VIA EDGAR AND FEDERAL EXPRESS

Division of Corporation Finance

Securities and Exchange Commission

100 F Street, NE

Washington, D.C. 20549

| Attention: | Mr. H. Christopher Owings, Assistant Director |

Mr. John Fieldsend, Attorney-Advisor

Mr. Robert W. Errett, Staff Attorney

Mail Stop 3561

| Re: | Crownbutte Wind Power, Inc. Registration Statement on Form S-l File No. 333-156467 |

Ladies and Gentlemen:

On behalf of our client, Crownbutte Wind Power, Inc., a Nevada corporation (“Crownbutte,” the “Company” or the “Registrant”), we submit the following responses to the comments of the Staff of the Securities and Exchange Commission as set forth in your letter dated January 28, 2009 (the “Comment Letter”), addressed to Timothy H. Simons, Chief Executive Officer of the Company, relating to the Registration Statement on Form S-1 filed by the Company on December 29, 2008 (the “Registration Statement”). Set forth below are the Staff’s comments, indicated in bold, together with the responses thereto by the Company.

In addition, we hereby submit via EDGAR transmission Amendment No. 1 to the Registration Statement, including certain exhibits thereto, with changes addressing the Staff’s comments as well as certain other changes. In order to expedite the Staff’s review, we have delivered separately to Messrs. Owings, Fieldsend and Errett a courtesy copy of Amendment No. 1, marked to show changes from the original Registration Statement.

Division of Corporation Finance

Securities and Exchange Commission

April 23, 2009

Page 2

General

| 1. | We note that Euromoney Institutional Investor PLC published an article dated August 29, 2008 citing your former Chief Financial Officer, Dan Gefroh, as stating that Crownbutte Wind Power will be “[g]oing public [sic] anytime.” Further, the article cites your Chief Executive Officer, Timothy Simons as saying that “[p]roceeds from the IPO will be used to fund the planned $40 million, 20 MW Gascoyne I wind farm in southwestern North Dakota and at least two planned wind projects in Montana.” Please provide us with your analysis as to whether these statements made by your representatives in this article constitute an offer of your securities. |

Response

The Company cannot confirm the accuracy of the first quotation attributed to Mr. Gefroh, as he is no longer associated with the Company, but for purposes of this response will assume it is correct. Mr. Simons believes he was misquoted in the second quotation. He believes the question was in the nature of, “If you had $40 million, what would you do with it?”, and that his response was to indicate that the Company would proceed with the construction of its first park, Gascoyne I, and at least two planned wind projects.

Section 2(a)(3) of the Securities Act defines an “offer” as “every attempt to offer to dispose or, or solicitation of an offer to buy, a security or interest in a security, for value.” The Commission has issued interpretive releases stating that any publicity that may “contribute to conditioning the public mind or arousing public interest” in the offering, can constitute a prohibited “offer” under the Securities Act (Publication of Information Prior to or After the Effective Date of a Registration Statement, Securities Act Release No. 33-3844, 22 Fed. Reg. 8359 (Oct. 8, 1957)). As discussed below, we do not believe that the statements attributed to Messrs. Simons and Gefroh were communications by the Company (or any other participant in the current proposed offering) conditioning the public mind or arousing public interest in the proposed offering.

First, the statements are isolated, very general in nature and contain no specific offering terms; and they could not be said as a practical matter to make the Company’s securities more attractive in the eyes of potential investors.

Second, the statements are significantly removed in time from the current proposed offering: four months prior to the original filing of the Registration Statement and eight months prior to the filing of Amendment No.1. We note that while the Company is not eligible for the exemption under Rule 163A for certain communications made more than 30 days before the date of the filing of a registration statement (because the Company is an issuer for an offering of penny stock as defined in Rule 3a51-1 of the Securities Exchange Act of 1934, as well as for other reasons), nevertheless the existence of that rule and the discussion in the adopting release (33-8591; 34-52056) indicate that the Commission believes that a 30-day timeframe may be adequate to assure “that these communications will not condition the market for a securities offering by providing a sufficient time period to cool any interest in the offering that might arise from the communication.” (Ibid. at III.D.2.a) (Rule 163A is, of course, a non-exclusive safe harbor, and other pre-filing communications are not presumed to be offers; whether they are depends on the facts and circumstances.)

Division of Corporation Finance

Securities and Exchange Commission

April 23, 2009

Page 3

From these two facts, we believe that the possible effects of these statements would be so attenuated by the time of the commencement of the offering that they cannot be said to have conditioned the market.

Third, the current offering is an offering only by selling stockholders, from which the Company will receive no proceeds, and is for an amount of approximately $3.9 million, not $40 million; the statement attributed to Mr. Simons makes no sense in light of the actual facts.

From all these facts and circumstances, we do not think it is reasonable to conclude that the statements in question were part of a selling effort for, or that they contributed to conditioning the public mind or arousing public interest in, a planned offering. We also do not believe the facts resemble any of the examples provided by the Commission in Release No. 33-3844.

Based on the foregoing, we respectfully submit that the statements in question did not constitute an offer of the Company’s securities.

| 2. | Please update the financial statements and related financial information included the filing as required by Rule 3-12 of Regulation S-X. |

Response

The financial statements have been updated to include the Company’s audited financial statements as of and for the fiscal year ended December 31, 2008, and the related financial information, including Management’s Discussion and Analysis of Financial Condition and Results of Operations, has been updated accordingly.

| 3. | We note your statements throughout this document that the shares being registered for resale in this offering may be sold by the selling stockholders at prevailing market prices or at negotiated prices. However, there is no public trading market for your common stock. Your prospectus must therefore be revised to set a fixed price at which the selling stockholders will offer and sell their shares until your common stock becomes quoted on the Over-the-Counter Bulletin Board or listed on an exchange. See Schedule A, Item 16, of the Securities Act. Please make the appropriate revisions on the front of the registration statement, on the front cover page of the prospectus, and in the summary, plan of distribution, and any other applicable section. |

Division of Corporation Finance

Securities and Exchange Commission

April 23, 2009

Page 4

Response

We have revised the disclosure as requested on the cover of the registration statement, the front cover of the prospectus and in the Summary, Determination of Offering Price and Plan of Distribution sections.

| 4. | Also, please indicate that you will need a market-maker to apply for the quotation of your common stock on the Over-the-Counter Bulletin Board, but there is no assurance that a market-maker will be obtained, and please disclose that you will file a post-effective amendment to reflect the change to a market price if your shares begin trading on a market or an exchange. |

Response

We have revised the disclosure as requested on the cover of the registration statement, the front cover of the prospectus and in the Determination of Offering Price and Plan of Distribution sections.

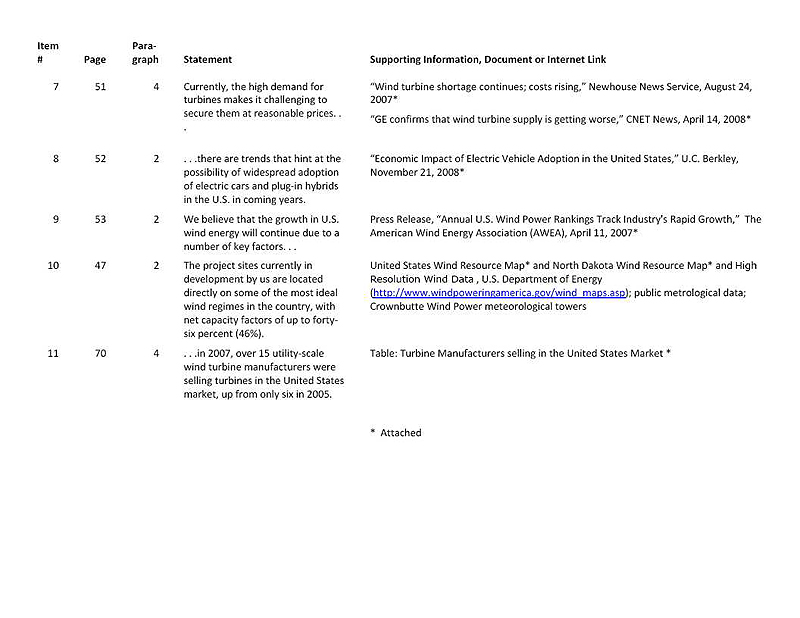

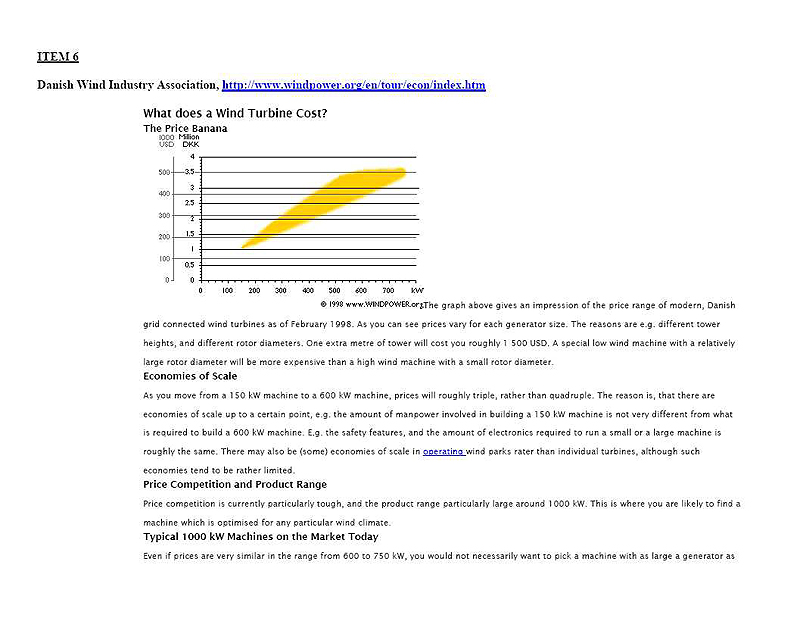

| 5. | Please provide us with sources, appropriately marked and dated, for each factual statement you make throughout your document or characterize the statement as your belief and provide us with the basis for your belief. Also, please provide us with sources for all the statistical claims you make throughout your document as well. The following are only examples of the statements and statistics for which you need sources or a basis of belief: |

| | · | “Based on spot prices for electricity over the past two years, our merchant parks would have received on average $0.05 per kWh.” Our Business, page 1. |

| | · | The spot price chart found on page 24 under Our Strategy. |

| | · | “The project sites currently in development by us are located directly on some of the most ideal wind regimes in the country, with net capacity factors of up to forty-six percent (46%).” Description of Business, page 33. |

We also note that you reference several reports or articles by various entities throughout your filing, especially in your Industry Overview subsection. Please provide copies of these documents to us, appropriately marked and dated, to highlight the information relied upon and cross referenced to your prospectus. Further, please tell us whether these reports and articles are publicly available without cost or at a nominal expense and whether you commissioned any of the referenced sources. We may have further comments once we examine your response, your revisions, and the marked sources you provide us.

Division of Corporation Finance

Securities and Exchange Commission

April 23, 2009

Page 5

Response

Attached as exhibits to this letter are a list (cross referenced to the prospectus) of each factual statement in the prospectus that is not either a matter of general knowledge or characterized as a statement of our belief, as well as each statistical claim, together with the applicable source, appropriately described and dated, followed by a copy of each such source or the relevant portion thereof. Also attached as exhibits are a list (cross referenced to the prospectus) of each report and article referenced in the prospectus, together with a copy, appropriately described and dated, of each such report and article or the relevant portion thereof.

Inside Front and Outside Back Cover Pages of Prospectus

| 6. | Please provide the dealer prospectus delivery obligation statement on either the inside front or outside back cover of your prospectus or tell us why it is not appropriate for you to do so. See Item 502(b) of Regulation S-K. |

Response

We have added the appropriate statement on the inside front cover of the prospectus.

Summary, page 1

| 7. | Please remove from the summary and elsewhere in the forepart of your document all defined terms. For example, please remove the second paragraph on page 1. The meanings of the terms you use in this part of your document should be clear from their context. If they are, you do not need the definitions. If they are not, you should revise the document using terms that are clear. See Updated Staff Legal Bulletin No. 7 (June 7, 1999) sample comments 3 and 5. |

Response

We have removed from the Summary and elsewhere in the forepart of the prospectus all defined terms, with one exception: Since the name of the North Dakota operating subsidiary is the same as the name of the Nevada parent (the registrant), “Crownbutte Wind Power, Inc.,” we believe it is appropriate to retain a definition (“Crownbutte ND”) to enhance comprehension of and avoid confusion to the reader.

Corporate Information and History, page 2

| 8. | In this regard, we note your statement in the sixth paragraph on page 2 that “[o]n July 2, 2008, a wholly-owned subsidiary of the Company merged with and into Crownbutte ND, with Crownbutte ND surviving the merger, thereby becoming our wholly-owned subsidiary.” For the sake of clarity, please identify the “Company” you refer to in this instance. |

Division of Corporation Finance

Securities and Exchange Commission

April 23, 2009

Page 6

Response

We have revised the disclosure as requested to indicate that the “Company” originally referred to is the registrant.

Risk Factors, page 4

| 9. | Some of your risk factor discussions do not clearly and concisely convey the actual risk, such as the first full risk factor on page 4 and the first full risk factor on page 7. Also, please consider whether certain subsections or elements of a discussion within a risk factor are necessary or should be separated into multiple risk factors, such as the last risk factor on page 8 and the bullet points in the last risk factor on page 6, and whether certain risk factors can be revised or combined so they are not repetitive, such as the first full risk factor on page 6 and the last risk factor on page 8. Accordingly, please thoroughly revise this section to more precisely articulate the risks to your offering from each risk factor. We may have additional comments based upon your response and your revisions. |

Response

We have revised the Risk Factors section as requested to more clearly and concisely convey the relevant risks.

Selling Stockholders, page 19

| 10. | We note that you are registering for resale 7,718,000 million shares of common stock, including 1,100,000 shares that were sold by Crownbutte ND in a private placement completed in April 2008, 3,118,000 shares that were sold by you in a private placement completed in September 2008, and 2,500,000 shares that were issued upon the exercise of warrants issued to a placement agent in your private placement completed in September 2008. However, it appears that the 1,100,000 shares sold by Crownbutte ND and the 3,118,000 shares sold by you were part of a unit that included one share of common stock and one warrant to purchase one share of common stock. If true, please disclose this in your Selling Stockholders section. Also, if true, please tell us whether the warrant holder has the right exercise the warrant to purchase the additional share of common stock within 60 days. If so, please revise your selling stockholder table as appropriate to include these shares as being beneficially owned by the selling stockholders. |

Division of Corporation Finance

Securities and Exchange Commission

April 23, 2009

Page 7

Response

We have disclosed in the Selling Stockholders section that the securities sold by Crownbutte ND in the private placement completed in April 2008 and by the Registrant in the private placement completed in September 2008 were units, with each unit consisting of one share of one share of common stock and a warrant to purchase one share of common stock.

The warrants included in the units are all currently exercisable. We have revised the selling stockholder table to include the shares underlying the warrants as being beneficially owned by the selling stockholders.

| 11. | Please disclose, by footnote or otherwise, in which private placement each of the selling stockholders in your table received his, her, or its shares. |

Response

We have revised the selling stockholder table to include footnotes indicating when the selling stockholders acquired their shares.

| 12. | We note your statement that of the 7,718,000 million shares of common stock being registered, 3,118,000 of those shares were sold by you in a private placement completed in September 2000. However, on page II-2 under your Recent Sales of Unregistered Transactions section you list numerous transactions taking place between July 2008 and September 2008 that appear to total 3,118,000 shares. Please revise your Selling Stockholders section to clearly indicate the date that each transaction took place rather than providing the aggregate number you currently provide. |

Response

Both the private placement completed by Crownbutte ND in April 2008 and the private placement completed by the Registrant in September 2008 were conducted with multiple closings. We have revised the Selling Stockholders section to include the dates of these closings and the number of units sold at each closing.

| 13. | We note your statement in the second paragraph on page 20 that “[t]he following table sets forth the name of each selling stockholder, the nature of any position, office or other material relationship, if any, which the selling stockholder has had, within the past three years, with us or with any of our predecessors or affiliates (in a footnote).” However, none of your footnotes describe any material relationship. Therefore, please provide a materially complete description of the relationships and arrangements that have existed in the past three years or are to be performed in the future between you, or your predecessor, and the selling stockholders, any affiliates of the selling stockholders, or any person with whom any selling stockholder has a contractual relationship regarding the transaction, or any predecessors of those persons. If there is no selling stockholder who held a position or office, or had any other material relationship with you or your predecessor, please state this in your document. See Item 507 of Regulation S-K. |

Division of Corporation Finance

Securities and Exchange Commission

April 23, 2009

Page 8

Response

We have revised the disclosure to indicate that no selling stockholder had any position, office or other material relationship within the past three years, with us or with any of our predecessors or affiliates.

| 14. | Also, please provide copies of all agreements between you, or your predecessor, and the selling stockholders, any affiliates of the selling stockholders, or any person with whom any selling stockholder has a contractual relationship regarding the transaction, or any predecessors of those persons. |

Response

We have filed as exhibits all agreements between the Registrant, or its predecessor, and the selling stockholders, any affiliates of the selling stockholders, or any person, to our knowledge, with whom any selling stockholders has a contractual relationship regarding the transaction, or any predecessors of those persons. Please see, for examples, Exhibits 4.1, 4.2, 10.4, 10.5 and 10.6.

| 15. | Please disclose the natural person or persons who exercise the sole or shared voting or dispositive powers with respect to the shares offered for resale by Phoenix Holdings and Reese Cole Partnership Ltd. See the Division of Corporation Finance’s Compliance & Disclosure Interpretation 240.04 for Regulation S-K (July 3, 2008). |

Response

We have added footnotes to the selling stockholder table identifying the natural person who has the power to vote and dispose of the shares being registered on behalf Phoenix Holdings Inc. and Reese Cole Partnership Ltd.

Determination of Offering Price, page 21

| 16. | Please discuss the factors you considered in setting the fixed offering price for which your stockholders will sell their shares until those shares are listed on the Over-the-Counter Bulletin Board or quoted on an exchange. See Item 505 of Regulation S-K. |

Division of Corporation Finance

Securities and Exchange Commission

April 23, 2009

Page 9

Response

We have revised the disclosure to add a discussion of the factors we considered in setting the fixed offering price for which the selling stockholders will sell their shares until those shares are listed on the Over-the-Counter Bulletin Board.

Market for Common Equity and Related Shareholder Matters, page 21

| 17. | We note your statement that “[t]here is a limited trading history regarding our common stock, because it has never been actively traded.” Please revise this statement to affirmatively state that there is no established public trading market for your common equity. See Item 201(a)(1)(i) of Regulation S-K. |

Response

We have revised the disclosure to affirmatively state that there is no established public trading market for our common stock.

Dividends, page 22

| 18. | We note your statement that you have never paid nor declared any cash dividends on your equity securities. However, we note that on page F-18 under Note 8 to your Notes to Financial Statements for the periods December 31, 2007 and 2006 that you paid cash distributions to your members in the amount of $153,333. Please revise or advise. |

Response

We have revised the disclosure under Dividends to be consistent with the notes to the financial statements.

Management’s Discussion and Analysis of Financial Condition and Results of …, page 22

| 19. | Please expand this section to discuss known material trends and uncertainties that will have, or are reasonably likely to have, a material impact on your revenues or income or result in your liquidity decreasing or increasing in any material way. In doing so, please provide additional information about the quality and variability of your earnings and cash flows so that investors can ascertain the likelihood of the extent that past performance is indicative of future performance. In addition, please discuss in reasonable detail any economic or industry-wide factors relevant to your company, and any material opportunities, challenges, and risks in the short and long terms and the actions you are taking to address them. For example, please discuss how the recent tightening of the credit markets will affect your current and proposed operations, if at all, especially in light of the several types of financing you need in order to fund your projects. As another example, please discuss how the trend in oil prices will affect your current and proposed operations, if at all. See Item 303 of Regulation S-K and SEC Release No. 33-8350. |

Division of Corporation Finance

Securities and Exchange Commission

April 23, 2009

Page 10

Response

We have revised the Registration Statement as requested.

Overview, page 22

| 20. | In the fourth paragraph in this section we note your statements that “… we may also target small development companies for acquisition” and “[w]e believe our ability to complete stalled projects that other developers have failed to bring to fruition is a core competency.” Please discuss if you have identified any companies for acquisition and, if so, describe their line of business. Also, please discuss the basis for your belief that your ability to complete stalled projects is a core competency since you have completed few projects to date. |

Response

We have removed this statement from the Registration Statement. We do not intend to seek acquisition opportunities at the current time.

Major Events and Material Transactions, page 23

| 21. | We note on your website under the tab “Our Business” your statement “[b]y concentrating on the carrying capacities of the accessible transmission systems in relationship to excellent wind resource locations, two more projects have subsequently been planned, developed and sold.” However, according to your discussion in the Major Events and Material Transactions subsection in your document, you have only developed and sold one project and sold the development rights to two other projects. Please revise or advise. |

Response

We regret that confusion may have arisen from the use of “development” to refer to the process of going from the “greenfield” state to being “construction-ready” or “shovel-ready.” Subsequently, we refer to the process as one of construction, not development. Therefore, the act of “selling a developed project” is merely an industry short-hand for the sale of development rights to a park.

To be explicit and clear, we have modified our website to remove any potential confusion. The sentence on our website now reads:

“By concentrating on the carrying capacities of the accessible transmission systems in relationship to excellent wind resource locations, one project has subsequently been planned, developed, and the development rights sold, and we have advised on the development and construction of another project as a consultant.”

Division of Corporation Finance

Securities and Exchange Commission

April 23, 2009

Page 11

Our Strategy, page 24

| 22. | We note that your description of the process involved with the development of a wind-park on page 24 differs from the descriptions found on page 34 and on your website under your “Project Development” link. Please revise or advise. |

Response

Our website has been modified to be consistent with the 14 step development process described on page 24 of the original Registration Statement.

The expanded 18 item list on page 34 of the original Registration Statement includes the 14 previously described steps in the “Development” process, plus four additional (subsequent) steps that describe construction and operation. To remove confusion, we have revised the first list in Management’s Discussion and Analysis to include the four additional construction and operation steps.

| 23. | For the benefit of your readers, please define the term “off-taking.” |

Response

We have added a definition of “off-taking.”

| 24. | We note in the last paragraph on page 24 your statement, “[o]ur current pipeline of projects includes 12 projects totaling 630 MW of potential capacity.” Please revise this statement so that it clearly indicates your current MW capacity, if any. Please revise a similar statement found in the first paragraph on page 35 and any other similar statement in your filing. |

Response

Because we decided not to pursue the Ralls, Texas, project, our current pipeline of projects includes 11 projects totaling 618 MW of potential generating capacity. For all references to the 11 projects and 618 MW of potential capacity, we have added clarification that 0 MW is currently in operation.

Division of Corporation Finance

Securities and Exchange Commission

April 23, 2009

Page 12

Crownbutte Projects in Development, page 25

| 25. | We note your list of projects currently under development. Please clarify in this section the projects you intend to develop and operate and those you intend to develop and then sell. |

Response

Language has been so added to clarify that we intend to construct as many of the projects in our pipeline as possible but that the total number we are able to construct will be a function of our success in securing project financing and that until cash flows from owned and operated wind projects generate enough income to cover our expenses, it will be necessary to sell the development rights to at least one of the projects currently in our pipeline. Precisely which project’s development rights are to be sold has not yet been determined.

Project Finance, page 25

| 26. | You state in the first paragraph that a “[f]ailure to secure the funding required for construction of wind parks is a significant risk to the success of this operating plan, and would mean that we would be relegated to being solely a green-field developer and not an owner-operator.” Please discuss the reason or reasons that failing to secure the funding required for construction would relegate you solely to developing and not owning and operating wind parks. Also, please include under the appropriate sub-caption in your Risk Factor section that without the funding required for construction of wind parks you would be relegated to being solely a green-field developer and not an owner-operator and how this makes an investment in you risky or speculative. |

Response

The section has been revised to elaborate on the issue of project finance, the owner/operator business model and the green-field developer business model.

The Risk Factor entitled, “We may be unable to secure the project financing required to construct the projects currently in our portfolio,” has also been modified as requested.

| 27. | We note your statement in the last paragraph on page 25 that you have entered into preliminary discussions with parties “interested in putting amounts of capital to work” that are sufficient to complete your projects. Please disclose why you believe the capital discussed would be sufficient. In this regard, please disclose the amount of capital you would require to complete your projects. Also, please disclose, if true, that you have no agreements with theses parties and there is no guarantee that any or all of the discussions will lead to final agreements and assured financing. |

Division of Corporation Finance

Securities and Exchange Commission

April 23, 2009

Page 13

Response

The paragraph has been revised to provide more specific information and elaboration, as requested.

| 28. | We note that your discussion is focused on the types of financing you will need in order to construct and operate wind parks. Please expand your discussion to discuss the amount of capital you need to maintain your current operations of developing and selling your wind parks, if any. |

Response

We have expanded our discussion of the amount of capital we need to maintain our current operations of developing and selling our wind parks under “liquidity and Capital resources.”

Financing upon commencement of commercial operations, page 26

| 29. | In the ninth paragraph on page 26 you state that “[w]e will seek to maximize project profitability, improve project returns and reduce equity capital requirements by monetizing the value of these incentives through tax equity financing transactions.” Please discuss how the use of tax equity financing will maximize project profitability, improve project returns, and reduce equity capital requirements. |

Response

We have removed the sentence.

Fiscal Year 2007 versus Fiscal Year 2006, page 28

| 30. | In this subsection and in your Nine Months Ended September 30, 2008 Compared to Nine Months Ended September 30, 2007 subsection, you discuss the changes in operation and cash flow amounts between the periods. However, the dollar amounts you disclose mostly repeat information that is available from the face of the financial statements. Therefore, please expand this information to explain the reasons for period-to-period changes. In this regard, where you identify intermediate causes of changes in your operating results, please be sure to fully describe the reasons underlying these causes. Finally, where changes in items are caused by more than one factor, please quantify the effect of each factor on the change, if possible. See Item 303 of Regulation S-K and SEC Release No. 33-8350. Please consider the following examples, but realize that these are examples only and not an exhaustive list of the revisions you should make: |

Division of Corporation Finance

Securities and Exchange Commission

April 23, 2009

Page 14

| | · | On page 28, you state that your revenues for 2007 increased by 519% due to several major contracts entered into during the year ended December 31, 2007. Also, you state that the increase in revenue during this period resulted from your receipt of the bulk of the revenues relating to the Gascoyne I sale to Boreal and the receipt of the proceeds from the sale of development rights at Baker, MY to Montana-Dakota Utilities. Please revise this subsection to disclose all the underlying factors that contributed to your increase in revenues from 2006 to 2007 and quantify the effect of each factor on the overall change. |

| | · | Also on page 28, we note the significant increase in costs of revenues in dollars from 2006 to 2007 and the decrease in gross margin percentage for that same period. Please discuss the correlation, if any, of cost of revenues to revenues and discuss the causes for the dollar increase and reasons for the decrease in gross margin |

| | · | On page 29, you state that the operating expenses increased significantly from 2006 to 2007 as a direct result of new hires and associated, salaries, payroll taxes, and other costs, such as travel. Please discuss the underlying cause or causes of this increase in hiring and quantify the effect of salaries, payroll taxes, and other material associated costs on the change in operating expenses. |

| | · | On page 30, you state that the cost of revenues increased from the first nine months in 2007 to the same period in 2008 because you continued to increase your rate of development activities. Please disclose the development activities that caused your costs to rise during this period and quantify the effect of each factor on the change. |

Response

The Registration Statement no longer includes a discussion of fiscal year 2007 versus fiscal year 2006. Where applicable, we have made the requested changes in the discussion of fiscal year 2008 versus fiscal year 2007.

Operating Expenses, page 29

| 31. | You state that “Crownbutte ND significantly enhanced its ability to develop new parks and position itself for its transformation from pure green-fielder to owner-operator of completed wind parks.” Please provide the basis for your statement and why this is relevant to your discussion in this subsection. |

Division of Corporation Finance

Securities and Exchange Commission

April 23, 2009

Page 15

Response

We have added disclosure to provide the basis for our statement and discuss why it is relevant.

Nine Months Ended September 30, 2008. Compared to Nine Months Ended ..., page 29

Revenues, page 30

| 32. | We note your discussion regarding the “lumpiness,” or inconsistency, of your revenues from the sale of brown-field sites. Please include in your Risk Factor section a sub-caption that describes the risk you face from the current inconsistency in your revenues and how this risk affects your operations. |

Response

We have added a description of these risks to Risk Factors under the caption “Our revenues may be inconsistent, creating a liquidity risk.”

Liquidity and Capital Resources, page 30

| 33. | In this section, please discuss your ability to generate adequate amounts of cash to meet your needs for cash and indicate any balance sheet conditions or income or cash flow items that you believe may be indicators of your liquidity condition. Also, please discuss your liquidity generally on both a long and short term basis and describe and quantify any prior period-to-period changes in your liquidity. See Instruction 5 to Item 303(a) of Regulation S-K. |

Response

We have revised the Registration Statement as requested.

| 34. | Please describe your material commitments for capital expenditures as of the end of the latest fiscal period, and indicate the general purpose of these commitments and the anticipated source of funds needed to fulfill these commitments. See Item 303(a)(2) of Regulation S-K. |

Response

We have revised the Registration Statement as requested.

| 35. | In the second paragraph under this subheading you state that you expect completion of the Gascoyne I project by late summer 2009, but in your Description of Business section and elsewhere in your document, you state that you do not intend to start construction on this project until mid-2009. Please clarify when you expect to begin and complete construction of the Gascoyne I project. |

Division of Corporation Finance

Securities and Exchange Commission

April 23, 2009

Page 16

Response

We have revised the disclosure to state that we expect construction start by mid-year 2009 and expect completion by year end 2009.

Critical Accounting Policies, page 31

| 36. | We note that your critical accounting policies simply repeat the information contained in Note 2to your annual financial statements. We remind you that this disclosure should supplement, not duplicate, the description of accounting policies that are already disclosed in the notes to the financial statements. The disclosure should provide greater insight into the quality and variability of information regarding financial condition and operating performance. While accounting policy notes in the financial statements generally describe the method used to apply an accounting principle, the discussion in your Management’s Discussion and Analysis of Financial Condition and Results of Operations section should present your analysis of the uncertainties involved in applying a principle at a given time or the variability that is reasonably likely to result from its application over time. You should also quantify the sensitivity of your estimates to change, based on other outcomes that are reasonably likely to occur and would have a material effect on your financial statements. See Section V of our Release 33-8350, available on our website at www.sec.gov/rules/interp/33-8350.htm. |

Response

We have revised the Registration Statement as requested.

Description of Business, Page 33

Regulation, page 46

| 37. | We note on page 12 your need to obtain certain permits relative to the “siting, construction, operation and decommissioning of wind energy projects.” Also, based on your disclosures on pages 24 and 25, it seems that a majority of your projects are at the stage where you are applying for local, state, or federal permits. Please discuss the material approvals you must obtain and the status of each approval within the government approval process. See Item 101(h)(4)(viii) of Regulation S-K. |

Division of Corporation Finance

Securities and Exchange Commission

April 23, 2009

Page 17

Response

We have revised the Regulation section as requested.

Environmental Regulation, page 47

| 38. | We note your discussion of various federal, state, and local environmental laws and more specifically the laws applicable in the State of New York. In light of the fact that you do not currently have any operations in the State of New York, please tell us why it is appropriate for you to review those laws in this subsection. If any state or local environmental laws exist in the states in which you develop and operate wind parks, please discuss the impact that those laws and regulations have upon your capital expenditures, earnings, and competitive position. See Item 101(h)(4)(ix) of Regulation S-K. |

Response

We included the references to New York examples of additional regulations than could be imposed, and we believe the examples are appropriate. We have revised the Registration Statement to expand the discussion of the relevant environmental laws and regulations.

Competition, page 48

| 39. | Please discuss, if known, your competitive position within the industry. See Item 101(h)(4)(iv) of Regulation S-K. |

Response

We have provided additional information about our competitive position to the best of our knowledge.

Our Competitive Advantages, page 49

| 40. | In the fourth paragraph on page 49, we note the discussion of your “strong relationships with key industry players.” Please explain the nature of the relationships you maintain with these key industry players. |

Response

Our “strong relationships” encompass longstanding business contacts with counterparty staff that encourage honest communication and information flow, as well as professional regard based on a history of interactions, negotiations and arms-length transactions. We believe that new entrants and those without such relationships may enjoy less efficient negotiations and may receive less advice and clarifying information at critical times than we do. However, to avoid possible undue emphasis, we have removed the reference from the Registration Statement.

Division of Corporation Finance

Securities and Exchange Commission

April 23, 2009

Page 18

Directors, Executive Officers, Promoters and Control Persons, page 50

Background of Officers and Directors, page 50·

| 41. | You must disclose the business experience of all of your officers, directors, and key employees during the past five years without gaps or ambiguities, including each person’s principal occupations and employment, the name and principal business of any corporation or other business association, and whether any of the business associations are your parent, subsidiary, or other affiliate. See Item 401(e)(1) of Regulation S-K. In this regard, you state that Timothy Simons founded Crownbutte ND in 1999, but was a public school teacher until 2002. Please disclose if five years ago Mr. Simons was devoting his full-time efforts to Crownbutte ND. If not, please disclose when Mr. Simons began full-time work at Crownbutte ND and disclose any other business experiences he had for the past five years. Also, please disclose Ryan Fegley’s business experience from approximately January 2004 to December 2005. |

Response

We have revised the disclosure as requested.

Security Ownership of Certain Beneficial Owners and Management, page 51

| 42. | In your table, you indicate that, as a group, your officers and directors beneficially own 18,582,164 shares of common stock. However, the individual disclosures of the shares they beneficially own equate only to 18,332,164 shares of common stock, as Timothy Simons owns 13 million shares, Ryan Fegley owns 5 million shares, and Manu Kalia owns 332,164 shares. Please revise or advise. |

Response

We have revised the Security Ownership of Certain Beneficial Owners and Management table to correct the error – as a group, the Registrant’s officers and directors now beneficially own 18,582,164 shares of common stock as of the specified date.

Executive Compensation, page 52

| 43. | Please revise your Executive Compensation section to include information for your fiscal year 2008 which ended on December 31, 2008. See the Division of Corporation Finance’s Compliance and Disclosure Interpretation 217.11 for Regulation S-K (July 3, 2008). |

Division of Corporation Finance

Securities and Exchange Commission

April 23, 2009

Page 19

Response

We have revised the Registration Statement as requested.

| 44. | Please include a narrative description of any material factors necessary to an understanding of the information disclosed in this section. See Item 402(o) of Regulation S-K. |

Response

We have revised the disclosure to provide a narrative description of the material factors we believe are necessary to an understanding of the information disclosed in this section.

| 45. | Please provide an Outstanding Equity Awards at Year-End table as of the end of your last completed fiscal year. See Item 402(p)(2) of Regulation S-K. |

Response

We have revised the Registration Statement as requested.

Plan of Distribution, page 53

| 46. | In this section; please discuss or reference the “penny stock” restrictions on your shares. |

Response

We have revised the Registration Statement as requested.

| 47. | We note your disclosure regarding short sales. Please be advised that short sales of ordinary shares “against the box” that are covered with shares subject to this registration statement cannot be made before the registration statement becomes effective. It is our view that shares underlying the short sale are deemed to be sold at the time the sale is made and, prior to effectiveness, this would constitute a violation of Section 5. Please confirm your understanding. Also, please revise the disclosure accordingly. See the Division of Corporation Finance’s Compliance and Disclosure Interpretation 239.10 for Regulation S-K (Nov. 26, 2008). |

Division of Corporation Finance

Securities and Exchange Commission

April 23, 2009

Page 20

Response

We confirm our understanding that short sales of ordinary shares “against the box” that are covered with shares subject to the Registration Statement cannot be made before the Registration Statement becomes effective, and we have revised the disclosure accordingly.

Description of Securities, page 55

Description of Common Stock, page 55

| 48. | You state that all of the outstanding shares of common stock are fully paid and non-assessable. However, this is a legal determination that should be made by counsel. Therefore, please remove this sentence or attribute these statements to counsel and file counsel’s consent to be named in this section. |

Response

We have removed the sentence.

Where You Can Find More Information, page 57

| 49. | In the first sentence of this section, you state that you file periodic reports with us. Please revise this statement to indicate that you will be required to file periodic reports upon effectiveness of this registration statement. |

Response

We have revised the disclosure as requested.

Consolidated Financial Statements, page F-l

Crownbutte Wind Power Inc. Financial Statements as of September 30, 2008, page F-2

| 50. | Please apply the comments issued below on your financial statements as of December 31, 2008 to your interim financial statements, as applicable. |

Response

We have applied the comments issued to the December 31, 2008 financial statements included in Amendment No. 1 to the Registration Statement.

Division of Corporation Finance

Securities and Exchange Commission

April 23, 2009

Page 21

Note 1 - Organization and Description of Business, page F-5

| 51. | We note your discussion of the July 2, 2008 reverse acquisition, both here and in Note 8 to your December 31, 2007 financial statements, and have the following comments: |

| | · | Please provide us with a detailed explanation of the ownership of ProMana Solutions’ equity immediately prior to and immediately following the merger, including the impact of the Split-Off Agreement and the cancellation of any related shares. Please also explain why Note 6 indicates that as part of the merger you issued 1.48 million shares of common stock to the pre-merger ProMana shareholders, and reconcile this to your disclosure in Note 1 that the pre-merger ProMana shareholders surrendered their shares and warrants in accordance with the Split-Off Agreement. |

Response:

The ownership of ProMana Solutions’ equity immediately prior to the merger was as follows (all numbers give effect to the one-for-65.723 reverse stock split):

| Common stock outstanding: | 1,626,952 |

| Warrants to purchase common stock: | 36,814 |

| Options to purchase common stock: | 0 |

On July 2, 2008, simultaneously with the closing of the merger, under the terms of a Split-Off Agreement, ProMana Solutions transferred all of its pre-merger operating assets and liabilities to its wholly-owned subsidiary, Pro Mana Technologies, Inc., a New Jersey corporation (“Pro Mana NJ”). Simultaneously, pursuant to the Split-Off Agreement, ProMana Solutions transferred all of the outstanding shares of capital stock of Pro Mana NJ to Robert A. Basso and Lawrence J. Kass, two of its stockholders prior to the merger, in consideration of and in exchange for (i) the surrender and cancellation of an aggregate of 144,702 shares of ProMana Solutions common stock and warrants to purchase warrants to purchase 19,062 shares of its common stock held by those stockholders and (ii) certain representations, covenants and indemnities.

At the closing of the merger, each share of Crownbutte ND’s common stock outstanding was converted into one share of our Common Stock. As a result, an aggregate of 18,100,000 shares of ProMana Solutions’ Common Stock were issued to the holders of Crownbutte ND’s common stock, and warrants to purchase an aggregate of 10,600,000 shares of Crownbutte ND’s outstanding at the time of the merger became warrants to purchase an equivalent number of shares of ProMana Solutions’ Common Stock.

Division of Corporation Finance

Securities and Exchange Commission

April 23, 2009

Page 22

Therefore, the ownership of ProMana Solutions’ equity immediately after the merger was as follows:

| Common stock outstanding: | 19,582,249 |

| Warrants to purchase common stock: | 10,617,752 |

| Options to purchase common stock: | 0 |

On the same date ProMana Solutions amended its Articles of Incorporation to change its name to Crownbutte Wind Power, Inc.

No shares were issued to pre-merger ProMana Solutions shareholders in connection with the merger. Only the Company name changed. The notes to the financial statements in Amendment No. 1 correctly reflect this.

| | · | Please tell us whether this transaction was accounted for using purchase accounting or as a recapitalization. Your disclosure that you accounted for the transaction as a reverse acquisition under the purchase method of accounting and as such a recapitalization of the company is unclear. Please be advised that the use of purchase accounting is only appropriate if the merger qualifies as a business combination under SFAS 141, requiring you to adjust the accounting acquiree’s net assets to fair value, and all disclosures required by SFAS 141 would need to be provided. However, given your disclosure that ProMana Solutions transferred its previous web-based business to certain of its shareholders contemporaneously with the merger; it appears that ProMana Solutions effectively may have been a shell company at the time that it merged with Crownbutte. In this situation, we believe the reverse acquisition should be accounted for as a recapitalization, as this is essentially a capital stock transaction, and the accounting acquiree’s net assets should be recorded at book value. Please revise your disclosures to better explain how you accounted for this merger and your reasons for this accounting. |

Response:

This transaction was accounted for as a recapitalization. We have revised the disclosure to read as follows:

For accounting purposes, the Merger was treated as a recapitalization of the Company. Crownbutte ND formerly Crownbutte Wind Power LLC is considered the acquirer for accounting purposes, and the Company’s historical financial statements before the Merger have been replaced with the historical financial statements of Crownbutte ND before the Merger in all subsequent filings with the Securities and Exchange Commission (the “SEC”).

Division of Corporation Finance

Securities and Exchange Commission

April 23, 2009

Page 23

| | · | Given the impact of the reverse acquisition on your capitalization, please provide us, and consider disclosing to your readers, an interim equity statement for 2008. We believe the most appropriate way to reflect this reverse acquisition is to retroactively restate the equity of Crownbutte prior to the merger date in a manner similar to a stock split, such that the number of shares outstanding immediately prior to the merger equals the 17 million common shares and 1 million warrants received by Crownbutte in the merger. We believe that the 1.48 million shares of common stock held by ProMana immediately prior to the merger should be reflected on a separate line item within the equity statement titled similar to “Shares effectively issued to former ProMana shareholders as part of the July 2, 2008 recapitalization,” presented as though this were an issuance of stock on July 2, 2008, Changes in equity subsequent to the merger date, such as the September 2008 private p1aceillent and September 2008 exercise of stock warrants, should be presented in accordance with U.S. GAAP. See SAB Topic 4C and paragraph 54 of SFAS 128. |

Response

We have included a statement of stockholders’ equity in the audited December 31, 2008 financial statements. We have retroactively restated the equity of Crownbutte prior to the merger date such that the number of shares outstanding immediately prior to the merger equals the 17 million common shares and 1.1 million warrants received by Crownbutte in the merger. The 1.48 million shares of common stock held by ProMana immediately prior to the merger is reflected on a separate line within the equity statement titled “Shares effectively issued to former ProMana shareholders as part of the July 2, 2008 recapitalization,” presented as an issuance of stock as part of the July 2, 2008 recapitalization.

| 52. | We note your statement that you effected a reverse stock split on July 31, 2008. Please provide an affirmative disclosure indicating, if true, that all share and per share amounts presented in your financial statements have been retroactively restated for this reverse stock split. |

Response

We have added a statement that all share and per share numbers presented in the financial statements have been retroactively restated for the reverse stock split. This disclosure was added in Note 1 under the subheading “Stock Split”.

Note 6 - Stockholders’ Equity, page F-8

| 53. | We note your disclosures concerning stock-based compensation here and in Note 3. Since this appears to be the first period in which you incurred stock-based compensation, and given the significance of the related expense to your results, please provide all disclosures indicated by paragraph A240 of SFAS 123R to better explain your accounting to your readers. In expanding your disclosure, we believe it would be helpful to your readers in understanding this large expense if you distinguish between stock-based compensation granted to employees and stock-based ‘compensation granted to non-employees. We also believe it provides useful information to clarify if any stock-based compensation was issued with exercise prices below fair market value on the date of issuance, which we assume is the case for stock warrants issued with an exercise price of $0.001, and to clarify the amount of compensation expense related to such below market issuances. |

Division of Corporation Finance

Securities and Exchange Commission

April 23, 2009

Page 24

Response

We have expanded our disclosure of stock-based compensation in Note 6 to the financial statements to provide all disclosures indicated by paragraph A240 of SFAS 123R in order to better explain our accounting to our readers. We have also disclosed that this stock-based compensation was granted to employees. We have also disclosed in Note 6 that the exercise price for these warrants was significantly less than the offering price of $.50, which is presumed to be the fair market value of our stock.

Note 10 - Project Development Costs, page F-10

| 54. | We note you capitalized project development costs and interconnect application deposits during the year. Please address the following: |

| | · | Please disclose the types of costs you capitalize as product development costs and the types of costs you capitalize as property and equipment for your projects. We read in Note 10 that certain costs were capitalized as project development costs and certain costs were capitalized as property and equipment for the New England, ND project. Please tell us the discerning factors that cause the difference in classification. |

| | · | For the projects in which you have capitalized deferred development costs, please tell us whether you intend to sell the wind parks after development or if you intend to operate them. For wind parks that you plan to sell, please tell us if you have potential buyers or whether you are capitalizing these costs solely due to your assessment that the project is probable of being technically, commercially and financially viable. |

| | · | Please tell us why you classified cash payments for interconnect application deposits and cash invested in project developments costs as cash flows used in investing activities rather than cash used in operating activities. With reference to your accounting policies at the top of page F-6, this is particularly unclear for interconnect application deposits that ate expensed. Your response should provide your analysis under SFAS 95. |

Division of Corporation Finance

Securities and Exchange Commission

April 23, 2009

Page 25

Response

Upon further review of our capitalization policies regarding project development costs and interconnect application deposits we have revised previously capitalized project development costs as follows. We have concluded that project development costs are essentially research and development costs. Our policy regarding research and development costs are to expense them as incurred. Therefore all project development costs that were previously capitalized in our unaudited financial statements as of September 30, 2008 have been expensed as of December 31, 2008.

Interconnect application deposits (deposits) are basically deposits that the Company makes with an Independent Systems Operator (ISO). The ISO uses up the deposits as needed to conduct various impact studies. As the deposits are used the Company expenses them as incurred. If a study is complete, any unused deposits are refunded to the Company. The amount capitalized as of December 31, 2008, represents unused deposits.

Crownbutte Wind Power LLC Financial Statements as of December 31, 2007, F -11

Statements of Operations, page F-13

| 55. | Based or your description of business, it appears that you earn revenues from the sale of wind parks and from consulting services to parties that purchase the wind park. Please separately present revenues from sales of Wind parks, revenues from services and other revenues, if applicable. See Rule 5-03 of Regulation S-X. |

Response

We have revised the statement of operations to separately present revenues from the sale of project development rights and consulting services.

| 56. | We note on page 29 that there was a cancellation of debt in 2006 that resulted in $43,784 of other income related to an agreement with three credit card lenders and one bank to pay old debts at a reduced rate; we have the following comments: |

| | · | Please tell us the terms of both the original debt agreements and the modified agreement allowing you to pay old debts at a reduced rate. |

Division of Corporation Finance

Securities and Exchange Commission

April 23, 2009

Page 26

| | · | Please explain to us why the cancellation occurred, clarify whether you provided any consideration to these lenders in exchange for the cancellation ‘and tell US the accounting literature you relied upon in determining it was appropriate to recognize a gain. |

| | · | If you continue to present financial statements for 2006, please address this transaction and your accounting in a footnote to your financial statements and tell us where this cancellation is presented in your statement of cash flows. |

Response

Financial statements for 2006 are no longer included in the Registration Statement. Below is a table describing the details of the cancellation of debt that occurred in 2006. The cancellation of debt arose from the company being delinquent on the loans and negotiating a settlement with each lender in exchange for writing off the remaining balances. There was no other consideration provided to these lenders in exchange for the cancellations. Since this constitutes a reduction of a liability (payable), we believe that it was appropriate to treat this as a gain.

| 2006 Cancellation of Debt Income Detail | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| Lender | Loan Type | | Pre-settlement Balance | | | Final Payments | | | Cancellation of Debt | | | Ending Balance | |

| | | | | | | | | | | | | | |

| Wells Fargo Card Services | Credit Card | | $ | 6,311 | | | $ | 5,360 | | | $ | 951 | | | $ | - | |

| First USA Bank | Credit Card | | $ | 11,254 | | | $ | 7,900 | | | $ | 3,354 | | | $ | - | |

| MBNA America | Credit Card | | $ | 19,018 | | | $ | 4,438 | | | | | | | | | |

| | | | | | | | $ | 4,438 | | | | | | | | | |

| | | | | | | | $ | 4,438 | | | $ | 5,704 | | | $ | - | |

| MBNA America | Line of Credit | | $ | 42,180 | | | $ | 8,436 | | | $ | 33,744 | | | $ | - | |

| | | | | | | | | | | | | | | | | | |

| | | | $ | 78,763 | | | $ | 35,010 | | | $ | 43,753 | | | $ | - | |

| 57. | We note on page 29 that you recognized $9,203 as other income in 2007 from the refund of the unused portion of a transmission study deposit made to Midwest Independent Systems Operator (MISO) during 2003. Please confirm to us that you received cash payments for the full amount of this refund during 2007, or tell us how you determined it was appropriate to recognize income prior to the receipt of this refund. Also, please tell us how you recorded the original deposit payment for the transmission study in 2003, such as whether this deposit payment was capitalized or expensed and the specific line item on your financial statements that included this deposit payment, as well as any subsequent journal entries made for this transaction. |

Division of Corporation Finance

Securities and Exchange Commission

April 23, 2009

Page 27

Response

Deposit balances are recorded on the balance sheet as cash deposits, and amounts are expensed to professional fees as invoiced. This unanticipated refund of an unused MISO deposit of $9,203 was received and deposited in its entirety in 2007, over three years after the deposit. The amount had been fully expensed in 2003 and was therefore recognized as other income in the period received.

| 58. | For each period in which a statement of operations is presented, please supplementally provide us with a break-out of your contracting revenues line item by type of revenue and by project Please ensure that this schedule includes and reconciles the projects listed on page 23 and the amounts disclosed in your Management’s Discussion and Analysis of Financial Condition and Results of Operations section. Additionally, please address the following: |

| | · | It appears that you recorded $400,000 of the total $473,000 selling price for Baker, MT during 2007 and that you recorded the residual $73,000 during 2008. Please tell US why the selling price was bifurcated and recorded over a two year period, particularly in light of your statement elsewhere in this filing that you sold the development rights to this wind park in 2007. Please also tell us the basis for how the amount was divided, and if applicable how you determined your methodology complied with SOP 81-1. |

| | · | It appears that you recorded $200,000 of revenues during 2008 for the amounts received from Westmoreland for the Gascoyne II, ND project. Please tell us your basis for recognizing revenue, including the services that were performed or the assets that were sold. Additionally, we note on page F-10 that this project is a joint venture agreement in which you are the managing party. Please tell us how you are accounting for this joint venture, including your consolidation policy. |

| | · | We note on page F-10 that you recognized $75,000 and $250,000 as revenues in 2006 and 2007, respectively, for the Gascoyne, ND project. We further note that revenues were for services rendered to the other party. Based on page 23, it appears that this project was sold in 2006 and subsequently re-acquired in 2008 for the same amount of$325,000. Please tell us the significant terms of the original and subsequent agreement and tell us in detail how you accounted for these transactions arid your basis in GAAP for your accounting. Please include journal entries by year and the basis for the bifurcation of revenues between 2006 and 2007; including if applicable how you determined your methodology complied with SOP 81-1. Additionally, please tell us who the “other party” represents and tell us the types of services that were rendered. |

Division of Corporation Finance

Securities and Exchange Commission

April 23, 2009

Page 28

Response

2007 and 2008 Contracting Revenues by Project:

| 2008: | |

| Project Development Rights: | $200,000 Gascoyne II |

| Consulting: | $ 73,000 Baker, MT |

| | |

| 2007: | |

| Project Development Rights: | $250,000 Gascoyne I |

| Consulting: | $400,000 Baker MT |

| Consulting: | $ 70,100 Gascoyne II |

Baker, MT project. This was a $473,000 consulting project to oversee development and construction of the Baker site for Montana Dakota Utility (MDU). This was incorrectly described elsewhere in the Registration Statement as a sale of development rights. That error has been corrected. Specific payments were made, and recognized, as development and/or construction milestones were achieved.

Gascoyne II project. In 2007, we received $70,100 from Westmoreland Coal to conduct feasibility studies for this 200 MW site. If the project was deemed feasible (which it was), then Westmoreland retained the right of first refusal to jointly develop the site alongside the Company. In 2008, the site was deemed feasible, so Crownbutte sold 40% ownership of the project’s development rights to Westmoreland Coal for $200,000—with Crownbutte retaining the remaining 60% stake. Going forward, each party is to split the future development costs (if any) that relate to this project, and as assets are added, they will be reflected by Crownbutte at 60% of total value, reflecting Crownbutte’s ownership. At December 31, 2008, the joint venture holds no assets, liabilities, or operations to consolidate.

Gascoyne I project. Development rights were sold to Boreal Energy for $325,000, with payments spread over time to accommodate Boreal’s financing abilities. There were no service revenues associated with this project. In 2006, $75,000 was paid to Crownbutte as a down payment in 2006, and the remaining $250,000 was paid as Boreal raised the necessary funds in 2007. In 2008 reacquired the rights to this project from Boreal Energy for $325,000, when Boreal Energy acknowledged that it would not be able to raise the necessary project financing required to construct Gascoyne I.

| 59. | We note your presentation of pro forma income tax expense as if you had been taxed as a C corporation on page F-17. Please present this pro forma income tax expense and the related pro forma earnings per share data on the face of your income statements for the latest year and interim period presented. Please consider presenting this pro forma information for all other periods, as we believe it provides valuable comparative data to your readers. |

Division of Corporation Finance

Securities and Exchange Commission

April 23, 2009

Page 29

Response

We have revised our Statements of Operations to present pro forma income tax expense and related pro forma earnings per share data for the year ended December 31, 2007 and 2008. Please note the pro forma income tax expense for the year ended December 31, 2008 was $-0- since we had a net loss.

Notes to Financial Statements, page F-16

Note 2 - Summary of Significant Accounting Policies, page F-16

| 60. | Please disclose the types of costs that you include in cost of revenues and the types of costs you include in the general and administrative expense line items. Based on page 30 of your Management’s Discussion and Analysis of Financial Condition and Results of Operations section, it appears that meteorological consulting, outsources tower contractors and depreciation on green-fielding equipment are classified as general and administrative expenses. Please tell us why you believe these costs are general and administrative in nature versus a cost of revenues. |

Response

We have revised the Summary of Significant Accounting Policies note to disclose the types of costs that we include in cost of revenues and the types of costs we include in the general and administrative expense line items.

The Company includes all direct costs related to its contract and sale of development rights revenues in cost of revenues. The types of costs include materials and supplies and subcontractor fees and expenses specific to the project or contract. Additionally, allocations of payroll, taxes, and benefits are added to cost of revenues based on time worked on each project. Any project expenses not directly related to revenue-generating contracts or sales are expensed to research and development. All expenses not directly related to a project are expensed as general and administrative. For example, meteorological consulting, tower construction outsourcing, and depreciation on green-fielding equipment would be considered cost of revenues if the work pertained to a contract where revenue recognition was applicable. In the case where no revenues or third party contracts for services or sale of development rights were in place, those same items would be expensed to research and development.

| 61. | We note you have not provided an equity footnote or earnings per share data. Given the reverse merger occurring in 2008 and its impact on your capitalization, we believe your stockholders’ equity and related historical earnings per share should be retroactively restated for all periods presented in a manner similar to a stock split as indicated in our comment above on your interim financial statements. Please revise to provide the disclosures required by SFAS 128, SFAS 129 and Article 5-02(30) of Regulation S-X. |

Division of Corporation Finance

Securities and Exchange Commission

April 23, 2009

Page 30

Response

The December 31, 2008, audited financial statements include an equity footnote as well as earnings per share data. Our statement of stockholders’ equity and historical earnings per share includes the recapitalization which occurred in 2008 retroactively. We have also included all required disclosures in the notes to the financial statements.

| 62. | We note disclosures elsewhere in your filing concerning your portfolio of projects under development. We assume from these disclosures and from the detail of property and equipment presented in Note 3 that you did not own any of the land related to these projects at December 31, 2007 or 2006. Please include footnote disclosure describing the significant terms of your easement, lease or other agreements for this land, including clarifying under what circumstances you are obligated to make payments for the use of this land, how the amount of payment is determined, the length of any agreements and whether you made any such payments during the periods covered by your financial statements. If so, please disclose the amount and how you accounted for these costs. If not, please tell us when you anticipate payments will begin and whether the costs incurred will be expensed or capitalized, and consider clarifying this to your readers. Finally, in the event you obtain an easement for a project which is later determined not to be viable and is subsequently terminated or where no revenues are generated, please explain your obligation to make payments and your accounting for any such payments. |

Response

We have included disclosure under the Properties section describing the significant terms of the land control agreements for our projects in development, including clarifying under what circumstances we are obligated to make payments for the use of the land, how the amount of payment is determined and the length of the agreements. The land control agreements for our projects in development start as a lease option. The provisions of our lease options and leases are substantially similar for all of our sites. We will trigger the shift from lease option to lease when construction on a project begins. We have no leases currently, only lease options. Total lease option payments in 2008 were approximately $14,300. We do not believe the amount of our lease option payments was material; therefore, we do not believe that specific footnote disclosure is warranted.

Division of Corporation Finance

Securities and Exchange Commission

April 23, 2009

Page 31

Revenue Recognition, page F-16

| 63. | Please expand your revenue recognition policy regarding revenue of custom-designed contract sales under the percentage-of-completion method. In doing so, please better describe the types of contracts that you account for under the percentage-of-completion method, and ensure that you provide all applicable disclosures as indicated by Appendix C of SOP 81-1. Please also explain to your readers in more detail how these contracts differ from the sale of products and services that you recognize under SAB 104. Your response should provide us with examples of the significant terms of representative contracts accounted for under percentage-of-completion and under SAB 104 and highlight the differences to help us better understand the circumstances under which you apply each method of accounting. |

Response

We have expanded our revenue recognition policy discussion regarding revenue of custom-designed contract sales under the percentage-of-completion method and have made the other changes requested.

Part II - Information Not Required in Prospectus, page II-I

Item 13. Other Expenses of Issuance and Distribution, page II-I

| 64. | We note that the amount you provide for the total expenses of this offering in your table does not equate to the sum of the individual entries. Please revise your table to provide a reasonably itemized statement of all expenses in connection with the issuance and distribution of the securities to be registered. In this regard, insofar as practicable, please itemize separately any and all applicable registration fees, federal taxes, state taxes and fees, trustees’ and transfer agents’ fees, costs of printing and engraving and legal, accounting and engineering fees. See Instruction to Item 511 of Regulation S-K. Also, please describe in greater detail the “Miscellaneous Fees and Expenses.” |

Response

We have revised the table of expenses as requested.

| 65. | We note your statements on the cover page and page 2 of the prospectus that you will bear all expenses of registration incurred in connection with this offering. However, because the securities to be registered in this offering are to be offered for the account of your selling stockholders, please reiterate in this section, if true, that the selling stockholders will not responsible for any of the expenses of this offering. See Item 511 of Regulation S-K. |

Division of Corporation Finance

Securities and Exchange Commission

April 23, 2009

Page 32

Response

We have revised the disclosure as requested.

Item 15. Recent Sales of Unregistered Securities, page II-2

Shares Issued in Connection with the Merger, page II-2

| 66. | Please state briefly the facts you relied upon in each sale of unregistered securities you discuss in this section. See Item 701 of Regulation S-K. |

Response

We have added statements of the facts we relied upon in claiming the applicable exemption from registration in each sale of unregistered securities discussed in this section.

Item 16. Exhibits, page II-3

| 67. | We note that you have not filed most of your exhibits in connection with the document. As all exhibits are subject to our review, please file all exhibits as soon as possible so that we may have to time to review them before you request that your registration statement become effective. Please note that we may have comments on the exhibits once they are filed. |

Response

We have filed the exhibits required by Item 601 of Regulation S-K.

| 68. | Also, please do not file your exhibits at the end and as part of your document, as you have done with Exhibits 5.1 and 23.2. Instead, please file all exhibits independently of your registration statement under the appropriate exhibit number as required by Item 601 (a)(l) of Regulation S-K. |

Response

We regret this error made by the EDGAR filing service we employed. It has been corrected so that in Amendment No. 1 each exhibit is filed a separate document within the EDGAR submission.

Division of Corporation Finance

Securities and Exchange Commission

April 23, 2009

Page 33

| 69. | We note that you discuss several documents in your disclosure that are not included on your exhibit list but that you may be required to file under Item 601(b) of Regulation S-K. In this regard, we note the following as examples only and not an exhaustive list of documents that you may be required to file as exhibits: |

| | · | As described on page 23 under the heading, Major Events and Material Transactions, you reference several agreements for the sale and purchase of property, projects and services. Also, in this subsection, you reference several joint ventures agreements. |

| | · | On page 32 under the heading, Deferred Financing Costs, you reference a December 31, 2007 financing agreement between you and Strasbourger Pearson Tulcin Wolff, Inc. |

| | · | On page·52 under the heading, Employment Agreements with Executive Officers, you reference employment agreements between you and Manu Kalia and Ryan Fegley. |

| | · | On page 52 under the heading, Certain Relationships and Related Transactions, you reference a Memorandum of Understanding between you and Manu Kalia. |

Please tell us why you do not need to file these agreements as exhibits or include them, and any other material document required to be filed, as exhibits to your registration statement. See Item 601(b) of Regulation S-K.

Response

We have revised the exhibit list and have filed the material documents required to be filed under Item 601(b) of Regulation S-K. Please see, for example, Exhibits 10.12, 10.13, 10.14 and 10.17 (agreements for sale and purchase of property, projects and services), 10.15 and 10.16 (joint venture agreements), 10.8 (agreement with Strasbourger Pearson Tulcin Wolff, Inc.), 10.10 and 10.11 (employment agreements with Manu Kalia and Ryan Fegley) and 10.9 (Memorandum of Understanding with Manu Kalia).

Please note that the agreement referenced on page 32 with Strasbourger Pearson Tulcin Wolff, Inc. as a “financing agreement” was actually a placement agency agreement dated as of November 15, 2007. The disclosure has been revised accordingly.