February 17, 2011

Erin K. Jaskot, Staff Attorney

Securities and Exchange Commission

Division of Corporation Finance 100

F Street N.E. Washington, D.C. 20549

Re: Dynamic Ventures Corp.

Amendment No. 1 to Current Report on Form 8-K

Filed January 21, 2011

Amendment No. 1 to Form 10-Q for the Quarter Ended September 30, 2010

Filed January 21, 2011

File No. 333-163913

Dear Ms. Jaskot:

Dynamic Ventures Corp., a Delaware corporation (the “Company”), has received and reviewed your letter of February 3, 2011, pertaining to the Company’s Amendment No. 1 to Current Report on Form 8-K as filed with the Securities & Exchange Commission (the “Commission”) on January 21, 2011, and the Company’s Amendment No. 1 to Quarterly Report on Form 10-Q as filed with the Commission on January 21, 2011.

Specific to your comments, our responses below are in addition to those filed via the Edgar system. The following numbered responses correspond to those numbered comments as set forth in the comment letter dated February 3, 2011

General

1. We note that your response letter dated January 21, 2011 is signed by Mark Summers as Chief Executive Officer. However, both Amendment No.1 to your Form 8-K and Amendment No. 1 to your Form 10-Q for the quarter ended September 30, 2010 are signed by Paul Kalkbrenner as Chief Executive Officer. Please advise.

RESPONSE: Our response letter contained an error, as Mark Summers is not Chief Executive Officer of the Company. We have revised the Filing throughout to identify Paul Kalkbrenner as Chief Executive Officer and Mark Summers as Chief Financial Officer.

Amendment No.1 to Form 8-K filed on January 21, 2011

General

2. Please amend your Form 8-K to address the comments below.

RESPONSE: We have revising our Filing to address the comments below.

Item 1.01 Entry into a Material Definitive Agreement, page 1

3. Please identify and explain the particular roles played by any individuals or entities in arranging or facilitating the transaction. In particular, we note that entities owned by Al Cain, David C. Brown and Paul Kalkbrenner, the officers and directors of the company, appear to have been on both sides of the transaction. Please clarify this in your disclosure here and under Item 5.01, Changes in Control of the Registrant.

RESPONSE: Our Filing contained an error in identifying the parties to the Share Exchange Agreement. The “controlling shareholders” of the Company that entered into the Share Exchange Agreement were Asher Atiah and Joseph Silver. Messrs. Atiah and Silver formed the Company and were the former officers and directors of the Company prior to the Share Exchange. As such, we have revised the Filing on page 2 to include the following information:

“On August 2, 2010, Dynamic Ventures Corp. (the “Company”) and its controlling shareholders entered into a share exchange agreement (the "Share Exchange Agreement") with Bundled Builder Solutions Inc. (“BBSI”) and its shareholders whereby the Company obtained all of the issued and outstanding shares of BBSI, in exchange for the issuance of 4,500,000 common shares of the Company. The transaction results in BBSI becoming a wholly-owned subsidiary of the Company.

The “controlling shareholders” of the Company that entered into the Share Exchange Agreement were Asher Atiah and Joseph Silver, the officers and directors of the Company at that time. The BBSI shareholders that entered into the Share Exchange Agreement include Michael K Flynn, Hope Williams, Mark Summers, John Butler, Bill Swicegood, Randy DeWitte, Mark Smith, Bruce Berg, Dale Pfeiffer, Judd Evans, Harley Pariseau, 21829251 Ontario Inc., DMEB Investments L.L.C., and K4K Holdings, Inc.”

Item 2.01 Completion of Acquisition or Disposition of Assets, page 2

Description of Our New Business, page 4

4. We note that your only Native American housing customer is Tribal Building Solutions, LLC, as you disclose on page 9. Please either file the contract with Tribal Building Solutions, LLC that you reference on page 4, or tell us why you are not required to do so. See Item 601(b)(IO) of Regulation S-K.

RESPONSE: We have attached to the Filing as exhibit 10.4 a copy of our Agreement with Tribal Building Solutions, LLC.

5. We note your revisions throughout this section in response to comment 9 in our letter dated December 30, 2010. However, we note that your disclosure continues to imply that your business is more developed than it actually is. For example, we note the following:

• On page 5, you state that your third product involves providing construction services for "bundles," and that part of your services include the actual construction of these bundles," when you actually have only one bundle in operation. In addition, you state that "each bundle" is capable of doing remodels, which implies that you have multiple bundles in operation.

• On page 6, you state that "all of the commercial buildings" that you design under the SIPs system are designed to be certified under the LEED system, when your only SIPs customer is the Bossier, LA hotel.

These are just examples. Please review your disclosure throughout your filing and revise it to clarify, as appropriate, that you intend to engage in certain projects or provide such products that are not currently in operation so as to remove the implication that such projects or products are part of your current business.

RESPONSE: We have revised the Filing throughout as requested. In regards to the above comments, we have revised the Filing as follows:

Page 5

“Our third product involves providing construction management services for a “bundle” of related trade activities for both residential and commercial buildings. Currently, Floor Art is our only trade bundle in operation. Bundled building means combining several construction trade activities into one group based on interrelated functions and installation sequences. Here, part of our services includes the actual construction of these bundles. For example, Floor Art provides finishes for houses and commercial buildings including flooring, tile, counter tops, and bath surroundings.”

DYNAMIC VENTURES CORP.

Page 5

“The Company intends for BBSI’s business model to be a single source solution for projects. For example, we develop a bundle of related trade activities under one management to provide a better system. Since all trades are working for the same company, we believe that communications are improved, scheduling delays are reduced, and cross-training of personnel increases efficiencies among trade activities and reduces overall construction time. Our bundle can operate in both residential and commercial construction and is capable of doing remodels, new builds or construction. We believe that this flexibility reduces market risk caused by different activity levels of different construction sectors.”

Page 6

“BBSI’s management team has several years of experience in commercial construction. Based on our experience, the primary marketing advantage of SIPs is its reduction in construction time combined with “green” energy efficient materials at comparable costs of conventional building. We believe that this combination will allow BBSI to become a preferred build out contractor. SIPs are eco-friendly, recyclable building products that offer high energy efficiency and less waste. The Bossier, LA hotel that we designed using the SIPs system is intended to be certified under the Leadership in Energy & Environmental Design (“LEED”) system. LEED is an internationally recognized “green” building certification system that provides a set of standards for the environmentally sustainable design, construction and operation of buildings and neighborhoods. All of our future SIPs system projects will be designed for certification under the LEED system.”

6. Please revise the third paragraph of this subsection to explain how you conduct your operations through your operating subsidiaries, such as Floor Art and BDC. For example, explain which of your operating subsidiaries is responsible for each product line.

RESPONSE: We have revised our Filing on page 4 and 11 to include the following information:

“BBSI offers construction management services for the following three types of projects, which make up our current product line: a) construction of residential houses in Native American communities; b) use of SIPs for commercial buildings, which we provide only through our subsidiary, EZ Build Systems, LLC; and c) construction by “bundles” of related trade activities for both residential and commercial projects. We offer construction by “bundles” only through our subsidiary, Floor Art. Floor Art is our only trade “bundle”. We also offer design software for our trade “bundle” only through our subsidiary, BDC. This software allows builders and designers to plan their projects and to choose products, designs, and more.”

7. We note on page 4 that you state that Bundled Builders' subsidiary, EZ Build Systems, LLC was formed in August 2010. However, we also note your disclosure on page 18 that Al Cain founded EZ-Build Systems, Inc. in 2001. Please revise your disclosure to explain the relationship, if any, between EZ Build Systems, LLC and EZ-Build Systems, Inc., including any compensation that was paid by you to Al Cain or EZ-Build Systems, Inc. in connection with the August 2010 formation of EZ Build Systems, LLC, or otherwise.

RESPONSE: There is no relationship between EZ Build Systems, LLC and EZ-Build Systems, Inc. In 2001, Al Cain founded EZ-Build Systems, Inc. When the Company began the process of forming EZ Build Systems, LLC, the Company liked the name “EZ Build Systems” and Mr. Cain allowed us to use the name for the LLC. There is no connection between the two companies, other than the similarities in name.

8. We note the disclosure in the last paragraph of this subsection regarding your revenues. Please revise to correlate the revenues to the specific product line that generated the revenue.

RESPONSE: We have revised the Filing on page 5 to include the following language:

“For the six months ended June 30, 2010, our revenues totaled $1,697,862 of which $1,691,862 (99.7%) was attributed to our trade bundle, Floor Art and $6,000 (0.3%) was attributed to BDC also from our trade bundle. For the nine months ended September 30, 2010, our revenues totaled $2,662,487, of which $2,263,869 (85.0%) was attributed to our trade bundle, Floor Art, $9,000 (0.3%) was attributed to BDC for our trade bundle and $389,618 (14.7%) was attributed to BBSI for the Native American housing product. Our SIPs product has not yet begun to generate revenues.”

DYNAMIC VENTURES CORP.

Industry and Market Data, page 8

9. Please remove all references to the web sites for: the sources you cite, as you are not permitted to incorporate by reference. Further, please include a complete citation for the source information you cite, such as the author (if any) and the name and date of the report. In addition, we reissue our comment asking you to provide us with copies of each source, clearly marked to highlight the portion or section that contains the information cited in your Form 8-K, and cross-reference it to the appropriate location in your filing.

RESPONSE: We have supplemented this response with copies of each source cited in our Filing. Further, we have revised the Filing on page 7 to include the following language:

“McGraw Hill Construction, a mainstay in construction industry forecasting and business planning, predicts an increase in overall U.S. construction starts for next year. The level of construction starts in 2011 is expected to advance 8% to $445.5 billion, following the 2% decline predicted for 2010 (“Construction Market to Increase 8% in 2011, Says McGraw-Hill Construction Outlook Report.” McGraw Hill Construction. October 29, 2010). Some of McGraw Hill Construction’s predictions are that single family housing in 2011 will climb 27% in dollars, multifamily housing will rise 24% in dollars and 23% in units, and continue to move gradually upward, and commercial buildings will increase 16% in 2011. Id.

In regards to the SIPs market, according to a July, 2010 news release by Structural Insulated Panel Association (“SIPA”), it is estimated that the SIPs building system accounts for between one and two percent of U.S. single family home starts. (“SIP Industry Grows Market Share Despite Retreating Housing Market.” Structural Insulated Panel Association. July 1, 2010.) Of the total 42 million square feet of SIPs produced in North America in 2009, 43 percent went to residential buildings, 32 percent to non-residential buildings, and the remaining 24 percent were used for non-building purposes, such as industrial coolers. Id. SIPA Executive Director Bill Wachtler attributes much of the industry’s growth to the increasing popularity of green and energy-efficient homes. Id.

Additionally, the U.S. “green” building market is accelerating at a dramatic rate. According to McGraw Hill Construction, the “green” building market is expected to reach $135 billion by 2015. (“Green Building Market Grows 50% in Two Years despite Recession, Says McGraw-Hill Construction Report.” McGraw Hill Construction. November 12, 2010). The value of green building construction starts was up 50% from 2008 to 2010— from $42 billion to $55 billion-$71 billion— and represents 25% of all new construction activity in 2010. Id. In nonresidential building, the “green” building market share is even higher than the overall market. Id. Today, a third of all new nonresidential construction is “green”— a $54 billion market opportunity. Id. In five years, nonresidential “green” building activity is expected to triple, representing $120 billion to $145 billion in new construction (40%-48% of the nonresidential market) and $14 billion to $18 billion in major retrofit and renovation projects. Id.

The foregoing information regarding industry and market data is current as of the date indicated and is widely available to the public. The Company is not funded or affiliated with any of the sources cited herein.”

Raw Materials and Suppliers, page 9

10. Please describe in greater detail the supply of SIPs panels, including alternative sources, and explain your arrangements with the listed suppliers.

RESPONSE: We have revised the Filing on page 8 to include the following language:

“The Company obtains all of its raw materials through sub-contractors who contract with various manufacturers, lumberyards, etc. across the United States. Raw materials for our “bundle” and Native American housing products are in ready supply. On the contrary, suppliers of SIPs panels within the U.S. are limited. Our principal suppliers of SIPs panels include: Insulspan, located in Delta, British Columbia and Blissfield, Michigan; Premier Building Systems, located in Phoenix, Arizona and Fife, Washington; and SIPs Team USA based in Bainbridge, Georgia. We do not have any contracts or fixed arrangements with any three of these SIPs suppliers. We pay for the SIPs panels on a job by job basis by submitting a purchase order to the supplier. Although the number of SIPs suppliers is limited, the number of actual SIPs panels that each supplier is able to provide is not limited and therefore, we have a ready supply of SIPs panels to address our needs.”

DYNAMIC VENTURES CORP.

Customers. page 9

11. We note your revised disclosure regarding your customers added in response to comment 11 in our letter dated December 30, 2010. Given that Floor Art has only four major customers, and Floor Art accounted for 77% of your revenues for the year ended December 31, 2009, 99.7% of your revenues for the six months ended June 30, 2010, and 85.0% of your revenues for the nine months ended September 30, 2010, please disclose the names of these customers or advise us as to why you do not believe you are required to do so. Further, please provide us with you analysis as to why you do not believe that the loss of any one of these customers would have a material effect on your business when Floor Art has accounted for such a significant portion of your revenues for the most recently completed fiscal periods. Please also address this comment in your related disclosure in your Management's Discussion and Analysis on page 12. Please also file any contracts with such customers as an exhibit to your Form 8-K, or tell us why you or not required to do so. See Item 60l(b)(l0) of Regulation S-K.

RESPONSE: We have attached to the Filing, as exhibits 10.5 through 10.12, the contracts with our customers: Maracay Construction, LLC, Shea Homes Limited Partnership, Mark Hancock Development Corporation, and Meritage Homes Construction, Inc. We have also revised the Filing to include the following language:

Page 9

“Customers

Floor Art, the Company’s only operating “bundle”, has four major customers: a) Maracay Construction, LLC; b) Shea Homes Limited Partnership; c) Mark Hancock Development Corporation; and d) Meritage Homes Construction, Inc. These four customers accounted for 77% of the Company’s revenues for the year ended December 31, 2009. Currently, we have only one Native American housing customer, Tribal Building Solutions, LLC, and only one SIPs customer, the Bossier, LA hotel. Although we have a limited number of customers, we have expanded our operations to include our three products, the Native American housing, SIPs and “bundle” of trade activities. By expanding our operations, we have expanded our customer base and have thereby mitigated the risk of losing any one of our current customers.”

Page 12

“Floor Art, the Company’s only operating “bundle”, has four major customers. These four customers accounted for 77% of the Company’s revenues for the year ended December 31, 2009. Currently, we have only one Native American housing customer, Tribal Building Solutions, LLC, and only one SIPs customer, the Bossier, LA hotel. Although we have a limited number of customers, we have expanded our operations to include our three products, the Native American housing, SIPs and “bundles” of trade activities. By expanding our operations, we have expanded our customer base and have thereby mitigated the risk of losing any one of our current customers.”

Management's Discussion and Analysis of Financial Condition and Results of Operations, page 11

12. We note your revisions in response to comment 19 in our letter dated December 30, 2010. However, you continue to refer to the company as "Dynamic" throughout your Management's Discussion and Analysis. Please revise accordingly.

RESPONSE: We have revised the Filing throughout to remove references to “Dynamic”.

13. We note your revised disclosure on page 12 stating that Floor Art has an anticipated increase of 50% in future revenues based on certain anticipated future projects. Please revise your disclosure to clarify whether you have entered into any binding contractual commitments for such projects.

RESPONSE: We have revised the Filing on page 12 to include the following information:

“In 2007, Floor Art received a silver National Homebuilders Association quality award for excellence, one of only two silvers awarded that year. Floor Art is the smallest firm to ever receive this recognition. In its third year of operation, Floor Art doubled revenues through an acquisition strategy. Subsequent acquisitions have given Floor Art an estimated 10%-15% increase in revenues, an introduction into the commercial market, and another anticipated increase of 50% in future revenues. This anticipated increase of 50% is based on anticipated future projects including a Native American 60-unit apartment complex and a build-out of a 67-unit single-family project at Estrella Mountain Park Ranch. It is expected that Floor Art will provide the interior installs for the Native American project at $5,000 per unit and will provide the interior installs for the Estrella project at $15,000 per unit for a total of $1,305,000. At this time, the Company has not entered into any binding contractual commitments for such projects. Floor Art’s acquisitions, increase in revenues and introduction into the commercial market have allowed the business to move forward, despite tight economic conditions, and to build upon its reputation for quality and innovative management.”

Security Ownership of Certain Beneficial Owners, page 15

14. We note that you have not listed any 5% shareholders. Based on the share holdings immediately prior to the share exchange, it would appear that Messrs. Silver and Atiah would be 5% shareholders. Please advise or revise accordingly.

RESPONSE: There are no 5% shareholders. Prior to the Share Exchange, Messrs. Silver and Atiah were the directors and officers of the Company and were beneficial owners of the Company’s stock. However, Messrs. Silver and Atiah sold all of their shares to Al Cain, Dave Brown and Paul Kalkbrenner and are no longer shareholders of the Company.

15. It appears that you have revised the number of shares owned by your officers and directors to account for the share split, but that the total shares owned, including the total shares owned by the directors and officers as a group, does not account for the share split. Please revise to reconcile this discrepancy.

RESPONSE: We have revised the Filing as requested.

Market for Common Equity and Related Shareholder Matters, page 14

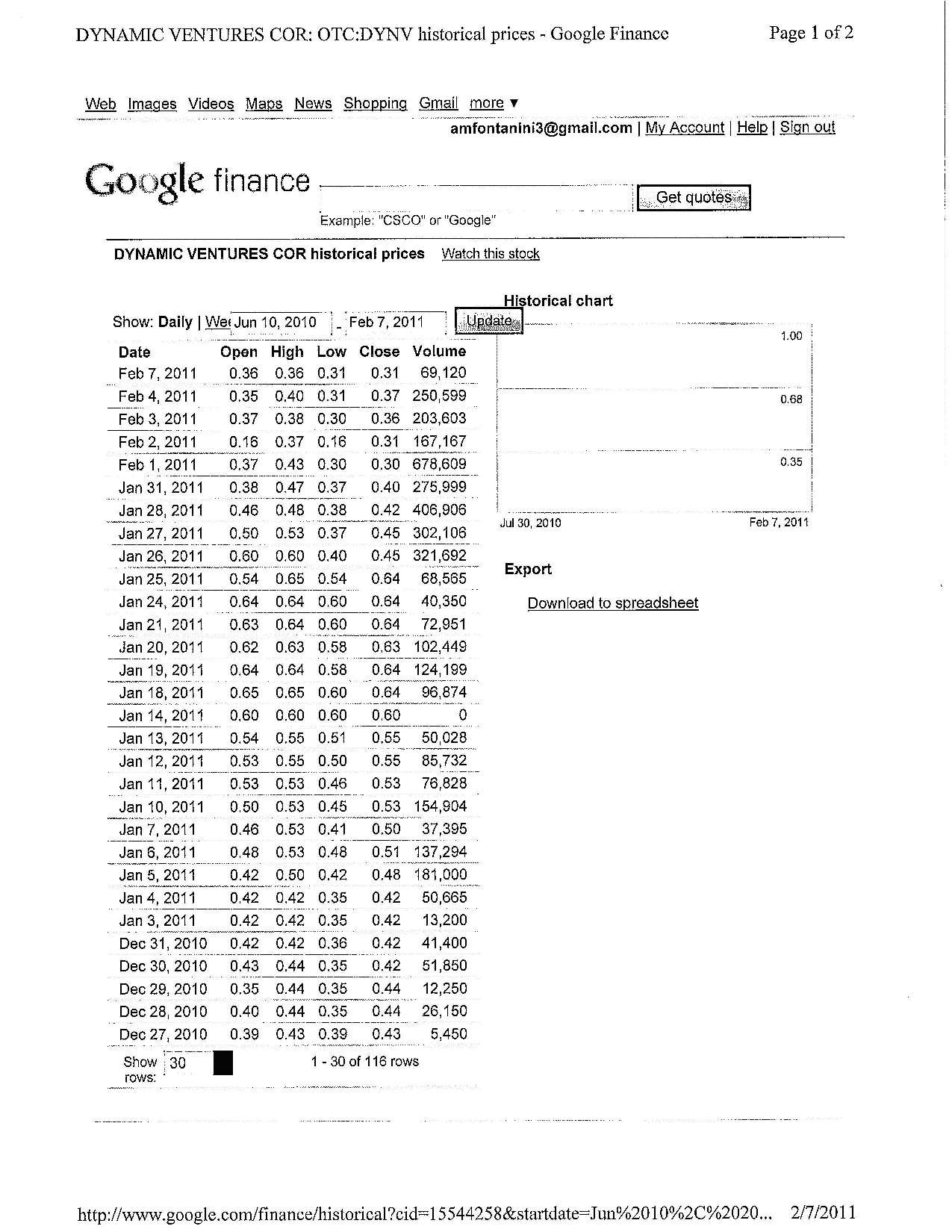

16. We note your revisions in response to comment 29 in our letter dated December 30, 2010. We have the following comments:

• Please clarify whether the prices have been adjusted to reflect the recent stock split.

RESPONSE: We have revised the Filing on page 16 to include the following language:

“The following table sets forth the high and low bid prices for our Common Stock per quarter as reported by the OTCBB since we began trading June 10, 2010 based on our fiscal year end December 31. These prices represent quotations between dealers without adjustment for retail mark-up, markdown or commission and may not represent actual transactions. These prices have been adjusted for the 5:1 stock split.”

| | First Quarter | Second Quarter | Third Quarter | Fourth Quarter |

2010 – High | ---- | ---- | $1.00 | $0.81 |

| 2010 – Low | ---- | ---- | $0.03 | $0.25 |

| 2011 – High | 0.65* | ---- | ---- | ---- |

| 2011 – Low | 0.16* | ---- | ---- | ---- |

| | | | | |

* First Quarter reflects trading price through February 7, 2011.”

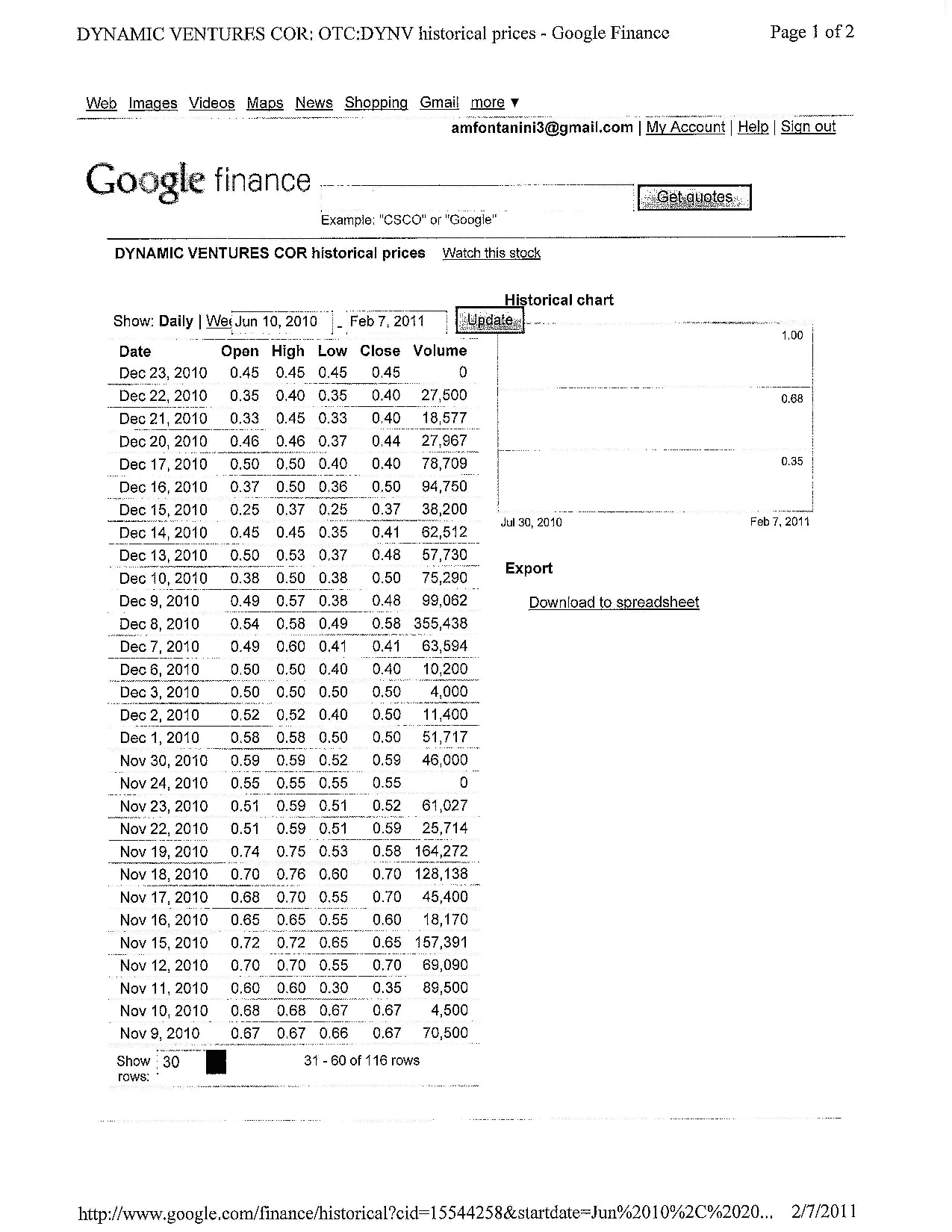

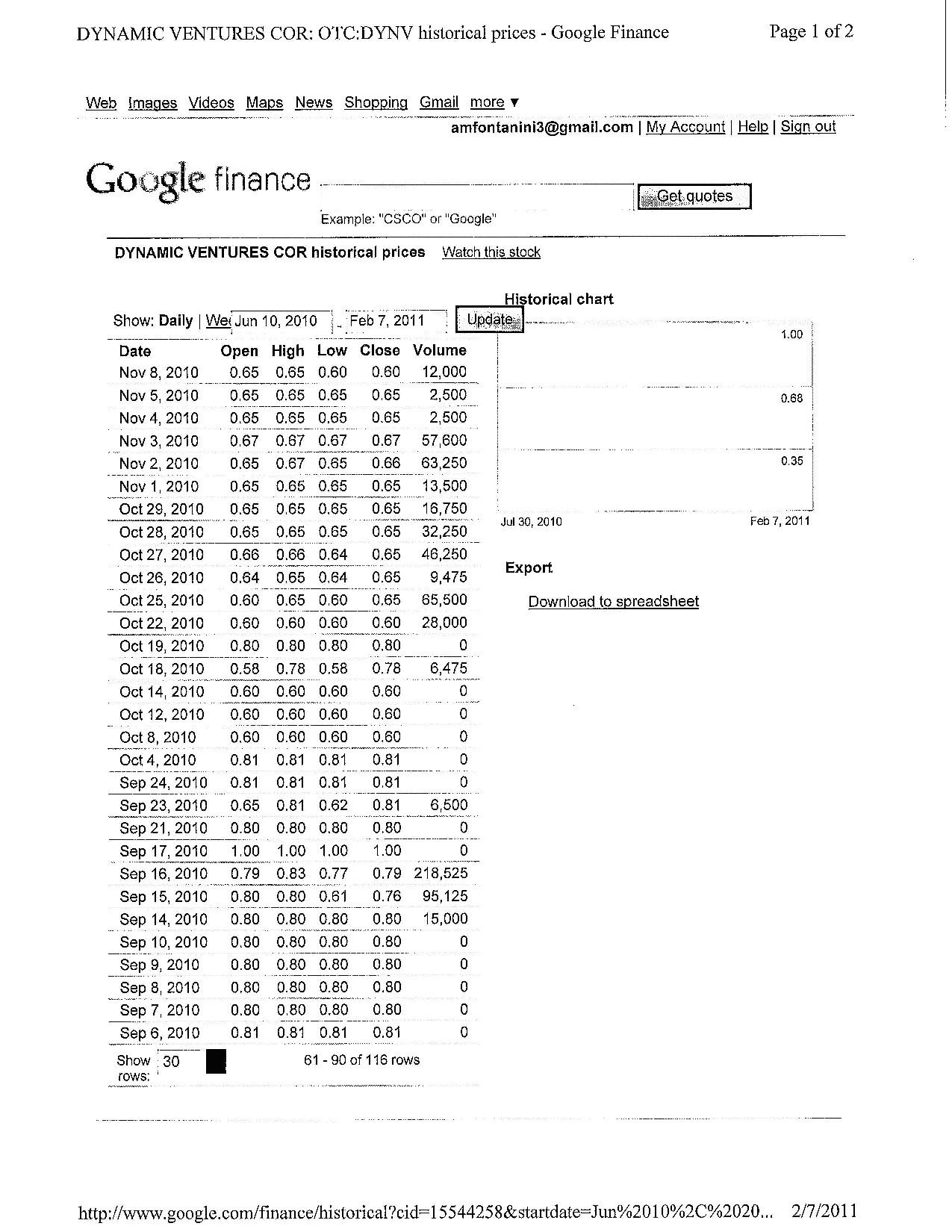

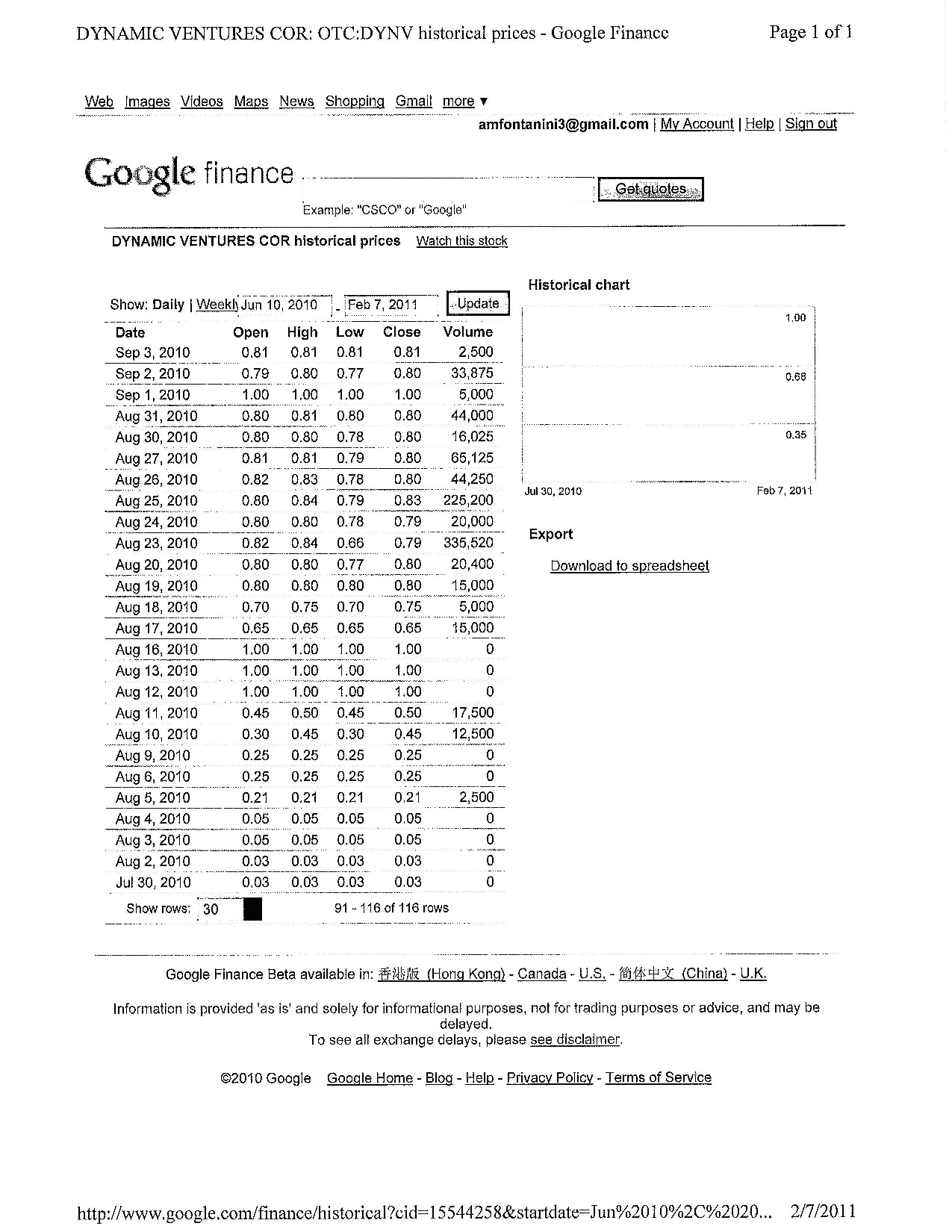

• Please supplementally provide us with documentation that supports the high and low bid prices you have listed in your disclosure.

RESPONSE: The high and low bid prices listed in our disclosure were obtained from Google Finance. We have attached a copy of the Company’s historical bid prices to this response.

DYNAMIC VENTURES CORP.

Certain Relationships and Related Transactions, page 15

17. We note that in response to comment 30 in our letter dated December 30, 2010, you state that as a result of your acquisition of Floor Art, LLC, you owed Dave Brown $152,888 for "cash advanced to the company." However, we also note that your disclosure states that Mr. Brown had forgiven the entire amount of his loan to Floor Art, LLC and Builder Design Center, LLC as of December 31, 2009. Please revise your disclosure to clarify whether the $152,888 that was due to Mr. Brown was in connection with the loan to Floor Art, LLC and Builder Design Center, LLC, or if it was in connection with another loan, and if so, please disclose the specifics of such other loan.

RESPONSE: We have revised the Filing on page 17 to include the following language:

“Dave Brown, a director and officer of the Company, was the majority owner of Floor Art, LLC and Builder Design Center, LLC at December 31, 2009. As of December 31, 2009, he had loaned Floor Art, LLC and Builder Design Center, LLC $544,700. The loans were due December 31, 2018 and bear interest at 3%. Accrued interest incurred was $248,507. As of December 31, 2009, he has forgiven the entire amount due, which is reflected as a capital contribution. On March 31, 2010, the Company acquired all of Dave Brown’s interest in Floor Art, LLC and Builder Design Center, LLC from Dave Brown in a transaction with a total dollar value of $747,774. As a result of this acquisition, the Company owed Dave Brown $453,297 on March 31, 2010. Subsequently, Dave Brown took a distribution of $150,000. The balance due as of June 30, 2010 is $303,297. This amount is unsecured, non-interest bearing, and due upon demand. The balance due as of September 30, 2010 is $283,547.”

18. We note your revisions in response to comment 30 in our letter dated December 30, 2010. Please further revise your disclosure to provide the material terms of any agreement entered into with JENAL Consulting, Inc., including the duration of any such agreement, the monthly payment required by such agreement, and the approximate total dollar value of the amount involved. See Item 404(d) of Regulation S-K. Please also advise us as to whether this agreement has been filed on EDGAR.

RESPONSE: We have revised the Filing on page 17 to include the following language:

“In August of 2010, the Company hired JENAL Consulting, Inc. (“JENAL”) to provide the Company with marketing of the SIPs panel construction system. The owner of JENAL is Jennifer Southam, the wife of Al Cain, a director of the Company. The Company has not entered into a master agreement or contract with JENAL. The Company pays JENAL after services are rendered to the Company and JENAL provides us with an invoice. As of September 30, 2010, the Company has paid JENAL a total of $21,332.”

Exhibit 99.3

Unaudited Pro Forma Financial Statements

19. We reviewed the changes you made in response to comment 43 in our letter dated December 30, 2010.As indicated in Rules 11-02(b)(6) and (7) of Regulation S-X, the 27,500,000 shares effectively issued in the August 2, 2010 transaction should be treated as if they were issued at the beginning of the fiscal year presented for purposes of calculating your pro forma weighted average shares outstanding. Please amend your Form 8-K/ A to revise your pro forma statements for the year ended December 31, 2009 and six months ended June 30, 2010 accordingly, along with the related pro forma footnotes (B) and (D).

RESPONSE: We have revised exhibit 99.3 to the Filing, as requested.

Form 10-Q for the Quarter Ended September 30, 2010

General

20. We note that in response to comment 48 in our letter dated December 30, 2010 you state that you have revised your filing to be consistent in your use of defined terms. Our comment was not intended to address the use of defined terms. Please confirm that in your future Exchange Act reports you will comply with the comments we issued in our letter dated December 30, 2010 relating to your Form 8-K to the extent such comments apply to your future Exchange Act reports.

RESPONSE: We confirm that in our future Exchange Act reports, we will comply with the comments issued in your letter dated December 30, 2010 relating to our Form 8-K.

Statements of Operations, page 5

21. In order not to imply a greater degree of precision than exists, please revise your presentations and discussions of net income (loss) per common share to round only to the nearest cent.

RESPONSE: We have revised the Filing, as requested.

Management's Discussion and Analysis of Financial Condition and Results of Operations, page 12

22. We note your response to comment 53 in our letter dated December 30, 2010. In particular, we note your disclosure that "as there have been no definitive agreements reached other than those previously disclosed, the terms and conditions of any contemplated projects or business opportunities remain confidential information." Please reconcile this disclosure with the following statement from your publicly available press release dated September 14, 2010:

"The annual sales opportunity for EZ-Build Systems is over $50 million in the Northeast and Midwest markets of the United States alone. One Tree will provide market development and commercialization activities, including advertising, estimating, market education and value engineering, etc. Under terms of the Agreement, One Tree will provide Dynamic with a consistent pipeline of business. They are currently in final negotiations on several Letters of intent totaling $28 million in sales of energy-efficient building products and services to be contracted in 2010."

Please clarify whether you have in fact reached a definitive agreement with One Tree Development, Inc. and advise as to how information relating to such agreement, or potential agreement, is confidential when it has been included in the September 14, 2010 press release.

RESPONSE: We have revised the Filing on page 14 to include the following information:

“Additionally, we anticipate a great opportunity for EZ Build Systems to receive a consistent pipeline of business. The Company is currently in the final negotiation process with One Tree Development, Inc. (“One Tree”) on several Letters of Intent totaling $28 million in sales of energy-efficient building products and services, whereby One Tree will exclusively offer EZ Build Systems’ eco-friendly systems to its clients. One Tree is a Utah corporation formed for the purpose of offering energy-efficient and cost-saving building products and services that enable development clients to achieve their construction goals. To date, no definitive agreements with One Tree have been finalized.

In regard to our Native American housing product, we believe that we have a niche in this market because there is a great need for this type of housing in Arizona and New Mexico, where we are based, as well as throughout the United States. We have seen that Native Americans are gaining a stronger financial footing and are more able to invest in housing. We believe that the homebuilding market will remain low but that it has reached a bottoming out level. Significant numbers of foreclosures are occurring nationwide and we anticipate that there will be a demand for our “bundles” product for rehabilitation of these REO properties. On January 13, 2011, the Company announced its intent to enter the $250 billion REO services market. The Company has drafted a term sheet with an investment group to raise between $6-$10 million dollars to take advantage of the current opportunity in the credit markets by acquiring and reselling distressed REOs. This investment will be targeted in and around the Phoenix metro area. To date, no definitive agreements have been reached.”

Controls and Procedures, page 16

23. We note your statement that a "control system, no matter how well conceived and operated, can provide only reasonable, not absolute, assurance ... " Please revise your disclosure regarding the conclusions of your chief executive officer and chief financial officer to clarify that, if true, your officers concluded that your disclosure controls and procedures were effective at the reasonable assurance level.

RESPONSE: We have revised the Filing on page 16 to include the following language:

“Under the supervision and with the participation of our chief executive officer and chief financial officer, we conducted an evaluation of the effectiveness of the design and operation of our disclosure controls and procedures, as defined in Rule 13a-15(e) and 15d-15(e) promulgated under the Exchange Act, as of September 30, 2010.

Our management, including our chief executive officer and chief financial officer, does not expect that our disclosure controls and procedures or our internal controls will prevent all error and all fraud. The design of a control system must reflect the fact that there are resource constraints and the benefits of controls must be considered relative to their costs. Due to the inherent limitations in all control systems, no evaluation of controls can provide absolute assurance that all control issues and instances of fraud, if any, within the Company have been detected. A control system, no matter how well conceived and operated, can provide only reasonable, not absolute, assurance that the objectives of the control system are met.

Based on this evaluation, our chief executive officer and chief financial officer concluded as of September 30, 2010, that our disclosure controls and procedures were effective, at the reasonable assurance level that the objectives of the control system were met, such that the information relating to the Company, including our consolidated subsidiaries, required to be disclosed in our SEC reports (i) is recorded, processed, summarized and reported within the time periods specified in SEC rules and forms and (ii) is accumulated and communicated to management, including our chief executive officer and chief financial officer, as appropriate, to allow timely decisions regarding required disclosure.”

Changes in Internal Controls over Financial Reporting, page 17

24. We note your revisions in response to comment 57 in our letter dated December 30, 2010. However, your statement that "[t]his change in the Company's internal controls has not materially affected, or is reasonably likely to materially affect, the Company's internal control over financial reporting," is unclear. To the extent true, please revise your disclosure to clarify that this change has not materially affected, and is not reasonably likely to materially affect, the Company's internal controls over financial reporting.

RESPONSE: We have revised the Filing on page 17 to include the following information:

“During the quarter ended September 30, 2010 the Company hired a new chief financial officer as a result of the stock exchange. This was not as a result of any control weaknesses or acts by the CEO or CFO. This change in the Company’s internal controls has not materially affected and is not reasonably likely to materially affect the Company’s internal control over financial reporting.”

Certifications

25. We note that your certifications filed as Exhibits 31.1, 31.2, 32.1 and32.2 are undated. In addition, we note that you have changed certain language in the certifications required by Rules 13a-14(a) and 15(d)-14(a). In particular, you have added the language "for the registrant and have," to paragraph 4, and have changed "our" to "my" and "subsidiaries" to "subsidiary" in paragraph 4(a). Please file an amendment to your Form 10-Q that includes the entire periodic report and dated certifications, including certifications that are in exactly the form set forth in Item 601 (b )(31 )(i) of Regulation S-K. Please address the comments above, as applicable, in your amended Form 10-Q.

RESPONSE: We have dated our Certifications and revised them to be in exactly the form set forth in Item 601(b)(31)(i) of Regulation S-K. Further, we have revised our Form 10-Q to address the comments set forth above.

In connection with the Company’s responding to the comments set forth in the February 3, 2011 letter, the Company acknowledges that:

• The Company is responsible for the adequacy and accuracy of the disclosure in the Filing;

• Staff comments or changes to disclosure in response to staff comments do not foreclose the Commission from taking any action with respect to the Filing; and,

• The Company may not assert staff comments as a defense in any proceeding initiated by the Commission or any person under the federal securities laws of the United States.

A copy of this letter and any related documents have also been filed via the EDGAR system. Thank you for your courtesies.

Very truly yours,

DYNAMIC VENTURES CORP.

/s/ Paul Kalkbrenner

By: Paul Kalkbrenner

Title: Chief Executive Officer

SUPPLEMENT TO QUESTION NUMBER 9

SUPPLEMENT TO QUESTION NUMBER 16