UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant ý Filed by a Party other than the Registrant ¨

Check the appropriate box:

|

| |

| ¨ | Preliminary Proxy Statement |

| | |

| ¨ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| | |

| ¨ | Definitive Proxy Statement |

| | |

| ¨ | Definitive Additional Materials |

| | |

| ý | Soliciting Material under §240.14a-12 |

Medidata Solutions, Inc.

(Name of Registrant as Specified in its Charter)

(Name of Person(s) Filing Proxy Statement, if Other Than the Registrant)

Payment of Filing Fee (Check the appropriate box):

|

| | | | |

ý

| | No fee required. |

| | |

¨

| | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | | |

| | | (1) | | Title of each class of securities to which transaction applies: |

| | | (2) | | Aggregate number of securities to which transaction applies: |

| | | (3) | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | | (4) | | Proposed maximum aggregate value of transaction: |

| | | (5) | | Total fee paid: |

| | |

¨

| | Fee paid previously with preliminary materials. |

| | |

¨

| | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | | |

| | | (1) | | Amount Previously Paid: |

| | | (2) | | Form, Schedule or Registration Statement No.: |

| | | (3) | | Filing Party: |

| | | (4) | | Date Filed: |

The following are a transcript and presentation used in the Medidata Solutions, Inc. and Dassault Systèmes joint conference call held at 9:00 AM EST on June 12, 2019.

C O R P O R A T E P A R T I C I P A N T S

Bernard S. Charlès Dassault Systèmes SE - Vice Chairman & CEO

François-José Bordonado Dassault Systèmes SE - Vice-President of IR

Glen M. de Vries Medidata Solutions, Inc. - Co-Founder, President & Director

Pascal Daloz Dassault Systèmes SE - Executive VP, CFO & Corporate Strategy Officer

Tarek A. Sherif Medidata Solutions, Inc. - Co-Founder, Chairman & CEO

C O N F E R E N C E C A L L P A R T I C I P A N T S

Adam Dennis Wood Morgan Stanley, Research Division - European Technology Equity Analyst

Glen Joseph Santangelo Guggenheim Securities, LLC, Research Division - Analyst

Jason Vincent Celino KeyBanc Capital Markets Inc., Research Division - Associate

Jay Vleeschhouwer Griffin Securities, Inc., Research Division - MD of Software Research

John Peter King BofA Merrill Lynch, Research Division - Research Analyst

Laurent Daure Kepler Cheuvreux, Research Division - Head of IT Software and Services Research

Michael Briest UBS Investment Bank, Research Division - MD of Global Technology Research Group & Head of the European Technology Research

Neil Steer Redburn (Europe) Limited, Research Division - Partner of Software and IT Services Research

Stacy Elizabeth Pollard JP Morgan Chase & Co, Research Division - Head of Software and IT Equity Research

P R E S E N T A T I O N

Operator

Good afternoon, ladies and gentlemen, and thank you for standing by, and welcome to today's acquisition of Medidata by the Dassault Systèmes Conference Call. (Operator Instructions) I must advise you that this conference is being recorded today, Wednesday, 12th of June 2019. I'd now like to hand the conference over to your speaker today, Mr. Francois Bordonado. Please go ahead, sir.

François-José Bordonado - Dassault Systèmes SE - Vice-President of IR

Thank you very much, Ron. Thank you for participating in this conference call. Earlier this morning, we announced the signing of a definitive merger agreement for Dassault Systèmes to acquire Medidata Solutions, Inc. On today's call, Bernard Charlès, our Vice Chairman and CEO; Pascal Daloz,our EVP, CFO and Corporate Strategy Officer. Joining us from Medidata are Tarek Sherif, co-Founder, Chairman and CEO; and Glen de Vries,co-Founder, President and Director.

Before we begin, let me remind you that some of the comments we'll make on this call will contain forward-looking statements, which could differ materially from actual results. Forward-looking statements by their nature address matters that are different degrees and certain such as statements without a confirmation of the proposed merger and the anticipated benefits thereof. These and other forward-looking statements are not guarantees of future results and are subject to risks, uncertainties and assumptions that could cause actual results to differ materially from those expressed in any forward-looking statements. This material does not constitute a solicitation of proxy and offer to purchase or a solicitation of an offer to sell shares of Medidata's common stock.

In connection with the proposed merger, Medidata will file a proxy statement with the United States Securities and Exchange Commission, the SEC. Medidata stockholders are strongly advised to read these documents and any other documents that Medidata will fill with the SEC because they will contain important information that Medidata stockholders should consider before voting on the merger. Please refer to the additional information and where to find it section of the press release announcing the signing of the definitive measure agreement for Dassault Systèmes to acquire Medidata Solutions, Inc. I would like now to turn the call over to Bernard Charlès.

Bernard S. Charlès - Dassault Systèmes SE - Vice Chairman & CEO

Thank you, and welcome to this exceptional conference call. I would like to give a special welcome to Tarek and Glenn from Medidata, who are here with us and who are taking the overnight flight from New York for this special call.

For many reason, our announcement should come as no surprise. It is in perfect alignment with our purpose. As the life science industry shifts its focus to personalized medicine on passion-centric experiences, we believe scientific innovation on industrial performance call for a unified new approach, and this is exactly what we have been working towards with our investments in life science over the last years.

The acquisition of Medidata with its clinical and commercial solutions reinforces our position as a science-based company by providing the life science industry with an integrated business experience platform for an end-to-end approach to research on discovery, development, clinical testing, manufacturing and commercialization of new therapies on health technologies.

Importantly, Medidata's leadership in clinical trials complements our life science solutions on the 3DEXPERIENCE collaborative platform. Further,with its recent expansion into real-world evidence analytics, coupled with the power of modeling and simulation, we will be able to demonstrate together how the virtual world will analyze the next generation of passion-inclusive therapeutics. We are now well positioned to be the enabler of the life science industry transformation, elevating our company's purpose of harmonizing product, nature on life.

Headquartered in New York, Medidata will become a new Dassault Systèmes brand and continue to be led by its cofounders and executive team.

Since 2010, we have taken several major steps expanding our capabilities on footprint in life science from our historical strengths on market leadership in medical device modeling and simulation. We initiated multiple research programs in life science, including our bio intelligence work focused on collaborative discovery and preclinical modeling and simulation on oncology with leading pharmaceutical companies and research institutes around the world.

In 2014, we created our BIOVIA brand formed from the combination of our bio intelligence capabilities and the acquisition of Accelrys,, a leading provider of software solutions for chemical, materials and bioscience research for the pharmaceutical and biotechnology consumer packaged goods, IO space, energy and chemical industries.

During that same year, we also signed a 5-year collaborative research agreement with the U.S. FDA targeting the development of testing paradigms for the insertion, placement and performance of pacemakers, pacemaker leads and also cardiovascular devices used to treat heart disease in connection with our leading heart project.

In 2018, we acquired COSMOlogic, bringing fluid phase computational chemistry software capabilities. As a result, we collaborate with the world's top 20 bio pharma companies, Android soft biotechnology companies, medical device manufacturers, research institutes, governmental regulators agencies to develop and bring to market innovative health products and technologies using the power of virtual universe to transform the passion experience.

Combining with Medidata is the next natural step. As we will discuss on this call, the company has a leading position in the clinical market and has introduced significant capabilities to address the commercial market. In turn, Medidata has produced a strong track record of client, revenue and earnings growth since its initial public offering.

Medidata fits perfectly in our industry solution experiences, offer the full offer on categories of industry solutions. They are highly complementary,both to the solutions themselves as well as the BIOVIA brand. And its customer base is also highly complementary to Dassault Systèmes on a combined basis looking across pharmaceutical, biopharma, contract research organizations as well as medical device companies. We also see a significant opportunity with the strengths we can bring to Medidata over the midterm on a geographic basis with a strong presence in Europe and Asia to extend its global reach.

Following completion of this acquisition, life sciences will become our second largest industry after transportation and mobility.

Finally, as we discussed on our first quarter earnings call in April, as drugs on therapeutics shift to the world of biological drugs, meaning large molecules, representing an estimate 40% of the pharmaceutical R&D pipeline currently, the industry is moving to a world of personalized health.And the reshaping of the passion experience is also still key for the quality of the service. As we think about the life science services, the life science industry on the broader ecosystem around health care, the opportunity for our company over the coming decades is significant.

I look forward to welcoming soon, I hope, Medidata on all its workforce with incredible talents at Dassault Systèmes. We have been following closely its progress for a number of years and initiated discussion last year to develop a more formal relationship as we discuss our potential partnership is the discussion led both companies to this morning announcement.

With that, let me now turn the call to Tarek, Tarek Sherif, Medidata's co-Founder, Chairman and CEO. Tarek, you have the floor.

Tarek A. Sherif - Medidata Solutions, Inc. - Co-Founder, Chairman & CEO

Thank you, Bernard. I would just start by saying how thrilled I am about what is ahead for Medidata and our 2 companies. Together, I believe we will deliver tremendous value for our stakeholders and unlock opportunities for our customers and patients advancing life sciences in the age of precision medicine.

It's great to be with you all today and to spend some time explaining the strategic rationale of this transaction to the investment community. For those of you who do not know us, Medidata is a global life sciences technology provider dedicated to improving the way trials are designed and conducted and drugs are analyzed and commercialized. Our cloud-based platform of solutions, data analytics and AI enables efficiency and improves quality throughout the clinical development programs by accelerating processes, enhancing decision-making, minimizing operational risk, reducing costs and transforming trial strategies.

Medidata was founded nearly 20 years ago to today by myself and our President, Glen de Vries. We IPO'ed on the NASDAQ Stock Exchange 10years ago this month. Over the course of these 2 decades, a lot has changed, as evidenced by revenue growth of nearly 5x as a public company.But one critical aspect has not changed, our DNA.

We are a mission-driven company, and everything we do ultimately power smarter treatments and healthier people. This point aligns well with Dassault Systèmes. Both of our companies clearly value the importance of a purpose to center our company and give customers a clear sense of motivation.

Today, our unified platform, pioneering analytics and clinical technology expertise power the development and commercialization of new therapies.The Medidata cloud is a connective tissue between patients, physicians, regulators, payers and life sciences companies themselves. Companies on our Medidata platform are individually and collaboratively reinventing the way research is done to create a smarter, more precise treatment. 13 of the top 15 drugs sold in 2018 were powered by our technology.

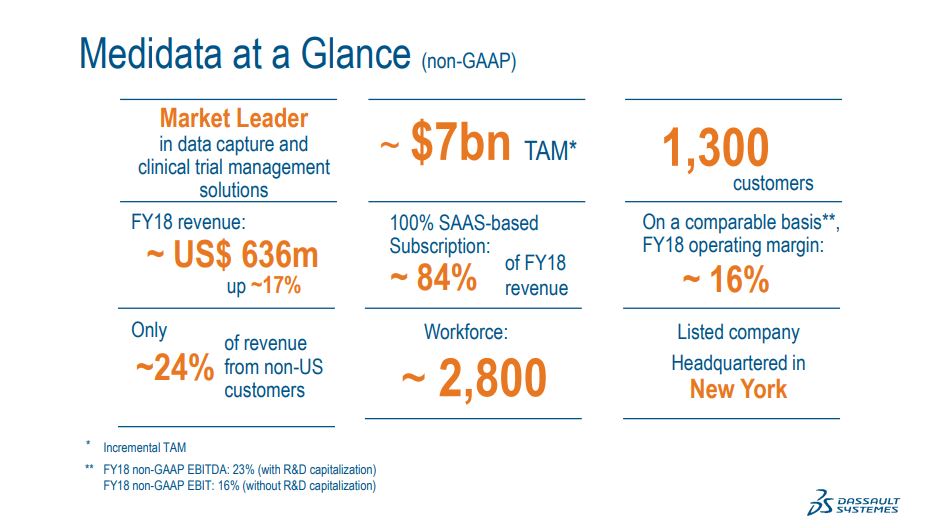

At the time of our IPO, we had about 150 customers. Over the past decade, we have grown that number eightfold. Today, we work with many of the world's largest pharmaceutical companies, biotech and medical device firms, academic medical centers and CROs. This has translated into strong top line growth of 18% on average and healthy profits with a non-GAAP operating income CAGR of 22% through our last fiscal year.

We're a pure SaaS, and our revenue's comprised about 85% subscription, 15% professional services. I think this progress is attributable to both our technology and our deep domain expertise, which reinforce strong customer relationships. Thanks to this trust we have built with our customers,we have consistently expanded customer relationships helping to drive our good growth.

We have 1,300 customers on our platform spending multi-study enterprise agreements and single-study contracts. We have run more than 17,000trials on our platform, reflective of the fact that we are the market leader in electronic data capture. Those 17,000 trials represent 4.9 million patients,600,000 site sponsor relationships and billions of data points, making us a strong partner with our customers in the advancement of innovation and improved patient outcomes.

We're headquartered in New York City and we have 16 offices around the globe, spanning 7 countries, including the U.K, Japan, Korea, China,Singapore and Germany, with a workforce of about 2,800 people.

In summary, I'm looking forward to this next evolution of Medidata as a part of Dassault Systèmes. This is a great move for our employees, for our customers and for our shareholders. Patients will be the ultimate beneficiaries, and we'll continue to create shareholder value along the way.

And with that, I want to turn it over to Medidata's co-Founder and President, Glen de Vries, to walk you through our product offerings in more detail. Go ahead, Glen.

Glen M. de Vries - Medidata Solutions, Inc. - Co-Founder, President & Director

Thanks, Tarek. First, I want to echo what Tarek said about the alignment of our 2 companies. I could not be more excited about what this transaction is going to do for our clients, broadly for life sciences and for those patients that we ultimately serve.

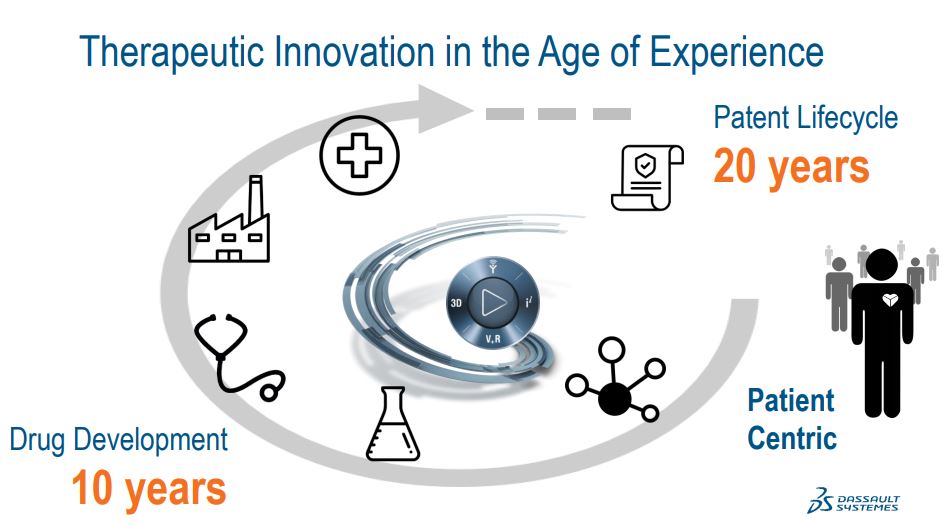

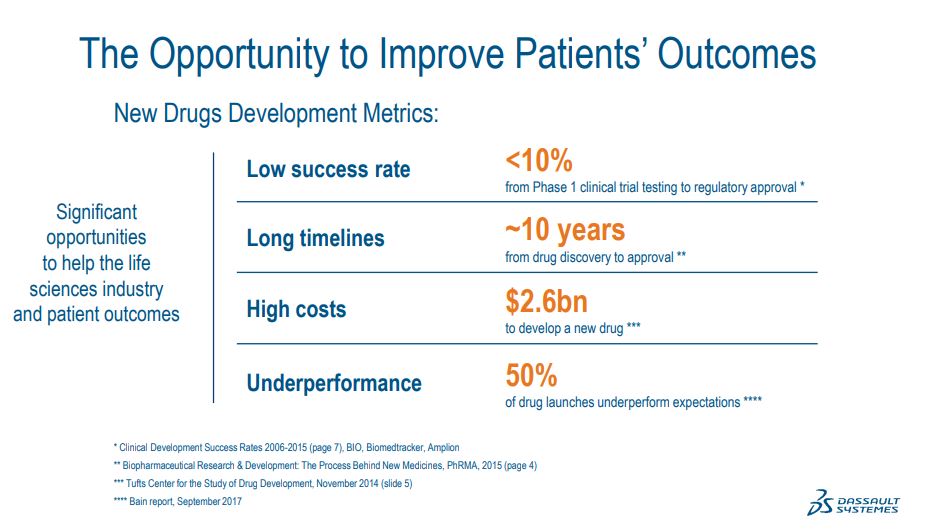

Medidata's focused on 2 areas of the life cycle of a therapy, the clinical and the commercial. And to set the stage for the challenges that we help life sciences companies address, let me just give you some statistics about the odds of developing a drug, and they really stack against the sponsor.

The industry average success rate to get a new drug from Phase I, the first clinical trial to regulatory approval is below 10%. The average time line from discovering a new drug to getting its regulatory approval is 10 years. As a result, the average cost to develop a new drug are estimated at $2.5 billion. And of course, the cost of not being able to help patients is not even something we can measure.

Finally, affecting life sciences companies, patients and society in the long run is the fact that even after all of that, 50% of drug launches under perform expectations. And that places an even larger burden on the few drugs that do succeed.

Nevertheless, there is incredible therapeutic innovation in the laboratories and the development pipelines of the life sciences industry, and investments in these new therapies are growing at a rapid clip. So now let me explain with you -- to you what we do in the Medidata platform from a clinical trial, planning and management perspective to commercial and real-world analytics as well as the new family of products we have centered around artificial intelligence.

So first for clinical. We have the Rave family. It unifies all the capabilities our customers and our partners need to run a clinical trial end-to-end.Simply put, enter data once and our platform masters it and populates it throughout the entire suite of Rave applications, by far the most comprehensive suite in the market. It spans across data capture, clinical data management, clinical operations financial management, everything you need to optimize a trial at every step.

Last year, we also acquired SHYFT Analytics, a leading platform for commercial and real-world data analytics with products that are specifically for the pharmaceutical biotech and medical device industry. The SHYFT platform is the most efficient and scalable way to transform massive amounts of complex health care data into on-demand clinical and commercial insights.

And fueled by one of the largest regulatory grade clinical data repositories in the entire world is coming from the Rave platform. We launched Acorn AI at the beginning of this year. Acorn AI builds on the foundation of innovation and data science that we've been building for a decade at Medidata. Acorn accelerates digital transformation in life sciences in the age of precision medicine. It is designed to provide actionable insight to the front lines of decision-making with data that is liquid beyond borders in an organization and goes beyond just integrated workflows to a truly intelligent platform for in the entire life cycle of a therapy through R&D and commercialization.

5

We're really well positioned to grow in the near term, both on the clinical and commercial side, and in the long term in the combination of our current electronic data capture market as well as with the broad clinical, commercial and data platform.

Again, on a personal note, I am just thrilled to be here. Looking forward to what our teams are going to accomplish together and the value that we are going to deliver to all of our stakeholders.

And with that, I will turn the call over to Pascal.

Pascal Daloz - Dassault Systèmes SE - Executive VP, CFO & Corporate Strategy Officer

Thank you, Glen. Let me begin by sharing with you how we are creating the first end-to-end scientific and business platform for the life science industry.

We began in research and discovery, where we have our designed to cure industry solutions, focused on speeding time to innovation with a higher quality novel therapeutics.

For preclinical development, we have our one lab industry solution experience. Medidata thus brings its significant capability in clinical testing,the largest area of investment for a life sciences company, presenting a significant opportunity for innovations combining both Medidata's real-world capabilities with our virtual world modeling and simulations capabilities.

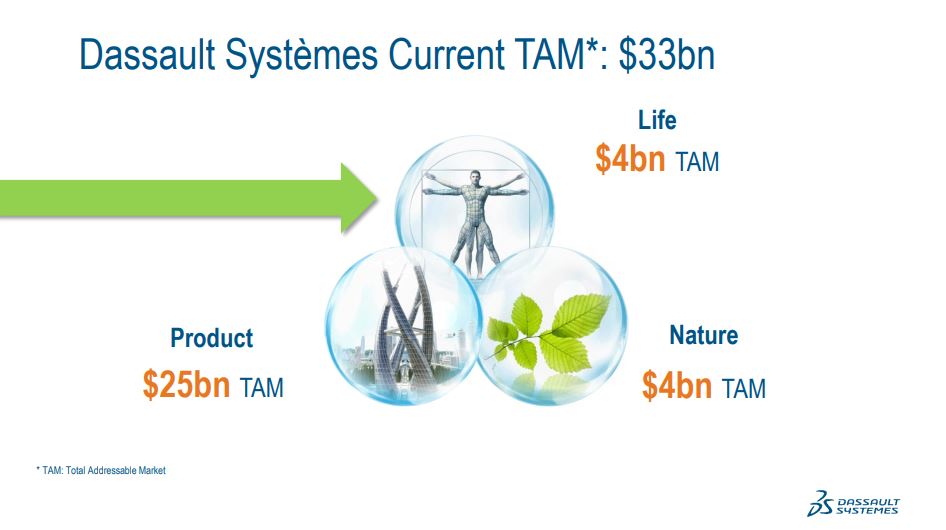

In manufacturing, we have 2 industry solution experiences to assist life sciences companies. And then in commercializations, Medidata brings critical assets. Our total addressable software market today is approximately $33 billion. When you look by our 3 fields, partner, nature and life,approximately $25 billion is in our targeted TAM in the products field, about $4 billion in nature and about $4 billion in life sciences.

The acquisition of Medidata would represent an important expansion of our addressable software market, adding an estimated $7 billion to about$40 billion in total.

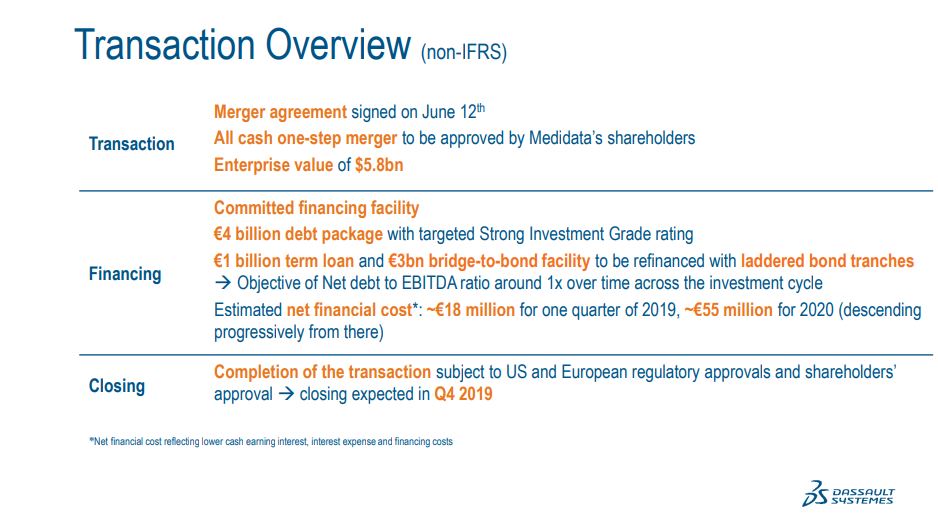

Turning to the transactions. We have signed a definitive agreement to acquire 100% of Medidata in all cash transactions in the amount of USD 5.8billion. The transaction was approved by both Boards of Directors. The transaction is subject to receive regulatory approvals, the approvals of Medidata Solutions' shareholders and the certain other customary closing conditions.

The transaction is expected to be completed during the first quarter. And we are, of course, well positioned to close sooner if this estimated timeline shortens.

In parallel with the signing of the definitive merger agreement we have in place a EUR 4 billion committed financing facility from a group of banks to fund the acquisition in addition to using approximately EUR 1.3 billion of our cash. This financing facility of EUR 4 billion equivalent debt package with an expected strong investment-grade rating is comprised of term loans in an amount of EUR 1 billion and a EUR 3 billion bridge-to bond facility that we expect to refinance in the next few months with letters from branches. Our objectives is to deleverage fairly and rapidly and to maintain our net debt-to-EBITDA ratio of around 1x across the investment cycle.

We estimate net financial cost to fund this acquisition in an amount of EUR 18 million for one quarter of year 2019, EUR 15 million for 2020 and descending progressively from there. This figure take into account the use of cash, of course, and estimated interest expenses as well as older financing costs.

As Medidata is a public company, it reports and filing present detailed information, but let me share a few figures here. For its fiscal year ended December 31 year 2018, Medidata's revenue totaled $636 million with $536 million of SaaS subscriptions, software revenue and a services revenue of $100 million. Approximately 76% of its sales were in Americas, 14% in Europe and 10% in Asia.

Medidata's non-GAAP operating margin was 23.4%, and its non-GAAP net income was about $104 million. We will wait to give our specific guidance for Medidata's contribution to our year 2019's financial results at the time of our third quarter earnings. For now, let me point out that we are likely to take into account natural post-closing onboarding events that may have a temporary productivity impact.

In addition, our guidance will take into account an estimate for the U.S. dollar to euro exchange rate. Then once consolidated, we may decide to expense certain Medidata R&D amounts that are currently capitalized, so the non-GAAP equivalent operating margin will be closer to about 16%in that case. Looking to our long term, based upon our 90 days, Medidata is likely to represent a large portion of the $0.80 contributions we assume from the acquisitions and the marketplace activities as part for our year 2023 EPS goal for EUR 6 per shares. Let me now turn the call back to Bernard.

Bernard S. Charlès - Dassault Systèmes SE - Vice Chairman & CEO

Thank you very much, Tarek, Glen and Pascal. Before opening some questions, I would like to share some final important points, not just on today's announcement, but also on our global priorities as a company towards the industries and customers we serve.

Our first priority continues building on our momentum with the 3DEXPERIENCE platform as a key enabler for industry renaissance in the industries we address.

Our objective, as we have shared with you since our 2018 Capital Markets Day, is to make 3DEXPERIENCE the large majority of our software business over the next 4 years.

Second, we have invested heavily many billions of euros to support our core industries on our leadership in transportation and mobility, aerospace and defense and industrial equipments to name a few. We will continue to advance our innovation on behalf of these clients. Our investment in biology, chemistry, material science clearly demonstrate the cross-industry benefits of our investment on expansion of our reach.

Third, we believe 3DEXPERIENCE platform can be a critical enabler for innovation on transformation across all major industries, where the drive to provide new types of customer experiences, in this case, passion experiences, our new business models is emerging and accelerating. We see these possibilities across the 3 fields addressed by our purpose, product, nature and life.

Fourth, our investment in Medidata complements very well our brands, notably BIOVA. Altogether with all our brands, we now have an end-to-end set of industry solution experiences for the life science industry.

To conclude, we believe the combination of scientific modeling, simulation and the gigantic patrimony of worldwide clinker trials knowledge and know-how that Medidata has been able to build over the years with its top expertise are profound catalyst to accelerate developments in personalized health, passion-centric experiences and the next standard of medical practices. We share the values, as Tarek said, and also the vision. So we are now happy to take your questions and waiting for the day to do the final closing.

François-José Bordonado - Dassault Systèmes SE - Vice-President of IR

Ron, do we have questions, please?

Q U E S T I O N S A N D A N S W E R S

Operator

(Operator Instructions) Our first question comes from the line of Jay Vleeschhouwer.

Jay Vleeschhouwer - Griffin Securities, Inc., Research Division - MD of Software Research

A question for you, Bernard. Over the last 20 or more years, when you've done an important acquisition, the essence of the IP that you were acquiring was readily identifiable. For today's purposes, when you bought Accelrys 5 years ago, it was readily apparent what the IT was.

And so with respect to Medidata, and I apologize if this is a too simplistic question, is it technology per se that is motivating you here? Or is it process and domain expertise? And then additionally, you mentioned that it's complementary. But in what way, if any, might this acquisition be orthogonal?That is to say, it takes it in some new directions over and above it's being complementary.

Bernard S. Charlès - Dassault Systèmes SE - Vice Chairman & CEO

I will give a -- thank you, Jay. I will give a shot on that, but I will let Glen and Tarek comment it, so I'm sure we, together, will have a complete answer. But in short, you know what? Today, when we do modeling and simulation for an airplane, we know this flight is going to go from A to B, and we certify.

And in life science, it's not the case. As a matter of fact, in life science, the clinical trial are so critical because the outcome of the clinical trial from my understanding is not only the approval to go to market, it's the extreme at the highest level possible, characterization of which passion could benefit, under which condition, with which therapeutics.

So data science has to be correlated to modeling and simulation. It will take years before we get the perfect model. But what, for me, is unique in Medidata is, first, the talents, the incredible phase on passion the team to have an impact for the sector and the knowledge and know-how, which is the precious IP capitalized over the years to make this possible one day. That's my motivation on this side. But Tarek and Glen, you please step it.

Glen M. de Vries - Medidata Solutions, Inc. - Co-Founder, President & Director

I think that was very well said. If you look at the innovations that we were talking about that are we're coming to patients, they are getting more precise. And that brings new challenges to the life sciences industry. You're developing that right therapy for the right patient at the right time,and inherently, if you're a life sciences company, means that your market for that therapy is actually shrinking. That has implications for the complexity of finding a patient, treating them, measuring the effect of that treatment, and whether it's in the commercial phase of the life cycle of your therapeutic or incredibly importantly, and then I think outsized way during the development of that, it means that you have to get more evidence out of every time you connect with a patient. Every time they encounter their doctor, every time a sensor measures something about them, we need to take that data and get more gearing out of it. And that is why, in the clinical trial and commercial parts of our business, we really feel like it's a combination, a fairly unique one, we think we have at Medidata, and, frankly, even more unique with the combination of what we have at Dassault Systèmes, is the ability to look at both the technology to connect all of these stakeholders, who are generating that evidence,create the new kinds of processes that are going to go with this next generation of clinical development and personalized medical therapeutic delivery and the data platform on which all of that needs to be managed.

So I hope that makes it clear that at least from, I think, the perspective all of us in the room, this is really about technology and process and a data ecosystem.

Jay Vleeschhouwer - Griffin Securities, Inc., Research Division - MD of Software Research

Just a quick follow-up. The data provided by Dassault this morning suggests that you have 1/10 of the TAM. And could you talk about how your market share has evolved over the last number of years and the competition comprising the other 90%, and what you have to do now with DS to meaningfully grow beyond that 1/10 share?all

Tarek A. Sherif - Medidata Solutions, Inc. - Co-Founder, Chairman & CEO

Sure. It's Tarek Sherif. I'm happy to do that. So when we began Medidata, we focused on one very specific area, which was electronic data capture.And over the 20-year history of the business, we have, I think, done a very good job of taking market share. And today, we run probably more than half of all electronic trials that are on globally. However, as Glen was pointing out earlier, the process of running clinical trials is very complex. There is a lot of process to writing it. There are a lot of steps involved. And over time, we evolved our platform to encompass a number of solutions that bring efficiencies to a vast majority of those process steps.

In terms of the market share there, it's typically dealt with by either siloed systems or very sort of manual processes. So still using spreadsheets, still transferring files manually. And what we bring in our platform is an integrated approach. And so in terms of the market share, while EDC we have a very strong market position in, in terms of the opportunity for the broader platform for the various solutions, there's an enormous opportunity.There's a lot of white space. And we feel like we have -- we're in a very strategic position to capture that.

So I think we feel very strongly that we're just at the beginning of capturing that TAM. And with our existing products, and now also in concert with Dassault Systèmes, we'll be other thing even more opportunities. And I suspect that TAM will continue to expand.

Operator

Our next question comes from the line of Adam Wood.

Adam Dennis Wood - Morgan Stanley, Research Division - European Technology Equity Analyst

Congratulations to everyone on the transaction. Maybe first of all, specifically on Medidata and the growth and competitive landscape, could you maybe just help us a little bit on the organic growth that you've seen over the last few years? Is that sort of mid-high-teens growth rate you fairly represented of the organic growth adjusting for M&A and also any lengthening of subscription contracts t hat you've seen? And then could you just talk a bit about, I think Viva's moved more into your market, how you see the capacity landscape, and whether you see any of the other maybe larger technology companies, the Microsofts and so on, looking at this space? And then secondly, when we think about the integration of the products and the platforms,

would it be fair to say that your aim is to bring Medidata onto the 3DEXPERIENCE platform? Or will they be kept more separate than that? And how long do you think it will take to be able to bring this integrated platform to market for customers?

Bernard S. Charlès - Dassault Systèmes SE - Vice Chairman & CEO

I'm sure, Tarek, you want to address that question.

Tarek A. Sherif - Medidata Solutions, Inc. - Co-Founder, Chairman & CEO

Absolutely. Happy to.

Bernard S. Charlès - Dassault Systèmes SE - Vice Chairman & CEO

Thank you.

Tarek A. Sherif - Medidata Solutions, Inc. - Co-Founder, Chairman & CEO

I will certainly take the first half, and I suspect Glen may want to join in for the second half. But in terms of our growth, we've shown very consistent growth over a long period of time. And yes, you're correct, it has been in the mid to high teens. And we feel very confident that our business, given the opportunities that we see out there and the customer relationships that we have as well as some of the new areas that we've entered into, we see that growth continuing. And as I've said, it's been probably, since we've been a public company, we've shown very consistent growth. So given that market dynamics and our ability to execute, I feel very good about that.

In terms of the competitive landscape, it is interesting. It certainly keeps evolving. One of the things that we like to say is that if you don't have competition, that's probably not a market worth being in. But I also would say that if you look at the offering that we have, sort of the breadth of the platform that we have as well as the kind of customer relationships we've built over several decades, our customer retention rates are -- have been consistently above 99% over the past -- since we've been a public company basically.

I think while we take competition seriously wherever it comes from, I think we're unmatched in the industry in terms of capability, domain expertise and the data assets that are special to Medidata, given the relationships that we have with our customers, and us being a strategic infrastructure provider to them in clinical trials puts us in a position to provide value to customers in a way that I think -- that's very unique for Medidata.

Glen M. de Vries - Medidata Solutions, Inc. - Co-Founder, President & Director

We are in this room having just signed a definitive purchase agreement, so I'm not prepared to tell you time lines for getting on to the 3DEXPERIENCEplatform. But what I can tell you is the philosophy behind the 3DEXPERIENCE platform and the way we built the Medidata platform to date is incredibly well matched.

If you think of the problem that we're just trying to solve in 2 dimensions, you go down from the DNA of an individual patient all the way through their physiology and behavior and the environment they live in. and they imagine that's the Y-axis. And on the X-axis, you have not just that patient,but all of the stakeholders who are necessary to generate that evidence that I was talking about, to connect the right patient with the right therapy at the right time, as Bernard was talking about.

And so the -- I'm sure the Medidata people who are on the call, who are familiar with Dassault Systèmes, I don't need to describe the compass related to the 3DEXPERIENCE and all the philosophies that are embedded in it. That is how we think about the Medidata platform. So yes, the answer is Medidata's products will be integrated into 3DEXPERIENCE platform. And not only will that be great for our clients in the existing things that they're using, that is how we will bring the research expertise, the industrialization capabilities that are in the broader Dassault Systèmes platform into both the clinical and commercial areas that we work in as well as the broader parts of future medicine and life sciences.

Bernard S. Charlès - Dassault Systèmes SE - Vice Chairman & CEO

Absolutely. And just to add one thing, I will be surprised if a sales force-based platform can fix to kind of research development production on test.It has never happened in those industries. I don't think it will happen in this one. But at the beginning of digitalization of every industry, every industry have started to manage documents. But at some point in time, the documents disappear and the experience on modeling and simulation become the master model. We have seen that in older industries. I believe it will happen in the life science.

Operator

And our next question comes from the line of Stacy Pollard.

Stacy Elizabeth Pollard - JP Morgan Chase & Co, Research Division - Head of Software and IT Equity Research

Just can you maybe talk about your accretion dilution expectations? And do you -- would you expect to get the margins of Medidata up to the first group level within 3 to 4 years? Also, you haven't mentioned per se anything, but do you see any synergies with your other life science solution,either revenue synergies or cost synergies? And then finally, do you still -- do you believe you still have potential or, I guess, enough scope to continue with acquisitions in other areas, either life sciences or perhaps, construction or simulation, et cetera?

Bernard S. Charlès - Dassault Systèmes SE - Vice Chairman & CEO

Pascal?

Pascal Daloz - Dassault Systèmes SE - Executive VP, CFO & Corporate Strategy Officer

Okay. So Stacy, for all the questions you asked, I will give details at some point of time. So -- because it's a little bit early to share the guidance. But what I could say, first, this transaction will be accretive at the EPS level, okay, for all the years. Point number one. Point number two, from a synergy standpoint, yes. Definitively, this is at least the rationale behind the transactions.

We have multiples. On one hand, you know it's a SaaS solutions. The company is using extensively Amazon. I think there is a lot of interest who use our own cloud infrastructure. That's one of the lever.

As Glen explained, there is a lot of value to have a common platform. This is a synergy at the development side. I could also go through the go-to markets to explain that we have a bunch of synergy relatively well in occupy, and I will quantify them at the right times.

On the revenue side, yes, we also have synergy because the way Medidata is approaching their customers is it's by studies. The way we approach them is by the infrastructure, the core infrastructure to structure the on-payer transformation of the companies. I think we did both.

We need to be able to enter by PCs, and you need to be able to enter with the end-to-end solutions. So if I combine all those kind of things, I'm pretty confident that this revenue and these activities combining BIOVIA and Medidata will grow very fast. It's already with the combination with some of the largest industry for us. And in the race to become the #1, I think they are well positioned, because if you look at the spending, if you look at the GDP, life science and health care is by far the largest.

In terms of scope, do we have enough to continue to do some acquisition? The answer is yes. If you do the math, I told you that we're going to use EUR 1.3 billion in cash of our cash to fund these acquisitions, meaning we still have EUR 1.6 billion in our pocket. And with a EUR 900 million cash flow generation per year, not taking into account the contribution of Medidata, I think we have some lever to continue to do some transactions to complement nicely what we have.

Operator

And our next question comes from the line of John King.

John Peter King - BofA Merrill Lynch, Research Division - Research Analyst

Just one, really. I was interested in maybe the response from both management teams. Just on the timing of the deal, why now? And obviously,for the Dassault team, I don't think you've gone into net debt before. Obviously, it speaks to the enthusiasm for which you have -- you hold this opportunity. And -- but I'd be interested in why you think this deal has happened and set for Medidata. It sounds like you're very confident with your own organic prospects. I'm just wondering, what is it that you see out in there that makes you want to do this deal now? Perhaps, again, that would speak to the synergy potential you see with Accelrys, but, yes, I'd be interested in your thoughts.

Bernard S. Charlès - Dassault Systèmes SE - Vice Chairman & CEO

Yes, of course. First of all, all acquisitions we have done in the past have been well thought years in advance, but it does not mean that because it's on paper, it will happen.

And basically, for all of them, and it's the case even -- here in the case of Medidata, we value at first -- first, we want to make sure we understand the industry we want to serve. And we have learned a lot in the last, as I tried to say it at the beginning of this call, in the last 10 years, with the research we have done and the relationship we have establish-ed with the Amgen of the world and with many also clients that we have observing where they are versus where we are with the most advanced, digitally enabled companies, which are also gigantic groups with gigantic revenue.Toyota still run a $50 billion revenue, just revenue, so we know where they are, and we can confirm. We were astonished with the level, low level of digitization of the sector. That's one piece.

So the why now is we observed that. The second is building relationship. This is about people. This is about trust to build a future. When we started a year ago to exchange, we were having in mind a partnership because we thought it was very complementary. And what happened is that we discovered that we shared more and more, and we wanted to do more and more together to a point where one of us asked, why should we not come together? And this is why we are here today.

So there is a matured progression in formulating not the sum of what we are only, but where we can go. Because there is one unique characteristic in what Dassault Systèmes has done across all industries, we have always been game-changer. We are never done me, too. Never. We always change the game. It's harder, but it's more fun. And I believe that's the time to do it in life science. That's my view from why we are together. And so it's the wedding day or -- Tarek?

Tarek A. Sherif - Medidata Solutions, Inc. - Co-Founder, Chairman & CEO

I have to echo what Bernard was saying. I think I couldn't agree more with everything that you've said. I think from Medidata's perspective, we've always been a mission-driven company. It's what gives us our passion. It's deeply ingrained in our culture. And as a mission-driven company, we have also had a massive impact on our industry. We partner with our customers. We've developed, I think, a unique technology, even a unique business model in our industry. And after we began to get to know the team here, we simply saw that there was so much potential in an industry that, I think, is going through major disruption that the time felt like now.

And when we started to think about the alignment, there's a cultural alignment. There's being a mission and vision-driven company. There's a passion around it, and there's industry readiness. And I think that the -- what was so attractive to us is that Dassault Systèmes brings a lot of experience in other industries that have gone through the same kind of transitions that our industry is going to go through. There is a -- they bring maturity and scale, and they bring capabilities that really completed the full circle that we saw was necessary to bring to make precision medicine a reality in our lifetime. And so the timing seem perfect to us.

Operator

And our next question comes from the line of Glen Santangelo.

Glen Joseph Santangelo - Guggenheim Securities, LLC, Research Division - Analyst

Tarek, I just want to follow up on the comments that you just made. I mean, essentially, I understand a little bit about the 3DEXPERIENCE and some of the life science solutions that they have, but you just specifically said that they bring certain capabilities to Medidata. What I'm really wondering,if you can elaborate a little bit on the complementary nature of these 2 companies, and what Medidata might be able to do under Dassault's ownership versus remaining an independent company. I just want to make sure I understand what the incremental value proposition's going to be in Medidata's legacy market.

And then secondarily, I was wondering, could you just comment, is there a breakup fee? And are there specific roles for you and Glen in the new combined company? Are you guys -- are you under contract? Are there any earnouts? Anything of that nature would be helpful.

Glen M. de Vries - Medidata Solutions, Inc. - Co-Founder, President & Director

Thanks, Glen. It's Glen. Let me start, and then I'll hand it over to Tarek. So if you look at what we've been doing, which obviously you're deeply familiar with, there are complexities beyond just the kind of clinical trial processes that we've been addressing to date around things like managing,frankly, a supply chain, the chain of custody of things and the clinical trial. As we see more of these cell therapies, other personalized therapies, not just life sciences, medicine is going to be struggling with processes. They just don't know how to scale. Things around getting a sample from a patient through a manufacturing process, a complex biologic style manufacturing process, which our colleagues to be at Dassault Systèmes are very good at managing, but then it's -- these get back to that same patient. So there's things that actually are just part of what is that future state of blocking and tackling and running at scale, the kind of development to bring the innovations that I was talking about people's pipelines to market.

Beyond that, if you look at the capabilities around looking at research data, some of the things in the BIOVIA brand, there are ways that we can,should, and I think, frankly, need to as the life sciences industry look at a much more sophisticated level at that interaction of drugs and devices at a deeper physiological and molecular level to figure out exactly how to optimize getting therapeutic value out of every single dollar invested in people's R&D pipelines. That is just as much a part and parcel of getting that gearing out, of getting that evidence gearing out of the data that's collected as just running a better clinical trial.

And so those are 2 very practical examples where, as we've talked about in the past, connecting some of the loops, making closed loop feedback systems in the world of clinical and parts of commercial that we've done at Medidata while actually synergistically with Dassault Systèmes, we can start to think about those feedback loops across discovery, research, development, commercialization, industrialization, delivery of those therapies in the marketplace in ways that we really couldn't even conceive of before we started talking about this combination. And so, hopefully, that gives us some very practical examples as well as philosophically how we've thought about it.

Bernard S. Charlès - Dassault Systèmes SE - Vice Chairman & CEO

And I'm happy to take the second half of the question. So Glen and I are -- we've always been driven by the mission that we set out 20 years ago.We are 100% committed to making this successful. We are definitely staying on. We will be running Medidata as a wholly-owned subsidiary,reporting into the senior management here at Dassault Systèmes, but we have no plans to go anywhere. As it relates to the other questions you asked, we'll have a regulatory filing in a couple of weeks that'll answer all those questions. But I'll -- what I'll say is that it's not financial incentives that bring us here, it's our desire to change the world. And I think, together, we can do that. And we're in here for the long term.

Operator

And our next question comes from the line of Michael Briest.

Michael Briest - UBS Investment Bank, Research Division - MD of Global Technology Research Group & Head of the European Technology Research

Tarek and Glen, I noticed that -- I mean, you have a lot of customers, 1,300, which suggests an average selling price or an average relationship of about $500,000 a year. But 20-odd percent comes from the top 5., so it's a very sort of weird shape of the system. Can you talk about why some customers are spending tens of millions with you and then some others are presumably spending very little, and what the potential to raise those amounts would be?

And then, Pascal, I guess one for you on cash flows. So the business made $77 million free cash flow in 2017, $49 million last year, and it's guiding for over $40 million this year. So I'm just curious why it's going down and what will happen to the shape of that. I mean, if you're paying $55 million of interest next year, will this thing generate enough cash to cover that in 2020?

Tarek A. Sherif - Medidata Solutions, Inc. - Co-Founder, Chairman & CEO

So happy to take the first question. I think when you think about our industry, first of all, there is -- to the second part of what you asked in that,there is an enormous opportunity to have our customers adopt more of the solutions that we have currently in the marketplace. The broader platform is now fully adopted by our customers even by our largest customers. And now with the offerings that we've brought forth with AcornAI and the SHYFT offering, there's even more opportunity to increase the average selling price to our customers.

You have to remember, in the pharma industry, in biotech, the top 100, 150 customers are fairly large in size, and then you have a lot of smaller biotechnology companies that tend to run fewer clinical trials. And so that -- when you look at the average ASP, I think that's a very healthy one.But you do get sort of this bimodal view of -- or skewing in revenue. But I think the most important thing is that there's a lot of white space for us to continue to drive adoption and drive higher revenue and higher ASP.

Pascal Daloz - Dassault Systèmes SE - Executive VP, CFO & Corporate Strategy Officer

Michael, related to the cash flows, I will say do the same answers that I did for Stacy. Again, wait a little bit. I will come with the details at the right time. But I can ensure you that we have notified the lever to accelerate the cash flow generations coming from these activities. So you can count on me.

Operator

And our next question comes from the line of Jason Celino.

Jason Vincent Celino - KeyBanc Capital Markets Inc., Research Division - Associate

I know it's still early, but what's some of the potential feedback you anticipate hearing from some of your customers, especially maybe some of the customers that are getting both of your companies' products?

Bernard S. Charlès - Dassault Systèmes SE - Vice Chairman & CEO

I think we can both speak. I got personally outstanding feedback from a few of them already because they understand that the future is a platform-based end-to-end. So we'll have the potential to discuss with more of them, but it's very positive from Tarek and Glen.

Tarek A. Sherif - Medidata Solutions, Inc. - Co-Founder, Chairman & CEO

Basically, it's the same. Or It's customers who brought us together in the first place, who introduced us. And I think they view this, as Bernard said,as something that is very, very value creating for the industry in the long term.

Bernard S. Charlès - Dassault Systèmes SE - Vice Chairman & CEO

It's positive, yes, right? Positive.

Operator

And our next question comes from the line of Neil Steer.

Neil Steer - Redburn (Europe) Limited, Research Division - Partner of Software and IT Services Research

My question just relates to something Bernard said, first of all, on the call in response to a question just a moment ago. The fact that Medidata is going to be run separately or autonomously separately. And I'm just wondering how that figures with achieving some of the synergies. And surely,given everything that you've said in the presentation, you would want to make this as quickly as possible part of the BIOVIA brand and run with that as soon as possible. So I'm just intrigued as to why the insistence that it's going to be separately run.

Pascal Daloz - Dassault Systèmes SE - Executive VP, CFO & Corporate Strategy Officer

Or it can be the other way around.

Bernard S. Charlès - Dassault Systèmes SE - Vice Chairman & CEO

Simply said, to answer your question, for me, it's very simple. This is an entire sector by itself, which is within an index of adoption of digital, which is where space, analyst space was 25 years ago. It's driven by data because there is weak capabilities for modeling and simulation. One day, they will come together.

But it's the reality today. It's driven by the power of data. And this is Medidata is doing that extreme work.So I -- in some way, and without going too much in the organization, Pascal and I, we agreed and with Tarek and Glen that this should be run and reporting directly to Pascal. Everything that is needed to make that business expand for their platform on end-to-end is in Tarek's and Glen's mission. But of course, we need to prepare this well. But for me, putting a powerful collaborative innovation platform, driven by the data approach, is very different than doing document management. And I believe that the current players can be marginalized just with that effect when customers will have realized how deep it can go.

Again, it happened in other industries before. So I don't see why it will not happen here.

Neil Steer - Redburn (Europe) Limited, Research Division - Partner of Software and IT Services Research

Okay. And just another sort of unrelated question. In reference to the fact that Medidata has refenced sort of the 10% of the $7 billion market opportunity at the moment, who would be the names of the sort of 3 or 4 next players that address the remaining 90% that you currently don't cover?

Glen M. de Vries - Medidata Solutions, Inc. - Co-Founder, President & Director

Oracle is a relatively large player. The way I look at that TAM, however, is not that there are other software players that are covering that. It's a lot of process work. It's a lot of manual work. And if you look at the penetration rates for technology, cloud technology into pharma, it's -- certainly, in the United States, it's among the lowest, only second above the U.S. government. And so I think there's a lot of room for modern technology to be adopted and replace the existing processes and homegrown systems, et cetera.

Operator

And our next question comes from the line of Lauren Daure.

Laurent Daure - Kepler Cheuvreux, Research Division - Head of IT Software and Services Research

I have 3 quick questions. The first is probably for Pascal. When you talked about accretive in EPS impact, I know it's very early, I don't want you to give us margin guidance, but I think you probably already know your -- the assumption you took for the tax rate of Medidata that will be useful, and then we make our own assumptions. The second question is, when you give us a breakdown of revenue, is it possible to have a rough view of the contribution of the 3 different product line that Medidata has? And my final question is back to the competitive landscape. I'm not too familiar with the health care industry, but I was wondering. The company, Viva, Is it competing directly with you? And what differentiates them with you?

Bernard S. Charlès - Dassault Systèmes SE - Vice Chairman & CEO

Can I start with the last one?

Tarek A. Sherif - Medidata Solutions, Inc. - Co-Founder, Chairman & CEO

Yes, please, please, please.

Bernard S. Charlès - Dassault Systèmes SE - Vice Chairman & CEO

I knew this -- I can't resist. I think many of the players are doing what happened 20 years ago in PBM for manufacturing document management,but the world is not going to stay on document, and the full integration is going to happen. I think it's visible already. And so like in any technology providing platforms for other market, the shift is not only capabilities, it's changing the paradigm to do the job. So multi-disciplined, multi-scale collaboration is now #1 priority when we talk with Amgen common customers, when we talk with other common customers. It's a multi-scale,multi-disciplined collaborative work for all functions end-to-end through the life cycle.

I have not heard any document management companies being able to do that. That's what we want to do together to be simple. That was the answer to the last point. So our target is very clear, is game-changer of the industry. And the previous question, I think Pascal, you want to...

Pascal Daloz - Dassault Systèmes SE - Executive VP, CFO & Corporate Strategy Officer

There is one to say -- no, there is one related to the split of revenue between the different product line. I don't know if you want to ...

Tarek A. Sherif - Medidata Solutions, Inc. - Co-Founder, Chairman & CEO

I'm happy to. So what we've historically talked about is sort of our core revenue, which is around RAVE EDC. And in comparison to the broader platform, our other solutions, including our analytics, and you can think of it as a -- about a 2/3, 1/3 breakdown with 2/3 still coming from core EDC and an about 1/3, from the rest of our solutions. So obviously, the rest of our solutions are growing faster. And over time, we'll see that split become50-50 and more.

Bernard S. Charlès - Dassault Systèmes SE - Vice Chairman & CEO

And related to your first question, I think I already gave the answer. When I was telling you that Medidata will represent a large portion of the $0.80contribution, we were assuming coming from the acquisitions on our long-term plans growing EUR 6. So I think you have the answer.

Laurent Daure - Kepler Cheuvreux, Research Division - Head of IT Software and Services Research

In fact, I have 2 gaps. I'm missing the margin and the tax rate.

Bernard S. Charlès - Dassault Systèmes SE - Vice Chairman & CEO

You can come back. Thank you very much, all of you, for participating and for your interest. As you can imagine, it's a special moment because we-- this is a definite commitment to really make sure we do something unique and so necessary for this huge market of health care discovery on new therapeutics. It goes very well with the biotech approach, the connection with how you produce things on the targeting of personalized health. So we have a plan together, and that's the one we want to execute. Thank you very much, and talk to you soon.

Operator

Thank you, and that does conclude our conference for today. Thank you all for participating. You may all disconnect.

D I S C L A I M E R

Thomson Reuters reserves the right to make changes to documents, content, or other information on this web site without obligation to notify any person of such changes.

In the conference calls upon which Event Transcripts are based, companies may make projections or other forward-looking statements regarding a variety of items. Such forward-looking statements are based upon current expectations and involve risks and uncertainties. Actual results may differ materially from those stated in any forward-looking statement based on a number of important factors and risks, which are more specifically identified in the companies' most recent SEC filings. Although the companies may indicate and believe that the assumptions underlying the forward-looking statements are reasonable, any of the assumptions could prove inaccurate or incorrect and, therefore, there can be no assurance that the results contemplated in the forward-looking statements will be realized.

THE INFORMATION CONTAINED IN EVENT TRANSCRIPTS IS A TEXTUAL REPRESENTATION OF THE APPLICABLE COMPANY'S CONFERENCE CALL AND WHILE EFFORTS ARE MADE TO PROVIDE AN ACCURATE TRANSCRIPTION,THERE MAY BE MATERIAL ERRORS, OMISSIONS, OR INACCURACIES IN THE REPORTING OF THE SUBSTANCE OF THE CONFERENCE CALLS. IN NO WAY DOES THOMSON REUTERS OR THE APPLICABLE COMPANY ASSUMEANY RESPONSIBILITY FOR ANY INVESTMENT OR OTHER DECISIONS MADE BASED UPON THE INFORMATION PROVIDED ON THIS WEB SITE OR IN ANY EVENT TRANSCRIPT. USERS ARE ADVISED TO REVIEW THE APPLICABLECOMPANY'S CONFERENCE CALL ITSELF AND THE APPLICABLE COMPANY'S SEC FILINGS BEFORE MAKING ANY INVESTMENT OR OTHER DECISIONS.

©2019, Thomson Reuters. All Rights Reserved.

12588841-2019-06-12T16:07:02.133

17

Important Additional Information and Where to Find It

In connection with the proposed merger, Medidata Solutions, Inc. (the “Company”) intends to file relevant materials with the Securities and Exchange Commission (the “SEC”), including a preliminary proxy statement on Schedule 14A. Following the filing of the definitive proxy statement with the SEC, the Company will mail the definitive proxy statement and a proxy card to each stockholder entitled to vote at the special meeting relating to the proposed merger. STOCKHOLDERS ARE URGED TO CAREFULLY READ THESE MATERIALS IN THEIR ENTIRETY (INCLUDING ANY AMENDMENTS OR SUPPLEMENTS THERETO) AND ANY OTHER RELEVANT DOCUMENTS THAT THE COMPANY WILL FILE WITH THE SEC WHEN THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT THE COMPANY AND THE TRANSACTION. The proxy statement and other relevant materials (when available), and any and all documents filed by the Company with the SEC, may be obtained free of charge at the SEC’s website (www.sec.gov) or at the Company’s website (https://investors.medidata.com) or by writing to the Corporate Secretary at 350 Hudson Street, 9th Floor, New York, New York 10014.

Participants in the Merger Solicitation

This document does not constitute a solicitation of proxy, an offer to purchase or a solicitation of an offer to sell any securities, nor shall there be any sale of securities in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction. No offer of securities shall be made except by means of a prospectus meeting the requirements of Section 10 of the Securities Act of 1933, as amended. The Company, its directors, executive officers and certain employees may be deemed to be participants in the solicitation of proxies from the stockholders of the Company in connection with the proposed merger. Information about the persons who may, under the rules of the SEC, be considered to be participants in the solicitation of the Company’s stockholders in connection with the proposed merger, and any interest they have in the proposed merger, will be set forth in the definitive proxy statement when it is filed with the SEC. Additional information regarding these individuals is set forth in the Company’s proxy statement for its 2019 annual meeting of stockholders, which was filed with the SEC on April 18, 2019, and its Annual Report on Form 10-K for the fiscal year ended December 31, 2018, which was filed with the SEC on March 1, 2019. These documents may be obtained for free at the SEC’s website at www.sec.gov, and via the Company’s Investor Relations section of its website at www.medidata.com.

Cautionary Statement Regarding Forward-Looking Statements

This document may include “forward-looking” statements within the meaning of the Private Securities Litigation Reform Act of 1995, including, without limitation, statements relating to the completion of the merger. In this context, forward-looking statements often address expected future business and financial performance and financial condition, and often contain words such as “expect,” “anticipate,” “intend,” “plan,” “believe,” “seek,” “see,” “will,” “would,” “target,” similar expressions, and variations or negatives of these words. Forward-looking statements by their nature address matters that are, to different degrees, uncertain, such as statements about the consummation of the proposed merger and the anticipated benefits thereof. These and other forward-looking statements are not guarantees of future results and are subject to risks, uncertainties and assumptions that could cause actual results to differ materially from those expressed in any forward-looking statements, including the failure to consummate the proposed merger or to make any filing or take other action required to consummate such merger in a timely matter or at all. The inclusion of such statements should not be regarded as a representation that any plans, estimates or expectations will be achieved. You should not place undue reliance on such statements. Important factors that could cause actual results to differ materially from such plans, estimates or expectations include, among others, that: (1) the Company may be unable to obtain stockholder approval as required for the merger; (2) conditions to the closing of the merger, including obtaining required regulatory approvals, may not be satisfied or waived on a timely basis or otherwise; (3) a governmental entity or a regulatory body may prohibit, delay or refuse to grant approval for the consummation of the merger and may require conditions, limitations or restrictions in connection with such approvals that can adversely affect the anticipated benefits of the proposed merger or cause the parties to abandon the proposed merger; (4) the merger may involve unexpected costs, liabilities or delays; (5) the business of the Company may suffer as a result of uncertainty surrounding the merger or the potential adverse changes to business relationships resulting from the proposed merger; (6) legal proceedings may be initiated related to the merger and the outcome of any legal proceedings related to the merger may be adverse to the Company; (7) the Company may be adversely affected by other general industry, economic, business, and/or competitive factors; (8) there may be unforeseen events, changes or other circumstances that could give rise to the termination of the merger agreement or affect the ability to recognize benefits of the merger; (9) risks that the proposed merger may disrupt current plans

and operations and present potential difficulties in employee retention as a result of the merger; (10) risks related to diverting management’s attention from the Company’s ongoing business operations; (11) there may be other risks to consummation of the merger, including the risk that the merger will not be consummated within the expected time period or at all which may affect the Company’s business and the price of the common stock of the Company; and (12) the risks described from time to time in the Company’s reports filed with the SEC under the heading “Risk Factors,” including the Annual Report on Form 10-K for the fiscal year ended December 31, 2018, Quarterly Reports on Form 10-Q and Current Reports on Form 8-K and in other of the Company’s filings with the SEC. Such risks include, without limitation: possible fluctuations in our financial and operating results; our customer concentration; our ability to retain and expand our customer base or increase new business from those customers; our ability to continue to release, and gain customer acceptance of, new and improved versions of our products; the impacts of security breaches and data loss and our vulnerability to technology infrastructure failures; and integration activities, performance and financial impact of acquired companies. Consequences of material differences in results as compared with those anticipated in the forward-looking statements could include, among other things, business disruption, operational problems, financial loss, legal liability to third parties and similar risks, any of which could have a material adverse effect on the Company’s financial condition, results of operations, credit rating or liquidity. These risks, as well as other risks associated with the proposed merger, will be more fully discussed in the proxy statement that will be filed with the SEC in connection with the proposed merger. There can be no assurance that the merger will be completed, or if it is completed, that it will close within the anticipated time period or that the expected benefits of the merger will be realized. Readers are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date on which such statements were made. Except as required by applicable law, the Company undertakes no obligation to update forward-looking statements to reflect events or circumstances arising after such date.