UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSRS

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-22311

Schwab Strategic Trust –Schwab Ariel ESG ETF and Schwab Crypto Thematic ETF

(Exact name of registrant as specified in charter)

211 Main Street,

San Francisco, California 94105

(Address of principal executive offices) (Zip code)

Jonathan de. St. Paer

Schwab Strategic Trust – Schwab Ariel ESG ETF and Schwab Crypto Thematic ETF

211 Main Street,

San Francisco, California 94105

(Name and address of agent for service)

Registrant’s telephone number, including area code: (415) 636-7000

Date of fiscal year end: March 31

Date of reporting period: September 30, 2022

Item 1: Report(s) to Shareholders.

Semiannual Report | September 30, 2022

Schwab Ariel ESG ETF

Ticker Symbol SAEF

Adviser

Charles Schwab Investment Management, Inc., dba Schwab Asset ManagementTM

Subadviser

Ariel Investments, LLC

| THIS FUND IS DIFFERENT FROM TRADITIONAL ETFs |

| Traditional ETFs tell the public what assets they hold each day. This fund will not. This may create additional risks for your investment. For example: |

| • You may have to pay more money to trade the fund’s shares. This fund will provide less information to traders, who tend to charge more for trades when they have less information. |

| • The price you pay to buy fund shares on an exchange may not match the value of the fund’s portfolio. The same is true when you sell shares. These price differences may be greater for this fund compared to other ETFs because it provides less information to traders. |

| • These additional risks may be even greater in bad or uncertain market conditions. |

| • The ETF will publish on its website each day a “Proxy Portfolio” designed to help trading in shares of the ETF. While the Proxy Portfolio includes some of the ETF’s holdings, it is not the ETF’s actual portfolio. |

| The differences between this fund and other ETFs may also have advantages. By keeping certain information about the fund secret, this fund may face less risk that other traders can predict or copy its investment strategy. This may improve the fund’s performance. If other traders are able to copy or predict the fund’s investment strategy, however, this may hurt the fund’s performance. |

| For additional information regarding the unique attributes and risks of the fund, see Proxy Portfolio Risk, Premium/Discount Risk, Trading Halt Risk, Authorized Participant Concentration Risk, Tracking Error Risk and Shares of the Fund May Trade at Prices Other Than NAV in the Principal Risks and Proxy Portfolio and Proxy Overlap sections of the prospectus and/or the Statement of Additional Information. These risks are also discussed in the Financial Notes of this report. |

This page is intentionally left blank.

Fund investment adviser: Charles Schwab Investment Management, Inc., dba Schwab Asset ManagementTM

Distributor: SEI Investments Distribution Co. (SIDCO)

The Sector/Industry classifications in this report use the Global Industry Classification Standard (GICS) which was developed by and is the exclusive property of MSCI Inc. (MSCI) and Standard & Poor’s (S&P). GICS is a service mark of MSCI and S&P and has been licensed for use by Charles Schwab & Co., Inc. The Industry classifications used in the Portfolio Holdings are sub-categories of Sector classifications.

Schwab Ariel ESG ETF | Semiannual Report

The performance data quoted represents past performance. Past performance does not guarantee future results. Investment return and principal value of an investment will fluctuate so that an investor’s shares, when sold or redeemed, may be worth more or less than the original cost. Current performance may be lower or higher than the performance quoted. To obtain performance information current to the most recent month end, please visit www.schwabassetmanagement.com/schwabetfs_prospectus.

| Total Returns for the 6 Months Ended September 30, 2022 |

| Schwab Ariel ESG ETF (Ticker Symbol: SAEF) | |

| Market Price Return1 | -21.14% |

| NAV Return1 | -21.30% |

| Russell 2500TM Index | -19.32% |

| ETF Category: Mid-Cap Blend2 | -17.56% |

| Performance Details | pages 4-5 |

All total returns on this page assume dividends and distributions were reinvested. Index figures do not include trading and management costs, which would lower performance. Indices are unmanaged and cannot be invested in directly. Performance results less than one year are not annualized.

For index definitions, please see the Glossary.

Performance does not reflect the deduction of taxes that a shareholder would pay on fund distributions or on the redemption or sale of fund shares.

Shares are bought and sold at market price, which may be higher or lower than the net asset value (NAV). Brokerage commissions will reduce returns.

Active semi-transparent (also referred to as non-transparent) ETFs operate differently from other exchange-traded funds (ETFs). Unlike other ETFs, an active semi-transparent ETF does not publicly disclose its entire portfolio composition each business day, which may affect the price at which shares of the ETF trade in the secondary market. Active semi-transparent ETFs have limited public trading history. There can be no assurance that an active trading market will develop, be maintained or operate as intended. There is a risk that the market price of an active semi-transparent ETF may vary significantly from the ETF’s net asset value and that its shares may trade at a wider bid/ask spread and, therefore, cost investors more to trade than shares of other ETFs. These risks are heightened during periods of market disruption or volatility.

Because environmental, social and governance (ESG) strategies exclude some securities, ESG-focused products may not be able to take advantage of the same opportunities or market trends as products that do not use such strategies. Additionally, the criteria used to select companies for investment may result in investing in securities, industries or sectors that underperform the market as a whole.

Value investing attempts to identify undervalued companies with characteristics for improved valuations. Securities that exhibit value characteristics tend to perform differently and shift in and out of favor with investors depending on changes in market and economic conditions. As a result, the fund’s performance may at times fall behind the performance of other funds that invest more broadly or in securities that exhibit different characteristics.

Mid-cap companies may be more vulnerable to adverse business or economic events than larger, more established companies and the value of securities issued by these companies may move sharply. Securities issued by small-cap companies may be riskier than those issued by larger companies, and their prices may move sharply, especially during market upturns and downturns.

| 1 | ETF performance must be shown based on both a market price and NAV basis. The fund’s per share NAV is the value of one share of the fund. NAV is calculated by taking the fund’s total assets (including the fair value of securities owned), subtracting liabilities, and dividing by the number of shares outstanding. The NAV Return is based on the NAV of the fund, and the Market Price Return is based on the market price per share of the fund. The price used to calculate market return (Market Price) is determined using the Official Closing Price on the primary stock exchange (generally, 4:00 p.m. Eastern time) and may not represent the returns you would receive if shares were traded at other times. Market Price and NAV returns assume that dividends and capital gain distributions have been reinvested in the fund at Market Price and NAV, respectively. |

| 2 | Source for category information: Morningstar, Inc. The Morningstar Category return represents all passively- and actively-managed ETFs and mutual funds within the category as of the report date. |

Schwab Ariel ESG ETF | Semiannual Report

The Investment Environment

For the six-month reporting period ended September 30, 2022, U.S. stocks generally lost ground as a result of accelerating inflation, rising interest rates, and geopolitical tensions, including the war in Ukraine. Albeit decelerating, COVID-19 continued to weigh on the U.S. economy, with highly transmissible variants and subvariants keeping infection rates high in many areas. Economic growth slowed and recession fears rose. For the reporting period, the S&P 500® Index, a bellwether for the overall U.S. stock market, returned -20.20%. The Russell 2500TM Index, which measures the performance of the small- to mid-cap segment of the U.S. equity universe, returned -19.32%. Among U.S. stocks, large-cap stocks underperformed small-cap stocks, with the Russell 1000® Index and Russell 2000® Index returning -20.51% and -19.01%, respectively. Among the sectors in the Russell 2500TM Index, all lost ground for the reporting period. The weakest were the communication services and real estate sectors. Although still negative for the reporting period, the financials and consumer staples sectors were the two best performers on a comparative basis.

The U.S. economy showed signs of weakening over the reporting period. Amid ongoing supply chain disruptions, persisting inflation, and a tight labor market, gross domestic product (GDP) decreased at an annualized rate of -0.6% for the second quarter of 2022, following a decrease at an annualized rate of -1.6% for the first quarter of 2022. The unemployment rate remained near pre-pandemic lows over the reporting period. Inflation remained stubbornly high due to supply chain bottlenecks and soaring energy and food prices.

Monetary policy around the world varied. In the United States, after raising interest rates by 0.25% in mid-March 2022—its first hike since December 2018—the U.S. Federal Reserve (Fed) increased the federal funds rate four times during the reporting period—by 0.50% in early May, 0.75% in mid-June, 0.75% in late July, and 0.75% in late September—in its ongoing efforts to achieve a return to price stability. The federal funds rate ended the reporting period in a range of 3.00% to 3.25%. The Fed reiterated that further rate hikes were likely by the end of 2022. In June, the Fed also began to reduce the $9 trillion in assets it holds on its balance sheet, vowing to be even more aggressive than during its last round of quantitative tightening in 2017 through 2019.

Asset Class Performance Comparison % returns during the 6 months ended September 30, 2022

Index figures assume dividends and distributions were reinvested. Index figures do not include trading and management costs, which would lower performance. Indices are unmanaged and cannot be invested in directly. Performance results less than one year are not annualized. Past performance is not a guarantee of future results.

For index definitions, please see the Glossary.

Data source: Index provider websites and Schwab Asset Management.

Nothing in this report represents a recommendation of a security by the investment adviser.

Management views may have changed since the report date.

| * | The net version of the index reflects reinvested dividends net of withholding taxes but reflects no deductions for expenses or other taxes. |

Schwab Ariel ESG ETF | Semiannual Report

The performance data quoted represents past performance. Past performance does not guarantee future results. Investment return and principal value of an investment will fluctuate so that an investor’s shares, when sold or redeemed, may be worth more or less than the original cost. Current performance may be lower or higher than the performance quoted. To obtain performance information current to the most recent month end, please visit www.schwabassetmanagement.com/schwabetfs_prospectus.

Average Annual Total Returns1

| Fund and Inception Date | 6 Months | Since Inception* |

| Fund: Schwab Ariel ESG ETF (11/16/21) | | |

| Market Price Return2 | -21.14% | -27.72% |

| NAV Return2 | -21.30% | -27.96% |

| Russell 2500TM Index | -19.32% | -27.31% |

| ETF Category: Mid-Cap Blend3 | -17.56% | N/A |

| Fund Expense Ratio4: 0.59% |

All total returns on this page assume dividends and distributions were reinvested. Index figures do not include trading and management costs, which would lower performance. Indices are unmanaged and cannot be invested in directly. Performance results less than one year are not annualized.

For index definitions, please see the Glossary.

Shares are bought and sold at market price, which may be higher or lower than the net asset value (NAV). Brokerage commissions will reduce returns.

Active semi-transparent (also referred to as non-transparent) ETFs operate differently from other exchange-traded funds (ETFs). Unlike other ETFs, an active semi-transparent ETF does not publicly disclose its entire portfolio composition each business day, which may affect the price at which shares of the ETF trade in the secondary market. Active semi-transparent ETFs have limited public trading history. There can be no assurance that an active trading market will develop, be maintained or operate as intended. There is a risk that the market price of an active semi-transparent ETF may vary significantly from the ETF’s net asset value and that its shares may trade at a wider bid/ask spread and, therefore, cost investors more to trade than shares of other ETFs. These risks are heightened during periods of market disruption or volatility.

Because environmental, social and governance (ESG) strategies exclude some securities, ESG-focused products may not be able to take advantage of the same opportunities or market trends as products that do not use such strategies. Additionally, the criteria used to select companies for investment may result in investing in securities, industries or sectors that underperform the market as a whole.

Value investing attempts to identify undervalued companies with characteristics for improved valuations. Securities that exhibit value characteristics tend to perform differently and shift in and out of favor with investors depending on changes in market and economic conditions. As a result, the fund’s performance may at times fall behind the performance of other funds that invest more broadly or in securities that exhibit different characteristics.

Mid-cap companies may be more vulnerable to adverse business or economic events than larger, more established companies and the value of securities issued by these companies may move sharply. Securities issued by small-cap companies may be riskier than those issued by larger companies, and their prices may move sharply, especially during market upturns and downturns.

| * | Inception (11/16/21) represents the date that the shares began trading in the secondary market. |

| 1 | Performance does not reflect the deduction of taxes that a shareholder would pay on fund distributions or on the redemption or sale of fund shares. |

| 2 | ETF performance must be shown based on both a market price and NAV basis. The fund’s per share NAV is the value of one share of the fund. NAV is calculated by taking the fund’s total assets (including the fair value of securities owned), subtracting liabilities, and dividing by the number of shares outstanding. The NAV Return is based on the NAV of the fund, and the Market Price Return is based on the market price per share of the fund. The price used to calculate market return (Market Price) is determined using the Official Closing Price on the primary stock exchange (generally, 4:00 p.m. Eastern time) and may not represent the returns you would receive if shares were traded at other times. NAV is used as a proxy for purposes of calculating Market Price Return on inception date. Market Price and NAV returns assume that dividends and capital gain distributions have been reinvested in the fund at Market Price and NAV, respectively. |

| 3 | Source for category information: Morningstar, Inc. The Morningstar Category return represents all passively- and actively-managed ETFs and mutual funds within the category as of the report date. |

| 4 | As stated in the prospectus. |

Schwab Ariel ESG ETF | Semiannual Report

Performance and Fund Facts as of September 30, 2022

| Number of Holdings | 61 |

| Weighted Average Market Cap (millions) | $14,261 |

| Price/Earnings Ratio (P/E) | 12.8 |

| Price/Book Ratio (P/B) | 1.8 |

| Portfolio Turnover Rate | 10% 1,2 |

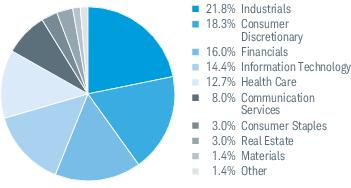

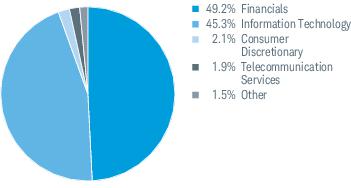

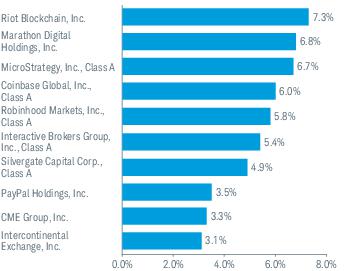

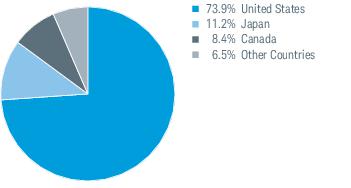

Sector Weightings % of Investments3

Top Holdings % of Net Assets4

Portfolio holdings may have changed since the report date.

Source of Sector Classification: S&P and MSCI.

| 1 | Not annualized. |

| 2 | Portfolio turnover rate excludes securities received or delivered from processing of in-kind creations or redemptions. |

| 3 | The percentage may differ from the Portfolio Holdings because the above calculation is based on a percentage of total investments, whereas the calculation in the Portfolio Holdings is based on a percentage of net assets. |

| 4 | This list is not a recommendation of any security by the investment adviser. |

Schwab Ariel ESG ETF | Semiannual Report

Fund Expenses (Unaudited)

Examples for a $1,000 Investment

As a fund shareholder, you may incur two types of costs: (1) transaction costs, including brokerage commissions on purchases and sales of fund shares; and, (2) ongoing costs, including management fees.

The expense examples below are intended to help you understand your ongoing cost (in dollars) of investing in the fund and to compare this cost with the ongoing cost of investing in other mutual funds. These examples are based on an investment of $1,000 invested for six months beginning April 1, 2022 and held through September 30, 2022.

Actual Return line in the table below provides information about actual account values and actual expenses. You may use this information, together with the amount you invested, to estimate the expenses that you paid over the period. To do so, simply divide your account value by $1,000 (for example, an $8,600 account value ÷ $1,000 = 8.6), then multiply the result by the number given for the fund under the heading entitled “Expenses Paid During Period.”

Hypothetical Return line in the table below provides information about hypothetical account values and hypothetical expenses based on the fund’s actual expense ratio and an assumed return of 5% per year before expenses. Because the return used is not an actual return, it may not be used to estimate the actual ending account value or expenses you paid for the period.

You may use this information to compare the ongoing costs of investing in the fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, including any brokerage commissions you may pay when purchasing or selling shares of a fund. Therefore, the hypothetical return lines of the table are useful in comparing ongoing costs only and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

| | EXPENSE RATIO

(ANNUALIZED) 1 | BEGINNING

ACCOUNT VALUE

AT 4/1/22 | ENDING

ACCOUNT VALUE

(NET OF EXPENSES)

AT 9/30/22 | EXPENSES PAID

DURING PERIOD

4/1/22-9/30/22 2 |

| Schwab Ariel ESG ETF | | | | |

| Actual Return | 0.59% | $1,000.00 | $ 787.00 | $2.64 |

| Hypothetical 5% Return | 0.59% | $1,000.00 | $1,022.11 | $2.99 |

| 1 | Based on the most recent six-month expense ratio. |

| 2 | Expenses for the fund are equal to its annualized expense ratio, multiplied by the average account value over the period, multiplied by 183 days of the period, and divided by 365 days of the fiscal year. |

Schwab Ariel ESG ETF | Semiannual Report

Financial Statements

FINANCIAL HIGHLIGHTS

| | 4/1/22–

9/30/22* | 11/16/21 1–

3/31/22 | | | | |

| Per-Share Data |

| Net asset value at beginning of period | $22.84 | $25.00 | | | | |

| Income (loss) from investment operations: | | | | | | |

| Net investment income (loss)2 | 0.07 | 0.05 | | | | |

| Net realized and unrealized gains (losses) | (4.93) | (2.16) | | | | |

| Total from investment operations | (4.86) | (2.11) | | | | |

| Less distributions: | | | | | | |

| Distributions from net investment income | (0.05) | (0.05) | | | | |

| Net asset value at end of period | $17.93 | $22.84 | | | | |

| Total return | (21.30%) 3 | (8.46%) 3 | | | | |

| Ratios/Supplemental Data |

| Ratios to average net assets: | | | | | | |

| Total expenses | 0.59% 4,5 | 0.59% 6 | | | | |

| Net investment income (loss) | 0.65% 4 | 0.61% 6 | | | | |

| Portfolio turnover rate7 | 10% 3 | 15% 3 | | | | |

| Net assets, end of period (x 1,000) | $10,665 | $10,622 | | | | |

| * | Unaudited. |

| 1 | Commencement of operations. |

| 2 | Calculated based on the average shares outstanding during the period. |

| 3 | Not annualized. |

| 4 | Annualized (except for proxy expenses). |

| 5 | Ratio includes less than 0.005% of non-routine proxy expenses. |

| 6 | Annualized. |

| 7 | Portfolio turnover rate excludes securities received or delivered from processing of in-kind creations or redemptions. |

Schwab Ariel ESG ETF | Semiannual Report

Portfolio Holdings as of September 30, 2022 (Unaudited)

This section shows all the securities in the fund’s portfolio and their values as of the report date.

The fund files its complete schedule of portfolio holdings with the U.S. Securities and Exchange Commission (SEC) for the first and third quarters of each fiscal year on Form N-PORT Part F. The fund’s Form N-PORT Part F is available on the SEC’s website at www.sec.gov. You can also obtain this information at no cost on the fund’s website at www.schwabassetmanagement.com/schwabetfs_prospectus, by calling 1-866-414-6349, or by sending an email request to orders@mysummaryprospectus.com. The fund also makes available its complete schedule of holdings approximately 30 days after the end of each calendar quarter on the fund’s website.

| SECURITY | NUMBER

OF SHARES | VALUE ($) |

| COMMON STOCKS 99.0% OF NET ASSETS |

| |

| Automobiles & Components 3.4% |

| BorgWarner, Inc. | 4,745 | 148,993 |

| Gentex Corp. | 8,925 | 212,772 |

| | | 361,765 |

| |

| Banks 2.8% |

| M&T Bank Corp. | 1,709 | 301,331 |

| |

| Capital Goods 14.8% |

| Generac Holdings, Inc. * | 1,125 | 200,408 |

| Kennametal, Inc. | 8,476 | 174,436 |

| Masco Corp. | 2,436 | 113,737 |

| nVent Electric PLC | 7,744 | 244,788 |

| Resideo Technologies, Inc. * | 15,515 | 295,716 |

| Sensata Technologies Holding PLC | 4,755 | 177,266 |

| Simpson Manufacturing Co., Inc. | 1,310 | 102,704 |

| Snap-on, Inc. | 744 | 149,804 |

| The Middleby Corp. * | 962 | 123,300 |

| | | 1,582,159 |

| |

| Commercial & Professional Services 7.1% |

| Brady Corp., Class A | 2,380 | 99,317 |

| Dun & Bradstreet Holdings, Inc. | 11,424 | 141,543 |

| Korn Ferry | 1,588 | 74,557 |

| Stericycle, Inc. * | 4,641 | 195,432 |

| The Brink's Co. | 4,983 | 241,377 |

| | | 752,226 |

| |

| Consumer Durables & Apparel 3.2% |

| Mattel, Inc. * | 12,227 | 231,579 |

| Mohawk Industries, Inc. * | 1,190 | 108,516 |

| | | 340,095 |

| |

| Consumer Services 11.1% |

| ADT, Inc. | 27,068 | 202,739 |

| Adtalem Global Education, Inc. * | 3,239 | 118,062 |

| Lindblad Expeditions Holdings, Inc. * | 30,595 | 206,822 |

| Norwegian Cruise Line Holdings Ltd. * | 27,403 | 311,298 |

| OneSpaWorld Holdings Ltd. * | 41,146 | 345,627 |

| | | 1,184,548 |

| |

| Diversified Financials 8.1% |

| KKR & Co., Inc. | 4,760 | 204,680 |

| Lazard Ltd., Class A | 5,697 | 181,335 |

| Northern Trust Corp. | 2,968 | 253,942 |

| The Goldman Sachs Group, Inc. | 777 | 227,700 |

| | | 867,657 |

| |

| SECURITY | NUMBER

OF SHARES | VALUE ($) |

| Food & Staples Retailing 1.1% |

| Walgreens Boots Alliance, Inc. | 3,808 | 119,571 |

| |

| Food, Beverage & Tobacco 0.7% |

| The JM Smucker Co. | 565 | 77,637 |

| |

| Health Care Equipment & Services 7.9% |

| Cardinal Health, Inc. | 2,261 | 150,763 |

| Envista Holdings Corp. * | 5,060 | 166,019 |

| Laboratory Corp. of America Holdings | 872 | 178,594 |

| Patterson Cos., Inc. | 5,804 | 139,412 |

| Zimmer Biomet Holdings, Inc. | 1,834 | 191,745 |

| Zimvie, Inc. * | 1,446 | 14,272 |

| | | 840,805 |

| |

| Household & Personal Products 1.1% |

| Reynolds Consumer Products, Inc. | 4,614 | 120,010 |

| |

| Insurance 5.2% |

| Aflac, Inc. | 3,641 | 204,624 |

| First American Financial Corp. | 3,927 | 181,035 |

| The Progressive Corp. | 1,402 | 162,926 |

| | | 548,585 |

| |

| Materials 1.4% |

| Axalta Coating Systems Ltd. * | 6,902 | 145,356 |

| |

| Media & Entertainment 8.0% |

| Madison Square Garden Entertainment Corp. * | 5,150 | 227,063 |

| Madison Square Garden Sports Corp. * | 952 | 130,100 |

| Manchester United Plc, Class A | 16,303 | 216,341 |

| Paramount Global, Class B | 6,691 | 127,397 |

| The Interpublic Group of Cos., Inc. | 6,096 | 156,058 |

| | | 856,959 |

| |

| Pharmaceuticals, Biotechnology & Life Sciences 4.9% |

| Bio-Rad Laboratories, Inc., Class A * | 281 | 117,216 |

| Charles River Laboratories International, Inc. * | 940 | 184,992 |

| Prestige Consumer Healthcare, Inc. * | 4,474 | 222,940 |

| | | 525,148 |

| |

| Real Estate 3.0% |

| CBRE Group, Inc., Class A * | 2,499 | 168,707 |

| Jones Lang LaSalle, Inc. * | 979 | 147,898 |

| | | 316,605 |

| |

| Retailing 0.7% |

| CarMax, Inc. * | 1,190 | 78,564 |

| |

Schwab Ariel ESG ETF | Semiannual Report

Portfolio Holdings as of September 30, 2022 (Unaudited) (continued)

| SECURITY | NUMBER

OF SHARES | VALUE ($) |

| Software & Services 5.5% |

| Fair Isaac Corp. * | 503 | 207,241 |

| Fiserv, Inc. * | 2,856 | 267,236 |

| The Hackett Group, Inc. | 6,386 | 113,160 |

| | | 587,637 |

| |

| Technology Hardware & Equipment 9.0% |

| Keysight Technologies, Inc. * | 1,423 | 223,923 |

| Knowles Corp. * | 9,610 | 116,954 |

| Littelfuse, Inc. | 862 | 171,271 |

| Motorola Solutions, Inc. | 727 | 162,826 |

| Zebra Technologies Corp., Class A * | 1,066 | 279,303 |

| | | 954,277 |

Total Common Stocks

(Cost $13,705,877) | 10,560,935 |

| SECURITY | NUMBEROF SHARES | VALUE ($) |

| SHORT-TERM INVESTMENTS 1.4% OF NET ASSETS |

| |

| Money Market Funds 1.4% |

| State Street Institutional U.S. Government Money Market Fund, Premier Class 2.94% (a) | 147,816 | 147,816 |

Total Short-Term Investments

(Cost $147,816) | 147,816 |

Total Investments in Securities

(Cost $13,853,693) | 10,708,751 |

| * | Non-income producing security. |

| (a) | The rate shown is the 7-day yield. |

The following is a summary of the inputs used to value the fund’s investments as of September 30, 2022 (see financial note 2(a) for additional information):

| DESCRIPTION | QUOTED PRICES IN

ACTIVE MARKETS FOR

IDENTICAL ASSETS

(LEVEL 1) | OTHER SIGNIFICANT

OBSERVABLE INPUTS

(LEVEL 2) | SIGNIFICANT

UNOBSERVABLE INPUTS

(LEVEL 3) | TOTAL |

| Assets | | | | |

| Common Stocks1 | $10,560,935 | $— | $— | $10,560,935 |

| Short-Term Investments1 | 147,816 | — | — | 147,816 |

| Total | $10,708,751 | $— | $— | $10,708,751 |

| 1 | As categorized in the Portfolio Holdings. |

Fund investments in mutual funds are classified as Level 1, without consideration to the classification level of the underlying securities held by the mutual funds, which could be Level 1, Level 2 or Level 3.

Schwab Ariel ESG ETF | Semiannual Report

Statement of Assets and Liabilities

As of September 30, 2022; unaudited

| Assets |

| Investments in securities, at value - unaffiliated (cost $13,853,693) | | $10,708,751 |

| Receivables: | | |

| Dividends | + | 7,984 |

| Total assets | | 10,716,735 |

| Liabilities |

| Payables: | | |

| Investments bought | | 45,486 |

| Management fees | + | 5,840 |

| Total liabilities | | 51,326 |

| Net assets | | $10,665,409 |

| Net Assets by Source |

| Capital received from investors | | $13,861,114 |

| Total distributable loss | + | (3,195,705) |

| Net assets | | $10,665,409 |

| Net Asset Value (NAV) |

| Net Assets | ÷ | Shares

Outstanding | = | NAV |

| $10,665,409 | | 595,000 | | $17.93 |

| | | | | |

| | | | | |

Schwab Ariel ESG ETF | Semiannual Report

Statement of Operations

| For the period April 1, 2022 through September 30, 2022; unaudited |

| Investment Income |

| Dividends received from securities - unaffiliated | | $68,158 |

| Expenses |

| Management fees | | 32,432 |

| Proxy fees1 | + | 423 |

| Total expenses | – | 32,855 |

| Net investment income | | 35,303 |

| REALIZED AND UNREALIZED GAINS (LOSSES) |

| Net realized losses on sales of securities - unaffiliated | | (58,884) |

| Net realized gains on sales of in-kind redemptions - unaffiliated | + | 28,537 |

| Net realized losses | | (30,347) |

| Net change in unrealized appreciation (depreciation) on securities - unaffiliated | + | (2,615,972) |

| Net realized and unrealized losses | | (2,646,319) |

| Decrease in net assets resulting from operations | | ($2,611,016) |

| 1 | Proxy fees are non-routine expenses (see financial note 2(d) for additional information). |

Schwab Ariel ESG ETF | Semiannual Report

Statement of Changes in Net Assets

For the current and prior report periods

Figures for the current period are unaudited

| OPERATIONS |

| | 4/1/22-9/30/22 | 11/16/21 1-3/31/22 |

| Net investment income | | $35,303 | $19,134 |

| Net realized losses | | (30,347) | (31,335) |

| Net change in unrealized appreciation (depreciation) | + | (2,615,972) | (528,970) |

| Decrease in net assets from operations | | ($2,611,016) | ($541,171) |

| DISTRIBUTIONS TO SHAREHOLDERS |

| Total distributions | | ($26,297) | ($18,371) |

| TRANSACTIONS IN FUND SHARES |

| | 4/1/22-9/30/22 | 11/16/21 1-3/31/22 |

| | | SHARES | VALUE | SHARES | VALUE |

| Shares sold | | 140,000 | $2,901,658 | 465,000 | $11,181,214 |

| Shares redeemed | + | (10,000) | (220,608) | — | — |

| Net transactions in fund shares | | 130,000 | $2,681,050 | 465,000 | $11,181,214 |

| SHARES OUTSTANDING AND NET ASSETS |

| | 4/1/22-9/30/22 | 11/16/21 1-3/31/22 |

| | | SHARES | NET ASSETS | SHARES | NET ASSETS |

| Beginning of period | | 465,000 | $10,621,672 | — | $— |

| Total increase | + | 130,000 | 43,737 | 465,000 | 10,621,672 |

| End of period | | 595,000 | $10,665,409 | 465,000 | $10,621,672 |

| 1 | Commencement of operations. |

Schwab Ariel ESG ETF | Semiannual Report

Financial Notes, unaudited

1. Business Structure of the Fund:

Schwab Ariel ESG ETF is a series of Schwab Strategic Trust (the trust), a no-load, open-end management investment company. The trust is organized as a Delaware statutory trust and is registered under the Investment Company Act of 1940, as amended (the 1940 Act). The list below shows all the operational funds in the trust as of the end of the period, including the fund discussed in this report, which is highlighted:

| SCHWAB STRATEGIC TRUST (ORGANIZED JANUARY 27, 2009) |

| Schwab Ariel ESG ETF | Schwab U.S. TIPS ETF |

| Schwab U.S. REIT ETF | Schwab Short-Term U.S. Treasury ETF |

| Schwab 1000 Index® ETF | Schwab Intermediate-Term U.S. Treasury ETF |

| Schwab U.S. Broad Market ETF | Schwab Long-Term U.S. Treasury ETF |

| Schwab U.S. Large-Cap ETF | Schwab U.S. Aggregate Bond ETF |

| Schwab U.S. Large-Cap Growth ETF | Schwab 1-5 Year Corporate Bond ETF |

| Schwab U.S. Large-Cap Value ETF | Schwab 5-10 Year Corporate Bond ETF |

| Schwab U.S. Mid-Cap ETF | Schwab Fundamental U.S. Broad Market Index ETF |

| Schwab U.S. Small-Cap ETF | Schwab Fundamental U.S. Large Company Index ETF |

| Schwab U.S. Dividend Equity ETF | Schwab Fundamental U.S. Small Company Index ETF |

| Schwab International Dividend Equity ETF | Schwab Fundamental International Large Company Index ETF |

| Schwab International Equity ETF | Schwab Fundamental International Small Company Index ETF |

| Schwab International Small-Cap Equity ETF | Schwab Fundamental Emerging Markets Large Company Index ETF |

| Schwab Emerging Markets Equity ETF | Schwab Crypto Thematic ETF |

The fund issues and redeems shares at its net asset value per share (NAV) only in large blocks of shares (Creation Units). These transactions are usually in exchange for a basket of securities and/or an amount of cash. As a practical matter, only institutional investors who have entered into an authorized participant agreement purchase or redeem Creation Units. Except when aggregated in Creation Units, shares of the fund are not redeemable securities.

Individual shares of the fund trade on national securities exchanges and elsewhere during the trading day and can only be bought and sold at market prices throughout the trading day through a broker-dealer. Because fund shares trade at market prices rather than NAV, shares may trade at a price greater than NAV (premium) or less than NAV (discount). A chart showing the frequency at which the fund’s daily closing market price was at a discount or premium to the fund’s NAV can be found at www.schwabassetmanagement.com.

The fund maintains its own account for purposes of holding assets and accounting, and is considered a separate entity for tax purposes. Within its account, the fund may also keep certain assets in segregated accounts, as required by securities law.

2. Significant Accounting Policies:

The following is a summary of the significant accounting policies the fund uses in its preparation of financial statements. The fund follows the investment company accounting and reporting guidance of the Financial Accounting Standards Board (FASB) Accounting Standard Codification Topic 946 Financial Services — Investment Companies. The accounting policies are in conformity with accounting principles generally accepted in the United States of America (GAAP).

The fund may invest in certain mutual funds and exchange-traded funds (ETFs), which are referred to as "underlying funds". For more information about the underlying funds’ operations and policies, please refer to those funds’ semiannual and annual reports, which are filed with the U.S. Securities and Exchange Commission (SEC) and are available on the SEC’s website at www.sec.gov.

(a) Security Valuation

Pursuant to Rule 2a-5 under the 1940 Act, the Board has designated authority to a Valuation Designee, the fund’s investment adviser, to make fair valuation determinations under adopted procedures, subject to Board oversight. The investment adviser has formed a Pricing Committee to administer the pricing and valuation of portfolio securities and other assets and to ensure that prices used for internal purposes or provided by third parties reasonably reflect fair value. The Valuation Designee may utilize independent pricing services, quotations from securities and financial instrument dealers and other market sources to determine fair value.

Securities held in the fund’s portfolio are valued every business day. The following valuation policies and procedures are used by the Valuation Designee to value various types of securities:

• Securities traded on an exchange or over-the-counter: Traded securities are valued at the closing value for the day, or, on days when no closing value has been reported, at the mean of the most recent bid and ask quotes.

Schwab Ariel ESG ETF | Semiannual Report

Financial Notes, unaudited (continued)

2. Significant Accounting Policies (continued):

• Mutual funds: Mutual funds are valued at their respective NAVs.

• Securities for which no quoted value is available: The Valuation Designee has adopted procedures to fair value the fund’s securities when market prices are not “readily available” or are unreliable. For example, a security may be fair valued when it’s de-listed or its trading is halted or suspended; when a security’s primary pricing source is unable or unwilling to provide a price; or when a security’s primary trading market is closed during regular market hours. Fair value determinations are made in good faith in accordance with adopted valuation procedures. The Valuation Designee considers a number of factors, including unobservable market inputs, when arriving at fair value. The Valuation Designee may employ methods such as the review of related or comparable assets or liabilities, related market activities, recent transactions, market multiples, book values, transactional back-testing, disposition analysis and other relevant information. Due to the subjective and variable nature of fair value pricing, there can be no assurance that a fund could obtain the fair value assigned to the security upon the sale of such security.

In accordance with the authoritative guidance on fair value measurements and disclosures under GAAP, the fund discloses the fair value of its investments in a hierarchy that prioritizes the significant inputs to valuation methods used to measure the fair value. The hierarchy gives the highest priority to valuations based upon unadjusted quoted prices in active markets for identical assets or liabilities (Level 1 measurements) and the lowest priority to valuations based upon unobservable inputs that are significant to the valuation (Level 3 measurements). If inputs used to measure the financial instruments fall within different levels of the hierarchy, the categorization is based on the lowest level input that is significant to the valuation. If it is determined that either the volume and/or level of activity for an asset or liability has significantly decreased (from normal conditions for that asset or liability) or price quotations or observable inputs are not associated with orderly transactions, increased analysis and management judgment will be required to estimate fair value.

The three levels of the fair value hierarchy are as follows:

• Level 1 — quoted prices in active markets for identical securities — Investments whose values are based on quoted market prices in active markets, and whose values are therefore classified as Level 1 prices, include active listed equities and mutual funds. Investments in mutual funds are valued daily at their NAVs, which are classified as Level 1 prices, without consideration to the classification level of the underlying securities held by an underlying fund.

• Level 2 — other significant observable inputs (including quoted prices for similar securities, interest rates, prepayment speeds, credit risk, etc.) — Investments that trade in markets that are not considered to be active, but whose values are based on quoted market prices, dealer quotations or valuations provided by alternative pricing sources supported by observable inputs are classified as Level 2 prices. These generally include U.S. government and sovereign obligations, most government agency securities, investment-grade corporate bonds, certain mortgage products, less liquid listed equities, and state, municipal and provincial obligations.

• Level 3 — significant unobservable inputs (including the Valuation Designee’s assumptions in determining the fair value of investments) — Investments whose values are classified as Level 3 prices have significant unobservable inputs, as they may trade infrequently or not at all. When observable prices are not readily available for these securities, one or more valuation methods are used for which sufficient and reliable data is available. The inputs used in estimating the value of Level 3 prices may include the original transaction price, quoted prices for similar securities or assets in active markets, completed or pending third-party transactions in the underlying investment or comparable issuers, and changes in financial ratios or cash flows. Level 3 prices may also be adjusted to reflect illiquidity and/or non-transferability, with the amount of such discount estimated in the absence of market information. Assumptions used due to the lack of observable inputs may significantly impact the resulting fair value and therefore the fund’s results of operations.

The inputs or methodology used for valuing securities are not necessarily an indication of the risk associated with investing in those securities.

The levels associated with valuing the fund’s investments as of September 30, 2022 are disclosed in the Portfolio Holdings.

(b) Security Transactions:

Security transactions are recorded as of the date the order to buy or sell the security is executed. Realized gains and losses from security transactions are based on the identified costs of the securities involved.

Schwab Ariel ESG ETF | Semiannual Report

Financial Notes, unaudited (continued)

2. Significant Accounting Policies (continued):

(c) Investment Income:

Interest income is recorded as it accrues. Dividends and distributions from portfolio securities and underlying funds are recorded on the date they are effective (the ex-dividend date). Any distributions from underlying funds are recorded in accordance with the character of the distributions as designated by the underlying funds.

(d) Expenses:

Pursuant to the Amended and Restated Advisory Agreement (Advisory Agreement) between the investment adviser and the trust, the investment adviser will pay the operating expenses of the fund, excluding taxes, any brokerage expenses, and extraordinary or non-routine expenses. Taxes, any brokerage expenses and extraordinary or non-routine expenses that are specific to the fund are charged directly to the fund. The Advisory Agreement excludes paying acquired fund fees and expenses, which are indirect expenses incurred by a fund through its investments in underlying funds.

(e) Distributions to Shareholders:

The fund makes distributions from net investment income, if any, quarterly and from net realized capital gains, if any, once a year. To receive a distribution, you must be a registered shareholder on the record date. Distributions are paid to shareholders on the payable date.

(f) Accounting Estimates:

The accounting policies described in this report conform to GAAP. Notwithstanding this, shareholders should understand that in order to follow these principles, fund management has to make estimates and assumptions that affect the information reported in the financial statements. It’s possible that once the results are known, they may turn out to be different from these estimates and these differences may be material.

(g) Federal Income Taxes:

The fund intends to meet federal income and excise tax requirements for regulated investment companies under subchapter M of the Internal Revenue Code, as amended. Accordingly, the fund distributes substantially all of its net investment income and net realized capital gains, if any, to its shareholders each year. As long as the fund meets the tax requirements, it is not required to pay federal income tax.

(h) Indemnification:

Under the fund’s organizational documents, the officers and trustees are indemnified against certain liabilities arising out of the performance of their duties to the fund. In addition, in the normal course of business the fund enters into contracts with its vendors and others that provide general indemnifications. The fund’s maximum exposure under these arrangements is unknown as this would involve future claims that may be made against the fund. However, based on experience, the fund expects the risk of loss attributable to these arrangements to be remote.

(i) Regulatory Update:

In October 2022, the SEC adopted rule and form amendments to require mutual funds and ETFs to transmit concise and visually engaging streamlined annual and semiannual reports to shareholders that highlight key information deemed important for retail investors to assess and monitor their fund investments. Other information, including financial statements, will no longer appear in funds’ streamlined shareholder reports but must be available online, delivered free of charge upon request, and filed on a semiannual basis on Form N-CSR. The rule and form amendments are effective 60 days after publication in the Federal Register. The compliance date is 18 months following the effective date. At this time, management is evaluating the impact of these rule and form amendment changes on the content of the current shareholder report and the newly created annual and semiannual streamlined shareholder reports.

3. Risk Factors:

Investing in the fund may involve certain risks, as discussed in the fund’s prospectus, including, but not limited to, those described below. Any of these risks could cause an investor to lose money.

Schwab Ariel ESG ETF | Semiannual Report

Financial Notes, unaudited (continued)

3. Risk Factors (continued):

Proxy Portfolio Risk. Unlike traditional ETFs that disclose their portfolio holdings on a daily basis, the fund does not disclose its holdings daily, rather it discloses a Proxy Portfolio. The goal of the Proxy Portfolio, during all market conditions, is to track closely the daily performance of the Actual Portfolio and minimize intra-day misalignment between the performance of the Proxy Portfolio and the performance of the Actual Portfolio. The Proxy Portfolio is designed to reflect the economic exposures and the risk characteristics of the Actual Portfolio on any given trading day.

The Proxy Portfolio is intended to provide authorized participants and other market participants with enough information to support an effective arbitrage mechanism that keeps the market price of the fund at or close to the underlying net asset value (NAV) per share of the fund. The Proxy Portfolio methodology is novel and not yet proven as an effective arbitrage mechanism. The effectiveness of the Proxy Portfolio as an arbitrage mechanism is contingent upon, among other things, the fund’s factor model analysis creating a Proxy Portfolio that performs in a manner substantially identical to the performance of the Actual Portfolio and the willingness of authorized participants and other market participants to trade based on a Proxy Portfolio. There is no guarantee that this arbitrage mechanism will operate as intended. Further, while the Proxy Portfolio may include some of the fund’s holdings, it is not the fund’s Actual Portfolio. ETFs trading on the basis of a published Proxy Portfolio may exhibit wider premiums and discounts, bid/ask spreads, and tracking error than other ETFs using the same investment strategies that publish their portfolios on a daily basis, especially during periods of market disruption or volatility. Therefore, shares of the fund may cost investors more to trade than shares of a traditional ETF.

• Each day the fund calculates the overlap between the holdings of the prior Business Day’s Proxy Portfolio compared to the Actual Portfolio (Proxy Overlap) and the difference, in percentage terms, between the Proxy Portfolio per share NAV and that of the Actual Portfolio (Tracking Error). If the Tracking Error becomes large, there is a risk that the performance of the Proxy Portfolio may deviate from the performance of the Actual Portfolio.

• The fund’s Board of Trustees (the Board) monitors its Tracking Error, bid/ask spread and premiums/discounts. If deviations become too large, the Board will consider the continuing viability of the fund, whether shareholders are being harmed, and what, if any, corrective measures would be appropriate. See the Statement of Additional Information for further discussion of the Board’s monitoring responsibilities.

• Although the fund seeks to benefit from keeping its portfolio information secret, market participants may attempt to use the Proxy Portfolio to identify the fund’s trading strategy, which if successful, could result in such market participants engaging in certain predatory trading practices that may have the potential to harm the fund and its shareholders. The Proxy Portfolio and any related disclosures have been designed to minimize the risk of predatory trading practices, but they may not be successful in doing so.

Premium/Discount Risk. Publication of the Proxy Portfolio is not the same level of transparency as the publication of the Actual Portfolio by a fully transparent ETF. Although the Proxy Portfolio is intended to provide authorized participants and other market participants with enough information to allow for an effective arbitrage mechanism that is intended to keep the market price of the fund at or close to the underlying NAV per share of the fund, there is a risk (which may increase during periods of market disruption or volatility) that market prices will vary significantly from NAV per share of the fund. This means the price paid to buy shares on an exchange may not match the value of the fund’s portfolio. The same is true when shares are sold.

Trading Halt Risk. If securities representing 10% or more of the fund’s Actual Portfolio do not have readily available market quotations, the fund will promptly request that the listing exchange halt trading in the fund’s shares which means that investors would not be able to trade their shares. Trading halts may have a greater impact on the fund compared to other ETFs due to the fund’s non-transparent structure. If the trading of a security held in the fund’s Actual Portfolio is halted, or otherwise does not have readily available market quotations, and the investment adviser believes that the lack of any such readily available market quotations may affect the reliability of the Proxy Portfolio as an arbitrage vehicle, or otherwise determines it is in the best interest of the fund, the investment adviser will promptly disclose on the fund’s website the identity and weighting of such security for so long as such security’s trading is halted or otherwise does not have readily available market quotations and remains in the Actual Portfolio.

Authorized Participant Concentration Risk. Only an authorized participant may engage in creation or redemption transactions directly with the fund. The fund may have a limited number of institutions that act as authorized participants, none of which are obligated to engage in creation and/or redemption transactions. To the extent that these institutions exit the business or are unable to proceed with creation and/or redemption orders with respect to the fund and no other authorized participant is able to step forward to process creation and/or redemption orders, fund shares may trade at a discount to NAV and possibly face trading halts and/or delisting. This risk may be more pronounced during periods of market volatility or market disruptions. The fact that the fund is offering a novel and unique structure may affect the number of entities willing to act as authorized participants.

Schwab Ariel ESG ETF | Semiannual Report

Financial Notes, unaudited (continued)

3. Risk Factors (continued):

Tracking Error Risk. Although the Proxy Portfolio is designed to reflect the economic exposure and risk characteristics of the fund’s Actual Portfolio on any given trading day, there is a risk that the performance of the Proxy Portfolio will diverge from the performance of the Actual Portfolio, potentially materially.

Equity Risk. The prices of equity securities rise and fall daily. These price movements may result from factors affecting individual companies, industries or the securities market as a whole. In addition, equity markets tend to move in cycles, which may cause stock prices to fall over short or extended periods of time.

Market Capitalization Risk. Securities issued by companies of different market capitalizations tend to go in and out of favor based on market and economic conditions. During a period when securities of a particular market capitalization fall behind other types of investments, the fund’s performance could be impacted.

Small-Cap Company Risk. Securities issued by small-cap companies may be riskier than those issued by larger companies, and their prices may move sharply, especially during market upturns and downturns.

Mid-Cap Company Risk. Mid-cap companies may be more vulnerable to adverse business or economic events than larger, more established companies and the value of securities issued by these companies may move sharply.

Management Risk. As with all actively managed funds, the fund is subject to the risk that its investment adviser and/or subadviser will select investments or allocate assets in a manner that could cause the fund to underperform or otherwise not meet its investment objective. The fund’s investment adviser and/or subadviser applies its own investment techniques and risk analyses in making investment decisions for the fund, but there can be no guarantee that they will produce the desired results.

ESG Risk. Because the fund considers ESG metrics in addition to fundamental financial metrics when selecting securities, its portfolio may perform differently than funds that do not screen for ESG attributes. Additionally, the criteria used to select companies for investment may result in the fund investing in securities, industries or sectors that underperform the market as a whole. ESG considerations may prioritize long-term rather than short-term returns. Furthermore, when screening securities’ ESG attributes, the portfolio management team utilizes information published by third-party sources and as a result there is a risk that this information might be incorrect, incomplete, inconsistent or incomparable, which could cause the subadviser to incorrectly assess a company’s business practices with respect to its ESG practices. ESG is not a uniformly defined characteristic and applying ESG criteria involves a subjective assessment.

Value Investing Risk. Value investing attempts to identify undervalued companies with characteristics for improved valuations. Securities that exhibit value characteristics tend to perform differently and shift in and out of favor with investors depending on changes in market and economic conditions. As a result, the fund’s performance may at times fall behind the performance of other funds that invest more broadly or in securities that exhibit different characteristics.

Market Risk. Financial markets rise and fall in response to a variety of factors, sometimes rapidly and unpredictably. Markets may be impacted by economic, political, regulatory and other conditions, including economic sanctions and other government actions. In addition, the occurrence of global events, such as war, terrorism, environmental disasters, natural disasters and epidemics, may also negatively affect the financial markets. As with any investment whose performance is tied to these markets, the value of an investment in the fund will fluctuate, which means that an investor could lose money over short or long periods.

Liquidity Risk. The fund may be unable to sell certain securities, such as illiquid securities, readily at a favorable time or price, or the fund may have to sell them at a loss.

Securities Lending Risk. Securities lending involves the risk of loss of rights in, or delay in recovery of, the loaned securities if the borrower fails to return the security loaned or becomes insolvent.

Market Trading Risk. Although fund shares are listed on national securities exchanges, there can be no assurance that an active trading market for fund shares will develop or be maintained. If an active market is not maintained, investors may find it difficult to buy or sell fund shares.

Shares of the Fund May Trade at Prices Other Than NAV. Fund shares may be bought and sold in the secondary market at market prices. Although it is expected that the market price of the shares of the fund will approximate the fund’s NAV, there may be times when the market price and the NAV vary significantly. In addition, due to the fund’s novel and unique structure, shares of the fund may trade at a larger premium or discount to the NAV of shares of traditional ETFs that disclose their portfolio holdings daily. As a result, an investor may pay more than NAV when buying shares of the fund in the secondary market, and an investor may receive less than NAV when selling those shares in the secondary market. The market price of fund shares may deviate, sometimes significantly, from NAV during periods of market disruptions or volatility.

Schwab Ariel ESG ETF | Semiannual Report

Financial Notes, unaudited (continued)

3. Risk Factors (continued):

Please refer to the fund’s prospectus for a more complete description of the principal risks of investing in the fund.

4. Affiliates and Affiliated Transactions:

Investment Adviser

Charles Schwab Investment Management Inc., dba Schwab Asset Management, a wholly owned subsidiary of The Charles Schwab Corporation, serves as the fund’s investment adviser pursuant to the Advisory Agreement between the investment adviser and the trust. Ariel Investments, LLC (Ariel), the fund’s subadviser, provides day-to-day portfolio management services to the fund, subject to the supervision of the investment adviser.

For its advisory services to the fund, the investment adviser is entitled to receive an annual management fee, payable monthly, equal to 0.59% of the fund’s average daily net assets.

The investment adviser (not the fund) pays a portion of the management fee it receives to Ariel in return for its portfolio management services.

Interfund Borrowing and Lending

Pursuant to an exemptive order issued by the SEC, the fund may enter into interfund borrowing and lending transactions with other funds in the Fund Complex (for definition refer to the Trustees and Officers section). All loans are for temporary or emergency purposes and the interest rate to be charged will be the average of the overnight repurchase agreement rate and the short-term bank loan rate. All loans are subject to numerous conditions designed to ensure fair and equitable treatment of all participating funds. The interfund lending facility is subject to the oversight and periodic review of the Board. The fund had no interfund borrowing or lending activity during the period.

5. Other Service Providers:

SEI Investments Distribution Co. is the principal underwriter and distributor of shares of the fund.

State Street Bank and Trust Company (State Street) serves as the fund’s transfer agent. As part of these services, the transfer agent maintains records pertaining to the sale, redemption and transfer of the fund’s shares. The transfer agent is also responsible for the order-taking function for the fund’s shares.

State Street also serves as custodian and accountant for the fund. The custodian is responsible for the daily safekeeping of securities and cash held by the fund. The fund’s accountant maintains all books and records related to the fund’s transactions.

6. Board of Trustees:

The Board may include people who are officers and/or directors of the investment adviser or its affiliates. Federal securities law limits the percentage of such “interested persons” who may serve on a trust’s board, and the trust was in compliance with these limitations throughout the report period. The fund does not pay any interested or non-interested trustees (independent trustees). The independent trustees are paid by the investment adviser. For information regarding the trustees, please refer to the Trustees and Officers table at the end of this report.

7. Borrowing from Banks:

During the period, the fund was a participant with other funds in the Fund Complex in a joint, syndicated, committed $850 million line of credit (the Syndicated Credit Facility), which matured on September 29, 2022. On September 29, 2022, the Syndicated Credit Facility was amended to run for a new 364 day period with the line of credit amount increasing to $1 billion, maturing on September 28, 2023. Under the terms of the Syndicated Credit Facility, in addition to the investment adviser paying the interest charged on any borrowings by the fund, the investment adviser paid a commitment fee of 0.15% per annum on its proportionate share of the unused portion of the Syndicated Credit Facility.

Schwab Ariel ESG ETF | Semiannual Report

Financial Notes, unaudited (continued)

7. Borrowing from Banks (continued):

During the period, the fund was a participant with other funds in the Fund Complex in a joint, unsecured, uncommitted $400 million line of credit (the Uncommitted Credit Facility), with State Street, which matured on September 29, 2022. On September 29, 2022, the Uncommitted Credit Facility was amended to run for a new 364 day period with the line of credit amount remaining unchanged, maturing on September 28, 2023. Under the terms of the Uncommitted Credit Facility, the investment adviser pays interest on the amount the fund borrows. There were no borrowings from either line of credit during the period.

The fund also has access to custodian overdraft facilities. The fund may have utilized the overdraft facility and incurred an interest expense, which is paid by the investment adviser. The interest expense is determined based on a negotiated rate above the current Federal Funds Rate.

8. Purchases and Sales of Investment Securities:

For the period ended September 30, 2022, purchases and sales of securities (excluding in-kind transactions and short-term obligations) were as follows:

PURCHASES

OF SECURITIES | SALES

OF SECURITIES |

| $1,290,462 | $1,008,935 |

9. In-Kind Transactions:

The consideration for the purchase of Creation Units of the fund often consists of the in-kind deposit of a designated portfolio of equity securities, which constitutes an optimized representation of the securities involved in a relevant fund’s underlying index, and an amount of cash. Investors purchasing and redeeming Creation Units are subject to a standard creation transaction fee and a standard redemption transaction fee paid to the custodian to offset transfer and other transaction costs associated with the issuance and redemption of Creation Units. Purchasers and redeemers of Creation Units for cash are subject to an additional variable charge paid to the fund that will offset the transaction costs to the fund of buying or selling portfolio securities. In addition, purchasers and redeemers of shares in Creation Units are responsible for payment of the costs of transferring securities to or out of the fund. From time to time, the investment adviser may cover the cost of any transaction fees when believed to be in the best interests of the fund.

The in-kind transactions for the period ended September 30, 2022, were as follows:

IN-KIND PURCHASES

OF SECURITIES | IN-KIND SALES

OF SECURITIES |

| $2,694,743 | $205,432 |

For the period ended September 30, 2022, the fund realized net capital gains or losses resulting from in-kind redemptions of Creation Units. Because such gains or losses are not taxable to the fund and are not distributed to existing fund shareholders, the gains or losses are reclassified from accumulated net realized gains or losses to capital received from investors at the end of the fund’s tax year. These reclassifications have no effect on net assets or net asset values per share. The net realized in-kind gains or losses on sales of in-kind redemptions for the period ended September 30, 2022 are disclosed in the fund’s Statement of Operations, if any.

10. Federal Income Taxes:

As of September 30, 2022, the tax basis cost of the fund’s investments and gross unrealized appreciation and depreciation were as follows:

| TAX COST | GROSS UNREALIZED

APPRECIATION | GROSS UNREALIZED

DEPRECIATION | NET UNREALIZED

APPRECIATION

(DEPRECIATION) |

| $13,875,418 | $88,080 | ($3,254,747) | ($3,166,667) |

Capital loss carryforwards have no expiration and may be used to offset future realized capital gains for federal income tax purposes. As of March 31, 2022, the fund had capital loss carryforwards of $14,758.

Schwab Ariel ESG ETF | Semiannual Report

Financial Notes, unaudited (continued)

10. Federal Income Taxes (continued):

The tax-basis components of distributions and components of distributable earnings on a tax basis are finalized at fiscal year-end; accordingly, tax basis balances have not been determined as of September 30, 2022. The tax-basis components of distributions paid during the fiscal year ended March 31, 2022 were as follows:

| | PRIOR FISCAL YEAR END DISTRIBUTIONS |

| | ORDINARY

INCOME |

| | $18,371 |

Distributions paid to shareholders are based on net investment income and net realized gains determined on a tax basis, which may differ from net investment income and net realized gains for financial reporting purposes. These differences reflect the differing character of certain income items and net realized gains and losses for financial statement and tax purposes, and may result in reclassification among certain capital accounts on the financial statements. The fund may also designate a portion of the amount paid to redeeming shareholders as a distribution for tax purposes.

As of March 31, 2022, management has reviewed the tax positions for open periods (for federal purposes, three years from the date of filing and for state purposes, four years from the date of filing) as applicable to the fund, and has determined that no provision for income tax is required in the fund’s financial statements. The fund recognizes interest and penalties, if any, related to unrecognized tax benefits as income tax expense in the Statement of Operations. During the period ended March 31, 2022, the fund did not incur any interest or penalties.

11. Subsequent Events:

Management has determined there are no subsequent events or transactions through the date the financial statements were issued that would have materially impacted the financial statements as presented.

Schwab Ariel ESG ETF | Semiannual Report

Shareholder Vote Results (unaudited)

A Special Meeting of Shareholders of Schwab Strategic Trust (the “Trust”) was held on June 1, 2022, for the purpose of seeking shareholder approval to elect the following individuals as trustees of the Trust: Walter W. Bettinger II, Richard A. Wurster, Michael J. Beer, Robert W. Burns, Nancy F. Heller, David L. Mahoney, Jane P. Moncreiff, Kiran M. Patel, Kimberly S. Patmore, and J. Derek Penn. The number of votes necessary to conduct the Special Meeting and approve the proposal was obtained. The results of the shareholder vote are listed below:

Proposal – To elect each of the

following individuals as trustees of the Trust: | For | Withheld |

| Walter W. Bettinger II | 1,707,011,744.958 | 53,766,812.577 |

| Richard A. Wurster | 1,741,778,933.018 | 18,999,624.517 |

| Michael J. Beer | 1,741,911,579.511 | 18,866,978.024 |

| Robert W. Burns | 1,742,002,589.714 | 18,775,967.821 |

| Nancy F. Heller | 1,743,265,288.229 | 17,513,269.306 |

| David L. Mahoney | 1,488,067,807.852 | 272,710,749.683 |

| Jane P. Moncreiff | 1,743,396,670.121 | 17,381,887.414 |

| Kiran M. Patel | 1,738,761,227.827 | 22,017,329.708 |

| Kimberly S. Patmore | 1,740,654,694.664 | 20,123,862.871 |

| J. Derek Penn | 1,739,737,491.136 | 21,041,066.399 |

Schwab Ariel ESG ETF | Semiannual Report

Liquidity Risk Management Program (unaudited)

The fund has adopted and implemented a liquidity risk management program (the “program”) as required by Rule 22e-4 under the Investment Company Act of 1940, as amended. The fund’s Board of Trustees (the “Board”) has designated the fund’s investment adviser, Charles Schwab Investment Management, Inc., dba Schwab Asset Management, as the administrator of the program. Personnel of the investment adviser or its affiliates conduct the day-to-day operation of the program.

Under the program, the investment adviser manages a fund’s liquidity risk, which is the risk that the fund could not meet shareholder redemption requests without significant dilution of remaining shareholders’ interests in the fund. The program is reasonably designed to assess and manage a fund’s liquidity risk, taking into consideration the fund’s investment strategy and the liquidity of its portfolio investments during normal and reasonably foreseeable stressed conditions; its historical redemption history and shareholder concentrations; and its cash holdings and access to other funding sources, including the custodian overdraft facility and lines of credit. The investment adviser’s process of determining the degree of liquidity of each fund’s investments is supported by third-party liquidity assessment vendors.

The fund’s Board reviewed a report at its meeting held on September 19, 2022 prepared by the investment adviser regarding the operation and effectiveness of the program for the period June 1, 2021, through May 31, 2022, which included individual fund liquidity metrics. No significant liquidity events impacting the fund were noted in the report. In addition, the investment adviser provided its assessment that the program had been operating effectively in managing the fund’s liquidity risk.

Schwab Ariel ESG ETF | Semiannual Report

Investment Advisory Agreement Approval

The Investment Company Act of 1940, as amended (the 1940 Act), requires that the continuation of a fund’s investment advisory agreement must be specifically approved (1) by the vote of the trustees or by a vote of the shareholders of the fund, and (2) by the vote of a majority of the trustees who are not parties to the investment advisory agreement or “interested persons” of any party (the Independent Trustees), cast in person at a meeting called for the purpose of voting on such approval. In connection with such approvals, the fund’s trustees must request and evaluate, and the investment adviser is required to furnish, such information as may be reasonably necessary to evaluate the terms of the investment advisory agreement.

The Board of Trustees (the Board or the Trustees, as appropriate) calls and holds one or more meetings each year that are dedicated, in whole or in part, to considering whether to renew the investment advisory agreement between Schwab Strategic Trust (the Trust) and Charles Schwab Investment Management, Inc. (dba Schwab Asset Management) (the investment adviser), and the subadvisory agreement between the investment adviser and Ariel Investments, LLC (Ariel) (such investment advisory and sub-advisory agreements, collectively, the Agreements) with respect to Schwab Ariel ESG ETF (the Fund), and to review certain other agreements pursuant to which the investment adviser provides investment advisory services to other funds in the Trust and certain other registered investment companies. In preparation for the meeting(s), the Board requests and reviews a wide variety of materials provided by the investment adviser and Ariel, including information about their affiliates, personnel, business goals and priorities, profitability, third-party oversight, corporate structure and operations. The Board also receives data provided by an independent provider of investment company data. This information is in addition to the detailed information about the Fund that the Board reviews during the course of each year, including information that relates to the Fund’s operations and performance, legal and compliance matters, risk management, portfolio turnover, and sales and marketing activity. In considering the renewal, the Independent Trustees receive advice from Independent Trustees’ legal counsel, including a memorandum regarding the responsibilities of trustees for the approval of investment advisory agreements. In addition, the Independent Trustees participate in question and answer sessions with representatives of the investment adviser and meet in executive session outside the presence of Fund management.

As part of the renewal process and ongoing oversight of the investment advisory and sub-advisory relationships, the Independent Trustees’ legal counsel, on behalf of the Independent Trustees, sends an information request letter to the investment adviser and the investment adviser sends an information request letter to Ariel seeking certain relevant

information. The responses by the investment adviser and Ariel are provided to the Trustees in the Board materials for their review prior to their meeting, and the Trustees are provided with the opportunity to request any additional materials.

The Board, including a majority of the Independent Trustees, considered information specifically relating to the continuance of the Agreements with respect to the Fund at meetings held on May 16, 2022 and June 8, 2022, and approved the renewal of the Agreements with respect to the Fund for an additional one-year term at the meeting on June 8, 2022 called for the purpose of voting on such approval.

The Board’s approval of the continuance of the Agreements was based on consideration and evaluation of a variety of specific factors discussed at these meetings and at prior meetings, including:

| 1. | the nature, extent and quality of the services provided to the Fund under the Agreements, including the resources of the investment adviser and its affiliates, and Ariel, dedicated to the Fund; |

| 2. | the Fund’s limited investment performance; |

| 3. | the Fund’s expenses and how those expenses compared to those of certain other similar exchange-traded funds; |

| 4. | the profitability of the investment adviser and its affiliates, including Charles Schwab & Co., Inc. (Schwab), with respect to the Fund, including both direct and indirect benefits accruing to the investment adviser and its affiliates, as well as the profitability of Ariel; and |

| 5. | the extent to which economies of scale would be realized as the Fund grows and whether fee levels in the Agreements reflect those economies of scale for the benefit of Fund investors. |

Nature, Extent and Quality of Services. The Board considered the nature, extent and quality of the services provided to the Fund and the resources of the investment adviser and its affiliates and Ariel dedicated to the Fund. In this regard, the Trustees evaluated, among other things, the investment adviser’s and Ariel’s experience, track record, compliance program, resources dedicated to hiring and retaining skilled personnel and specialized talent, and information security resources. The Trustees also considered information provided by the investment adviser and Ariel relating to services and support provided with respect to the Fund’s portfolio management team, portfolio strategy, and internal investment guidelines, as well as trading infrastructure, liquidity management, product design and analysis, shareholder communications, securities valuation, fund accounting and custody, and vendor and risk oversight. The Trustees also considered investments the investment adviser has made in its infrastructure, including modernizing the investment adviser’s

Schwab Ariel ESG ETF | Semiannual Report

technology and use of data, increasing expertise in key areas (including portfolio management and trade operations), and improving business continuity, cybersecurity, due diligence, risk management processes, and information security programs, which are designed to provide enhanced services to the Fund and its shareholders. The Trustees considered Schwab’s overall financial condition and its reputation as a full service brokerage firm, as well as the wide range of products, services and account features that benefit Fund shareholders who are brokerage clients of Schwab. Following such evaluation, the Board concluded, within the context of its full deliberations, that the nature, extent and quality of services provided by the investment adviser and Ariel to the Fund and the resources of the investment adviser and its affiliates and Ariel supported renewal of the Agreements with respect to the Fund.

Fund Performance. The Board considered that the Fund commenced operations on November 16, 2021 and therefore had less than one year of performance history available.