1 THIRD QUARTER 2021 Supplemental Operating and Financial Data ALL AMOUNTS IN THIS REPORT ARE UNAUDITED. Exhibit 99.2

2 Supplemental Q3 2021 2 Table of Contents CORPORATE INFORMATION Company Profile ...................................................................................................................................................................... 3 Investor Information and Research Coverage ................................................................................................................... 4 Company Highlights ............................................................................................................................................................... 5 PORTFOLIO OVERVIEW Third Quarter 2021 Highlights .............................................................................................................................................. 6 Loan Portfolio Summary ......................................................................................................................................................... 7 Portfolio Growth and Diversification ................................................................................................................................... 8 Portfolio Credit Quality .......................................................................................................................................................... 9 Capital Structure Overview .................................................................................................................................................... 10 Interest Rate Sensitivity ........................................................................................................................................................... 11 APPENDIX Loan Investment Details ......................................................................................................................................................... 13 Purchase Discount Details ..................................................................................................................................................... 15 Condensed Consolidated Balance Sheet .......................................................................................................................... 16 Condensed Consolidated Statements of Operations ...................................................................................................... 17 Reconciliation of Net Income to Distributable Earnings .................................................................................................. 18 Pro Forma Condensed Consolidated Statements of Operations .................................................................................. 19 WARNING CONCERNING FORWARD-LOOKING STATEMENTS ................................................................................................ 21 NON-GAAP FINANCIAL MEASURES AND CERTAIN DEFINITIONS Non-GAAP Financial Measures ............................................................................................................................................. 22 Other Measures and Definitions .......................................................................................................................................... 23 Please refer to Non-GAAP Financial Measures and Certain Definitions for terms used throughout this document.

3 Supplemental Q3 2021 3 Management: Our manager, Tremont Realty Capital LLC, or TRC, or our Manager, is registered with the SEC as an investment adviser. TRC is owned by The RMR Group LLC, or RMR LLC, the majority owned operating subsidiary of The RMR Group Inc., or RMR Inc., a holding company listed on The Nasdaq Stock Market LLC, or Nasdaq, under the symbol “RMR”. We collectively refer to RMR Inc. and its consolidated subsidiaries, including RMR LLC, as RMR. RMR is an alternative asset management company that is focused on commercial real estate and related businesses. RMR primarily provides management services to publicly traded real estate companies, privately held real estate funds and real estate related operating businesses. As of September 30, 2021, RMR had $32.7 billion of real estate assets under management and the combined RMR managed companies had approximately $10.0 billion of annual revenues, nearly 2,100 properties and approximately 37,000 employees. We believe our Manager’s relationship with RMR provides us with a depth of market knowledge that may allow us to identify high quality investment opportunities and to evaluate them more thoroughly than many of our competitors, including other commercial mortgage REITs. We also believe RMR’s broad platform provides us with access to RMR’s extensive network of real estate owners, operators, intermediaries, sponsors, financial institutions and other real estate related professionals and businesses with which RMR has historical relationships. We also believe that our Manager provides us with significant experience and expertise in investing in middle market and transitional CRE. The Company: Seven Hills Realty Trust (formerly RMR Mortgage Trust, or RMRM), or SEVN, we, our or us, is a real estate finance company that focuses on originating and investing in floating rate first mortgage loans secured by middle market and transitional commercial real estate, or CRE. We define middle market CRE as commercial properties that have values up to $100.0 million and transitional CRE as commercial properties subject to redevelopment or repositioning activities that are expected to increase the value of the properties. On September 30, 2021, we completed our previously announced merger with Tremont Mortgage Trust, or TRMT, whereby TRMT merged with and into RMRM, or the Merger. The Merger was effective after the close of trading on September 30, 2021. Accordingly, the assets acquired and liabilities assumed from TRMT in the Merger are included in SEVN's condensed consolidated balance sheet as of September 30, 2021; however, TRMT's results of operations are excluded from SEVN's condensed consolidated statements of operations for all periods presented. Upon the closing of the Merger, RMR Mortgage Trust changed its name to Seven Hills Realty Trust. Certain pro forma financial information within the Appendix is presented as if the Merger had occurred on July 1, 2021. Business Change: As previously announced, on January 5, 2021, the Securities and Exchange Commission, or SEC, issued an order granting our request to deregister as an investment company under the Investment Company Act of 1940. This order enables us to proceed with full implementation of our new business mandate to operate as a commercial mortgage real estate investment trust, or REIT. As a result of the changes to our business, we have not provided a comparison of our financial statements to prior periods in which we were operating as a registered investment company because it would not be useful to our shareholders. Corporate Headquarters: Two Newton Place 255 Washington Street, Suite 300 Newton, MA 02458-1634 (617) 332-9530 Stock Exchange Listing: Nasdaq Trading Symbol: Common Shares: SEVN Key Data (as of and for the three months ended September 30, 2021): (dollars in thousands) Q3 2021 income from investments, net $ 4,022 Q3 2021 net income $ 2,484 Q3 2021 Distributable Earnings $ 2,484 Loans held for investment, net $ 434,474 Total assets $ 456,203 Company Profile RETURN TO TABLE OF CONTENTSCORPORATE INFORMATION

4 Supplemental Q3 2021 4 Investor Information and Research Coverage Board of Trustees Barbara D. Gilmore William A. Lamkin Joseph L. Morea Jeffrey P. Somers Independent Trustee Independent Trustee Lead Independent Trustee Independent Trustee Matthew P. Jordan Adam D. Portnoy Managing Trustee Chair of the Board & Managing Trustee Executive Officers Equity Research Coverage Thomas J. Lorenzini G. Douglas Lanois JMP Securities President Chief Financial Officer and Treasurer Steven C. Delaney (212) 906-3517 Contact Information sdelaney@jmpsecurities.com Investor Relations Inquiries Seven Hills Realty Trust Financial, investor and media inquiries should be directed to: Jones Trading Institutional Services, LLC Two Newton Place Kevin Barry, Director, Investor Relations Jason M. Stewart 255 Washington Street, Suite 300 at (617) 332-9530 or ir@sevnreit.com (646) 465-9932 (617) 796-8253 jstewart@jonestrading.com ir@sevnreit.com www.sevnreit.com SEVN is followed by the analysts listed above. Please note that any opinions, estimates or forecasts regarding SEVN’s performance made by these analysts do not represent opinions, estimates or forecasts of SEVN or its management. SEVN does not by its reference above imply its endorsement of or concurrence with any information, conclusions or recommendations provided by any of these analysts. CORPORATE INFORMATION RETURN TO TABLE OF CONTENTS

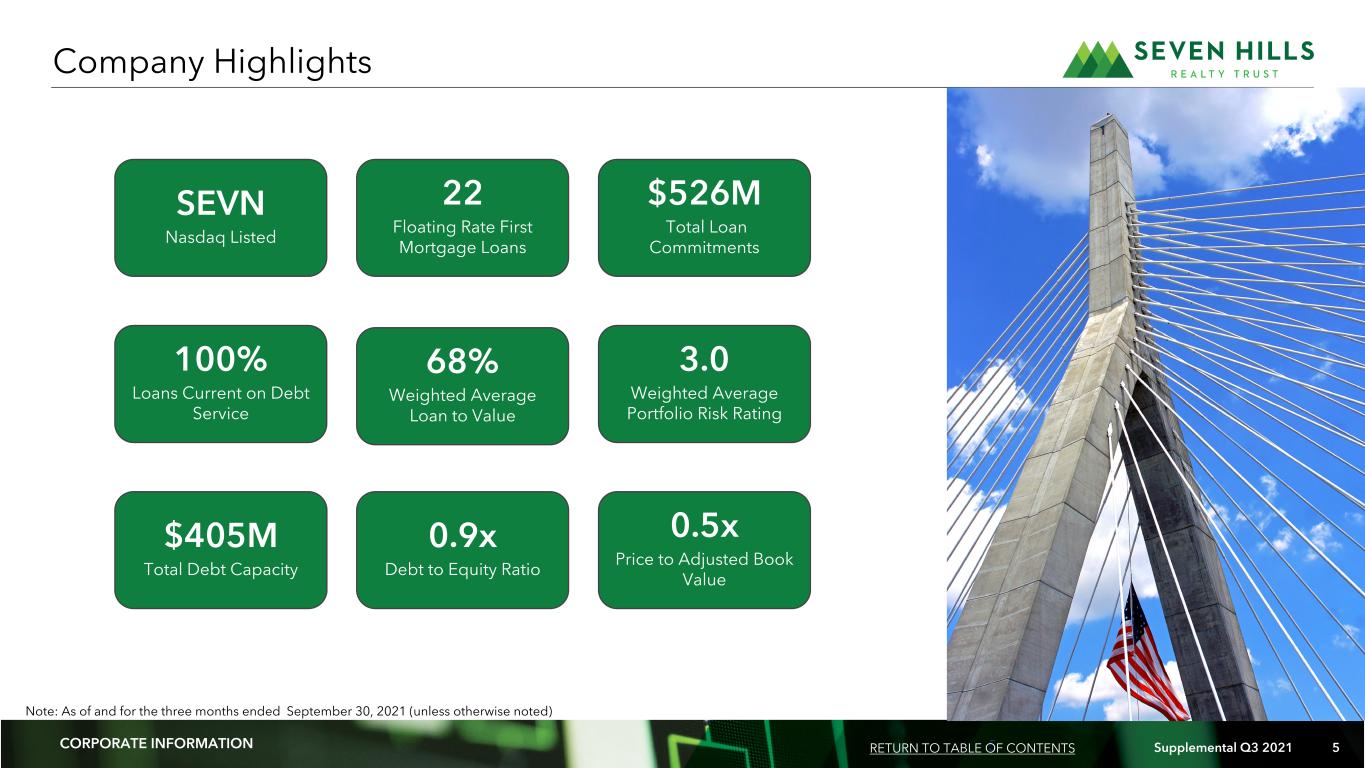

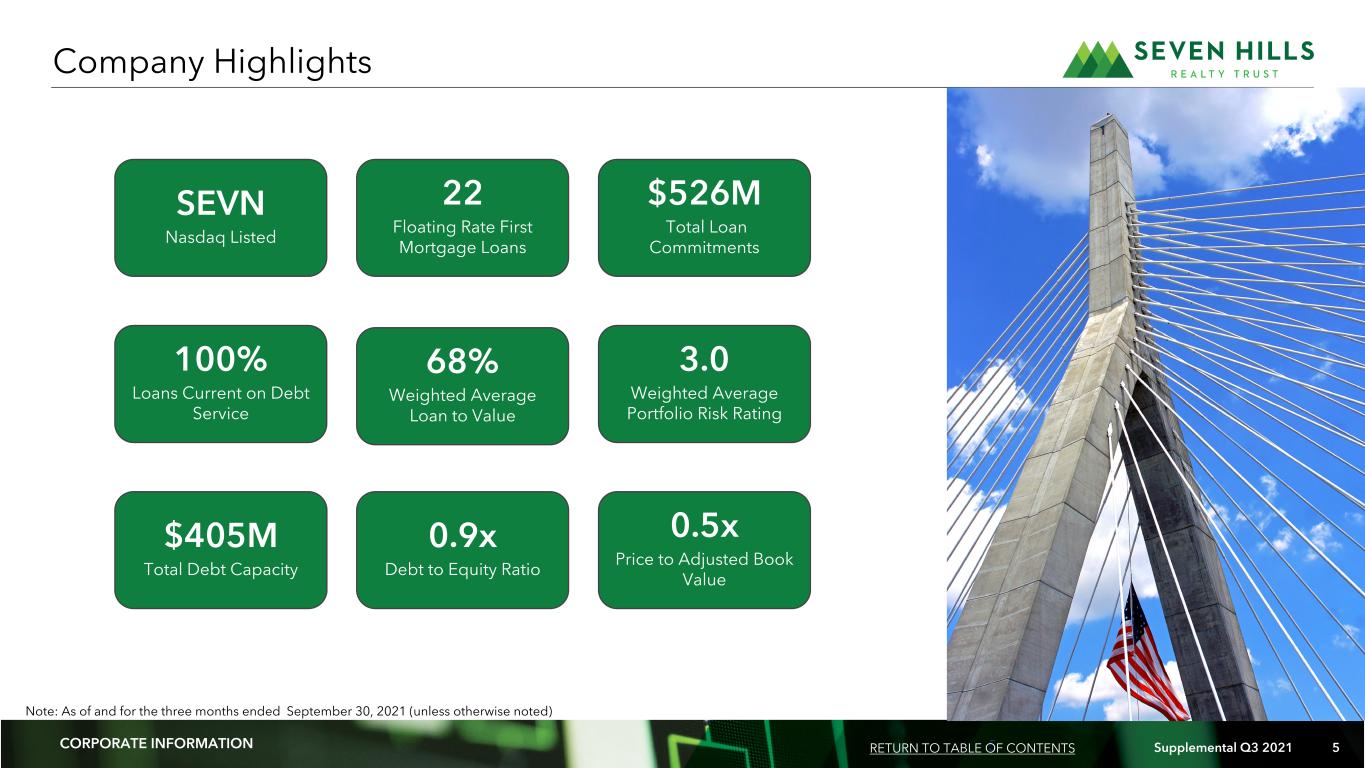

5 Supplemental Q3 2021 5 Note: As of and for the three months ended September 30, 2021 (unless otherwise noted) Company Highlights CORPORATE INFORMATION 22 Floating Rate First Mortgage Loans SEVN Nasdaq Listed $526M Total Loan Commitments 100% Loans Current on Debt Service $405M Total Debt Capacity 68% Weighted Average Loan to Value 0.9x Debt to Equity Ratio 3.0 Weighted Average Portfolio Risk Rating 0.5x Price to Adjusted Book Value RETURN TO TABLE OF CONTENTS

6 Supplemental Q3 2021 6 Merger Closed Financial Results Loan Portfolio Capitalization Note: As of and for the three months ended September 30, 2021 (unless otherwise noted) • Generated net income and Distributable Earnings of $2.5 million, or $0.24 per diluted share, and pro forma Distributable Earnings of $0.22 per diluted share. • Paid two distributions totaling $0.30 per common share during the quarter. • Book value per common share of $16.32 and Adjusted Book Value per Common Share of $18.83. • Executed on investment plan, closing four new loans with a total committed principal of $76.1 million. • Increased portfolio to 22 first mortgage loans with an aggregate total loan commitment of $525.9 million. • All loans current on debt service and credit quality remains strong at a risk rating of 3.0. • Completed the Merger with Tremont Mortgage Trust on September 30, 2021. • Acquired loan investment portfolio of 10 loans with a fair value of $205.6 million, reflecting a purchase price discount of $36.4 million to be accreted into income in future quarters. • Anticipate total aggregate loan commitments of approximately $950.0 million when fully invested. • Outstanding principal balance of $216.3 million under our Master Repurchase Facilities. • Master Repurchase Facilities have $189.1 million available, comprised of $167.2 million immediately available to be drawn on new loans and $21.9 million available to be drawn to fund future advances. • Weighted average spread on borrowings is 1.98% with no LIBOR floor. Third Quarter 2021 Highlights PORTFOLIO OVERVIEW RETURN TO TABLE OF CONTENTS

7 Supplemental Q3 2021 7 (dollars in thousands) Third Quarter 2021 Portfolio Activity (dollars in millions) Total Loan Commitments Unfunded Commitments Third Quarter Originations TRMT Loans Acquired in the Merger As of September 30, 2021 Number of loans 4 10 22 Average loan commitment $19,015 $21,823 $23,904 Total loan commitments $76,060 $218,235 $525,885 Unfunded loan commitments $4,524 $13,543 $53,963 Principal balance $71,536 $204,692 $472,018 Weighted average coupon rate 4.26% 4.94% 4.86% Weighted average All In Yield 4.41% 5.50% 5.43% Weighted average Maximum Maturity 5.0 3.1 3.7 Weighted average LTV 75% 67% 68% Weighted average LIBOR floor 0.73% 1.48% 1.01% Loans with active LIBOR floors 100% 100% 100% Weighted average risk rating 3.0 3.0 3.0 Principal Balance Third Quarter 2021 Portfolio Summary $525.9 PORTFOLIO OVERVIEW RETURN TO TABLE OF CONTENTS

8 Supplemental Q3 2021 8 Retail Geographic Region (2) Property Type (2) (dollars in millions) Portfolio Growth and Diversification (1) Includes loans originated by TRMT and owned by SEVN at September 30, 2021. (2) Based on principal balance of loans held for investment as of September 30, 2021. Total Loan Commitments Unfunded Commitments Principal Balance Loan Originations by Quarter (1) PORTFOLIO OVERVIEW Loan Count 1 4 2 3 6 RETURN TO TABLE OF CONTENTS

9 Supplemental Q3 2021 9 Loan Count Loan to Value (1) % of Portfolio Portfolio Credit Quality Loan Count 2 2 6 10 2 0 2 17 3 0 Risk Rating Distribution (1) % of Portfolio Weighted Average LTV: 68% Weighted Average Risk Rating: 3.0 (1) Percentage of portfolio based on principal balance of loans held for investment as of September 30, 2021. PORTFOLIO OVERVIEW RETURN TO TABLE OF CONTENTS

10 Supplemental Q3 2021 10 CA PI TA L ST RU CT UR E OV ER VI EW Secured Financing Maximum Facilities Size (1) Coupon Rate (2) Remaining Maturity (3) Principal Balance Master Repurchase Facilities $ 405,482 L + 1.98% 1.3 $ 216,345 Reconciliation of Book Value per Common Share to Adjusted Book Value per Common Share Shareholders’ equity $ 236,649 Total outstanding common shares 14,502 Book value per common share $ 16.32 Unaccreted purchase discount per common share 2.51 Adjusted Book Value per Common Share (4) $ 18.83 Capital Structure Detail (dollars in thousands, except per share data) (1) The maximum facility amount stated in the master repurchase agreement with UBS is $192,000. The maximum facility amount stated in the master repurchase agreement with Citibank assumed in the Merger with TRMT is $213,482. (2) The weighted average coupon rate and outstanding debt to funded investments are based on outstanding principal balances as of September 30, 2021. (3) The weighted average remaining maturity is determined using the earlier of the underlying loan maturity date and the respective repurchase agreement maturity date. (4) Adjusted Book Value per Common Share excludes the impact of the unaccreted purchase discount resulting from the excess fair value over the purchase price of the loans held for investment acquired in the Merger. The purchase discount of $36.4 million was allocated to each acquired loan held for investment and will be accreted into income over the remaining term of the respective loan held for investment. (dollars in millions) Capital Structure Overview as of September 30, 2021 Capital Structure Composition Outstanding Debt to Funded Investments (2) Leverage Capacity RETURN TO TABLE OF CONTENTS (dollars in millions) PORTFOLIO OVERVIEW RETURN TO TABLE OF CONTENTS

11 Supplemental Q3 2021 11 The interest income on our loans held for investment and the interest expense on our borrowings float with LIBOR subject to applicable LIBOR floor arrangements. We have interest rate floor provisions in our loan agreements with borrowers which set a minimum LIBOR for each loan. These floors range from 0.25% to 2.50% and the portfolio weighted average is 1.01% as of September 30, 2021. As a result, our interest income will increase if LIBOR exceeds the floor established in any of our investments, and if LIBOR decreases below the floor established in any of our investments, our interest income will not be impacted. The above table illustrates the incremental impact on our annual income from investments, net, due to hypothetical increases and decreases in LIBOR, taking into consideration our borrowers’ interest rate floors as of September 30, 2021. The hypothetical decreases in LIBOR have been limited to eight basis points to result in a LIBOR of 0.00%. The results in the table above are based on our loan portfolio and debt outstanding and LIBOR of 0.08% at September 30, 2021. Any changes to the mix of our investments or debt outstanding could impact the interest rate sensitivity analysis and this illustration is not meant to forecast future results. LIBOR is currently expected to be phased out for new contracts by December 31, 2021 and for pre-existing contracts by June 30, 2023. Our master repurchase agreements, or the Master Repurchase Agreements, with UBS and Citibank state that at such time as LIBOR shall no longer be made available or used for determining the interest rate of loans, the replacement base rate shall be an alternative benchmark rate (including any mathematical or other adjustments to the benchmark rate (if any) incorporated therein so that the resulting rate approximates LIBOR as close as reasonably possible) as determined by UBS or Citibank under similar facilities for the financing of similar assets and is consistent with the pricing index of similarly situated counterparties. We also currently expect that, as a result of any phase out of LIBOR, the interest rates under our loan agreements with borrowers would be amended to replace LIBOR for an alternative benchmark rate (which may include the secured overnight financing rate, or SOFR, or another rate based on SOFR) that will approximate the existing interest rate as calculated in accordance with LIBOR. Interest Rate Sensitivity Net Interest Income Per Share Sensitivity to LIBOR (Annualized impact per share) PORTFOLIO OVERVIEW RETURN TO TABLE OF CONTENTS

12 Supplemental Q3 2021 12APPENDIX Appendix

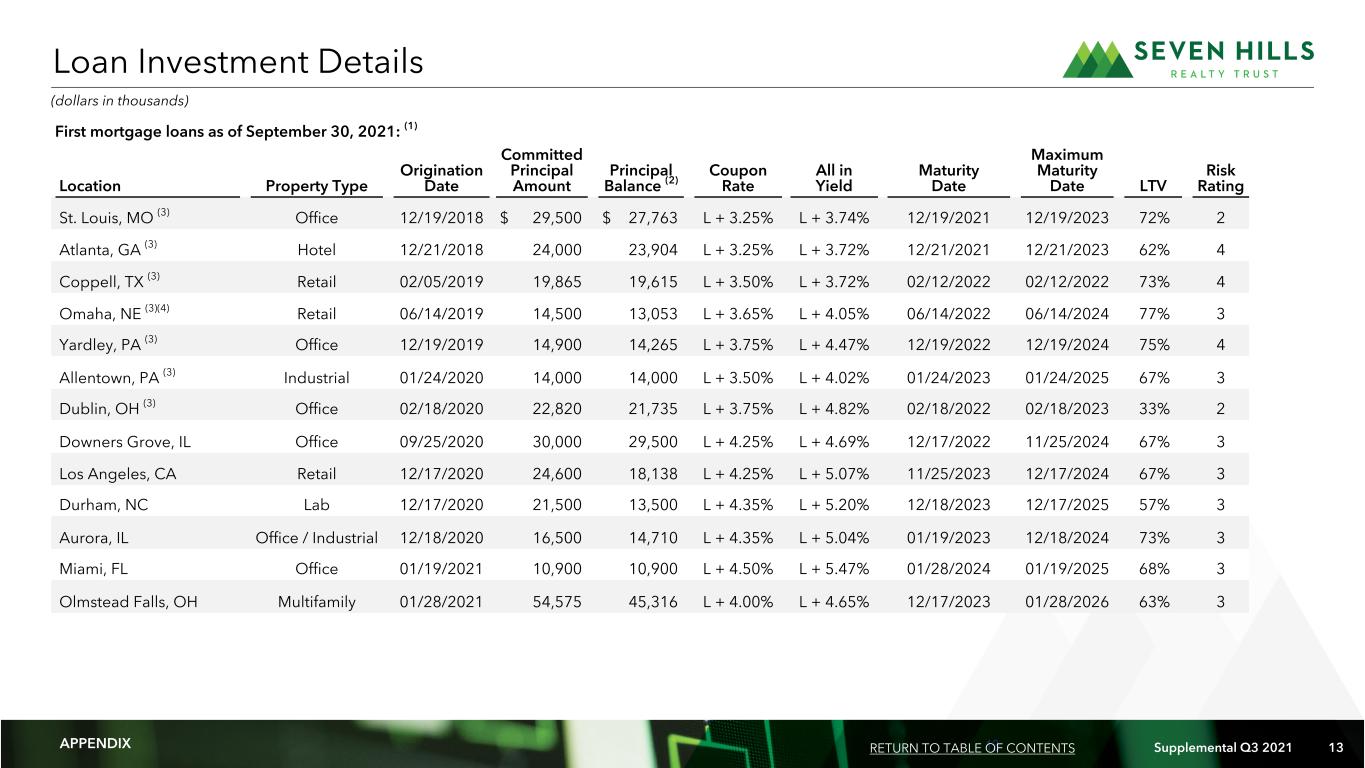

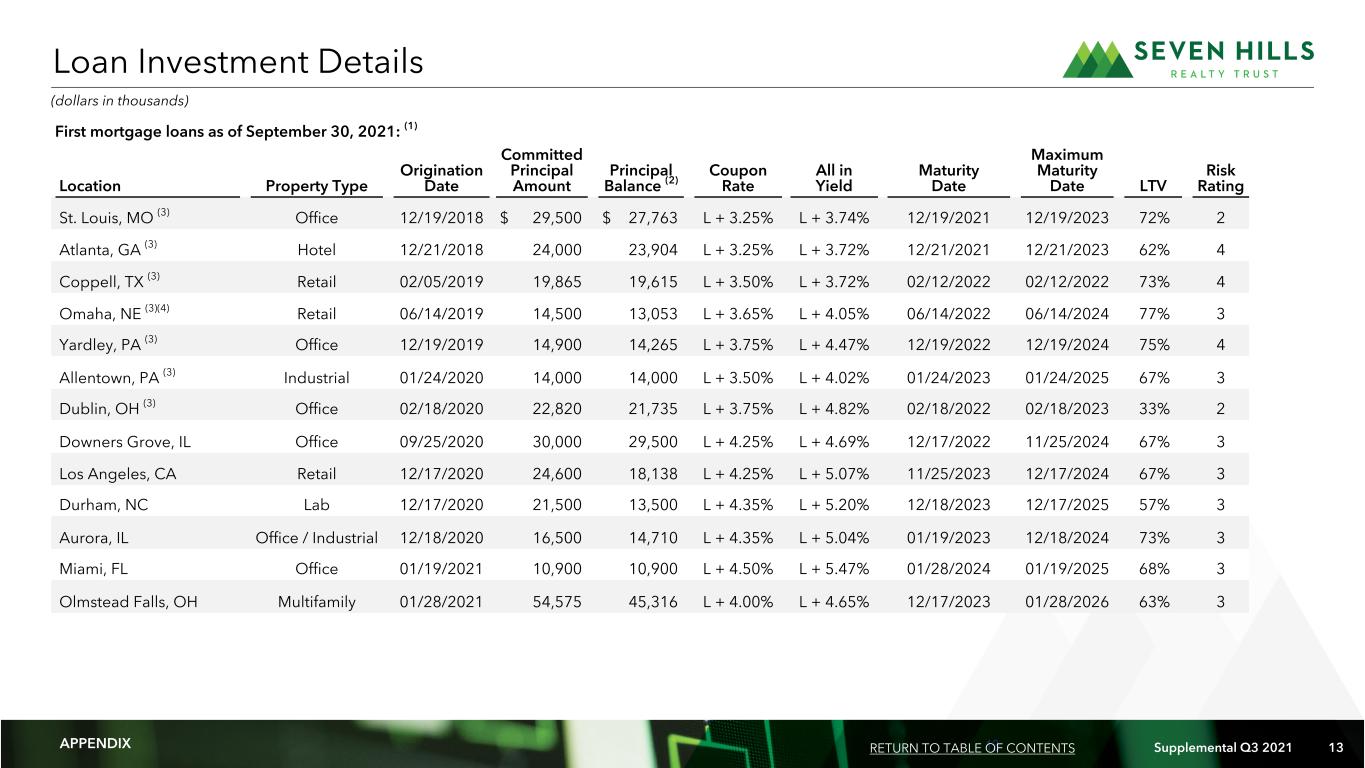

13 Supplemental Q3 2021 13 First mortgage loans as of September 30, 2021: (1) Location Property Type Origination Date Committed Principal Amount Principal Balance (2) Coupon Rate All in Yield Maturity Date Maximum Maturity Date LTV Risk Rating St. Louis, MO (3) Office 12/19/2018 $ 29,500 $ 27,763 L + 3.25% L + 3.74% 12/19/2021 12/19/2023 72% 2 Atlanta, GA (3) Hotel 12/21/2018 24,000 23,904 L + 3.25% L + 3.72% 12/21/2021 12/21/2023 62% 4 Coppell, TX (3) Retail 02/05/2019 19,865 19,615 L + 3.50% L + 3.72% 02/12/2022 02/12/2022 73% 4 Omaha, NE (3)(4) Retail 06/14/2019 14,500 13,053 L + 3.65% L + 4.05% 06/14/2022 06/14/2024 77% 3 Yardley, PA (3) Office 12/19/2019 14,900 14,265 L + 3.75% L + 4.47% 12/19/2022 12/19/2024 75% 4 Allentown, PA (3) Industrial 01/24/2020 14,000 14,000 L + 3.50% L + 4.02% 01/24/2023 01/24/2025 67% 3 Dublin, OH (3) Office 02/18/2020 22,820 21,735 L + 3.75% L + 4.82% 02/18/2022 02/18/2023 33% 2 Downers Grove, IL Office 09/25/2020 30,000 29,500 L + 4.25% L + 4.69% 12/17/2022 11/25/2024 67% 3 Los Angeles, CA Retail 12/17/2020 24,600 18,138 L + 4.25% L + 5.07% 11/25/2023 12/17/2024 67% 3 Durham, NC Lab 12/17/2020 21,500 13,500 L + 4.35% L + 5.20% 12/18/2023 12/17/2025 57% 3 Aurora, IL Office / Industrial 12/18/2020 16,500 14,710 L + 4.35% L + 5.04% 01/19/2023 12/18/2024 73% 3 Miami, FL Office 01/19/2021 10,900 10,900 L + 4.50% L + 5.47% 01/28/2024 01/19/2025 68% 3 Olmstead Falls, OH Multifamily 01/28/2021 54,575 45,316 L + 4.00% L + 4.65% 12/17/2023 01/28/2026 63% 3 Loan Investment Details (dollars in thousands) APPENDIX RETURN TO TABLE OF CONTENTS

14 Supplemental Q3 2021 14 First mortgage loans as of September 30, 2021: (1) Location Property Type Origination Date Committed Principal Amount Principal Balance (2) Coupon Rate All in Yield Maturity Date Maximum Maturity Date LTV Risk Rating Colorado Springs, CO Office / Industrial 04/06/2021 34,275 29,404 L + 4.50% L + 5.03% 04/06/2024 04/06/2025 73% 3 Londonderry, NH Industrial 04/06/2021 39,240 34,323 L + 4.00% L + 4.62% 04/06/2024 04/06/2026 73% 3 Westminster, CO (3) Office 05/24/2021 15,250 13,506 L + 3.75% L + 4.25% 05/24/2024 05/24/2026 66% 3 Plano, TX Office 07/01/2021 27,384 24,827 L + 4.75% L + 5.18% 07/01/2024 07/01/2026 78% 3 Portland, OR Multifamily 07/09/2021 19,688 19,688 L + 3.57% L + 3.97% 07/09/2024 07/09/2026 75% 3 Portland, OR (3) Multifamily 07/30/2021 13,400 13,400 L + 3.57% L + 4.01% 07/30/2024 07/30/2026 71% 3 Seattle, WA Multifamily 08/16/2021 12,500 12,200 L + 3.55% L + 3.89% 08/16/2024 08/16/2026 70% 3 Dallas, TX (3) Office 08/25/2021 50,000 43,450 L + 3.25% L + 3.64% 08/25/2024 08/25/2026 72% 3 Sandy Springs, GA Retail 09/23/2021 16,488 14,821 L + 3.75% L + 4.11% 09/23/2024 09/23/2026 72% 3 Total/weighted average $ 525,885 $ 472,018 L + 3.86% L + 4.41% 68% 3.0 Loan Investment Details (Continued) (dollars in thousands) APPENDIX RETURN TO TABLE OF CONTENTS (1) As of October 29, 2021, all of our borrowers had paid their debt service obligations owed and due to us, and none of the loans included in our investment portfolio were in default. (2) The principal balance excludes the impact of the $36,443 purchase discount related to the Merger with TRMT. (3) These first mortgage loans were acquired in the Merger with TRMT. (4) In October 2021, we received $13,130 of repayment proceeds which included the outstanding principal of $13,053, as well as immaterial accrued interest and our associated legal expenses.

15 Supplemental Q3 2021 15 Purchase Discount Details (1) The estimate of purchase discount accretion is based on information as of September 30, 2021 and is subject to change as a result of early repayment. (dollars in millions) The fair value of the loans acquired in the Merger exceeded the purchase price of the loans. In accordance with U.S. generally accepted accounting principles, or GAAP, a purchase discount is recorded for the difference between the fair value and purchase price of the loans acquired. The purchase discount will be accreted into income over the remaining term of the loans. Purchase Discount Fair value of TRMT loans acquired in the Merger $ 205.6 Less: Purchase price of TRMT loans acquired in the Merger 169.2 Purchase discount $ 36.4 Estimate of Purchase Discount Accretion $18.1 $5.1 $2.1 $2.1 $2.1 $4.6 $2.3 Q4 2021 Q1 2022 Q2 2022 Q3 2022 Q4 2022 2023 2024 (1) PORTFOLIO OVERVIEW RETURN TO TABLE OF CONTENTS

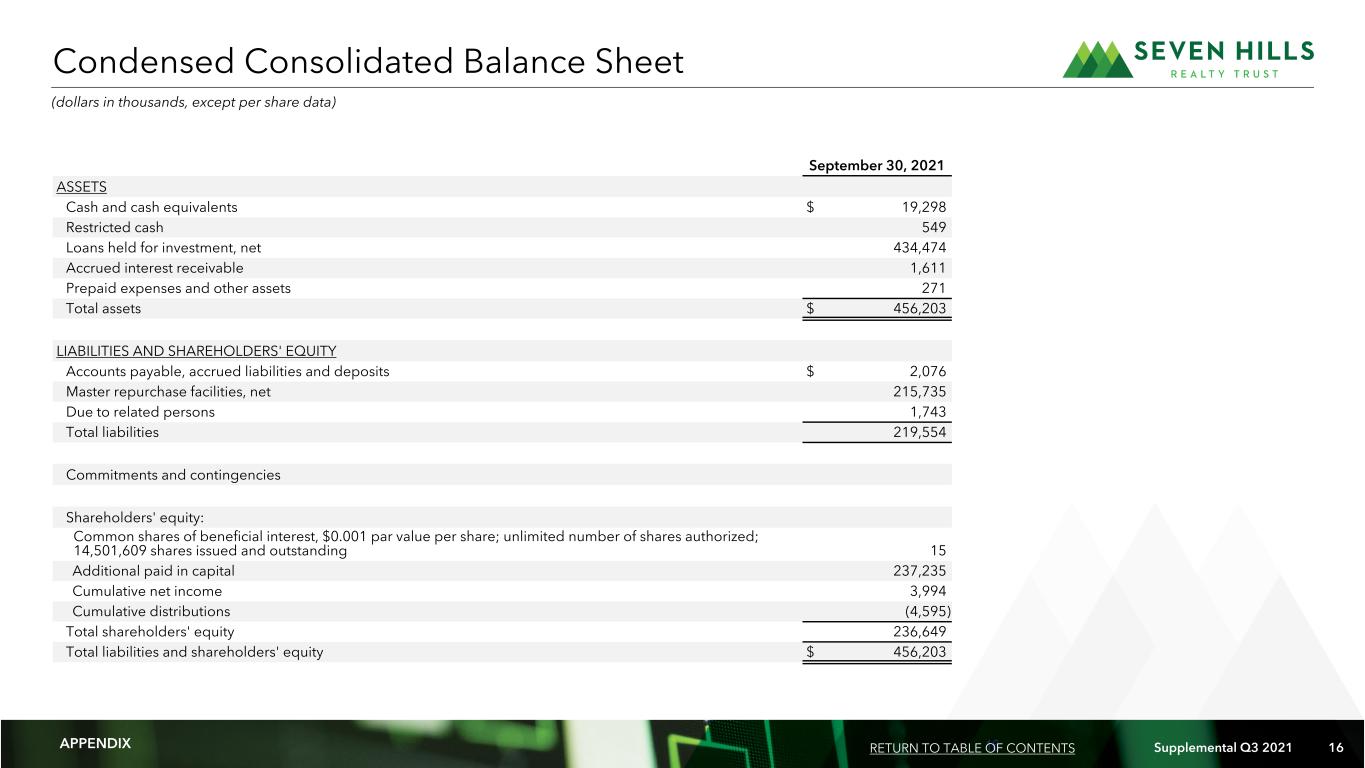

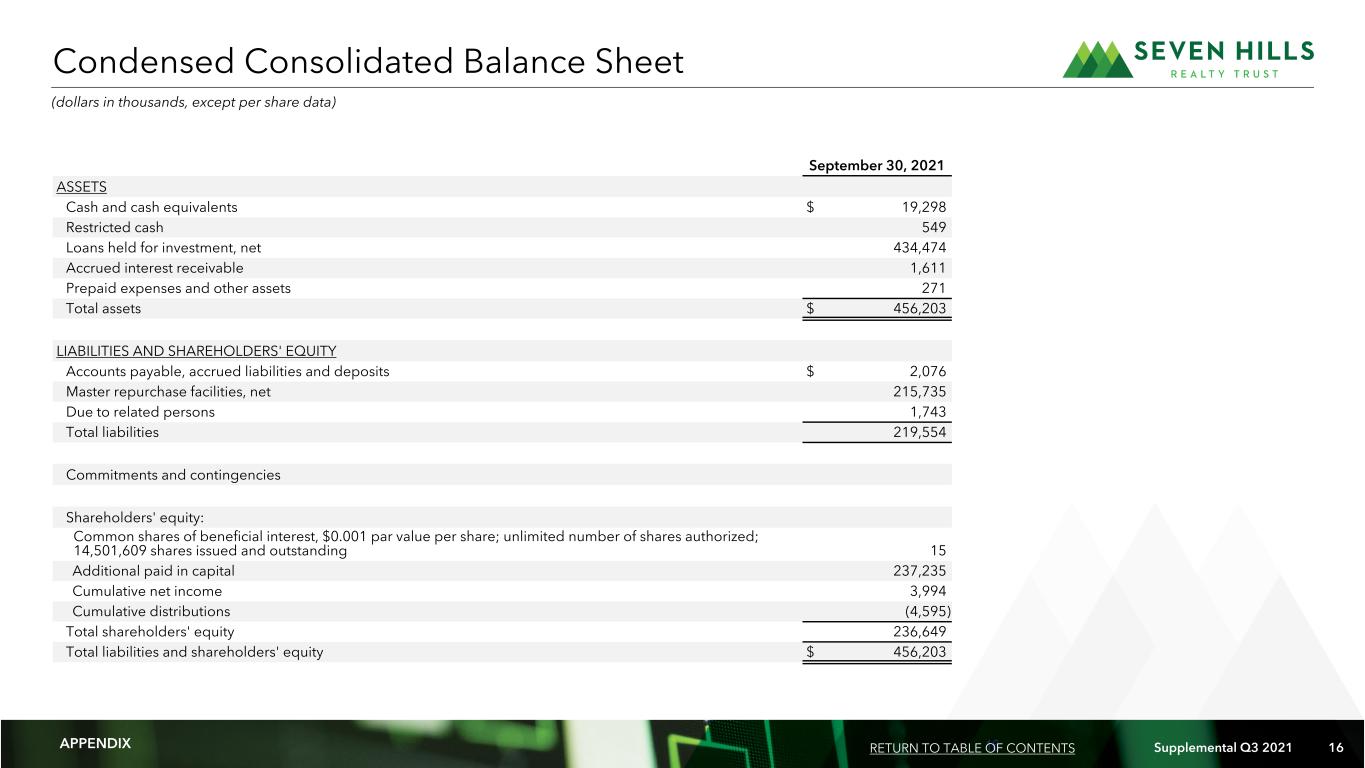

16 Supplemental Q3 2021 16 Financial Summary September 30, 2021 ASSETS Cash and cash equivalents $ 19,298 Restricted cash 549 Loans held for investment, net 434,474 Accrued interest receivable 1,611 Prepaid expenses and other assets 271 Total assets $ 456,203 LIABILITIES AND SHAREHOLDERS' EQUITY Accounts payable, accrued liabilities and deposits $ 2,076 Master repurchase facilities, net 215,735 Due to related persons 1,743 Total liabilities 219,554 Commitments and contingencies Shareholders' equity: Common shares of beneficial interest, $0.001 par value per share; unlimited number of shares authorized; 14,501,609 shares issued and outstanding 15 Additional paid in capital 237,235 Cumulative net income 3,994 Cumulative distributions (4,595) Total shareholders' equity 236,649 Total liabilities and shareholders' equity $ 456,203 Condensed Consolidated Balance Sheet (dollars in thousands, except per share data) APPENDIX RETURN TO TABLE OF CONTENTS

17 Supplemental Q3 2021 17 Condensed Consolidated Statements of Operations Three Months Ended September 30, 2021 Nine Months Ended September 30, 2021 INCOME FROM INVESTMENTS: Interest income from investments $ 4,510 $ 9,566 Less: interest and related expenses (488) (680) Income from investments, net 4,022 8,886 OTHER EXPENSES: Base management fees 731 2,167 General and administrative expenses 433 1,739 Reimbursement of shared services expenses 349 950 Total expenses 1,513 4,856 Income before income tax expense 2,509 4,030 Income tax expense (25) (36) Net income $ 2,484 $ 3,994 Weighted average common shares outstanding - basic 10,263 10,225 Weighted average common shares outstanding - diluted 10,264 10,225 Net income per common share - basic and diluted $ 0.24 $ 0.39 (amounts in thousands, except per share data) APPENDIX RETURN TO TABLE OF CONTENTS

18 Supplemental Q3 2021 18 Three Months Ended September 30, 2021 Nine Months Ended September 30, 2021 Reconciliation of net income to Distributable Earnings: Net income $ 2,484 $ 3,994 Non-cash equity compensation expense — 181 Distributable Earnings $ 2,484 $ 4,175 Weighted average common shares outstanding - basic 10,263 10,225 Weighted average common shares outstanding - diluted 10,264 10,225 Distributable Earnings per common share - basic and diluted $ 0.24 $ 0.41 Reconciliation of Net Income to Distributable Earnings (amounts in thousands, except per share data) APPENDIX RETURN TO TABLE OF CONTENTS

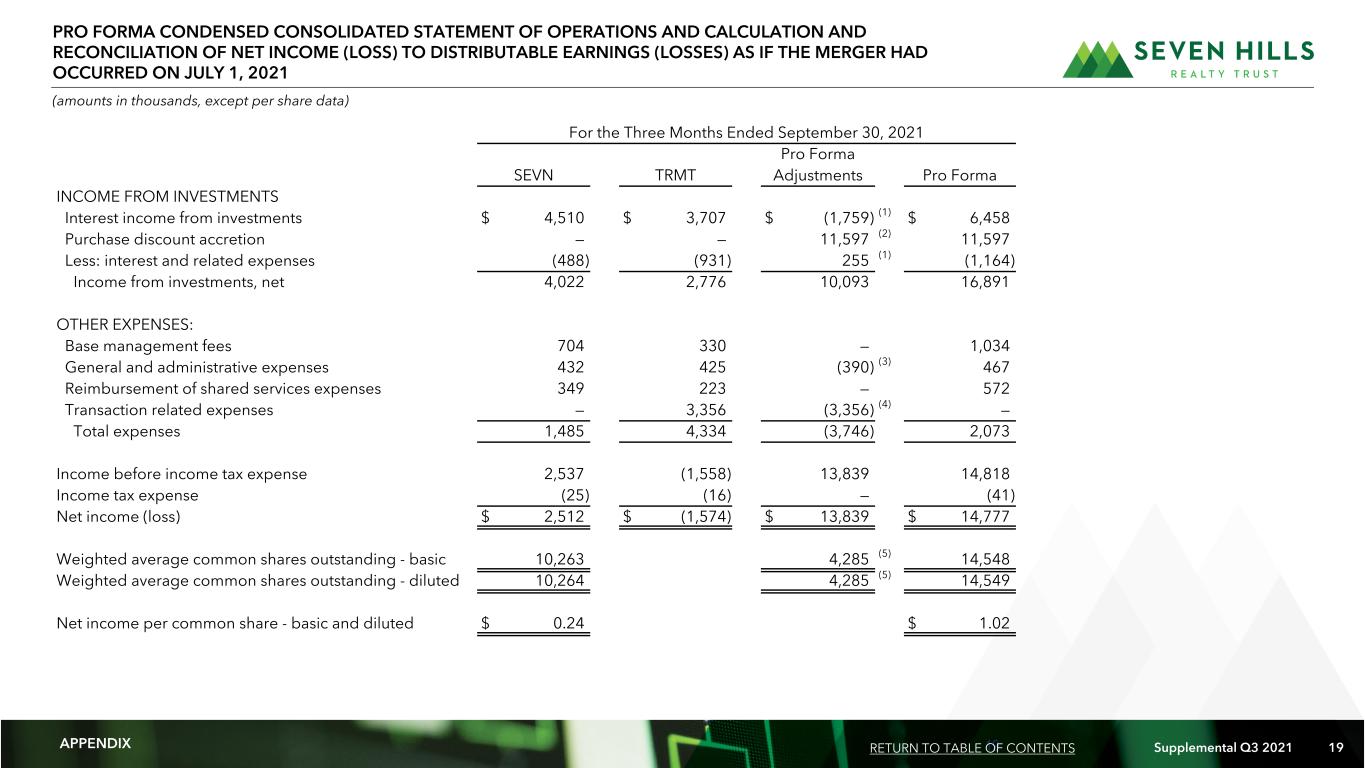

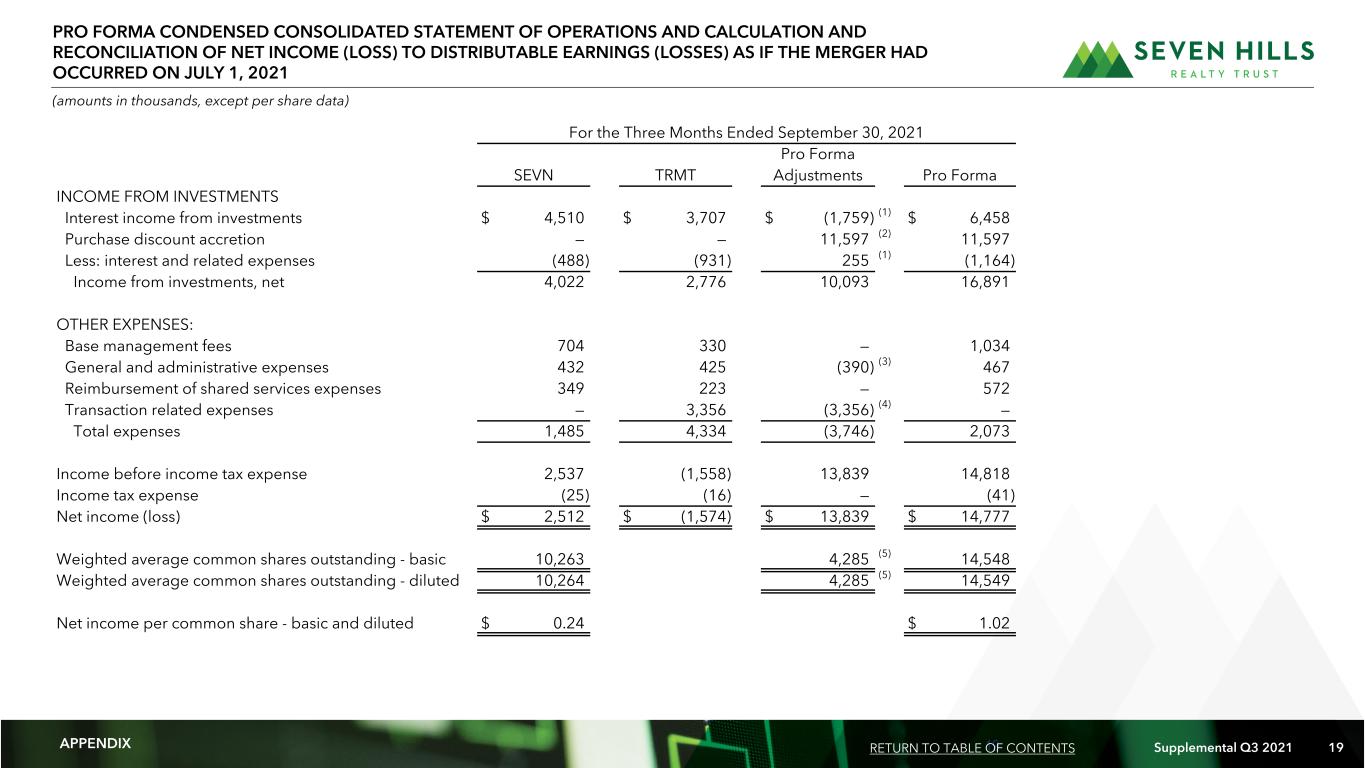

19 Supplemental Q3 2021 19 PRO FORMA CONDENSED CONSOLIDATED STATEMENT OF OPERATIONS AND CALCULATION AND RECONCILIATION OF NET INCOME (LOSS) TO DISTRIBUTABLE EARNINGS (LOSSES) AS IF THE MERGER HAD OCCURRED ON JULY 1, 2021 (amounts in thousands, except per share data) For the Three Months Ended September 30, 2021 Pro Forma SEVN TRMT Adjustments Pro Forma INCOME FROM INVESTMENTS Interest income from investments $ 4,510 $ 3,707 $ (1,759) (1) $ 6,458 Purchase discount accretion — — 11,597 (2) 11,597 Less: interest and related expenses (488) (931) 255 (1) (1,164) Income from investments, net 4,022 2,776 10,093 16,891 OTHER EXPENSES: Base management fees 704 330 — 1,034 General and administrative expenses 432 425 (390) (3) 467 Reimbursement of shared services expenses 349 223 — 572 Transaction related expenses — 3,356 (3,356) (4) — Total expenses 1,485 4,334 (3,746) 2,073 Income before income tax expense 2,537 (1,558) 13,839 14,818 Income tax expense (25) (16) — (41) Net income (loss) $ 2,512 $ (1,574) $ 13,839 $ 14,777 Weighted average common shares outstanding - basic 10,263 4,285 (5) 14,548 Weighted average common shares outstanding - diluted 10,264 4,285 (5) 14,549 Net income per common share - basic and diluted $ 0.24 $ 1.02 APPENDIX RETURN TO TABLE OF CONTENTS

20 Supplemental Q3 2021 20 PRO FORMA CONDENSED CONSOLIDATED STATEMENT OF OPERATIONS AND CALCULATION AND RECONCILIATION OF NET INCOME (LOSS) TO DISTRIBUTABLE EARNINGS (LOSSES) AS IF THE MERGER HAD OCCURRED ON JULY 1, 2021 (CONTINUED) (amounts in thousands, except per share data) For the Three Months Ended September 30, 2021 Pro Forma SEVN TRMT Adjustments Pro Forma Reconciliation of net income to Distributable Earnings (Losses): Net income (loss) $ 2,512 $ (1,574) $ 13,839 $ 14,777 Non-cash equity compensation expense — 38 (38) — Non-cash accretion of purchase discount — — (11,597) (2) (11,597) Distributable Earnings (Losses) $ 2,512 $ (1,536) $ 2,204 $ 3,180 Weighted average common shares outstanding - basic 10,263 4,285 (5) 14,548 Weighted average common shares outstanding - diluted 10,264 4,285 (5) 14,549 Distributable Earnings per common share - basic and diluted $ 0.24 $ 0.22 (1) The adjustments to interest income and interest expense represent the effect of recording any loan payoffs as if they occurred prior to July 1, 2021 and to reflect any loan originations as if those transactions had occurred on July 1, 2021. (2) This adjustment represents the effects of the Merger as if the Merger occurred on July 1, 2021, assuming the purchase price of the 10 TRMT loans acquired was $169,150 and the fair value was $205,593 resulting in a purchase discount of $36,443. This adjustment reflects the accretion of the purchase discount on loans acquired from TRMT allocated to each loan over each loan's remaining term. (3) This adjustment eliminates duplicative public company, legal and audit fee costs that TRMT incurred during the three months ended September 30, 2021 that would not have been incurred by us had the Merger occurred on July 1, 2021. (4) This adjustment removes transaction related expenses incurred by TRMT during the three months ended September 30, 2021 which would not have been incurred by us had the Merger occurred on July 1, 2021. (5) The adjustment reflects the issuance of approximately 4,285 of SEVN's common shares issued to TRMT shareholders as part of the Merger as if the Merger occurred on July 1, 2021. APPENDIX RETURN TO TABLE OF CONTENTS

21 Supplemental Q3 2021 21 This supplemental operating and financial data may contain forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995 and other securities laws. Also, whenever we use words such as “believe”, “expect”, “anticipate”, “intend”, “plan”, “estimate”, “will”, “may” and negatives or derivatives of these or similar expressions, we are making forward-looking statements. These forward-looking statements are based upon our present intent, beliefs or expectations, but forward-looking statements are not guaranteed to occur and may not occur. Actual results may differ materially from those contained in or implied by our forward-looking statements. Forward-looking statements involve known and unknown risks, uncertainties and other factors, some of which are beyond our control. The information contained in our filings with the SEC, including under "Risk Factors" in the joint proxy statement/ prospectus that is included in the registration statement on Form S-4 filed on June 9, 2021, as subsequently amended and declared effective on July 26, 2021, and under “Summary of Principal Risk Factors” included in our Current Report on Form 8-K filed on March 24, 2021 and our periodic reports, identifies other important factors that could cause SEVN’s actual results to differ materially from those stated in or implied by SEVN’s forward looking statements. SEVN’s filings with the SEC are available on the SEC’s website at www.sec.gov. Warning Concerning Forward-Looking Statements WARNING CONCERNING FORWARD-LOOKING STATEMENTS RETURN TO TABLE OF CONTENTS

22 Supplemental Q3 2021 22 ON -G AA P FI NA NC IA L ME AS UR ES A ND C ER TA IN D EF IN IT IO NS Non-GAAP Financial Measures: We present Distributable Earnings and Adjusted Book Value per Common Share, which are considered “non-GAAP financial measures” within the meaning of the applicable SEC rules. Distributable Earnings does not represent net income or cash generated from operating activities and should not be considered as an alternative to net income determined in accordance with GAAP or an indication of our cash flows from operations determined in accordance with GAAP, a measure of our liquidity or operating performance or an indication of funds available for our cash needs. In addition, our methodology for calculating Distributable Earnings may differ from the methodologies employed by other companies to calculate the same or similar supplemental performance measures; therefore, our reported Distributable Earnings may not be comparable to the distributable earnings as reported by other companies. Management believes that Adjusted Book Value per Common Share is a more meaningful measure of our capital adequacy than book value per common share because it excludes the unaccreted purchase discount resulting from the Merger that will be accreted into income over the remaining term of the respective loans acquired in the Merger. Our methodology for calculating Adjusted Book Value per Common Share may differ from the methodologies employed by other companies to calculate the same or similar supplemental capital adequacy measures; therefore, our Adjusted Book Value per Common Share may not be comparable to the adjusted book value per common share reported by other companies. We elected to be taxed as a REIT under the Internal Revenue Code of 1986, as amended, effective for our 2020 taxable year. In order to maintain our qualification for taxation as a REIT, we are generally required to distribute substantially all of our taxable income, subject to certain adjustments, to our shareholders. We believe that one of the factors that investors consider important in deciding whether to buy or sell securities of a REIT is its distribution rate. Over time, Distributable Earnings may be a useful indicator of distributions to our shareholders and is a measure that is considered by our Board of Trustees when determining the amount of such distributions. We believe that Distributable Earnings provides meaningful information to consider in addition to net income and cash flows from operating activities determined in accordance with GAAP. This measure helps us to evaluate our performance excluding the effects of certain transactions, the variability of any management incentive fees that may be paid or payable and GAAP adjustments that we believe are not necessarily indicative of our current loan portfolio and operations. In addition, Distributable Earnings is used in determining the amount of base management and management incentive fees payable by us to our Manager under our management agreement. Distributable Earnings: We calculate Distributable Earnings as net income, computed in accordance with GAAP, including realized losses not otherwise included in net income determined in accordance with GAAP, and excluding: (a) the management incentive fees earned by our Manager, if any; (b) depreciation and amortization, if any; (c) non-cash equity compensation expense; (d) unrealized gains, losses and other similar non-cash items that are included in net income for the period of the calculation (regardless of whether such items are included in or deducted from net income or in other comprehensive income under GAAP), if any; and (e) one-time events pursuant to changes in GAAP and certain non-cash items, if any. Distributable Earnings are reduced for realized losses on loan investments when amounts are deemed uncollectable. Non-GAAP Financial Measures NON-GAAP FINANCIAL MEASURES AND CERTAIN DEFINITIONS RETURN TO TABLE OF CONTENTS

23 Supplemental Q3 2021 23 ON -G AA P FI NA NC IA L ME AS UR ES A ND C ER TA IN D EF IN IT IO NS Other Measures and Definitions: Adjusted Book Value: Adjusted Book Value excludes the impact of the unaccreted purchase discount resulting from the excess fair value over the purchase price of the loans held for investment acquired in the Merger. All In Yield: All In Yield represents the yield on a loan, including amortization of deferred fees over the initial term of the loan and excluding any purchase discount accretion. LTV: Loan to value ratio, or LTV, represents the initial loan amount divided by the underwritten in-place value of the underlying collateral at closing. Master Repurchase Facilities: Collectively, we refer to the master repurchase facility with UBS and the master repurchase facility with Citibank as our Master Repurchase Facilities. Maximum Maturity: Maximum Maturity assumes all borrower loan extension options have been exercised, which options are subject to the borrower meeting certain conditions. Other Measures and Definitions NON-GAAP FINANCIAL MEASURES AND CERTAIN DEFINITIONS RETURN TO TABLE OF CONTENTS