Annual Meeting of Limited Partners May 21, 2013 Exhibit 99.1

2 This document may contain certain “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, that reflect Steel Partners Holdings L.P.’s (“SPLP” or the “Company”) current expectations and projections about its future results, performance, prospects and opportunities. Forward-looking statements are based on information currently available to the Company and are subject to a number of risks, uncertainties and other factors that could cause its actual results, performance, prospects or opportunities in 2013 and beyond to differ materially from those expressed in, or implied by, these forward-looking statements. These factors include, without limitation, SPLP's subsidiaries need for additional financing and the terms and conditions of any financing that is consummated, their customers' acceptance of its new and existing products, the risk that the Company and its subsidiaries will not be able to compete successfully, and the possible volatility of the Company's unit price and the potential fluctuation in its operating results. Although SPLP believes that the expectations reflected in its forward-looking statements are reasonable and achievable, any such statements involve significant risks and uncertainties and no assurance can be given that the actual results will be consistent with the forward-looking statements. Investors should read carefully the factors described in the “Risk Factors” section of the Company's filings with the SEC, including the Company's Form 10-K for the year ended December 31, 2012 for information regarding risk factors that could affect the Company's results. Except as otherwise required by federal securities laws, SPLP undertakes no obligation to publicly update or revise any forward-looking statements, whether as a result of new information, future events, changed circumstances or any other reason. Forward-Looking Statements

3 As of May 15, 2013: 29,900,432 units outstanding Since July 15, 2009, Steel Partners has repurchased, either directly or indirectly though majority owned subsidiaries, a total of 2,317,020 common units of SPLP. Market Cap: $405 million Management owns 11,742,035 = 39.3% Steel Partners Holdings L.P. (NYSE: SPLP) is a global diversified holding company that engages in multiple businesses, including diversified industrial products, energy, defense, supply chain management and logistics, banking, food products and services, oilfield services, sports, training, education, and the entertainment and lifestyle industries. The securities of some of the companies in which we have interests are traded on national securities exchanges, while others are privately held or not actively traded.

4 Continue to build and increase value for our unitholders and other constituents – a goal that we put in place nearly 23 years ago when we founded the Company: Invest in market-leading businesses Promote a continuous improvement culture Implement rigid capital allocation policies Adhere to a value-based investment philosophy If all holdings consolidated: 7,500-plus employees 97 plants and facilities totaling approximately 3 million square feet 12 countries Combined revenues in excess of $2.3 billion We continue with our operational excellence programs: Lean Manufacturing Design for Six Sigma Six Sigma Strategy Deployment Steel Partners Holdings L.P. (NYSE: SPLP) – Overview

5 Steel Partners continues to be guided by our philosophies and strategies: Invest in good companies with simple business models at prices that have a built- in margin of safety Create a continuous improvement culture and implement operational excellence programs Control costs and use leverage prudently, or not at all Avoid complex businesses or investments that cannot be easily explained or understood Reward people who deliver results Ensure the right core principles and culture exists Steel Partners Holdings L.P. – Philosophy and Strategy

6 Steel Partners Holdings L.P. – Companies Market Value Steel Excel, Inc. $ 179.4 mm Handy & Harman Ltd. $ 109.7 mm GenCorp Inc. $ 55.6 mm ModusLink Global Solutions Inc. $ 46.1 mm DGT Holdings Corp. $ 31.0 mm WebBank $ 30.7 mm JPS Industries, Inc. $ 28.2 mm API Group PLC $ 23.5 mm Nathan's Famous, Inc. $ 18.8 mm SL Industries, Inc. $ 18.0 mm CoSine Communications, Inc. $ 9.6 mm F&H Acquisitions Corp. $ 5.3 mm TOTAL $ 556.1 mm

7 Ownership and market value as of March 29, 2013. All figures are in USD millions, are estimates, approximate for the entire company without regard to level of SPH ownership and are not based on GAAP. Market Value represents interest of Steel Partners Holdings L.P. in each company. Steel Partners Holdings L.P. – Companies Handy & Harman Ltd. 53.0% Mgt/BOD Market Value: $109.7 mm Diversified Industrial JPS Industries, Inc. 39.1% MGT/BOD Market Value: $28.1 mm GenCorp Inc. 7.0% BOD Market Value: $55.6 mm API Group PLC 32.4% Market Value: $23.5 mm Steel Excel, Inc. 51.6% Mgt/BOD Market Value: $179.4 mm SL Industries, Inc. 24.0% BOD Market Value: $18.0 mm WebBank 100% BOD Book Value: $30.7 mm Financial Services

8 Steel Partners Holdings L.P. – Companies Other ModusLink Global Solutions Inc. 27.2% BOD Market Value: $46.1 mm Nathan’s Famous, Inc. 10.1% Market Value: $18.8 mm F&H Acquisitions Corp. (Fox & Hound) 43.7% BOD Market Value: $5.3 mm DGT Holdings Corp. 74.7% Mgt/BOD Market Value: $31.0 mm CoSine Communications, Inc. 48.6% MGT/BOD Market Value: $9.6 mm Ownership and market value as of March 29, 2013. All figures are in USD millions, are estimates, approximate for the entire company without regard to level of SPH ownership and are not based on GAAP. Market Value represents interest of Steel Partners Holdings L.P. in each company.

9 Steel Partners Holdings L.P. – Companies Handy & Harman Ltd. Revenue: $631.6 EBITDA: $74.9 EBIT: $59.9 Corp. Exp.: $23.6 NOLs: $162.9 Cash: $31.0 Debt: $147.6 Pension: $(217.0) Diversified Industrial/Financial Services Steel Excel, Inc. Revenue: $112.0 EBITDA: $25.3 EBIT: $5.4 Corp. Exp.: $8.9 NOLs: $154.3 Cash & Mkt. Sec.: $261.8 Debt: $0.3 SL Industries, Inc. Revenue: $200.3 EBITDA: $18.3 EBIT: $15.5 Corp. Exp.: $5.4 NOLs: $1.6 Cash: $3.4 GenCorp Inc. Revenue: $1,036,.7 EBITDAP: $114.5 EBIT: $26.3 Corp. Exp.: $12.9 Cash: $146.7 Debt: $708.1 Pension: $(474.6) WebBank Shareholders’ Equity: $16.2 Pre-Tax Income: $12.7 Corp. Exp.: $8.5 All figures are in USD millions, are estimates, approximate for the entire company without regard to level of SPH ownership and are not based on GAAP. All figures are for the last twelve months based on most recent financials available. EBITDA is after Parent Corporate Expenses. JPS Industries, Inc. Revenue: $158.3 EBITDA: $11.3 EBIT: $5.9 NOLs: $62.0 Cash & Mkt. Sec.: $1.09 Debt: $33.7 Pension: $(56.8)

10 Steel Partners Holdings L.P. – Companies Other DGT Holdings Corp. Revenue: $11.7 Corp. Exp.: $2.5 NOLs: $24.6 Cash: $56.6 Debt: $2.3 CoSine Communications, Inc. Corp. Exp.: $0.7 NOLs: $355.7 Cash: $20.2 F&H Acquisitions Corp. Revenue: $293.4 EBITDA: $21.5 EBIT: $5.9 NOLs: $26.7 Cash: $4.3 Debt: $107.7 Nathan’s Famous, Inc. Revenue: $71.0 EBITDA: $12.96 EBIT: $11.96 Cash: $32.47 ModusLink Global Solutions Inc. Revenue: $773.11 EBITDA: ($27.23) EBIT: ($42.19) NOLs: $2,000.0 Cash: $51.8 Pension: $(3.01) All figures are in USD millions, are estimates, approximate for the entire company without regard to level of SPH ownership and are not based on GAAP. All figures are for the last twelve months based on most recent financials available.

11 Acquisitions and Investments Fox & Hound – Invested $10.9 million to acquire an indirect interest in F&H Holding Corp.; March 19, 2012 Steel Excel – Assumed majority interest May 31, 2012 50% of CrossFit Southbay (Steel Excel); November 5, 2012 50% of CrossFit Torrance (Steel Excel); November 5, 2012 Inmet Metal Processing Plant, Ltd., (Handy & Harman/Lucas-Milhaupt); November 14, 2012 – $4 million W.P. Hickman Co.,(Handy & Harman/OMG); December 31, 2012 – $8.4 million 40% of AgainFaster LLC (Steel Excel); January 30, 2013 30% investment in Ruckus Sports LLC (Steel Excel) Additional 10% on May 14, 2013 ModusLink Global Solutions – $30 million investment; March 12, 2013 13.5% of Forbes Energy Services (Steel Excel) as of April 23, 2013 Wolverine Joining Technologies, (Handy & Harman/Lucas-Milhaupt); April 26, 2013 – $60 million Steel Partners Holdings L.P. – Key Activities 2012/2013

12 Steel Partners Holdings L.P. – Key Activities 2012/2013 Divestitures DGT Holdings Inc. sold subsidiary RFI Corporation to EMS Development Corporation, an affiliate of Ultra Electronics Defense, Inc.; August 16, 2012 - $12.5 million. Entities associated with Steel Partners II, LP sold heir respective interests in Barbican Group Holdings Limited to an entity controlled by Carlson Capital L.P. Proceeds to Steel Partners Holdings L.P. aggregate GBP21 million. Continental Industries to Burndy LLC; January 18, 2013 – $37.4 million JPS Proxy Contest All four Steel Partners-nominated directors were elected to board positions at JPS Industries, Inc. – Mikel Williams, CEO and President; Jack Howard, Chairman; John J. Quicke and Alan B. Howe

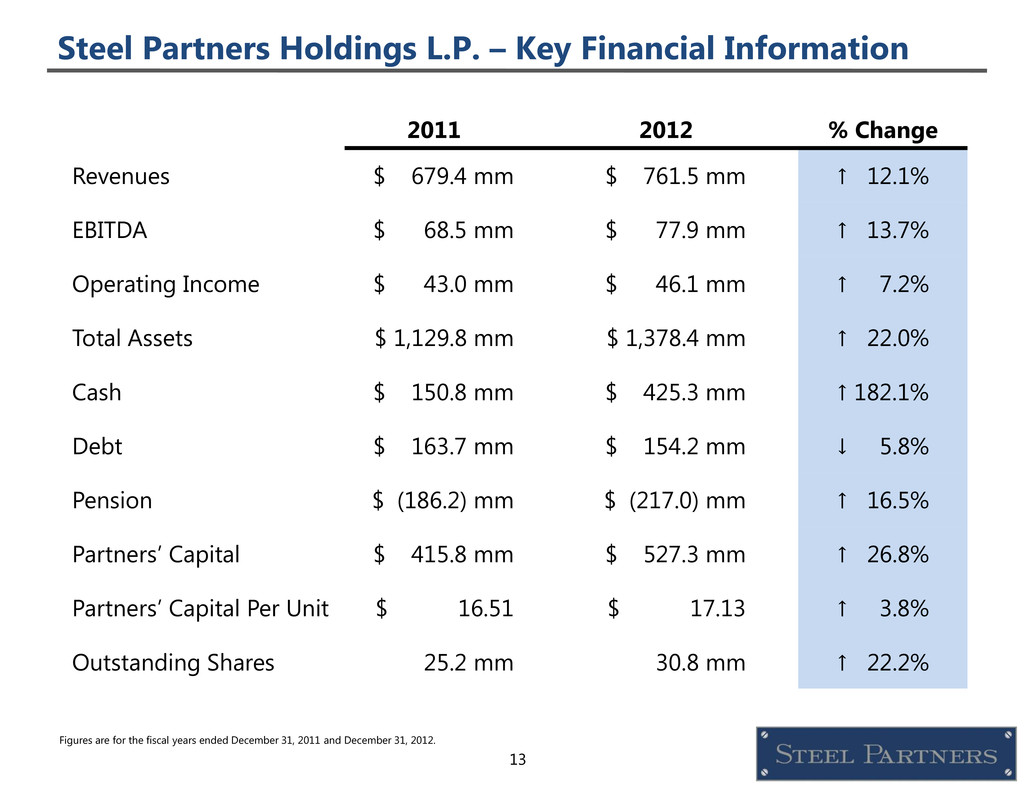

13 2011 2012 % Change Revenues $ 679.4 mm $ 761.5 mm ↑ 12.1% EBITDA $ 68.5 mm $ 77.9 mm ↑ 13.7% Operating Income $ 43.0 mm $ 46.1 mm ↑ 7.2% Total Assets $ 1,129.8 mm $ 1,378.4 mm ↑ 22.0% Cash $ 150.8 mm $ 425.3 mm ↑ 182.1% Debt $ 163.7 mm $ 154.2 mm ↓ 5.8% Pension $ (186.2) mm $ (217.0) mm ↑ 16.5% Partners’ Capital $ 415.8 mm $ 527.3 mm ↑ 26.8% Partners’ Capital Per Unit $ 16.51 $ 17.13 ↑ 3.8% Outstanding Shares 25.2 mm 30.8 mm ↑ 22.2% Steel Partners Holdings L.P. – Key Financial Information Figures are for the fiscal years ended December 31, 2011 and December 31, 2012.

14 Steel Partners LP (NYSE: SPLP) Stock Source: Capital IQ As of May 15, 2013 01/03/12 - $12.05 12/31/12 - $11.79 05/15/13 - $13.55 14.9% increase YTD

Annual Meeting of Limited Partners May 21, 2013