UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

SCHEDULE 14A

(Rule 14a-101)

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

Filed by the Registrant x Filed by a Party other than the Registrant ¨

Check the appropriate box:

| | |

| ¨ | | Preliminary Proxy Statement |

| |

| ¨ | | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| |

| x | | Definitive Proxy Statement |

| |

| ¨ | | Definitive Additional Materials |

| |

| ¨ | | Soliciting Material Pursuant to §240.14a-12 |

NIMBLE STORAGE, INC.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| | | | |

| |

| x | | No fee required. |

| |

| ¨ | | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | |

| | 1) | | Title of each class of securities to which transaction applies: |

| | 2) | | Aggregate number of securities to which transaction applies: |

| | 3) | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | 4) | | Proposed maximum aggregate value of transaction: |

| | 5) | | Total fee paid: |

| |

| ¨ | | Fee paid previously with preliminary materials. |

| |

| ¨ | | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | |

| | 1) | | Amount Previously Paid: |

| | 2) | | Form, Schedule or Registration Statement No.: |

| | 3) | | Filing Party: |

| | 4) | | Date Filed: |

NIMBLE STORAGE, INC.

211 River Oaks Parkway

San Jose, California 95134

NOTICE OF 2016 ANNUAL MEETING OF STOCKHOLDERS

| | |

Time and Date: | | Monday, July 25, 2016, at 9:00 a.m. (Pacific Time) |

Place: | | Fenwick & West LLP, 801 California Street, Mountain View, California 94041 |

Items of Business: | | 1. To elect three Class III directors of Nimble Storage, Inc. each to serve until the third annual meeting of stockholders following this meeting and until his successor has been elected and qualified or until his earlier resignation or removal. 2. To hold a non-binding advisory vote on the compensation paid to our NEOs as disclosed in this proxy statement. 3. To hold a non-binding advisory vote on the frequency of future advisory votes on executive compensation. 4. To ratify the appointment of Ernst & Young LLP as the independent registered public accounting firm for the fiscal year ending January 31, 2017. 5. To transact such other business as may properly come before the Annual Meeting and any adjournment or postponement thereof. |

Record Date: | | Only stockholders of record at the close of business on May 26, 2016 are entitled to notice of, and to vote at, the meeting and any adjournments thereof. |

Proxy Voting: | | Each share of stock that you own represents one vote. For questions regarding your stock ownership, if you are a registered holder, you can contact our transfer agent, American Stock Transfer & Trust Company, through its website at www.amstock.com or by phone at (800) 937-5449. |

This notice of the Annual Meeting, proxy statement and form of proxy are being distributed and made available on or about June 10, 2016.

Whether or not you expect to attend the Annual Meeting, we encourage you to read the proxy statement and vote through the Internet or request, sign and return your proxy card as soon as possible, so that your shares may be represented at the Annual Meeting.

| | |

| | By Order of the Board of Directors, |

| | /s/ Aparna Bawa |

| | Aparna Bawa Vice President, General Counsel and Secretary |

San Jose, California

May 31, 2016

|

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE STOCKHOLDER MEETING TO BE HELD ON JULY 25, 2016. THIS PROXY STATEMENT AND THE ANNUAL REPORT ARE AVAILABLE AT http://astproxyportal.com/ast/18702 |

TABLE OF CONTENTS

NIMBLE STORAGE, INC.

211 River Oaks Parkway

San Jose, California 95134

PROXY STATEMENT FOR THE 2016 ANNUAL MEETING OF STOCKHOLDERS

We are providing you with these proxy materials in connection with the solicitation by the board of directors of Nimble Storage of proxies to be used at our 2016 Annual Meeting of Stockholders, or the Annual Meeting, to be held at the offices of Fenwick & West LLP located at 801 California Street, Mountain View, California 94041 on Monday, July 25, 2016, at 9:00 a.m. (Pacific Time), and any adjournment or postponement thereof. This proxy statement contains important information regarding the Annual Meeting, the proposals on which you are being asked to vote, information you may find useful in determining how to vote, and information about voting procedures. As used herein, “we,” “us,” “our,” “Nimble Storage” or the “Company” refers to Nimble Storage, Inc., a Delaware corporation.

INTERNET AVAILABILITY OF PROXY MATERIALS

Under rules adopted by the U.S. Securities and Exchange Commission, or the SEC, we are furnishing proxy materials to our stockholders primarily via the Internet, instead of mailing printed copies of those materials to each stockholder. On or about June 10, 2016, we expect to send a Notice of Internet Availability of Proxy Materials, or Notice of Internet Availability, to our stockholders, which contains instructions on how to access our proxy materials, including our proxy statement and our annual report. The Notice of Internet Availability also provides instructions on how to vote through the Internet and includes instructions on how to receive a paper copy of the proxy materials by mail.

This process is designed to reduce our environmental impact and lowers the costs of printing and distributing our proxy materials without impacting our stockholders’ timely access to this important information. However, if you would prefer to receive printed proxy materials, please follow the instructions included in the Notice of Internet Availability.

GENERAL INFORMATION ABOUT THE MEETING

Date and Location of the Meeting

The accompanying proxy is solicited on behalf of Nimble Storage, Inc.’s board of directors for use at the Annual Meeting to be held at the offices of Fenwick & West LLP located at 801 California Street, Mountain View, California 94041 on July 25, 2016, at 9:00 a.m. (Pacific Time), and any adjournment or postponement thereof.

Purpose of the Meeting

At the Annual Meeting, stockholders will act upon the proposals described in this proxy statement. In addition, we will consider any other matters that are properly presented for a vote at the Annual Meeting. As of May 31, 2016, we are not aware of any other matters to be submitted for consideration at the Annual Meeting. If any other matters are properly presented for a vote at the Annual Meeting, the persons named in the proxy, who are officers of the Company, have the authority in their discretion to vote the shares represented by the proxy. Following the Annual Meeting, management will respond to questions from stockholders.

1

Record Date

Only holders of record of common stock at the close of business on May 26, 2016, the record date, will be entitled to vote at the Annual Meeting. At the close of business on May 26, 2016, or the Record Date, we had 84,220,083 shares of common stock outstanding and entitled to vote.

Quorum

The holders of a majority of the voting power of the shares of stock entitled to vote at the Annual Meeting as of the record date must be present at the Annual Meeting in order to hold the Annual Meeting and conduct business. This presence is called a quorum. Your shares are counted as present at the Annual Meeting if you are present and vote in person at the Annual Meeting or if you have properly submitted a proxy.

Voting Rights

Each holder of shares of common stock is entitled to one vote for each share of common stock held as of the close of business on the Record Date. You may vote all shares owned by you as of the Record Date, including (i) shares held directly in your name as the stockholder of record and (ii) shares held for you as the beneficial owner in street name through a broker, bank, trustee or other nominee.

Stockholder of Record: Shares Registered in Your Name. If on the Record Date your shares were registered directly in your name with our transfer agent, American Stock Transfer & Trust Company, then you are considered the stockholder of record with respect to those shares. As a stockholder of record, you may vote at the Annual Meeting, by telephone, through the Internet or, if you request or receive paper proxy materials, by mail, by filling out and returning the proxy card.

Beneficial Owner: Shares Registered in the Name of a Broker or Nominee. If on the Record Date your shares were held in an account with a brokerage firm, bank or other nominee, then you are the beneficial owner of the shares held in street name. As a beneficial owner, you have the right to direct your nominee on how to vote the shares held in your account. However, the organization that holds your shares is considered the stockholder of record for purposes of voting at the Annual Meeting. Because you are not the stockholder of record, you may not vote your shares at the Annual Meeting unless you request and obtain a valid proxy from the organization that holds your shares giving you the right to vote the shares at the Annual Meeting.

Required Vote

Each director will be elected by a plurality of the votes cast, which means that the three individuals nominated for election to the board of directors at the Annual Meeting receiving the highest number of “FOR” votes will be elected. You may either vote “FOR” all nominees to the board of directors or “WITHHOLD” your vote with respect to any nominee you specify or all nominees. With respect to the (i) approval of the non-binding advisory vote on the compensation program of our named executive officers, or NEOs, and (ii) ratification of Ernst & Young LLP as our independent registered public accounting firm for the fiscal year ending January 31, 2017, approval or ratification, respectively, will be obtained if the number of votes cast “FOR” the proposals at the Annual Meeting exceeds the number of votes “AGAINST” the proposals. With respect to the non-binding advisory vote on the frequency of future non-binding advisory votes on the compensation program of our NEOs, you may vote to have such non-binding advisory votes every “ONE YEAR,” “TWO YEARS” or “THREE YEARS,” or you may “ABSTAIN.” The frequency receiving the greatest number of votes cast by stockholders will be considered the frequency of the non-binding advisory vote of our stockholders.

Abstentions (shares present or represented at the Annual Meeting and marked “abstain”) are counted for purposes of determining whether a quorum is present and have no effect on the outcome of the matters voted upon. Broker non-votes occur when shares held by a broker for a beneficial owner are

2

not voted either because (i) the broker did not receive voting instructions from the beneficial owner or (ii) the broker lacked discretionary authority to vote the shares. A broker is entitled to vote shares held for a beneficial owner on “routine” matters without instructions from the beneficial owner of those shares. Absent instructions from the beneficial owner of such shares, a broker is not entitled to vote shares held for a beneficial owner on “non-routine” matters. At our Annual Meeting, only the ratification of Ernst & Young LLP as our independent registered public accounting firm for the fiscal year ending January 31, 2017, is considered a routine matter. All of the other proposals presented at the Annual Meeting are non-routine matters. Broker non-votes and abstentions are counted for purposes of determining whether a quorum is present, but have no effect on the outcome of the matters voted upon. Accordingly, we encourage you to provide voting instructions to your broker, whether or not you plan to attend the Annual Meeting.

Voting Instructions; Voting of Proxies

If you are a stockholder of record, you may:

| | • | | vote in person — we will provide a ballot to stockholders who attend the Annual Meeting and wish to vote in person; |

| | • | | vote by phone or via the Internet — in order to do either, please follow the instructions shown on your Notice of Internet Availability or proxy card; or |

| | • | | vote by mail — if you request or receive a paper proxy card and voting instructions by mail, simply complete, sign and date the enclosed proxy card and return it before the Annual Meeting in the envelope provided. |

Votes submitted through the Internet must be received by 11:59 p.m., Eastern Time, on July 24, 2016. Submitting your proxy (whether by phone, through the Internet or, if you requested or received a paper proxy card, by mail) will not affect your right to vote in person should you decide to attend the Annual Meeting. If you are not the stockholder of record, please refer to the voting instructions provided by your nominee to direct it how to vote your shares. For Proposal 1, you may either vote “FOR” all of the nominees to the board of directors, or you may “WITHOLD” your vote with respect to any nominee you specify or all nominees. For Proposals 2 and 4, you may vote “FOR” or “AGAINST” or “ABSTAIN” from voting. For Proposal 3, you may vote “ONE YEAR” or “TWO YEARS” or “THREE YEARS” or “ABSTAIN” from voting. Your vote is important. Whether or not you plan to attend the Annual Meeting, we urge you to vote by proxy to ensure that your vote is counted.

All proxies will be voted in accordance with the instructions specified on the proxy card. If you sign a physical proxy card and return it without instructions as to how your shares should be voted on a particular proposal at the Annual Meeting, your shares will be voted in accordance with the recommendations of our board of directors stated above.

If you received a Notice of Internet Availability, please follow the instructions included on the notice on how to access your proxy card and vote through the Internet or by mail. If you do not vote and you hold your shares in street name, and your broker does not have discretionary power to vote your shares, your shares may constitute “broker non-votes” (as described above) and will not be counted in determining the number of shares necessary for approval of the proposals. However, shares that constitute broker non-votes will be counted for the purpose of establishing a quorum for the Annual Meeting.

If you receive more than one proxy card or Notice of Internet Availability, your shares are registered in more than one name or are registered in different accounts. To make certain all of your shares are voted, please follow the instructions included on each Notice of Internet Availability on how to access each proxy card and vote each proxy card through the Internet or by mail. If you requested or received paper proxy materials and you intend to vote by mail, please complete, sign and return each proxy card you received to ensure that all of your shares are voted.

3

Expenses of Soliciting Proxies

We will pay the expenses of soliciting proxies. Following the original mailing of the soliciting materials, we and our agents may solicit proxies by mail, email, telephone, facsimile, by other similar means or in person. Our directors, officers and other employees, without additional compensation, may solicit proxies personally or in writing, by telephone, email or otherwise. Following the original mailing of the soliciting materials, we will request brokers, custodians, nominees and other record holders to forward copies of the soliciting materials to persons for whom they hold shares and to request authority for the exercise of proxies. In such cases, upon the request of the record holders, we will reimburse such holders for their reasonable expenses. If you choose to access the proxy materials and/or vote through the Internet, you are responsible for any Internet access charges you may incur.

Revocability of Proxies

A stockholder of record who has given a proxy may revoke it at any time before it is exercised at the Annual Meeting by:

| | • | | delivering to our Corporate Secretary (by any means, including facsimile) a written notice stating that the proxy is revoked; |

| | • | | signing and delivering a proxy bearing a later date; |

| | • | | voting again through the Internet or by telephone; or |

| | • | | attending and voting at the Annual Meeting (although attendance at the Annual Meeting will not, by itself, revoke a proxy). |

Please note, however, that if your shares are held of record by a broker, bank or other nominee and you wish to revoke a proxy, you must contact that organization to revoke any prior voting instructions.

Electronic Access to the Proxy Materials

The Notice of Internet Availability will provide you with instructions regarding how to:

| | • | | view our proxy materials for the Annual Meeting through the Internet; and |

| | • | | instruct us to send our future proxy materials to you electronically by email. |

Choosing to receive your future proxy materials by email will reduce the impact of our annual meetings of stockholders on the environment and lower the costs of printing and distributing our proxy materials. If you choose to receive future proxy materials by email, you will receive an email next year with instructions containing a link to those materials and a link to the proxy voting site. Your election to receive proxy materials by email will remain in effect until you terminate it.

Voting Results

Voting results will be tabulated and certified by the inspector of elections appointed for the Annual Meeting. Preliminary results will be announced at the Annual Meeting. Final results will be published in a current report on Form 8-K to be filed with the SEC within four business days of the Annual Meeting.

4

CORPORATE GOVERNANCE

We are strongly committed to good corporate governance practices. These practices provide an important framework within which our board of directors and management can pursue our strategic objectives for the benefit of our stockholders.

Corporate Governance Guidelines

Our board of directors has adopted Corporate Governance Guidelines that set forth expectations for directors, the board of directors and board of directors’ committee structure and functions and other policies for the governance of the Company. The Corporate Governance Guidelines are reviewed by our Nominating and Corporate Governance Committee and changes are recommended to our board of directors as warranted.

Board Responsibilities, Leadership Structure and Lead Independent Director

The board of directors is responsible for the management and direction of the Company and for establishing broad corporate policies. The board of directors meets periodically during our fiscal year to review significant developments affecting the Company and to act on matters requiring board of directors’ approval.

The positions of Chairperson and Chief Executive Officer are filled by the same person, Suresh Vasudevan. Our board of directors believes that the current board of directors’ leadership structure, which includes a lead independent director, coupled with a strong emphasis on board of directors independence, provides effective independent oversight of management while allowing the board of directors and management to benefit from Mr. Vasudevan’s executive leadership, operational experience and familiarity with our business as Chief Executive Officer. Independent directors and management sometimes have different perspectives and roles in strategy development. Our independent directors bring experience, oversight and expertise from outside of our Company, while Mr. Vasudevan brings company-specific experience and expertise. Our board of directors believes that Mr. Vasudevan’s combined role enables strong leadership, creates clear accountability and enhances our ability to communicate our message and strategy clearly and consistently to stockholders.

Our Corporate Governance Guidelines state that when the Chairperson and Chief Executive Officer positions are held by the same person, a lead independent director shall be designated. Because Mr. Vasudevan is our Chief Executive Officer and Chairman, our board of directors appointed Jerry M. Kennelly to serve as our lead independent director. As lead independent director, Mr. Kennelly, among other responsibilities, presides over executive sessions of our independent directors, serves as a liaison between the Chairman and the independent directors and performs such functions and responsibilities as our board of directors otherwise determines and delegates.

Role of Board in Risk Oversight

Our board of directors, as a whole, has responsibility for risk oversight, although the committees of our board of directors oversee and review risk areas which are particularly relevant to them. The oversight responsibility of the board of directors and its committees is informed by reports from our management team and from our internal audit department, which are designed to provide visibility to the board of directors about the identification, assessment and management of key risks and our risk mitigation strategies. Each committee of the board of directors meets with key management personnel and representatives of outside advisors to oversee risks associated with their respective principal areas of focus. The Audit Committee reviews our major financial risk exposures and the steps management has taken to monitor and control such exposures, including our risk assessment and risk management policies and guidelines. The Nominating and Corporate Governance Committee reviews our major legal compliance risk exposures and monitors the steps management has taken to mitigate these exposures, including our legal risk assessment and legal risk management policies and guidelines. The Compensation Committee evaluates risks arising from our compensation policies and practices.

5

Director Independence

Our common stock is listed on the New York Stock Exchange. The listing rules of this stock exchange generally require that a majority of the members of our board of directors be independent. In addition, the listing rules generally require that, subject to specified exceptions, each member of a listed company’s audit, compensation and governance committees be independent.

Our board of directors determines the independence of our directors by applying the independence principles and standards established by the New York Stock Exchange. Under the rules of the New York Stock Exchange, a director will only qualify as an “independent director” if, in the opinion of that company’s board of directors, that person does not have a relationship that would interfere with the exercise of independent judgment in carrying out the responsibilities of a director. Material relationships may include commercial, industrial, consulting, legal, accounting, charitable, family and other business, professional and personal relationships. The rules also specify various relationships that preclude a determination of director independence.

Applying these standards, the board of directors annually reviews the independence of our directors, taking into account all relevant facts and circumstances. In its most recent review, the board of directors considered, among other things, the relationships that each non-employee director has with our Company and all other facts and circumstances our board of directors deemed relevant in determining their independence, including the beneficial ownership of our capital stock by each non-employee director. In particular, our board of directors considered Frank Calderoni’s service as a former Executive Advisor and the former Executive Vice President and Chief Financial Officer of Cisco Systems, Inc., which sells us products and services and to which we sell products and services in the ordinary course of business on arm’s-length terms.

Based upon this review, our board of directors has determined that all of the members of our board of directors other than Messrs. Vasudevan and Mehta are “independent” as that term is defined under the applicable rules, regulations and the listing standards of the New York Stock Exchange.

All members of our Audit Committee, Compensation Committee and Nominating and Corporate Governance Committee must be independent directors under the applicable rules, regulations and the listing standards of the New York Stock Exchange. Audit Committee members must also satisfy the independence criteria set forth in Rule 10A-3 under the Securities Exchange Act of 1934, as amended, or the Exchange Act. In order to be considered independent for purposes of Rule 10A-3, a member of an audit committee of a listed company may not, other than in his or her capacity as a member of the audit committee, the board of directors or any other board of directors committee: (i) accept, directly or indirectly, any consulting, advisory or other compensatory fee from the listed company or any of its subsidiaries; or (ii) be an affiliated person of the listed company or any of its subsidiaries. Our board of directors has determined that all members of our Audit Committee, Compensation Committee and Nominating and Corporate Governance Committee are independent and all members of our Audit Committee satisfy the additional SEC independence requirements for the members of such committee.

Certain Relationships and Related Party Transactions

Our board of directors adopted a written related person transactions policy providing that our executive officers, directors, nominees for election as a director, beneficial owners of more than 5% of our common stock and any member of the immediate family of and any entity affiliated with any of the foregoing persons are not permitted to enter into a material related person transaction with us without the review and approval of our Audit Committee, or a committee composed solely of independent directors in the event it is inappropriate for our Audit Committee to review such transaction due to a conflict of interest. The policy provides that any request for us to enter into a transaction with a related party in which the amount involved exceeds $120,000 will be presented to our Audit Committee for review, consideration and approval. In approving or rejecting any such proposal, our Audit Committee

6

will consider the facts and circumstances available and deemed relevant to the Audit Committee, including, but not limited to, whether the transaction is on terms no less favorable than terms generally available to an unaffiliated third party under the same or similar circumstances and the extent of the related person’s interest in the transaction.

Other than the compensation arrangements, including employment, termination of employment and change in control arrangements and indemnification arrangements, discussed in the section entitled “Executive Compensation— Executive Compensation Tables and Other Information,” since February 1, 2015, there has not been, nor is there currently proposed, any transaction or series of similar transactions to which we were or will be a party in which the amount involved exceeds $120,000 and in which any related party had or will have a direct or indirect material interest.

Nomination to the Board of Directors

Candidates for nomination to our board of directors are selected by our board of directors based on the recommendation of the Nominating and Corporate Governance Committee in accordance with the Committee’s charter, our certificate of incorporation and bylaws, our Corporate Governance Guidelines and the criteria adopted by the board of directors regarding director candidate qualifications. In recommending candidates for nomination, the Nominating and Corporate Governance Committee considers candidates recommended by directors, officers, employees, stockholders and others, using the same criteria to evaluate all candidates. Evaluations of candidates generally involve a review of background materials, internal discussions and interviews with selected candidates as appropriate, and the Committee may also engage consultants or third-party search firms to assist in identifying and evaluating potential nominees.

Additional information regarding the process for properly submitting stockholder nominations for candidates for membership on our board of directors is set forth below under the heading “Additional Information - Stockholder Proposals to be Presented at the Next Annual Meeting.”

Director Qualifications

With the goal of developing a diverse, experienced and highly-qualified board of directors, the Nominating and Corporate Governance Committee is responsible for developing and recommending to the board of directors the desired qualifications, expertise and characteristics of members of our board of directors, including the specific minimum qualifications that the Committee believes must be met by a Committee-recommended nominee for membership on the board of directors and any specific qualities or skills that the Committee believes are necessary for one or more of the members of the board of directors to possess.

Since the identification, evaluation and selection of qualified directors is a complex and subjective process that requires consideration of many intangible factors and will be significantly influenced by the particular needs of the board of directors from time to time, our board of directors has not adopted a specific set of minimum qualifications, qualities or skills that are necessary for a nominee to possess, other than those that are necessary to meet U.S. legal, regulatory and New York Stock Exchange listing requirements and the provisions of our certificate of incorporation, bylaws, Corporate Governance Guidelines and charters of the board of directors’ committees. In addition, neither the board of directors nor the Nominating and Corporate Governance Committee has a formal policy with regard to the consideration of diversity in identifying nominees. When considering nominees, the Nominating and Corporate Governance Committee may take into consideration many factors including, among other things, a candidate’s independence, integrity, skills, financial and other expertise, breadth of experience, knowledge about our business or industry and ability to devote adequate time and effort to the responsibilities of the board of directors in the context of its existing composition. Through the nomination process, the Nominating and Corporate Governance Committee seeks to promote board of directors’ membership that reflects a diversity of business experience, expertise, viewpoints, personal backgrounds

7

and other characteristics that are expected to contribute to the board of directors’ overall effectiveness. The brief biographical description of each director set forth under the heading “Director Biographies” includes the primary individual experience, qualifications, attributes and skills of each of our directors that led to the conclusion that each director should serve as a member of our board of directors at this time.

Codes of Business Conduct and Ethics

We have adopted our Code of Business Conduct and Ethics for employees, which applies to all employees, including all of our executive officers, and our Code of Business Conduct and Ethics for Directors, which applies to our board of directors. We intend to satisfy the disclosure requirement under Item 5.05 of Form 8-K regarding amendment to, or waiver from, a provision of our Codes of Business Conduct and Ethics by posting such information on our website at the address below or by filing a current report on Form 8-K with the SEC.

Communication with Directors

Stockholders and interested parties who wish to communicate with our board of directors, non-management members of our board of directors as a group, a committee of the board of directors or a specific member of our board of directors (including our chairman or lead independent director, if any) may do so by letters addressed to the attention of our Corporate Secretary. The address for these communications is: Nimble Storage, Inc. 211 River Oaks Parkway San Jose, California 95134, Attn: Corporate Secretary.

All communications are reviewed by the Corporate Secretary and provided to the members of the board of directors, provided that sales materials; abusive, threatening or otherwise inappropriate materials; and other routine items and items unrelated to the duties and responsibilities of the board of directors will not be provided to directors.

Internet Availability of Corporate Governance Documents

Our Codes of Business Conduct and Ethics, Corporate Governance Guidelines and the charters of each of our Audit Committee, Compensation Committee, and Nominating and Corporate Governance Committee are available on our website at http://investors.nimblestorage.com/company/investor-relations under “Corporate Governance.”

BOARD OF DIRECTORS

Board and Committee Meetings and Attendance

The board of directors meets periodically during the Company’s fiscal year to review significant developments affecting the Company and to act on matters requiring board of directors’ approval. The board of directors held six meetings during the fiscal year ended January 31, 2016, or Fiscal 2016, the Audit Committee held eight meetings during Fiscal 2016, the Compensation Committee held seven meetings during Fiscal 2016 and the Nominating and Corporate Governance Committee held four meetings during Fiscal 2016. During Fiscal 2016, each member of the board of directors participated in at least 75% or more of the aggregate of all meetings of the board of directors and of all meetings of committees on which such member served, that were held during the period in which such director served.

Sessions of Independent Directors

In order to promote open discussion among independent directors, our independent directors regularly hold sessions amongst themselves. The presiding independent director, typically our lead independent director, provides feedback to our Chief Executive Officer, as needed, promptly after the independent director session. Neither Mr. Vasudevan nor Mr. Mehta participates in such sessions.

8

Committees of Our Board of Directors

Our board of directors has established an Audit Committee, a Compensation Committee and a Nominating and Corporate Governance Committee. The composition and responsibilities of each committee are described below. Members serve on these committees until their resignations or until otherwise determined by our board of directors.

Audit Committee

Our Audit Committee is comprised of Frank Calderoni, William D. “B.J.” Jenkins, Jr. and William J. Schroeder. Mr. Calderoni is the chair of our Audit Committee. The composition of our Audit Committee meets the requirements for independence under the current New York Stock Exchange listing standards and SEC rules and regulations. Each member of our Audit Committee is financially literate. In addition, our board of directors has determined that each of Messrs. Calderoni, Jenkins and Schroeder is an “Audit Committee financial expert” as defined in Item 407(d)(5)(ii) of Regulation S-K promulgated under the Securities Act of 1933, as amended, or the Securities Act. This designation does not impose any duties, obligations or liabilities that are greater than are generally imposed on members of our Audit Committee and our board of directors. Our Audit Committee is directly responsible for, among other things:

| | • | | selecting a firm to serve as the independent registered public accounting firm to audit our financial statements; |

| | • | | ensuring the independence of the independent registered public accounting firm; |

| | • | | discussing the scope and results of the audit with the independent registered public accounting firm and reviewing with management and that firm our interim and year-end operating results; |

| | • | | establishing procedures for employees to anonymously submit concerns about questionable accounting or audit matters; |

| | • | | considering the adequacy of our internal controls and internal audit function; |

| | • | | reviewing material related party transactions or those that require disclosure; and |

| | • | | approving or, as permitted, pre-approving all audit and non-audit services to be performed by the independent registered public accounting firm. |

The Audit Committee operates under a written charter that was adopted by our board of directors and satisfies the applicable standards of the SEC and the New York Stock Exchange.

Compensation Committee

During Fiscal 2016, our Compensation Committee was comprised of Frank Calderoni, James J. Goetz, and Ping Li. The board of directors appointed Jerry M. Kennelly to the Compensation Committee in April 2016. Mr. Goetz is the chair of our Compensation Committee. The composition of our Compensation Committee meets the requirements for independence under the current New York Stock Exchange and SEC rules and regulations. Each member of this Committee is a non-employee director, as defined pursuant to Rule 16b-3 promulgated under the Exchange Act, and an outside director, as defined pursuant to Section 162(m) of the Internal Revenue Code of 1986, as amended, or the Code, and meets the requirements for independence under the current New York Stock Exchange listing standards and SEC rules and regulations. Our Compensation Committee is responsible for, among other things:

| | • | | reviewing and approving the compensation of our executive officers; |

| | • | | reviewing and recommending to our board of directors the compensation of our directors; |

9

| | • | | administering our stock and equity incentive plans; |

| | • | | reviewing and approving, or making recommendations to our board of directors with respect to, incentive compensation and equity plans; and |

| | • | | reviewing our overall compensation philosophy. |

For additional information about the Compensation Committee’s responsibilities please see the section entitled “Executive Compensation - Compensation Discussion and Analysis.” The Compensation Committee operates under a written charter that was adopted by our board of directors and satisfies the applicable standards of the SEC and the New York Stock Exchange.

Nominating and Corporate Governance Committee

Our Nominating and Corporate Governance Committee is comprised of Ping Li and William J. Schroeder. Mr. Schroeder is the chair of our Nominating and Corporate Governance Committee. Messrs. Li and Schroeder meet the requirements for independence under the current New York Stock Exchange listing standards. Our Nominating and Corporate Governance Committee is responsible for, among other things:

| | • | | identifying and recommending candidates for membership on our board of directors; |

| | • | | recommending directors to serve on board of directors’ committees; |

| | • | | reviewing and recommending our corporate governance guidelines and policies; |

| | • | | reviewing proposed waivers of the codes of conduct for directors, executive officers and employees; |

| | • | | evaluating, and overseeing the process of evaluating, the performance of our board of directors and individual directors; and |

| | • | | assisting our board of directors on corporate governance matters. |

The Nominating and Corporate Governance Committee operates under a written charter that was adopted by our board of directors and satisfies the applicable standards of the SEC and the New York Stock Exchange.

Board Attendance at Annual Stockholders’ Meeting

Our policy is to invite and encourage each member of our board of directors to be present at our annual meetings of stockholders. At our 2015 Annual Meeting of Stockholders, five of the directors who were on the board of directors as of the date of the meeting attended the meeting in person or by phone.

Non-Employee Director Compensation

In May 2014, our Compensation Committee approved a Board Compensation Policy that provides for initial and annual grants of restricted stock units, or RSUs, to non-employee directors for board of directors and committee service. In May 2016, our board of directors amended our Board Compensation Policy to better align our non-employee director compensation to that of our peer group for Fiscal 2017, effective immediately. Upon joining our board of directors, non-employee directors were entitled to receive $600,000 worth of RSUs under our prior Board Compensation Policy and are now entitled to receive $490,000 worth of RSUs under our current Board Compensation Policy. The initial RSUs vest over three years with approximately 16.6% of the RSUs vesting on the non-employee director’s completion of six months of service and the remainder vesting ratably on each six month anniversary thereafter, subject to continued service.

10

Pursuant to the Board Compensation Policy, our non-employee directors have received or will receive the following equity grants in connection with their ongoing service as a director and in connection with their committee leadership or service. Each non-employee director annually is eligible to receive:

| | | | |

| | | Prior Board Compensation Policy | | Current Board Compensation

Policy (effective May 2016) |

Annual Grant | | $265,000 worth of RSUs | | $240,000 worth of RSUs |

Lead Independent Director | | $20,000 worth of RSUs | | $30,000 worth of RSUs |

Audit Committee Chair | | $20,000 worth of RSUs | | $20,000 worth of RSUs |

Audit Committee Member | | $10,000 worth of RSUs | | $10,000 worth of RSUs |

Compensation Committee Chair | | $16,000 worth of RSUs | | $20,000 worth of RSUs |

Compensation Committee Member | | $8,000 worth of RSUs | | $8,000 worth of RSUs |

Nominating and Corporate Governance Committee Chair | | $9,000 worth of RSUs | | $10,000 worth of RSUs |

Nominating and Corporate Governance Committee Member | | $4,500 worth of RSUs | | $5,000 worth of RSUs |

Under our prior Board Compensation Policy, the number of RSUs for each of these grants was calculated based on the average of the closing prices of our common stock on the New York Stock Exchange for the ten trading days prior to the grant date, rounded to the nearest whole share. Under our current Board Compensation Policy, the number of RSUs, rounded to the nearest whole share, for each of these grants will be calculated based on the greater of (i) the average of the closing prices of our common stock on the New York Stock Exchange for the 30 calendar days prior to the grant date and (ii) $10.00.

The grant date for the RSUs is the first business day following each annual meeting of stockholders, and the RSUs vest as to 50% of the underlying shares on each of December 10 of the year of the grant date and June 10 of the year following the grant date, subject to the director’s continuous service through each such vesting date.

A newly appointed or elected non-employee director will be eligible for annual equity grants at the first annual meeting of stockholders at which he or she has served as a non-employee director for at least six months. In the event we are party to a merger or consolidation, sale of all or substantially all assets or other similar change in control transaction, the vesting of all awards granted to non-employee directors will accelerate immediately prior to the consummation of such event.

11

Director Compensation Table for Fiscal 2016

The following table provides information for Fiscal 2016, regarding all compensation awarded to, earned by or paid to each of our non-employee directors. Mr. Goetz elected to decline any compensation for service on our board of directors and as employees Messrs. Vasudevan and Mehta did not receive compensation for their service as directors during Fiscal 2016. Other than as described below, none of our non-employee directors received any fees or reimbursement of any expenses.

| | | | | | |

Director Name | | Fees Earned or Paid in Cash ($) | | Restricted

Stock Unit Awards ($)(1) | | Total ($) |

James J. Goetz | | — | | — | | — |

William D. “BJ” Jenkins, Jr. | | — | | 554,117 | | 554,117 |

Ping Li | | — | �� | 285,236 | | 285,236 |

Frank Calderoni | | — | | 301,153 | | 301,153 |

Jerry M. Kennelly | | — | | 292,933 | | 292,933 |

William J. Schroeder | | — | | 291,916 | | 291,916 |

| (1) | Amounts listed in the “Restricted Stock Unit Awards” column represent the aggregate fair value amount computed as of the grant date of each RSU award during Fiscal 2016 in accordance with Financial Accounting Standards Board Accounting Standards Codification Topic 718, or ASC 718. Assumptions used in the calculation of these amounts are set forth in notes 2 and 8 to the notes to our audited consolidated financial statements included in our Annual Report on Form 10-K for Fiscal 2016. |

The following table provides information about the aggregate number of shares of our common stock subject to outstanding option and RSU awards held by our non-employee directors as of January 31, 2016:

| | | | |

Director Name | | Number of Shares

Underlying Stock Options

Held at Fiscal Year-End | | Number of Shares

Underlying Restricted

Stock Unit Awards Held at

Fiscal Year-End |

James J. Goetz | | — | | — |

William D. “BJ” Jenkins, Jr. | | — | | 19,517 |

Ping Li | | — | | 5,188 |

Frank Calderoni | | — | | 5,478 |

Jerry M. Kennelly | | — | | 5,328 |

William J. Schroeder | | — | | 5,310 |

12

PROPOSAL 1

ELECTION OF DIRECTORS

Our board of directors consists of eight directors and is divided into three classes with each class serving for three years, and with the terms of office of the respective classes expiring in successive years. Directors in Class III will stand for election at the Annual Meeting. The terms of office of directors in Class I and Class II do not expire until the annual meetings of stockholders to be held in 2017 and 2018, respectively. At the recommendation of our Nominating and Corporate Governance Committee, our board of directors proposes that each of Frank Calderoni, Jerry M. Kennelly and William J. Schroeder, each of whom is currently serving as a Class III director, be elected as a Class III director for a three-year term expiring at the 2019 annual meeting of stockholders and until such director’s successor is duly elected and qualified or until such director’s earlier death, resignation or removal.

Shares represented by proxies will be voted “FOR” the election of each of the three nominees named above, unless the proxy is marked to withhold authority to so vote. If any nominee for any reason is unable to serve or for good cause will not serve, the proxies may be voted for such substitute nominee as the proxy holder might determine. Each nominee has consented to being named in this proxy statement and to serve if elected. Proxies may not be voted for more than three directors. Stockholders may not cumulate votes in the election of directors.

OUR BOARD OF DIRECTORS RECOMMENDS A VOTE “FOR” ELECTION OF EACH

OF THE THREE NOMINATED DIRECTORS.

DIRECTOR BIOGRAPHIES

Director Nominees

The nominees and their ages as of May 5, 2016, occupations and length of service on the board of directors are provided in the table below. Additional biographical information for each director nominee is set forth below the table.

| | | | | | |

Name of Nominee | | Age | | Principal Occupation | | Director Since |

Frank Calderoni(2)(3) | | 58 | | Chief Financial Officer and Executive Vice President of Operations of Red Hat, Inc. | | June 2012 |

Jerry M. Kennelly(1)(3) | | 65 | | Chief Executive Officer and Chairman of Riverbed Technology, Inc. | | March 2013 |

William J. Schroeder(2)(4) | | 71 | | Retired Silicon Valley Entrepreneur | | April 2013 |

| (1) | Lead Independent Director |

| (2) | Member of the Audit Committee |

| (3) | Member of the Compensation Committee |

| (4) | Member of the Nominating and Corporate Governance Committee |

Frank Calderoni has served as a director since June 2012. Mr. Calderoni joined Red Hat, Inc. as the Chief Financial Officer and Executive Vice President of Operations in June 2015. Prior to Red Hat, Mr. Calderoni served as an Executive Advisor at Cisco Systems, Inc., a designer, manufacturer and seller of Internet Protocol-based networking and other products related to the communications and information technology industry, from January 2015 to July 2015. From February 2008 to January 2015, Mr. Calderoni served as Executive Vice President and Chief Financial Officer at Cisco, managing Cisco’s financial strategy and operations. He joined Cisco in 2004 from QLogic Corporation, a storage networking company where he was Senior Vice President and Chief Financial Officer. Prior to that, he was Senior Vice President, Finance and Administration and Chief Financial Officer for SanDisk Corporation, a flash data storage company. Before joining SanDisk, Mr. Calderoni spent 21 years at International Business Machines Corporation, a provider of information technology products

13

and services, where he became Vice President. He held controller responsibilities for several divisions within the company. Mr. Calderoni has served on the board of directors of Adobe Systems Incorporated since May 2012 and the board of directors of Palo Alto Networks since February 2016. Mr. Calderoni holds a B.S. in Accounting and Finance from Fordham University and an M.B.A. in Finance from Pace University.

Mr. Calderoni’s Qualifications: Our board of directors believes that Mr. Calderoni’s experience as chief financial officer of publicly traded global technology companies and his understanding of accounting principles and financial reporting rules and regulations give him a breadth of knowledge and valuable expertise which qualify him to serve on our board of directors.

Jerry M. Kennelly has served as a director since March 2013. Mr. Kennelly co-founded Riverbed Technology, Inc., a network infrastructure company, in 2002 and currently serves as the chairman of its board of directors and its Chief Executive Officer. Immediately prior to founding Riverbed, Mr. Kennelly spent six years at Inktomi Corporation, an infrastructure software company, where he served as Executive Vice President, Chief Financial Officer and Secretary. From June 1990 until joining Inktomi in October 1996, Mr. Kennelly worked for Sybase, Inc., an infrastructure software company, in a number of senior financial and operational positions, most recently as Vice President of Corporate Finance. From November 1988 until June 1990, Mr. Kennelly worked at Oracle Corporation, a developer of software and hardware systems, as finance director for U.S. operations. From June 1980 until November 1988, Mr. Kennelly worked at Hewlett-Packard Company, a provider of information technology products and services, as Worldwide Sales and Marketing Controller for the Tandem Computers Division. Mr. Kennelly holds a B.A. in political economy from Williams College and an M.S. in accounting from the New York University Graduate School of Business Administration.

Mr. Kennelly’s Qualifications: Our board of directors believes that Mr. Kennelly’s in-depth knowledge of our business and markets, extensive operating experience and strong leadership skills give him a breadth of knowledge and valuable expertise which qualify him to serve on our board of directors.

William J. Schroeder has served as a director since April 2013. Mr. Schroeder served as the Chairman of Oxford Semiconductor, a provider of connectivity solutions, from July 2006 and Interim Chief Executive Officer from April 2007 until the sale of the company in January 2009. From February 2002 until his retirement from full-time employment in October 2004, Mr. Schroeder served as President and Chief Executive Officer of Vormetric, Inc., an enterprise data storage security company. Prior to that, Mr. Schroeder served as a consultant to various technology companies from January 2001 to February 2002. Mr. Schroeder currently serves on the board of directors of Xirrus, Inc., a privately held company. Mr. Schroeder holds an M.B.A. with High Distinction from the Harvard Business School and an M.S.E.E. and a B.E.E. from Marquette University.

Mr. Schroeder’s Qualifications: Our board of directors believes that Mr. Schroeder’s management experience in the information technology and data storage industries gives him a breadth of knowledge and valuable expertise, which qualify him to serve on our board of directors.

14

Continuing Directors

The directors who are serving for terms that do not expire as of the date of the Annual Meeting and their ages as of May 5, 2016, occupations and length of service on the board of directors are provided in the table below. Additional biographical information for each continuing director is set forth below the table.

| | | | | | |

Name of Director | | Age | | Principal Occupation | | Director Since |

Class I Directors: | | | | | | |

Suresh Vasudevan | | 45 | | Chief Executive Officer and Chairman of Nimble Storage | | September 2009 |

Varun Mehta | | 54 | | Founder, Vice President of Product Operations of Nimble Storage | | November 2007 |

Class II Directors: | | | | | | |

James J. Goetz(2) | | 50 | | Managing Member of Sequoia Capital Operations, LLC | | December 2007 |

William D. “BJ” Jenkins, Jr.(1) | | 50 | | President, Chief Executive Officer and Board Member of Barracuda Networks, Inc. | | March 2015 |

Ping Li(2)(3) | | 43 | | Partner at Accel Partners | | March 2011 |

| (1) | Member of the Audit Committee |

| (2) | Member of the Compensation Committee |

| (3) | Member of the Nominating and Corporate Governance Committee |

Suresh Vasudevan has served as our Chief Executive Officer since March 2011, as a director since September 2009 and as the Chairman of our board of directors since September 2013. From January 2009 to January 2011, Mr. Vasudevan was Chief Executive Officer of Omneon Video Networks, Inc. (acquired by Harmonic Inc.), a provider of storage and networking equipment for the broadcast industry. From February 1999 to December 2008, Mr. Vasudevan held positions at NetApp, Inc., a provider of integrated data storage solutions, most recently as Senior Vice President. Before joining NetApp, Mr. Vasudevan worked at the management consulting firm McKinsey & Co. in New Delhi, Mumbai and Chicago as a senior engagement manager from April 1993 to January 1998. Mr. Vasudevan holds a Post Graduate Diploma in Management from the Indian Institute of Management in Calcutta and a B.S. in Electrical Engineering from the Birla Institute of Technology and Science in Pilani, India.

Mr. Vasudevan’s Qualifications: Our board of directors believes that Mr. Vasudevan’s management experience and his data storage industry experience give him a breadth of knowledge and valuable understanding of our industry which qualify him to serve as our Chief Executive Officer and on our board of directors.

Varun Mehta has served as our Vice President of Product Operations since April 2016, was our Vice President of Engineering from March 2011 to April 2016, was our founding Chief Executive Officer from November 2007 to March 2011 and has served as a director since November 2007. From March 2006 to April 2007, Mr. Mehta was Vice President of Engineering at PeakStream, Inc., a developer of a software application platform for the high performance computing market, which was acquired in May 2007 by Google Inc., a provider of information technology products and services. From November 2002 to February 2006, Mr. Mehta held positions at Data Domain, Inc., a developer of de-duplication appliances for data backup systems and other storage applications, most recently as Vice President of Engineering. Prior to that, Mr. Mehta held senior management positions at FastForward Networks, Inc., a developer of multi-streaming media technology; Panasas, Inc., a provider of network-attached storage technology; NetApp, Inc., a provider of data storage solutions; and Sun Microsystems, Inc., a

15

provider of computer hardware, software and information technology services. Mr. Mehta holds an M.S. in computer engineering from Rice University and an M.B.A. from the University of California, Berkeley.

Mr. Mehta’s Qualifications: Our board of directors believes that Mr. Mehta’s management experience and his information technology and data storage industry experience give him a breadth of knowledge and valuable understanding of our industry which qualify him to serve on our board of directors.

James J. Goetz has served as a director since December 2007. Mr. Goetz has been a Managing Member of Sequoia Capital Operations, LLC, a venture capital firm, since 2004. Mr. Goetz has served on the board of directors of Barracuda Networks, Inc. since July 2009; Palo Alto Networks, Inc. since April 2005; and a number of privately held companies. Mr. Goetz also served on the boards of directors of Jive Software, Inc. from August 2007 to December 2015 and Ruckus Wireless, Inc. from July 2012 to February 2015. Mr. Goetz holds an M.S. in Electrical Engineering with a concentration in Computer Networking from Stanford University and a B.S. in Electrical Engineering with a concentration in Computer Engineering from the University of Cincinnati.

Mr. Goetz’s Qualifications: Our board of directors believes that Mr. Goetz’s investment experience in the information technology and enterprise storage industries gives him a breadth of knowledge and valuable insight regarding our business which qualify him to serve on our board of directors.

William D. “BJ” Jenkins, Jr. has served as a director since March 2015. Mr. Jenkins has served as President, Chief Executive Officer and a board member of Barracuda Networks, Inc. since November 2012. Previously, he served as President of EMC’s Backup Recovery Systems (BRS) Division. Mr. Jenkins joined EMC in 1998 and held a wide range of senior leadership roles within EMC before becoming President of the BRS Division, including serving as Chief of Staff for the division. Over the years, Mr. Jenkins also held the positions of Senior Vice President of Global Marketing; Vice President of Telecom, Media and Entertainment and Outsourcing Sales; Vice President of Global Field Marketing and Director of Operations Global Channels. Mr. Jenkins is a graduate of the University of Illinois, where he earned a B.S. degree in general engineering, and received his M.B.A. from Harvard Business School. Mr. Jenkins has served on the board of directors of Apigee Corp. since September 2013.

Mr. Jenkins’ Qualifications: Our board of directors believes that Mr. Jenkins’s experience in the information technology and data storage industries give him a breadth of knowledge and valuable insight regarding our business which qualify him to serve on our board of directors.

Ping Li has served as a director since March 2011. Mr. Li has been a partner at Accel Partners, a venture capital firm, since 2004. Mr. Li serves on the boards of a number of private companies. Prior to Accel, Mr. Li worked at Juniper Networks, Inc., a provider of network infrastructure and services, as a Senior Product Line Manager and Director of Corporate Development from 2000 to 2004. Mr. Li also served as a strategy consultant for McKinsey & Company, a management consulting firm, advising technology clients in their growth strategies, from 1998 to 1999. Mr. Li holds an A.B. from Harvard University with honors and an M.B.A. from the Stanford Graduate School of Business.

Mr. Li’s Qualifications: Our board of directors believes that Mr. Li’s investment experience in the information technology and data storage industries give him a breadth of knowledge and valuable insight regarding our business which qualify him to serve on our board of directors.

16

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The following table sets forth certain information with respect to the beneficial ownership of our common stock as of May 5, 2016, by:

| | • | | each stockholder known by us to be the beneficial owner of more than 5% of our common stock; |

| | • | | each of our directors or director nominees; |

| | • | | all of our current directors and executive officers as a group. |

We have determined beneficial ownership in accordance with the rules of the SEC, and the information is not necessarily indicative of beneficial ownership for any other purpose. Except as indicated by the footnotes below, we believe, based on information furnished to us, that the persons and entities named in the table below have sole voting and sole investment power with respect to all shares of common stock that they beneficially owned, subject to applicable community property laws.

Applicable percentage ownership is based on 84,158,746 shares of common stock outstanding as of May 5, 2016. In computing the number of shares of common stock beneficially owned by a person and the percentage ownership of that person, we deemed to be outstanding all shares of common stock subject to options and RSUs held by that person or entity that are currently exercisable or subject to settlement or that will become exercisable or subject to settlement within 60 days of May 5, 2016. We did not deem these shares outstanding, however, for the purpose of computing the percentage ownership of any other person. Unless otherwise indicated, the address of each beneficial owner listed in the table below is c/o Nimble Storage, Inc., 211 River Oaks Parkway, San Jose, California 95134.

| | | | | | | | | | |

Name of Beneficial Owner | | Number

of Shares

Owned (#) | | Shares

Issuable

Within 60

Days (#) | | Shares

Issuable

Pursuant to

Options

within 60

Days(#) | | Total

Shares

Beneficially

Owned(#) | | Percentage

of Shares

Beneficially

Owned(%) |

5% Stockholders: | | | | | | | | | | |

Entities Affiliated with Sequoia Capital(1) | | 6,470,108 | | - | | - | | 6,470,108 | | 7.7 |

Wellington Management Group LLP(2) | | 4,470,739 | | - | | - | | 4,470,739 | | 5.3 |

FMR LLC(3) | | 9,941,261 | | - | | - | | 9,941,261 | | 11.8 |

| | | | | | |

Named Executive Officers: | | | | | | | | | | |

Suresh Vasudevan(4) | | 701,167 | | - | | 2,678,333 | | 3,379,500 | | 3.9 |

Anup Singh(5) | | 471,830 | | 4,687 | | 20,833 | | 497,350 | | * |

Varun Mehta(6) | | 6,621,321 | | - | | 166,665 | | 6,787,986 | | 8.0 |

Denis Murphy | | 52,125 | | 58,750 | | - | | 110,875 | | * |

Umesh Maheshwari(7) | | 4,857,316 | | - | | 397,808 | | 5,255,124 | | 6.2 |

| | | | | | |

Non-Employee Directors: | | | | | | | | | | |

Frank Calderoni(8) | | 211,053 | | 5,478 | | - | | 216,531 | | * |

James J. Goetz(9) | | 6,692,931 | | - | | - | | 6,692,931 | | 8.0 |

William D. “BJ” Jenkins, Jr. | | 3,903 | | 3,903 | | - | | 7,806 | | * |

Jerry M. Kennelly(10) | | 83,811 | | 5,328 | | - | | 89,139 | | * |

Ping Li(11) | | 265,699 | | 5,188 | | - | | 270,887 | | * |

William J. Schroeder(12) | | 175,560 | | 5,310 | | - | | 180,870 | | * |

All executive officers and directors as a

group (10 persons)(13) | | 15,279,400 | | 88,644 | | 3,316,566 | | 18,223,875 | | 20.9 |

| * | Represents beneficial ownership of less than one percent. |

17

| (1) | Represents (i) 5,075,096 shares held by Sequoia Capital XII, LP, (ii) 189,900 shares held by Sequoia Technology Partners XII, LP, (iii) 542,412 shares held by Sequoia Capital XII Principals Fund, LLC and (iv) 662,700 shares held by SC US GF V Holdings, Ltd. Sequoia Capital U.S. Growth Fund V, L.P. and Sequoia Capital USGF Principals Fund V, L.P. together own 100% of the outstanding ordinary shares of SC US GF V Holdings, Ltd. SC XII Management, LLC is the general partner of Sequoia Capital XlI, L.P. and Sequoia Technology Partners XlI, L.P., and is the managing member of Sequoia Capital XII Principals Fund, LLC (collectively, the “Sequoia Capital XII Funds”). The managing members of SC XlI Management, LLC are Roelof Botha, James J. Goetz, Michael Goguen, Douglas Leone and Michael Moritz. As a result, and by virtue of the relationships described in this footnote, each of the managing members of SC XII Management, LLC, including James J. Goetz, a member of our board of directors, may be deemed to share beneficial ownership of the shares held by the Sequoia Capital XII Funds. SC US (TTGP), LTD. is the general partner of SCGF V Management, L.P., which is the general partner of each of Sequoia Capital U.S. Growth Fund V, L.P. and Sequoia Capital USGF Principals Fund V, L.P. (collectively, the “Sequoia Capital GFV Funds”). The directors and stockholders of SC US (TTGP), LTD. that exercise voting and investment discretion with respect to the Sequoia Capital GFV Funds’ investments are Roelof Botha, Scott Carter, James J. Goetz, Michael Goguen, Patrick Grady, Douglas Leone and Michael Moritz. As a result, and by virtue of the relationships described in this footnote, each such person, including Mr. Goetz, may be deemed to share beneficial ownership of the shares held by SC US GF V Holdings, Ltd. The address of each of the entities identified in this footnote is 2800 Sand Hill Road, Suite 101, Menlo Park, California 94025. |

| (2) | As of December 31, 2015, based on information set forth in a Schedule 13G/A filed with the SEC on February 11, 2016 filed by Wellington Management Group LLP, or Wellington. The Schedule 13G/A reported that Wellington had shared voting power as to 3,489,596 shares of common stock and shared dispositive power as to 4,470,739 shares of common stock. The address for Wellington is 280 Congress Street, Boston, Massachusetts 02210. |

| (3) | As of December 31, 2015, based on information set forth in a Schedule 13G/A filed with the SEC on February 12, 2016 jointly by FMR LLC, or FMR, and Abigail P. Johnson, as Director, Vice Chairman, Chief Executive Officer and President of FMR. The Schedule 13G/A reported that FMR had sole voting power as to 432,404 shares of common stock and sole dispositive power as to 9,941,261 shares of common stock. The Schedule 13G/A also reports FMR is a parent holding company, and the following entities beneficially own shares of our common stock being reported: Fidelity Management & Research (Hong Kong) Limited, FMR Co., Inc.. The address for FMR is 245 Summer Street, Boston, Massachusetts 02210. |

| (4) | Includes 168,056 shares that are unvested and exercisable. |

| (5) | Represents (i) 355,926 shares of common stock held in the Singh Family Trust, of which Mr. Singh is a co-trustee, (ii) 57,952 shares of common stock held in the Anup V. Singh 2013 Grantor Retained Annuity Trust, of which Mr. Singh is a co-trustee, and (iii) 57,952 shares of common stock held in the Monisha Singh 2013 Grantor Retained Annuity Trust, of which Mr. Singh is a co-trustee. |

| (6) | Represents (i) 104 shares of common stock held directly by Mr. Mehta, (ii) 4,121,217 shares held in the Mehta Family Trust, of which Mr. Mehta is a co-trustee, (iii) 600,000 shares held in the Jai Vir Mehta 2012 GST Trust, of which Mr. Mehta is a co-trustee, (iv) 650,000 shares held in the Jai Vir Mehta Trust, of which Mr. Mehta is a co-trustee, (v) 600,000 shares held in the Kimaya Jia Mehta 2012 GST Trust, of which Mr. Mehta is a co-trustee, and (vi) 650,000 shares held in the Kimaya Jia Mehta Trust, of which Mr. Mehta is a co-trustee. |

| (7) | Represents (i) 86,058 shares of common stock held directly by Dr. Maheshwari, (ii) 1,108,000 shares held in the Maheshwari Children’s Trust, of which Dr. Maheshwari is a co-trustee, (iii) 2,163,258 shares held in the Umesh Maheshwari 2015 Revocable Trust, of which Dr. Maheshwari is a trustee, and (iv) 1,500,000 shares held in the Umesh Maheshwari 2015 GRAT, of which Dr. Maheshwari is a trustee. |

| (8) | Includes 4,064 shares that are unvested and subject to our right of repurchase as of May 5, 2016. |

| (9) | Represents (i) 217,931 shares of common stock held directly by Mr. Goetz, (ii) 4,892 shares of common stock held in the Goetz Children’s Trust, of which Mr. Goetz is a co-trustee, and (iii) shares held by entities affiliated with Sequoia Capital. See footnote (1) above regarding Mr. Goetz’s relationship to entities affiliated with Sequoia Capital. |

| (10) | Represents (i) 10,652 shares of common stock held directly by Mr. Kennelly, (ii) 70,000 shares of common stock held in The Kennelly Family Delaware Dynasty Trust, of which Mr. Kennelly is a co-trustee, 22,917 shares of which were unvested and subject to our right of repurchase as of May 5, 2016, and (iii) 3,159 shares of common stock held by Kennelly Partners, L.P., of which Mr. Kennelly is a general partner. |

| (11) | Represents (i) 5,188 shares of common stock held directly by Mr. Li, (ii) 256,850 shares held in the Li Family Trust, of which Mr. Li is a co-trustee, and (iii) 3,661 shares held in the Li Family GST Exempt Trust, of which Mr. Li is a co-trustee. |

| (12) | Represents (i) 15,560 shares of common stock held directly by Mr. Schroeder, and (ii) 160,000 shares held in the William J. and Marilee J. Schroeder Revocable Trust dated 11-1-1993, of which Mr. Schroeder is a co-trustee, 15,000 shares of which were unvested and subject to our right of repurchase as of May 5, 2016. |

18

| (13) | Represents (i) 15,279,400 shares of issued and outstanding stock, 41,981 shares of which were unvested and subject to our right of repurchase as of May 5, 2016, (ii) 2,865,831 shares of common stock that our directors and executive officers as a group have the right to acquire from us within 60 days of May 5, 2016 pursuant to the exercise of stock options and (iii) 88,644 shares of common stock that our directors and executive officers as a group have the right to acquire from us within 60 days of May 5, 2016 pursuant to settlement of RSUs. Excludes the shares of stock beneficially owned by Dr. Maheshwari. |

19

EXECUTIVE OFFICER BIOGRAPHIES

The names of our executive officers, their ages as of May 5, 2016 and their positions are shown below.

| | | | |

Name | | Age | | Position(s) |

Suresh Vasudevan | | 45 | | Chief Executive Officer and Chairman |

Anup Singh | | 45 | | Chief Financial Officer |

Varun Mehta | | 54 | | Founder, Vice President of Product Operations and Director |

Umesh Maheshwari | | 47 | | Founder, Chief Technology Officer |

Denis Murphy | | 51 | | Vice President of Worldwide Sales |

The board of directors chooses executive officers, who serve at the discretion of our board. There is no family relationship between any of the directors or executive officers and any other director or executive officer of the Company.

Each of Messrs. Vasudevan’s and Mehta’s biographies is the section entitled “Director Biographies – Continuing Directors.”

Anup Singh has served as our Chief Financial Officer since November 2011. Previously, Mr. Singh served as Chief Financial Officer at Clearwell Systems, Inc., a developer of an enterprise-classe-discovery managementplatform, from September 2007 to July 2011. Prior to Clearwell, he held leadership positions in finance at Asurion, LLC, Trimble Navigation Limited, At Home Corporation (doing business as Excite@Home), 3Com Corporation and Ernst & Young LLP. Mr. Singh holds B.A. and M.A. Honors degrees in Economind Management Science from Cambridge University, where he was a Cambridge Commonwealth Trust scholar, and is a Fellow of the Institute of Chartered Accountants in England and Wales.

Umesh Maheshwari has served as our Chief Technology Officer since November 2007 and was a founder of our Company. From March 2003 to November 2007, he held positions at Data Domain, most recently as Technical Director. From January 2001 to March 2003, Dr. Maheshwari held positions at Zambeel, Inc., a maker of scalable file servers, most recently as Principal Engineer. Dr. Maheshwari holds a Ph.D. in computer science from the Massachusetts Institute of Technology and a B.Tech. in computer science from the Indian Institute of Technology Delhi.

Denis Murphy has served as our Vice President of Worldwide Sales since May 2015. Previously, Mr. Murphy served as a consultant advising early stage technical founders from January 2014 to May 2015. From February 2013 to August 2013 he served as Managing Director of the Americas for Anaplan Corporation, an enterprise planning cloud company. From April 2012 to August 2012, he served as Vice President of Worldwide Sales at Nicira, Inc., a software-defined networking company acquired by VMware, Inc. in August 2012, and from September 2003 to April 2012, Mr. Murphy served as Senior Vice President of Sales, Americas at Riverbed Technology. From August 2013 to January 2014 and from August 2012 to February 2013, Mr. Murphy was unemployed. Mr. Murphy holds an M.B.A. from Thunderbird School of Global Management and a B.S.E.E. in electrical engineering from the University of Massachusetts, Amherst.

20

EXECUTIVE COMPENSATION

Compensation Discussion and Analysis

This Compensation Discussion and Analysis describes the compensation philosophy established for our NEOs, the design of our executive compensation program, the process used to examine performance in the context of our executive pay decisions and the factors considered in making those decisions for each NEO listed below.

| | |

Suresh Vasudevan | | Chief Executive Officer and President |

Anup Singh | | Chief Financial Officer |

Varun Mehta | | Vice President of Product Operations |

Denis Murphy | | Vice President of Worldwide Sales |

Umesh Maheshwari | | Chief Technology Officer |

In May 2015, Mr. Murphy joined the Company as our Vice President of Worldwide Sales. Mr. Mehta was our Vice President of Engineering during Fiscal 2016 and became our Vice President of Product Operations in April 2016. In November 2015, our board of directors determined that Dr. Maheshwari is no longer an officer as defined in Rule 16a-1 under the Exchange Act or an executive officer as defined in Rule 3b-7 under the Exchange Act. Dr. Maheshwari is included in this proxy statement as an NEO for Fiscal 2016 pursuant to Regulation S-K, Item 402(a)(3)(iv).

Exit from Emerging Growth Company Status

Beginning in Fiscal 2016, we no longer qualified as an emerging growth company under the SEC’s rules. With our new status, this year we are required to provide expanded and enhanced disclosure in our proxy statement, including this Compensation Discussion and Analysis and certain additional disclosure tables and associated footnotes. Also included for the first time are an advisory vote on NEO compensation (Proposal 2) and an advisory vote on the frequency of our say-on-pay vote (Proposal 3).

Executive Summary

Business Overview and Guiding Principles

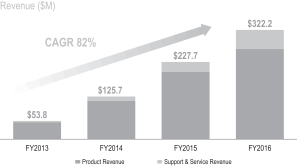

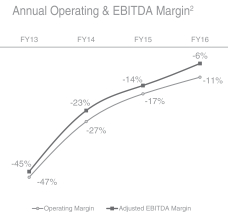

Our mission is to engineer and deliver the industry’s most efficient predictive flash storage platform. Our innovative technology combines flash storage with predictive analytics to predict and prevent the app-data gap that causes application delays and impacts productivity. We believe our target market presents a substantial growth opportunity as applications and data grow in volume and diversity, creating new risks, opportunities and challenges. Our strategy depends on our continued discipline in investing in innovation and bringing this innovation to market in order to capture this tremendous growth opportunity.

We operate in the highly competitive and rapidly evolving data storage market. Our ability to innovate, grow and ultimately succeed is directly correlated to our ability to attract, incentivize and retain talented and seasoned technology leaders who are experts in their fields and innovate on product offerings and business strategy, while retaining financial discipline. Our Compensation Committee believes our executive compensation program will attract, incentivize and retain our executive officers to realize our mission, thereby increasing value for our stockholders.

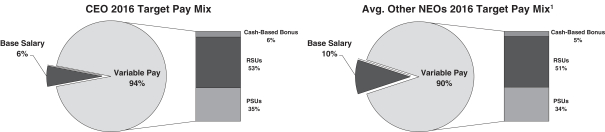

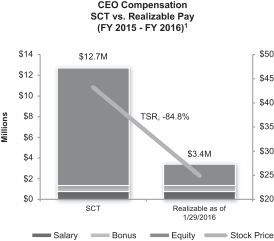

Compensation Philosophy

We believe that a well-designed compensation program should align our executive officers’ interests with the drivers of stockholder returns and profitable growth, support achievement of the Company’s

21

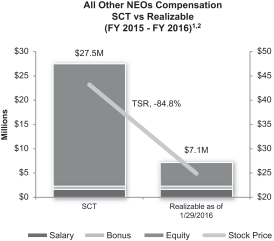

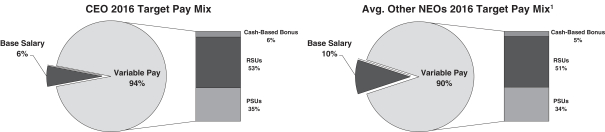

primary business goals, and attract top-notch executive officers whose talents and contributions sustain the growth in long-term stockholder value. Our Compensation Committee believes that our executive compensation program appropriately balances short-term and long-term strategic objectives and directly links compensation to stockholder value by providing short-term bonuses that are tied to our revenue and non-GAAP operating income performance and by granting long-term and performance-based equity incentive awards.