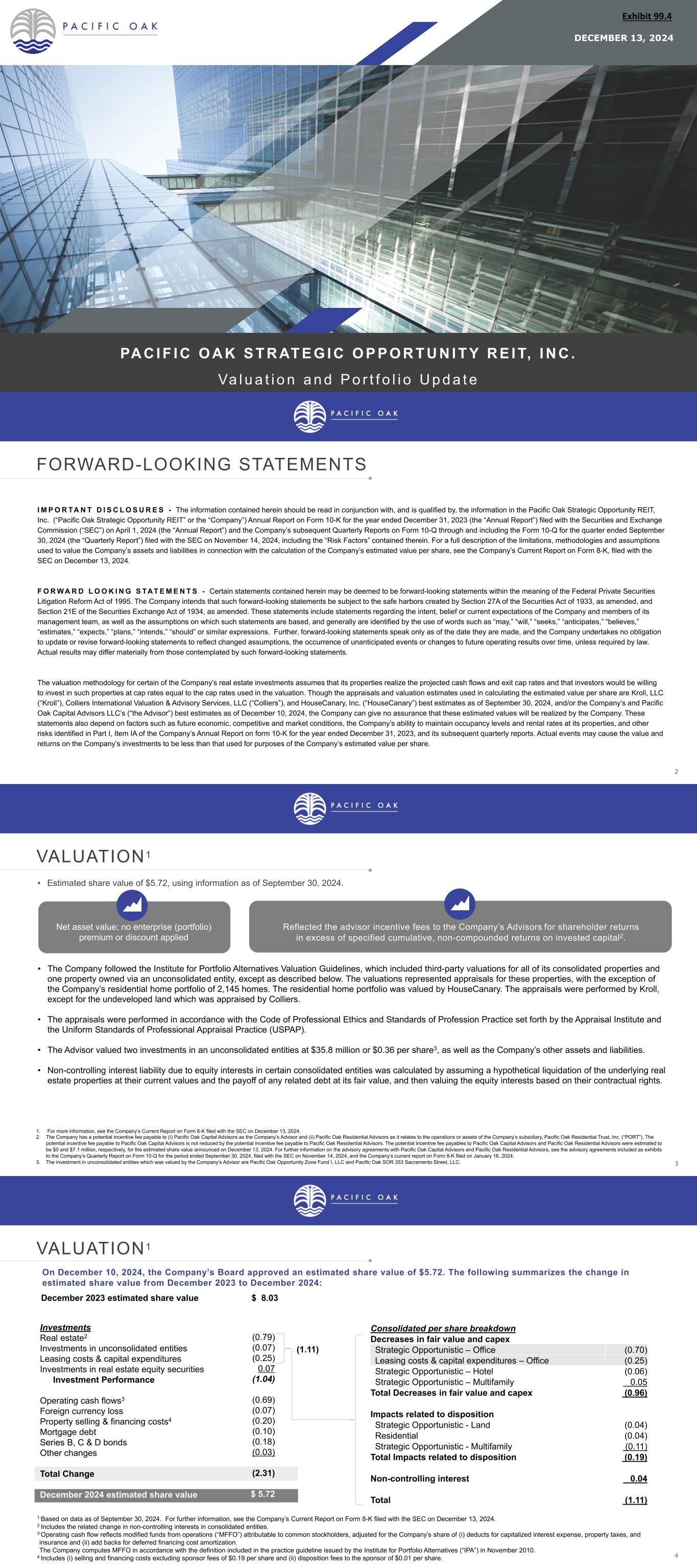

PA C I F I C O A K S T R AT E G I C O P P O R T U N I T Y R E I T, I N C . Va l u a t i o n a n d P o r t f o l i o U p d a t e DECEMBER 13, 2024 Exhibit 99.4 2 FORWARD-LOOKING STATEMENTS I M P O R TA N T D I S C L O S U R E S - The information contained herein should be read in conjunction with, and is qualified by, the information in the Pacific Oak Strategic Opportunity REIT, Inc. (“Pacific Oak Strategic Opportunity REIT” or the “Company”) Annual Report on Form 10-K for the year ended December 31, 2023 (the “Annual Report”) filed with the Securities and Exchange Commission (“SEC”) on April 1, 2024 (the “Annual Report”) and the Company’s subsequent Quarterly Reports on Form 10-Q through and including the Form 10-Q for the quarter ended September 30, 2024 (the “Quarterly Report”) filed with the SEC on November 14, 2024, including the “Risk Factors” contained therein. For a full description of the limitations, methodologies and assumptions used to value the Company’s assets and liabilities in connection with the calculation of the Company’s estimated value per share, see the Company’s Current Report on Form 8-K, filed with the SEC on December 13, 2024. F O R W A R D L O O K I N G S TAT E M E N T S - Certain statements contained herein may be deemed to be forward-looking statements within the meaning of the Federal Private Securities Litigation Reform Act of 1995. The Company intends that such forward-looking statements be subject to the safe harbors created by Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. These statements include statements regarding the intent, belief or current expectations of the Company and members of its management team, as well as the assumptions on which such statements are based, and generally are identified by the use of words such as “may,” “will,” “seeks,” “anticipates,” “believes,” “estimates,” “expects,” “plans,” “intends,” “should” or similar expressions. Further, forward-looking statements speak only as of the date they are made, and the Company undertakes no obligation to update or revise forward-looking statements to reflect changed assumptions, the occurrence of unanticipated events or changes to future operating results over time, unless required by law. Actual results may differ materially from those contemplated by such forward-looking statements. The valuation methodology for certain of the Company’s real estate investments assumes that its properties realize the projected cash flows and exit cap rates and that investors would be willing to invest in such properties at cap rates equal to the cap rates used in the valuation. Though the appraisals and valuation estimates used in calculating the estimated value per share are Kroll, LLC (“Kroll”), Colliers International Valuation & Advisory Services, LLC (“Colliers”), and HouseCanary, Inc. (“HouseCanary”) best estimates as of September 30, 2024, and/or the Company’s and Pacific Oak Capital Advisors LLC’s (“the Advisor”) best estimates as of December 10, 2024, the Company can give no assurance that these estimated values will be realized by the Company. These statements also depend on factors such as future economic, competitive and market conditions, the Company’s ability to maintain occupancy levels and rental rates at its properties, and other risks identified in Part I, Item IA of the Company’s Annual Report on form 10-K for the year ended December 31, 2023, and its subsequent quarterly reports. Actual events may cause the value and returns on the Company’s investments to be less than that used for purposes of the Company’s estimated value per share. 3 VALUATION1 • Estimated share value of $5.72, using information as of September 30, 2024. • The Company followed the Institute for Portfolio Alternatives Valuation Guidelines, which included third-party valuations for all of its consolidated properties and one property owned via an unconsolidated entity, except as described below. The valuations represented appraisals for these properties, with the exception of the Company’s residential home portfolio of 2,145 homes. The residential home portfolio was valued by HouseCanary. The appraisals were performed by Kroll, except for the undeveloped land which was appraised by Colliers. • The appraisals were performed in accordance with the Code of Professional Ethics and Standards of Profession Practice set forth by the Appraisal Institute and the Uniform Standards of Professional Appraisal Practice (USPAP). • The Advisor valued two investments in an unconsolidated entities at $35.8 million or $0.36 per share3, as well as the Company’s other assets and liabilities. • Non-controlling interest liability due to equity interests in certain consolidated entities was calculated by assuming a hypothetical liquidation of the underlying real estate properties at their current values and the payoff of any related debt at its fair value, and then valuing the equity interests based on their contractual rights. Reflected the advisor incentive fee payable to the Company’s Advisors for shareholder returns in excess of a 7.0% per year cumulative, non-compounded return on invested capital2. Net asset value; no enterprise (portfolio) premium or discount applied 1. For more information, see the Company’s Current Report on Form 8-K filed with the SEC on December 13, 2024. 2. The Company has a potential incentive fee payable to (i) Pacific Oak Capital Advisors as the Company’s Advisor and (ii) Pacific Oak Residential Advisors as it relates to the operations or assets of the Company’s subsidiary, Pacific Oak Residential Trust, Inc. (“PORT”). The potential incentive fee payable to Pacific Oak Capital Advisors is not reduced by the potential incentive fee payable to Pacific Oak Residential Advisors. The potential incentive fee payables to Pacific Oak Capital Advisors and Pacific Oak Residential Advisors were estimated to be $0 and $7.1 million, respectively, for the estimated share value announced on December 13, 2024. For further information on the advisory agreements with Pacific Oak Capital Advisors and Pacific Oak Residential Advisors, see the advisory agreements included as exhibits to the Company’s Quarterly Report on Form 10-Q for the period ended September 30, 2024, filed with the SEC on November 14, 2024, and the Company’s current report on Form 8-K filed on January 16, 2024. 3. The investment in unconsolidated entities which was valued by the Company’s Advisor are Pacific Oak Opportunity Zone Fund I, LLC and Pacific Oak SOR 353 Sacramento Street, LLC. Net asset value; no enterprise (portfolio) premium or discount applied Reflected the advisor incentive fees to the Company’s Advisors for shareholder returns in excess of specified cumulative, non-compounded returns on invested capital2. 4 1 Based on data as of September 30, 2024. For further information, see the Company’s Current Report on Form 8-K filed with the SEC on December 13, 2024. 2 Includes the related change in non-controlling interests in consolidated entities. 3 Operating cash flow reflects modified funds from operations (“MFFO”) attributable to common stockholders, adjusted for the Company’s share of (i) deducts for capitalized interest expense, property taxes, and insurance and (ii) add backs for deferred financing cost amortization. The Company computes MFFO in accordance with the definition included in the practice guideline issued by the Institute for Portfolio Alternatives (“IPA”) in November 2010. 4 Includes (i) selling and financing costs excluding sponsor fees of $0.19 per share and (ii) disposition fees to the sponsor of $0.01 per share. On December 10, 2024, the Company’s Board approved an estimated share value of $5.72. The following summarizes the change in estimated share value from December 2023 to December 2024: Investments Real estate2 Investments in unconsolidated entities Leasing costs & capital expenditures Investments in real estate equity securities Investment Performance Operating cash flows3 Foreign currency loss Property selling & financing costs4 Mortgage debt Series B, C & D bonds Other changes Total Change December 2024 estimated share value December 2023 estimated share value $ 8.03 (0.79) (0.07) (0.25) 0.07 (1.04) (0.69) (0.07) (0.20) (0.10) (0.18) (0.03) (2.31) $ 5.72 VALUATION1 Consolidated per share breakdown Decreases in fair value and capex Strategic Opportunistic – Office (0.70) Leasing costs & capital expenditures – Office (0.25) Strategic Opportunistic – Hotel (0.06) Strategic Opportunistic – Multifamily 0.05 Total Decreases in fair value and capex (0.96) Impacts related to disposition Strategic Opportunistic - Land (0.04) Residential (0.04) Strategic Opportunistic - Multifamily (0.11) Total Impacts related to disposition (0.19) Non-controlling interest 0.04 Total (1.11) (1.11)

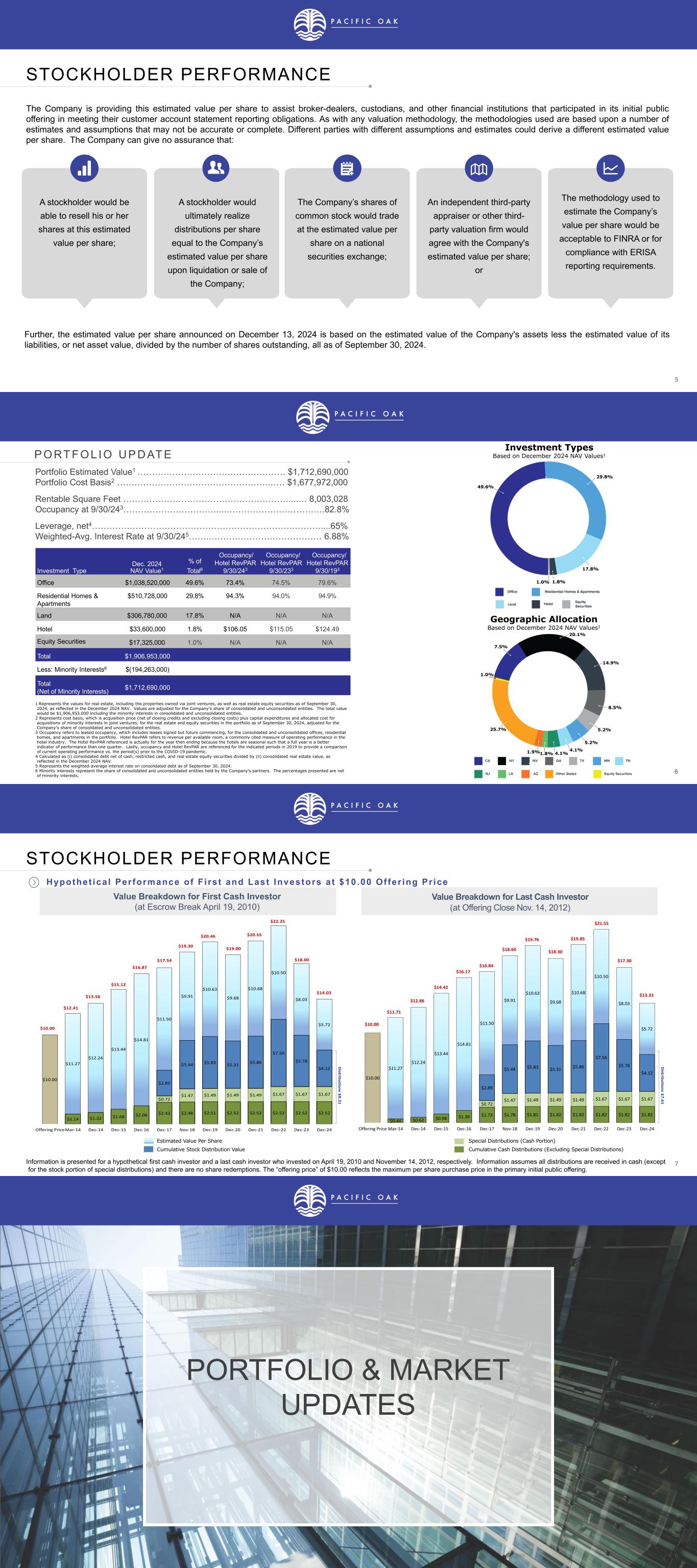

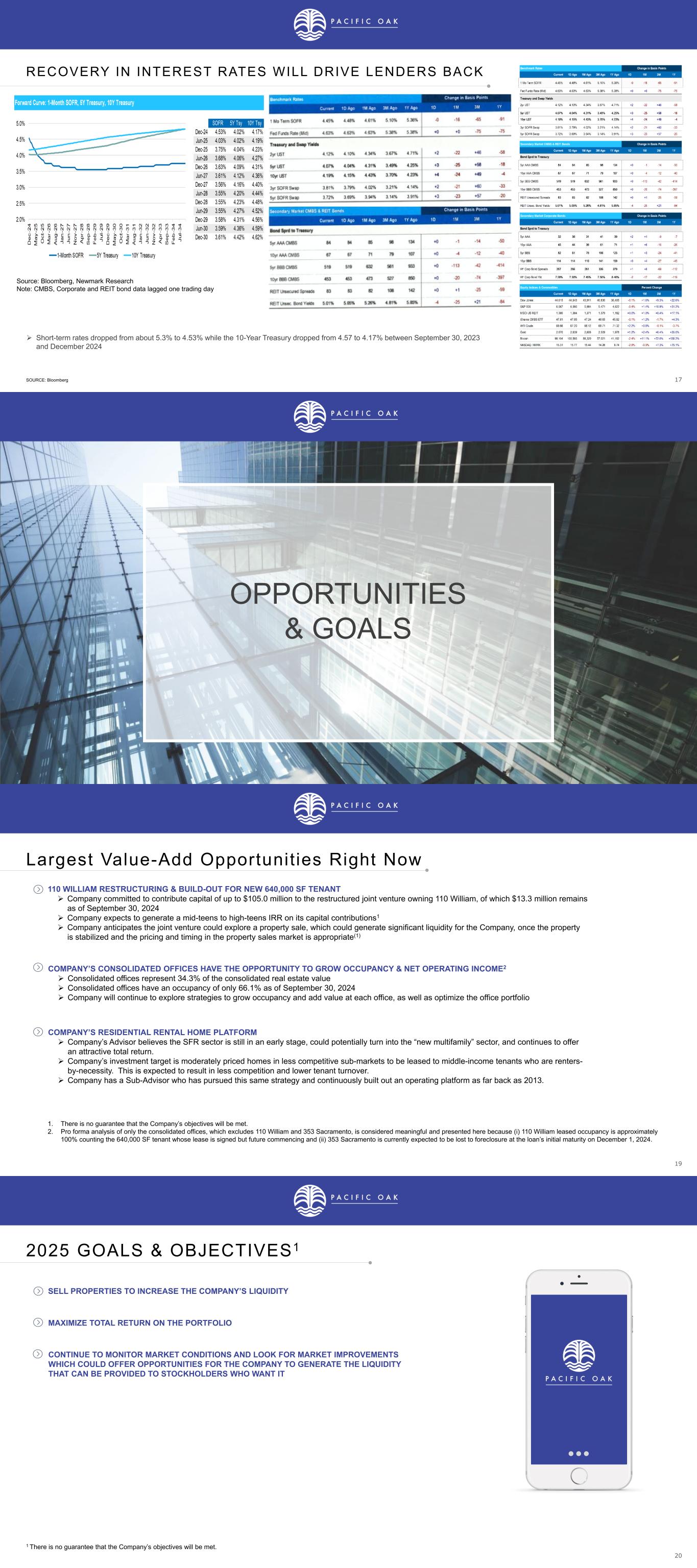

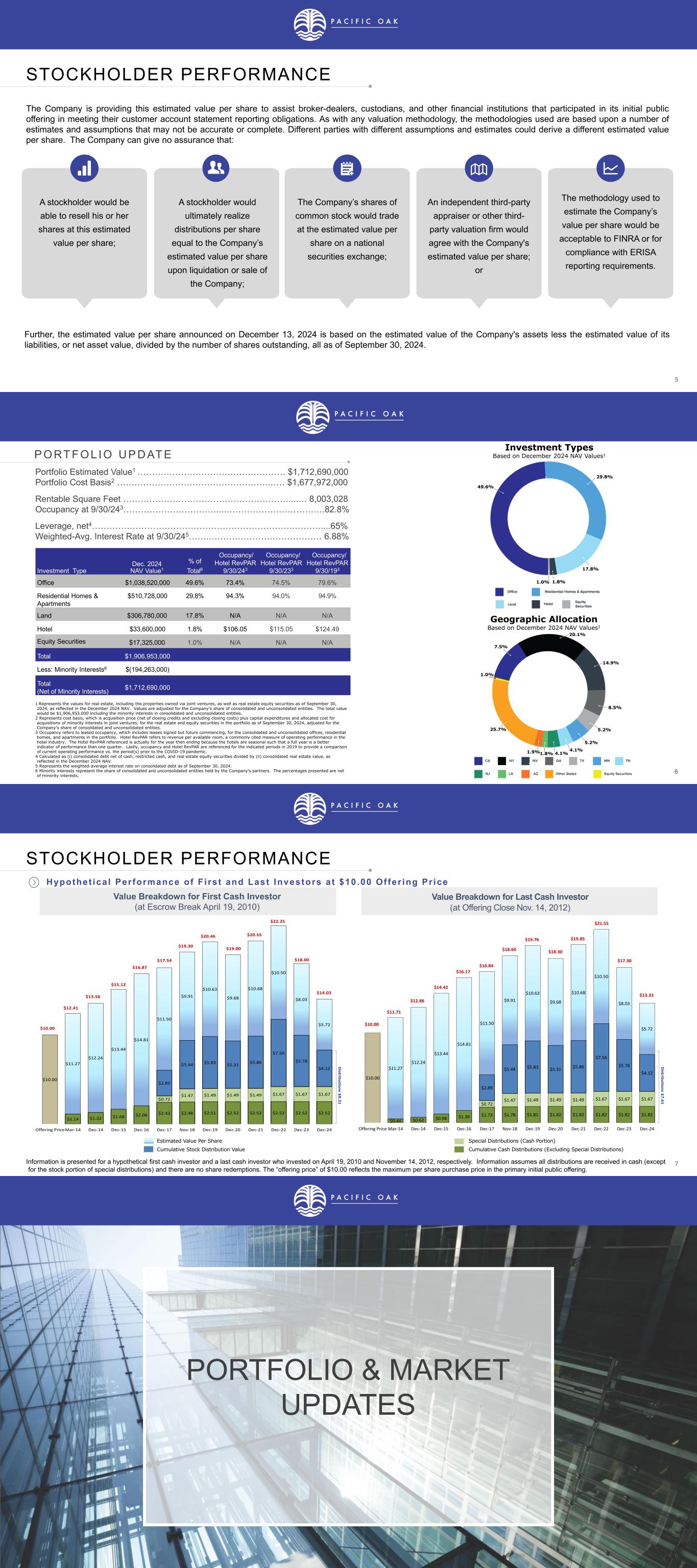

5 The Company is providing this estimated value per share to assist broker-dealers, custodians, and other financial institutions that participated in its initial public offering in meeting their customer account statement reporting obligations. As with any valuation methodology, the methodologies used are based upon a number of estimates and assumptions that may not be accurate or complete. Different parties with different assumptions and estimates could derive a different estimated value per share. The Company can give no assurance that: Further, the estimated value per share announced on December 13, 2024 is based on the estimated value of the Company's assets less the estimated value of its liabilities, or net asset value, divided by the number of shares outstanding, all as of September 30, 2024. The methodology used to estimate the Company’s value per share would be acceptable to FINRA or for compliance with ERISA reporting requirements. The Company’s shares of common stock would trade at the estimated value per share on a national securities exchange; A stockholder would ultimately realize distributions per share equal to the Company’s estimated value per share upon liquidation or sale of the Company; A stockholder would be able to resell his or her shares at this estimated value per share; An independent third-party appraiser or other third- party valuation firm would agree with the Company's estimated value per share; or STOCKHOLDER PERFORMANCE 6 P O RT F O L I O U P D AT E Investment Type Dec. 2024 NAV Value1 % of Total6 Occupancy/ Hotel RevPAR 9/30/243 Occupancy/ Hotel RevPAR 9/30/233 Occupancy/ Hotel RevPAR 9/30/193 Office $1,038,520,000 49.6% 73.4% 74.5% 79.6% Residential Homes & Apartments $510,728,000 29.8% 94.3% 94.0% 94.9% Land $306,780,000 17.8% N/A N/A N/A Hotel $33,600,000 1.8% $106.05 $115.05 $124.49 Equity Securities $17,325,000 1.0% N/A N/A N/A Total $1,906,953,000 Less: Minority Interests6 $(194,263,000) Total (Net of Minority Interests) $1,712,690,000 Portfolio Estimated Value1 …………………………………………… $1,712,690,000 Portfolio Cost Basis2 …………………………………………….…… $1,677,972,000 Rentable Square Feet …………………………………………………....… 8,003,028 Occupancy at 9/30/243……………………………...…………………………….82.8% Leverage, net4…………………………………………………………….………....65% Weighted-Avg. Interest Rate at 9/30/245…….………………………………… 6.88% 1 Represents the values for real estate, including the properties owned via joint ventures, as well as real estate equity securities as of September 30, 2024, as reflected in the December 2024 NAV. Values are adjusted for the Company’s share of consolidated and unconsolidated entities. The total value would be $1,906,953,000 including the minority interests in consolidated and unconsolidated entities. 2 Represents cost basis, which is acquisition price (net of closing credits and excluding closing costs) plus capital expenditures and allocated cost for acquisitions of minority interests in joint ventures, for the real estate and equity securities in the portfolio as of September 30, 2024, adjusted for the Company’s share of consolidated and unconsolidated entities. 3 Occupancy refers to leased occupancy, which includes leases signed but future commencing, for the consolidated and unconsolidated offices, residential homes, and apartments in the portfolio. Hotel RevPAR refers to revenue per available room, a commonly cited measure of operating performance in the hotel industry. The Hotel RevPAR referenced is actually for the year then ending because the hotels are seasonal such that a full year is a better indicator of performance than one quarter. Lastly, occupancy and Hotel RevPAR are referenced for the indicated periods in 2019 to provide a comparison of current operating performance vs. the period(s) prior to the COVID-19 pandemic. 4 Calculated as (i) consolidated debt net of cash, restricted cash, and real estate equity securities divided by (ii) consolidated real estate value, as reflected in the December 2024 NAV. 5 Represents the weighted-average interest rate on consolidated debt as of September 30, 2024. 6 Minority interests represent the share of consolidated and unconsolidated entities held by the Company’s partners. The percentages presented are net of minority interests. Investment Types1 By value in December 2024 NAV Geographic Allocation1 By value in December 2024 NAV 49.6% 29.8% 17.8% 1.0% 1.8% Invest ent Types Based on Decemb r 2024 NAV Values1 Geographic Allocation Based on December 2024 NAV Values1 7.5% 1.0% 20.1% 14.9% 8.5% 5.2% 5.2% 4.1% 4.1%1.9% 25.7% 1.8% 7 $1.14 $1.32 $1.68 $2.06 $2.43 $2.48 $2.51 $2.52 $2.52 $2.52 $2.52 $2.52 $0.72 $1.47 $1.49 $1.49 $1.49 $1.67 $1.67 $1.67 $2.89 $5.44 $5.83 $5.31 $5.86 $7.56 $5.78 $4.12 $10.00 $11.27 $12.24 $13.44 $14.81 $11.50 $9.91 $10.63 $9.68 $10.68 $10.50 $8.03 $5.72 $10.00 $12.41 $13.56 $15.12 $16.87 $17.54 $19.30 $20.46 $19.00 $20.55 $22.25 $18.00 $14.03 Offering PriceMar-14 Dec-14 Dec-15 Dec-16 Dec-17 Nov-18 Dec-19 Dec-20 Dec-21 Dec-22 Dec-23 Dec-24 $0.44 $0.62 $0.98 $1.36 $1.73 $1.78 $1.81 $1.82 $1.82 $1.82 $1.82 $1.82 $0.72 $1.47 $1.49 $1.49 $1.49 $1.67 $1.67 $1.67 $2.89 $5.44 $5.83 $5.31 $5.86 $7.56 $5.78 $4.12 $10.00 $11.27 $12.24 $13.44 $14.81 $11.50 $9.91 $10.63 $9.68 $10.68 $10.50 $8.03 $5.72 $10.00 $11.71 $12.86 $14.42 $16.17 $16.84 $18.60 $19.76 $18.30 $19.85 $21.55 $17.30 $13.33 Offering Price Mar-14 Dec-14 Dec-15 Dec-16 Dec-17 Nov-18 Dec-19 Dec-20 Dec-21 Dec-22 Dec-23 Dec-24 STOCKHOLDER PERFORMANCE Hypothet ica l Per formance of F i rs t and Last Investors a t $10 .00 Of fer ing Pr ice Value Breakdown for First Cash Investor (at Escrow Break April 19, 2010) Value Breakdown for Last Cash Investor (at Offering Close Nov. 14, 2012) Information is presented for a hypothetical first cash investor and a last cash investor who invested on April 19, 2010 and November 14, 2012, respectively. Information assumes all distributions are received in cash (except for the stock portion of special distributions) and there are no share redemptions. The “offering price” of $10.00 reflects the maximum per share purchase price in the primary initial public offering. Special Distributions (Cash Portion) Cumulative Cash Distributions (Excluding Special Distributions) D istributions $8.31 D istributions $7.61 Estimated Value Per Share Cumulative Stock Distribution Value 8 PORTFOLIO & MARKET UPDATES

9 DEBT RESTRUCTURED, TO LOWER LEVERAGE AND INTEREST RATE, EXTEND THE MATURITY UP TO 5 YEARS, & PROVIDE FUTURE FUNDING Former mezzanine loan, which had a balance of $89.0 million and interest rate of 1-month SOFR + 9.50% as of June 30, 2023, was converted to a 22.5% preferred equity interest in the joint venture owning the property. Senior loans, which had a balance of $248.7 million and interest rate of 1-month SOFR + 4.00% as of June 30, 2023, had their maturity dates extended by up to 5 years. The new senior loans have a 3-year initial term and grant two 1-year extension options subject to meeting certain conditions. The new weighted-average interest rate is initially 1-month SOFR + 2.04% (such spread increasing up to 3.50% during the loan term and any extension period). Senior loans will provide up to $57 million of future funding, which it is currently funding. EQUITY RESTRUCTURED, WITH THE COMPANY ACQUIRING THE INTEREST OF ITS FORMER PARTNER The Company acquired the former partner’s 40% interest in the joint venture for (i) the purchase price of $1.00 and (ii) contingent consideration of 10% of the net cash received by the Company from distributions and/or from the sale of interests to a third-party after such time that the Company has achieved certain returns on its future contributions to the joint venture. Following the deal, the Company owns 100% of the common equity of the joint venture. The Company also committed to contribute capital of up to $105.0 million to the joint venture, in exchange for a 77.5% preferred equity interest in the joint venture, which capital shall be used toward the leasing and base building capital costs associated with the 640,000 SF new lease as well as interest and carrying cost shortfalls until rent payments begin on the 640,000 SF new lease. The Company has completed its funding obligation of $105.0 million. The Company’s preferred equity interest will receive a disproportionately larger share of joint venture distributions until certain return thresholds are achieved, according to the joint venture’s revised waterfall calculation. 110 Wi l l i am Debt & Equ i ty Res t ruc tu r ing , and 640,000 SF Lease S ign ing , as Announced in Ju ly 2023 10 640,000 SF LEASE SIGNED FOR 20 YEAR TERM WITH AA CREDIT-RATED TENANT (JUNE 2023), DEBT & EQUITY RESTRUCTURED (JULY 2023) 110 Will iam Update Lease brings the building occupancy up to essentially 100%. Lease was the largest office lease signed, year-to-date, as of lease signing on June 27, 2023. Tenant to take occupancy gradually (in tranches of approximately 200,000 SF each), as tenant improvements are completed. CONSTRUCTION IS ON SCHEDULE EQUITY COMMITMENT REMAINING: $13.3 million as of Sept. 30, 2024 and subsequently funded in full. Tranche A is expected to be delivered in January 2025, Tranche B in February 2025, and Tranche C in July 2025 (marking “substantial completion of the work”) Full occupancy of the space is expected in the second half of 2025, in line with the original schedule. 11 PARK HIGHLANDS LAND SALES 12 Park Highlands Land Sales1 The Company has all of the Park Highlands land under sales contract as of Sept. 30, 2024. In accordance with the sales contracts, specific land parcels closed on October 3, 2024 and December 3, 2024 and the remainder is currently expected to close in December 2026 and December 2027. 1. The approximately 395 developable acres (454 gross acres) is under a sale contract executed March 10, 2024 and subsequently amended; currently, according to the contract, closings are expected to occur in December 2026 and December 2027 and the buyer has waived its contingencies. The anticipated closing dates may be changed in certain circumstances. SOLD SOLD SOLD SOLD SOLD SOLD SOLD First takedown completed December 3, 2024 Second and Third takedowns in December 2026 and 2027

13 Park Highlands Land Sales Under Contract1 The Company has all of the Park Highlands land under sales contract as of August 2024. The sales recently closed in October 2024 to DR Horton, and in December 2024 to KB Homes. Final contracted sales with KB Homes are scheduled for December 2026 and December 2027. These current and future sales generate proceeds of $141.3 million after selling costs & fees and the Israeli Series C bond paydown. The sales would close out an incredibly profitable and timely investment by the Company, which had acquired the large acreage via joint venture deals in 2011 and 2013 at the depths of the housing bust and then subsequently bought out its joint venture partners. At the time of the partner buyouts in 2016, the Company’s acquisition basis was just $68.4 million or $55K per estimated developable acre. 3 Following is a history of the Park Highlands land sales, which are expected to total $492.3 million upon the final closing: 1. The approximately 395 developable acres (454 gross acres) is under a sale contract executed March 10, 2024 and subsequently amended; currently, according to the contract, closings are expected to occur in December 2026 and December 2027 and the buyer has waived its contingencies. The anticipated closing dates may be changed in certain circumstances. 2. Equals (i) the Company’s share of the joint venture purchase prices plus (ii) the joint venture partner buyout prices. Excludes acquisition costs and fees, land development and carrying costs, and other costs incurred since acquisition. 3. Equals the sale price, net of seller concessions including those related to infrastructure costs which can vary significantly by land parcel. Excludes selling costs and fees, and Israeli Series C bond paydowns. Disposition Sale Sale Price Parcels Date Acres Price (3) Per Acre (3) Sales Closed: Park Highlands Village 3 May-17 101.62 17,415,876 171,382 Park Highlands Village 3 South Feb-18 25.52 2,506,563 98,220 Park Highlands Village 4 Jul-18 82.97 19,268,850 232,239 Park Highlands West Oct-18 15.27 3,500,000 229,208 Park Highlands Village 1 PH 1 & 2 Jun-21 192.74 54,079,093 280,581 Park Highlands Casino Site Nov-22 66.86 52,086,511 779,038 Park Highlands Village 1 PH 3 First Closing Feb-23 71.43 36,655,303 513,164 Park Highlands Village 1 PH 3 Second Closing Oct-23 114.73 49,609,906 432,406 Park Highlands Village 1 PH 4 Oct-24 122.13 62,117,226 508,616 Park Highlands Village 2 First Closing (1) Dec-24 184.66 91,055,227 493,084 Total - Sales Closed as of Dec. 5, 2024 977.93 388,294,555 397,056 Sales Under Contract: Park Highlands Village 2 Second Closing (1) Dec-26 113.83 52,290,546 459,361 Park Highlands Village 2 Third Closing (1) Dec-27 96.97 51,654,227 532,671 Total - Sales Under Contract 210.81 103,944,773 493,084 Total - Sales Closed & Under Contract 1,188.74 492,239,328 414,085 14 MARKET UPDATE 15 $10.63 Property Type Index Value Change in Commercial Property Values (Unlevered) Past 12 months From Recent Peak All Property 125.5 -3% -19% Core Sector 125.9 -3% -21% Apartment 152.3 2% -20% Industrial 213.7 -9% -16% Mall 85.3 5% -13% Office 71.6 -8% -37% Strip Retail 114.3 3% -13% Healthcare 123.6 -5% -18% Lodging 103.0 -4% -9% Manufactured Housing 278.5 -3% -14% Net Lease 94.3 -3% -19% Self-storage 246.8 -8% -21% US STOCK MARKET INDICES AS OF 9/30/24 Index 1 Year Since 12/31/19 (1) S&P 500 34.4% 78.4% Dow 26.3% 48.3% Russell 2000 24.9% 33.7% GREEN STREET CPPI3 1. Selected for measuring returns against pre-COVID levels. Percentages are cumulative since 12/31/19, not annualized. 2. Selected, for comparison purposes, as a relatively recent, multi-year average prior to the low-rate environment which began with the Great Recession of 2008. 3. Green Street Advisors, Commercial Property Price Index (CPPI), October 4, 2024. Green Street’s CPPI is a time series of unleveraged U.S. commercial property values that captures the prices at which commercial real estate transactions are currently being negotiated and contracted. Features that differentiate this index are its timeliness, its emphasis on high-quality properties, and its ability to capture changes in the aggregate value of the commercial property sector. Green Street CPPI History, Past Seven Years(3) US TREASURY RATES RESET Date 1 Year 10 Years 30 Years Sept. 30, 2024 3.98 3.81 4.14 Sept. 30, 2023 5.47 4.57 4.71 Sept. 30, 2022 4.05 3.83 3.79 Sept. 30, 2021 0.09 1.52 2.08 Historical Avg. 2001-2007(2) 3.10 4.52 5.06 NAREIT Equity Index 29.5% 8.1% NAREIT Equity Office Index 51.1% -22.5% 16 Office market remains challenged, though conditions differ depending on market, location, asset quality, and other property-specific factors. Challenges include: Tenants continue to rethink their use of office space, as they navigate a “new normal” with hybrid work arrangements A “tenant market” in which tenants have the negotiating power to seek higher buildout allowances and rent concessions Cap and discount rates remain elevated, along with interest rates, at least relative to the low-rate environment from 2008 to 2022 Office investors need (i) transactions to provide price discovery and (ii) improved clarity and confidence in the sector’s outlook, financing conditions and the outcome of potential loan defaults. Prime offices continue to outperform non-prime offices, a “flight to quality”. The next tiers down would be expected to benefit as tenant demand trickles-down.1 Prime office vacancy rate was 15.5% in Q3 20241 Prime office had 49 million sq. ft. of positive net absorption from Q1 2020 to Q1 2024 (170 million sq. ft. negative for non-prime) 1 Prime vs. non-prime rent premiums increased to 84% in Q1 2024 from 60% in Q2 2018 1 Signs of a possible recovery emerged in the market in Q3 2024; though the path and duration of a continued recovery, if any, would remain to be seen 2 Net absorption was positive in Q3 2024, totaling 4.3 million sq. ft., an increase of 2.4.1 million sq. ft. in Q2 2024. 2 Average size of leases for at least 10,000 sq ft. increased for the second consecutive quarter to 29,875 sq. ft. 2 Sublease availability fell to 4.1% of total inventory in Q3 2024, down from 4.6% a year ago 2 Average asking rent ticked up $0.25 year-over-year to $36.23 per sq. ft. in Q3 2024 2 1. Prime offices as defined by CBRE, which includes subjectivity and local relativity. CBRE defines prime offices as best in class in terms of design and offerings, with an emphasis on occupant productivity and well-being. They are typically newly constructed or extensively renovated and amenitized. They are well-located in desirable areas and often near public transport or major thoroughfares to support shorter commutes, at least in urban settings. The CBRE Research and CBRE Economic Advisors dataset of highly desired prime office buildings represent approximately 8% of total U.S. office space by square footage and 2% by building count. Source: CBRE Research report titled “U.S. Office Market Recovery Continues”, published in October 2024. 2. CBRE report titled “U.S. Office Market Recovery Continues”, published for Q3 2024.

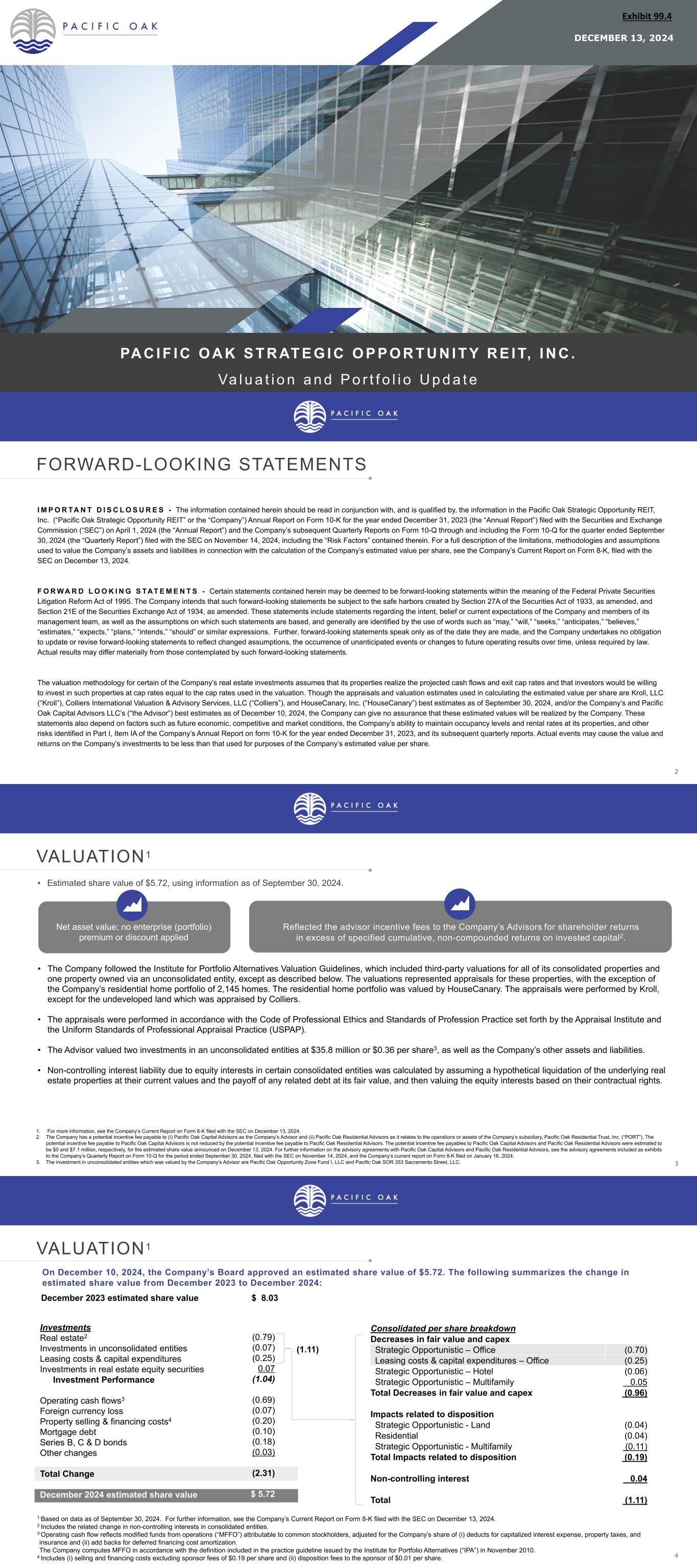

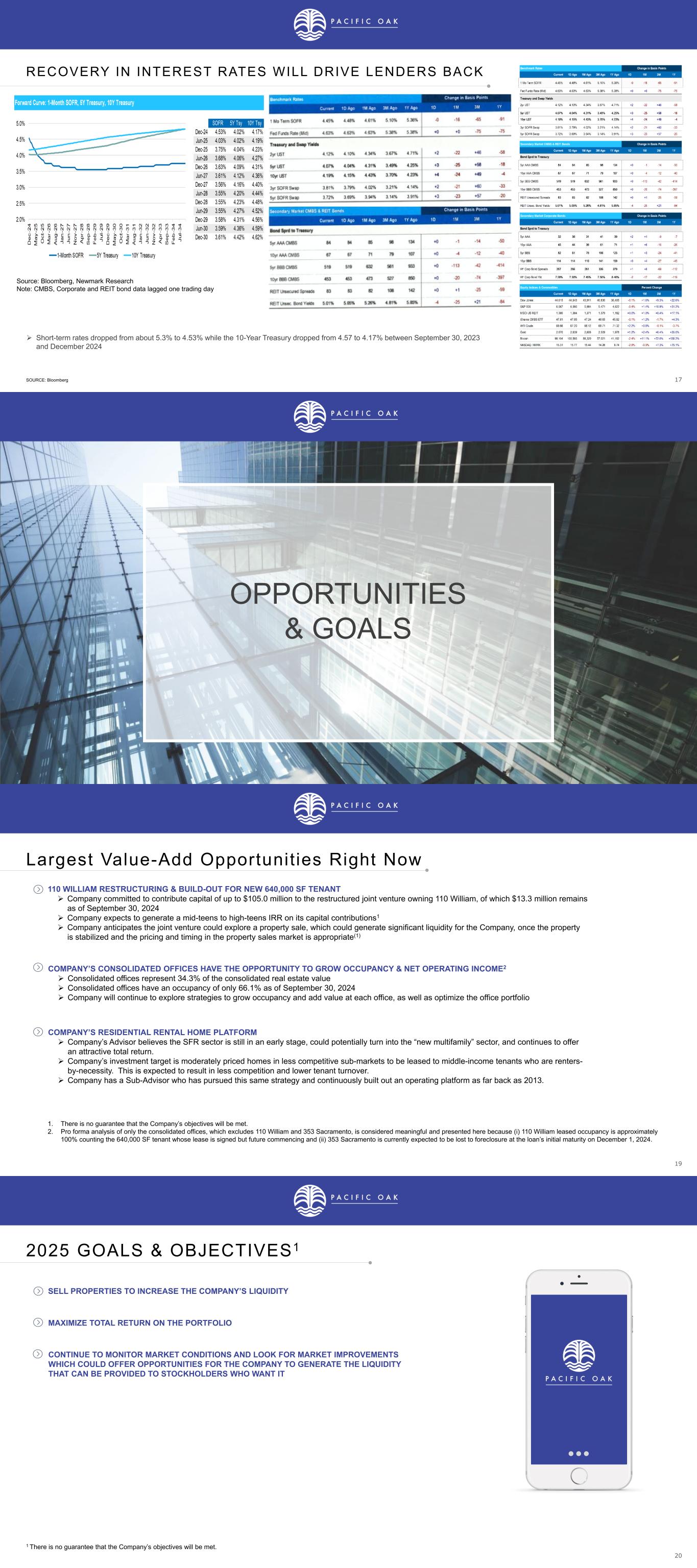

17 RECOVERY IN INTEREST RATES WILL DRIVE LENDERS BACK SOURCE: Bloomberg Short-term rates dropped from about 5.3% to 4.53% while the 10-Year Treasury dropped from 4.57 to 4.17% between September 30, 2023 and December 2024 Source: Bloomberg, Newmark Research Note: CMBS, Corporate and REIT bond data lagged one trading day 18 OPPORTUNITIES & GOALS 19 COMPANY’S CONSOLIDATED OFFICES HAVE THE OPPORTUNITY TO GROW OCCUPANCY & NET OPERATING INCOME2 Consolidated offices represent 34.3% of the consolidated real estate value Consolidated offices have an occupancy of only 66.1% as of September 30, 2024 Company will continue to explore strategies to grow occupancy and add value at each office, as well as optimize the office portfolio COMPANY’S RESIDENTIAL RENTAL HOME PLATFORM Company’s Advisor believes the SFR sector is still in an early stage, could potentially turn into the “new multifamily” sector, and continues to offer an attractive total return. Company’s investment target is moderately priced homes in less competitive sub-markets to be leased to middle-income tenants who are renters- by-necessity. This is expected to result in less competition and lower tenant turnover. Company has a Sub-Advisor who has pursued this same strategy and continuously built out an operating platform as far back as 2013. 110 WILLIAM RESTRUCTURING & BUILD-OUT FOR NEW 640,000 SF TENANT Company committed to contribute capital of up to $105.0 million to the restructured joint venture owning 110 William, of which $13.3 million remains as of September 30, 2024 Company expects to generate a mid-teens to high-teens IRR on its capital contributions1 Company anticipates the joint venture could explore a property sale, which could generate significant liquidity for the Company, once the property is stabilized and the pricing and timing in the property sales market is appropriate(1) Largest Value-Add Opportunit ies Right Now 1. There is no guarantee that the Company’s objectives will be met. 2. Pro forma analysis of only the consolidated offices, which excludes 110 William and 353 Sacramento, is considered meaningful and presented here because (i) 110 William leased occupancy is approximately 100% counting the 640,000 SF tenant whose lease is signed but future commencing and (ii) 353 Sacramento is currently expected to be lost to foreclosure at the loan’s initial maturity on December 1, 2024. 20 2025 GOALS & OBJECTIVES1 SELL PROPERTIES TO INCREASE THE COMPANY’S LIQUIDITY MAXIMIZE TOTAL RETURN ON THE PORTFOLIO 1 There is no guarantee that the Company’s objectives will be met. CONTINUE TO MONITOR MARKET CONDITIONS AND LOOK FOR MARKET IMPROVEMENTS WHICH COULD OFFER OPPORTUNITIES FOR THE COMPANY TO GENERATE THE LIQUIDITY THAT CAN BE PROVIDED TO STOCKHOLDERS WHO WANT IT

21 PACIFIC OAK LOS ANGELES, CA PACIFIC OAK COSTA MESA, CA 3200 Park Center Drive, Suite 800 Costa Mesa, CA 92626 11766 Wilshire Blvd., Suite 1670 Los Angeles, CA 90025 1-866-PAC-OAK7 INFO@PACIFICOAKCAPITAL.COM PacificOakCapitalMarkets.com // Pacif icOakCapitalAdvisors.com THANK YOU!