As filed with the Securities and Exchange Commission on January 26, 2009

File No. 333- _____

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM S-4

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

Alpha Arizona Corp.

(Exact Name of Registrant as Specified in Its Charter)

Arizona

(State or Other Jurisdiction of Incorporation or Organization)

2000

(Primary Standard Industrial Classification Code Number)

03-0561397

(IRS Employer Identification Number)

328 West 77th Street

New York, New York 10024

(212) 877-1588

(Address, Including Zip Code, and Telephone Number, Including

Area Code, of Registrant’s Principal Executive Offices)

Steven M. Wasserman

Chief Executive Officer

328 West 77th Street

New York, New York 10024

(Name, Address, Including Zip Code, and Telephone Number,

Including Area Code, of Agent for Service)

Copies to:

Mitchell S. Nussbaum, Esq. Loeb & Loeb LLP 345 Park Avenue New York, New York 10154 Telephone: (212) 407-4159 Facsimile: (212) 504-3013 | Liza Mark, Esq. Dorsey & Whitney LLP Suite 3008, One Pacific Place 88 Queensway Hong Kong Telephone: (852) 2526-5000 Facsimile: (852) 2524-3000 |

Approximate date of commencement of proposed sale of the securities to the public: As soon as practicable after (i) this Registration Statement becomes effective, (ii) all other conditions to the merger of Alpha Security Group Corporation, a Delaware corporation, into the Registrant, with the Registrant surviving and, following such merger, the transfer of domicile and continuation of the Registrant into Bermuda to continue as Alpha Bermuda, a Bermuda company, and (iii) all other conditions to the share exchange between Alpha Bermuda and the shareholders of Soya China Pte. Ltd., pursuant to the Agreement and Plan of Merger, Conversion and Share Exchange attached as Annex A to the Proxy Statement/Prospectus contained herein have been satisfied or, with respect to the share exchange only, waived.

If the securities being registered on this Form are being offered in connection with the formation of a holding company and there is compliance with General Instruction G, please check the following box. o

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a small reporting company. See the definitions of “large accelerated filer,” “accelerated filer,” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | o | Accelerated filer | o | |

| Non-accelerated filer | o | (Do not check if a smaller reporting company) | Smaller reporting company | x |

CALCULATION OF REGISTRATION FEE

| Title of Securities | Amount to be Registered | Proposed Maximum Offering Price Per Security (1) | Proposed Maximum Aggregate Offering Price | Amount of Registration Fee | |||||||||||||

| Units, each consisting of one Share, $0.0001 par value, and one warrant | 6,000,000 | Units | $ | 9.83 | $ | 58,980,000.00 | $ | 2,317.91 | |||||||||

| Shares included as part of the Units | 6,000,000 | Shares | - | - | - | (2) | |||||||||||

| Warrants included as part of the Units | 6,000,000 | Warrants | - | - | - | (2) | |||||||||||

Shares underlying the Warrants included in the Units (3) | 6,000,000 | Shares | $ | 7.50 | $ | 45,000,000.00 | $ | 1,768.50 | |||||||||

| Shares held in escrow by initial stockholders of Alpha Security Group Corporation | 1,580,000 | Shares | $ | 9.86 | $ | 15,578,800.00 | $ | 612.25 | |||||||||

| Warrants issued to insiders (“Insider Warrants”) | 3,200,000 | Warrants | $ | 7.50 | $ | 24,000,000.00 | $ | 943.20 | |||||||||

Shares underlying the Insider Warrants to the extent such Insider Warrants are subsequently transferred prior to exercise (3) | 3,200,000 | Shares | - | - | - | (2) | |||||||||||

| Representative’s Unit Purchase Option | 1 | $ | 100.00 | $ | 100.00 | $ | 0.00 | (2) | |||||||||

Units underlying the Representative’s Unit Purchase Option (“Underwriter’s Units”) (3) | 105,000 | Units | $ | 11.00 | $ | 1,155,000.00 | $ | 45.39 | |||||||||

Shares included as part of the Underwriter’s Units (3) | 105,000 | Shares | - | - | - | (2) | |||||||||||

Warrants included as part of the Underwriter’s Units (3) | 105,000 | Warrants | - | - | - | (2) | |||||||||||

Shares underlying the Warrants uncluded in the Underwriter’s Units (3) | 105,000 | Shares | $ | 7.50 | $ | 787,500.00 | $ | 30.95 | |||||||||

| Total Fee | - | $ | 5,718.20 | ||||||||||||||

| (1) | Based on the market price of the units and common stock of Alpha Security Group Corporation on January 21, 2009 for the purpose of calculating the registration fee pursuant to rule 457(f)(1). |

| (2) | No fee pursuant to Rule 457(i). |

| (3) | Pursuant to Rule 416, there are also being registered such additional securities as may be issued to prevent dilution resulting from stock splits, stock dividends or similar transactions as a result of the anti-dilution provisions contained in the Warrants. |

The Registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933, as amended, or until this Registration Statement shall become effective on such date as the Commission, acting pursuant to said Section 8(a), may determine.

After the consummation of the proposed acquisition discussed in this registration statement, Alpha intends to file a post-effective amendment to convert this Form S-4 onto Form S-3, which will be used in connection with (i) the sale by Alpha Bermuda to certain Alpha Bermuda warrant holders of ordinary shares underlying certain Alpha warrants, and (ii) the resale from time to time of ordinary shares by certain Alpha warrant holders who may be deemed to be “underwriters” of such shares. The post-effective amendment will contain all applicable disclosure related to the primary and secondary offerings of ordinary shares underlying the Alpha warrants.

Consent under the Exchange Control Act 1972 (and its related regulations) has been obtained from the Bermuda Monetary Authority for the issue and transfer of the common shares to and between non-residents of Bermuda for exchange control purposes provided our shares remain listed on an appointed stock exchange, which includes the NYSE Alternext. This prospectus will be filed with the Registrar of Companies in Bermuda in accordance with Bermuda law. In granting such consent and in accepting this prospectus for filing, neither the Bermuda Monetary Authority nor the Registrar of Companies in Bermuda accepts any responsibility for our financial soundness or the correctness of any of the statements made or opinions expressed in this prospectus.

The information in this proxy statement/prospectus is not complete and may be changed. Alpha may not sell these securities until the Securities and Exchange Commission declares our registration statement effective. This proxy statement/prospectus is not an offer to sell these securities and is not soliciting an offer to buy these securities in any state where the offer or sale is not permitted.

PRELIMINARY PROXY STATEMENT/PROSPECTUS

SUBJECT TO COMPLETION, DATED JANUARY 23, 2009

PROXY STATEMENT FOR SPECIAL MEETING OF STOCKHOLDERS

OF ALPHA SECURITY GROUP CORPORATION

AND PROSPECTUS FOR SHARES, WARRANTS AND UNITS

OF ALPHA ARIZONA CORP.

Proxy Statement/Prospectus dated ______ ___, 2009

and first mailed to stockholders and warrantholders on or about ______ ___, 2009

Dear Alpha Security Group Corporation Stockholders:

The stockholders of Alpha Security Group Corporation, or “Alpha,” a Delaware corporation, are cordially invited to attend the special meeting of the stockholders (“special meeting”) relating to the acquisition agreement dated as of December 31, 2008, or the “Acquisition Agreement,” by and among Alpha, Alpha Arizona Corp., a corporation incorporated in the State of Arizona and a wholly owned subsidiary of Alpha, or “Alpha Arizona,” Soya China Pte. Ltd., a company incorporated in Singapore, or “Soya,” and all of the shareholders of Soya listed in the Acquisition Agreement and indicated as a “selling shareholder” for the purposes of the Acquisition Agreement and the other related proposals. We refer to the shareholders of Soya who are party to the Acquisition Agreement each as a “selling shareholder” and collectively the “selling shareholders”. The transactions contemplated under the Acquisition Agreement, including the corporate reorganization of Alpha and the business combination with Soya are referred to in this proxy statement/prospectus as the “business combination”.

Pursuant to the Acquisition Agreement, Alpha will acquire from the selling shareholders all of Soya’s issued and outstanding shares in exchange for an aggregate of 6,300,000 shares of Alpha common stock and an aggregate of US$30,000,000. The selling shareholders have agreed to place 3,150,000 of the shares in escrow, to be released to the selling shareholders if the thresholds of $12.8 million and $17.2 million of adjusted net income of the combined company are met for the fiscal years ending December 31, 2008 and December 31, 2009, respectively. Subject to certain exceptions related to force majeure situations, in the event that such thresholds are not met, the escrowed shares shall be released from escrow and repurchased by Alpha Bermuda for the aggregate consideration of $1.00 and then retired and cancelled. In addition, the selling shareholders are entitled to receive an aggregate of up to an additional 6 million shares of Alpha Bermuda, if the thresholds of $19.5 million, $26 million and $34 million of the adjusted net income of the combined company are met for the fiscal years ending December 31, 2009, December 31, 2010 and December 31, 2011, respectively and we refer to these issuances as “deferred stock payment.” In addition, Alpha Bermuda shall also pay to the selling shareholders 50% of all proceeds from the exercise of Alpha Bermuda’s warrants, up to but no more than $5,000,000.

Soya manufactures, develops and sells soybean products in the People’s Republic of China (“PRC”) through a sales and distribution network of (i) flagship and franchise stores; (ii) distributors and (iii) other retail channels, including supermarkets and railway operators. Soya currently sells three categories of soybean products – fresh soybean products, vacuum-packed soybean products and soybean beverages. Since its inception, Soya has produced and sold more than 200 soybean products. These soybean products are sold under Soya’s Dougongfang (豆工坊), Protein Duo (可口双蛋白) and Soybean Joy (伊逗时光) brands.

Alpha Security Group Corporation is a blank check company formed on April 20, 2005 for the purpose of acquiring, through a merger, capital stock exchange, asset acquisition, stock acquisition or other similar type transaction, assets and/or an operating business in the U.S. homeland security or defense industries or a combination thereof. At the special meeting, stockholders will be asked to vote on a proposal to amend Alpha’s Fourth Amended and Restated Certificate of Incorporation to delete the provision restricting Alpha only to enter into a business combination in the U.S. homeland security or defense industries.

On March 28, 2007, Alpha consummated its initial public offering, or “IPO,” of 6,000,000 units with each unit consisting of one share of common stock, par value $0.0001 per share, and one warrant, each to purchase one share of common stock at an exercise price of $7.50 per share. The units were sold at an offering price of $10.00 per unit, generating total gross proceeds of $60,000,000. Prior to the consummation of the IPO, Alpha consummated the private sale of 3,200,000 warrants at a price of $1.00 per warrant, generating total proceeds of $3,200,000, to Steven M. Wasserman, an officer and director of Alpha, and another individual who is a former director of Alpha. The net proceeds from the sale of our units and the private placement of warrants, after deducting certain offering expenses, were approximately $57,828,431. Because payment of a portion of underwriting and other costs was deferred, $60,002,831 was placed in the trust account established in connection with the IPO. $1,825,000 in interest earned on the funds in the trust account is available to be used by Alpha to provide for business, legal and accounting due diligence on prospective acquisitions and continuing general and administrative expenses. Through December 31, 2008, Alpha has used approximately $3,232,766 of the total of the net proceeds that were not deposited into the trust account and amounts allowed to be withdrawn from the trust account to pay general and administrative expenses. The net proceeds deposited into the trust account remain on deposit in the trust account earning interest.

The shares of Alpha’s common stock, warrants and units are traded on NYSE Alternext US LLC, referred to herein as the Alternext, under the symbols “HDS,” “HDS.WT” and “HDS.U,” respectively. Each of Alpha’s units consists of one share of common stock and one warrant to purchase an additional share of Alpha’s common stock for the consideration of $7.50 per share. Alpha’s units commenced trading on the Alternext on March 23, 2007. Alpha’s common stock and warrants commenced trading separately on June 14, 2007. Following consummation of the business combination, Alpha will be reorganized into a Bermuda company, or “Alpha Bermuda.” It is contemplated that the Alpha Bermuda securities will continue to be listed on the Alternext or another public trading market following the business combination.

As of December 31, 2008, there was approximately $60,214,030 in the trust account, or approximately $10.04 per share issued in the IPO. If the holders of 35% or more of the shares of Alpha’s common stock issued in the IPO vote against the business combination and exercise their redemption rights, Alpha will not complete the business combination. On ______ ___, 2009, the record date for the special meeting of stockholders, the last sale price of Alpha’s common stock was $___.

Each stockholder’s vote is very important. Whether or not you plan to attend the Alpha special meeting in person, please submit your proxy card without delay. Stockholders may revoke proxies at any time before they are voted at the meeting. Voting by proxy will not prevent a stockholder from voting such stockholder’s shares in person if such stockholder subsequently chooses to attend the Alpha special meeting. The proxy statement/prospectus constitutes a proxy statement of Alpha and a prospectus of Alpha Arizona for the securities of Alpha Bermuda that will be issued to the securityholders of Alpha.

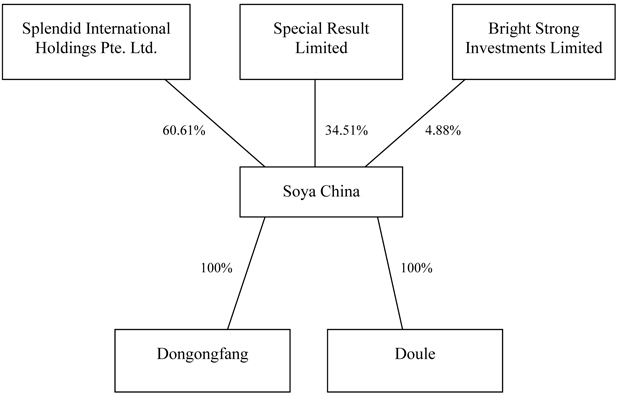

Unless the context indicates otherwise, all references to “Soya” in this proxy statement/prospectus refer to Soya China Pte. Ltd. and its subsidiaries, including Shandong Soy Bean Process Food Col, Ltd, or “Dougongfang,” and Dezhou City Doule Food Co., Ltd, or “Doule.” Unless the context indicates otherwise, all references to “China” or the “PRC” refer to the People’s Republic of China. In addition, all references to “initial stockholders” in this proxy statement/prospectus refer to the stockholders of Alpha immediately prior to the IPO holding an aggregate of 1,580,000 shares of Alpha’s common stock.

YOUR VOTE IS IMPORTANT. WHETHER YOU PLAN TO ATTEND THE SPECIAL MEETING OR NOT, PLEASE SIGN, DATE AND RETURN THE ENCLOSED PROXY CARD AS SOON AS POSSIBLE IN THE ENVELOPE PROVIDED. IF YOU RETURN YOUR PROXY CARD WITHOUT AN INDICATION OF HOW YOU WISH TO VOTE, YOUR SHARES WILL BE VOTED BY THE PROXY HOLDERS IN FAVOR OF EACH PROPOSAL. IF YOU ABSTAIN, (1) YOUR VOTE IS NOT CONSIDERED A VOTE CAST AT THE MEETING WITH RESPECT TO THE BUSINESS COMBINATION PROPOSAL AND THEREFORE YOUR VOTE WILL HAVE NO EFFECT ON THE VOTE RELATING TO THE BUSINESS COMBINATION, (2) YOUR VOTE WILL HAVE THE EFFECT OF A VOTE AGAINST THE OUTCOME OF THE APPROVAL OF THE OTHER PROPOSALS. IF YOU RETURN YOUR PROXY CARD WITHOUT AN INDICATION OF HOW YOU DESIRE TO VOTE, YOU WILL NOT BE ELIGIBLE TO HAVE YOUR STOCK REDEEMED. YOU MUST AFFIRMATIVELY VOTE AGAINST THE BUSINESS COMBINATION PROPOSAL AND DEMAND REDEMPTION AND COMPLY WITH THE OTHER REQUIREMENTS APPLICABLE THERETO. SEE “SPECIAL MEETING OF STOCKHOLDERS— REDEMPTION RIGHTS” FOR MORE SPECIFIC INSTRUCTIONS.

Alpha encourages you to read this proxy statement/prospectus carefully. In particular, you should review the matters discussed under the caption “RISK FACTORS” beginning on page [13] .

Alpha’s board of directors unanimously recommends that Alpha stockholders vote “FOR” approval of each of the proposals.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of the securities to be issued in the business combination or otherwise, or passed upon the adequacy or accuracy of this proxy statement/prospectus. Any representation to the contrary is a criminal offense.

| /s/ Steven M. Wasserman | |

| Steven M. Wasserman | |

| Chief Executive Officer, Chief Financial Officer, President and Secretary of | |

| Alpha Security Group Corporation |

January ___, 2009

HOW TO OBTAIN ADDITIONAL INFORMATION

If you would like to receive additional information or if you want additional copies of this document, agreements contained in the appendices or any other documents filed by Alpha with the Securities and Exchange Commission, such information is available without charge upon written or oral request. Please contact the following:

Alpha Security Group Corporation

328 West 77th Street

New York, New York 10024

(212) 877-1588

If you would like to request documents, please do so no later than ______ ___, 2009, to receive them before Alpha’s special meeting. Please be sure to include your complete name and address in your request. Please see “Where You Can Find Additional Information” to find out where you can find more information about Alpha and Soya. You should rely only on the information contained in this proxy statement/prospectus in deciding how to vote at the Alpha special meeting. Neither Alpha nor Soya has authorized anyone to give any information or to make any representations other than those contained in this proxy statement/prospectus. Do not rely upon any information or representations made outside of this proxy statement/prospectus. The information contained in this proxy statement/prospectus may change after the date of this proxy statement/prospectus. Do not assume after the date of this proxy statement/prospectus that the information contained in this proxy statement/prospectus is still correct.

Alpha Security Group Corporation

328 West 77th Street

New York, New York 10024

Notice of Special Meeting of Alpha Security Group Corporation Stockholders

To Be Held on , 2009

To Alpha Stockholders:

A special meeting of stockholders of Alpha Security Group Corporation, a Delaware corporation, or Alpha, will be held at ____________ New York, New York, on ______ ___, 2009, at a.m., for the following purposes:

1. To consider and vote upon a proposal to amend Alpha’s certificate of incorporation to eliminate the provision that purports to prohibit amending its “business combination” provisions.

2. To consider and vote upon a proposal to amend Alpha’s certificate of incorporation to delete the provision restricting Alpha to only enter into a business combination in the U.S. homeland security or defense industries or a combination thereof. This proposal, together with proposal 1 above are called the Certificate of Incorporation Amendment Proposals.

3. To consider and vote upon a proposal to ratify the actions of the officers and directors of Alpha in pursuing a business combination transaction with an operating business that is not in the U.S. homeland security or defense industries or a combination thereof and the execution of the Acquisition Agreement by Alpha. This Proposal is called the Ratification Proposal.

4. To consider and vote upon the corporate reorganization of Alpha, to be accomplished through a merger and continuation as described in the Acquisition Agreement, that would result in holders of Alpha securities holding securities in a Bermuda company rather than a Delaware corporation. The reorganization involves two steps. First, Alpha, the current Delaware corporation, will effect a short-form merger, or the “merger”, pursuant to which it will merge with and into Alpha Arizona, its wholly owned Arizona subsidiary, with Alpha Arizona surviving the merger. Second, after the merger, Alpha Arizona will become a Bermuda company, “Alpha Bermuda,” pursuant to a transfer of domicile from Arizona and continuation as a Bermuda company, or the “continuation,” under Arizona and Bermuda law, following which Alpha Bermuda will change its name to Soya China Ltd. The reorganization will change Alpha’s place of incorporation from Delaware to Bermuda. We refer to the merger and the continuation transactions as the “redomestication”. This proposal is called the Redomestication Proposal and consists of the merger of Alpha into Alpha Arizona, and the transfer of domicile and continuation of Alpha Arizona to Bermuda as the entity Alpha Bermuda.

5. To consider and vote upon the authorization for the Alpha Bermuda board of directors to complete the share exchange included in the Acquisition Agreement, or the “share exchange”, which will only take place if the Redomestication Proposal, the Certificate of Incorporation Amendment Proposals and the Ratification Proposal are approved. Pursuant to the Acquisition Agreement, Alpha will acquire from the selling shareholders all of Soya’s issued and outstanding shares in exchange for an aggregate of 6,300,000 shares of Alpha common stock and an aggregate of US$30,000,000. The selling shareholders have agreed to place 3,150,000 of the shares in escrow, to be released to the selling shareholders if the thresholds of $12.8 million and $17.2 million of adjusted net income of the combined company are met for the fiscal years ending December 31, 2008 and December 31, 2009, respectively. Subject to certain exceptions related to force majeure situations, in the event that such thresholds are not met, the escrowed shares shall be released from escrow and repurchased by Alpha Bermuda for the aggregate consideration of $1.00 and then retired and cancelled. In addition, the selling shareholders are entitled to receive an aggregate of up to an additional 6 million shares if the thresholds of $19.5 million, $26 million and $34 million of the adjusted net income of the combined company are met for the fiscal years ending December 31, 2009, December 31, 2010 and December 31, 2011, respectively. Alpha Bermuda shall also pay the selling shareholders 50% of the proceeds from the exercise of Alpha Bermuda’s warrants, up to but no more than $5,000,000. We refer to the share exchange transaction as the “business combination”. This proposal is called the Business Combination Proposal.

6. To consider and vote upon the adoption of the Soya China Ltd. 2009 Omnibus Securities and Incentive Plan, or the “Incentive Plan,” which provides for the grant of the right to purchase up to 1.5 million shares of Alpha Bermuda, representing up to ____ % of Alpha Bermuda’s share capital on a fully diluted basis upon the completion of the business combination, to directors, officers, employees and/or consultants of Alpha Bermuda and its subsidiaries. This proposal is called the Incentive Plan Proposal.

7. To consider and vote upon the adjournment of the special meeting in the event Alpha does not receive the requisite stockholder vote to approve the business combination. This proposal is called the Adjournment Proposal.

As of January 22, 2009, there were 7,580,000 shares of Alpha common stock with a par value of $0.0001 issued and outstanding and entitled to vote. Only Alpha stockholders who hold shares of record as of the close of business on _____ ___, 2009 are entitled to vote at the special meeting or any adjournment of the special meeting. Approval of the business combination will require the affirmative vote of the holders of a majority of the shares of Alpha common stock issued in the IPO and cast at the special meeting; provided, however, that if holders of 35% or more of the shares issued in the IPO vote against approval of the business combination and demand redemption of their shares then the business combination will not be completed and Alpha shall be liquidated. All other proposals will require the affirmative vote of a majority of the outstanding shares of Alpha’s common stock.

Alpha will not consummate the business combination unless the Business Combination Proposal is approved and holders of less than 35% of the shares issued in the IPO demand redemption. Similarly, the business combination will not be consummated if the Certificate of Incorporation Amendment Proposals, the Ratification Proposal and Redomestication Proposal are not approved and effected, the Certificate of Incorporation Amendment Proposals and Ratification Proposal will not be effected unless the Ratification Proposal, the Redomestication Proposal and the Business Combination Proposal are approved and the business combination is also consummated and the redomestication will not be effected unless the Certificate of Incorporation Amendment Proposals, the Ratification Proposal and the Business Combination Proposal are approved and the business combination is also consummated. The approval of the Incentive Plan Proposal and the Adjustment Proposal is not a condition to any of the other proposals.

Whether or not you plan to attend the special meeting in person, please submit your proxy card without delay. Voting by proxy will not prevent you from voting your shares in person if you subsequently choose to attend the special meeting. If you fail to return your proxy card, the effect will be that your shares will not be counted for purposes of determining whether a quorum is present at the special meeting. You may revoke a proxy at any time before it is voted at the special meeting by executing and returning a proxy card dated later than the previous one, by attending the special meeting in person and casting your vote by ballot or by submitting a written revocation to Alpha at 328 West 77th Street, New York, New York 10024, that is received by Alpha before it takes the vote at the special meeting. If you hold your shares through a bank or brokerage firm, you should follow the instructions of your bank or brokerage firm regarding revocation of proxies.

Alpha’s board of directors unanimously recommends that Alpha stockholders vote “FOR” approval of each of the proposals.

| By order of the Board of Directors | |

| /s/ Steven M. Wasserman | |

| Steven M. Wasserman | |

| Chief Executive Officer, Chief Financial Officer, President and Secretary of | |

| Alpha Security Acquisition Corp. |

January ___, 2009

Table of Contents

| Page | ||

| QUESTIONS AND ANSWERS ABOUT THE ALPHA SPECIAL MEETING | i | |

| SUMMARY | 1 | |

| SOYA SUMMARY FINANCIAL INFORMATION | 10 | |

| MARKET PRICE INFORMATION | 12 | |

| RISK FACTORS | 13 | |

| SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS | 37 | |

| DIVIDEND POLICY | 38 | |

| SPECIAL MEETING OF ALPHA STOCKHOLDERS | 39 | |

| THE AMENDMENT TO CERTIFICATE OF INCORPORATION PROPOSALS | 45 | |

| CONSIDERATION OF THE RATIFICATION PROPOSAL | 46 | |

| THE REDOMESTICATION PROPOSAL | 47 | |

| THE BUSINESS COMBINATION PROPOSAL | 61 | |

| THE ACQUISITION AGREEMENT | 74 | |

| THE INCENTIVE PLAN PROPOSAL | 81 | |

| THE ADJOURNMENT PROPOSAL | 85 | |

| SELECTED HISTORICAL CONSOLIDATED FINANCIAL AND OPERATING DATA OF SOYA | 86 | |

| UNAUDITED PRO FORMA CONSOLIDATED FINANCIAL STATEMENTS | 88 | |

| CAPITALIZATION OF ALPHA | 95 | |

| MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS OF SOYA | 95 | |

| DESCRIPTION OF CERTAIN INCOME STATEMENT ITEMS | 101 | |

| THE INDUSTRY | 118 | |

| BUSINESS OF SOYA | 122 | |

| INFORMATION ON SOYA | ||

| BUSINESS STRATEGIES | 126 | |

| SOYA’S PRODUCTS | 127 | |

| SALES AND DISTRIBUTION NETWORK AND FRANCHISING | 129 | |

| CUSTOMERS AND MARKETING | 132 | |

| COMPETITION AND SOYA’S MARKET POSITION | 134 | |

| RAW MATERIALS AND SUPPLIERS | 134 | |

| PRODUCTION FACILITIES, EQUIPMENT AND CAPACITY | 135 | |

| QUALITY ASSURANCE | 138 | |

| AWARDS AND COMMITTEE MEMBERSHIPS | 139 | |

| PRODUCT DEVELOPMENT | 141 | |

| INTELLECTUAL PROPERTY | 141 | |

| PERMITS, APPROVALS, CERTIFICATIONS & GOVERNMENT REGULATIONS | 146 | |

| EMPLOYEES | 146 | |

| LITIGATION | 146 | |

| INSURANCE | 147 | |

| MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS OF ALPHA | 147 | |

| ALPHA BUSINESS | 149 | |

| DIRECTORS, EXECUTIVE OFFICERS, EXECUTIVE COMPENSATION AND CORPORATE GOVERNANCE | 150 | |

| SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT | 163 | |

| CERTAIN TRANSACTIONS | 166 | |

| DESCRIPTION OF ALPHA’S SECURITIES | 170 | |

| COMPARISON OF ALPHA AND ALPHA BERMUDA STOCKHOLDER RIGHTS | 174 | |

| COMPARISON OF BERMUDA CORPORATE LAW TO DELAWARE CORPORATE LAW | 178 | |

| MATERIAL U.S. FEDERAL INCOME TAX CONSEQUENCES | 184 | |

| EXPERTS | 193 | |

| LEGAL MATTERS | 194 | |

| STOCKHOLDER PROPOSALS AND OTHER MATTERS | 194 | |

| ENFORCEABILITY OF CIVIL LIABILITIES | 194 | |

| WHERE YOU CAN FIND ADDITIONAL INFORMATION | 195 |

i

Table of Contents

| Page | ||

| Annex A — | Agreement and Plan of Merger, Conversion and Share Exchange by and among Alpha Security Group Corporation, Soya China Pte. Ltd., Alpha Arizona Corp., and the Selling Shareholders | A-1 |

| Annex B — | Fairness Opinion of New Century Capital Partners | B-1 |

| Annex C — | Opinion of Morris James LLP | C-1 |

| Annex D — | [Alpha Bermuda] 2009 Omnibus Securities and Incentive Plan | D-1 |

INFORMATION NOT REQUIRED IN PROSPECTUS | A | |

ii

QUESTIONS AND ANSWERS ABOUT THE ALPHA SPECIAL MEETING

| Q: | What is the purpose of this document? |

| A: | This document serves as Alpha’s proxy statement and as the prospectus of Alpha Arizona. As a proxy statement, this document is being provided to Alpha stockholders because the Alpha board of directors is soliciting their proxies to vote to approve, at a special meeting of stockholders, certain proposals related to the business combination. |

| Q: | What is being voted on? |

| A: | You are being asked to vote on seven proposals: |

| · | The elimination of the provision in Alpha’s certificate of incorporation that purports to prohibit amending its “business combination” provisions. |

| · | An amendment to Alpha’s certificate of incorporation to delete the provision restricting Alpha only to enter into a business combination in the U.S. homeland security or defense industries. This proposal, together with the proposal above are called the Certificate of Incorporation Amendment Proposals. |

| · | Ratify the actions of the officers and directors of Alpha in pursuing a business combination transaction with an operating business that is not in the U.S. homeland security or defense industries and the execution of the Acquisition Agreement by Alpha. We refer to this proposal as the Ratification Proposal. |

| · | The redomestication of Alpha to Bermuda by means of the merger and the transfer of domicile and continuation as a Bermuda company, resulting in it becoming Alpha Bermuda. This proposal is called the Redomestication Proposal. This proposal, together with the proposal above are called the Certificate Incorporation Amendment Proposals. |

| · | The proposed share exchange resulting in Soya becoming a subsidiary of Alpha Bermuda. This proposal is called the Business Combination Proposal. |

| · | The approval of the Incentive Plan. This proposal is called the Incentive Plan Proposal. |

| · | The approval of the adjournment of the special meeting in the event that Alpha does not receive the requisite stockholder vote to approve the business combination. This proposal is called the Adjournment Proposal. |

| Q: | Why is Alpha proposing the Certificate of Incorporation Amendment Proposals? |

| A: | Alpha’s certificate of incorporation currently specifies that it can only pursue a business combination with an operating business in the U.S. homeland security or defense industries or a combination thereof. In evaluating potential candidates for a business combination, the Alpha Board of Directors believes that potential acquisition targets in these industries were inadequate. Soya proved to be an attractive opportunity to the Alpha Board of Directors and as a result, Alpha is seeking stockholder approval to amend its certificate of incorporation so that it may engage in a business combination with an operating business that is not in the U.S. homeland security or defense industries or a combination thereof (which would include Soya). |

| Q: | Why is Alpha proposing the Redomestication Proposal? |

| A: | Soya is a business that is operated entirely outside of the United States, and it is expected that Soya’s business will continue to be operated outside of the United States for the foreseeable future. As part of the negotiation for the business combination, both Alpha and Soya believed that the regulatory and tax burden of the operation of a Bermuda company going forward is generally less onerous than that of a United States company. Therefore, the redomestication is a precondition to the consummation of the business combination. See “The Redomestication Proposal” in this proxy statement/prospectus for further details . |

i

| Q: | Why is Alpha proposing the Business Combination Proposal? |

| A: | Alpha was organized to effect a business combination with an operating business in the U.S. homeland security or defense industries or a combination thereof. |

| The officers and directors of Alpha were not able to identify a potential candidate for a business combination transaction that satisfied the provisions in Alpha’s certificate of incorporation which was as attractive as the opportunity presented by Soya. Since the Board of Directors of Alpha determined that entering into a business combination for the acquisition of Soya was superior to any other potential combinations it had identified and to dissolving and liquidating Alpha, the Board of Directors of Alpha concluded that it was in the best interests of Alpha and its stockholders to enter into the Acquisition Agreement. |

| Alpha believes that a business combination with Soya will provide Alpha stockholders with an opportunity to participate in a combined company with significant growth. |

| Q: | Why is Alpha proposing the Incentive Plan Proposal? |

| A: | Alpha is proposing the Incentive Plan to enable the surviving company after the business combination to attract, retain and reward its directors, officers, employees and consultants using equity-based incentives. |

| Q: | When and where is the special meeting of Alpha stockholders? |

| A: | The special meeting of Alpha stockholders will take place at ___________, New York, New York on ______ ___, 2009, at a.m. |

| Q: | Who may vote at the special meeting? |

| A: | Only holders of record of shares of Alpha common stock as of the close of business on ______ ___, 2009 may vote at the special meeting. As of January 23, 2009, there were 7,580,000 shares of Alpha common stock with a par value of $0.0001 outstanding and entitled to vote. |

| Q: | What is the quorum requirement for the special meeting? |

| A: | Stockholders representing a majority of Alpha common stock issued and outstanding as of the record date and entitled to vote at the special meeting must be present in person or represented by proxy in order to hold the special meeting and conduct business. This is called a quorum. Shares of Alpha common stock will be counted for purposes of determining if there is a quorum if the stockholder (i) is present and entitled to vote at the meeting, or (ii) has properly submitted a proxy card. In the absence of a quorum, stockholders representing a majority of the votes present in person or represented by proxy at such meeting, may adjourn the meeting until a quorum is present. |

| Q: | What vote is required in order to approve each of the Certificate of Incorporation Amendment Proposals? |

| A: | Approval of each of the Certificate of Incorporation Amendment Proposals will require the affirmative vote of a majority of the outstanding shares of Alpha’s common stock. Alpha has received an opinion from Delaware counsel, Morris James LLP, concerning the validity of the Certificate of Incorporation Amendment Proposals. Morris James concluded in its opinion, based upon the analysis set forth therein and its examination of Delaware law, and subject to the assumptions, qualifications, limitations and exceptions set forth in its opinion, that “it is our opinion that the Amendment, if duly adopted by the Board of Directors of the Company and duly approved by the holders of a majority of the outstanding shares of capital stock of the Company in accordance with the General Corporation Law, would be valid under the General Corporation Law.” The Certificate of Incorporation Amendment Proposals will not be effected unless the Ratification Proposal, the Redomestication Proposal and the Business Combination Proposal are approved and the business combination is also consummated. |

| Q: | What vote is required in order to adopt the Redomestication Proposal? |

| A: | The affirmative vote of the holders of a majority of the outstanding shares of Alpha common stock is required to approve the Redomestication Proposal. Alpha will not be redomesticated into Alpha Bermuda unless the Certificate of Incorporation Amendment Proposals the Ratification Proposal, and the Business Combination Proposal are approved and the business combination is also consummated. |

ii

| Q: | What vote is required to approve the business combination? |

| A: | Approval of the business combination will require the affirmative vote of the holders of a majority of the shares of Alpha common stock issued in the IPO and cast at the special meeting; provided, however, that if holders of 35% or more of the shares sold in the IPO vote against approval of the business combination and demand redemption, then the business combination will not be completed. Alpha will not consummate the business combination unless the Certificate of Incorporation Amendment Proposals, the Ratification Proposal and Redomestication Proposal are also approved. The approval of the Incentive Plan Proposal and the Adjournment Proposal is not a condition to any of the other proposals. With respect to the Business Combination Proposal, all of Alpha’s initial stockholders, including all of its officers and directors, have agreed to vote the respective shares of common stock owned by them immediately prior to Alpha’s IPO in accordance with the majority of the shares of common stock voted by the public stockholders. In addition, Alpha’s initial stockholders have agreed to vote any shares of common stock acquired by them following Alpha’s IPO in favor of the business combination. |

| Q: | What vote is required in order to adopt the Incentive Plan Proposal? |

| A: | The approval of the Incentive Plan will require the affirmative vote of a majority of the outstanding shares of Alpha common stock present in person or represented by proxy at the special meeting. The approval of the Incentive Plan is not a condition to the approval of the Certificate of Incorporation Amendment Proposals, the Ratification Proposal, the Business Combination Proposal or the Redomestication Proposal . |

| Q: | What will I receive in the redomestication? |

| A: | Alpha security holders will receive an equal number of common shares of Alpha Bermuda in exchange for their Alpha common stock, and Alpha Bermuda will assume the outstanding Alpha warrants, the terms and conditions of which will not change, except that on exercise, they will receive Alpha Bermuda common shares. However, as a result of the issuance of Alpha Bermuda shares to the selling shareholders in the business combination, the ownership interests of the public holders of Alpha common stock will be diluted from 79.2% to 43.2% of Alpha's outstanding common stock following the closing of the business combination. Following the issuance of any shares in connection with the deferred stock payment, the insider purchases or the issuance of any shares in connection with the exercise of outstanding warrants, the public holders of Alpha common stock will experience further dilution in their ownership of the company. |

| Q: | Do I have redemption rights in connection with the Business Combination Proposal? |

| A: | If you hold shares of common stock issued in Alpha’s initial public offering, then you have the right to vote against the Business Combination Proposal and demand that Alpha redeem these shares for $10.00 per share plus a portion of the interest income (net of taxes and up to $1,825,000 to be applied to fund Alpha’s working capital requirements and dissolution and liquidation expenses if Alpha fails to complete a business combination). We sometimes refer to these rights to vote against the Business Combination Proposal and demand redemption of the shares for a pro rata portion of the trust account as “redemption rights”. Holders of warrants issued by Alpha do not have any redemption rights. |

| If you wish to exercise your redemption rights, you must vote against the Business Combination Proposal and elect to exercise redemption rights on the enclosed proxy card and follow certain redemption provisions. See “Special Meeting of Stockholders – Redemption Rights” in this proxy statement/prospectus for further details. If you do so and, notwithstanding your votes the business combination is completed, then you will be entitled to receive $10.00 per share (plus a portion of the interest income on the trust amount, net of taxes and an amount up to $1,825,000 to be applied to fund Alpha’s working capital requirements and dissolution and liquidation expenses if Alpha fails to consummate a business combination). If a stockholder votes against the Business Combination Proposal but fails to properly exercise redemption rights (or does not vote against such proposal), such stockholder will not be entitled to have its shares redeemed for cash. Any request for redemption, once made, may be withdrawn at any time up to the date of the special meeting. If the Business Combination Proposal is not approved, then your shares cannot be redeemed for cash until either you vote against a subsequently proposed business combination and exercise your redemption rights or unless Alpha fails to achieve a business combination before March 28, 2009, at which time your shares will be automatically redeemed for cash upon Alpha’s liquidation. |

iii

| Q: | Has the board of directors of Alpha recommended approval of the proposals? |

| A: | Yes. Alpha’s board of directors has unanimously recommended to its stockholders that they vote “FOR” the approval of the Certificate of Incorporation Amendment Proposals, the Ratification Proposal, Redomestication Proposal, Business Combination Proposal, Incentive Plan Proposal and the other proposals at the special meeting. After careful deliberation of the terms and conditions of these proposals, Alpha’s board of directors has unanimously determined that the business combination and related proposals are fair to, and in the best interests of, Alpha and its stockholders. Alpha’s directors have interests in the business combination that may be different from, or in addition to, your interests as a stockholder of Alpha. For a description of such interests, see “The Business Combination Proposal—Interests of Certain Persons in the Business Combination” in this proxy statement/prospectus. |

| Q: | How is management of Alpha voting? |

| A: | Alpha’s initial stockholders, including all of its directors, officers and a special advisor, who purchased or received shares of common stock prior to Alpha’s IPO, presently, together with their affiliates, own an aggregate of approximately 20.8% of the outstanding shares of Alpha common stock (an aggregate of 1,580,000 shares). All of these persons have agreed to vote all of the shares acquired prior to the IPO in accordance with the vote of the majority of all other voting Alpha stockholders on the Business Combination Proposal. Moreover, all of these persons have agreed to vote all of their shares which were acquired in or following the IPO in favor of the Business Combination Proposal. Alpha’s current officers and directors will also vote “FOR” the Certificate of Incorporation Amendment Proposals, “FOR” the Ratification Proposal, “FOR” the Redomestication Proposal, “FOR” the Incentive Plan Proposal, and “FOR” the Adjournment Proposal. |

| Q: | How can I vote? |

| A: | Please vote your shares of Alpha common stock as soon as possible after carefully reading and considering the information contained in this proxy statement/prospectus. You may vote your shares prior to the special meeting by signing and returning the enclosed proxy card. If you hold your shares in “street name” (which means that you hold your shares through a bank, brokerage firm or nominee), you must vote in accordance with the instructions on the voting instruction card that your bank, brokerage firm or nominee provides to you. |

| Q: | What should I do if I receive more than one set of voting materials? |

| A: | You may receive more than one set of voting materials, including multiple copies of this proxy statement/prospectus and multiple proxy cards or voting instruction cards, if your shares are registered in more than one name or are registered in different accounts. For example, if you hold your shares in more than one brokerage account, you will receive a separate voting instruction card for each brokerage account in which you hold shares. Please complete, sign, date and return each proxy card and voting instruction card that you receive in order to cast a vote with respect to all of your Alpha shares. |

| Q: | If my shares are held in “street name” by my bank, brokerage firm or nominee, will they automatically vote my shares for me? |

| A: | No. Your bank, brokerage firm or nominee cannot vote your shares without instructions from you. You should instruct your bank, brokerage firm or nominee how to vote your shares, following the instructions contained in the voting instruction card that your bank, brokerage firm or nominee provides to you. |

| Q: | What if I abstain from voting or fail to instruct my bank, brokerage firm or nominee? |

| A: | Abstaining from voting or failing to instruct your bank, brokerage firm or nominee to vote your shares will have no effect on the outcome of the Business Combination Proposal but will be counted for purposes of determining if a quorum is present and will have the same effect as a vote “against” the other proposals. |

iv

| Q: | What will happen if I sign and return my proxy card without indicating how I wish to vote? |

| A: | Proxies received by Alpha without an indication of how the stockholders intend to vote on a proposal will be voted in favor of such proposal. Alpha stockholders will not be entitled to exercise their redemption rights if such stockholders return proxy cards to Alpha without an indication that they desire to vote against the Business Combination Proposal or, for stockholders holding their shares in street name, if such stockholders fail to provide voting instructions to their brokers. |

| Q: | What do I do if I want to change my vote or revoke my proxy? |

| A: | You may change your vote by ensuring that the bank, broker, or other nominee who is the record owner of your shares sends a later-dated, signed proxy card reflecting your changed instructions to Alpha, but such later-dated proxy must be received by Alpha no later than 5:00 P.M., New York City time, on ___, 2009 (the business day prior to the date of the special meeting of Alpha shareholders). |

| You also may revoke your proxy by ensuring that your bank, broker or nominee sends a notice of revocation to Alpha, but such revocation must be received by Alpha no later than 5:00 P.M., New York City time, on ___, 2009 (the business day prior to the date of the special meeting of Alpha shareholders). |

| You may also change your vote or revoke your proxy by obtaining a proxy from the record holder of your shares authorizing you to vote your shares or revoke your proxy, attending the special meeting and requesting a ballot and voting at the special meeting or requesting return of your proxy, as applicable. |

Alpha Security Group Corporation

328 West 77th Street

New York, New York 10024

(212) 877-1588

| Q: | How do I exercise my redemption rights? |

| A: | If you wish to exercise your redemption rights, you must vote against the Business Combination Proposal and, prior to or contemporaneously with your vote against the Business Combination Proposal, affirmatively demand that Alpha redeem all (and not less than all) of your shares. Any action that does not include a vote against the Business Combination Proposal will prevent you from exercising your redemption rights. If, notwithstanding your vote, the business combination is completed and you have fulfilled the other requirements for exercising your redemption rights, then you will be entitled to receive cash at the redemption price. |

| Q: | What additional redemption procedures are required if my shares are held in “street name”? |

| A: | All of our public shares are held in “street name.” Accordingly, your bank or broker must, by 5:00 P.M., New York City time, on ___, 2009, the business day prior to the special meeting, electronically transfer your shares to The Depository Trust Company, or DTC, account of American Stock Transfer & Trust Company, our stock transfer agent, and provide American Stock Transfer & Trust Company with the necessary stock powers, written instructions that you want to redeem your shares and a written certificate addressed to American Stock Transfer & Trust Company stating that you were the owner of such shares as of the record date, you have owned such shares since the record date and you will continue to own such shares through the initial closing of the acquisition. If your bank or broker does not provide each of these documents to American Stock Transfer & Trust Company, 59 Maiden Lane, Plaza Level, New York, New York 10038, attn: ___________, tel.800-937-5449, fax ___________ by 5:00 p.m., New York City time, on ___, 2009, the business day prior to the special meeting, your shares will not be redeemed. |

v

| If you demand redemption of your shares, and later decide that you do not want to redeem such shares, your bank or broker must make arrangements with American Stock Transfer & Trust Company, at the telephone number stated above, to withdraw the redemption. To be effective, withdrawals of shares previously submitted for redemption must be completed prior to the commencement of the special meeting. |

| American Stock Transfer & Trust Company can assist with this process. We urge shareholders who may wish to exercise their redemption rights to promptly contact the account executive at the organization holding their account to accomplish these additional procedures. If such shareholders fail to act promptly, they may be unable to timely satisfy the redemption requirements. |

| Q: | If I voted for the redomestication and the business combination, do I need to send in my stock certificate to exchange them for Alpha Bermuda shares? |

| A: | No. It will not be necessary to replace current Alpha certificates after the redomestication. DO NOT DESTROY YOUR CURRENT CERTIFICATES IN THE ALPHA NAME. Issued and outstanding Alpha certificates will represent rights in Alpha Bermuda. Stockholders may, if they like, submit their stock certificates to our transfer agent, American Stock Transfer & Trust Company, 59 Maiden Lane, Plaza Level, New York, New York 10038, Tel: (800-937-5449), for new share certificates and entry into the Register of Members of Alpha Bermuda, subject to normal requirements as to proper endorsement, signature guarantee, if required, and payment of applicable taxes. |

| Q: | How is Alpha paying for the business combination? |

| A: | The $30,000,000 cash consideration of the business combination will be funded with cash drawn from Alpha’s trust account and by Alpha Bermuda issuing 6,300,000 common shares, valued at $63,000,000 based on a price of $10.00 per share. The shareholders of Soya are also entitled to an additional 6,000,000 common shares of Alpha Bermuda if certain thresholds for the adjusted net income of the combined company are met for the fiscal years ending December 31, 2009, December 31, 2010 and December 31, 2011, respectively, as set forth more particularly herein. |

| Q: | Is the consummation of the business combination subject to any conditions? |

| A: | Yes. The obligations of each of Alpha, the selling shareholders of Soya, and the other parties to the Acquisition Agreement to consummate the business combination are subject to several conditions, as more fully described in the section titled “The Acquisition Agreement – Conditions to Closing” in this proxy statement/prospectus. |

| Q: | What will happen in the business combination? |

| A: | Upon consummation of the transactions contemplated by the Acquisition Agreement, Alpha will be continued into Alpha Bermuda to continue as Alpha Bermuda, which will acquire from the selling shareholders all of Soya’s issued and outstanding shares in exchange for an aggregate of 6,300,000 common shares of Bermuda and an aggregate of US$30,000,000. In addition, the selling shareholders are entitled to receive an aggregate of up to an additional 6,000,000 newly issued common shares of Alpha Bermuda if certain thresholds for the adjusted net income of the combined company are met for the fiscal years ending December 31, 2009, December 31, 2010 and December 31, 2011, respectively, as set forth more particularly herein. Soya will become the wholly-owned subsidiary of Alpha Bermuda. Furthermore, as a consequence of the business combination, the Board of Directors of Alpha will be reconstituted. For a detailed description of the business combination, see the section titled “The Acquisition Agreement” in this proxy statement/prospectus. |

vi

| Q: | Has Alpha received a valuation or fairness opinion with respect to the Business Combination Proposal? |

| A: | Yes. Our Board of Directors has obtained a fairness opinion from New Century Capital Partners, which states that the consideration to be paid by Alpha for all of the outstanding shares of Soya is fair from a financial point of view to the holders of Alpha common stock. |

| Q: | When is the business combination expected to occur? |

| A: | Assuming the requisite stockholder approval is received, Alpha expects that the business combination will occur during the first quarter of 2009. |

| Q: | May I seek statutory appraisal rights or dissenter rights with respect to my shares? |

| A: | Under applicable Delaware and Arizona corporate law, you do not have appraisal rights or dissenter rights with respect to your shares for the Redomestication Proposal. See “Special Meeting of Alpha Stockholders – Appraisal and Dissenter Rights” in this proxy statement/prospectus for further details. |

| Q: | What happens if the business combination is not consummated? |

| A: | If Alpha does not consummate the business combination or another qualifying business combination by March 28, 2009, then pursuant to Article Sixth of its Fourth Amended and Restated Certificate of Incorporation, Alpha’s officers must take all actions necessary in accordance with the Delaware General Corporation Law to dissolve and liquidate Alpha as soon as reasonably practicable. Following dissolution, Alpha would no longer exist as a corporation. In any liquidation, the funds held in the trust account, plus any interest earned thereon (net of taxes) and up to $1,825,000 to be applied to fund Alpha’s working capital requirements and dissolution and liquidation expenses if Alpha fails to complete a business combination, together with any remaining out-of-trust net assets will be distributed pro-rata to public holders of shares of Alpha common stock who acquired such shares of common stock in Alpha’s IPO or in the aftermarket. If the business combination or another business combination is not effected by March 28, 2009, the warrants will expire worthless. The estimated consideration that each share of Alpha common stock would be paid at liquidation would be $____ per share, based on amounts on deposit in the trust account as of December 31, 2008. The closing price of Alpha’s common stock on the Alternext on _________, 2009 was $____ per share. Holders of shares issued prior to Alpha’s IPO have waived any right to any liquidation distribution with respect to such shares. |

| Q: | What happens to the funds deposited in the trust account following the business combination? |

| A: | Following the closing of the business combination, funds in the trust account will be released to Alpha. Alpha stockholders exercising redemption rights will receive their per share redemption price. The balance of the funds will be utilized to fund the business combination and for working capital purposes including paying expenses incurred in connection with the business combination and to fund the on-going business obligations of Alpha Bermuda. In addition, the $1.8 million of funds in the trust account reflecting the underwriters’ deferred compensation will be disbursed. |

| Q: | Who will manage Alpha Bermuda after the business combination? |

| A: | Effective upon the closing, the current management of Soya consisting of Zhao Guangchun, Zhao Jinguo, Zhao Benxi, Leow Wei Chang Yo Yongchun and Sun Dejun, of Alpha Bermuda will serve in the offices of Chairman and Chief Executive Officer, Chief Financial Officer, Chief Operating Officer, Group Financial Controller, General Manager of Sales and General Manager of Production of Alpha Bermuda, respectively. In addition, the board of directors of Alpha Bermuda will consist of seven members. The members will include three designees by Alpha, which initially will be Steven M. Wasserman, Robert B. Blaha and Gary E. Johnson, and three designees of Soya, which initially will be Zhao Guangchun, Zhang Jinguo and Zhao Benxi, and one designee mutually agreed to by Alpha and Soya, which initially will be Li Lite. Simultaneously therewith, all other current directors of Alpha will resign as directors of the Alpha Bermuda board. |

vii

| Q: | How much dilution will I experience? |

| A: | Currently there are 7,580,000 shares of common stock of Alpha outstanding and 9,200,000 warrants outstanding. At least 6,300,000 additional shares will be issued for the acquisition of Soya. Therefore, Alpha’s initial stockholders will own approximately 11.4% of the company following the business combination (assuming no redemption by the Alpha Stockholders). To the extent the 6 million additional shares representing consideration to be issued to the selling shareholders upon achieving one or more of the after-tax profit targets or outstanding warrants are issued, the initial stockholders will own approximately 7.9% of Alpha Bermuda, experiencing further dilution of their ownership interest in the company. Alpha’s initial stockholders would experience further dilution upon the exercise of any warrants and to the extent any deferred stock payment is made. |

| Q: | Will the ownership structure of Alpha change significantly after the business combination? |

| A: | Yes. Upon completion of the business combination, the selling shareholders will own approximately 45.38% of the common stock of Alpha, assuming no exercise of the outstanding warrants (assuming no redemption by the Alpha Stockholders). If the selling shareholders purchase up to $22 million of Alpha’s common stock which they will use their best efforts to, pursuant to the terms of the Acquisition Agreement, and to the extent they are issued up to an additional 6 million shares upon the Alpha Bermuda’s net income after the business combination satisfying certain agreed to net income thresholds, the selling shareholders percentage ownership in Alpha will be greater. Assuming that 34.99% of the holders of Alpha common stock issued in the IPO demand redemption, the selling shareholders are issued the 6 million deferred stock payment, and they purchase the $22 million of common stock, the selling shareholders will hold 72.66% of the voting securities of Alpha Bermuda immediately after the completion of the business combination. Therefore, the selling shareholders will be able to exercise significant influence over Alpha Bermuda, the surviving entity. |

| Q: | What will the name of the surviving company be after the business combination? |

| A: | The name of the surviving company following completion of the stock purchase and redomestication merger will be “____________.” |

| Q: | What is the anticipated dividend policy after the business combination? |

| A: | Alpha Bermuda intends to retain cash flows for reinvestment in its business. Retained cash flows may be used to fund the growth of Soya’s current business and for other purposes, as determined by Alpha Bermuda’s management and board of directors after the business combination. Alpha Bermuda’s dividend policy reflects its judgment that by reinvesting cash flows in its business, it will be able to provide value to its shareholders by enhancing its long-term value. Alpha Bermuda’s objectives are to increase value through the growth of Soya’s current business. The declaration and payment of dividends are not guaranteed or assured. The board of directors will continually review its dividend policy and make adjustments that it believes appropriate. Under Bermuda law, a company may not declare or pay dividends if there are reasonable grounds for believing that: (i) the company is, or would after the payment be, unable to pay its liabilities as they become due; or (ii) that the realisable value of its assets would thereby be less than the aggregate of its liabilities, its issued share capital and its share premium accounts. |

| Q: | Will the Alpha stockholders be taxed as a result of the merger, continuation or the share exchange? |

| A: | Generally, for U.S. federal income tax purposes, stockholders of Alpha should not recognize any gain or loss as a result of the merger, continuation or share exchange. We urge you to consult your own tax advisors with regard to your particular tax consequences of the merger, continuation or share exchange. See “Material U.S. Federal Income Tax Consequences” in this proxy statement/prospectus for further details. |

| Q: | Will Alpha be taxed on the merger? |

| A: | Alpha should not recognize any gain or loss for U.S. federal income tax purposes as a result of the merger. |

viii

| Q: | Will Alpha Arizona be taxed on the continuation? |

| A: | Alpha Arizona should recognize gain, but not loss, for U.S. federal income tax purposes as a result of the continuation equal to the excess, if any, of the fair market value of each of its assets over such asset’s adjusted tax basis at the effective time of the continuation. For this purpose, the valuation of Alpha Arizona’s assets at the time of continuation may take into account a variety of factors, including possibly the fair market value of Alpha Arizona’s shares immediately prior to the continuation. Since any such gain will be determined based on the value of Alpha Arizona’s assets at that time, the amount of such gain (and any U.S. federal income tax liability to Alpha Arizona by reason of such gain) cannot be determined at this time. Any U.S. federal income tax liability incurred by Alpha Arizona as a result of such gain should become a liability of Alpha Bermuda by reason of the continuation. See “Material U.S. Federal Income Tax Consequences” in this proxy statement/prospectus for further details. |

| Q: | Will Alpha Bermuda be taxed on the share exchange? |

| A: | Alpha Bermuda should not recognize any gain or loss for U.S. federal income tax purposes as a result of the share exchange. |

| Q: | What other important considerations are there? |

| A: | As further disclosed in “The Business Combination Proposal” and “The Amendment to Alpha’s Certificate of Incorporation Proposals” below, the business combination with Soya is not a qualifying business combination as disclosed in the Alpha IPO documents. Therefore, Alpha stockholders may have securities law claims against Alpha for rescission (under which a successful claimant has the right to receive the total amount paid for his or her shares pursuant to an allegedly deficient prospectus, plus interest and less any income earned on the shares, in exchange for surrender of the shares) or damages (compensation for loss on an investment caused by alleged material misrepresentations or omissions in the sale of the security). Such claims for recission may entitle Alpha’s stockholders asserting them to up to US$10.00 per share, based on the initial offering price of the Units comprised of stock and warrants, less any amount received from sale of the original warrants purchased with them and plus interest from the date of Alpha’s IPO (which may be more than the pro rata shares of the trust account to which they are entitled on conversion or liquidation). In general, a claim for rescission must be made by a person who purchased shares pursuant to a defective prospectus or other representation, and within the applicable statute of limitations period, which, for claims made under federal law (Section 12 of the Securities Act) and most state statutes, is one year from the time the claimant discovered or reasonably should have discovered the facts giving rise to the claim, but not more than three years from the occurrence of the event giving rise to the claim. A successful claimant for damages under federal or state law could be awarded an amount to compensate for the decrease in value of his or her shares caused by the alleged violation (including, possibly, punitive damages), together with interest, while retaining the shares. Claims under the anti-fraud provisions of the federal securities laws must generally be brought within two years of discovery, but not more than five years after occurrence. Rescission and damages claims would not necessarily be finally adjudicated by the time the business combination may be completed, and such claims would not be extinguished by consummation of that transaction. |

| Even if some Alpha stockholders do not pursue such claims, others may. If they do, holders of such claims, who may include all stockholders who own shares issued in Alpha’s IPO, might seek to have the claims satisfied from funds in the trust account. If Alpha incurs material liability as a result of potential securities law or other claims, the trust account could be depleted to the extent of any judgments arising from such claims, together with any expenses related to defending such claims that are not fully indemnified. A consequence might be that holders of public shares who elect redemption in connection with the business combination vote would not receive the entire amount of their pro rata portion of the trust account to which they would otherwise be entitled, or might be unable to satisfy a rescission or damages award. Alpha cannot predict whether stockholders will bring such claims, how many might bring them or the extent to which they might be successful. Moreover, attendant litigation could result in delay in payments to public shareholders on conversion or liquidation. |

ix

SUMMARY

This summary highlights selected information from this proxy statement/prospectus but may not contain all of the information that may be important to you. Accordingly, we encourage you to read carefully this entire proxy statement/prospectus, including the Acquisition Agreement attached as Annex A. Please read these documents carefully as they are the legal documents that govern the business combination and your rights in the business combination. Unless the context otherwise requires, references to “Alpha,” “we,” “us” or “our” in this proxy statement/prospectus refers to Alpha Security Group Corporation, including its subsidiaries, before the consummation of the business combination and to Alpha Bermuda, including its subsidiaries, after the consummation of the business combination.

The Parties

Alpha

Alpha Security Group Corporation

328 West 77th Street

New York, New York 10024

(212) 877-1588

Alpha Security Group Corporation is a blank check company formed on April 20, 2005 for the purpose of acquiring, through a merger, capital stock exchange, asset acquisition, stock acquisition or other similar type of transactions an operating business in the U.S. homeland security or defense industries or a combination thereof. At the special meeting, stockholders will be asked to vote on a proposal to amend Alpha’s Fourth Amended and Restated Certificate of Incorporation to delete the provision restricting Alpha from entering into a business combination with companies solely in the U.S. homeland security or defense industries.

On March 28, 2007, Alpha consummated its initial public offering, or “IPO,” of 6,000,000 units, with each unit consisting of one share of common stock, par value $0.0001 per share, and one warrant, each to purchase one share of common stock at an exercise price of $7.50 per share. The units were sold at an offering price of $10.00 per unit, generating total gross proceeds of $60,000,000. Prior to the consummation of the IPO, Alpha consummated the private sale of 3,200,000 warrants at a price of $1.00 per warrant, generating total proceeds of $3,200,000, to Steven M. Wasserman, an officer and director of Alpha, and an individual who is a former director of Alpha. The net proceeds from the sale of our units and the private placement of warrants after deducting certain offering expenses were approximately $57,828,431. Because payment of a portion of underwriting and other costs of the IPO was deferred, $60,002,831 was placed in the trust account established in connection with the IPO. $1,825,000 in interest earned on the funds in the trust account is available to be used by Alpha to provide for business, legal and accounting due diligence on prospective acquisitions and continuing general and administrative expenses. Through December 31, 2008, Alpha has used approximately $3,232,766 of the total of the net proceeds that were not deposited into the trust account and amounts allowed to be withdrawn from the trust account to pay general and administrative expenses. The net proceeds deposited into the trust account remain on deposit in the trust account earning interest. As of December 31, 2008, there was $60,214,030 held in the trust account.

See “Alpha Business” in this proxy statement/prospectus for further details.

Soya

Soya China Pte. Ltd.

50 Raffles Place #11-05A

Singapore Land Tower

Singapore 048623

1

Soya manufactures, develops and sells soybean products in the PRC through a sales and distribution network of (i) flagship and franchise stores; (ii) distributors and (iii) other retail channels, including supermarkets and railway operators. Soya currently sells three categories of soybean products – fresh soybean products, vacuum-packed soybean products and soybean beverages. Since its inception, Soya has produced and sold more than 200 soybean products. These soybean products are sold under Soya’s Dougongfang (豆工坊), Protein Duo (可口双蛋白) and Soybean Joy (伊逗时光) brands.

Soya has rapidly expanded its distribution network since implementing its franchise model beginning in April 2006. The number of its franchise stores increased from 90 as of December 31, 2006 to 730 as of November 30, 2008. As of November 30, 2008, Soya had seven flagship stores and 730 franchise stores located in the Shandong and Hebei provinces and the direct-controlled municipality city of Tianjin. Also as of such date, Soya distributes its products through a network of 93 distributors, nine supermarkets and two railway operators, selling its products in more than 15 provinces in the PRC.

Soya’s Dougongfang (豆工坊) brand is the company’s flagship brand and the focus of its marketing strategies. Soya believes that the Dougongfang brand is well-recognized among its customers in the PRC as a premium brand of high-quality soybean products. Soya has received multiple awards and accreditations, including being awarded the “PRC Top 10 Soybean Product Enterprise for 2007,” by the PRC Food Products Association Soybean Product Committee (中国食品工业协会豆制品专业委员会). A 2007 market survey commissioned by Soya and prepared by Converging Knowledge Pte Ltd., an independent research firm spun off from Arthur Andersen’s Asia-Pacific Corporate Finance Research and Knowledge division, indicated that the Dougongfang brand was ranked second among soybean product producers in the PRC based on the number of franchised outlets.

Soya also places a large emphasis on developing a wide variety of soybean products of the highest quality. It believes that having a wide variety of products will encourage greater brand recognition and stimulate consumer interest by offering new products periodically. Soya rotates the production and sales of its products to ensure sustainable customer appeal. In addition, a wider variety of products would allow for a greater coverage of the different consumer segments. For example, the traditional soy milk would be targeted to the more mature consumer whereas flavored soy milk tea would be targeted more towards office workers. To produce high quality products, Soya has established stringent quality assurance procedures at its production facility in Dezhou to ensure adherence to cleanliness and hygiene standards. Soya has achieved internationally recognized accreditation, including ISO9001:2000, ISO14001:2004 and Hazard Analysis and Critical Control Point Accreditation Certificate (HACCP). As at the Latest Practicable Date, Soya’s production facility in Dezhou has a production capacity of approximately 49,000 tons per annum for its fresh soybean products, 15,000 tons per annum for its vacuum-packed soybean products and 34,000 tons per annum for its soybean beverages. Soya also supplements its production capability by engaging third party OEM producers in 2008. For the nine months ended September 30, 2008, Soya’s OEM contractors produced 1,960 tons of soybean beverages for Soya.

For the fiscal years 2007 and 2006, Soya’s revenue was $41.78 million and $13.73 million, respectively, representing an increase of approximately 204.3%. For the nine-month periods ended September 30, 2008 and 2007, Soya’s revenue was $45.39 million and $28.57 million, respectively, representing an increase of approximately 58.9%.

Soya’s principal executive offices are located at Ling County Economic Development Zone, Dezhou City, Shandong Province, People’s Republic of China, and its phone number is +86 0534-2137518.

See “Information on Soya” in this proxy statement/prospectus for further details.

Effect of Proposals

If the first six of the proposals are approved:

| · | We will amend our Fourth Amended and Restated Certificate of Incorporation; |

| · | We will ratify the Acquisition Agreement; |

2

| · | We will acquire an operating business in China; |

| · | We will change our corporate domicile from the state of Delaware to Bermuda, which means we will be governed by the laws of Bermuda. |

| · | Each share of common stock of Alpha will automatically convert into one share of Alpha Bermuda; |

| · | Each outstanding warrant of Alpha will be assumed by Alpha Bermuda; |

| · | We will change our corporate name to “______________,”; |

| · | The Alpha Bermuda Memorandum of Association and Bye-Laws will become the equivalent of our certificate of incorporation and By-laws, and our authorized capital will increase from ______ to _______; |

| · | The executive officers of Alpha Bermuda after completion of the business combination will all be current executive officers of Soya. Three of the seven directors of Alpha Bermuda after completion of the business combination will be nominated by the current shareholders of Soya and are currently expected to be executive officers of Alpha Bermuda; and |

| · | We will have a new Incentive Plan in place, |

See “Special Meeting of Alpha Shareholders – Purpose of the Alpha Special Meeting” in this proxy statement/prospectus for further details.

Special Meeting of Alpha’s Stockholders

The special meeting of the stockholders of Alpha will be held at _____________ on ____________, 2009, at Alpha’s offices at ____________________.

See “Special Meeting of Alpha Stockholders – Date, Time and Place” in this proxy statement/prospectus for further details.

Voting Power; Record Date