UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

Investment Company Act File Number 811-22263

Exchange Traded Concepts Trust

(Exact name of registrant as specified in charter)

10900 Hefner Pointe Drive

Suite 400

Oklahoma City, OK 73120

(Address of principal executive offices) (Zip code)

J. Garrett Stevens

Exchange Traded Concepts Trust

10900 Hefner Pointe Drive

Suite 400

Oklahoma City, OK 73120

(Name and address of agent for service)

Copy to:

Christopher Menconi

Morgan, Lewis & Bockius LLP

1111 Pennsylvania Avenue NW

Washington, DC 20004

Registrant’s telephone number, including area code: 1-405-778-8377

Date of fiscal year end: November 30, 2022

Date of reporting period: November 30, 2022

| Item 1. | Reports to Stockholders. |

| (a) | A copy of the report transmitted to stockholders pursuant to Rule 30e-1 under the Investment Company Act of 1940, as amended (the “Act”) (17 CFR § 270.30e-1) is attached hereto. |

EXCHANGE TRADED CONCEPTS TRUST

Capital Link Global Fintech Leaders ETF

(formerly Capital Link NextGen Protocol ETF)

Annual Report

November 30, 2022

Capital Link

Global Fintech Leaders ETF

Table of Contents

1 | ||

3 | ||

5 | ||

6 | ||

7 | ||

8 | ||

9 | ||

20 | ||

21 | ||

23 | ||

24 | ||

27 | ||

28 |

The Fund files its complete schedule of holdings with the U.S. Securities and Exchange Commission (the “Commission”) for the first and third quarters of each fiscal year as an exhibit to its reports on Form N-PORT within sixty days after the end of the period. The Fund’s Form N-PORT reports are available on the Commission’s website at https://www.sec.gov.

Exchange Traded Concepts, LLC’s proxy voting policies and procedures are attached to the Fund’s Statement of Additional Information (the “SAI”). The SAI, as well as information relating to how the Fund voted proxies relating to the Fund’s securities during the most recent 12-month period ended June 30, is available without charge, upon request, by calling 1-833-466-6383 and on the Commission’s website at https://www.sec.gov.

Global Fintech Leaders ETF

Management Discussion of Fund Performance

November 30, 2022 (Unaudited)

Dear Shareholders,

On behalf of the entire Capital Link ETF team, we want to express our appreciation for the confidence you have placed in the Capital Link Global Fintech Leaders ETF (the “Fund”). The following information pertains to the fiscal year December 1, 2021 through November 30, 2022.

The Fund tracks the AF Global Fintech Leaders Index, which seeks to give investors access to companies that are involved in, invest in, or have adopted digital assets or new technology solution providers (“Fintech Leaders”). Fintech Leaders are grouped into two categories : (1) Digital Asset Providers (companies that use technology to increase operational efficiencies, optimize settlement processes, enhance the customer experience, increase data security/integrity, or create digital assets) and (2) Solutions Providers (companies that assist financial services businesses and organizations in the adoption and implementation of the latest technologies and applications).

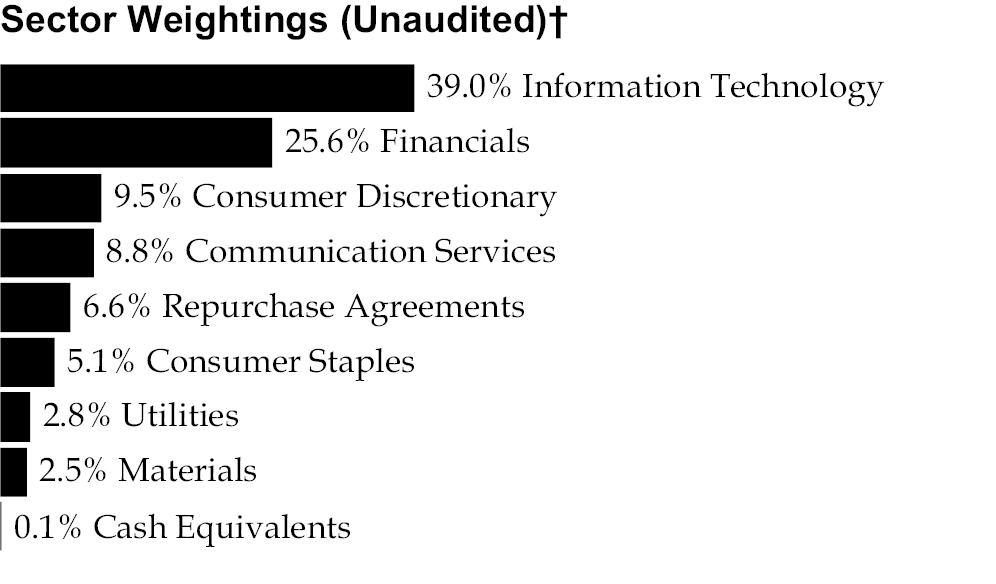

The Fund’s performance during the period was tied heavily to the Financials and Information Technology Sectors, in which the Fund is concentrated. Negative performance in these sectors during the fiscal year relative to more defensive sectors (for instance Utilities and Consumer Staples), account for the Fund’s underperformance relative to the benchmark S&P 500® Index.

An additional headwind was foreign currency exposure, as the Fund’s significant holdings in the Eurozone, China, Japan and South Korea were negatively impacted by the decline in value relative to the US Dollar of the Euro, Renminbi, Yen, and Won, respectively.

The Fund had negative performance during the fiscal year ended November 30, 2022. The market price for the Fund decreased 22.23% and the net asset value decreased 23.02%, while the S&P 500® Index, a broad market index, decreased 9.21% over the same period. The Fund’s Index returned negative 22.86%.

The Fund commenced operations on January 29, 2018, with outstanding shares of 525,000 as of November 30, 2022.

We appreciate your investment in Capital Link Global Fintech Leaders ETF.

Sincerely,

J. Garrett Stevens,

Chief Executive Officer

Exchange Traded Concepts, LLC, Adviser to the Fund

1

Capital Link

Global Fintech Leaders ETF

Management Discussion of Fund Performance

November 30, 2022 (Unaudited) (Concluded)

Growth of a $10,000 Investment

(at Net Asset Value)

AVERAGE TOTAL RETURN | ||||||||||||||

One Year | Three Year | Annualized | ||||||||||||

Net Asset Value | Market Price | Net Asset Value | Market Price | Net Asset Value | Market Price | |||||||||

Capital Link Global Fintech Leaders ETF | -23.02% | -22.23% | 6.98% | 7.33% | 7.26% | 7.48% | ||||||||

AF Global Fintech Leaders Index | -22.86% | -22.86% | 7.32% | 7.32% | 7.69% | 7.69% | ||||||||

S&P 500® Index | -9.21% | -9.21% | 10.91% | 10.91% | 9.60% | 9.60% | ||||||||

* The Fund commenced operations on January 29, 2018.

The performance data quoted herein represents past performance and the return and value of an investment in the Fund will fluctuate so that shares, when redeemed or sold in the market, may be worth more or less than their original cost. Past performance is no guarantee of future performance and should not be considered as a representation of the future results of the Fund. The Fund’s performance assumes the reinvestment of all dividends and all capital gains. Index returns assume reinvestment of dividends and, unlike a Fund’s returns, do not reflect any fees or expenses. If such fees and expenses were included in the index returns, the performance would have been lower. Please note that one cannot invest directly in an unmanaged index.

Investors should consider the investment objectives, risks, charges and expenses of the Fund carefully before investing. A prospectus, containing this and other information, is available at cli-etfs.com. Investors should read the prospectus carefully before investing. There are risks associated with investing, including possible loss of principal.

Current performance may be lower or higher than the performance data shown above.

There are no assurances that the Fund will meet its stated objective

The Fund’s holdings and allocations are subject to change and should not be considered recommendations to buy individual securities.

Returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. The S&P 500® Index is a market-value weighted index consisting of 500 stocks chosen for market size, liquidity, and industry group representation, with each stock’s weight in the S&P 500® Index proportionate to its market value.

2

† Sector weightings percentages based on the total fair value of investments. Repurchase agreements purchased from cash collateral received for securities lending activity are included in total investments. Please see Notes 2 and 6 in Notes to Financial Statements for more detailed information.

Description | Shares | Fair Value | |||

COMMON STOCK — 99.7%†† |

| ||||

| |||||

Canada — 2.7% |

| ||||

Materials — 2.7% |

| ||||

TMX Group(A) | 4,454 | $ | 463,371 | ||

| |||||

China — 9.6% |

| ||||

Communication Services — 4.5% |

| ||||

Baidu ADR* | 3,264 |

| 354,471 | ||

Tencent Holdings | 11,600 |

| 426,817 | ||

| 781,288 | ||||

Financials — 5.1% |

| ||||

China Construction Bank, Cl H | 739,000 |

| 445,928 | ||

Ping An Insurance Group of China, Cl A | 70,000 |

| 440,504 | ||

| 886,432 | ||||

| 1,667,720 | ||||

France — 5.9% |

| ||||

Financials — 2.9% |

| ||||

BNP Paribas | 9,240 |

| 508,333 | ||

| |||||

Utilities — 3.0% |

| ||||

Engie | 35,208 |

| 526,380 | ||

| 1,034,713 | ||||

Germany — 6.2% |

| ||||

Consumer Discretionary — 3.0% |

| ||||

Mercedes-Benz Group | 7,980 |

| 529,152 | ||

| |||||

Information Technology — 3.2% |

| ||||

SAP | 5,195 |

| 558,762 | ||

| 1,087,914 | ||||

Hong Kong — 2.6% |

| ||||

Financials — 2.6% |

| ||||

Hong Kong Exchanges & Clearing | 11,400 |

| 446,916 | ||

Description | Shares | Fair Value | |||

Japan — 12.6% |

| ||||

Consumer Discretionary — 5.2% |

| ||||

HIS*(A) | 31,300 | $ | 451,982 | ||

Rakuten Group*(A) | 97,900 |

| 458,139 | ||

| 910,121 | ||||

Financials — 4.9% |

| ||||

Monex Group | 129,000 |

| 397,520 | ||

SBI Holdings | 24,000 |

| 450,279 | ||

| 847,799 | ||||

Information Technology — 2.5% |

| ||||

GMO internet group | 24,300 |

| 441,454 | ||

| 2,199,374 | ||||

Singapore — 2.5% |

| ||||

Financials — 2.5% |

| ||||

Singapore Exchange | 66,050 |

| 436,220 | ||

| |||||

South Korea — 7.7% |

| ||||

Communication Services — 4.9% |

| ||||

Kakao | 9,173 |

| 392,279 | ||

SK Telecom | 12,018 |

| 455,624 | ||

| 847,903 | ||||

Information Technology — 2.8% |

| ||||

Samsung SDS | 5,092 |

| 492,270 | ||

| 1,340,173 | ||||

Taiwan — 2.4% |

| ||||

Information Technology — 2.4% |

| ||||

Hon Hai Precision Industry | 130,515 |

| 424,415 | ||

| |||||

United Kingdom — 2.6% |

| ||||

Financials — 2.6% |

| ||||

HSBC Holdings PLC | 74,291 |

| 450,948 | ||

| |||||

United States — 44.9% |

| ||||

Consumer Discretionary — 1.9% |

| ||||

Amazon.com* | 3,390 |

| 327,270 | ||

| |||||

Consumer Staples — 5.4% |

| ||||

Bunge | 4,662 |

| 488,764 | ||

Nestle | 3,892 |

| 458,911 | ||

| 947,675 | ||||

Financials — 7.0% |

| ||||

CME Group, Cl A | 2,245 |

| 396,243 | ||

Intercontinental Exchange | 4,369 |

| 473,206 | ||

Signature Bank NY | 2,458 |

| 342,891 | ||

| 1,212,340 | ||||

Information Technology — 30.6% |

| ||||

Block, Cl A* | 6,081 |

| 412,109 | ||

Cisco Systems | 9,870 |

| 490,736 | ||

DocuSign, Cl A* | 7,055 |

| 332,079 | ||

International Business Machines | 3,497 |

| 520,703 | ||

The accompanying notes are an integral part of the financial statements.

3

Capital Link

Global Fintech Leaders ETF

Schedule of Investments

November 30, 2022 (Concluded)

Description | Shares/ | Fair Value | ||||

Intuit |

| 1,005 | $ | 409,628 | ||

Mastercard, Cl A |

| 1,345 |

| 479,358 | ||

Microsoft |

| 1,708 |

| 435,779 | ||

Oracle |

| 5,951 |

| 494,112 | ||

PayPal Holdings* |

| 4,695 |

| 368,135 | ||

Salesforce* |

| 2,779 |

| 445,335 | ||

Visa, Cl A(A) |

| 2,202 |

| 477,834 | ||

VMware, Cl A* |

| 3,824 |

| 464,578 | ||

|

| 5,330,386 | ||||

|

| 7,817,671 | ||||

Total Common Stock |

|

| 17,369,435 | |||

|

| |||||

MONEY MARKET — 0.1% |

|

| ||||

JPMorgan U.S. Government Money Market Fund, Cl I 2.76%(B) |

| 20,597 |

| 20,597 | ||

Total Money Market |

|

| 20,597 | |||

|

| |||||

REPURCHASE AGREEMENTS(C)(D) — 7.1% |

| |||||

BofA Securities, Inc. | $ | 287,331 |

| 287,331 | ||

Deutsche Bank Securities |

| 287,331 |

| 287,331 | ||

HSBC Securities USA |

| 287,331 |

| 287,331 | ||

Description | Face | Fair Value | ||||

JPMorgan Securities LLC | $ | 85,048 | $ | 85,048 | ||

RBC Dominion Securities |

| 287,331 |

| 287,331 | ||

|

| |||||

Total Repurchase Agreements |

|

| 1,234,372 | |||

|

| |||||

Total Investments — 106.9% |

| $ | 18,624,404 | |||

Percentages are based on net assets of $17,423,598.

* Non-income producing security.

†† More narrow industries are utilized for compliance purposes, whereas broad sectors are utilized for reporting purposes.

(A) Certain securities or partial positions of certain securities are on loan at November 30, 2022 (see Note 6). The total market value of securities on loan at November 30, 2022 was $1,625,992.

(B) The rate reported is the 7-day effective yield as of November 30, 2022.

(C) This security was purchased with cash collateral held from securities on loan. The total value of such securities as of November 30, 2022 was $1,234,372. The total value of non-cash collateral held from securities on loan as of November 30, 2022 was $445,892.

(D) Tri-Party Repurchase Agreement.

ADR — American Depositary Receipt

Cl — Class

The following is a summary of the inputs used as of November 30, 2022 when valuing the Fund’s investments carried at value:

Level 1 | Level 2 | Level 3 | Total | |||||||||

Investments in Securities Common Stock | $ | 17,369,435 | $ | — | $ | — | $ | 17,369,435 | ||||

Repurchase Agreements |

| — |

| 1,234,372 |

| — |

| 1,234,372 | ||||

Money Market |

| 20,597 |

| — |

| — |

| 20,597 | ||||

Total Investments in Securities | $ | 17,390,032 | $ | 1,234,372 | $ | — | $ | 18,624,404 | ||||

The accompanying notes are an integral part of the financial statements.

4

Assets: |

|

| ||

Investments and Repurchase Agreements, at Cost | $ | 21,665,615 |

| |

Investments at Fair Value* | $ | 17,390,032 |

| |

Repurchase Agreements at Value |

| 1,234,372 |

| |

Dividends Receivable |

| 22,735 |

| |

Reclaims Receivable |

| 22,167 |

| |

Total Assets |

| 18,669,306 |

| |

|

| |||

Liabilities: |

|

| ||

Payable Upon Return on Securities Loaned |

| 1,234,372 |

| |

Foreign Currency Payable |

| 886 |

| |

Advisory Fees Payable |

| 10,450 |

| |

|

| |||

Total Liabilities |

| 1,245,708 |

| |

|

| |||

Net Assets | $ | 17,423,598 |

| |

|

| |||

Net Assets Consist of: |

|

| ||

Paid-in Capital | $ | 17,710,199 |

| |

Total Distributable Earnings (Accumulated Losses) |

| (286,601 | ) | |

|

| |||

Net Assets | $ | 17,423,598 |

| |

|

| |||

Outstanding Shares of Beneficial Interest (unlimited authorization – no par value) |

| 525,000 |

| |

Net Asset Value, Offering and Redemption Price Per Share | $ | 33.19 |

|

* Includes Market Value of Securities on Loan of $1,625,992.

The accompanying notes are an integral part of the financial statements.

5

Investment Income: |

|

| ||

Dividend Income | $ | 481,587 |

| |

Income from Securities Lending |

| 5,520 |

| |

Less: Foreign Taxes Withheld |

| (61,927 | ) | |

Total Investment Income |

| 425,180 |

| |

|

| |||

Expenses: |

|

| ||

Advisory Fees |

| 210,250 |

| |

Less: Management Fee Waiver |

| (44,263 | ) | |

|

| |||

Net Expenses |

| 165,987 |

| |

|

| |||

Net Investment Income (Loss) |

| 259,193 |

| |

|

| |||

Net Realized Gain (Loss) on: |

|

| ||

Investments(1) |

| 3,781,792 |

| |

Foreign Currency Transactions |

| (5,951 | ) | |

Net Realized Gain (Loss) |

| 3,775,841 |

| |

|

| |||

Net Change in Unrealized Appreciation (Depreciation) on: |

|

| ||

Investments |

| (10,331,595 | ) | |

Foreign Currency Translations |

| (497 | ) | |

|

| |||

Net Unrealized Appreciation (Depreciation) |

| (10,332,092 | ) | |

|

| |||

Net Realized and Unrealized Gain (Loss) on Investments |

| (6,556,251 | ) | |

|

| |||

Net Decrease in Net Assets Resulting from Operations | $ | (6,297,058 | ) |

(1) Includes realized gains (losses) as a result of in-kind transactions (See Note 4 in Notes to Financial Statements).

The accompanying notes are an integral part of the financial statements.

6

Year Ended | Year Ended | |||||||

Operations: |

|

|

|

| ||||

Net Investment Income (Loss) | $ | 259,193 |

| $ | 456,407 |

| ||

Net Realized Gain (Loss)(1) |

| 3,775,841 |

|

| 1,251,204 |

| ||

Net Change in Unrealized Appreciation (Depreciation) |

| (10,332,092 | ) |

| 3,448,744 |

| ||

|

|

|

| |||||

Net Increase (Decrease) in Net Assets Resulting from Operations |

| (6,297,058 | ) |

| 5,156,355 |

| ||

|

|

|

| |||||

Distributions: |

| (645,458 | ) |

| (80,523 | ) | ||

|

|

|

| |||||

Capital Share Transactions: |

|

|

|

| ||||

Issued |

| — |

|

| 11,466,382 |

| ||

Redeemed |

| (6,456,759 | ) |

| (2,790,908 | ) | ||

Increase (Decrease) in Net Assets from Capital Share Transactions |

| (6,456,759 | ) |

| 8,675,474 |

| ||

|

|

|

| |||||

Total Increase (Decrease) in Net Assets |

| (13,399,275 | ) |

| 13,751,306 |

| ||

|

|

|

| |||||

Net Assets: |

|

|

|

| ||||

Beginning of Year |

| 30,822,873 |

|

| 17,071,567 |

| ||

End of Year | $ | 17,423,598 |

| $ | 30,822,873 |

| ||

|

|

|

| |||||

Share Transactions: |

|

|

|

| ||||

Issued |

| — |

|

| 300,000 |

| ||

Redeemed |

| (175,000 | ) |

| (75,000 | ) | ||

|

|

|

| |||||

Net Increase (Decrease) in Shares Outstanding from Share Transactions |

| (175,000 | ) |

| 225,000 |

| ||

(1) Includes realized gains (losses) as a result of in-kind transactions (See Note 4 in Notes to Financial Statements).

Amounts designated as “—” are $0.

The accompanying notes are an integral part of the financial statements.

7

Selected Per Share Data & Ratios

Year or Period Ended November 30,

For a Share Outstanding Throughout the Period/Year

Net Asset | Net | Net | Total from | Distributions | Distributions | Total | Net | Net | Net | Ratio of | Ratio of | Ratio of | Portfolio Turnover(2) | |||||||||||||||

2022 | $ 44.03 | $ 0.43 | $ (10.35) | $ (9.92) | $ (0.70) | $ (0.22) | $ (0.92) | $ 33.19 | (23.02)% | $ 17,424 | 0.75^% | 0.95% | 1.17% | 82% | ||||||||||||||

2021 | 35.94 | 0.69 | 7.55 | 8.24 | (0.15) | — | (0.15) | 44.03 | 23.02 | 30,823 | 0.75^ | 0.95 | 1.66 | 20 | ||||||||||||||

2020 | 28.25 | 0.22 | 7.94 | 8.16 | (0.47) | — | (0.47) | 35.94 | 29.30 | 17,072 | 0.75^ | 0.95 | 0.72 | 26 | ||||||||||||||

2019 | 24.24 | 0.36 | 3.94 | 4.30 | (0.21) | (0.08) | (0.29) | 28.25 | 18.22 | 8,475 | 0.73^ | 0.96 | 1.41 | 31 | ||||||||||||||

2018(3) | 25.00 | 0.27 | (1.03)(4) | (0.76) | — | — | — | 24.24 | (3.04) | 10,303 | 0.65(5) | 0.95(5) | 1.30(5) | 66 |

* Per share data calculated using average shares method.

^ The Ratio of Expenses to Average Net Assets includes the effect of a voluntary and/or contractual fee waiver (depending on the year) reducing expenses 0.20% (See Note 3 in Notes to Financial Statements).

(1) Total return is for the period indicated and has not been annualized for periods less than one year. Returns do not reflect the deduction of taxes the shareholder would pay on fund distributions or redemption of Fund shares.

(2) Portfolio turnover rate is for the period indicated and periods of less than one year have not been annualized. Excludes effect of securities received or delivered from processing in-kind creations or redemptions.

(3) Commenced operations on January 29, 2018.

(4) The amount shown for a share outstanding throughout the period does not accord with the aggregate net gains on investments for that period because the sales and repurchase of Fund shares in relation to fluctuating market value of the investments of the Fund.

(5) Annualized.

Amounts designated as “—” are $0.

The accompanying notes are an integral part of the financial statements.

8

1. ORGANIZATION

Exchange Traded Concepts Trust (the “Trust”) is a Delaware statutory trust formed on July 17, 2009. The Trust is registered with the Commission under the Investment Company Act of 1940 (the “1940 Act”) as an open-end management investment company with multiple investment portfolios. The financial statements herein are those of the Capital Link Global Fintech Leaders ETF (formerly Capital Link NextGen Protocol ETF) (the “Fund”). The Fund seeks to provide investment results that, before fees and expenses, correspond generally to the total return performance of the AF Global Fintech Leaders Index (the “Index”). Exchange Traded Concepts, LLC (the “Adviser”), an Oklahoma limited liability company, serves as the investment adviser for the Fund. The Fund commenced operations on January 29, 2018. The Fund is classified as “diversified” under the 1940 Act.

Shares of the Fund are listed and traded on the NYSE Arca, Inc. (the “Exchange”). Market prices for shares of the Fund may be different from their net asset value (“NAV”). The Fund issues and redeems shares on a continuous basis to certain institutional investors (typically market makers or other broker-dealers) at NAV only in large blocks of shares, typically at least 25,000 shares, called “Creation Units.” Transactions for the Fund are generally conducted in exchange for the deposit or delivery of a portfolio of in-kind securities constituting a substantial replication, or a representation, of the securities included in the Index and a specified cash payment. Once created, shares trade in a secondary market at market prices that change throughout the day in share amounts less than a Creation Unit.

2. SIGNIFICANT ACCOUNTING POLICIES

The following significant accounting policies, which are consistently followed in the preparation of the financial statements of the Trust, are in conformity with accounting principles generally accepted in the United States of America (“U.S. GAAP”) for investment companies. The accompanying financial statements have been prepared in accordance with U.S. GAAP on the accrual basis of accounting. Management has reviewed Financial Accounting Standards Board (“FASB”) Accounting Standards Codification (“ASC”) Topic 946, Financial Services — Investment Companies (“ASC 946”), and concluded that the Fund meets the criteria of an “investment company,” and therefore, the Fund prepares its financial statements in accordance with investment company accounting as outlined in ASC 946.

Use of Estimates and Indemnifications — The Fund is an investment company in conformity with U.S. GAAP. Therefore, the Fund follows the accounting and reporting guidelines for investment companies. The preparation of financial statements in conformity with U.S. GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of increases and decreases in net assets from operations during the reporting period. Actual results could differ from those estimates.

In the normal course of business, the Trust, on behalf of the Fund, enters into contracts that contain a variety of representations which provide general indemnifications. The Fund’s maximum exposure under these arrangements cannot be known; however, the Fund expects any risk of loss to be remote.

Security Valuation — The Fund records its investments at fair value. Securities listed on a securities exchange, market or automated quotation system for which quotations are readily available (except for securities traded on the NASDAQ Stock Market (“NASDAQ”)), including securities traded over the counter, are valued at the last quoted sale price on the primary exchange or market (foreign or domestic) on which they are traded (or at approximately 4:00 pm Eastern Time if a security’s primary exchange is normally open at that time), or, if there is no such reported sale, at the most recent quoted bid price for long positions and at the most recent quoted ask price for short positions. For securities traded on NASDAQ, the NASDAQ Official Closing Price will be used. If available, debt securities are priced based upon valuations provided by independent, third-party pricing agents. Such values generally reflect the last reported sales price if the security is actively traded.

9

Capital Link

Global Fintech Leaders ETF

Notes to the Financial Statements

November 30, 2022 (Continued)

2. SIGNIFICANT ACCOUNTING POLICIES (continued)

The third-party pricing agents may also value debt securities at an evaluated bid price by employing methodologies that utilize actual market transactions, broker-supplied valuations, or other methodologies designed to identify the fair value for such securities. Debt obligations with remaining maturities of sixty days or less when acquired will be valued at their market value. If a market value is not available from a pricing vendor or from an independent broker, the security shall be fair valued according to the Trust’s fair value procedures. Prices for most securities held in the Fund are provided daily by recognized independent pricing agents. If a security price cannot be obtained from an independent, third-party pricing agent, the Fund seeks to obtain a bid price from at least one independent broker.

In December 2020, the SEC adopted Rule 2a-5 under the 1940 Act, establishing requirements to determine fair value in good faith for purposes of the 1940 Act. The rule permits fund boards to designate a fund’s investment adviser to perform fair-value determinations, subject to board oversight and certain other conditions. The rule also defines when market quotations are “readily available” for purposes of the 1940 Act and requires a fund to fair value a portfolio investment when a market quotation is not readily available. The SEC also adopted new Rule 31a-4 under the 1940 Act, which sets forth recordkeeping requirements associated with fair-value determinations. The compliance date for Rule 2a-5 and Rule 31a-4 was September 8, 2022.

Effective September 8, 2022, and pursuant to the requirements of Rule 2a-5, the Trust’s Board of Trustees (the “Board”) designated the Adviser as the Board’s valuation designee to perform fair-value determinations for the Fund through a Fair Value Committee (the “Committee”) established by the Adviser and approved new Adviser Fair Value Procedures for the Fund. Prior to September 8, 2022, fair-value determinations were performed in accordance with the Trust’s Fair Value Procedures established by the Trust’s Board and were implemented through a Fair Value Committee designated by the Board.

Some of the more common reasons that may necessitate that a security be valued using fair value procedures include: the security’s trading has been halted or suspended; the security has been de-listed from a national exchange; the security’s primary trading market is temporarily closed at a time, when under normal conditions, it would be open; the security has not been traded for an extended period of time; the security’s primary pricing source is not able or willing to provide a price; or trading of the security is subject to local government-imposed restrictions. In addition, the Fund may fair value its securities if an event that may materially affect the value of the Fund’s securities that traded outside of the United States (a ‘‘Significant Event’’) has occurred between the time of the security’s last close and the time that the Fund calculates its net asset value. A Significant Event may relate to a single issuer or to an entire market sector. Events that may be Significant Events include, but are not limited to: government actions, natural disasters, armed conflict, acts of terrorism and significant market fluctuations. If the Adviser becomes aware of a Significant Event that has occurred with respect to a security or group of securities after the closing of the exchange or market on which the security or securities principally trade, but before the time at which the Fund calculates its net asset value, it may request that a Committee meeting be called. When a security is valued in accordance with the fair value procedures, the Committee will determine the value after taking into consideration relevant information reasonably available to the Committee.

In accordance with the authoritative guidance on fair value measurements and disclosure under U.S. GAAP, the Fund discloses fair value of its investments in a hierarchy that prioritizes the inputs to valuation techniques used to measure the fair value. The objective of a fair value measurement is to determine the price that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants at the measurement

10

Capital Link

Global Fintech Leaders ETF

Notes to the Financial Statements

November 30, 2022 (Continued)

2. SIGNIFICANT ACCOUNTING POLICIES (continued)

date (an exit price). Accordingly, the fair value hierarchy gives the highest priority to quoted prices (unadjusted) in active markets for identical assets or liabilities (Level 1) and the lowest priority to unobservable inputs (Level 3). The three levels of the fair value hierarchy are described below:

• Level 1 - Unadjusted quoted prices in active markets for identical, unrestricted assets or liabilities that the Fund has the ability to access at the measurement date;

• Level 2 - Quoted prices which are not active, or inputs that are observable (either directly or indirectly) for substantially the full term of the asset or liability; and

• Level 3 - Prices, inputs or exotic modeling techniques which are both significant to the fair value measurement and unobservable (supported by little or no market activity).

The valuation techniques used by the Fund to measure fair value during the year ended November 30, 2022 maximized the use of observable inputs and minimized the use of unobservable inputs. Investments are classified within the level of the lowest significant input considered in determining fair value.

Federal Income Taxes — It is the Fund’s intention to qualify as a regulated investment company for Federal income tax purposes by complying with the appropriate provisions of Subchapter M of the Internal Revenue Code of 1986, as amended. Accordingly, no provisions for Federal income taxes have been made in the financial statements.

The Fund’s policy is to classify interest and penalties associated with underpayment of federal and state income taxes, if any, as income tax expense on its Statement of Operations. As of November 30, 2022, the Fund did not have any interest or penalties associated with the underpayment of any income taxes. Current tax years remain open and subject to examination by tax jurisdictions. The Fund has reviewed all major jurisdictions and concluded that there is no impact on the Fund’s net assets and no tax liability resulting from unrecognized tax benefits relating to uncertain income tax positions taken or expected to be taken on its tax returns.

Security Transactions and Investment Income — Security transactions are accounted for on trade date. Costs used in determining realized gains and losses on the sale of investment securities are based on specific identification. Dividend income is recorded on the ex-dividend date. Interest income is recognized on the accrual basis. Withholding taxes and reclaims on foreign dividends, if any, have been provided for in accordance with the Fund’s understanding of the applicable country’s tax rules and rates.

Repurchase Agreements — Securities pledged as collateral for repurchase agreements are held by the Fund’s custodian bank until the repurchase date of the repurchase agreement. The Fund may also invest in tri-party repurchase agreements. Securities held as collateral for tri-party repurchase agreements are maintained by the broker’s custodian bank in a segregated account until the repurchase date of the repurchase agreement. Provisions of the repurchase agreements and the Fund’s policies require that the market value of the collateral, including accrued interest thereon, is sufficient in the event of default by the counterparty. If the counterparty defaults and the value of the collateral declines, or if the counterparty enters into an insolvency proceeding, realization of the collateral by the Fund may be delayed or limited.

At November 30, 2022, the market value of the repurchase agreements outstanding was $1,234,372.

Foreign Currency Translation — The books and records of the Fund are maintained in U.S. dollars. Investment securities and other assets and liabilities denominated in a foreign currency are translated into U.S. dollars on the date of valuation. Purchases and sales of investment securities, income and expenses are translated into U.S. dollars at the relevant rates of exchange prevailing on the respective dates of such transactions. The Fund does not isolate that portion of realized or unrealized gains and losses resulting from changes in the foreign exchange rate from fluctuations arising from changes in the market prices of the securities. These gains and losses are included in

11

Capital Link

Global Fintech Leaders ETF

Notes to the Financial Statements

November 30, 2022 (Continued)

2. SIGNIFICANT ACCOUNTING POLICIES (continued)

net realized and unrealized gains and losses on investments on the Statement of Operations. Net realized and unrealized gains and losses on foreign currency transactions represent net foreign exchange gains or losses from foreign currency exchange contracts, disposition of foreign currencies, currency gains or losses.

Realized between trade and settlement dates on securities transactions and the difference between the amount of the investment income and foreign withholding taxes recorded on the Fund’s books and the U.S. dollar equivalent amounts actually received or paid. The Fund may be subject to foreign taxes related to foreign income received, capital gain on the sale of securities and certain foreign currency transactions (a portion of which may be reclaimable). All foreign taxes are recorded in accordance with the applicable regulations and rates that exist in the foreign jurisdictions in which the Fund invests.

Dividends and Distributions to Shareholders — The Fund pays out dividends from its net investment income and distributes its net capital gains, if any, to investors at least annually. All distributions are recorded on ex-dividend date.

Creation Units — The Fund issues and redeems shares at NAV and only in Creation Units or multiples thereof. Purchasers of Creation Units (“Authorized Participants”) at NAV must pay a standard creation transaction fee of $500 per transaction, regardless of the number of Creation Units created in a given transaction. An Authorized Participant who holds Creation Units and wishes to redeem at NAV would also pay a standard minimum redemption transaction fee of $500 per transaction to the custodian on the date of such redemption, regardless of the number of Creation Units redeemed in a given transaction. The Fund may charge, either in lieu of or in addition to the fixed creation transaction fee, a variable fee for creations and redemptions in order to cover certain non-standard brokerage, tax, foreign exchange, execution, market impact and other costs and expenses related to the execution of trades resulting from such transactions. In all cases, such fees will be limited in accordance with the requirements of the Commission applicable to management investment companies offering redeemable securities.

The Adviser may retain all or a portion of the transaction fee to the extent the Adviser bears the expenses that otherwise would be borne by the Trust in connection with the purchase or redemption of a Creation Unit, which the transaction fee is designed to cover.

Except when aggregated in Creation Units, shares are not redeemable securities of the Fund. Shares of the Fund may only be purchased or redeemed by certain Authorized Participants. An Authorized Participant is either (i) a broker-dealer or other participant in the clearing process through the Continuous Net Settlement System of the National Securities Clearing Corporation or (ii) a Depository Trust Company (“DTC”) participant and, in each case, must have executed an Authorized Participant Agreement with the Fund’s distributor. Most retail investors will not qualify as Authorized Participants or have the resources to buy and sell whole Creation Units. Therefore, they will be unable to purchase or redeem the shares directly from the Fund. Rather, most retail investors will purchase shares in the secondary market with the assistance of a broker and will be subject to customary brokerage commissions or fees.

The following table discloses the Creation Unit breakdown based on the NAV as of November 30, 2022:

Creation |

| Creation |

| Value |

| Redemption | |||||||

25,000 | $ | 500 | $ | 829,750 | $ | 500 |

To the extent contemplated by an Authorized Participant Agreement, in the event an Authorized Participant has submitted a redemption request in proper form but is unable to transfer all or part of the shares comprising a Creation Unit to be redeemed to SEI Investments Distribution Co. (the “Distributor”), on behalf of the Fund, by the time as set forth in the Authorized Participant Agreement, the Distributor may nonetheless accept the redemption

12

Capital Link

Global Fintech Leaders ETF

Notes to the Financial Statements

November 30, 2022 (Continued)

2. SIGNIFICANT ACCOUNTING POLICIES (continued)

request in reliance on the undertaking by the Authorized Participant to deliver the missing shares as soon as possible, which undertaking shall be secured by the Authorized Participant’s delivery and maintenance of collateral equal to a percentage of the value of the missing shares as specified in the Authorized Participant Agreement. An Authorized Participant Agreement may permit the Fund to use such collateral to purchase the missing shares, and could subject an Authorized Participant to liability for any shortfall between the cost of the Fund acquiring such shares and the value of the collateral. Amounts are disclosed as Segregated Cash Balance from Authorized Participants for Deposit Securities and Collateral Payable upon Return of Deposit Securities on the Statement of Assets and Liabilities, when applicable.

3. SERVICE PROVIDERS

Investment Advisory Agreement

The Adviser is an Oklahoma limited liability company located at 10900 Hefner Pointe Drive, Suite 400, Oklahoma City, Oklahoma 73120, its principal place of business, and 295 Madison Avenue, New York, New York 10017. The Adviser serves as investment adviser to the Fund pursuant to an investment advisory agreement with the Trust (the “Advisory Agreement”). Under the Advisory Agreement, the Adviser provides investment advisory services to the Fund and is responsible for the day-to-day management of the Fund, including, among other things, implementing changes to the Fund’s portfolio in connection with any rebalancing or reconstitution of the Index, trading portfolio securities on behalf of the Fund, and selecting broker-dealers to execute purchase and sale transactions, subject to the oversight of the Board. The Adviser also arranges for transfer agency, custody, fund administration and accounting, and other non-distribution related services necessary for the Fund to operate. The Adviser administers the Fund’s business affairs, provides office facilities and equipment and certain clerical, bookkeeping and administrative services, and provides its officers and employees to serve as officers or Trustees of the Trust.

For the services it provides, the Fund pays the Adviser a fee calculated daily and paid monthly at an annual rate of 0.95% of the average daily net assets of the Fund.

The Adviser has contractually agreed to waive a portion of its management fee in an amount equal to 0.20% of the Fund’s average daily net assets through March 31, 2023, unless earlier terminated by the Board for any reason at any time. The waived fees are not subject to recoupment.

Under the Advisory Agreement, the Adviser has agreed to pay all expenses incurred by the Fund except for the advisory fee, interest, taxes, brokerage commissions and other expenses incurred in placing orders for the purchase and sale of securities and other investment instruments, acquired fund fees and expenses, accrued deferred tax liability, extraordinary expenses, and distribution fees and expenses paid by the Fund under any distribution plan adopted pursuant to Rule 12b-1 under the 1940 Act (“Excluded Expenses”).

The Adviser has entered into an arrangement with Capital Link, the Fund’s index provider, pursuant to which the Adviser and the Fund are permitted to use the Index. As part of an arrangement between Capital Link and the Adviser, Capital Link has agreed to assume the Adviser’s obligation to pay all expenses of the Fund (except Excluded Expenses) and, to the extent applicable, to pay the Adviser a minimum fee.

A Trustee and certain officers of the Trust are affiliated with the Adviser and receive no compensation from the Trust for serving as officers and/or Trustee.

Distribution Arrangement

The “Distributor serves as the Fund’s underwriter and distributor of shares pursuant to a distribution agreement (the “Distribution Agreement”). Under the Distribution Agreement, the Distributor, as agent, receives orders to purchase shares in Creation Units and transmits such orders to the Fund’s custodian and transfer agent. The

13

Capital Link

Global Fintech Leaders ETF

Notes to the Financial Statements

November 30, 2022 (Continued)

3. SERVICE PROVIDERS (continued)

Distributor has no obligation to sell any specific quantity of Fund shares. The Distributor bears the following costs and expenses relating to the distribution of shares: (i) the expenses of maintaining its registration or qualification as a dealer or broker under federal or state laws; (ii) filing fees; and (iii) all other expenses incurred in connection with the distribution services that are not reimbursed by the Adviser, as contemplated in the Distribution Agreement. The Distributor does not maintain any secondary market in Fund shares.

The Fund has adopted a Distribution and Service Plan (the “Plan”) pursuant to Rule 12b-1 under the 1940 Act. In accordance with the Plan, the Fund is authorized to pay an amount up to 0.25% of its average daily net assets each year for certain distribution-related activities. For the year ended November 30, 2022, no fees were charged by the Distributor under the Plan and the Plan will only be implemented with approval of the Board.

Administrator, Custodian and Transfer Agent

SEI Investments Global Funds Services serves as the Fund’s administrator pursuant to an administration agreement. The Bank of New York Mellon serves as the Fund’s custodian and transfer agent pursuant to a custodian agreement and transfer agency services agreement. The Adviser of the Fund pays these fees.

An officer of the Trust is affiliated with the administrator and receives no compensation from the Trust for serving as an officer.

4. INVESTMENT TRANSACTIONS

For the year ended November 30, 2022, the purchases and sales of investments in securities, excluding in-kind transactions, long-term U.S. Government and short-term securities were:

Purchases | Sales and | |||||||

$ | 18,277,735 | $ | 19,551,921 | |||||

There were no purchases or sales of long-term U.S. Government securities by the Fund.

For the year ended November 30, 2022, there were in-kind transactions associated with creations and redemptions:

Purchases | Sales | Net Realized | |||||||||

$ | — | $ | 5,475,226 | $ | 1,086,784 | ||||||

5. TAX INFORMATION

The amount and character of income and capital gain distributions to be paid, if any, are determined in accordance with Federal income tax regulations, which may differ from U.S. GAAP. As a result, net investment income (loss) and net realized gain (loss) on investment transactions for a reporting period may differ significantly from distributions during such period. These book/tax differences may be temporary or permanent. To the extent these differences are permanent in nature, they are charged or credited to paid-in capital and distributable earnings (accumulated losses), as appropriate, in the period that the differences arise.

Accordingly, the following permanent differences which are primarily attributable to redemption in kind transactions, have been reclassified within the components of net assets for the year ended November 30, 2022.

Paid-in | Distributable | |||||||

$ | 1,076,012 | $ | (1,076,012) | |||||

14

Capital Link

Global Fintech Leaders ETF

Notes to the Financial Statements

November 30, 2022 (Continued)

5. TAX INFORMATION (continued)

The tax character of dividends and distributions declared during the last two fiscal years were as follows:

Ordinary | |||

2022 | $ | 645,458 | |

2021 |

| 80,523 | |

As of November 30, 2022, the components of distributable earnings (accumulated losses) on a tax basis were as follows:

Undistributed Ordinary Income | $ | 269,776 |

| |

Undistributed Long-Term Capital Gains |

| 2,634,073 |

| |

Other Temporary Differences |

| 1 |

| |

Unrealized Depreciation |

| (3,190,451 | ) | |

Total Distributable Earnings (Accumulated Losses) | $ | (286,601 | ) |

For Federal income tax purposes, the cost of securities owned at November 30, 2022, and the net realized gains or losses on securities sold for the period, were different from amounts reported for financial reporting purposes primarily due to wash sales which cannot be used for federal income tax purposes in the current period and have been deferred for use in future years. The Federal tax cost and aggregate gross unrealized appreciation and depreciation on investments held by the Fund at November 30, 2022, were as follows:

Federal | Aggregated | Aggregated | Net | |||||||||||||

$ | 21,814,341 | $ | 1,168,215 | $ | (4,358,666 | ) | $ | (3,190,451 | ) | |||||||

6. SECURITIES LENDING

The Fund has entered into a Securities Lending Agreement with the Bank of New York Mellon (the “Lending Agent”) to lend portfolio securities to brokers, dealers and other financial organizations that meet capital and other credit requirements or other criteria established by the Trust’s Board. These loans, if and when made, may not exceed 33 1/3% of the total asset value of the Fund (including the loan collateral). The Fund will not lend portfolio securities to the Adviser or its affiliates unless permissible under the 1940 Act and the rules and promulgations thereunder. Loans of portfolio securities will be fully collateralized by cash, letters of credit or U.S. government securities, and the collateral will be maintained in an amount equal to at least 102% of the value of domestic equity securities and American Depositary Receipts (“ADR”) and 105% of the value of foreign equity securities (other than ADRs). However, due to market fluctuations during the day, the value of securities loaned on a particular day may, during the course of the day, exceed the value of collateral. On each business day, the amount of collateral is adjusted based on the prior day’s market fluctuations and the current day’s lending activity. Income from lending activity is determined by the amount of interest earned on collateral, less any amounts payable to the borrowers of the securities and the lending agent and the Fund earns a return from the collateral.

Lending securities involves certain risks, including the risk that the Fund bears may be delayed or restricted from recovering the loaned securities or disposing of the collateral for the loan, which could give rise to loss because at adverse market actions expenses and/or delays in connection with the disposition of the underlying securities. Any gain or loss in the market price of the securities loaned and income from lending activity by the Fund that might occur during the term of the loan would be for the account of the Fund.

15

Capital Link

Global Fintech Leaders ETF

Notes to the Financial Statements

November 30, 2022 (Continued)

6. SECURITIES LENDING (continued)

Securities pledged as collateral for repurchase agreements are held by BNY and are designated as being held on the Fund’s behalf under a book-entry system. The Fund monitors the adequacy of the collateral on a daily basis and can require the seller to provide additional collateral in the event the market value of the securities pledged falls below the carrying value of the repurchase agreement, including accrued interest. It is the Fund’s policy to only enter into repurchase agreements with banks and other financial institutions which are deemed by the Adviser to be creditworthy. The Fund bears the risk of loss in the event that the other party to a repurchase agreement defaults on its obligations and the Fund is prevented from exercising its rights to dispose of the underlying securities received as collateral and the risk of a possible decline in the value of the underlying securities during the period. For financial statement purposes, the Fund records the securities lending collateral (included in repurchase agreements, at value or restricted cash) as an asset and the obligation to return securities lending collateral as a liability on the Statement of Assets and Liabilities.

Cash collateral received in connection with securities lending is invested in repurchase agreements by the lending agent. The Fund does not have effective control of the non-cash collateral and therefore it is not disclosed in the Fund’s Schedule of Investments.

Securities lending transactions are entered into by the Fund under the Securities Lending Agreement, which permits the Fund, under certain circumstances such as an event of default, to offset amounts payable by the Fund to the same counterparty against amounts receivable from the counterparty to create a net payment due to or from the Fund.

The following is a summary of securities lending agreements held by the Fund, with cash collateral of overnight maturities and non-cash collateral, which would be subject to offset as of November 30, 2022:

Gross | Value of | Value of | Net | |||||||||||

$ | 1,625,992 | $ | 1,234,372 | $ | 391,620 | $ | — | |||||||

* The amount of collateral reflected in the table is presented on the Statement of Assets and Liabilities.

** The amount of collateral reflected in the table does not include any over-collaterization received by the Fund.

The value of loaned securities and related collateral outstanding at November 30, 2022 are shown in the Schedule of Investments. The value of the collateral held may be temporarily less than that required under the lending contract. As of November 30, 2022, the cash collateral was invested in Repurchase Agreements and the non-cash collateral consisted of U.S. Government Securities (U.S. Treasury Bills, Notes and Bonds and U.S. Treasury Inflation Indexed Bonds) with the following maturities:

Remaining Contractual Maturity of the collateral, as of November 30, 2022:

Overnight and | <30 Days | Between 30 & | >90 Days | Total | |||||||||||

Repurchase Agreements | $ | 1,234,372 | $ | — | $ | — | $ | — | $ | 1,234,372 | |||||

U.S. Government Securities |

| — |

| — |

| 5,918 |

| 439,974 |

| 445,892 | |||||

Total | $ | 1,234,372 |

|

| $ | 5,918 | $ | 439,974 | $ | 1,680,264 | |||||

16

Capital Link

Global Fintech Leaders ETF

Notes to the Financial Statements

November 30, 2022 (Continued)

7. PRINCIPAL RISKS OF INVESTING IN THE FUND

As with all exchange traded funds (“ETFs”) a shareholder of the Fund is subject to the risk that his or her investment could lose money. The Fund is subject to the principal risks noted below, any of which may adversely affect the Fund’s NAV, trading price, yield, total return and ability to meet its investment objective. Additional principal risks are disclosed in the Fund’s prospectus. Please refer to the Fund’s prospectus for a complete description of the principal risks of investing in the Fund.

Digital Assets Risk. The technology relating to digital assets is new and developing. Digital asset technology is used by companies to optimize their business practices, whether by using the technology within their business or operating business lines involved in the operation of the technology. Currently, there are few public companies for which digital asset technology represents an attributable and significant revenue stream. Digital asset technology may never develop optimized transactional processes that lead to increased realized economic returns to any company in which the Fund invests. In addition, an investment in companies actively engaged in digital asset technology may be subject to the risks:

• that digital asset technology is new and many of its uses may be untested; that the cryptographic keys necessary to transact on a digital asset ledger may be subject to theft, loss, or destruction; that competing platforms and technologies may be developed such that consumers or investors use an alternative to digital assets;

• that companies that use digital asset technology may be subject to cybersecurity risk; that companies may not be able to develop digital asset technology applications or may not be able to capitalize on those technologies;

• that digital asset companies may be subject to the risks posed by conflicting intellectual property claims;

• that there may be a lack of liquid markets and possible manipulation of digital assets;

• that there may be risks posed by the lack of regulation in this space; and

• that digital asset systems built using third party products may be subject to technical defects or vulnerabilities beyond a company’s control.

Emerging Markets Securities Risk: Emerging markets are subject to greater market volatility, lower trading volume, political and economic instability, uncertainty regarding the existence of trading markets and more governmental limitations on foreign investment than more developed markets. In addition, securities in emerging markets may be subject to greater price fluctuations than securities in more developed markets. Differences in regulatory, accounting, auditing, and financial reporting and recordkeeping standards could impede the Sub-Adviser’s ability to evaluate local companies and impact the Fund’s performance. Investments in securities of issuers in emerging markets may also be exposed to risks related to a lack of liquidity, greater potential for market manipulation, issuers’ limited reliable access to capital, and foreign investment structures. Additionally, the Fund may have limited rights and remedies available to it to pursue claims against issuers in emerging markets.

Limited Authorized Participants, Market Makers and Liquidity Providers Concentration Risk: Because the Fund is an ETF, only a limited number of institutional investors (known as “Authorized Participants”) are authorized to purchase and redeem shares directly from the Fund. In addition, there may be a limited number of market makers and/or liquidity providers in the marketplace. To the extent either of the following events occurs, the risk of which is higher during periods of market stress, Fund shares may trade at a material discount to NAV and possibly face delisting: (i) Authorized Participants exit the business or otherwise become unable to process creation and/or redemption orders and no other Authorized Participants step forward to perform these services, or (ii) market makers and/or liquidity providers exit the business or significantly reduce their business activities and no other entities step forward to perform their functions.

17

Capital Link

Global Fintech Leaders ETF

Notes to the Financial Statements

November 30, 2022 (Continued)

7. PRINCIPAL RISKS OF INVESTING IN THE FUND (continued)

Market Risk: The market price of a security or instrument could decline, sometimes rapidly or unpredictably, due to general market conditions that are not specifically related to a particular company, such as real or perceived adverse economic or political conditions throughout the world, changes in the general outlook for corporate earnings, changes in interest or currency rates or adverse investor sentiment generally. Local, regional, or global events such as war, acts of terrorism, the spread of infectious illness or other public health issues, recessions, or other events could have a significant impact on the market generally and on specific securities. The market value of a security may also decline because of factors that affect a particular industry or industries, such as labor shortages or increased production costs and competitive conditions within an industry.

Sector Focus Risk: The Fund may invest a significant portion of its assets in one or more sectors and thus will be more susceptible to the risks affecting those sectors. While the Fund’s sector exposure is expected to vary over time based on the composition of its Index, the Fund anticipates that it may be subject to some or all of the risks described below. The list below is not a comprehensive list of the sectors to which the Fund may have exposure over time and should not be relied on as such.

Financials Sector Risk. Financial services companies are subject to extensive governmental regulation, which may limit both the amounts and types of loans and other financial commitments they can make, the interest rates and fees they can charge, the scope of their activities, the prices they can charge and the amount of capital they must maintain. Profitability is largely dependent on the availability and cost of capital funds and can fluctuate significantly when interest rates change or due to increased competition. In addition, deterioration of the credit markets generally may cause an adverse impact in a broad range of markets, including U.S. and international credit and interbank money markets generally, thereby affecting a wide range of financial institutions and markets.

Information Technology Sector Risk: The Fund is subject to the risk that market or economic factors impacting technology companies and companies that rely heavily on technology advances could have a major effect on the value of the Fund’s investments. The value of stocks of technology companies and companies that rely heavily on technology is particularly vulnerable to rapid changes in technology product cycles, rapid product obsolescence, the loss of patent, copyright and trademark protections, government regulation and competition, both domestically and internationally, including competition from foreign competitors with lower production costs. Information technology companies may also be smaller and less experienced companies, with limited product lines, markets or financial resources and fewer experienced management or marketing personnel. Information technology company stocks, especially those which are Internet related, have experienced extreme price and volume fluctuations that are often unrelated to their operating performance.

8. RECENT MARKET EVENTS

The spread of COVID-19 around the world has caused significant volatility in U.S. and international markets. There is significant uncertainty around the breadth and duration of business disruptions related to the COVID-19 pandemic, as well as its impact on the U.S. and international economies. The operational and financial performance of the issuers of securities in which the Fund invests depends on future developments, including the duration and spread of the outbreak, and such developments may in turn impact the value of the Fund’s investments. The ultimate impact of the pandemic on the financial performance of the Fund’s investments is not reasonably able to be approximated at this time.

On February 24, 2022, Russia engaged in military actions in the sovereign territory of Ukraine. The current political and financial uncertainty surrounding Russia and Ukraine may increase market volatility and the economic risk of investing in securities in these countries and may also cause uncertainty for the global economy and broader financial markets. The ultimate fallout and long-term impact from these events are not known.

18

Capital Link

Global Fintech Leaders ETF

Notes to the Financial Statements

November 30, 2022 (Conclued)

9. OTHER

At November 30, 2022, the records of the Trust reflected that 100% of the Fund’s total shares outstanding were held by three Authorized Participants in the form of Creation Units. However, the individual shares comprising such Creation Units are listed and traded on the Exchange and have been purchased and sold by persons other than Authorized Participants.

10. SUBSEQUENT EVENTS

The Fund has evaluated the need for additional disclosures and/or adjustments resulting from subsequent events through the date the financial statements were issued. Based on this evaluation, no additional disclosures and/or adjustments were required to the financial statements.

19

Global Fintech Leaders ETF

Report of Independent Registered Public Accounting Firm

November 30, 2022

To the Shareholders of Capital Link Global Fintech Leaders ETF and

Board of Trustees of Exchange Traded Concepts Trust

Opinion on the Financial Statements

We have audited the accompanying statement of assets and liabilities, including the schedule of investments, of Capital Link Global Fintech Leaders ETF (formerly Capital Link NextGen Protocol ETF) (the “Fund”), a series of Exchange Traded Concepts Trust, as of November 30, 2022, the related statement of operations for the year then ended, the statements of changes in net assets for each of the two years in the period then ended, the related notes, and the financial highlights for each of the five periods in the period then ended (collectively referred to as the “financial statements”). In our opinion, the financial statements present fairly, in all material respects, the financial position of the Fund as of November 30, 2022, the results of its operations for the year then ended, the changes in net assets for each of the two years in the period then ended, and the financial highlights for each of the five periods in the period then ended, in conformity with accounting principles generally accepted in the United States of America.

Basis for Opinion

These financial statements are the responsibility of the Fund’s management. Our responsibility is to express an opinion on the Fund’s financial statements based on our audits. We are a public accounting firm registered with the Public Company Accounting Oversight Board (United States) (“PCAOB”) and are required to be independent with respect to the Fund in accordance with the U.S. federal securities laws and the applicable rules and regulations of the Securities and Exchange Commission and the PCAOB.

We conducted our audits in accordance with the standards of the PCAOB. Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement whether due to error or fraud.

Our audits included performing procedures to assess the risks of material misstatement of the financial statements, whether due to error or fraud, and performing procedures that respond to those risks. Such procedures included examining, on a test basis, evidence regarding the amounts and disclosures in the financial statements. Our procedures included confirmation of securities owned as of November 30, 2022, by correspondence with the custodian and counterparties. Our audits also included evaluating the accounting principles used and significant estimates made by management, as well as evaluating the overall presentation of the financial statements. We believe that our audits provide a reasonable basis for our opinion.

We have served as the auditor of one or more investment companies advised by Exchange Traded Concepts, LLC since 2012.

COHEN & COMPANY, LTD.

Cleveland, Ohio

January 24, 2023

20

Global Fintech Leaders ETF

Trustees and Officers of the Trust

November 30, 2022 (Unaudited)

Set forth below is information about the Trustees of the Trust. The address of each Trustee of the Trust is c/o Exchange Traded Concepts Trust, 10900 Hefner Pointe Drive, Suite 400, Oklahoma City, Oklahoma 73120. The Fund’s Statement of Additional Information (“SAI”) includes additional information about the Trustees. The SAI may be obtained without charge by calling 833-466-6383.

Name and | Position(s) | Term of Office | Principal | Number of | Other Directorships | |||||

Interested Trustee(3) |

|

|

|

|

| |||||

J. Garrett Stevens | Trustee and President | Trustee (Since 2009); President (Since 2011) | Investment Adviser/Vice President, T.S.Phillips Investments, Inc. (since 2000); Chief Executive Officer, Exchange Traded Concepts, LLC (since 2009); President, Exchange Traded Concepts Trust (since 2011); President, Exchange Listed Funds Trust (since 2012). | 20 | None. | |||||

Independent Trustees |

|

|

|

|

| |||||

Timothy Jacoby | Trustee | Since 2014 | None | 38 | Independent Trustee, Bridge Builder Trust (16 portfolios) (since 2022); Independent Trustee, Edward Jones Money Market Fund (since 2017); Audit Committee Chair, Perth Mint Physical Gold ETF (2018 to 2020). | |||||

Linda Petrone | Trustee | Since 2019 | Founding Partner, Sage Search Advisors (since 2012). | 38 | None. | |||||

Stuart Strauss | Trustee | Since 2021 | Partner, Dechert LLP (2009 to 2020). | 38 | None. | |||||

Mark Zurack | Trustee | Since 2011 | Professor, Columbia Business School (since 2002). | 20 | Independent Trustee, AQR Funds (32 portfolios) (since 2014); Independent Trustee, Exchange Listed Funds Trust (2019). |

(1) Each Trustee shall serve during the continued life of the Trust until he or she dies, resigns, is declared bankrupt or incompetent by a court of competent jurisdiction, or is removed.

(2) The fund complex includes each series of the Trust and of Exchange Listed Funds Trust.

(3) Mr. Stevens is an “interested person” of the Trust, as that term is defined in the 1940 Act, by virtue of his employment with, and ownership interest in, the Adviser.

21

Capital Link

Global Fintech Leaders ETF

Trustees and Officers of the Trust

November 30, 2022 (Unaudited) (Concluded)

Set forth below is information about each of the persons currently serving as officers of the Trust. The address of J. Garrett Stevens, James J. Baker, Richard Malinowski, Christopher W. Roleke and Matthew Fleischer is c/o Exchange Traded Concepts Trust, 10900 Hefner Pointe Drive, Suite 400, Oklahoma City, Oklahoma 73120; and the address of Eric Olsen is SEI Investments Company, One Freedom Valley Drive, Oaks, Pennsylvania 19456.

Name and | Position(s) | Term of Office | Principal Occupation(s) | |||

Officers |

|

|

| |||

J. Garrett Stevens | Trustee and President | Trustee (Since 2009); President (Since 2011) | Investment Adviser/Vice President, T.S. Phillips Investments, Inc. (since 2000); Chief Executive Officer, Exchange Traded Concepts, LLC (since 2009); President, Exchange Listed Funds Trust (since 2012). | |||

James J. Baker Jr. | Vice President | Since 2015 | Managing Partner, Exchange Traded Concepts, LLC (since 2011); Managing Partner, Yorkville ETF Advisors (2012 to 2016). | |||

Richard Malinowski | Vice President and Secretary | Since 2022 | General Counsel, Exchange Traded Concepts, LLC (since 2022); Senior Vice President and Senior Managing Counsel, Ultimus Fund Solutions LLC, (2020 to 2022); Senior Vice President, Ultimus Fund Solutions LLC (2017 to 2020). | |||

Christopher Roleke | Treasurer | Since 2022 | Controller, Exchange Traded Concepts, LLC (since 2022); Managing Director/Fund Principal Financial Officer, Foreside Management Services, LLC (2011 to 2022). | |||

Eric Olsen | Assistant Treasurer | Since 2021 | Director, Fund Accounting, SEI Investments Global Funds Services (since 2021); Deputy Head of Fund Operations, Traditional Assets, Aberdeen Standard Investments (2013 to 2021). | |||

Matthew Fleischer | Chief Compliance Officer | Since 2021 | Chief Compliance Officer, Exchange Listed Funds Trust (since 2021); Vice President, Compliance, Goldman Sachs Group, Inc., Goldman Sachs Asset Management Funds (2017 to 2021); Associate Counsel, Ameriprise Financial, Columbia Threadneedle Funds (2015 to 2017). |

(1) Each officer serves at the pleasure of the Board.

22

All ETFs have operating expenses. As a shareholder of the Fund you incur an advisory fee. In addition to the advisory fee, a shareholder may pay brokerage expenses, taxes, interest, litigation expenses, and other extraordinary expenses (including acquired fund fees and expenses), if any. It is important for you to understand the impact of these ongoing costs on your investment returns. Shareholders may incur brokerage commissions on their purchases and sales of Fund shares, which are not reflected in these examples.

The following examples use the annualized expense ratio and are intended to help you understand the ongoing costs (in dollars) of investing in the Fund and to compare these costs with those of other funds. The examples are based on an investment of $1,000 made at the beginning of the period shown and held for the entire period (June 1, 2022 to November 30, 2022) (Unless otherwise noted below). The table below illustrates the Fund’s costs in two ways:

Actual Fund Return. This section helps you to estimate the actual expenses after fee waivers that your Fund incurred over the period. The “Expenses Paid During Period” column shows the actual dollar expense cost incurred by a $1,000 investment in the Fund, and the “Ending Account Value” number is derived from deducting that expense cost from the Fund’s gross investment return.

You can use this information, together with the actual amount you invested in the Fund, to estimate the expenses you paid over that period. Simply divide your actual account value by $1,000 to arrive at a ratio (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply that ratio by the number shown for your Fund under “Expenses Paid During Period.”

Hypothetical 5% Return. This section helps you compare your Fund’s costs with those of other funds. It assumes that the Fund had an annual 5% return before expenses during the year, but that the expense ratio (Column 3) for the period is unchanged. This example is useful in making comparisons because the Commission requires all funds to make this 5% calculation. You can assess your Fund’s comparative cost by comparing the hypothetical result for your Fund in the “Expenses Paid During Period” column with those that appear in the same charts in the shareholder reports for other funds.

NOTE: Because the return is set at 5% for comparison purposes — NOT your Fund’s actual return — the account values shown may not apply to your specific investment.

| Beginning | Ending | Annualized | Expenses | ||||

Actual Fund Return | $ 1,000.00 | $ 914.80 | 0.75% | $ 3.60 | ||||

Hypothetical 5% Return | $ 1,000.00 | $ 1,021.31 | 0.75% | $ 3.80 |

(1) Expenses are equal to the Fund’s annualized expense ratio (including broker expense) multiplied by the average account value over the period, multiplied 183/365 (to reflect the one-half year period shown).

23

Global Fintech Leaders ETF

Board Considerations of Approval of Advisory Agreement

(Unaudited)

At a meeting held on September 21, 2022 (the “Meeting”), the Board of Trustees (the “Board”) of Exchange Traded Concepts Trust (the “Trust”) considered and approved the continuance of the investment advisory agreement between the Trust, on behalf of the Capital Link Global Fintech Leaders ETF (the “Fund”), and Exchange Traded Concepts, LLC (“ETC”) pursuant to which ETC provides advisory services to the Fund (the “Agreement”).

Pursuant to Section 15 of the Investment Company Act of 1940 (the “1940 Act”), the Agreement must be approved by a vote of (i) the Trustees or the shareholders of the Fund and (ii) a majority of the Trustees who are not parties to the Agreement or “interested persons” of any party thereto, as defined in the 1940 Act (the “Independent Trustees”), cast in person at a meeting called for the purpose of voting on such approval. In connection with its consideration of such approval, the Board must request and evaluate, and ETC is required to furnish, such information as may be reasonably necessary to evaluate the terms of the Agreement. In addition, rules under the 1940 Act require the Fund to disclose in its shareholder reports the material factors and the conclusions with respect thereto that formed the basis for the Board’s approval of the Agreement.

Consistent with these responsibilities, prior to the Meeting, the Board reviewed materials from ETC and, at the Meeting, representatives from ETC presented additional information to help the Board evaluate the Agreement. Among other things, representatives from ETC provided an overview of its advisory business, including investment personnel and investment processes. Prior to the Meeting, the Trustees met to review and discuss certain information provided. During the Meeting, the Board discussed the materials it received, including a memorandum from legal counsel to the Independent Trustees on the responsibilities of Trustees in considering the approval of investment advisory agreements under the 1940 Act, considered ETC’s oral presentation, and deliberated on the approval of the Agreement in light of this information. Throughout the process, the Trustees were afforded the opportunity to ask questions of and request additional materials from ETC. The Independent Trustees were assisted in their review by independent legal counsel and met with counsel separately and without management present.

In considering whether to approve the continuance of the Agreement, the Board took into consideration (i) the nature, extent, and quality of the services provided by ETC to the Fund; (ii) the Fund’s performance; (iii) ETC’s costs of and profits realized from providing advisory services to the Fund, including any fall-out benefits enjoyed by ETC or its affiliates; (iv) comparative fee and expense data; (v) the extent to which the advisory fee for the Fund reflects economies of scale shared with Fund shareholders; and (vi) other factors the Board deemed to be relevant.

Nature, Extent, and Quality of Services. With respect to the nature, extent, and quality of the services provided to the Fund, the Board considered ETC’s specific responsibilities in all aspects of day-to-day management of the Fund. The Board noted that such responsibilities include developing, implementing, and maintaining the Fund’s investment program; implementing changes to the Fund’s portfolio in connection with any rebalancing or reconstitution of the underlying index; trading portfolio securities and other investment instruments on behalf of the Fund; selecting broker-dealers to execute purchase and sale transactions; determining the daily baskets of deposit securities and cash components; executing portfolio securities trades for purchases and redemptions of Fund shares conducted on a cash-in-lieu basis; overseeing general portfolio compliance with relevant law; monitoring compliance with various policies and procedures and applicable securities regulations; quarterly reporting to the Board; and implementing Board directives as they relate to the Fund. The Board noted that it had been provided with ETC’s registration form on Form ADV as well as ETC’s responses to a detailed series of questions, which included a description of ETC’s operations, services, personnel, compliance program, risk management program, and financial condition, and whether there had been material changes to such information since it was last presented to the Board. The Board considered the qualifications, experience, and responsibilities of ETC’s investment personnel, the quality of ETC’s compliance infrastructure, and the determination of the Trust’s Chief Compliance Officer that ETC has appropriate compliance policies and procedures in place. The Board considered ETC’s experience working with ETFs, including the Fund, other series of the Trust, and other ETFs outside of the Trust.