UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended December 31, 2008

Commission File Number 001-34251

MEAD JOHNSON NUTRITION COMPANY

(Exact name of registrant as specified in its charter)

| | |

| Delaware | | 80-0318351 |

(State or other jurisdiction of

incorporation or organization) | | (IRS Employer

Identification No.) |

2400 West Lloyd Expressway

Evansville, Indiana 47721-0001

(Address of principal executive offices)

Registrant’s telephone number: (812) 429-5000

Securities registered pursuant to Section 12(b) of the Act:

| | |

Title of each class | | Name of each exchange on which registered |

| Common Stock, $0.01 Par Value | | New York Stock Exchange |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ¨ No x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ¨ No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ¨ No x

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of the registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. x

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or a smaller reporting company. See definitions of “accelerated filer”, “large accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

Large accelerated filer ¨ Accelerated filer ¨ Non-accelerated filer x Smaller reporting company ¨

Indicate by check mark if the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ¨ No x

The registrant completed the initial public offering of its Class A common stock on February 17, 2009. Accordingly, there was no public market for the registrant’s common stock as of June 30, 2008, the last business day of the registrant’s most recently completed second fiscal quarter. At March 16, 2009, there were 76,844,571 shares of Class A common stock outstanding and 127,655,429 shares of Class B common stock outstanding.

DOCUMENTS INCORPORATED BY REFERENCE: NONE

TABLE OF CONTENTS

i

PART I

Our Company

Mead Johnson Nutrition Company is a global leader in pediatric nutrition with approximately $2.9 billion in net sales for the year ended December 31, 2008. We are committed to creating trusted nutritional brands and products that help improve the health and development of infants and children around the world and provide them with the best start in life. Our Enfa family of brands, includingEnfamil®infant formula, is the world’s leading brand franchise in pediatric nutrition, based on retail sales. Our comprehensive product portfolio addresses a broad range of nutritional needs for infants, children and expectant and nursing mothers. We have more than 100 years of innovation experience during which we have developed or improved many breakthrough or industry-defining products across each of our product categories. Our singular focus on pediatric nutrition and our implementation of a business model that integrates nutritional science with health care and consumer marketing expertise differentiate us from many of our competitors.

We market our portfolio of more than 70 products to mothers, health care professionals and retailers in more than 50 countries in Asia, North America, Latin America and Europe. Our two reportable segments are Asia/Latin America and North America/Europe, which comprised 52.6% and 47.4%, respectively, of our net sales for the year ended December 31, 2008. See “Item 8. Financial Statements—Note 16. Segment Information.” For the year ended December 31, 2008, 61.5% of our net sales were generated in countries outside of the United States.

We believe mothers and health care professionals associate the Mead Johnson name and the Enfa family of brands with quality, science-based pediatric nutrition products. We believe the strength of our brands allows us to create and maintain consumer loyalty across our product portfolio and stages of pediatric development.

The two principal product categories in which we operate are infant formula and children’s nutrition, which represented 67.0% and 29.7% of our net sales for the year ended December 31, 2008, respectively.

Our History

Mead Johnson was founded in 1905, and we introducedDextri-Maltose®, our first infant formula product, in 1911. Over the next several decades, we built upon our leadership in science-based nutrition, introducing many innovative infant feeding products while expanding into vitamins, pharmaceutical products and nutrition. During the course of our history, we have expanded our operations into geographies outside of the United States, including Europe, Asia and Latin America. Throughout our history, our deeply-held commitment to support breastfeeding and our commitment to improve the health and development of infants and children around the world have been hallmarks of our organization. In 1967, we became a wholly owned subsidiary of Bristol-Myers Squibb Company (with its subsidiaries, BMS).

In February 2009, we consummated an initial public offering of 34.5 million shares of our Class A common stock. BMS beneficially owns 127,655,429 shares of our Class B common stock (representing 100% of the outstanding shares of Class B common stock) and 42,344,571 shares of our Class A common stock (or approximately 55.1% of the outstanding shares of Class A common stock). Each share of Class B common stock has 10 votes per share and each share of Class A common stock has one vote per share. The shares of Class B common stock are convertible into shares of Class A common stock on a one-for-one basis. As a result, BMS’s share ownership represents 83.1% of our outstanding stock, with 97.5% of the combined voting power of our capital stock. Due to its level of ownership, BMS has the ability to exercise substantial control and influence over our management and affairs.

1

Our Brands

The Mead Johnson name has been associated with science-based nutritional products for more than 100 years. In addition to the Mead Johnson name, our products are marketed around the world under brands that we have developed through our global sales and marketing efforts.

Enfa Family of Brands

The Enfa family of brands includes several of the world’s leading infant formula and children’s nutrition brands. We have positioned the Enfa family of brands as providing unique, clinically supported health and developmental benefits. The Enfa family of brands features products that include DHA and ARA, which support brain, visual and nervous system development. Our Enfa family of brands, includingEnfamil® infant formula, which accounted for 61.0 % of our net sales for the year ended December 31, 2008, is the world’s leading brand franchise in pediatric nutrition, based on retail sales.

Building upon the strength of our brand equity, we have extended the Enfa family of brands into the fast-growing children’s nutrition category. We believe we have enhanced consumer retention by creating links between age groups and leveraging brand loyalty. Additionally, the use of the Enfa prefix in our prenatal nutrition products (such asEnfaMama A+®) reinforces the scientific basis, quality and innovation that these products hold in common with our core pediatric nutrition line.

We consistently promote the brand through our global sales and marketing operations. Our studies show mothers and health care professionals often associate the Enfa family of brands with science, superior nutrition, quality and good value. Mothers often describe the Enfa family of brands as science-based, sophisticated, trustworthy, reliable and comforting. Additionally, health care professionals frequently comment on our professional and innovative approach to nutrition science.

Complementary Brands

In addition to the Enfa family of brands, we market several other powerful brands on a local, regional or global basis. These brands complement the Enfa family of brands portfolio and are designed to meet the nutritional needs of broad consumer populations (such as ChocoMilk® andCal-C-Tose®) or the specific nutritional needs of infants under the supervision of health care professionals (such asNutramigen®).

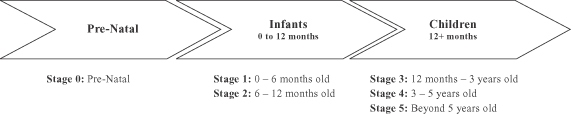

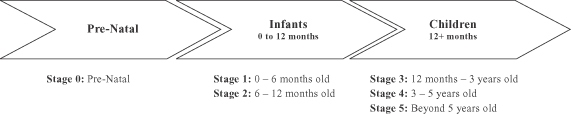

Stages of Development

Generally, there are five stages of pediatric development and we produce different products for each of these stages. The stages of development are illustrated below:

In the United States, our business is focused on the infant formula category (Stages 1 and 2). However, outside of the United States, we market both infant formula products (Stages 1 and 2) and children’s nutrition products designed for the changing nutritional needs of growing toddlers and children (Stages 3, 4 and 5). This allows us to take advantage of brand loyalty developed in Stages 1 and 2 to retain consumers as their children grow older.

2

Our Products

Our pediatric nutrition products are grouped by category of feeding: (1) infant formula products, (2) children’s nutrition products and (3) other products. Infant formula, children’s nutrition and other product sales comprised approximately 67.0%, 29.7% and 3.3% of our net sales for the year ended December 31, 2008 respectively.

Infant Formula

General

Our infant formula products include formulas for routine feeding and mild intolerance as well as specialty formula products, including formulas for severe intolerance, formulas for premature and low birth weight infants and medical nutrition products. The table below illustrates our key infant formula brands and products:

| | | | |

ROUTINE INFANT FORMULA | | ROUTINE FORMULA FOR

COMMON FEEDING PROBLEMS | | SPECIALTY FORMULAS |

Stage 1 • Enfamil LIPIL® • Enfalac A+® • Enfamil Premium® Stage 2 • Enfamil NEXT STEP LIPIL® • Enfapro A+® • Enfapro Premium® | | Many available in stages 1 and 2 • Enfamil Gentlease®: for gas/fussiness • Enfamil ProSobee®: soy formula • Enfamil LactoFree®: for lactoseintolerance • Enfamil A.R.®: for anti-regurgitation • Enfamil®HA: for infants with milk protein allergy | | Many available in stages 1 and 2 • Nutramigen LIPIL®: for severe protein sensitivity • Nutramigen AA®: for multiple food allergies • Pregestimil®: for fat malabsorption • Enfamil Premature®: for premature infants |

Routine Infant Formula

We design routine infant formula as a breast milk substitute for healthy, full-term infants without special nutritional needs both for use as the infant’s sole source of nutrition and as a supplement to breastfeeding. We endeavor to bring routine infant formula closer to breast milk. We also provide products within our routine formula line for healthy full-term infants who experience common feeding problems with symptoms such as mild spit-up, fussiness or gas.

Each product is referred to as a “formula”, as it is formulated for the specific nutritional needs of an infant of a given age. Generally, routine infant formula has the following four main components: (1) protein from cow’s milk that is processed to have a profile similar to human milk, (2) a blend of vegetable fats (including DHA/ARA) to replace bovine milk fat in order to better resemble the composition of human milk, (3) a carbohydrate, generally lactose from cow’s milk and (4) a vitamin and mineral “micronutrient” pre-mix that is blended into the product to meet the specific needs of the infant at a given age. Patterned after breast milk, which changes composition to meet the infant’s changing nutritional needs, we produce two stages of infant formula. Stage 1 formula is consumed by newborn infants up to six months of age, and Stage 2 formula is generally consumed by infants aged from six to twelve months. Our most prominent product form around the world is milk-based powder, but we also produce several infant formulas in ready-to-use and concentrated liquid form for sale in the United States and Canada.

We market the same product under different names in different regions, based on regional marketing strategies and regional brand recognition. For example, our premium Stage 1 infant formula containing DHA and ARA is sold under the brandsEnfamil LIPIL® in the United States,Enfamil Premium® in Latin America andEnfamil A+®/Enfalac A+® in Asia and Europe. We market all of our routine infant formulas for mild intolerance such asGentlease andProsobee® under the Enfa family of brands name. In parts of Asia, Latin America and Europe, we use the nameEnfapro for our Stage 2 products.

3

Routine infant formula products comprised 86.1%, 86.1% and 86.0% of our infant formula net sales for the years ended December 31, 2008, 2007 and 2006, respectively.

Specialty Formulas

Our specialty formulas include: (1) formulas for severe intolerance, (2) formulas for premature and low birth weight infants and (3) medical nutrition products. Specialty infant formula products comprised 13.9%, 13.9% and 14.0% of our infant formula net sales for the years ended December 31, 2008, 2007 and 2006, respectively.

Formulas for Severe Intolerance

We design formulas for severe intolerance to be used on the specific recommendation and under the supervision of a doctor. We specially formulate these products for use by infants displaying symptoms of certain conditions or diagnosed with special medical needs.

Nutramigen® infant formula was the first infant formula to include protein hydrolysate in the United States. This ingredient is easier for infants with severe intolerance to digest because its protein is extensively hydrolyzed (or broken down into peptides, a process that would otherwise be performed in the infant’s stomach). We designedNutramigen® infant formula for use by infants with severe milk protein allergies.Nutramigen®with LGG infant formula is a variant ofNutramigen® we market in Europe. LGG is a probiotic ingredient that has been associated with reduced incidence of infant atopic dermatitis, a non-contagious skin disease characterized by chronic inflammation of the skin, resulting from an allergy to cow’s milk.Nutramigen AA® infant formula is an amino acid formula we formulated with fully broken-down proteins which can be consumed without the need for digestion of the protein. We have designed this product for infants who experience a severe allergy to cow’s milk or multiple other food allergies.Pregestimil® infant formula is a variation of theNutramigen® formulation designed mainly for fat malabsorption. It contains medium chain triglycerides oil instead of fat.

Formulas for Premature and Low Birth Weight Infants

We also design products for premature and low birth weight infants to meet these infants’ unique needs under the supervision of a doctor, most often in the hospital. Typically, such infants need extra assistance obtaining the requisite nutrition. They require a higher density of nutrients and calories because they cannot take in enough volume of breast milk or routine infant formula. We designedEnfamil® Human Milk Fortifier product as a supplement to a mother’s breast milk that improves nutritional density.EnfaCare® infant formula, another of our products, is a hypercaloric formula available at retail for premature babies when they are able to go home. In addition,Enfamil Premature® is an infant formula used primarily in the hospital.

Medical Nutrition

We also produce medical foods, or foods for special medical purposes, for nutritional management of individuals with rare, inborn errors of metabolism such as maple syrup urine disease (Mead Johnson BCAD®) and phenylketonuria (Mead Johnson Phenyl-Free®). Category 1 products are intended for infants and young children from zero to three years of age and Category 2 products are suitable for children and adults. We produce approximately 20 formulas targeted at specific disorders for use under the direct and continuous supervision of a physician. We market these medical nutrition products under the Mead Johnson brand name.

Children’s Nutrition Products

Children’s nutrition products are designed to provide children with enhanced nutrition. Our children’s nutrition business is present primarily in Asia, Latin America and Europe. We separate our children’s nutrition

4

products into two categories: (1) Enfa branded children’s nutrition products and (2) other children’s nutrition products. The table below illustrates our key children’s nutrition products:

| | |

ENFA BRANDED CHILDREN’S NUTRITION PRODUCTS | | OTHER CHILDREN’S NUTRITION PRODUCTS |

Stage 3 • Enfagrow A+® • Enfagrow Premium® Stage 4 • Enfakid A+® Stage 5 • EnfaSchool A+® | | Many available in stages 3, 4 and 5 • Sustagen KID®: nutritious powdered milk for picky eaters • Lactum®: nutritious powdered milk for picky eaters • ChocoMilk®: nutritious milk modifier • Cal-C-Tose®: nutritious milk modifier |

Enfa Branded Children’s Nutrition Products

Outside of the United States, we market children’s nutrition products under the Enfa family of brands. We design these products to meet the changing nutrition needs of children at different stages of development. We offer products at Stages 3, 4 and 5 that are designed for children’s nutritional needs at one to three years of age, three to five years of age and beyond five years of age, respectively. These products are not breast milk substitutes and are not designed for use as the sole source of nutrition but instead are designed to be a part of a child’s appropriate diet. Our use of the Enfa prefix allows for a consistent equity across Stages 3 and 4, with products such asEnfagrow®offered at Stage 3 andEnfakid®offered at Stage 4. Enfa branded children’s nutrition products comprised 56.1%, 53.4% and 53.4% of our children’s nutrition products sales for the years ended December 31, 2008, 2007 and 2006, respectively.

Other Products

We also produce a range of other products, including pre-natal and post-natal nutritional supplements for expectant and nursing mothers, includingExpecta LIPIL®, EnfaMama A+®andEnfamil Poly-Vi-Sol®.Our products for expectant or nursing women contain vitamin supplements that provide the developing fetus or breastfed infant with an increased supply of DHA for brain, visual and nervous system development. These products also supplement the mother’s diet by providing either DHA or ARA with increased proteins, as well as 24 vitamins and minerals. Our pediatric vitamin products, such asEnfamil Poly-Vi-Sol®,provide a range of benefits for infants, including multivitamins and iron supplements. These products comprised 3.3%, 3.4% and 4.3% of our net sales for the years ended December 31, 2008, 2007 and 2006, respectively.

The Special Supplemental Nutrition Program for Women, Infants and Children (“WIC”)

The WIC program is a U.S. Department of Agriculture (“USDA”) program created to provide nutritious foods, nutrition education and referrals to health care professionals and other social services to those considered to be at nutritional risk, including low-income pregnant, postpartum and breastfeeding women and infants and children up to age five. It is estimated that approximately 51% of all infants born in the United States during the 12-month period ending December 31, 2008 benefited from the WIC program. The USDA program is administered individually by each state.

Participation in the WIC program is an important part of our U.S. business based on the volume of infant formula sold under the program. Our financial results reflect net WIC sales, after taking into account the rebates we paid to the state WIC agencies, which represented approximately 12% of our U.S. net sales in 2008.

WIC Eligibility and Participation

The WIC program is available in all 50 U.S. states, 34 Indian Tribal Organizations, American Samoa, District of Columbia, Guam, Commonwealth Islands of the Northern Marianas, Puerto Rico and the U.S. Virgin Islands. To be eligible to participate in WIC, one must: (1) be a pregnant or postpartum woman or a child less than five years of

5

age, (2) be at “nutrition risk”, as determined by a health care professional and (3) meet certain income requirements. Under the WIC eligibility guidelines, families who are at or below 185% of U.S. poverty level may participate (with some adjunct eligibility for families qualifying for other federal aid programs).

Process

Most state WIC programs provide vouchers that participants use at authorized food stores to obtain the products covered by the program, including infant formula. Each state WIC agency is responsible for authorizing stores to accept WIC vouchers. Nearly 49,000 stores currently are authorized to accept WIC vouchers.

State WIC agencies enter into contracts with manufacturers, pursuant to which the state agency provides mothers with vouchers for a single manufacturer’s brand of infant formula and, in return, the manufacturer gives the state agency a rebate for each can of infant formula purchased by WIC participants. The manufacturer’s brand of infant formula provided by WIC varies from state to state depending on which manufacturer received the particular state’s exclusive contract.

Retailers purchase infant formula directly from the manufacturer, paying the manufacturer’s published wholesale price. Mothers redeem the vouchers received from the WIC agency for infant formula at authorized retailers. The retailer is then reimbursed the full retail price by the WIC agency for redeemed vouchers. On a monthly basis, each state WIC agency invoices the contracted manufacturer for an amount equal to the number of cans of infant formula redeemed by the agency and paid to retailers during the month multiplied by the agreed rebate per can.

Contracts

The bid solicitation process is determined by each state’s procurement laws, but the process is relatively standardized across the WIC program. Some states form groups and hold their bid processes jointly while other states solicit bids individually. Some states split bids between separate contracts for milk- and soy-based formulas. During the bid process, each manufacturer submits a sealed bid. The manufacturer with the lowest net price, calculated as the manufacturer’s published wholesale price less the manufacturer’s rebate bid, is awarded the contract. No other factors are considered. WIC contracts are generally three years in duration with some contracts providing for extensions. Specific contract provisions can vary significantly from state to state.

Our WIC Participation

Manufacturers that choose to compete for WIC contracts must have a widely distributed infant formula brand in order to meet the requirements of the contract bidding process. As of December 31, 2008, we hold the contracts that supply approximately 41% of WIC births. A large number of WIC contracts matured in 2006 and 2007, which resulted in significant turnover in contract holdings, but a less significant change in the overall percentage of WIC births covered by each respective WIC contract holder.

6

As of December 31, 2008, we hold the exclusive WIC contract for the following states and territories:

| | |

State | | Date of Expiration(1) |

New York(2) | | June 30, 2009 |

Arkansas | | September 30, 2009 |

Indiana | | September 30, 2009 |

Mississippi | | September 30, 2009 |

Missouri | | September 30, 2009 |

Nebraska | | September 30, 2009 |

New Mexico | | September 30, 2009 |

North Carolina | | September 30, 2009 |

South Dakota | | September 30, 2009 |

Colorado | | December 31, 2009 |

California | | July 31, 2010 |

Louisiana | | September 30, 2010 |

Illinois | | January 31, 2011 |

Michigan | | November 1, 2011 |

Puerto Rico | | September 30, 2012 |

(1) | Many contracts include one or two year extension provisions. |

(2) | The New York WIC contract is split into milk and soy products. We hold the exclusive WIC contract for milk products only. |

Sales and Marketing

We conduct regional marketing in North America, Europe, Asia and Latin America within a global strategic framework focused on both mothers and health care professionals in compliance with our policy with respect to the International Code of Marketing of Breast-milk Substitutes (“International Code”). See “—Regulatory—Global Policy and Guidance—WHO”. We employ approximately 1,350 individuals worldwide as part of our health care professional sales force and approximately 550 individuals worldwide as part of our retail sales force. Our marketing activities vary from region to region depending on our market position, consumer trends and the regulatory environment. Our marketing teams seek to anticipate market and consumer trends, and attempt to capture deep consumer insight to determine strategy for brand positioning and communication, product innovation and demand-generation programs. The marketing teams work with advertising agencies to create strong marketing campaigns for health care professionals, retail sales organizations and consumers.

Health Care Professionals

Our health care professional sales force educates health care professionals about the benefits of our infant formula products in each of the countries where we market our infant formula products. Primary marketing efforts for infant formula products are directed toward securing the recommendation of the Enfa family of brands by physicians or other health care professionals. We focus on neonatal intensive care units, physicians and other health care professionals, hospital group purchasing organizations and other integrated buying organizations. We believe we have an industry-leading health care professional sales force.

Our health care professional sales force receives continuous training about our products and on customer service skills. We support health care professionals by organizing continuing medical education programs, symposia and other educational interfaces with health care professionals.

Retail Sales Organization

Our retail sales force markets our products to each of the retail channels where our products are purchased by consumers, including mass merchandisers, club stores, grocery stores, drug stores and, to a limited extent,

7

convenience stores. The size, role and purpose of our retail sales organization varies significantly from country to country depending on our market position, the consolidation of the retail trade, consumer trends and the regulatory environment. In North America, Latin America and Asia, we focus on all retail channels, while in Europe we focus only on pharmacies, with a specialized product line. In most countries, we have entered into logistics partnerships with distributors and wholesalers.

Consumers

As their children grow older, mothers play an increasing role in brand selection. We participate in a variety of marketing activities intended for mothers of older children, including print and television advertising, direct mail, online/internet and promotional programs. Our marketing is evidence-based and emphasizes our superior nutritional science. Our direct marketing efforts focus upon the targeted direct-mail and coupon distribution programs designed to reach consumers at key decision points starting from the pre-natal period. Direct mail includes educational materials as well as discount coupons.

In the United Statesour Enfamil Family Beginnings® program provides new or prospective mothers with many resources to help them with their newborns, including free samples, instant redeemable checks and nutritional and developmental information post-birth. The program also includes post-natal magazines used to better inform mothers on nutritional and developmental topics and an e-mail initiative that periodically provides pertinent updates to program participants. The marketing materials at each of these stages are designed to develop interest in our products with respect to mothers’ current and future needs in order to create brand loyalty. The program is focused primarily on non-WIC mothers.

Global Supply Chain

We manage sourcing, manufacturing and distribution through our fully-integrated global supply chain. We operate in-house production facilities at seven different locations around the world and additionally utilize third-party manufacturers for a portion of our requirements. We use our in-house production facilities for the manufacture of products distributed throughout Europe and Latin America. We utilize a third-party manufacturer in addition to in-house facilities for products distributed throughout North America. Our in-house production facilities and third-party manufacturers provide certain material for finishing products in China, the Philippines and Thailand for distribution throughout Asia. In addition, our liquid manufacturing facility at Evansville, Indiana, manufactures and packages liquid products that are distributed worldwide and also manufactures adult nutritional products for a third party. We believe our global manufacturing facilities and third-party supply chain will continue to meet our worldwide demand.

Locations

Our in-house manufacturing and finishing facilities are located in the United States, Mexico, the Netherlands, China, the Philippines and Thailand. See “Item 2. Properties” for a description of our global manufacturing facilities.

As the production process advances, regional or sub-regional teams support the global team, overseeing manufacturing activities such as the finishing of our products. Our four regional quality departments perform regional and manufacturing site quality control and assurance. These departments focus on regulatory requirements, food safety, continuous quality improvement, third-party compliance and ingredient supplier manufacturing operations.

Suppliers

We generally enter into long-term supplier agreements. We have over 30 suppliers, through which we source approximately 80% of our materials. Through these suppliers, we obtain key raw materials (such as dairy, agricultural oil and agricultural products) and primary packaging materials (such as cans). Our suppliers also provide us with minor raw materials and secondary packaging materials (such as cardboard and shipping cases).

8

We procure key raw materials and primary packaging materials on a global basis. Certain raw materials, while managed and contracted on a global basis, are subject to regional and local variations in price under the terms of the supply agreement. For example, milk prices vary at the local level around the world partly due to government pricing regulation. Dairy products, consisting primarily of milk powders, non-fat dry milk, lactose and whey protein concentrates, accounted for approximately 43.0% of our global expenditures for materials in 2008.

Distribution

We manage our distribution networks locally with regional oversight. We generally enter into distribution agreements with third-party logistics providers and distributors and maintain a small staff at the local or regional level to track performance and implement initiatives.

Customers

Our products are sold principally to wholesale and retail customers, both nationally and internationally. One of our customers, Wal-Mart Stores, Inc. (including sales to Sam’s Club), accounted for approximately 13.0%, 15.2%, and 15.8% of our gross sales for the years ended December 31, 2008, 2007 and 2006, respectively.

Competition

We compete in two primary categories, infant formula and children’s nutrition. The competitive landscape in each category is similar around the world, as the majority of the large global players are active in these categories. Our main global competitors for sales of infant formula and children’s nutrition products are Nestlé S.A., Abbott Laboratories, Groupe Danone and Wyeth. Wyeth does not compete with us in the United States. We also compete against significant local competitors in Asia and Europe.

Many other companies, including manufacturers of private label, store and economy brand products, manufacture and sell one or more products that are similar to those marketed by us. We believe sources of competitive advantage include product quality and efficacy, brand identity, image and associated value, broad distribution capabilities and consumer satisfaction. Significant expenditures for advertising, promotion and marketing are generally required to achieve acceptance of products among consumers and health care professionals.

Research and Development

During the past six years, we have nearly doubled our research and development expenditures and the number of individuals within our research and development department. We have three main research and development facilities. Our research and development organization consists of approximately 300 people many of whom have extensive industry experience and advanced educational backgrounds.

With respect to infant formula, we organize our research and development on a global scale because these science-based products address nutritional needs that are broadly common around the world. With respect to children’s nutritional products, we organize our research and development on a more regional basis to incorporate geographic-specific consumer behaviors and preferences.

We are in the process of implementing a global formulation management system to support our innovative portfolio management and product development process. We expect this system will provide significant benefits throughout the product development and manufacturing process. In addition, we are making a significant investment in a pilot plant that will allow us to accelerate product development.

We also have strong external development relationships that complement our internal research and development capabilities. We manage our research and development activities in collaboration with leading scientists and institutes around the world and we have an active portfolio of projects involving commercial

9

technology suppliers. We believe this approach allows us to be at the forefront of scientific and technological developments relevant for pediatric nutrition. Research and development expense was $72.8 million, $67.2 million and $62.0 million in 2008, 2007 and 2006, respectively.

Intellectual Property

Patents

We own or license approximately 22 active U.S. and 120 non-U.S. patents and have 43 U.S. and 311 non-U.S. patent applications pending as of December 31, 2008.

Trademarks

We file and maintain our trademarks in those countries in which we have, or desire to have, a business presence. We hold an extensive portfolio of trademarks across our key geographies. We maintain more than 5,000 trademark registrations and applications in more than 140 countries worldwide.

Regulatory

We are subject to the laws and regulations in each country in which we market our products. We have proven processes, systems and resources in place to manage the current regulatory requirements and to participate proactively in the shaping of future regional, country and global policy, guidance and regulations.

United States Food and Drug Administration

The main regulatory body in the United States is the U.S. FDA. The U.S. FDA’s Center for Food Safety and Applied Nutrition is responsible for the regulation of infant formula. The Office of Nutritional Products, Labeling, and Dietary Supplements (“ONPLDS”) has program responsibility for infant formula while the Office of Food Additive Safety (“OFAS”) has program responsibility for food ingredients and packaging. The ONPLDS evaluates whether the infant formula manufacturer has met the requirements under the Federal Food, Drug and Cosmetic Act (“FFDCA”) and consults with the OFAS regarding the safety of ingredients in infant formula and of packaging materials for infant formula.

All manufacturers of pediatric nutrition products must begin with safe food ingredients, which are either generally recognized as safe or approved as food additives. The specific requirements for infant formula are governed by the Infant Formula Act of 1980, as amended (“Formula Act”). The purpose of the Formula Act is to ensure the safety and nutrition of infant formulas, including minimum, and in some cases, maximum levels of specified nutrients.

Once an infant formula product is formulated, the manufacturer must provide regulatory agencies assurance of the nutritional quality of that particular formulation before marketing the infant formula. The U.S. FDA has established requirements for certain labeling, nutrient content, manufacturers quality control procedures (to assure the nutrient content of infant formulas), as well as company records and reports. A manufacturer must notify the U.S. FDA 90 days before the first processing of any infant formula that differs fundamentally in processing or in composition from any previous formulation produced by the manufacturer. The U.S. FDA currently is finalizing incremental good manufacturing practices, quality control procedures, quality factors, notification requirements, and reports and records, for the production of infant formulas.

In addition, as part of its responsibility to implement the provisions of the FFDCA, the U.S. FDA continuously monitors infant formula products. The FFDCA requires infant formula manufacturers to test product composition during production and shelf-life, to keep records on production, testing and distribution of each batch of infant formula and to use good manufacturing practices and quality control procedures. In addition,

10

the FFDCA requires infant formula manufacturers to maintain records of all complaints, some of which are reviewed to reveal the possible existence of a hazard to health. The U.S. FDA conducts yearly inspections of all facilities that manufacture infant formula. The U.S. FDA also inspects new facilities during early production runs. As part of the inspection, the U.S. FDA collects and analyzes samples of infant formula.

Outside of the United States

Country-specific regulatory laws have provisions that include requirements for certain labeling, nutrient content and manufacturers quality control procedures (to assure the nutrient content of infant formulas), as well as company records and reports. With the exception of the European Union, most other countries’ regulatory agencies have not promulgated specific requirements for the testing of new and reformulated infant formulas. Other countries will generally refer to the U.S. FDA, European Union or the WHO in establishing standards and regulations for infant formulas.

Global Policy and Guidance

WHO

The WHO is the directing and coordinating authority for health within the United Nations system. It is responsible for providing leadership on global health matters, shaping the health research agenda, setting norms and standards, articulating evidence-based policy options, providing technical support to countries and monitoring and assessing health trends.

Many Member States of the WHO adopted the International Code 26 years ago with the aim to protect, promote and support appropriate infant and young child feeding practices. Countries have taken variable action to enact legislation based on the guidance of the International Code. In 1983, we believe we were the first U.S. infant formula manufacturer to adopt the International Code in developing countries and develop a specific set of marketing guidelines. While the International Code is not international law, it is our policy to comply with all applicable regulations and International Code guidance in developing countries. In developed countries such as the United States and Canada, we comply with those countries’ laws and regulations.

CODEX

The CODEX is the publication of internationally recognized standards, codes of practice, guidelines and other recommendations relating to infant formula and food production. These texts are developed and maintained by the CODEX Commission, a body that was established in 1963 by the WHO. In 2007, new comprehensive and more restrictive infant formula standards were published by CODEX. It is usual practice for countries in Central America, Latin America, Africa and Asia to incorporate CODEX standards directly into national law. We maintain material compliance with all country law and with new CODEX standards where national regulatory requirements have not yet been enacted.

Environmental, Health, and Safety

Our facilities and operations are subject to various environmental, health, and safety laws and regulations in each of the jurisdictions in which we operate. Among other things, these requirements regulate the emission or discharge of materials into the environment, the use, management, treatment, storage and disposal of solid and hazardous substances and wastes, the control of combustible dust, the reduction of noise emissions and fire and explosion risks, the cleanup of contamination and the prevention of workplace exposures and injuries. Pollution controls and various permits and programs are required for many of our operations. Each of our global manufacturing facilities undergoes periodic internal audits relating to environmental, health, and safety requirements and we incur operating and capital costs to improve our facilities or maintain compliance with applicable requirements on an ongoing basis. If we violate or become subject to liabilities under environmental,

11

health, and safety laws and regulations, including requirements under the permits and programs required for our operations, we could incur, among other things, substantial costs (including civil or criminal fines or penalties or clean-up costs), third-party claims for property damage or personal injury, or requirements to install additional pollution control or safety equipment.

From time to time, we may be responsible under various state, Federal and foreign laws, including the U.S. Comprehensive Environmental Response, Compensation, and Liability Act (“CERCLA”), for certain costs of investigating and/or remediating contamination at our current or former sites and/or at waste disposal or reprocessing facilities operated by third parties. Liability under CERCLA and analogous state or foreign laws may be imposed without regard to knowledge, fault or ownership at the time of the disposal or release. Most of our facilities have a history of industrial operations, and contaminants have been detected at some of our facilities. We also have been named as a “potentially responsible party”, or are involved in investigation and remediation, at three third-party disposal sites. As of December 31, 2008, management believes that those future site costs that were probable and reasonably estimable, as well as any related accruals, are not material to us.

We are also occasionally a party to environmental proceedings and other matters. For example, the U.S. Environmental Protection Agency (“EPA”) investigates industrial and commercial facilities throughout the United States that use refrigeration equipment containing ozone-depleting substances (“ODS”) and is responsible for enforcing compliance with regulations governing the prevention, service and repair of leaks (“ODS requirements”). In 2004, the EPA sent Mead Johnson a request for information regarding compliance with ODS requirements at our facility in Evansville, Indiana. We responded to the request in June 2004, and, as a result, identified potential violations at the Evansville facility. In addition, BMS performed a voluntary corporate-wide audit at all of its facilities, including the Mead Johnson facilities, in the United States that use ODS-containing refrigeration equipment. The audit report that BMS submitted to the EPA in November 2004 identified potential violations of ODS requirements at several facilities, including two potential administrative violations of ODS requirements at our Zeeland, Michigan facility. In July 2008, BMS (acting on behalf of BMS and Mead Johnson) and EPA entered into a proposed consent decree, which requires BMS to retire or retrofit by July 2009 certain industrial refrigeration equipment at five facilities, including Evansville, Indiana. Under the proposed consent decree, BMS is also required to pay $127,000 in civil penalties, a de minimis portion of which is attributable to Mead Johnson and will be paid by BMS. Mead Johnson believes that it does not have any material obligations remaining under the proposed consent decree. It is possible that we may have additional obligations, or additional costs may be imposed on us, if the proposed consent decree does not become final or is otherwise modified before being finalized by the court.

We are not aware of any pending litigation or significant financial obligations or liabilities arising from current or former operations or properties that are likely to have a material adverse impact on our business, financial position or results of operations. Liabilities or obligations, which could require us to make significant expenditures, could arise in the future, however, as the result of, among other things, changes in, or new interpretations of, existing laws, regulations or enforcement policies, claims relating to on- or off-site contamination, or the imposition of unanticipated investigation or cleanup obligations.

Insurance

Our business involves an inherent risk of product liability and any claims of this type could have an adverse impact on us. We will take what we believe are appropriate precautions, primarily self-insurance combined with product liability insurance coverage, to provide adequate coverage for possible product liability claims. Though our insurance coverage and cash flows have been adequate to provide for liability claims in the past, product liability claims could exceed our insurance coverage limits and cash flows, and insurance may not be available on commercially reasonable terms or at all. We evaluate our insurance requirements on an ongoing basis to ensure we maintain adequate levels of coverage.

12

Employees

As of December 31, 2008, we employed approximately 5,300 people worldwide. Our manufacturing workforces at Zeeland, Michigan; Evansville, Indiana; Guangzhou, China and Chonburi, Thailand are not unionized. The manufacturing workforce at Delicias, Mexico is unionized and covered by a collective bargaining agreement which becomes subject to salary and benefits review on March 31, 2009, and to total contract review on March 31, 2010. The manufacturing workforce and the non-supervised sales force at Makati, Philippines are unionized and covered by a collective bargaining agreement, which expires on December 31, 2010. In addition, several of our workforces in Europe have works council representation. We believe our employee relations are satisfactory.

Available Information

The company’s internet web site address iswww.meadjohnson.com. On its web site, the company makes available, free of charge, its annual, quarterly and current reports, including amendments to such reports, as soon as reasonably practicable after the company electronically files such material with, or furnishes such material to, the SEC. Stockholders and other interested parties may request email notification of the posting of these documents through the Investors section of our web site.

13

In addition to the other information in this Annual Report, any of the factors described below could significantly and negatively affect the company’s business, prospects, financial condition or operating results, which could cause the trading price of the company’s Class A common stock to decline.

Risks Related to Our Business

Our success depends on sustaining the strength of our brands, particularly our Enfa family of brands.

The Enfa family of brands accounted for 61.0% of our net sales for the year ended December 31, 2008. The willingness of consumers to purchase our products depends upon our ability to offer attractive brand value propositions. This in turn depends in part on consumers attributing a higher value to our products than to alternatives. If the difference in the value attributed to our products as compared to those of our competitors narrows, or if there is a perception of such a narrowing, consumers may choose not to buy our products. If we fail to promote and maintain the brand equity of our products across each of our markets, then consumer perception of our products’ nutritional quality may be diminished and our business could be materially adversely affected. Our ability to maintain or improve our brand value propositions will impact whether these circumstances will result in decreased market share and profitability.

We may experience liabilities or negative effects on our reputation as a result of real or perceived quality issues, including product recalls, injuries or other claims.

Whether real or perceived, contamination, spoilage or other adulteration, product misbranding or product tampering could require us to recall products. From time to time we have experienced recalls of our products. While such recalls have not been material to our business on a global level in the past, we cannot assure you that such material product recalls will not occur in the future. We may also be subject to liability if our products or operations violate or are alleged to violate applicable laws or regulations or in the event our products cause, or are alleged to cause, injury, illness or death.

Powder milk products are not sterile. A substantial portion of our products must be prepared and maintained according to label instruction to retain their flavor and nutritional value and avoid contamination or deterioration. Depending on the specific type of product, a risk of contamination or deterioration may exist at each stage of the production cycle, including the purchase and delivery of raw food materials, the processing and packaging of food products and upon use and handling by health care professionals, hospital personnel and consumers. In the event that certain of our products are found, or are alleged, to have suffered contamination or deterioration, whether or not such products were under our control, our brand reputation and business could be materially adversely affected.

Whether real or perceived, reports or allegations of inadequate product quality control with respect to other manufacturers of pediatric nutrition products also could adversely impact sales of our products. For example, although the U.S. FDA currently permits the use of bisphenol-A (“BPA”) in food packaging materials, including polycarbonate baby bottles and some of our infant formula packaging, recent public reports and allegations regarding the potential health hazards of BPA, and several lawsuits against baby bottle manufacturers and infant formula manufacturers (including us) related to BPA content, could contribute to a perceived safety risk about our products and adversely impact sales or otherwise disrupt our business. Further, the U.S. FDA or other regulatory authorities could prohibit the use of BPA in the future. In addition, in November 2008 and December 2008, the U.S. FDA released test results that identified extremely low trace levels of melamine and cyanuric acid in infant formula produced by U.S. manufacturers. The U.S. FDA has found no melamine in our products and only a trace amount of cyanuric acid, which the U.S. FDA believes does not raise public health concerns, was found in a sampling of our products. Chinese authorities found significant levels of melamine in Chinese dairy used in certain infant formula products of other manufacturers, which led to the deaths of several infants in September 2008. We do not use dairy

14

or protein-containing raw ingredients from China at any of our manufacturing sites and we have not been adversely impacted by these events in China thus far. Events such as these may create a perception of contamination risk among consumers with respect to all products in our industry.

In addition, we advertise our products and could be the target of claims relating to false or deceptive advertising under foreign laws and U.S. Federal and state laws, including the consumer protection statutes of some states. A significant product liability or other legal claim or judgment against us or a widespread product recall may negatively impact our profitability. Even if a product liability or consumer fraud claim is unsuccessful or is not merited or fully pursued, the negative publicity surrounding such assertions regarding our products or processes could materially adversely affect our reputation and brand image and therefore our business.

We are subject to numerous governmental regulations, and it can be costly to comply with these regulations. Changes in governmental regulations could harm our business.

As a producer of pediatric nutrition products, our activities are subject to extensive regulation by governmental authorities and international organizations, including rules and regulations with respect to the environment, employee health and safety, hygiene, quality control and tax laws. It can be costly to comply with these regulations and to develop compliant product processes. Our activities may also be subject to all kinds of barriers or sanctions imposed by countries or international organizations limiting international trade and increasingly dictating the specific content of our products and, with regard to the protection of consumer health and safety, limiting information and advertising about the health benefits of products that we market. In addition, regulatory changes or decisions that restrict the marketing, promotion and availability of our products, continued access to health care professionals, the ability to include genetically modified organisms in our products, as well as the manufacture and labeling of our products, could materially adversely affect our business. For example, regulations in the Philippines require governmental review of all advertisements for products intended for children under the age of two. In addition, certain activists, along with governmental and quasi-governmental entities, such as the United Nations Childrens’ Fund (“UNICEF”), have advocated against the marketing and sale of pediatric nutrition products. These efforts could result in increased regulatory restrictions on our activities in the future. Our activities could be materially adversely affected by any significant changes in such regulations or their enforcement. Our ability to anticipate and comply with evolving global standards requires significant investment in monitoring the global regulatory environment and we may be unable to comply with changes in regulation restricting our ability to continue to operate our business or manufacture, market or sell our products.

Commodity price increases will increase our operating costs and may reduce our profitability.

Commodity prices impact our business directly through the cost of raw materials used to make our products (such as skim milk powder, lactose and whey protein concentrate), the cost of inputs used to manufacture and ship our products (such as crude oil and energy) and the amount we pay to produce or purchase packaging for our products (such as cans, pouches, cardboard and plastic). Commodities such as these are susceptible to price volatility caused by conditions outside of our control, including fluctuations in commodities markets, currency fluctuations and changes in governmental agricultural programs. Our dairy costs have increased significantly over the past two years. If, as a result of consumer sensitivity to pricing or otherwise, we are unable to increase our prices to offset the increased cost of commodities, we may experience lower profitability and we may be unable to maintain historical levels of productivity.

Our business is particularly vulnerable to commodity price increases in Asia, the fastest growing region in the pediatric nutrition industry. Commodity price increases in Asia could reduce our sales and limit our ability to pursue our growth strategy in that region. We employ various purchasing and pricing contract techniques in an effort to minimize commodity price volatility. Generally, these techniques include setting fixed terms with suppliers such as incorporating clauses setting forth unit pricing that is based on an average commodity price over a corresponding period of time. If we fail to manage our commodity price exposure adequately, our business may be materially adversely affected.

15

Our profitability may suffer as a result of competition in our markets.

The pediatric nutrition industry is intensely competitive. Our primary competitors, including Nestlé S.A., Abbott Laboratories, Groupe Danone and Wyeth, all have substantial financial, marketing and other resources. We compete against large global companies, as well as regional and local companies, in each of the regions in which we operate. In most product categories, we compete not only with other widely advertised branded products, but also with private label, store and economy brand products that are generally sold at lower prices. Competition in our product categories is based on the following factors:

| | • | | brand recognition and loyalty; |

| | • | | effectiveness of marketing, promotional activity and the ability to identify and satisfy consumer preferences; |

| | • | | distribution and availability of products. |

From time to time, in order to protect our existing market share or capture increased market share, we may need to improve our brand recognition and product value proposition, and increase our spending on marketing, advertising and new product innovation. The success of marketing, advertising and new product innovation is subject to risks, including uncertainties about trade and consumer acceptance. We may also need to reduce prices for some of our products in order to respond to competitive and customer pressures and to maintain our market share. Competitive and customer pressures may restrict our ability to increase prices, including in response to commodity and other cost increases. Our business will suffer if profit margins decrease, either as a result of a reduction in prices or an increase in costs with an inability to increase prices proportionally.

Economic downturns, such as the current downturn, could cause consumers to shift their purchases from our higher-priced premium products to lower-priced products, including private label or store brands, which could materially adversely affect our business.

The willingness of consumers to purchase premium brand pediatric nutrition products depends in part on local economic conditions. In periods of economic uncertainty, consumers tend to shift their purchases from our higher-priced premium products to lower-priced products, including private label and store brand products. We believe private label and store brand product manufacturers gained market share in the United States over the past 12 months.

Turmoil in the financial markets could adversely affect our liquidity, cash flow and financial flexibility, as well as the demand for our products.

Recent turmoil in the financial markets has adversely affected economic activity and credit markets in the United States and other regions of the world in which we do business. This could have an adverse impact on our customers, distributors, suppliers, counterparties to certain financial instruments, financial service providers and other service providers. We believe that, based on our expected operating cash flows and relationship with BMS, the current lack of liquidity in the credit markets will not have a material impact on our liquidity, cash flow, or financial flexibility.

Our operations face significant foreign currency exchange rate exposure that could materially negatively impact our operating results.

We hold assets, incur liabilities, earn revenue and pay expenses in a variety of currencies other than the U.S. dollar, primarily the Chinese renminbi, the Mexican peso, the Philippine peso, the Hong Kong dollar and the

16

Euro. Because our financial statements are presented in U.S. dollars, we must translate our assets, liabilities, revenue and expenses into U.S. dollars at the then-applicable exchange rates. Consequently, increases in the value of the U.S. dollar versus these other currencies may negatively affect the value of these items in our financial statements, even if their value has not changed in their original currency. While we intend to mitigate some of this risk with hedging and other activities, our business will nevertheless remain subject to substantial foreign exchange risk from foreign currency translation exposures that we will not be able to manage through effective hedging or the use of other financial instrument approaches.

The international nature of our business subjects us to additional business risks that could cause our revenue and profitability to decline.

We operate our business and market our products internationally in more than 50 countries. For the year ended December 31, 2008 and year ended December 31, 2007, 61.5% and 56.2%, respectively, of our net sales were generated in countries outside of the United States. The risks associated with our operations outside of the United States include:

| | • | | multiple regulatory requirements that are subject to change and that could restrict our ability to manufacture, market or sell our products; |

| | • | | inflation, recession, fluctuations in foreign currency exchange and interest rates and discriminatory fiscal policies; |

| | • | | adverse tax consequences from the repatriation of cash; |

| | • | | trade protection measures, including increased duties and taxes, and import or export licensing requirements; |

| | • | | government health promotional programs intended to discourage the use of our products; |

| | • | | differing local product preferences and product requirements; |

| | • | | difficulty in establishing, staffing and managing operations; |

| | • | | differing labor regulations; |

| | • | | potentially negative consequences from changes in or interpretations of tax laws; |

| | • | | political and economic instability; |

| | • | | enforcement of remedies in various jurisdictions; |

| | • | | changes in foreign medical reimbursement policies and programs; and |

| | • | | diminished protection of intellectual property in some countries. |

These and other risks could have a material adverse effect on our business.

Our international operations are subject to political and economic risks of developing countries, and special risks associated with doing business in corrupt environments.

We operate our business and market our products internationally in more than 50 countries, and we are focusing on increasing our sales and in some cases establishing new production facilities in regions, including Asia, Latin America, India and the Middle East, which are less developed, have less stability in legal systems and financial markets, and are generally recognized as potentially more corrupt business environments than the United States, and therefore present greater political, economic and operational risks. We have in place policies, procedures and certain ongoing training of employees with regard to business ethics and many key legal requirements, such as applicable anti-corruption laws, including the U.S. Foreign Corrupt Practices Act

17

(“FCPA”), which make it illegal for us to give anything of value to foreign officials in order to obtain or retain any business or other advantages; however, there can be no assurance that our employees will adhere to our code of business ethics or any other of our policies, applicable anti-corruption laws, including the FCPA, or other legal requirements. If we fail to enforce our policies and procedures properly or maintain adequate record-keeping and internal accounting practices to accurately record our transactions, we may be subject to regulatory sanctions. If we believe or have reason to believe that our employees have or may have violated applicable anti-corruption laws, including the FCPA, or other laws or regulations, we are required to investigate or have outside counsel investigate the relevant facts and circumstances, and if violations are found or suspected could face civil and criminal penalties, and significant costs for investigations, litigation, fees, settlements and judgments, which in turn could have a material adverse effect on our business.

Sales of our products are subject to changing consumer preferences, and our success depends upon our ability to predict, identify and interpret changes in consumer preferences and develop and offer new products rapidly enough to meet those changes.

Our success depends on our ability to predict, identify and interpret the tastes, dietary habits and nutritional needs of consumers and to offer products that appeal to those preferences. If we do not succeed in offering products that consumers want to buy, our sales and market share will decrease, resulting in reduced profitability. If we are unable to predict accurately which shifts in consumer preferences will be long lasting, or to introduce new and improved products to satisfy those preferences, our sales will decline. In addition, given the variety of cultures and backgrounds of consumers in our global consumer base, we must offer a sufficient array of products to satisfy the broad spectrum of consumer preferences. As such, we must be successful in developing innovative products across our product categories.

The consolidation of our retail customers may put pressures on our profitability.

Our retail customers, such as mass merchandisers, club stores, grocery stores, drug stores and convenience stores, have consolidated in recent years and consolidation is expected to continue throughout the United States, Europe and other major markets. This consolidation has produced large, sophisticated customers with increased buying power which are more capable of operating with reduced inventories, resisting price increases and demanding lower pricing, increased promotional programs and specifically tailored products. These customers also may use shelf space currently used for our products for their private label or store brand products. Meeting demands from these customers may adversely affect our margins and, if we fail to effectively respond to these demands, our sales could decline, each of which could materially adversely affect our profitability.

We rely on third parties to provide us with materials and services in connection with the manufacturing and distribution of our products.

Unaffiliated third-party suppliers provide us with materials necessary for commercial production of our products, including certain key raw materials (such as dairy, agricultural oil and agricultural products) and primary packaging materials (such as cans). In particular, Martek Biosciences Corporation (Martek) provides us with most of the supply of DHA and ARA that we use in our products. We may be unable to manufacture our products in a timely manner, or at all, if any of our third-party suppliers, including Martek, should cease or interrupt production or otherwise fail to supply us or if the supply agreements are suspended, terminated or otherwise expire without renewal. If these suppliers are not able to supply us with the quantities of materials we need or if these suppliers are not able to provide services in the required time period, this could have a material adverse effect on our business. We also utilize third parties in several countries throughout the world to distribute our products. If any of our third-party distributors fail to distribute our products in a timely manner, or at all, or if our distribution agreements are suspended, terminated or otherwise expire without renewal, our profitability could be materially adversely affected.

18

The manufacture of many of our products is a highly exacting and complex process, and if we or one of our suppliers should encounter problems manufacturing products, our business could suffer.

The manufacture of many of our products is a highly exacting and complex process, in part due to strict regulatory requirements. Problems may arise during the manufacturing process for a variety of reasons, including equipment malfunction, failure to follow specific protocols and procedures, problems with raw materials, maintenance of our manufacturing environment, natural disasters, various contagious diseases and process safety issues. If problems arise during the production of a batch of product, that batch of product may have to be discarded. This could, among other things, lead to increased costs, lost revenue, damage to customer relations, time and expenses being spent investigating the cause and, depending on the cause, similar losses with respect to other batches or products. If problems are not discovered before the affected product is released to the market, recall and product liability costs as well as reputational damage may also be incurred. To the extent that we or one of our suppliers experience significant manufacturing problems, this could have a material adverse effect on our business.

We may experience difficulties and delays inherent in the manufacturing and selling of our products.

We may experience difficulties and delays inherent in the manufacturing and selling of our products, such as: (1) seizure or recalls of products or forced closings of manufacturing plants; (2) the failure to obtain, the imposition of limitations on the use of, or loss of, patent, trademark or other intellectual property rights; (3) our failure, or the failure of any of our vendors or suppliers, to comply with current good manufacturing practices and other applicable regulations and quality assurance guidelines that could lead to temporary manufacturing shutdowns, product shortages and delays in product manufacturing; (4) construction delays related to the construction of new facilities or the expansion of existing facilities, including those intended to support future demand for our products; (5) other manufacturing or distribution problems, including changes in manufacturing production sites and limits to manufacturing capability due to regulatory requirements, changes in types of products produced or physical limitations that could impact continuous supply; (6) availability of raw materials; and (7) restrictions associated with the transportation of goods in and out of foreign countries.

If we fail to increase our production and manufacturing capacity, we will be unable to continue to grow and our ability to produce new products, expand within our existing markets and enter into new markets will be limited.

Global growth and demand for our products has increased the utilization of our production and manufacturing facilities, including manufacturing capacity provided by third-party manufacturers and packaging capacity with respect to our products. If we are unable to successfully expand our production and manufacturing capacity, we will be unable to continue our growth and expand within our existing markets or enter into additional geographic markets or new product categories. In addition, failure to successfully expand our production and manufacturing capacity will limit our ability to introduce and distribute new products, including our existing pipeline of innovations and product improvements, or otherwise take advantage of opportunities in new and existing markets. Further, increasing our production and manufacturing facilities requires significant investment and build times. Delays in increasing capacity could also limit our ability to continue our growth and materially adversely affect our business.

Disruption of our global supply chain could materially adversely affect our business.

Our ability to manufacture, distribute and sell products is critical to our success. Damage or disruption to raw material supplies or our manufacturing or distribution capabilities due to weather, natural disaster, fire, terrorism, strikes, various contagious diseases or other reasons could impair our ability to manufacture or sell our products. Failure to take adequate steps to mitigate the likelihood or potential impact of such events, or to effectively manage such events if they occur, particularly when a product is sourced from a single location, could materially adversely affect our business.

19

Changes in WIC, or our participation in it, could materially adversely affect our business.

Participation in the WIC program is an important part of our U.S. business based on the volume of infant formula sold under the program. As of December 31, 2008, we hold the contracts that supply approximately 41% of WIC births. As a result, our business strategy includes bidding for new WIC contracts and maintaining current WIC relationships. Our failure to win bids for new contracts pursuant to the WIC program or our inability to maintain current WIC relationships could have a material adverse effect on our business. In addition, any changes to how the WIC program is administered and any changes to the eligibility requirements and/or overall participation in the WIC program could also have a material adverse effect on our business.

Our business could be harmed by a failure of our information technology, administrative or outsourcing systems.

We rely on our information technology, administrative and outsourcing systems to effectively manage our business data, communications, supply chain, order entry and fulfillment and other business processes. The failure of our information technology, administrative or outsourcing systems to perform as we anticipate could disrupt our business and result in transaction errors, processing inefficiencies and the loss of sales and customers, causing our business to suffer. In addition, our information technology, administrative and outsourcing systems may be vulnerable to damage or interruption from circumstances beyond our control, including fire, natural disasters, systems failures, security breaches and viruses. Any such damage or interruption could have a material adverse effect on our business and prevent us from paying our suppliers or employees, receiving payments from our customers or performing other information technology, administrative or outsourcing services on a timely basis.

We may face difficulties as we expand our operations into countries in which we have no prior operating experience or as we expand our operations into new product categories.

We intend to continue to expand our global footprint in order to enter into new markets. This may involve expanding into countries other than those in which we currently operate. It may involve expanding into less developed countries, which may have less political, social or economic stability and less developed infrastructure and legal systems. We also intend to expand our product portfolio by adding new product categories. As we expand our business into new countries or product categories we may encounter regulatory, personnel, technological and other difficulties that increase our expenses or delay our ability to start up our operations or become profitable in such countries or product categories. This may affect our relationships with customers, suppliers and regulators and could have a material adverse effect on our business.

Resources devoted to research and development may not yield new products that achieve commercial success.

Our ability to develop new pediatric nutrition products depends on, among other factors, our ability to understand the composition and variation of breast milk. Analyzing breast milk requires significant investment in research and development and testing of new ingredients and new production processes. We devote significant resources to investment in research and development in order gain a deep understanding of the composite ingredients of breast milk. The research and development process is expensive, prolonged and entails considerable uncertainty. Development of a new product, from discovery through testing and registration to initial product launch, typically takes between five and seven years. Each of these periods varies considerably from product to product and country to country. Because of the complexities and uncertainties associated with research and development, products that we are currently developing may not complete the development process or obtain the regulatory approvals required for us to market such products successfully. The development of new products may take longer and cost more to develop and may be less successful than we currently anticipate as a result of:

| | • | | products that may appear promising in development but fail to reach market within the expected or optimal time frame, or fail to ever reach market, for any number of reasons, including efficacy and the difficulty or excessive cost to manufacture; |

20

| | • | | failure to enter into or successfully implement optimal alliances where appropriate for the discovery and commercialization of products, or otherwise to maintain a consistent scope and variety of promising late-stage pipeline products; or |

| | • | | failure of one or more of our products to achieve or maintain commercial viability. |

We cannot assure you that any of our products currently in our development pipeline will be commercially successful.

We could incur substantial costs to comply with environmental, health, and safety laws and regulations and to address violations of or liabilities under these requirements.