Filed Pursuant to Rule 424(b)(3)

Registration No. 333-156633

KBS STRATEGIC OPPORTUNITY REIT, INC.

SUPPLEMENT NO. 21 DATED APRIL 13, 2012

TO THE PROSPECTUS DATED APRIL 27, 2011

This document supplements, and should be read in conjunction with, the prospectus of KBS Strategic Opportunity REIT, Inc. dated April 27, 2011, as supplemented by supplement no. 1 dated April 27, 2011, supplement no. 14 dated January 12, 2012, supplement no. 15 dated January 23, 2012, supplement no. 16 dated February 2, 2012, supplement no. 17 dated February 14, 2012, supplement no. 18 dated February 22, 2012, supplement no. 19 dated March 14, 2012 and supplement no. 20 dated March 19, 2012. As used herein, the terms “we,” “our” and “us” refer to KBS Strategic Opportunity REIT, Inc. and, as required by context, KBS Strategic Opportunity Limited Partnership, which we refer to as our “Operating Partnership,” and to their subsidiaries. Capitalized terms used in this supplement have the same meanings as set forth in the prospectus. The purpose of this supplement is to disclose prior performance information through December 31, 2011.

PRIOR PERFORMANCE SUMMARY

In January 2006, our sponsors teamed to launch the initial public offering of their first public non-traded REIT, KBS Real Estate Investment Trust, Inc., which we refer to as KBS REIT I, and in April 2008, our sponsors launched KBS Real Estate Investment Trust II, Inc., which we refer to as KBS REIT II. They are currently sponsoring the initial public offerings of KBS Real Estate Investment Trust III, Inc., which we refer to as KBS REIT III and, together with Legacy Partners Residential Realty LLC and certain of its affiliates, they are sponsoring KBS Legacy Partners Apartment REIT, Inc., which we refer to as KBS Legacy Partners Apartment REIT. As described below, KBS REIT I and KBS REIT II have acquired a diverse portfolio of commercial properties and real estate-related investments. KBS REIT III is targeting to acquire a diverse portfolio of commercial properties and real estate-related investments and KBS Legacy Partners Apartment REIT is targeting to acquire a diverse portfolio of equity investments in high-quality apartment communities located throughout the United States. Our advisor, KBS Capital Advisors, is also the external advisor to KBS REIT I, KBS REIT II, KBS REIT III and KBS Legacy Partners Apartment REIT. Each of these programs is a publicly registered, non-traded REIT.

Since 1992, two of our sponsors, Peter M. Bren and Charles J. Schreiber, Jr., have partnered to acquire, manage, develop and sell high-quality U.S. commercial real estate assets as well as real estate-related investments on behalf of institutional investors. Since the formation of the first investment advisor affiliated with Messrs. Bren and Schreiber in 1992, investment advisors affiliated with Messrs. Bren and Schreiber have sponsored 14 private real estate funds that have raised over $2.2 billion of equity from institutional investors as of December 31, 2011. Together, Messrs. Bren and Schreiber founded KBS Realty Advisors LLC, a registered investment advisor with the SEC and a nationally recognized real estate investment advisor. We refer to the investment advisors affiliated with Messrs. Bren and Schreiber as KBS investment advisors.

Unless otherwise indicated, the information presented below represents the historical experience of KBS REIT I, KBS REIT II, KBS Legacy Partners Apartment REIT, KBS REIT III, and the 14 private real estate funds sponsored by KBS investment advisors as of the 10 years ended December 31, 2011. By purchasing shares in this offering, you will not acquire any ownership interest in any funds to which the information in this section relates and you should not assume that you will experience returns, if any, comparable to those experienced by the investors in the real estate funds discussed. Further, the private funds discussed in this section were conducted through privately held entities that were subject neither to the up-front commissions, fees and expenses associated with this offering nor all of the laws and regulations that will apply to us as a publicly offered REIT. We have omitted from this discussion information regarding the prior performance of entities for which an institutional investor engaged a KBS investment advisor if the investor had the power to reject the real estate acquisitions proposed by the KBS investment advisor. Such entities are not considered “funds” or “programs” as those terms are used in this prospectus.

KBS REIT I

On January 27, 2006, our sponsors launched the initial public offering of KBS REIT I, a publicly registered, non-traded REIT. Its primary initial public offering was for a maximum of 200,000,000 shares of common stock at a price of $10.00 per share, plus an additional 80,000,000 shares of common stock initially priced at $9.50 per share pursuant to its dividend reinvestment plan. KBS REIT I accepted gross offering proceeds of $1.7 billion in its primary initial public offering, and as of December 31, 2011, KBS REIT I had accepted gross offering proceeds of $222.6 million from shares issued pursuant to its dividend reinvestment plan. As of December 31, 2011, KBS REIT I had approximately 42,000 stockholders. Of the amount raised pursuant to its dividend reinvestment plan, $62.4 million has been used to fund share redemptions pursuant to its share redemption program. KBS REIT I ceased offering shares in its primary public offering on May 30, 2008, and KBS REIT I terminated its dividend reinvestment plan effective April 10, 2012.

1

As of December 31, 2011, KBS REIT I owned 892 real estate properties (of which 250 properties were held for sale), including the GKK Properties (defined below). As of December 31, 2011, KBS REIT I’s real estate portfolio held for investment was approximately 85% occupied. In addition, as of December 31, 2011, KBS REIT I also owned seven real estate loans receivable, two investments in securities directly or indirectly backed by commercial mortgage loans, a preferred membership in a real estate joint venture, a participation interest with respect to another real estate joint venture and a 10-story condominium building with 62 units acquired through foreclosure, of which four condominium units, two retail spaces and parking spaces have not been sold and are held for sale.

KBS REIT I had investment objectives similar to ours. Like ours, its primary investment objectives were to provide investors with attractive and stable returns and to preserve and return their capital contributions and, like us, it will seek to realize growth in the value of its investments by timing asset sales to maximize asset value. In addition, investments in real estate and real estate-related assets involve similar assessments of the risks and rewards of the operation of the underlying real estate and financing thereof as well as an understanding of the real estate and real estate-finance markets. KBS REIT I’s current objectives are to (i) pay down its outstanding debt obligations and manage its upcoming debt maturities, (ii) manage its reduced cash flow, (iii) strategically reinvest capital into existing assets to better position its overall portfolio and (iv) to attempt to improve the overall return to its stockholders in the future.

KBS REIT I acquired and manages a diverse portfolio of real estate and real estate-related assets. It sought to diversify its portfolio by property type, geographic region, investment size and investment risk with the goal of attaining a portfolio of income-producing real estate and real estate-related assets that would provide attractive and stable returns to its investors. In constructing its portfolio, KBS REIT I targeted approximately 70% core investments (which are generally existing properties with at least 80% occupancy and minimal near-term lease rollover) and approximately 30% enhanced-return properties (which are higher-yield and higher-risk investments than core properties, such as properties with moderate vacancies or near-term lease rollovers, poorly managed and positioned properties, properties owned by distressed sellers and built-to-suit properties) and real estate-related investments, including mortgage loans, mezzanine debt, commercial mortgage-backed securities and other similar structured finance investments. With proceeds from its initial public offering and debt financing (as a percentage of its total investments), the purchase price of KBS REIT I’s real estate properties represented 65% of its portfolio and the purchase price of its real estate-related investments represented 35% of its portfolio.

As described in more detail below, subsequent to KBS REIT I’s acquisition of these properties, loans and other investments, KBS REIT I’s portfolio composition changed as a result of the restructuring of certain investments, KBS REIT I taking title to properties underlying investments in loans that became impaired, the sale of assets and the repayment of debt investments.

KBS REIT I used the net proceeds from its initial public offering and debt financing to purchase or fund $3.1 billion of real estate and real estate-related investments, including $34.5 million in acquisition fees and closing costs. KBS REIT I used the net proceeds from its initial public offering for real estate properties and real estate-related assets in the amounts of $0.8 billion and $0.8 billion, respectively, and had debt financing on its real estate properties and real estate-related assets in the amounts of $1.2 billion and $0.3 billion, respectively, at acquisition.

With proceeds from its initial public offering and debt financing, as a percentage of the amount invested (based on purchase price), KBS REIT I invested in the following types of assets (including its investments through a consolidated joint venture): 35% in 22 office properties, 29% in 42 industrial properties and a master lease in another industrial property, 26% in interests in 12 mezzanine loans, 5% in interests in six mortgage loans, 2% in interests in two loans representing subordinated debt of a private REIT, 2% in two investments in securities directly or indirectly backed by commercial mortgage loans and 1% in interests in two B-notes. All of KBS REIT I’s real property investments were made within the United States. As a percentage of amount invested (based on purchase price), the geographic locations of KBS REIT I’s investments in real properties were as follows (including its investments through a consolidated joint venture): 40% in 26 properties and a master lease in another property in the East; 30% in 22 properties in the South; 15% in nine properties in the West; and 15% in seven properties in the Midwest. All of the real properties purchased by KBS REIT I had prior owners and operators.

KBS REIT I did not acquire any properties or real estate-related investments during the three years ended December 31, 2011. However, as described below, KBS REIT I did restructure certain investments during this period and took title to certain properties underlying its original investments in real estate loans.

2

KBS REIT I had disposed of 12 properties and two real estate-related investments as of December 31, 2011 for approximately $273.8 million, including closing costs. Also as of December 31, 2011, KBS REIT I had sold 23 of 27 condo units from the Tribeca building, on which it had foreclosed. See Table V under “Prior Performance Tables” in this supplement. KBS REIT I originally intended to hold its core properties for four to seven years. With respect to the GKK Properties, KBS REIT I’s management is in the process of determining which properties to hold and which properties to sell. KBS REIT I expects the average hold period to be significantly shorter than that of its core properties. However, economic and market conditions may influence KBS REIT I to hold its investments for different periods of time, and KBS REIT I currently expects its hold period is likely to last for several more years. In general, KBS REIT I intends to hold its real estate-related investments to maturity, though economic and market conditions may also influence the length of time that KBS REIT I holds these investments.

The following summarizes asset sales, restructurings, pay-offs and discounted pay-offs of KBS REIT I’s investments in real estate loans receivable as of December 31, 2011:

| | • | | One Madison Park Mezzanine Loan – The borrowers paid off the loan in full with an outstanding principal balance of $21.0 million, including a spread maintenance premium in November 2007. |

| | • | | Arden Portfolio Mezzanine Loans – KBS REIT I released the borrowers from liability and received a preferred membership interest in a joint venture that owns the properties that had secured the loans. KBS REIT I wrote-off its investment in this loan in July 2009. |

| | • | | 18301 Von Karman Loans – KBS REIT I foreclosed on the office property securing the loans in October 2009 and subsequently disposed of the property in June 2010. |

| | • | | Tribeca Loans – KBS REIT I foreclosed on the condominium building securing the loans in February 2010. As of December 31, 2011, KBS REIT I had sold 23 of the 27 condo units from the Tribeca Building. |

| | • | | 55 East Monroe Mezzanine Loan Origination – The borrower paid off the loan in full with an outstanding principal balance of $55.0 million in September 2010 at maturity. |

| | • | | 200 Professional Drive Loan Origination – KBS REIT I foreclosed on the property securing the loan and received $4.1 million upon the sale of the property in December 2010. |

| | • | | Artisan Multifamily Portfolio Mezzanine Loan – KBS REIT I wrote-off this investment in January 2011. |

| | • | | 2600 Michelson Mezzanine Loan – KBS REIT I sold the loan at a discount in June 2011 and received $52,000 upon the sale. |

| | • | | GKK Mezzanine Loans – In May 2011, the borrower (the “GKK Borrower”) under the GKK Mezzanine Loan (defined below) defaulted on its payment obligations and, as a result, on September 1, 2011, KBS REIT I entered into a settlement agreement (the “Settlement Agreement”) with the GKK Borrower pursuant to which the GKK Borrower transferred all of its interest in certain real estate properties (the “GKK Properties”) which indirectly secured the GKK Mezzanine Loan, and the mortgage debt related to the GKK Properties, to KBS REIT I in satisfaction of its obligations. |

| | • | | San Antonio Business Park Mortgage Loan – KBS REIT I sold the loan to an unaffiliated buyer for $26.0 million in December 2011. |

| | • | | Park Central Mezzanine Loan – KBS REIT I released the borrower under the loan from all outstanding debt and liabilities under a discounted payoff agreement at a discounted amount of $7.3 million in December 2011. |

KBS REIT I’s primary public offering was subject to the up-front commissions, fees and expenses similar to those associated with this offering and KBS REIT I has fee arrangements with KBS affiliates structured similarly to ours. For more information regarding the fees paid to KBS affiliates by KBS REIT I and the operating results of KBS REIT I, see Tables II and III under “Prior Performance Tables” in this supplement.

The KBS REIT I prospectus disclosed that KBS REIT I may seek to publicly list its shares of common stock if its independent directors believe a public listing would be in the best interests of its stockholders. To date, the independent directors have not made such a determination. If KBS REIT I does not list its shares of common stock on a national securities exchange by November 2012, its charter requires that KBS REIT I either (i) seek stockholder approval of the liquidation of the company or (ii) if a majority of its conflicts committee determines that liquidation is not then in the best interests of the stockholders, postpone the decision of whether to liquidate the company. As we have not reached November 2012, none of the actions described in (i) or (ii) above has occurred.

3

However, KBS REIT I has disclosed that due to the continuing impact of the disruptions in the financial markets on the values of KBS REIT I’s investments and the transfers under the Settlement Agreement, it is increasingly likely that KBS REIT I will postpone such a liquidity event in order to attempt to improve the overall return to stockholders.

If a majority of its conflicts committee does determine that liquidation is not then in the best interests of KBS REIT I’s stockholders, its charter requires that the conflicts committee revisit the issue of liquidation at least annually. Further postponement of listing or stockholder action regarding liquidation would only be permitted if a majority of the conflicts committee again determined that liquidation would not be in the best interest of the stockholders. If KBS REIT I sought and failed to obtain stockholder approval of its liquidation, the KBS REIT I charter would not require KBS REIT I to list or liquidate and would not require the conflicts committee to revisit the issue of liquidation, and KBS REIT I could continue to operate as before. If KBS REIT I sought and obtained stockholder approval of its liquidation, KBS REIT I would begin an orderly sale of its properties and other assets. The precise timing of such sales would take account of the prevailing real estate and financial markets, the economic conditions in the submarkets where its properties are located and the federal income tax consequences to the stockholders. In making the decision to apply for listing of its shares, KBS REIT I’s directors will try to determine whether listing its shares or liquidating its assets will result in greater value for stockholders.

The continued disruptions in the financial markets and deteriorating economic conditions have adversely affected the fair values and recoverability of certain of KBS REIT I’s investments. KBS REIT I disclosed fair values below its book values for certain assets in its financial statements and recognized impairments related to a limited number of assets.

On a quarterly basis, KBS REIT I evaluates its real estate securities for impairment. KBS REIT I reviews the projected future cash flows under these securities for changes in assumptions due to prepayments, credit loss experience and other factors. If, based on KBS REIT I’s quarterly estimate of cash flows, there has been an adverse change in the estimated cash flows from the cash flows previously estimated, the present value of the revised cash flows is less than the present value previously estimated, and the fair value of the securities is less than its amortized cost basis, an other-than-temporary impairment is deemed to have occurred. KBS REIT I recognized an other-than-temporary impairment related to its real estate securities of $5.1 million for the year ended December 31, 2009 and a $50.1 million impairment related to its real estate securities for the year ended December 31, 2008. Continued stress in the economy in general and the CMBS market in particular could result in additional other-than-temporary impairments on KBS REIT I’s fixed rate securities in the future. During the years ended December 31, 2011 and 2010, KBS REIT I did not recognize any other-than-temporary impairments on its real estate securities.

With respect to its loan portfolio, KBS REIT I considers a loan held for investment to be impaired when it becomes probable, based on current information and events, that it will be unable to collect all amounts due under the contractual terms of the loan agreement or other loan documents. KBS REIT I also considers a loan to be impaired if it grants the borrower a concession through a modification of the loan terms or if it expects to receive assets (including equity interests in the borrower) in partial satisfaction of the loan. When KBS REIT I has a collateral-dependent loan that is identified as being impaired, it is evaluated for impairment by comparing the estimated fair value of the underlying collateral, less costs to sell, to the carrying value of the loan. When KBS REIT I has a loan that is identified as being impaired in connection with a troubled debt restructuring resulting from a concession granted by KBS REIT I to the borrower through a modification of the loan terms, the loan is evaluated for impairment by comparing the carrying value of the loan to the present value of the modified cash flow stream discounted at the rate used to recognize interest income. Since inception, KBS REIT I has invested approximately $1.1 billion in real estate-related loans. As of December 31, 2011, KBS REIT I has recorded $74.1 million of asset-specific loan loss reserves related to its investments in the Sandmar Mezzanine Loan, the 11 South LaSalle Loan Origination and its subordinated debt investment in Petra Fund REIT Corp. Over the last five years, KBS REIT I also charged-off approximately $235.2 million of reserves for loan losses related to 10 of its real estate-related loan investments.

4

In August 2007, KBS REIT I entered a joint venture (the “KBS-New Leaf Joint Venture”) with New Leaf Industrial Partners Fund, L.P. to acquire a portfolio of industrial properties (the “National Industrial Portfolio”) for approximately $515.9 million plus closing costs. The National Industrial Portfolio consisted of 23 industrial properties and a master lease with respect to another industrial property. KBS REIT I had an 80% membership interest in the KBS-New Leaf Joint Venture and consolidated the joint venture in its financial statements. The mortgage and mezzanine loans with which the KBS-New Leaf Joint Venture financed a portion of its purchase of the National Industrial Portfolio (the “NIP Loans”) were to mature on December 31, 2011. However, due to a decline in the operating performance of the National Industrial Portfolio resulting from increased vacancies, lower rental rates and tenant bankruptcies, in addition to declines in market value across all real estate types in the period following the initial investment, it became unlikely that the KBS-New Leaf Joint Venture would be able to refinance or extend the NIP Loans upon their maturities. As a result, on December 28, 2011, the KBS-New Leaf Joint Venture entered into an agreement in lieu of foreclosure and related documents to transfer the National Industrial Portfolio properties to certain indirect wholly owned subsidiaries of the lender under the NIP Loans in full satisfaction of the debt outstanding under, and other obligations related to, the NIP Loans. As a result, KBS REIT I recorded a gain on extinguishment of debt of $115.5 million (including amounts for noncontrolling interest of approximately $24.2 million), which represents the difference between the carrying amount of the outstanding debt and other liabilities of approximately $446.1 million and the carrying value of the real estate properties and other assets of approximately $328.3 million, net of closing costs of $2.3 million, upon transfer of the properties (during the year ended December 31, 2010, KBS REIT I had recognized an impairment charge on real estate of $123.5 million with respect to 17 properties within the National Industrial Portfolio).

In addition, for the year ended December 31, 2011, KBS REIT I recorded $52.6 million in real estate impairments due to changes in cash flow estimates of the properties.

In the future, especially given the current market uncertainty, KBS REIT I may recognize material charges for impairment with respect to investments other than those described above or a different impairment charge for investments described above. Moreover, even if KBS REIT I does not recognize any material charge for impairment with respect to an asset, the fair value of the asset may have declined based on general economic conditions or other factors.

As of December 15, 2011, pursuant to the Settlement Agreement, the GKK Borrower transfered to KBS REIT I the equity interests in the indirect owners of or holders of a leasehold interest in approximately 867 properties, including approximately 576 bank branch properties and approximately 291 office buildings and operations centers. KBS REIT I also assumed approximately $1.5 billion of mortgage debt related to the GKK Properties. In consideration of the performance of the Settlement Agreement, KBS REIT I agreed to release the GKK Borrower from its obligations under KBS REIT I’s investment in a senior mezzanine loan with an original face amount of $500,000,000 (the “GKK Mezzanine Loan”). KBS REIT I’s estimated fair values of the underlying GKK Properties and related current assets and liabilities was approximately $1.9 billion and supported the approximately $1.9 billion total of the combined outstanding mortgage loan balance encumbering the GKK Properties (including a portion of a mortgage loan secured by some of the GKK Properties which KBS REIT I owns), plus KBS REIT I’s carrying value of the GKK Mezzanine Loan and a portion of a junior mezzanine loan relating to the GKK Properties that KBS REIT I owned prior to KBS REIT I’s entry into the Settlement Agreement.

In connection with the maturity of the GKK Mezzanine Loan in May 2011, KBS REIT I, through wholly owned subsidiaries, amended and restated two master repurchase agreements secured by the GKK Mezzanine Loan. The amended and restated master repurchase agreements contain mandatory amortization payments and other restrictions on KBS REIT I’s cash flows and operations that significantly limit KBS REIT I’s operating flexibility and liquidity. These restrictions will likely be in place until April 28, 2013.

In order to manage its reduced cash flows from operations and to redirect available funds to reduce its debt, and as a result of the general impact of current economic conditions on rental rates, occupancy rates and property cash flows, in March 2012, KBS REIT I’s board of directors approved the suspension of monthly distribution payments. For record dates beginning on July 18, 2006 through June 30, 2009, KBS REIT I had paid monthly distributions based on daily record dates that amounted to $0.70 per share on an annualized basis. For record dates beginning on July 1, 2009 through February 28, 2012, KBS REIT I had paid monthly distributions based on daily record dates that amounted to $0.525 per share on an annualized basis.

5

On March 22, 2012, the board of directors of KBS REIT I approved an estimated value per share of KBS REIT I’s common stock of $5.16 based on the estimated value of KBS REIT I’s assets less the estimated value of its liabilities, or net asset value, divided by the number of shares outstanding, all as of December 31, 2011. KBS REIT I provided this estimated value per share to assist broker-dealers that participated in its initial public offering in meeting their customer account statement reporting obligations under the National Association of Securities Dealers (“NASD”) Rule 2340. The estimated value per share was based upon the recommendation and valuation of KBS Capital Advisors, KBS REIT I’s external advisor. As with any valuation methodology, KBS Capital Advisors’ methodology was based upon a number of estimates and assumptions that may not be accurate or complete. Different parties with different assumptions and estimates could have derived a different estimated value per share, and such differences could be significant. The estimated value per share is not audited and does not represent the fair value of KBS REIT I’s assets less its liabilities according to U.S. generally accepted accounting principles, nor does it represent a liquidation value of KBS REIT I’s assets and liabilities or the price at which KBS REIT I’s shares of common stock would trade on a national securities exchange. Markets for real estate and real estate-related investments can fluctuate and values are expected to change in the future. For a full description of the methodologies used to value KBS REIT I’s assets and liabilities in connection with the calculation of the estimated value per share, see KBS REIT I’s Annual Report on Form 10-K for the year ended December 31, 2011 filed with the SEC.

KBS REIT I has not had funds available for ordinary redemptions since the April 2009 redemption date, and on March 20, 2012, KBS REIT I’s board of directors amended and restated its share redemption program, which amendment and restatement will become effective on April 25, 2012, to provide only for redemptions sought upon a stockholder’s death, “qualifying disability” or “determination of incompetence” (each as defined in the share redemption program). Such redemptions are subject to an annual dollar limitation, which will be $10.0 million in the aggregate for the calendar year 2012 (subject to review and adjustment during the year by the board of directors), and further subject to the limitations described in the share redemption program plan document. Moreover, KBS REIT I has entered into financing agreements that, during the terms thereof, require KBS REIT I to continue to limit redemptions under its share redemption program to those sought upon a stockholder’s death, “qualifying disability” or “determination of incompetence.” These financing arrangements will likely be in place until April 28, 2013.

Upon request, prospective investors may obtain from us without charge copies of offering materials and any public reports prepared in connection with KBS REIT I, including a copy of the most recent Annual Report on Form 10-K filed with the SEC. For a reasonable fee, we also will furnish upon request copies of the exhibits to the Form 10-K. Many of the offering materials and reports prepared in connection with KBS REIT I are also available on its web site atwww.kbsreit.com. Neither the contents of that web site nor any of the materials or reports relating to KBS REIT I are incorporated by reference in or otherwise a part of this prospectus. In addition, the SEC maintains a web site atwww.sec.gov that contains reports, proxy and other information that KBS REIT I files electronically as KBS Real Estate Investment Trust, Inc. with the SEC.

KBS REIT II

On April 22, 2008, our sponsors launched the initial public offering of KBS REIT II, a publicly registered, non-traded REIT. Its primary initial public offering was for a maximum of 200,000,000 shares of common stock at a price of $10.00 per share, plus an additional 80,000,000 shares of common stock initially priced at $9.50 per share pursuant to its dividend reinvestment plan. As of December 31, 2011, KBS REIT II had accepted aggregate gross offering proceeds of approximately $1.8 billion in its primary offering and $134.3 million pursuant to its dividend reinvestment plan, from approximately 51,000 investors. Of the amount raised pursuant to its dividend reinvestment plan, $48.9 million had been used to fund share redemptions pursuant to its share redemption program as of December 31, 2011. KBS REIT II ceased offering shares in its primary public offering on December 31, 2010, and continues to offer shares under its dividend reinvestment plan. See Table I under “Prior Performance Tables” in this supplement for more information regarding KBS REIT II’s initial public offering.

As of December 31, 2011, KBS REIT II owned 27 real estate properties (consisting of 20 office properties, one office/flex property, a portfolio of four industrial properties and two industrial properties) and a leasehold interest in one industrial property encompassing 11.3 million rentable square feet. At December 31, 2011, the portfolio was approximately 95% occupied. In addition, KBS REIT II owned seven real estate loans receivable.

KBS REIT II has investment objectives that are similar to ours. Like ours, its primary investment objectives are to provide investors with attractive and stable returns and to preserve and return their capital contributions and, like us, it will seek to realize growth in the value of its investments by timing asset sales to maximize asset value. In addition, both real estate or real estate-related assets involve similar assessments of the risks and rewards of the operation of the underlying real estate and financing thereof as well as an understanding of the real estate and real estate-finance markets.

6

KBS REIT II has acquired and manages a diverse portfolio of real estate and real estate-related assets. It has diversified its portfolio by investment type, investment size, investment risk and geographic region with the goal of attaining a portfolio of income-producing real estate and real estate-related assets that provide attractive and stable returns to its investors. Based on KBS REIT II’s investments to date, KBS REIT II has allocated approximately 90% of its portfolio to investments in core properties and approximately 10% of its portfolio to other real estate-related investments such as mortgage loans and participations in such loans.

KBS REIT II used the net proceeds from its initial public offering and debt financing to purchase or fund $3.0 billion of real estate and real estate-related assets as of December 31, 2011, including $37.6 million of acquisition and origination fees and expenses. As of December 31, 2011, KBS REIT II had used the net proceeds from its initial public offering for the acquisition of real estate properties and real estate-related assets in the amounts of $2.8 billion and $418.9 million, respectively, and had debt financing on its real estate properties in the amount of $1.3 billion and debt financing on five of its real estate loans receivable in the amount of $121.0 million. On November 22, 2010, KBS REIT II originated a first mortgage loan in the amount of $175.0 million (the “One Kendall Square First Mortgage”) and on November 30, 2010, KBS REIT II sold, at par, a pari-passu participation interest with respect to 50% of the outstanding principal balance of this loan. The acquisition amounts presented herein do not include the 50% participation interest KBS REIT II sold. However, KBS REIT II paid an origination fee on this 50% participation interest and the origination fees presented herein include such amount paid.

As of December 31, 2011, with proceeds from its initial public offering and debt financing, as a percentage of amount invested (based on purchase price), KBS REIT II had invested in the following types of assets: 80% in 20 office properties, 6% in five mortgage loans, 6% in a participation in a mortgage loan, 3% in a portfolio of four industrial properties, 2% in an A-Note, 1% in an office/flex property, 1% in two industrial properties, and 1% in a leasehold interest in an industrial property. All of KBS REIT II’s real property investments have been made within the United States. As a percentage of amount invested (based on purchase price), the geographic locations of KBS REIT II’s investments in real properties were as follows: 30% in three properties in the Midwest, 28% in nine properties in the West, 31% in ten properties in the East, and 11% in six properties in the South. All of the real properties purchased by KBS REIT II had prior owners and operators.

During the three years ended December 31, 2011, KBS REIT II invested in the following types of assets: 17 office properties, seven industrial properties (including a leasehold interest in one property, a portfolio of four properties and two individual properties) and six mortgage loans. The geographic locations of properties acquired by KBS REIT II during the three years ended December 31, 2011 were as follows: eight properties in the West; seven properties in the East; six properties in the South; and three properties in the Midwest. KBS REIT II funded these investments with a combination of proceeds from its initial public offering in the amount of $1.5 billion and debt financing of $719.7 million.

Other than its investment in CMBS, which KBS REIT II acquired and sold in 2009, and interests with respect to the One Kendall Square First Mortgage, KBS REIT II has not sold any assets. On November 22, 2010, KBS REIT II originated the One Kendall Square First Mortgage in the amount of $175.0 million. On November 30, 2010, KBS REIT II sold, at par, a pari-passu participation interest with respect to 50% of the outstanding principal balance of the One Kendall Square First Mortgage, leaving it with an $87.5 million interest. On April 5, 2011, KBS REIT II restructured the One Kendall Square First Mortgage to provide for two debt tranches with varying interest rates – the A-Note, with an original principal amount of $90.0 million, in which KBS REIT II held a $45.0 million interest, and the B-Note, with an original principal amount of $85.0 million, in which KBS REIT II held a $42.5 million interest. On April 6, 2011, KBS REIT II sold and transferred its $45.0 million interest in the A-Note, at par, to an unaffiliated buyer.

KBS REIT II intends to hold its core properties for four to seven years, though economic and market conditions may influence KBS REIT II to hold its investments for different periods of time. KBS REIT II generally intends to hold its real estate-related investments until maturity, though the hold period will vary depending upon the type of asset, interest rates and economic and market conditions. See Table V under “Prior Performance Tables” in this supplement for more information regarding KBS REIT II’s sale of CMBS.

KBS REIT II’s primary offering was subject to the up-front commissions, fees and expenses similar to those associated with this offering and it has fee arrangements with KBS affiliates structured similar to ours. For more information regarding the fees paid to KBS affiliates by KBS REIT II and the operating results of KBS REIT II, see Tables II and III under “Prior Performance Tables” in this supplement.

7

The KBS REIT II prospectus disclosed that KBS REIT II may seek to list its shares of common stock if its independent directors believe listing would be in the best interests of its stockholders. To date, the independent directors have not made such a determination. If KBS REIT II does not list its shares of common stock on a national securities exchange by March 2018, its charter requires that KBS REIT II either (i) seek stockholder approval of the liquidation of the company or (ii) if a majority of its conflicts committee determines that liquidation is not then in the best interests of the stockholders, postpone the decision of whether to liquidate the company. As we have not reached March 2018, none of the actions described in (i) or (ii) above have occurred.

If a majority of its conflicts committee does determine that liquidation is not then in the best interests of KBS REIT II’s stockholders, its charter requires that the conflicts committee revisit the issue of liquidation at least annually. Further postponement of listing or stockholder action regarding liquidation would only be permitted if a majority of the conflicts committee again determined that liquidation would not be in the best interest of the stockholders. If KBS REIT II sought and failed to obtain stockholder approval of its liquidation, the KBS REIT II charter would not require KBS REIT II to list or liquidate and would not require the conflicts committee to revisit the issue of liquidation, and KBS REIT II could continue to operate as before. If KBS REIT II sought and obtained stockholder approval of its liquidation, KBS REIT II would begin an orderly sale of its properties and other assets. The precise timing of such sales would take account of the prevailing real estate and financial markets, the economic conditions in the submarkets where its properties are located and the federal income tax consequences to the stockholders. In making the decision to apply for listing of its shares, KBS REIT II’s directors will try to determine whether listing its shares or liquidating its assets will result in greater value for stockholders.

On December 19, 2011, the board of directors of KBS REIT II approved an estimated value per share of KBS REIT II’s common stock of $10.11 based on the estimated value of KBS REIT II’s assets less the estimated value of its liabilities, or net asset value, divided by the number of shares outstanding, all as of September 30, 2011. KBS REIT II provided this estimated value per share to assist broker-dealers that participated in its initial public offering in meeting their customer account statement reporting obligations under NASD Rule 2340. The estimated value per share was based upon the recommendation and valuation of KBS Capital Advisors LLC, KBS REIT II’s external advisor. As with any valuation methodology, KBS Capital Advisors’ methodology was based upon a number of estimates and assumptions that may not be accurate or complete. Different parties with different assumptions and estimates could have derived a different estimated value per share, and such differences could be significant. The estimated value per share does not represent the fair value of KBS REIT II’s assets less its liabilities according to U.S. generally accepted accounting principles, nor does it represent a liquidation value of KBS REIT II’s assets and liabilities or the price at which KBS REIT II’s shares of common stock would trade on a national securities exchange. Markets for real estate and real estate-related investments can fluctuate and values are expected to change in the future. For a full description of the methodologies used to value KBS REIT II’s assets and liabilities in connection with the calculation of the estimated value per share, see KBS REIT II’s Annual Report on Form 10-K for the year ended December 31, 2011 filed with the SEC.

Upon request, prospective investors may obtain from us without charge copies of offering materials and any public reports prepared in connection with KBS REIT II, including a copy of the most recent Annual Report on Form 10-K filed with the SEC. For a reasonable fee, we also will furnish upon request copies of the exhibits to the Form 10-K. Many of the offering materials and reports prepared in connection with KBS REIT II are also available on its web site atwww.kbsreitii.com. Neither the contents of that web site nor any of the materials or reports relating to KBS REIT II are incorporated by reference in or otherwise a part of this prospectus. In addition, the SEC maintains a web site atwww.sec.govthat contains reports, proxy and other information that KBS REIT II files electronically as KBS Real Estate Investment Trust II, Inc. with the SEC.

KBS Legacy Partners Apartment REIT

On March 12, 2010, our sponsors, together with Legacy Partners Residential Realty LLC and certain of its affiliates, launched the initial public offering of KBS Legacy Partners Apartment REIT, a publicly registered, non-traded REIT. Its primary initial public offering is for a maximum of 200,000,000 shares of common stock at a price of $10.00 per share, plus an additional 80,000,000 shares of common stock initially priced at $9.50 per share pursuant to its dividend reinvestment plan. As of December 31, 2011, KBS Legacy Partners Apartment REIT had accepted aggregate gross offering proceeds of approximately $46.6 million from approximately 1,400 investors, including $0.4 million under the dividend reinvestment plan. No amounts have been used to fund share redemptions pursuant to its share redemption program. KBS Legacy Partners Apartment REIT’s primary offering is expected to last until March 12, 2013, although it may extend the offering in certain circumstances.

8

As of December 31, 2011, KBS Legacy Partners Apartment REIT had investment objectives that are similar to ours. Like ours, its primary investment objectives are to provide investors with attractive and stable returns and to preserve and return their capital contributions and, like us, it will seek to realize growth in the value of its investments by timing asset sales to maximize asset value. In addition, both real estate or real estate-related assets involve similar assessments of the risks and rewards of the operation of the underlying real estate and financing thereof as well as an understanding of the real estate and real estate-finance markets.

KBS Legacy Partners Apartment REIT intends focus its investment activities on, and use the proceeds of its offering principally for, investment in and management of a diverse portfolio of equity investments in high quality apartment communities located throughout the United States. It plans to diversify its portfolio by investment type and investment risk, as well as by other factors, with the goal of attaining a portfolio of income-producing properties that provide attractive and stable returns to its investors. KBS Legacy Partners Apartment REIT intends to make the majority of its equity investments in investment types that have relatively low investment risk characteristics.

KBS Legacy Partners Apartment REIT intends to allocate between 70% and 80% of its portfolio to investments in core apartment communities, which are high-quality, well-positioned, existing properties producing rental income, generally with at least 85% occupancy. Such properties are generally newer properties that are well-located in major urban or suburban submarkets. Core apartment communities generally have fewer near-term capital expenditure requirements (with minor deferred maintenance or cosmetic improvements, if any, required) and have the demonstrated ability to produce high occupancies and stable cash flows. As a result, core apartment communities tend to have a relatively low investment risk profile.

KBS Legacy Partners Apartment REIT intends to allocate between 20% and 30% of its portfolio to investments in value-added and opportunity-oriented properties at various phases of leasing, development, redevelopment or repositioning. These properties are higher-yield and higher-risk investments than core properties and may experience short-term decreases in income during the lease-up, redevelopment or repositioning phase. Examples of value-added properties include: properties with moderate vacancies, poorly managed and positioned properties and properties owned by distressed sellers. Examples of opportunity-oriented properties include properties under development or construction. Properties that need to be redeveloped or repositioned may require minor or even major construction activity. Construction and development activities may expose KBS Legacy Partners Apartment REIT to risks such as cost overruns, carrying costs of projects under construction and development, builder’s ability to build in conformity with plans and specifications, availability and costs of materials and labor, inability to obtain tenants, weather conditions and government regulation. Because of these risks, it will seek to acquire such properties only if its sponsors believe that there is long-term growth potential of the investment after the necessary lease-up, redevelopment or repositioning is complete.

KBS Legacy Partners Apartment REIT may make its investments through the acquisition of individual assets or by acquiring portfolios of assets or make equity investments in REITs and other real estate companies with investment objectives similar to it. KBS Legacy Partners Apartment REIT does not expect its non-controlling equity investments in other public companies to exceed 5% of the proceeds of its offering, assuming its sells the maximum offering amount, or to represent a substantial portion of its assets at any one time.

Although this is its target portfolio, KBS Legacy Partners Apartment REIT’s portfolio may vary from its expected composition to the extent that KBS Capital Advisors presents KBS Legacy Partners Apartment REIT with good investment opportunities that allow it to meet the REIT requirements under the Internal Revenue Code.

On October 26, 2010, KBS Legacy Partners Apartment REIT made its first investment and acquired a 453,178 square foot Class A apartment complex, containing 504 units located in Irving, Texas (“Legacy at Valley Ranch”). The purchase price of Legacy at Valley Ranch was $36.1 million plus closing costs. As of December 31, 2011, Legacy at Valley Ranch was 96% occupied. As of December 31, 2011, this was the only property that KBS Legacy Partners Apartment REIT owned. KBS Legacy Partners Apartment REIT funded this investment with proceeds from debt financing. This property had a prior owner and operator.

KBS Legacy Partners Apartment REIT’s offering is subject to up-front commissions, fees and expenses similar to those associated with this offering and it has fee arrangements with KBS affiliates structured similarly to ours. See Table II under “Prior Performance Tables” in this supplement.

9

The KBS Legacy Partners Apartment REIT prospectus discloses that the program may seek to publicly list its shares of common stock if its independent directors believe a public listing would be in the best interests of its stockholders. To date, such a determination has not been made. If KBS Legacy Partners Apartment REIT does not list its shares of common stock on a national securities exchange by January 31, 2020, its charter requires that KBS Legacy Partners Apartment REIT either (i) seek stockholder approval of the liquidation of the company or (ii) if a majority of its conflicts committee determines that liquidation is not then in the best interests of the stockholders, postpone the decision of whether to liquidate the company. As we have not reached January 31, 2020, none of the actions described in (i) or (ii) above have occurred.

If a majority of the conflicts committee of KBS Legacy Partners Apartment REIT were to determine that liquidation is not then in the best interests of its stockholders, KBS Legacy Partners Apartment REIT’s charter requires that its conflicts committee revisit the issue of liquidation at least annually. Further postponement of listing or stockholder action regarding liquidation would only be permitted if a majority of the conflicts committee again determined that liquidation would not be in the best interest of the stockholders. If KBS Legacy Partners Apartment REIT sought and failed to obtain stockholder approval of its liquidation, the KBS Legacy Partners Apartment REIT charter would not require KBS Legacy Partners Apartment REIT to list or liquidate, and the company could continue to operate as before. If KBS Legacy Partners Apartment REIT sought and obtained stockholder approval of its liquidation, it would begin an orderly sale of its assets. The precise timing of such sales would take account of the prevailing real estate finance markets and the debt markets generally as well as the federal income tax consequences to its stockholders. In making the decision to apply for listing of its shares, KBS Legacy Partners Apartment REIT’s directors will try to determine whether listing its shares or liquidating its assets will result in greater value for stockholders.

Upon request, prospective investors may obtain from us without charge copies of offering materials and any public reports prepared in connection with KBS Legacy Partners Apartment REIT, including a copy of the most recent Annual Report on Form 10-K filed with the SEC. For a reasonable fee, we also will furnish upon request copies of the exhibits to the Form 10-K. Many of the offering materials and reports prepared in connection with KBS Legacy Partners Apartment REIT are also available on its web site atwww.kbslegacyreit.com. Neither the contents of that web site nor any of the materials or reports relating to KBS Legacy Partners Apartment REIT are incorporated by reference in or otherwise a part of this prospectus. In addition, the SEC maintains a web site atwww.sec.gov that contains reports, proxy and other information that KBS Legacy Partners Apartment REIT files electronically as KBS Legacy Partners Apartment REIT, Inc. with the SEC.

KBS REIT III

On October 26, 2010, our sponsors launched the initial public offering of KBS REIT III, a publicly registered, non-traded REIT. Its primary initial public offering is for a maximum of 200,000,000 shares of common stock at a price of $10.00 per share, plus an additional 80,000,000 shares of common stock initially priced at $9.50 per share pursuant to its dividend reinvestment plan. On March 24, 2011, KBS REIT III broke escrow in its initial public offering and through December 31, 2011, KBS REIT III had sold 10,448,043 shares of common stock for gross offering proceeds of $104.0 million, including 77,864 shares of common stock under its dividend reinvestment plan for gross offering proceeds of $0.7 million, from approximately 3,000 investors. As of December 31, 2011, KBS REIT III had not redeemed any shares under its share redemption program because no shares were eligible for redemption. KBS REIT III’s primary offering is expected to last until October 26, 2012, although it may extend the offering.

As of December 31, 2011, KBS REIT III owned two office buildings encompassing 311,970 rentable square feet in the aggregate that were collectively 97% occupied. In addition, KBS REIT III owned one first mortgage loan.

KBS REIT III has investment objectives that are similar to ours. Like ours, its primary investment objectives are to provide investors with attractive and stable returns and to preserve and return their capital contributions and, like us, it will seek to realize growth in the value of its investments by timing asset sales to maximize asset value. In addition, both real estate and real estate-related assets involve similar assessments of the risks and rewards of the operation of the underlying real estate assets and the financing thereof as well as an understanding of the real estate and real estate-finance markets.

KBS REIT III intends to invest in and manage a diverse portfolio of real estate and real estate-related assets. It plans to diversify its portfolio by investment type, investment size and investment risk with the goal of attaining a portfolio of income-producing real estate and real estate-related assets that provides attractive and stable returns to its investors and allows it to preserve and return its investors’ capital contributions. KBS REIT III intends to allocate approximately 70% of its portfolio to, and expects that, once it has fully invested the proceeds from its public offering, approximately 60% to 80% of its portfolio will consist of, investments in core properties. KBS REIT III intends to allocate approximately 30% of its portfolio to, and expects that, once it has fully invested the proceeds from its public offering, approximately 20% to 40% of its portfolio will consist of, investments in other real estate-related assets. Although these percentages represent its target portfolio, KBS REIT III may make adjustments to its target portfolio based on real estate market conditions and investment opportunities.

10

KBS REIT III used the net proceeds from its initial public offering and debt financing to purchase or fund $94.8 million of real estate and real estate-related assets as of December 31, 2011, including $1.4 million in acquisition and origination fees and expenses. All of KBS REIT III’s investments were made in 2011. As of December 31, 2011, KBS REIT III had used the net proceeds from its initial public offering for the acquisition of real estate properties and real estate-related assets in the amounts of $84.5 million and $10.3 million, respectively, and had debt financing on its real estate properties in the amount of $42.3 million.

As of December 31, 2011, with proceeds from its initial public offering and debt financing, as a percentage of amount invested (based on purchase price), KBS REIT III had invested 89% in two office properties and 11% in one mortgage loan. All of KBS REIT III’s real property investments have been made within the United States. Both office properties are located in Texas. All of the real properties purchased by KBS REIT III had prior owners and operators.

KBS REIT III’s primary offering was subject to the up-front commissions, fees and expenses similar to those associated with this offering and KBS REIT III has fee arrangements with KBS affiliates structured similar to ours. For more information regarding the fees paid to KBS affiliates by KBS REIT III, see Table II under “Prior Performance Tables” in this supplement.

The KBS REIT III prospectus discloses that KBS REIT III may seek to list its shares of common stock if its independent directors believe listing would be in the best interests of its stockholders. To date, the independent directors have not made such a determination. If KBS REIT III does not list its shares of common stock on a national securities exchange by September 2020, its charter requires that KBS REIT III either (i) seek stockholder approval of the liquidation of the company or (ii) if a majority of its conflicts committee determines that liquidation is not then in the best interests of the stockholders, postpone the decision of whether to liquidate the company. As we have not reached September 2020, neither of the actions described in (i) or (ii) above have occurred.

If a majority of the conflicts committee of KBS REIT III were to determine that liquidation is not then in the best interests of its stockholders, KBS REIT III’s charter requires that its conflicts committee revisit the issue of liquidation at least annually. Further postponement of listing or stockholder action regarding liquidation would only be permitted if a majority of the conflicts committee again determined that liquidation would not be in the best interest of the stockholders. If KBS REIT III sought and failed to obtain stockholder approval of its liquidation, the KBS REIT III charter would not require KBS REIT III to list or liquidate and would not require the conflicts committee to revisit the issue of liquidation, and KBS REIT III could continue to operate as before. If KBS REIT III sought and obtained stockholder approval of its liquidation, KBS REIT III would begin an orderly sale of its properties and other assets. The precise timing of such sales would take account of the prevailing real estate and financial markets, the economic conditions in the submarkets where its properties are located and the federal income tax consequences to the stockholders. In making the decision to apply for listing of its shares, KBS REIT III’s directors will try to determine whether listing its shares or liquidating its assets will result in greater value for stockholders.

Upon request, prospective investors may obtain from us without charge copies of offering materials and any public reports prepared in connection with KBS REIT III, including a copy of the most recent Annual Report on Form 10-K filed with the SEC. For a reasonable fee, we also will furnish upon request copies of the exhibits to the Form 10-K. Many of the offering materials and reports prepared in connection with KBS REIT III are also available on its web site atwww.kbsreitiii.com. Neither the contents of that web site nor any of the materials or reports relating to KBS REIT III are incorporated by reference in or otherwise a part of this prospectus. In addition, the SEC maintains a web site atwww.sec.gov that contains reports, proxy and other information that KBS REIT III files electronically as KBS Real Estate Investment Trust III, Inc. with the SEC.

Private Programs

During the 10-year period ended December 31, 2011, KBS investment advisors managed 14 private real estate funds, six of which were multi-investor, commingled funds and eight of which were single-client, separate accounts. All of these private funds were limited partnerships for which affiliates of Messrs. Bren and Schreiber act or acted as a general partner. In all cases, affiliates of Messrs. Bren and Schreiber had responsibility for acquiring, investing, managing, developing and selling the real estate and real estate-related assets of each of the funds. Six of the 14 private funds managed by KBS investment advisors during the 10-year period ended December 31, 2011 used private REITs to structure the ownership of some of their investments.

11

Five of the 14 private real estate funds managed by KBS investment advisors raised approximately $370.1 million of equity capital from one institutional investor during the 10-year period ended December 31, 2011. The institutional investor investing in the private fund was a public pension fund. During this 10-year period, nine of the 14 private funds managed by KBS investment advisors did not raise any capital as they had completed their respective offering stages.

During the 10-year period ended December 31, 2011, KBS investment advisors acquired 23 real estate investments and invested over $735.9 million in these assets (including equity, debt and reinvestment of income and sales proceeds) on behalf of the five private funds raising capital for new investments during this period. Debt financing was used in acquiring the properties in all of these five private funds.

Each of the private funds managed by KBS investment advisors during the 10-year period ended December 31, 2011 have or had (eight of the funds have been fully liquidated) investment objectives that are similar to ours. Like ours, their primary investment objectives are to provide investors with attractive and stable returns and to preserve and return their capital contributions and, like us, they seek to realize growth in the value of their investments by timing asset sales to maximize asset value. In addition, investments in real estate and real estate-related assets involve similar assessments of the risks and rewards of the operation of the underlying real estate and financing thereof as well as an understanding of the real estate and real estate-finance markets.

For each of the private funds, the KBS investment advisor has focused on acquiring a diverse portfolio of real estate investments. The KBS investment advisor typically diversified the portfolios of the private funds by property type and geographic region as well as investment size and investment risk. In constructing the portfolios for 12 of the 14 private funds, the KBS investment advisor specialized in acquiring a mix of value-added, enhanced-return and core real estate assets, focusing primarily on value-added and enhanced-return properties. Value-added and enhanced-return assets are assets that are undervalued or that could be repositioned to enhance their value. For two of the 14 private funds, the KBS investment advisor is focusing on the acquisition of core real estate assets.

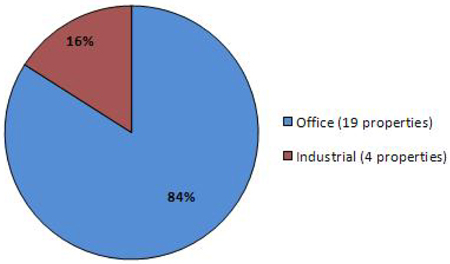

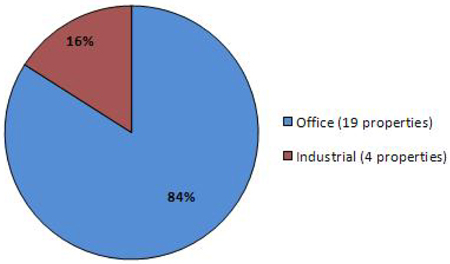

Substantially all of the assets acquired by the private funds have involved commercial properties. The chart below shows amounts invested (based on purchase price) by property type, during the 10-year period ended December 31, 2011, by KBS investment advisors on behalf of the private funds.

KBS INVESTMENT ADVISORS – PRIVATE PROGRAMS

CAPITAL INVESTED BY PROPERTY TYPE

12

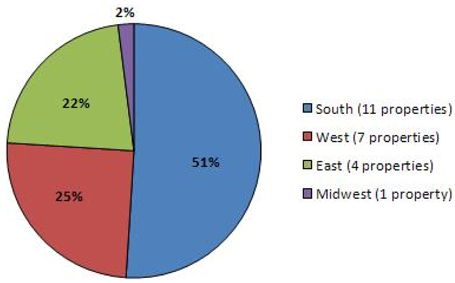

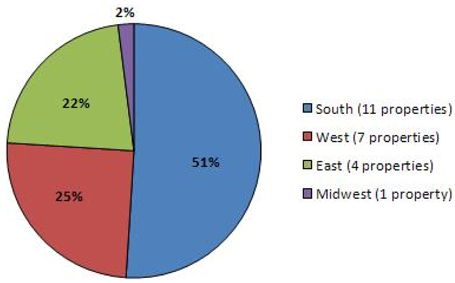

The KBS investment advisors for the private funds also sought to diversify the investments of the funds by geographic region as illustrated by the chart below. This chart shows investments in different geographic regions by amount invested (based on purchase price) during the 10-year period ended December 31, 2011. KBS investment advisors have emphasized their investment activity within those regions that have exhibited the potential for strong or sustainable growth. All investments by the private funds were within the United States.

KBS INVESTMENT ADVISORS – PRIVATE PROGRAMS

CAPITAL INVESTED BY REGION

In seeking to diversify the portfolios of the private funds by investment risk, KBS investment advisors have purchased both low-risk, high-quality properties and high-quality but under-performing properties in need of repositioning. Substantially all of the properties purchased by the private funds had prior owners and operators.

During the three years ended December 31, 2011, KBS investment advisors invested in three office properties on behalf of the private funds. These properties were geographically located in the East, South and West of the United States. Debt financing was used in acquiring all of these properties.

As stated above, during the 10-year period ended December 31, 2011, KBS investment advisors invested over $735.9 million (including equity, debt and reinvestment of income and sales proceeds) for its clients through five private funds. Of the properties acquired during the 10-year period ended December 31, 2011, KBS investment advisors sold one property on behalf of these five private funds, which represents 4% of all properties these five private funds had acquired during this period. During the 10-year period ended December 31, 2011, KBS investment advisors sold another 87 properties on behalf of the remaining nine funds that did not acquire properties during the period.

Though the private funds were not subject to the up-front commissions, fees and expenses associated with this offering, the private funds have fee arrangements with KBS affiliates structured similarly to ours. The percentage of the fees varied based on the market factors at the time the particular fund was formed. Historically a majority of the private funds paid (i) asset management fees; (ii) acquisition fees; and (iii) real estate commissions, disposition fees and/or incentive fees based on participation interests in the net cash flows of the funds’ assets after achieving a stipulated return for the investors or based on gains from the sale of assets.

13

The recession that started in the late 1990s resulted in more business failures among smaller tenants typical to Class B buildings. This resulted in higher vacancy rates for these buildings and in real estate funds investing additional capital to cover the costs of re-letting the properties, these events affected the performance of five of the 14 private funds. These private funds also retained the buildings for a longer period of time so that the buildings would be sufficiently leased for disposition. As a result, rental rates on newly leased space and renewals in the buildings owned by these funds decreased. Higher vacancy rates also increased the period of time it took the KBS investment advisors to get the properties to the planned stabilized occupancy level for disposition for these five funds. These adverse market conditions reduced the distributions made by these private funds and may have caused the total returns to investors to be lower than they otherwise would. One of these private funds is still in its operating stage, while the other four funds are fully liquidated.

14

PRIOR PERFORMANCE TABLES

The tables presented in this section provide summary unaudited information related to the historical experience of KBS REIT I, KBS REIT II, KBS REIT III and KBS Legacy Partners Apartment REIT. By purchasing shares in this offering, you will not acquire any ownership interest in any funds to which the information in this section relates and you should not assume that you will experience returns, if any, comparable to those experienced by the investors in the funds discussed.

The information in this section should be read together with the summary information in this supplement under “Prior Performance Summary.” The following tables are included in this section:

| | • | | Table I — Experience in Raising and Investing Funds; |

| | • | | Table II — Compensation to Sponsor; |

| | • | | Table III — Operating Results of Prior Programs; and |

| | • | | Table V — Sales or Disposals of Properties. |

Table IV (Results of Completed Programs) has been omitted since none of the prior public programs sponsored by our sponsors have completed their operations and sold all of their properties during the five years ended December 31, 2011.

P-1

TABLE I

EXPERIENCE IN RAISING AND INVESTING FUNDS

(UNAUDITED)

Prior Performance Is Not Indicative of Future Results

Table I provides a summary of the experience of our sponsors in raising and investing funds for the public program that had an offering close during the three years ended December 31, 2011. Information is provided as to the manner in which the proceeds of the offering were applied. This program has investment objectives similar to ours. All percentage amounts except “Percent leveraged” represent percentages of the dollar amount raised for the program.

| | | | |

| | | KBS | |

| | | REIT II | |

Dollar amount offered | | $ | 2,000,000,000 | |

| | | | |

Dollar amount raised | | $ | 1,820,569,000 | |

| | | | |

Percentage amount raised | | | 91.0% | |

| | | | |

Percentage available for investment before offering expenses and reserves | | | 100.0% | |

Less offering expenses: | | | | |

Selling commissions and dealer manager fees | | | 9.2% | |

Organizational and offering expenses | | | 1.1% | |

Reserves | | | - | |

| | | | |

Percentage available for investment before offering expenses and reserves | | | 89.7% | |

| | | | |

Acquisition costs: | | | | |

Prepaid items and fees related to purchase of property | | | - | |

Purchase price (cash down payment)(1) | | | 160.4% | |

Acquisition and origination fees(2) | | | 1.3% | |

Other capitalized costs(3) | | | 1.1% | |

| | | | |

Total acquisition costs (includes mortgage financing)(4) | | | 162.8% | |

| | | | |

Percent leveraged(5) | | | 47.0% | |

| | | | |

Date offering began | | | 4/22/2008(6) | |

Length of offering (in months) | | | 35(6) | |

Months to invest 90% of amount available for investment | | | 44(6) | |

P-2

TABLE I

EXPERIENCE IN RAISING AND INVESTING FUNDS (CONTINUED)

(UNAUDITED)

Prior Performance Is Not Indicative of Future Results

(1) “Purchase price (cash down payment)” includes both debt- and equity-financed payments. See the “Percent leveraged” line for the approximate percentage of the purchase price financed with mortgage or other debt.

(2) Represents acquisition and origination fees as if they were calculated as a percentage of dollar amounts raised. Acquisition and origination fees of KBS REIT II are calculated as a percentage of purchase price (including leverage used to fund the acquisition or origination) plus other acquisition and origination expenses and are paid to KBS REIT II’s advisor.

(3) Other capitalized costs include legal fees, outside broker fees, environmental studies, title and other closing costs.

(4) Total acquisition costs include the cash down payment, acquisition and origination fees, acquisition and origination expenses and mortgage or other financing.

(5) “Percent leveraged” represents financing outstanding as of December 31, 2011 divided by total acquisition or origination cost for properties and other investments acquired.

(6) KBS REIT II is a publicly registered, non-traded REIT. KBS REIT II launched its initial public offering on April 22, 2008. On June 24, 2008, KBS REIT II broke escrow in its initial public offering and then commenced real estate operations. KBS REIT II ceased offering shares of common stock in its primary offering on December 31, 2010 and terminated its primary offering on March 22, 2011 upon the completion of review of subscriptions submitted in accordance with its processing procedures. KBS REIT II continues to issue shares under its dividend reinvestment plan; dollar amount of shares offered under and proceeds from the dividend reinvestment plan are omitted from Table I. With proceeds from its initial public offering and debt financing, KBS REIT II acquired 27 real estate properties, a leasehold interest in one industrial property, seven real estate loans receivable and an investment in real estate securities through December 2011.

P-3

TABLE II

COMPENSATION TO SPONSOR (CONTINUED)

(UNAUDITED)

Prior Performance Is Not Indicative of Future Results

Table II summarizes the amount and type of compensation paid to KBS affiliates during the three years ended December 31, 2011 in connection with (1) each public program sponsored by our sponsors that had offerings close during this period and (2) all other public programs that have made payments to KBS affiliates during this period. Each of the programs represented has investment objectives similar to ours. All figures are as of December 31, 2011.

| | | | | | | | | | | | | | | | |

| | | KBS REIT I (3) | | | KBS REIT II (4) | | | KBS LEGACY (5) | | | KBS REIT III (6) | |

Date offering commenced | | | (3) | | | | (4) | | | | (5) | | | | (6) | |

Dollar amount raised | | $ | 1,703,098,000 | | | $ | 1,820,569,000 | | | $ | 46,257,000 | | | $ | 103,290,000 | |

Amount paid to sponsor from proceeds of offering: | | | | | | | | | | | | | | | | |

Underwriting fees (1) | | $ | 21,852,000 | | | $ | 37,410,000 | | | $ | 1,926,000 | | | $ | 2,651,000 | |

Acquisition fees: | | | | | | | | | | | | | | | | |

- real estate commissions | | | - | | | | - | | | | - | | | | - | |

- advisory fees(2) | | | - | | | | 20,053,000 | | | | 506,000 | | | | 1,075,000 | |

- other | | | - | | | | - | | | | - | | | | - | |

Other | | | - | | | | - | | | | - | | | | - | |

Dollar amount of cash generated from operations

before deducting payments to sponsors | | $ | 249,101,000 | | | $ | 237,249,000 | | | $ | (1,957,000 | ) | | $ | 902,000 | |

Amount paid to sponsor from operations: | | | | | | | | | | | | | | | | |

Property management fees | | $ | - | | | $ | - | | | $ | - | | | $ | - | |

Partnership and asset management fees | | | 56,916,000 | (7) | | | 34,614,000 | | | | 429,000 | | | | 178,000 | |

Reimbursements | | | - | | | | - | | | | - | | | | - | |

Leasing commissions | | | - | | | | - | | | | - | | | | - | |

Construction management fees | | | - | | | | - | | | | - | | | | - | |

Loan servicing fees | | | - | | | | - | | | | - | | | | - | |

Dollar amount of property sales and refinancing

before deducting payments to sponsors | | | | | | | | | | | | | | | | |

- cash | | $ | 316,005,000 | | | $ | - | | | $ | - | | | $ | - | |

- notes | | | - | | | | - | | | | - | | | | - | |

Amounts paid to sponsor from property sales and refinancing: | | | | | | | | | | | | | | | | |

-Real estate commissions | | $ | - | | | $ | - | | | $ | - | | | $ | - | |

-Disposition fees | | | 2,815,000 | | | | 450,000 | | | | - | | | | - | |

- Incentive fees | | | - | | | | - | | | | - | | | | - | |

- Other | | | - | | | | - | | | | - | | | | - | |

P-4

TABLE II

COMPENSATION TO SPONSOR (CONTINUED)

(UNAUDITED)

Prior Performance Is Not Indicative of Future Results

(1) Underwriting fees include (i) dealer manager fees paid to the KBS-affiliated dealer manager that are not reallowed to participating broker-dealers as a marketing fee, (ii) the reimbursed portion of a dual employee’s salary paid by the KBS-affiliated dealer manager attributable to time spent planning and coordinating training and education meetings on behalf of the respective program, (iii) the reimbursed travel, meal and lodging costs of wholesalers and other registered persons of the KBS-affiliated dealer manager attending retail conferences and training and education meetings, (iv) reimbursed costs for promotional items for broker-dealers paid for by the KBS-affiliated dealer manager, (v) reimbursed legal fees paid for by the KBS-affiliated dealer manager and (vi) reimbursed attendance and sponsorship fees incurred by employees of the KBS-affiliated dealer manager and its affiliates to attend retail conferences sponsored by participating broker-dealers and other meetings with participating broker-dealers.

(2) Advisory fees are acquisition fees and origination fees that are calculated as a percentage of purchase price (including any debt used to fund the acquisition or origination) plus acquisition or origination expenses and are paid to the advisor of each program.

(3) KBS REIT I is a publicly registered, non-traded REIT. KBS REIT I launched its initial public offering on January 27, 2006. On July 5, 2006, KBS REIT I broke escrow in its initial public offering and then commenced real estate operations. KBS REIT I ceased offering shares of common stock in its primary offering on May 30, 2008 and terminated its primary offering on September 17, 2008 upon the completion of review of subscriptions submitted in accordance with its processing procedures. KBS REIT I terminated its dividend reinvestment plan effective April 10, 2012; proceeds from the dividend reinvestment plan are included in “Dollar amount raised.” With proceeds from its initial public offering and debt financing, KBS REIT I acquired 64 real estate properties, one master lease, 21 real estate loans receivable and two investments in securities directly or indirectly backed by commercial mortgage loans. As discussed under “Prior Performance Summary – KBS REIT I” in this supplement, subsequent to KBS REIT I’s acquisition of these properties, loans and other investments, KBS REIT I’s portfolio composition changed as a result of the restructuring of certain investments, KBS REIT I taking title to properties underlying investments in loans that became impaired or under which the borrower defaulted, the sale of assets and the repayment of debt investments.

(4) KBS REIT II is a publicly registered, non-traded REIT. KBS REIT II launched its initial public offering on April 22, 2008. On June 24, 2008, KBS REIT II broke escrow in its initial public offering and then commenced real estate operations. KBS REIT II ceased offering shares of common stock in its primary offering on December 31, 2010 and terminated its primary offering on March 22, 2011 upon the completion of review of subscriptions submitted in accordance with its processing procedures. KBS REIT II continues to issue shares under its dividend reinvestment plan; proceeds from the dividend reinvestment plan are included in “Dollar amount raised” in this table, but are omitted from Table I. With proceeds from its initial public offering and debt financing, KBS REIT II acquired 27 real estate properties, a leasehold interest in one industrial property, and seven real estate loans receivable and an investment in real estate securities through December 2011. For more information about this program’s experience in raising capital, see Table I.