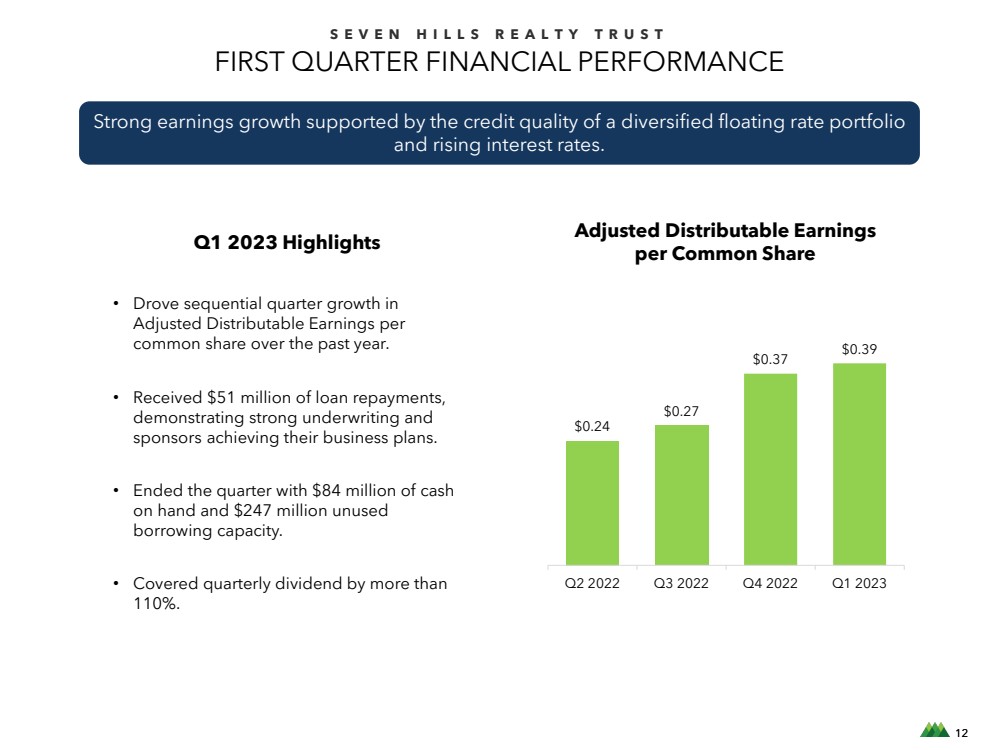

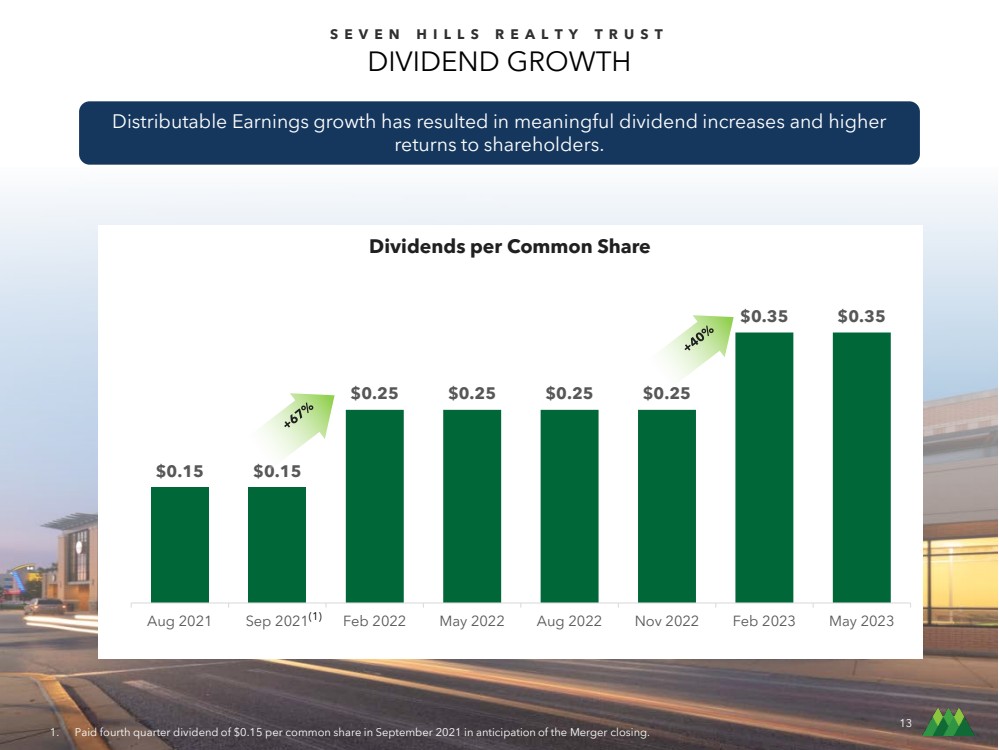

| 23 SEVEN HILLS REALTY TRUST NON-GAAP FINANCIAL MEASURES AND CERTAIN DEFINITIONS Non-GAAP Financial Measures: We present Distributable Earnings, Distributable Earnings per common share, Adjusted Distributable Earnings, Adjusted Distributable Earnings per common share and Adjusted Book Value per common share, which are considered non-GAAP financial measures within the meaning of the applicable SEC rules. These non-GAAP financial measures do not represent net income, net income per common share or cash generated from operating activities and should not be considered as alternatives to net income or net income per common share determined in accordance with GAAP or as an indication of our cash flows from operations determined in accordance with GAAP, a measure of our liquidity or operating performance or an indication of funds available for our cash needs. In addition, our methodologies for calculating these non-GAAP financial measures may differ from the methodologies employed by other companies to calculate the same or similar supplemental performance measures; therefore, our reported Distributable Earnings, Distributable Earnings per common share, Adjusted Distributable Earnings, and Adjusted Distributable Earnings per common share may not be comparable to distributable earnings, distributable earnings per common share, adjusted distributable earnings and adjusted distributable earnings per common share, as reported by other companies. We believe that Adjusted Book Value per common share is a meaningful measure of our capital adequacy because it excludes the impact of certain non-cash estimates or adjustments. Adjusted Book Value per common share does not represent book value per common share or alternative measures determined in accordance with GAAP. Our methodology for calculating Adjusted Book Value per common share may differ from the methodologies employed by other companies to calculate the same or similar supplemental capital adequacy measures; therefore, our Adjusted Book Value per common share may not be comparable to the adjusted book value per common share reported by other companies. In order to maintain our qualification for taxation as a REIT, we are generally required to distribute substantially all of our taxable income, subject to certain adjustments, to our shareholders. We believe that one of the factors that investors consider important in deciding whether to buy or sell securities of a REIT is its distribution rate. Over time, Distributable Earnings, Distributable Earnings per common share, Adjusted Distributable Earnings and Adjusted Distributable Earnings per common share may be useful indicators of distributions to our shareholders and are measures that are considered by our Board of Trustees when determining the amount of distributions. We believe that Distributable Earnings, Distributable Earnings per common share, Adjusted Distributable Earnings and Adjusted Distributable Earnings per common share provide meaningful information to consider in addition to net income, net income per common share and cash flows from operating activities determined in accordance with GAAP. These measures help us to evaluate our performance excluding the effects of certain transactions, the variability of any management incentive fees that may be paid or payable and GAAP adjustments that we believe are not necessarily indicative of our current loan portfolio and operations. In addition, Distributable Earnings is used in determining the amount of base management and management incentive fees payable by us to Tremont under our management agreement. Distributable Earnings: We calculate Distributable Earnings and Distributable Earnings per common share as net income and net income per common share, respectively, computed in accordance with GAAP, including realized losses not otherwise included in net income determined in accordance with GAAP, and excluding: (a) the management incentive fees earned by Tremont, if any; (b) depreciation and amortization, if any; (c) non-cash equity compensation expense; (d) unrealized gains, losses and other similar non-cash items that are included in net income for the period of the calculation (regardless of whether such items are included in or deducted from net income or in other comprehensive income under GAAP), if any; and (e) one-time events pursuant to changes in GAAP and certain non-cash items, if any. Distributable Earnings are reduced for realized losses on loan investments when amounts are deemed uncollectable. This is generally at the time a loan is repaid, or in the case of foreclosure, when the underlying asset is sold, but may also be when, in our determination, it is nearly certain that all amounts due will not be collected. The realized loss amount reflected in Distributable Earnings will equal the difference between the cash received or expected to be received and the carrying value of the asset. Adjusted Distributable Earnings: We define Adjusted Distributable Earnings and Adjusted Distributable Earnings per common share as Distributable Earnings and Distributable Earnings per common share, respectively, excluding the effects of certain non-recurring transactions. |