UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

☒ ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES

EXCHANGE ACT OF 1934

For the fiscal year ended December 31, 2013

OR

☐ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES

EXCHANGE ACT OF 1934

For the transition period from ____________ to ____________

Commission File Number: 000-53681

ECHO AUTOMOTIVE, INC.

(Exact name of registrant as specified in its charter)

| Nevada | 98-0599680 |

(State or Other Jurisdiction of

Incorporation) | (I.R.S. Employer

Identification No.) |

16000 North 80th Street, Suite E Scottsdale, AZ 85260

(Address of Principal Executive Offices)

(480) 682-5445

(Registrant’s telephone number)

Securities registered pursuant to Section 12(b) of the Act:

None

Securities registered pursuant to Section 12(g) of the Act:

Common Stock, Par Value $0.001

(Title of class)

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☐ No ☒

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ☐ No ☒

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Website, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ☒ No ☐

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of Registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment of this Form 10-K. ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer”, “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

| Large accelerated filer ☐ | | Accelerated filer ☐ | | Non-accelerated filer ☐ | | Smaller reporting company ☒ |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes ☐ No ☒

The aggregate market value of the voting and non-voting common equity held by non-affiliates of the registrant was $11,000,000 as of June 30, 2013.

| Class | | Outstanding at March 7, 2014 |

| Common stock, par value $0.001 | | 90,463,661 |

TABLE OF CONTENTS

PART I

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING STATEMENTS

Some discussions in this Annual Report on Form 10-K contain forward-looking statements that have been made pursuant to the provisions of the Private Securities Litigation Reform Act of 1995. These statements involve risks and uncertainties and relate to future events or future financial performance. A number of important factors could cause our actual results to differ materially from those expressed in any forward-looking statements made by us in this Form 10-K. Forward-looking statements are often identified by words such as “believe,” “expect,” “estimate,” “anticipate,” “intend,” “project,” “plans,” “seek” and similar expressions or words which, by their nature, refer to future events. In some cases, you can also identify forward-looking statements by terminology such as “may,” “will,” “should,” “plans,” “predicts,” “potential” or “continue” or the negative of these terms or other comparable terminology.

These forward-looking statements are only predictions and involve known and unknown risks, uncertainties and other factors, including the risks in the section entitled “Risk Factors” below that may cause our or our industry’s actual results, levels of activity, performance or achievements to be materially different from any future results, levels of activity, performance or achievements expressed or implied by these forward-looking statements. In addition, you are directed to factors discussed in the “Management’s Discussion and Analysis of Financial Condition and Results of Operations” section as well as those discussed elsewhere in this Form 10-K.

Although we believe that the expectations reflected in the forward-looking statements are reasonable, we cannot guarantee future results, levels of activity or achievements. Except as required by applicable law, including the securities laws of the United States, we do not intend to update any of the forward-looking statements to conform these statements to actual results. However, readers should carefully review the risk factors set forth in other reports or documents the Company files from time to time with the Securities and Exchange Commission (the “SEC”), particularly the Company’s Quarterly Reports on Form 10-Q and any Current Reports on Form 8-K. All written and oral forward-looking statements made subsequent to the date of this report and attributable to us or persons acting on our behalf are expressly qualified in their entirety by this section.

Unless otherwise indicated, references to “we,” “our,” “us,” “ECAU,” the “Company” or the “Registrant” refer to Echo Automotive, Inc., a Nevada corporation and its wholly owned subsidiaries Echo Automotive, LLC, an Arizona limited liability company (“Echo LLC”), and Advanced Technical Asset Holdings, LLC, an Arizona limited liability company (“ATAH”).

Corporate History

We were organized under the laws of the State of Nevada on September 2, 2008. On August 27, 2012, we effected a stock dividend of four shares of common stock of the Company for each share of common stock issued and outstanding. Effective September 24, 2012, we amended our Articles of Incorporation to change our name from “Canterbury Resources, Inc.” to “Echo Automotive, Inc.” On October 11, 2012, we closed a voluntary exchange transaction (the “Exchange”) with Echo Automotive, LLC, an Arizona limited liability company (“Echo LLC”), and DBPJ Stock Holding, LLC, an Arizona limited liability company and sole member of Echo (the “Echo LLC Member”) pursuant to an Exchange Agreement dated September 21, 2012 (the “Exchange Agreement”) by and among the Company, Echo LLC, and the Echo LLC Member. As a result of the Exchange, the Echo LLC Member acquired 70% of our issued and outstanding common stock, Echo LLC became our wholly-owned subsidiary, and we acquired the business and operations of Echo LLC.

On April 5, 2013, we entered into and consummated an exchange agreement (the “ATAH Exchange Agreement”) with Advanced Technical Asset Holdings, LLC, an Arizona limited liability company (d/b/a Advanced Technical Holdings) (“ATAH”). Pursuant to the terms and conditions of the ATAH Exchange Agreement, ATAH exchanged all of its issued and outstanding units and all securities convertible or exchangeable into units of ATAH (collectively, the “Units”) for Six Million (6,000,000) shares of our common stock (the “Exchange Shares”). As part of the exchange, ATAH transferred to Echo (i) certain of its assets and intellectual property which were previously acquired by ATAH from Bright Automotive, Inc. pursuant to a bid asset and intellectual property acquisition agreement; (ii) One Hundred Thousand Dollars ($100,000) in cash; and (iii) a promissory note from the sole member of ATAH made payable to Echo in the amount of Four Hundred Thousand Dollars ($400,000). As a result of the exchange transaction, ATAH became our wholly-owned subsidiary.

Nature of Operations

Echo LLC, formerly known as Controlled Carbon, LLC, was incorporated on November 25, 2009. Echo LLC is an Arizona limited liability company in the development stage with several technologies and specific methods that we believe, allow commercial fleet vehicles to reduce their overall fuel expenses. The business plan for Echo LLC is based on providing the marketplace a business proposition for reducing the use of fossil fuels by augmenting power trains within existing commercial fleet vehicles with energy efficient electrical assist delivered through electric motors powered by Echo LLC’s plug-in battery modules to achieve tangible operating results including the potential of a quick return on the investment (of the Echo LLC conversion) for such amended vehicles.

Echo LLC operations to date have been largely funded by advances, private “family and friends” capital contributions, and subsequent equity conversions by the majority stockholders and debt and equity private placements. Echo LLC’s working and growth capital is dependent on more significant future funding expected to be provided in part by equity investments from other accredited investors including institutional investors. There can be no assurance that any of these strategies will occur or be achieved on satisfactory terms.

For the year ended December 31, 2013, we had a net loss of $6,402,638 as compared to a net loss of $2,362,922 for the year ended December 31, 2012. In 2011, we shifted from our previous business plan of marketing carbon credits and entered into a new business model of the development of technology that allows commercial vehicle fleets to reduce their overall fuel expense.

Strategy

We develop technologies and products that allow the conversion of existing vehicles into fuel efficient hybrids and plug-in hybrids. Key to our strategy is the bolt-on nature of our solutions that introduce little, or in some cases, no additional points of failure, making our offerings very low risk compared to other solutions. Actual results may vary since our product is in development stage. We currently have demonstration vehicles that provide us some proof points of the system to help validate our product performance claims. Those proof points include hundreds of hours of our products being operated without major failure on both an automobile dynamometer (in which a demonstration vehicle is operating on an indoor “roller” to simulate road testing) and on actual roadways. Additionally, the products have been tested and continue to be tested using specialized equipment (such as battery testing chambers and electric vehicle dynamometers) for the electric motor and battery modules. We currently do not use independent third party validation as a means of validating our proof points and instead use actual customer testing of our equipment through ride and drive demonstrations. As part of our strategy, we are marketing and selling beta systems on a select basis to customers to be installed onto their vehicles to validate our product performance claims prior to proceeding to higher volume production. The beta units will be released on a small scale so that we can capture information and do necessary course correction(s) within the products as applicable. We expect to have at least two cycles of beta units over the course of 6 months before we proceed with higher volume production. If need be, we will do a third cycle if the beta units need additional corrections as an assurance to our customer(s).We have developed a modular platform called EchoDrive™. This platform includes component technologies, such as battery modules, control systems, propulsion modules and vehicle interface systems that can then be deployed in different configurations on a broad range of vehicles. By leveraging the EchoDrive™ platform, solutions can be configured as hybrid, plug-in hybrid or even pseudo electric, where electrons generated by braking are captured as electricity and harnessed in the battery cells for electric motor use.

The electric and hybrid vehicle industry is subject to many obstacles including failures of manufacturers, absence of well-developed supply chain(s), capacity constraints, and high initial fixed and variable costs. We believe we have mitigated some of these obstacles by being able to source key items such as electric motors and batteries from multiple suppliers. This approach does not limit to us to specific suppliers for the electric motors and battery cells. In fact, we have incorporated a design approach to different battery cell chemistries to give us further flexibility for sourcing our materials. We anticipate having several choices of vendors as a result and create relief of some of that single source or limited source dependency. Since we are pre-production, actual results may vary and we could be subject to some or all of the obstacles that could result in an extremely negative effect for our business performance.

One of our business fundamentals is to keep our overhead expenses low and to maintain simplicity in our system design so that our inflection point of profitability is not dependent on large volume.

We believe that we are competitively priced but do anticipate that we will have to provide volume discounts to large commercial customers. It will be important that we balance our business with smaller orders with smaller companies to ensure pricing balance. Our strategy is specifically that beta units are being sold at a significantly higher price, estimated to be at approximately $30,000 per unit, and that the production kits will be sold at a price of $12,000 to $14,000. As we move to higher volume, we will reduce the price of each kit through volume discounts or reduced pricing for pre-orders or sizeable order commitments. Any discounts requested by customers in the early stages of our production ramp up will be mitigated by providing such discounts on future units that are produced in late 2015 or later. This strategy will provide us with the ability to manage potential gross margin degradation that we have sensitivity to in our production ramp up in 2014 and 2015.

We believe by developing these technologies in modular fashion, we can efficiently modify, augment and reposition our offerings to fulfill a broad range of customer needs or quickly adapt to changes in the marketplace. In addition, the characteristics of each vehicle as well the mission of each customer is different, so the EchoDrive™ platform will allow for unparalleled configurability from motor placement to battery capacity. This flexibility, we believe, allows EchoDrive™’s to be easily bolted on to or retrofit in an existing vehicle and assist it with inexpensive electrical energy to increase its fuel efficiency. This modular solution will likely allow us to deploy our solution on a broad range of vehicles quickly and with reduced research and development expense.

By targeting the commercial fleet vehicle market, we plan to benefit from the need to reduce overall operating costs by selling multiple kits to each customer for like type vehicles. We are currently in the process of assembling a financing program as an option to our customers to acquire EchoDrive™kits.

Our sales and marketing strategy employs both direct as well as indirect sales channels, including distribution partnerships with service companies, fleet financing and other entities that currently serve the fleet market.

The Opportunity

Although there has been much promise and excitement surrounding next generation hybrids, alternative fuel and electric vehicles, to date in the world of commercial fleet vehicle electrification, there has yet to be any significant adoption due to the overwhelming capital expenditure required to realize a sustainable and profitable business. We believe that widespread adoption of these new vehicles will probably take a decade or more as fleet operators are, by their nature, risk adverse and slow in their adoption of unproven vehicles. The current electric fleet vehicle industry is largely fragmented and has been relatively inept in its ability to profitably and reliably deliver vehicles, parts and know-how in any volume. With failures of two of the top leaders in fleet electrification within the first half of 2011 (Bright Automotive and Azure Dynamics), we believe fleet operators will remain skeptical for years to come. Until the cost of producing electric vehicles drops drastically, and the return on investment is reasonably shorter than the vehicle’s expected lifetime, we believe that fleets will not adopt these vehicles in mass.

The Solution

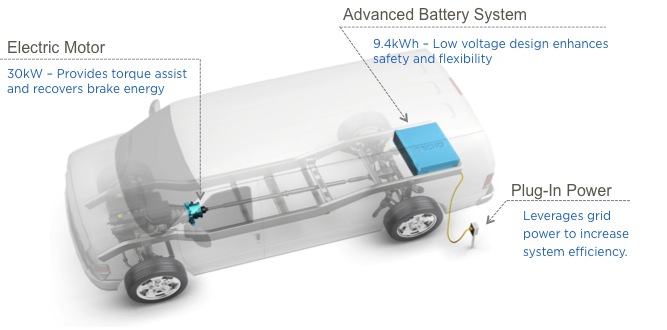

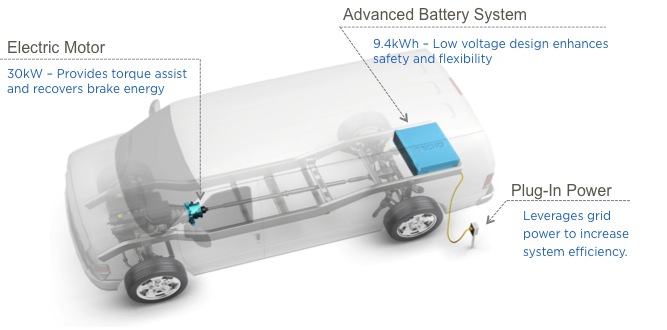

EchoDrive™ system is a solution for converting commercial fleet vehicles into fuel-efficient plug-in hybrids. Today’s internal combustion engines are highly inefficient in that they still only use a small percentage of the energy received from fossil fuels consumed. We believe that fleet operators can reduce their operating expenses with EchoDrive™. EchoDrive™ can be bolted onto new and existing vehicles to reduce a vehicle’s fuel consumption. The EchoDrive™ components include an electric motor, system controller and modular battery-packs that enable the ‘right-sizing’ of the battery and align to the customer’s needs and budget. With EchoDrive™ installed, these vehicles are then plugged in using any available power source from a standard 110 voltage outlet to any industry standard rapid charger via the integrated ‘J-Plug’, thereby increasing energy efficiency with grid power.

During operation of the vehicle, EchoDrive™ applies the stored energy via the electric motor to assist the power train when the internal combustion engine is most inefficient, reducing the workload of the engine and the use of fossil fuels. Like hybrid vehicles, EchoDrive™ recaptures energy (electrons) for its battery packs when the vehicles utilize their brakes. Additionally, EchoDrive™’s engineering allows for uninterrupted driving in the unlikely event of most system or component failures, making EchoDrive™a good alternative for critical fleet operations.

Technology, Products and Distribution

EchoDrive™ is a modular set of components that can be assembled in different configurations to support a broad range of client requirements (see diagram below). This approach will enable us to move our offerings into other product areas including hybrids and OEM fittings. We have developed our system and software to be component sourcing independent therefore allowing for flexible system revisions and changes where necessary. We are also employing a “self-learning” type programming style that will allow for the system to improve itself over time. This programming approach analyzes captured real data and permits additional adjustments for use of the electric motor and battery components in response to actual drive demand to optimize potential incremental efficiency gain.

The status of EchoDriveTM in development is that we have operational demonstration vehicles containing our product. The demonstration vehicles have spent significant time in our research and development facility, in Anderson, Indiana, including laboratory time on our dynamometer, electric motor and battery cycling testing. It has also been road tested as part of ride and drive demonstration for potential customers. We believe we have completed this phase of our product development and are currently taking customer orders for beta product units, which we are planning to produce and distribute over the next 4 – 6 months. We have orders for beta units that will be deployed in the second and third quarter of 2014. We will moving to low volume production in the fourth quarter of 2014 and moving to more normalized production in 2015, most likely in the fourth quarter.

Since EchoDriveTM consists of finished components, we have been able to arrive at a relatively complete cost of the bill of materials to determine a projected sales price of approximately $12,000 to $14,000 based on volume levels. We continue to manage our costs by receiving price quotations from qualified suppliers and vendors including price discounts based on volume.

EchoDriveTM has a remaining estimated budget of approximately $5,000,000 to complete the development and marketing efforts to deliver to the market a finished product. The current timetable has us providing products for pilot programs over the next six months to proceed to low level manufacturing capacity by late fourth quarter of 2014 or the first quarter of 2015. We will need to raise an additional $3,500,000 to ramp up our production in 2014, which includes capital expenditures for automatized welding equipment, conveyer belts, and specialized tooling. We are working with a variety of capital sources including venture capital funds, private equity firms, current high net worth Echo investors, and finance institutions to meet all our capital needs. There can be no assurance that we will be successful in procuring the additional capital we require, or even if we are successful, on terms that are satisfactory to us.

The working capital needs for EchoSolutionsTM is limited to marketing expenses. We would be able to provide these services relatively immediately upon receipt of a customer order.

EchoFinanceTM would be provided through a third party program and would require limited working capital from us. We would be able to provide these services relatively immediately upon receipt of a customer order.

Products in Development

We have developed a plug-in hybrid electric vehicle (PHEV) technology, branded as EchoDrive™. EchoDrive™ is being targeted at commercial vehicle fleets in the United States and internationally. Our EchoDriveTM product is active in our demonstration vehicles and we anticipate providing it as part of pilot programs with certain customer fleets over the next six months.

We have EchoSolutions™ as a consulting business unit to assist with product and service development for customers or within the supplier chain including auto manufacturers. We are leveraging the institutional knowledge of our engineering team that have extensive working experience in electric vehicle, battery and electric motor industries and who are responsible for the development of EchoDriveTM. To date, we have seen interest from several companies for EchoSolutionsTM services and we have submitted proposals for consideration, however no definitive agreements have been entered.

Additionally, we are in the process of launching our financing solution for customers for renting EchoDrive™ through EchoFinance™. We are currently in the initial stages of exploratory work with several interested third parties who would serve as underwriters for EchoFinanceTM financing solutions.

Distribution

We are focused on direct sales via our in-house marketing team to reach large-scale U.S. fleet customers, while national and regional distribution partners will also be leveraged to access medium and small-sized fleets. Internationally, we will partner with leading distribution agents to deploy the EchoDrive™ product through a licensing strategy. No distribution agreements are currently in place.

Strategic Advantages of EchoDrive™

Short Term Return on Investment

EchoDrive™’s solution objective is to achieve a more competitive payback with less reliance on extensive government subsidies, such as rebates and tax credits.. Specifically, we perform an analysis of the drive cycle of customer fleet vehicle to identify what assumed fuel savings we can provide the customer with EchoDriveTM installed. An example would be providing $3,000 of fuel saving per annum would equate to an approximately 4 year return on investment for a $12,500 EchoDriveTM kit.

Low Risk to Fleet Operations

In the event of a component failure, the vehicle will simply revert to its pre conversion operating capabilities of full gasoline powered engine operation. We reduce the anxiety of unproven new technologies affecting the operations of the vehicle because EchoDriveTM was designed such that the existing gasoline powered engine, that is part of the original vehicle, can operate without interference and disruption in the event that our system has a failure. As we are still developing EchoDriveTM, we have taken precautions by designing the installation of the system such that the existing vehicle powertrain will operate regardless if our system has a failure. The existing vehicle is not dependent on the EchoDriveTM system however the vehicle would benefit from the electric motor assist if the EchoDriveTM system is functioning.

Flexible Electric Energy System

We believe our scalable and modular electrical storage system allows fleets to deploy the right amount of expensive batteries for the need on each vehicle to shorten the return on investment and align to the customer needs and budget. Battery cells are relatively expensive and therefore we do not provide a “one size fits all” approach with our battery approach. We perform a significant review of how many battery packs are required for any given customer which alleviates the incremental cost.

Flexible Solution Set

EchoDrive™’s flexible strategy and design is designed for broad deployment. Complete retrofit kits and new vehicles require significant design and regulatory approval. EchoDrive™ can be fitted on most vehicles with simply engineered adapter plates and brackets. Our strategy is to fit many types of fleet vehicles through its “simple” design and flexible component approach.

Scalable

By leveraging mostly off-the-shelf components from industry leading automotive suppliers, EchoDrive™ can scale without the same manufacturing risks that plague full retrofit providers and Original Equipment Manufacturers (“OEMs”).

Disadvantages of EchoDrive™

While we believe that EchoDrive™ substantially reduces energy costs, it does not provide the full benefit of an all-electric vehicle or range-extending hybrid. In the case of an electric vehicle, efficiency ratings are significantly higher. Range-extending hybrid vehicles also offer significant efficiency results compared to EchoDrive™. Furthermore, EchoDrive™ does not include start/stop capability, which is a feature that shuts the internal combustion engine off at idle conditions thereby further increasing efficiency where drive cycles have more frequent idle opportunities.

Recent Developments

Bright Automotive, Inc. Facilities and Key Staff

Bright Automotive, Inc. was established in 2008 as an offspring of the non-profit Rocky Mountain Institute to commercialize and develop the IDEA plug-in hybrid electric fleet vehicle. Bright Automotive ceased operations in March 2012 after failing to obtain a loan through the Advanced Technology Vehicles Manufacturing Loan Program. We successfully hired key members of the Bright Automotive team and acquired certain facilities and intellectual property in a bid to accelerate EchoDrive™’s commercialization in spring of 2012. In the first quarter of 2013, Bright Automotive, Inc.’s assets, including all of its intellectual properties and patents, were auctioned off and were purchased by Advanced Technical Asset Holdings, LLC (“ATAH”). In the second quarter of 2013, we acquired ATAH for 6,000,000 shares of our common stock as part of an exchange agreement with ATAH in which we received full ownership of the assets described above (“ATAH Exchange”). We have been in dialogue with a number of parties that are interested in using acquired assets for the purposes of their own developmental plans. Additionally, we are in negotiations for use of several of our proprietary components (including the motor design) by various industry suppliers. We anticipate monetizing these efforts at small incremental levels in 2014 with greater revenue opportunities for 2015.

System Patent Filed

In January 2012, a System Patent (Dual Fuel Plug-in Hybrid, Provisional Patent #: 61587987) was filed by CleanFutures. As discussed in detail in the “Intellectual Property” section below, we which we have a binding licensing with CleanFutures for the use of their technology.

We have a Bright perpetual license to develop and sell derivative works that are derived from Bright intellectual property regarding battery design. Those intellectual property rights for us include U.S Patents Applications No. 12/569,987 and No. 61/482,908. As noted above, during 2013, Bright Automotive, Inc.’s assets, including all of its intellectual properties and patents, were auctioned off and were purchased by ATAH. We have full ownership of those licenses and patents as part of the ATAH Exchange.

To further protect EchoDrive™, we have a provisional utility patent filed for electric drive retrofitting to internal combustion automobiles.

Revenues and Customers

We are in the research and development phase and therefore currently have no contracted customers. Our sales plan intends to generate revenue through the following distribution channels:

| · | Pre–Sales Activities such as Fleet Evaluations |

| · | EchoDrive™ Product Sales |

| · | Installation and Support Services |

| · | Echo Solutions™ Consulting Services |

| · | Referral and commission revenue from such partners as financing partners. |

| · | Territory sales for Echo Automotive™ distributors. |

Our sales strategy for direct sales is marketing to decision makers for companies that have fleet vehicles. That sales strategy also includes setting up appointments to have them test drive one of our demonstration vehicles to showcase our product and have them experience the performance. We have been executing this sales strategy since late 2012 resulting in a pipeline of leads for future marketing. We have received beta unit orders from two different customers subsequent to December 31, 2013.

We also have a sales strategy to sell through contracted distributors both domestically and internationally. This approach would leverage the pipeline of contracted distributors to present our product. We would have some margin degradation with this approach in order to accommodate a fee of the contracted distributors. We have several currently contracted, including Meineke and Dickinson, and are in the process of pursuing and negotiating for additional distributors. Our current arrangement is that these contracted distributors are receiving 100% of the revenue of the installation of EchoDriveTM kits and that the parties will work together cooperatively in the event that the distributor is able to gain traction in selling EchoDriveTM kits to new customers. In such an event, we would consider doing a profit share with the distributor which is currently undefined. Most of the revenues retained by the distributors are related to the installation of EchoDrive kits with the remainder being related to sale of EchoDriveTM kits. We anticipate that less than ten percent (10%) of our revenue will come from distributors.

We will focus our initial sales efforts on the fleet vehicle market. We will aim to increase our conversion rate and enhance our margins by focusing on fleets that will benefit most from the EchoDrive™ technology.

Additionally, through Echo Solutions™, we intend to provide services to automotive companies and component manufacturers and specialty equipment manufacturers and converters. We anticipate the annual revenue contribution from the foregoing to be less than $1,000,000.

Intellectual Property

We entered into a License Agreement with CleanFutures, LLC (“CleanFutures”) dated February 1, 2012 (the “License Agreement”). In accordance with the License Agreement, CleanFutures has agreed to provide us, within the original equipment, service parts and aftermarket passenger automobile, light truck, field, heavy truck industries and any other automotive sector (with the exception of the hummer market), an exclusive license, with the right to grant sublicenses, under CleanFutures’ patents and CleanFutures’ technology, to make, have made, use, sell or import any products using CleanFutures’ dual-fuel, plugin hybrid technology (Provisional Patent #61587987). After execution of the License Agreement, we and CleanFutures determined that the original intent of the License Agreement was not being met or adhered to. Therefore, we and CleanFutures voluntarily negotiated and on April 5, 2013 agreed upon a revised license agreement that is more aligned with the actual metrics of our relationship with CleanFutures. The revised agreement provides us with a non-exclusive perpetual right to the CleanFutures Patents and Technology, which provides us with additional technology to include in our platform, royalty free by providing a commitment to issue CleanFutures 1,850,000 shares of our restricted common stock.

Further, we have entered into a License Agreement with Bright Automotive, Inc. (“Bright”) dated June 28, 2012 (the “Bright Agreement”). In accordance with the Bright Agreement, Bright has provided to us a royalty-free, perpetual, fully-paid up, worldwide, non-exclusive, non-transferable and non-sub-licensable limited license to use Bright’s Battery Management Software and CAD, and certain other intellectual property of Bright, as detailed in the Bright Agreement, to develop, modify and/or sell, offer for sale, market, distribute, import and export derivative works. In consideration of the granting of the license, we paid to Bright a one-time up-front license fee in the amount of $50,000, which we have included within intangible assets in the accompanying balance sheets as of December 31, 2013 and 2012.

As noted above, in the first quarter of 2013, Bright Automotive, Inc.’s assets, including all of its intellectual properties and patents, were auctioned off and were purchased by ATAH. We have full ownership of those licenses and patents as part of the ATAH Exchange. As a result of the completion of the ATAH Exchange, we have full exclusivity and ownership of the Bright Battery Management Software, as originally defined in the Bright Agreement without further obligation to Bright.

We are developing additional intellectual property and are taking all necessary steps to protect our ability to do so. However, the validity of patents, even when licensed, approved and issued, can still be challenged by third parties. There is the risk that there are competing patents or technologies existing at the time the patent was issued, prior or afterwards, that were overlooked when the patent was filed and/or issued. Patents can be challenged and lost based on previously existing prior art. There are also multiple rules and regulations one must follow when challenging a patent or making claims when prosecuting a patent. Patent law is complex and expensive. Although we feel secure with our patents and respective licenses, there always remains the possibility that challenges to the licenses or underlying patents may arise and make our patents invalid.

We will continue to evaluate the business benefits in pursuing patents in the future. We have engaged with both our legal team and outside intellectual property process experts to create an internal workflow to capture, protect and file the appropriate documentation to best protect our intellectual property. However, third parties may, in an unauthorized manner, attempt to use, copy or otherwise obtain and market or distribute our intellectual property or technology or otherwise develop a product with the same functionality as our IP. Policing unauthorized use of intellectual property rights is difficult, and nearly impossible on a worldwide basis. Therefore, we cannot be certain that the steps we have taken or will take in the future will prevent misappropriation of our technology or intellectual property, particularly in foreign countries where we may do business, where the laws may not protect proprietary rights as fully as do the laws of the United States or where the enforcement of such laws is not common or effective.

We also have a number of trademarks we have filed which include, but are not limited to Echo Automotive™, EchoDrive™, and EchoFinance™. Echo Solutions™ is a common law trademark of ours. We have also filed a number of patents as part of our component design.

Manufacturing

We intend to rely on third party suppliers for the manufacture of existing components and outsource proprietary product manufacturing to subcontractors. We believe this approach allows for greater agility in responding to changing market demands, while effective communication and transfer of information between our suppliers will ensure products are drop shipped as per our requirements.

We will continuously monitor product demand to evaluate the optimal lot size. The optimal manufacturing lot size determines the cost effectiveness of the production process. The frequency and the volume of the production runs are then evaluated to enable just-in-time delivery from our vendor and supplier partners, while a range of production and control methods will be utilized to implement this across all aspects of the manufacturing process. Our manufacturing process is largely based on us assembling components that have been manufactured and completed by third party suppliers and vendors. A number of those components would have a higher cost to procure them resulting in higher bill of material cost for our product. This would include the lithium-ion batteries and the electric motors.

We believe that the manufacturing process will allow us to synchronize our inventory management system with our supply chain operations to ensure better inventory maintenance, inventory record accuracy and inventory access speed. Since our manufacturing process is actually more of an assembly process, we are able to manage our labor costs by scaling our headcount based on the number of EchoDriveTM kit units we need to fulfill. We have completed time studies for our prototype assemblies to gauge our manufacturing costs. However, we do not anticipate cost efficiencies until we achieve volumes in excess of 100 units per month or more. The volume will be determined on how successful we are in procuring customer orders to fulfill.

Quality Control & Warranties

Our staff includes employees, contractors and consultants who are six sigma certified and trained and will therefore include best business practices when deemed applicable as part of our quality assurance program intended to result in OEM grade processes and quality control. We will require third party providers to adhere to these practices and/or standards. All components and systems analysis work will encompass Design Failure Mode and Effects Analysis (DFMEA) work, which is in concert with OEM vehicle design and validation practices. Furthermore, each EchoDrive™ kit will be fully tested on in-house simulation equipment for effective operation of each component and system prior to shipment.

Industry

The demand for advance powertrain vehicles is on the rise. With increasing energy costs the market continues to grow. We believe the top 100 U.S. commercial fleets represent a significant opportunity for EchoDrive™. The industry is very fragmented, however, with small component technology randomly appearing in the market resulting in cohesive end-to-end providers being scarce and the commercialization of these products being at a premium. We believe if material costs such as lithium ion (used in most battery storage systems) decrease, the adoption rate for such technologies will increase. The focus on advanced vehicle technology is growing and we believe a variety of opportunities are emerging as a result.

The lithium ion battery currently used for our battery storage in each EchoDriveTM kit represents a significant portion of the material cost of the entire kit. Therefore, we anticipate our overall price for our product to be lower with lithium ion cost decreasing. Inversely, the EchoDriveTM kit would be materially higher with a cost increase of lithium ion.

We believe based on industry research that the price of lithium ion may trend to a lower price by 2020. We have designed our current pricing to current lithium ion pricing but in the event the price does drop in the future, we believe it will be cost beneficial for our future production.

Markets

The U.S. Market

According to the U.S. Department of Transportation, there are over 100 million light-to-medium duty trucks on the road in the U.S. today. Many of these vehicles are used in commercial or government fleets. Initially, we intend to focus on selling EchoDrive™ into the existing fleet market, which consists of roughly 25 to 30 million vehicles in use today and approximately 2 million new vehicles purchased annually. We are initially focused on the top 100 commercial fleets, which represent significant potential opportunity for EchoDrive™.

Short ROI Drives International Adoption

We believe that there is opportunity internationally for achieving even greater ROI from use of our products due to the higher fuel prices relative to the United States. We believe international territory licensing will be key to servicing these markets to execute our international strategy.

Competition

Many companies today rely on commercial fleets to conduct business and with ever-increasing energy costs, we believe the future demand for advance vehicle technology solutions has the potential to increase. However, the number of commercial vehicles utilizing electric or hybrid technologies is currently a small percentage of all commercial vehicles. There are new companies bringing technologies to market; however, most are focused on achieving very high efficiency ratings, which creates a very capital-intensive enterprise resulting in an expensive end-product for the customer. In most cases these technologies require the removal of most of the original powertrain, which is replaced with technologies that often have not been time-tested, therefore adding inherent risk to fleet operations. Additionally many competitors rely on government subsidies to support their financial equations, leaving them at the mercy of often varying political mandates.

Our current competitors that provide similar vehicle solutions are XL Hybrids, Alt-e, and Via Motors. Their solutions are slightly different from the Echo product but similar enough that the consumer marketplace will view it as such. Our competitors have the advantage of being larger and having already established market share with their products. Therefore, as a development stage company with no established market share, we are at a competitive disadvantage and it will be a challenge to compete in the marketplace.

Government Regulation

We conduct business within the confines of local, state and federal regulations, both in operations and for our products. Internationally, each unique market has specific requirements which are fully evaluated prior to solicitation.

Our products are subject to product safety regulations by federal, state, and local organizations. Accordingly, we may be required, or may voluntarily determine to obtain approval of our products from one or more of the organizations engaged in regulating product safety. These approvals could require significant time and resources from our technical staff and, if redesign were necessary, could result in a delay in the introduction of our products in various markets and applications.

All products can be subject to Federal Motor Vehicle Safety Standards (FMVSS) requirements and we voluntarily comply with Environmental Protection Agency emission standards where and if applicable. Our engineering team believes that we are not required to complete FMVSS testing because the EchoDrive system does not fall into the category of motor vehicle equipment subject to FMVSS certification according to the NHTSA requirements for Motor Vehicle Aftermarket Equipment. We are completing voluntary due diligence as part of the product development level of the battery pack. Our engineering team also believes that we are not required to recertify emissions of the vehicle with an add-on plug-in hybrid electric vehicle system such as EchoDrive. The projected timetable to complete the development and testing is the end of the first quarter of 2014.

The Department of Transportation, National Highway Traffic Safety Administration (NHTSA) is charged with writing and enforcing safety, theft-resistance, and fuel economy standards for motor vehicles through their Federal Motor Vehicle Safety Standards. These standards require manufacturers to design their electrically powered vehicles so that, in the event of a crash, the electrical energy storage, conversion, and traction systems are either electrically isolated from the vehicle's chassis or their voltage is below specified levels considered safe from electric shock hazards. Our products are designed to meet or exceed FMVSS requirements.

Our products have been designed to comply with EPA emission standards and we believe they will comply with future requirements if and when they go into effect. Because we expect that environmental standards will become even more stringent over time, we will continue to incur some level of research, development and production costs in this area for the foreseeable future.

Further, federal, state, and local regulations impose significant environmental requirements on the manufacture, storage, transportation, and disposal of various components of plug-in hybrid electric systems. Although we believe that our operations are in material compliance with current applicable environmental regulations, there can be no assurance that changes in such laws and regulations will not impose costly compliance requirements on us or otherwise subject us to future liabilities. Moreover, federal, state, and local governments may enact additional regulations relating to the manufacture, storage, transportation, and disposal of components of plug-in hybrid electric systems. Compliance with such additional regulations could require us to devote significant time and resources and could adversely affect demand for our products. There can be no assurance that additional or modified regulations relating to the manufacture, storage, transportation, and disposal of components of plug-in hybrid electric systems will not be imposed.

We are currently spending over $300,000 annually on research and development activities in response to potential regulatory requirements and safety standards. Potential additional standards if imposed on our product could add additional development expenses and would result in a cost increase to production cost and production delays. We would try to recuperate a portion of such expenses by adding it to the selling price for each product unit.

The Magnuson-Moss Warranty Act enables purchasers of vehicles to make modifications to a vehicle without affecting the vehicle’s manufacture warranty. In the event of a related failure, the burden of proof is on the manufacture to show the failure was due to the installation of said component(s).

While we do not construct our products around government subsidies and tax incentives, there are many state and federal subsidies which our products would be eligible for. For example, in Colorado, consumers can qualify for up to $6,000 in government rebates for plug-in hybrid electric vehicle (“PHEV”) conversions. There are a number of other states that offer a variety of incentives for such conversions. The federal government also offers up to $7,500 in tax credits for similar PHEV conversions.

Employees

We have 25 full-time employees. All employees are required to execute non-disclosure agreements as part of their employment.

Corporate Information

Our principal executive offices are located at: 16000 North 80th Street, Suite E, Scottsdale, AZ 85260. Our main telephone number is: (480) 682-5445. The Registrant’s website is located at: http://www.echoautomotive.com/.

You should carefully consider the risks described below together with all of the other information included in our public filings before making an investment decision with regard to our securities. If any of the following events described in these risk factors actually occurs, our business, financial condition or results of operations could be harmed. In that case, the trading price of our common stock could decline, and you may lose all or part of your investment.

Risks Related to Our Business and Industry

We have incurred losses in prior periods and may incur losses in the future.

We cannot be assured that we can achieve or sustain profitability on a quarterly or annual basis in the future. Our operations are subject to the risks and competition inherent in the establishment of a business enterprise. There can be no assurance that future operations will be profitable. We may not achieve our business objectives and the failure to achieve such goals would have an adverse impact on us.

Our future is dependent upon our ability to obtain financing. If we do not obtain such financing, we may have to cease our activities and investors could lose their entire investment.

There is no assurance that we will operate profitably or generate positive cash flow in the future. We will require additional financing in order to proceed with the manufacture and distribution of our products, including our Echo Drive™ technology. We will also need more funds if the costs of the development and operation of our existing technologies are greater than we have anticipated. We will also require additional financing to sustain our business operations if we are not successful in earning revenues. We may not be able to obtain financing on commercially reasonable terms or terms that are acceptable to us when it is required. Our future is dependent upon our ability to obtain financing. If we do not obtain such financing, our business could fail and investors could lose their entire investment.

Because we may never earn significant revenues from our operations, our business may fail and investors may lose all of their investment in our Company.

We have a history of limited revenues from operations. We have yet to generate positive earnings and there can be no assurance that we will ever operate profitably. Additionally, our company has a limited operating history. If our business plan is not successful and we are not able to operate profitably, then our stock may become worthless and investors may lose all of their investment in our company.

Prior to obtaining meaningful customers and distribution for our products, we anticipate that we will incur increased operating expenses without realizing any significant revenues. We therefore expect to incur significant losses into the foreseeable future. We recognize that if we are unable to generate significant revenues from the sale of our products in the future, we will not be able to earn profits or continue operations. There is no history upon which to base any assumption as to the likelihood that we will prove successful, and we can provide no assurance that we will generate sufficient revenues or ever achieve profitability. If we are unsuccessful in addressing these risks, our business will fail and investors may lose all of their investment in our company.

Our independent auditors have expressed substantial doubt about our ability to continue as a going concern.

Our independent auditors have expressed substantial doubt about our ability to continue as a going concern, which may hinder our ability to obtain future financing. Our ability to continue as a going concern is an issue raised as a result of recurring losses from operations. We continue to experience net operating losses. Our ability to continue as a going concern is subject to our ability to obtain necessary funding from outside sources, including obtaining additional funding from the sale of our securities. Our continued net operating losses increase the difficulty in meeting such goals and there can be no assurances that such methods will prove successful.

Our limited operating history makes evaluating our business and future prospects difficult, and may increase the risk of your investment.

We have a very limited operating history on which investors can base an evaluation of our business, operating results and prospects. Of even greater significance is the fact that we have no operating history with respect to augmenting existing power trains with highly efficient electrical energy delivered by electric motors powered by our modular plug-in battery modules.

While the basic technology has been verified, we only recently have begun the commercialization of the complete plug-in hybrid electric vehicle (PHEV) system in preparation for our initial conversion of a vehicle. This limits our ability to accurately forecast the cost of the conversions or to determine a precise date on which the commercial platform for vehicle conversions will be widely released.

We are currently evaluating, qualifying and selecting our suppliers for the hybrid conversion system. However, we may not be able to engage suppliers for the remaining components in a timely manner, at an acceptable price or in the necessary quantities. In addition, we may also need to do extensive testing to ensure that the conversions are in compliance with applicable National Highway Traffic Safety Administration (NHTSA) safety regulations and United States Environmental Protection Agency (EPA) regulations prior to full distribution to our licensees. Our plan to complete the initial commercialization of the hybrid conversion system is dependent upon the timely availability of funds, upon our finalizing the engineering, component procurement, build out and testing in a timely manner. Any significant delays would materially adversely affect our business, prospects, financial condition and operating results. Consequently, it is difficult to predict our future revenues and appropriately budget for our expenses, and we have limited insight into trends that may emerge and affect our business. In the event that actual results differ from our estimates or we adjust our estimates in future periods, our operating results and financial position could be materially affected. If the markets for hybrid electric conversions and/or electric motors and generators do not develop as we expect or develop more slowly than we expect, our business, prospects, financial condition and operating results will be harmed.

Decreases in the price of oil, gasoline and diesel fuel may influence the conversions to plug-in hybrid electric vehicles, which may slow the growth of our business and negatively impact our financial results.

The market for plug-in hybrid electric vehicle conversions is relatively new, rapidly evolving, characterized by rapidly changing technologies, evolving government regulation, and changing consumer demands and behaviors. Prices for oil, gasoline and diesel fuel can be very volatile. Increases in the price of fuels will likely raise interest in plug-in hybrid conversions. Decreases in the price of fuels will likely reduce interest in conversions and reduced interest could slow the growth of our business.

Our growth depends in part on environmental regulations and programs mandating the use of vehicles that get better gas mileage and generate fewer emissions and any modification or repeal of these regulations may adversely impact our business.

Enabling commercial customers to meet environmental regulations and programs in the United States that promote or mandate the use of vehicles that get better gas mileage and generate fewer emissions is an integral part of our business plan. Industry participants with a vested interest in gasoline and diesel invest significant time and money in efforts to influence environmental regulations in ways that delay or repeal requirements for cleaner vehicle emissions. Furthermore, the economic recession may result in the delay, amendment or waiver of environmental regulations due to the perception that they impose increased costs on the transportation industry or the general public that cannot be absorbed in a shrinking economy. The delay, repeal or modification of federal or state regulations or programs that encourage the use of more efficient and/or cleaner vehicles could slow our growth and adversely affect our business.

Some aspects of our business will depend in part on the availability of federal, state and local rebates and tax credits for hybrid electric vehicles, and as such, a reduction in these incentives would increase the cost of conversions for our customers and could significantly reduce our revenue.

Hybrid conversions for the general public will depend in part on tax credits, rebates and similar federal, state and local government incentives that promote hybrid electric vehicles. We anticipate that fleet owners will be less reliant on incentives. As for other products we create, there should be no reliance at all. Nonetheless, any reduction, elimination or discriminatory application of federal, state and local government incentives and other economic subsidies or tax credits because of policy changes, the reduced need for such subsidies or incentives due to the perceived success of the hybrid conversions, fiscal tightening or other reasons may have a direct or indirect material adverse effect on our business, financial condition, and operating results.

We may experience significant delays in the design and implementation of our technology into the motors of the companies with which we may have research and development agreements with, which could harm our business and prospects.

Any delay in the financing, design, and implementation of our technology into the motor of the companies with which we may have research and development agreements could materially damage our brand, business, prospects, financial condition and operating results. Motor manufacturers often experience delays in the design, manufacture and commercial release of new product lines.

If we are unable to adequately control the costs associated with operating our business, including our costs of sales and materials, our business, financial condition, operating results and prospects will suffer.

If we are unable to maintain a sufficiently low level of costs for designing, marketing, selling and distributing our conversion system relative to their selling prices, our operating results, gross margins, business and prospects could be materially and adversely impacted. We have made, and will be required to continue to make, significant investments for the design and sales of our system and technologies. There can be no assurances that our costs of producing and delivering our system and technologies will be less than the revenue we generate from sales, licenses and/or royalties or that we will achieve our expected gross margins.

We may be required to incur substantial marketing costs and expenses to promote our systems and technologies, even though our marketing expenses to date have been relatively limited. If we are unable to keep our operating costs aligned with the level of revenues we generate, our operating results, business and prospects will be harmed. Many of the factors that impact our operating costs are beyond our control. For example, the costs of our components could increase due to shortages as global demand for these products increases. Indeed, if the popularity of hybrid conversions exceeds current expectations without significant expansion in battery production capacity and advancements in battery technology, shortages could occur which would result in increased costs to us.

We will be dependent on our suppliers, some of which are single or limited source suppliers, and the inability of these suppliers to continue to deliver, or their refusal to deliver, necessary components at prices and volumes acceptable to us would have a material adverse effect on our business, prospects and operating results.

We are currently and continually evaluating, qualifying and selecting suppliers for our conversion system. We will source globally from a number of suppliers, some of whom may be single source suppliers for these components. While we obtain components from multiple sources whenever possible, it may not always be possible to avoid purchasing from a single source. To date, we have not qualified alternative sources for any of our single sourced components.

While we believe that we may be able to establish alternate supply relationships and can obtain or engineer replacements for our single source components, we may be unable to do so in the short term or at all at prices or costs that are favorable to us. In particular, while we believe that we will be able to secure alternate sources of supply for almost all of our single-sourced components in a relatively short time frame, qualifying alternate suppliers or developing our own replacements for certain highly customized components may be time consuming and costly.

The supply chain will expose us to potential sources of delivery failure or component shortages. If we experience significant increased demand, or need to replace our existing suppliers, there can be no assurance that additional supplies of component parts will be available when required on terms that are favorable to us, at all, or that any supplier would allocate sufficient supplies to us in order to meet our requirements or fill our orders in a timely manner. The loss of any single or limited source supplier or the disruption in the supply of components from these suppliers could lead to delays to our customers, which could hurt our relationships with our customers and also materially adversely affect our business, prospects and operating results.

Changes in our supply chain may result in increased cost and delay. A failure by our suppliers to provide the necessary components could prevent us from fulfilling customer orders in a timely fashion which could result in negative publicity, damage our brand and have a material adverse effect on our business, prospects, financial condition and operating results.

Fluctuation in the price, availability and quality of materials could increase our cost of goods and decrease our profitability.

We purchase materials directly from various suppliers. The prices we charge for our products are dependent in part on the cost of materials used to produce them. The price, availability and quality of our materials may fluctuate substantially, depending on a variety of factors, including demand, supply conditions, transportation costs, government regulation, economic climates and other unpredictable factors. Any material price increases could increase our cost of goods and decrease our profitability unless we are able to pass higher prices on to our customers. We do not have any long-term written agreements with most of these suppliers, and do not anticipate entering into any such agreements in the near future.

The use of plug-in hybrid electric vehicles in vehicle components or electric motors may not become sufficiently accepted for us to expand our business.

To expand our conversion business, we must license new fleet, dealer and service center customers. We cannot guarantee that we will be able to develop these customers or that they will sign our license contracts. Whether we will be able to expand our customer base will depend on a number of factors, including the level of acceptance of plug-in hybrid electric vehicles by fleet owners and the general public. A failure to expand our customer base could have a material adverse effect on our business, prospects, financial condition and operating results.

If there are advances in other alternative vehicle fuels or technologies, or if there are improvements in gasoline or diesel engines, demand for hybrid electric conversions and/or our other products may decline and our business may suffer.

Technological advances in the production, delivery and use of alternative fuels that are, or are perceived to be, cleaner, more cost-effective than our traditional fuel or electric combination have the potential to slow adoption of plug-in hybrid electric vehicles. Hydrogen, compressed natural gas and other alternative fuels in experimental or developmental stages may eventually offer a cleaner, more cost-effective alternative to our gasoline or diesel and electric combination. Equally, any significant improvements in the fuel economy or efficiency of the internal combustion engine may slow conversions to plug-in hybrid vehicles and, consequently, would have a detrimental effect on our business and operations.

While we are not aware of any pending innovations in or introductions of new heat reduction or heat transfer technologies, that does not mean none are in the offing. We have no control of what our competitors are doing nor awareness of their plans until such information is released for general consumption. The introduction of any new technology that offers better or equivalent results at a lower price would have a detrimental effect on our business and operations.

Our strategy of using beta systems testing as a means of performance evaluation may not be an adequate means of evaluating our product performance claims and may result in higher warranty claims.

As part of our strategy, we are marketing and selling beta systems on a select and limited basis to customers to be installed onto their vehicles to validate our product performance claims prior to proceeding to higher volume production. The beta units will be released on a small scale so that we can capture information and do necessary course correction(s) within the products as applicable. Due to the small scale nature of this beta testing approach, we may not be able to adequately validate our performance claims and we may incur higher than expected warranty claims, which could have a material adverse effect on our business, prospects, financial condition and operating results.

Our research and commercialization efforts may not be sufficient to adapt to changes in electric vehicle technology.

As technologies change, we plan to upgrade or adapt our conversion system in order to continue to provide vehicles with the latest technology, in particular battery technology. However, our conversions may not compete effectively with alternative vehicles if we are not able to source and integrate the latest technology into our conversion system. For example, we do not manufacture battery cells and that makes us dependent upon other suppliers of battery cell technology for our battery packs.

Any failure to keep up with advances in electric or internal combustion vehicle technology would result in a decline in our competitive position which would materially and adversely affect our business, prospects, operating results and financial condition.

Our success depends on attracting large commercial customers to purchase our products.

Our success depends on attracting large commercial customers to purchase our products. If our prospective customers do not perceive our products, such as the EchoDriveTM, to be of sufficiently high value and quality, cost competitive and appealing in performance, investors may lose confidence in us, and our business and prospects, operating results and financial condition may suffer as a result. Additionally, these commercial customers may be able to exert pricing pressure on us and we may need to provide volume discounts in order to retain such customers. To date, we have limited experience selling our products and we may not be successful in attracting and retaining large commercial customers. If for any of these reasons we are not able to attract and maintain customers, our business, prospects, operating results and financial condition would be adversely affected.

The cyclical nature of business cycles can adversely affect our business.

Our business is directly related to general economic conditions which can be cyclical. It also depends on other factors, such as corporate and consumer confidence and preferences. A significant increase in global sales of electric or hybrid vehicles could have a direct impact on our earnings and cash flows by lowering the need to convert existing vehicles to plug-in hybrids. Equally, a significant decrease in the global sales of electric motors and generators could have a direct impact on our earnings and cash flows. The realization of either situation would also have an adverse effect on our business, results of operations and financial condition.

A prolonged economic downturn or economic uncertainty could adversely affect our business and cause us to require additional sources of financing, which may not be available.

Our sensitivity to economic cycles and any related fluctuation in the businesses of our fleet customers, electric motor manufacturers or income of the general public may have a material adverse effect on our financial condition, results of operations or cash flows. If global economic conditions deteriorate or economic uncertainty increases, our customers and potential customers may experience lowered incomes or deterioration of their businesses, which may result in the delay or cancellation of plans to convert their vehicles, reduced license sales or reduced royalties from sales by licensees. As a consequence, our cash flow could be adversely impacted.

Any changes in business credit availability or cost of borrowing could adversely affect our business.

Declines in the availability of business credit and increases in corporate borrowing costs could negatively impact the number of conversions performed and the number of electric motors manufactured. Substantial declines in the number of conversions by our customers could have a material adverse effect on our business, results of operations and financial condition. In addition, the disruption in the capital markets that began in 2008 has reduced the availability of debt financing to support the conversion of existing vehicles into plug-in hybrids. If our potential customers are unable to access credit to convert their vehicles, it would impair our ability to grow our business.

We may incur material losses and costs as a result of warranty claims and product liability actions that may be brought against us.

We face an inherent business risk of exposure to product liability in the event that our hybrid conversions or other products fail to perform as expected and, in the case of product liability, failure of our products results in bodily injury and/or property damage. Our customers have expectations of proper performance and reliability of our hybrid conversions and any other products that we may supply. If flaws in the design of our products were to occur, we could experience a rate of failure in our hybrid conversions or other products that could result in significant charges for product re-work or replacement costs. Although we will engage in extensive quality programs and processes, these may not be sufficient to avoid conversion or product failures, which could cause us to:

| | · lose revenue; |

| | · incur increased costs such as costs associated with customer support; |

| | · experience delays, cancellations or rescheduling of conversions or orders for our products; |

| | · experience increased product returns or discounts; or |

| | · damage our reputation; |

all of which could negatively affect our financial condition and results of operations. If any of our hybrid conversions or other products are or are alleged to be defective, we may be required to participate in a recall involving such conversions or products. A recall claim brought against us, or a product liability claim brought against us in excess of our available insurance, may have a material adverse effect on our business.

If we are unable to enforce our intellectual property rights or if our intellectual property rights become obsolete, our competitive position could be adversely impacted.

We utilize a variety of intellectual property rights in our products. We view our portfolio of process and design technologies as one of our competitive strengths and we use it as part of our efforts to differentiate our product offerings. We may not be able to successfully preserve these intellectual property rights in the future and these rights could be invalidated, circumvented, challenged or infringed upon. In addition, the laws of some foreign countries in which our products may be sold do not protect intellectual property rights to the same extent as the laws of the United States. If we are unable to protect and maintain our intellectual property rights, or if there are any successful intellectual property challenges or infringement proceedings against us, our ability to differentiate our product offerings could diminish. In addition, if our intellectual property rights or work processes become obsolete, we may not be able to differentiate our product offerings and some of our competitors may be able to offer more attractive products to our customers. As a result, our business and financial performance could be materially and adversely affected.

Developments or assertions by us or against us relating to intellectual property rights could materially impact our business.

We expect to own or license significant intellectual property, including patents, and intend to be involved in numerous licensing arrangements. Our intellectual property should play an important role in maintaining our competitive position in a number of the markets we intend to serve. We will attempt to protect proprietary and intellectual property rights to our products and conversion system through available patent laws and licensing and distribution arrangements with reputable domestic and international companies. Despite these precautions, patent laws afford only limited practical protection in certain countries.

Litigation may also be necessary in the future to enforce our intellectual property rights or to determine the validity and scope of the proprietary rights of others or to defend against claims of invalidity. Such litigation could result in substantial costs and the diversion of resources. As we create or adopt new technology, we will also face an inherent risk of exposure to the claims of others that we have allegedly violated their intellectual property rights.

We cannot assure that we will not experience any intellectual property claim losses in the future or that we will not incur significant costs to defend such claims nor can we assure that infringement or invalidity claims will not materially adversely affect our business, results of operations and financial condition. Regardless of the validity or the success of the assertion of these claims, we could incur significant costs and diversion of resources in enforcing our intellectual property rights or in defending against such claims, which could have a material adverse effect on our business, results of operations and financial condition.

Any such imposition of a liability that is not covered by insurance, is in excess of insurance coverage or is not covered by an indemnification could have a material adverse effect on our business, results of operations and financial condition.

Liability or alleged liability could harm our business by damaging our reputation, requiring us to incur expensive legal costs in defense, exposing us to awards of damages and costs and diverting our attention away from our business operations. Any such liability could severely impact our business operations and/or revenues. If any claims or actions are asserted against us, we may seek to settle such claim by obtaining a license from the plaintiff covering the disputed intellectual property rights. We cannot provide any assurances, however, that under such circumstances a license, or any other form of settlement, would be available on reasonable terms or at all.

We may incur material losses, additional costs or even interruption of business operations as a result of fines or sanctions brought by government regulators.

We will likely be subject to various U.S. federal, state and local, and non-U.S. environmental, transportation and safety laws and regulations, such as requirements for aftermarket fuel conversion certification by the Environmental Protection Agency or separate requirements for aftermarket fuel conversion certification by California and other states. We cannot assure you that we will be at all times in complete compliance with such laws, regulations and permits. If we violate or fail to comply with these laws, regulations or certifications, we could be fined or otherwise sanctioned by regulators.

We may face risks from doing business internationally.

We may license, sell or distribute products outside the U.S., and derive revenues from these sources. Consequently, our revenues and results of operations will be vulnerable to currency fluctuations. We will report our revenues and results of operations in U.S. dollars, but a significant portion of our revenues could be earned outside of the U.S. We cannot accurately predict the impact of future exchange rate fluctuations on revenues and operating margins. Such fluctuations could have a material adverse effect on our business, results of operations and financial condition. Our business will also be subject to other risks inherent in the international marketplace, many of which are beyond our control. These risks include:

| | · | laws and policies affecting trade, investment and taxes, including laws and policies relating to the repatriation of funds and withholding taxes, and changes in these laws; |

| | · | changes in local regulatory requirements, including restrictions on conversions; |

| | · | differing cultural tastes and attitudes; |

| | · | differing degrees of protection for intellectual property; |

| | · | financial instability; |

| | · | the instability of foreign economies and governments; |

| | · | war and acts of terrorism. |

Any of the foregoing could have a material adverse effect on our business, financial condition and results of operations.

Our long-term growth depends upon technological innovation and commercialization.