UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D. C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

|

| |

Filed by the Registrant x | Filed by a Party other than the Registrant o |

|

| |

| Check the appropriate box: |

| o | Preliminary Proxy Statement |

| o | Confidential, for Use of the Commission Only (permitted by Rule 14a-6(e)(2)) |

| x | Definitive Proxy Statement |

| o | Definitive Additional Materials |

| o | Soliciting Material under §240.14a-12 |

STONEGATE MORTGAGE CORPORATION

(Name of registrant as specified in its charter)

N/A

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

|

| |

| Payment of Filing Fee (Check the appropriate box): |

| x | No fee required. |

| o | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | (1) Title of each class of securities to which transaction applies: |

| | (2) Aggregate number of securities to which transaction applies: |

| | (3) Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | (4) Proposed maximum aggregate value of transaction: |

| | (5) Total fee paid: |

| o | Fee paid previously with preliminary materials. |

| o | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | (1) Amount Previously Paid: |

| | (2) Form, Schedule or Registration Statement No.: |

| | (3) Filing Party: |

| | (4) Date Filed: |

2015 PROXY STATEMENT

April 15, 2015

Dear Fellow Shareholder:

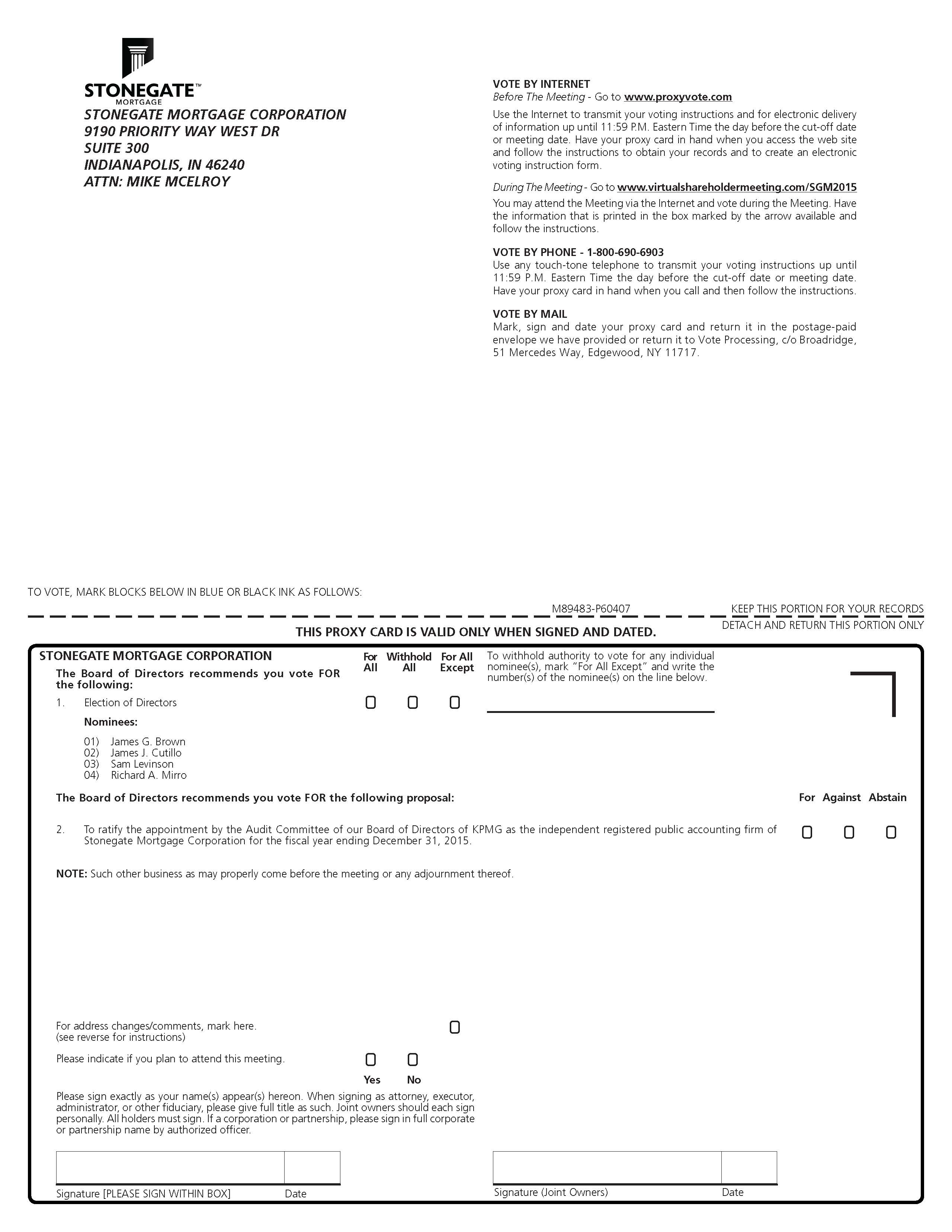

Stonegate Mortgage Corporation is holding a Virtual Annual Meeting of Shareholders this year on Thursday, May 28, 2015, at 9:00 a.m. Eastern Daylight Time. You may attend the Annual Meeting, vote, and submit a question during the Annual Meeting via a virtual meeting at www.virtualshareholdermeeting.com/SGM2015. You will need to provide your 12-Digit control number that is on your Notice of Internet Availability of Proxy Materials or on your proxy card if you receive materials by mail. The matters to be considered by shareholders at the Annual Meeting are described in detail in the accompanying materials.

It is very important that you be represented at the Annual Meeting regardless of the number of shares you own or whether you are able to attend the Annual Meeting. We urge you to complete your proxy card in one of the manners described in the accompanying materials even if you plan to attend the Annual Meeting. This will not prevent you from voting at the Annual Meeting but will ensure that your vote is counted if you are unable to attend.

Your continued support for and interest in Stonegate Mortgage Corporation is sincerely appreciated.

Sincerely,

James J. Cutillo

Chief Executive Officer

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

AND

IMPORTANT NOTICE REGARDING THE AVAILABILTIY OF PROXY MATERIALS FOR SHAREHOLDERS MEETING TO BE HELD MAY 28, 2015

NOTICE

Date: Thursday, May 28, 2015

Time: 9:00 a.m. Eastern Daylight Time

Virtual Meeting: www.virtualshareholdermeeting.com/SGM2015

PURPOSE

| |

| • | To elect four (4) Directors for two (2) year terms or until their successors are elected and qualified; |

| |

| • | To ratify the appointment by the Audit Committee of our Board of Directors of KPMG as the independent registered public accounting firm of Stonegate Mortgage Corporation for the fiscal year ending December 31, 2015; and |

| |

| • | To transact such other business as may properly come before the meeting and any adjournment of the meeting. Management is not aware of any such other business at this time. |

PROCEDURES

| |

| • | Our Board of Directors has fixed March 31, 2015 as the record date for the determination of shareholders entitled to notice of and to vote at the Annual Meeting. |

| |

| • | Only shareholders of record at the close of business on that date will be entitled to vote at the Annual Meeting. |

The proxy statement for our 2015 Annual Meeting of Shareholders and our annual report to shareholders on form 10-K for the year ended December 31, 2014 are available on our website at www.stonegatemtg.com under Investor Relations. The approximate date on which this proxy statement, the proxy card and other accompanying materials are first being sent or given to shareholders is on or about April 15, 2015. Additionally, you may access our annual report and proxy materials at www.proxyvote.com, a website that does not identify or track visitors of the site.

By order of the Board of Directors,

Michael J. McElroy

Secretary

April 15, 2015

TABLE OF CONTENTS

|

| | | | |

| | | | Page |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| Employment Arrangements | | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

PLEASE VOTE

It is very important that you vote to play a part in the future of your Company. NYSE rules provide that if your shares are held through a broker, bank or other nominee, they cannot vote on your behalf on non-discretionary matters.

Proposals Which Require Your Vote

|

| | | | | |

| | | Board Recommendation | Broker Non-Votes | Abstentions | Votes required for Approval |

| PROPOSAL 1 | To elect four directors for 2 year term. | FOR all nominees | Do not count | Do not count | For the nominees to be elected by the holders of voting shares, approval by a majority of the votes cast. Under our Code of Regulations, a nominee who receives more AGAINST votes than FOR votes will be required to tender his or her resignation. |

| PROPOSAL 2 | To ratify the appointment of KPMG as our independent registered public accounting firm for 2015. | FOR | Discretionary vote | Do not count | Majority of votes present in person or by proxy |

| | | | | | |

|

| | |

| By Internet using a computer | By telephone | By mail |

| | |

| Vote 24/7 | Dial toll-free 24/7 | Cast your ballot, sign your |

| www.proxyvote.com | 1-800-690-6903 | proxy card and send by pre-paid mail |

Visit our dedicated annual meeting website: www.virtualshareholdermeeting.com/SGM2015

| |

| • | Review and download easy to read, interactive versions of our Proxy and Annual Report |

| |

| • | Sign up for future electronic delivery to reduce our impact on the environment |

STONEGATE MORTGAGE CORPORATION

9190 Priority Way West Drive, Suite 300

Indianapolis, IN 46240

PROXY STATEMENT

GENERAL

This proxy statement is furnished to the shareholders of Stonegate Mortgage Corporation (the “Company,” "Stonegate," “we,” “us,” or “our”) in connection with the solicitation of proxies by the Board of Directors of the Company (the “Board”) to be voted at the virtual annual meeting of shareholders to be held on Thursday, May 28, 2015 (the “Annual Meeting”), at 9:00 a.m., Eastern Daylight Time, or any adjournments or postponements thereof. This proxy statement and the form of proxy, along with the Annual Report for the fiscal year ended December 31, 2014, is being first sent or given to shareholders on or about April 15, 2015.

ABOUT THE ANNUAL MEETING AND PROXY MATERIALS

What is the purpose of the Annual Meeting?

At the Annual Meeting, shareholders will vote upon (1) the election of four directors, (2) the ratification of the appointment of KPMG LLP, an independent public accounting firm ("KPMG") as our independent registered public accounting firm for fiscal 2015, and (3) such other business as may properly come before the Annual Meeting or any adjournments or postponements thereof. In addition, our management will report on the performance of the Company and respond to questions from shareholders.

Why did I receive a notice in the mail regarding the Internet availability of proxy materials instead of a full set of proxy materials?

Pursuant to rules adopted by the Securities and Exchange Commission (the “SEC”), we have elected to provide access to our proxy materials over the Internet. Accordingly, we are sending a Notice of Internet Availability of Proxy Materials (the “Notice of Internet Availability”) to our shareholders of record and beneficial owners. All shareholders will have the ability to access the proxy materials on the website referred to in the Notice of Internet Availability or request a printed set of the proxy materials at no cost to the shareholder. Instructions on how to access the proxy materials over the Internet or to request a printed copy may be found in the Notice of Internet Availability.

If you do not affirmatively elect to receive printed copies of the proxy materials, you will only be able to view our proxy materials electronically on the Internet. Providing our proxy materials to shareholders on the Internet rather than printing and mailing hard copies saves us these costs. We encourage you to view our proxy materials on the Internet. Shareholders who have affirmatively elected to receive a printed set of our proxy materials may change their election and elect to view all future proxy materials on the Internet instead of receiving them by mail.

Who is entitled to vote?

Only shareholders of record at the close of business on March 31, 2015 (the “Record Date”) will be entitled to vote at the Annual Meeting, or any adjournments or postponements thereof. Each outstanding share of the Company’s common stock (the “Common Stock”) entitles its holder to cast one vote on each matter to be voted upon.

Shareholders have cumulative voting rights in the election of directors. If any shareholder gives proper written notice to any officer of the Company before the Annual Meeting, or to the presiding officer at the Annual Meeting, that shareholder may cumulate their votes for the election of directors by multiplying the number of votes to which the shareholder is entitled by the number of directors to be elected and casting all such votes for one nominee or distributing them among any two or more nominees. If such notice is given by any shareholder, votes for directors by all shareholders will be cumulated. For instance, if a shareholder only votes for one nominee, such vote will be automatically cumulated and cast for that nominee. If a shareholder has voted for more than one nominee, the total number of votes that the shareholder is entitled to cast will be divided equally among the nominees for whom the shareholder has voted.

Who can attend the Annual Meeting?

All shareholders as of the Record Date, or their duly appointed proxies, may attend the virtual Annual Meeting via a virtual meeting at www.virtualshareholdermeeting.com/SGM2015. If you hold your shares in street name, you must request a legal proxy from your broker or nominee to attend and vote at the Annual Meeting.

What constitutes a quorum?

The presence at the Annual Meeting, in person or by proxy, of the holders of a majority of the shares of Common Stock outstanding on the Record Date will constitute a quorum. A quorum is required for business to be conducted at the Annual Meeting. As of the Record Date, 25,780,973 shares of Common Stock were outstanding, so holders of at least 12,890,487 shares of Common Stock must be present, attending the virtual Annual Meeting or by proxy, to have a quorum. If you vote your proxy electronically through the Internet or by telephone, or submit a properly executed paper proxy card, your shares will be considered part of the quorum even if you abstain from voting.

How do I vote?

You may vote in the following ways:

| |

| 1. | By Internet before the Annual Meeting: You may access the website at www.proxyvote.com to cast your vote 24 hours a day, 7 days a week. You will need your control number found in the Notice of Internet Availability. Follow the instructions provided to obtain your records and create an electronic ballot. |

| |

| 2. | By telephone: If you reside in the United States or Canada, you may call 1-800-690-6903 by using any touch-tone telephone, 24 hours a day, 7 days a week. Have your Notice of Internet Availability in hand when you call and follow the voice prompts to cast your vote. |

| |

| 3. | By mail: If you request a paper proxy card, mark, sign and date each proxy card you receive and return it in the postage-paid envelope provided or mail to the location indicated on the proxy card. |

| |

| 4. | At the Annual Meeting: If you are a shareholder of record, you may attend the Annual Meeting and vote your shares at www.virtualshareholdermeeting.com/SGM2015 during the meeting. You will need your control number found in the Notice of Internet Availability. Follow the instructions provided to vote. |

Shares represented by proxies submitted through the Internet or by telephone, or those paper proxy cards properly signed, dated and returned, will be voted at the Annual Meeting in accordance with the instructions set forth therein. If a proxy is properly submitted, whether through the Internet, by telephone, or by mail using a paper proxy card, but contains no instructions, the shares represented thereby will be voted FOR all directors in Proposal 1 and FOR ratification of the appointment of KPMG LLP as our independent registered public accounting firm for fiscal 2015 in

Proposal 2, and at the discretion of the proxy holders as to any other matters that may properly come before the Annual Meeting.

The Internet and telephone voting procedures are designed to verify shareholders’ identities, allow them to give voting instructions and confirm that their instructions have been recorded properly. Shareholders voting through the Internet should be aware that they may incur costs to access the Internet and that these costs will be at the expense of the shareholder.

When do I vote?

If you wish to vote by Internet or telephone, you must do so before 11:59 p.m. Eastern Daylight Time on May 27, 2015 using www.proxyvote.com or calling 1-800-690-6903, as applicable. If you want to vote after May 27, 2015 or revoke an earlier proxy, you must submit a signed proxy card or vote during the virtual Annual Meeting at www.virtualshareholdermeeting.com/SGM2015.

Can I change my vote after I vote electronically or return my proxy card?

Yes. Even after you have voted electronically through the Internet or by telephone or submitted your proxy card, you may change your vote at any time before the proxy is exercised at the Annual Meeting. You may change your vote by:

| |

| 1. | Returning a later-dated proxy by Internet, telephone or mail; |

| |

| 2. | Delivering a written notice of revocation to our Secretary at 9190 Priority Way West Drive, Suite 300, Indianapolis, IN 46240; or |

| |

| 3. | Attending the virtual Annual Meeting and voting. Your attendance at the Annual Meeting will not by itself revoke a proxy that you have previously submitted. |

Shareholders who hold shares through a broker or other intermediary should consult that party as to the procedures to be used for revoking a vote.

What does the Board recommend?

The Board’s recommendations are set forth after the description of the proposals in this proxy statement. In summary, the Board recommends a vote:

| |

| 1. | FOR the election of each of the nominated directors (see Proposal 1 on page 12); and |

| |

| 2. | FOR the ratification of the appointment of KPMG LLP as our independent registered public accounting firm for fiscal 2015 (see Proposal 2 on page 19); and |

If you return a properly executed proxy card without specific voting instructions, the persons named as proxy holders on the proxy card will vote in accordance with the recommendations of the Board. With respect to any other matter that properly comes before the Annual Meeting, the proxy holders will vote as recommended by the Board or, if no recommendation is given, at their own discretion.

What vote is required to approve each proposal?

For Proposal 1, the election of directors, each shareholder will be entitled to vote for four nominees, and the four nominees receiving the highest number of “FOR” votes will be elected.

For Proposal 2, the ratification of the appointment of KPMG as our independent registered public accounting firm for fiscal 2015, each shareholder is entitled to one vote for each share of Common Stock held, and the affirmative vote of the holders of a majority of the shares of Common Stock represented in person or by proxy and entitled to vote on the proposal will be required for approval.

With respect to any other matter that properly comes before the Annual Meeting, the affirmative vote of the holders of a majority of the shares of Common Stock represented in person or by proxy and entitled to vote on the proposal will be required for approval.

A “WITHHELD” vote will be counted for purposes of determining whether there is a quorum, but will not be considered to have been voted in favor of the director nominee with respect to whom authority has been withheld.

A properly executed proxy marked “ABSTAIN” with respect to Proposal 2, and any other matter that properly comes before the Annual Meeting, will not be voted, although it will be counted for purposes of determining whether there is a quorum. In Proposal 2, abstentions will have the same effect as a negative vote.

If your shares are held in the “street name” of a broker or other nominee, your broker or nominee may not be permitted to exercise voting discretion with respect to the proposal to be acted upon. If you do not give your broker instructions as to how to vote your shares, your broker has authority under New York Stock Exchange ("NYSE") rules to vote those shares for or against “routine” matters, such as the ratification of accounting firms. Brokers cannot vote on their customers’ behalf on “non-routine” proposals such as the election of directors or the non-binding, advisory vote on the compensation of the Company’s named executive officers. These rules apply notwithstanding the fact that shares of Common Stock are traded on the NYSE.

If your brokerage firm votes your shares only on “routine” matters because you do not provide voting instructions, your shares will be counted for purposes of establishing a quorum to conduct business at the Annual Meeting and in determining the number of shares voted for or against the routine matter. If your brokerage firm lacks discretionary voting power with respect to an item that is not a routine matter and you do not provide voting instructions (a “broker non-vote”), your shares will be counted for purposes of establishing a quorum to conduct business at the Annual Meeting, but will not be counted in determining the number of shares voted for or against the non-routine matter.

Who will count the vote?

Broadridge Financial Solutions, Inc. will act as inspector of elections to determine whether or not a quorum is present and tabulate votes cast by proxy or at the Annual Meeting.

What does it mean if I receive more than one Notice of Internet Availability?

If your shares are registered in more than one account, you will receive more than one Notice of Internet Availability. To ensure that all your shares are voted, vote electronically through the Internet or by telephone, or sign, date and return a paper proxy card for each Notice of Internet Availability you receive. We encourage you to have all accounts registered in the same name and address (whenever possible). You can accomplish this by contacting our transfer agent: American Stock Transfer & Trust Company, LLC at 1-800-937-5449.

How will voting on any other business be conducted?

We do not know of any business to be considered at the Annual Meeting other than the matters described in this proxy statement. However, if any other business is properly presented at the Annual Meeting, your proxy gives authority to each of Jim Cutillo and Mike McElroy to vote on such matters at their discretion.

How are proxies solicited?

In addition to use of the Internet and mail, proxies may be solicited by our officers, directors, and other employees by telephone, through electronic transmission, facsimile transmission, or personal solicitation. No additional compensation will be paid to such individuals for such activity.

What is “householding”?

We may send a single Notice of Internet Availability, as well as other shareholder communications, to any household at which two or more shareholders reside unless we receive other instruction from you. This practice, known as “householding,” is designed to reduce duplicate mailings and printing and postage costs, and conserve natural resources. If your Notice of Internet Availability is being householded and you wish to receive multiple copies of the Notice of Internet Availability, or if you are receiving multiple copies and would like to receive a single copy, or if you

would like to opt out of this practice for future mailings, you may contact Broadridge Financial Solutions, Inc., by telephone at 1-800-542-1061 or in writing at Broadridge, Householding Department, 51 Mercedes Way, Edgewood, New York 11717.

Who pays for the cost of this proxy solicitation?

We will bear the entire cost of the solicitation of proxies, including the preparation, assembly, printing and mailing of the Notice of Internet Availability, the proxy statement and any additional information furnished to shareholders. We will reimburse banks, brokerage houses, and other custodians, nominees and certain fiduciaries for their reasonable expenses incurred in mailing proxy materials to their principals.

PROPOSAL 1

ELECTION OF DIRECTORS

General Information

Four directors will be elected at the Annual Meeting. Upon the recommendation of the Governance and Nominating Committee, the Board has nominated for election of the four persons named below. Each has consented to being named a nominee and will, if elected, serve until the annual meeting of shareholders in 2016 or until a successor is elected.

Nominees of Directors

The names of the nominees, their principal occupations for at least the past five years and other information are set forth below:

James G. Brown, age 50 - Mr. Brown is the co-founder and Managing Partner of Long Ridge Equity Partners, a private investment firm focused on the financial services industry that is an affiliate of ours, which he founded in July 2007. He is also a Managing Director of TH Lee Putnam Ventures, a technology-focused private equity firm, which he co-founded in August 1999. Mr. Brown has served as a director for Liquidnet’s Board of Directors since March 2000 and as a director for FXCM’s Board of Directors since January 2008. Mr. Brown graduated from New York University with a B.S. and graduated with honors from Wharton Business School of the University of Pennsylvania with a Masters of Business Administration. We believe Mr. Brown is qualified to serve on our Board because of his extensive experience investing in and serving on the boards of growth companies, and because of his deep understanding of our business. Mr. Brown was designated as a director nominee by Stonegate Investors Holdings pursuant to the Shareholders' Agreement (see below under "Other Information Regarding the Board") and has been a member of our Board since February 2012. James J. Cutillo, age 47 - Mr. Cutillo co-founded Stonegate in 2005 with Ms. Cutillo, and since that time has served as the Company’s Chief Executive Officer and a Director. Prior to founding Stonegate, he was a director for GMAC Residential Funding Corporation ("RFC") in Minneapolis, Minn. from May of 2002 to August of 2004. From 1997 to 2002, Mr. Cutillo was a partner at NISYS, a firm that provided business process and software solutions in the mortgage banking and financial services industries. He served on active duty with the 101st Airborne, Ft. Campbell, Kentucky and in the Indiana National Guard. We believe Mr. Cutillo is qualified to serve on our Board because he is our Chief Executive Officer and founder, and an accomplished financial services executive with experience in the mortgage banking arena. Pursuant to his employment agreement, Mr. Cutillo is entitled to be nominated as a director of the Company for as long as his employment agreement is in effect and he serves as our CEO.

Sam D. Levinson, age 41 - Mr. Levinson has been a member of our Board since May 2013. Since 2004 Mr. Levinson has been a principal and managing partner at Glick Family Investments, a private family office located in New York, New York where he oversees private equity investments. Mr. Levinson has experience serving as a member on several boards and as a Chairman of the Audit Committee for Canary Wharf Group. Mr. Levinson has served as a director of Canary Wharf Group in London, a U.K. property developer and manager of office and retail space, since 2004; of

Songbird Estates, Canary Wharf Group’s holding company, since 2004; of Coleman Cable Inc., a manufacturer of wire and cable, since 2005; of American European Group Insurance Company since 2006 and of Dynasty Financial Partners, LLC, which provides investment and technology platforms for independent financial, investment, and wealth management advisors, since 2011. Additionally, Mr. Levinson served as a director of West Coast Bancorp of Portland, Oregon from February 2011 until its sale in April 2013. Mr. Levinson is also the founder, president and controlling shareholder of Trapeze Inc., a real estate investment company, where he has served since 2002. We believe Mr. Levinson is qualified to serve on our Board because he is an experienced executive and director with numerous years of experience in the financial industry.

Richard A. Mirro, age 63 - Mr. Mirro brings over 35 years of industry experience to Stonegate’s Board. For six years, he served North American Mortgage Corporation as President and Chief Operating Officer (1996-1999) and then as Chairman and Chief Executive Officer (1999-2002). Prior to that, he spent a decade from February 1986 to August 1996, with Chase Manhattan Mortgage where he held a variety of titles, including Chief Operations Officer, Chairman and Chief Executive Officer. Mr. Mirro also served as the CEO of Fleet Mortgage from August 1996 to December 1996. Mr. Mirro earned his B.A. in economics from St. Vincent College and a Master of Arts in mathematical economics from Duquesne University. We believe Mr. Mirro is qualified to serve on our Board because he is an accomplished financial services executive with more than 30 years of experience in the mortgage banking arena. Mr. Mirro was designated as a director nominee by Stonegate Investors Holdings pursuant to the Shareholders' Agreement (see below under "Other Information Regarding the Board") and has been a member of our Board since February 2012. Continuing Directors and Executive Officers

Kevin Bhatt, age 36 - Mr. Bhatt is a partner of Long Ridge Equity Partners, a private investment firm focused on the financial services industry that is an affiliate of ours. Prior to joining Long Ridge in February 2010, he was a Vice President of AEA Investors, a leading middle market private equity firm, from July 2006 to February 2010. Mr. Bhatt earned his B.A. degree in economics with honors from Princeton University and his Master of Business Administration degree from Harvard Business School. We believe Mr. Bhatt is qualified to serve on our Board because of his numerous years of experience in the financial industry and deep understanding of our business. Mr. Bhatt was designated as a director nominee by Stonegate Investors Holdings, LLC ("Stonegate Investor Holdings") pursuant to the Shareholders' Agreement (see below under "Other Information Regarding the Board") and has been a member of our Board of since February 2012. Richard A. Kraemer, age 70 - Mr. Kraemer has been a member of our Board since May 2013 and brings with him over 35 years of experience. His knowledge comes from holding several senior executive positions at multiple banks and public companies as well as taking positions on several boards. Mr. Kraemer is a retired investor. Mr. Kraemer served as Chairman of the Board of Directors of Saxon Capital Inc., a publicly-traded mortgage real estate investment trust (“REIT”), from 2001 through 2006. Mr. Kraemer is a member of the Board of Directors of FBR Capital Markets. Mr. Kraemer also served as a trustee and member of the audit committee of American Financial Realty Trust (NYSE: AFR), a publicly-traded REIT, from 2002 to 2008, and he served as a director of Urban Financial Group, Inc. from 2001 to 2013. From 1996 to 1999, Mr. Kraemer was Vice Chairman of Republic New York Corporation, a publicly-traded holding company for Republic National Bank. From 1993 to 1996, Mr. Kraemer was Chairman and Chief Executive Officer of Brooklyn Bancorp, a publicly-traded holding company for Crossland Federal Savings Bank. Mr. Kraemer earned his Bachelor of Science degree in Business Administration with a major in Real Estate from Pace University, New York. We believe Mr. Kraemer is qualified to serve on our Board because of his executive expertise with financial institutions and his extensive board service of several publicly-traded companies.

J. Scott Mumphrey, age 63 - Mr. Mumphrey has been a member of our Board since February 2010 and brings with him over 35 years of executive management experience. He has extensive expertise in long and short range strategic planning, development, operations and property management. He is currently a principal at Second Curve Investments, LLC, a private equity and advisory services firm he co-founded in 2009 focused on small to moderate sized companies. Additionally, Mr. Mumphrey has served as an organizational consultant to Beijing Hualian Group, a leading Chinese retail enterprise, from October 2012 to the present. Prior to founding Second Curve Investments, LLC, he worked for Simon Property Group, the largest real estate company in the world, as President of Simon Management Group from 2002 to 2009. He was also Executive Vice President of Property Management for Simon Property Group, Inc. from 1992 to 1999. Mr. Mumphrey joined Simon Property Group and Melvin Simon & Associates, Inc. in 1974. Mr. Mumphrey earned his B.S. degree in Business Administration from Louisiana State University. We believe Mr. Mumphrey is qualified to serve on our Board because of his extensive executive management experience, his advisory work with multiple startup companies, and his investment background.

Robert B. Eastep, age 52, - Mr. Eastep joined Stonegate in May 2014 as Chief Financial Officer. Mr. Eastep has extensive experience in the banking and mortgage finance industries, serving as a public company executive and board member. Since October 2012, Mr. Eastep has served as President, Chief Executive Officer and Director of Union Mortgage Group. Union Mortgage Group is a non-bank affiliate of Union First Market Bankshares, a NASDAQ-listed community bank headquartered in Richmond, VA. Prior to Union Mortgage Group, Mr. Eastep served as Senior Vice President and Chief Financial Officer for Central Virginia Bankshares, Inc., a NASDAQ-listed community bank headquartered in Powhatan, VA. In addition, Mr. Eastep served as Director and Audit Committee Chairman for CreXus Investment Corporation, a NYSE-listed real estate investment trust, from its inception in 2008 to its sale to Annaly Capital Management in 2013. Mr. Eastep's additional experience includes serving as Executive Vice President and Chief Financial Officer of Saxon Capital, Inc., a NYSE-listed real estate investment trust that was a leading independent residential mortgage lender and servicer prior to its sale to Morgan Stanley. He was also a Senior Manager (Financial Services Audit Practice) for KPMG Peat Marwick LLP where he directed numerous audit engagements and served as a member of KPMG's Regulatory Advisory Practice for financial institutions.

Barbara A. Cutillo, age 47 - Ms. Cutillo co-founded the Company in 2005 with Mr. Cutillo, and served as Chief Financial Officer until April 2013. She currently serves as the Chief Administrative Officer and leads the Company’s corporate support areas which include: strategic planning, legal, human resources and corporate communications. Prior to co-founding Stonegate in 2005, Ms. Cutillo was the Director of Finance for a non-regulated subsidiary of Citizens Gas and Coke Utility in Indianapolis, Indiana from 1997 to 2000. The subsidiary provided venture capital and/or mezzanine debt to companies in the natural gas industry. She has deep finance and accounting experience having been a Senior Associate for Coopers & Lybrand where she was engaged in the audit practice. She holds a BS in Accounting from University of Kentucky, an MBA in Finance from the Kelley School of Business at Indiana University and has a current CPA designation in the state of Indiana.

Steve Landes, age 46 - Mr. Landes joined Stonegate in February 2008 as Executive Vice President of Loan Origination. He oversees the Company’s retail, wholesale and correspondent lending channels. Mr. Landes’ experience in mortgage lending encompasses 22 years, including positions as Senior Vice President of Retail Lending at Novastar Mortgage from April 2000 to February 2006, where he was responsible for 4,500 employees in over 400 retail offices throughout the Unites States; CEO of Ampro Financial Services, a national title company, from March 2002 to August 2003 and Regional President for IndyMac Bank from February 2006 to January 2008, with responsibility for sales and operations of the wholesale and correspondent lending channels throughout the central United States. Mr. Landes holds a BS degree in finance from the University of Central Missouri.

Lisa A. Rogers, age 51 - Ms. Rogers joined Stonegate in June 2014 as Executive Vice President - Loan Originations. Ms. Rogers brings over two decades of experience in building and leading high-performance mortgage banking teams, including sales, operations, strategy and regulatory compliance. Ms. Rogers was previously a Senior Vice President of Wells Fargo Home Mortgage, a leading mortgage lender, where she led the National Wholesale Operations, including operational risk, regulatory compliance, customer service and financial performance. Her efforts significantly reduced operations costs while also implementing a service strategy that increased the division's market share. She joins Stonegate Mortgage from NationStar, where she was EVP, National Production Manager.

Eric M. Scholtz, age 50 - Mr. Scholtz joined Stonegate in January 2013 as Executive Vice President of Structured Finance. Mr. Scholtz is a capital markets executive with over 20 years’ experience in the structuring, pricing and trading of mortgage and asset-backed securities. Prior to joining Stonegate, Mr. Scholtz served in a number of senior executive positions at RFC from May 1986 to February 2007, most recently as Executive Vice President of Capital Markets and Senior Vice President, Head of Trading where he was responsible for the acquisition and ultimate sale/securitization of $150 billion annual volume in Agency and non-Agency mortgage loans. Mr. Scholtz is a graduate of the University of Iowa.

John F. Macke, age 49 - Mr. Macke joined Stonegate in January 2012 as Executive Vice President of Capital Markets and in April 2013 he became our Chief Financial Officer. In May 2014 he returned to his previous position as Executive Vice President of Capital Markets. From May 2010 to December 2011, Mr. Macke was the Executive Vice President and Chief Financial Officer of Americare Ambulance Service, a provider of emergent and non-emergent ambulance transportation. Prior to that, from May 2008 to January 2010, Mr. Macke was the Chief Financial Officer and Founder of Automated Call Technologies, a telecommunications transaction processing business. Additionally, from 1987 to 2006, Mr. Macke was with Irwin Mortgage, a residential mortgage lending company, where he was the senior vice president responsible for capital markets, strategy and business development. He spent a large portion of his career

managing the financial analysis department which included servicing valuation and mortgage servicing rights hedging among other duties. Mr. Macke was also the Chief Operating Officer of Freedom Mortgage after its acquisition of Irwin Mortgage. He holds an MBA from the Kelley School of Business at Indiana University and a BS degree in finance from the University of Dayton.

Robert Meachum, age 52 - Mr. Meachum joined Stonegate in March 2013 as Executive Vice President of Servicing. Mr. Meachum has over 20 years’ experience in mortgage banking and has held executive positions at Homeward Residential (previously American Home), Saxon Mortgage and GMAC ResCap. Prior to joining Stonegate, he served as Senior Vice President, Subservicing and Special Servicing from April 2012 to March 2013 at Homeward Residential, a banking firm involved in the acquisition, purchase, sale, securitization, and servicing of residential mortgages. He was responsible for Homeward’s fee-based servicing, including business development, sub- and special servicing operations and oversight of primary servicing operations. From October 2007 to March 2012, Mr. Meachum served as Executive Vice President, Servicing at Saxon Mortgage Services Inc., a wholly-owned subsidiary of Morgan Stanley and one of the nation’s premier subprime servicers with a particular focus on managing distressed assets. As EVP, Servicing at Saxon, Mr. Meachum was responsible for managing the operational credit risk of Saxon’s $37 billion servicing portfolio and developing the business strategy and turnaround efforts of Saxon’s servicing platform. Additionally, Mr. Meachum served as a director for the Board of Directors of Saxon Mortgage Services Inc. and its subsidiaries from January 2011 to January 2012. At GMAC ResCap, Mr. Meachum served as Managing Director for Homecomings Financial, whose servicing portfolio exceeded $100 billion, where he was responsible for servicing and consumer originations. Mr. Meachum earned degrees in Political Science and Accounting from Southern Methodist University and is a Certified Public Accountant.

Michael J. McElroy, age 45 - Mr. McElroy has served as our General Counsel and Secretary since October 2013. Prior to that, Mr. McElroy served as Senior Vice President and General Counsel of Home Loan Servicing Solutions, Ltd. from March 2012 to October 2013, where he served as chief legal officer. From January 2011 to March 2012, he served as Senior Vice President and Deputy General Counsel of Ocwen Financial Corporation, where his duties included directing transactional legal matters. Prior to joining Ocwen, from June 2010 to January 2011 he was an Associate General Counsel at Fannie Mae where he was responsible for mortgage-backed security offerings, loss mitigation on the securities portfolio and structured transactions. Before joining Fannie Mae, from September 1997 to June 2010 he was an associate and then a partner at Orrick, Herrington & Sutcliffe LLP in the Financial Markets Group, where he represented financial institutions in connection with securities offerings, derivatives and regulatory compliance. Mr. McElroy holds a Bachelor of Arts in Economics and Political Science from Kenyon College, a Masters in Government from the University of Virginia, and a Juris Doctor from the Georgetown University Law Center.

James J. Cutillo, our Chief Executive Officer and a Director, and Barbara A. Cutillo, our Chief Administrative Officer, are married. There are no other family relationships among any of our directors, director nominees or executive officers.

Voting Information and Board Voting Recommendation

In accordance with Ohio law, directors are elected by a plurality of votes cast. The four nominees receiving the highest number of votes will be elected. If any nominee is unable to serve as a director, the Board may act to reduce the number of directors or the persons named in the proxies may vote for the election of such substitute nominee as the Board may propose. It is intended that proxies will be voted for such nominees in the latter circumstance. The proxies cannot be voted for a greater number of persons than four.

THE BOARD RECOMMENDS THAT SHAREHOLDERS

VOTE “FOR” EACH NOMINEE LISTED

Other Information Regarding the Board

Composition. Our current Code of Regulations (the “Regulations”) provides that our Board shall consist of not less than six and not more than eleven directors as the Board or shareholders may from time to time determine. Our Regulations currently provide for a staggered Board with two separate "classes" of directors which are comprised of at least three directors each. Our directors are divided into the following classes:

|

| |

| Class I | Class II |

| Kevin Bhatt | James J. Cutillo |

| J. Scott Mumphrey | James G. Brown |

| Richard A. Kraemer | Sam D. Levinson |

| | Richard A. Mirro |

Under our shareholders’ agreement, as amended (the “Shareholders’ Agreement”) with Stonegate Investors Holdings, which is our largest shareholder, Stonegate Investors Holdings is entitled to nominate (i) two directors until the date on which their beneficial ownership of Common Stock falls below 15% of the outstanding shares of Common Stock and (ii) thereafter one director until the date on which their beneficial ownership of Common Stock falls below 10% of the outstanding shares of Common Stock. In addition, at least one Stonegate Investors Holdings nominated director will be on each committee of our Board until the date on which their beneficial ownership of Common Stock falls below 10% of the outstanding shares of Common Stock for so long as their representation on those committees is permitted by the corporate governance rules of the national securities exchange on which our shares of Common Stock are then listed. See “Certain Relationships and Related Party Transactions” for a further description of the Shareholders’ Agreement. Our Board has determined that Messrs. Mirro, Kraemer, Levinson and Mumphrey are our independent directors with independence being determined in accordance with the NYSE listing standards. Our independent directors will meet regularly in executive sessions without members of management present. Our Chairman of the Board will lead those executive sessions.

Our Board believes its members collectively have or will have the experience, qualifications, attributes and skills to effectively oversee the management of our Company, including a high degree of personal and professional integrity, an ability to exercise sound business judgment on a broad range of issues, sufficient experience and background to have an appreciation of the issues facing our Company, a willingness to devote the necessary time to Board duties, a commitment to representing the best interests of our Company and our shareholders and a dedication to enhancing stockholder value.

Meetings. The Board met seven times during fiscal 2014. In addition, during fiscal 2014 the Audit Committee met six times, and the Corporate Governance and Nominating and Compensation Committees met four times. Other than Mr. Brown, who attended 86% of the Board meetings in 2014 and Mr. Mirro, who attended 83% of the Audit Committee meetings in 2014, all of the directors attended 100% of the number of Board meetings and meetings of Board committees on which he served that were held during fiscal 2014. All of the directors who were serving on the Board at the time attended last year’s annual meeting of shareholders.

Committees. Our Board has three committees: the Audit Committee, the Compensation Committee and the Corporate Governance and Nominating Committee. Each of these committees consists of three members.

Audit Committee. The Audit Committee assists the Board in overseeing our accounting and financial reporting processes and the audits of our financial statements. Further, the Audit Committee supervises the Company’s internal audit function. The members of our audit committee are Mr. Mirro, who is the chair of the committee, Mr. Mumphrey and Mr. Kraemer.

All members of our Audit Committee meet the requirements for financial literacy under the applicable rules and regulations of the SEC and the NYSE. Our Board has affirmatively determined that each member of our Audit Committee is an independent director as defined under the applicable rules and regulations of the SEC and the NYSE. Our Board has determined that all members of our Audit Committee qualify as “audit committee financial experts” under SEC rules and regulations.

Compensation Committee. The Compensation Committee supports the Board in fulfilling its oversight responsibilities relating to senior management and director compensation, including the administration of our executive compensation arrangements and 2011 Omnibus Incentive Plan, the 2013 Omnibus Incentive Compensation Plan and the 2013 Non-Employee Director Plan.

The Compensation Committee charter permits the Compensation Committee to delegate its duties and responsibilities to a subcommittee of the Compensation Committee. In particular, the Compensation Committee may delegate approval of certain transactions to a subcommittee consisting solely of members of the Compensation Committee who are (i) "Non-Employee Directors" for the purposes of rule 16b-3 under the Securities Exchange Act of 1934, as in effect from time to time, and (ii) "outside directors" for the purposes of Section 162(m) of the Internal Revenue Code, as in effect from time to time. Mr. Cutillo and our human resources department provide both advice and comparative compensation data to assist the Compensation Committee with determining the compensation of any of our executives or directors. No members of the Board of Directors other than Mr. Cutillo has a role in recommending to the Compensation Committee the compensation of any of our executives or directors.

The members of our Compensation Committee are Mr. Levinson, who is the chair of the Compensation Committee, Mr. Kraemer and Mr. Mumphrey. Our Board has affirmatively determined that each of the committee members are independent directors of our Compensation Committee as defined under the applicable rules and regulations of the SEC and the NYSE.

Corporate Governance and Nominating Committee. The Corporate Governance and Nominating Committee assists the Board in identifying and recommending candidates to fill vacancies on the Board and for election by the shareholders, recommending committee assignments for members to the Board, overseeing the Board’s annual evaluation of the performance of the Board, its committees and individual directors, reviewing compensation received by directors for service on the Board and its committees and developing and recommending to the Board appropriate corporate governance policies, practices and procedures for our Company.

It is the policy of our Corporate Governance and Nominating Committee to consider candidates for Director recommended by you, our shareholders and will evaluate such candidates in the same manner and subject to the same criteria as other candidates identified by or submitted for consideration to the Corporate Governance and Nominating Committee. Shareholders may nominate candidates by timely submitting a nomination in proper written form to the Secretary. In evaluating all nominees for Director, our Corporate Governance and Nominating Committee takes into account the applicable requirements for Directors under the Securities Exchange Act of 1934, as amended, and the listing standards of the NYSE. In addition, our Corporate Governance and Nominating Committee takes into account our best interests, as well as such factors as personal qualities and characteristics, accomplishments, reputation in the business community, knowledge, contacts, ability and willingness to commit adequate time to Board and committee matters, the fit of the individual’s skills and personality with those of other directors and diversity of viewpoints, background, experience and other demographics.

The members of our Corporate Governance and Nominating Committee are Mr. Kraemer, who is the chair of the committee, Mr. Levinson and Mr. Mirro. Our Board has affirmatively determined that each of the committee members are independent directors of our Corporate Governance and Nominating Committee as defined under the applicable rules and regulations of the SEC and the NYSE.

|

| | | | | | |

| Director | | Audit Committee | | Compensation Committee | | Corporate Governance and Nominating Committee |

| Richard A. Kraemer | | Member | | Member | | Chair |

| Sam D. Levinson | | | | Chair | | Member |

| Richard A. Mirro | | Chair | | | | Member |

| Joseph Scott Mumphrey | | Member | | Member | | |

Each of the three committees operates under a written charter adopted by the Board, a copy of which is available to shareholders on our website at www.stonegatemtg.com (select “Investor Relations” and click on “Corporate Governance”).

Compensation Committee Interlocks and Insider Participation

None of the members of our Compensation Committee is, or has at any time during the past year been, an officer or employee of ours. None of our executive officers currently serve, or in the past year has served, as a member of the board of directors or compensation committee of any other entity that has one or more executive officers serving on our Board or Compensation Committee.

Governing Documents

The following primary documents make up Stonegate’s corporate governance framework:

•Corporate Governance Guidelines

•Audit Committee Charter

•Compensation Committee Charter

•Corporate Governance and Nominating Committee Charter

•Code of Ethics

These documents are accessible on Stonegate’s website at www.stonegatemtg.com by clicking on “Investor Relations,” then “Corporate Governance.” You may also obtain a free copy of any of these documents by sending a written request to Stonegate Mortgage Corporation, 9190 Priority Way West Drive, Suite 300, Indianapolis, IN 46240, Attention: Secretary. Any substantive amendment to or grant of a waiver from a provision of the Code of Ethics, which applies to all of our directors, officers and employees, for the chief executive officer and senior financial officers requiring disclosure under applicable SEC or NYSE rules will be posted on Stonegate’s website.

Corporate Governance Guidelines

This document sets forth the Company’s primary principles and policies regarding corporate governance. The Corporate Governance Guidelines are reviewed from time to time as deemed appropriate by the Board. The matters covered by the Corporate Governance Guidelines include the following:

•Board Composition

•Board Leadership

•Selection of Directors

•Director Continuation

•Board Meetings

•Executive Sessions

•Board Committees

•Management Succession

•Executive Compensation

•Board Compensation

•Expectations for Directors

•Evaluation of Board Performance

•Outside Advice and Reliance on Management.

Board Leadership Structure

Richard A. Kraemer serves as our Chairman of the Board. The Chairman of the Board presides over meetings of the Board and is primarily responsible for the direction and implementation of the Board’s oversight functions over the management and strategic direction of the Company. The Board is free to select its Chairman and the Company’s Chief Executive Officer in the manner it considers in the best interests of the Company at any given point in time.

Board’s Role in Risk Oversight

Our Board and each of its Committees are involved in overseeing risk associated with the Company. The Board and the Audit Committee monitor Stonegate’s credit risk, liquidity risk, regulatory risk, operational risk and enterprise risk by regular reviews with management and internal and external auditors. In its periodic meetings with the internal auditors and the independent accountants, the Audit Committee discusses the scope and plan for the internal audit and includes management in its review of accounting and financial controls, assessment of business risks and legal and ethical compliance programs. The Board and the Corporate Governance and Nominating Committee monitor the

Company’s governance and succession risk by regular reviews with management. The Board and the Compensation Committee monitor the Company’s compensation policies and related risks by regular reviews with management. The Board's role in risk oversight is consistent with the Company’s leadership structure with the Chief Executive Officer and other members of senior management having responsibility for assessing and managing the Company’s risk exposure, and the Board and its Committees providing oversight in connection with these efforts.

Communications with the Board

Any Stonegate stockholder or other interested party who wishes to communicate with the Board or any of its members may do so by writing to: Corporate Secretary, Stonegate Mortgage Corporation, 9190 Priority Way West Drive, Suite 300, Indianapolis, IN 46240, United States. Communications may also be made on the website at www.stonegatemtg.com by clicking on “Investor Relations,” then “Corporate Governance,” then “Contact the Board.”

PROPOSAL 2

RATIFICATION OF APPOINTMENT OF

INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

THIS SECTION SHOULD BE READ IN CONJUNCTION WITH THE

“AUDIT COMMITTEE REPORT” BELOW.

KPMG has been our independent registered public accounting firm since June 17, 2013 and audited our consolidated financial statements for the fiscal years ending December 31, 2013 and 2014. The Audit Committee has selected KPMG to serve as our independent registered public accounting firm and to serve as auditors for the fiscal year ending December 31, 2015. Shareholder ratification of the appointment is requested. Consistent with our Audit Committee Charter and the requirements of the Sarbanes Oxley Act of 2002 and applicable rules and regulations of the SEC and the NYSE, the ratification of the appointment of independent auditors by the shareholders will in no manner impinge upon or detract from the authority and power of the Audit Committee to appoint, retain, oversee and, if necessary, disengage the independent auditors. In the event the appointment of KPMG is not ratified by the shareholders, the Audit Committee will reconsider the appointment.

Representatives of KPMG are expected to be present at the virtual Annual Meeting. They will have an opportunity to make a statement if they desire to do so and will be available to respond to appropriate questions.

Change in the Company's Independent Registered Accounting Firm

On June 17, 2013, the Company engaged KPMG as the Company's independent registered public accounting firm for the Company's year ending December 31, 2013. As a result of the engagement of KPMG, on June 17, 2013, the Company dismissed Richey May LLP ("Richey May") as the Company's independent registered public accounting firm, which dismissal was approved by the Company's Audit Committee on June 17, 2013.

During the years ended December 31, 2012 and 2011, Richey May's reports on the Company's consolidated financial statements did not contain an adverse opinion or disclaimer of opinion, and were not qualified or modified as to uncertainty, audit scope or accounting principles. During the years ended December 31, 2012 and 2011 and the subsequent interim period through June 17, 2013, (i) there were no disagreements between the Company and Richey May regarding any matter of accounting principles or practices, financial statement disclosure or auditing scope or procedure, which if not resolved to the satisfaction of Richey May would have caused Richey May to make reference to the subject matter of the disagreement with its reports on the Company's financial statements; and (ii) there were no reportable events as described in paragraph (a)(1)(v) of Item 304 of Regulation S-K.

On December 5, 2013, the Company provided Richey May with a copy of the disclosures it is making in response to Item 304 of Regulation S-K, and requested Richey May furnish it with a letter addressed to the SEC stating whether

it agrees with the above statements on From S-1 (File No. 333-192715).

During the years ended December 31, 2012 and 2011 and the subsequent interim period through June 17, 2013, the Company did not consult with KPMG regarding either (i) application of accounting principles to a specified transaction, either completed or proposed, or the type of audit opinion that might be rendered on the Company's financial statements; or (ii0 any matter that was either the subject of a disagreement (as defined in paragraph (a)(1)(iv) of Item 304 of Regulation S-K and the related instructions thereof) or a "reportable event" (as defined in Paragraph (a)(1)(v) of Item 304 Regulation S-K).

Fees and Services

The following table presents (i) the aggregate fees (including out-of-pocket expenses) for professional services rendered by KPMG during the 2013 and 2014 fiscal year for the audits of our annual financial statements and for other services, and (ii) the aggregate fees (including out-of-pocket expenses) for professional services rendered by Richey May for 2013 and 2014 and Deloitte for 2014.

|

| | | | | | | | | | | | | | | | | | | | |

| Fee Category | | Fiscal Year 2013 KPMG | | Fiscal Year 2014 KPMG | | Fiscal Year 2013 Richey May | | Fiscal Year 2014 Richey May | | Fiscal Year 2014 Deloitte |

Audit fees (1) | | $ | 581,023 |

| | $ | 550,000 |

| | $ | 204,932 |

| | $ | — |

| | $ | — |

|

Audit-related fees(2) | | $ | 835,236 |

| | $ | 333,363 |

| | $ | — |

| | $ | — |

| | $ | — |

|

Tax fees(3) | | $ | — |

| | $ | — |

| | $ | 124,395 |

| | $ | 50,470 |

| | $ | 98,334 |

|

All other fees(4) | | $ | — |

| | $ | — |

| | $ | 4,135 |

| | $ | — |

| | $ | — |

|

| Total fees | | $ | 1,416,259 |

| | $ | 883,636 |

| | $ | 333,461 |

| | $ | 50,470 |

| | $ | 983,334 |

|

| |

| (1) | Audit fees consisted principally of fees for audit work performed on our consolidated financial statements, review of quarterly financial statements, and other required audits. |

| |

| (2) | Audit-related fees consisted principally of fees for comfort letter procedures, review of registration statements and periodic reports filed with the SEC and other accounting and reporting consultation. |

| |

| (3) | Tax fees consisted principally of fees for tax compliance and tax advice. |

| |

| (4) | All other fees represent fees for advisory services. |

The Audit Committee has determined that the provision of the services identified in the table is compatible with maintaining the independence of KPMG. The Audit Committee approved 100% of the services identified in the table.

Pre-Approval Policy

The Audit Committee’s current practice on pre-approval of services performed by the independent registered public accounting firm is to require pre-approval of all audit services and permissible non-audit services. The Audit Committee reviews each non-audit service to be provided and assesses the impact of the service on the firm’s independence. In addition, the Audit Committee has delegated authority to grant certain pre-approvals to the Audit Committee Chair. Pre-approvals granted by the Audit Committee Chair are reported to the full Audit Committee at its next regularly scheduled meeting.

Board Voting Recommendation

THE BOARD RECOMMENDS THAT SHAREHOLDERS VOTE

“FOR” THE PROPOSAL TO RATIFY THE APPOINTMENT OF KPMG.

AUDIT COMMITTEE REPORT

The Audit Committee is presently composed of three directors, Richard Mirro, Richard Kraemer and J. Scott Mumphrey, all of whom are independent, as defined by the applicable rules for companies listed on the NYSE. The Audit Committee operates under a written charter adopted by the Board, a copy of which is available to shareholders on our website at www.stonegatemtg.com (select “Investor Relations” and click on “Corporate Governance”).

Management is responsible for our internal controls over the financial reporting processes. The independent registered public accounting firm is responsible for performing an independent audit of our consolidated financial statements and internal controls in accordance with auditing standards generally accepted in the United States and for issuing reports on such audit. The Audit Committee’s responsibility is to monitor and oversee these processes.

Management has represented to the Audit Committee that our consolidated financial statements were prepared in accordance with accounting principles generally accepted in the United States, and the Audit Committee has reviewed and extensively discussed the consolidated financial statements with management and KPMG, our independent registered public accounting firm.

In reviewing our fiscal 2014 audited consolidated financial statements, the Audit Committee discussed with KPMG matters required to be discussed by Statement on Auditing Standards No. 61. KPMG also provided to the Audit Committee the written disclosures required by Independence Standard No. 1 (Independence Discussions with Audit Committees), and the Audit Committee discussed with KPMG that firm’s independence.

Based upon the Audit Committee’s discussions with management and KPMG and the Audit Committee’s review of the representations of management and the reports of KPMG, the Audit Committee recommended that the Board include the audited consolidated financial statements in the Company’s Annual Report on Form 10-K for the fiscal year ended December 31, 2014.

SUBMITTED BY THE AUDIT COMMITTEE OF THE COMPANY’S BOARD OF DIRECTORS

|

| | |

| Richard A. Mirro (Chair) | J. Scott Mumphrey | Richard A. Kraemer |

EXECUTIVE COMPENSATION

Summary Compensation Table

The following table presents compensation awarded in 2014 to our principal executive officer and our two other most highly compensated persons serving as executive officers as of December 31, 2014 or paid to or accrued for those executive officers for services rendered during 2014. We refer to these executive officers as our “named executive officers.”

|

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Name & Principal Position | | Year | | Salary | | Bonus(1) | | Equity Awards(3) | | Non-equity Incentive Plan Compensation(4) | | All Other Compensation (9) | | Total |

James J. Cutillo Chief Executive Officer and Director | | 2014 | | $ | 433,333 |

| | $ | — |

| | $ | — |

| | $ | — |

| | $ | 68,241 |

| | $ | 501,574 |

|

| | 2013 | | $ | 384,377 |

| | $ | — |

| | $ | 6,498,819 |

| | $ | 153,751 |

| (5) | $ | 810,275 |

| | $ | 7,847,221 |

|

Robert B. Eastep Chief Financial Officer | | 2014 | (2) | $ | 209,376 |

| | $ | 25,000 |

| | $ | 190,170 |

| | $ | — |

| | $ | 21,534 |

| | $ | 446,080 |

|

Michael J. McElroy General Counsel and Secretary | | 2014 | (2) | $ | 275,000 |

| | $ | 85,000 |

| | $ | — |

| | $ | — |

| | $ | 19,288 |

| | $ | 379,288 |

|

| |

| (2) | Compensation for Messrs. Eastep and McElroy is provided only for 2014 because they were not a named executive officer in 2013. |

| |

| (3) | Based on the grant-date fair value of the stock options awarded to each named executive officer determined in accordance with FASB ASC Topic 718. The Company used the Black-Scholes option pricing model to estimate |

the fair value of the stock options granted on the grant date. See “Notes to Consolidated Financial Statements-18. Stock-Based Compensation” in the Company’s Annual Reports on Form 10-K for the fiscal years ended December 31, 2014 and 2013, for additional information regarding the assumptions used in the Black-Scholes option pricing model for stock options granted during 2014 and 2013.

| |

| (4) | For 2014, the Board determined that the non-equity incentive plan compensation would be zero. |

| |

| (5) | Mr. Cutillo’s employment agreement provides certain targets for his annual bonuses, as discussed below in connection with his employment agreement. All or a portion of the annual bonus, at the election of Mr. Cutillo, may be payable in shares of Common Stock in accordance with the terms of his employment agreement. |

| |

| (6) | All Other Compensation includes: for each named executive officer, company matching 401(k) contributions and disability insurance premiums; for Mr. Cutillo, HSA contributions, monthly automobile expenses, monthly country club dues, health insurance premiums and other personal travel related expenses; for Mr. Eastep, HSA contributions, monthly automobile expenses and rental and utilities costs for an apartment in Indianapolis, IN; and for Mr. McElroy, rental and utilities costs for an apartment in Indianapolis, Indiana. Mr. Cutillo also received a $250,000 bonus upon the completion of the May 2013 private equity offering and an additional $250,000 bonus upon the completion of the IPO. |

Outstanding Equity Awards at Fiscal Year End

The table below reports the number of stock options held by each of our named executive officers as of December 31, 2014.

|

| | | | | | | | | | | | | | | | | | | |

| | | | | Option Awards (1) | | Stock Awards |

| Name | | Grant Date | | Number of Securities Underlying Unexercised Options (#) Exercisable | | Number of Securities Underlying Unexercised Options (#) Unexercisable | | Option Exercise Price ($/sh) | | Option Expiration Date | | Number of Shares of or Units of Stock Granted That Have Not Vested (#) | | Market Value of Shares or Units of Stock Granted That Have Not Vested ($)(2) |

| James J. Cutillo | | 5/15/2013 | | 224,305 |

| | 672,913 |

| | 18.00 |

| | 5/15/2023 | | — |

| | — |

|

| Robert B. Eastep | | 9/24/2014 | | — |

| | 31,312 |

| | 14.04 |

| | 9/24/2024 | | — |

| | — |

|

| Michael J. McElroy | | 12/19/2013 | | — |

| | — |

| | — |

| | | | 23,474 |

| | 280,749.00 |

|

| |

| (1) | One-quarter (1/4) of the optioned shares will vest in a lump sum on each of the first, second and third anniversaries of the vesting commencement date, subject to the recipient's continued service through each anniversary. |

| |

| (2) | Per share grant date fair value of stock awards is $11.96. |

Bonuses

The Company maintains an annual bonus program (the “Annual Incentive Plan”). Participants in the Annual Incentive Plan are selected by the Board after being recommended for participation by the Chief Executive Officer. The Board sets a maximum bonus payout based on a participant’s salary, establishes performance goals for each participant and determines whether such goals have been met for the annual performance period pursuant to the terms of the plan. Our Board relies primarily on the judgment of its members in making bonus determinations after reviewing our performance and financial condition for the year and carefully evaluating an executive officer’s performance during the year. In addition, our Board considers an executive officer’s leadership qualities, business responsibilities and length of career with us in determining an appropriate bonus amount. To date, bonuses for our executive officers have been approved by our Board on a discretionary basis in those instances where it desires to reward outstanding performance during the fiscal year by our executive officers.

Employment Arrangements

Employment Agreement with Mr. Cutillo. We have entered into an employment agreement with Mr. Cutillo, which became effective on March 9, 2012, and was amended on May 14, 2013. The agreement’s term expires on May 14, 2015, with subsequent automatic two-year renewals, unless either party provides the other with at least 60 days’ prior notice of non-renewal. During the term of the agreement, Mr. Cutillo will serve as our Chief Executive Officer and the Company will nominate him to serve as a member of the Board.

Material terms of the employment agreement include:

| |

| • | an annual base salary of $400,000, reconsidered for an increase annually by the Board, provided that Mr. Cutillo’s base salary for any year shall not be less than his base salary for the prior year unless the decrease is part of a company payroll reduction policy and the decrease is not disproportionate to that of other executives; |

| |

| • | eligibility for annual cash performance bonuses of up to 200% of base salary, as discussed below; |

| |

| • | eligibility for grants of awards under the Amended and Restated 2011 Omnibus Incentive Plan, as amended, and the 2013 Omnibus Incentive Compensation Plan at the sole discretion of the Board; and |

| |

| • | participation in our benefit plans on the same basis as our other senior executives, with full payment of Mr. Cutillo’s health insurance premiums to the extent permitted by tax law (and if not permitted, a cash payment intended to cover the cost of such premiums). |

During 2012 and through April 1, 2013, Mr. Cutillo’s annual rate of base salary was $300,000. In response to a salary survey of our industry peers during 2012, the Board reviewed our total executive compensation levels and determined to target our total executive compensation between the 50th and 75th percentile of our peer group. As a result, upon amending Mr. Cutillo’s employment agreement on May 14, 2013, his annual rate of base salary was increased to $400,000 in order to position his total compensation within the range targeted relative to our peer group.

Mr. Cutillo’s employment agreement provides for an annual bonus based on financial targets and strategic goals. Fifty percent of the annual bonus will be based on the achievement of financial targets, and 50% will be based on strategic goals, as specified by the Board for the calendar year. Mr. Cutillo will receive a bonus payment equal to 50% of his base salary if we achieve or exceed the “budgeted targets” and 100% of his base salary if we achieve or exceed the “stretch targets” (as defined in the employment agreement) based on net income and EBITDA as set forth in the annual budget for the calendar year. If net income and EBITDA fall between the budgeted targets and the stretch targets, Mr. Cutillo will receive an amount equal to between 50% and 100% of base salary determined based on straight-line interpolation. All or a portion of the annual bonus, at the election of Mr. Cutillo, may be payable in Common Stock, in accordance with the terms set forth in his employment agreement.

Prior to our IPO, Mr. Cutillo would have been eligible for a special one-time payment (the “Designated Payment”) upon the earlier to occur of (1) certain designated sales of the Company (excluding an IPO) or (2) Mr. Cutillo’s termination of employment for any reason prior to our IPO. The amount of the Designated Payment that could have become payable ranged from $1,000,000 to $2,250,000 depending on the Company’s share price received in connection with either the designated sale or on the last day of Mr. Cutillo’s employment, as applicable, and would have been subject to a four-year vesting schedule, with accelerated vesting upon a Change in Control (as defined below in “Executive Compensation-Awards to Mr. Cutillo; Other Awards to Senior Management “). Mr. Cutillo’s entitlement to the Designated Payment terminated upon the completion of our IPO and no amounts were paid in respect thereof. Mr. Cutillo received a special, one-time bonus equal to $250,000 upon the completion of the IPO in October 2013 and a similar one-time cash bonus of $250,000 upon the completion of the May 2013 private offering. These amounts are reported in the “All Other Compensation” column of the Summary Compensation Table.

If we terminate Mr. Cutillo’s employment for “cause,” he will be entitled to receive his annual base salary through the termination date, reimbursement for any unreimbursed business expenses incurred in accordance with Company policy prior to the date of termination, and such employee benefits, if any, as to which he has a vested right under the terms and conditions of the employee benefit plans or policies of the Company, all reduced by amounts owed by Mr. Cutillo to the Company, and Mr. Cutillo’s earned but unused vacation (the “Cutillo Accrued Payments”), but thereafter will have no further rights under the employment agreement. “Cause” generally means failure to exercise duties after written notice, dishonest actions including fraud and embezzlement, conviction of certain crimes, excessive alcohol use in the workplace, use of illegal drugs, misconduct that might subject us to liability, breach of duty of loyalty, Mr.

Cutillo’s breach of his employment agreement or any other agreement with us, insubordination, or being found guilty by a court of law of discrimination or harassment of any employee.

If Mr. Cutillo resigns without “good reason,” he will be entitled to receive his annual base salary through the termination date and payment of the Cutillo Accrued Payments. “Good reason” generally means a diminution in Mr. Cutillo’s base salary (other than a diminution resulting from a payroll reduction policy generally impacting all Company employees or generally impacting all senior executives of the Company and the decrease to Mr. Cutillo’s base salary is not materially disproportionate to the percentage decrease in salary applicable to other senior executives of the Company), a material diminution in Mr. Cutillo’s authority, duties or responsibilities that typically would result in Mr. Cutillo no longer being the CEO or reporting to the Board of a similarly situated company, a material change in the geographic location in which Mr. Cutillo must work or any other action of the Company constituting a material breach of the employment agreement, or Mr. Cutillo no longer serving on the Board.

If we terminate Mr. Cutillo’s employment without “cause” (other than by reason of death or disability) or Mr. Cutillo resigns for “good reason,” in each case as provided by the employment agreement, he will be entitled to receive his annual base salary through the termination date, payment of the Cutillo Accrued Payments, the annual bonus earned by Mr. Cutillo and, subject to the execution of a release of claims in favor of us, continuation for one year of his then current base salary, paid in semi-monthly payments over a period of twelve months in accordance with our standard payroll policy.

If Mr. Cutillo is terminated by us due to “disability” (as defined in the employment agreement) or dies during the term of the agreement, he or his estate will, in each case, be entitled to his annual base salary through the termination date, payment of the Cutillo Accrued Payments and any annual bonus earned by Mr. Cutillo.

Prior to the expiration of any market-standoff or lock-up period imposed on Mr. Cutillo in connection with our IPO, Mr. Cutillo had the right to cause us to repurchase all of the shares of our capital stock and all “eligible stock options” (as defined in the employment agreement) owned beneficially or of record by him upon his resignation, “disability,” death or termination without “cause,” or the acquisition of our Company by a third-party that is primarily engaged in a business that is not the core business of our Company. If Mr. Cutillo had exercised this put option, he would have sold the shares to us at a purchase price equal to the product of (a) the number of purchased shares held by Mr. Cutillo on the date of purchase and (b) the per share “market value” (as defined in the employment agreement) as of the date he delivered written notice to us exercising the option. The lock-up period imposed on Mr. Cutillo in connection with our IPO expired on April 7, 2014 and Mr. Cutillo’s put option terminated on the same day.

The employment agreement also contains a confidentiality provision, which applies indefinitely, non-competition restrictions which apply during the term of the employment agreement and for one year following Mr. Cutillo’s termination for any reason and customer and employee non-solicitation restrictions which apply for two years following Mr. Cutillo’s termination for any reason.

Employment Agreement with Mr. Eastep. We have entered into an employment agreement with Mr. Eastep, which became effective on August 7, 2014. The agreement provides for at-will employment, meaning that either we or Mr. Eastep can terminate the agreement at any time for any or no reason. During the term of the agreement, Mr. Eastep will serve as our President.

Material terms of the employment agreement include:

| |

| • | an annual base salary of $325,000, redetermined annually by the Board; |

| |

| • | a one-time discretionary bonus of $25,000; |

| |

| • | a one-time grant of stock options under the 2013 Plan with a grant-date fair value equal to $190,170; |

| |

| • | eligibility for annual cash performance bonuses of up to 200% of base salary, as determined by the Board in its sole discretion, payable in cash or grants of stock, as determined by the Board; |

| |

| • | participation in our benefit plans on the same basis as peer executives. |