UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORMN-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number:811-22311

Schwab Strategic Trust – U.S. Equity ETFs and International Equity ETFs

(Exact name of registrant as specified in charter)

211 Main Street, San Francisco, California 94105

(Address of principal executive offices) (Zip code)

Jonathan de St. Paer

Schwab Strategic Trust – U.S. Equity ETFs and International Equity ETFs

211 Main Street, San Francisco, California 94105

(Name and address of agent for service)

Registrant’s telephone number, including area code: (415)636-7000

Date of fiscal year end: August 31

Date of reporting period: August 31, 2019

Item 1: Report(s) to Shareholders.

Annual Report | August 31, 2019

Schwab International Equity ETFs

| Schwab International Equity ETF | SCHF |

| Schwab International Small-Cap Equity ETF | SCHC |

| Schwab Emerging Markets Equity ETF | SCHE |

| New Notice Regarding Shareholder Report Delivery Options |

| Beginning on January 1, 2021, paper copies of a fund’s shareholder reports will no longer be sent by mail, unless you specifically request paper copies of the reports from your financial intermediary (such as a bank or broker-dealer). Instead, the reports will be made available on a fund’s websitewww.schwabfunds.com/schwabetfs_prospectus, and you will be notified by mail each time a report is posted and the mailing will provide a website link to access the report. You will continue to receive other fund regulatory documents (such as prospectuses or supplements) in paper unless you have elected to receive all fund documents electronically. |

| If you would like to receive a fund’s future shareholder reports in paper free of charge after January 1, 2021, you can make that request: |

| • If you invest through Charles Schwab & Co, Inc. (broker-dealer), by calling 1-866-345-5954 and using the unique identifier attached to this mailing; or |

| • If you invest through another financial intermediary (such as a bank or broker-dealer) by contacting them directly. |

| If you already receive shareholder reports and other fund documents electronically, you will not be affected by this change and you need not take any action. |

This page is intentionally left blank.

Fund investment adviser: Charles Schwab Investment Management, Inc. (CSIM)

Distributor: SEI Investments Distribution Co. (SIDCO)

The Sector/Industry classifications in this report use the Global Industry Classification Standard (GICS), which was developed by and is the exclusive property of MSCI Inc. (MSCI) and Standard & Poor’s (S&P). GICS is a service mark of MSCI and S&P and has been licensed for use by Charles Schwab & Co, Inc.

Schwab International Equity ETFs | Annual Report

Schwab International Equity ETFs

The performance data quoted represents past performance. Past performance does not guarantee future results. Investment return and principal value of an investment will fluctuate so that an investor’s shares, when sold or redeemed, may be worth more or less than the original cost. Current performance may be lower or higher than the performance quoted. To obtain performance information current to the most recent month end, please visitwww.schwabfunds.com/schwabetfs_prospectus.

| Total Returns for the 12 Months Ended August 31, 2019 |

| Schwab International Equity ETF (Ticker Symbol: SCHF) | |

| Market Price Return1 | -3.61% |

| NAV Return1 | -3.79% |

| FTSE Developed ex US Index (Net)* | -3.95% |

| ETF Category: Morningstar Foreign Large Blend2 | -4.13% |

| Performance Details | pages 8-10 |

| |

| Schwab International Small-Cap Equity ETF (Ticker Symbol: SCHC) | |

| Market Price Return1 | -10.42% |

| NAV Return1 | -10.57% |

| FTSE Developed Small Cap ex US Liquid Index (Net)* | -10.71% |

| ETF Category: Morningstar Foreign Small/Mid Blend2 | -9.97% |

| Performance Details | pages 11-13 |

| |

| Schwab Emerging Markets Equity ETF (Ticker Symbol: SCHE) | |

| Market Price Return1 | -0.95% |

| NAV Return1 | -0.97% |

| FTSE Emerging Index (Net)* | -0.99% |

| ETF Category: Morningstar Diversified Emerging Markets2 | -2.54% |

| Performance Details | pages 14-16 |

All total returns on this page assume dividends and distributions were reinvested. Index figures do not include trading and management costs, which would lower performance. Indices are unmanaged and cannot be invested in directly. Performance results less than one year are not annualized.

For index definitions, please see the Glossary.

Performance does not reflect the deduction of taxes that a shareholder would pay on fund distributions or on the redemption or sale of fund shares.

Shares are bought and sold at market price, which may be higher or lower than the net asset value (NAV). Brokerage commissions will reduce returns.

Index ownership — FTSE is a trademark of the London Stock Exchange Group companies (LSEG) and is used by the Schwab International Equity ETFs under license. The Schwab International Equity ETFs are not sponsored, endorsed, sold or promoted by FTSE nor LSEG and neither FTSE nor LSEG makes any representation regarding the advisability of investing in shares of the funds. Fees payable under the license are paid by the investment adviser.

| * | The total return cited for the index is calculated net of foreign withholding taxes; the underlying tax rate information is available from FTSE. |

| 1 | ETF performance must be shown based on both a market price and NAV basis. The fund’s per share NAV is the value of one share of the fund. NAV is calculated by taking the fund’s total assets (including the market value of securities owned), subtracting liabilities, and dividing by the number of shares outstanding. The NAV Return is based on the NAV of the fund, and the Market Price Return is based on the market price per share of the fund. The price used to calculate market return (Market Price) is determined using the Official Closing Price on the primary stock exchange (generally, 4:00 p.m. Eastern time) and may not represent the returns you would receive if shares were traded at other times. Market Price and NAV returns assume that dividends and capital gain distributions have been reinvested in the fund at Market Price and NAV, respectively. |

| 2 | Source for category information: Morningstar, Inc. The Morningstar Category return represents all passively- and actively-managed ETFs within the category as of the report date. |

Schwab International Equity ETFs | Annual Report

Schwab International Equity ETFs

Jonathan de St. Paer

President and CEO of

Charles Schwab Investment

Management, Inc. and the

funds covered in this report.

Dear Shareholder,

If there’s a lesson investors may have learned from recent market cycles, it could be that markets are unpredictable. International stock prices were on a steady climb between the late December 2018 sell-off and the end of April 2019, returning more than 12% over that span, as measured by the MSCI EAFE® Index (Net)*. However, uncertainty around an escalating U.S.-China trade war, geopolitical uncertainty, and global monetary policy in the months that followed contributed to a cycle of unsettling one-day declines followed by recoveries. When all was said and done, international stock prices, represented by the MSCI EAFE® Index (Net)*, returned -3.3% for the 12-month period ended August 31, 2019.

The ups and downs have understandably put investors on edge, leading many to seek safety in other asset classes such as cash and short-term fixed income. While market fluctuations can be difficult to endure, investors may make matters worse through impulsive reactions to sudden market movements—rather than having a long-term investing plan and sticking to it. In fact, a recent study by the Schwab Center for Financial Research found that those who stayed invested through the last five market corrections—when the S&P 500® Index fell 20% or more—ended up earning substantially higher returns than those who moved into cash.1 The study showed that missing out on even the first month of gains after the market had hit bottom led to lower returns over time. This is in large part because some of the biggest gains generally occur in the months right after the market has hit a low and begins to recover.

At Charles Schwab Investment Management, we believe that maintaining exposure to a mix of asset classes that perform differently over time is a better way to weather various market cycles. We designed the Schwab International Equity ETFs with this long-term investing strategy in mind. Offering simple, low-cost access to international small-, mid-, and large-cap stocks within both developed and emerging markets, the Schwab International Equity ETFs can serve as part of the core of a diversified portfolio.

We have taken great care in developing and designing each of our products. We provide straightforward offerings that meet specific investor needs, without unnecessary cost or complexity. While we may not be able to take all

| * | The net version of the index reflects reinvested dividends net of withholding taxes, but reflects no deductions for expenses or other taxes. |

| 1 | Schwab Center for Financial Research. (2019, May 24). Why Waiting for a Market Rebound Could Cost You. |

Schwab International Equity ETFs | Annual Report

Schwab International Equity ETFs

From the President(continued)

“In fact, a recent study by the Schwab Center for Financial Research found that those who stayed invested through the last five market corrections—when the S&P 500® Index fell 20% or more—ended up earning substantially higher returns than those who moved into cash.”

of the surprises out of investing, we can remain constant in our commitment to offering products with clear objectives, transparency, and a consistent investing approach.

Thank you for investing with Charles Schwab Investment Management. For more information about the Schwab International Equity ETFs, please continue reading this report. In addition, you can find further details about these funds by visiting our website at www.schwabfunds.com. We are also happy to hear from you at 1-877-824-5615.

Sincerely,

Past performance cannot guarantee future results.

Diversification and asset allocation strategies do not ensure a profit and cannot protect against losses in a declining market.

Management views may have changed since the report date.

Schwab International Equity ETFs | Annual Report

Schwab International Equity ETFs

The Investment Environment

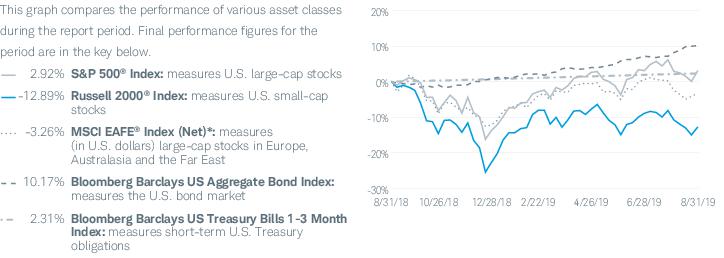

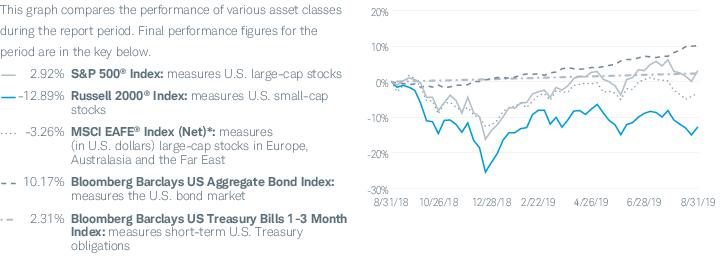

Over the 12-month reporting period ended August 31, 2019, international equity markets lost ground as economic momentum slowed, dampened by uncertainties from several fronts, including trade, inflation, and geopolitical concerns. After a steep decline in December 2018, international equities recovered through the first four months of 2019, when investor sentiment was buoyed by seemingly constructive trade talks between the U.S. and China, the Federal Reserve (Fed) putting interest rate hikes on hold, and stimulus measures implemented in China to boost growth. In the U.S., stocks followed a similar trajectory, but with a steeper decline in December and a more robust recovery in early 2019. In May, however, trade talks between the U.S. and China stalled, and global markets fell throughout the month. Global markets subsequently regained some upward momentum through August when volatility spiked and there were large daily swings amid ongoing trade skirmishes and other geopolitical uncertainty. Following recent monetary tightening measures after a long period of generally accommodative policies, interest rates were lowered in several key economies, including the United States. Over the period, the U.S. dollar strengthened against a basket of foreign currencies. In this environment, the MSCI EAFE® Index (Net)*, a broad measure of developed international equity performance, returned -3.26%, while the MSCI Emerging Markets Index (Net)* returned -4.36%. For comparison, the S&P 500® Index, a bellwether for the overall U.S. stock market, returned 2.92% for the reporting period.

Economic growth around the globe was uneven over the reporting period as uncertainty related to the trade dispute between the U.S. and China created headwinds for equity markets. Despite these escalating trade tensions, the U.S. maintained steady growth in its tenth year of expansion, albeit at a declining pace. U.S. gross domestic product (GDP) grew at an annual rate of 2.0% in the second quarter of 2019, down from 3.1% in the first quarter of 2019. Unemployment remained low, ending the period at 3.7%, up just slightly from its nearly 50-year low of 3.6% in April and May. Consumer confidence, which hit an 18-year high in October 2018, the highest since 2000, fell the subsequent three months before rebounding in February. However, in August, it fell to its lowest level since October 2016.

Asset Class Performance Comparison % returns during the 12 months ended August 31, 2019

Index figures assume dividends and distributions were reinvested. Index figures do not include trading and management costs, which would lower performance. Indices are unmanaged and you cannot invest in them directly. Performance results less than one year are not annualized. Past performance is not a guarantee of future results.

For index definitions, please see the Glossary.

Data source: Index provider websites and CSIM

Nothing in this report represents a recommendation of a security by the investment adviser.

Management views may have changed since the report date.

| * | The net version of the index reflects reinvested dividends net of withholding taxes, but reflects no deductions for expenses or other taxes. |

Schwab International Equity ETFs | Annual Report

Schwab International Equity ETFs

The Investment Environment(continued)

Outside the U.S., economic growth generally weakened as trade issues dominated headlines and real and proposed tariffs increasingly impacted businesses and consumers worldwide. In the eurozone, economic growth softened in the second quarter of 2019, down slightly from the first quarter but consistent with the final quarter of 2018. Growth was subdued by higher inflation and tepid wage growth that constrained consumer spending. Germany’s GDP contracted on a slump from exports, and Italy’s economy stagnated due to weak domestic demand. The United Kingdom’s economy contracted in the second quarter of 2019 amid growing Brexit-related economic and political uncertainty that dampened industrial output, construction, and services sectors. Japan’s economy, however, logged steady increases in recent quarters after contracting sharply in the third quarter of 2018. Several Asian economies, including China and India, exhibited signs of slowing, but still outpaced many developed economies.

In response to the economic environment, to bolster growth, and to ensure stability given ongoing trade tensions, a number of central banks reduced their policy rates, including the U.S., while others maintained their generally accommodative stances. In the U.S., after raising rates four times in 2018, the Fed cut its short-term interest rate by 0.25% in July 2019 amid growing signs of global economic weakness that threatened to dampen U.S. economic growth, along with continued low inflation and weakness in manufacturing. Outside the U.S., the European Central Bank held interest rates steady, but in July 2019 signaled that it may launch a stimulus package in coming months that could include interest rate cuts and asset purchases to combat the region’s economic malaise. Also in July 2019, the Bank of Japan announced that it would maintain its short-term interest rate target of –0.1% and increase the size of its asset purchases. Despite ongoing uncertainties over the economy’s wider direction and growing Brexit-related division, in August 2019, the Bank of England maintained its key official bank rate at 0.75%, where it has sat since August 2018. Central banks in key emerging market economies—including India, Thailand, and China—lowered their policy rates in response to inflation and trade-related pressures.

Schwab International Equity ETFs | Annual Report

Schwab International Equity ETFs

| Christopher Bliss, CFA, Vice President and Head of Passive Equity Strategies, leads the portfolio management team for Schwab’s passive equity mutual funds and ETFs. He also has overall responsibility for all aspects of the management of the funds. Prior to joining CSIM in 2016, Mr. Bliss spent 12 years at BlackRock (formerly Barclays Global Investors) managing and leading institutional index teams, most recently as a managing director and head of the Americas institutional index team. Prior to BlackRock, he worked as an equity analyst and portfolio manager for Harris Bretall and before that, as a research analyst for JP Morgan. |

| Chuck Craig, CFA, Senior Portfolio Manager, is responsible for the day-to-day co-management of the funds. Prior to joining CSIM in 2012, Mr. Craig worked at Guggenheim Funds (formerly Claymore Group), where he spent more than five years as a managing director of portfolio management and supervision, and three years as vice president of product research and development. Prior to that, he worked as an equity research analyst at First Trust Portfolios (formerly Niké Securities), and a trader and analyst at PMA Securities, Inc. |

| Jane Qin, Portfolio Manager, is responsible for the day-to-day co-management of the funds. Prior to joining CSIM in 2012, Ms. Qin spent more than four years at The Bank of New York Mellon Corporation. During that time, Ms. Qin spent more than two years as an associate equity portfolio manager and nearly two years as a performance analyst. She also worked at Wells Fargo Funds Management as a mutual fund analyst and at CIGNA Reinsurance in the risk management group as a risk analyst. |

| David Rios, Portfolio Manager, is responsible for the day-to-day co-management of the funds. He joined CSIM in 2008 and became a Portfolio Manager in 2014. Prior to this role, Mr. Rios served as an Associate Portfolio Manager on the Schwab Equity Index Strategies team for four years. His first role with CSIM was as a trade operations specialist. He also previously worked as a senior fund accountant at Investors Bank & Trust (subsequently acquired by State Street Corporation). |

Schwab International Equity ETFs | Annual Report

Schwab International Equity ETFas of August 31, 2019

The Schwab International Equity ETF (the fund) seeks to track as closely as possible, before fees and expenses, the total return of the FTSE Developed ex US Index (the index). The index is comprised of large- and mid-capitalization companies in developed countries outside the United States, as defined by the index provider. The index defines the large- and mid-capitalization universe as approximately the top 90% of the eligible universe. The fund invests in a representative sample of securities included in the index which, when taken together, are expected to perform similarly to the index as a whole. Due to the use of representative sampling, the fund may not hold all of the securities included in the index.

Market Highlights. International equity markets lost ground over the 12-month reporting period as economic momentum slowed, dampened by uncertainties from several fronts, including trade, inflation, and geopolitical concerns. Following recent monetary tightening measures after a long period of generally accommodative policies, interest rates were lowered in several key economies, including the United States. Over the period, the U.S. dollar strengthened against a basket of foreign currencies.

Performance. During the 12-month reporting period ended August 31, 2019, the fund generally tracked the index. The fund’s market price return was -3.61% and its NAV return was -3.79%. The index returned -3.95%1 during the same period.

Contributors and Detractors. Swiss stocks were the largest contributors to the total return of the fund. Stocks from Switzerland represented an average weight of approximately 7% of the fund’s investments and returned approximately 11% in U.S. dollar terms. One example from this market is multinational food and drink processing conglomerate Nestle S.A. The fund’s holdings of Nestle S.A. returned approximately 37% in U.S. dollar terms. Stocks from Canada also contributed to the total return of the fund, representing an average weight of approximately 8% of the fund’s investments and returning approximately 3% in U.S. dollar terms.

Stocks from Japan were the largest detractors from the total return of the fund. Japanese stocks represented an average weight of approximately 22% of the fund’s investments and returned approximately -6% in U.S. dollar terms. One example from this market is bank holding and financial services company Mitsubishi UFJ Financial Group, Inc. The fund’s holdings of Mitsubishi UFJ Financial Group, Inc. returned approximately -18% in U.S. dollar terms. Stocks from Germany also detracted from the total return of the fund, representing an average weight of approximately 8% of the fund’s investments and returning approximately -10% in U.S. dollar terms.

Management views and portfolio holdings may have changed since the report date.

| 1 | The total return cited for the index is calculated net of foreign withholding taxes; the underlying tax rate information is available from FTSE. |

Schwab International Equity ETFs | Annual Report

Schwab International Equity ETF

Performance and Fund Factsas of August 31, 2019

The performance data quoted represents past performance. Past performance does not guarantee future results. Investment return and principal value of an investment will fluctuate so that an investor’s shares, when sold or redeemed, may be worth more or less than the original cost. Current performance may be lower or higher than the performance quoted. To obtain performance information current to the most recent month end, please visitwww.schwabfunds.com/schwabetfs_prospectus.

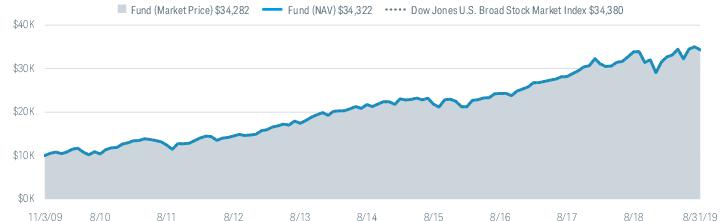

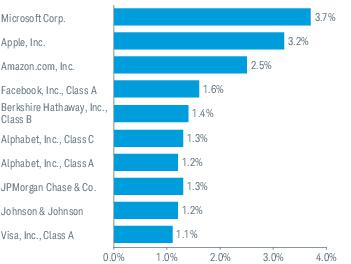

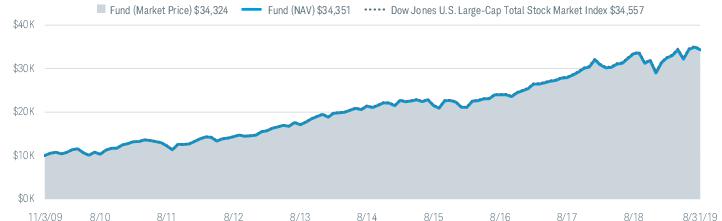

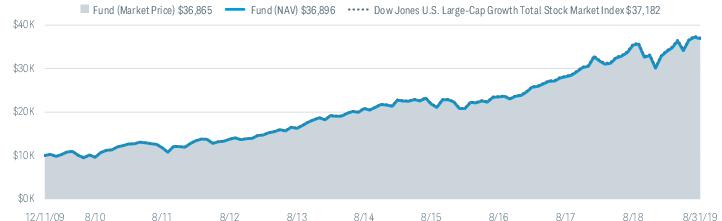

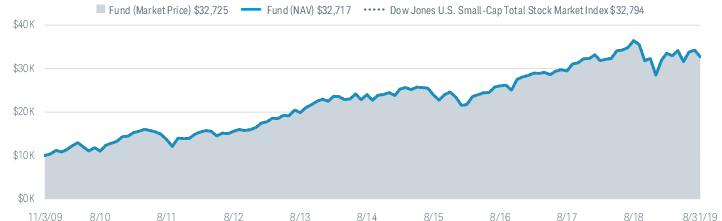

Performance of Hypothetical $10,000 Investment (November 3, 2009 – August 31, 2019)1

Average Annual Total Returns1

| Fund and Inception Date | 1 Year | 5 Years | Since Inception* |

| Fund: Schwab International Equity ETF (11/3/09) | | | |

| Market Price Return2 | -3.61% | 1.78% | 4.81% |

| NAV Return2 | -3.79% | 1.78% | 4.80% |

| FTSE Developed ex US Index (Net)3 | -3.95% | 1.70% | 4.80% |

| ETF Category: Morningstar Foreign Large Blend4 | -4.13% | 1.56% | N/A |

| Fund Expense Ratio5: 0.06% |

All total returns on this page assume dividends and distributions were reinvested. Index figures do not include trading and management costs, which would lower performance. Indices are unmanaged and cannot be invested in directly. Performance results less than one year are not annualized.

For index definitions, please see the Glossary.

Shares are bought and sold at market price, which may be higher or lower than the net asset value (NAV). Brokerage commissions will reduce returns.

International investing may involve risk of capital loss from unfavorable fluctuations in currency values, from differences in generally accepted accounting principles, or from economic or political instability in other nations.

Index ownership — FTSE is a trademark of the London Stock Exchange Group companies (LSEG) and is used by the fund under license. The Schwab International Equity ETF is not sponsored, endorsed, sold or promoted by FTSE nor LSEG and neither FTSE nor LSEG makes any representation regarding the advisability of investing in shares of the fund. Fees payable under the license are paid by the investment adviser.

| * | Inception (11/3/09) represents the date that the shares began trading in the secondary market. |

| 1 | Performance does not reflect the deduction of taxes that a shareholder would pay on fund distributions or on the redemption or sale of fund shares. |

| 2 | ETF performance must be shown based on both a market price and NAV basis. The fund’s per share NAV is the value of one share of the fund. NAV is calculated by taking the fund’s total assets (including the market value of securities owned), subtracting liabilities, and dividing by the number of shares outstanding. The NAV Return is based on the NAV of the fund, and the Market Price Return is based on the market price per share of the fund. The price used to calculate market return (Market Price) is determined using the Official Closing Price on the primary stock exchange (generally, 4:00 p.m. Eastern time) and may not represent the returns you would receive if shares were traded at other times. NAV is used as a proxy for purposes of calculating Market Price Return on inception date. Market Price and NAV returns assume that dividends and capital gain distributions have been reinvested in the fund at Market Price and NAV, respectively. |

| 3 | The total return cited for the index is calculated net of foreign withholding taxes; the underlying tax rate information is available from FTSE. |

| 4 | Source for category information: Morningstar, Inc. The Morningstar Category return represents all passively- and actively-managed ETFs within the category as of the report date. |

| 5 | As stated in the prospectus. |

Schwab International Equity ETFs | Annual Report

Schwab International Equity ETF

Performance and Fund Factsas of August 31, 2019 (continued)

| Number of Holdings | 1,481 |

| Weighted Average Market Cap (millions) | $59,781 |

| Price/Earnings Ratio (P/E) | 14.5 |

| Price/Book Ratio (P/B) | 1.5 |

| Portfolio Turnover Rate | 8%2 |

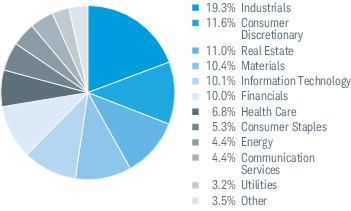

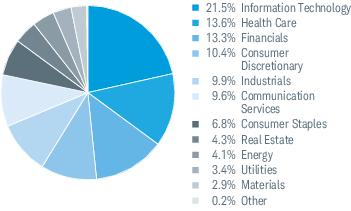

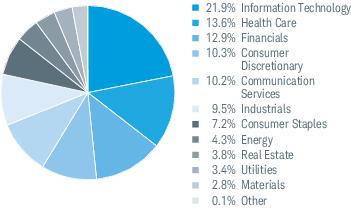

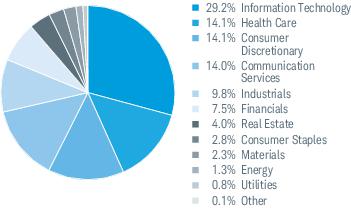

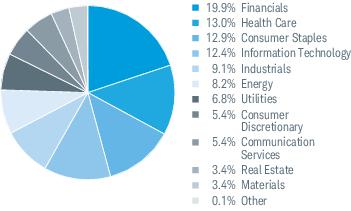

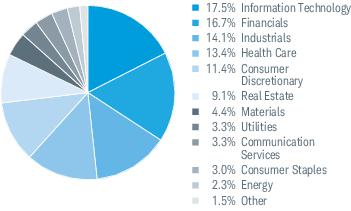

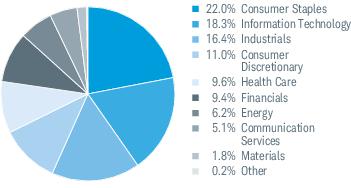

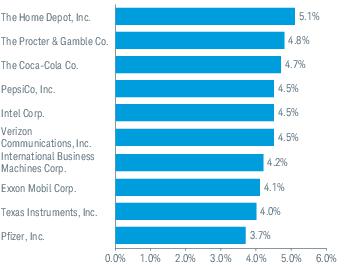

Sector Weightings % of Investments1

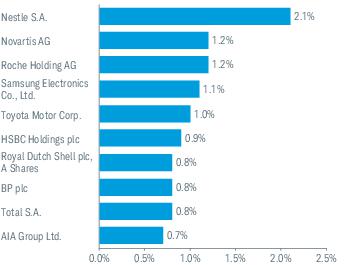

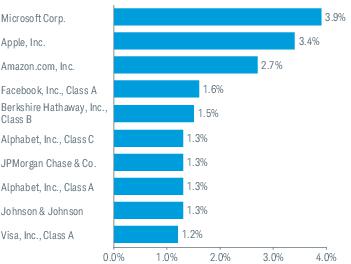

Top Equity Holdings % of Net Assets3

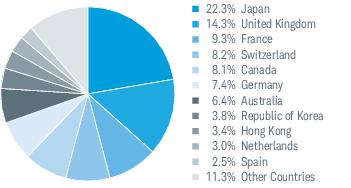

Country Weightings % of Investments4

Portfolio holdings may have changed since the report date.

An index is a statistical composite of a specified financial market or sector. Unlike the fund, an index does not actually hold a portfolio of securities and its return is not inclusive of trading and management costs incurred by the fund.

Source of Sector Classification: S&P and MSCI.

| 1 | Excludes derivatives. |

| 2 | Portfolio turnover rate excludes securities received or delivered from processing of in-kind creations or redemptions. |

| 3 | This list is not a recommendation of any security by the investment adviser. |

| 4 | The percentage may differ from the Portfolio Holdings because the above calculation is based on a percentage of total investments, excluding derivatives, whereas the calculation in the Portfolio Holdings is based on a percentage of net assets. |

Schwab International Equity ETFs | Annual Report

Schwab International Small-Cap Equity ETFas of August 31, 2019

The Schwab International Small-Cap Equity ETF (the fund) seeks to track as closely as possible, before fees and expenses, the total return of the FTSE Developed Small Cap ex US Liquid Index (the index). The index is comprised of small-capitalization companies in developed countries outside the United States, as defined by the index provider. The index defines the small-capitalization universe as approximately the bottom 10% of the eligible universe with a minimum free float capitalization of $150 million. The fund invests in a representative sample of securities included in the index which, when taken together, are expected to perform similarly to the index as a whole. Due to the use of representative sampling, the fund may not hold all of the securities included in the index.

Market Highlights. International equity markets lost ground over the 12-month reporting period as economic momentum slowed, dampened by uncertainties from several fronts, including trade, inflation, and geopolitical concerns. Following recent monetary tightening measures after a long period of generally accommodative policies, interest rates were lowered in several key economies, including the United States. Over the period, the U.S. dollar strengthened against a basket of foreign currencies.

Performance. During the 12-month reporting period ended August 31, 2019, the fund generally tracked the index. The fund’s market price return was -10.42% and its NAV return was -10.57%. The index returned -10.71%1 during the same period.

Contributors and Detractors. Stocks from Sweden were the largest contributors to the total return of the fund. Swedish stocks represented an average weight of approximately 5% of the fund’s investments and returned approximately 4% in U.S. dollar terms. One example from this market is Fabege AB, a real estate company focused on urban development in Stockholm. The fund’s holdings of Fabege AB returned approximately 28% in U.S. dollar terms. Stocks from Singapore also contributed to the total return of the fund, representing an average weight of approximately 2% of the fund’s investments and returning approximately 11% in U.S. dollar terms.

Stocks from Japan were the largest detractors from the total return of the fund. Japanese stocks represented an average weight of 19% of the fund’s investments and returned approximately -12% in U.S. dollar terms. One example from this market is OUTSOURCING, Inc. The fund’s holdings of OUTSOURCING, Inc. returned approximately -51% in U.S. dollar terms. Stocks from South Korea also detracted from the total return of the fund, representing an average weight of approximately 5% of the fund’s investments and returning approximately -31% in U.S. dollar terms.

Management views and portfolio holdings may have changed since the report date.

| 1 | The total return cited for the index is calculated net of foreign withholding taxes; the underlying tax rate information is available from FTSE. |

Schwab International Equity ETFs | Annual Report

Schwab International Small-Cap Equity ETF

Performance and Fund Factsas of August 31, 2019

The performance data quoted represents past performance. Past performance does not guarantee future results. Investment return and principal value of an investment will fluctuate so that an investor’s shares, when sold or redeemed, may be worth more or less than the original cost. Current performance may be lower or higher than the performance quoted. To obtain performance information current to the most recent month end, please visitwww.schwabfunds.com/schwabetfs_prospectus.

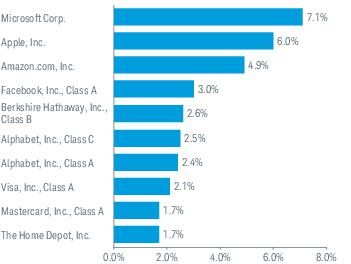

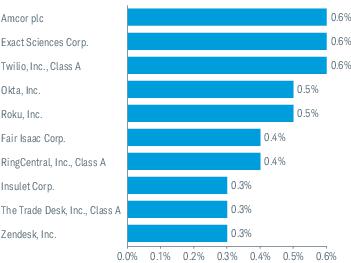

Performance of Hypothetical $10,000 Investment (January 14, 2010 – August 31, 2019)1

Average Annual Total Returns1

| Fund and Inception Date | 1 Year | 5 Years | Since Inception* |

| Fund: Schwab International Small-Cap Equity ETF (1/14/10) | | | |

| Market Price Return2 | -10.42% | 1.12% | 4.93% |

| NAV Return2 | -10.57% | 1.18% | 4.94% |

| FTSE Developed Small Cap ex US Liquid Index (Net)3 | -10.71% | 1.02% | 4.98% |

| ETF Category: Morningstar Foreign Small/Mid Blend4 | -9.97% | 2.20% | N/A |

| Fund Expense Ratio5: 0.12% |

All total returns on this page assume dividends and distributions were reinvested. Index figures do not include trading and management costs, which would lower performance. Indices are unmanaged and cannot be invested in directly. Performance results less than one year are not annualized.

For index definitions, please see the Glossary.

Shares are bought and sold at market price, which may be higher or lower than the net asset value (NAV). Brokerage commissions will reduce returns.

International investing may involve risk of capital loss from unfavorable fluctuations in currency values, from differences in generally accepted accounting principles, or from economic or political instability in other nations.

Small-company stocks may be subject to greater volatility than many other asset classes.

Index ownership — FTSE is a trademark of the London Stock Exchange Group companies (LSEG) and is used by the fund under license. The Schwab International Small-Cap Equity ETF is not sponsored, endorsed, sold or promoted by FTSE nor LSEG and neither FTSE nor LSEG makes any representation regarding the advisability of investing in shares of the fund. Fees payable under the license are paid by the investment adviser.

| * | Inception (1/14/10) represents the date that the shares began trading in the secondary market. |

| 1 | Performance does not reflect the deduction of taxes that a shareholder would pay on fund distributions or on the redemption or sale of fund shares. |

| 2 | ETF performance must be shown based on both a market price and NAV basis. The fund’s per share NAV is the value of one share of the fund. NAV is calculated by taking the fund’s total assets (including the market value of securities owned), subtracting liabilities, and dividing by the number of shares outstanding. The NAV Return is based on the NAV of the fund, and the Market Price Return is based on the market price per share of the fund. The price used to calculate market return (Market Price) is determined using the Official Closing Price on the primary stock exchange (generally, 4:00 p.m. Eastern time) and may not represent the returns you would receive if shares were traded at other times. NAV is used as a proxy for purposes of calculating Market Price Return on inception date. Market Price and NAV returns assume that dividends and capital gain distributions have been reinvested in the fund at Market Price and NAV, respectively. |

| 3 | The total return cited for the index is calculated net of foreign withholding taxes; the underlying tax rate information is available from FTSE. |

| 4 | Source for category information: Morningstar, Inc. The Morningstar Category return represents all passively- and actively-managed ETFs within the category as of the report date. |

| 5 | As stated in the prospectus. |

Schwab International Equity ETFs | Annual Report

Schwab International Small-Cap Equity ETF

Performance and Fund Factsas of August 31, 2019 (continued)

| Number of Holdings | 2,119 |

| Weighted Average Market Cap (millions) | $2,343 |

| Price/Earnings Ratio (P/E) | 14.0 |

| Price/Book Ratio (P/B) | 1.3 |

| Portfolio Turnover Rate | 20%2 |

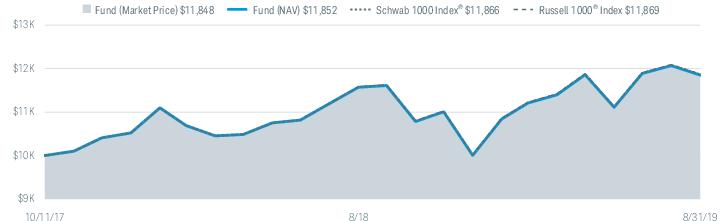

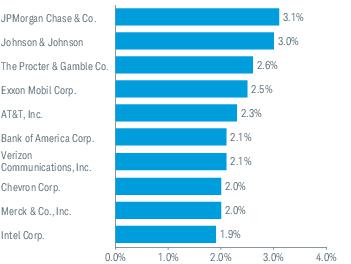

Sector Weightings % of Investments1

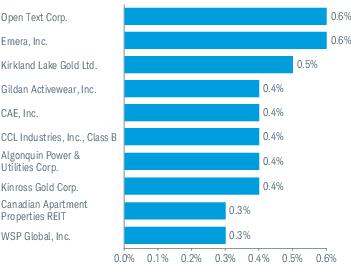

Top Equity Holdings % of Net Assets3

Country Weightings % of Investments4

Portfolio holdings may have changed since the report date.

An index is a statistical composite of a specified financial market or sector. Unlike the fund, an index does not actually hold a portfolio of securities and its return is not inclusive of trading and management costs incurred by the fund.

Source of Sector Classification: S&P and MSCI.

| 1 | Excludes derivatives. |

| 2 | Portfolio turnover rate excludes securities received or delivered from processing of in-kind creations or redemptions. |

| 3 | This list is not a recommendation of any security by the investment adviser. |

| 4 | The percentage may differ from the Portfolio Holdings because the above calculation is based on a percentage of total investments, excluding derivatives, whereas the calculation in the Portfolio Holdings is based on a percentage of net assets. |

Schwab International Equity ETFs | Annual Report

Schwab Emerging Markets Equity ETFas of August 31, 2019

The Schwab Emerging Markets Equity ETF (the fund) seeks to track as closely as possible, before fees and expenses, the total return of the FTSE Emerging Index (the index). The index is comprised of large- and mid-capitalization companies in emerging market countries, as defined by the index provider. The index defines the large- and mid-capitalization universe as approximately the top 90% of the eligible universe. The fund invests in a representative sample of securities included in the index which, when taken together, are expected to perform similarly to the index as a whole. Due to the use of representative sampling, the fund may not hold all of the securities included in the index.

Market Highlights. International equity markets lost ground over the 12-month reporting period, particularly in emerging markets, as economic momentum slowed, dampened by uncertainties from several fronts, including trade, inflation, and geopolitical concerns. Following recent monetary tightening measures after a long period of generally accommodative policies, interest rates were lowered in several key developed and emerging market economies, including the United States, India, Thailand, and China. Over the period, the U.S. dollar strengthened against a basket of foreign currencies.

Performance. During the 12-month reporting period ended August 31, 2019, the fund generally tracked the index. The fund’s market price return was -0.95% and its NAV return was -0.97%. The index returned -0.99%1 during the same period.

Contributors and Detractors. Stocks from Brazil were the largest contributors to the total return of the fund. Brazilian stocks represented an average weight of approximately 9% of the fund’s investments and returned approximately 32% in U.S. dollar terms. One example from this market is Banco Bradesco S.A., a banking and financial services company. The fund’s preferred stock holdings of Banco Bradesco S.A. returned approximately 43% in U.S. dollar terms. Stocks from Russia also contributed to the fund’s total return, representing an average weight of approximately 4% of the fund’s investments and returning approximately 26% in U.S. dollar terms.

Stocks from China were the largest detractors from the total return of the fund. Chinese stocks represented an average weight of approximately 34% of the fund’s investments and returned approximately -5% in U.S. dollar terms. One example from this market is Baidu, Inc. ADR, a multinational technology company. The fund’s Class A holdings of Baidu, Inc. ADR returned approximately -54% in U.S. dollar terms. Stocks from India also detracted from the fund’s total return, representing an average weight of approximately 11% of the fund’s investments and returning approximately -9% in U.S. dollar terms.

Management views and portfolio holdings may have changed since the report date.

| 1 | The total return cited for the index is calculated net of foreign withholding taxes; the underlying tax rate information is available from FTSE. |

Schwab International Equity ETFs | Annual Report

Schwab Emerging Markets Equity ETF

Performance and Fund Factsas of August 31, 2019

The performance data quoted represents past performance. Past performance does not guarantee future results. Investment return and principal value of an investment will fluctuate so that an investor’s shares, when sold or redeemed, may be worth more or less than the original cost. Current performance may be lower or higher than the performance quoted. To obtain performance information current to the most recent month end, please visitwww.schwabfunds.com/schwabetfs_prospectus.

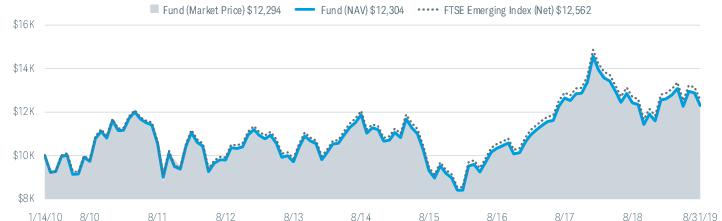

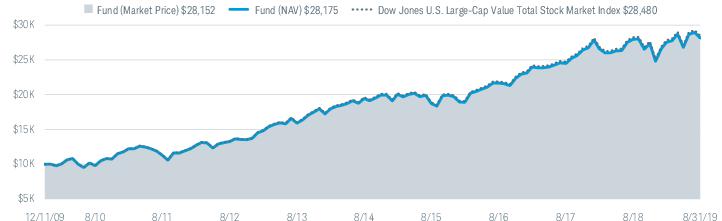

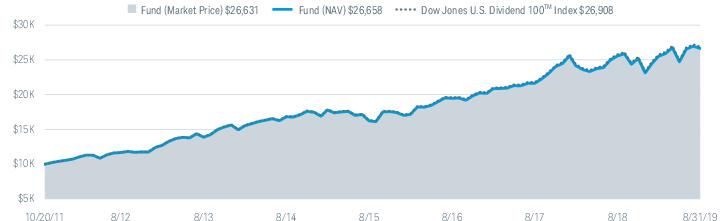

Performance of Hypothetical $10,000 Investment (January 14, 2010 – August 31, 2019)1

Average Annual Total Returns1

| Fund and Inception Date | 1 Year | 5 Years | Since Inception* |

| Fund: Schwab Emerging Markets Equity ETF (1/14/10) | | | |

| Market Price Return2 | -0.95% | 0.62% | 2.17% |

| NAV Return2 | -0.97% | 0.71% | 2.18% |

| FTSE Emerging Index (Net)3 | -0.99% | 0.83% | 2.40% |

| ETF Category: Morningstar Diversified Emerging Markets4 | -2.54% | 0.02% | N/A |

| Fund Expense Ratio5: 0.13% |

All total returns on this page assume dividends and distributions were reinvested. Index figures do not include trading and management costs, which would lower performance. Indices are unmanaged and cannot be invested in directly. Performance results less than one year are not annualized.

For index definitions, please see the Glossary.

Shares are bought and sold at market price, which may be higher or lower than the net asset value (NAV). Brokerage commissions will reduce returns.

International investing may involve risk of capital loss from unfavorable fluctuations in currency values, from differences in generally accepted accounting principles, or from economic or political instability in other nations.

Emerging markets involve heightened risks related to the same factors as international investing, as well as increased volatility and lower trading volume.

Index ownership — FTSE is a trademark of the London Stock Exchange Group companies (LSEG) and is used by the fund under license. The Schwab Emerging Markets Equity ETF is not sponsored, endorsed, sold or promoted by FTSE nor LSEG and neither FTSE nor LSEG makes any representation regarding the advisability of investing in shares of the fund. Fees payable under the license are paid by the investment adviser.

| * | Inception (1/14/10) represents the date that the shares began trading in the secondary market. |

| 1 | Performance does not reflect the deduction of taxes that a shareholder would pay on fund distributions or on the redemption or sale of fund shares. |

| 2 | ETF performance must be shown based on both a market price and NAV basis. The fund’s per share NAV is the value of one share of the fund. NAV is calculated by taking the fund’s total assets (including the market value of securities owned), subtracting liabilities, and dividing by the number of shares outstanding. The NAV Return is based on the NAV of the fund, and the Market Price Return is based on the market price per share of the fund. The price used to calculate market return (Market Price) is determined using the Official Closing Price on the primary stock exchange (generally, 4:00 p.m. Eastern time) and may not represent the returns you would receive if shares were traded at other times. NAV is used as a proxy for purposes of calculating Market Price Return on inception date. Market Price and NAV returns assume that dividends and capital gain distributions have been reinvested in the fund at Market Price and NAV, respectively. |

| 3 | The total return cited for the index is calculated net of foreign withholding taxes; the underlying tax rate information is available from FTSE. |

| 4 | Source for category information: Morningstar, Inc. The Morningstar Category return represents all passively- and actively-managed ETFs within the category as of the report date. |

| 5 | As stated in the prospectus. |

Schwab International Equity ETFs | Annual Report

Schwab Emerging Markets Equity ETF

Performance and Fund Factsas of August 31, 2019 (continued)

| Number of Holdings | 1,203 |

| Weighted Average Market Cap (millions) | $83,743 |

| Price/Earnings Ratio (P/E) | 13.3 |

| Price/Book Ratio (P/B) | 1.7 |

| Portfolio Turnover Rate | 13%2 |

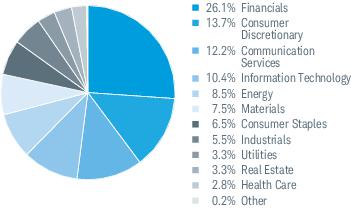

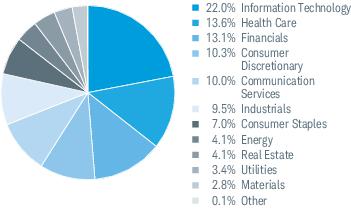

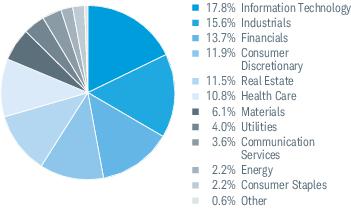

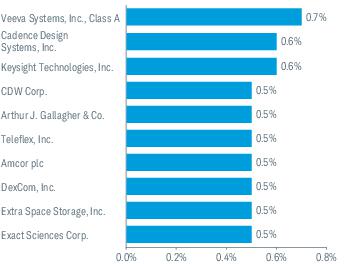

Sector Weightings % of Investments1

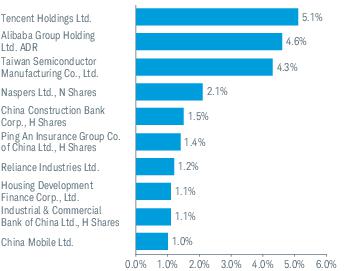

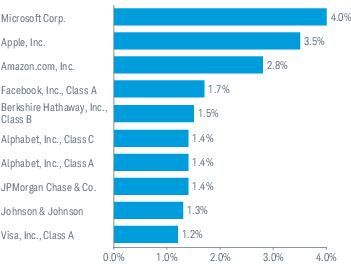

Top Equity Holdings % of Net Assets3

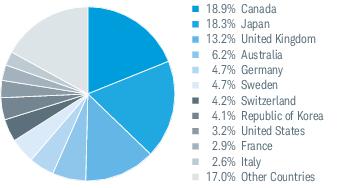

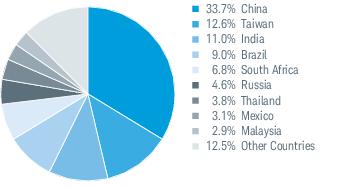

Country Weightings % of Investments4

Portfolio holdings may have changed since the report date.

An index is a statistical composite of a specified financial market or sector. Unlike the fund, an index does not actually hold a portfolio of securities and its return is not inclusive of trading and management costs incurred by the fund.

Source of Sector Classification: S&P and MSCI.

| 1 | Excludes derivatives. |

| 2 | Portfolio turnover rate excludes securities received or delivered from processing of in-kind creations or redemptions. |

| 3 | This list is not a recommendation of any security by the investment adviser. |

| 4 | The percentage may differ from the Portfolio Holdings because the above calculation is based on a percentage of total investments, excluding derivatives, whereas the calculation in the Portfolio Holdings is based on a percentage of net assets. |

Schwab International Equity ETFs | Annual Report

Schwab International Equity ETFs

Examples for a $1,000 Investment

As a fund shareholder, you may incur two types of costs: (1) transaction costs, including brokerage commissions on purchases and sales of fund shares; and, (2) ongoing costs, including management fees.

The expense examples below are intended to help you understand your ongoing cost (in dollars) of investing in a fund and to compare this cost with the ongoing cost of investing in other mutual funds. These examples are based on an investment of $1,000 invested for six months beginning March 1, 2019 and held through August 31, 2019.

Actual Return lines in the table below provide information about actual account values and actual expenses. You may use this information, together with the amount you invested, to estimate the expenses that you paid over the period. To do so, simply divide your account value by $1,000 (for example, an $8,600 account value ÷ $1,000 = 8.6), then multiply the result by the number given for your fund under the heading entitled “Expenses Paid During Period.”

Hypothetical Return lines in the table below provide information about hypothetical account values and hypothetical expenses based on a fund’s actual expense ratio and an assumed return of 5% per year before expenses. Because the return used is not an actual return, it may not be used to estimate the actual ending account value or expenses you paid for the period.

You may use this information to compare the ongoing costs of investing in a fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only, and do not reflect any transactional costs, including any brokerage commissions you may pay when purchasing or selling shares of a fund. Therefore, the hypothetical return lines of the table are useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

| | Expense Ratio

(Annualized)1 | Beginning

Account Value

at 3/1/19 | Ending

Account Value

(Net of Expenses)

at 8/31/19 | Expenses Paid

During Period

3/1/19-8/31/192 |

| Schwab International Equity ETF | | | | |

| Actual Return | 0.06% | $1,000.00 | $999.00 | $0.30 |

| Hypothetical 5% Return | 0.06% | $1,000.00 | $1,024.90 | $0.31 |

| Schwab International Small-Cap Equity ETF | | | | |

| Actual Return | 0.12% | $1,000.00 | $966.70 | $0.59 |

| Hypothetical 5% Return | 0.12% | $1,000.00 | $1,024.60 | $0.61 |

| Schwab Emerging Markets Equity ETF | | | | |

| Actual Return | 0.13% | $1,000.00 | $975.50 | $0.65 |

| Hypothetical 5% Return | 0.13% | $1,000.00 | $1,024.54 | $0.66 |

| 1 | Based on the most recent six-month expense ratio. |

| 2 | Expenses for each fund are equal to its annualized expense ratio, multiplied by the average account value over the period, multiplied by 184 days of the period, and divided by 365 days of the fiscal year. |

Schwab International Equity ETFs | Annual Report

Schwab International Equity ETF

Financial Statements

Financial Highlights

| | 9/1/18–

8/31/19 | 9/1/17–

8/31/18 | 9/1/16–

8/31/17 | 9/1/15–

8/31/16 | 9/1/14–

8/31/15 | |

| Per-Share Data |

| Net asset value at beginning of period | $33.25 | $32.51 | $28.32 | $28.55 | $32.37 | |

| Income (loss) from investment operations: | | | | | | |

| Net investment income (loss)1 | 1.00 | 0.98 | 0.88 | 0.84 | 0.87 | |

| Net realized and unrealized gains (losses) | (2.30) | 0.56 | 4.02 | (0.45) | (3.85) | |

| Total from investment operations | (1.30) | 1.54 | 4.90 | 0.39 | (2.98) | |

| Less distributions: | | | | | | |

| Distributions from net investment income | (1.13) | (0.80) | (0.71) | (0.62) | (0.84) | |

| Net asset value at end of period | $30.82 | $33.25 | $32.51 | $28.32 | $28.55 | |

| Total return | (3.79%) | 4.70% | 17.76% | 1.47% | (9.27%) | |

| Ratios/Supplemental Data |

| Ratios to average net assets: | | | | | | |

| Total expenses | 0.06% | 0.06% | 0.06%2 | 0.08% | 0.08% | |

| Net investment income (loss) | 3.22% | 2.91% | 2.95% | 3.06% | 2.86% | |

| Portfolio turnover rate3 | 8% | 5% | 5% | 5% | 4% | |

| Net assets, end of period (x 1,000) | $18,138,537 | $16,294,052 | $11,413,011 | $6,168,595 | $4,042,603 | |

| |

1

Calculated based on the average shares outstanding during the period.

2

Effective October 7, 2016 and March 1, 2017, the annual operating expense ratio was reduced. The ratio presented for the period ended 8/31/17 is a blended ratio.

3

Portfolio turnover rate excludes securities received or delivered from processing of in-kind creations or redemptions.

Schwab International Equity ETFs | Annual Report

Schwab International Equity ETF

Condensed Portfolio Holdings as of August 31, 2019

This section shows the fund’s 50 largest portfolio holdings in unaffiliated issuers, any holdings exceeding 1% of the fund’s net assets as of the report date, and any affiliated issuers. The remaining securities held by the fund are grouped as "Other Securities" in each category. You can request a complete schedule of portfolio holdings as of the report date, free of charge, by calling Schwab ETFs at 1-877-824-5615. This complete schedule, filed on the fund’s Form N-CSR(S), is also available on the U.S. Securities and Exchange Commission (SEC)’s website atwww.sec.gov.

In addition, the fund files its complete schedule of portfolio holdings with the SEC for the first and third quarters of each fiscal year on Form N-Q. Effective March 31, 2019, Form N-PORT Part F has replaced Form N-Q. The fund’s Form N-Q and Form N-PORT Part F are available on the SEC’s website. The fund also makes available its complete schedule of portfolio holdings on a daily basis on the fund’s website atwww.schwabfunds.com/schwabetfs_prospectus.

| Security | Number

of Shares | % of Net

Assets | Value ($) |

| Common Stock98.8% of net assets | |

| |

| Australia 6.4% | |

| BHP Group Ltd. | 3,316,925 | 0.5 | 81,100,105 |

| Commonwealth Bank of Australia | 1,993,408 | 0.6 | 106,168,789 |

| CSL Ltd. | 515,171 | 0.5 | 83,605,128 |

| Westpac Banking Corp. | 3,881,836 | 0.4 | 73,806,224 |

| Other Securities | | 4.4 | 813,897,710 |

| | | 6.4 | 1,158,577,956 |

| |

| Austria 0.2% | |

| Other Securities | | 0.2 | 34,970,237 |

| |

| Belgium 0.9% | |

| Anheuser-Busch InBev S.A. | 866,107 | 0.5 | 82,217,591 |

| Other Securities | | 0.4 | 79,602,501 |

| | | 0.9 | 161,820,092 |

| |

| Canada 8.0% | |

| Canadian National Railway Co. | 813,602 | 0.4 | 75,065,928 |

| Enbridge, Inc. | 2,222,316 | 0.4 | 74,473,007 |

| Royal Bank of Canada | 1,638,833 | 0.7 | 122,813,810 |

| The Bank of Nova Scotia | 1,383,170 | 0.4 | 73,696,896 |

| The Toronto-Dominion Bank | 2,072,619 | 0.6 | 112,615,211 |

| Other Securities | | 5.5 | 996,160,060 |

| | | 8.0 | 1,454,824,912 |

| |

| Denmark 1.5% | |

| Novo Nordisk A/S, B Shares | 1,861,306 | 0.5 | 96,850,811 |

| Other Securities | | 1.0 | 180,635,550 |

| | | 1.5 | 277,486,361 |

| |

| Finland 1.0% | |

| Other Securities | | 1.0 | 186,818,270 |

| |

| France 9.3% | |

| Air Liquide S.A. | 474,536 | 0.4 | 66,185,110 |

| Airbus SE | 618,214 | 0.5 | 85,332,498 |

| Danone S.A. | 669,190 | 0.3 | 60,031,581 |

| L'Oreal S.A. | 270,229 | 0.4 | 73,980,798 |

| LVMH Moet Hennessy Louis Vuitton SE | 280,766 | 0.6 | 112,051,748 |

| Sanofi | 1,219,089 | 0.6 | 104,877,803 |

| Total S.A. | 2,710,428 | 0.8 | 135,482,746 |

| Other Securities | | 5.7 | 1,047,982,523 |

| | | 9.3 | 1,685,924,807 |

| |

| Security | Number

of Shares | % of Net

Assets | Value ($) |

| Germany 7.0% | |

| adidas AG | 219,479 | 0.4 | 65,186,828 |

| Allianz SE | 472,934 | 0.6 | 104,424,126 |

| BASF SE | 1,028,232 | 0.4 | 68,144,252 |

| Bayer AG | 1,050,852 | 0.4 | 77,929,269 |

| Deutsche Telekom AG | 3,617,574 | 0.3 | 60,458,960 |

| SAP SE | 1,096,823 | 0.7 | 131,175,373 |

| Siemens AG | 849,294 | 0.5 | 85,064,175 |

| Other Securities | | 3.7 | 671,420,057 |

| | | 7.0 | 1,263,803,040 |

| |

| Hong Kong 3.3% | |

| AIA Group Ltd. | 13,628,774 | 0.7 | 132,628,921 |

| Other Securities | | 2.6 | 474,520,989 |

| | | 3.3 | 607,149,910 |

| |

| Ireland 0.2% | |

| Other Securities | | 0.2 | 35,514,241 |

| |

| Israel 0.4% | |

| Other Securities | | 0.4 | 79,226,093 |

| |

| Italy 2.1% | |

| Enel S.p.A. | 8,815,409 | 0.4 | 64,014,350 |

| Other Securities | | 1.7 | 326,435,355 |

| | | 2.1 | 390,449,705 |

| |

| Japan 22.3% | |

| Keyence Corp. | 101,041 | 0.3 | 59,875,443 |

| Mitsubishi UFJ Financial Group, Inc. | 13,975,047 | 0.4 | 67,199,246 |

| SoftBank Group Corp. | 1,926,923 | 0.5 | 87,573,381 |

| Sony Corp. | 1,406,635 | 0.5 | 80,068,667 |

| Toyota Motor Corp. | 2,823,090 | 1.0 | 185,111,936 |

| Other Securities | | 19.6 | 3,560,092,454 |

| | | 22.3 | 4,039,921,127 |

| |

| Netherlands 3.0% | |

| ASML Holding N.V. | 442,518 | 0.5 | 98,561,069 |

| Unilever N.V. | 1,633,012 | 0.6 | 101,499,129 |

| Other Securities | | 1.9 | 348,871,376 |

| | | 3.0 | 548,931,574 |

| |

| New Zealand 0.3% | |

| Other Securities | | 0.3 | 48,582,730 |

| |

Schwab International Equity ETFs | Annual Report

Schwab International Equity ETF

Condensed Portfolio Holdings as of August 31, 2019 (continued)

| Security | Number

of Shares | % of Net

Assets | Value ($) |

| Norway 0.6% | |

| Other Securities | | 0.6 | 110,247,442 |

| |

| Poland 0.3% | |

| Other Securities | | 0.3 | 51,766,256 |

| |

| Portugal 0.1% | |

| Other Securities | | 0.1 | 24,290,643 |

| |

| Republic of Korea 3.6% | |

| Samsung Electronics Co., Ltd. | 5,289,728 | 1.1 | 192,155,238 |

| Other Securities | | 2.5 | 455,377,464 |

| | | 3.6 | 647,532,702 |

| |

| Singapore 1.2% | |

| Other Securities | | 1.2 | 210,625,854 |

| |

| Spain 2.5% | |

| Banco Santander S.A. | 18,015,863 | 0.3 | 68,249,496 |

| Iberdrola S.A. | 7,019,929 | 0.4 | 72,297,479 |

| Other Securities | | 1.8 | 306,332,801 |

| | | 2.5 | 446,879,776 |

| |

| Sweden 2.2% | |

| Other Securities | | 2.2 | 400,254,614 |

| |

| Switzerland 8.1% | |

| Nestle S.A. | 3,355,283 | 2.1 | 376,407,512 |

| Novartis AG | 2,464,978 | 1.2 | 221,747,124 |

| Roche Holding AG | 783,410 | 1.2 | 214,251,095 |

| Other Securities | | 3.6 | 660,337,220 |

| | | 8.1 | 1,472,742,951 |

| |

| United Kingdom 14.3% | |

| AstraZeneca plc | 1,477,317 | 0.7 | 131,661,864 |

| BP plc | 22,377,584 | 0.8 | 136,317,239 |

| British American Tobacco plc | 2,568,986 | 0.5 | 90,104,841 |

| Diageo plc | 2,624,340 | 0.6 | 111,973,724 |

| GlaxoSmithKline plc | 5,514,703 | 0.6 | 114,952,469 |

| HSBC Holdings plc | 22,775,731 | 0.9 | 164,039,163 |

| Rio Tinto plc | 1,240,480 | 0.4 | 62,687,281 |

| Royal Dutch Shell plc, A Shares | 4,948,725 | 0.8 | 137,139,973 |

| Royal Dutch Shell plc, B Shares | 4,251,034 | 0.7 | 117,261,834 |

| Unilever plc | 1,225,395 | 0.4 | 77,542,383 |

| Other Securities | | 7.9 | 1,445,261,966 |

| | | 14.3 | 2,588,942,737 |

| Total Common Stock |

| (Cost $17,366,469,751) | | | 17,927,284,030 |

| Security | Number

of Shares | % of Net

Assets | Value ($) |

| Preferred Stock0.7% of net assets | |

| |

| Germany 0.5% | |

| Other Securities | | 0.5 | 79,514,178 |

| |

| Italy 0.0% | |

| Other Securities | | 0.0 | 3,593,556 |

| |

| Republic of Korea 0.2% | |

| Other Securities | | 0.2 | 36,376,892 |

| |

| Spain 0.0% | |

| Other Securities | | 0.0 | 5,617,842 |

| Total Preferred Stock |

| (Cost $126,758,465) | | | 125,102,468 |

|

| Other Investment Companies0.2% of net assets | |

| |

| United States 0.2% | |

| Money Market Fund 0.1% | |

| Other Securities | | 0.1 | 16,096,739 |

| Securities Lending Collateral 0.1% | |

| Other Securities | | 0.1 | 19,458,984 |

| Total Other Investment Companies |

| (Cost $35,555,723) | | | 35,555,723 |

| | Number of

Contracts | Notional

Amount

($) | Current Value/

Unrealized

Depreciation

($) |

| Futures Contracts | |

| Long | |

| MSCI EAFE Index, expires 09/20/19 | 894 | 82,422,330 | (63,284) |

The following footnotes may not be applicable to the Condensed Portfolio Holdings. Please refer to the complete schedule of portfolio holdings.

| * | Non-income producing security. |

| (a) | All or a portion of this security is on loan. Securities on loan were valued at $18,723,737. |

| (b) | Fair-valued by management using significant unobservable inputs in accordance with procedures approved by the fund’s Board of Trustees. |

| (c) | The rate shown is the 7-day yield. |

| | |

| REIT — | Real Estate Investment Trust |

| RSP — | Risparmio (Convertible Savings Shares) |

Schwab International Equity ETFs | Annual Report

Schwab International Equity ETF

Condensed Portfolio Holdings as of August 31, 2019 (continued)

The following is a summary of the inputs used to value the fund’s investments as of August 31, 2019 and reflects the complete schedule of portfolio holdings (see financial note 2(a) for additional information):

| Description | Quoted Prices in

Active Markets for

Identical Assets

(Level 1) | Other Significant

Observable Inputs

(Level 2) | Significant

Unobservable Inputs

(Level 3) | Total | |

| Assets | | | | | |

| Common Stock1 | $17,295,843,477 | $— | $— | $17,295,843,477 | |

| Hong Kong | 607,149,910 | — | —* | 607,149,910 | |

| Portugal | 24,290,643 | — | —* | 24,290,643 | |

| Preferred Stock1 | 125,102,468 | — | — | 125,102,468 | |

| Other Investment Companies1 | 35,555,723 | — | — | 35,555,723 | |

| Liabilities | | | | | |

| Futures Contracts2 | (63,284) | — | — | (63,284) | |

| Total | $18,087,878,937 | $— | $— | $18,087,878,937 | |

| * | Level 3 amount shown includes securities determined to have no value at August 31, 2019. |

| 1 | As categorized in the complete schedule of Portfolio Holdings. |

| 2 | Futures contracts are valued at unrealized appreciation or depreciation. |

Fund investments in underlying mutual funds are classified as Level 1, without consideration to the classification level of the investments held by the underlying mutual funds, which could be Level 1, Level 2 or Level 3.

Schwab International Equity ETFs | Annual Report

Schwab International Equity ETF

Statement of Assets and Liabilities

As of August 31, 2019

| Assets |

| Investments in unaffiliated issuers, at value (cost $17,509,324,955) including securities on loan of $18,723,737 | | $18,068,483,237 |

| Collateral invested for securities on loan, at value (cost $19,458,984) | | 19,458,984 |

| Deposit with broker for futures contracts | | 4,108,500 |

| Foreign currency, at value (cost $3,383,949) | | 3,381,214 |

| Receivables: | | |

| Dividends | | 49,655,286 |

| Foreign tax reclaims | | 16,037,856 |

| Variation margin on futures contracts | | 375,480 |

| Income from securities on loan | + | 95,888 |

| Total assets | | 18,161,596,445 |

| Liabilities |

| Collateral held for securities on loan | | 19,458,984 |

| Payables: | | |

| Investments bought | | 2,628,207 |

| Management fees | + | 972,271 |

| Total liabilities | | 23,059,462 |

| Net Assets |

| Total assets | | 18,161,596,445 |

| Total liabilities | – | 23,059,462 |

| Net assets | | $18,138,536,983 |

| Net Assets by Source | | |

| Capital received from investors | | 17,957,193,724 |

| Total distributable earnings1 | | 181,343,259 |

| Net Asset Value (NAV) |

| Net Assets | ÷ | Shares

Outstanding | = | NAV |

| $18,138,536,983 | | 588,500,000 | | $30.82 |

| | | | | |

| 1 | The SEC eliminated the requirement to disclose total distributable earnings (loss) by each of its components as previously disclosed as the previous presentation did not provide insight into the tax implications of distributions (see financial note 11 for additional information). |

Schwab International Equity ETFs | Annual Report

Schwab International Equity ETF

Statement of Operations

For the period September 1, 2018 through August 31, 2019

| Investment Income |

| Dividends (net of foreign withholding tax of $53,699,652) | | $546,461,757 |

| Securities on loan, net | + | 2,769,439 |

| Total investment income | | 549,231,196 |

| Expenses |

| Management fees | | 10,029,402 |

| Professional fees | + | 93,919* |

| Total expenses | | 10,123,321 |

| Expense reduction by CSIM | – | 93,919* |

| Net expenses | – | 10,029,402 |

| Net investment income | | 539,201,794 |

| Realized and Unrealized Gains (Losses) |

| Net realized losses on investments | | (303,859,334) |

| Net realized gains on futures contracts | | 63,224 |

| Net realized losses on foreign currency transactions | + | (1,105,920) |

| Net realized losses | | (304,902,030) |

| Net change in unrealized appreciation (depreciation) on investments | | (816,947,205) |

| Net change in unrealized appreciation (depreciation) on futures contracts | | (321,244) |

| Net change in unrealized appreciation (depreciation) on foreign currency translations | + | (359,001) |

| Net change in unrealized appreciation (depreciation) | + | (817,627,450) |

| Net realized and unrealized losses | | (1,122,529,480) |

| Decrease in net assets resulting from operations | | ($583,327,686) |

| * | Includes professional fees associated with the filing of tax claims in the European Union deemed to be non-routine expenses of the fund. See financial notes 2 (d) and 4 for additional information. |

Schwab International Equity ETFs | Annual Report

Schwab International Equity ETF

Statement of Changes in Net Assets

For the current and prior report periods

| Operations | |

| | 9/1/18-8/31/19 | 9/1/17-8/31/18 |

| Net investment income | | $539,201,794 | $414,988,466 |

| Net realized losses | | (304,902,030) | (59,555,035) |

| Net change in unrealized appreciation (depreciation) | + | (817,627,450) | 141,092,417 |

| Increase (decrease) in net assets resulting from operations | | (583,327,686) | 496,525,848 |

| Distributions to Shareholders1 | |

| Total distributions | | ($592,259,760) | ($308,067,760) |

| Transactions in Fund Shares | | | |

| | | 9/1/18-8/31/19 | 9/1/17-8/31/18 |

| | | SHARES | VALUE | SHARES | VALUE |

| Shares sold | | 98,500,000 | $3,020,072,181 | 138,900,000 | $4,692,583,434 |

| Shares redeemed | + | — | — | — | — |

| Net transactions in fund shares | | 98,500,000 | $3,020,072,181 | 138,900,000 | $4,692,583,434 |

| Shares Outstanding and Net Assets | | | |

| | | 9/1/18-8/31/19 | 9/1/17-8/31/18 |

| | | SHARES | NET ASSETS | SHARES | NET ASSETS |

| Beginning of period | | 490,000,000 | $16,294,052,248 | 351,100,000 | $11,413,010,726 |

| Total increase | + | 98,500,000 | 1,844,484,735 | 138,900,000 | 4,881,041,522 |

| End of period2 | | 588,500,000 | $18,138,536,983 | 490,000,000 | $16,294,052,248 |

| 1 | For the period ended August 31, 2018, the fund distributed to shareholders $308,067,760 from net investment income. The SEC eliminated the requirement to disclose distributions to shareholders from net investment income and from net realized gains in 2018 (see financial note 11 for additional information). |

| 2 | End of period - Net assets include net investment income not yet distributed of $292,309,858 at August 31, 2018. The SEC eliminated the requirement to disclose undistributed net investment income in 2018. |

Schwab International Equity ETFs | Annual Report

Schwab International Small-Cap Equity ETF

Financial Statements

Financial Highlights

| | 9/1/18–

8/31/19 | 9/1/17–

8/31/18 | 9/1/16–

8/31/17 | 9/1/15–

8/31/16 | 9/1/14–

8/31/15 | |

| Per-Share Data |

| Net asset value at beginning of period | $35.86 | $34.80 | $29.96 | $29.46 | $33.32 | |

| Income (loss) from investment operations: | | | | | | |

| Net investment income (loss)1 | 0.82 | 0.84 | 0.73 | 0.67 | 0.73 | |

| Net realized and unrealized gains (losses) | (4.63) | 1.22 | 4.70 | 0.50 | (3.84) | |

| Total from investment operations | (3.81) | 2.06 | 5.43 | 1.17 | (3.11) | |

| Less distributions: | | | | | | |

| Distributions from net investment income | (0.90) | (1.00) | (0.59) | (0.67) | (0.75) | |

| Net asset value at end of period | $31.15 | $35.86 | $34.80 | $29.96 | $29.46 | |

| Total return | (10.57%) | 5.93% | 18.52% | 4.12% | (9.29%) | |

| Ratios/Supplemental Data |

| Ratios to average net assets: | | | | | | |

| Total expenses | 0.12% | 0.12% | 0.14%2 | 0.17%3 | 0.18%4 | |

| Net investment income (loss) | 2.54% | 2.31% | 2.31% | 2.34% | 2.40% | |

| Portfolio turnover rate5 | 20% | 16% | 12% | 23% | 23% | |

| Net assets, end of period (x 1,000) | $2,186,842 | $2,280,998 | $1,538,038 | $787,951 | $609,773 | |

| |

1

Calculated based on the average shares outstanding during the period.

2

Effective March 1, 2017, the annual operating expense ratio was reduced. The ratio presented for the period ended 8/31/17 is a blended ratio.

3

Effective March 1, 2016, the annual operating expense ratio was reduced. The ratio presented for the period ended 8/31/16 is a blended ratio.

4

Effective March 4, 2015, the annual operating expense ratio was reduced. The ratio presented for the period ended 8/31/15 is a blended ratio.

5

Portfolio turnover rate excludes securities received or delivered from processing of in-kind creations or redemptions.

Schwab International Equity ETFs | Annual Report

Schwab International Small-Cap Equity ETF

Condensed Portfolio Holdings as of August 31, 2019

This section shows the fund’s 50 largest portfolio holdings in unaffiliated issuers, any holdings exceeding 1% of the fund’s net assets as of the report date, and any affiliated issuers. The remaining securities held by the fund are grouped as "Other Securities" in each category. You can request a complete schedule of portfolio holdings as of the report date, free of charge, by calling Schwab ETFs at 1-877-824-5615. This complete schedule, filed on the fund’s Form N-CSR(S), is also available on the U.S. Securities and Exchange Commission (SEC)’s website atwww.sec.gov.

In addition, the fund files its complete schedule of portfolio holdings with the SEC for the first and third quarters of each fiscal year on Form N-Q. Effective March 31, 2019, Form N-PORT Part F has replaced Form N-Q. The fund’s Form N-Q and Form N-PORT Part F are available on the SEC’s website. The fund also makes available its complete schedule of portfolio holdings on a daily basis on the fund’s website atwww.schwabfunds.com/schwabetfs_prospectus.

| Security | Number

of Shares | % of Net

Assets | Value ($) |

| Common Stock99.0% of net assets | |

| |

| Australia 6.4% | |

| Afterpay Touch Group Ltd. * | 218,358 | 0.2 | 4,557,738 |

| Charter Hall Group | 587,909 | 0.2 | 5,010,712 |

| Other Securities | | 6.0 | 130,451,291 |

| | | 6.4 | 140,019,741 |

| |

| Austria 1.0% | |

| Other Securities | | 1.0 | 22,164,676 |

| |

| Belgium 2.2% | |

| Argenx SE * | 47,559 | 0.3 | 6,190,648 |

| Other Securities | | 1.9 | 42,166,227 |

| | | 2.2 | 48,356,875 |

| |

| Canada 19.5% | |

| Air Canada * | 167,895 | 0.3 | 5,654,200 |

| Algonquin Power & Utilities Corp. | 614,505 | 0.4 | 8,046,649 |

| Allied Properties Real Estate Investment Trust | 137,790 | 0.3 | 5,443,991 |

| AltaGas Ltd. | 340,711 | 0.2 | 4,635,803 |

| Aurora Cannabis, Inc. *(a) | 993,603 | 0.3 | 5,488,445 |

| B2Gold Corp. * | 1,238,347 | 0.2 | 4,454,620 |

| CAE, Inc. | 341,355 | 0.4 | 8,952,605 |

| Cameco Corp. | 494,970 | 0.2 | 4,350,730 |

| Canadian Apartment Properties REIT | 183,236 | 0.3 | 7,384,323 |

| Canopy Growth Corp. *(a) | 223,364 | 0.2 | 5,288,254 |

| CCL Industries, Inc., Class B | 183,363 | 0.4 | 8,325,022 |

| Cronos Group, Inc. *(a) | 419,976 | 0.2 | 4,642,871 |

| Emera, Inc. | 293,524 | 0.6 | 12,741,168 |

| Empire Co., Ltd., A Shares | 215,316 | 0.3 | 5,951,653 |

| First Quantum Minerals Ltd. | 852,256 | 0.2 | 5,233,601 |

| Gildan Activewear, Inc. | 258,545 | 0.4 | 9,496,976 |

| H&R Real Estate Investment Trust | 361,284 | 0.3 | 6,152,812 |

| IA Financial Corp., Inc. * | 137,430 | 0.3 | 5,726,595 |

| Keyera Corp. | 264,168 | 0.3 | 6,387,506 |

| Kinross Gold Corp. * | 1,556,869 | 0.4 | 7,756,226 |

| Kirkland Lake Gold Ltd. | 233,459 | 0.5 | 11,374,274 |

| Onex Corp. | 103,173 | 0.3 | 6,073,293 |

| Open Text Corp. | 325,324 | 0.6 | 12,752,955 |

| Pan American Silver Corp. | 258,086 | 0.2 | 4,766,278 |

| Parkland Fuel Corp. | 183,809 | 0.3 | 5,743,340 |

| Ritchie Bros. Auctioneers, Inc. | 136,740 | 0.2 | 5,420,000 |

| TMX Group Ltd. | 69,379 | 0.3 | 6,020,539 |

| Toromont Industries Ltd. | 98,020 | 0.2 | 4,704,045 |

| Security | Number

of Shares | % of Net

Assets | Value ($) |

| WSP Global, Inc. | 129,424 | 0.3 | 7,020,531 |

| Other Securities | | 10.4 | 229,574,497 |

| | | 19.5 | 425,563,802 |

| |

| Denmark 1.4% | |

| Royal Unibrew A/S | 62,729 | 0.3 | 5,442,208 |

| SimCorp A/S | 49,540 | 0.2 | 4,620,641 |

| Other Securities | | 0.9 | 19,987,995 |

| | | 1.4 | 30,050,844 |

| |

| Finland 1.1% | |

| Other Securities | | 1.1 | 23,919,817 |

| |

| France 3.0% | |

| Altran Technologies S.A. | 290,817 | 0.2 | 4,634,195 |

| Euronext N.V. | 87,261 | 0.3 | 6,856,462 |

| Other Securities | | 2.5 | 53,200,259 |

| | | 3.0 | 64,690,916 |

| |

| Germany 4.7% | |

| Dialog Semiconductor plc * | 95,902 | 0.2 | 4,537,095 |

| MorphoSys AG * | 39,823 | 0.2 | 4,714,421 |

| Other Securities | | 4.3 | 92,753,627 |

| | | 4.7 | 102,005,143 |

| |

| Hong Kong 1.5% | |

| Other Securities | | 1.5 | 32,127,970 |

| |

| Ireland 0.4% | |

| Other Securities | | 0.4 | 8,080,396 |

| |

| Israel 0.7% | |

| Other Securities | | 0.7 | 14,467,744 |

| |

| Italy 2.7% | |

| Other Securities | | 2.7 | 58,817,278 |

| |

| Japan 18.8% | |

| Other Securities | | 18.8 | 411,624,440 |

| |

Schwab International Equity ETFs | Annual Report

Schwab International Small-Cap Equity ETF

Condensed Portfolio Holdings as of August 31, 2019 (continued)

| Security | Number

of Shares | % of Net

Assets | Value ($) |

| Netherlands 2.2% | |

| IMCD N.V. | 65,928 | 0.2 | 4,632,085 |

| Takeaway.com N.V. * | 45,605 | 0.2 | 4,361,825 |

| Other Securities | | 1.8 | 39,427,850 |

| | | 2.2 | 48,421,760 |

| |

| New Zealand 1.0% | |

| Other Securities | | 1.0 | 23,005,996 |

| |

| Norway 1.8% | |

| Other Securities | | 1.8 | 40,210,171 |

| |

| Poland 0.7% | |

| Other Securities | | 0.7 | 14,839,992 |

| |

| Portugal 0.4% | |

| Other Securities | | 0.4 | 9,292,784 |

| |

| Republic of Korea 4.2% | |

| Other Securities | | 4.2 | 92,936,622 |

| |

| Singapore 1.4% | |

| Other Securities | | 1.4 | 30,184,815 |

| |

| Spain 1.6% | |

| Other Securities | | 1.6 | 36,202,163 |

| |

| Sweden 4.8% | |

| Fabege AB | 335,395 | 0.3 | 5,613,971 |

| Other Securities | | 4.5 | 99,086,516 |

| | | 4.8 | 104,700,487 |

| |

| Switzerland 4.1% | |

| Other Securities | | 4.1 | 89,460,496 |

| |

| United Kingdom 13.4% | |

| BBA Aviation plc | 1,322,232 | 0.2 | 5,169,001 |

| Beazley plc | 662,400 | 0.2 | 4,594,179 |

| Dechra Pharmaceuticals plc | 125,105 | 0.2 | 4,570,775 |

| HomeServe plc | 342,091 | 0.2 | 4,782,747 |

| Intermediate Capital Group plc | 348,711 | 0.3 | 5,673,695 |

| SSP Group plc | 549,818 | 0.2 | 4,734,044 |

| The Unite Group plc | 357,673 | 0.2 | 4,560,650 |

| Other Securities | | 11.9 | 260,100,528 |

| | | 13.4 | 294,185,619 |

| Total Common Stock |

| (Cost $2,259,590,662) | | | 2,165,330,547 |

|

| Preferred Stock0.3% of net assets | |

| |

| Germany 0.2% | |

| Other Securities | | 0.2 | 3,784,268 |

| |

| Security | Number

of Shares | % of Net

Assets | Value ($) |

| Italy 0.0% | |

| Other Securities | | 0.0 | 457,102 |

| |

| Republic of Korea 0.0% | |

| Other Securities | | 0.0 | 208,497 |

| |

| Sweden 0.1% | |

| Other Securities | | 0.1 | 1,012,759 |

| Total Preferred Stock |

| (Cost $6,791,000) | | | 5,462,626 |

|

| Rights0.0% of net assets | |

| |

| Singapore 0.0% | |

| Other Securities | | 0.0 | 2,560 |

| Total Rights |

| (Cost $—) | | | 2,560 |

|

| Warrants0.0% of net assets | |

| |

| Singapore 0.0% | |

| Other Securities | | 0.0 | — |

| Total Warrants |

| (Cost $—) | | | — |

|

| Other Investment Companies3.6% of net assets | |

| |

| Switzerland 0.3% | |

| BB Biotech AG | 69,486 | 0.2 | 4,438,340 |

| Other Securities | | 0.1 | 1,438,860 |

| | | 0.3 | 5,877,200 |

| |

| United Kingdom 0.1% | |

| Other Securities | | 0.1 | 2,322,963 |

| |

| United States 3.2% | |

| Money Market Fund 0.1% | |

| Other Securities | | 0.1 | 2,035,557 |

| Securities Lending Collateral 3.1% | |

| Wells Fargo Government Money Market Fund, Select Class 2.03%(c) | | 3.1 | 68,896,383 |

| | | 3.2 | 70,931,940 |

| Total Other Investment Companies |

| (Cost $78,846,277) | | | 79,132,103 |

| | Number of

Contracts | Notional

Amount

($) | Current Value/

Unrealized

Appreciation

($) |

| Futures Contracts | |

| Long | |

| MSCI EAFE Index, expires 09/20/19 | 77 | 7,099,015 | 139,722 |

Schwab International Equity ETFs | Annual Report

Schwab International Small-Cap Equity ETF

Condensed Portfolio Holdings as of August 31, 2019 (continued)

The following footnotes may not be applicable to the Condensed Portfolio Holdings. Please refer to the complete schedule of portfolio holdings.

| * | Non-income producing security. |

| (a) | All or a portion of this security is on loan. Securities on loan were valued at $65,060,287. |

| (b) | Fair-valued by management using significant unobservable inputs in accordance with procedures approved by the fund’s Board of Trustees. |

| (c) | The rate shown is the 7-day yield. |

| | |

| CVA — | Dutch Certificate |

| REIT — | Real Estate Investment Trust |

| RSP — | Risparmio (Convertible Savings Shares) |

The following is a summary of the inputs used to value the fund’s investments as of August 31, 2019 and reflects the complete schedule of portfolio holdings (see financial note 2(a) for additional information):

| Description | Quoted Prices in

Active Markets for

Identical Assets

(Level 1) | Other Significant

Observable Inputs

(Level 2) | Significant

Unobservable Inputs

(Level 3) | Total | |

| Assets | | | | | |

| Common Stock1 | $1,422,234,796 | $— | $— | $1,422,234,796 | |

| Australia | 139,545,363 | — | 474,378* | 140,019,741 | |

| Hong Kong | 32,106,862 | — | 21,108* | 32,127,970 | |

| Japan | 411,333,381 | — | 291,059 | 411,624,440 | |

| Republic of Korea | 92,717,117 | — | 219,505 | 92,936,622 | |

| Singapore | 29,950,236 | — | 234,579* | 30,184,815 | |

| Spain | 36,202,163 | — | —* | 36,202,163 | |

| Preferred Stock1 | 5,462,626 | — | — | 5,462,626 | |

| Rights1 | | | | | |

| Singapore | — | — | 2,560 | 2,560 | |

| Warrants1 | | | | | |

| Singapore | — | — | —* | — | |

| Other Investment Companies1 | 79,132,103 | — | — | 79,132,103 | |

| Futures Contracts2 | 139,722 | — | — | 139,722 | |

| Total | $2,248,824,369 | $— | $1,243,189 | $2,250,067,558 | |

| * | Level 3 amount shown includes securities determined to have no value at August 31, 2019. |

| 1 | As categorized in the complete schedule of Portfolio Holdings. |

| 2 | Futures contracts are valued at unrealized appreciation or depreciation. |

Fund investments in underlying mutual funds are classified as Level 1, without consideration to the classification level of the investments held by the underlying mutual funds, which could be Level 1, Level 2 or Level 3.

Schwab International Equity ETFs | Annual Report

Schwab International Small-Cap Equity ETF

Statement of Assets and Liabilities

As of August 31, 2019

| Assets |