| | |

| | DLA PiperLLP (US) 4141 Parklake Avenue, Suite 300 Raleigh, North Carolina 27612-2350 www.dlapiper.com Robert H. Bergdolt robert.bergdolt@dlapiper.com T 919.786.2002 F 919.786.2200 |

March 3, 2009

VIA COURIERAND EDGAR

Mr. Tom Kluck

Ms. Stacie Gorman

Division of Corporation Finance

Securities and Exchange Commission

100 F Street, N.E., Mail Stop 4561 CF/AD8

Washington, D.C. 20549

| Re: | KBS Strategic Opportunity REIT, Inc. |

(Confidential, For Use of the Commission Only)

Dear Mr. Kluck and Ms. Gorman:

On behalf of our client, KBS Strategic Opportunity REIT, Inc. (the “Company”), we are writing to respond to the first comment set forth in the comment letter from the staff of the Commission’s Division of Corporation Finance to Keith D. Hall, Chief Executive Officer of the Company, dated February 11, 2009, in connection with the Company’s above-referenced registration statement. Such comment is reproduced below:

We note that you intend to operate your business in a manner that will permit you to maintain an exemption from registration under the Investment Company Act of 1940. Please provide us with a detailed analysis of this exemption and how your investment strategy will support this exemption.

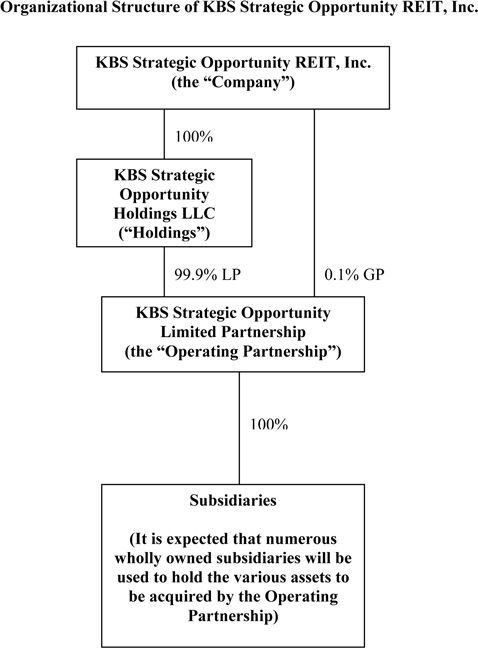

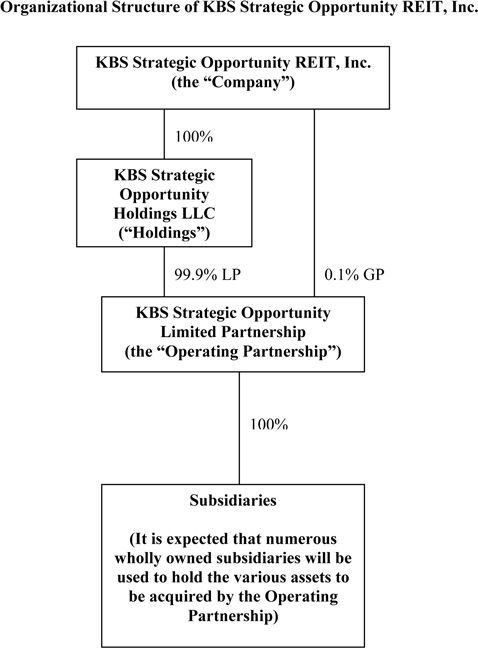

Please refer to the enclosed diagram for an illustration of how the Company intends to own its assets. As currently contemplated, neither the Company nor any of the entities through which the Company will own its assets will be an investment company under the Investment Company Act of 1940 Act (the “’40 Act”). We will discuss each entity below, starting from the bottom of the diagram.

Subsidiaries

It is expected that all of the Company’s assets, other than cash held directly by the Company or the Operating Partnership, will be held through subsidiaries of the Operating Partnership (“Subsidiaries”). When possible, the Subsidiaries will rely on the exception from the definition of an investment company set forth at Section 3(c)(5)(C) of the ’40 Act; all other Subsidiaries will rely on the exception set forth at Section 3(c)(1) of the ’40 Act.

Mr. Tom Kluck

Ms. Stacie Gorman

March 3, 2009

Page Two

Section 3(c)(5)(C)

Section 3(c)(5)(C) generally excludes from the definition of “investment company” any company that is engaged primarily in the business of “purchasing or otherwise acquiring mortgages and other liens on and interests in real estate.” The Staff has provided guidance through the no-action letter process on the meaning of being engaged primarily in the business of “purchasing or otherwise acquiring mortgages and other liens on and interests in real estate” for purposes of Section 3(c)(5)(C). In various letters, the Staff has stated that it would regard an issuer as being engaged primarily in this business, within the meaning of Section 3(c)(5)(C), if (1) at least 55% of the value of the issuer’s assets consists of real estate interests (“Qualifying Assets”), (2) at least 80% of the value of the issuer’s assets consists of investments in (a) Qualifying Assets plus (b) other assets that are not Qualifying Assets but are real estate-related assets (“Real Estate Related Assets”) and (3) no more than 20% of the value of the issuer’s assets consists of assets other than Qualifying Assets and Real Estate Related Assets (“Miscellaneous Assets”).1

Whether a Subsidiary can satisfy the requirements of Section 3(c)(5)(C) depends on the type of assets it owns. Set forth below is a summary of how a Subsidiary expects to classify its various assets as Qualifying Assets, Real Estate Related Assets or Miscellaneous Assets (absent additional guidance from the Staff).

Real Estate-Related Loans

First Mortgage Loans

A Subsidiary will treat a first mortgage loan as a Qualifying Asset provided that the loan is fully secured, i.e., the value of the real estate securing the loan is greater than the value of the note evidencing the loan. If the loan is not fully secured, the entire value of the loan will be classified as a Real Estate Related Asset.

Second Mortgages

A Subsidiary will treat a second mortgage loan as a Qualifying Asset provided that the loan is fully secured, i.e., the value of the real estate securing the loan is greater than the sum of the value of the note evidencing the second mortgage loan plus the outstanding amount owed on the senior loan. If the loan is not fully secured, the entire value of the loan will be classified as a Real Estate Related

1 | NAB Asset Corp., SEC No-Action Letter (June 20, 1991). |

Mr. Tom Kluck

Ms. Stacie Gorman

March 3, 2009

Page Three

Asset if the real estate securing the loan is worth at least 55% of the value of the loan; otherwise, the entire value of the loan will be treated as a Miscellaneous Asset.2

B-Notes

A Subsidiary will treat a B-Note as a Qualifying Asset if: (1) the B-Note is a participation interest in a mortgage loan that is fully secured by real property; (2) the Subsidiary as B-Note holder has the right to receive its proportionate share of the interest and the principal payments made on the mortgage loan by the borrower, and the Subsidiary’s returns on the B-Note are based on such payments3; (3) the Subsidiary invests in B-Notes only after performing the same type of due diligence and credit underwriting procedures that it would perform if it were underwriting the underlying mortgage loan; (4) the Subsidiary as B-Note holder has approval rights in connection with any material decisions pertaining to the administration and servicing of the mortgage loan and with respect to any material modification to the mortgage loan agreements; and (5) in the event that the mortgage loan becomes non-performing, the Subsidiary as B-Note holder has effective control over the remedies relating to the enforcement of the mortgage loan, including ultimate control of the foreclosure process, by having the right to: (a) appoint the special servicer to manage the resolution of the loan; (b) advise, direct or approve the actions of the special servicer; (c) terminate the special servicer at any time without cause; (d) cure the default so that the mortgage loan is no longer non-performing; and (e) purchase the A-Note at par plus accrued interest, thereby acquiring the entire mortgage loan. If these conditions are not met, a Subsidiary will treat the B-Note as a Real Estate Related Asset.4

Mezzanine Loans

A Subsidiary will treat a mezzanine loan as a Qualifying Asset if the loan meets the following criteria: (1) the loan is a “Tier I” loan, meaning that the loan is made to the entity that owns 100% of the equity of the property-owning entity; (2) the loan is made specifically and exclusively for the financing of real estate; (3) the loan is underwritten based on the same considerations as a second mortgage and after the lender performs a hands-on analysis of the property being financed; (4) the

3 | In the event that the A-Note holder becomes bankrupt and the B-Note holder is treated as an unsecured creditor of the A-Note holder, the B-Note holder may not receive its full payment on the B-Note notwithstanding the fact that the borrower has been making full and timely payments on the underlying mortgage loan. In the event that this occurs, the B-Note would no longer be treated as a Qualifying Asset. |

4 | Capital Trust, Inc., SEC No-Action Letter (Feb. 3, 2009). |

Mr. Tom Kluck

Ms. Stacie Gorman

March 3, 2009

Page Four

Subsidiary as lender exercises ongoing control rights over the management of the underlying property to the same extent as is customary by holders of a second mortgage; (5) the Subsidiary as lender has the right to readily cure defaults or purchase the mortgage loan in the event of a default on the mortgage loan; (6) the true measure of the collateral securing the loan is the property being financed and any incidental assets related to the ownership of the property; and (7) the Subsidiary as lender has the right to foreclose on the collateral and, through its ownership of the property-owning entity, become the owner of the underlying property.5

Convertible Mortgages

A convertible mortgage is a mortgage loan coupled with an option to purchase the underlying real estate. A Subsidiary will treat such a convertible mortgage as two assets: a mortgage and an option. The mortgage will be valued as though the option did not exist and treated as either a Qualifying Asset, Real Estate Related Asset or Miscellaneous Asset according to the positions set forth above. The option will also be assigned an independent value. The option will be treated as a Real Estate Related Asset.

Fund Level or Corporate Level Debt

If a Subsidiary provides financing to an entity that is primarily engaged in the real estate business, such loan will be viewed as a Real Estate Related Asset but not as a Qualifying Asset unless the loan is a fully secured mortgage loan or otherwise fits within one of the categories above and meets the corresponding requirements.

Participations

A participation interest in a loan will be treated as a Qualifying Asset only if the interest is a participation in a mortgage loan, such as an A-Note or a B-Note. With respect to A-Notes, a Subsidiary will treat an A-Note as a Qualifying Asset if the A-Note is fully secured and the Subsidiary is the controlling investor with the ability to foreclose on the mortgage.6 With respect to B-Notes, the participation interest must meet the tests for B-Notes described above.

5 | Capital Trust, Inc., SEC No-Action Letter (May 24, 2007). |

6 | Northwestern Ohio Building & Construction Trades Found., SEC No-Action Letter (May 21, 1984). |

Mr. Tom Kluck

Ms. Stacie Gorman

March 3, 2009

Page Five

Other Real Estate-Related Loans

The other real estate-related loans described in the Company’s prospectus, i.e., bridge loans, wraparound mortgage loans, construction loans, pre-development loans, land loans, investments in distressed debt and loans on leasehold interests,7 will be treated in accordance with the principles described above. For example, if such loans are fully secured first or second mortgages, then the loans will be Qualifying Assets.

Real Estate-Related Debt Securities

A Subsidiary will treat a mortgage-backed security as a Qualifying Asset if the certificate represents all of the beneficial interests in a pool of mortgages, referred to as a “whole pool” certificate.8 However, a partial pool certificate will generally not be treated as a Qualifying Asset unless (1) the Subsidiary directly, or through the ability to appoint a special servicer, has foreclosure rights with respect to the underlying mortgages; (2) the Subsidiary owns 100% of the first-loss class; and (3) the pool does not contain more than 15% “real estate related notes,” that is, notes backed by mortgages with respect to which the special servicer does not have the unilateral right to foreclose. To the extent the pool contains “real estate related notes” but less than 15%, only a prorated portion of the asset will be treated as a Qualifying Asset. With respect to other classes of partial pool certificates, such class will generally only count as a Qualifying Asset if (1) the class is not investment grade, (2) the Subsidiary acquires 100% of such class and 100% of the controlling class, (3) each such class is contiguous for credit purposes with the controlling class or other qualifying class and (4) each such class is entitled to exercise all rights of the initial controlling class, including foreclosure rights, if it becomes the controlling class.9

7 | A Subsidiary will consider a leasehold interest to be an interest in real estate and, therefore, a loan secured by a leasehold interest to be a loan secured by real estate, if such leasehold interest is an interest in real estate under applicable state law. Health Facility Credit Corp., SEC No-Action Letter (Feb. 6, 1985); Apache Petroleum Mortgage Co., SEC No-Action Letter (Dec. 31, 1981). |

8 | Landmark Funding Corp., SEC No-Action letter (Aug. 21, 1984); Salomon Brothers Mortgage Securities, Inc., SEC No-Action Letter (Nov. 8, 1983). |

9 | JER Investors Trust, Inc., Registration Statement on Form S-11, Amendment No. 6, Registration No. 333-122802 (filed July 11, 2005), at pages 65-67; Letter from Quadra Realty Trust, Inc. to Karen J. Garnett, Assistant Director, Division of Corporation Finance, SEC, re: Quadra Realty Trust Form S-11, Registration No. 333-138591 (dated Dec. 15, 2006) at pages 3-4. |

Mr. Tom Kluck

Ms. Stacie Gorman

March 3, 2009

Page Six

We do not generally expect investments in collateralized debt obligations (“CDOs”) to be Qualifying Assets. A Subsidiary will treat a CDO investment as a Real Estate Related Asset if the entity that issues the CDOs primarily owns debt obligations related to real estate.

Equity Securities

If a Subsidiary owns at least a majority of the voting securities of an entity, then the Subsidiary will treat the value of its equity interests in such entity as a Qualifying Asset, Real Estate Related Asset and/or Miscellaneous Asset in proportion to the value of such entity’s Qualifying Assets, Real Estate Related Assets and Miscellaneous Assets. If a Subsidiary owns less than a majority of the voting securities of an entity, then the Subsidiary’s equity interests in such entity will be treated as Real Estate Related Assets if the entity primarily engages in the real estate business, and otherwise such equity interests will be treated as Miscellaneous Assets.10 Note that a Subsidiary will measure Section 3(c)(5)(C) compliance on an unconsolidated basis.11 Therefore, if the entity in which a Subsidiary invests is leveraged, such debt will affect the value of the entity’s securities.

Real Property

A Subsidiary will treat an investment in real property as a Qualifying Asset.

Section 3(c)(1)

Section 3(c)(1) generally excludes from the definition of “investment company” any issuer whose outstanding securities are beneficially owned by not more than one hundred persons and which is not making and does not presently propose to make a public offering of its securities. The Company expects all of the Subsidiaries that do not satisfy the requirements under Section 3(c)(5)(C) to qualify under Section 3(c)(1) because (i) no such Subsidiary proposes to conduct a public offering of its securities and (ii) all such Subsidiaries will be wholly owned by the Operating Partnership.

10 | NAB Asset Corp., SEC No-Action Letter (June 20, 1991). |

11 | Letter from Quadra Realty Trust, Inc. to Karen J. Garnett, Assistant Director, Division of Corporation Finance, SEC, re: Quadra Realty Trust Form S-11, Registration No. 333-138591 (dated Dec. 15, 2006) at page 5. |

Mr. Tom Kluck

Ms. Stacie Gorman

March 3, 2009

Page Seven

Operating Partnership

The Operating Partnership may rely on the exclusion from the definition of “investment company” set forth at Section 3(c)(5)(C) of the ’40 Act. For purposes of calculating compliance with Section 3(c)(5)(C), if the Operating Partnership owns at least a majority of the voting securities of an entity, then the Operating Partnership will treat the value of its equity interests in such entity as a Qualifying Asset, Real Estate Related Asset and/or Miscellaneous Asset in proportion to the value of such entity’s Qualifying Assets, Real Estate Related Assets and Miscellaneous Assets.12 If the Operating Partnership owns less than a majority of the voting securities of an entity, then the Operating Partnership will treat the value of its equity interest in such entity as a Real Estate Related Asset if the entity is primarily engaged in the real estate business,13 otherwise the Operating Partnership will treat the value of its equity interest in such entity as a Miscellaneous Asset. Note that the Operating Partnership will measure Section 3(c)(5)(C) compliance on an unconsolidated basis.14 Therefore, if the entity in which the Operating Invests is leveraged, such debt will affect the value of the entity’s securities.

The Operating Partnership does not expect to own any assets directly other than (i) cash contributed by the Company from the proceeds of the Company’s public offering or (ii) government securities, certificates of deposit or other appropriate short-term securities acquired with such offering proceeds. For purposes of calculating its compliance with Section 3(c)(5)(C), the Operating Partnership intends to ignore such cash or other appropriate securities to the extent it intends to invest such cash and securities as soon as reasonably possible (but within one year) and in such a way that the Operating Partnership would continue to satisfy the requirements of Section 3(c)(5)(C) after giving effect to the investment.15

The Operating Partnership may not need to rely on Section 3(c)(5)(C). As noted above, the Operating Partnership intends to conduct all of its business through Subsidiaries. Many if not most of those Subsidiaries are likely to meet the requirements of Section 3(c)(5)(C). If the value of the

13 | JER Investors Trust, Inc., Registration Statement on Form S-11, Amendment No. 6, Registration No. 333-122802 (filed July 11, 2005) at page 67. |

14 | Letter from Quadra Realty Trust, Inc. to Karen J. Garnett, Assistant Director, Division of Corporation Finance, SEC, re: Quadra Realty Trust Form S-11, Registration No. 333-138591 (dated Dec. 15, 2006) at page 5. |

15 | Medidentic Mortgage Investors, SEC No-Action Letter (May 23, 1984). |

Mr. Tom Kluck

Ms. Stacie Gorman

March 3, 2009

Page Eight

Operating Partnership’s investments in such “Section 3(c)(5)(C) Subsidiaries” comprises more than 60% of the Operating Partnership’s total assets (excluding U.S. government securities and cash items) on an unconsolidated basis, then the Operating Partnership will not meet the definition of an investment company set forth in Section 3(a)(1)(C). In addition, as a mere holding company, the Operating Partnership is not engaged primarily in the business of investing, reinvesting or trading in securities and thus does not meet the Section 3(a)(1)(A) definition of an investment company.16

KBS Strategic Opportunity Holdings LLC

KBS Strategic Opportunity Holdings LLC (“Holdings”) will only own its 99.9% limited partnership interest in the Operating Partnership. It will have sufficient voting power to replace the general partner of the Operating Partnership. Therefore, the Operating Partnership will be a majority-owned subsidiary of Holdings.17 As Holdings’ only asset will consist of a majority-owned subsidiary that need not rely on Section 3(c)(1) or Section 3(c)(7) to avoid investment company status, Holdings will not meet the definition of an investment company under Section 3(a)(1)(C). And as a mere holding company, Holdings is not engaged primarily in the business of investing, reinvesting or trading in securities and thus does not meet the Section 3(a)(1)(A) definition of an investment company.

The Company

The Company’s only assets will consist of (i) its interest in Holdings, its wholly owned subsidiary, and (ii) its general partner interest in the Operating Partnership. The Company’s interests in Holdings are not investment securities because Holdings is a majority-owned subsidiary of the Company. A general partner interest is not a security when, as is the case here, the general partner will truly manage the partnership. Therefore, none of the Company’s assets are investment securities, and the Company will not meet the definition of an investment company under Section 3(a)(1)(C). In addition, as a mere holding company, the Company is not engaged primarily in the business of investing, reinvesting or trading in securities and thus does not meet the Section 3(a)(1)(A) definition of an investment company.

16 | Investment Company Act Determinations under the 1940 Act, Robert H. Rosenblum (2003) at page 73. |

17 | Great American Management and Investment, Inc., SEC No-Action Letter (Sept. 27, 1982). |

Mr. Tom Kluck

Ms. Stacie Gorman

March 3, 2009

Page Nine

Thank you for your assistance in connection with the Staff’s review of the Company’s registration statement. Please do not hesitate to contact me with any questions regarding the foregoing analysis.

Very truly yours,

DLA Piper LLP (US)

/s/ Robert H. Bergdolt

Robert H. Bergdolt

Partner

| cc: | Rochelle Kauffman Plesset, Senior Counsel, |

| | Division of Investment Management |