Registration Statement No. 333 -

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM F-3

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

Star Bulk Carriers Corp.

(Exact name of registrant as specified in its charter)

Republic of the Marshall Islands (State or other jurisdiction of incorporation or organization) | N/A (I.R.S. Employer Identification No.) |

7, Fragoklisias Street, 2nd floor Maroussi 151 25 Athens, Greece 011-30-210-617-8400 (Address and telephone number of Registrant’s principal executive offices) | Seward & Kissel LLP Attention: Gary J. Wolfe, Esq. One Battery Park Plaza New York, New York 10004 (212) 574-1200 (Name, address and telephone number of agent for service) |

Copies to:

Gary J. Wolfe, Esq. Robert E. Lustrin, Esq. Seward & Kissel LLP One Battery Park Plaza New York, New York 10004 (212) 574-1200 |

Approximate date of commencement of proposed sale to the public:

From time to time after this registration statement becomes effective as determined by market conditions and other factors.

If the only securities being registered on this Form are being offered pursuant to dividend or interest reinvestment plans, please check the following box. o

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box. x

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

If this Form is a registration statement pursuant to General Instruction I.C. or a post-effective amendment thereto that shall become effective upon filing with the Commission pursuant to Rule 462(e) under the Securities Act, check the following box. o

If this Form is a post-effective amendment to a registration statement filed pursuant to General Instruction I.C. filed to register additional securities or additional classes of securities pursuant to Rule 413(b) under the Securities Act, check the following box. o

CALCULATION OF REGISTRATION FEE

Title of Each Class of Securities to be Registered | Amount to be Registered (1) | Proposed Maximum Aggregate Offering Price (2) | Amount of Registration Fee |

Primary Offering | |||

| Common Shares, par value $0.01 per share | |||

| Preferred Shares, par value $0.01 per share (3) | |||

| Debt Securities (3)(4) | |||

| Guarantees(5) | |||

| Warrants(6) | |||

| Purchase Contracts(7) | |||

| Units(8) | |||

| Primary Offering Total | $250,000,000 | $9,825.00 | |

Secondary Offering | |||

| Common Shares, par value $0.01 per share, to be offered by certain selling shareholders | 14,305,599 (11) | 40,341,789 (9) | 1,585.43 (9) |

| Warrants | 1,132,500 | 226,500 (10) | 8.90 (10) |

| Secondary Offering Total | 15,438,099 | 40,568,289 | 1,594.33 |

TOTAL | 290,568,289 | 11,419.33 |

| (1) | Such amount in U.S. dollars or the equivalent thereof in foreign currencies as shall result in an aggregate initial public offering price for all securities of $250,000,000. |

| (2) | Estimated solely for the purpose of calculating the registration fee pursuant to Rule 457(o) under the Securities Act of 1933. Pursuant to General Instruction II(C) of Form F-3, the table does not specify by each class information as to the proposed maximum aggregate offering price Any securities registered hereunder may be sold separately or as units with other securities registered hereunder. In no event will the aggregate offering price of all securities sold by Star Bulk Carriers Corp. pursuant to this registration statement exceed $250,000,000. |

| (3) | Also includes such indeterminate amount of debt securities and number of preferred shares and common shares as may be issued upon conversion of or in exchange for any other debt securities or preferred shares that provide for conversion or exchange into other securities. |

| (4) | If any debt securities are issued at an original issue discount, then the offering may be in such greater principal amount as shall result in a maximum aggregate offering price not to exceed $250,000,000. |

| (5) | The debt securities may be guaranteed pursuant to guarantees by the subsidiaries of Star Bulk Carriers Corp. No separate compensation will be received for the guarantees. Pursuant to Rule 457(n), no separate fees for the guarantees are payable. |

| (6) | There is being registered hereunder an indeterminate number of warrants as may from time to time be sold at indeterminate prices. |

| (7) | There is being registered hereunder an indeterminate number of purchase contracts as may from time to time be sold at indeterminate prices. |

| (8) | There is being registered hereunder an indeterminate number of units as may from time to time be sold at indeterminate prices. Units may consist of any combination of the securities registered hereunder. |

| (9) | Pursuant to Rule 457(c), the offering price and registration fee are computed based on the average of the high and low prices of the common stock of Star Bulk Carriers Corp. on the Nasdaq Global Market on January 15, 2009. |

| (10) | Pursuant to Rule 457(c), the offering price and registration fee are computed based on the average of the high and low prices of the warrants of Star Bulk Carriers Corp. on the Nasdaq Global Market on January 15, 2009. |

| (11) | Includes 1,132,500 common shares which may be issued upon the exercise of the warrants issued pursuant to the Private Placement (defined below). |

TABLE OF ADDITIONAL REGISTRANTS

Exact Name of Registrant as Specified in its Charter | Country of Formation | IRS Employer I.D. No. | Primary Standard Industrial Classification Code No. |

| Star Bulk Management Inc. | Marshall Islands | N/A | 4412 |

| Star Alpha LLC | Marshall Islands | N/A | 4412 |

| Star Beta LLC | Marshall Islands | N/A | 4412 |

| Star Gamma LLC | Marshall Islands | N/A | 4412 |

| Star Delta LLC | Marshall Islands | N/A | 4412 |

| Star Epsilon LLC | Marshall Islands | N/A | 4412 |

| Star Zeta LLC | Marshall Islands | N/A | 4412 |

| Star Theta LLC | Marshall Islands | N/A | 4412 |

| Star Iota LLC | Marshall Islands | N/A | 4412 |

| Star Kappa LLC | Marshall Islands | N/A | 4412 |

| Lamda LLC | Marshall Islands | N/A | 4412 |

| Star Omicron LLC | Marshall Islands | N/A | 4412 |

| Star Cosmo LLC | Marshall Islands | N/A | 4412 |

| Star Ypsilon LLC | Marshall Islands | N/A | 4412 |

PROSPECTUS

| The information in this prospectus is not complete and may be changed. These securities may not be sold until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any state where the offer or sale is not permitted. |

Subject to completion, dated January 21, 2009

$250,000,000

Common Shares, Preferred Shares, Debt Securities,

Warrants, Purchase Contracts and Units

And

14,305,599 of our Common Shares and 1,132,500 of our Warrants Offered by Selling Shareholders

Through this prospectus, we may periodically offer:

(1) our common shares,

(2) our preferred shares,

(3) our debt securities, including guaranteed debt securities,

(4) our warrants,

(5) our purchase contracts, and

(6) our units.

The aggregate offering price of all securities issued under this prospectus, which in no case will exceed the total number of authorized but unissued common shares or preferred shares under our then existing amended and restated articles of incorporation, may not exceed $250.0 million. In addition, the selling shareholders named in the section “Selling Shareholders” may sell in one or more offerings pursuant to this registration statement up to 14,305,599 of our common shares, which includes up to 1,132,500 our common shares which may be issued upon the exercise of the warrants and up to 1,132,500 of our warrants that were previously acquired in private transactions. We will not receive any of the proceeds from the sale of either of our common shares or our warrants by the selling shareholders.

Our common shares and warrants are currently listed on Nasdaq Global Market under the symbols “SBLK” and “SBLKW,” respectively.

The securities issued under this prospectus may be offered directly or through underwriters, agents or dealers. The names of any underwriters, agents or dealers will be included in a supplement to this prospectus.

An investment in these securities involves risks. See the section entitled “Risk Factors” beginning on page 7 of this prospectus, and other risk factors contained in the applicable prospectus supplement and in the documents incorporated by reference herein and therein.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The date of this prospectus is

TABLE OF CONTENTS

| PROSPECTUS SUMMARY | 2 |

RISK FACTORS | 6 |

| RECENT DEVELOPMENTS | & #160; 21 |

| THE INTERNATIONAL DRY BULK SHIPPING INDUSTRY | 29 |

| CAUTIONARY STATEMENT REGARDING FORWARD LOOKING STATEMENTS | 40 |

| PER SHARE MARKET PRICE INFORMATION | 41 |

| PER SHARE MARKET PRICE INFORMATION | 42 |

| USE OF PROCEEDS | 43 |

| CAPITALIZATION | 44 |

| ENFORCEMENT OF CIVIL LIABILITIES | 45 |

| SELLING SHAREHOLDERS | 46 |

| PLAN OF DISTRIBUTION | 48 |

| DESCRIPTION OF CAPITAL STOCK | 50 |

| DESCRIPTION OF OTHER SECURITIES | 52 |

| EXPENSES | 61 |

| LEGAL MATTERS | 62 |

| EXPERTS | 63 |

| INDUSTRY AND MARKET DATA | 64 |

| WHERE YOU CAN FIND ADDITIONAL INFORMATION | 65 |

| INDEX TO AUDITED FINANCIAL STATEMENTS | F-1 |

Unless otherwise indicated, all dollar references in this prospectus are to U.S. dollars and financial information presented in this prospectus that is derived from financial statements incorporated by reference is prepared in accordance with accounting principles generally accepted in the United States.

This prospectus is part of a registration statement that we filed with the U.S. Securities and Exchange Commission, or the Commission, using a shelf registration process. Under the shelf registration process, we may sell the common shares, preferred shares, debt securities (and related guarantees), warrants, purchase contracts and units described in this prospectus in one or more offerings up to a total dollar amount of $250.0 million. In addition, the selling shareholders may sell in one or more offerings pursuant to this registration statement up to 14,305,599 of our common shares and up to 1,132,500 of our warrants that were previously acquired in private transactions. This prospectus provides you with a general description of the securities we or any selling shareholder may offer. Each time we or a selling shareholder offer securities, we will provide you with a prospectus supplement that will describe the specific amounts, prices and terms of the offered securities. The prospectus supplement may also add, update or change the information contained in this prospectus. You should read carefully both this prospectus and any prospectus supplement, together with the additional information described below.

This prospectus does not contain all the information provided in the registration statement we filed with the Commission. For further information about us or the securities offered hereby, you should refer to that registration statement, which you can obtain from the Commission as described below under “Where You Can Find More Information.”

PROSPECTUS SUMMARY

Unless we otherwise specify, when used in this prospectus, the terms “Star Bulk Carriers Corp.,” “Star Bulk,” “Company,” “we,” “us,” and “our” refer to Star Bulk Carriers Corp. and its subsidiaries. Our functional currency is in the U.S. dollar as all of our revenues are received in U.S. dollars and a majority of our expenditures are made in U.S. dollars. All references in this prospectus to “$” or “dollars” are to U.S. dollars.

Our Company

We are an international company providing worldwide transportation of drybulk commodities through our vessel-owning subsidiaries for a broad range of customers of major and minor bulk cargoes including iron ore, coal, grain, cement and fertilizer. We were incorporated in the Marshall Islands on December 13, 2006 as a wholly-owned subsidiary of Star Maritime Acquisition Corp., or Star Maritime. We merged with Star Maritime on November 30, 2007 and commenced operations on December 3, 2007, which was the date we took delivery of our first vessel.

We maintain our principal executive offices at 7, Fragoklisias Street, 2nd floor, Maroussi 151 25, Athens, Greece. Our telephone number at that address is 011-30-210-617-8400.

Our Fleet

We own and operate a fleet of 12 vessels consisting of four Capesize and eight Supramax drybulk carriers with an average age of 9.7 years and a combined cargo carrying capacity of approximately 1.1 million dwt.

Our fleet carries a variety of drybulk commodities including coal, iron ore, and grains, or major bulks, as well as bauxite, phosphate, fertilizers and steel products, or minor bulks. We charter all of our vessels under medium- to long-term time charters with terms of approximately one to five years, other than the Star Beta and the Star Sigma, which are currently employed in the spot market.

The following table represents a list of all of the vessels in our fleet as of January 8, 2009:

Vessel Name | Vessel Type | Size (dwt.) | Year Built | Average Daily Hire Rate | Type/ Remaining Term | Vessel Delivery Date | ||||||

Star Alpha (ex A Duckling)(1) | Capesize | 175,075 | 1992 | $47,500 | Time charter/0.5 year | January 9, 2008 | ||||||

Star Beta (ex B Duckling) | Capesize | 174,691 | 1993 | N/A | Spot | December 28, 2007 | ||||||

Star Gamma (ex C Duckling) | Supramax | 53,098 | 2002 | $28,500 | Time charter/0.05 year | January 4, 2008 | ||||||

Star Delta (ex F Duckling) | Supramax | 52,434 | 2000 | $25,800 | Time charter/0.1 year | January 2, 2008 | ||||||

Star Epsilon (ex G Duckling) | Supramax | 52,402 | 2001 | $25,550 | Time charter/0.06 year | December 3, 2007 | ||||||

Star Zeta (ex I Duckling) | Supramax | 52,994 | 2003 | $42,500 | Time charter/2.2 years | January 2, 2008 | ||||||

Star Theta (ex J Duckling) | Supramax | 52,425 | 2003 | $32,500 | Time charter/0.2 year | December 6, 2007 | ||||||

Star Kappa (ex E Duckling) | Supramax | 52,055 | 2001 | $47,800 | Time charter/1.6 years | December 14, 2007 | ||||||

Star Sigma (ex Sinfonia) | Capesize | 184,403 | 1991 | N/A | Spot | April 15, 2008 | ||||||

Star Omicron (ex Nord Wave) | Supramax | 53,489 | 2005 | $43,000 | Time charter/2.1 years | April 17, 2008 | ||||||

Star Cosmo (ex Victoria) | Supramax | 52,247 | 2005 | $39,868 | Time charter/2.3 years | July 1, 2008 | ||||||

Star Ypsilon (ex Falcon Cape) | Capesize | 150,940 | 1991 | $91,932 | Time charter/2.5 years | September 18, 2008 | ||||||

Recently Sold | ||||||||||||

Star Iota (ex Mommy Duckling)(2) | Panamax | 78,585 | 1983 | $18,000 | March 7, 2008 | |||||||

| (1) | The Star Alpha is currently off-hire and undergoing unscheduled repairs. We expect the total period for which this vessel is off-hire for such repairs to be approximately 25 days. |

| (2) | On April 24, 2008, we entered into an agreement to sell Star Iota for gross proceeds of $18.4 million. We delivered this vessel to its purchasers on October 6, 2008. |

2

Certain Risks

Our business depends on our ability to manage a number of risks relating to our industry and our operations. These risks include the following:

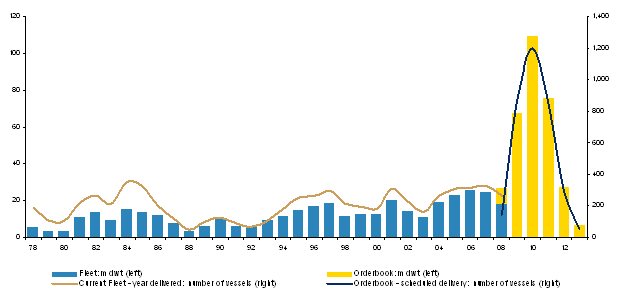

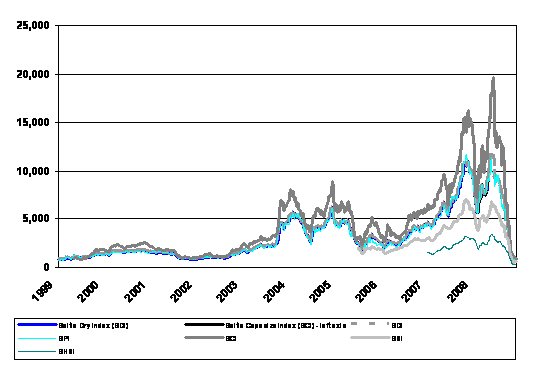

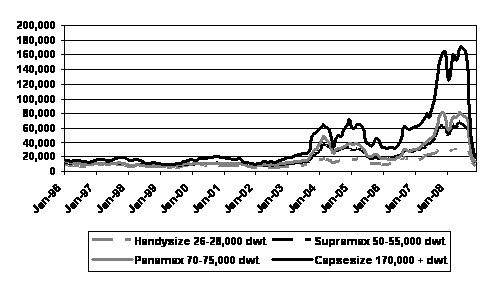

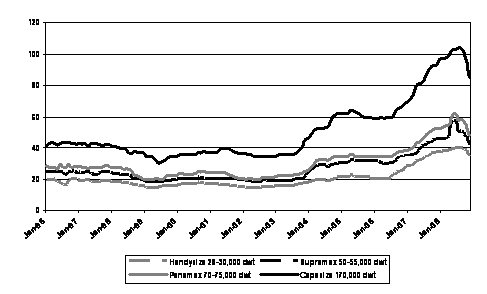

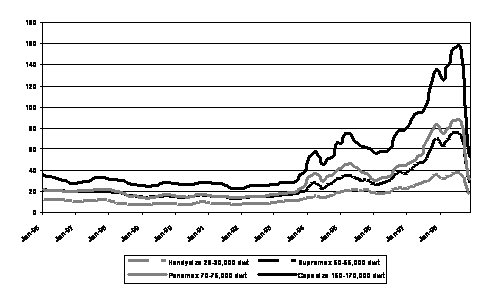

| ● | Cyclical nature of charter hire rates. The cyclical nature of the drybulk shipping industry and the volatility in charter hire rates for our vessels may affect our ability to successfully charter our vessels in the future or renew existing charters at rates sufficient to allow us to meet our obligations or to pay dividends. Charter rates are affected by, among other factors, the demand for carriage of drybulk cargo and the supply of drybulk vessels in the global fleet, which, according to Drewry, as of November 2008, amounted to 70.6% of the existing drybulk carried fleet based on current newbuilding orders. Charter hire rates have decreased sharply from their historical highs and the value of secondhand vessels has also decreased sharply from their historically high levels. The Baltic Dry Index, or BDI, a daily average of charter rates in 26 shipping routes measured on a time charter and voyage basis and covering Supramax, Panamax, and Capesize drybulk carriers, has fallen over 94% from May 2008 through December 8, 2008 |

● | Our operations are subject to international laws and regulations. Our business and the operation of our vessels are materially affected by applicable government regulation in the form of international conventions and national, state and local laws and regulations. Because such conventions, laws, and regulations are often revised, we cannot predict the ultimate cost of complying with them or with additional regulations that may be applicable to our operations that are adopted in the future. |

● | Servicing our current and future debt limits funds available for other purposes, including the payment of dividends. To finance our future fleet expansion, we expect to incur additional secured debt. We must dedicate a portion of our cash flow from operations to pay the principal and interest on our debt. These payments limit funds otherwise available for working capital, capital expenditures and other purposes and may limit funds available for other purposes, including distributing cash to our shareholders, and our inability to service debt could lead to acceleration of our debt payments and foreclosure on our fleet. |

Prospective investors in our securities should also carefully consider the factors set forth in the section of this prospectus entitled “Risk Factors” beginning on page 7.

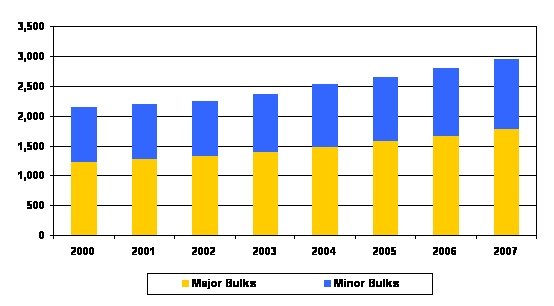

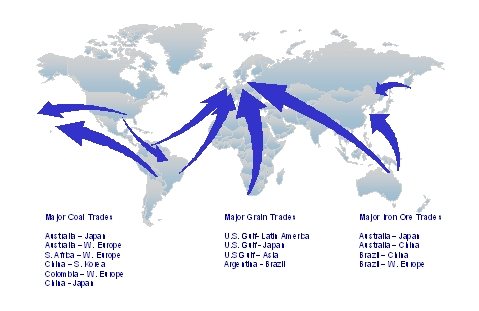

Drybulk Shipping Industry Trends

The maritime shipping industry is fundamental to international trade with ocean-going vessels representing the most efficient and often the only method of transporting large volumes of many essential commodities, finished goods and crude and refined petroleum products between the continents and across the seas. It is a global industry whose performance is closely tied to the level of economic activity in the world.

The drybulk shipping industry involves the carriage of bulk commodities. According to Drewry Shipping Consultants, Ltd., or Drewry, charter hire rates have fallen sharply from the highs recorded in 2008. The Baltic Dry Index, or BDI, a daily average of charter rates in 26 shipping routes measured on a time charter and voyage basis and covering Supramax, Panamax, and Capesize drybulk carriers, declined from a high of 11,793 in May 2008 to 920 on January 14, 2009 after reaching a low of 663 in December 2008, which represents a decline of 92%. The BDI fell over 70% in October alone.

We currently employ two of our vessels in the spot market. Their charters will expire over the next month. Vessels trading in the spot market are exposed to increased risk of declining charter rates and freight rate volatility compared to vessels employed on time charters. Since mid-August 2008, the spot day rates in the drybulk charter market have declined very significantly, and drybulk vessel values have also declined both as a result of a slowdown in the availability of global credit and the significant deterioration in charter rates. Charter rates and vessel values have been affected in part by the lack of availability of credit to finance both vessel purchases and purchases of commodities carried by sea, resulting in a decline in cargo shipments, and the excess supply of iron ore in China which resulted in falling iron ore prices and increased stockpiles in Chinese ports.

3

Capesize rates, which averaged $100,000/day in August 2008, fell to an average of approximately $10,334 per day during the fourth quarter through December 2008. We believe that the root cause of the fall has been a sharp slowdown in Chinese steel demand and prices leading to reduced demand for iron ore. Iron ore price negotiations between Companhia Vale do Rio Doce and Chinese steel mills in the third and fourth quarter of 2008 resulted in a number of Chinese mills turning to domestic mining companies for iron ore. Additionally, the unwillingness of banks to issue letters of credit resulted in reduced financing for the purchase of commodities carried by sea which has led to a significant decline in cargo shipments.

Corporate Structure

Star Bulk is a holding company that owns its vessels through separate wholly-owned subsidiaries. Star Bulk’s wholly-owned subsidiary, Star Bulk Management, performs operational and technical management services for all of our vessels, including chartering, marketing, making capital expenditures, managing personnel, accounting, paying vessel taxes and maintaining insurance.

Star Maritime Acquisition Corp., or Star Maritime, was organized under the laws of the State of Delaware on May 13, 2005 as a blank check company formed to acquire, through a merger, capital stock exchange, asset acquisition or similar business combination, one or more assets or target businesses in the shipping industry. Following the formation of Star Maritime, our officers and directors were the holders of 9,026,924 shares of common stock representing all of our then issued and outstanding capital stock. On December 21, 2005, Star Maritime consummated its initial public offering of 18,867,500 units, at a price of $10.00 per unit, each unit consisting of one share of Star Maritime common stock and one warrant to purchase one share of Star Maritime common stock at an exercise price of $8.00 per share. In addition, Star Maritime completed during December 2005 a private placement of an aggregate of 1,132,500 units, or the Private Placement, each unit consisting of one share of common stock and one warrant, to Messrs. Tsirigakis and Syllantavos, our Chief Executive Officer and Chief Financial Officer, respectively, and Messrs. Pappas and Erhardt, our Chairman of the Board and one of our directors. The gross proceeds of the Private Placement of $11.3 million were used to pay all fees and expenses of the initial public offering and as a result, the entire gross proceeds of the initial public offering amounting to $188.7 million were deposited in a trust account maintained by American Stock Transfer & Trust Company, or the Trust Account. Star Maritime’s common stock and warrants started trading on the American Stock Exchange under the symbols, SEA and SEA.WS, respectively on December 21, 2005.

On January 12, 2007, Star Maritime and Star Bulk entered into definitive agreements to acquire a fleet of eight drybulk carriers with a combined cargo-carrying capacity of approximately 692,000 dwt. from certain subsidiaries of TMT Co. Ltd., or TMT, a shipping company headquartered in Taiwan. These eight drybulk carriers are referred to as the initial fleet, or initial vessels. The aggregate purchase price specified in the Master Agreement by and among the Company, Star Maritime and TMT, or the Master Agreement for the initial fleet was $224.5 million in cash and 12,537,645 shares of common stock of Star Bulk. As additional consideration for eight vessels, we agreed to issue 1,606,962 shares of common stock of Star Bulk to TMT in two installments as follows: (i) 803,481 additional shares of Star Bulk’s common stock, no more than 10 business days following Star Bulk’s filing of its Annual Report on Form 20-F for the fiscal year ended December 31, 2007, and (ii) 803,481 additional shares of Star Bulk’s common stock, no more than 10 business days following Star Bulk’s filing of its Annual Report on Form 20-F for the fiscal year ended December 31, 2008. The shares in respect of the first installment were issued to a nominee of TMT on July 17, 2008.

On November 2, 2007, the U.S. Securities and Exchange Commission, SEC or Commission, declared effective our joint proxy/registration statement filed on Forms F-1/F-4 and on November 27, 2007 we obtained shareholder approval for the acquisition of the initial fleet and for effecting the Redomiciliation Merger as a result of which Star Maritime merged into Star Bulk with Star Maritime merging out of existence and Star Bulk being the surviving entity. Each share of Star Maritime common stock was exchanged for one share of Star Bulk common stock and each warrant of Star Maritime was assumed by Star Bulk with the same terms and conditions except that each became exercisable for common stock of Star Bulk. The Redomiciliation Merger became effective after stock markets closed on Friday, November 30, 2007 and the common shares and warrants of Star Maritime ceased trading on the American Stock Exchange under the symbols SEA and SEAU, respectively. Star Bulk shares and warrants started trading on the Nasdaq Global Market on Monday, December 3, 2007 under the ticker symbols SBLK and SBLKW, respectively. Immediately following the effective date of the Redomiciliation Merger, TMT and its affiliates owned 30.2% of Star Bulk’s outstanding common stock.

4

We began our operations on December 3, 2007 with the delivery of our first vessel the Star Epsilon. Of the initial fleet of eight drybulk vessels Star Bulk agreed to acquire, three of such eight vessels were delivered by the end of December 2007. Additionally, on December 3, 2007, we entered into an agreement to acquire an additional Supramax vessel, the Star Kappa from TMT, which was not included in the initial fleet and was delivered to us on December 14, 2007. As noted above, on July 17, 2008, we issued 803,481 additional shares to TMT as the first installment of additional shares in accordance with the Master Agreement.

We maintain our principal executive offices at 7, Fragoklisias Street, 2nd floor, Maroussi 151 25, Athens, Greece. Our telephone number at that address is 30-210-617-8400.

The Securities We May Offer

We may use this prospectus to offer up to $250.0 million of:

● | common shares, |

● | preferred shares, |

● | debt securities, including guaranteed debt securities, |

● | warrants, |

● | purchase contracts, or |

● | units. |

We may also offer securities of the types listed above that are convertible or exchangeable into one or more of the securities listed above.

Our debt securities may be guaranteed pursuant to guarantees by our subsidiaries.

In addition, the selling shareholders named in this prospectus or in a prospectus supplement to the registration statement of which this prospectus is a part may sell in one or more offerings pursuant to this registration statement up to 14,305,599 of our common shares and up to 1,132,500 of our warrants that were previously acquired in private transactions. We will not receive any proceeds from the sale of either of our common shares or our warrants sold by the selling shareholders.

A prospectus supplement will describe the specific types, amounts, prices, and detailed terms of any of these offered securities and may describe certain risks in addition to those set forth below associated with an investment in the securities. Terms used in the prospectus supplement will have the meanings described in this prospectus, unless otherwise specified.

5

RISK FACTORS

An investment in our securities involves a high degree of risk. You should carefully consider the following risks, the risks and the discussion of risks under the heading “Risk Factors” in our annual report on Form 20-F for the year ended December 31, 2007, and the documents we have incorporated by reference in this prospectus that summarize the risks that may materially affect our business before making an investment in our securities. Please see “Where You Can Find Additional Information – Information Incorporated by Reference.” In addition, you should also consider carefully the risks set forth under the heading “Risk Factors” in any prospectus supplement before investing in any securities offered by this prospectus. The occurrence of one or more of those risk factors could adversely impact our results of operations or financial condition.

Industry Specific Risk Factors

Charterhire rates for drybulk carriers are volatile and may decrease in the future, which would adversely affect our earnings and ability to pay dividends

The drybulk shipping industry is cyclical with attendant volatility in charterhire rates and profitability. The degree of charterhire rate volatility among different types of drybulk carriers varies widely. According to Drewry, charterhire rates for Capesize, Panamax and Supramax drybulk carriers have decreased sharply from their historically high levels. The Baltic Dry Index, or BDI, a daily average of charter rates in 26 shipping routes measured on a time charter and voyage basis and covering Supramax, Panamax, and Capesize drybulk carriers, fell over 92% from May 2008 through January 14, 2009, including a decline of over 70% in October 2008 alone. The decline in charter rates is due to various factors, including the economic recession in the U.S. and other parts of the world, the lack of trade financing for purchases of commodities carried by sea, which has resulted in a significant decline in cargo shipments, and the excess supply of iron ore in China which has resulted in falling iron ore prices and increased stockpiles in Chinese ports. If the drybulk shipping market remains depressed in the future our earnings and available cash flow may decrease. Our ability to re-charter our vessels on the expiration or termination of their current time charters and the charter rates payable under any renewal or replacement charters will depend upon, among other things, economic conditions in the drybulk shipping market. Fluctuations in charter rates and vessel values result from changes in the supply and demand for drybulk cargoes carried internationally at sea, including coal, iron, ore, grains and minerals.

The factors affecting the supply and demand for vessel capacity are outside of our control, and the nature, timing and degree of changes in industry conditions are unpredictable.

The factors that influence demand for vessel capacity include:

● | demand for and production of drybulk products; |

● | global and regional economic and political conditions; |

● | the distance drybulk cargo is to be moved by sea; and |

● | changes in seaborne and other transportation patterns. |

The factors that influence the supply of vessel capacity include:

● | the number of new building deliveries; |

● | port and canal congestion; |

● | the scrapping of older vessels; |

● | vessel casualties; and |

● | the number of vessels that are out of service. |

We anticipate that the future demand for our drybulk carriers will be dependent upon continued economic growth in the world’s economies, including China and India, seasonal and regional changes in demand, changes in the capacity of the global drybulk carrier fleet and the sources and supply of drybulk cargo to be transported by sea. The capacity of the global drybulk carrier fleet seems likely to increase and economic growth may not continue. Adverse economic, political, social or other developments could also have a material adverse effect on our business and operating results.

6

Sharp declines in the spot drybulk charter market may affect our earnings and cash flows from the two vessels we operate in the spot market

We currently employ two of our vessels in the spot market. Their charters will expire over the next month. Vessels trading in the spot market are exposed to increased risk of declining charter rates and freight rate volatility compared to vessels employed on time charters. Since mid-August 2008, the spot day rates in the drybulk charter market have declined very significantly, and drybulk vessel values have also declined both as a result of a slowdown in the availability of global credit and the significant deterioration in charter rates. Charter rates and vessel values have been affected in part by the lack of availability of credit to finance both vessel purchases and purchases of commodities carried by sea, resulting in a decline in cargo shipments, and the excess supply of iron ore in China which resulted in falling iron ore prices and increased stockpiles in Chinese ports. There can be no assurance as to how long charter rates and vessel values will remain at their currently low levels or whether they will improve to any significant degree. Charter rates may remain at depressed levels for some time which will adversely affect our revenue and profitability.

The market values of our vessels have declined and may further decrease, which could limit the amount of funds that we can borrow or trigger certain financial covenants under our current or future credit facilities and/or we may incur a loss if we sell vessels following a decline in their market value

The fair market values of our vessels have generally experienced high volatility and have recently declined significantly. According to Drewry, the market prices for secondhand Capesize, Panamax and Supramax drybulk carriers have recently decreased sharply from their historically high levels.

The fair market value of our vessels may continue to fluctuate (i.e., increase and decrease) depending on a number of factors including:

● | prevailing level of charter rates; |

● | general economic and market conditions affecting the shipping industry; |

● | types and sizes of vessels; |

● | supply and demand for vessels; |

● | other modes of transportation; |

● | cost of newbuildings; |

● | governmental or other regulations; and |

● | technological advances. |

In addition, as vessels grow older, they generally decline in value. If the fair market value of our vessels declines, we may not be in compliance with certain provisions of our term loans and we may not be able to refinance our debt or obtain additional financing. In addition, if we sell one or more of our vessels at a time when vessel prices have fallen and before we have recorded an impairment adjustment to our consolidated financial statements, the sale may be less than the vessel’s carrying value on our consolidated financial statements, resulting in a loss and a reduction in earnings. Furthermore, if vessel values fall significantly we may have to record an impairment adjustment in our financial statements which could adversely affect our financial results.

World events could affect our results of operations and financial condition

Terrorist attacks in New York on September 11, 2001, in London on July 7, 2005 and in Mumbai on November 26, 2008 and the continuing response of the United States and others to these attacks, as well as the threat of future terrorist attacks in the United States or elsewhere, continues to cause uncertainty in the world’s financial markets and may affect our business, operating results and financial condition. The continuing presence of U.S. and other armed forces in Iraq and Afghanistan may lead to additional acts of terrorism and armed conflict around the world, which may contribute to further economic instability in the global financial markets. These uncertainties could also adversely affect our ability to obtain additional financing on terms acceptable to us or at all. In the past, political conflicts have also resulted in attacks on vessels, mining of waterways and other efforts to disrupt international shipping, particularly in the Arabian Gulf region. Acts of terrorism and piracy have also affected vessels trading in regions such as the South China Sea and the Gulf of Aden off the coast of Somalia. Any of these occurrences could have a material adverse impact on our operating results, revenues and costs.

7

Terrorist attacks on vessels, such as the October 2002 attack on the M.V. Limburg, a very large crude carrier not related to us, may in the future also negatively affect our operations and financial condition and directly impact our vessels or our customers. Future terrorist attacks could result in increased volatility and turmoil of the financial markets in the United States and globally. Any of these occurrences could have a material adverse impact on our revenues and costs.

Acts of piracy on ocean-going vessels have recently increased in frequency, which could adversely affect our business

Acts of piracy have historically affected ocean-going vessels trading in regions of the world such as the South China Sea, the Gulf of Aden and off the Nigerian coast. Throughout 2008, the frequency of incidents of piracy has increased significantly, particularly in the Gulf of Aden, with drybulk vessels and tankers particularly vulnerable to such attacks. For example, in November 2008, the M/V Sirius Star, a tanker vessel not affiliated with us, was captured by pirates in the Indian Ocean while carrying crude oil estimated to be worth $100 million. If these piracy attacks result in regions in which our vessels are deployed being characterized as “war risk” zones by insurers, as the Gulf of Aden temporarily was in May 2008, premiums payable by charterers for such coverage could increase significantly. We may not be adequately insured to cover losses from these incidents, which could have a material adverse effect on us. In addition, any act of piracy against our vessels or unavailability of insurance for our vessels, could have a material adverse impact on our business, financial condition, results of operations and ability to pay dividends.

Disruptions in world financial markets and the resulting governmental action in the United States and in other parts of the world could have a material adverse impact on our results of operations, financial condition and cash flows, and could cause the market price of our common stock to further decline

The United States and other parts of the world are exhibiting deteriorating economic trends and have been in a recession. For example, the credit markets in the United States have experienced significant contraction, deleveraging and reduced liquidity, and the United States federal government and state governments have implemented and are considering a broad variety of governmental action and/or new regulation of the financial markets. Securities and futures markets and the credit markets are subject to comprehensive statutes, regulations and other requirements. The Commission, other regulators, self-regulatory organizations and exchanges are authorized to take extraordinary actions in the event of market emergencies, and may effect changes in law or interpretations of existing laws.

Recently, a number of financial institutions have experienced serious financial difficulties and, in some cases, have entered bankruptcy proceedings or are in regulatory enforcement actions. These difficulties have resulted, in part, from declining markets for assets held by such institutions, particularly the reduction in the value of their mortgage and asset-backed securities portfolios. These difficulties have been compounded by a general decline in the willingness by banks and other financial institutions to extend credit to originators and banks in the asset-backed securities industry and the resulting difficulty for such originators and banks to obtain credit and liquidity. In addition, these difficulties may adversely affect the financial institutions that provide our capital commitments and may impair their ability to continue to perform under their financing obligations to us, which could have an impact on our ability to fund current and future obligations, including our ability to make distributions to our shareholders.

We face risks attendant to changes in economic environments, changes in interest rates, and instability in the banking and securities markets around the world, among other factors. Major market disruptions and the current adverse changes in market conditions and regulatory climate in the United States and worldwide may adversely affect our business or impair our ability to borrow amounts under our credit facilities or any future financial arrangements. We cannot predict how long the current market conditions will last. However, these recent and developing economic and governmental factors, together with the concurrent decline in charter rates and vessel values, may have a material adverse effect on our results of operations, financial condition or cash flows, have caused the trading price of our common shares on the Nasdaq Global Market to decline precipitously and could cause the price of our common shares to continue to decline or impair our ability to make distributions to our shareholders.

A further economic slowdown in the Asia Pacific region could exacerbate the effect of recent slowdowns in the economies of the United States and the European Union and may have a material adverse effect on our business, financial condition and results of operations

We anticipate a significant number of the port calls made by our vessels will continue to involve the loading or discharging of dry bulk commodities in ports in the Asia Pacific region. As a result, negative changes in economic conditions in any Asia Pacific country, particularly in China, may exacerbate the effect of recent slowdowns in the economies of the United States and the European Union and may have a material adverse effect on our business, financial position and results of operations, as well as our future prospects. In recent years, China has been one of the world’s fastest growing economies in terms of gross domestic product, which has had a significant impact on shipping demand. Through the end of the third quarter of 2008, China’s gross domestic product was approximately 2.3% lower than it was during the same period in 2007, and it is likely that China and other countries in the Asia Pacific region will continue to experience slowed or even negative economic growth in the near future. Moreover, the current economic slowdown in the economies of the United States, the European Union and other Asian countries may further adversely affect economic growth in China and elsewhere. China has recently announced a $586.0 billion stimulus package aimed in part at increasing investment and consumer spending and maintaining export growth in response to the recent slowdown in its economic growth. Our business, financial condition, results of operations, ability to pay dividends as well as our future prospects, will likely be materially and adversely affected by a further economic downturn in any of these countries.

8

Changes in the economic and political environment in China and policies adopted by the government to regulate its economy may have a material adverse effect on our business, financial condition and results of operations

The Chinese economy differs from the economies of most countries belonging to the Organization for Economic Cooperation and Development, or OECD, in such respects as structure, government involvement, level of development, growth rate, capital reinvestment, allocation of resources, rate of inflation and balance of payments position. Prior to 1978, the Chinese economy was a planned economy. Since 1978, increasing emphasis has been placed on the utilization of market forces in the development of the Chinese economy. Annual and five year State Plans are adopted by the Chinese government in connection with the development of the economy. Although state-owned enterprises still account for a substantial portion of the Chinese industrial output, in general, the Chinese government is reducing the level of direct control that it exercises over the economy through State Plans and other measures. There is an increasing level of freedom and autonomy in areas such as allocation of resources, production, pricing and management and a gradual shift in emphasis to a “market economy” and enterprise reform. Limited price reforms were undertaken, with the result that prices for certain commodities are principally determined by market forces. Many of the reforms are unprecedented or experimental and may be subject to revision, change or abolition based upon the outcome of such experiments. If the Chinese government does not continue to pursue a policy of economic reform the level of imports to and exports from China could be adversely affected by changes to these economic reforms by the Chinese government, as well as by changes in political, economic and social conditions or other relevant policies of the Chinese government, such as changes in laws, regulations or export and import restrictions, all of which could, adversely affect our business, operating results and financial condition.

Charter rates are subject to seasonal fluctuations and market volatility, which may adversely affect our financial condition and ability to pay dividends

We own and operate a fleet of 12 vessels consisting of four Capesize and eight Supramax drybulk carriers with an average age of 9.7 years and a combined cargo carrying capacity of approximately 1.1 million dwt. We employ all of our vessels on medium-to long-term time charters other than the Star Beta and the Star Sigma, which are currently employed in the spot market. We may in the future employ additional vessels in our fleet in the spot market. Demand for vessel capacity has historically exhibited seasonal variations and, as a result, fluctuations in charter rates. This seasonality may result in quarter-to-quarter volatility in our operating results for vessels trading in the spot market. The drybulk sector is typically stronger in the fall and winter months in anticipation of increased consumption of coal and other raw materials in the northern hemisphere. As a result, our revenues from our drybulk carriers may be weaker during the fiscal quarters ended June 30 and September 30, and, conversely, our revenues from our drybulk carriers may be stronger in fiscal quarters ended December 31 and March 31. Seasonality in the sector in which we operate could materially affect our operating results and cash available for dividends in the future.

Rising fuel prices may adversely affect our profits

Fuel is a significant, if not the largest, expense in our shipping operations when vessels are not under period charter. Changes in the price of fuel may adversely affect our profitability. The price and supply of fuel is unpredictable and fluctuates based on events outside our control, including geopolitical developments, supply and demand for oil and gas, actions by OPEC and other oil and gas producers, war and unrest in oil producing countries and regions, regional production patterns and environmental concerns. Further, fuel may become much more expensive in the future, which may reduce the profitability and competitiveness of our business versus other forms of transportation, such as truck or rail.

We are subject to international safety regulations and the failure to comply with these regulations may subject us to increased liability, may adversely affect our insurance coverage and may result in a denial of access to, or detention in, certain ports

Our business and the operation of our vessels are materially affected by government regulation in the form of international conventions, national, state and local laws and regulations in force in the jurisdictions in which the vessels operate, as well as in the country or countries of their registration. Because such conventions, laws, and regulations are often revised, we cannot predict the ultimate cost of complying with such conventions, laws and regulations or the impact thereof on the resale prices or useful lives of our vessels. Additional conventions, laws and regulations may be adopted which could limit our ability to do business or increase the cost of our doing business and which may materially adversely affect our operations. We are required by various governmental and quasi-governmental agencies to obtain certain permits, licenses, certificates, and financial assurances with respect to our operations.

The operation of our vessels is affected by the requirements set forth in the United Nations’ International Maritime Organization’s International Management Code for the Safe Operation of Ships and Pollution Prevention, or ISM Code. The ISM Code requires shipowners, ship managers and bareboat charterers to develop and maintain an extensive “Safety Management System” that includes the adoption of a safety and environmental protection policy setting forth instructions and procedures for safe operation and describing procedures for dealing with emergencies. The failure of a shipowner or bareboat charterer to comply with the ISM Code may subject it to increased liability, may invalidate existing insurance or decrease available insurance coverage for the affected vessels and may result in a denial of access to, or detention in, certain ports. If we are subject to increased liability for noncompliance or if our insurance coverage is adversely impacted as a result of noncompliance, we may have less cash available for distribution to our stockholders as dividends. If any of our vessels are denied access to, or are detained in, certain ports, this may decrease our revenues.

9

Increased inspection procedures and tighter import and export controls could increase costs and disrupt our business

International shipping is subject to various security and customs inspection and related procedures in countries of origin and destination. Inspection procedures may result in the seizure of contents of our vessels, delays in the loading, offloading or delivery and the levying of customs duties, fines or other penalties against us.

It is possible that changes to inspection procedures could impose additional financial and legal obligations on us. Changes to inspection procedures could also impose additional costs and obligations on our customers and may, in certain cases, render the shipment of certain types of cargo uneconomical or impractical. Any such changes or developments may have a material adverse effect on our business, financial condition and results of operations.

Maritime claimants could arrest one or more of our vessels, which could interrupt our cash flow

Crew members, suppliers of goods and services to a vessel, shippers of cargo and other parties may be entitled to a maritime lien against a vessel for unsatisfied debts, claims or damages. In many jurisdictions, a claimant may seek to obtain security for its claim by arresting a vessel through foreclosure proceedings. The arrest or attachment of one or more of our vessels could interrupt our cash flow and require us to pay large sums of money to have the arrest or attachment lifted. In addition, in some jurisdictions, such as South Africa, under the “sister ship” theory of liability, a claimant may arrest both the vessel which is subject to the claimant’s maritime lien and any “associated” vessel, which is any vessel owned or controlled by the same owner. Claimants could attempt to assert “sister ship” liability against one vessel in our fleet for claims relating to another of our vessels.

Governments could requisition our vessels during a period of war or emergency, resulting in a loss of earnings

A government could requisition one or more of our vessels for title or for hire. Requisition for title occurs when a government takes control of a vessel and becomes her owner, while requisition for hire occurs when a government takes control of a vessel and effectively becomes her charterer at dictated charter rates. Generally, requisitions occur during periods of war or emergency, although governments may elect to requisition vessels in other circumstances. Although we would be entitled to compensation in the event of a requisition of one or more of our vessels, the amount and timing of payment would be uncertain. Government requisition of one or more of our vessels may negatively impact our revenues and reduce the amount of cash we have available for distribution as dividends to our stockholders.

Company Specific Risk Factors

Star Bulk has a limited operating history and may not operate profitably in the future

Star Bulk was formed December 13, 2006 and in January 2007 entered into agreements to acquire eight drybulk carriers. Star Bulk took delivery of its first vessel in December 2007. Accordingly, the consolidated financial statements do not provide a meaningful basis for you to evaluate its operations and ability to be profitable in the future. Star Bulk may not be profitable in the future.

The current low drybulk charter rates and drybulk vessel values and any future declines in these rates and values may affect our ability to comply with various covenants in our loan agreements.

Our loan agreements for our borrowings, which are secured by liens on our vessels, contain various financial covenants. Among those covenants are requirements that relate to our financial position, operating performance and liquidity. For example, under certain provisions of our loan agreements we are required to maintain a ratio of the fair market value of our vessels to the aggregate amounts outstanding of 125% for the first three years and 135% thereafter.

The market value of drybulk vessels is sensitive, among other things, to changes in the drybulk charter market, with vessel values deteriorating in times when drybulk charter rates are falling and improving when charter rates are anticipated to rise. The current decline in charter rates in the drybulk market coupled with the prevailing difficulty in obtaining financing for vessel purchases have adversely affected drybulk vessel values. A continuation of these conditions would lead to a significant decline in the fair market values of our vessels, which may result in our not being in compliance with these loan covenants. In such a situation, unless our lenders were willing to provide waivers of covenant compliance or modifications to our covenants, or would be willing to refinance, we would have to reduce or eliminate our dividend, sell vessels in our fleet and/or seek to raise additional capital in the equity markets. Furthermore, if the value of our vessels deteriorate significantly, we may have to record an impairment adjustment in our financial statements, which would adversely affect our financial results and further hinder our ability to raise capital.

10

If we are not in compliance with our covenants and are not able to obtain covenant waivers or modifications, our lenders could require us to post additional collateral, enhance our equity and liquidity, increase our interest payments or pay down our indebtedness to a level where we are in compliance with our loan covenants, sell vessels in our fleet, or they could accelerate our indebtedness, which would impair our ability to continue to conduct our business. If our indebtedness is accelerated, we might not be able to refinance our debt or obtain additional financing and could lose our vessels if our lenders foreclose their liens. In addition, if we find it necessary to sell our vessels at a time when vessel prices are low, we will recognize losses and a reduction in our earnings, which could affect our ability to raise additional capital necessary for us to comply with our loan agreements.

We are dependent on medium- to long-term time charters in a volatile shipping industry and a decline in charterhire rates would affect our results of operations and ability to pay dividends

We charter all of our vessels pursuant to medium- to long-term time charters with remaining terms of approximately one to five years other than the Star Beta and the Star Sigma, which are currently employed in the spot market. The time charter market is highly competitive and spot market charterhire rates (which affect time charter rates) may fluctuate significantly based upon available charters and the supply of, and demand for, seaborne shipping capacity. Our ability to re-charter our vessels on the expiration or termination of their current time charters and the charter rates payable under any renewal or replacement charters will depend upon, among other things, economic conditions in the drybulk shipping market. The drybulk carrier charter market is volatile, and in the past, time charter and spot market charter rates for drybulk carriers have declined below operating costs of vessels. If future charterhire rates are depressed, we may not be able to operate our vessels profitably or to pay you dividends.

We depend upon a few significant customers for a large part of our revenues and the loss of one or more of these customers could adversely affect our financial performance.

We derive a significant part of our charterhire (net of commissions) from a small number of customers, with 68% of our revenues for the nine-month period ended September 30, 2008 generated from six charterers. Our fleet is employed under fixed rate period charters to ten customers. If one or more of these customers is unable to perform under one or more charters with us and we are not able to find a replacement charter, or if a customer exercises certain rights to terminate the charter, we could suffer a loss of revenues that could materially adversely affect our business, financial condition, results of operations and cash available for distribution as dividends to our shareholders.

We could lose a customer or the benefits of a time charter if, among other things:

● | the customer fails to make charter payments because of its financial inability, disagreements with us or otherwise; |

● | the customer terminates the charter because we fail to deliver the vessel within a fixed period of time, the vessel is lost or damaged beyond repair, there are serious deficiencies in the vessel or prolonged periods of off-hire, default under the charter; or |

● | the customer terminates the charter because the vessel has been subject to seizure for more than a specified number of days. |

If we lose a key customer, we may be unable to obtain charters on comparable terms or may become subject to the volatile spot market, which is highly competitive and subject to significant price fluctuations. The time charters on which we deploy all of our vessels provide for charter rates that are significantly above current market rates, particularly spot market rates that most directly reflect the current depressed levels of the drybulk charter market. If it were necessary to secure substitute employment, in the spot market or on time charters, for any of these vessels due to the loss of a customer in these market conditions, such employment would be at a significantly lower charter rate than currently generated by such vessel, or we may be unable to secure a charter at all, in either case, resulting in a significant reduction in revenues. The loss of any of our customers, time charters or vessels, or a decline in payments under our charters, could have a material adverse effect on our business, results of operations and financial condition and our ability to pay dividends.

11

We are subject to certain risks with respect to our counterparties on contracts, and failure of such counterparties to meet their obligations could cause us to suffer losses or otherwise adversely affect our business.

We enter into, among other things, charter parties with our customers and credit facilities with banks. Such agreements subject us to counterparty risks. The ability of each of our counterparties to perform its obligations under a contract with us will depend on a number of factors that are beyond our control and may include, among other things, general economic conditions, the condition of the maritime and offshore industries, the overall financial condition of the counterparty, charter rates received for specific types of vessels, and various expenses. Consistent with drybulk shipping industry practice, we have not independently analyzed the creditworthiness of the charterers. In addition, in depressed market conditions, our charterers may no longer need a vessel that is currently under charter or may be able to obtain a comparable vessel at lower rates. As a result, charterers may seek to renegotiate the terms of their existing charter parties or avoid their obligations under those contracts. Should a counterparty fail to honor its obligations under agreements with us, we could sustain significant losses which could have a material adverse effect on our business, financial condition, results of operations and cash flows.

Investment in derivative instruments such as freight forward agreements could result in losses.

From time to time, we may take positions in derivative instruments including freight forward agreements, or FFAs. FFAs and other derivative instruments may be used to hedge a vessel owner’s exposure to the charter market for a specified route and period of time. Upon settlement, if the contracted charter rate is less than the average of the rates, as reported by an identified index, for the specified route and time period, the seller of the FFA is required to pay the buyer an amount equal to the difference between the contracted rate and the settlement rate, multiplied by the number of days in the specified period. Conversely, if the contracted rate is greater than the settlement rate, the buyer is required to pay the seller the settlement sum. If we take positions in FFAs or other derivative instruments we could suffer losses in the settling or termination of the FFA. This could adversely affect our results of operation and cash flow.

Our earnings may be adversely affected if we are not able to take advantage of favorable charter rates

We charter our drybulk carriers to customers pursuant to medium- to long-term time charters, which generally last from one to five years other than the Star Beta and the Star Sigma, which are currently employed in the spot market. We may in the future extend the charter periods for the vessels in our fleet. Our vessels that are committed to longer-term charters may not be available for employment on short-term charters during periods of increasing short-term charterhire rates when these charters may be more profitable than long-term charters.

If we fail to manage our planned growth properly, we may not be able to successfully expand our fleet which would adversely affect our overall financial position

We intend to continue to expand our fleet. Our growth will depend on:

● | locating and acquiring suitable vessels; |

● | identifying and consummating acquisitions or joint ventures; |

● | obtaining required financing; |

● | integrating any acquired vessels successfully with our existing operations; |

● | enhancing our customer base; and |

● | managing our expansion. |

Growing any business by acquisition presents numerous risks such as undisclosed liabilities and obligations, difficulty experienced in obtaining additional qualified personnel and managing relationships with customers and suppliers and integrating newly acquired operations into existing infrastructures. We may not be successful in executing our growth plans and may incur significant expenses and losses.

12

Our loan agreements may contain restrictive covenants that may limit our liquidity and corporate activities

Our current term loan agreements with Commerzbank AG and Piraeus Bank A.E., and any future loan agreements may impose operating and financial restrictions on us. These restrictions may limit our ability to:

● | incur additional indebtedness; |

● | create liens on our assets; |

● | sell capital stock of our subsidiaries; |

● | make investments; |

● | engage in mergers or acquisitions; |

● | pay dividends; |

● | make capital expenditures; |

● | change the management of our vessels or terminate or materially amend the management agreement relating to each vessel; and |

● | sell our vessels. |

Therefore, we may need to seek permission from our lenders in order to engage in some important corporate actions. The lenders’ interests may be different from ours, and we cannot guarantee that we will be able to obtain the lenders’ permission when needed. This may prevent us from taking actions that are in our best interest.

Servicing debt will limit funds available for other purposes, including capital expenditures and payment of dividends

As of January 8, 2009, we had $120.0 million outstanding under our term loan agreement with Commerzbank AG in connection with the purchase of the vessels in our initial fleet and $175.0 million outstanding under our term loan agreements with Piraeus Bank A.E. in connection with the purchase of four additional vessels in our current fleet: the Star Omicron, the Star Sigma, the Star Cosmo and the Star Ypislon. On April 14, 2008, we entered into a loan agreement, which was subsequently amended on April 17, 2008 and September 18, 2008, for up to $150.0 million with Piraeus Bank A.E. in order to partially finance the acquisition cost of vessels the Star Omicron, the Star Sigma and the Star Ypsilon and also to provide us with additional liquidity. The loan is secured by a first priority mortgage on the Star Omicron, the Star Beta, and the Star Sigma. The loan bears interest at LIBOR plus a margin and is repayable in twenty-four quarterly installments through September 2014. As of January 8, 2009, we had outstanding borrowings in the amount of $143.0 million under this loan. On July 1, 2008, the Company entered into a loan agreement of up to $35.0 million with Piraeus Bank A.E. to partially finance the acquisition of the Star Cosmo. The loan bears interest at LIBOR plus a margin and is repayable in twenty-four quarterly installments through July 2014. As of January 8, 2009, we had outstanding borrowings in the amount of $32.0 million under this loan facility.

We may be required to dedicate a portion of our cash flow from operations to pay the principal and interest on our debt. These payments limit funds otherwise available for working capital expenditures and other purposes, including payment of dividends. If we are unable to service our debt, it may have a material adverse effect on our financial condition and results of operations.

13

In the highly competitive international drybulk shipping industry, we may not be able to compete for charters with new entrants or established companies with greater resources which may adversely affect our results of operations

We employ our vessels in a highly competitive market that is capital intensive and highly fragmented. Competition arises primarily from other vessel owners, some of whom have substantially greater resources than us. Competition for the transportation of drybulk cargoes can be intense and depends on price, location, size, age, condition and the acceptability of the vessel and its managers to the charterers. Due in part to the highly fragmented market, competitors with greater resources could operate larger fleets through consolidations or acquisitions and may be able to offer more favorable terms.

We may be unable to attract and retain key management personnel and other employees in the shipping industry, which may negatively affect the effectiveness of our management and our results of operations

Our success depends to a significant extent upon the abilities and efforts of our management team. As of January 8, 2009, we had 22 employees. Twenty of our employees, through Star Bulk Management, are engaged in the day to day management of the vessels in our fleet. Our success depends upon our ability to retain key members of our management team and the ability of Star Bulk Management to recruit and hire suitable employees. The loss of any members of our senior management team could adversely affect our business prospects and financial condition. Difficulty in hiring and retaining personnel could adversely affect our results of operations. We do not maintain “key-man” life insurance on any of our officers or employees of Star Bulk Management.

As we expand our fleet, we will need to expand our operations and financial systems and hire new shoreside staff and seafarers to staff our vessels; if we cannot expand these systems or recruit suitable employees, our performance may be adversely affected

Our operating and financial systems may not be adequate as we expand our fleet, and our attempts to implement those systems may be ineffective. In addition, we rely on our wholly-owned subsidiary, Star Bulk Management, to recruit shoreside administrative and management personnel. Shoreside personnel are recruited by Star Bulk Management through referrals from other shipping companies and traditional methods of securing personnel, such as placing classified advertisements in shipping industry periodicals. Star Bulk Management has sub-contracted crew management, which includes the recruitment of seafarers, to Bernhardt, a major international third-party technical management company, and Union. Star Bulk Management and its crewing agent may not be able to continue to hire suitable employees as Star Bulk expands its fleet. If we are unable to operate our financial and operations systems effectively, recruit suitable employees or if Star Bulk Management’s unaffiliated crewing agent encounters business or financial difficulties, our performance may be materially adversely affected.

Risks involved with operating ocean going vessels could affect our business and reputation, which would adversely affect our revenues

The operation of an ocean-going vessel carries inherent risks. These risks include the possibility of:

● | crew strikes and/or boycotts; |

● | marine disaster; |

● | piracy; |

● | environmental accidents; |

● | cargo and property losses or damage; and |

● | business interruptions caused by mechanical failure, human error, war, terrorism, piracy, political action in various countries or adverse weather conditions. |

Any of these circumstances or events could increase our costs or lower our revenues.

Our vessels may suffer damage and may face unexpected drydocking costs, which could adversely affect our cash flow and financial condition

If our vessels suffer damage, they may need to be repaired at a drydocking facility. The costs of drydock repairs are unpredictable and can be substantial. We may have to pay drydocking costs that our insurance does not cover. The loss of earnings while these vessels are being repaired and reconditioned, as well as the actual cost of these repairs, would decrease our earnings.

14

Purchasing and operating secondhand vessels may result in increased operating costs and vessel off-hire, which could adversely affect our earnings

Our inspection of secondhand vessels prior to purchase does not provide us with the same knowledge about their condition and cost of any required or anticipated repairs that we would have had if these vessels had been built for and operated exclusively by us. We will not receive the benefit of warranties on secondhand vessels.

Typically, the costs to maintain a vessel in good operating condition increase with the age of the vessel. Older vessels are typically less fuel efficient and more costly to maintain than more recently constructed vessels. Cargo insurance rates increase with the age of a vessel, making older vessels less desirable to charterers.

Governmental regulations, safety or other equipment standards related to the age of vessels may require expenditures for alterations, or the addition of new equipment, to our vessels and may restrict the type of activities in which the vessels may engage. As our vessels age, market conditions may not justify those expenditures or enable us to operate our vessels profitably during the remainder of their useful lives.

We inspected the thirteen vessels that we acquired from both related and unrelated third parties, considered the age and condition of the vessels in budgeting for their operating, insurance and maintenance costs, and if we acquire additional secondhand vessels in the future, we may encounter higher operating and maintenance costs due to the age and condition of those additional vessels.

We may not have adequate insurance to compensate us for the loss of a vessel, which may have a material adverse effect on our financial condition and results of operation

We have procured hull and machinery insurance, protection and indemnity insurance, which includes environmental damage and pollution insurance coverage and war risk insurance for our fleet. We do not maintain, for our vessels, insurance against loss of hire, which covers business interruptions that result from the loss of use of a vessel. We may not be adequately insured against all risks. We may not be able to obtain adequate insurance coverage for our fleet in the future. The insurers may not pay particular claims. Our insurance policies may contain deductibles for which we will be responsible and limitations and exclusions which may increase our costs or lower our revenue. Moreover, insurers may default on claims they are required to pay. If our insurance is not enough to cover claims that may arise, the deficiency may have a material adverse effect on our financial condition and results of operations.

We may not be able to pay dividends

We intend to pay a regular quarterly dividend either in cash or stock however, we may incur other expenses or liabilities that would reduce or eliminate the cash available for distribution as dividends. Our loan agreements, including future credit facilities we may enter into, may also prohibit or restrict the declaration and payment of dividends under some circumstances.

In addition, the declaration and payment of dividends will be subject at all times to the discretion of our board of directors. The timing and amount of dividends will depend on our earnings, financial condition, cash requirements and availability, fleet renewal and expansion, restrictions in our loan agreements, the provisions of Marshall Islands law affecting the payment of dividends and other factors. Marshall Islands law generally prohibits the payment of dividends other than from surplus or while a company is insolvent or would be rendered insolvent upon the payment of such dividends, or if there is no surplus, dividends may be declared or paid out of net profits for the fiscal year in which the dividend is declared and for the preceding fiscal year.

We are a holding company, and depend on the ability of our subsidiaries to distribute funds to us in order to satisfy our financial obligations or to make dividend payments

We are a holding company and our wholly-owned subsidiaries, conduct all of our operations and own all of our operating assets. We will have no significant assets other than the equity interests in our wholly-owned subsidiaries. As a result, our ability to make dividend payments depends on our subsidiaries and their ability to distribute funds to us. If we are unable to obtain funds from our subsidiaries, our board of directors may exercise its discretion not to pay dividends. We and our subsidiaries will be permitted to pay dividends under our credit facilities only for so long as we are in compliance with all applicable financial covenants, terms and conditions.

15

We depend on officers who may engage in other business activities in the international shipping industry which may create conflicts of interest

Prokopios Tsirigakis, our Chief Executive Officer and a member of our board of directors, and George Syllantavos, our Chief Financial Officer, Secretary and member of our board of directors participate in business activities not associated with the Company. As a result, Mr. Tsirigakis and Mr. Syllantavos may devote less time to the Company than if they were not engaged in other business activities and may owe fiduciary duties to the shareholders of both the Company as well as shareholders of other companies which they may be affiliated, which may create conflicts of interest in matters involving or affecting the Company and its customers. It is not certain that any of these conflicts of interest will be resolved in our favor.

In accordance with Star Bulk’s Code of Ethics, all ongoing and future transactions between Star Bulk and any of its officers and directors or their respective affiliates, including loans by Star Bulk’s officers and directors, if any, will be on terms believed by Star Bulk to be no less favorable than are available from unaffiliated third parties, and such transactions or loans, including any forgiveness of loans, will require prior approval, in each instance by a majority of Star Bulk’s uninterested “independent” directors or the members of Star Bulk’s board who do not have an interest in the transaction, in either case who had access, at Star Bulk’s expense, to its attorneys or independent legal counsel.

We are incorporated in the Republic of the Marshall Islands, which does not have a well-developed body of corporate law, which may negatively affect the ability of public shareholders to protect their interests