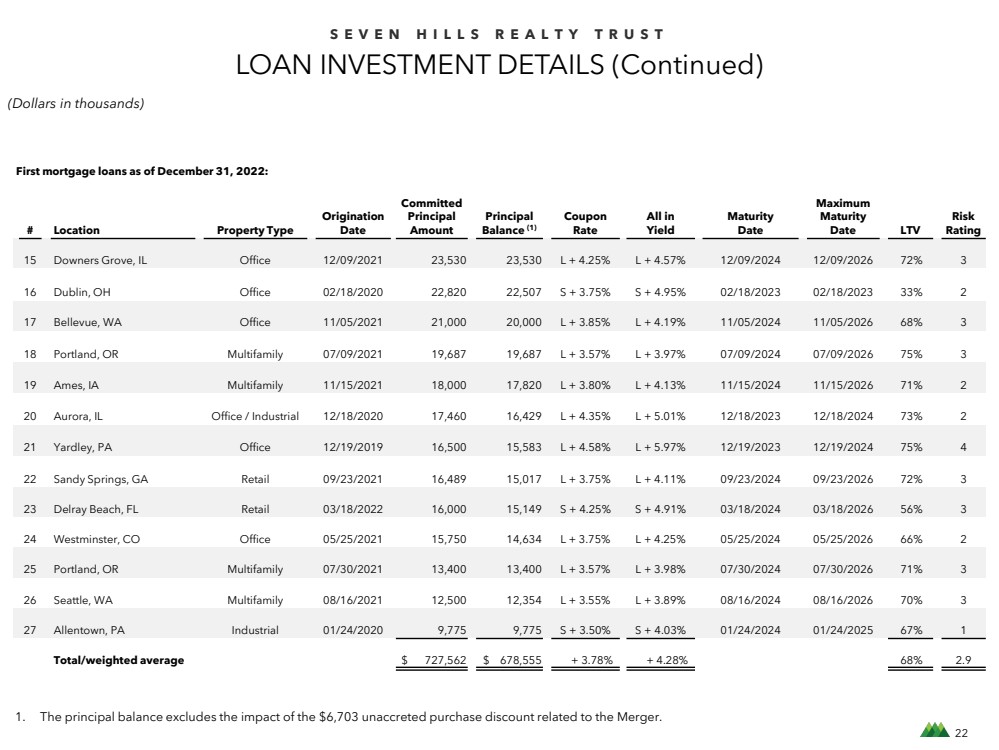

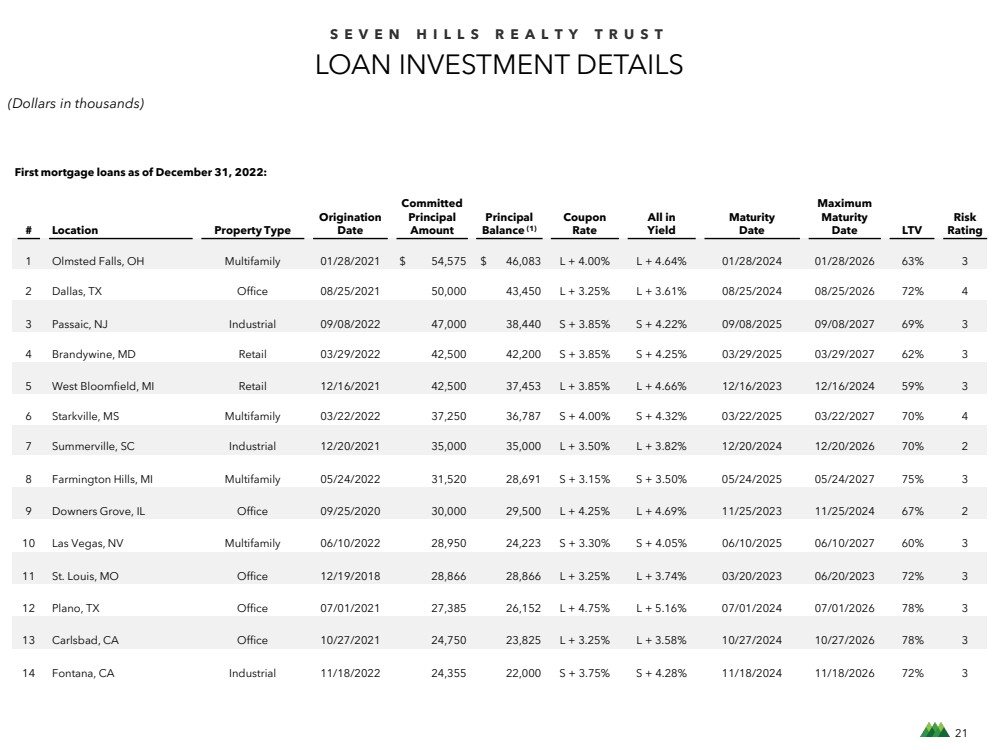

| 21 SEVEN HILLS REALTY TRUST LOAN INVESTMENT DETAILS (1) (Dollars in thousands) First mortgage loans as of December 31, 2022: # Location Property Type Origination Date Committed Principal Amount Principal Balance (1) Coupon Rate All in Yield Maturity Date Maximum Maturity Date LTV Risk Rating 1 Olmsted Falls, OH Multifamily 01/28/2021 $ 54,575 $ 46,083 L + 4.00% L + 4.64% 01/28/2024 01/28/2026 63% 3 2 Dallas, TX Office 08/25/2021 50,000 43,450 L + 3.25% L + 3.61% 08/25/2024 08/25/2026 72% 4 3 Passaic, NJ Industrial 09/08/2022 47,000 38,440 S + 3.85% S + 4.22% 09/08/2025 09/08/2027 69% 3 4 Brandywine, MD Retail 03/29/2022 42,500 42,200 S + 3.85% S + 4.25% 03/29/2025 03/29/2027 62% 3 5 West Bloomfield, MI Retail 12/16/2021 42,500 37,453 L + 3.85% L + 4.66% 12/16/2023 12/16/2024 59% 3 6 Starkville, MS Multifamily 03/22/2022 37,250 36,787 S + 4.00% S + 4.32% 03/22/2025 03/22/2027 70% 4 7 Summerville, SC Industrial 12/20/2021 35,000 35,000 L + 3.50% L + 3.82% 12/20/2024 12/20/2026 70% 2 8 Farmington Hills, MI Multifamily 05/24/2022 31,520 28,691 S + 3.15% S + 3.50% 05/24/2025 05/24/2027 75% 3 9 Downers Grove, IL Office 09/25/2020 30,000 29,500 L + 4.25% L + 4.69% 11/25/2023 11/25/2024 67% 2 10 Las Vegas, NV Multifamily 06/10/2022 28,950 24,223 S + 3.30% S + 4.05% 06/10/2025 06/10/2027 60% 3 11 St. Louis, MO Office 12/19/2018 28,866 28,866 L + 3.25% L + 3.74% 03/20/2023 06/20/2023 72% 3 12 Plano, TX Office 07/01/2021 27,385 26,152 L + 4.75% L + 5.16% 07/01/2024 07/01/2026 78% 3 13 Carlsbad, CA Office 10/27/2021 24,750 23,825 L + 3.25% L + 3.58% 10/27/2024 10/27/2026 78% 3 14 Fontana, CA Industrial 11/18/2022 24,355 22,000 S + 3.75% S + 4.28% 11/18/2024 11/18/2026 72% 3 |