|

| | |

| | UNITED STATES | |

| | SECURITIES AND EXCHANGE COMMISSION | |

| | Washington, DC 20549 | |

|

| | | | |

| (Mark One) | | Form 10-K/A (Amendment No. 1) | | |

|

| | |

| þ | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 | |

| | For the fiscal year ended December 31, 2013 | |

| | or | |

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 | |

| | For the transition period from __________________________________to __________________________________ | |

| | Commission file number 001-34258 | |

WEATHERFORD INTERNATIONAL LTD.

(Exact name of registrant as specified in its charter)

|

| | |

| Switzerland | | 98-0606750 |

| (State or other jurisdiction of incorporation or organization) | | (IRS Employer Identification No.) |

| 4-6 Rue Jean-François Bartholoni, 1204 Geneva, Switzerland | | Not Applicable |

| (Address of principal executive offices) | | (Zip Code) |

Registrant’s telephone number, including area code: +41.22.816.1500

Securities registered pursuant to Section 12(b) of the Act:

|

| | |

| Title of each class | | Name of each exchange on which registered |

| Registered Shares, par value 1.16 Swiss francs per share | | New York Stock Exchange |

| | | SIX Stock Exchange |

| | | NYSE Euronext Paris |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes þ No ¨

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes o No þ

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes þ No o

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes þ No o

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. |

| | | |

Large accelerated filer þ | Accelerated filer o | Non-accelerated filer o | Smaller reporting company o |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes o No þ

The aggregate market value of the voting stock held by nonaffiliates of the registrant as of June 30, 2013 was approximately $8.0 billion based upon the closing price on the New York Stock Exchange as of such date.

As of April 4, 2014, there were 772,618,358 shares of Weatherford registered shares, 1.16 Swiss francs par value per share, outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

None.

Weatherford International Ltd.

Form 10-K/A for the Year Ended December 31, 2013

Table of Contents

EXPLANATORY NOTE

The purpose of this Amendment No. 1 (this “Amendment”) to our Annual Report on Form 10-K for the year ended December 31, 2013, which was filed with the Securities and Exchange Commission (the “SEC”) on February 25, 2014 (the “Original Filing”) is to provide the information required by Items 10, 11, 12, 13 and 14 of Part III of Form 10-K, as a definitive proxy statement containing such information will not be filed within 120 days after the end of the fiscal year covered by the Original Filing. This Amendment amends and restates in its entirety Items 10, 11, 12, 13, and 14 of Part III of the Original Filing. This Amendment does not reflect events occurring after the date of the Original Filing or modify or update any of the other disclosures contained therein in any way other than as required to reflect the amendments described above. The reference on the cover of the Original Filing to the incorporation by reference of our definitive proxy statement for the 2014 annual general meeting of shareholders has been deleted. In addition, in connection with the filing of this Amendment and pursuant to the rules of the SEC, we are including with this Amendment certain currently dated certifications. Accordingly, Item 15 of Part IV has also been amended to reflect the filing of these currently dated certifications.

Part III

|

| |

| Item 10. | Directors, Executive Officers and Corporate Governance |

Board of Directors

The board of directors (“Board”) of Weatherford International Ltd. (the “Company”) currently consists of nine members, as set forth in the table below, each of whom was elected by our shareholders for a term of one year until the next annual shareholder meeting. Our Articles of Association do not limit the number of terms a member may be re-elected to the Board. All of our directors are independent under the rules of the New York Stock Exchange (the “NYSE”), other than Bernard J. Duroc-Danner, who is an employee.

|

| | | | |

| Name | | Age | | Position |

| Bernard J. Duroc-Danner | | 60 | | Chairman of the Board, President and Chief Executive Officer |

| Robert A. Rayne | | 65 | | Independent Vice-Chairman of the Board and Presiding Director |

| David J. Butters | | 73 | | Independent Non-Employee Director |

| John D. Gass | | 62 | | Independent Non-Employee Director |

| Francis S. Kalman | | 66 | | Independent Non-Employee Director |

| William E. Macaulay | | 68 | | Independent Non-Employee Director |

| Robert K. Moses, Jr. | | 74 | | Independent Non-Employee Director |

| Guillermo Ortiz | | 65 | | Independent Non-Employee Director |

| Emyr Jones Parry | | 66 | | Independent Non-Employee Director |

Director Biographies

|

| |

| Bernard J. Duroc-Danner |

| |

Age: 60 |

Director since: 1988 |

Committees: None |

Other Public Company Boards: LMS Capital plc |

Dr. Duroc-Danner joined EVI, Inc., Weatherford’s predecessor company, at its inception in May 1987 and was directly responsible for the growth of EVI, Inc.’s oilfield service and equipment business. He has directed the growth of the Company since that time. He was elected EVI’s President and Chief Executive Officer in 1990. Subsequent to the merger of EVI, Inc. with Weatherford Enterra, Inc. on May 27, 1998, Dr. Duroc-Danner was elected as our Chairman of the Board. Dr. Duroc-Danner’s family has been in the oil business for two generations. He holds an M.B.A. and a Ph.D. in Economics from Wharton (University of Pennsylvania). Prior to the start-up of EVI, Dr. Duroc-Danner held positions at Arthur D. Little Inc. and Mobil Oil Inc. Dr. Duroc-Danner has been a director of LMS Capital plc, an investment company listed on the London Stock Exchange, since 2006. Dr. Duroc-Danner also serves on the National Petroleum Council and is a member of the Society of Petroleum Engineers. Dr. Duroc-Danner was the recipient of Ernst & Young’s 2008 Entrepreneur of the Year in the Energy, Chemicals and Mining category.

During the past five years, Dr. Duroc-Danner also was a director of Helix Energy Solutions Group, Inc.

Specific qualifications and experience of particular relevance to our Company

Dr. Duroc-Danner is a valued member of the Board because of his educational background, depth of knowledge of the oilfield service industry, domestically and internationally, and his 27 years of experience in successfully leading and expanding the Company’s business. As President and Chief Executive Officer, Dr. Duroc-Danner serves as an important link between senior management and the Board, and he brings to the Board an invaluable perspective in strategic planning for the future growth of the Company.

|

| |

| David J. Butters |

| |

Age: 73 |

Director since: 1984 |

Committees: Audit; Corporate Governance & Nominating (Chairman) |

Other Public Company Boards: GulfMark Offshore, Inc. (Chairman) |

Mr. Butters has been Chairman, President and Chief Executive Officer of Navigator Holdings, Ltd., an international shipping company the principal business of which is the transport of liquefied petroleum gas, since September 2008 and has been Chairman and President of Navigator Holdings since August 2006. From 1969 to September 2008, Mr. Butters was a Managing Director of Lehman Brothers Inc., an investment banking company. In addition to serving as Chairman of the Board of GulfMark Offshore, Inc., Mr. Butters is also Chairman of the Board of Directors of ACOL Tankers Ltd., a privately held oil tanker company. Mr. Butters holds a B.S. from Boston College and an M.B.A. from Columbia University Business School.

Specific qualifications and experience of particular relevance to our Company

Mr. Butters’ extensive career experience in investment banking is an asset to the Audit Committee in carrying out its duties. In addition, his chief executive officer experience and his depth of knowledge of the Company’s business as a result of his 29-year directorship on our Board provide us with a valuable perspective in making strategic decisions and planning for our future.

|

| |

| John D. Gass |

| |

Age: 62 |

Director since: 2013 |

Committees: Compensation; Health, Safety and Environment |

Other Public Company Boards: Southwestern Energy Company, Suncor Energy Inc. |

Mr. Gass is a retired Vice President of Chevron Corporation and President of Chevron Gas and Midstream, a position he held from 2003 until his retirement in 2012. Mr. Gass joined Chevron in 1974 and over the next 38 years held positions of increasing responsibility both domestically and abroad, in engineering, operations and executive management.

Mr. Gass has been a director of Southwestern Energy Company since November 2012. He became a director of Suncor Energy Inc. in February 2014. Mr. Gass received a bachelor’s degree in civil engineering from Vanderbilt University and a master’s degree in civil engineering from Tulane University. He serves on the Board of Visitors for the Vanderbilt School of Engineering and is on the advisory board for the Vanderbilt Eye Institute. He is a member of the American Society of Civil Engineers and the Society of Petroleum Engineers.

Specific qualifications and experience of particular relevance to our Company

Mr. Gass has 38 years of experience in the international exploration and production industry, including executive leadership experience, which is a valuable asset to our Board in its strategic planning and decision-making processes.

|

| |

| Francis S. Kalman |

| |

Age: 66 |

Director since: 2013 |

Committees: Audit Committee (Vice Chairman) |

Other Public Company Boards: Ensco plc, Kraton Performance Polymers, Inc., CHC Group Ltd. |

Mr. Kalman serves as a senior advisor to a private investment subsidiary of Tudor, Pickering, Holt & Co., LLC that specializes in direct investments in upstream, midstream and oilfield service companies. Mr. Kalman served as Executive Vice President of McDermott International, Inc. from 2002 until his retirement in 2008 and as Chief Financial Officer from 2002 until 2007. From 2000 to 2002, he was Senior Vice President and Chief Financial Officer of Chemical Logistics Corporation, from 1999 to 2000, he was a principal of Pinnacle Equity Partners, LLC, from 1998 to 1999, he was Executive Vice President and Chief Financial Officer of Chemical Logistics Corporation and from 1996 to 1997, he was Senior Vice President and Chief Financial Officer of Keystone International, Inc. Mr. Kalman started his career as a Certified Public Accountant with PriceWaterhouse & Co. In addition to the above, he has served in various financial capacities with Atlantic Richfield Company (1975 to 1982), United Gas Pipeline (1982 to 1991) and American Ref-Fuel (1991 to 1996). Mr. Kalman has a B.S. in Accounting from Long Island University.

In addition to his directorships on the boards of Ensco plc, Kraton Performance Polymers, Inc. and CHC Group Ltd., during the past five years, Mr. Kalman also served on the board of Pride International, Inc., which merged into Ensco plc.

Specific qualifications and experience of particular relevance to our Company

Mr. Kalman has extensive experience in accounting and financial reporting, including chief financial officer experience and serving as chairman of the audit committee of a public company. In addition to financial expertise, he also has executive leadership and strategic planning experience in the international energy service industry that complements the mix of skills of our other members of the Board.

|

| |

| William E. Macaulay |

| |

Age: 68 |

Director since: 1998 |

Committees: Compensation (Chairman) |

Other Public Company Boards: Dresser-Rand Group, Inc. (Chairman), CHC Group Ltd. (Chairman), Glencore Xstrata plc |

Mr. Macaulay is the Chairman and Chief Executive Officer of First Reserve Corporation. He has been with First Reserve, a private equity investment firm focused on the energy industry, since 1983. Mr. Macaulay is responsible for supervision of all aspects of the firm’s investment program and strategy, as well as overall management of the firm. Mr. Macaulay served as a director of Weatherford Enterra from October 1995 to May 1998. Mr. Macaulay also served as Director of Corporate Finance for Oppenheimer & Co., Inc., where he worked from 1972 to 1982. Mr. Macaulay holds a B.B.A. from City College of New York and an M.B.A. from the Wharton School of the University of Pennsylvania.

Currently, Mr. Macaulay serves as Chairman of Dresser-Rand Group, Inc., a supplier of compression and turbine equipment to the oil, gas, petrochemical and industrial process industries, and is a director of Glencore Xstrata plc, a multinational mining and commodities trading company headquartered in Baar, Switzerland. Mr. Macaulay also serves as Chairman of CHC Group Ltd., an international commercial operator of helicopters focusing on flight services to oil and gas companies and government search-and-rescue agencies, and helicopter maintenance, repair and overhaul services. Previously, Mr. Macaulay served as Chairman of the Board of Foundation Coal Holdings, Inc., a coal company, and as a director of Dresser, Inc., a provider of equipment and services in global energy infrastructures, National Oilwell Varco, Inc., an international provider of drilling systems and associated services to the oil and gas exploration and production industry, and Pride International, Inc., a contract drilling and related services company, which merged into Ensco plc.

Specific qualifications and experience of particular relevance to our Company

Mr. Macaulay’s investment and financial expertise, chief executive officer experience and extensive knowledge of the oilfield service industry are important assets to the Board in its decision-making process and in strategic planning.

|

| |

| Robert K. Moses, Jr. |

| |

Age: 74 |

Director since: 1998 |

Committees: Audit; Compensation; Health, Safety and Environment |

Other Public Company Boards: None |

Mr. Moses has been a private investor, principally in the oil and gas exploration and oilfield services business in Houston, Texas, for more than the past five years. He served as Chairman of the Board of Directors of Weatherford Enterra from May 1989 to December 1992 and as a director of Weatherford Enterra from December 1992 to May 1998. Mr. Moses holds a B.A. in Economics from the University of Texas at Austin.

Specific qualifications and experience of particular relevance to our Company

Mr. Moses’ investment experience, extensive knowledge of and experience in the oilfield service industry and institutional knowledge of one of Weatherford’s most significant legacy companies provide a unique perspective that is an asset to the Board in its decision-making process.

|

| |

| Guillermo Ortiz |

| |

Age: 65 |

Director since: 2010 |

Committees: Audit; Compensation |

Other Public Company Boards: Grupo Aeroportuario del Sureste S.A.B. de C.V., Grupo Comercial Chedraui S.A.B. de C.V., Mexichem S.A.B. de C.V., Vitro S.A.B. de C.V. |

Dr. Ortiz is Chairman of Banorte, the third largest bank in Mexico and served as Governor of the Bank of Mexico from 1998 until 2009, and as Chairman of the Board of the Bank for International Settlements (BIS) in 2009. He previously served as Secretary of Finance and Public Credit in Mexico, from 1994 to 1998. Dr. Ortiz was also Executive Director at the International Monetary Fund and is a director of several international non-profit organizations. Dr. Ortiz holds a B.A. in Economics from the National Autonomous University of Mexico and both a M.Sc. and a Ph.D. in Economics from Stanford University.

Specific qualifications and experience of particular relevance to our Company

Dr. Ortiz is a valuable member of the Audit Committee because of his extensive finance and banking experience, particularly relating to global economic matters and multinational financing. In addition, he brings to the Board an important international perspective.

|

| |

| Emyr Jones Parry |

| |

Age: 66 |

Director since: 2010 |

Committees: Corporate Governance & Nominating; Health, Safety and Environment (Chairman) |

Other Public Company Boards: None |

Sir Emyr has been the President of the University of Aberystwyth, located in Wales, since 2008, Chairman of the All Wales Convention, a body established by the Welsh Assembly Government to review Wales’s constitutional arrangements, since 2007, Chairman of Redress, a human rights organization, and Chairman of the Corporate and Social Responsibility External Advisory Group of First Group plc, a transport operator, since 2008. Sir Emyr previously held numerous diplomatic positions, including UK Permanent Representative to the UN from 2003 to 2007 and UK Ambassador to NATO from 2001 to 2003, after specializing in European Union affairs including energy policy. Sir Emyr received a B.S. in Theoretical Physics from the University of Cardiff and a Ph.D. in Polymer Physics from the University of Cambridge.

Specific qualifications and experience of particular relevance to our Company

Sir Emyr brings to the Board a wealth of government relations experience, a high level of public and social policy knowledge and an important international perspective that are valuable to the Board in making global business decisions.

|

| |

| Robert A. Rayne |

| |

Age: 65 |

Director since: 1987 |

Committees: Audit (Chairman); Corporate Governance & Nominating |

Other Public Company Boards: ChyronHego Corporation, Derwent London plc (Non-Executive Chairman), LMS Capital plc |

Mr. Rayne has been a non-executive director of LMS Capital plc, an investment company listed on the London Stock Exchange, since February 2010, and was the Chairman of LMS Capital from February 2010 to January 2012. Mr. Rayne was the Chief Executive Officer and a director of LMS Capital from June 2006, when the investment business of London Merchant Securities plc was demerged and LMS Capital was formed to hold this business, until February 2010. Mr. Rayne was employed by London Merchant Securities from 1968 to June 2006 and served as its Chief Executive Director from May 2001 to June 2006. Mr. Rayne attended Malvern College and received a diploma from the New York Institute of Finance in Accounting, Law, and Working in the Stock Exchange.

Mr. Rayne is Vice Chairman and Presiding Director of the Company’s Board. As Presiding Director, Mr. Rayne leads the executive sessions of the non-management directors, which are held at least twice each year.

Specific qualifications and experience of particular relevance to our Company

Mr. Rayne has expertise in a wide range of sectors in addition to the oilfield service industry, including the real estate, media, consumer and technology industries. His 27-year tenure on our Board and his financial and investment expertise, chief executive office experience, international perspectives and diversity of expertise are beneficial to the Board in carrying out its duties.

Former Director

Mr. Nicholas F. Brady served as a director of the Company beginning in 2004. Mr. Brady resigned from the Board of Directors in February 2014 due to other personal commitments.

Meetings of the Board and Committees

Meetings in 2013

During 2013, the Board of Directors met five times, the Audit Committee met 11 times, the Compensation Committee met four times, the Corporate Governance and Nominating Committee met four times and the Health, Safety and Environment Committee met one time, for its inaugural meeting. All of the directors participated in at least 75% of all Board of Director and respective committee meetings.

Committees

The Board has created the following committees: Audit; Compensation; Corporate Governance and Nominating; and Health, Safety and Environment. All members of the Audit, Compensation, Corporate Governance and Nominating, and Health, Safety and Environment Committees are considered independent under the current rules of the NYSE and the SEC. The members of each committee are shown in the following table.

|

| | | | |

| NAME | AUDIT | COMPENSATION | CORPORATE GOVERNANCE & NOMINATING | HEALTH, SAFETY & ENVIRONMENT |

| Bernard J. Duroc-Danner | | | | |

| David J. Butters | ü | | ü(Chairman) | |

| John D. Gass | | ü | | ü |

| Francis S. Kalman | ü | | | |

| William E. Macaulay | | ü(Chairman) | | |

| Robert K. Moses, Jr. | ü | ü | | ü |

| Guillermo Ortiz | ü | ü | | |

| Emyr Jones Parry | | | ü | ü(Chairman) |

| Robert A. Rayne | ü(Chairman) | | ü | |

Audit Committee

The Audit Committee has been established in accordance with Section 3(a)(58)(A) of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). The Board of Directors has adopted a written charter for the Audit Committee. The charter is available on our website at www.weatherford.com, by clicking on “About Weatherford,” then “Corporate Governance,” then “Committee Charters.” The primary functions of the Audit Committee are:

| |

| • | overseeing the integrity of our financial statements, financial reporting process and systems of internal accounting and financial controls; |

| |

| • | overseeing our compliance with legal and regulatory requirements; |

| |

| • | overseeing our independent auditor’s qualifications and independence; and |

| |

| • | overseeing the performance of our internal audit function and independent auditor. |

The Board of Directors has determined that Mr. Rayne is an “audit committee financial expert” as defined by applicable SEC rules because of his extensive financial experience. For more information regarding Mr. Rayne’s experience, please see his biography on page 8 of this Form 10-K/A.

Mr. Kalman currently serves on the audit committees of four public companies, including the Company’s Audit Committee. In connection with his commencement of service on the fourth audit committee, the Board of Directors of the Company determined that his service on these other audit committees would not impair his ability to effectively serve on the Company’s Audit Committee.

Compensation Committee

The Board of Directors has adopted a written charter for the Compensation Committee. The charter is available on our website at www.weatherford.com, by clicking on “About Weatherford,” then “Corporate Governance,” then “Committee Charters.” The primary functions of the Compensation Committee are:

| |

| • | evaluating the performance and determining and approving the compensation of our executive officers; |

| |

| • | making decisions regarding executive compensation, incentive compensation plans and equity-based plans; and |

| |

| • | administering or having administered our incentive compensation plans and equity-based plans for executive officers and employees. |

All members of the Compensation Committee satisfy the qualification standards of section 162(m) (“section 162(m)”) of the U.S. Internal Revenue Code of 1986, as amended (the “Code”), and Section 16 of the Exchange Act.

Corporate Governance and Nominating Committee

The Board of Directors has adopted a written charter for the Corporate Governance and Nominating Committee. The charter is available on our website at www.weatherford.com, by clicking on “About Weatherford,” then “Corporate Governance,” then “Committee Charters.” The primary functions of the Corporate Governance and Nominating Committee are:

| |

| • | identifying individuals qualified to serve as Board members; |

| |

| • | recommending to the Board the director nominees for the next Annual General Meeting of Shareholders; |

| |

| • | reviewing and structuring our compensation policy regarding fees and equity compensation paid and granted to our directors; |

| |

| • | developing and recommending to the Board the Corporate Governance Guidelines for the Company; |

| |

| • | overseeing the Board in its annual review of the Board’s and management’s performance; and |

| |

| • | recommending to the Board director nominees for each committee. |

Health, Safety and Environment Committee

The Board of Directors has adopted a written charter for the Health, Safety and Environment Committee. The charter is available on our website at www.weatherford.com, by clicking on “About Weatherford,” then “Corporate Governance,” then “Committee Charters.” The primary functions of the Health, Safety and Environment Committee are:

| |

| • | overseeing the Company’s adherence to policies, practices and procedures that promote best practices relating to health, safety and environmental stewardship; |

| |

| • | encouraging the Company to promote safety awareness among all employees and monitor safety performance and safety inspections; and |

| |

| • | providing suggestions and recommendations to executive management of the Company for resolution of health, safety and environmental concerns of strategic significance. |

Corporate Governance Matters

We are committed to adhering to sound principles of corporate governance. A copy of our Corporate Governance Principles is available on our website at www.weatherford.com, by clicking on “About Weatherford,” then “Corporate Governance,” then “Corporate Governance Policies.”

Director Nominations

In obtaining the names of possible nominees for directors, the Corporate Governance and Nominating Committee conducts its own inquiries and will consider suggestions from other directors, management, shareholders and other sources, and its process for evaluating nominees identified in unsolicited recommendations from shareholders is the same as its process for unsolicited recommendations from other sources. The Corporate Governance and Nominating Committee will consider nominees recommended by shareholders who submit their recommendations in writing to Chairman, Corporate Governance and Nominating Committee, care of the Corporate Secretary, Weatherford International Ltd., 4-6 Rue Jean-François Bartholoni, 1204 Geneva, Switzerland. Recommendations received before December 1st in any year will be considered for inclusion in the slate of director nominees to be presented at the Annual General Meeting in the following year. Unsolicited recommendations must contain the name, address and telephone number of the potential nominee, a statement regarding the potential nominee’s background, experience, expertise and qualifications, a signed statement confirming his or her willingness and ability to serve as a director and abide by our corporate governance policies and his or her availability for a personal interview with the Corporate Governance and Nominating Committee, and evidence that the person making the recommendation is a shareholder of Weatherford.

The Corporate Governance and Nominating Committee believes that nominees should possess the highest personal and professional ethics, integrity and values and be committed to representing the long-term interests of our shareholders. Directors should have a record of accomplishment in their chosen professional field and demonstrate sound business judgment. Directors must be willing and able to devote sufficient time to carrying out their duties and responsibilities effectively, including attendance at (in person) and participation in Board and Committee meetings, and should be committed to serve on the Board for an extended period of time. The Corporate Governance and Nominating Committee will consider whether and to what extent a nominee will bring diversity, whether in educational background, experience, expertise and/or regional knowledge, to the Board in determining whether a candidate will be an appropriate fit with, and an asset to, the Board of Directors.

Rule 14a-8 under the Exchange Act addresses when a shareholder may submit a proposal for inclusion of a nominee for director in our proxy materials. Shareholders who do not comply with Rule 14a-8 but who wish to have a nominee considered by our shareholders at the Annual General Meeting must comply with the deadlines and procedures set forth in our Articles.

Communication with Directors

Any shareholder or other interested party that desires to communicate with the Board of Directors or any of its specific members, including the Presiding Director or the non-management directors as a group, should send their communication to the Corporate Secretary, Weatherford International Ltd., 4-6 Rue Jean-François Bartholoni, 1204 Geneva, Switzerland. All such communications will be forwarded to the appropriate members of the Board.

Leadership Structure

|

| |

| | Our Board Leadership |

| | |

| Ÿ | Bernard J. Duroc-Danner is our Chairman and CEO. |

| | |

| Ÿ | Robert A. Rayne is our Vice-Chairman and Presiding Director over executive sessions of non-management directors. |

| | |

| Ÿ | Eight of our nine directors are independent. |

| | |

| Ÿ | All of the members of the Audit, Compensation, Corporate Governance and Nominating, and Health, Safety and Environment Committees are independent. |

The Board has determined that the most effective leadership structure for the Company is to combine the role of Chief Executive Officer and Chairman. The Board believes that by serving both as Chief Executive Officer and Chairman, Dr. Duroc-Danner brings multiple perspectives to the Board and also is best informed to lead the Board because of his role in the management of the Company’s business and strategic direction.

The Board has appointed Mr. Rayne as Presiding Director to preside over executive sessions of non-management directors. The Board believes it is in the best interest of the Company’s shareholders to have a Presiding Director who has the authority to call executive sessions as a counterbalance to the Company’s combined roles of Chief Executive Officer and Chairman. The Board believes executive sessions provide the Board with the ability to independently evaluate management, openly discuss strategic and other business issues involving the Company and ensure that the Company is upholding high standards of corporate governance. For information on how to communicate with our Presiding Director and other non-management members of the Board of Directors, please see “Communication with Directors.”

Executive Sessions

Executive sessions of non-management directors are held after each regularly scheduled Board meeting and at such additional times as may be needed. In 2013, the non-management directors held four executive sessions.

Director Attendance at Annual General Meeting

All directors are expected to attend our 2014 Annual General Meeting of Shareholders. All of our directors other than Mr. Brady attended our 2013 Annual General Meeting of Shareholders.

Code of Conduct

We have adopted a Code of Business Conduct that applies to our directors, officers and employees. We also have adopted a Supplemental Code of Business Conduct that applies to our President and Chief Executive Officer, our Chief Financial Officer and our Chief Accounting Officer. These documents are available on our website at www.weatherford.com, by clicking on “About Weatherford,” then “Corporate Governance,” then “Code of Business Conduct” or “Supplemental Code of Conduct,” as applicable. Any amendments to, or waivers of, our Code of Business Conduct (to the extent applicable to our President and Chief Executive Officer, our Chief Financial Officer or our Chief Accounting Officer) or to the Supplemental Code of Business Conduct will be posted at this location on our website.

Risk Management Oversight

The Audit Committee is responsible for the oversight of risk management for the Company. As part of their oversight function, the Audit Committee discusses and implements guidelines and policies concerning financial and compliance risk assessment and risk management, including the process by which major financial risk exposure is monitored and mitigated, and works with members of management to assess and monitor risks facing the Company’s business and operations, as well as the effectiveness of the Company’s guidelines and policies for managing and assessing financial and compliance risk. The Audit Committee meets and discusses, as appropriate, issues regarding the Company’s risk management policies and procedures directly with those individuals responsible for day-to-day risk management in the Company’s internal audit and compliance departments.

In addition, the Corporate Governance and Nominating Committee periodically provides oversight with respect to risks associated with our corporate governance policies and practices, including our Code of Business Conduct and Supplemental Code of Business Conduct. The Corporate Governance and Nominating Committee also oversees and reviews, on an annual basis, an evaluation of the Board, each of our Board committees and management.

The Compensation Committee reviews our compensation plans and practices to ensure that they do not encourage excessive risk taking and instead encourage behaviors that support sustainable value creation. See “Risk Analysis of our Compensation Programs” in the Compensation Discussion and Analysis section of this Form 10-K/A.

Our Health, Safety and Environment Committee oversees the Company’s policies and practices to promote good stewardship, to encourage safety awareness, to monitor safety performance, and to provide suggestions to management for the resolution of health, safety and environmental concerns, all with a view towards reducing risks in those areas.

Executive Officers

The following persons are our executive officers and their ages as of April 16, 2014. (Dr. Duroc‑Danner’s biography is presented on page 4). None of the executive officers or directors have any familial relationships with each other.

|

| | |

| Name | Age | Position |

| Bernard J. Duroc-Danner | 60 | Chairman of the Board, President and Chief Executive Officer |

| Krishna Shivram | 51 | Executive Vice President and Chief Financial Officer |

| Dharmesh Mehta | 48 | Executive Vice President and Chief Operating Officer |

| Douglas M. Mills | 39 | Vice President and Chief Accounting Officer |

| Alejandro Cestero | 39 | Vice President, Co-General Counsel and Corporate Secretary |

| William B. Jacobson | 45 | Senior Vice President, Co-General Counsel and Chief Compliance Officer |

Krishna Shivram was appointed Executive Vice President and Chief Financial Officer in November 2013. Mr. Shivram has over 25 years of financial and operational management experience in the oilfield service industry and previously worked for Schlumberger Ltd. in a variety of roles across the globe. Immediately prior to joining Weatherford, Mr. Shivram had served as Vice President and Treasurer of Schlumberger Ltd. since January 2011. Prior to his serving as Vice President and Treasurer, Mr. Shivram held a number of senior management positions at Schlumberger, including Controller - Drilling Group from May 2010 to January 2011, Manager - Mergers and Acquisitions from May 2009 to April 2010 and Controller - Oilfield Services from August 2006 to April 2009. Mr. Shivram is a Chartered Accountant and has experience in financial accounting, income taxes and treasury operations, along with a strong background in corporate finance and mergers and acquisitions.

Dharmesh Mehta was appointed Executive Vice President in March 2013 and Chief Operating Officer in November 2013. Mr. Mehta joined the Company in 2001 and has served in various senior management capacities, including Senior Vice President - Completion and Production Systems and Chief Administrative Officer. Prior to joining the Company, Mr. Mehta had 10 years of experience in the software and oil and gas industries. Mr. Mehta holds a bachelor’s degree from the University of Houston and a master’s degree from the University of Wisconsin.

Douglas M. Mills was appointed Vice President and Chief Accounting Officer in June 2013 and serves as the Company’s principal accounting officer. Mr. Mills joined Weatherford in 2003 and has served in various financial reporting capacities, including Vice President of Corporate Accounting since 2011, and has had other corporate and regional controller positions of increasing responsibility while at Weatherford. Mr. Mills has over five years of public accounting experience with the firms of Ernst & Young and Arthur Andersen. He is a certified public accountant and holds a MPA/BBA from the University of Texas.

Alejandro Cestero was appointed Vice President and Co-General Counsel in July 2013. Mr. Cestero previously served as Vice President, General Counsel, Secretary and Chief Compliance Officer of Lufkin Industries, Inc. from May 2011 to July 2013. Prior to joining Lufkin, Mr. Cestero was the Senior Vice President, General Counsel, Secretary and Chief Compliance Officer of Seahawk Drilling, Inc. from August 2009 until February 2011. In February 2011, having experienced a significant, prolonged reduction in its cash flow as a result of the deepwater offshore drilling moratorium declared in response to the Deepwater Horizon/BP oil spill in the Gulf of Mexico, Seahawk Drilling filed for reorganization under Chapter 11 of the United States Bankruptcy Code and its assets were simultaneously sold to Hercules Offshore, Inc. Prior to his work with Seahawk Drilling, Mr. Cestero was employed by Pride International, Inc. where he served in various positions within the General Counsel’s office, including as Deputy General Counsel-Business Affairs and Assistant Secretary. Prior to joining Pride International, he was an attorney with the international law firms of Bracewell & Giuliani LLP and Vinson & Elkins LLP. Mr. Cestero holds a J.D. from Stanford University Law School and a B.A. and an M.B.A. from Rice University.

William B. Jacobson joined the Company in March 2009 and was appointed Vice President and Chief Compliance Officer in June 2009, Co-General Counsel in December 2009 and Senior Vice President in March 2012. During the past five years, Mr. Jacobson also served as a federal prosecutor for the Fraud Section of the U.S. Department of Justice’s Criminal Division, where he held various positions, including Assistant Chief for FCPA Enforcement, and was in private practice. Mr. Jacobson holds a B.A. from Tufts University and a J.D. from Georgetown University Law Center.

Section 16(a) Beneficial Ownership Reporting Compliance

All of our executive officers and directors are required to file initial reports of share ownership and reports of changes in ownership with the SEC pursuant to Section 16(a) of the Exchange Act.

We have reviewed these reports, including any amendments, and written representations from the executive officers and directors of the Company. Based on this review, we believe that, except as set forth below, all filing requirements were met for the executive officers subject to Section 16(a) and our directors during 2013. Due to an administrative error by Dr. Guillermo Ortiz, a Form 4 that was required to be filed in January of 2013 was not filed until April 11, 2013.

|

| |

| Item 11. | Executive Compensation |

Compensation Discussion and Analysis

This Compensation Discussion and Analysis (“CD&A”) is designed to provide shareholders with an understanding of our compensation philosophy, core principles, and decision making process. It explains the compensation-related actions taken with respect to our executive officers who are identified in the Summary Compensation Table (the “NEOs”). Details regarding the compensation we paid to the NEOs for 2013 are found in the tables and narrative which follows them.

Summary Discussion

Our compensation program is designed to reward our NEOs currently serving the Company (“current NEOs”) for the achievement of strategic and operational goals and the achievement of increased shareholder value while at the same time avoiding the encouragement of unnecessary or excessive risk-taking.

2013 Highlights

In 2013 Weatherford achieved significant progress in key areas:

| |

| • | We successfully remediated our material weakness in internal control over income tax accounting; |

| |

| • | We negotiated a settlement of our U.S. governmental investigations; |

| |

• | We initiated a focus on cash and returns as a guiding principle and value system and substantially improved our working capital metrics; |

| |

• | We commenced our divestiture of non-core assets; and |

| |

• | We achieved significant improvement in our safety statistics over prior years. |

We believe that these achievements position Weatherford on a path towards capital efficiency, operational excellence, and administrative quality.

Our Company’s Future

After a constructive year of problem-solving in 2013, as noted above, our financial and operational performance is now turning around. We have put legacy issues behind us, and we are now keenly focused on improving our performance and consequently generating value for our shareholders. We have identified three initiatives that will drive us in 2014 and beyond:

| |

| • | Core. We will grow our core, with emphasis on four product lines: well construction, formation evaluation, completion, and artificial lift. We have begun an aggressive divestiture program to dispose of non-core assets and business lines: land drilling rigs, pipeline and specialty services, drilling fluids, testing and production services, and wellheads. In March 2014 we signed an agreement to sell our pipeline and specialty services business. |

| |

| • | Cost. We will emphasize efficiency and cost-saving. Running support functions and operations with a lower cost structure is now a key management metric for us. We have embarked on an aggressive cost-reduction program, including a lower support headcount and eliminating unprofitable operations. |

| |

| • | Cash. We plan to generate free cash flow, efficient working capital, and lower capital intensity compatible with growing our core. We will strive to reduce our net debt to total capitalization ratio from 52% to 25% over the next few years through a combination of higher free cash flow augmented by the proceeds of divestitures. |

We believe these initiatives serve as key principles and elements of our compensation program.

Compensation Highlights

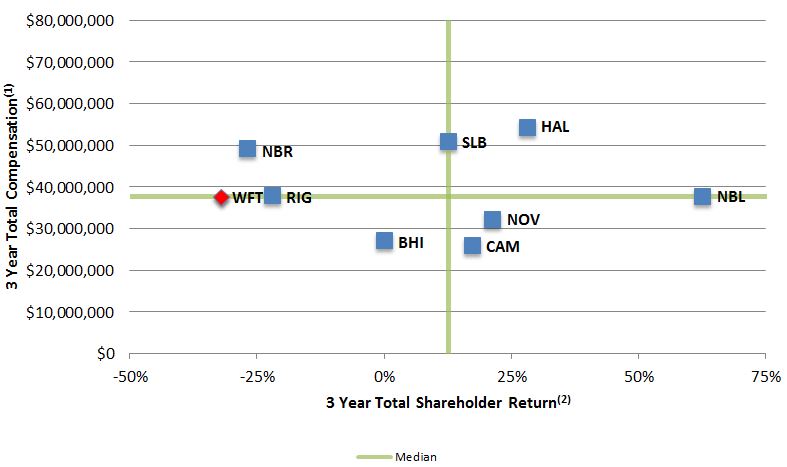

We structure our executive compensation program to align pay with performance. Our CEO’s compensation for the years 2011-2013, relative to our peers, correlates strongly with our total shareholder return for the three year period ended December 31, 2013, relative to our peers.

| |

| (1) | 3-Year Total Compensation is the sum of base salary, annual incentives, bonuses, long-term incentive awards and all other compensation paid (perquisites and change in pension included) for the years 2011-2013 for our chief executive officer and for the chief executive officer of each of our peers as reported in their respective publicly available proxy statements, other than Nabors Industries Ltd., whose information is for the years 2010-2012 due to the lack of publicly available information for 2013. |

| |

| (2) | 3-Year Total Shareholder Return is the percentage increase (or decrease) in stock price for the three years ended December 31, 2013, adjusted for cash dividends paid. |

Source: Longnecker & Associates research.

Pro-Active Approach to Executive Compensation

Over the past two years, we have engaged with our investors to improve our executive compensation program based on their feedback.

| |

| • | In 2012 and 2013, we engaged with shareholders in response to the negative say-on-pay vote of 2011, and addressed the primary concerns that led to the negative result. During 2013, the approval of our say-on-pay proposal for 2012 compensation was over 70%. To continue to further understand investor concerns, during 2013, we reached out proactively to our 50 largest shareholders, and had meaningful engagement, including telephonic and personal meetings, with 19 of our 20 largest investors regarding executive compensation. No major concerns regarding compensation were raised by these investors. |

We have established and continue to maintain preferred pay practices in our executive compensation program.

| |

| • | We pay annual bonuses to executives only on the achievement of pre-determined and measurable objectives that benefit our Company and shareholders. |

| |

| • | For 2013 those objectives focused on profitability, capital efficiency and safety. |

| |

| • | For 2014, we have established similar pre-determined and measurable objectives, including objectives focused on cost savings achieved and net debt reduction. |

| |

| • | The primary retirement benefit available to our CEO is denominated in shares such that the value of that benefit correlates directly with shareholder returns. |

| |

| • | We prohibit our executives, as well as directors, from engaging in hedging or derivative transactions involving our shares. |

| |

| • | We have an Executive Compensation Clawback Policy, a copy of which has been filed with the SEC. |

| |

| • | We maintain share ownership guidelines, requiring executive officers to hold equity equivalent in value to three times (or six times in the case of the CEO) their latest annual base salary. |

| |

| • | The severance benefits under our executive employment agreements are not augmented by a change of control and are “double-trigger” arrangements. |

We avoid objectionable pay practices in our executive compensation program.

| |

| • | We do not pay discretionary bonuses or multi-year guaranteed bonuses, except in the case of extraordinary achievement or sign-on bonuses. |

| |

| • | We do not provide Section 280G or Section 409A tax gross-ups. |

We engage in best governance practices with respect to executive compensation.

| |

| • | Our Compensation Committee comprises only independent directors. |

| |

| • | The Compensation Committee engaged a compensation consultant that is independent of management and the Company, and the Committee meets with the consultant in executive sessions separate from management. |

| |

| • | We provide detailed, forward-looking disclosure of our current year annual cash incentive metrics and long-term performance metrics. See “2014 Annual Incentive Goals” on page 22 and “-Grants in 2014” on page 25. |

| |

| • | We compare our executives’ total compensation to a consistent peer group for market comparable data. We regularly evaluate that peer group to ensure it is appropriate to the Company, but we add or remove peers only when clearly warranted. |

| |

| • | We conduct an annual comprehensive risk analysis of our executive compensation program with our independent compensation consultants to ensure that our program does not encourage inappropriate risk-taking. |

| |

| • | We review annually a calculation of the shareholder value transfer and “burn rate” resulting from equity grants to ensure they are not excessive. |

This CD&A Covers Our NEOs

This CD&A covers the compensation of all of our current NEOs, namely:

| |

| • | Dr. Bernard J. Duroc-Danner, Chairman, President and Chief Executive Officer |

| |

| • | Mr. Krishna Shivram, Executive Vice President and Chief Financial Officer |

| |

| • | Mr. Dharmesh Mehta, Executive Vice President and Chief Operating Officer |

| |

| • | Mr. William B. Jacobson, Senior Vice President, Co-General Counsel and Chief Compliance Officer |

We also address historical compensation with respect to Mr. Peter T. Fontana, who retired effective December 13, 2013, but was Executive Vice President and Chief Operating Officer until that date, Mr. John H. Briscoe, who left the Company effective September 11, 2013 but was Senior Vice President and Chief Financial Officer until that date, Mr. Nicholas W. Gee, who left the Company effective February 28, 2014, but was Executive Vice President, Strategy and Development and Chief Safety Officer until that date, and Mr. Joseph C. Henry, who left the Company effective June 30, 2013 but was Senior Vice President and Co-General Counsel until that date, as all four are considered NEOs for 2013 pursuant to applicable SEC rules.

Elements of Our Executive Compensation Package

Our compensation program is designed to reward our NEOs for the achievement of strategic and operational goals and the achievement of increased shareholder value, while at the same time avoiding the encouragement of unnecessary or excessive risk-taking. The following table summarizes the objective of each element of our NEOs’ compensation package, the key features of those elements and the extent to which the element is performance-based. This table should be read in conjunction with our Summary Compensation Table on page 30 and the more detailed discussion under “Our Executive Compensation Program” beginning on page 20.

|

| | | |

| Compensation Element | Objective | Key Features | Performance/At-risk? |

| Base Salary | To provide a base level of income. | Reviewed annually and subject to upward adjustment based on market factors, experience, individual performance and leadership. | No. |

| Annual Cash Incentive | To motivate and reward executives’ contributions to the achievement of predetermined financial and operational objectives. | Compensation Committee establishes performance measures that incentivize performance relevant to meeting financial, operational and safety goals that will ultimately drive shareholder value. | Yes, pays out only based on achievement of pre-set, measurable goals; may not pay out. |

| Performance Units (Long-Term Equity Awards) | To correlate realized pay with increases in shareholder value on absolute terms over a long-term period. | In periods of low shareholder return, executives realize little or no value. In periods of high shareholder return, executives may realize substantial value. | Yes, pays out only based on increased shareholder value; may not vest depending upon shareholder return. |

Restricted Share Units (Long-Term Equity Awards) | To incentivize management to contribute to long-term increases in shareholder value. To retain executives in the hyper-competitive energy market. | Provides “skin in the game.” A portion of NEOs’ compensation is paid in equity, and value is realized based on future share price. Provides a straight-line, direct correlation of realized pay to increase in shareholder value. | Yes, value increases or decreases in correlation to share price. |

| Severance | To provide a measure of financial security in the event an executive’s employment is terminated without cause. To attract and encourage retention and to ensure continued dedication by executive officers. | Severance benefits are provided pursuant to the executive officers’ employment agreements. Change of control benefits are “double trigger” arrangement. | No, except does not apply in termination for cause or voluntary termination without good reason. |

| Broad-based Retirement Plans | To provide retirement savings in tax‑efficient manner. | Executives participate in retirement plans such as 401(k) plans that are generally available to all employees, including matching contributions. | No. |

| CEO Retirement Plan | To further align our CEO’s long term interests with shareholder value.

| We previously maintained a Supplemental Executive Retirement Plan (“SERP”). The vested, fixed balance of the CEO’s primary pension benefit is denominated in shares, such that the benefit value is linked directly to share value in a 1:1 correlation. The SERP was frozen in 2010, and no further contributions have been made to any employees. None of our NEOs, other than our CEO, participate in the SERP. | Yes, value is based on share price and increases or decreases in correlation to share price. |

| Perquisites | We provide limited perquisites to executives to assist executives in carrying out their duties and increasing productivity. | Perquisites provided to executives include club membership dues and an auto allowance. Perquisites are industry standard and included in many cases for non-executive employees. | No. |

| Expatriate Benefits | To assist in absorbing part of the additional burden of an overseas assignment. | As a multi-national industry, ex‑pat benefits, including housing and schooling assistance and tax normalization, are industry standard. Tax benefits provided to executives are less than those provided to non‑executive expatriates. | No. |

Oversight of Our Executive Compensation Practices

Our executive compensation program is administered by the Compensation Committee of the Board of Directors. The Committee currently consists of four directors, Messrs. Gass, Macaulay (Chairman), Moses, and Dr. Ortiz. At all times in 2013, all of the persons serving on the Committee were independent, as defined by the standards of the NYSE, and satisfied the qualification standards of section 162(m) of the Code and Section 16 of the Exchange Act. The members of the Committee draw upon a combination of their respective business experience, other board service, advice from our independent compensation consultant, and director continuing education through third party service providers in order to keep themselves abreast of current trends and best practices in the area of executive compensation.

The Committee is responsible for, among other functions, reviewing and approving the total compensation for our NEOs consistent with the philosophy and objectives described below.

Compensation Philosophy and Objectives

The Committee follows a “pay for performance” philosophy in our executive compensation structure. The Committee’s objective is to provide compensation to our executive officers at a level and in a manner that maximizes shareholder value.

The Committee believes that our executive compensation program should reward enhanced financial performance of the Company and maximize shareholder value by aligning the short-term and long-term interests of our executive officers with those of our shareholders. Our programs are intended to:

| |

| • | Attract, retain and motivate individuals of outstanding ability in key executive positions; |

| |

| • | Drive and reward strong business performance to create superior value for our shareholders; |

| |

| • | Ensure that performance-based compensation does not encourage excessive risk taking; and |

| |

| • | Encourage our executives to focus on both the short-term and long-term performance goals of the Company. |

Our executive compensation also is intended to be market competitive. For 2013, the Committee approved base salary, annual performance compensation and long-term incentive compensation (together, the “total direct compensation”) for each NEO that was intended to be competitive with our peer group. However, in setting the compensation of our NEOs, the Committee also takes into consideration historical and individual circumstances, including tenure and experience, individual performance, anticipated future contributions, retention factors, including apparent career alternatives for each individual, and the availability of comparable data for certain positions.

The Committee believes that a majority of executive compensation should be “at risk” – that is, the ultimate, realized value of the compensation is tied to the Company’s financial and equity performance. During periods when our financial performance meets or exceeds established objectives, we believe that NEOs should be rewarded under our incentive compensation programs for their efforts in achieving our goals. Likewise, when our performance does not meet the established goals, incentive compensation may be reduced or eliminated.

Incentive compensation is designed to balance short-term annual results and long-term multi-year success of the Company. Short-term awards primarily are payable in cash, while long-term awards are equity-based awards.

To further illustrate our pay-for-performance, below is our CEO’s total compensation for the last three years, as set forth in the Summary Compensation Table of this Form 10-K/A and our annual proxy statements, compared to the total amount of compensation realized by our CEO for each year. As performance thresholds were not met for certain performance units previously granted to our CEO, his 2013 realized compensation was significantly lower than his total compensation as described in the Summary Compensation Table.

|

| | | | | | |

| Years | Total Compensation(a) | Total Realized Compensation(b) |

| 2013 | $ | 13,157,887 |

| $ | 5,721,947 |

|

| 2012 | $ | 7,177,376 |

| $ | 7,898,312 |

|

| 2011 | $ | 17,317,221 |

| $ | 11,931,255 |

|

(a)As set forth in the Summary Compensation Table, and includes salary, non-equity incentives, bonus, long term incentive awards (granted during the year and valued as of the grant date), change in actuarial value of pension benefit and all other compensation, as described therein.

(b)Includes all compensation set forth in the Summary Compensation Table and described in the preceding footnote with the following exceptions: (i) the actuarial value of pension benefit is excluded as it does not reflect actual compensation received, but rather reflects an increase in the year-over-year present value of the actuarial future benefit, and (ii) long term incentive awards (e.g. RSUs and PUs), are included only to the extent they were “realized”, i.e. to the extent they vested (or restrictions lapsed) during the years set forth above.

Clawback Policy

Our Weatherford International Executive Compensation Clawback Policy sets out the terms under which we may seek to recover incentive compensation from our officers under certain circumstances. The purpose of the policy is to enable the Committee to recoup performance-based compensation that is paid but is subsequently determined not to have been earned because financial results are restated, including if the Committee determines that an officer has engaged in fraud, willful misconduct or gross negligence that has caused or contributed to a restatement of our financial statements.

Mandatory Minimum Share Ownership Guidelines

The Committee believes that it is important to align the interests of management with the interests of our shareholders. In furtherance of this philosophy, the Company has adopted the following mandatory minimum share ownership guidelines. Share ownership includes shares owned directly as well as equity-based awards not yet fully vested, deferred compensation plans and retirements plans (including our 401(k) plan and suspended plans). The minimum guidelines are based on a multiple of the latest annual base salary or, in the case of directors, annual cash retainer. The guidelines are as follows:

|

| |

| Chief Executive Officer | 6x |

| Other executives | 3x |

| Directors | 5x |

A transition period of two years is allowed for new directors to achieve the ownership amount. Executive officers are required to achieve ownership amounts within three years of hire or appointment.

The Committee has reviewed the share ownership of our executive officers and directors and, subject to the transition periods described above, determined that they meet or exceed these share ownership guidelines.

Risk Analysis of our Compensation Programs

The Committee reviews our compensation plans and policies to ensure that they do not encourage unnecessary risk taking and instead encourage behaviors that support sustainable value creation. In 2013, the Committee, with the assistance of L&A, reviewed the Company’s compensation policies and practices for executive officers, and believes that our compensation programs are not reasonably likely to have a material adverse effect on the Company. We believe the following factors reduce the likelihood of excessive risk-taking:

| |

| • | The program design provides a balanced mix of cash and equity, annual and long-term incentives, fixed and variable pay, and performance metrics; |

| |

| • | Maximum payout levels for bonuses are capped; |

| |

| • | The Committee has downward discretion over incentive program payouts; |

| |

| • | Executive officers are subject to share ownership guidelines; |

| |

| • | Compliance and ethical behaviors are integral factors considered in all performance assessments; and |

| |

| • | The Company has a clawback policy. |

Compensation Consultants and Independence

As set forth in its charter, which can be found on our website, the Committee has the authority to retain and terminate compensation consultants to provide advice to the Committee. The Committee retained Longnecker & Associates (“L&A”) in 2013 to provide information, analyses and advice regarding executive compensation. The NYSE has adopted guidelines for Compensation Committees to consider when identifying Committee adviser independence. The Committee reviewed these guidelines and determined that L&A is an independent consultant, and L&A performs no services for the Company other than those related to executive and non-employee director compensation.

Our management communicates with L&A and provides data to L&A regarding our executive officers, but does not direct L&A’s activities. L&A has not performed or provided compensation services in the past to our management.

Market Analysis and Peer Group

When considering our compensation practices and levels, the Committee reviews the compensation practices and levels of a peer group of publicly-traded energy service and exploration and production companies to determine market levels. There are a limited number of companies and potential peers for us to determine an appropriate peer group. The Committee periodically reviews the composition of our peer group to ensure that the companies in the group are relevant for comparative purposes and have executive positions with responsibilities similar to ours and that compete with us for executive talent. The Committee and L&A review data for potential peers relating to enterprise value, revenue and market capitalization. Based on these factors and directly comparable business lines, the Committee determined that the following companies would comprise our peer group for 2013. The Company’s revenues were in the 50th percentile of this peer group. This is the same peer group we used in 2012, and we used the same peer group in early 2014 to establish executive compensation for 2014:

|

| | | |

| • | Baker Hughes Incorporated | • | National Oilwell Varco, Inc. |

| • | Cameron International Corporation | • | Noble Energy Inc. |

| • | Halliburton Company | • | Schlumberger Limited |

| • | Nabors Industries Ltd. | • | Transocean Ltd. |

Section 162(m) of the Internal Revenue Code

The Committee considers the tax impact of our executive compensation programs. Section 162(m), as interpreted by U.S. Internal Revenue Service Notice 2007-49, imposes a $1 million limitation on the deductibility of certain compensation paid to certain officers. As a multi-national Swiss company, the significant majority of our executive compensation is not a U.S. tax expense, so section 162(m) is not a concern for the Company. The Committee may take into account the potential application of section 162(m) on incentive compensation awards and other compensation decisions, and it may approve compensation that will not meet these requirements in order to ensure competitive levels of compensation for our executive officers.

Our Executive Compensation Program

Below is a detailed discussion and analysis of each component of our executive compensation as applied to each of our NEOs for 2013 and 2014.

Base Salary

Base salary provides a fixed level of compensation to the executive, representative of his skills, responsibilities and experience. Base salaries for our executive officers are reviewed annually. Proposed increases to base salaries are reviewed by the Committee following recommendations from Dr. Duroc-Danner (other than for his own base salary). The Committee does not rely on predetermined formulas or criteria when evaluating executive base salaries, but considers comparable market data provided by L&A. The Committee also considers individual contributions, retention and succession planning concerns in setting base salaries.

Dr. Duroc-Danner’s salary has not been increased in over five years. His salary is higher than the average salary of CEOs of our peers. However, the Committee believes his salary is appropriate in light of his unique experience and in-depth understanding of our industry - having led the Company for 27 years - and considering alternative career opportunities that could be available to him. None of the CEOs of our peers has this level of experience or tenure.

Mr. Shivram joined the Company and became an NEO in 2013. His salary was determined based on market factors and value he was giving up at his previous employer when he was hired as Chief Financial Officer in November 2013. In light of his recent hire, he received no increase in base salary for 2014.

Mr. Mehta became an NEO in 2012. His salary was set based on market factors and the personal contribution he has made to the Company. For 2014, he received a 5% increase in base salary as a market adjustment, considering his promotion from Chief Administrative Officer to Chief Operating Officer and the significant contribution he made in 2013 in helping direct and coordinate internal organizational and systems improvements.

Mr. Jacobson did not receive a salary increase for 2013 or 2014.

The table below shows the annual base salaries of the NEOs currently serving the Company effective after adjustments for the applicable year. Where adjustments were made during the year, these annualized amounts may be higher than the actual amount paid for the entire year. See the Summary Compensation Table on page 30 for the actual amounts paid.

|

| | | | | | | | | | |

| Executive | 2012 Salary | | 2013 Salary | | 2014 Salary | | |

| Dr. Duroc-Danner | CHF | 1,760,000 |

| CHF | 1,760,000 |

| CHF | 1,760,000 |

| |

Mr. Shivram(a) | | — |

| $ | 750,000 |

| $ | 750,000 |

| |

| Mr. Mehta | $ | 620,000 |

| $ | 715,000 |

| $ | 750,000 |

| |

| Mr. Jacobson | $ | 1,000,000 |

| $ | 1,000,000 |

| $ | 1,000,000 |

| |

| (a)Information for 2012 is not presented for Mr. Shivram as he joined Weatherford in 2013. |

Annual Incentive Compensation

Our annual incentive compensation is generally structured to deliver cash payouts in line with market multiples when performance targets are achieved or exceeded. The Committee annually establishes the terms of any awards under our Executive Non-Equity Incentive Compensation Plan (the “ICP”), including the financial metrics and goals for each award, during the first quarter.

For each award under the ICP, the Committee establishes goals at three levels: threshold, target and superior. Target represents a strong but achievable level of performance that will increase shareholder value. Superior represents an extraordinary level of performance that will substantially increase shareholder value. Threshold is the entry-level of performance under the ICP, established so that smaller awards will be earned for satisfactory performance short of target.

The Committee establishes potential award payments as a percentage of the executive’s annual base salary in effect at the end of the plan year, with a percentage determined for achievement of threshold, target or superior level. If results fall between the threshold and target goal levels or between the target and superior goal levels, the award payment will be determined by linear interpolation to derive the percentage of salary.

2013 Annual Incentive Results

For 2013, the Committee adopted multiple metrics to determine the short-term incentive payouts that include goals based on profitability, capital efficiency and safety as set forth in the following table, which also shows the actual results of these metrics.

|

| | | | | | | |

($ in millions) Objective | | Profitability | | Capital Efficiency | | Safety |

| Performance Metric | Operating Income(a) | Reduction in Days Working Capital(b) | Lost-Time Incident Rate | Preventable Vehicle Incident Rate |

| Metric Weight | | 45% | | 45% | | 5% | 5% |

| 2013 Superior | | $2,757 | | 12 days | | 0.14 | 0.69 |

| 2013 Target | | $2,282 | | 10 days | | 0.15 | 0.73 |

| 2013 Threshold | | $2,007 | | 8 days | | 0.17 | 0.81 |

| 2013 Actual | | $1,715 | | 14 days | | 0.15 | 0.62 |

| |

| (a) | Operating Income is regional operating income before corporate, R&D and items. |

| |

| (b) | Days Working Capital is calculated as [(Receivables + Inventory - Payables)/Annual Revenue] * 365 and the reduction is based on the change from December 31, 2012 to December 31, 2013. |

The Company did not achieve the threshold level for profitability in 2013. However, the Company achieved substantial improvements in its capital efficiency and met or surpassed targets in its safety metrics, which resulted in the non-equity incentive payments reflected in our Summary Compensation Table on page 30. These payouts are calculated based on the program as described above and do not include any discretionary additional payouts. Our CEO’s target annual incentive potential for 2013 was CHF 2,112,000. His maximum potential was CHF 4,224,000, but his achieved and paid incentive was CHF 2,217,600.

2014 Annual Incentive Goals

For 2014, the Committee’s approach has evolved slightly. The Committee adopted a plan to ensure that all of the Company’s key focus areas are covered by its officer group. The goal for 2014 is to incentivize the officers to transform the Company, with these key strategies:

| |

| • | focus on and grow the core of the Company’s business; |

| |

| • | divest non-core businesses; |

| |

| • | continue to improve our safety record. |

The objectives for Dr. Duroc-Danner and Messrs. Shivram and Mehta, i.e. the current NEOs who received objectives and who are collectively referred to as the “Executive Management,” are 25% related to profitability (defined by non-GAAP earnings per share instead of operating income), 25% related to cost reduction (defined by annualized cost savings), 20% related to free cash flow generation, 20% related to net debt reduction, and 10% for achievement of safety objectives. “Earnings per share” (“EPS”) means earnings per share from continuing operations before charges and credits and includes both core and non-core businesses and will be adjusted as and when non-core businesses are divested. “Annualized cost savings” means reductions in costs during the year, including but not limited to headcount reduction, closure of uneconomic or marginal locations, savings in foreign-exchange and hedging costs, and savings from manufacturing consolidations and variances; however annualized savings do not include any reductions in our cost base as a result of divesting any businesses from our previously announced divestiture program. “Free cash flow” (“FCF”) means net income from continuing operations before charges and credits and including both core and non-core businesses, plus depreciation and amortization, plus or minus movement in working capital accounts (accounts receivable, inventories and accounts payable), minus capital expenditures. The safety objective includes lost-time injury rate (“LTIR”) and preventable vehicle injury rate (“PVIR”) and the safety incentive is split equally between these two measures.

The Committee determined that, given these executives’ senior roles at the Company, and the fundamental importance of these objectives in creating value for our shareholders, all of our Executive Management, and most of our other officers, should have these common objectives. In lieu of these objectives, certain non-Executive Management officers were given other goals with particular focus on their business or corporate responsibilities.

The table below shows the threshold, target and superior objectives for our Executive Management for 2014:

|

| | | | | |

| ($ in millions, except per share amounts) |

| Objective | Profitability | Cost Reduction | Free Cash Flow | Net Debt Reduction | Safety |

| Performance Metric | Earnings per Share | Annualized Cost Savings | FCF | Amount of Reduction | LTIR/PVIR |

| Metric Weight | 25% | 25% | 20% | 20% | 10% |

| 2014 Superior | $1.30 | $600 | $700 | $1,200 | 0.13/0.60 |

| 2014 Target | $1.10 | $500 | $500 | $800 | 0.14/0.61 |

| 2014 Threshold | $0.90 | $400 | $300 | $600 | 0.15/0.62 |

| 2013 Actual | $0.60 | n/a | $(346) | $42 | 0.15/0.62 |

The Committee believes that these metrics are appropriate representations of and incentives towards the relevant objectives of profitability, cost reduction, free cash flow generation, net debt reduction and safety, and that the weighting assigned to each element is appropriate. The targets are also tied to internal budgets and expectations and require significant improvement over the performance in 2013. The Committee believes these targets are rigorous and are at or above market expectations.

.

The potential payouts under the 2014 annual bonus structure for our Executive Management, expressed as a percentage of salary based on achievement of various levels, as shown in the table below, are percentages we determined to be within market ranges based on market data from the Company’s peer group and industry. These are the same percentages that were set for 2013 for individuals with similar titles. For each metric, the percentage of salary determined by performance will be multiplied by the weighting percentage for the metric shown above to determine the payout on that metric.

|

| | | | | | | | | |

| | Threshold |

| | Target |

| | Superior |

| |

| Dr. Duroc-Danner | 60 |

| % | 120 |

| % | 240 |

| % |

| Mr. Shivram | 50 |

| % | 100 |

| % | 200 |

| % |

| Mr. Mehta | 50 |

| % | 100 |

| % | 200 |

| % |

Award payments under the ICP are made after the public release of our year-end financial results for the applicable year and after determination of the award payments by the Committee. No award payment is made until the calculation of the payment award is approved by the Committee. Plan awards earned for a year generally are paid in February or March of the following year. Awards are paid in cash in the currency in which the recipient is ordinarily paid.