UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-22311

Schwab Strategic Trust

(Exact name of registrant as specified in charter)

211 Main Street, San Francisco, California 94105

(Address of principal executive offices) (Zip code)

Jonathan de St. Paer

Schwab Strategic Trust

211 Main Street, San Francisco, California 94105

(Name and address of agent for service)

Registrant’s telephone number, including area code: (415) 636-7000

Date of fiscal year end: December 31

Date of reporting period: December 31, 2020

Item 1: Report(s) to Shareholders.

| Schwab U.S. TIPS ETF | SCHP |

| Schwab Short-Term U.S. Treasury ETF | SCHO |

| Schwab Intermediate-Term U.S. Treasury ETF | SCHR |

| Schwab Long-Term U.S. Treasury ETF | SCHQ |

| Schwab U.S. Aggregate Bond ETF | SCHZ |

| Schwab 1-5 Year Corporate Bond ETF | SCHJ |

| Schwab 5-10 Year Corporate Bond ETF | SCHI |

| Total Returns for the 12 Months Ended December 31, 2020 | |

| Schwab U.S. TIPS ETF (Ticker Symbol: SCHP) | |

| Market Price Return1 | 10.86% |

| NAV Return1 | 10.94% |

| Bloomberg Barclays US Treasury Inflation-Linked Bond Index (Series-L)SM | 10.99% |

| ETF Category: Morningstar Inflation-Protected Bond2 | 10.01% |

| Performance Details | pages 7-8 |

| Schwab Short-Term U.S. Treasury ETF (Ticker Symbol: SCHO) | |

| Market Price Return1 | 3.11% |

| NAV Return1 | 3.11% |

| Bloomberg Barclays US Treasury 1-3 Year Index | 3.16% |

| ETF Category: Morningstar Short Government2 | 3.11% |

| Performance Details | pages 9-10 |

| Schwab Intermediate-Term U.S. Treasury ETF (Ticker Symbol: SCHR) | |

| Market Price Return1 | 7.72% |

| NAV Return1 | 7.62% |

| Bloomberg Barclays US Treasury 3-10 Year Index | 7.67% |

| ETF Category: Morningstar Intermediate Government2 | 5.65% |

| Performance Details | pages 11-12 |

| Schwab Long-Term U.S. Treasury ETF (Ticker Symbol: SCHQ) | |

| Market Price Return1 | 17.72% |

| NAV Return1 | 17.64% |

| Bloomberg Barclays US Long Treasury Index | 17.70% |

| ETF Category: Morningstar Long Government2 | 17.48% |

| Performance Details | pages 13-14 |

| Total Returns for the 12 Months Ended December 31, 2020 | |

| Schwab U.S. Aggregate Bond ETF (Ticker Symbol: SCHZ) | |

| Market Price Return1 | 7.46% |

| NAV Return1 | 7.50% |

| Bloomberg Barclays US Aggregate Bond Index | 7.51% |

| ETF Category: Morningstar Intermediate Core Bond2 | 7.52% |

| Performance Details | pages 15-16 |

| Schwab 1-5 Year Corporate Bond ETF (Ticker Symbol: SCHJ) | |

| Market Price Return1 | 5.29% |

| NAV Return1 | 5.31% |

| Bloomberg Barclays US 1-5 Year Corporate Bond Index | 5.41% |

| ETF Category: Morningstar Short-Term Bond2 | 3.81% |

| Performance Details | pages 17-18 |

| Schwab 5-10 Year Corporate Bond ETF (Ticker Symbol: SCHI) | |

| Market Price Return1 | 9.75% |

| NAV Return1 | 9.83% |

| Bloomberg Barclays US 5-10 Year Corporate Bond Index | 9.75% |

| ETF Category: Morningstar Corporate Bond2 | 9.24% |

| Performance Details | pages 19-20 |

| 1 | ETF performance must be shown based on both a Market Price and a Net Asset Value (NAV) basis. The fund’s per share net asset value (NAV) is the value of one share of the fund. NAV is calculated by taking the fund’s total assets (including the market value of securities owned), subtracting liabilities, and dividing by the number of shares outstanding. The NAV Return is based on the NAV of the fund, and the Market Price Return is based on the market price per share of the fund. The price used to calculate market return (Market Price) is determined using the Official Closing Price of the primary stock exchange (generally, 4:00 p.m. Eastern time) and may not represent the returns you would receive if shares were traded at other times. Market Price and NAV returns assume that dividends and capital gain distributions have been reinvested in the fund at Market Price and NAV, respectively. |

| 2 | Source for category information: Morningstar, Inc. The Morningstar Category return represents all passively- and actively-managed ETFs within the category as of the report date. |

President of Charles Schwab

Investment Management, Inc.

and the funds covered

in this report.

| Matthew Hastings, CFA, Vice President and Head of Taxable Bond Strategies, leads the portfolio management team for Schwab Fixed-Income ETFs and Schwab’s taxable bond funds. He also has overall responsibility for all aspects of the management of the funds. Prior to joining CSIM in 1999, Mr. Hastings was in fixed-income sales and trading at Lehman Brothers. He has worked in the fixed-income securities industry since 1996. |

| Steven Hung, Senior Portfolio Manager, is responsible for the day-to-day co-management of the Schwab U.S. Aggregate Bond ETF, Schwab 1-5 Year Corporate Bond ETF and Schwab 5-10 Year Corporate Bond ETF. His primary focus is corporate bonds. Prior to joining CSIM in 1999, Mr. Hung was an associate in Schwab’s management training program for nine months. In that role, he worked as a clerk on the options trading floor of the Pacific Coast Stock Exchange. |

| Mark McKissick, CFA, Senior Portfolio Manager, is responsible for the day-to-day co-management of the Schwab U.S. TIPS ETF, Schwab Short-Term U.S. Treasury ETF, Schwab Intermediate-Term U.S. Treasury ETF, Schwab Long-Term U.S. Treasury ETF and Schwab U.S. Aggregate Bond ETF. Prior to joining CSIM in 2016, Mr. McKissick worked at Denver Investments for 17 years, most recently as a director of fixed income and portfolio manager. In this role he co-managed multiple bond strategies, as well as oversaw the firm’s fixed-income business including the investment process, client service and other administrative functions. |

| Alfonso Portillo, Jr., Senior Portfolio Manager, is responsible for the day-to-day co-management of the Schwab U.S. Aggregate Bond ETF. His primary focus is securitized products. Prior to joining CSIM in 2007, Mr. Portillo worked for ten years at Pacific Investment Management Company, most recently as a vice president and member of the mortgage- and asset-backed portfolio management team. He has worked in fixed-income asset management since 1996. |

| Weighted Average Maturity4 | 8.1 Yrs |

| Weighted Average Duration4 | 7.6 Yrs |

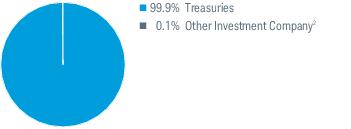

| 1 | The percentage may differ from the Portfolio Holdings because the above calculation is based on a percentage of total investments, whereas the calculation in the Portfolio Holdings is based on a percentage of net assets. |

| 2 | Includes the fund’s position in money market mutual funds registered under the Investment Company Act of 1940, as amended. |

| 3 | Less than 0.05%. |

| 4 | See Glossary for definitions of maturity and duration. |

| Fund and Inception Date | 1 Year | 5 Years | 10 Years |

| Fund: Schwab U.S. TIPS ETF (8/5/2010) | |||

| Market Price Return2 | 10.86% | 5.03% | 3.70% |

| NAV Return2 | 10.94% | 5.02% | 3.73% |

| Bloomberg Barclays US Treasury Inflation-Linked Bond Index (Series-L)SM | 10.99% | 5.08% | 3.81% |

| ETF Category: Morningstar Inflation-Protected Bond3 | 10.01% | 4.59% | 3.20% |

| Fund Expense Ratio4: 0.05% | |||

| 1 | Performance does not reflect the deduction of taxes that a shareholder would pay on fund distributions or on the redemption or sale of fund shares. |

| 2 | ETF performance must be shown based on both a Market Price and a Net Asset Value (NAV) basis. The fund’s per share net asset value (NAV) is the value of one share of the fund. NAV is calculated by taking the fund’s total assets (including the market value of securities owned), subtracting liabilities, and dividing by the number of shares outstanding. The NAV Return is based on the NAV of the fund, and the Market Price Return is based on the market price per share of the fund. The price used to calculate market return (Market Price) is determined using the Official Closing Price of the primary stock exchange (generally, 4:00 p.m. Eastern time) and may not represent the returns you would receive if shares were traded at other times. NAV is used as a proxy for purposes of calculating Market Price Return on inception date. Market Price and NAV returns assume that dividends and capital gain distributions have been reinvested in the fund at Market Price and NAV, respectively. |

| 3 | Source for category information: Morningstar, Inc. The Morningstar Category return represents all passively- and actively-managed ETFs within the category as of the report date. |

| 4 | As stated in the prospectus. |

| Weighted Average Maturity3 | 2.0 Yrs |

| Weighted Average Duration3 | 2.0 Yrs |

| 1 | The percentage may differ from the Portfolio Holdings because the above calculation is based on a percentage of total investments, whereas the calculation in the Portfolio Holdings is based on a percentage of net assets. |

| 2 | Includes the fund’s position in money market mutual funds registered under the Investment Company Act of 1940, as amended. |

| 3 | See Glossary for definitions of maturity and duration. |

| Fund and Inception Date | 1 Year | 5 Years | 10 Years |

| Fund: Schwab Short-Term U.S. Treasury ETF (8/5/2010) | |||

| Market Price Return2 | 3.11% | 1.84% | 1.22% |

| NAV Return2 | 3.11% | 1.84% | 1.22% |

| Bloomberg Barclays US Treasury 1-3 Year Index | 3.16% | 1.91% | 1.31% |

| ETF Category: Morningstar Short Government3 | 3.11% | 1.74% | 1.27% |

| Fund Expense Ratio4: 0.05% | |||

| 1 | Performance does not reflect the deduction of taxes that a shareholder would pay on fund distributions or on the redemption or sale of fund shares. |

| 2 | ETF performance must be shown based on both a Market Price and a Net Asset Value (NAV) basis. The fund’s per share net asset value (NAV) is the value of one share of the fund. NAV is calculated by taking the fund’s total assets (including the market value of securities owned), subtracting liabilities, and dividing by the number of shares outstanding. The NAV Return is based on the NAV of the fund, and the Market Price Return is based on the market price per share of the fund. The price used to calculate market return (Market Price) is determined using the Official Closing Price of the primary stock exchange (generally, 4:00 p.m. Eastern time) and may not represent the returns you would receive if shares were traded at other times. NAV is used as a proxy for purposes of calculating Market Price Return on inception date. Market Price and NAV returns assume that dividends and capital gain distributions have been reinvested in the fund at Market Price and NAV, respectively. |

| 3 | Source for category information: Morningstar, Inc. The Morningstar Category return represents all passively- and actively-managed ETFs within the category as of the report date. |

| 4 | As stated in the prospectus. |

| Weighted Average Maturity3 | 5.6 Yrs |

| Weighted Average Duration3 | 5.3 Yrs |

| 1 | The percentage may differ from the Portfolio Holdings because the above calculation is based on a percentage of total investments, whereas the calculation in the Portfolio Holdings is based on a percentage of net assets. |

| 2 | Includes the fund’s position in money market mutual funds registered under the Investment Company Act of 1940, as amended. |

| 3 | See Glossary for definitions of maturity and duration. |

| Fund and Inception Date | 1 Year | 5 Years | 10 Years |

| Fund: Schwab Intermediate-Term U.S. Treasury ETF (8/5/2010) | |||

| Market Price Return2 | 7.72% | 3.54% | 3.31% |

| NAV Return2 | 7.62% | 3.56% | 3.30% |

| Bloomberg Barclays US Treasury 3-10 Year Index | 7.67% | 3.63% | 3.39% |

| ETF Category: Morningstar Intermediate Government3 | 5.65% | 2.88% | 2.70% |

| Fund Expense Ratio4: 0.05% | |||

| 1 | Performance does not reflect the deduction of taxes that a shareholder would pay on fund distributions or on the redemption or sale of fund shares. |

| 2 | ETF performance must be shown based on both a Market Price and a Net Asset Value (NAV) basis. The fund’s per share net asset value (NAV) is the value of one share of the fund. NAV is calculated by taking the fund’s total assets (including the market value of securities owned), subtracting liabilities, and dividing by the number of shares outstanding. The NAV Return is based on the NAV of the fund, and the Market Price Return is based on the market price per share of the fund. The price used to calculate market return (Market Price) is determined using the Official Closing Price of the primary stock exchange (generally, 4:00 p.m. Eastern time) and may not represent the returns you would receive if shares were traded at other times. NAV is used as a proxy for purposes of calculating Market Price Return on inception date. Market Price and NAV returns assume that dividends and capital gain distributions have been reinvested in the fund at Market Price and NAV, respectively. |

| 3 | Source for category information: Morningstar, Inc. The Morningstar Category return represents all passively- and actively-managed ETFs within the category as of the report date. |

| 4 | As stated in the prospectus. |

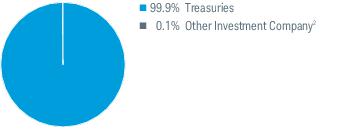

| Weighted Average Maturity4 | 24.5 Yrs |

| Weighted Average Duration4 | 18.3 Yrs |

| 1 | The percentage may differ from the Portfolio Holdings because the above calculation is based on a percentage of total investments, whereas the calculation in the Portfolio Holdings is based on a percentage of net assets. |

| 2 | Includes the fund’s position in money market mutual funds registered under the Investment Company Act of 1940, as amended. |

| 3 | Less than 0.05%. |

| 4 | See Glossary for definitions of maturity and duration. |

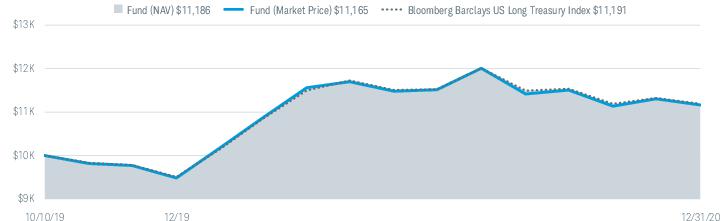

| Fund and Inception Date | 1 Year | Since Inception* |

| Fund: Schwab Long-Term U.S. Treasury ETF (10/10/2019) | ||

| Market Price Return2 | 17.72% | 9.40% |

| NAV Return2 | 17.64% | 9.56% |

| Bloomberg Barclays US Long Treasury Index | 17.70% | 9.59% |

| ETF Category: Morningstar Long Government3 | 17.48% | N/A |

| Fund Expense Ratio4: 0.05% | ||

| * | Inception (10/10/19) represents the date that the shares began trading in the secondary market. |

| 1 | Performance does not reflect the deduction of taxes that a shareholder would pay on fund distributions or on the redemption or sale of fund shares. |

| 2 | ETF performance must be shown based on both a Market Price and a Net Asset Value (NAV) basis. The fund’s per share net asset value (NAV) is the value of one share of the fund. NAV is calculated by taking the fund’s total assets (including the market value of securities owned), subtracting liabilities, and dividing by the number of shares outstanding. The NAV Return is based on the NAV of the fund, and the Market Price Return is based on the market price per share of the fund. The price used to calculate market return (Market Price) is determined using the Official Closing Price of the primary stock exchange (generally, 4:00 p.m. Eastern time) and may not represent the returns you would receive if shares were traded at other times. NAV is used as a proxy for purposes of calculating Market Price Return on inception date. Market Price and NAV returns assume that dividends and capital gain distributions have been reinvested in the fund at Market Price and NAV, respectively. |

| 3 | Source for category information: Morningstar, Inc. The Morningstar Category return represents all passively- and actively-managed ETFs within the category as of the report date. |

| 4 | As stated in the prospectus. |

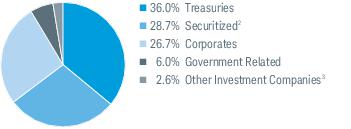

| Weighted Average Maturity4 | 8.1 Yrs |

| Weighted Average Duration4 | 6.3 Yrs |

| 1 | The percentage may differ from the Portfolio Holdings because the above calculation is based on a percentage of total investments, whereas the calculation in the Portfolio Holdings is based on a percentage of net assets. |

| 2 | The fund may seek to obtain exposure to U.S. agency mortgage pass-through securities, in part or in full, through the use of “to-be-announced” or “TBA” transactions, which are standardized contracts for future delivery of mortgage pass-through securities in which the exact mortgage pools to be delivered are not specified until a few days prior to settlement. These transactions represented approximately 1.3% of total investments on December 31, 2020. |

| 3 | Includes the fund’s position in money market mutual funds registered under the Investment Company Act of 1940, as amended. |

| 4 | See Glossary for definitions of maturity and duration. |

| Fund and Inception Date | 1 Year | 5 Years | Since Inception* |

| Fund: Schwab U.S. Aggregate Bond ETF (7/14/2011) | |||

| Market Price Return2 | 7.46% | 4.31% | 3.54% |

| NAV Return2 | 7.50% | 4.35% | 3.54% |

| Bloomberg Barclays US Aggregate Bond Index | 7.51% | 4.44% | 3.64% |

| ETF Category: Morningstar Intermediate Core Bond3 | 7.52% | 4.26% | N/A |

| Fund Expense Ratio4: 0.04% | |||

| * | Inception (7/14/11) represents the date that the shares began trading in the secondary market. |

| 1 | Performance does not reflect the deduction of taxes that a shareholder would pay on fund distributions or on the redemption or sale of fund shares. |

| 2 | ETF performance must be shown based on both a Market Price and a Net Asset Value (NAV) basis. The fund’s per share net asset value (NAV) is the value of one share of the fund. NAV is calculated by taking the fund’s total assets (including the market value of securities owned), subtracting liabilities, and dividing by the number of shares outstanding. The NAV Return is based on the NAV of the fund, and the Market Price Return is based on the market price per share of the fund. The price used to calculate market return (Market Price) is determined using the Official Closing Price of the primary stock exchange (generally, 4:00 p.m. Eastern time) and may not represent the returns you would receive if shares were traded at other times. NAV is used as a proxy for purposes of calculating Market Price Return on inception date. Market Price and NAV returns assume that dividends and capital gain distributions have been reinvested in the fund at Market Price and NAV, respectively. |

| 3 | Source for category information: Morningstar, Inc. The Morningstar Category return represents all passively- and actively-managed ETFs within the category as of the report date. |

| 4 | As stated in the prospectus. |

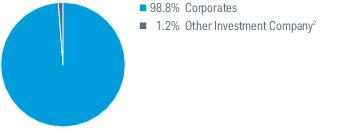

| Weighted Average Maturity3 | 2.9 Yrs |

| Weighted Average Duration3 | 2.8 Yrs |

| 1 | The percentage may differ from the Portfolio Holdings because the above calculation is based on a percentage of total investments, excluding derivatives, whereas the calculation in the Portfolio Holdings is based on a percentage of net assets. |

| 2 | Includes the fund’s position in money market mutual funds registered under the Investment Company Act of 1940, as amended. |

| 3 | See Glossary for definitions of maturity and duration. |

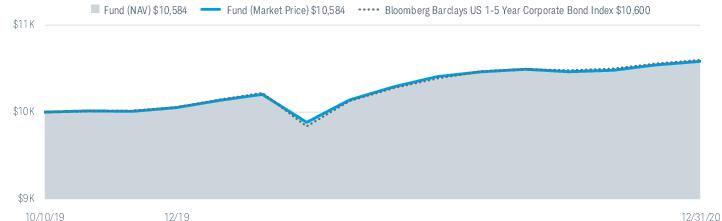

| Fund and Inception Date | 1 Year | Since Inception* |

| Fund: Schwab 1-5 Year Corporate Bond ETF (10/10/2019) | ||

| Market Price Return2 | 5.29% | 4.73% |

| NAV Return2 | 5.31% | 4.74% |

| Bloomberg Barclays US 1-5 Year Corporate Bond Index | 5.41% | 4.86% |

| ETF Category: Morningstar Short-Term Bond3 | 3.81% | N/A |

| Fund Expense Ratio4: 0.05% | ||

| * | Inception (10/10/19) represents the date that the shares began trading in the secondary market. |

| 1 | Performance does not reflect the deduction of taxes that a shareholder would pay on fund distributions or on the redemption or sale of fund shares. |

| 2 | ETF performance must be shown based on both a Market Price and a Net Asset Value (NAV) basis. The fund’s per share net asset value (NAV) is the value of one share of the fund. NAV is calculated by taking the fund’s total assets (including the market value of securities owned), subtracting liabilities, and dividing by the number of shares outstanding. The NAV Return is based on the NAV of the fund, and the Market Price Return is based on the market price per share of the fund. The price used to calculate market return (Market Price) is determined using the Official Closing Price of the primary stock exchange (generally, 4:00 p.m. Eastern time) and may not represent the returns you would receive if shares were traded at other times. NAV is used as a proxy for purposes of calculating Market Price Return on inception date. Market Price and NAV returns assume that dividends and capital gain distributions have been reinvested in the fund at Market Price and NAV, respectively. |

| 3 | Source for category information: Morningstar, Inc. The Morningstar Category return represents all passively- and actively-managed ETFs within the category as of the report date. |

| 4 | As stated in the prospectus. |

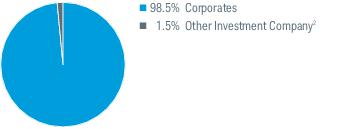

| Weighted Average Maturity3 | 7.3 Yrs |

| Weighted Average Duration3 | 6.4 Yrs |

| 1 | The percentage may differ from the Portfolio Holdings because the above calculation is based on a percentage of total investments, excluding derivatives, whereas the calculation in the Portfolio Holdings is based on a percentage of net assets. |

| 2 | Includes the fund’s position in money market mutual funds registered under the Investment Company Act of 1940, as amended. |

| 3 | See Glossary for definitions of maturity and duration. |

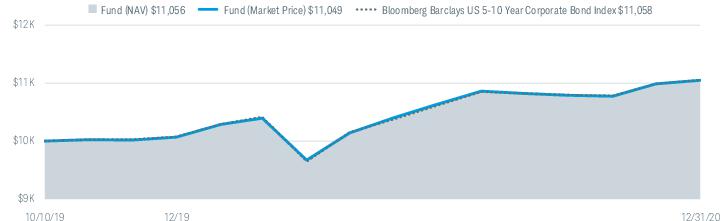

| Fund and Inception Date | 1 Year | Since Inception* |

| Fund: Schwab 5-10 Year Corporate Bond ETF (10/10/2019) | ||

| Market Price Return2 | 9.75% | 8.46% |

| NAV Return2 | 9.83% | 8.52% |

| Bloomberg Barclays US 5-10 Year Corporate Bond Index | 9.75% | 8.52% |

| ETF Category: Morningstar Corporate Bond3 | 9.24% | N/A |

| Fund Expense Ratio4: 0.05% | ||

| * | Inception (10/10/19) represents the date that the shares began trading in the secondary market. |

| 1 | Performance does not reflect the deduction of taxes that a shareholder would pay on fund distributions or on the redemption or sale of fund shares. |

| 2 | ETF performance must be shown based on both a Market Price and a Net Asset Value (NAV) basis. The fund’s per share net asset value (NAV) is the value of one share of the fund. NAV is calculated by taking the fund’s total assets (including the market value of securities owned), subtracting liabilities, and dividing by the number of shares outstanding. The NAV Return is based on the NAV of the fund, and the Market Price Return is based on the market price per share of the fund. The price used to calculate market return (Market Price) is determined using the Official Closing Price of the primary stock exchange (generally, 4:00 p.m. Eastern time) and may not represent the returns you would receive if shares were traded at other times. NAV is used as a proxy for purposes of calculating Market Price Return on inception date. Market Price and NAV returns assume that dividends and capital gain distributions have been reinvested in the fund at Market Price and NAV, respectively. |

| 3 | Source for category information: Morningstar, Inc. The Morningstar Category return represents all passively- and actively-managed ETFs within the category as of the report date. |

| 4 | As stated in the prospectus. |

| Expense Ratio (Annualized)1 | Beginning Account Value at 7/1/20 | Ending Account Value (Net of Expenses) at 12/31/20 | Expenses Paid During Period 7/1/20-12/31/202 | |

| Schwab U.S. TIPS ETF | ||||

| Actual Return | 0.05% | $1,000.00 | $1,046.50 | $0.26 |

| Hypothetical 5% Return | 0.05% | $1,000.00 | $1,024.85 | $0.25 |

| Schwab Short-Term U.S. Treasury ETF | ||||

| Actual Return | 0.05% | $1,000.00 | $1,001.10 | $0.25 |

| Hypothetical 5% Return | 0.05% | $1,000.00 | $1,024.85 | $0.25 |

| Schwab Intermediate-Term U.S. Treasury ETF | ||||

| Actual Return | 0.05% | $1,000.00 | $ 997.90 | $0.25 |

| Hypothetical 5% Return | 0.05% | $1,000.00 | $1,024.85 | $0.25 |

| Schwab Long-Term U.S. Treasury ETF | ||||

| Actual Return | 0.05% | $1,000.00 | $ 970.80 | $0.25 |

| Hypothetical 5% Return | 0.05% | $1,000.00 | $1,024.85 | $0.25 |

| Schwab U.S. Aggregate Bond ETF | ||||

| Actual Return | 0.04% | $1,000.00 | $1,012.40 | $0.20 |

| Hypothetical 5% Return | 0.04% | $1,000.00 | $1,024.90 | $0.20 |

| Schwab 1-5 Year Corporate Bond ETF | ||||

| Actual Return | 0.05% | $1,000.00 | $1,019.50 | $0.25 |

| Hypothetical 5% Return | 0.05% | $1,000.00 | $1,024.85 | $0.25 |

| Schwab 5-10 Year Corporate Bond ETF | ||||

| Actual Return | 0.05% | $1,000.00 | $1,041.50 | $0.26 |

| Hypothetical 5% Return | 0.05% | $1,000.00 | $1,024.85 | $0.25 |

| 1 | Based on the most recent six-month expense ratio. |

| 2 | Expenses for each fund are equal to its annualized expense ratio, multiplied by the average account value over the period, multiplied by 184 days of the period, and divided by 366 days of the fiscal year. |

| 1/1/20– 12/31/20 | 1/1/19– 12/31/19 | 1/1/18– 12/31/18 | 1/1/17– 12/31/17 | 1/1/16– 12/31/16 | ||

| Per-Share Data | ||||||

| Net asset value at beginning of period | $56.57 | $53.27 | $55.39 | $54.84 | $53.15 | |

| Income (loss) from investment operations: | ||||||

| Net investment income (loss)1 | 0.81 | 1.21 | 1.51 | 1.17 | 0.99 | |

| Net realized and unrealized gains (losses) | 5.37 | 3.23 | (2.23) | 0.43 | 1.46 | |

| Total from investment operations | 6.18 | 4.44 | (0.72) | 1.60 | 2.45 | |

| Less distributions: | ||||||

| Distributions from net investment income | (0.69) | (1.14) | (1.40) | (1.05) | (0.76) | |

| Net asset value at end of period | $62.06 | $56.57 | $53.27 | $55.39 | $54.84 | |

| Total return | 10.94% | 8.36% | (1.31%) | 2.95% | 4.60% | |

| Ratios/Supplemental Data | ||||||

| Ratios to average net assets: | ||||||

| Total expenses | 0.05% | 0.05% | 0.05% | 0.05% 2 | 0.07% | |

| Net investment income (loss) | 1.36% | 2.18% | 2.80% | 2.13% | 1.78% | |

| Portfolio turnover rate3 | 23% | 20% | 17% | 19% | 16% | |

| Net assets, end of period (x 1,000) | $14,090,007 | $8,733,970 | $5,779,263 | $2,880,386 | $1,614,977 | |

| Security Rate, Maturity Date | Face Amount ($) | Value ($) |

| Treasuries 99.8% of net assets | ||

| U.S. Treasury Inflation Protected Securities | ||

| 0.13%, 01/15/22 | 430,749,026 | 438,667,145 |

| 0.13%, 04/15/22 | 424,843,354 | 433,890,835 |

| 0.13%, 07/15/22 | 420,841,464 | 434,176,941 |

| 0.13%, 01/15/23 | 496,869,157 | 516,466,969 |

| 0.63%, 04/15/23 | 414,575,831 | 436,782,444 |

| 0.38%, 07/15/23 | 484,620,296 | 513,786,199 |

| 0.63%, 01/15/24 | 465,142,403 | 499,519,981 |

| 0.50%, 04/15/24 | 284,706,553 | 305,341,896 |

| 0.13%, 07/15/24 | 448,260,692 | 480,349,299 |

| 0.13%, 10/15/24 | 355,819,541 | 381,716,354 |

| 0.25%, 01/15/25 | 445,954,032 | 481,514,986 |

| 2.38%, 01/15/25 | 272,462,123 | 318,489,929 |

| 0.13%, 04/15/25 | 322,083,760 | 346,621,234 |

| 0.38%, 07/15/25 | 425,593,557 | 467,775,279 |

| 0.13%, 10/15/25 | 354,411,770 | 385,576,370 |

| 0.63%, 01/15/26 | 364,559,490 | 407,260,762 |

| 2.00%, 01/15/26 | 194,458,787 | 231,326,176 |

| 0.13%, 07/15/26 | 347,748,971 | 382,718,483 |

| 0.38%, 01/15/27 | 345,508,059 | 385,784,855 |

| 2.38%, 01/15/27 | 159,595,408 | 198,612,952 |

| 0.38%, 07/15/27 | 354,806,539 | 399,401,237 |

| 0.50%, 01/15/28 | 370,293,504 | 419,989,599 |

| 1.75%, 01/15/28 | 160,349,463 | 196,869,087 |

| 3.63%, 04/15/28 | 152,732,668 | 210,255,340 |

| 0.75%, 07/15/28 | 326,778,497 | 380,406,946 |

| 0.88%, 01/15/29 | 268,876,899 | 316,211,865 |

| 2.50%, 01/15/29 | 143,722,362 | 188,962,377 |

| 3.88%, 04/15/29 | 184,619,032 | 266,232,098 |

| 0.25%, 07/15/29 | 323,445,895 | 366,475,491 |

| Security Rate, Maturity Date | Face Amount ($) | Value ($) |

| 0.13%, 01/15/30 | 380,978,552 | 425,288,129 |

| 0.13%, 07/15/30 | 419,037,839 | 470,499,310 |

| 3.38%, 04/15/32 | 63,936,425 | 97,509,600 |

| 2.13%, 02/15/40 | 83,163,497 | 128,971,465 |

| 2.13%, 02/15/41 | 118,485,786 | 186,060,412 |

| 0.75%, 02/15/42 | 203,339,527 | 259,176,429 |

| 0.63%, 02/15/43 | 151,263,670 | 188,755,449 |

| 1.38%, 02/15/44 | 211,282,525 | 304,590,327 |

| 0.75%, 02/15/45 | 230,919,737 | 298,307,254 |

| 1.00%, 02/15/46 | 122,594,575 | 167,410,540 |

| 0.88%, 02/15/47 | 147,110,071 | 197,989,374 |

| 1.00%, 02/15/48 | 126,059,356 | 175,698,011 |

| 1.00%, 02/15/49 | 123,182,785 | 173,662,936 |

| 0.25%, 02/15/50 | 162,403,081 | 193,780,742 |

| Total Treasuries | ||

| (Cost $13,110,977,207) | 14,058,883,107 | |

| Security | Number of Shares | Value ($) |

| Other Investment Company 0.0% of net assets | ||

| Money Market Fund 0.0% | ||

| State Street Institutional U.S. Government Money Market Fund, Premier Class 0.03% (a) | 1,860,948 | 1,860,948 |

| Total Other Investment Company | ||

| (Cost $1,860,948) | 1,860,948 | |

| (a) | The rate shown is the 7-day yield. |

| Description | Quoted Prices in Active Markets for Identical Assets (Level 1) | Other Significant Observable Inputs (Level 2) | Significant Unobservable Inputs (Level 3) | Total | |

| Assets | |||||

| Treasuries | $— | $14,058,883,107 | $— | $14,058,883,107 | |

| Other Investment Company1 | 1,860,948 | — | — | 1,860,948 | |

| Total | $1,860,948 | $14,058,883,107 | $— | $14,060,744,055 |

| 1 | As categorized in Portfolio Holdings. |

| Assets | ||

| Investments in unaffiliated issuers, at value (cost $13,112,838,155) | $14,060,744,055 | |

| Receivables: | ||

| Investments sold | 178,477,565 | |

| Interest | 31,119,443 | |

| Fund shares sold | 21,691,969 | |

| Dividends | + | 231 |

| Total assets | 14,292,033,263 | |

| Liabilities | ||

| Payables: | ||

| Investments bought | 201,445,235 | |

| Management fees | + | 580,843 |

| Total liabilities | 202,026,078 | |

| Net Assets | ||

| Total assets | 14,292,033,263 | |

| Total liabilities | – | 202,026,078 |

| Net assets | $14,090,007,185 | |

| Net Assets by Source | ||

| Capital received from investors | 13,183,901,564 | |

| Total distributable earnings | 906,105,621 | |

| Net Asset Value (NAV) | ||||

| Net Assets | ÷ | Shares Outstanding | = | NAV |

| $14,090,007,185 | 227,050,000 | $62.06 | ||

| Investment Income | ||

| Interest | $150,535,770* | |

| Dividends | 23,110 | |

| Securities on loan, net | + | 6,861 |

| Total investment income | 150,565,741 | |

| Expenses | ||

| Management fees | 5,343,459 | |

| Total expenses | – | 5,343,459 |

| Net investment income | 145,222,282 | |

| Realized and Unrealized Gains (Losses) | ||

| Net realized losses on investments | (194,059) | |

| Net realized gains on in-kind redemptions | + | 163,733,542 |

| Net realized gains | 163,539,483 | |

| Net change in unrealized appreciation (depreciation) on investments | + | 744,938,595 |

| Net realized and unrealized gains | 908,478,078 | |

| Increase in net assets resulting from operations | $1,053,700,360 | |

| * | See financial note 2(b) regarding inflation-protected securities. |

| Operations | ||||

| 1/1/20-12/31/20 | 1/1/19-12/31/19 | |||

| Net investment income | $145,222,282 | $153,051,236 | ||

| Net realized gains | 163,539,483 | 1,958,522 | ||

| Net change in unrealized appreciation (depreciation) | + | 744,938,595 | 361,225,335 | |

| Increase in net assets resulting from operations | 1,053,700,360 | 516,235,093 | ||

| Distributions to Shareholders | ||||

| Total distributions | ($145,346,920) | ($152,790,170) | ||

| Transactions in Fund Shares | ||||||||

| 1/1/20-12/31/20 | 1/1/19-12/31/19 | |||||||

| SHARES | VALUE | SHARES | VALUE | |||||

| Shares sold | 117,700,000 | $7,091,983,560 | 55,400,000 | $3,115,333,976 | ||||

| Shares redeemed | + | (45,050,000) | (2,644,299,382) | (9,500,000) | (524,072,192) | |||

| Net transactions in fund shares | 72,650,000 | $4,447,684,178 | 45,900,000 | $2,591,261,784 | ||||

| Shares Outstanding and Net Assets | ||||||||

| 1/1/20-12/31/20 | 1/1/19-12/31/19 | |||||||

| SHARES | NET ASSETS | SHARES | NET ASSETS | |||||

| Beginning of period | 154,400,000 | $8,733,969,567 | 108,500,000 | $5,779,262,860 | ||||

| Total increase | + | 72,650,000 | 5,356,037,618 | 45,900,000 | 2,954,706,707 | |||

| End of period | 227,050,000 | $14,090,007,185 | 154,400,000 | $8,733,969,567 | ||||

| 1/1/20– 12/31/20 | 1/1/19– 12/31/19 | 1/1/18– 12/31/18 | 1/1/17– 12/31/17 | 1/1/16– 12/31/16 | ||

| Per-Share Data | ||||||

| Net asset value at beginning of period | $50.48 | $49.88 | $50.03 | $50.41 | $50.43 | |

| Income (loss) from investment operations: | ||||||

| Net investment income (loss)1 | 0.65 | 1.14 | 0.94 | 0.57 | 0.42 | |

| Net realized and unrealized gains (losses) | 0.91 | 0.60 | (0.20) 2 | (0.39) | (0.03) | |

| Total from investment operations | 1.56 | 1.74 | 0.74 | 0.18 | 0.39 | |

| Less distributions: | ||||||

| Distributions from net investment income | (0.65) | (1.14) | (0.89) | (0.56) | (0.41) | |

| Net asset value at end of period | $51.39 | $50.48 | $49.88 | $50.03 | $50.41 | |

| Total return | 3.11% | 3.53% | 1.50% | 0.35% | 0.78% | |

| Ratios/Supplemental Data | ||||||

| Ratios to average net assets: | ||||||

| Total expenses | 0.05% | 0.06% 3 | 0.06% | 0.06% | 0.08% 4 | |

| Net investment income (loss) | 1.26% | 2.27% | 1.89% | 1.13% | 0.83% | |

| Portfolio turnover rate5 | 74% | 77% | 65% | 65% | 66% | |

| Net assets, end of period (x 1,000) | $7,507,924 | $5,262,952 | $4,254,630 | $2,181,398 | $1,414,092 | |

| Security Rate, Maturity Date | Face Amount ($) | Value ($) |

| Treasuries 99.6% of net assets | ||

| Bonds | ||

| 7.25%, 08/15/22 | 9,818,000 | 10,951,864 |

| 7.63%, 11/15/22 | 6,025,000 | 6,868,735 |

| 7.13%, 02/15/23 | 12,077,000 | 13,864,019 |

| 6.25%, 08/15/23 | 17,260,000 | 20,018,903 |

| Notes | ||

| 2.50%, 01/15/22 | 87,677,000 | 89,836,389 |

| 1.38%, 01/31/22 | 54,485,000 | 55,227,784 |

| 1.50%, 01/31/22 | 51,224,000 | 51,988,358 |

| 1.88%, 01/31/22 | 93,580,000 | 95,356,558 |

| 2.00%, 02/15/22 | 69,106,000 | 70,566,404 |

| 2.50%, 02/15/22 | 75,775,000 | 77,796,654 |

| 1.13%, 02/28/22 | 90,358,000 | 91,423,943 |

| 1.75%, 02/28/22 | 61,704,000 | 62,875,412 |

| 1.88%, 02/28/22 | 62,548,000 | 63,824,615 |

| 2.38%, 03/15/22 | 85,249,000 | 87,555,052 |

| 0.38%, 03/31/22 | 99,920,000 | 100,249,814 |

| 1.75%, 03/31/22 | 65,671,000 | 67,008,790 |

| 1.88%, 03/31/22 | 52,990,000 | 54,150,191 |

| 2.25%, 04/15/22 | 84,609,000 | 86,929,138 |

| 0.13%, 04/30/22 | 65,987,000 | 66,006,332 |

| 1.75%, 04/30/22 | 69,715,000 | 71,233,207 |

| 1.88%, 04/30/22 | 80,209,000 | 82,081,065 |

| 1.75%, 05/15/22 | 61,415,000 | 62,787,242 |

| 2.13%, 05/15/22 | 80,767,000 | 82,983,360 |

| 0.13%, 05/31/22 | 90,935,000 | 90,954,537 |

| 1.75%, 05/31/22 | 76,003,000 | 77,750,178 |

| 1.88%, 05/31/22 | 71,200,000 | 72,968,875 |

| 1.75%, 06/15/22 | 85,884,000 | 87,913,680 |

| 0.13%, 06/30/22 | 68,424,000 | 68,440,037 |

| 1.75%, 06/30/22 | 75,667,000 | 77,509,905 |

| 2.13%, 06/30/22 | 67,207,000 | 69,220,585 |

| 1.75%, 07/15/22 | 82,141,000 | 84,196,129 |

| 0.13%, 07/31/22 | 78,893,000 | 78,908,409 |

| 1.88%, 07/31/22 | 87,531,000 | 89,953,489 |

| 2.00%, 07/31/22 | 99,132,000 | 102,067,237 |

| 1.50%, 08/15/22 | 89,680,000 | 91,689,042 |

| 1.63%, 08/15/22 | 28,668,000 | 29,368,462 |

| 0.13%, 08/31/22 | 72,210,000 | 72,218,462 |

| 1.63%, 08/31/22 | 79,409,000 | 81,383,368 |

| 1.88%, 08/31/22 | 133,934,000 | 137,818,610 |

| 1.50%, 09/15/22 | 70,048,000 | 71,684,278 |

| 0.13%, 09/30/22 | 75,819,000 | 75,826,405 |

| 1.75%, 09/30/22 | 70,667,000 | 72,666,931 |

| 1.88%, 09/30/22 | 89,444,000 | 92,169,247 |

| 1.38%, 10/15/22 | 76,541,000 | 78,248,223 |

| 0.13%, 10/31/22 | 81,938,000 | 81,947,602 |

| 1.88%, 10/31/22 | 59,890,000 | 61,802,503 |

| 2.00%, 10/31/22 | 74,668,000 | 77,220,129 |

| 1.63%, 11/15/22 | 140,891,000 | 144,831,545 |

| 0.13%, 11/30/22 | 139,132,000 | 139,148,305 |

| 2.00%, 11/30/22 | 127,986,000 | 132,560,500 |

| Security Rate, Maturity Date | Face Amount ($) | Value ($) |

| 1.63%, 12/15/22 | 78,470,000 | 80,771,991 |

| 0.13%, 12/31/22 | 112,000,000 | 112,006,562 |

| 2.13%, 12/31/22 | 124,867,000 | 129,832,415 |

| 1.50%, 01/15/23 | 71,428,000 | 73,422,962 |

| 1.75%, 01/31/23 | 66,269,000 | 68,502,990 |

| 2.38%, 01/31/23 | 72,274,000 | 75,636,435 |

| 1.38%, 02/15/23 | 77,544,000 | 79,588,617 |

| 2.00%, 02/15/23 | 116,704,000 | 121,331,132 |

| 1.50%, 02/28/23 | 64,874,000 | 66,784,742 |

| 2.63%, 02/28/23 | 76,105,000 | 80,186,725 |

| 0.50%, 03/15/23 | 92,290,000 | 93,043,461 |

| 1.50%, 03/31/23 | 61,287,000 | 63,156,732 |

| 2.50%, 03/31/23 | 76,161,000 | 80,192,178 |

| 0.25%, 04/15/23 | 94,740,000 | 94,987,953 |

| 1.63%, 04/30/23 | 68,917,000 | 71,296,790 |

| 2.75%, 04/30/23 | 80,071,000 | 84,922,177 |

| 0.13%, 05/15/23 | 102,734,000 | 102,709,922 |

| 1.75%, 05/15/23 | 114,088,000 | 118,442,061 |

| 1.63%, 05/31/23 | 54,855,000 | 56,813,495 |

| 2.75%, 05/31/23 | 63,275,000 | 67,242,046 |

| 0.25%, 06/15/23 | 104,829,000 | 105,107,452 |

| 1.38%, 06/30/23 | 64,176,000 | 66,143,897 |

| 2.63%, 06/30/23 | 62,995,000 | 66,880,512 |

| 0.13%, 07/15/23 | 66,796,000 | 66,764,689 |

| 1.25%, 07/31/23 | 67,593,000 | 69,520,457 |

| 2.75%, 07/31/23 | 67,242,000 | 71,749,315 |

| 0.13%, 08/15/23 | 111,900,000 | 111,838,805 |

| 2.50%, 08/15/23 | 106,845,000 | 113,439,340 |

| 1.38%, 08/31/23 | 61,528,000 | 63,539,677 |

| 2.75%, 08/31/23 | 50,846,000 | 54,353,580 |

| 0.13%, 09/15/23 | 107,819,000 | 107,743,190 |

| 1.38%, 09/30/23 | 65,802,000 | 68,015,106 |

| 2.88%, 09/30/23 | 55,055,000 | 59,149,716 |

| 0.13%, 10/15/23 | 134,605,000 | 134,510,357 |

| 1.63%, 10/31/23 | 59,943,000 | 62,446,088 |

| 2.88%, 10/31/23 | 58,650,000 | 63,149,555 |

| 0.25%, 11/15/23 | 144,097,000 | 144,496,644 |

| 2.75%, 11/15/23 | 141,440,000 | 151,976,175 |

| 2.13%, 11/30/23 | 48,907,000 | 51,713,421 |

| 2.88%, 11/30/23 | 42,832,000 | 46,210,040 |

| 0.13%, 12/15/23 | 142,000,000 | 141,839,141 |

| 2.25%, 12/31/23 | 50,500,000 | 53,654,278 |

| 2.63%, 12/31/23 | 70,000,000 | 75,137,891 |

| Total Treasuries | ||

| (Cost $7,414,295,456) | 7,482,301,214 | |

| Security | Number of Shares | Value ($) |

| Other Investment Company 0.1% of net assets | ||

| Money Market Fund 0.1% | ||

| State Street Institutional U.S. Government Money Market Fund, Premier Class 0.03% (a) | 6,484,056 | 6,484,056 |

| Total Other Investment Company | ||

| (Cost $6,484,056) | 6,484,056 | |

| (a) | The rate shown is the 7-day yield. |

| Description | Quoted Prices in Active Markets for Identical Assets (Level 1) | Other Significant Observable Inputs (Level 2) | Significant Unobservable Inputs (Level 3) | Total | |

| Assets | |||||

| Treasuries | $— | $7,482,301,214 | $— | $7,482,301,214 | |

| Other Investment Company1 | 6,484,056 | — | — | 6,484,056 | |

| Total | $6,484,056 | $7,482,301,214 | $— | $7,488,785,270 |

| 1 | As categorized in Portfolio Holdings. |

| Assets | ||

| Investments in unaffiliated issuers, at value (cost $7,420,779,512) | $7,488,785,270 | |

| Receivables: | ||

| Investments sold | 676,616,205 | |

| Fund shares sold | 280,072,115 | |

| Interest | 26,120,447 | |

| Dividends | + | 48 |

| Total assets | 8,471,594,085 | |

| Liabilities | ||

| Payables: | ||

| Investments bought | 662,724,317 | |

| Management fees | 320,509 | |

| Fund shares redeemed | + | 300,625,502 |

| Total liabilities | 963,670,328 | |

| Net Assets | ||

| Total assets | 8,471,594,085 | |

| Total liabilities | – | 963,670,328 |

| Net assets | $7,507,923,757 | |

| Net Assets by Source | ||

| Capital received from investors | 7,442,389,565 | |

| Total distributable earnings | 65,534,192 | |

| Net Asset Value (NAV) | ||||

| Net Assets | ÷ | Shares Outstanding | = | NAV |

| $7,507,923,757 | 146,100,000 | $51.39 | ||

| Investment Income | ||

| Interest | $91,564,896 | |

| Dividends | + | 16,880 |

| Total investment income | 91,581,776 | |

| Expenses | ||

| Management fees | 3,497,770 | |

| Total expenses | – | 3,497,770 |

| Net investment income | 88,084,006 | |

| Realized and Unrealized Gains (Losses) | ||

| Net realized gains on investments | 22,772,264 | |

| Net realized gains on in-kind redemptions | + | 59,856,837 |

| Net realized gains | 82,629,101 | |

| Net change in unrealized appreciation (depreciation) on investments | + | 22,483,068 |

| Net realized and unrealized gains | 105,112,169 | |

| Increase in net assets resulting from operations | $193,196,175 | |

| Operations | ||||

| 1/1/20-12/31/20 | 1/1/19-12/31/19 | |||

| Net investment income | $88,084,006 | $122,485,147 | ||

| Net realized gains | 82,629,101 | 21,531,491 | ||

| Net change in unrealized appreciation (depreciation) | + | 22,483,068 | 44,234,324 | |

| Increase in net assets resulting from operations | 193,196,175 | 188,250,962 | ||

| Distributions to Shareholders | ||||

| Total distributions | ($88,160,440) | ($122,565,815) | ||

| Transactions in Fund Shares | ||||||||

| 1/1/20-12/31/20 | 1/1/19-12/31/19 | |||||||

| SHARES | VALUE | SHARES | VALUE | |||||

| Shares sold | 133,700,000 | $6,866,598,962 | 92,750,000 | $4,666,572,488 | ||||

| Shares redeemed | + | (91,850,000) | (4,726,663,144) | (73,800,000) | (3,723,935,297) | |||

| Net transactions in fund shares | 41,850,000 | $2,139,935,818 | 18,950,000 | $942,637,191 | ||||

| Shares Outstanding and Net Assets | ||||||||

| 1/1/20-12/31/20 | 1/1/19-12/31/19 | |||||||

| SHARES | NET ASSETS | SHARES | NET ASSETS | |||||

| Beginning of period | 104,250,000 | $5,262,952,204 | 85,300,000 | $4,254,629,866 | ||||

| Total increase | + | 41,850,000 | 2,244,971,553 | 18,950,000 | 1,008,322,338 | |||

| End of period | 146,100,000 | $7,507,923,757 | 104,250,000 | $5,262,952,204 | ||||

| 1/1/20– 12/31/20 | 1/1/19– 12/31/19 | 1/1/18– 12/31/18 | 1/1/17– 12/31/17 | 1/1/16– 12/31/16 | ||

| Per-Share Data | ||||||

| Net asset value at beginning of period | $54.97 | $52.89 | $53.35 | $53.41 | $53.55 | |

| Income (loss) from investment operations: | ||||||

| Net investment income (loss)1 | 0.94 | 1.28 | 1.21 | 0.89 | 0.79 | |

| Net realized and unrealized gains (losses) | 3.24 | 2.07 | (0.55) 2 | (0.07) | (0.15) | |

| Total from investment operations | 4.18 | 3.35 | 0.66 | 0.82 | 0.64 | |

| Less distributions: | ||||||

| Distributions from net investment income | (0.94) | (1.27) | (1.12) | (0.88) | (0.78) | |

| Net asset value at end of period | $58.21 | $54.97 | $52.89 | $53.35 | $53.41 | |

| Total return | 7.62% | 6.38% | 1.28% | 1.54% | 1.16% | |

| Ratios/Supplemental Data | ||||||

| Ratios to average net assets: | ||||||

| Total expenses | 0.05% | 0.06% 3 | 0.06% | 0.06% | 0.09% 4 | |

| Net investment income (loss) | 1.63% | 2.35% | 2.34% | 1.66% | 1.44% | |

| Portfolio turnover rate5 | 51% | 38% | 41% | 30% | 30% | |

| Net assets, end of period (x 1,000) | $3,952,710 | $4,735,743 | $3,480,449 | $1,165,708 | $790,506 | |

| Security Rate, Maturity Date | Face Amount ($) | Value ($) |

| Treasuries 99.6% of net assets | ||

| Bonds | ||

| 7.50%, 11/15/24 | 7,321,000 | 9,374,598 |

| 7.63%, 02/15/25 | 2,789,000 | 3,630,820 |

| 6.88%, 08/15/25 | 3,275,000 | 4,258,268 |

| 6.00%, 02/15/26 | 6,133,000 | 7,883,301 |

| 6.75%, 08/15/26 | 3,310,000 | 4,469,664 |

| 6.50%, 11/15/26 | 4,110,000 | 5,544,486 |

| 6.63%, 02/15/27 | 2,767,000 | 3,791,330 |

| 6.38%, 08/15/27 | 3,467,000 | 4,780,397 |

| 6.13%, 11/15/27 | 9,751,000 | 13,393,913 |

| 5.50%, 08/15/28 | 5,629,000 | 7,641,807 |

| 5.25%, 11/15/28 | 7,050,000 | 9,507,035 |

| 5.25%, 02/15/29 | 5,021,000 | 6,810,124 |

| 6.13%, 08/15/29 | 3,750,000 | 5,435,156 |

| 6.25%, 05/15/30 | 6,600,000 | 9,837,609 |

| Notes | ||

| 2.75%, 02/15/24 | 37,924,000 | 40,975,697 |

| 2.13%, 02/29/24 | 28,838,000 | 30,606,581 |

| 2.38%, 02/29/24 | 38,619,000 | 41,283,108 |

| 2.13%, 03/31/24 | 54,401,000 | 57,807,438 |

| 2.00%, 04/30/24 | 26,645,000 | 28,243,700 |

| 2.25%, 04/30/24 | 41,625,000 | 44,463,955 |

| 2.50%, 05/15/24 | 58,293,000 | 62,817,539 |

| 2.00%, 05/31/24 | 50,657,000 | 53,759,741 |

| 1.75%, 06/30/24 | 33,131,000 | 34,911,791 |

| 2.00%, 06/30/24 | 30,132,000 | 32,016,427 |

| 1.75%, 07/31/24 | 31,845,000 | 33,592,743 |

| 2.13%, 07/31/24 | 30,559,000 | 32,645,607 |

| 2.38%, 08/15/24 | 61,109,000 | 65,871,205 |

| 1.25%, 08/31/24 | 39,401,000 | 40,873,920 |

| 1.88%, 08/31/24 | 26,034,000 | 27,604,176 |

| 1.50%, 09/30/24 | 32,901,000 | 34,457,372 |

| 2.13%, 09/30/24 | 25,213,000 | 26,991,698 |

| 1.50%, 10/31/24 | 26,200,000 | 27,462,922 |

| 2.25%, 10/31/24 | 23,400,000 | 25,195,219 |

| 2.25%, 11/15/24 | 51,337,000 | 55,317,623 |

| 1.50%, 11/30/24 | 34,478,000 | 36,157,456 |

| 2.13%, 11/30/24 | 21,872,000 | 23,470,536 |

| 1.75%, 12/31/24 | 26,376,000 | 27,942,075 |

| 2.25%, 12/31/24 | 19,038,000 | 20,548,398 |

| 1.38%, 01/31/25 | 31,052,000 | 32,454,192 |

| 2.50%, 01/31/25 | 21,366,000 | 23,308,136 |

| 2.00%, 02/15/25 | 53,642,000 | 57,449,325 |

| 1.13%, 02/28/25 | 32,471,000 | 33,617,632 |

| 2.75%, 02/28/25 | 22,488,000 | 24,792,142 |

| 0.50%, 03/31/25 | 35,245,000 | 35,571,292 |

| 2.63%, 03/31/25 | 21,440,000 | 23,557,200 |

| 0.38%, 04/30/25 | 42,092,000 | 42,249,845 |

| 2.88%, 04/30/25 | 23,363,000 | 25,959,396 |

| 2.13%, 05/15/25 | 51,038,000 | 55,097,116 |

| 0.25%, 05/31/25 | 14,699,000 | 14,671,439 |

| 2.88%, 05/31/25 | 23,706,000 | 26,381,259 |

| Security Rate, Maturity Date | Face Amount ($) | Value ($) |

| 0.25%, 06/30/25 | 33,840,000 | 33,755,400 |

| 2.75%, 06/30/25 | 22,401,000 | 24,845,859 |

| 0.25%, 07/31/25 | 39,588,000 | 39,473,566 |

| 2.88%, 07/31/25 | 24,327,000 | 27,156,914 |

| 2.00%, 08/15/25 | 50,406,000 | 54,310,496 |

| 0.25%, 08/31/25 | 46,321,000 | 46,169,009 |

| 2.75%, 08/31/25 | 14,303,000 | 15,907,059 |

| 0.25%, 09/30/25 | 40,211,000 | 40,057,067 |

| 3.00%, 09/30/25 | 23,459,000 | 26,402,371 |

| 0.25%, 10/31/25 | 52,014,000 | 51,792,534 |

| 3.00%, 10/31/25 | 23,836,000 | 26,871,366 |

| 2.25%, 11/15/25 | 53,899,000 | 58,872,025 |

| 0.38%, 11/30/25 | 57,013,000 | 57,095,401 |

| 2.88%, 11/30/25 | 24,431,000 | 27,435,250 |

| 0.38%, 12/31/25 | 55,000,000 | 55,045,117 |

| 2.63%, 12/31/25 | 20,915,000 | 23,263,036 |

| 2.63%, 01/31/26 | 27,933,000 | 31,111,470 |

| 1.63%, 02/15/26 | 47,487,000 | 50,506,876 |

| 2.50%, 02/28/26 | 28,272,000 | 31,337,745 |

| 2.25%, 03/31/26 | 21,866,000 | 23,979,998 |

| 2.38%, 04/30/26 | 19,450,000 | 21,477,814 |

| 1.63%, 05/15/26 | 48,746,000 | 51,903,065 |

| 2.13%, 05/31/26 | 26,609,000 | 29,049,544 |

| 1.88%, 06/30/26 | 19,708,000 | 21,264,624 |

| 1.88%, 07/31/26 | 21,397,000 | 23,100,402 |

| 1.50%, 08/15/26 | 56,424,000 | 59,743,318 |

| 1.38%, 08/31/26 | 18,609,000 | 19,575,796 |

| 1.63%, 09/30/26 | 22,345,000 | 23,822,738 |

| 1.63%, 10/31/26 | 22,222,000 | 23,700,284 |

| 2.00%, 11/15/26 | 48,216,000 | 52,480,103 |

| 1.63%, 11/30/26 | 23,958,000 | 25,560,191 |

| 1.75%, 12/31/26 | 22,925,000 | 24,637,211 |

| 1.50%, 01/31/27 | 22,686,000 | 24,047,160 |

| 2.25%, 02/15/27 | 49,276,000 | 54,473,078 |

| 1.13%, 02/28/27 | 14,797,000 | 15,345,529 |

| 0.63%, 03/31/27 | 23,295,000 | 23,436,044 |

| 0.50%, 04/30/27 | 37,791,000 | 37,699,475 |

| 2.38%, 05/15/27 | 51,490,000 | 57,439,509 |

| 0.50%, 05/31/27 | 28,658,000 | 28,560,608 |

| 0.50%, 06/30/27 | 38,800,000 | 38,637,828 |

| 0.38%, 07/31/27 | 39,082,000 | 38,565,996 |

| 2.25%, 08/15/27 | 49,860,000 | 55,290,066 |

| 0.50%, 08/31/27 | 39,024,000 | 38,786,198 |

| 0.38%, 09/30/27 | 45,619,000 | 44,924,023 |

| 0.50%, 10/31/27 | 50,095,000 | 49,703,633 |

| 2.25%, 11/15/27 | 48,895,000 | 54,292,550 |

| 0.63%, 11/30/27 | 56,207,000 | 56,198,218 |

| 0.63%, 12/31/27 | 55,000,000 | 54,944,141 |

| 2.75%, 02/15/28 | 55,032,000 | 63,106,226 |

| 2.88%, 05/15/28 | 52,505,000 | 60,831,965 |

| 2.88%, 08/15/28 | 47,889,000 | 55,633,549 |

| 3.13%, 11/15/28 | 62,504,000 | 74,008,642 |

| 2.63%, 02/15/29 | 48,289,000 | 55,445,581 |

| 2.38%, 05/15/29 | 40,350,000 | 45,611,262 |

| 1.63%, 08/15/29 | 45,610,000 | 48,799,137 |

| Security Rate, Maturity Date | Face Amount ($) | Value ($) |

| 1.75%, 11/15/29 | 39,496,000 | 42,692,708 |

| 1.50%, 02/15/30 | 47,842,000 | 50,626,554 |

| 0.63%, 05/15/30 | 73,860,000 | 72,227,002 |

| 0.63%, 08/15/30 | 105,303,000 | 102,695,106 |

| 0.88%, 11/15/30 | 75,509,000 | 75,255,337 |

| Total Treasuries | ||

| (Cost $3,810,570,195) | 3,937,465,183 | |

| Security | Number of Shares | Value ($) |

| Other Investment Company 0.1% of net assets | ||

| Money Market Fund 0.1% | ||

| State Street Institutional U.S. Government Money Market Fund, Premier Class 0.03% (a) | 3,865,148 | 3,865,148 |

| Total Other Investment Company | ||

| (Cost $3,865,148) | 3,865,148 | |

| (a) | The rate shown is the 7-day yield. |

| Description | Quoted Prices in Active Markets for Identical Assets (Level 1) | Other Significant Observable Inputs (Level 2) | Significant Unobservable Inputs (Level 3) | Total | |

| Assets | |||||

| Treasuries | $— | $3,937,465,183 | $— | $3,937,465,183 | |

| Other Investment Company1 | 3,865,148 | — | — | 3,865,148 | |

| Total | $3,865,148 | $3,937,465,183 | $— | $3,941,330,331 |

| 1 | As categorized in Portfolio Holdings. |

| Assets | ||

| Investments in unaffiliated issuers, at value (cost $3,814,435,343) | $3,941,330,331 | |

| Receivables: | ||

| Investments sold | 195,999,084 | |

| Fund shares sold | 61,081,283 | |

| Interest | 15,002,294 | |

| Dividends | + | 51 |

| Total assets | 4,213,413,043 | |

| Liabilities | ||

| Payables: | ||

| Investments bought | 205,236,074 | |

| Management fees | 164,098 | |

| Fund shares redeemed | + | 55,303,010 |

| Total liabilities | 260,703,182 | |

| Net Assets | ||

| Total assets | 4,213,413,043 | |

| Total liabilities | – | 260,703,182 |

| Net assets | $3,952,709,861 | |

| Net Assets by Source | ||

| Capital received from investors | 3,828,435,117 | |

| Total distributable earnings | 124,274,744 | |

| Net Asset Value (NAV) | ||||

| Net Assets | ÷ | Shares Outstanding | = | NAV |

| $3,952,709,861 | 67,900,000 | $58.21 | ||

| Investment Income | ||

| Interest | $70,928,301 | |

| Dividends | 18,576 | |

| Securities on loan, net | + | 20,249 |

| Total investment income | 70,967,126 | |

| Expenses | ||

| Management fees | 2,112,084 | |

| Total expenses | – | 2,112,084 |

| Net investment income | 68,855,042 | |

| Realized and Unrealized Gains (Losses) | ||

| Net realized gains on investments | 20,029,809 | |

| Net realized gains on in-kind redemptions | + | 294,547,724 |

| Net realized gains | 314,577,533 | |

| Net change in unrealized appreciation (depreciation) on investments | + | (12,306,381) |

| Net realized and unrealized gains | 302,271,152 | |

| Increase in net assets resulting from operations | $371,126,194 | |

| Operations | ||||

| 1/1/20-12/31/20 | 1/1/19-12/31/19 | |||

| Net investment income | $68,855,042 | $100,694,259 | ||

| Net realized gains | 314,577,533 | 24,699,981 | ||

| Net change in unrealized appreciation (depreciation) | + | (12,306,381) | 127,844,208 | |

| Increase in net assets resulting from operations | 371,126,194 | 253,238,448 | ||

| Distributions to Shareholders | ||||

| Total distributions | ($68,701,360) | ($100,812,255) | ||

| Transactions in Fund Shares | ||||||||

| 1/1/20-12/31/20 | 1/1/19-12/31/19 | |||||||

| SHARES | VALUE | SHARES | VALUE | |||||

| Shares sold | 53,250,000 | $3,088,045,843 | 46,950,000 | $2,562,077,403 | ||||

| Shares redeemed | + | (71,500,000) | (4,173,504,097) | (26,600,000) | (1,459,209,492) | |||

| Net transactions in fund shares | (18,250,000) | ($1,085,458,254) | 20,350,000 | $1,102,867,911 | ||||

| Shares Outstanding and Net Assets | ||||||||

| 1/1/20-12/31/20 | 1/1/19-12/31/19 | |||||||

| SHARES | NET ASSETS | SHARES | NET ASSETS | |||||

| Beginning of period | 86,150,000 | $4,735,743,281 | 65,800,000 | $3,480,449,177 | ||||

| Total increase or decrease | + | (18,250,000) | (783,033,420) | 20,350,000 | 1,255,294,104 | |||

| End of period | 67,900,000 | $3,952,709,861 | 86,150,000 | $4,735,743,281 | ||||

| 1/1/20– 12/31/20 | 10/10/19 1– 12/31/19 | |||||

| Per-Share Data | ||||||

| Net asset value at beginning of period | $47.34 | $50.00 | ||||

| Income (loss) from investment operations: | ||||||

| Net investment income (loss)2 | 0.86 | 0.22 | ||||

| Net realized and unrealized gains (losses) | 7.50 | (2.67) | ||||

| Total from investment operations | 8.36 | (2.45) | ||||

| Less distributions: | ||||||

| Distributions from net investment income | (0.83) | (0.21) | ||||

| Net asset value at end of period | $54.87 | $47.34 | ||||

| Total return | 17.64% | (4.91%) 3 | ||||

| Ratios/Supplemental Data | ||||||

| Ratios to average net assets: | ||||||

| Total expenses | 0.05% | 0.06% 4,5 | ||||

| Net investment income (loss) | 1.55% | 2.07% 4 | ||||

| Portfolio turnover rate6 | 45% | 3% 3 | ||||

| Net assets, end of period (x 1,000) | $90,535 | $18,935 | ||||

| Security Rate, Maturity Date | Face Amount ($) | Value ($) |

| Treasuries 99.4% of net assets | ||

| Bonds | ||

| 5.38%, 02/15/31 | 376,200 | 540,641 |

| 4.50%, 02/15/36 | 386,000 | 566,576 |

| 4.75%, 02/15/37 | 228,400 | 348,221 |

| 5.00%, 05/15/37 | 294,800 | 462,076 |

| 4.38%, 02/15/38 | 310,200 | 461,229 |

| 4.50%, 05/15/38 | 351,300 | 530,573 |

| 3.50%, 02/15/39 | 397,100 | 539,342 |

| 4.25%, 05/15/39 | 534,000 | 792,615 |

| 4.50%, 08/15/39 | 570,500 | 873,043 |

| 4.38%, 11/15/39 | 613,700 | 928,221 |

| 4.63%, 02/15/40 | 618,300 | 963,920 |

| 1.13%, 05/15/40 | 2,241,000 | 2,128,250 |

| 4.38%, 05/15/40 | 598,800 | 909,147 |

| 1.13%, 08/15/40 | 2,935,900 | 2,781,077 |

| 3.88%, 08/15/40 | 595,200 | 853,368 |

| 1.38%, 11/15/40 | 2,341,200 | 2,315,776 |

| 4.25%, 11/15/40 | 590,800 | 887,862 |

| 4.75%, 02/15/41 | 627,500 | 1,002,921 |

| 4.38%, 05/15/41 | 578,400 | 887,076 |

| 3.75%, 08/15/41 | 585,200 | 831,898 |

| 3.13%, 11/15/41 | 614,600 | 804,070 |

| 3.13%, 02/15/42 | 707,200 | 927,647 |

| 3.00%, 05/15/42 | 604,800 | 778,396 |

| 2.75%, 08/15/42 | 791,500 | 981,584 |

| 2.75%, 11/15/42 | 1,071,800 | 1,328,362 |

| 3.13%, 02/15/43 | 994,500 | 1,305,126 |

| 2.88%, 05/15/43 | 1,451,700 | 1,836,514 |

| 3.63%, 08/15/43 | 1,165,600 | 1,647,230 |

| 3.75%, 11/15/43 | 1,129,800 | 1,627,177 |

| 3.63%, 02/15/44 | 1,409,300 | 1,996,472 |

| 3.38%, 05/15/44 | 1,353,800 | 1,852,485 |

| 3.13%, 08/15/44 | 1,467,500 | 1,936,641 |

| 3.00%, 11/15/44 | 1,322,900 | 1,713,466 |

| 2.50%, 02/15/45 | 1,595,700 | 1,904,244 |

| 3.00%, 05/15/45 | 1,174,400 | 1,524,701 |

| 2.88%, 08/15/45 | 1,306,400 | 1,663,313 |

| 3.00%, 11/15/45 | 676,100 | 880,409 |

| 2.50%, 02/15/46 | 1,476,400 | 1,765,221 |

| 2.50%, 05/15/46 | 1,447,900 | 1,731,259 |

| 2.25%, 08/15/46 | 1,569,100 | 1,792,819 |

| 2.88%, 11/15/46 | 1,310,300 | 1,675,341 |

| 3.00%, 02/15/47 | 1,403,100 | 1,836,197 |

| 3.00%, 05/15/47 | 1,044,200 | 1,368,636 |

| 2.75%, 08/15/47 | 1,512,300 | 1,897,818 |

| 2.75%, 11/15/47 | 1,568,600 | 1,970,309 |

| 3.00%, 02/15/48 | 1,793,700 | 2,356,333 |

| 3.13%, 05/15/48 | 1,888,800 | 2,537,337 |

| 3.00%, 08/15/48 | 2,078,800 | 2,736,870 |

| 3.38%, 11/15/48 | 2,096,600 | 2,946,706 |

| 3.00%, 02/15/49 | 2,222,200 | 2,933,130 |

| 2.88%, 05/15/49 | 2,221,400 | 2,870,639 |

| Security Rate, Maturity Date | Face Amount ($) | Value ($) |

| 2.25%, 08/15/49 | 2,257,100 | 2,585,437 |

| 2.38%, 11/15/49 | 1,937,100 | 2,277,757 |

| 2.00%, 02/15/50 | 2,383,600 | 2,591,234 |

| 1.25%, 05/15/50 | 2,754,200 | 2,500,512 |

| 1.38%, 08/15/50 | 3,219,200 | 3,015,485 |

| 1.63%, 11/15/50 | 2,341,200 | 2,332,420 |

| Total Treasuries | ||

| (Cost $89,728,702) | 90,033,129 | |

| Security | Number of Shares | Value ($) |

| Other Investment Company 0.0% of net assets | ||

| Money Market Fund 0.0% | ||

| State Street Institutional U.S. Government Money Market Fund, Premier Class 0.03% (a) | 265 | 265 |

| Total Other Investment Company | ||

| (Cost $265) | 265 | |

| (a) | The rate shown is the 7-day yield. |

| Description | Quoted Prices in Active Markets for Identical Assets (Level 1) | Other Significant Observable Inputs (Level 2) | Significant Unobservable Inputs (Level 3) | Total | |

| Assets | |||||

| Treasuries | $— | $90,033,129 | $— | $90,033,129 | |

| Other Investment Company1 | 265 | — | — | 265 | |

| Total | $265 | $90,033,129 | $— | $90,033,394 |

| 1 | As categorized in Portfolio Holdings. |

| Assets | ||

| Investments in unaffiliated issuers, at value (cost $89,728,967) | $90,033,394 | |

| Receivables: | ||

| Investments sold | 2,171,300 | |

| Interest | + | 507,279 |

| Total assets | 92,711,973 | |

| Liabilities | ||

| Payables: | ||

| Investments bought | 2,172,759 | |

| Management fees | + | 3,864 |

| Total liabilities | 2,176,623 | |

| Net Assets | ||

| Total assets | 92,711,973 | |

| Total liabilities | – | 2,176,623 |

| Net assets | $90,535,350 | |

| Net Assets by Source | ||

| Capital received from investors | 90,824,997 | |

| Total distributable loss | (289,647) | |

| Net Asset Value (NAV) | ||||

| Net Assets | ÷ | Shares Outstanding | = | NAV |

| $90,535,350 | 1,650,000 | $54.87 | ||

| Investment Income | ||

| Interest | $941,095 | |

| Dividends | + | 153 |

| Total investment income | 941,248 | |

| Expenses | ||

| Management fees | 29,448 | |

| Total expenses | – | 29,448 |

| Net investment income | 911,800 | |

| Realized and Unrealized Gains (Losses) | ||

| Net realized losses on investments | (607,597) | |

| Net realized gains on in-kind redemptions | + | 1,932,140 |

| Net realized gains | 1,324,543 | |

| Net change in unrealized appreciation (depreciation) on investments | + | 913,961 |

| Net realized and unrealized gains | 2,238,504 | |

| Increase in net assets resulting from operations | $3,150,304 | |

| Operations | ||||

| 1/1/20-12/31/20 | 10/10/19*-12/31/19 | |||

| Net investment income | $911,800 | $69,454 | ||

| Net realized gains (losses) | 1,324,543 | (18,893) | ||

| Net change in unrealized appreciation (depreciation) | + | 913,961 | (609,534) | |

| Increase (decrease) in net assets resulting from operations | 3,150,304 | (558,973) | ||

| Distributions to Shareholders | ||||

| Total distributions | ($911,465) | ($66,835) | ||

| Transactions in Fund Shares | ||||||||

| 1/1/20-12/31/20 | 10/10/19*-12/31/19 | |||||||

| SHARES | VALUE | SHARES | VALUE | |||||

| Shares sold | 1,550,000 | $86,042,044 | 400,000 | $19,560,860 | ||||

| Shares redeemed | + | (300,000) | (16,680,585) | — | — | |||

| Net transactions in fund shares | 1,250,000 | $69,361,459 | 400,000 | $19,560,860 | ||||

| Shares Outstanding and Net Assets | ||||||||

| 1/1/20-12/31/20 | 10/10/19*-12/31/19 | |||||||

| SHARES | NET ASSETS | SHARES | NET ASSETS | |||||

| Beginning of period | 400,000 | $18,935,052 | — | $— | ||||

| Total increase | + | 1,250,000 | 71,600,298 | 400,000 | 18,935,052 | |||

| End of period | 1,650,000 | $90,535,350 | 400,000 | $18,935,052 | ||||

| * | Commencement of operations. |

| 1/1/20– 12/31/20 | 1/1/19– 12/31/19 | 1/1/18– 12/31/18 | 1/1/17– 12/31/17 | 1/1/16– 12/31/16 | ||

| Per-Share Data | ||||||

| Net asset value at beginning of period | $53.43 | $50.59 | $52.07 | $51.55 | $51.41 | |

| Income (loss) from investment operations: | ||||||

| Net investment income (loss)1 | 1.19 | 1.43 | 1.35 | 1.18 | 1.06 | |

| Net realized and unrealized gains (losses) | 2.79 | 2.90 | (1.42) | 0.59 | 0.23 2 | |

| Total from investment operations | 3.98 | 4.33 | (0.07) | 1.77 | 1.29 | |

| Less distributions: | ||||||

| Distributions from net investment income | (1.36) | (1.49) | (1.41) | (1.25) | (1.15) | |

| Net asset value at end of period | $56.05 | $53.43 | $50.59 | $52.07 | $51.55 | |

| Total return | 7.50% | 8.64% | (0.09%) | 3.46% | 2.49% | |

| Ratios/Supplemental Data | ||||||

| Ratios to average net assets: | ||||||

| Total expenses | 0.04% | 0.04% | 0.04% | 0.04% | 0.05% 3 | |

| Net investment income (loss) | 2.14% | 2.71% | 2.67% | 2.26% | 2.01% | |

| Portfolio turnover rate4,5 | 68% | 63% | 71% | 101% | 119% | |

| Net assets, end of period (x 1,000) | $8,732,745 | $7,383,509 | $5,544,583 | $4,925,693 | $3,309,447 | |

| Security Rate, Maturity Date | Face Amount ($) | Value ($) |

| Corporates 27.2% of net assets | ||

| Financial Institutions 8.2% | ||

| Banking 5.7% | ||

| Ally Financial, Inc. | ||

| 4.13%, 02/13/22 | 200,000 | 207,938 |

| 4.63%, 05/19/22 | 150,000 | 158,480 |

| 3.05%, 06/05/23 (a) | 300,000 | 316,605 |

| 1.45%, 10/02/23 (a) | 200,000 | 204,256 |

| 3.88%, 05/21/24 (a) | 250,000 | 274,428 |

| 5.13%, 09/30/24 | 250,000 | 288,353 |

| 4.63%, 03/30/25 | 150,000 | 171,134 |

| 5.80%, 05/01/25 (a) | 250,000 | 298,635 |

| 8.00%, 11/01/31 | 600,000 | 882,372 |

| 8.00%, 11/01/31 | 400,000 | 575,312 |

| American Express Co. | ||

| 2.75%, 05/20/22 (a) | 675,000 | 696,350 |

| 2.50%, 08/01/22 (a) | 700,000 | 722,736 |

| 2.65%, 12/02/22 | 450,000 | 470,003 |

| 3.40%, 02/27/23 (a) | 600,000 | 638,382 |

| 3.70%, 08/03/23 (a) | 800,000 | 866,840 |

| 3.40%, 02/22/24 (a) | 325,000 | 354,432 |

| 2.50%, 07/30/24 (a) | 450,000 | 481,239 |

| 3.00%, 10/30/24 (a) | 650,000 | 710,073 |

| 4.20%, 11/06/25 (a) | 650,000 | 757,009 |

| 3.13%, 05/20/26 (a) | 50,000 | 56,279 |

| 4.05%, 12/03/42 | 500,000 | 644,375 |

| American Express Credit Corp. | ||

| 2.70%, 03/03/22 (a) | 400,000 | 410,432 |

| 3.30%, 05/03/27 (a) | 550,000 | 625,988 |

| Australia & New Zealand Banking Group Ltd. | ||

| 2.63%, 05/19/22 | 650,000 | 671,086 |

| 2.63%, 11/09/22 | 500,000 | 521,995 |

| 2.05%, 11/21/22 | 250,000 | 258,723 |

| Banco Bilbao Vizcaya Argentaria S.A. | ||

| 0.88%, 09/18/23 | 600,000 | 604,944 |

| 1.13%, 09/18/25 | 400,000 | 403,764 |

| Banco Santander S.A. | ||

| 3.50%, 04/11/22 | 200,000 | 207,440 |

| 3.13%, 02/23/23 | 200,000 | 210,712 |

| 3.85%, 04/12/23 | 600,000 | 644,160 |

| 2.71%, 06/27/24 | 400,000 | 427,048 |

| 2.75%, 05/28/25 | 600,000 | 642,624 |

| 5.18%, 11/19/25 | 400,000 | 468,948 |

| 4.25%, 04/11/27 | 200,000 | 232,062 |

| 3.80%, 02/23/28 | 600,000 | 681,132 |

| 4.38%, 04/12/28 | 400,000 | 469,336 |

| 3.31%, 06/27/29 | 600,000 | 676,260 |

| 3.49%, 05/28/30 | 400,000 | 449,448 |

| Bancolombia S.A. | ||

| 3.00%, 01/29/25 (a) | 350,000 | 364,823 |

| Security Rate, Maturity Date | Face Amount ($) | Value ($) |

| Bank of America Corp. | ||

| 2.50%, 10/21/22 (a) | 1,500,000 | 1,527,195 |

| 3.30%, 01/11/23 | 1,700,000 | 1,803,275 |

| 3.12%, 01/20/23 (a)(b) | 2,750,000 | 2,829,942 |

| 2.88%, 04/24/23 (a)(b) | 350,000 | 361,389 |

| 4.10%, 07/24/23 | 500,000 | 547,665 |

| 3.00%, 12/20/23 (a)(b) | 1,300,000 | 1,368,289 |

| 4.13%, 01/22/24 | 950,000 | 1,054,300 |

| 3.55%, 03/05/24 (a)(b) | 1,000,000 | 1,068,350 |

| 4.00%, 04/01/24 | 650,000 | 721,727 |

| 3.86%, 07/23/24 (a)(b) | 750,000 | 814,380 |

| 4.20%, 08/26/24 | 950,000 | 1,065,748 |

| 0.81%, 10/24/24 (a)(b) | 400,000 | 404,264 |

| 4.00%, 01/22/25 | 750,000 | 843,382 |

| 3.46%, 03/15/25 (a)(b) | 1,075,000 | 1,171,212 |

| 3.95%, 04/21/25 | 1,000,000 | 1,127,450 |

| 3.88%, 08/01/25 | 2,300,000 | 2,626,301 |

| 0.98%, 09/25/25 (a)(b) | 650,000 | 658,365 |

| 3.09%, 10/01/25 (a)(b) | 350,000 | 380,765 |

| 2.46%, 10/22/25 (a)(b) | 350,000 | 373,776 |

| 2.02%, 02/13/26 (a)(b) | 500,000 | 524,745 |

| 4.45%, 03/03/26 | 500,000 | 583,545 |

| 3.50%, 04/19/26 | 1,000,000 | 1,134,500 |

| 4.25%, 10/22/26 | 650,000 | 761,410 |

| 1.20%, 10/24/26 (a)(b) | 400,000 | 406,740 |

| 3.56%, 04/23/27 (a)(b) | 750,000 | 847,597 |

| 3.25%, 10/21/27 (a) | 1,000,000 | 1,121,500 |

| 4.18%, 11/25/27 (a) | 1,200,000 | 1,394,652 |

| 3.82%, 01/20/28 (a)(b) | 1,250,000 | 1,436,600 |

| 3.71%, 04/24/28 (a)(b) | 500,000 | 570,955 |

| 3.59%, 07/21/28 (a)(b) | 850,000 | 967,334 |

| 3.42%, 12/20/28 (a)(b) | 1,700,000 | 1,921,425 |

| 3.97%, 03/05/29 (a)(b) | 1,000,000 | 1,167,510 |

| 4.27%, 07/23/29 (a)(b) | 650,000 | 774,839 |

| 3.97%, 02/07/30 (a)(b) | 950,000 | 1,121,123 |

| 3.19%, 07/23/30 (a)(b) | 1,500,000 | 1,682,250 |

| 2.88%, 10/22/30 (a)(b) | 800,000 | 876,624 |

| 2.50%, 02/13/31 (a)(b) | 1,200,000 | 1,275,048 |

| 2.59%, 04/29/31 (a)(b) | 1,000,000 | 1,071,750 |

| 1.90%, 07/23/31 (a)(b) | 750,000 | 759,120 |

| 1.92%, 10/24/31 (a)(b) | 950,000 | 963,233 |

| 6.11%, 01/29/37 | 650,000 | 951,944 |

| 4.24%, 04/24/38 (a)(b) | 700,000 | 868,679 |

| 7.75%, 05/14/38 | 550,000 | 936,232 |

| 4.08%, 04/23/40 (a)(b) | 500,000 | 615,615 |

| 2.68%, 06/19/41 (a)(b) | 1,050,000 | 1,095,759 |

| 5.88%, 02/07/42 | 500,000 | 762,470 |

| 5.00%, 01/21/44 | 1,150,000 | 1,623,386 |

| 4.88%, 04/01/44 | 250,000 | 346,875 |

| 4.75%, 04/21/45 | 200,000 | 274,412 |

| 4.44%, 01/20/48 (a)(b) | 750,000 | 995,955 |

| 3.95%, 01/23/49 (a)(b) | 400,000 | 500,252 |

| 4.33%, 03/15/50 (a)(b) | 1,025,000 | 1,341,766 |

| 4.08%, 03/20/51 (a)(b) | 1,800,000 | 2,281,212 |

| 2.83%, 10/24/51 (a)(b) | 550,000 | 574,178 |

| Security Rate, Maturity Date | Face Amount ($) | Value ($) |

| Bank of America NA | ||

| 3.34%, 01/25/23 (a)(b) | 250,000 | 258,275 |

| 6.00%, 10/15/36 | 600,000 | 899,952 |

| Bank of Montreal | ||

| 2.90%, 03/26/22 | 450,000 | 464,711 |

| 2.35%, 09/11/22 | 900,000 | 932,067 |

| 2.05%, 11/01/22 | 200,000 | 206,520 |

| 2.55%, 11/06/22 (a) | 500,000 | 520,135 |

| 0.45%, 12/08/23 | 200,000 | 200,714 |

| 3.30%, 02/05/24 | 500,000 | 542,920 |

| 2.50%, 06/28/24 | 300,000 | 320,472 |

| 1.85%, 05/01/25 | 475,000 | 499,054 |

| 4.34%, 10/05/28 (a)(b) | 300,000 | 330,222 |

| 3.80%, 12/15/32 (a)(b) | 429,000 | 486,070 |

| Bank of New York Mellon Corp. | ||

| 2.60%, 02/07/22 (a) | 750,000 | 767,662 |

| 1.95%, 08/23/22 | 750,000 | 771,705 |

| 1.85%, 01/27/23 (a) | 300,000 | 309,438 |

| 2.95%, 01/29/23 (a) | 500,000 | 526,095 |

| 3.50%, 04/28/23 | 250,000 | 268,283 |

| 2.20%, 08/16/23 (a) | 500,000 | 524,200 |

| 3.65%, 02/04/24 (a) | 100,000 | 109,874 |

| 3.25%, 09/11/24 (a) | 350,000 | 385,336 |

| 2.10%, 10/24/24 | 250,000 | 265,595 |

| 3.00%, 02/24/25 (a) | 250,000 | 275,313 |

| 1.60%, 04/24/25 (a) | 450,000 | 470,246 |

| 3.95%, 11/18/25 (a) | 950,000 | 1,101,135 |

| 2.45%, 08/17/26 (a) | 200,000 | 217,986 |

| 3.25%, 05/16/27 (a) | 300,000 | 339,864 |

| 3.40%, 01/29/28 (a) | 250,000 | 286,923 |

| 3.44%, 02/07/28 (a)(b) | 300,000 | 344,058 |

| 3.00%, 10/30/28 (a) | 350,000 | 397,870 |

| 3.30%, 08/23/29 (a) | 250,000 | 286,173 |

| Bank of Nova Scotia | ||

| 2.70%, 03/07/22 | 700,000 | 720,251 |

| 2.00%, 11/15/22 | 400,000 | 413,136 |

| 2.38%, 01/18/23 | 250,000 | 260,293 |

| 1.95%, 02/01/23 | 350,000 | 361,561 |

| 1.63%, 05/01/23 | 550,000 | 566,054 |

| 0.80%, 06/15/23 | 150,000 | 151,475 |

| 3.40%, 02/11/24 | 500,000 | 544,565 |

| 2.20%, 02/03/25 | 400,000 | 424,524 |

| 1.30%, 06/11/25 | 550,000 | 564,525 |

| 4.50%, 12/16/25 | 300,000 | 350,325 |

| 2.70%, 08/03/26 | 650,000 | 718,217 |

| BankUnited, Inc. | ||

| 4.88%, 11/17/25 (a) | 200,000 | 231,566 |

| Barclays Bank PLC | ||

| 1.70%, 05/12/22 (a) | 950,000 | 966,568 |

| Barclays PLC | ||

| 3.68%, 01/10/23 (a) | 550,000 | 567,143 |

| 4.61%, 02/15/23 (a)(b) | 950,000 | 991,705 |

| 4.34%, 05/16/24 (a)(b) | 750,000 | 812,317 |

| 4.38%, 09/11/24 | 200,000 | 221,532 |

| 1.01%, 12/10/24 (a) | 250,000 | 251,890 |

| 3.65%, 03/16/25 | 800,000 | 883,904 |

| 3.93%, 05/07/25 (a)(b) | 700,000 | 766,507 |

| 4.38%, 01/12/26 | 900,000 | 1,037,016 |

| 5.20%, 05/12/26 | 850,000 | 993,361 |

| 4.34%, 01/10/28 (a) | 400,000 | 460,284 |

| 4.84%, 05/09/28 (a) | 700,000 | 809,606 |

| 4.97%, 05/16/29 (a)(b) | 950,000 | 1,144,018 |

| 5.09%, 06/20/30 (a)(b) | 500,000 | 601,520 |

| 2.65%, 06/24/31 (a)(b) | 200,000 | 209,002 |

| 3.56%, 09/23/35 (a)(b) | 400,000 | 431,500 |

| Security Rate, Maturity Date | Face Amount ($) | Value ($) |

| 5.25%, 08/17/45 | 500,000 | 692,055 |

| 4.95%, 01/10/47 | 500,000 | 683,155 |

| BBVA USA | ||

| 2.88%, 06/29/22 (a) | 250,000 | 258,758 |

| 2.50%, 08/27/24 (a) | 250,000 | 265,545 |

| 3.88%, 04/10/25 (a) | 250,000 | 281,130 |

| BNP Paribas S.A. | ||

| 3.25%, 03/03/23 | 375,000 | 398,681 |

| 4.25%, 10/15/24 | 300,000 | 338,109 |

| BPCE S.A. | ||

| 4.00%, 04/15/24 | 750,000 | 832,155 |

| 3.38%, 12/02/26 | 250,000 | 283,668 |

| Canadian Imperial Bank of Commerce | ||

| 2.55%, 06/16/22 | 250,000 | 258,568 |

| 0.95%, 06/23/23 | 500,000 | 506,845 |

| 2.61%, 07/22/23 (a)(b) | 100,000 | 103,381 |

| 3.50%, 09/13/23 | 700,000 | 759,983 |

| 3.10%, 04/02/24 | 250,000 | 270,720 |

| 2.25%, 01/28/25 | 250,000 | 265,428 |

| Capital One Bank USA NA | ||

| 3.38%, 02/15/23 | 250,000 | 264,810 |

| 2.28%, 01/28/26 (a)(b) | 500,000 | 523,240 |

| Capital One Financial Corp. | ||

| 3.05%, 03/09/22 (a) | 500,000 | 514,855 |

| 3.50%, 06/15/23 | 2,100,000 | 2,255,484 |

| 3.90%, 01/29/24 (a) | 250,000 | 273,998 |

| 3.30%, 10/30/24 (a) | 700,000 | 770,420 |

| 3.20%, 02/05/25 (a) | 500,000 | 546,335 |

| 4.20%, 10/29/25 (a) | 550,000 | 628,199 |

| 3.75%, 07/28/26 (a) | 400,000 | 453,236 |

| 3.75%, 03/09/27 (a) | 250,000 | 286,738 |

| 3.65%, 05/11/27 (a) | 700,000 | 803,670 |

| 3.80%, 01/31/28 (a) | 550,000 | 636,025 |

| CIT Bank NA | ||

| 2.97%, 09/27/25 (a)(b) | 250,000 | 260,913 |

| Citibank NA | ||

| 3.65%, 01/23/24 (a) | 850,000 | 930,138 |

| Citigroup, Inc. | ||

| 4.50%, 01/14/22 | 1,300,000 | 1,355,861 |

| 2.75%, 04/25/22 (a) | 950,000 | 978,481 |

| 4.05%, 07/30/22 | 100,000 | 105,655 |

| 2.70%, 10/27/22 (a) | 400,000 | 416,224 |

| 3.14%, 01/24/23 (a)(b) | 1,000,000 | 1,028,750 |

| 3.50%, 05/15/23 | 450,000 | 482,665 |

| 2.88%, 07/24/23 (a)(b) | 950,000 | 986,261 |

| 3.88%, 10/25/23 | 350,000 | 385,200 |

| 4.04%, 06/01/24 (a)(b) | 450,000 | 489,240 |

| 3.75%, 06/16/24 | 500,000 | 553,235 |

| 4.00%, 08/05/24 | 250,000 | 278,655 |

| 3.88%, 03/26/25 | 450,000 | 504,157 |

| 3.35%, 04/24/25 (a)(b) | 550,000 | 599,269 |

| 3.30%, 04/27/25 | 765,000 | 849,838 |

| 4.40%, 06/10/25 | 750,000 | 860,265 |

| 5.50%, 09/13/25 | 1,000,000 | 1,203,370 |

| 3.70%, 01/12/26 | 750,000 | 854,062 |

| 4.60%, 03/09/26 | 800,000 | 939,400 |

| 3.11%, 04/08/26 (a)(b) | 1,100,000 | 1,205,028 |

| 3.40%, 05/01/26 | 500,000 | 563,335 |

| 3.20%, 10/21/26 (a) | 1,000,000 | 1,118,250 |

| 4.30%, 11/20/26 | 500,000 | 584,180 |

| 4.45%, 09/29/27 | 1,150,000 | 1,359,852 |

| 3.89%, 01/10/28 (a)(b) | 750,000 | 862,845 |

| 6.63%, 01/15/28 | 350,000 | 459,725 |

| 3.67%, 07/24/28 (a)(b) | 1,250,000 | 1,424,312 |

| 4.13%, 07/25/28 | 900,000 | 1,053,603 |

| 3.52%, 10/27/28 (a)(b) | 600,000 | 678,636 |

| Security Rate, Maturity Date | Face Amount ($) | Value ($) |

| 4.08%, 04/23/29 (a)(b) | 300,000 | 352,794 |

| 3.98%, 03/20/30 (a)(b) | 950,000 | 1,118,007 |

| 2.98%, 11/05/30 (a)(b) | 900,000 | 992,601 |

| 2.67%, 01/29/31 (a)(b) | 750,000 | 805,402 |

| 4.41%, 03/31/31 (a)(b) | 1,350,000 | 1,638,360 |

| 2.57%, 06/03/31 (a)(b) | 700,000 | 746,508 |

| 6.63%, 06/15/32 | 250,000 | 355,698 |

| 5.88%, 02/22/33 | 350,000 | 471,468 |

| 6.00%, 10/31/33 | 350,000 | 481,701 |

| 3.88%, 01/24/39 (a)(b) | 800,000 | 960,752 |

| 8.13%, 07/15/39 | 300,000 | 538,053 |

| 5.32%, 03/26/41 (a)(b) | 600,000 | 842,880 |

| 5.88%, 01/30/42 | 400,000 | 612,968 |

| 6.68%, 09/13/43 | 300,000 | 488,769 |

| 5.30%, 05/06/44 | 500,000 | 701,225 |

| 4.65%, 07/30/45 | 550,000 | 745,288 |

| 4.75%, 05/18/46 | 650,000 | 867,061 |

| 4.28%, 04/24/48 (a)(b) | 350,000 | 457,156 |

| 4.65%, 07/23/48 (a) | 800,000 | 1,106,080 |

| Citizens Bank NA | ||

| 3.25%, 02/14/22 (a) | 500,000 | 515,050 |

| 2.65%, 05/26/22 (a) | 250,000 | 257,555 |

| 3.70%, 03/29/23 (a) | 250,000 | 267,470 |

| Citizens Financial Group, Inc. | ||

| 2.85%, 07/27/26 (a) | 150,000 | 166,788 |

| 3.25%, 04/30/30 (a) | 450,000 | 508,999 |

| 2.64%, 09/30/32 (a)(c) | 250,000 | 266,065 |

| Comerica, Inc. | ||

| 3.70%, 07/31/23 (a) | 300,000 | 324,360 |

| 4.00%, 02/01/29 (a) | 400,000 | 479,216 |

| Cooperatieve Rabobank UA | ||

| 2.75%, 01/10/22 | 250,000 | 256,308 |

| 3.88%, 02/08/22 | 1,250,000 | 1,299,550 |

| 2.75%, 01/10/23 | 250,000 | 262,265 |

| 4.63%, 12/01/23 | 450,000 | 501,777 |

| 3.38%, 05/21/25 | 750,000 | 837,555 |

| 4.38%, 08/04/25 | 500,000 | 571,540 |

| 3.75%, 07/21/26 | 250,000 | 282,973 |

| 5.25%, 05/24/41 | 700,000 | 1,034,516 |

| 5.75%, 12/01/43 | 500,000 | 748,520 |

| 5.25%, 08/04/45 | 500,000 | 717,355 |

| Credit Suisse AG | ||

| 2.80%, 04/08/22 | 500,000 | 516,105 |

| 1.00%, 05/05/23 | 500,000 | 507,590 |

| 3.63%, 09/09/24 | 1,300,000 | 1,443,221 |

| 2.95%, 04/09/25 | 500,000 | 548,795 |

| Credit Suisse Group AG | ||

| 3.80%, 06/09/23 | 600,000 | 646,326 |

| 3.75%, 03/26/25 | 1,250,000 | 1,389,987 |

| 4.55%, 04/17/26 | 750,000 | 883,080 |

| 4.88%, 05/15/45 | 500,000 | 702,245 |

| Credit Suisse Group Funding Guernsey Ltd. | ||

| 3.80%, 09/15/22 | 500,000 | 528,660 |

| Credit Suisse USA, Inc. | ||

| 7.13%, 07/15/32 | 250,000 | 390,440 |

| Deutsche Bank AG | ||

| 3.30%, 11/16/22 | 500,000 | 522,395 |

| 3.95%, 02/27/23 | 1,000,000 | 1,062,020 |

| 3.70%, 05/30/24 | 99,000 | 106,854 |

| 3.70%, 05/30/24 | 250,000 | 269,498 |

| 3.96%, 11/26/25 (a)(b) | 450,000 | 492,480 |

| 4.10%, 01/13/26 | 200,000 | 222,280 |

| 4.10%, 01/13/26 | 200,000 | 223,438 |

| 2.13%, 11/24/26 (a)(b) | 550,000 | 563,128 |

| 3.55%, 09/18/31 (a)(b) | 750,000 | 815,025 |

| Security Rate, Maturity Date | Face Amount ($) | Value ($) |

| Discover Bank | ||

| 4.20%, 08/08/23 | 500,000 | 547,590 |

| 2.45%, 09/12/24 (a) | 250,000 | 264,913 |

| 4.68%, 08/09/28 (a)(b) | 250,000 | 266,040 |

| 4.65%, 09/13/28 (a) | 1,000,000 | 1,199,240 |

| Discover Financial Services | ||

| 3.85%, 11/21/22 | 1,250,000 | 1,330,487 |

| 3.95%, 11/06/24 (a) | 200,000 | 223,580 |