Exhibit 99.1

Disclosures For the purposes of this notice, the “presentation” that follows shall mean and include the slides that follow, the oral presentation of the slides by members of management of Selecta Biosciences, Inc. (“Selecta”) and Cartesian Therapeutics, Inc. (“Cartesian”) or any person on their behalf, any question-and-answer session that follows such oral presentation, hard copies of this document and any materials distributed at, or in connection with, such oral presentation. No Representations and Warranties This presentation is being distributed solely to qualified institutional buyers and accredited investors with sufficient knowledge and experience in investment, financial and business matters and the capacity to conduct their own due diligence investigation and evaluation. This presentation is for informational purposes only and to assist such parties in making their own evaluation with respect to the potential combination (the “Proposed Merger”) of Cartesian with and into a wholly-owned subsidiary of Selecta and related transactions and not for any other purpose. This presentation does not purport to contain all of the information that may be required to evaluate a possible investment decision with respect to the Proposed Merger and related transactions. The recipient agrees and acknowledges that this presentation is not intended to form the basis of any investment decision by the recipient and does not constitute investment, tax or legal advice. No representation or warranty, express or implied, is or will be given by Selecta or Cartesian or any of their respective affiliates, directors, officers, employees or advisors or any other person as to the accuracy or completeness of the information in this presentation or any other written, oral or other communications transmitted or otherwise made available to any party in the course of its evaluation of a possible transaction between Selecta and Cartesian. Forward-looking Statements Any statements in this presentation about the future expectations, plans and prospects of Selecta and/or Cartesian, including without limitation, statements regarding the Proposed Merger, expectations regarding the timing and perceived benefits of the Proposed Merger, the proposed concurrent financing (the “Financing”), expectations regarding the use of proceeds from the Financing, expectations regarding the timing and outcome of the special stockholder meeting to be held following the Proposed Merger, including the likelihood that stockholders will approve the conversion of preferred stock issued in the Proposed Merger and the Financing into common stock, Selecta’s and Cartesian’s ability to efficiently integrate operations following the Proposed Merger, the combined company’s cash runway, the combined company’s ability to execute its development plans and manage its operating expenses, the unique proprietary technology platform of Selecta, Cartesian or the combined company, expectations regarding the safety and efficacy of Cartesian’s Descartes-08 product candidate, RNA Armory proprietary platform and other pipeline candidates, the anticipated timing or the outcome of ongoing and planned clinical trials, studies and data readouts, the anticipated timing or the outcome of the FDA’s review of the combined company’s regulatory filings, the combined company’s and its partners’ ability to conduct its and their clinical trials and preclinical studies, the timing or making of any regulatory filings, the anticipated timing or outcome of selection of developmental product candidates, the potential treatment applications of the combined company’s product candidates, the novelty of treatment paradigms that the combined company is able to develop, whether the observations made in non-human study subjects will translate to studies performed with human beings, the potential of any therapies developed by the combined company to fulfill unmet medical needs, and other statements containing the words “anticipate,” “believe,” “continue,” “could,” “estimate,” “expect,” “hypothesize,” “intend,” “may,” “plan,” “potential,” “predict,” “project,” “should,” “target,” “would,” and similar expressions, constitute forward-looking statements within the meaning of The Private Securities Litigation Reform Act of 1995. Actual results may differ materially from those indicated by such forward-looking statements as a result of various important factors, including, but not limited to, the following: the uncertainties related to the timing and expected benefits of the Proposed Merger, the uncertainty inherent in the outcome of stockholder votes at the special stockholder meeting to be held in connection with the Proposed Merger, the uncertainties inherent in the initiation, completion and cost of clinical trials including proof of concept trials, including the uncertain outcomes, the availability and timing of data from ongoing and future clinical trials and the results of such trials, whether preliminary results from a particular clinical trial will be predictive of the final results of that trial and whether results of early clinical trials will be indicative of the results of later clinical trials, the ability to predict results of studies performed on human beings based on results of studies performed on non-human subjects, the unproven approach of the combined company’s technology, potential delays in enrollment of patients, undesirable side effects of the combined company’s product candidates, its reliance on third parties to conduct its clinical trials, the combined company’s inability to maintain its existing or future collaborations, licenses or contractual relationships, its inability to protect its proprietary technology and intellectual property, potential delays in regulatory approvals, the availability of funding sufficient for its foreseeable and unforeseeable operating expenses and capital expenditure requirements, recurring losses from operations and negative cash flows, substantial fluctuation in the price of the combined company’s common stock, risks related to geopolitical conflicts and pandemics and other important factors discussed in the “Risk Factors” section of the Selecta’s most recent Annual Report on Form 10-K and subsequently filed Quarterly Reports on Form 10-Q, and in other filings that the Selecta makes with the Securities and Exchange Commission (the “SEC”). In addition, any forward-looking statements included in this presentation represent Selecta’s and Cartesian’s views only as of the date of its publication and should not be relied upon as representing its views as of any subsequent date. Each of Selecta and Cartesian specifically disclaims any intention to update any forward-looking statements included in this presentation, except as required by law. Disclaimers and Forward-Looking Statements

No Offer or Solicitation; Important Information About the Proposed Merger and Where to Find It This presentation is not a proxy statement or solicitation of a proxy, consent or authorization with respect to any securities or in respect of the Proposed Merger and shall not constitute an offer to sell or a solicitation of an offer to buy the securities of Selecta or Cartesian, nor shall there be any sale of any such securities in any state or jurisdiction in which such offer, solicitation, or sale would be unlawful prior to registration or qualification under the securities laws of such state or jurisdiction. No offer of securities shall be made, except by means of a prospectus meeting the requirements of Section 10 of the Securities Act of 1933, as amended, or an exemption therefrom. The combined company expects to file a proxy statement with the SEC relating to the proposals to be voted upon at an upcoming meeting of stockholders (the “Meeting Proposals”). The definitive proxy statement will be sent to all combined company stockholders. Before making any voting decision, investors and security holders of the combined company are urged to read the proxy statement and all other relevant documents filed or that will be filed with the SEC in connection with the Meeting Proposals as they become available because they will contain important information about the merger agreement and the related transactions and the Meeting Proposals to be voted upon. Investors and security holders will be able to obtain free copies of the proxy statement and all other relevant documents filed or that will be filed with the SEC by the combined company through the website maintained by the SEC at www.sec.gov. Participants in Solicitation Selecta, Cartesian, and their respective directors, executive officers and employees may be deemed to be participants in the solicitation of proxies in respect of the Proposed Merger. Information regarding Selecta’s directors and executive officers is available in the Selecta’s Annual Report on Form 10-K for the year ended December 31, 2022 filed with the SEC on March 2, 2023. Information regarding the persons who may, under the rules of the SEC, be deemed participants in the proxy solicitation and a description of their direct and indirect interests, by security holdings or otherwise, will be contained in the proxy statement and other relevant materials to be filed with the SEC when they become available. Disclaimers and Forward-Looking Statements

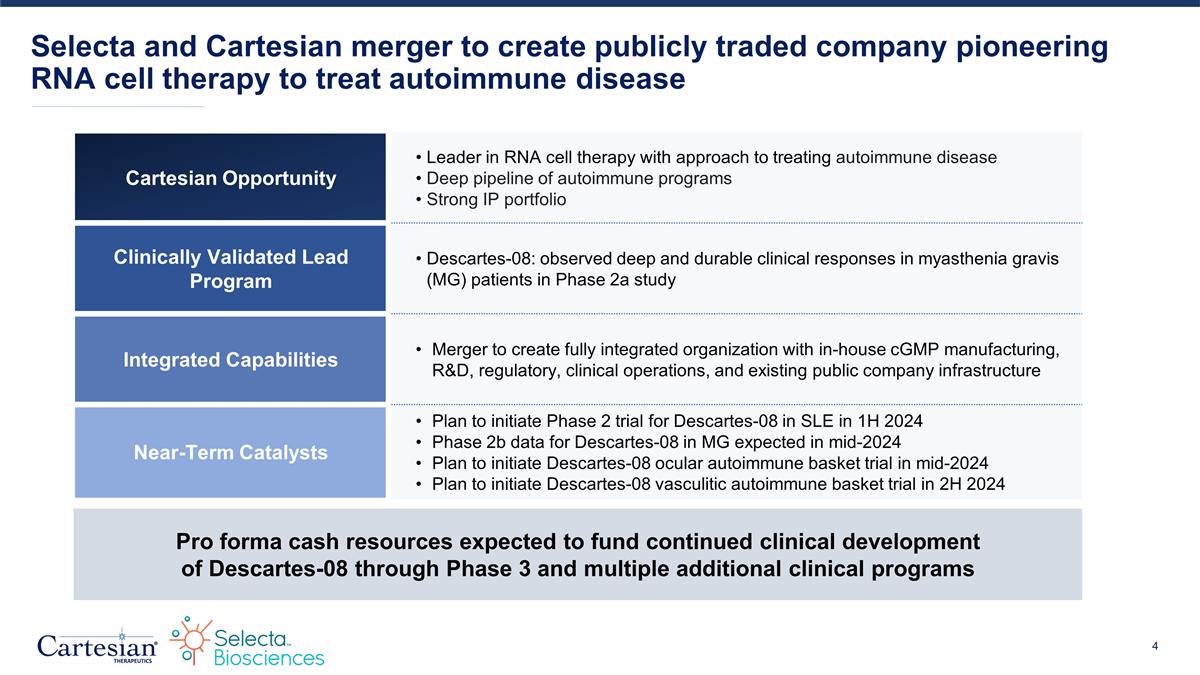

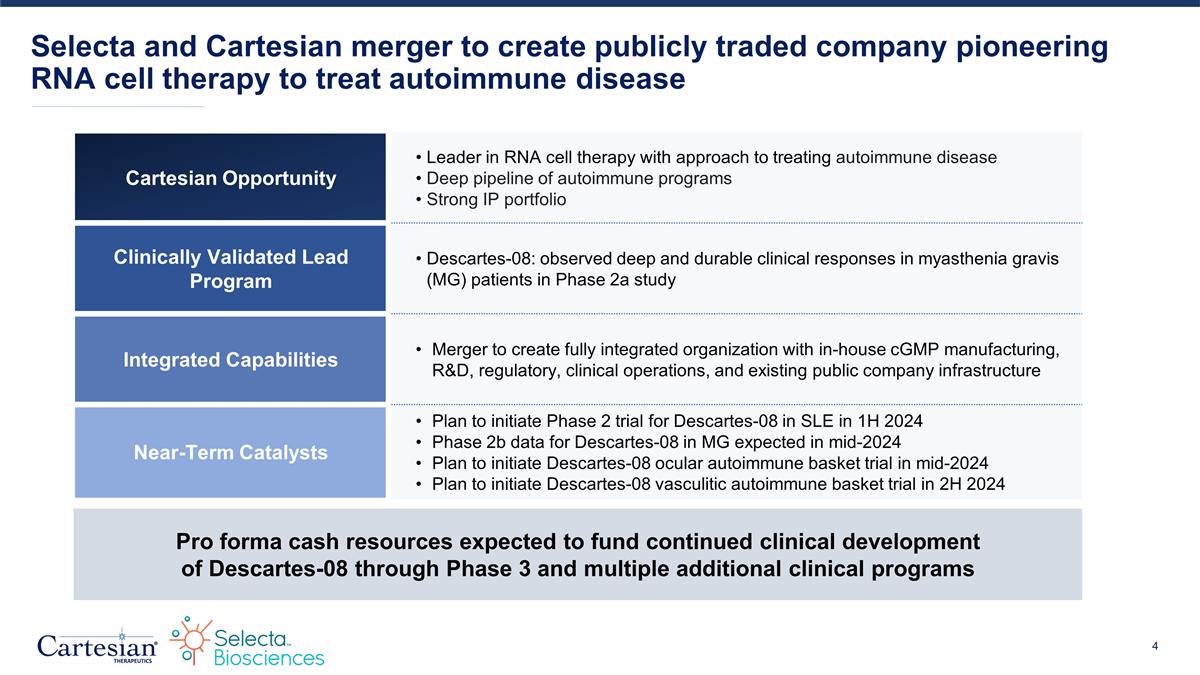

Selecta and Cartesian merger to create publicly traded company pioneering RNA cell therapy to treat autoimmune disease Pro forma cash resources expected to fund continued clinical development of Descartes-08 through Phase 3 and multiple additional clinical programs Cartesian Opportunity Leader in RNA cell therapy with approach to treating autoimmune disease Deep pipeline of autoimmune programs Strong IP portfolio Clinically Validated Lead Program Descartes-08: observed deep and durable clinical responses in myasthenia gravis (MG) patients in Phase 2a study Integrated Capabilities Merger to create fully integrated organization with in-house cGMP manufacturing, R&D, regulatory, clinical operations, and existing public company infrastructure Near-Term Catalysts Plan to initiate Phase 2 trial for Descartes-08 in SLE in 1H 2024 Phase 2b data for Descartes-08 in MG expected in mid-2024 Plan to initiate Descartes-08 ocular autoimmune basket trial in mid-2024 Plan to initiate Descartes-08 vasculitic autoimmune basket trial in 2H 2024

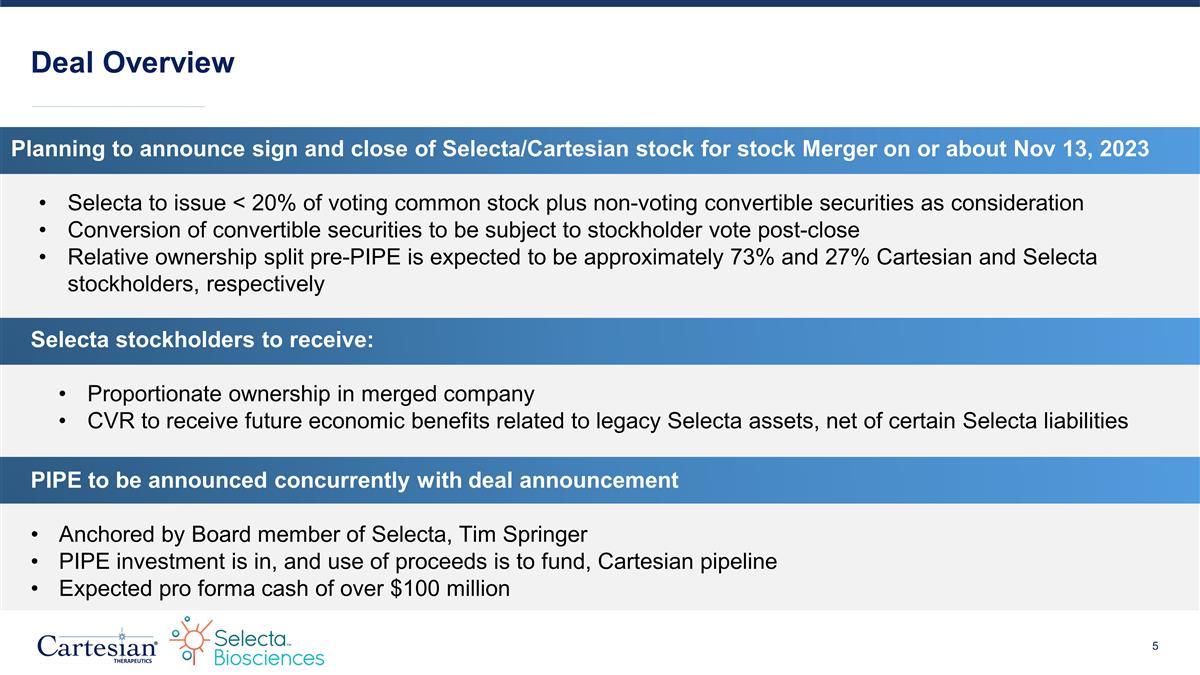

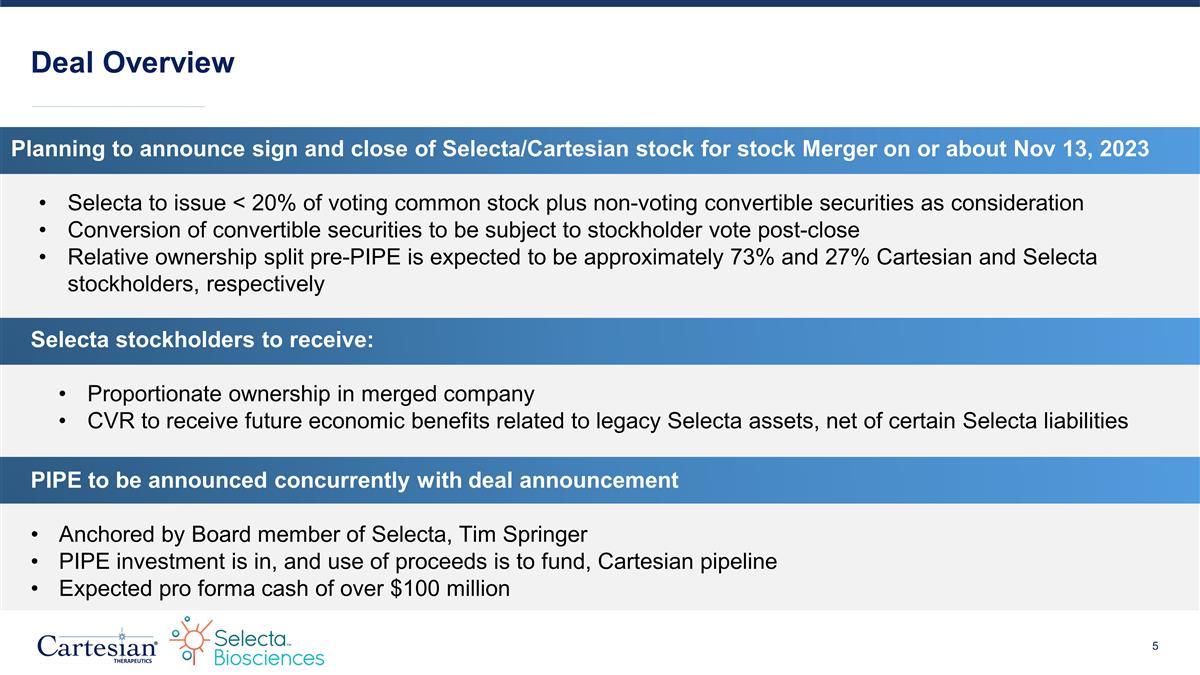

Planning to announce sign and close of Selecta/Cartesian stock for stock Merger on or about Nov 13, 2023 Selecta to issue < 20% of voting common stock plus non-voting convertible securities as consideration Conversion of convertible securities to be subject to stockholder vote post-close Relative ownership split pre-PIPE is expected to be approximately 73% and 27% Cartesian and Selecta stockholders, respectively Deal Overview Selecta stockholders to receive: Proportionate ownership in merged company CVR to receive future economic benefits related to legacy Selecta assets, net of certain Selecta liabilities PIPE to be announced concurrently with deal announcement Anchored by Board member of Selecta, Tim Springer PIPE investment is in, and use of proceeds is to fund, Cartesian pipeline Expected pro forma cash of over $100 million

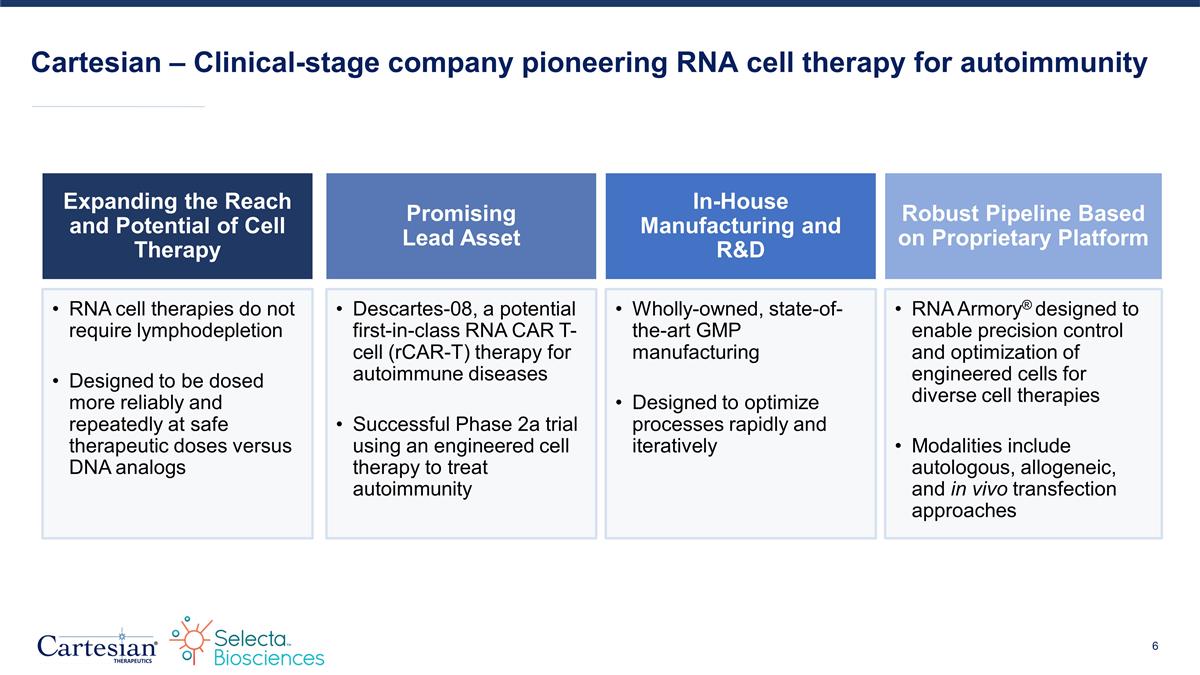

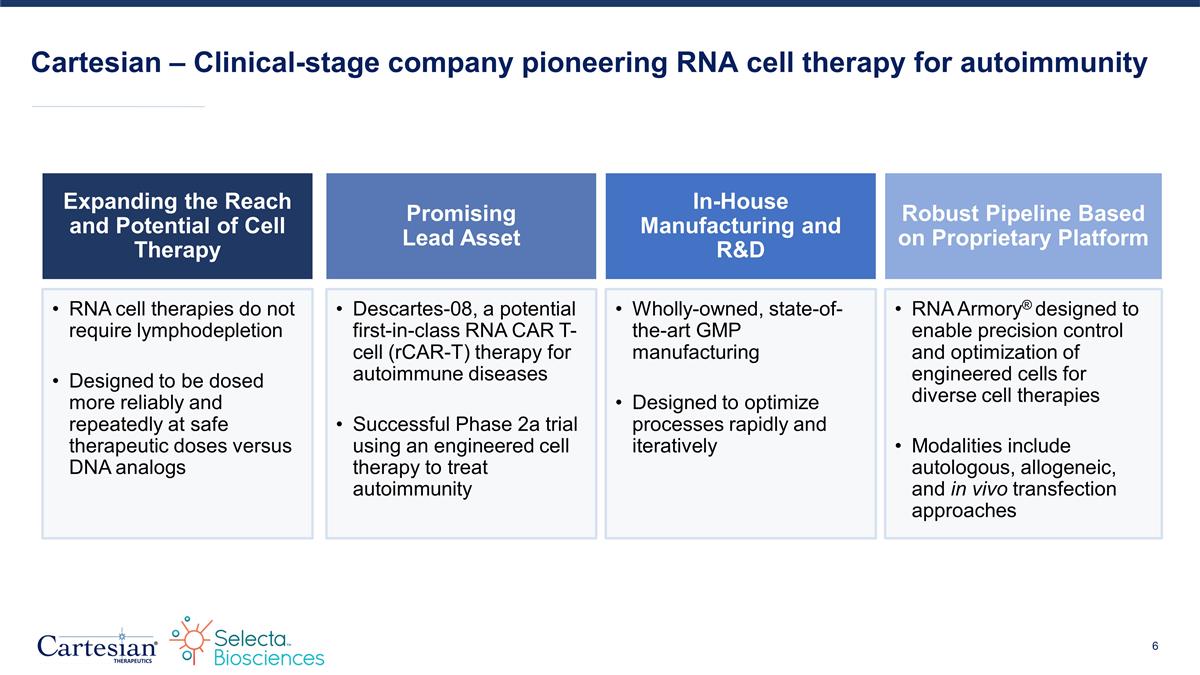

Cartesian – Clinical-stage company pioneering RNA cell therapy for autoimmunity Expanding the Reach and Potential of Cell Therapy RNA cell therapies do not require lymphodepletion Designed to be dosed more reliably and repeatedly at safe therapeutic doses versus DNA analogs Promising Lead Asset Descartes-08, a potential first-in-class RNA CAR T-cell (rCAR-T) therapy for autoimmune diseases Successful Phase 2a trial using an engineered cell therapy to treat autoimmunity In-House Manufacturing and R&D Wholly-owned, state-of-the-art GMP manufacturing Designed to optimize processes rapidly and iteratively Robust Pipeline Based on Proprietary Platform RNA Armory® designed to enable precision control and optimization of engineered cells for diverse cell therapies Modalities include autologous, allogeneic, and in vivo transfection approaches

Combined organization overview Matthew Bartholomae General Counsel Metin Kurtoglu, MD, PhD COO Milos Miljkovic, MD CMO Blaine Davis CFO Chris Jewell, PhD Chief Scientific Officer Carsten Brunn, PhD President and CEO Murat Kalayoglu, MD, PhD Director Cartesian Co-Founder and pre-merger CEO Carrie S. Cox Chairman Michael Singer, MD, PhD Director Cartesian Co-Founder and pre-merger Chief Strategy Officer Timothy Springer, PhD Director Management Select Board Members Experienced management team to lead the RNA cell therapy company of the future Emily English, PhD VP, Quality

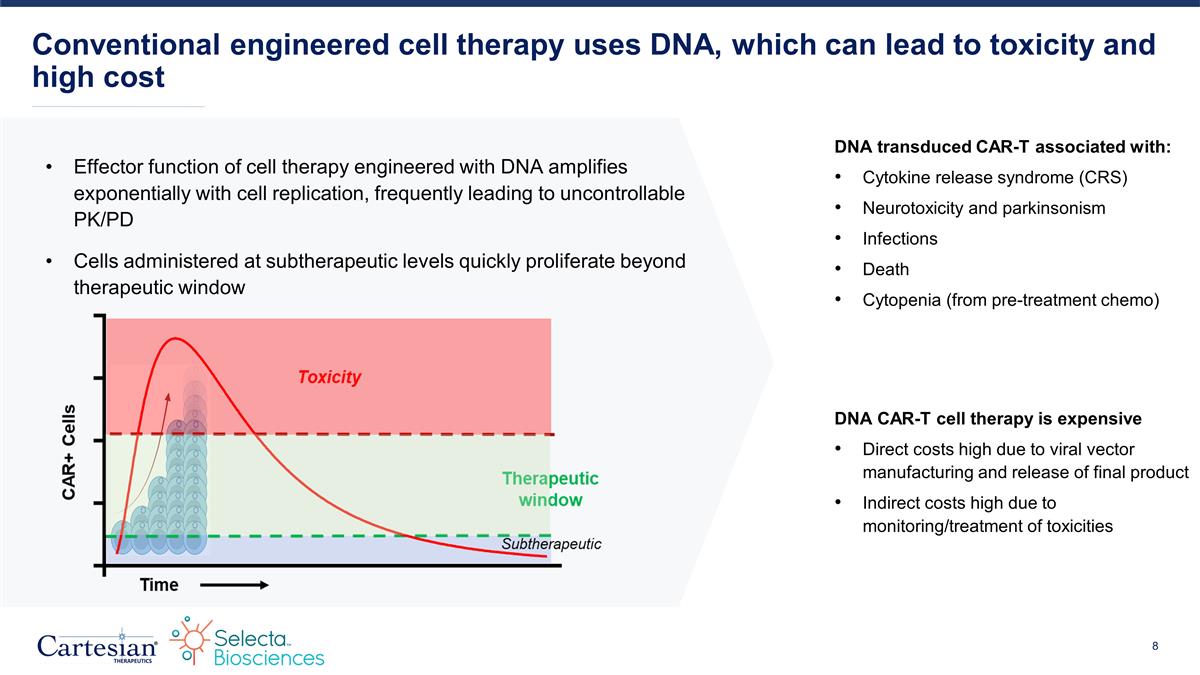

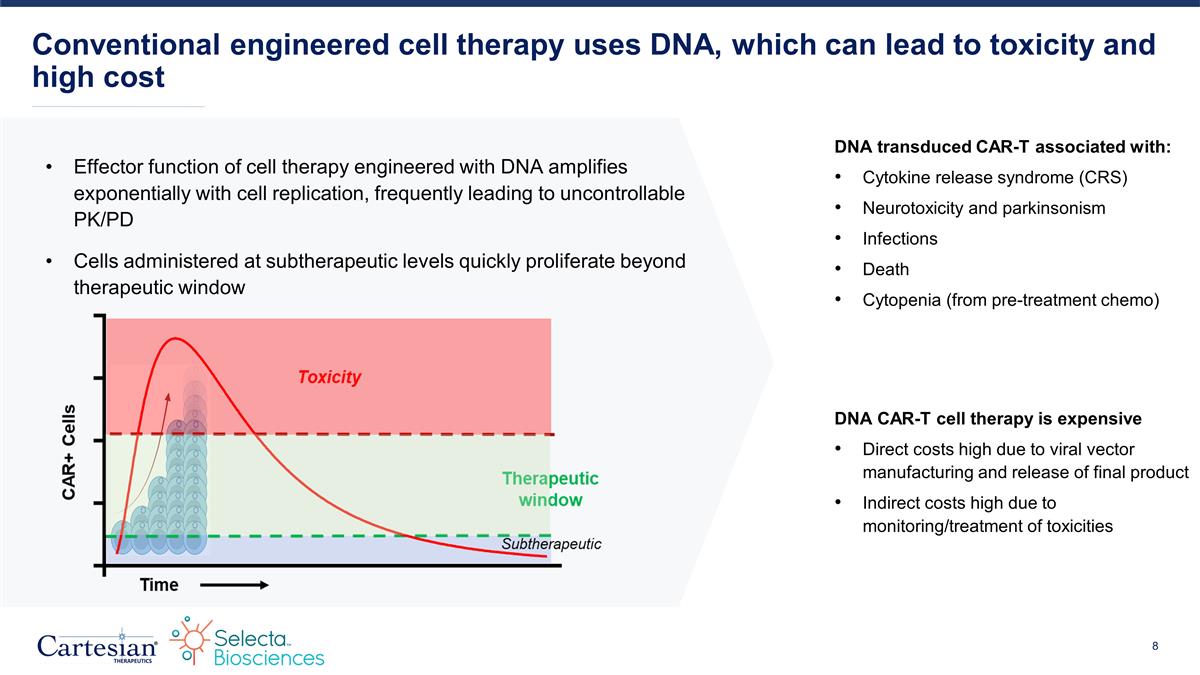

Effector function of cell therapy engineered with DNA amplifies exponentially with cell replication, frequently leading to uncontrollable PK/PD Cells administered at subtherapeutic levels quickly proliferate beyond therapeutic window Conventional engineered cell therapy uses DNA, which can lead to toxicity and high cost DNA CAR-T cell therapy is expensive Direct costs high due to viral vector manufacturing and release of final product Indirect costs high due to monitoring/treatment of toxicities DNA transduced CAR-T associated with: Cytokine release syndrome (CRS) Neurotoxicity and parkinsonism Infections Death Cytopenia (from pre-treatment chemo)

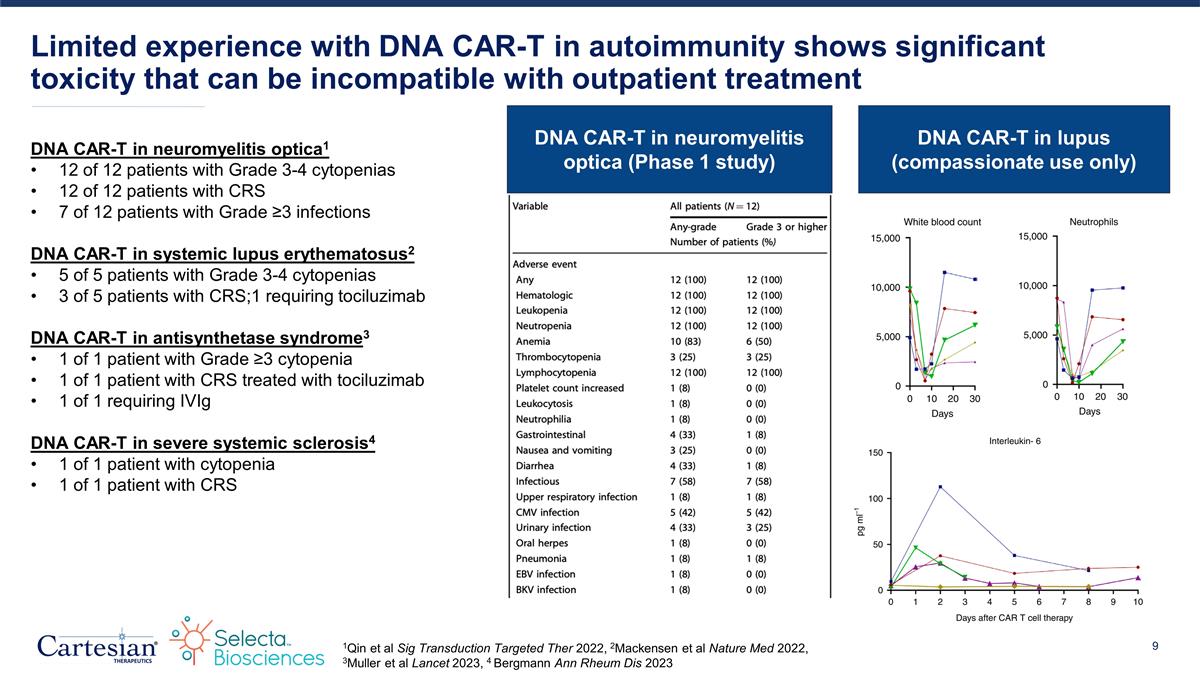

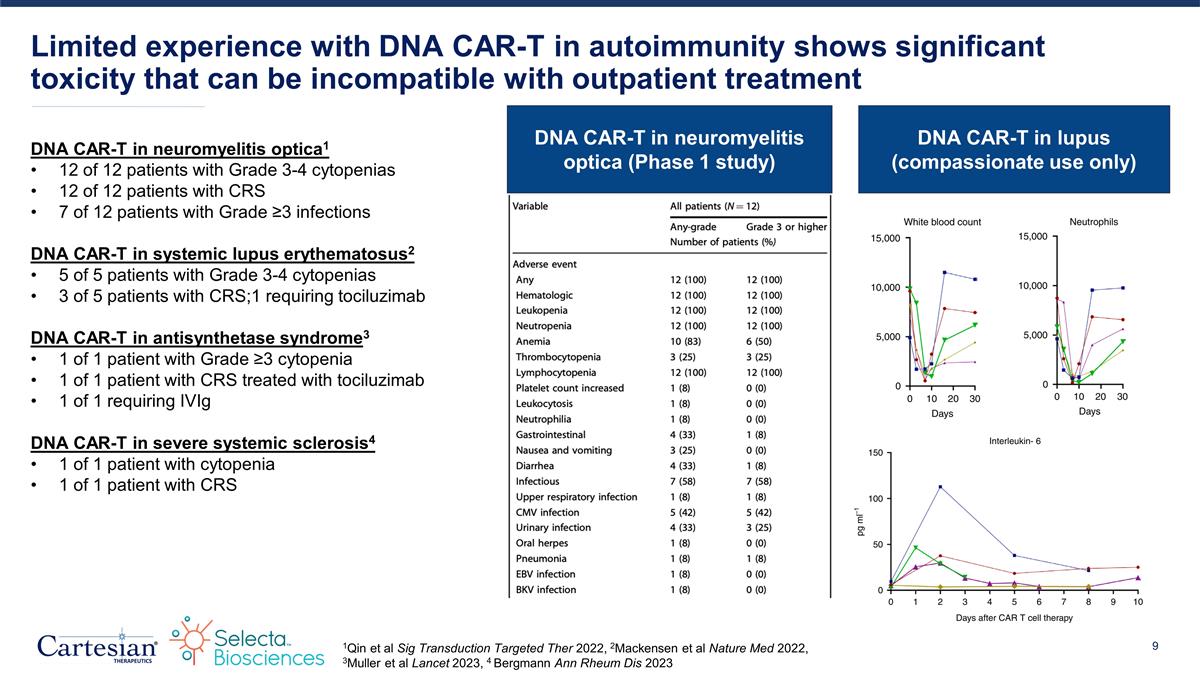

Limited experience with DNA CAR-T in autoimmunity shows significant toxicity that can be incompatible with outpatient treatment DNA CAR-T in neuromyelitis optica1 12 of 12 patients with Grade 3-4 cytopenias 12 of 12 patients with CRS 7 of 12 patients with Grade ≥3 infections DNA CAR-T in systemic lupus erythematosus2 5 of 5 patients with Grade 3-4 cytopenias 3 of 5 patients with CRS;1 requiring tociluzimab DNA CAR-T in antisynthetase syndrome3 1 of 1 patient with Grade ≥3 cytopenia 1 of 1 patient with CRS treated with tociluzimab 1 of 1 requiring IVIg DNA CAR-T in severe systemic sclerosis4 1 of 1 patient with cytopenia 1 of 1 patient with CRS 1Qin et al Sig Transduction Targeted Ther 2022, 2Mackensen et al Nature Med 2022, 3Muller et al Lancet 2023, 4 Bergmann Ann Rheum Dis 2023 DNA CAR-T in neuromyelitis optica (Phase 1 study) DNA CAR-T in lupus (compassionate use only)

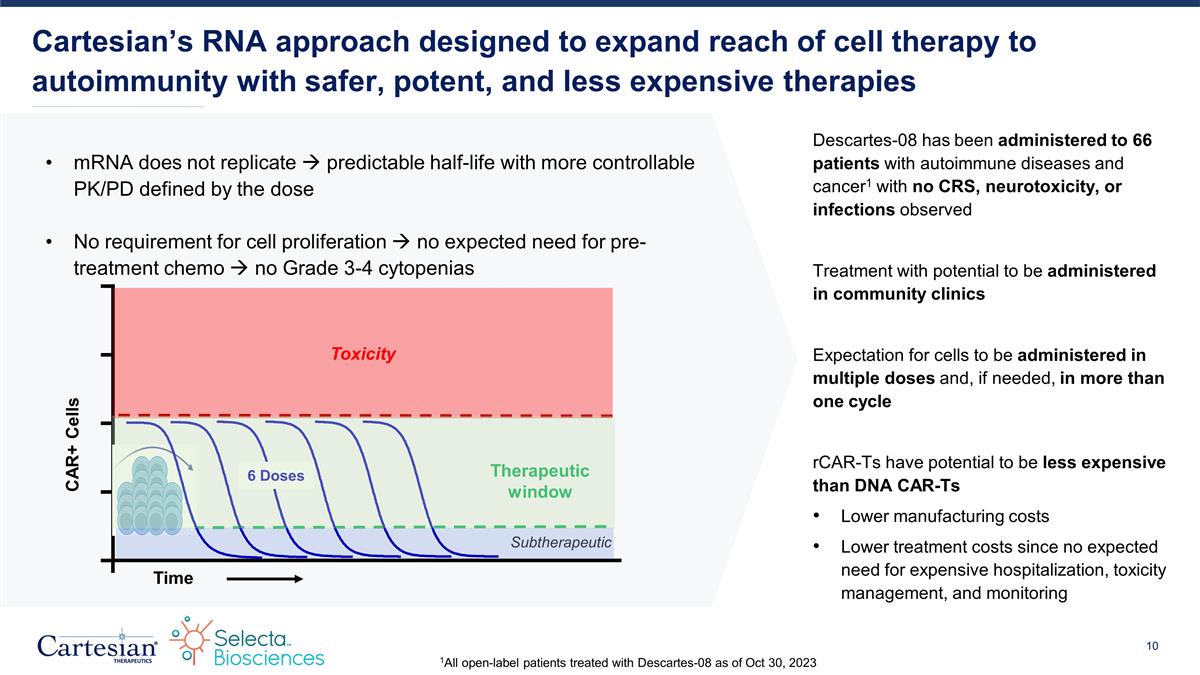

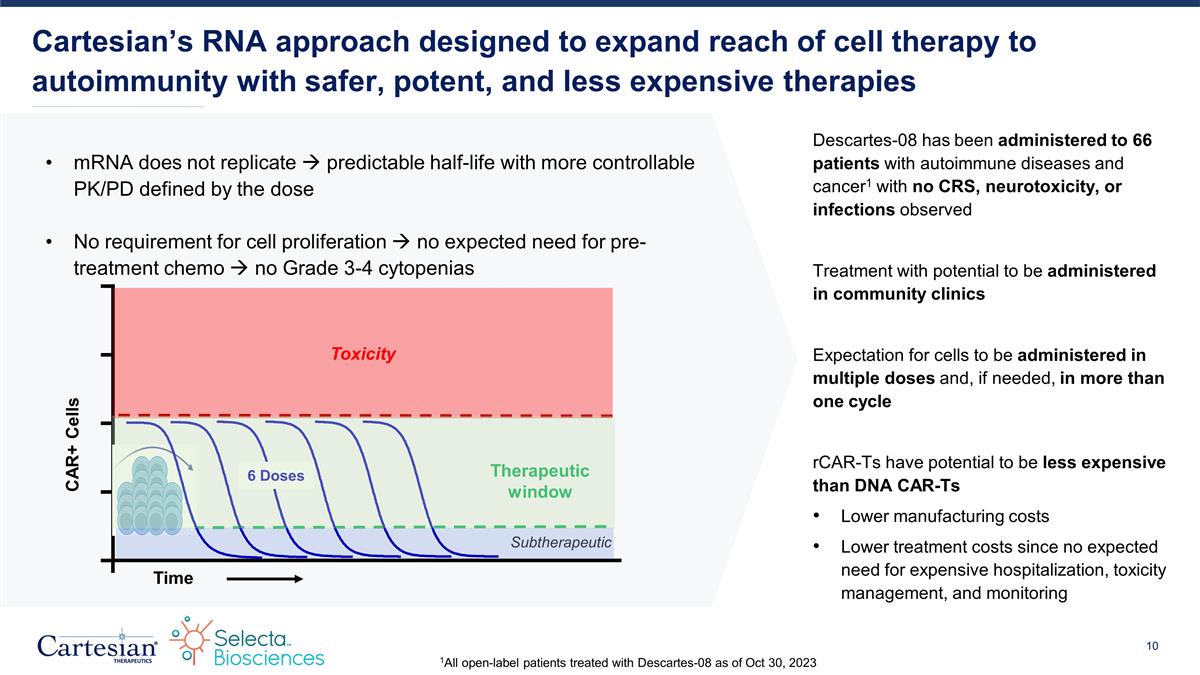

mRNA does not replicate à predictable half-life with more controllable PK/PD defined by the dose No requirement for cell proliferation à no expected need for pre-treatment chemo à no Grade 3-4 cytopenias Cartesian’s RNA approach designed to expand reach of cell therapy to autoimmunity with safer, potent, and less expensive therapies Descartes-08 has been administered to 66 patients with autoimmune diseases and cancer1 with no CRS, neurotoxicity, or infections observed Treatment with potential to be administered in community clinics Expectation for cells to be administered in multiple doses and, if needed, in more than one cycle rCAR-Ts have potential to be less expensive than DNA CAR-Ts Lower manufacturing costs Lower treatment costs since no expected need for expensive hospitalization, toxicity management, and monitoring Time Therapeutic window Subtherapeutic Toxicity CAR+ Cells 6 Doses 1All open-label patients treated with Descartes-08 as of Oct 30, 2023

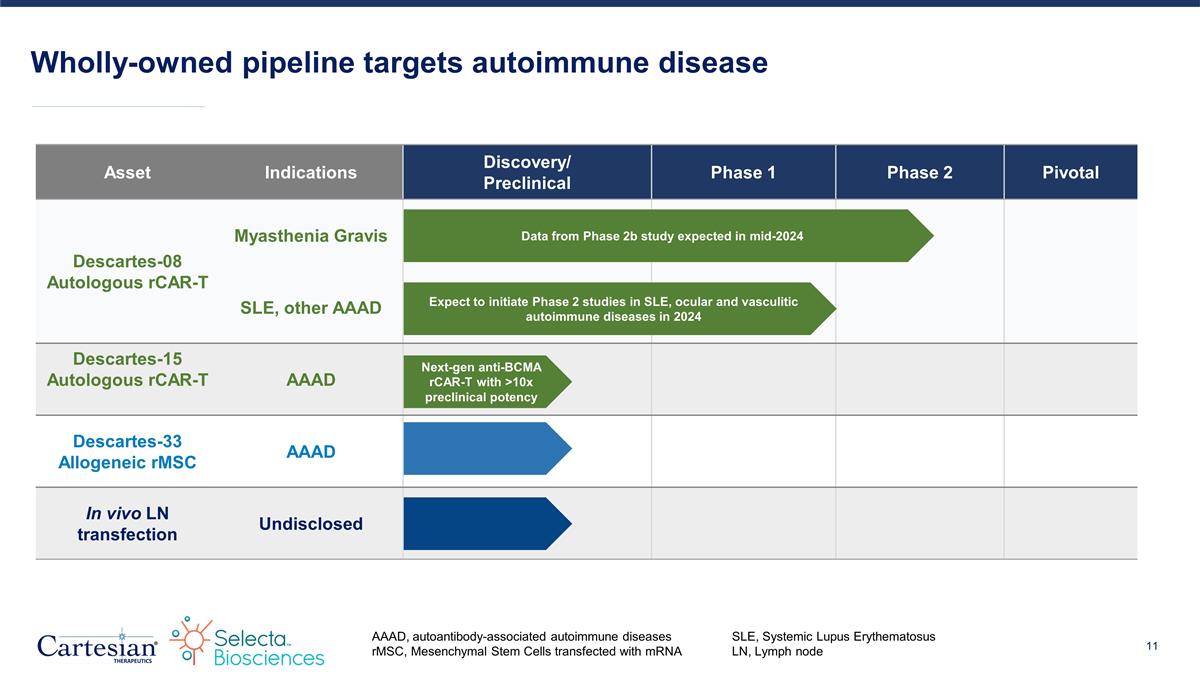

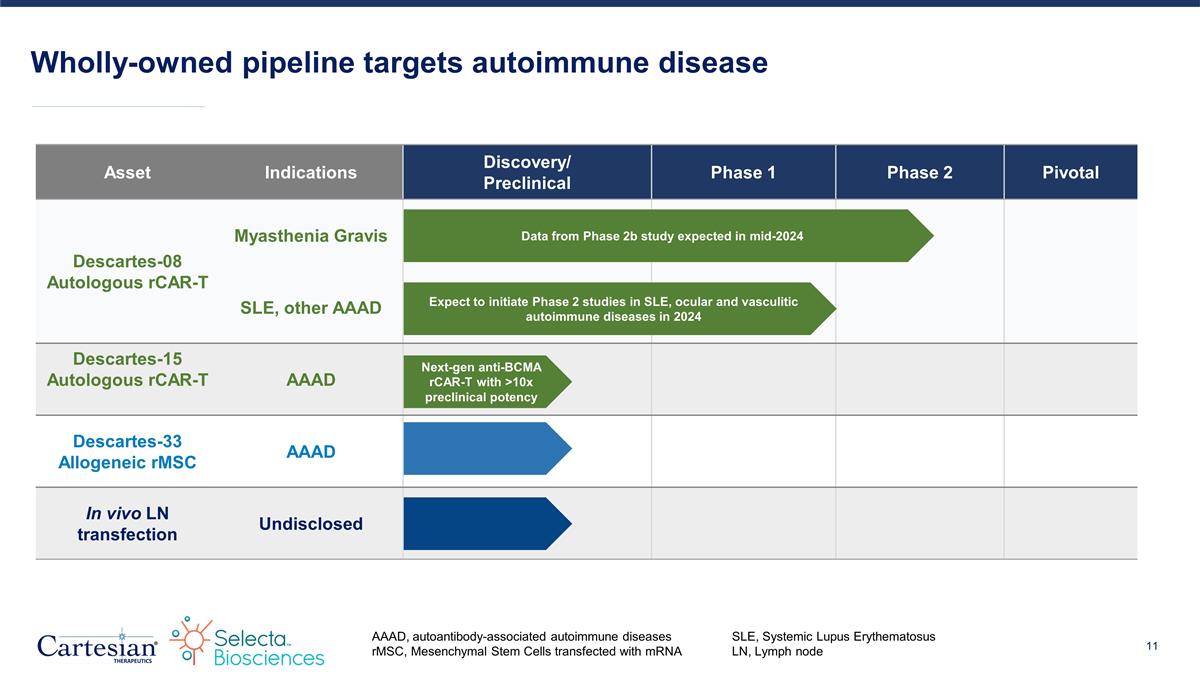

Wholly-owned pipeline targets autoimmune disease AAAD, autoantibody-associated autoimmune diseasesSLE, Systemic Lupus Erythematosus rMSC, Mesenchymal Stem Cells transfected with mRNALN, Lymph node Asset Indications Discovery/ Preclinical Phase 1 Phase 2 Pivotal Descartes-08 Autologous rCAR-T Myasthenia Gravis SLE, other AAAD Descartes-15 Autologous rCAR-T AAAD Descartes-33 Allogeneic rMSC AAAD In vivo LN transfection Undisclosed Data from Phase 2b study expected in mid-2024 Expect to initiate Phase 2 studies in SLE, ocular and vasculitic autoimmune diseases in 2024 Next-gen anti-BCMA rCAR-T with >10x preclinical potency

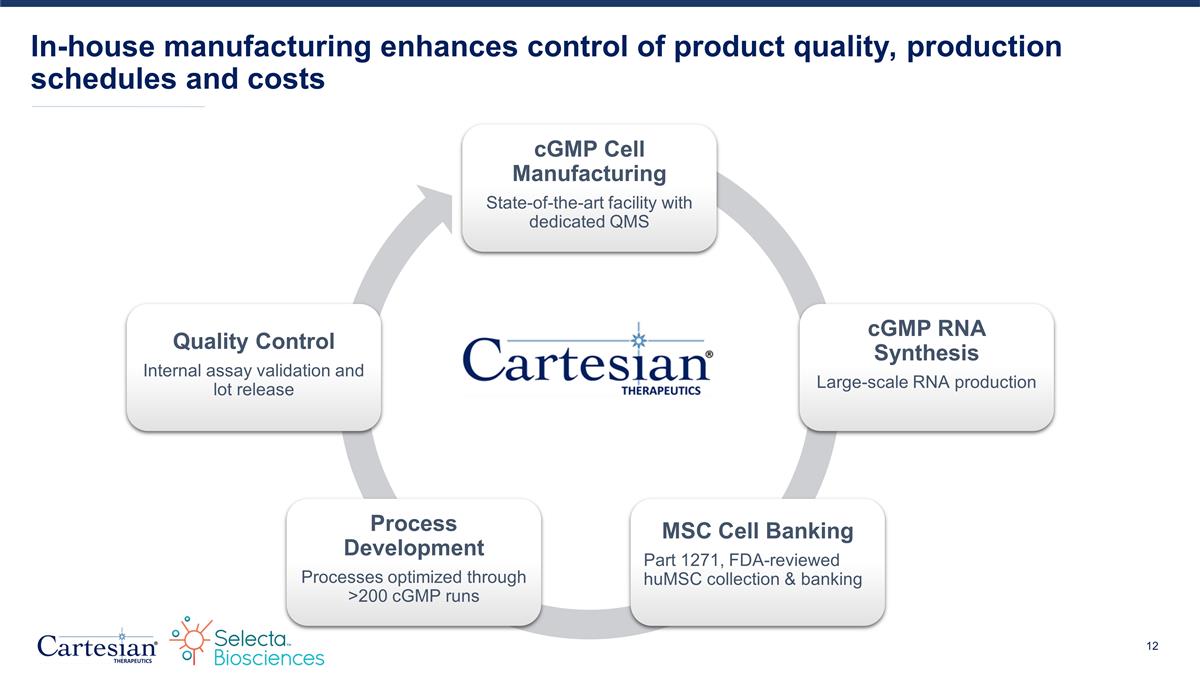

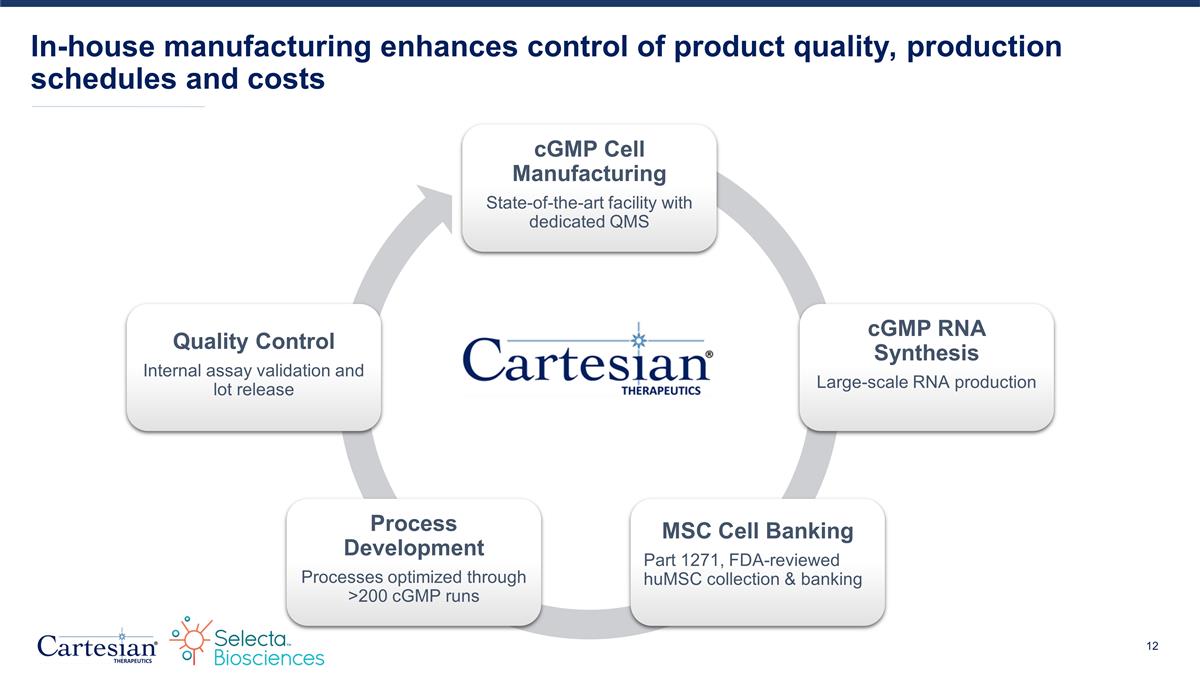

In-house manufacturing enhances control of product quality, production schedules and costs cGMP Cell Manufacturing State-of-the-art facility with dedicated QMS cGMP RNA Synthesis Large-scale RNA production MSC Cell Banking Part 1271, FDA-reviewed huMSC collection & banking Process Development Processes optimized through >200 cGMP runs Quality Control Internal assay validation and lot release

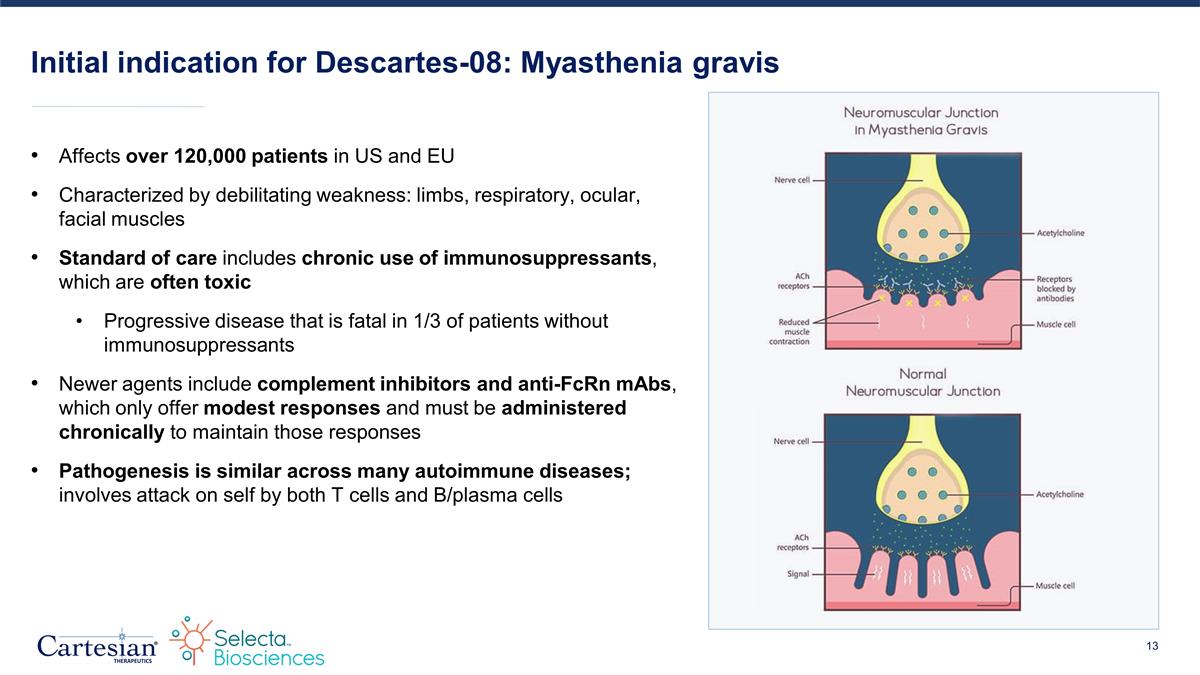

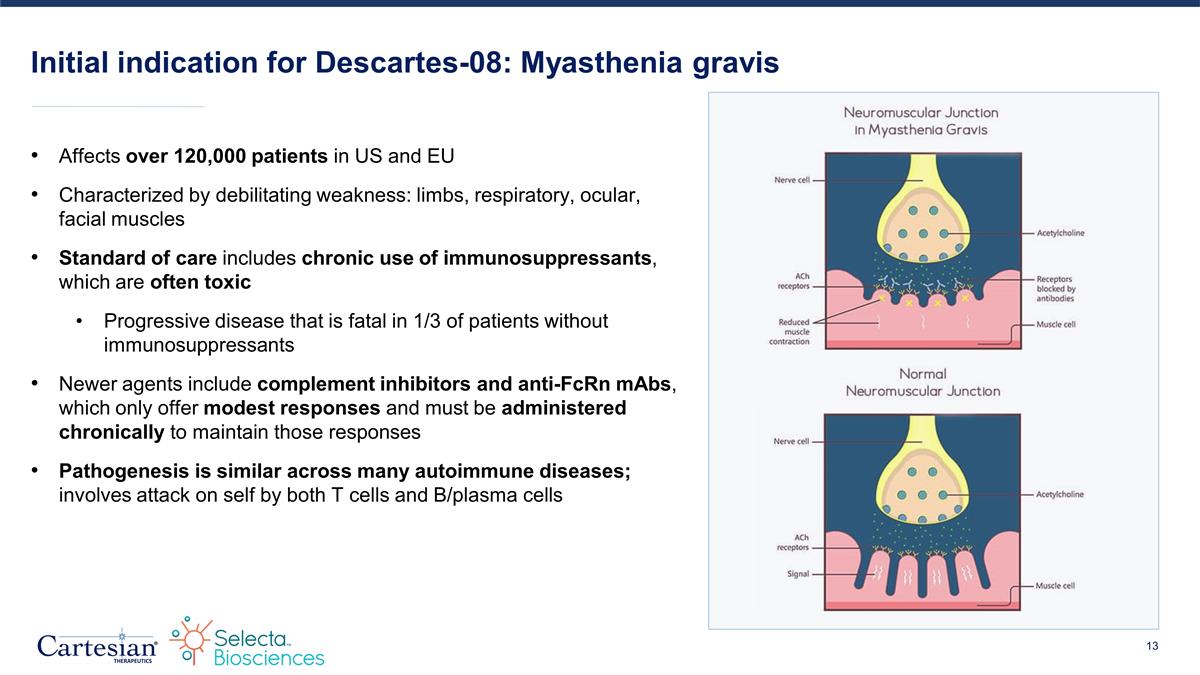

Initial indication for Descartes-08: Myasthenia gravis Affects over 120,000 patients in US and EU Characterized by debilitating weakness: limbs, respiratory, ocular, facial muscles Standard of care includes chronic use of immunosuppressants, which are often toxic Progressive disease that is fatal in 1/3 of patients without immunosuppressants Newer agents include complement inhibitors and anti-FcRn mAbs, which only offer modest responses and must be administered chronically to maintain those responses Pathogenesis is similar across many autoimmune diseases; involves attack on self by both T cells and B/plasma cells

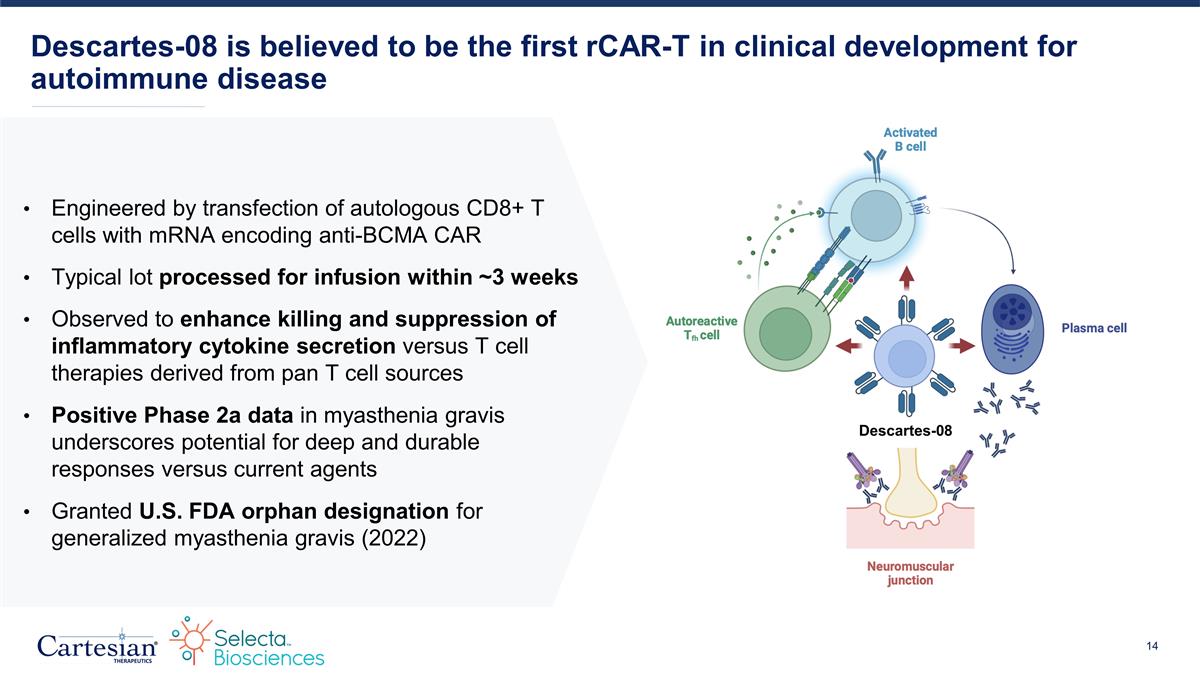

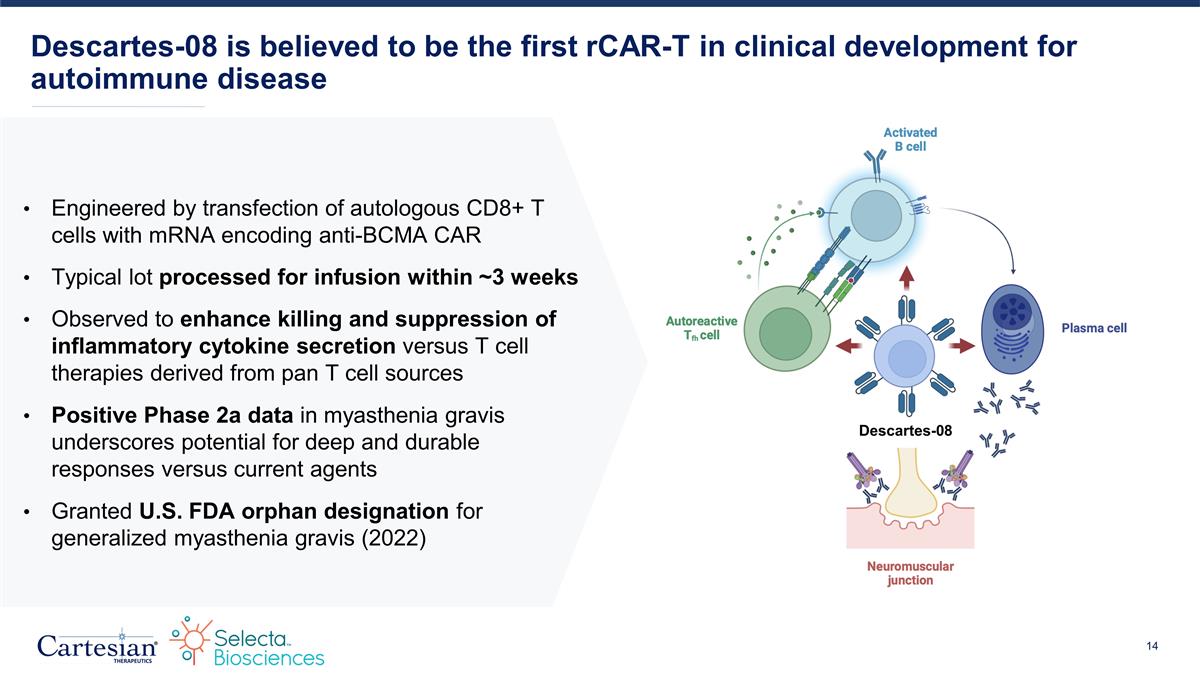

Descartes-08 is believed to be the first rCAR-T in clinical development for autoimmune disease Descartes-08 Engineered by transfection of autologous CD8+ T cells with mRNA encoding anti-BCMA CAR Typical lot processed for infusion within ~3 weeks Observed to enhance killing and suppression of inflammatory cytokine secretion versus T cell therapies derived from pan T cell sources Positive Phase 2a data in myasthenia gravis underscores potential for deep and durable responses versus current agents Granted U.S. FDA orphan designation for generalized myasthenia gravis (2022)

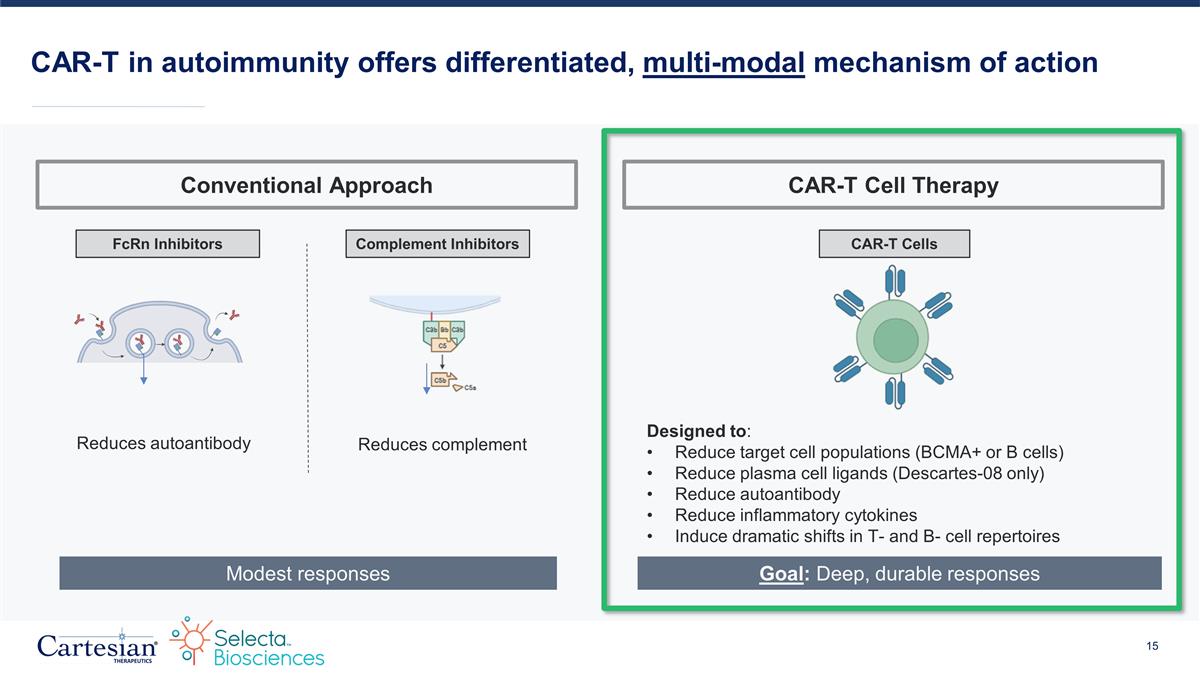

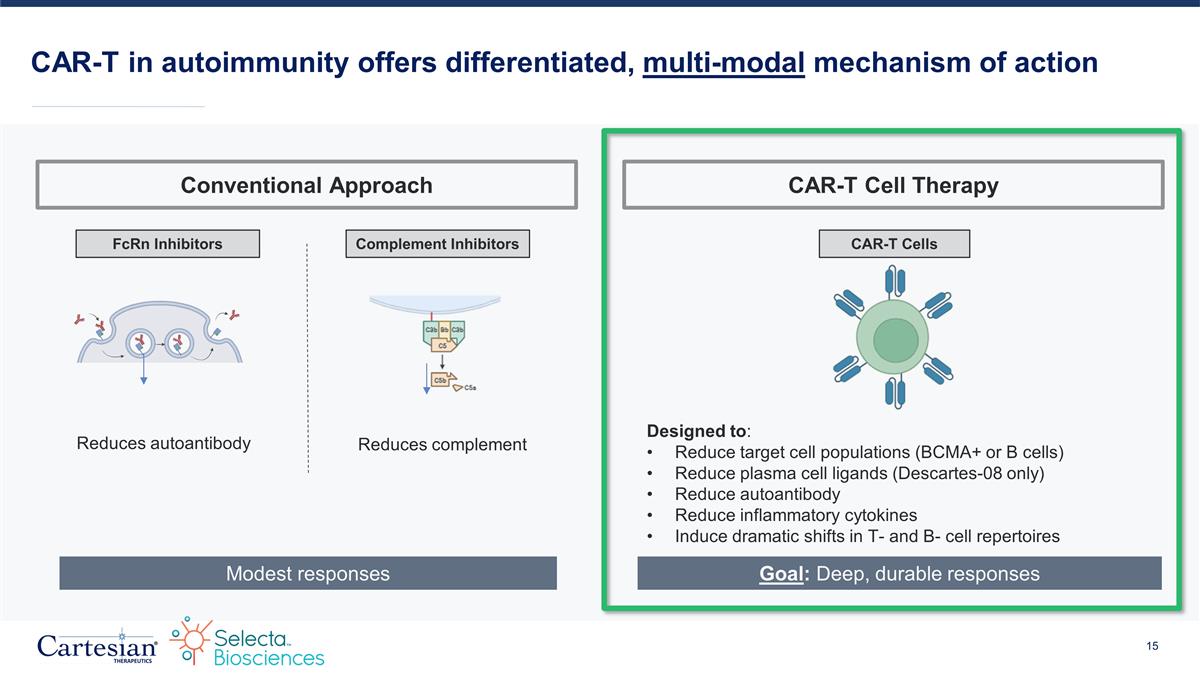

CAR-T in autoimmunity offers differentiated, multi-modal mechanism of action FcRn Inhibitors Complement Inhibitors Reduces complement Reduces autoantibody CAR-T Cells Designed to: Reduce target cell populations (BCMA+ or B cells) Reduce plasma cell ligands (Descartes-08 only) Reduce autoantibody Reduce inflammatory cytokines Induce dramatic shifts in T- and B- cell repertoires Modest responses Goal: Deep, durable responses Conventional Approach CAR-T Cell Therapy

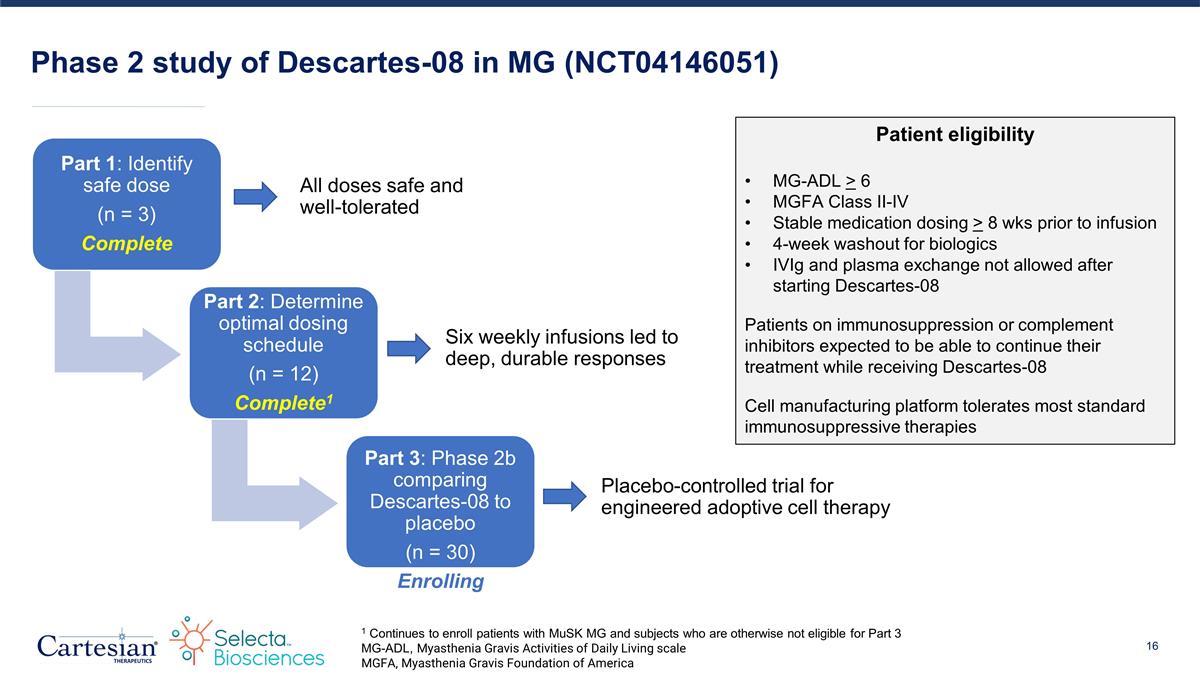

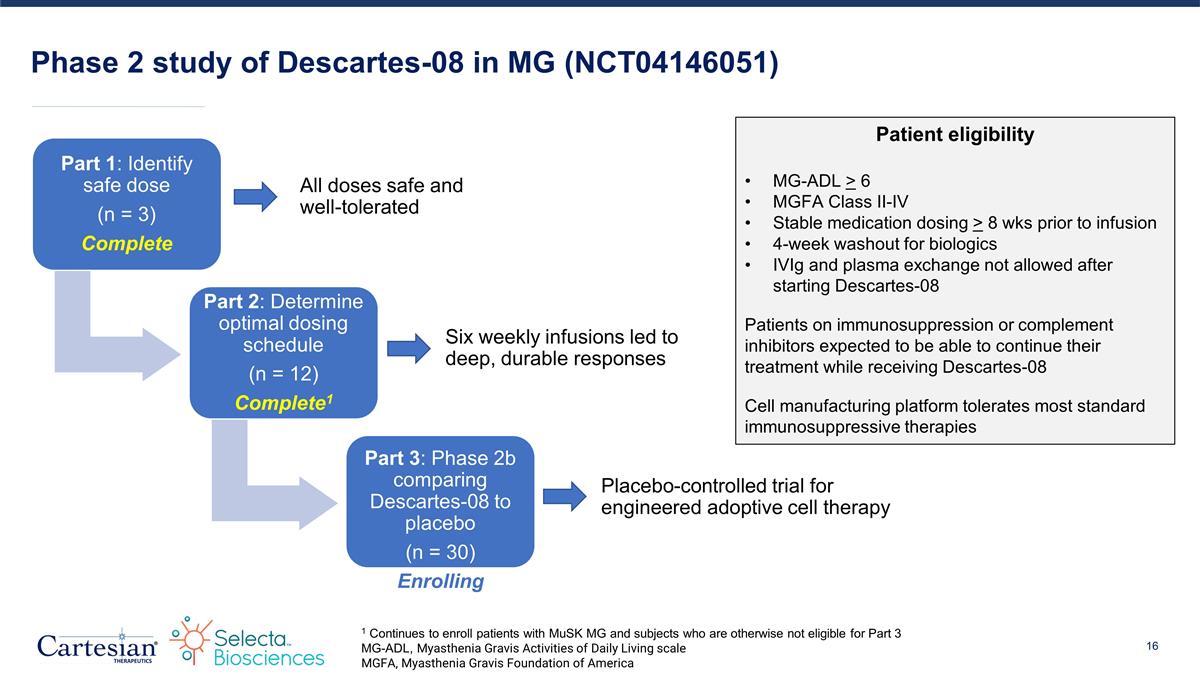

Phase 2 study of Descartes-08 in MG (NCT04146051) Part 1: Identify safe dose (n = 3) Complete Part 2: Determine optimal dosing schedule (n = 12) Complete1 Part 3: Phase 2b comparing Descartes-08 to placebo (n = 30) Enrolling All doses safe and well-tolerated Six weekly infusions led to deep, durable responses Placebo-controlled trial for engineered adoptive cell therapy 1 Continues to enroll patients with MuSK MG and subjects who are otherwise not eligible for Part 3 MG-ADL, Myasthenia Gravis Activities of Daily Living scale MGFA, Myasthenia Gravis Foundation of America Patient eligibility MG-ADL > 6 MGFA Class II-IV Stable medication dosing > 8 wks prior to infusion 4-week washout for biologics IVIg and plasma exchange not allowed after starting Descartes-08 Patients on immunosuppression or complement inhibitors expected to be able to continue their treatment while receiving Descartes-08 Cell manufacturing platform tolerates most standard immunosuppressive therapies

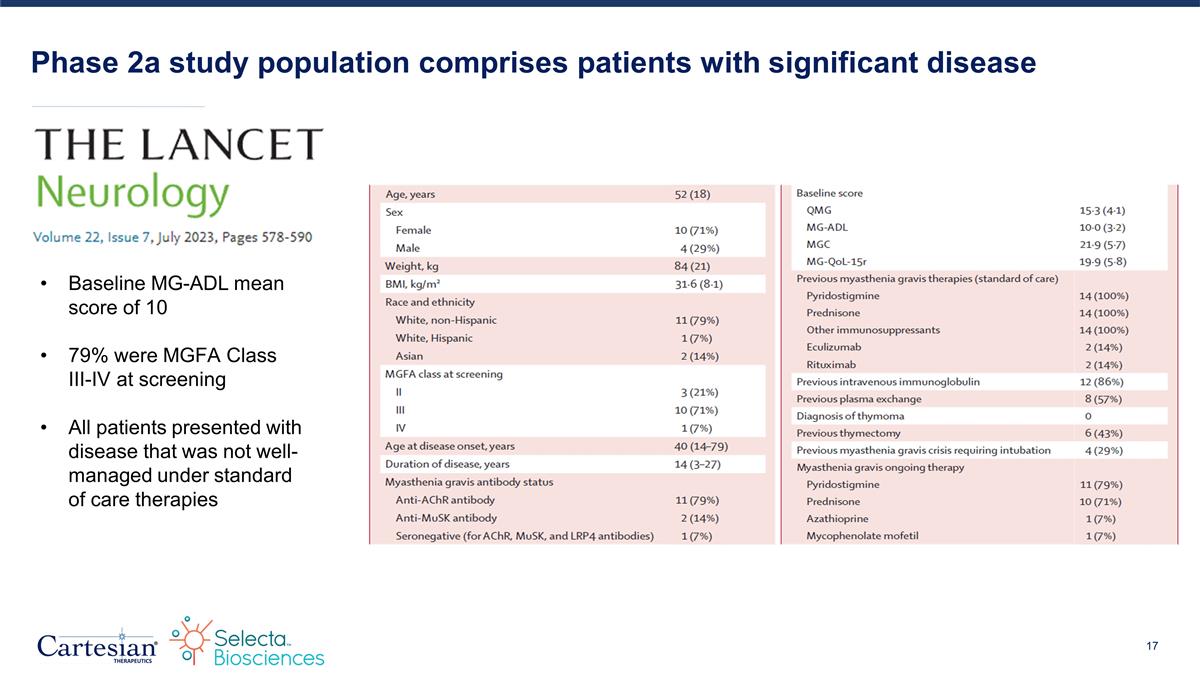

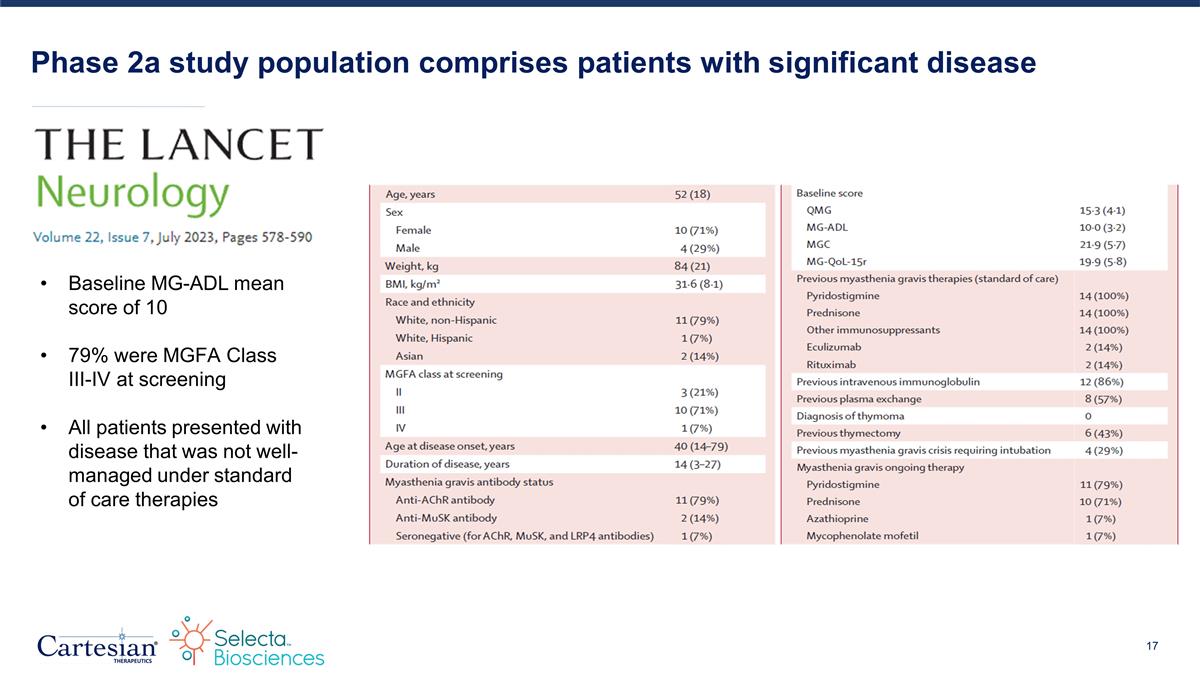

Phase 2a study population comprises patients with significant disease Baseline MG-ADL mean score of 10 79% were MGFA Class III-IV at screening All patients presented with disease that was not well-managed under standard of care therapies

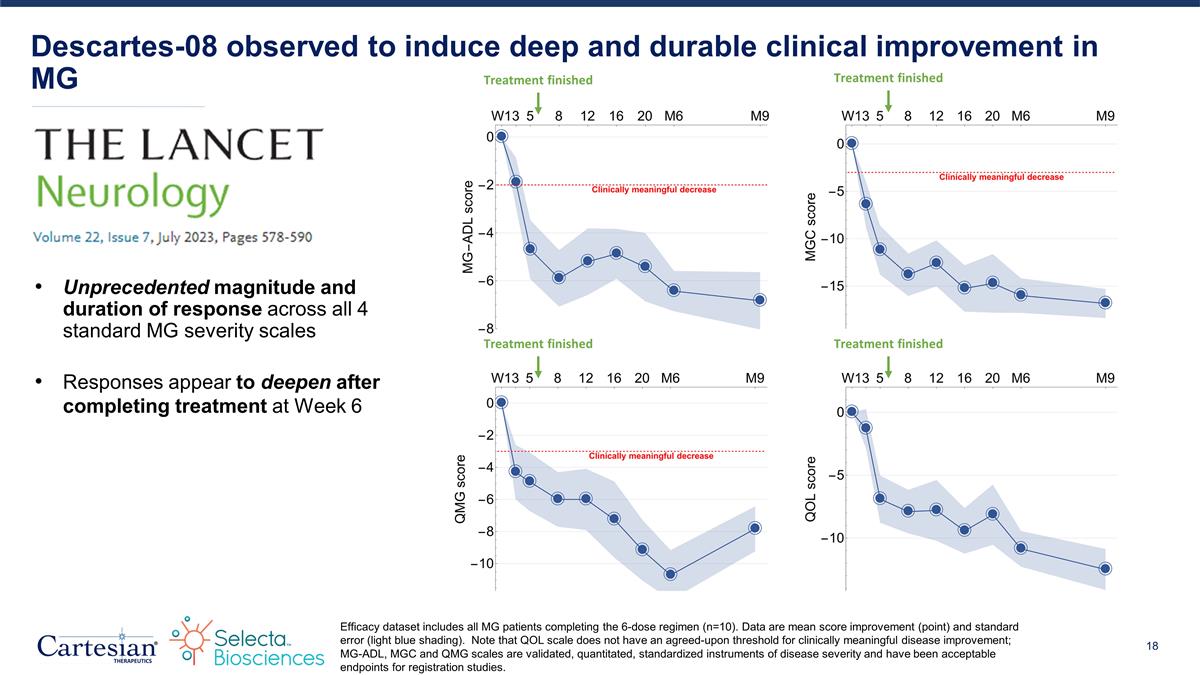

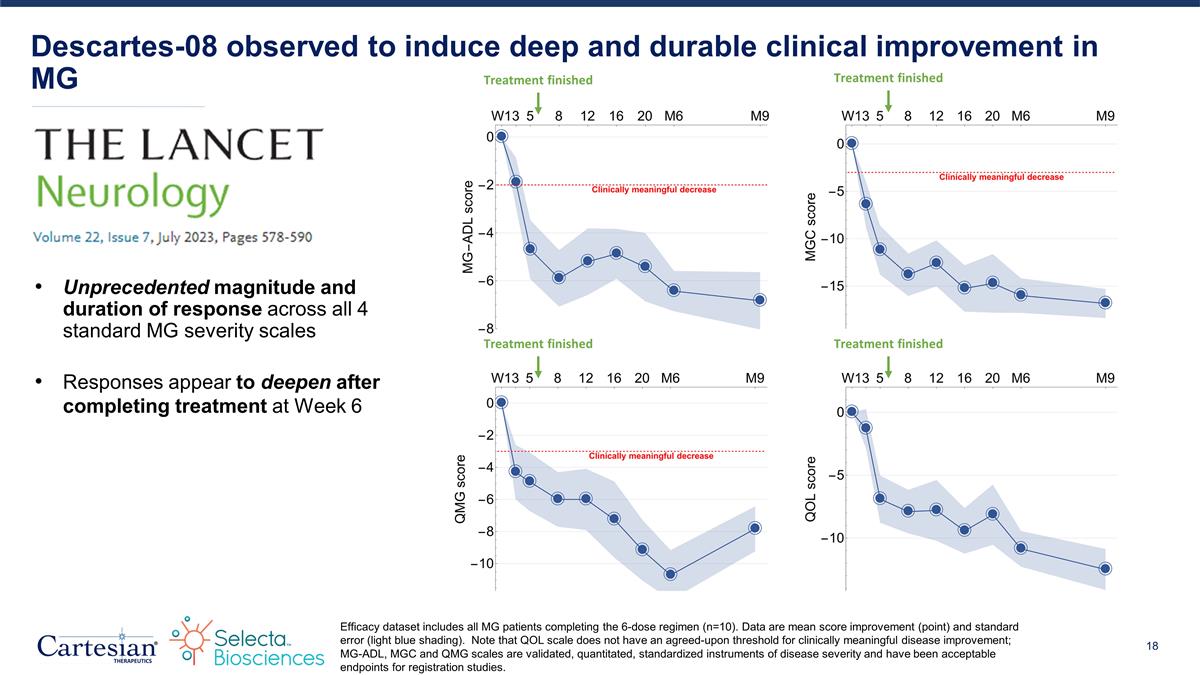

Descartes-08 observed to induce deep and durable clinical improvement in MG Efficacy dataset includes all MG patients completing the 6-dose regimen (n=10). Data are mean score improvement (point) and standard error (light blue shading). Note that QOL scale does not have an agreed-upon threshold for clinically meaningful disease improvement; MG-ADL, MGC and QMG scales are validated, quantitated, standardized instruments of disease severity and have been acceptable endpoints for registration studies. Treatment finished Treatment finished Treatment finished Treatment finished Unprecedented magnitude and duration of response across all 4 standard MG severity scales Responses appear to deepen after completing treatment at Week 6

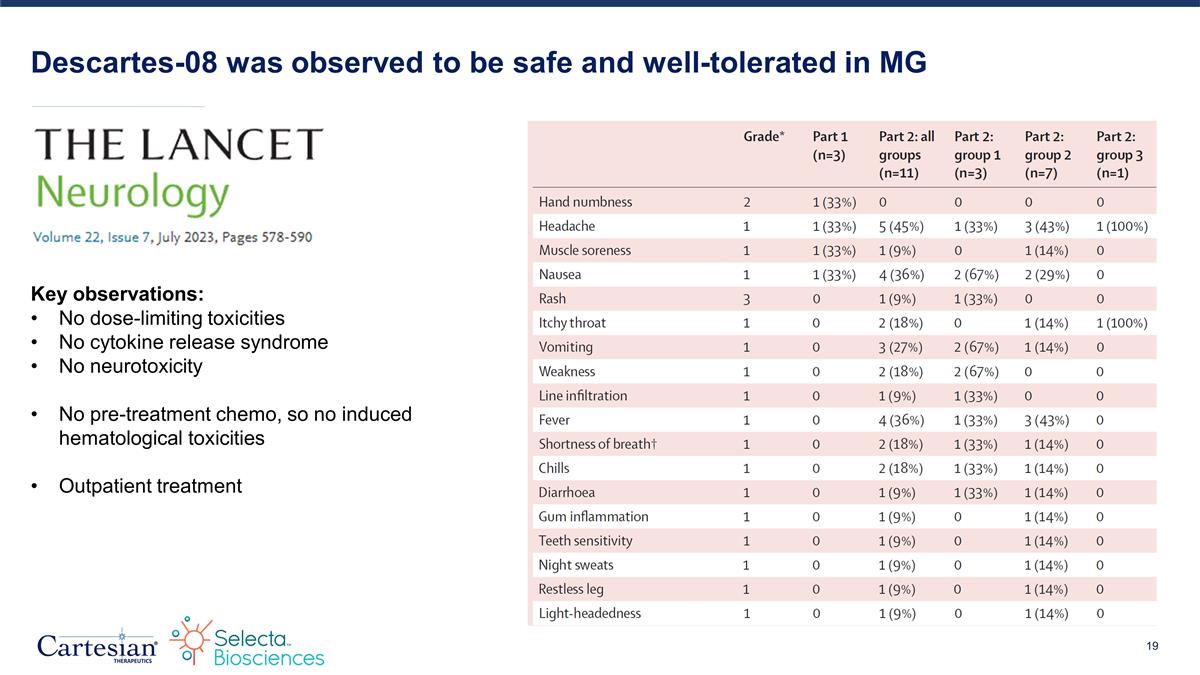

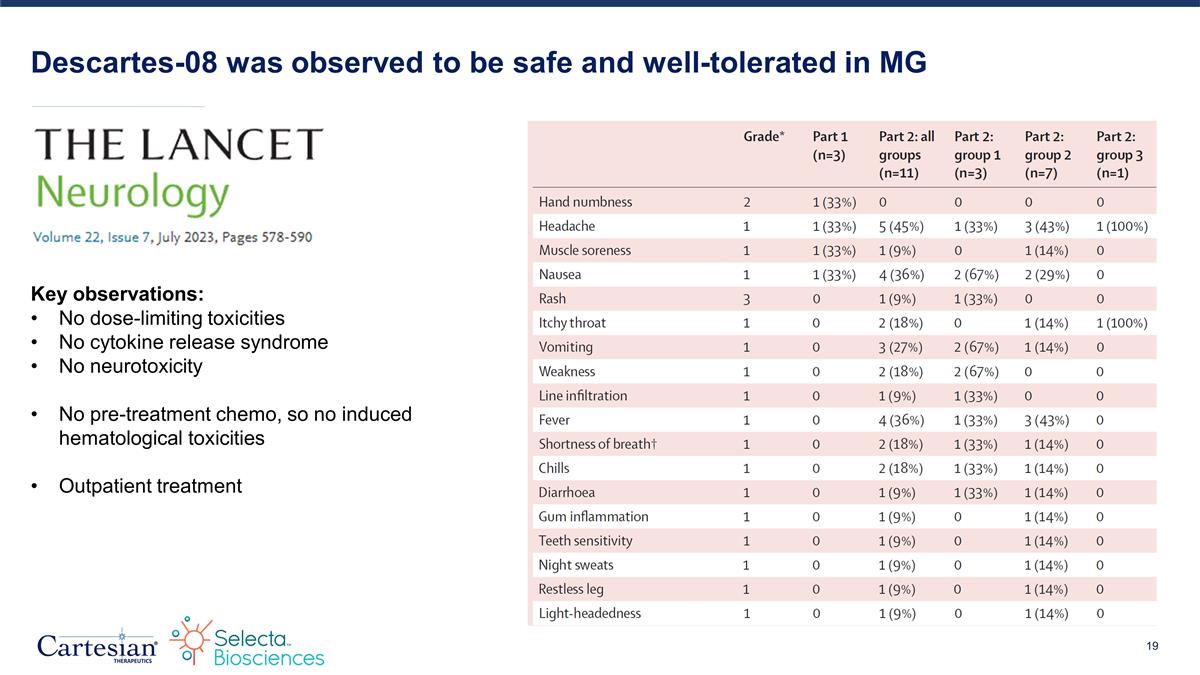

Descartes-08 was observed to be safe and well-tolerated in MG Key observations: No dose-limiting toxicities No cytokine release syndrome No neurotoxicity No pre-treatment chemo, so no induced hematological toxicities Outpatient treatment

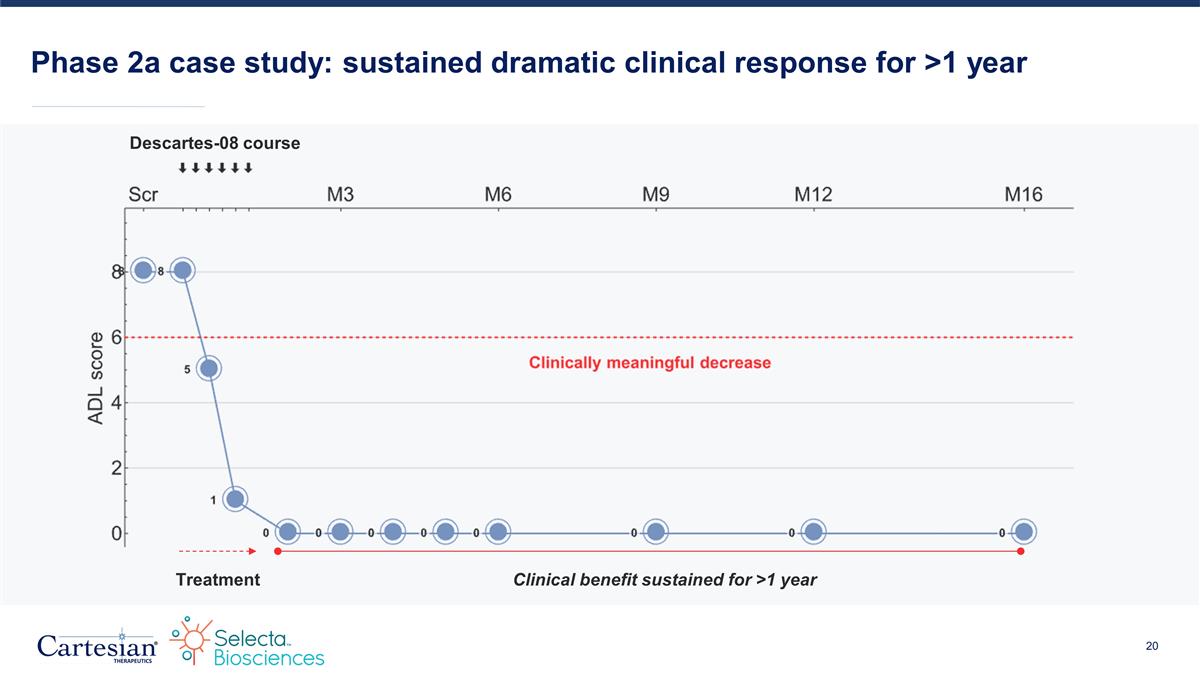

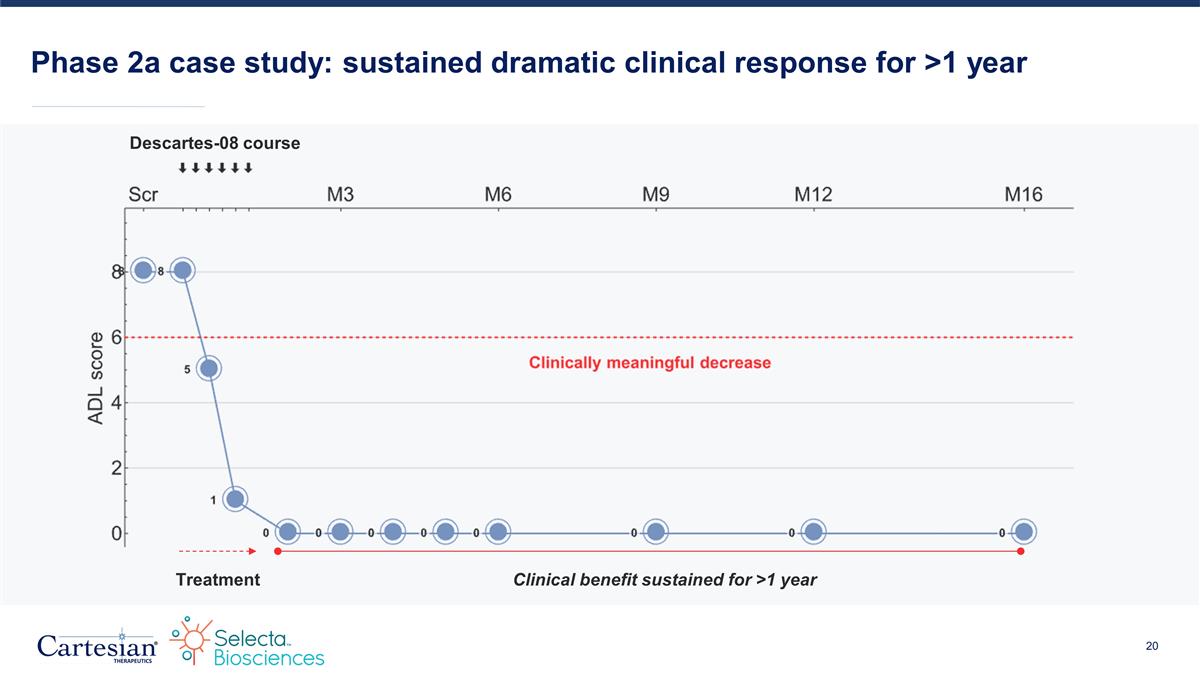

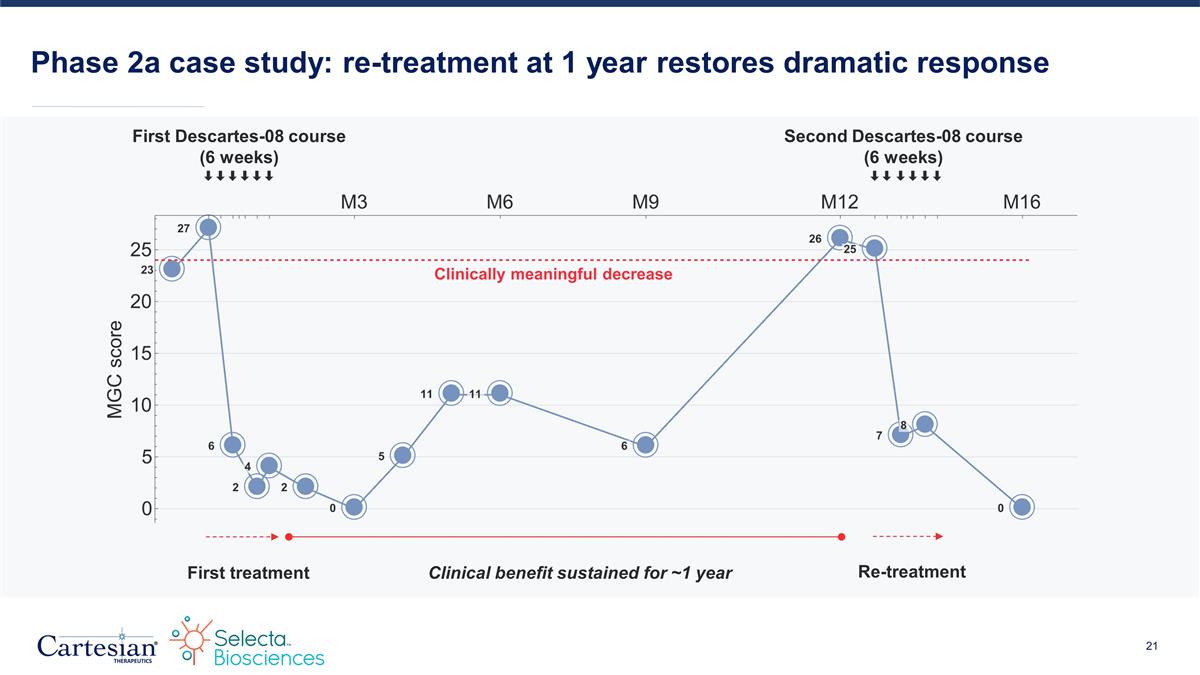

Phase 2a case study: sustained dramatic clinical response for >1 year Treatment Clinical benefit sustained for >1 year Descartes-08 course

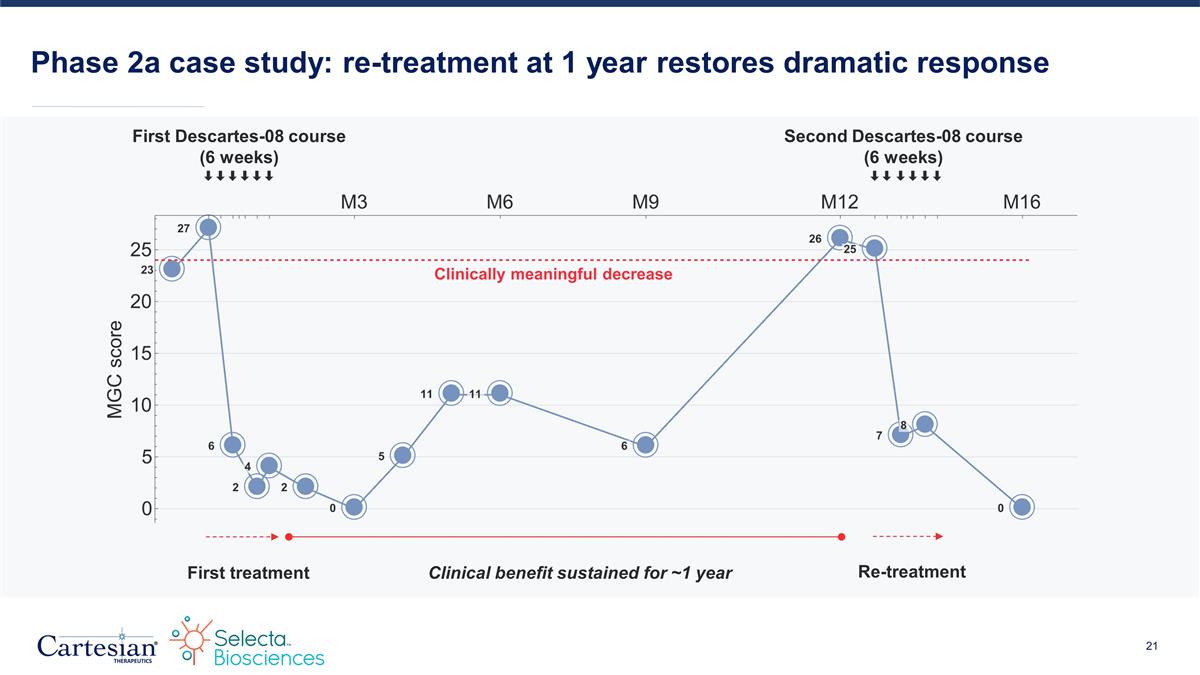

Phase 2a case study: re-treatment at 1 year restores dramatic response First treatment Clinical benefit sustained for ~1 year Re-treatment First Descartes-08 course (6 weeks) Second Descartes-08 course (6 weeks)

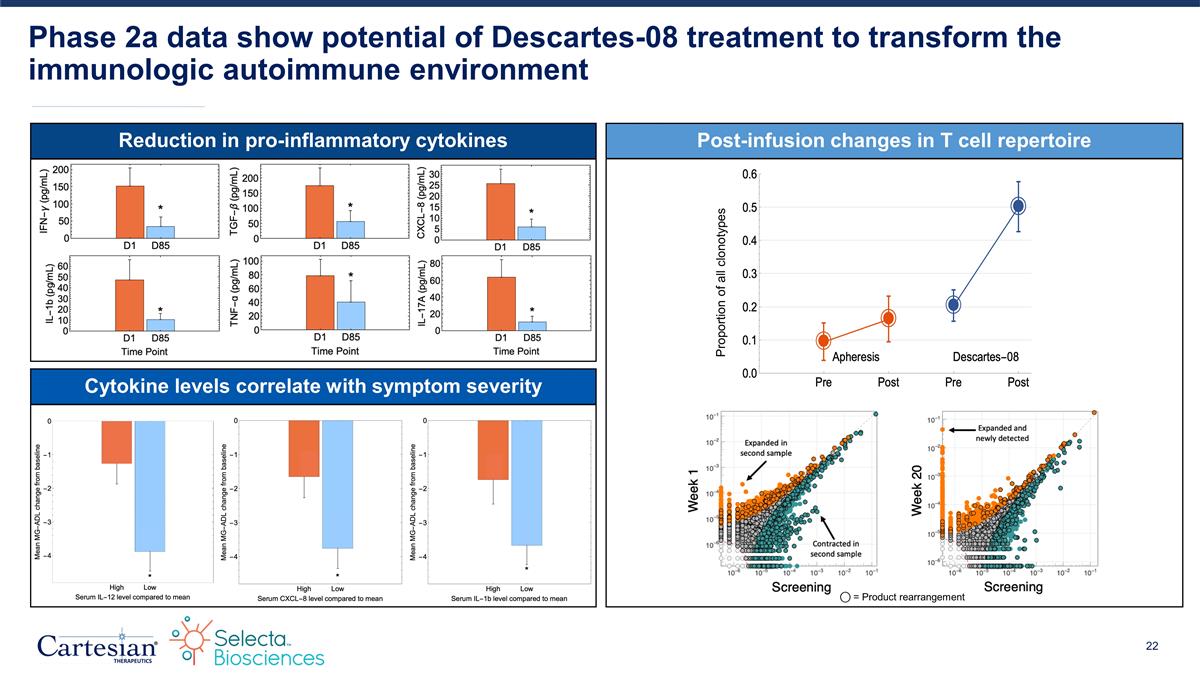

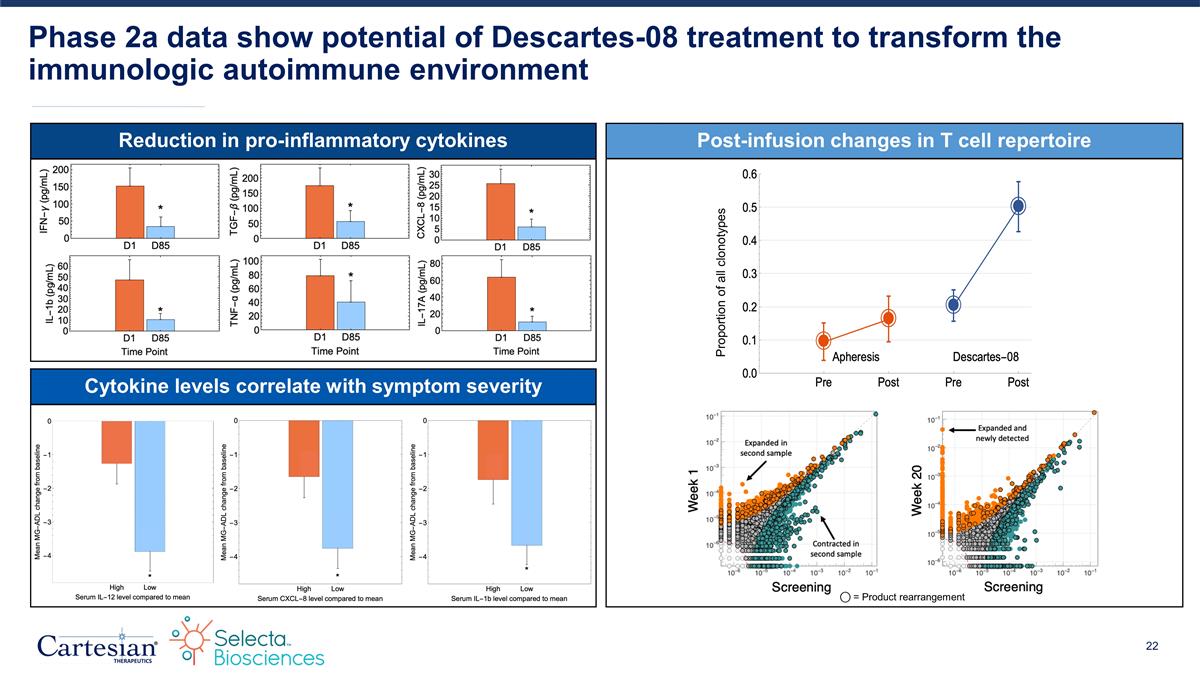

Reduction in pro-inflammatory cytokines Phase 2a data show potential of Descartes-08 treatment to transform the immunologic autoimmune environment Cytokine levels correlate with symptom severity Post-infusion changes in T cell repertoire Proportion of all clonotypes ⃝ = Product rearrangement

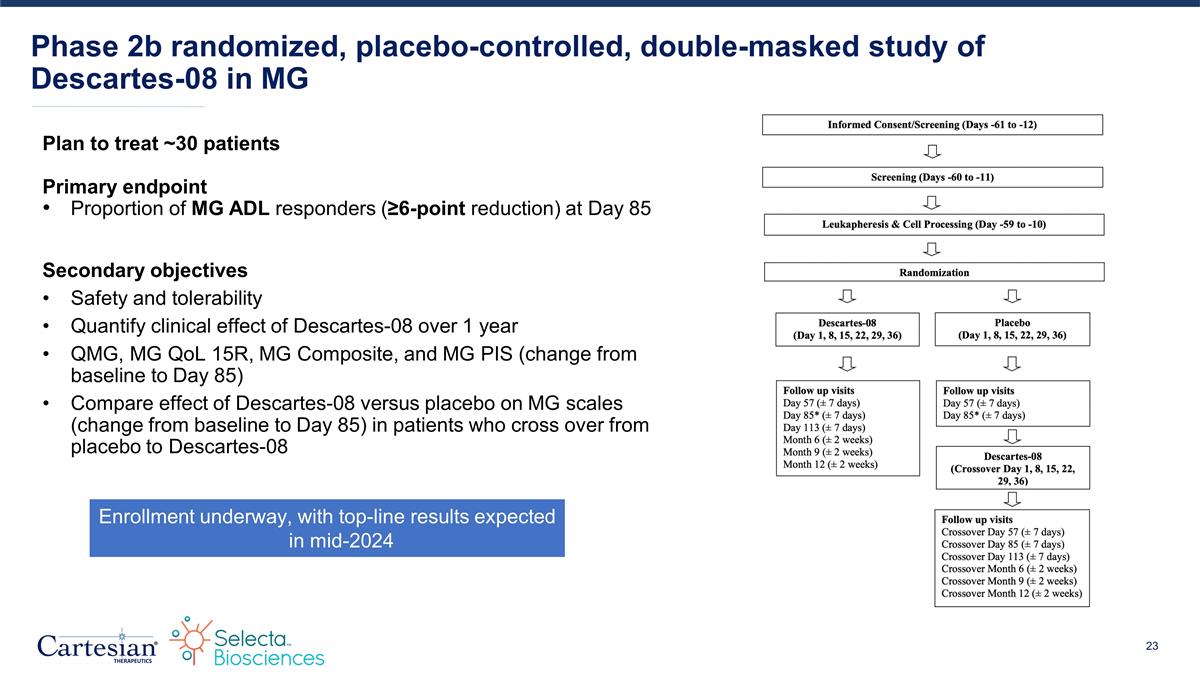

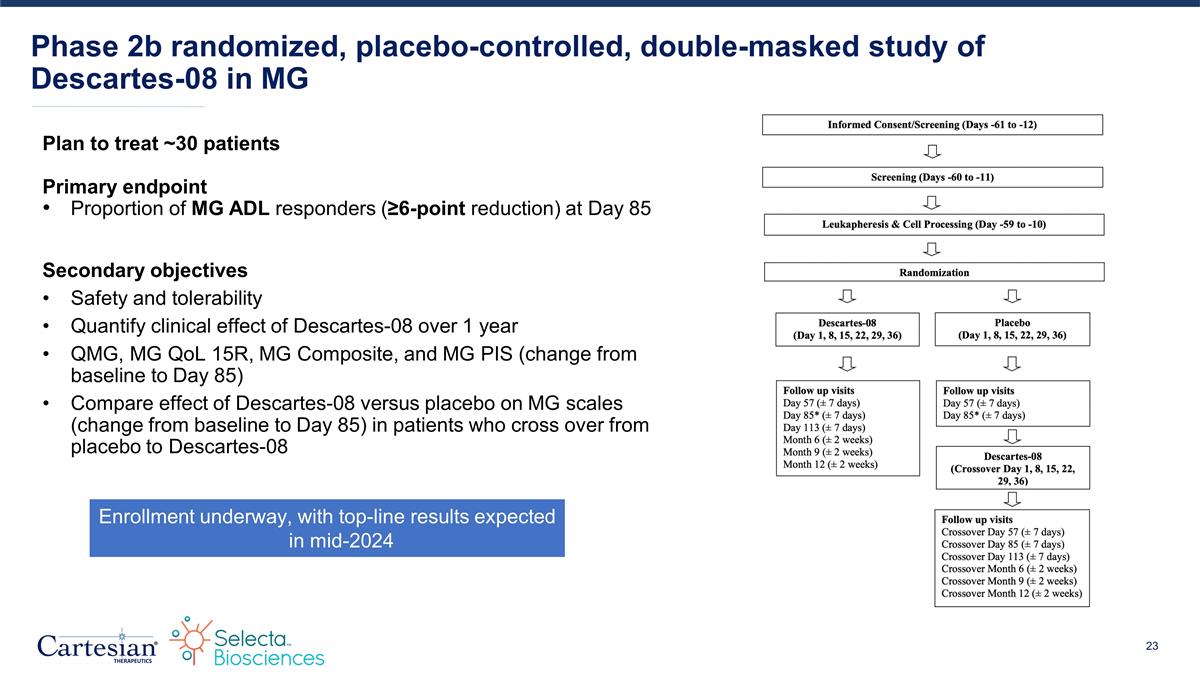

Plan to treat ~30 patients Primary endpoint Proportion of MG ADL responders (≥6-point reduction) at Day 85 Secondary objectives Safety and tolerability Quantify clinical effect of Descartes-08 over 1 year QMG, MG QoL 15R, MG Composite, and MG PIS (change from baseline to Day 85) Compare effect of Descartes-08 versus placebo on MG scales (change from baseline to Day 85) in patients who cross over from placebo to Descartes-08 Phase 2b randomized, placebo-controlled, double-masked study of Descartes-08 in MG Enrollment underway, with top-line results expected in mid-2024

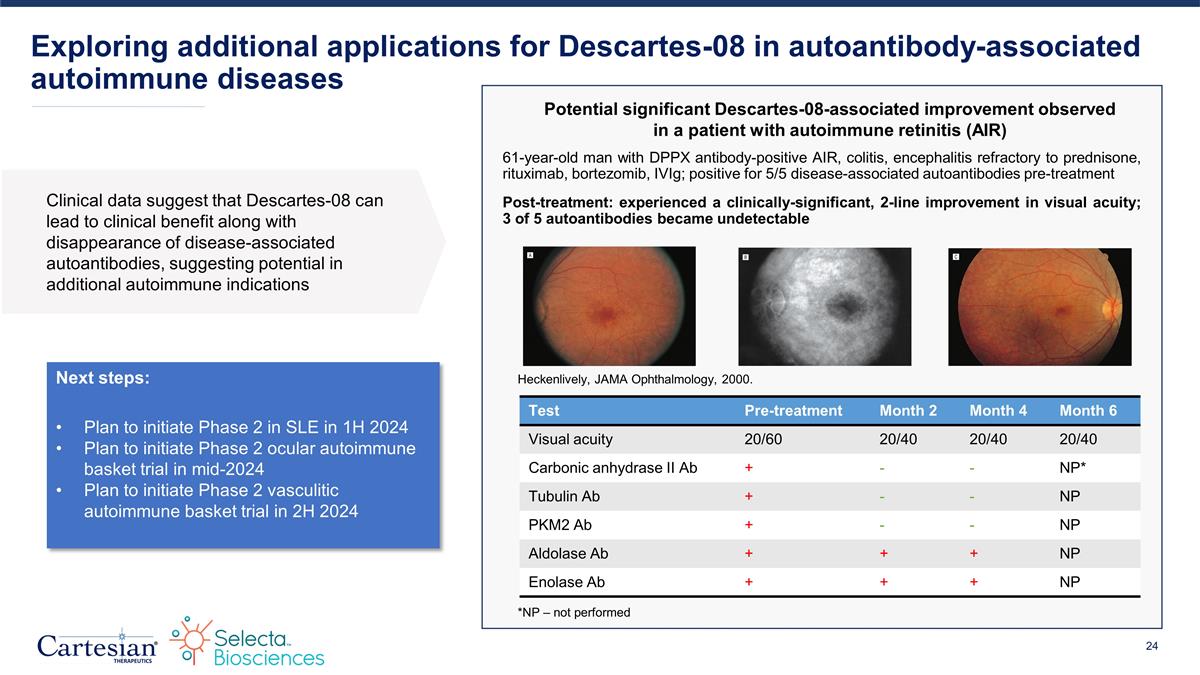

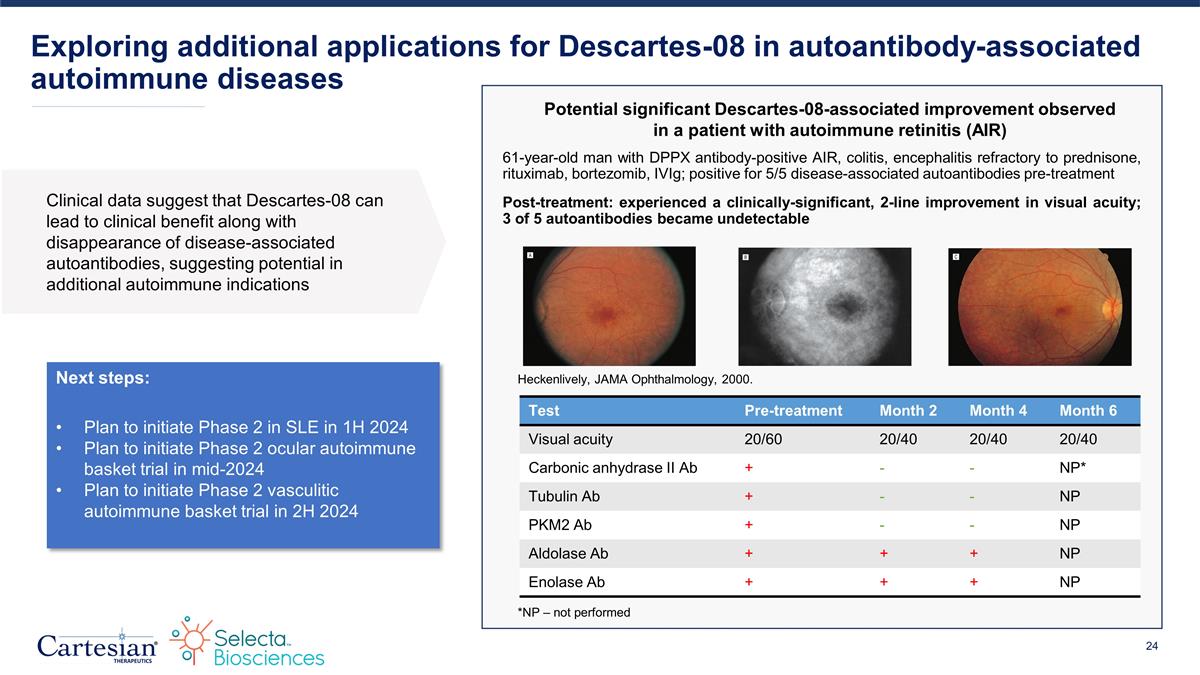

Exploring additional applications for Descartes-08 in autoantibody-associated autoimmune diseases 61-year-old man with DPPX antibody-positive AIR, colitis, encephalitis refractory to prednisone, rituximab, bortezomib, IVIg; positive for 5/5 disease-associated autoantibodies pre-treatment Post-treatment: experienced a clinically-significant, 2-line improvement in visual acuity; 3 of 5 autoantibodies became undetectable Test Pre-treatment Month 2 Month 4 Month 6 Visual acuity 20/60 20/40 20/40 20/40 Carbonic anhydrase II Ab + - - NP* Tubulin Ab + - - NP PKM2 Ab + - - NP Aldolase Ab + + + NP Enolase Ab + + + NP *NP – not performed Heckenlively, JAMA Ophthalmology, 2000. Potential significant Descartes-08-associated improvement observed in a patient with autoimmune retinitis (AIR) Next steps: Plan to initiate Phase 2 in SLE in 1H 2024 Plan to initiate Phase 2 ocular autoimmune basket trial in mid-2024 Plan to initiate Phase 2 vasculitic autoimmune basket trial in 2H 2024 Clinical data suggest that Descartes-08 can lead to clinical benefit along with disappearance of disease-associated autoantibodies, suggesting potential in additional autoimmune indications

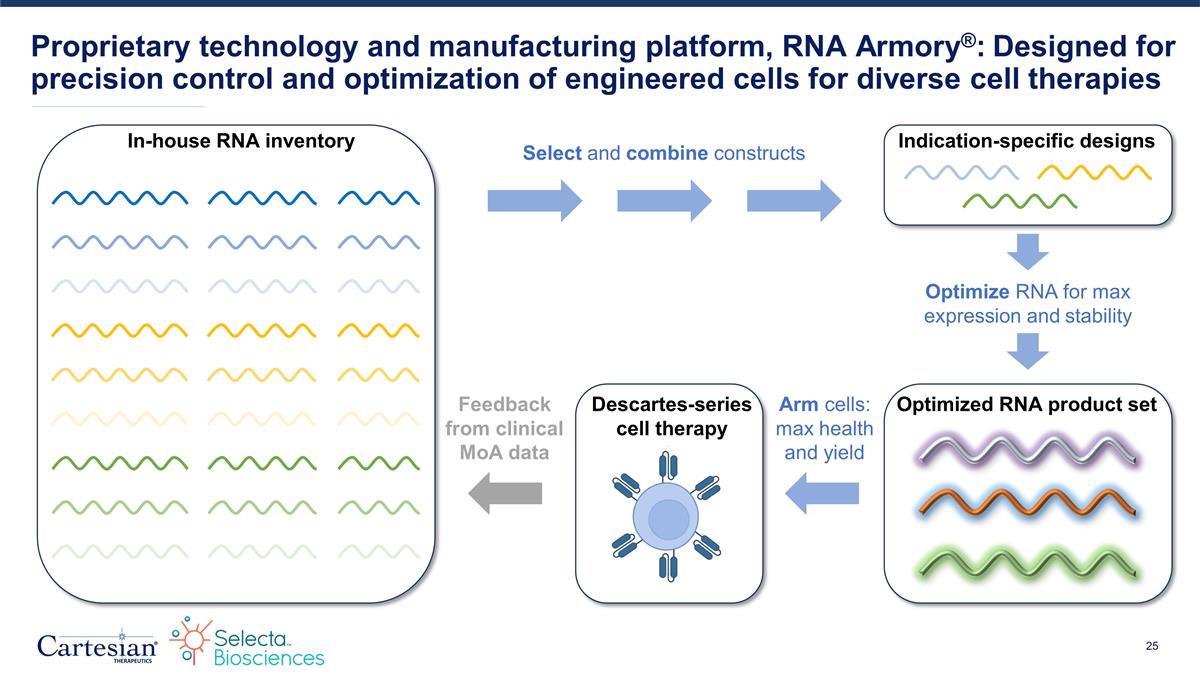

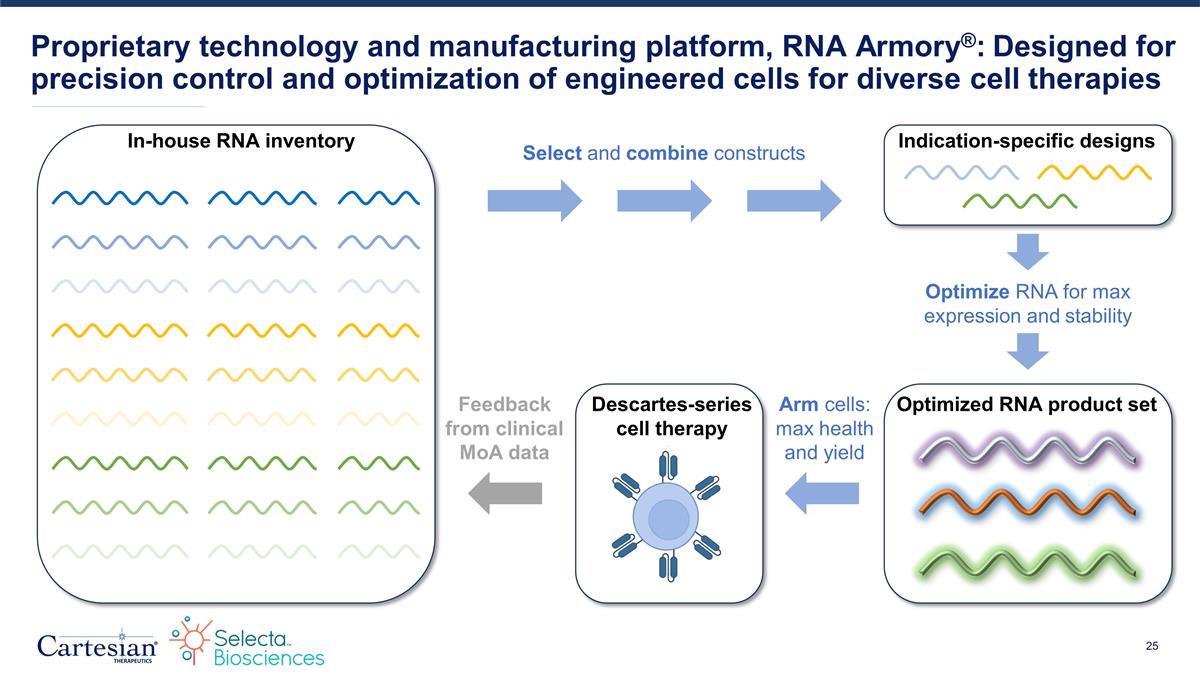

Proprietary technology and manufacturing platform, RNA Armory®: Designed for precision control and optimization of engineered cells for diverse cell therapies Select and combine constructs In-house RNA inventory Optimize RNA for max expression and stability Indication-specific designs Optimized RNA product set Feedback from clinical MoA data Descartes-series cell therapy Arm cells: max health and yield

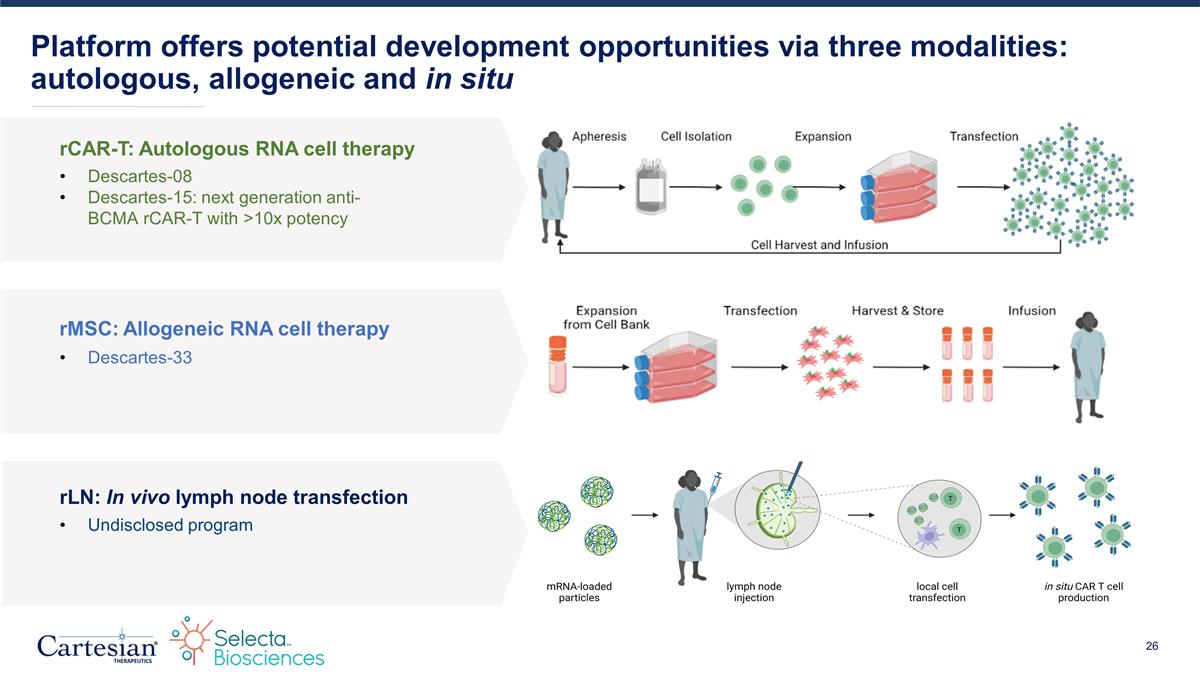

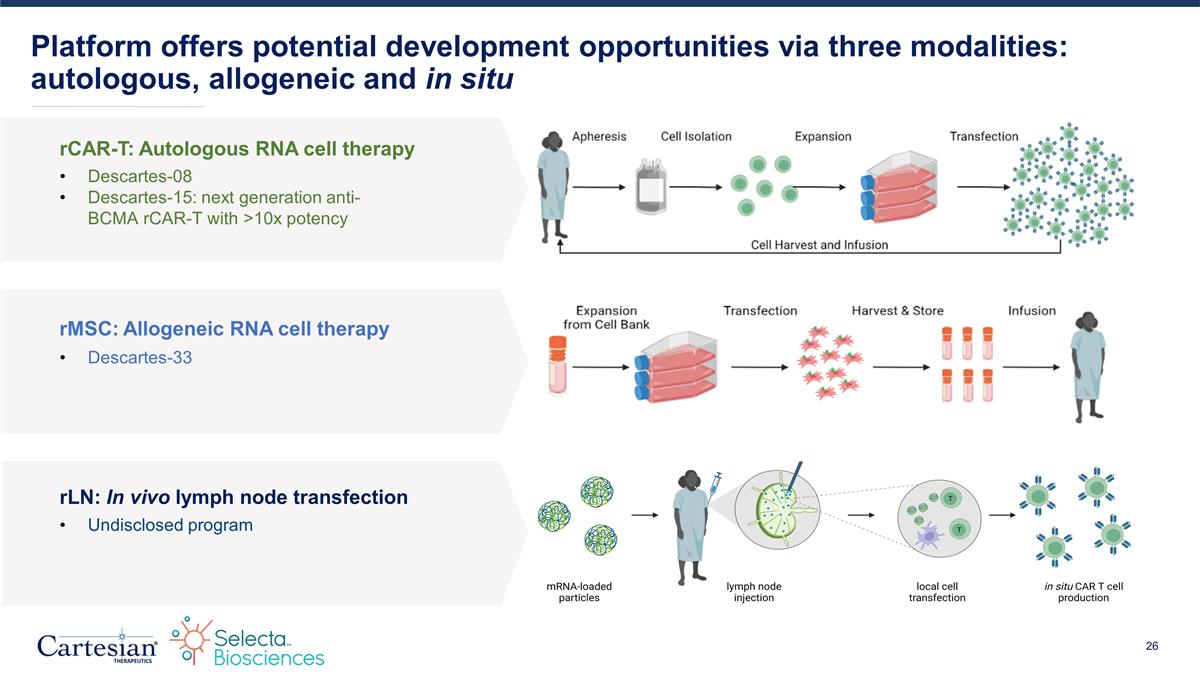

Platform offers potential development opportunities via three modalities: autologous, allogeneic and in situ rCAR-T: Autologous RNA cell therapy rMSC: Allogeneic RNA cell therapy rLN: In vivo lymph node transfection Descartes-08 Descartes-15: next generation anti-BCMA rCAR-T with >10x potency Undisclosed program Descartes-33

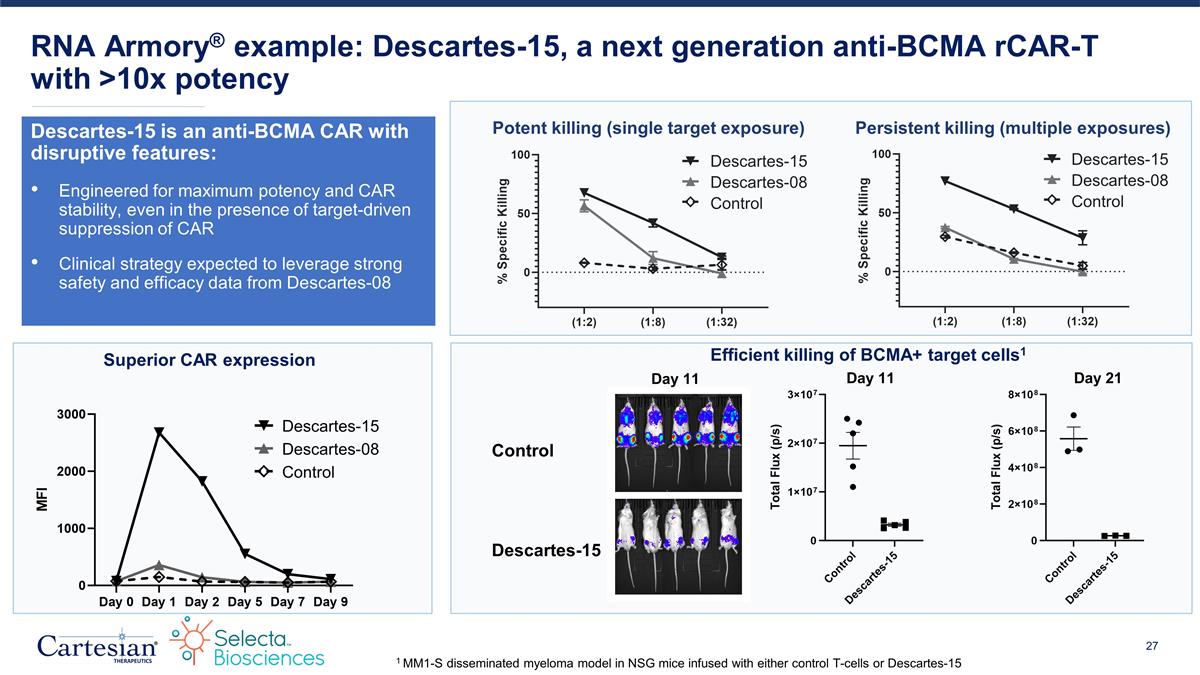

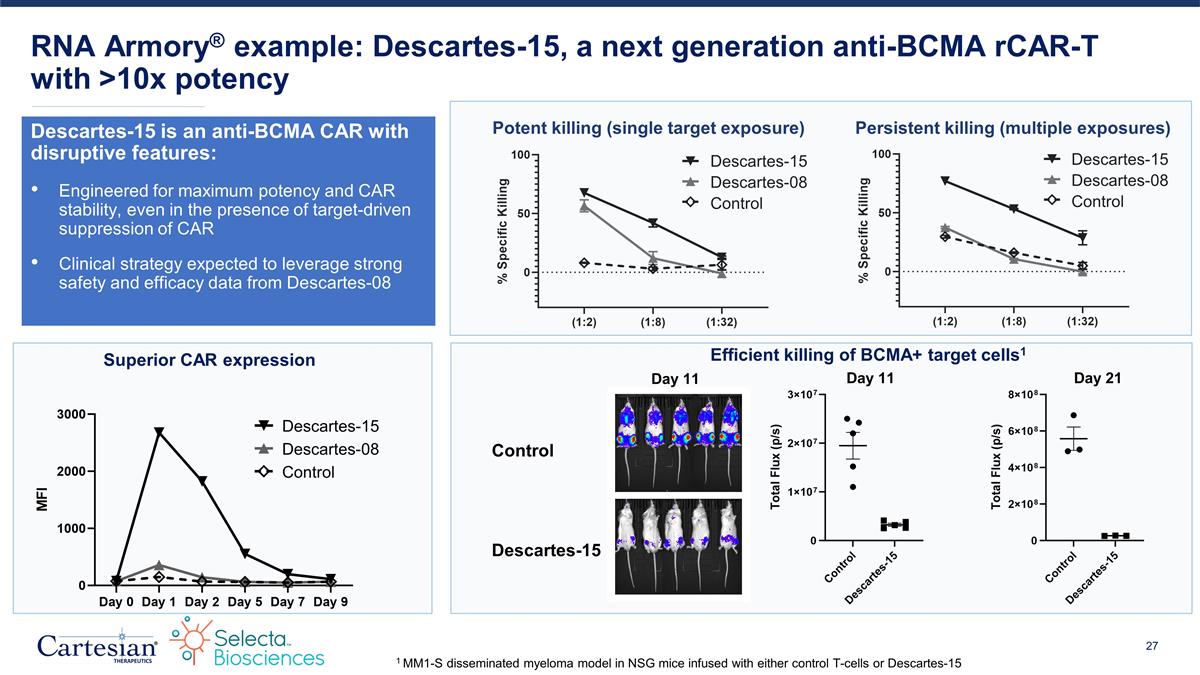

Descartes-15 is an anti-BCMA CAR with disruptive features: Engineered for maximum potency and CAR stability, even in the presence of target-driven suppression of CAR Clinical strategy expected to leverage strong safety and efficacy data from Descartes-08 RNA Armory® example: Descartes-15, a next generation anti-BCMA rCAR-T with >10x potency Potent killing (single target exposure) Persistent killing (multiple exposures) Descartes-08 Descartes-15 Control Descartes-08 Descartes-15 Control Descartes-08 Descartes-15 Control Control Descartes-15 Day 11 Day 21 Day 11 Superior CAR expression Efficient killing of BCMA+ target cells1 1 MM1-S disseminated myeloma model in NSG mice infused with either control T-cells or Descartes-15

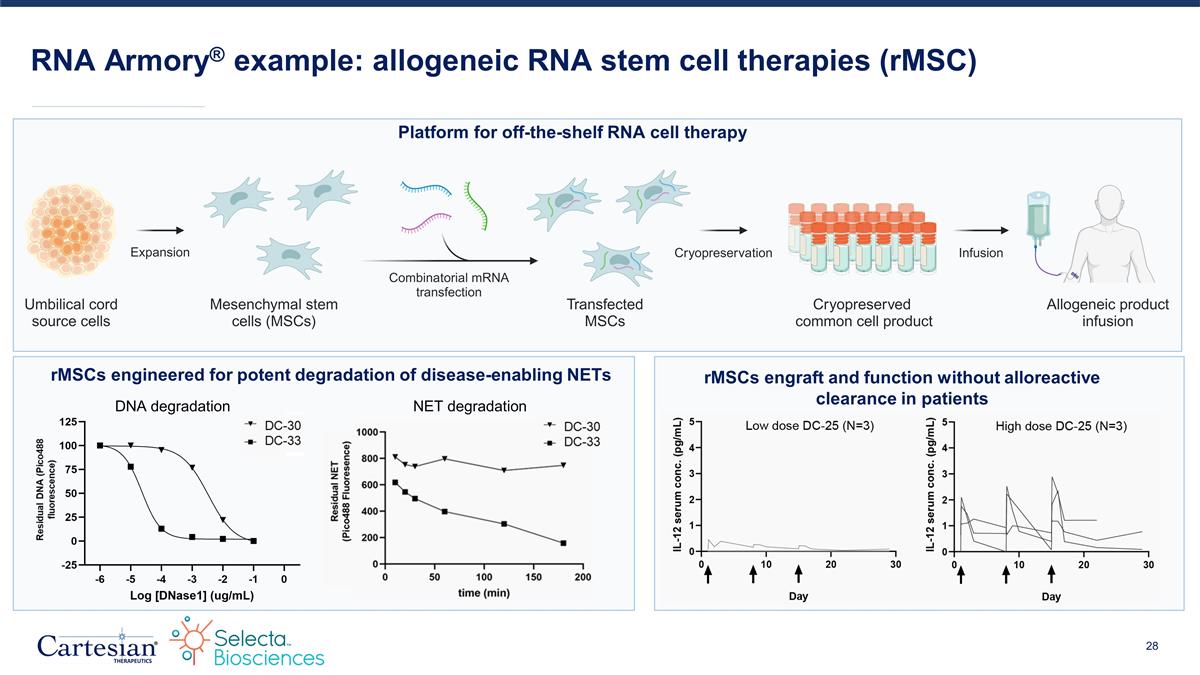

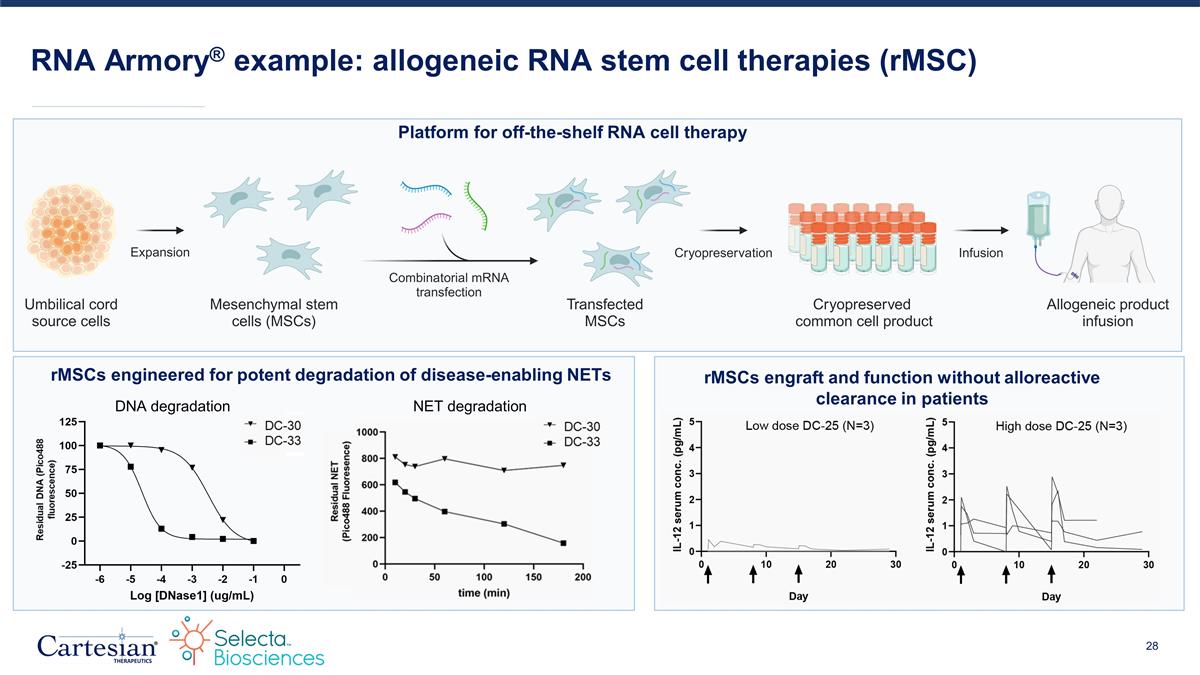

Platform for off-the-shelf RNA cell therapy RNA Armory® example: allogeneic RNA stem cell therapies (rMSC) rMSCs engineered for potent degradation of disease-enabling NETs rMSCs engraft and function without alloreactive clearance in patients DNA degradation NET degradation

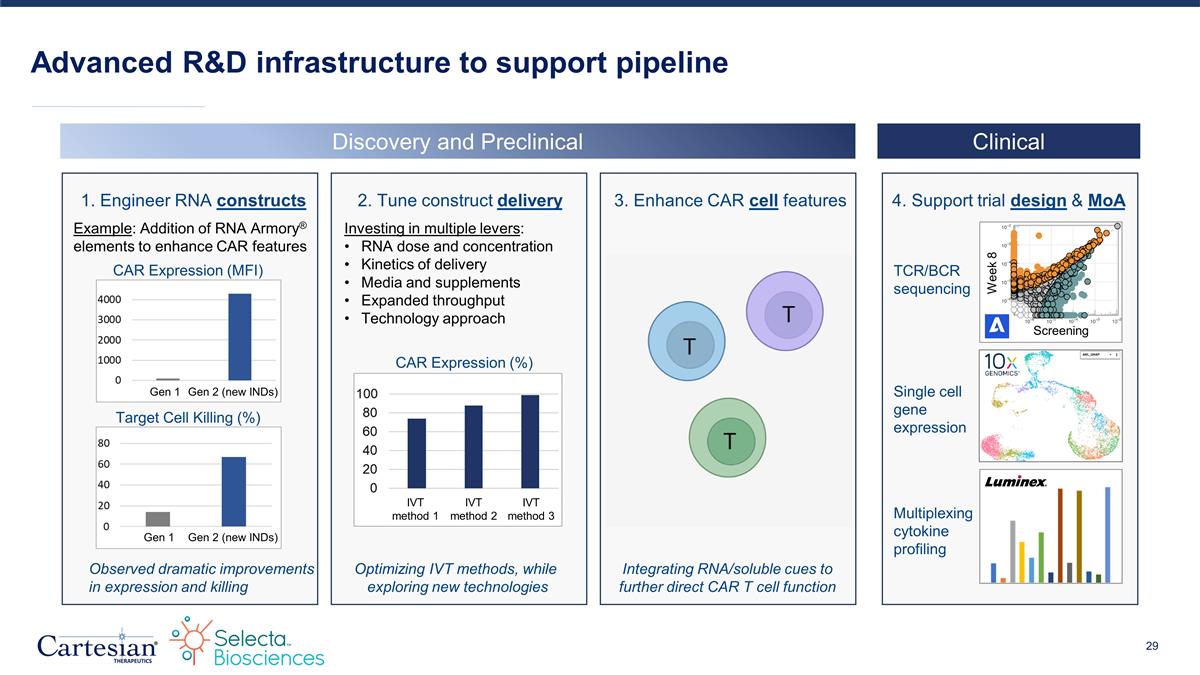

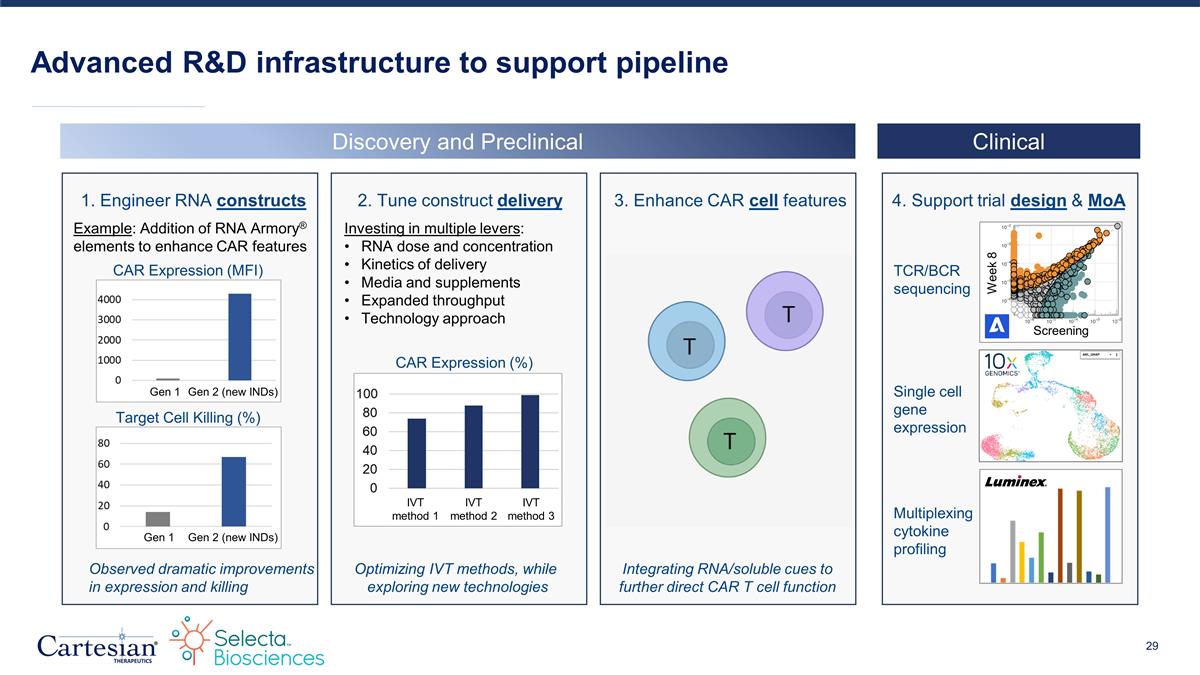

Advanced R&D infrastructure to support pipeline Discovery and Preclinical Clinical 4. Support trial design & MoA Week 8 Screening 1. Engineer RNA constructs 3. Enhance CAR cell features 2. Tune construct delivery TCR/BCR sequencing Single cell gene expression Multiplexing cytokine profiling Example: Addition of RNA Armory® elements to enhance CAR features CAR Expression (MFI) Gen 1 Gen 2 (new INDs) Target Cell Killing (%) Gen 1 Gen 2 (new INDs) Observed dramatic improvements in expression and killing Integrating RNA/soluble cues to further direct CAR T cell function Optimizing IVT methods, while exploring new technologies Investing in multiple levers: RNA dose and concentration Kinetics of delivery Media and supplements Expanded throughput Technology approach CAR Expression (%) IVT method 1 IVT method 2 IVT method 3

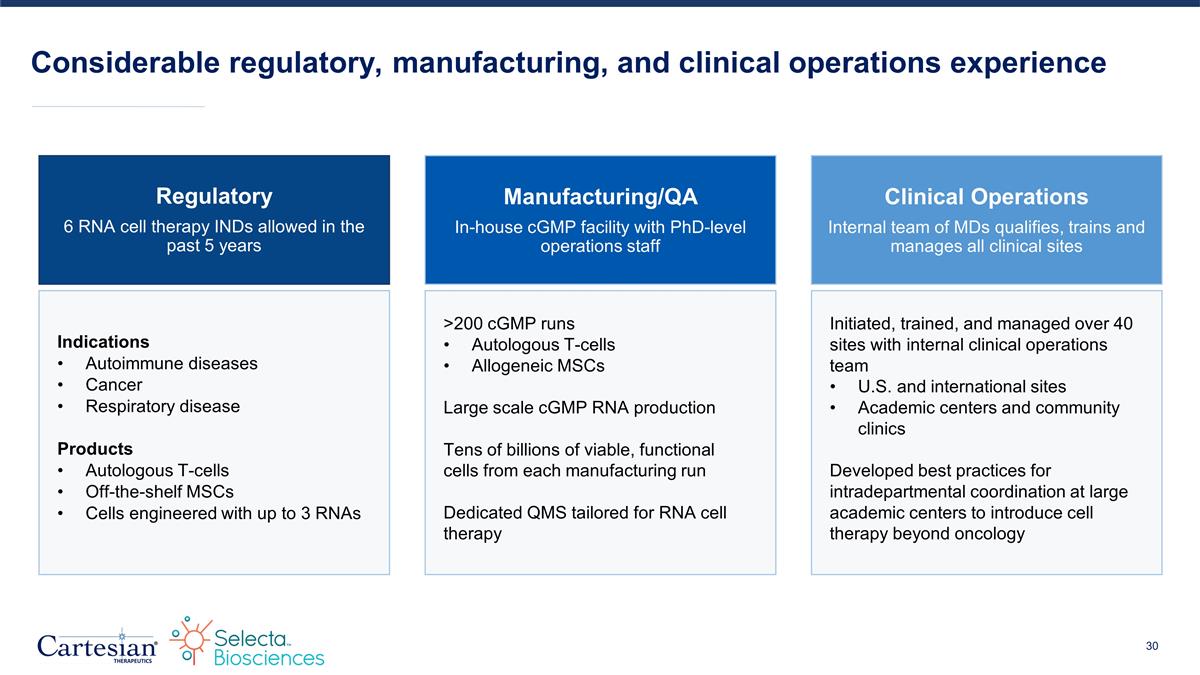

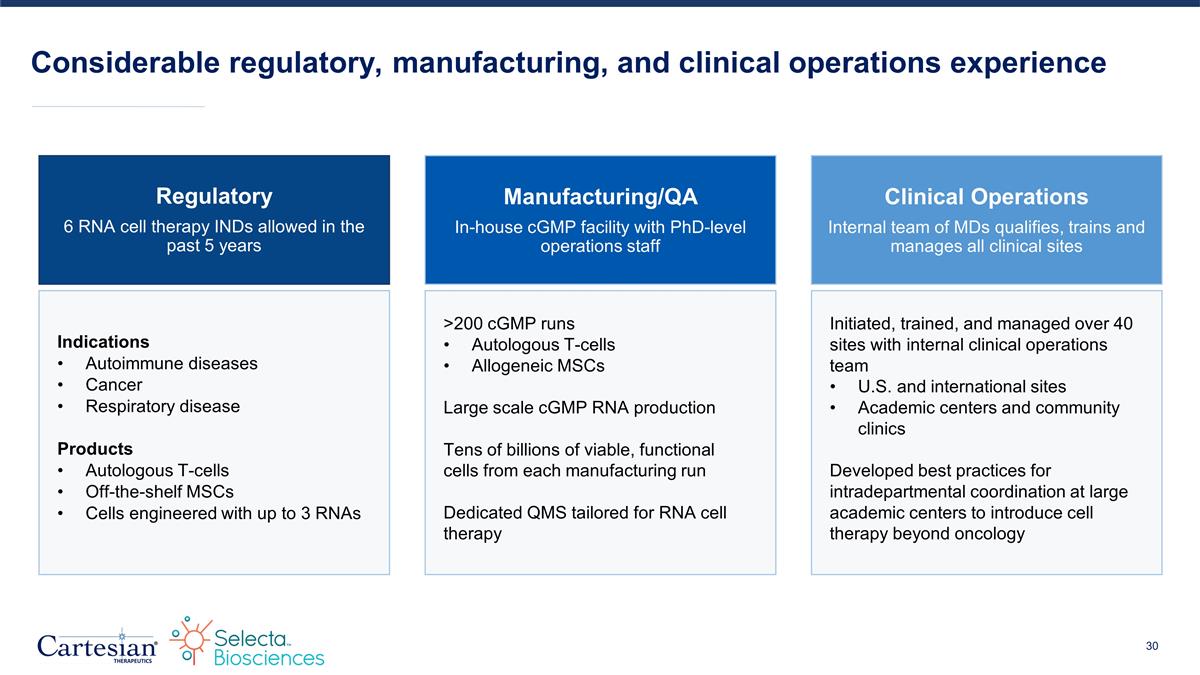

Considerable regulatory, manufacturing, and clinical operations experience Regulatory 6 RNA cell therapy INDs allowed in the past 5 years Indications Autoimmune diseases Cancer Respiratory disease Products Autologous T-cells Off-the-shelf MSCs Cells engineered with up to 3 RNAs Clinical Operations Internal team of MDs qualifies, trains and manages all clinical sites Initiated, trained, and managed over 40 sites with internal clinical operations team U.S. and international sites Academic centers and community clinics Developed best practices for intradepartmental coordination at large academic centers to introduce cell therapy beyond oncology Manufacturing/QA In-house cGMP facility with PhD-level operations staff >200 cGMP runs Autologous T-cells Allogeneic MSCs Large scale cGMP RNA production Tens of billions of viable, functional cells from each manufacturing run Dedicated QMS tailored for RNA cell therapy

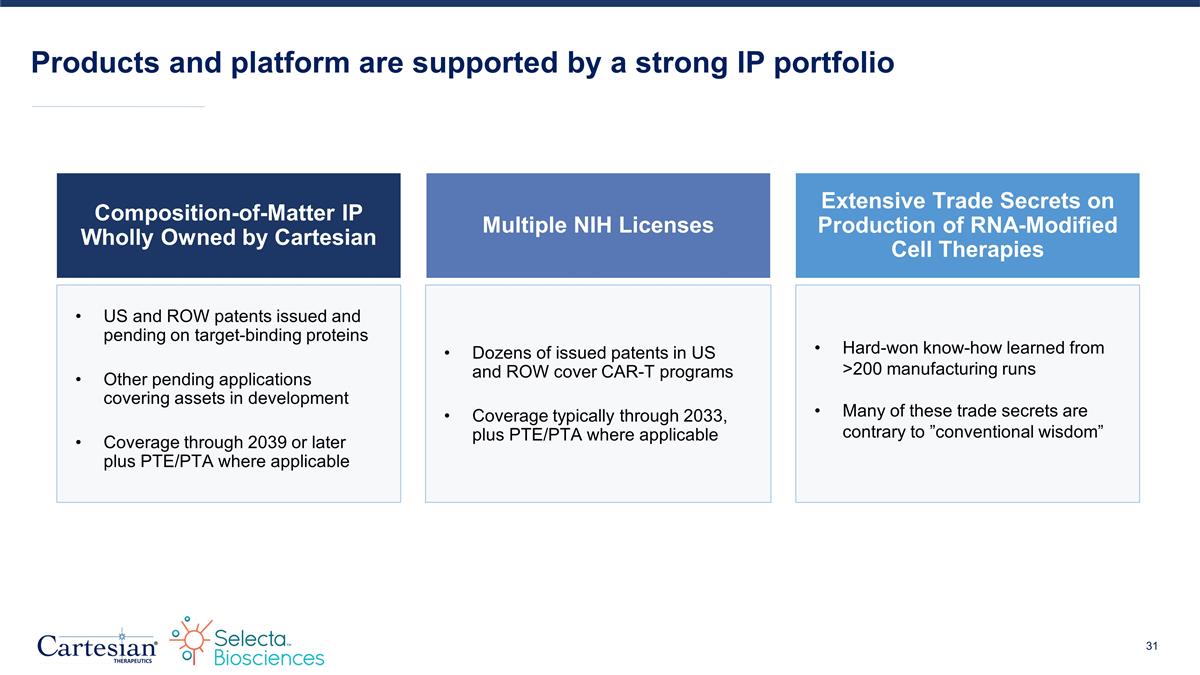

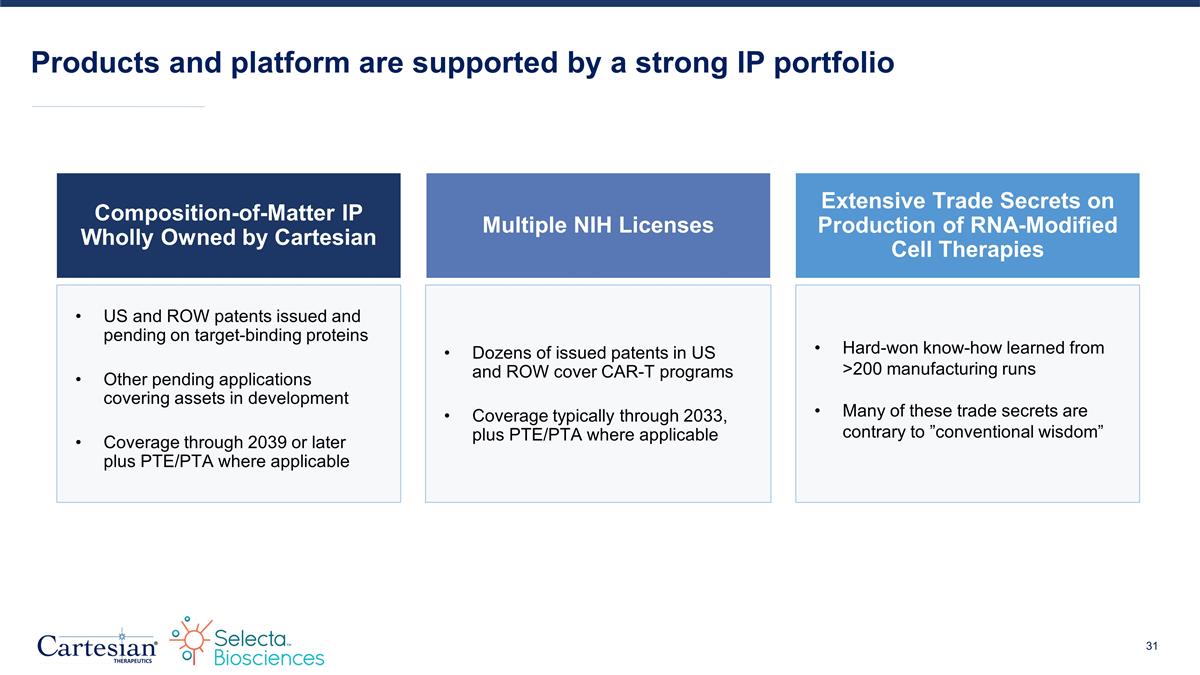

Products and platform are supported by a strong IP portfolio Composition-of-Matter IP Wholly Owned by Cartesian US and ROW patents issued and pending on target-binding proteins Other pending applications covering assets in development Coverage through 2039 or later plus PTE/PTA where applicable Multiple NIH Licenses Dozens of issued patents in US and ROW cover CAR-T programs Coverage typically through 2033, plus PTE/PTA where applicable Extensive Trade Secrets on Production of RNA-Modified Cell Therapies Hard-won know-how learned from >200 manufacturing runs Many of these trade secrets are contrary to ”conventional wisdom”

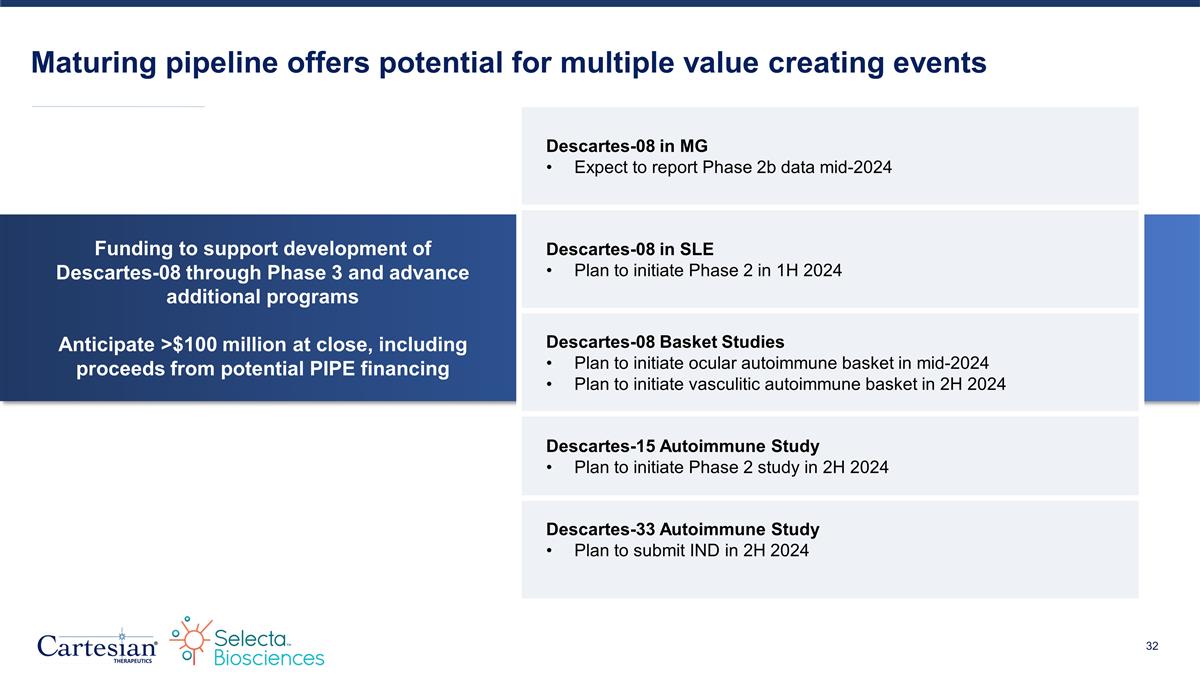

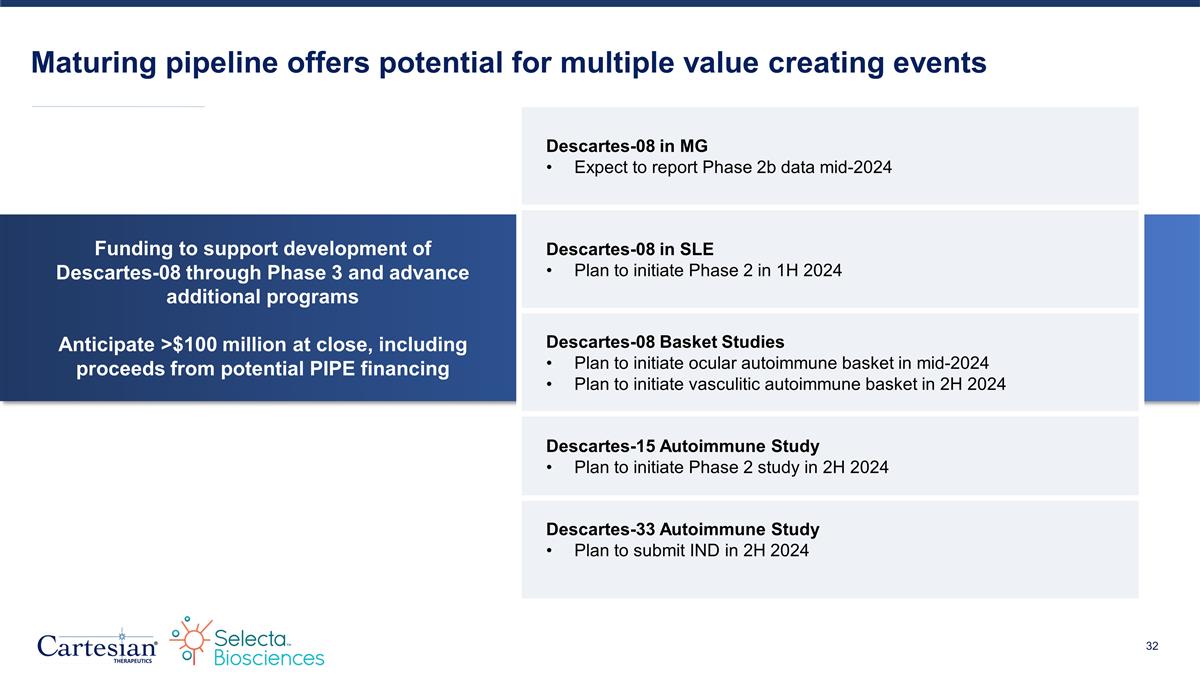

Funding to support development of Descartes-08 through Phase 3 and advance additional programs Anticipate >$100 million at close, including proceeds from potential PIPE financing Maturing pipeline offers potential for multiple value creating events Descartes-08 in MG Expect to report Phase 2b data mid-2024 Descartes-08 in SLE Plan to initiate Phase 2 in 1H 2024 Descartes-08 Basket Studies Plan to initiate ocular autoimmune basket in mid-2024 Plan to initiate vasculitic autoimmune basket in 2H 2024 Descartes-15 Autoimmune Study Plan to initiate Phase 2 study in 2H 2024 Descartes-33 Autoimmune Study Plan to submit IND in 2H 2024

Selecta and Cartesian merger to create publicly traded company pioneering RNA cell therapy to treat autoimmune disease Pro forma cash resources expected to fund continued clinical development of Descartes-08 through Phase 3 and multiple additional clinical programs Cartesian Opportunity Leader in RNA cell therapy with approach to treating autoimmune disease Deep pipeline of autoimmune programs Clinically Validated Lead Program Descartes-08: observed deep and durable clinical responses in myasthenia gravis (MG) patients in Phase 2a study Integrated Capabilities Merger to create fully integrated organization with in-house cGMP manufacturing, R&D, regulatory, clinical operations and existing public company infrastructure Near-Term Catalysts Plan to initiate Phase 2 trial for Descartes-08 in SLE in 1H 2024 Phase 2b data for Descartes-08 in MG expected in mid-2024 Plan to initiate ocular autoimmune basket planned in mid-2024 Plan to initiate vasculitic autoimmune basket in 2H 2024