UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSRS

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-22311

Schwab Strategic Trust – Schwab Fixed-Income ETFs

(Exact name of registrant as specified in charter)

211 Main Street, San Francisco, California 94105

(Address of principal executive offices) (Zip code)

Jonathan de St. Paer

Schwab Strategic Trust – Schwab Fixed-Income ETFs

211 Main Street, San Francisco, California 94105

(Name and address of agent for service)

Registrant’s telephone number, including area code: (415) 636-7000

Date of fiscal year end: December 31

Date of reporting period: June 30, 2022

Item 1: Report(s) to Shareholders.

Semiannual Report | June 30, 2022

Schwab Fixed-Income ETFs

| Schwab U.S. TIPS ETF | SCHP |

| Schwab Short-Term U.S. Treasury ETF | SCHO |

| Schwab Intermediate-Term U.S. Treasury ETF | SCHR |

| Schwab Long-Term U.S. Treasury ETF | SCHQ |

| Schwab U.S. Aggregate Bond ETF | SCHZ |

| Schwab 1-5 Year Corporate Bond ETF | SCHJ |

| Schwab 5-10 Year Corporate Bond ETF | SCHI |

This page is intentionally left blank.

Fund investment adviser: Charles Schwab Investment Management, Inc., dba Schwab Asset ManagementTM

Distributor: SEI Investments Distribution Co. (SIDCO)

Schwab Fixed-Income ETFs | Semiannual Report

The performance data quoted represents past performance. Past performance does not guarantee future results. Investment return and principal value of an investment will fluctuate so that an investor’s shares, when sold or redeemed, may be worth more or less than the original cost. Current performance may be lower or higher than the performance quoted. To obtain performance information current to the most recent month end, please visit www.schwabassetmanagement.com/schwabetfs_prospectus.

| Total Returns for the 6 Months Ended June 30, 2022 |

Schwab U.S. TIPS ETF

(Ticker Symbol: SCHP) | |

| Market Price Return1 | -8.98% |

| NAV Return1 | -8.88% |

| Bloomberg US Treasury Inflation-Linked Bond Index (Series-L)SM | -8.92% |

| ETF Category: Morningstar Inflation-Protected Bond2 | -6.81% |

| Performance Details | page 6 |

| |

Schwab Short-Term U.S. Treasury ETF

(Ticker Symbol: SCHO) | |

| Market Price Return1 | -3.04% |

| NAV Return1 | -3.00% |

| Bloomberg US Treasury 1-3 Year Index | -3.01% |

| ETF Category: Morningstar Short Government2 | -3.68% |

| Performance Details | page 7 |

| |

Schwab Intermediate-Term U.S. Treasury ETF

(Ticker Symbol: SCHR) | |

| Market Price Return1 | -7.62% |

| NAV Return1 | -7.70% |

| Bloomberg US Treasury 3-10 Year Index | -7.73% |

| ETF Category: Morningstar Intermediate Government2 | -8.10% |

| Performance Details | page 8 |

| |

Schwab Long-Term U.S. Treasury ETF

(Ticker Symbol: SCHQ) | |

| Market Price Return1 | -20.81% |

| NAV Return1 | -20.99% |

| Bloomberg US Long Treasury Index | -21.25% |

| ETF Category: Morningstar Long Government2 | -21.10% |

| Performance Details | page 9 |

| Total Returns for the 6 Months Ended June 30, 2022 |

Schwab U.S. Aggregate Bond ETF

(Ticker Symbol: SCHZ) | |

| Market Price Return1 | -10.34% |

| NAV Return1 | -10.27% |

| Bloomberg US Aggregate Bond Index | -10.35% |

| ETF Category: Morningstar Intermediate Core Bond2 | -10.53% |

| Performance Details | page 10 |

| |

Schwab 1-5 Year Corporate Bond ETF

(Ticker Symbol: SCHJ) | |

| Market Price Return1 | -5.54% |

| NAV Return1 | -5.56% |

| Bloomberg US 1-5 Year Corporate Bond Index | -5.60% |

| ETF Category: Morningstar Short-Term Bond2 | -4.86% |

| Performance Details | page 11 |

| |

Schwab 5-10 Year Corporate Bond ETF

(Ticker Symbol: SCHI) | |

| Market Price Return1 | -12.83% |

| NAV Return1 | -12.87% |

| Bloomberg US 5-10 Year Corporate Bond Index | -12.94% |

| ETF Category: Morningstar Corporate Bond2 | -13.83% |

| Performance Details | page 12 |

All total returns on this page assume dividends and distributions were reinvested. Index figures do not include trading and management costs, which would lower performance. Indices are unmanaged and cannot be invested in directly. Performance results less than one year are not annualized.

For index definitions, please see the Glossary.

Performance does not reflect the deduction of taxes that a shareholder would pay on fund distributions or on the redemption or sale of fund shares.

Shares are bought and sold at market price, which may be higher or lower than the net asset value (NAV). Brokerage commissions will reduce returns.

Fixed income securities are subject to increased loss of principal during periods of rising interest rates. An investment in the fund(s) is not insured or guaranteed by the Federal Deposit Insurance Corporation (FDIC) or any other government agency.

U.S. Treasury Inflation-Protected Securities (TIPS) generally have lower yields than conventional fixed rate bonds and will likely decline in price during periods of deflation, which could result in losses.

Index ownership — Bloomberg Index Services Limited. BLOOMBERG® is a trademark and service mark of Bloomberg Finance L.P. and its affiliates (collectively Bloomberg). Bloomberg or Bloomberg’s licensors own all proprietary rights in the Bloomberg Indices. Neither Bloomberg nor Bloomberg’s licensors approves or endorses this material, or guarantees the accuracy or completeness of any information herein, or makes any warranty, express or implied, as to the results to be obtained therefrom and, to the maximum extent allowed by law, neither shall have any liability or responsibility for injury or damages arising in connection therewith.

| 1 | ETF performance must be shown based on both a Market Price and a NAV basis. The fund’s per share NAV is the value of one share of the fund. NAV is calculated by taking the fund’s total assets (including the fair value of securities owned), subtracting liabilities, and dividing by the number of shares outstanding. The NAV Return is based on the NAV of the fund, and the Market Price Return is based on the market price per share of the fund. The price used to calculate market return (Market Price) is determined using the Official Closing Price of the primary stock exchange (generally, 4:00 p.m. Eastern time) and may not represent the returns you would receive if shares were traded at other times. Market Price and NAV returns assume that dividends and capital gain distributions have been reinvested in the fund at Market Price and NAV, respectively. |

| 2 | Source for category information: Morningstar, Inc. The Morningstar Category return represents all passively- and actively-managed ETFs and mutual funds within the category as of the report date. |

Schwab Fixed-Income ETFs | Semiannual Report

The Investment Environment

For the six-month reporting period ended June 30, 2022, both U.S. fixed-income and U.S. equity markets lost ground as inflation accelerated, interest rates rose, and, in late February, Russia invaded Ukraine. Economic growth slowed around the world and fears of an impending recession rose. The spread of COVID-19 continued to weigh on economic growth worldwide, with the highly transmissible Omicron variant and subvariants keeping infection rates high in many areas. For the six-month reporting period, the Bloomberg US Aggregate Bond Index, representing the broad U.S. bond market, returned -10.35%. The Bloomberg US 1-5 Year Corporate Bond Index and Bloomberg US 5-10 Year Corporate Bond Index returned -5.60% and -12.94%, respectively, while the Bloomberg US Treasury 1-3 Year Index and the Bloomberg US Treasury 3-10 Year Index returned -3.01% and -7.73%, respectively. The Bloomberg US Treasury Inflation-Linked Bond Index (Series-L)SM returned -8.92%.

Amid fading government stimuli, ongoing supply chain disruptions, persisting inflation, and a widening U.S. trade deficit, gross domestic product (GDP) decreased at an annualized rate of -1.6% for the first quarter of 2022. The unemployment rate, which has fallen steadily since skyrocketing in April 2020, ended the reporting period near pre-pandemic lows. Inflation rose through the reporting period, with just a slight downtick in April, ending the reporting period at its highest level in more than 40 years, due to imbalances in the labor market, supply chain bottlenecks, and soaring energy costs.

Monetary policies around the world varied. In the United States, after maintaining the federal funds rate in a range of 0.00% to 0.25% through mid-March, the U.S. Federal Reserve (Fed) shifted its stance as inflation continued to rise and indicators of economic activity and employment continued to strengthen. After issuing successively stronger signals that interest rates could begin to rise sooner in 2022 than previously anticipated, the Fed increased the federal funds rate by 0.25% in mid-March, 0.50% in early May, and 0.75% in mid-June in an effort to achieve a return to price stability. The federal funds rate ended the reporting period in a range of 1.50% to 1.75%. In addition, the Fed’s bond-buying program, which it had begun to scale back in November 2021, was ended altogether in early March 2022. In June, the Fed also began to reduce the $9 trillion in assets it holds on its balance sheet, vowing to be more aggressive than during its last round of quantitative tightening in 2017 through 2019.

Yields of U.S. Treasury Securities: Effective Yields of Three-Month, Two-Year and 10-Year Treasuries

Index figures assume dividends and distributions were reinvested. Index figures do not include trading and management costs, which would lower performance. Indices are unmanaged and cannot be invested in directly. Performance results less than one year are not annualized. Past performance is not an indication of future results.

For index definitions, please see the Glossary.

Data source: Bloomberg L.P.

Nothing in this report represents a recommendation of a security by the investment adviser.

Management views may have changed since the report date.

Schwab Fixed-Income ETFs | Semiannual Report

The Investment Environment (continued)

Outside the United States, after holding its policy rate unchanged since March 2016, at 0.00%, the European Central Bank announced in June its intention to raise interest rates in July for the first time in 11 years. The European Central Bank also intended to end its long-running asset purchase program and downgraded its growth forecasts. Also in June, the Bank of England raised its key official bank rate for the fifth consecutive time, to 1.25%, bringing borrowing costs to a 13-year high as the Bank of England wrestles with soaring inflation. In contrast, the Bank of Japan upheld its short-term interest rate target of -0.1%, also unchanged since 2016, and vowed to defend its cap on bond yields with unlimited buying, as opposed to the monetary tightening being employed in many other countries around the globe.

Bond markets were volatile during the reporting period, particularly as the Fed’s tightening cycle accelerated. As inflation continued to rise and Fed monetary policy shifted, bond yields began to rise in early 2022, exerting downward pressure on bond prices. Yields touched reporting-period highs in mid-June before falling back slightly. (Bond yields and bond prices typically move in opposite directions.) During the reporting period, portions of the yield curve inverted, which is often an indicator of a possible recession. The yield on the 10-year U.S. Treasury began the reporting period at 1.52%, hit a reporting-period high of 3.49% in mid-June, and ended the reporting period at 2.98% as concerns about slowing economic growth mounted. Short-term rates also rose, with the yield on the three-month U.S. Treasury climbing from 0.06% to 1.72% over the reporting period.

Schwab Fixed-Income ETFs | Semiannual Report

| Matthew Hastings, CFA, Managing Director and Head of Taxable Bond Strategies for Schwab Asset Management, leads the portfolio management team for the Schwab Fixed-Income ETFs and Schwab Taxable Bond Funds. He also has overall responsibility for all aspects of the management of the funds. Prior to joining Schwab in 1999, Mr. Hastings was in fixed-income sales and trading at Lehman Brothers. He has worked in the fixed-income securities industry since 1996. |

| Steven Hung, Senior Portfolio Manager, is responsible for the day-to-day co-management of the Schwab U.S. Aggregate Bond ETF, Schwab 1-5 Year Corporate Bond ETF and Schwab 5-10 Year Corporate Bond ETF. His primary focus is corporate bonds. Prior to joining Schwab in 1999, Mr. Hung was an associate in Schwab’s management training program for nine months. In that role, he worked as a clerk on the options trading floor of the Pacific Coast Stock Exchange. |

| Mark McKissick, CFA, Senior Portfolio Manager, is responsible for the day-to-day co-management of the Schwab U.S. TIPS ETF, Schwab Short-Term U.S. Treasury ETF, Schwab Intermediate-Term U.S. Treasury ETF, Schwab Long-Term U.S. Treasury ETF and Schwab U.S. Aggregate Bond ETF. Prior to joining Schwab in 2016, Mr. McKissick worked at Denver Investments for 17 years, most recently as a director of fixed income and portfolio manager. In this role he co-managed multiple bond strategies, as well as oversaw the firm’s fixed-income business including the investment process, client service and other administrative functions. |

| Alfonso Portillo, Jr., Senior Portfolio Manager, is responsible for the day-to-day co-management of the Schwab U.S. Aggregate Bond ETF. His primary focus is securitized products. Prior to joining Schwab in 2007, Mr. Portillo worked for ten years at Pacific Investment Management Company, most recently as a vice president and member of the mortgage- and asset-backed portfolio management team. He has worked in fixed-income asset management since 1996. |

Schwab Fixed-Income ETFs | Semiannual Report

Schwab U.S. TIPS ETF as of June 30, 2022

The performance data quoted represents past performance. Past performance does not guarantee future results. Investment return and principal value of an investment will fluctuate so that an investor’s shares, when sold or redeemed, may be worth more or less than the original cost. Current performance may be lower or higher than the performance quoted. To obtain performance information current to the most recent month end, please visit www.schwabassetmanagement.com/schwabetfs_prospectus.

Average Annual Total Returns1

| Fund and Inception Date | 6 Months | 1 Year | 5 Years | 10 Years |

| Fund: Schwab U.S. TIPS ETF (8/5/2010) | | | | |

| Market Price Return2 | -8.98% | -5.14% | 3.15% | 1.64% |

| NAV Return2 | -8.88% | -5.17% | 3.15% | 1.66% |

| Bloomberg US Treasury Inflation-Linked Bond Index (Series-L)SM | -8.92% | -5.14% | 3.21% | 1.73% |

| ETF Category: Morningstar Inflation-Protected Bond3 | -6.81% | -3.79% | 2.85% | 1.39% |

| Fund Expense Ratio4: 0.04% |

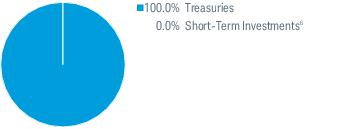

Portfolio Composition % of Investments5

By Security Type

| Weighted Average Maturity7 | 7.4 Yrs |

| Weighted Average Duration7 | 6.9 Yrs |

All total returns on this page assume dividends and distributions were reinvested. Index figures do not include trading and management costs, which would lower performance. Indices are unmanaged and cannot be invested in directly. Performance results less than one year are not annualized.

For index definitions, please see the Glossary.

Shares are bought and sold at market price, which may be higher or lower than the net asset value (NAV). Brokerage commissions will reduce returns.

Index ownership — Bloomberg® and Bloomberg US Treasury Inflation-Linked Bond Index (Series-L)SM are service marks of Bloomberg Finance L.P. and its affiliates, including Bloomberg Index Services Limited (BISL), the administrator of the indices (collectively, Bloomberg). Bloomberg is not affiliated with Charles Schwab Investment Management, Inc., and Bloomberg does not approve, endorse, review, or recommend Schwab U.S. TIPS ETF. Bloomberg does not guarantee the timeliness, accurateness, or completeness of any data or information relating to Schwab U.S. TIPS ETF.

Portfolio holdings may have changed since the report date.

An index is a statistical composite of a specified financial market or sector. Unlike the fund, an index does not actually hold a portfolio of securities and its return is not inclusive of operational and transaction costs incurred by the fund.

Fixed income securities are subject to increased loss of principal during periods of rising interest rates. An investment in the fund is not insured or guaranteed by the Federal Deposit Insurance Corporation (FDIC) or any other government agency.

TIPS generally have lower yields than conventional fixed rate bonds and will likely decline in price during periods of deflation, which could result in losses.

| 1 | Performance does not reflect the deduction of taxes that a shareholder would pay on fund distributions or on the redemption or sale of fund shares. |

| 2 | ETF performance must be shown based on both a Market Price and a NAV basis. The fund’s per share NAV is the value of one share of the fund. NAV is calculated by taking the fund’s total assets (including the fair value of securities owned), subtracting liabilities, and dividing by the number of shares outstanding. The NAV Return is based on the NAV of the fund, and the Market Price Return is based on the market price per share of the fund. The price used to calculate market return (Market Price) is determined using the Official Closing Price of the primary stock exchange (generally, 4:00 p.m. Eastern time) and may not represent the returns you would receive if shares were traded at other times. NAV is used as a proxy for purposes of calculating Market Price Return on inception date. Market Price and NAV returns assume that dividends and capital gain distributions have been reinvested in the fund at Market Price and NAV, respectively. |

| 3 | Source for category information: Morningstar, Inc. The Morningstar Category return represents all passively- and actively-managed ETFs and mutual funds within the category as of the report date. |

| 4 | As stated in the prospectus. Effective July 1, 2022, the management fee was reduced to 0.04%. For more information, see financial note 4 or refer to the prospectus. |

| 5 | The percentage may differ from the Portfolio Holdings because the above calculation is based on a percentage of total investments, whereas the calculation in the Portfolio Holdings is based on a percentage of net assets. |

| 6 | Less than 0.05%. |

| 7 | See Glossary for definitions of maturity and duration. |

Schwab Fixed-Income ETFs | Semiannual Report

Schwab Short-Term U.S. Treasury ETF as of June 30, 2022

The performance data quoted represents past performance. Past performance does not guarantee future results. Investment return and principal value of an investment will fluctuate so that an investor’s shares, when sold or redeemed, may be worth more or less than the original cost. Current performance may be lower or higher than the performance quoted. To obtain performance information current to the most recent month end, please visit www.schwabassetmanagement.com/schwabetfs_prospectus.

Average Annual Total Returns1

| Fund and Inception Date | 6 Months | 1 Year | 5 Years | 10 Years |

| Fund: Schwab Short-Term U.S. Treasury ETF (8/5/2010) | | | | |

| Market Price Return2 | -3.04% | -3.56% | 0.84% | 0.70% |

| NAV Return2 | -3.00% | -3.54% | 0.85% | 0.70% |

| Bloomberg US Treasury 1-3 Year Index | -3.01% | -3.51% | 0.90% | 0.77% |

| ETF Category: Morningstar Short Government3 | -3.68% | -4.36% | 0.60% | 0.55% |

| Fund Expense Ratio4: 0.03% |

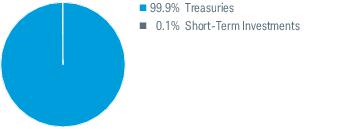

Portfolio Composition % of Investments5

By Security Type

| Weighted Average Maturity6 | 2.0 Yrs |

| Weighted Average Duration6 | 1.9 Yrs |

All total returns on this page assume dividends and distributions were reinvested. Index figures do not include trading and management costs, which would lower performance. Indices are unmanaged and cannot be invested in directly. Performance results less than one year are not annualized.

For index definitions, please see the Glossary.

Shares are bought and sold at market price, which may be higher or lower than the net asset value (NAV). Brokerage commissions will reduce returns.

Index ownership — Bloomberg® and Bloomberg US Treasury 1-3 Year Index are service marks of Bloomberg Finance L.P. and its affiliates, including Bloomberg Index Services Limited (BISL), the administrator of the indices (collectively, Bloomberg). Bloomberg is not affiliated with Charles Schwab Investment Management, Inc., and Bloomberg does not approve, endorse, review, or recommend Schwab Short-Term U.S. Treasury ETF. Bloomberg does not guarantee the timeliness, accurateness, or completeness of any data or information relating to Schwab Short-Term U.S. Treasury ETF.

Portfolio holdings may have changed since the report date.

An index is a statistical composite of a specified financial market or sector. Unlike the fund, an index does not actually hold a portfolio of securities and its return is not inclusive of operational and transaction costs incurred by the fund.

Fixed income securities are subject to increased loss of principal during periods of rising interest rates. An investment in the fund is not insured or guaranteed by the Federal Deposit Insurance Corporation (FDIC) or any other government agency.

| 1 | Performance does not reflect the deduction of taxes that a shareholder would pay on fund distributions or on the redemption or sale of fund shares. |

| 2 | ETF performance must be shown based on both a Market Price and a NAV basis. The fund’s per share NAV is the value of one share of the fund. NAV is calculated by taking the fund’s total assets (including the fair value of securities owned), subtracting liabilities, and dividing by the number of shares outstanding. The NAV Return is based on the NAV of the fund, and the Market Price Return is based on the market price per share of the fund. The price used to calculate market return (Market Price) is determined using the Official Closing Price of the primary stock exchange (generally, 4:00 p.m. Eastern time) and may not represent the returns you would receive if shares were traded at other times. NAV is used as a proxy for purposes of calculating Market Price Return on inception date. Market Price and NAV returns assume that dividends and capital gain distributions have been reinvested in the fund at Market Price and NAV, respectively. |

| 3 | Source for category information: Morningstar, Inc. The Morningstar Category return represents all passively- and actively-managed ETFs and mutual funds within the category as of the report date. |

| 4 | As stated in the prospectus. Effective July 1, 2022, the management fee was reduced to 0.03%. For more information, see financial note 4 or refer to the prospectus. |

| 5 | The percentage may differ from the Portfolio Holdings because the above calculation is based on a percentage of total investments, whereas the calculation in the Portfolio Holdings is based on a percentage of net assets. |

| 6 | See Glossary for definitions of maturity and duration. |

Schwab Fixed-Income ETFs | Semiannual Report

Schwab Intermediate-Term U.S. Treasury ETF as of June 30, 2022

The performance data quoted represents past performance. Past performance does not guarantee future results. Investment return and principal value of an investment will fluctuate so that an investor’s shares, when sold or redeemed, may be worth more or less than the original cost. Current performance may be lower or higher than the performance quoted. To obtain performance information current to the most recent month end, please visit www.schwabassetmanagement.com/schwabetfs_prospectus.

Average Annual Total Returns1

| Fund and Inception Date | 6 Months | 1 Year | 5 Years | 10 Years |

| Fund: Schwab Intermediate-Term U.S. Treasury ETF (8/5/2010) | | | | |

| Market Price Return2 | -7.62% | -8.30% | 0.82% | 1.06% |

| NAV Return2 | -7.70% | -8.34% | 0.82% | 1.06% |

| Bloomberg US Treasury 3-10 Year Index | -7.73% | -8.31% | 0.86% | 1.13% |

| ETF Category: Morningstar Intermediate Government3 | -8.10% | -8.54% | 0.34% | 0.76% |

| Fund Expense Ratio4: 0.03% |

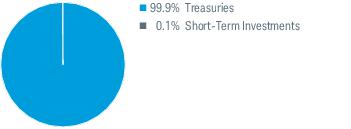

Portfolio Composition % of Investments5

By Security Type

| Weighted Average Maturity6 | 5.6 Yrs |

| Weighted Average Duration6 | 5.3 Yrs |

All total returns on this page assume dividends and distributions were reinvested. Index figures do not include trading and management costs, which would lower performance. Indices are unmanaged and cannot be invested in directly. Performance results less than one year are not annualized.

For index definitions, please see the Glossary.

Shares are bought and sold at market price, which may be higher or lower than the net asset value (NAV). Brokerage commissions will reduce returns.

Index ownership — Bloomberg® and Bloomberg US Treasury 3-10 Year Index are service marks of Bloomberg Finance L.P. and its affiliates, including Bloomberg Index Services Limited (BISL), the administrator of the indices (collectively, Bloomberg). Bloomberg is not affiliated with Charles Schwab Investment Management, Inc., and Bloomberg does not approve, endorse, review, or recommend Schwab Intermediate-Term U.S. Treasury ETF. Bloomberg does not guarantee the timeliness, accurateness, or completeness of any data or information relating to Schwab Intermediate-Term U.S. Treasury ETF.

Portfolio holdings may have changed since the report date.

An index is a statistical composite of a specified financial market or sector. Unlike the fund, an index does not actually hold a portfolio of securities and its return is not inclusive of operational and transaction costs incurred by the fund.

Fixed income securities are subject to increased loss of principal during periods of rising interest rates. An investment in the fund is not insured or guaranteed by the Federal Deposit Insurance Corporation (FDIC) or any other government agency.

| 1 | Performance does not reflect the deduction of taxes that a shareholder would pay on fund distributions or on the redemption or sale of fund shares. |

| 2 | ETF performance must be shown based on both a Market Price and a NAV basis. The fund’s per share NAV is the value of one share of the fund. NAV is calculated by taking the fund’s total assets (including the fair value of securities owned), subtracting liabilities, and dividing by the number of shares outstanding. The NAV Return is based on the NAV of the fund, and the Market Price Return is based on the market price per share of the fund. The price used to calculate market return (Market Price) is determined using the Official Closing Price of the primary stock exchange (generally, 4:00 p.m. Eastern time) and may not represent the returns you would receive if shares were traded at other times. NAV is used as a proxy for purposes of calculating Market Price Return on inception date. Market Price and NAV returns assume that dividends and capital gain distributions have been reinvested in the fund at Market Price and NAV, respectively. |

| 3 | Source for category information: Morningstar, Inc. The Morningstar Category return represents all passively- and actively-managed ETFs and mutual funds within the category as of the report date. |

| 4 | As stated in the prospectus. Effective July 1, 2022, the management fee was reduced to 0.03%. For more information, see financial note 4 or refer to the prospectus. |

| 5 | The percentage may differ from the Portfolio Holdings because the above calculation is based on a percentage of total investments, whereas the calculation in the Portfolio Holdings is based on a percentage of net assets. |

| 6 | See Glossary for definitions of maturity and duration. |

Schwab Fixed-Income ETFs | Semiannual Report

Schwab Long-Term U.S. Treasury ETF as of June 30, 2022

The performance data quoted represents past performance. Past performance does not guarantee future results. Investment return and principal value of an investment will fluctuate so that an investor’s shares, when sold or redeemed, may be worth more or less than the original cost. Current performance may be lower or higher than the performance quoted. To obtain performance information current to the most recent month end, please visit www.schwabassetmanagement.com/schwabetfs_prospectus.

Average Annual Total Returns1

| Fund and Inception Date | 6 Months | 1 Year | Since Inception* |

| Fund: Schwab Long-Term U.S. Treasury ETF (10/10/2019) | | | |

| Market Price Return2 | -20.81% | -18.28% | -6.15% |

| NAV Return2 | -20.99% | -18.44% | -6.20% |

| Bloomberg US Long Treasury Index | -21.25% | -18.45% | -6.19% |

| ETF Category: Morningstar Long Government3 | -21.10% | -18.80% | N/A |

| Fund Expense Ratio4: 0.03% |

Portfolio Composition % of Investments5

By Security Type

| Weighted Average Maturity7 | 23.6 Yrs |

| Weighted Average Duration7 | 16.9 Yrs |

All total returns on this page assume dividends and distributions were reinvested. Index figures do not include trading and management costs, which would lower performance. Indices are unmanaged and cannot be invested in directly. Performance results less than one year are not annualized.

For index definitions, please see the Glossary.

Shares are bought and sold at market price, which may be higher or lower than the net asset value (NAV). Brokerage commissions will reduce returns.

Index ownership — Bloomberg® and Bloomberg US Long Treasury Index are service marks of Bloomberg Finance L.P. and its affiliates, including Bloomberg Index Services Limited (BISL), the administrator of the indices (collectively, Bloomberg). Bloomberg is not affiliated with Charles Schwab Investment Management, Inc., and Bloomberg does not approve, endorse, review, or recommend Schwab Long-Term U.S. Treasury ETF. Bloomberg does not guarantee the timeliness, accurateness, or completeness of any data or information relating to Schwab Long-Term U.S. Treasury ETF.

Portfolio holdings may have changed since the report date.

An index is a statistical composite of a specified financial market or sector. Unlike the fund, an index does not actually hold a portfolio of securities and its return is not inclusive of operational and transaction costs incurred by the fund.

Fixed income securities are subject to increased loss of principal during periods of rising interest rates. An investment in the fund is not insured or guaranteed by the Federal Deposit Insurance Corporation (FDIC) or any other government agency.

| * | Inception (10/10/19) represents the date that the shares began trading in the secondary market. |

| 1 | Performance does not reflect the deduction of taxes that a shareholder would pay on fund distributions or on the redemption or sale of fund shares. |

| 2 | ETF performance must be shown based on both a Market Price and a NAV basis. The fund’s per share NAV is the value of one share of the fund. NAV is calculated by taking the fund’s total assets (including the fair value of securities owned), subtracting liabilities, and dividing by the number of shares outstanding. The NAV Return is based on the NAV of the fund, and the Market Price Return is based on the market price per share of the fund. The price used to calculate market return (Market Price) is determined using the Official Closing Price of the primary stock exchange (generally, 4:00 p.m. Eastern time) and may not represent the returns you would receive if shares were traded at other times. NAV is used as a proxy for purposes of calculating Market Price Return on inception date. Market Price and NAV returns assume that dividends and capital gain distributions have been reinvested in the fund at Market Price and NAV, respectively. |

| 3 | Source for category information: Morningstar, Inc. The Morningstar Category return represents all passively- and actively-managed ETFs and mutual funds within the category as of the report date. |

| 4 | As stated in the prospectus. Effective July 1, 2022, the management fee was reduced to 0.03%. For more information, see financial note 4 or refer to the prospectus. |

| 5 | The percentage may differ from the Portfolio Holdings because the above calculation is based on a percentage of total investments, whereas the calculation in the Portfolio Holdings is based on a percentage of net assets. |

| 6 | Less than 0.05%. |

| 7 | See Glossary for definitions of maturity and duration. |

Schwab Fixed-Income ETFs | Semiannual Report

Schwab U.S. Aggregate Bond ETF as of June 30, 2022

The performance data quoted represents past performance. Past performance does not guarantee future results. Investment return and principal value of an investment will fluctuate so that an investor’s shares, when sold or redeemed, may be worth more or less than the original cost. Current performance may be lower or higher than the performance quoted. To obtain performance information current to the most recent month end, please visit www.schwabassetmanagement.com/schwabetfs_prospectus.

Average Annual Total Returns1

| Fund and Inception Date | 6 Months | 1 Year | 5 Years | 10 Years |

| Fund: Schwab U.S. Aggregate Bond ETF (7/14/2011) | | | | |

| Market Price Return2 | -10.34% | -10.41% | 0.76% | 1.42% |

| NAV Return2 | -10.27% | -10.31% | 0.81% | 1.46% |

| Bloomberg US Aggregate Bond Index | -10.35% | -10.29% | 0.88% | 1.54% |

| ETF Category: Morningstar Intermediate Core Bond3 | -10.53% | -10.74% | 0.72% | 1.47% |

| Fund Expense Ratio4: 0.03% |

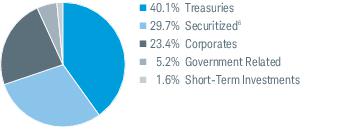

Portfolio Composition % of Investments5

By Security Type

| Weighted Average Maturity7 | 8.8 Yrs |

| Weighted Average Duration7 | 6.5 Yrs |

All total returns on this page assume dividends and distributions were reinvested. Index figures do not include trading and management costs, which would lower performance. Indices are unmanaged and cannot be invested in directly. Performance results less than one year are not annualized.

For index definitions, please see the Glossary.

Shares are bought and sold at market price, which may be higher or lower than the net asset value (NAV). Brokerage commissions will reduce returns.

Index ownership — Bloomberg® and Bloomberg US Aggregate Bond Index are service marks of Bloomberg Finance L.P. and its affiliates, including Bloomberg Index Services Limited (BISL), the administrator of the indices (collectively, Bloomberg). Bloomberg is not affiliated with Charles Schwab Investment Management, Inc., and Bloomberg does not approve, endorse, review, or recommend Schwab U.S. Aggregate Bond ETF. Bloomberg does not guarantee the timeliness, accurateness, or completeness of any data or information relating to Schwab U.S. Aggregate Bond ETF.

Portfolio holdings may have changed since the report date.

An index is a statistical composite of a specified financial market or sector. Unlike the fund, an index does not actually hold a portfolio of securities and its return is not inclusive of operational and transaction costs incurred by the fund.

Fixed income securities are subject to increased loss of principal during periods of rising interest rates. An investment in the fund is not insured or guaranteed by the Federal Deposit Insurance Corporation (FDIC) or any other government agency.

| 1 | Performance does not reflect the deduction of taxes that a shareholder would pay on fund distributions or on the redemption or sale of fund shares. |

| 2 | ETF performance must be shown based on both a Market Price and a NAV basis. The fund’s per share NAV is the value of one share of the fund. NAV is calculated by taking the fund’s total assets (including the fair value of securities owned), subtracting liabilities, and dividing by the number of shares outstanding. The NAV Return is based on the NAV of the fund, and the Market Price Return is based on the market price per share of the fund. The price used to calculate market return (Market Price) is determined using the Official Closing Price of the primary stock exchange (generally, 4:00 p.m. Eastern time) and may not represent the returns you would receive if shares were traded at other times. NAV is used as a proxy for purposes of calculating Market Price Return on inception date. Market Price and NAV returns assume that dividends and capital gain distributions have been reinvested in the fund at Market Price and NAV, respectively. |

| 3 | Source for category information: Morningstar, Inc. The Morningstar Category return represents all passively- and actively-managed ETFs and mutual funds within the category as of the report date. |

| 4 | As stated in the prospectus. Effective July 1, 2022, the management fee was reduced to 0.03%. For more information, see financial note 4 or refer to the prospectus. |

| 5 | The percentage may differ from the Portfolio Holdings because the above calculation is based on a percentage of total investments, whereas the calculation in the Portfolio Holdings is based on a percentage of net assets. |

| 6 | The fund may seek to obtain exposure to U.S. agency mortgage pass-through securities, in part or in full, through the use of “to-be-announced” or “TBA” transactions, which are standardized contracts for future delivery of mortgage pass-through securities in which the exact mortgage pools to be delivered are not specified until a few days prior to settlement. These transactions represented approximately 1.6% of total investments on June 30, 2022. |

| 7 | See Glossary for definitions of maturity and duration. |

Schwab Fixed-Income ETFs | Semiannual Report

Schwab 1-5 Year Corporate Bond ETF as of June 30, 2022

The performance data quoted represents past performance. Past performance does not guarantee future results. Investment return and principal value of an investment will fluctuate so that an investor’s shares, when sold or redeemed, may be worth more or less than the original cost. Current performance may be lower or higher than the performance quoted. To obtain performance information current to the most recent month end, please visit www.schwabassetmanagement.com/schwabetfs_prospectus.

Average Annual Total Returns1

| Fund and Inception Date | 6 Months | 1 Year | Since Inception* |

| Fund: Schwab 1-5 Year Corporate Bond ETF (10/10/2019) | | | |

| Market Price Return2 | -5.54% | -6.18% | -0.26% |

| NAV Return2 | -5.56% | -6.14% | -0.25% |

| Bloomberg US 1-5 Year Corporate Bond Index | -5.60% | -6.14% | -0.15% |

| ETF Category: Morningstar Short-Term Bond3 | -4.86% | -5.19% | N/A |

| Fund Expense Ratio4: 0.03% |

Portfolio Composition % of Investments5

By Security Type

| Weighted Average Maturity6 | 3.2 Yrs |

| Weighted Average Duration6 | 2.8 Yrs |

All total returns on this page assume dividends and distributions were reinvested. Index figures do not include trading and management costs, which would lower performance. Indices are unmanaged and cannot be invested in directly. Performance results less than one year are not annualized.

For index definitions, please see the Glossary.

Shares are bought and sold at market price, which may be higher or lower than the net asset value (NAV). Brokerage commissions will reduce returns.

Index ownership — Bloomberg® and Bloomberg US 1-5 Year Corporate Bond Index are service marks of Bloomberg Finance L.P. and its affiliates, including Bloomberg Index Services Limited (BISL), the administrator of the indices (collectively, Bloomberg). Bloomberg is not affiliated with Charles Schwab Investment Management, Inc., and Bloomberg does not approve, endorse, review, or recommend Schwab 1-5 Year Corporate Bond ETF. Bloomberg does not guarantee the timeliness, accurateness, or completeness of any data or information relating to Schwab 1-5 Year Corporate Bond ETF.

Portfolio holdings may have changed since the report date.

An index is a statistical composite of a specified financial market or sector. Unlike the fund, an index does not actually hold a portfolio of securities and its return is not inclusive of operational and transaction costs incurred by the fund.

Fixed income securities are subject to increased loss of principal during periods of rising interest rates. An investment in the fund is not insured or guaranteed by the Federal Deposit Insurance Corporation (FDIC) or any other government agency.

| * | Inception (10/10/19) represents the date that the shares began trading in the secondary market. |

| 1 | Performance does not reflect the deduction of taxes that a shareholder would pay on fund distributions or on the redemption or sale of fund shares. |

| 2 | ETF performance must be shown based on both a Market Price and a NAV basis. The fund’s per share NAV is the value of one share of the fund. NAV is calculated by taking the fund’s total assets (including the fair value of securities owned), subtracting liabilities, and dividing by the number of shares outstanding. The NAV Return is based on the NAV of the fund, and the Market Price Return is based on the market price per share of the fund. The price used to calculate market return (Market Price) is determined using the Official Closing Price of the primary stock exchange (generally, 4:00 p.m. Eastern time) and may not represent the returns you would receive if shares were traded at other times. NAV is used as a proxy for purposes of calculating Market Price Return on inception date. Market Price and NAV returns assume that dividends and capital gain distributions have been reinvested in the fund at Market Price and NAV, respectively. |

| 3 | Source for category information: Morningstar, Inc. The Morningstar Category return represents all passively- and actively-managed ETFs and mutual funds within the category as of the report date. |

| 4 | As stated in the prospectus. Effective July 1, 2022, the management fee was reduced to 0.03%. For more information, see financial note 4 or refer to the prospectus. |

| 5 | The percentage may differ from the Portfolio Holdings because the above calculation is based on a percentage of total investments, excluding derivatives, whereas the calculation in the Portfolio Holdings is based on a percentage of net assets. |

| 6 | See Glossary for definitions of maturity and duration. |

Schwab Fixed-Income ETFs | Semiannual Report

Schwab 5-10 Year Corporate Bond ETF as of June 30, 2022

The performance data quoted represents past performance. Past performance does not guarantee future results. Investment return and principal value of an investment will fluctuate so that an investor’s shares, when sold or redeemed, may be worth more or less than the original cost. Current performance may be lower or higher than the performance quoted. To obtain performance information current to the most recent month end, please visit www.schwabassetmanagement.com/schwabetfs_prospectus.

Average Annual Total Returns1

| Fund and Inception Date | 6 Months | 1 Year | Since Inception* |

| Fund: Schwab 5-10 Year Corporate Bond ETF (10/10/2019) | | | |

| Market Price Return2 | -12.83% | -13.35% | -2.05% |

| NAV Return2 | -12.87% | -13.30% | -2.01% |

| Bloomberg US 5-10 Year Corporate Bond Index | -12.94% | -13.27% | -1.94% |

| ETF Category: Morningstar Corporate Bond3 | -13.83% | -13.91% | N/A |

| Fund Expense Ratio4: 0.03% |

Portfolio Composition % of Investments5

By Security Type

| Weighted Average Maturity6 | 7.6 Yrs |

| Weighted Average Duration6 | 6.4 Yrs |

All total returns on this page assume dividends and distributions were reinvested. Index figures do not include trading and management costs, which would lower performance. Indices are unmanaged and cannot be invested in directly. Performance results less than one year are not annualized.

For index definitions, please see the Glossary.

Shares are bought and sold at market price, which may be higher or lower than the net asset value (NAV). Brokerage commissions will reduce returns.

Index ownership — Bloomberg® and Bloomberg US 5-10 Year Corporate Bond Index are service marks of Bloomberg Finance L.P. and its affiliates, including Bloomberg Index Services Limited (BISL), the administrator of the indices (collectively, Bloomberg). Bloomberg is not affiliated with Charles Schwab Investment Management, Inc., and Bloomberg does not approve, endorse, review, or recommend Schwab 5-10 Year Corporate Bond ETF. Bloomberg does not guarantee the timeliness, accurateness, or completeness of any data or information relating to Schwab 5-10 Year Corporate Bond ETF.

Portfolio holdings may have changed since the report date.

An index is a statistical composite of a specified financial market or sector. Unlike the fund, an index does not actually hold a portfolio of securities and its return is not inclusive of operational and transaction costs incurred by the fund.

Fixed income securities are subject to increased loss of principal during periods of rising interest rates. An investment in the fund is not insured or guaranteed by the Federal Deposit Insurance Corporation (FDIC) or any other government agency.

| * | Inception (10/10/19) represents the date that the shares began trading in the secondary market. |

| 1 | Performance does not reflect the deduction of taxes that a shareholder would pay on fund distributions or on the redemption or sale of fund shares. |

| 2 | ETF performance must be shown based on both a Market Price and a NAV basis. The fund’s per share NAV is the value of one share of the fund. NAV is calculated by taking the fund’s total assets (including the fair value of securities owned), subtracting liabilities, and dividing by the number of shares outstanding. The NAV Return is based on the NAV of the fund, and the Market Price Return is based on the market price per share of the fund. The price used to calculate market return (Market Price) is determined using the Official Closing Price of the primary stock exchange (generally, 4:00 p.m. Eastern time) and may not represent the returns you would receive if shares were traded at other times. NAV is used as a proxy for purposes of calculating Market Price Return on inception date. Market Price and NAV returns assume that dividends and capital gain distributions have been reinvested in the fund at Market Price and NAV, respectively. |

| 3 | Source for category information: Morningstar, Inc. The Morningstar Category return represents all passively- and actively-managed ETFs and mutual funds within the category as of the report date. |

| 4 | As stated in the prospectus. Effective July 1, 2022, the management fee was reduced to 0.03%. For more information, see financial note 4 or refer to the prospectus. |

| 5 | The percentage may differ from the Portfolio Holdings because the above calculation is based on a percentage of total investments, excluding derivatives, whereas the calculation in the Portfolio Holdings is based on a percentage of net assets. |

| 6 | See Glossary for definitions of maturity and duration. |

Schwab Fixed-Income ETFs | Semiannual Report

Fund Expenses (Unaudited)

Examples for a $1,000 Investment

As a fund shareholder, you may incur two types of costs: (1) transaction costs, including brokerage commissions on purchases and sales of fund shares; and, (2) ongoing costs, including management fees.

The expense examples below are intended to help you understand your ongoing cost (in dollars) of investing in a fund and to compare this cost with the ongoing cost of investing in other mutual funds. These examples are based on an investment of $1,000 invested for six months beginning January 1, 2022 and held through June 30, 2022.

Actual Return lines in the table below provide information about actual account values and actual expenses. You may use this information, together with the amount you invested, to estimate the expenses that you paid over the period. To do so, simply divide your account value by $1,000 (for example, an $8,600 account value ÷ $1,000 = 8.6), then multiply the result by the number given for your fund under the heading entitled “Expenses Paid During Period.”

Hypothetical Return lines in the table below provide information about hypothetical account values and hypothetical expenses based on a fund’s actual expense ratio and an assumed return of 5% per year before expenses. Because the return used is not an actual return, it may not be used to estimate the actual ending account value or expenses you paid for the period.

You may use this information to compare the ongoing costs of investing in a fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only, and do not reflect any transactional costs, including any brokerage commissions you may pay when purchasing or selling shares of a fund. Therefore, the hypothetical return lines of the table are useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

| | EXPENSE RATIO

(ANNUALIZED) 1 | BEGINNING

ACCOUNT VALUE

AT 1/1/22 | ENDING

ACCOUNT VALUE

(NET OF EXPENSES)

AT 6/30/22 | EXPENSES PAID

DURING PERIOD

1/1/22-6/30/222 |

| Schwab U.S. TIPS ETF | | | | |

| Actual Return | 0.05% | $1,000.00 | $ 911.20 | $0.24 |

| Hypothetical 5% Return | 0.05% | $1,000.00 | $1,024.55 | $0.25 |

| Schwab Short-Term U.S. Treasury ETF | | | | |

| Actual Return | 0.04% | $1,000.00 | $ 970.00 | $0.20 |

| Hypothetical 5% Return | 0.04% | $1,000.00 | $1,024.60 | $0.20 |

| Schwab Intermediate-Term U.S. Treasury ETF | | | | |

| Actual Return | 0.04% | $1,000.00 | $ 923.00 | $0.19 |

| Hypothetical 5% Return | 0.04% | $1,000.00 | $1,024.60 | $0.20 |

| Schwab Long-Term U.S. Treasury ETF | | | | |

| Actual Return | 0.04% | $1,000.00 | $ 790.10 | $0.18 |

| Hypothetical 5% Return | 0.04% | $1,000.00 | $1,024.60 | $0.20 |

| Schwab U.S. Aggregate Bond ETF | | | | |

| Actual Return | 0.04% | $1,000.00 | $ 897.30 | $0.19 |

| Hypothetical 5% Return | 0.04% | $1,000.00 | $1,024.60 | $0.20 |

| Schwab 1-5 Year Corporate Bond ETF | | | | |

| Actual Return | 0.04% | $1,000.00 | $ 944.40 | $0.19 |

| Hypothetical 5% Return | 0.04% | $1,000.00 | $1,024.60 | $0.20 |

| Schwab 5-10 Year Corporate Bond ETF | | | | |

| Actual Return | 0.04% | $1,000.00 | $ 871.30 | $0.19 |

| Hypothetical 5% Return | 0.04% | $1,000.00 | $1,024.60 | $0.20 |

| 1 | Based on the most recent six-month expense ratio. Effective July 1, 2022, the management fee of the Schwab U.S. TIPS ETF, Schwab Short-Term U.S. Treasury ETF, Schwab Intermediate-Term U.S. Treasury ETF, Schwab Long-Term U.S. Treasury ETF, Schwab U.S. Aggregate Bond ETF, Schwab 1-5 Year Corporate Bond ETF and Schwab 5-10 Year Corporate Bond ETF were reduced to 0.04%, 0.03%, 0.03%, 0.03%, 0.03%, 0.03% and 0.03%, respectively. If the fund expense changes had been in place throughout the entire most recent fiscal half-year, the expenses paid during period under the actual return and hypothetical 5% return example would have been the following; For Schwab U.S. TIPS ETF, $0.19 and $0.20, respectively, for Schwab Short-Term U.S. Treasury ETF, $0.15 and $0.15, respectively, for Schwab Intermediate-Term U.S. Treasury ETF, $0.14 and $0.15, respectively, for Schwab Long-Term U.S. Treasury ETF, $0.13 and $0.15, respectively, for Schwab U.S. Aggregate Bond ETF, $0.14 and $0.15, respectively, for Schwab 1-5 Year Corporate Bond ETF, $0.14 and $0.15, respectively, and for Schwab 5-10 Year Corporate Bond ETF, $0.14 and $0.15, respectively. (See financial note 4) |

| 2 | Expenses for each fund are equal to its annualized expense ratio, multiplied by the average account value over the period, multiplied by 181 days of the period, and divided by 365 days of the fiscal year. |

Schwab Fixed-Income ETFs | Semiannual Report

Financial Statements

FINANCIAL HIGHLIGHTS

| | 1/1/22–

6/30/22* | 1/1/21–

12/31/21 | 1/1/20–

12/31/20 | 1/1/19–

12/31/19 | 1/1/18–

12/31/18 | 1/1/17–

12/31/17 |

| Per-Share Data |

| Net asset value at beginning of period | $62.83 | $62.06 | $56.57 | $53.27 | $55.39 | $54.84 |

| Income (loss) from investment operations: | | | | | | |

| Net investment income (loss)1 | 2.11 | 2.93 | 0.81 | 1.21 | 1.51 | 1.17 |

| Net realized and unrealized gains (losses) | (7.63) | 0.60 | 5.37 | 3.23 | (2.23) | 0.43 |

| Total from investment operations | (5.52) | 3.53 | 6.18 | 4.44 | (0.72) | 1.60 |

| Less distributions: | | | | | | |

| Distributions from net investment income | (1.50) | (2.76) | (0.69) | (1.14) | (1.40) | (1.05) |

| Net asset value at end of period | $55.81 | $62.83 | $62.06 | $56.57 | $53.27 | $55.39 |

| Total return | (8.88%) 2 | 5.80% | 10.94% | 8.36% | (1.31%) | 2.95% |

| Ratios/Supplemental Data |

| Ratios to average net assets: | | | | | | |

| Total expenses | 0.05% 3 | 0.05% | 0.05% | 0.05% | 0.05% | 0.05% 4 |

| Net investment income (loss) | 7.09% 3 | 4.69% | 1.36% | 2.18% | 2.80% | 2.13% |

| Portfolio turnover rate5 | 8% 2 | 19% | 23% | 20% | 17% | 19% |

| Net assets, end of period (x 1,000,000) | $15,768 | $21,304 | $14,090 | $8,734 | $5,779 | $2,880 |

| * | Unaudited. |

| 1 | Calculated based on the average shares outstanding during the period. |

| 2 | Not annualized. |

| 3 | Annualized. |

| 4 | Effective March 1, 2017, the annual operating expense ratio was reduced. The ratio presented for the period ended 12/31/17 is a blended ratio. |

| 5 | Portfolio turnover rate excludes securities received or delivered from processing of in-kind creations or redemptions. |

Schwab Fixed-Income ETFs | Semiannual Report

Portfolio Holdings as of June 30, 2022 (Unaudited)

This section shows all the securities in the fund’s portfolio and their values as of the report date.

The fund files its complete schedule of portfolio holdings with the U.S. Securities and Exchange Commission (SEC) for the first and third quarters of each fiscal year on Form N-PORT Part F. The fund’s Form N-PORT Part F is available on the SEC’s website at www.sec.gov. You can also obtain this information at no cost on the fund’s website at www.schwabassetmanagement.com/schwabetfs_prospectus, by calling 1-866-414-6349, or by sending an email request to orders@mysummaryprospectus.com. The fund also makes available its complete schedule of portfolio holdings on a daily basis on the fund’s website.

For fixed rate obligations, the rate shown is the interest rate (the rate established when the obligation was issued). For variable rate obligations, the rate shown is the rate as of the report date based on each security’s rate reset date. The reference rate and spread used is shown parenthetically in the security description, if available; if not, the reference rate is described in a footnote. The maturity date shown for all the securities is the final legal maturity. Inflation-protected securities are fixed-income securities whose principal value is periodically adjusted by the rate of inflation. The interest rate on these instruments is generally lower at issuance than typical bonds or notes. Over the life of an inflation-indexed instrument interest will be paid based on a principal value, which is adjusted for any inflation or deflation.

SECURITY

RATE, MATURITY DATE | FACE

AMOUNT ($) | VALUE ($) |

| TREASURIES 99.8% OF NET ASSETS |

| U.S. Treasury Inflation Protected Securities |

| 0.38%, 07/15/23 | 610,335,928 | 621,398,322 |

| 0.63%, 01/15/24 | 580,974,545 | 590,786,560 |

| 0.50%, 04/15/24 | 326,230,084 | 330,900,387 |

| 0.13%, 07/15/24 | 527,496,896 | 532,828,085 |

| 0.13%, 10/15/24 | 470,536,961 | 473,542,097 |

| 0.25%, 01/15/25 | 482,389,961 | 485,265,941 |

| 2.38%, 01/15/25 | 328,797,281 | 348,612,548 |

| 0.13%, 04/15/25 | 385,447,684 | 385,598,278 |

| 0.38%, 07/15/25 | 528,966,649 | 534,174,992 |

| 0.13%, 10/15/25 | 468,948,056 | 468,921,574 |

| 0.63%, 01/15/26 | 445,360,175 | 450,666,156 |

| 2.00%, 01/15/26 | 212,204,322 | 224,942,727 |

| 0.13%, 04/15/26 | 362,339,181 | 359,018,310 |

| 0.13%, 07/15/26 | 443,896,252 | 440,397,910 |

| 0.13%, 10/15/26 | 501,252,577 | 496,676,683 |

| 0.38%, 01/15/27 | 413,362,661 | 411,988,263 |

| 2.38%, 01/15/27 | 205,169,867 | 222,980,390 |

| 0.13%, 04/15/27 | 512,194,919 | 504,211,418 |

| 0.38%, 07/15/27 | 455,732,321 | 454,318,826 |

| 0.50%, 01/15/28 | 465,409,722 | 462,386,979 |

| 1.75%, 01/15/28 | 192,888,102 | 204,761,399 |

| 3.63%, 04/15/28 | 198,065,855 | 231,432,649 |

| 0.75%, 07/15/28 | 405,137,464 | 408,428,639 |

| 0.88%, 01/15/29 | 347,489,380 | 350,727,160 |

| 2.50%, 01/15/29 | 178,112,078 | 198,189,667 |

| 3.88%, 04/15/29 | 234,583,742 | 283,220,302 |

| 0.25%, 07/15/29 | 410,625,555 | 398,351,120 |

| 0.13%, 01/15/30 | 463,762,179 | 442,681,118 |

| 0.13%, 07/15/30 | 513,521,509 | 489,758,060 |

| 0.13%, 01/15/31 | 531,503,622 | 505,533,383 |

| 0.13%, 07/15/31 | 543,444,131 | 517,005,155 |

| 0.13%, 01/15/32 | 592,772,146 | 562,412,847 |

SECURITY

RATE, MATURITY DATE | FACE

AMOUNT ($) | VALUE ($) |

| 3.38%, 04/15/32 | 82,500,268 | 103,145,901 |

| 2.13%, 02/15/40 | 107,975,907 | 126,157,948 |

| 2.13%, 02/15/41 | 155,690,487 | 180,968,885 |

| 0.75%, 02/15/42 | 252,356,645 | 230,830,509 |

| 0.63%, 02/15/43 | 198,166,236 | 175,233,445 |

| 1.38%, 02/15/44 | 272,565,986 | 278,896,653 |

| 0.75%, 02/15/45 | 300,023,944 | 269,303,313 |

| 1.00%, 02/15/46 | 154,481,302 | 146,446,915 |

| 0.88%, 02/15/47 | 189,321,757 | 175,066,603 |

| 1.00%, 02/15/48 | 137,648,049 | 131,363,684 |

| 1.00%, 02/15/49 | 128,933,561 | 124,139,644 |

| 0.25%, 02/15/50 | 194,871,818 | 153,851,499 |

| 0.13%, 02/15/51 | 196,132,404 | 151,256,551 |

| 0.13%, 02/15/52 | 118,024,665 | 91,942,422 |

Total Treasuries

(Cost $17,351,646,860) | 15,730,721,917 |

| SECURITY | NUMBER

OF SHARES | VALUE ($) |

| SHORT-TERM INVESTMENTS 0.0% OF NET ASSETS |

| |

| Money Market Funds 0.0% |

| State Street Institutional U.S. Government Money Market Fund, Premier Class 1.43% (a) | 1,137,973 | 1,137,973 |

Total Short-Term Investments

(Cost $1,137,973) | 1,137,973 |

Total Investments in Securities

(Cost $17,352,784,833) | 15,731,859,890 |

| (a) | The rate shown is the 7-day yield. |

Schwab Fixed-Income ETFs | Semiannual Report

Portfolio Holdings as of June 30, 2022 (Unaudited) (continued)

The following is a summary of the inputs used to value the fund’s investments as of June 30, 2022 (see financial note 2(a) for additional information):

| DESCRIPTION | QUOTED PRICES IN

ACTIVE MARKETS FOR

IDENTICAL ASSETS

(LEVEL 1) | OTHER SIGNIFICANT

OBSERVABLE INPUTS

(LEVEL 2) | SIGNIFICANT

UNOBSERVABLE INPUTS

(LEVEL 3) | TOTAL |

| Assets | | | | |

| Treasuries 1 | $— | $15,730,721,917 | $— | $15,730,721,917 |

| Short-Term Investments1 | 1,137,973 | — | — | 1,137,973 |

| Total | $1,137,973 | $15,730,721,917 | $— | $15,731,859,890 |

| 1 | As categorized in the Portfolio Holdings. |

Fund investments in mutual funds are classified as Level 1, without consideration to the classification level of the underlying securities held by the mutual funds, which could be Level 1, Level 2 or Level 3.

Schwab Fixed-Income ETFs | Semiannual Report

Statement of Assets and Liabilities

As of June 30, 2022; unaudited

| Assets |

| Investments in securities, at value - unaffiliated (cost $17,352,784,833) | | $15,731,859,890 |

| Receivables: | | |

| Investments sold | | 238,136,788 |

| Interest | | 37,991,075 |

| Dividends | + | 17,249 |

| Total assets | | 16,008,005,002 |

| Liabilities |

| Payables: | | |

| Investments bought | | 236,704,062 |

| Fund shares redeemed | | 2,790,270 |

| Management fees | | 649,660 |

| Due to custodian | + | 4,851 |

| Total liabilities | | 240,148,843 |

| Net assets | | $15,767,856,159 |

| Net Assets by Source |

| Capital received from investors | | $17,262,707,130 |

| Total distributable loss | + | (1,494,850,971) |

| Net assets | | $15,767,856,159 |

| Net Asset Value (NAV) |

| Net Assets | ÷ | Shares

Outstanding | = | NAV |

| $15,767,856,159 | | 282,550,000 | | $55.81 |

| | | | | |

| | | | | |

Schwab Fixed-Income ETFs | Semiannual Report

Statement of Operations

| For the period January 1, 2022 through June 30, 2022; unaudited |

| Investment Income |

| Interest received from securities - unaffiliated | | $672,470,530 |

| Dividends received from securities - unaffiliated | + | 25,806 |

| Total investment income | | 672,496,336 |

| Expenses |

| Management fees | | 4,708,436 |

| Total expenses | – | 4,708,436 |

| Net investment income | | 667,787,900 |

| REALIZED AND UNREALIZED GAINS (LOSSES) |

| Net realized losses on sales of securities - unaffiliated | | (121,587,531) |

| Net realized gains on sales of in-kind redemptions - unaffiliated | + | 89,428,543 |

| Net realized losses | | (32,158,988) |

| Net change in unrealized appreciation (depreciation) on securities - unaffiliated | + | (2,367,889,154) |

| Net realized and unrealized losses | | (2,400,048,142) |

| Decrease in net assets resulting from operations | | ($1,732,260,242) |

Schwab Fixed-Income ETFs | Semiannual Report

Statement of Changes in Net Assets

For the current and prior report periods

Figures for the current period are unaudited

| OPERATIONS |

| | 1/1/22-6/30/22 | 1/1/21-12/31/21 |

| Net investment income | | $667,787,900 | $856,417,676 |

| Net realized gains (losses) | | (32,158,988) | 439,588,857 |

| Net change in unrealized appreciation (depreciation) | + | (2,367,889,154) | (200,941,689) |

| Increase (decrease) in net assets resulting from operations | | ($1,732,260,242) | $1,095,064,844 |

| DISTRIBUTIONS TO SHAREHOLDERS |

| Total distributions | | ($457,432,840) | ($852,013,180) |

| TRANSACTIONS IN FUND SHARES |

| | 1/1/22-6/30/22 | 1/1/21-12/31/21 |

| | | SHARES | VALUE | SHARES | VALUE |

| Shares sold | | 92,500,000 | $5,527,695,769 | 203,700,000 | $12,711,611,994 |

| Shares redeemed | + | (149,000,000) | (8,873,875,138) | (91,700,000) | (5,740,942,233) |

| Net transactions in fund shares | | (56,500,000) | ($3,346,179,369) | 112,000,000 | $6,970,669,761 |

| SHARES OUTSTANDING AND NET ASSETS |

| | 1/1/22-6/30/22 | 1/1/21-12/31/21 |

| | | SHARES | NET ASSETS | SHARES | NET ASSETS |

| Beginning of period | | 339,050,000 | $21,303,728,610 | 227,050,000 | $14,090,007,185 |

| Total increase (decrease) | + | (56,500,000) | (5,535,872,451) | 112,000,000 | 7,213,721,425 |

| End of period | | 282,550,000 | $15,767,856,159 | 339,050,000 | $21,303,728,610 |

Schwab Fixed-Income ETFs | Semiannual Report

Schwab Short-Term U.S. Treasury ETF

Financial Statements

FINANCIAL HIGHLIGHTS

| | 1/1/22–

6/30/22* | 1/1/21–

12/31/21 | 1/1/20–

12/31/20 | 1/1/19–

12/31/19 | 1/1/18–

12/31/18 | 1/1/17–

12/31/17 |

| Per-Share Data |

| Net asset value at beginning of period | $50.84 | $51.39 | $50.48 | $49.88 | $50.03 | $50.41 |

| Income (loss) from investment operations: | | | | | | |

| Net investment income (loss)1 | 0.16 | 0.21 | 0.65 | 1.14 | 0.94 | 0.57 |

| Net realized and unrealized gains (losses) | (1.69) | (0.55) | 0.91 | 0.60 | (0.20) 2 | (0.39) |

| Total from investment operations | (1.53) | (0.34) | 1.56 | 1.74 | 0.74 | 0.18 |

| Less distributions: | | | | | | |

| Distributions from net investment income | (0.11) | (0.21) | (0.65) | (1.14) | (0.89) | (0.56) |

| Net asset value at end of period | $49.20 | $50.84 | $51.39 | $50.48 | $49.88 | $50.03 |

| Total return | (3.00%) 3 | (0.66%) | 3.11% | 3.53% | 1.50% | 0.35% |

| Ratios/Supplemental Data |

| Ratios to average net assets: | | | | | | |

| Total expenses | 0.04% 4 | 0.05% 5 | 0.05% | 0.06% 6 | 0.06% | 0.06% |

| Net investment income (loss) | 0.65% 4 | 0.41% | 1.26% | 2.27% | 1.89% | 1.13% |

| Portfolio turnover rate7 | 38% 3 | 73% | 74% | 77% | 65% | 65% |

| Net assets, end of period (x 1,000,000) | $8,826 | $8,956 | $7,508 | $5,263 | $4,255 | $2,181 |

| * | Unaudited. |

| 1 | Calculated based on the average shares outstanding during the period. |

| 2 | The per share amount does not accord with the change in aggregate gains and losses in securities during the period because of the timing of sales and repurchases of fund shares in relation to fluctuating market values. |

| 3 | Not annualized. |

| 4 | Annualized. |

| 5 | Effective December 20, 2021, the annual operating expense ratio was reduced to 0.04%. The ratio presented for period ended 12/31/21 is a blended ratio. |

| 6 | Effective December 13, 2019, the annual operating expense ratio was reduced to 0.05%. The ratio presented for the period ended 12/31/19 is a blended ratio. |

| 7 | Portfolio turnover rate excludes securities received or delivered from processing of in-kind creations or redemptions. |

Schwab Fixed-Income ETFs | Semiannual Report

Schwab Short-Term U.S. Treasury ETF

Portfolio Holdings as of June 30, 2022 (Unaudited)

This section shows all the securities in the fund’s portfolio and their values as of the report date.

The fund files its complete schedule of portfolio holdings with the U.S. Securities and Exchange Commission (SEC) for the first and third quarters of each fiscal year on Form N-PORT Part F. The fund’s Form N-PORT Part F is available on the SEC’s website at www.sec.gov. You can also obtain this information at no cost on the fund’s website at www.schwabassetmanagement.com/schwabetfs_prospectus, by calling 1-866-414-6349, or by sending an email request to orders@mysummaryprospectus.com. The fund also makes available its complete schedule of portfolio holdings on a daily basis on the fund’s website.

For fixed-rate obligations, the rate shown is the interest rate (the rate established when the obligation was issued). All securities are currently in a fixed-rate coupon period based on index eligibility requirements and the fund’s investment objective. Variable rate securities are subject to index requirements and will be removed from the index and fund prior to converting from a fixed rate coupon to a variable rate coupon. The maturity date shown for all the securities is the final legal maturity.

SECURITY

RATE, MATURITY DATE | FACE

AMOUNT ($) | VALUE ($) |

| TREASURIES 99.7% OF NET ASSETS |

| Bonds |

| 6.25%, 08/15/23 | 18,075,000 | 18,771,876 |

| 7.50%, 11/15/24 | 9,180,000 | 10,125,612 |

| 7.63%, 02/15/25 | 8,600,000 | 9,596,055 |

| Notes |

| 0.13%, 07/15/23 | 213,104,000 | 207,006,396 |

| 0.13%, 07/31/23 | 10,323,000 | 10,016,133 |

| 1.25%, 07/31/23 | 68,141,000 | 66,932,562 |

| 2.75%, 07/31/23 | 63,946,000 | 63,818,607 |

| 0.13%, 08/15/23 | 94,758,600 | 91,810,349 |

| 2.50%, 08/15/23 | 109,234,000 | 108,711,298 |

| 0.13%, 08/31/23 | 18,247,000 | 17,661,813 |

| 1.38%, 08/31/23 | 121,142,000 | 118,972,327 |

| 2.75%, 08/31/23 | 53,133,000 | 53,024,036 |

| 0.13%, 09/15/23 | 218,893,000 | 211,650,719 |

| 0.25%, 09/30/23 | 258,732,000 | 250,292,889 |

| 1.38%, 09/30/23 | 7,477,000 | 7,334,616 |

| 2.88%, 09/30/23 | 69,877,000 | 69,831,962 |

| 0.13%, 10/15/23 | 103,008,000 | 99,352,423 |

| 0.38%, 10/31/23 | 146,243,000 | 141,350,143 |

| 1.63%, 10/31/23 | 57,942,000 | 56,951,780 |

| 2.88%, 10/31/23 | 61,611,000 | 61,558,053 |

| 0.25%, 11/15/23 | 23,383,000 | 22,536,280 |

| 2.75%, 11/15/23 | 142,921,000 | 142,535,784 |

| 0.50%, 11/30/23 | 145,269,000 | 140,369,008 |

| 2.13%, 11/30/23 | 64,943,000 | 64,213,660 |

| 2.88%, 11/30/23 | 59,786,000 | 59,724,112 |

| 0.13%, 12/15/23 | 14,690,200 | 14,100,584 |

| 0.75%, 12/31/23 | 162,050,000 | 156,796,036 |

| 2.25%, 12/31/23 | 58,687,000 | 58,076,059 |

| 2.63%, 12/31/23 | 67,609,000 | 67,286,801 |

| 0.13%, 01/15/24 | 217,701,600 | 208,457,785 |

| 0.88%, 01/31/24 | 135,671,000 | 131,304,090 |

| 2.25%, 01/31/24 | 64,487,000 | 63,774,116 |

| 2.50%, 01/31/24 | 78,958,000 | 78,387,405 |

| 0.13%, 02/15/24 | 151,909,000 | 145,159,138 |

| 2.75%, 02/15/24 | 121,804,000 | 121,413,847 |

| 1.50%, 02/29/24 | 133,682,000 | 130,548,828 |

| 2.13%, 02/29/24 | 61,041,000 | 60,227,915 |

| 2.38%, 02/29/24 | 58,428,000 | 57,888,226 |

| 0.25%, 03/15/24 | 145,689,000 | 139,121,614 |

| 2.13%, 03/31/24 | 107,475,000 | 105,925,849 |

| 2.25%, 03/31/24 | 130,405,000 | 128,777,484 |

| 0.38%, 04/15/24 | 104,960,000 | 100,222,450 |

| 2.00%, 04/30/24 | 9,119,000 | 8,962,089 |

| 2.25%, 04/30/24 | 91,806,000 | 90,635,114 |

| 2.50%, 04/30/24 | 121,259,000 | 120,224,035 |

| 0.25%, 05/15/24 | 124,263,000 | 118,129,941 |

| 2.50%, 05/15/24 | 151,952,000 | 150,637,260 |

| 2.00%, 05/31/24 | 157,257,000 | 154,437,431 |

| 2.50%, 05/31/24 | 120,792,000 | 119,725,634 |

SECURITY

RATE, MATURITY DATE | FACE

AMOUNT ($) | VALUE ($) |

| 0.25%, 06/15/24 | 128,485,000 | 121,867,520 |

| 1.75%, 06/30/24 | 83,312,000 | 81,330,086 |

| 2.00%, 06/30/24 | 59,418,000 | 58,307,394 |

| 3.00%, 06/30/24 | 118,000,000 | 118,076,054 |

| 0.38%, 07/15/24 | 114,568,000 | 108,691,915 |

| 1.75%, 07/31/24 | 86,364,000 | 84,221,768 |

| 2.13%, 07/31/24 | 56,999,000 | 56,019,330 |

| 0.38%, 08/15/24 | 130,796,000 | 123,745,278 |

| 2.38%, 08/15/24 | 157,288,000 | 155,254,315 |

| 1.25%, 08/31/24 | 78,361,000 | 75,511,231 |

| 1.88%, 08/31/24 | 64,058,000 | 62,561,645 |

| 0.38%, 09/15/24 | 149,937,000 | 141,532,328 |

| 1.50%, 09/30/24 | 79,696,000 | 77,108,993 |

| 2.13%, 09/30/24 | 54,465,000 | 53,469,312 |

| 0.63%, 10/15/24 | 149,176,000 | 141,361,742 |

| 1.50%, 10/31/24 | 78,875,000 | 76,216,050 |

| 2.25%, 10/31/24 | 56,416,000 | 55,472,795 |

| 0.75%, 11/15/24 | 138,242,000 | 131,092,297 |

| 2.25%, 11/15/24 | 152,895,000 | 150,374,622 |

| 1.50%, 11/30/24 | 89,947,000 | 86,788,314 |

| 2.13%, 11/30/24 | 58,811,000 | 57,604,915 |

| 1.00%, 12/15/24 | 139,943,000 | 133,290,241 |

| 1.75%, 12/31/24 | 81,461,000 | 78,963,075 |

| 2.25%, 12/31/24 | 66,173,000 | 64,963,275 |

| 1.13%, 01/15/25 | 131,176,000 | 125,109,110 |

| 1.38%, 01/31/25 | 74,978,000 | 71,920,303 |

| 2.50%, 01/31/25 | 67,104,000 | 66,233,745 |

| 1.50%, 02/15/25 | 129,821,000 | 124,790,436 |

| 2.00%, 02/15/25 | 136,683,000 | 133,217,873 |

| 1.13%, 02/28/25 | 84,383,000 | 80,328,661 |

| 2.75%, 02/28/25 | 68,700,000 | 68,222,321 |

| 1.75%, 03/15/25 | 124,365,000 | 120,255,126 |

| 0.50%, 03/31/25 | 101,681,000 | 94,912,858 |

| 2.63%, 03/31/25 | 41,300,000 | 40,890,227 |

| 2.63%, 04/15/25 | 119,009,000 | 117,730,583 |

| 0.38%, 04/30/25 | 109,190,000 | 101,350,500 |

| 2.88%, 04/30/25 | 63,626,000 | 63,367,519 |

| 2.13%, 05/15/25 | 130,864,000 | 127,689,526 |

| 2.75%, 05/15/25 | 116,768,000 | 115,883,118 |

| 0.25%, 05/31/25 | 107,171,000 | 98,907,112 |

| 2.88%, 05/31/25 | 58,021,000 | 57,783,023 |

| 2.88%, 06/15/25 | 115,000,000 | 114,555,273 |

| 0.25%, 06/30/25 | 110,000,000 | 101,290,234 |

| 2.75%, 06/30/25 | 45,000,000 | 44,655,469 |

Total Treasuries

(Cost $9,063,036,517) | 8,797,285,736 |

Schwab Fixed-Income ETFs | Semiannual Report

Schwab Short-Term U.S. Treasury ETF

Portfolio Holdings as of June 30, 2022 (Unaudited) (continued)

| SECURITY | NUMBER

OF SHARES | VALUE ($) |

| SHORT-TERM INVESTMENTS 0.1% OF NET ASSETS |

| |

| Money Market Funds 0.1% |

| State Street Institutional U.S. Government Money Market Fund, Premier Class 1.43% (a) | 6,683,113 | 6,683,113 |

Total Short-Term Investments

(Cost $6,683,113) | 6,683,113 |

Total Investments in Securities

(Cost $9,069,719,630) | 8,803,968,849 |

| (a) | The rate shown is the 7-day yield. |

The following is a summary of the inputs used to value the fund’s investments as of June 30, 2022 (see financial note 2(a) for additional information):

| DESCRIPTION | QUOTED PRICES IN

ACTIVE MARKETS FOR

IDENTICAL ASSETS

(LEVEL 1) | OTHER SIGNIFICANT

OBSERVABLE INPUTS

(LEVEL 2) | SIGNIFICANT

UNOBSERVABLE INPUTS

(LEVEL 3) | TOTAL |

| Assets | | | | |

| Treasuries 1 | $— | $8,797,285,736 | $— | $8,797,285,736 |

| Short-Term Investments1 | 6,683,113 | — | — | 6,683,113 |

| Total | $6,683,113 | $8,797,285,736 | $— | $8,803,968,849 |

| 1 | As categorized in the Portfolio Holdings. |

Fund investments in mutual funds are classified as Level 1, without consideration to the classification level of the underlying securities held by the mutual funds, which could be Level 1, Level 2 or Level 3.

Schwab Fixed-Income ETFs | Semiannual Report

Schwab Short-Term U.S. Treasury ETF

Statement of Assets and Liabilities

As of June 30, 2022; unaudited

| Assets |

| Investments in securities, at value - unaffiliated (cost $9,069,719,630) | | $8,803,968,849 |

| Receivables: | | |

| Investments sold | | 372,207,101 |

| Interest | | 28,262,327 |

| Fund shares sold | | 7,367,910 |

| Dividends | + | 1,265 |

| Total assets | | 9,211,807,452 |

| Liabilities |

| Payables: | | |

| Investments bought | | 385,666,973 |

| Management fees | | 286,836 |

| Due to custodian | + | 4,296 |

| Total liabilities | | 385,958,105 |

| Net assets | | $8,825,849,347 |

| Net Assets by Source |

| Capital received from investors | | $9,171,791,705 |

| Total distributable loss | + | (345,942,358) |

| Net assets | | $8,825,849,347 |

| Net Asset Value (NAV) |

| Net Assets | ÷ | Shares

Outstanding | = | NAV |

| $8,825,849,347 | | 179,400,000 | | $49.20 |

| | | | | |

| | | | | |

Schwab Fixed-Income ETFs | Semiannual Report

Schwab Short-Term U.S. Treasury ETF

Statement of Operations

| For the period January 1, 2022 through June 30, 2022; unaudited |

| Investment Income |

| Interest received from securities - unaffiliated | | $28,724,054 |

| Dividends received from securities - unaffiliated | + | 7,142 |

| Total investment income | | 28,731,196 |

| Expenses |

| Management fees | | 1,666,909 |

| Total expenses | – | 1,666,909 |

| Net investment income | | 27,064,287 |

| REALIZED AND UNREALIZED GAINS (LOSSES) |

| Net realized losses on sales of securities - unaffiliated | | (61,740,159) |

| Net realized losses on sales of in-kind redemptions - unaffiliated | + | (15,689,116) |

| Net realized losses | | (77,429,275) |

| Net change in unrealized appreciation (depreciation) on securities - unaffiliated | + | (206,545,684) |

| Net realized and unrealized losses | | (283,974,959) |

| Decrease in net assets resulting from operations | | ($256,910,672) |

Schwab Fixed-Income ETFs | Semiannual Report

Schwab Short-Term U.S. Treasury ETF

Statement of Changes in Net Assets

For the current and prior report periods

Figures for the current period are unaudited

| OPERATIONS |

| | 1/1/22-6/30/22 | 1/1/21-12/31/21 |

| Net investment income | | $27,064,287 | $34,884,979 |

| Net realized gains (losses) | | (77,429,275) | 32,936,548 |

| Net change in unrealized appreciation (depreciation) | + | (206,545,684) | (127,210,855) |

| Decrease in net assets from operations | | ($256,910,672) | ($59,389,328) |

| DISTRIBUTIONS TO SHAREHOLDERS |

| Total distributions | | ($19,128,080) | ($34,862,540) |

| TRANSACTIONS IN FUND SHARES |

| | 1/1/22-6/30/22 | 1/1/21-12/31/21 |

| | | SHARES | VALUE | SHARES | VALUE |

| Shares sold | | 40,200,000 | $2,000,585,228 | 137,050,000 | $7,021,323,331 |

| Shares redeemed | + | (36,950,000) | (1,854,504,681) | (107,000,000) | (5,479,187,668) |

| Net transactions in fund shares | | 3,250,000 | $146,080,547 | 30,050,000 | $1,542,135,663 |

| SHARES OUTSTANDING AND NET ASSETS |

| | 1/1/22-6/30/22 | 1/1/21-12/31/21 |

| | | SHARES | NET ASSETS | SHARES | NET ASSETS |

| Beginning of period | | 176,150,000 | $8,955,807,552 | 146,100,000 | $7,507,923,757 |

| Total increase (decrease) | + | 3,250,000 | (129,958,205) | 30,050,000 | 1,447,883,795 |

| End of period | | 179,400,000 | $8,825,849,347 | 176,150,000 | $8,955,807,552 |

Schwab Fixed-Income ETFs | Semiannual Report

Schwab Intermediate-Term U.S. Treasury ETF

Financial Statements

FINANCIAL HIGHLIGHTS

| | 1/1/22–

6/30/22* | 1/1/21–