Exhibit 99.2

Teva Announces the Acquisition of Auspex

March 30, 2015

Cautionary Statement Regarding Forward-Looking 2 Statements

This presentation contains forward-looking statements, which are based on management’s current beliefs and expectations and involve a number of known and unknown risks and uncertainties that could cause our future results, performance or achievements to differ significantly from the results, performance or achievements expressed or implied by such forward-looking statements. All statements, other than statements of historical fact, are statements that could be deemed forward-looking statements, including statements about the planned acquisition of Auspex, the expected financial impact and benefits to us of such acquisition, and anticipated milestones and other expectations regarding Auspex’s product development activities and clinical trials, including the on-going clinical trials for SD-809. Important factors that could cause or contribute to such differences include risks relating to: our ability to complete the planned acquisition of Auspex, including the satisfaction of the minimum tender and other closing conditions; uncertainties as to the timing of the acquisition; the possibility that we may not realize the expected benefits of the acquisition in a timely manner or at all; our ability to successfully integrate Auspex into our business; future results of on-going or later clinical trials for Auspex’s product candidates, including SD-809; the ability to obtain regulatory approval of Auspex’s product candidates in the planned indications; the ability to commercialize Auspex’s product candidates and market acceptance of such products; our ability to achieve expected results from the research and development efforts invested in our pipeline of specialty and other products; and other factors that are discussed in our Annual Report on Form 20-F for the year ended December 31, 2014, Auspex’s Annual Report on Form 10-K for the year ended December

31, 2014, and such parties’ other filings with the United States Securities and Exchange Commission (“SEC”). Forward-looking statements speak only as of the date on which they are made and we assume no obligation to update or revise any forward-looking statement, whether as a result of new information, future events or otherwise. This presentation was provided on March 30, 2015 as part of an oral presentation and is qualified thereby.

Additional Information and Where to Find It

THE TENDER OFFER DESCRIBED IN THIS DOCUMENT HAS NOT YET COMMENCED. THIS DOCUMENT IS NEITHER AN OFFER TO PURCHASE NOR A SOLICITATION OF AN OFFER TO SELL SHARES OF AUSPEX. At the time the offer is commenced, an affiliate of Teva will file a Tender Offer Statement on Schedule TO with the SEC, and Auspex will file a Solicitation/Recommendation Statement on Schedule 14D-9 with respect to the tender offer. The Offer to Purchase, the related Letter of Transmittal and certain other offer documents, as well as the Solicitation/Recommendation

Statement, will be made available to all stockholders of Auspex at no expense to them. The Tender Offer Statement and the Solicitation/Recommendation Statement will be available at no expense on the SEC’s web site at http://www.sec.gov. Free copies of these materials and certain other offering documents will be made available by the information agent for the offer.

AUSPEX STOCKHOLDERS AND OTHER INVESTORS ARE URGED TO READ THE TENDER OFFER MATERIALS (INCLUDING THE OFFER TO PURCHASE, RELATED LETTER OF TRANSMITTAL AND CERTAIN OTHER OFFER DOCUMENTS) AND THE SOLICITATION/RECOMMENDATION STATEMENT WHEN AVAILABLE, INCLUDING ALL AMENDMENTS TO THOSE MATERIALS. SUCH DOCUMENTS WILL

CONTAIN IMPORTANT INFORMATION, WHICH SHOULD BE READ CAREFULLY BEFORE ANY DECISION IS MADE WITH RESPECT TO THE TENDER OFFER.

In addition to the Solicitation/Recommendation Statement, Auspex files annual, quarterly and current reports, proxy statements and other information with the SEC. You may read and copy any reports, statements or other information filed by Auspex at the SEC’s public reference room at 100 F Street, N.E., Washington, D.C. 20549. Please call the SEC at 1-800-SEC-0330 for further information on the public reference room. Auspex’s filings with the SEC are also available to the public from commercial document-retrieval services and at the SEC’s website, http://www.sec.gov.

3

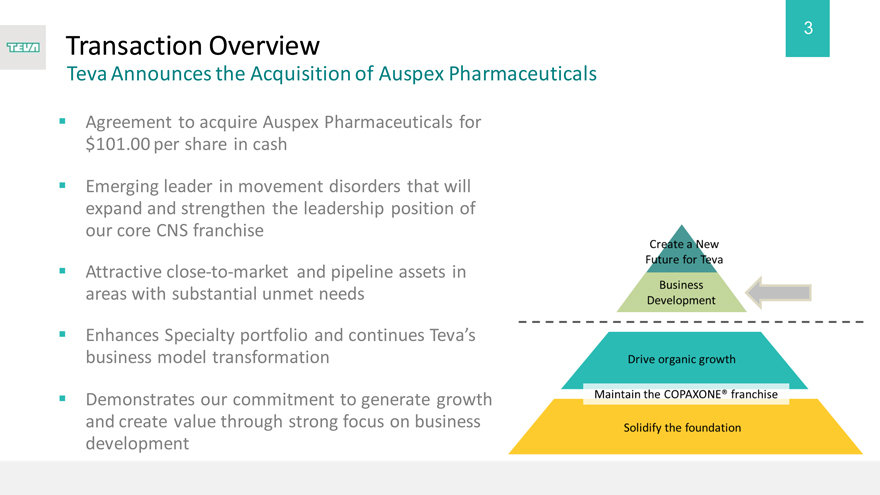

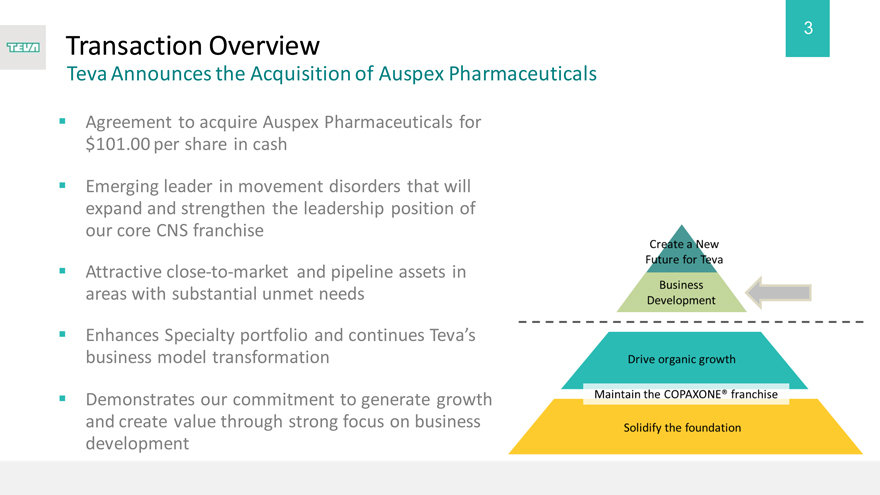

Transaction Overview

Teva Announces the Acquisition of Auspex Pharmaceuticals

Agreement to acquire Auspex Pharmaceuticals for $101.00 per share in cash

Emerging leader in movement disorders that will expand and strengthen the leadership position of our core CNS franchise

Attractive close-to-market and pipeline assets in areas with substantial unmet needs

Enhances Specialty portfolio and continues Teva’s business model transformation

Demonstrates our commitment to generate growth and create value through strong focus on business development

4

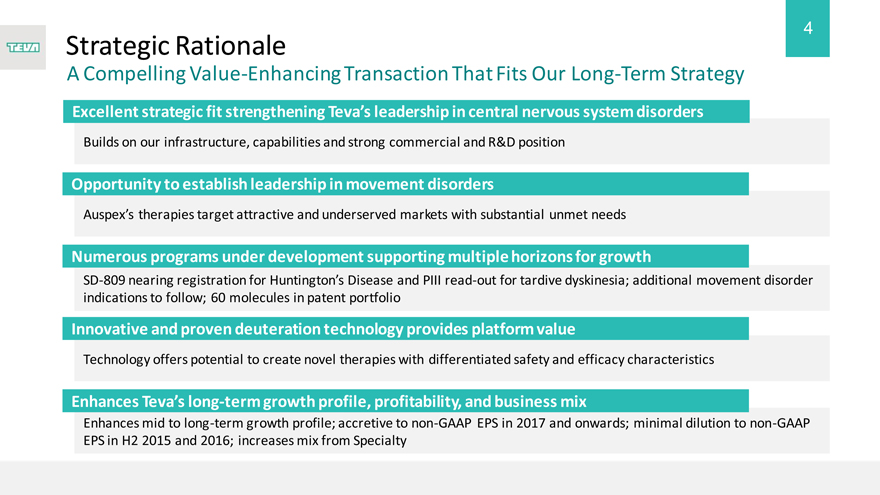

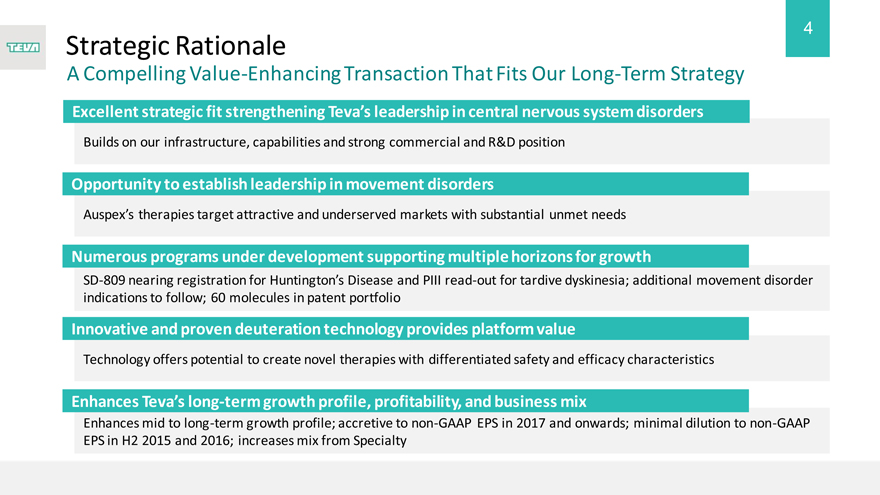

Strategic Rationale

A Compelling Value-Enhancing Transaction That Fits Our Long-Term Strategy

Excellent strategic fit strengthening Teva’s leadership in central nervous system disorders

Builds on our infrastructure, capabilities and strong commercial and R&D position

Opportunity to establish leadership in movement disorders

Auspex’s therapies target attractive and underserved markets with substantial unmet needs

Numerous programs under development supporting multiple horizons for growth

SD-809 nearing registration for Huntington’s Disease and PIII read-out for tardive dyskinesia; additional movement disorder indications to follow; 60 molecules in patent portfolio

Innovative and proven deuteration technology provides platform value

Technology offers potential to create novel therapies with differentiated safety and efficacy characteristics

Enhances Teva’s long-term growth profile, profitability, and business mix

Enhances mid to long-term growth profile; accretive to non-GAAP EPS in 2017 and onwards; minimal dilution to non-GAAP EPS in H2 2015 and 2016; increases mix from Specialty

5

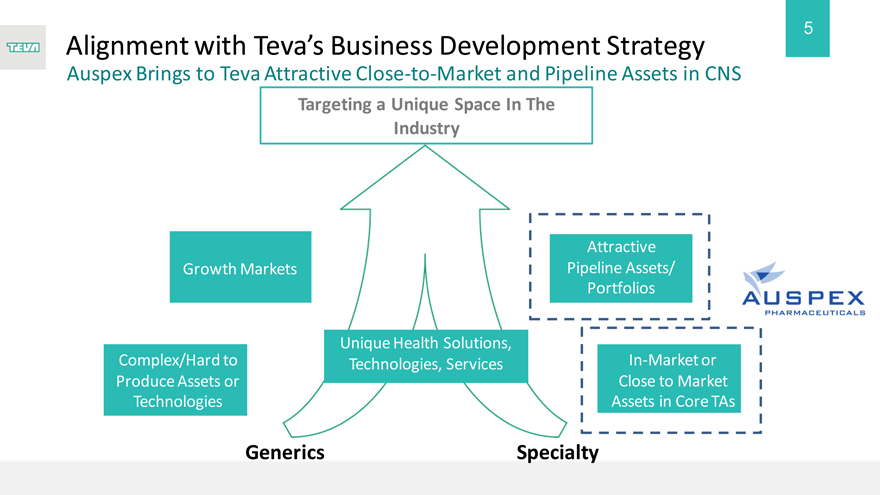

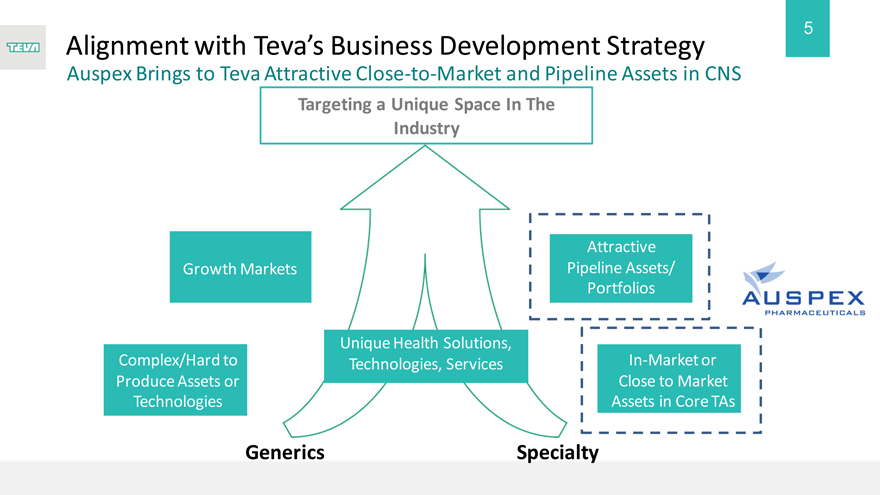

Alignment with Teva’s Business Development Strategy

Auspex Brings to Teva Attractive Close-to-Market and Pipeline Assets in CNS

Targeting a Unique Space In The Industry

Growth Markets

Complex/Hard to Produce Assets or Technologies

Generics

Unique Health Solutions,

Technologies, Services

Attractive Pipeline Assets/ Portfolios

In-Market or Close to Market Assets in Core TAs

Specialty

6

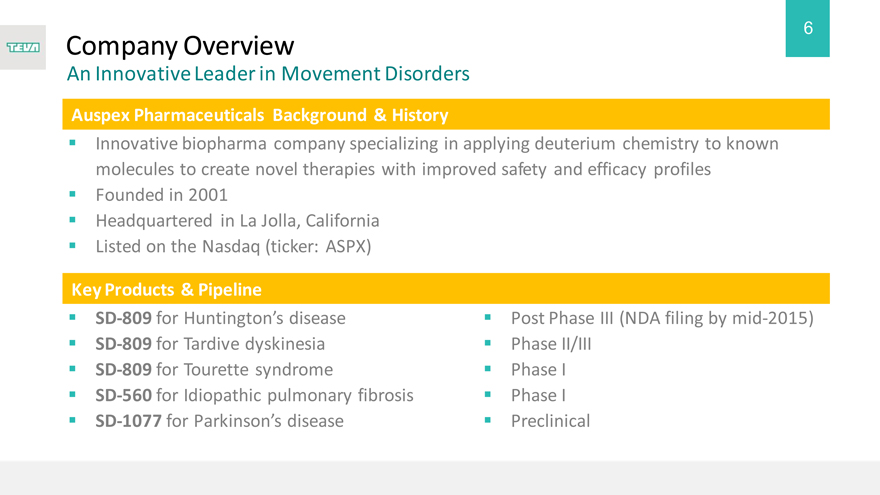

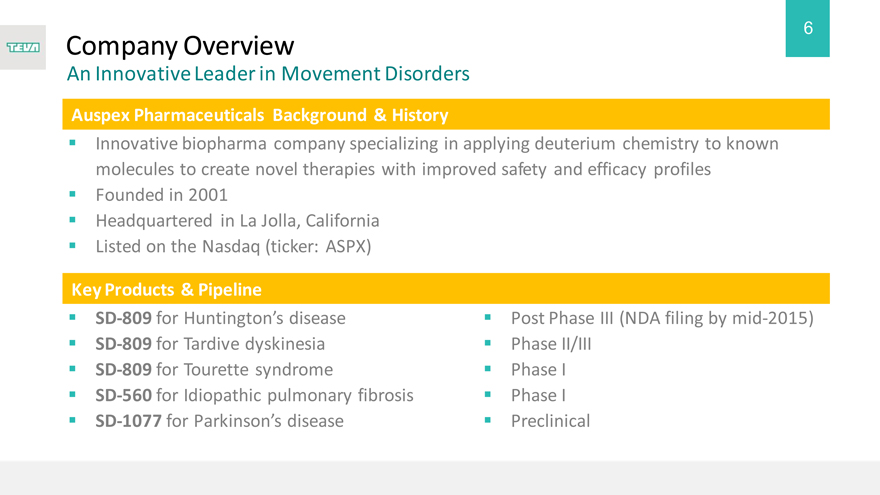

Company Overview

An Innovative Leader in Movement Disorders

Auspex Pharmaceuticals Background & History

Innovative biopharma company specializing in applying deuterium chemistry to known molecules to create novel therapies with improved safety and efficacy profiles Founded in 2001 Headquartered in La Jolla, California Listed on the Nasdaq (ticker: ASPX)

Key Products & Pipeline

SD-809 for Huntington’s disease

SD-809 for Tardive dyskinesia SD-809 for Tourette syndrome

SD-560 for Idiopathic pulmonary fibrosis

SD-1077 for Parkinson’s disease

Post Phase III (NDA filing by mid-2015) Phase II/III

Phase I Phase I Preclinical

7

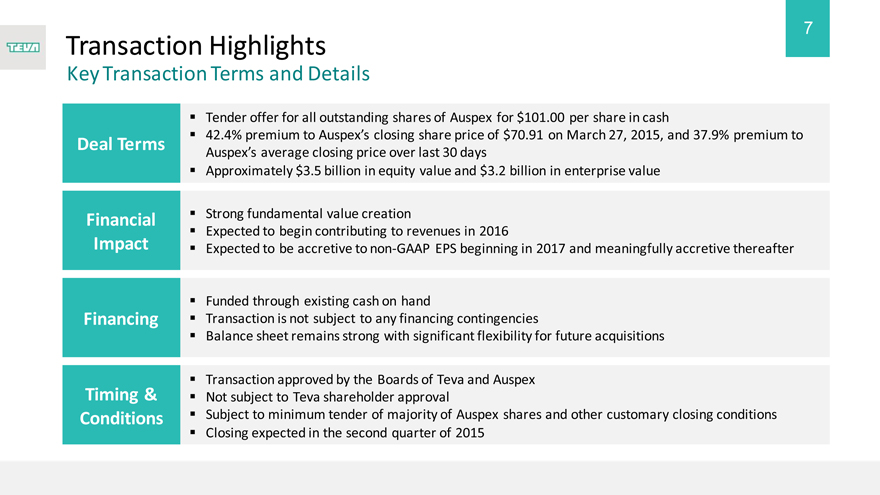

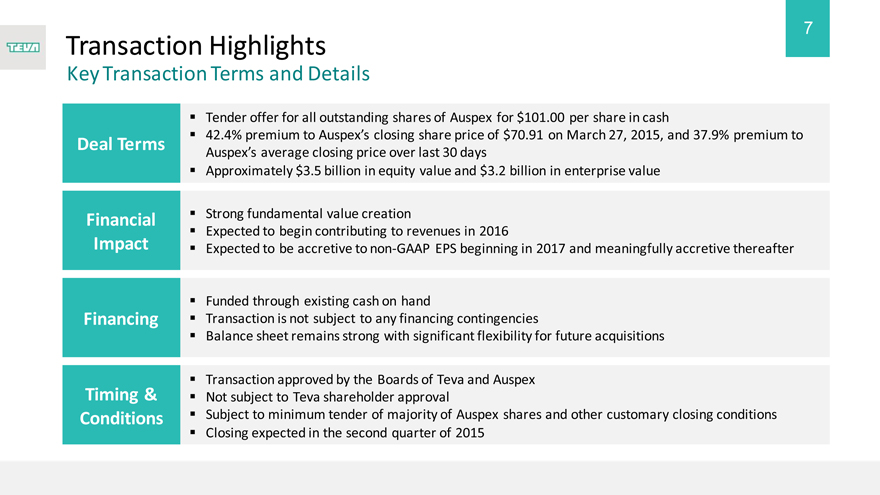

Transaction Highlights

Key Transaction Terms and Details

Deal Terms

Financial Impact

Financing

Timing & Conditions

Tender offer for all outstanding shares of Auspex for $101.00 per share in cash

42.4% premium to Auspex’s closing share price of $70.91 on March 27, 2015, and 37.9% premium to Auspex’s average closing price over last 30 days

Approximately $3.5 billion in equity value and $3.2 billion in enterprise value

Strong fundamental value creation

Expected to begin contributing to revenues in 2016

Expected to be accretive to non-GAAP EPS beginning in 2017 and meaningfully accretive thereafter

Funded through existing cash on hand

Transaction is not subject to any financing contingencies

Balance sheet remains strong with significant flexibility for future acquisitions

Transaction approved by the Boards of Teva and Auspex Not subject to Teva shareholder approval

Subject to minimum tender of majority of Auspex shares and other customary closing conditions

Closing expected in the second quarter of 2015

8

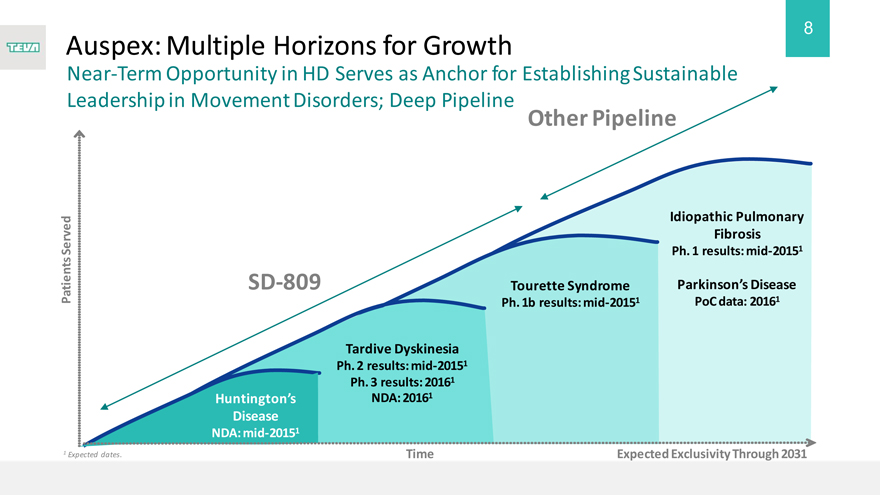

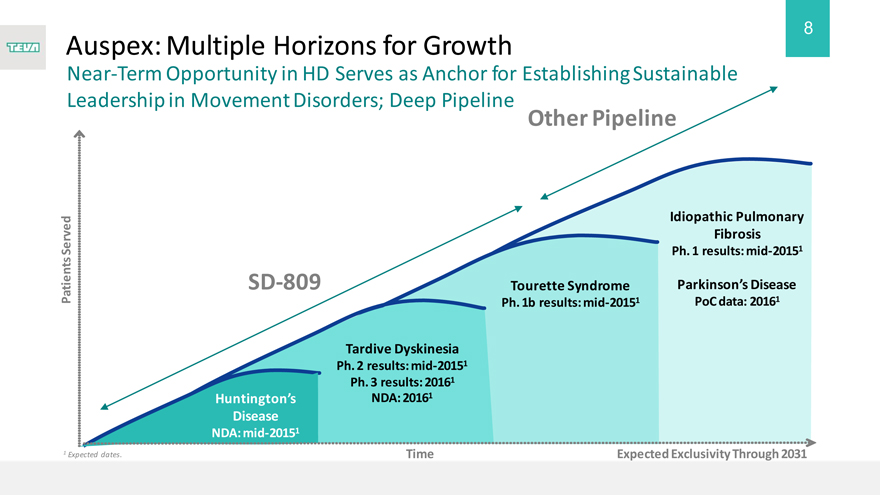

Auspex: Multiple Horizons for Growth

Near-Term Opportunity in HD Serves as Anchor for Establishing Sustainable Leadership in Movement Disorders; Deep Pipeline Pipeline

Other

Patients Served

SD-809

Huntington’s

Disease

NDA: mid-20151

1 Expected dates.

Tardive Dyskinesia

Ph. 2 results: mid-20151 Ph. 3 results: 20161 NDA: 20161

Time

Tourette Syndrome

Ph. 1b results: mid-20151

Idiopathic Pulmonary Fibrosis

Ph. 1 results: mid-20151

Parkinson’s Disease

PoC data: 20161

Expected Exclusivity Through 2031

9

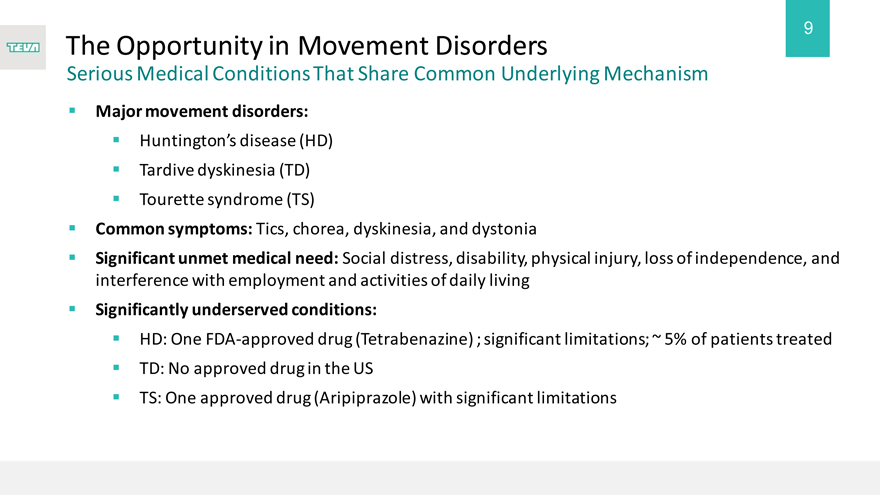

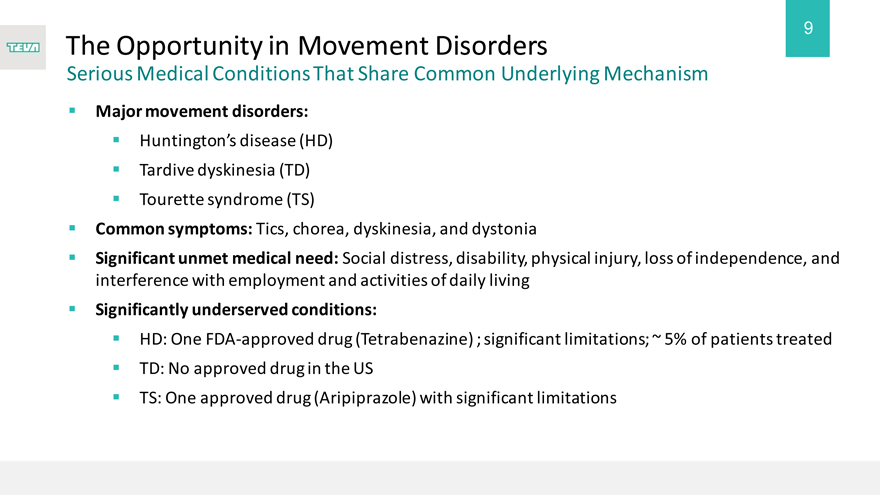

The Opportunity in Movement Disorders

Serious Medical Conditions That Share Common Underlying Mechanism

Major movement disorders:

Huntington’s disease (HD)

Tardive dyskinesia (TD) Tourette syndrome (TS)

Common symptoms: Tics, chorea, dyskinesia, and dystonia

Significant unmet medical need: Social distress, disability, physical injury, loss of independence, and interference with employment and activities of daily living

Significantly underserved conditions:

HD: One FDA-approved drug (Tetrabenazine) ; significant limitations; ~ 5% of patients treated TD: No approved drug in the US

TS: One approved drug (Aripiprazole) with significant limitations

10

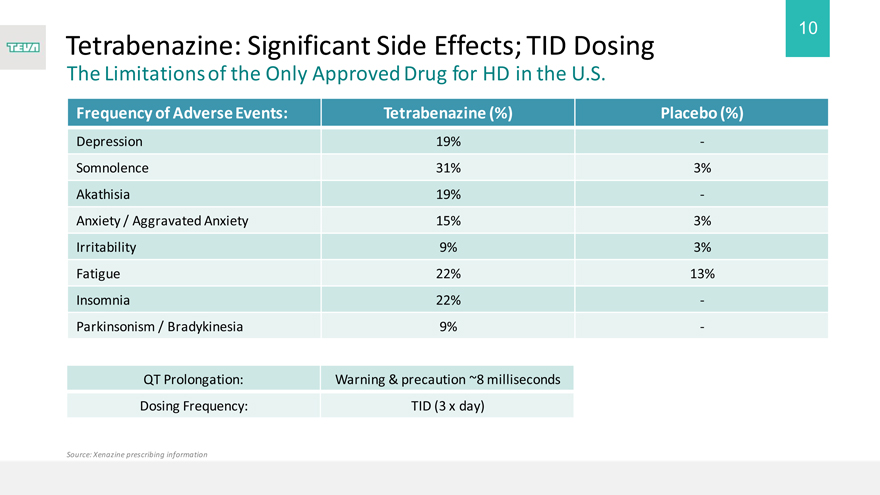

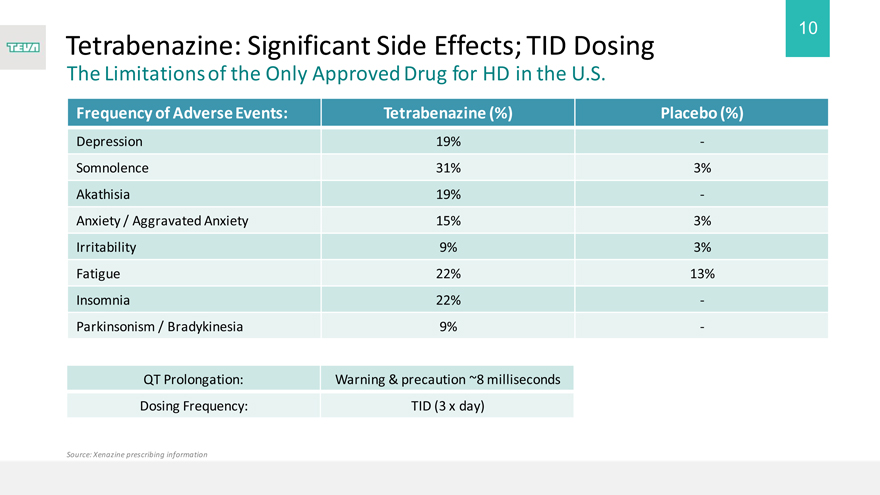

Tetrabenazine: Significant Side Effects; TID Dosing

The Limitations of the Only Approved Drug for HD in the U.S.

Frequency of Adverse Events:

Depression

Somnolence

Akathisia

Anxiety / Aggravated Anxiety Irritability Fatigue Insomnia Parkinsonism / Bradykinesia

QT Prolongation:

Dosing Frequency:

Source: Xenazine prescribing information

Tetrabenazine (%)

19%

31% 19% 15% 9% 22% 22% 9%

Warning & precaution ~8 milliseconds

TID (3 x day)

Placebo (%)

-

3%—3% 3% 13%—

-

11

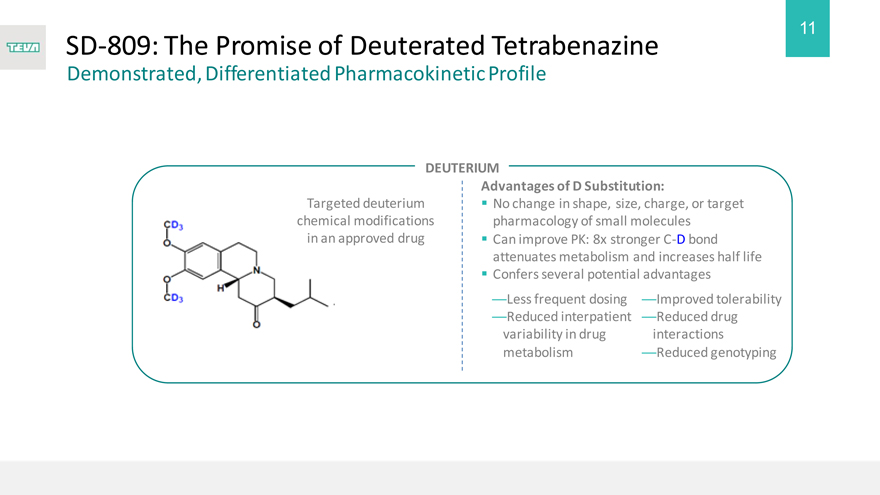

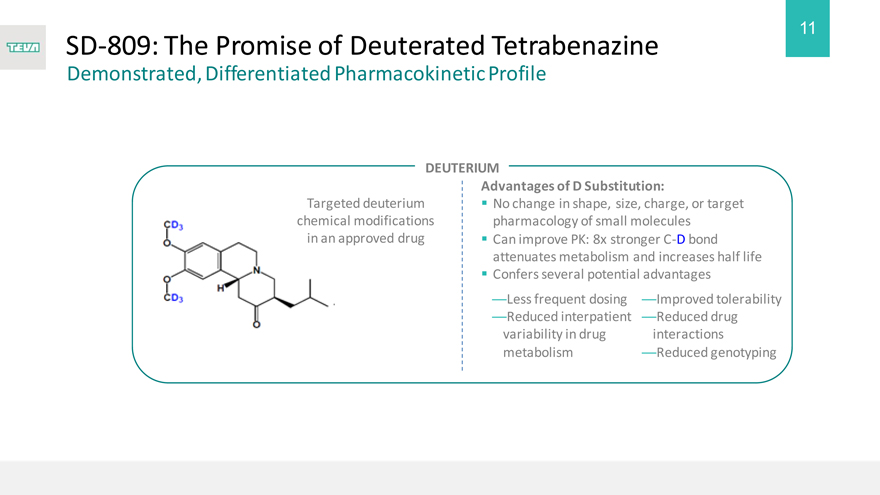

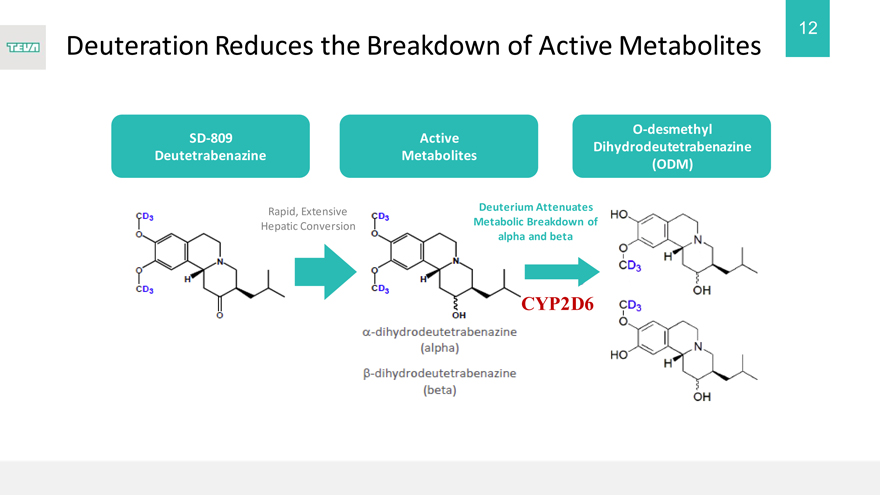

SD-809: The Promise of Deuterated Tetrabenazine

Demonstrated, Differentiated Pharmacokinetic Profile

Targeted deuterium chemical modifications in an approved drug

DEUTERIUM

Advantages of D Substitution:

No change in shape, size, charge, or target pharmacology of small molecules Can improve PK: 8x stronger C-D bond attenuates metabolism and increases half life Confers several potential advantages

—Less frequent dosing —Improved tolerability

—Reduced interpatient —Reduced drug variability in drug interactions metabolism —Reduced genotyping

12

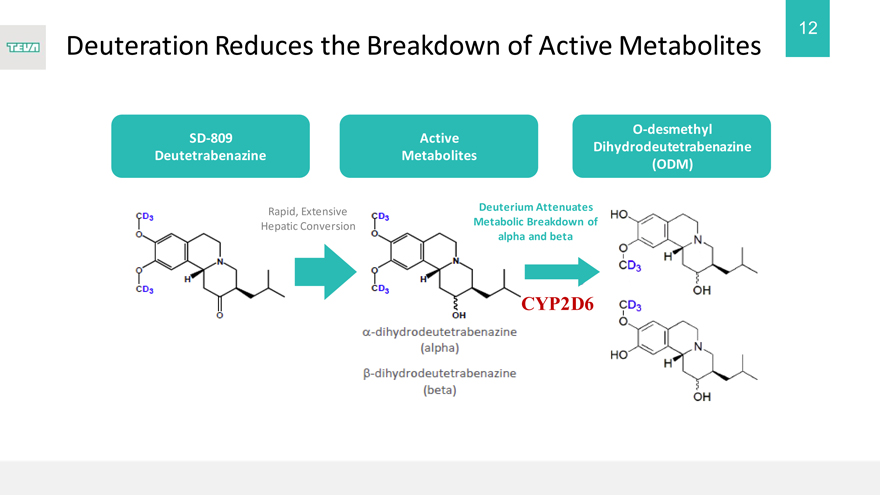

Deuteration Reduces the Breakdown of Active Metabolites

SD-809

Deutetrabenazine

Rapid, Extensive Hepatic Conversion

Active

Metabolites

Deuterium Attenuates Metabolic Breakdown of alpha and beta

CYP2D6

O-desmethyl Dihydrodeutetrabenazine (ODM)

13

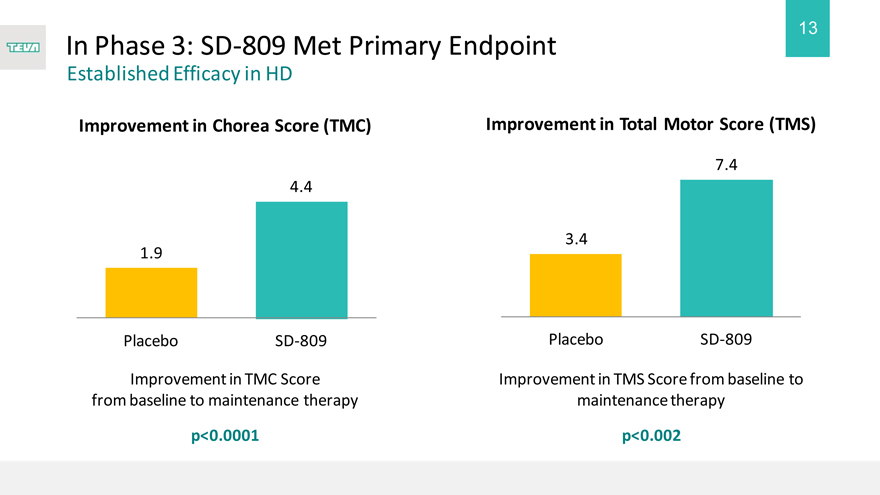

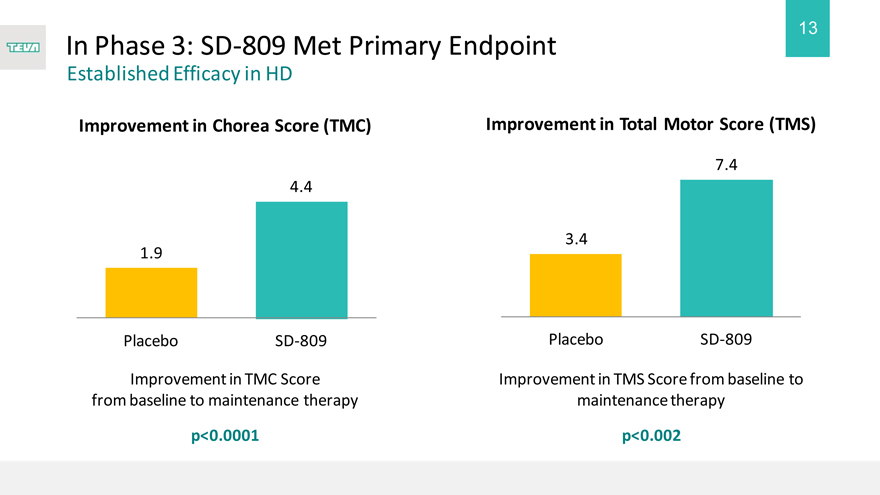

In Phase 3: SD-809 Met Primary Endpoint

Established Efficacy in HD

Improvement in Chorea Score (TMC) Improvement in Total Motor Score (TMS)

4.4

1.9

Placebo SD-809

Improvement in TMC Score from baseline to maintenance therapy

p<0.0001

7.4

3.4

Placebo SD-809

Improvement in TMS Score from baseline to maintenance therapy

p<0.002

14

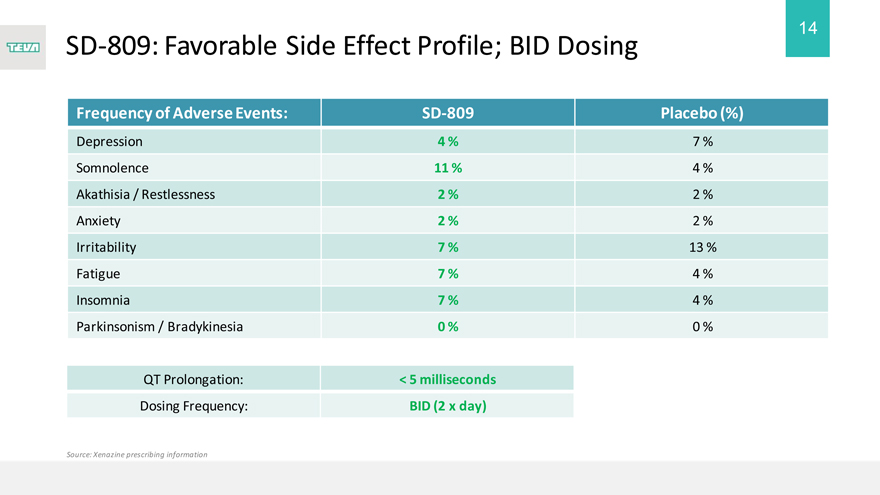

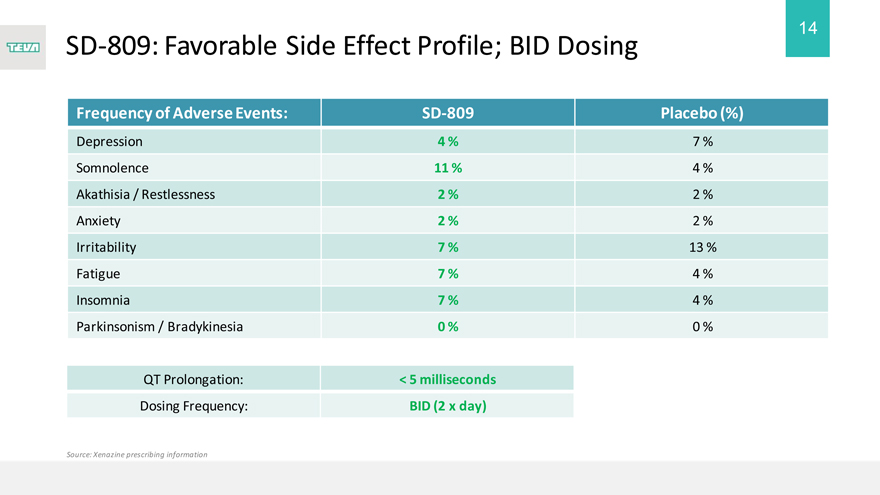

SD-809: Favorable Side Effect Profile; BID Dosing

Frequency of Adverse Events:

Depression

Somnolence

Akathisia / Restlessness Anxiety Irritability Fatigue Insomnia Parkinsonism / Bradykinesia

QT Prolongation:

Dosing Frequency:

Source: Xenazine prescribing information

SD-809

4 %

11 %

2 %

2 %

7 %

7 %

7 %

0 %

< 5 milliseconds BID (2 x day)

Placebo (%)

7 %

4 %

2 %

2 %

13 %

4 %

4 %

0 %

15

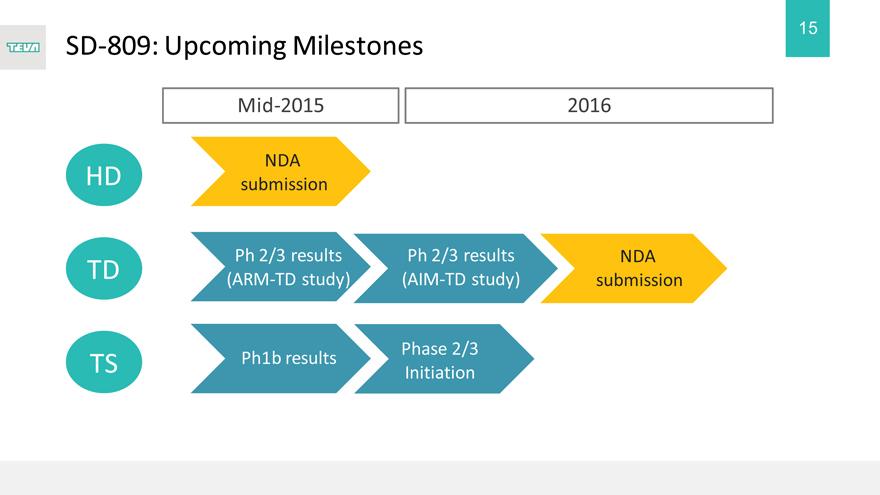

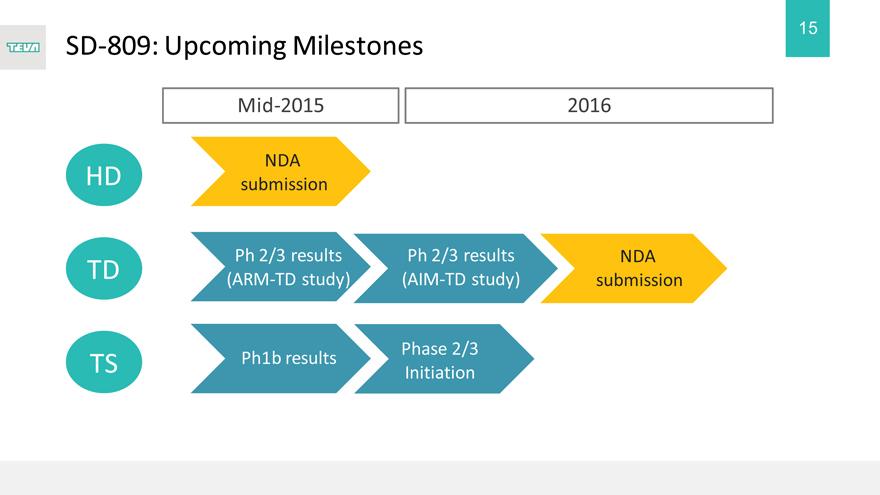

SD-809: Upcoming Milestones

Mid-2015 2016

HD TD TS

NDA submission

Ph 2/3 results (ARM-TD study)

Ph1b results

Ph 2/3 results (AIM-TD study)

Phase 2/3 Initiation

NDA submission

16

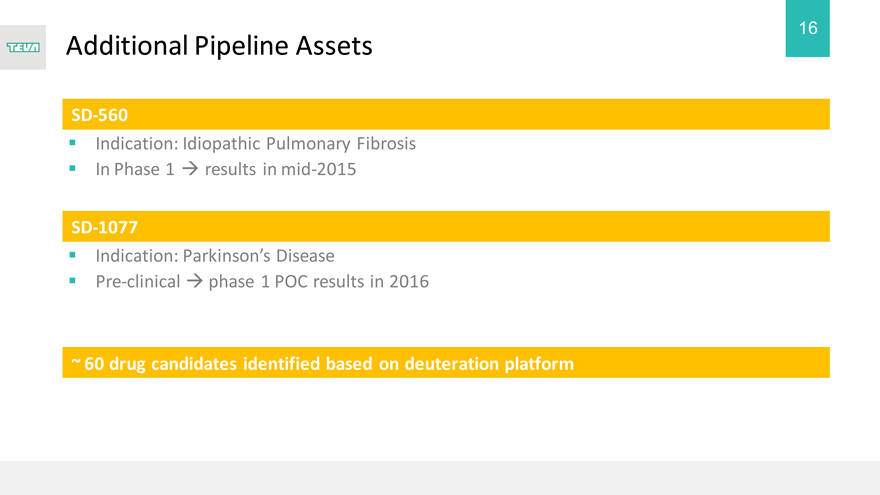

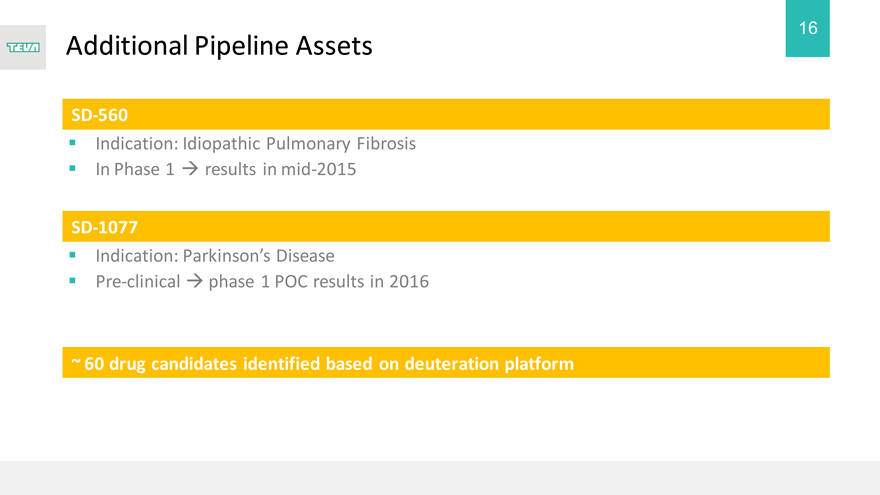

Additional Pipeline Assets

SD-560

Indication: Idiopathic Pulmonary Fibrosis In Phase 1 results in mid-2015

SD-1077

Indication: Parkinson’s Disease

Pre-clinical phase 1 POC results in 2016

~ 60 drug candidates identified based on deuteration platform

17

Highly Complementary to Teva’s Existing Specialty Pipeline

Phase 1

TV-46763 (abuse deterrent)

Pain

TV-46139 (abuse deterrent)

Pain

Fluticasone Salmeterol Spiromax EU

Asthma, COPD

Reslizumab SC

Asthma

Fluticasone Salmeterol (MDI) EU

Asthma, COPD

TEV-90110

HIV

TEV-90112

HIV

Phase 2

Laquinimod

Multiple sclerosis (progressive forms)

Laquinimod

Huntington’s disease

Pridopidine

Huntington’s disease

TV-45070 Topical

Osteoarthritis pain

TV-45070 Topical

Neuropathic pain

TEV-48125

Chronic and episodic migraine

CEP-41750 (mesenchymal precursor cell) Acute myocardial infarction

Albutropin

Growth hormone deficiency

Phase 3

Laquinimod

Multiple sclerosis (relapsing remitting)

Fluticasone Propionate RespiClick US

Asthma

Fluticasone Salmeterol RespiClick US

Asthma

QVAR® (BAI) US

Asthma

Reslizumab IV

Asthma

CEP-41750 (mesenchymal precursor cell) Chronic heart failure

Registration

CEP-33237 ER Hydrocodone (abuse det.) US—Pain Copaxone® 40mg 3w ROW

Multiple sclerosis

Copaxone® 20mg per Day Japan

Multiple sclerosis

ProAir® RespiClick US

Asthma, exercise ind. bronchospasm

Auspex Early Assets

SD-1077

Parkinson’s disease

+ multiple early CNS: depression (1), Pain (5),

Schizophrenia (1), MS (1), others Multiple early candidates in

Respiratory: IPF, PAH, others

SD-809

Tourette syndrome SD-560

Idiopathic pulmonary fibrosis

SD-809

Tardive dyskinesia

SD-809

HD (Mid-2015 NDA filing)

Note: Pipeline correct as of March 1, 2015. Phase 1 includes also projects designated for IND filing

CNS & Pain Respiratory Other

18

SD-809: Significant Near-Term Commercial Opportunity

SD-809 Provides Substantial Addressable Market Opportunities with Significant Commercial Potential

Huntington’s

Disease

Tardive Dyskinesia

Tourette Syndrome

Estimated Patient Population (US)

~30,000 Patients ~350,000 Patients ~150,000 Patients

% of Physicians that Suggested They Would Prescribe SD-8091

Mild 81% Moderate 84% Severe 84%

Mild 64% Moderate 94% Severe 85%

Mild 73% Moderate 90% Severe 89%

Other Considerations

Only one approved drug in the US: Tetrabenazine

– Only 5% of patients treated

– 2014 sales of ~$300mm

– Annual price per patient of $80-$85k

– Established reimbursement landscape Received FDA orphan designation Expected launch in 2016

No approved treatment in the US

– Tetrabenazine is approved in the EU

Limited off-label usage of Tetrabenazine in the US despite significant clinical response

– Improved profile should result in increased usage Only one approved drug in the US: Aripiprazole

– Associated with drowsiness, agitation, weight gain, and sleep disturbances Limited off-label usage of Tetrabenazine despite significant clinical response Received FDA orphan designation

Majority of movement disorder patients treated by neurologists – Highly synergistic with Teva’s premier neuroscience sales force

1 Source: Healogix physician survey.

19

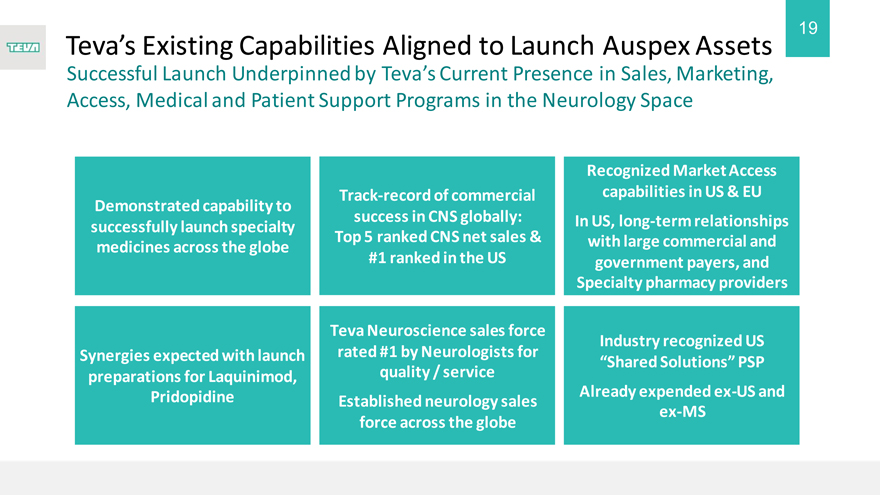

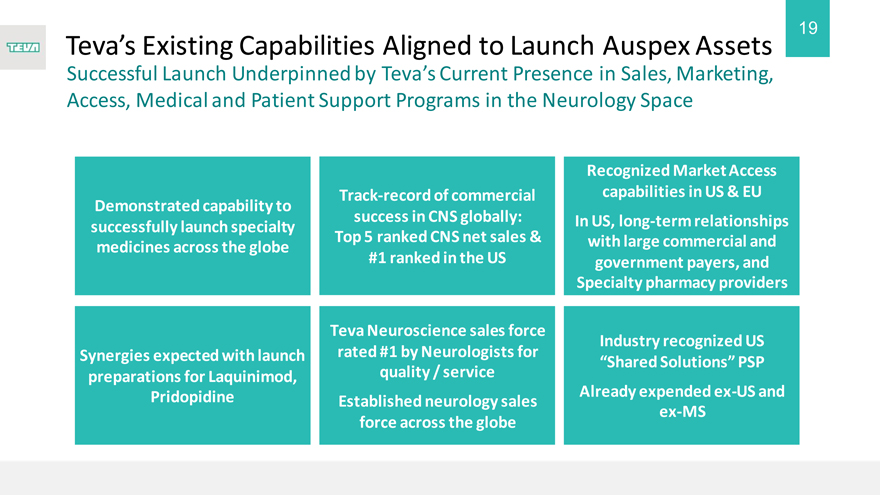

Teva’s Existing Capabilities Aligned to Launch Auspex Assets

Successful Launch Underpinned by Teva’s Current Presence in Sales, Marketing, Access, Medical and Patient Support Programs in the Neurology Space

Demonstrated capability to successfully launch specialty medicines across the globe

Synergies expected with launch preparations for Laquinimod, Pridopidine

Track-record of commercial success in CNS globally: Top 5 ranked CNS net sales & #1 ranked in the US

Teva Neuroscience sales force rated #1 by Neurologists for quality / service Established neurology sales force across the globe

Recognized Market Access capabilities in US & EU

In US, long-term relationships with large commercial and government payers, and Specialty pharmacy providers

Industry recognized US

“Shared Solutions” PSP

Already expended ex-US and ex-MS

20

Final Remarks

21

Q&A

Thank You