UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSRS

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-22311

Schwab Strategic Trust – Schwab U.S. Equity ETFs, Schwab International Equity ETFs and Schwab High Yield Bond ETF

(Exact name of registrant as specified in charter)

211 Main Street, San Francisco, California 94105

(Address of principal executive offices) (Zip code)

Omar Aguilar

Schwab Strategic Trust

211 Main Street, San Francisco, California 94105

(Name and address of agent for service)

Registrant’s telephone number, including area code: (415) 636-7000

Date of fiscal year end: August 31

Date of reporting period: February 29, 2024

Item 1: Report(s) to Shareholders.

Semiannual Report | February 29, 2024

Schwab International Equity ETFs

Schwab International Dividend Equity ETF | |

Schwab International Equity ETF | |

Schwab International Small-Cap Equity ETF | |

Schwab Emerging Markets Equity ETF | |

No Action Required – Notice Regarding Shareholder Report Delivery |

Beginning on July 24, 2024, fund shareholder reports will be streamlined to highlight key information deemed important for investors to assess and monitor their fund investments. Other information, including financial statements, will not appear in the streamlined shareholder reports but will available online and delivered free of charge upon request. |

• If you already receive the full shareholder reports, you will receive the streamlined shareholder reports in the same way that you currently receive the full shareholder reports (either in paper or electronically). |

• If you currently receive a notification when a shareholder report is available on a fund’s website, beginning July 24, 2024, you will begin to receive the streamlined shareholder report (in paper). |

This page is intentionally left blank.

Fund investment adviser: Charles Schwab Investment Management, Inc., dba Schwab Asset Management®

Distributor: SEI Investments Distribution Co. (SIDCO)

The Sector/Industry classifications in this report use the Global Industry Classification Standard (GICS) which was developed by and is the exclusive property of MSCI Inc. (MSCI) and Standard & Poor’s (S&P). GICS is a service mark of MSCI and S&P and has been licensed for use by Charles Schwab & Co., Inc.

Schwab International Equity ETFs | Semiannual Report1

Schwab International Equity ETFs

The performance data quoted represents past performance. Past performance does not guarantee future results. Investment returns and principal value of an investment will fluctuate so that an investor’s shares, when sold or redeemed, may be worth more or less than the original cost. Current performance may be lower or higher than the performance data quoted. To obtain performance information current to the most recent month end, please visit www.schwabassetmanagement.com/schwabetfs_prospectus.

Total Returns for the 6 Months Ended February 29, 2024 |

Schwab International Dividend Equity ETF (Ticker Symbol: SCHY) | |

| |

| |

MSCI EAFE® Index (Net)2,3 | |

Dow Jones International Dividend 100 Index (Net)2 | |

ETF Category: Morningstar Foreign Large Value4 | |

| |

| |

Schwab International Equity ETF (Ticker Symbol: SCHF) | |

| |

| |

MSCI EAFE® Index (Net)2,3 | |

FTSE Developed ex US Index (Net)2 | |

ETF Category: Morningstar Foreign Large Blend4 | |

| |

Total Returns for the 6 Months Ended February 29, 2024 |

Schwab International Small-Cap Equity ETF (Ticker Symbol: SCHC) | |

| |

| |

MSCI EAFE® Index (Net)2,3 | |

FTSE Developed Small Cap ex US Liquid Index (Net)2 | |

ETF Category: Morningstar Foreign Small/Mid Blend4 | |

| |

| |

Schwab Emerging Markets Equity ETF (Ticker Symbol: SCHE) | |

| |

| |

MSCI Emerging Markets Index (Net)2,5 | |

FTSE Emerging Index (Net)2 | |

ETF Category: Morningstar Diversified Emerging Markets4 | |

| |

All total returns on this page assume dividends and distributions were reinvested. Index figures do not include trading and management costs, which would lower performance. Indices are unmanaged and cannot be invested in directly. Performance results less than one year are not annualized.

For index definitions, please see the Glossary.

Performance does not reflect the deduction of taxes that a shareholder would pay on fund distributions or on the redemption or sale of fund shares.

Shares are bought and sold at market price, which may be higher or lower than the net asset value (NAV). Brokerage commissions will reduce returns.

Index ownership — Dow Jones® is a registered trademark of Dow Jones Trademark Holdings LLC (Dow Jones). The Dow Jones International Dividend 100 Index is a product of S&P Dow Jones Indices LLC and/or its affiliates, and has been licensed for use by Charles Schwab Investment Management, Inc., dba Schwab Asset Management. The Schwab International Dividend Equity ETF is not sponsored, endorsed, sold or promoted by S&P Dow Jones Indices LLC, Dow Jones, or any of their respective affiliates and neither S&P Dow Jones Indices LLC, Dow Jones, nor any of their respective affiliates make any representation regarding the advisability of investing in such product.

Index ownership — FTSE is a trademark of the London Stock Exchange Group companies (LSEG) and is used by the Schwab International Equity ETF, Schwab International Small-Cap Equity ETF, and Schwab Emerging Markets Equity ETF under license. The Schwab International Equity ETF, Schwab International Small-Cap Equity ETF, and Schwab Emerging Markets Equity ETF are not sponsored, endorsed, sold or promoted by FTSE nor LSEG and neither FTSE nor LSEG makes any representation regarding the advisability of investing in shares of the funds. Fees payable under the license are paid by the investment adviser.

1

ETF performance must be shown based on both a market price and NAV basis. The fund’s per share NAV is the value of one share of the fund. NAV is calculated by taking the fund’s total assets (including the fair value of securities owned), subtracting liabilities, and dividing by the number of shares outstanding. The NAV Return is based on the NAV of the fund, and the Market Price Return is based on the market price per share of the fund. The price used to calculate market return (Market Price) is determined using the Official Closing Price on the primary stock exchange (generally, 4:00 p.m. Eastern time) and may not represent the returns you would receive if shares were traded at other times. Market Price and NAV returns assume that dividends and capital gain distributions have been reinvested in the fund at Market Price and NAV, respectively.

2

The net version of the index reflects reinvested dividends net of withholding taxes but reflects no deductions for expenses or other taxes.

3

In anticipation of new regulatory requirements, the fund’s regulatory index has changed to the MSCI EAFE® Index (Net). The MSCI EAFE® Index (Net) provides a broad measure of market performance. The fund generally invests in securities that are included in the second index listed. The fund does not seek to track the regulatory index.

4

Source for category information: Morningstar, Inc. The Morningstar Category return represents all passively- and actively-managed ETFs and mutual funds within the category as of the report date.

5

In anticipation of new regulatory requirements, the fund’s regulatory index has changed to the MSCI Emerging Markets Index (Net). The MSCI Emerging Markets Index (Net) provides a broad measure of market performance. The fund generally invests in securities that are included in the second index listed. The fund does not seek to track the regulatory index.

2Schwab International Equity ETFs | Semiannual Report

Schwab International Equity ETFs

Fund Management

| Christopher Bliss, CFA, Managing Director and Head of Passive Equity Strategies for Schwab Asset Management, is responsible for overseeing the investment process and portfolio management of investment strategies for passive equity Schwab Funds and Schwab ETFs, and Schwab Personalized Indexing™ separately managed accounts. Before joining Schwab in 2016, Mr. Bliss spent 12 years at BlackRock (formerly Barclays Global Investors) managing and leading institutional index teams, most recently as a managing director and the head of the Americas institutional index team. In this role, Mr. Bliss was responsible for overseeing a team of portfolio managers managing domestic, developed international and emerging markets index strategies. Prior to BlackRock, he worked as an equity analyst and portfolio manager for Harris Bretall and before that, as a research analyst for JP Morgan. |

| Joselle Duncan, CFA, Portfolio Manager for Schwab Asset Management, is responsible for the day-to-day co-management of the funds. Prior to joining Schwab in 2022, Ms. Duncan worked at BlackRock, Inc. for over 20 years as a vice president and portfolio manager focused on international ETFs. Before that, she held several positions at Blackrock (formerly Barclays Global Investors) including portfolio manager for institutional and mutual funds, securities lending trader, and securities lending product specialist. |

| Jiwei Gu, CFA, Portfolio Manager for Schwab Asset Management, is responsible for the day-to-day co-management of the funds. Ms. Gu joined the portfolio management team as an associate portfolio manager in 2018. Prior to joining Schwab, she spent four years at CoBank, most recently as an enterprise risk analyst performing bank-level loan portfolio credit risk analysis, data analytics, and risk management methodology research. Before that, Ms. Gu worked in commercial credit underwriting and capital markets supporting lending activities. |

| David Rios, Portfolio Manager for Schwab Asset Management, is responsible for the day-to-day co-management of the funds. Prior to this role, Mr. Rios was an associate portfolio manager on the equity index strategies team for four years. His first role with Schwab Asset Management was as a trade operations specialist. Prior to joining Schwab in 2008, Mr. Rios was a senior fund accountant at Investors Bank & Trust (subsequently acquired by State Street Corporation). |

Schwab International Equity ETFs | Semiannual Report3

Schwab International Dividend Equity ETF

The performance data quoted represents past performance. Past performance does not guarantee future results. Investment returns and principal value of an investment will fluctuate so that an investor’s shares, when sold or redeemed, may be worth more or less than the original cost. Current performance may be lower or higher than the performance data quoted. To obtain performance information current to the most recent month end, please visit www.schwabassetmanagement.com/schwabetfs_prospectus.

Average Annual Total Returns1

| | | |

Fund: Schwab International Dividend Equity ETF (4/29/21) | | | |

| | | |

| | | |

MSCI EAFE® Index (Net)3,4 | | | |

Dow Jones International Dividend 100 Index (Net)3 | | | |

ETF Category: Morningstar Foreign Large Value5 | | | |

Fund Expense Ratio6: 0.14% |

All total returns on this page assume dividends and distributions were reinvested. Index figures do not include trading and management costs, which would lower performance. Indices are unmanaged and cannot be invested in directly. Performance results less than one year are not annualized.

For index definitions, please see the Glossary.

Shares are bought and sold at market price, which may be higher or lower than the net asset value (NAV). Brokerage commissions will reduce returns.

International investing may involve risk of capital loss from unfavorable fluctuations in currency values, from differences in generally accepted accounting principles, or from economic or political instability in other nations.

Emerging markets involve heightened risks related to the same factors as international investing, as well as increased volatility and lower trading volume.

The fund may underperform other funds that do not limit their investment to dividend paying stocks. Stocks held by the fund may reduce or stop paying dividends, affecting the fund’s ability to generate income. Diversification strategies do not ensure a profit and do not protect against losses in declining markets.

Index ownership — Dow Jones® is a registered trademark of Dow Jones Trademark Holdings LLC (Dow Jones). The Dow Jones International Dividend 100 Index is a product of S&P Dow Jones Indices LLC and/or its affiliates, and has been licensed for use by Charles Schwab Investment Management, Inc., dba Schwab Asset Management. The Schwab International Dividend Equity ETF is not sponsored, endorsed, sold or promoted by S&P Dow Jones Indices LLC, Dow Jones, or any of their respective affiliates and neither S&P Dow Jones Indices LLC, Dow Jones, nor any of their respective affiliates make any representation regarding the advisability of investing in such product.

*

Inception (4/29/21) represents the date that the shares began trading in the secondary market.

1

Performance does not reflect the deduction of taxes that a shareholder would pay on fund distributions or on the redemption or sale of fund shares.

2

ETF performance must be shown based on both a market price and NAV basis. The fund’s per share NAV is the value of one share of the fund. NAV is calculated by taking the fund’s total assets (including the fair value of securities owned), subtracting liabilities, and dividing by the number of shares outstanding. The NAV Return is based on the NAV of the fund, and the Market Price Return is based on the market price per share of the fund. The price used to calculate market return (Market Price) is determined using the Official Closing Price on the primary stock exchange (generally, 4:00 p.m. Eastern time) and may not represent the returns you would receive if shares were traded at other times. NAV is used as a proxy for purposes of calculating Market Price Return on inception date. Market Price and NAV returns assume that dividends and capital gain distributions have been reinvested in the fund at Market Price and NAV, respectively.

3

The net version of the index reflects reinvested dividends net of withholding taxes but reflects no deductions for expenses or other taxes.

4

In anticipation of new regulatory requirements, the fund’s regulatory index has changed from the Dow Jones International Dividend 100 Index (Net) to the MSCI EAFE® Index (Net). The MSCI EAFE® Index (Net) provides a broad measure of market performance. The fund generally invests in securities that are included in the Dow Jones International Dividend 100 Index (Net). The fund does not seek to track the regulatory index.

5

Source for category information: Morningstar, Inc. The Morningstar Category return represents all passively- and actively-managed ETFs and mutual funds within the category as of the report date.

6

As stated in the prospectus.

4Schwab International Equity ETFs | Semiannual Report

Schwab International Dividend Equity ETF

Performance and Fund Facts as of February 29, 2024

| |

Weighted Average Market Cap (millions) | |

Price/Earnings Ratio (P/E) | |

| |

| |

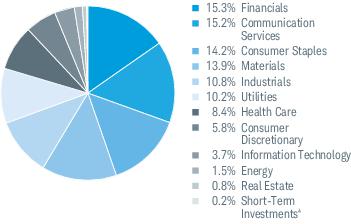

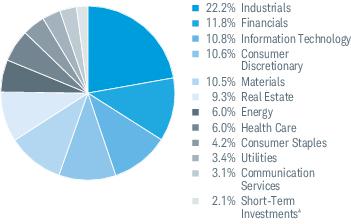

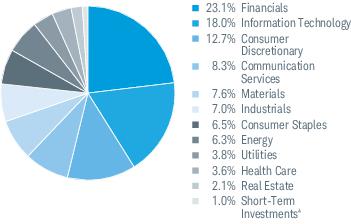

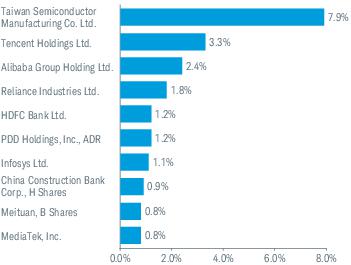

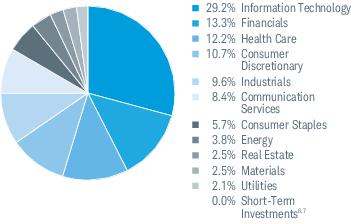

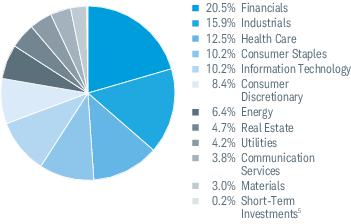

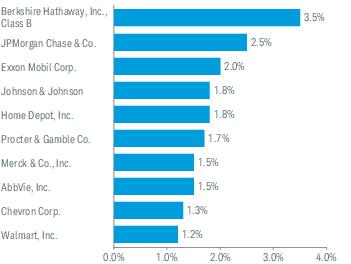

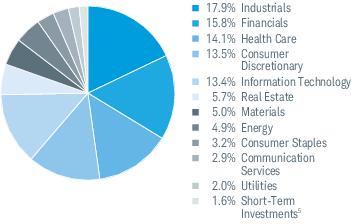

Sector Weightings % of Investments1

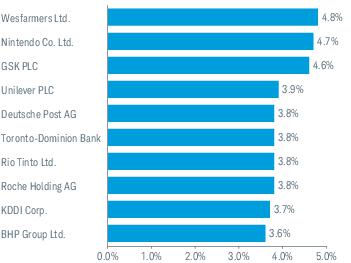

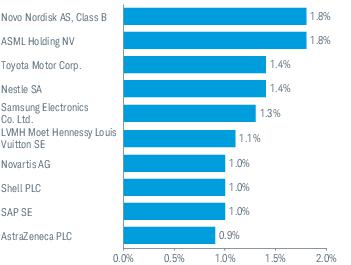

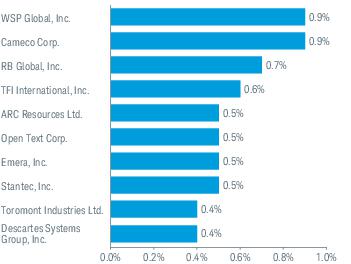

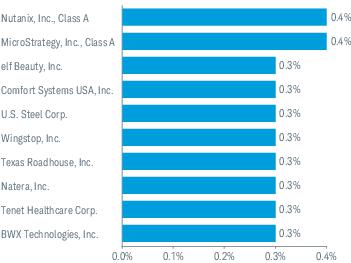

Top Equity Holdings % of Net Assets5

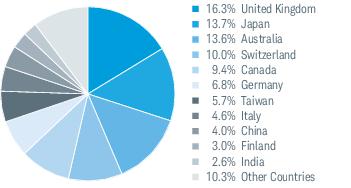

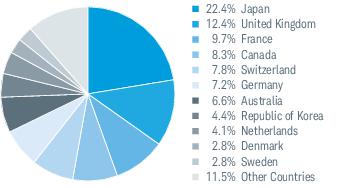

Country Weightings % of Investments6

Portfolio holdings may have changed since the report date.

An index is a statistical composite of a specified financial market or sector. Unlike the fund, an index does not actually hold a portfolio of securities and its return is not inclusive of trading and management costs incurred by the fund.

Source of Sector Classification: S&P and MSCI.

3

Portfolio turnover rate excludes securities received or delivered from processing of in-kind creations or redemptions.

4

Includes the fund’s position(s) in money market mutual funds registered under the Investment Company Act of 1940, as amended.

5

This list is not a recommendation of any security by the investment adviser.

6

The percentage may differ from the Portfolio Holdings because the above calculation is based on a percentage of total investments, excluding derivatives, whereas the calculation in the Portfolio Holdings is based on a percentage of net assets.

Schwab International Equity ETFs | Semiannual Report5

Schwab International Equity ETF

The performance data quoted represents past performance. Past performance does not guarantee future results. Investment returns and principal value of an investment will fluctuate so that an investor’s shares, when sold or redeemed, may be worth more or less than the original cost. Current performance may be lower or higher than the performance data quoted. To obtain performance information current to the most recent month end, please visit www.schwabassetmanagement.com/schwabetfs_prospectus.

Average Annual Total Returns1

| | | | |

Fund: Schwab International Equity ETF (11/3/09) | | | | |

| | | | |

| | | | |

MSCI EAFE® Index (Net)3,4 | | | | |

FTSE Developed ex US Index (Net)3 | | | | |

ETF Category: Morningstar Foreign Large Blend5 | | | | |

Fund Expense Ratio6: 0.06% |

All total returns on this page assume dividends and distributions were reinvested. Index figures do not include trading and management costs, which would lower performance. Indices are unmanaged and cannot be invested in directly. Performance results less than one year are not annualized.

For index definitions, please see the Glossary.

Shares are bought and sold at market price, which may be higher or lower than the net asset value (NAV). Brokerage commissions will reduce returns.

International investing may involve risk of capital loss from unfavorable fluctuations in currency values, from differences in generally accepted accounting principles, or from economic or political instability in other nations.

Index ownership — FTSE is a trademark of the London Stock Exchange Group companies (LSEG) and is used by the fund under license. The Schwab International Equity ETF is not sponsored, endorsed, sold or promoted by FTSE nor LSEG and neither FTSE nor LSEG makes any representation regarding the advisability of investing in shares of the fund. Fees payable under the license are paid by the investment adviser.

1

Performance does not reflect the deduction of taxes that a shareholder would pay on fund distributions or on the redemption or sale of fund shares.

2

ETF performance must be shown based on both a market price and NAV basis. The fund’s per share NAV is the value of one share of the fund. NAV is calculated by taking the fund’s total assets (including the fair value of securities owned), subtracting liabilities, and dividing by the number of shares outstanding. The NAV Return is based on the NAV of the fund, and the Market Price Return is based on the market price per share of the fund. The price used to calculate market return (Market Price) is determined using the Official Closing Price on the primary stock exchange (generally, 4:00 p.m. Eastern time) and may not represent the returns you would receive if shares were traded at other times. NAV is used as a proxy for purposes of calculating Market Price Return on inception date. Market Price and NAV returns assume that dividends and capital gain distributions have been reinvested in the fund at Market Price and NAV, respectively.

3

The net version of the index reflects reinvested dividends net of withholding taxes but reflects no deductions for expenses or other taxes.

4

In anticipation of new regulatory requirements, the fund’s regulatory index has changed from the FTSE Developed ex US Index (Net) to the MSCI EAFE® Index (Net). The MSCI EAFE® Index (Net) provides a broad measure of market performance. The fund generally invests in securities that are included in the FTSE Developed ex US Index (Net). The fund does not seek to track the regulatory index.

5

Source for category information: Morningstar, Inc. The Morningstar Category return represents all passively- and actively-managed ETFs and mutual funds within the category as of the report date.

6

As stated in the prospectus.

6Schwab International Equity ETFs | Semiannual Report

Schwab International Equity ETF

Performance and Fund Facts as of February 29, 2024

| |

Weighted Average Market Cap (millions) | |

Price/Earnings Ratio (P/E) | |

| |

| |

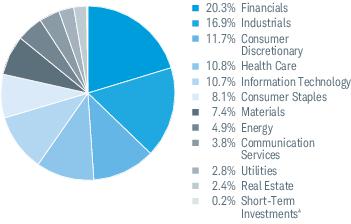

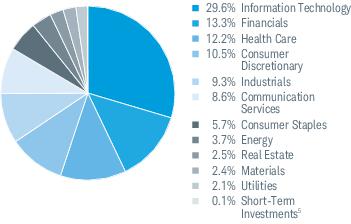

Sector Weightings % of Investments1

Top Equity Holdings % of Net Assets5

Country Weightings % of Investments6

Portfolio holdings may have changed since the report date.

An index is a statistical composite of a specified financial market or sector. Unlike the fund, an index does not actually hold a portfolio of securities and its return is not inclusive of trading and management costs incurred by the fund.

Source of Sector Classification: S&P and MSCI.

3

Portfolio turnover rate excludes securities received or delivered from processing of in-kind creations or redemptions.

4

Includes the fund’s position(s) in money market mutual funds registered under the Investment Company Act of 1940, as amended.

5

This list is not a recommendation of any security by the investment adviser.

6

The percentage may differ from the Portfolio Holdings because the above calculation is based on a percentage of total investments, excluding derivatives, whereas the calculation in the Portfolio Holdings is based on a percentage of net assets.

Schwab International Equity ETFs | Semiannual Report7

Schwab International Small-Cap Equity ETF

The performance data quoted represents past performance. Past performance does not guarantee future results. Investment returns and principal value of an investment will fluctuate so that an investor’s shares, when sold or redeemed, may be worth more or less than the original cost. Current performance may be lower or higher than the performance data quoted. To obtain performance information current to the most recent month end, please visit www.schwabassetmanagement.com/schwabetfs_prospectus.

Average Annual Total Returns1

| | | | |

Fund: Schwab International Small-Cap Equity ETF (1/14/10) | | | | |

| | | | |

| | | | |

MSCI EAFE® Index (Net)3,4 | | | | |

FTSE Developed Small Cap ex US Liquid Index (Net)3 | | | | |

ETF Category: Morningstar Foreign Small/Mid Blend5 | | | | |

Fund Expense Ratio6: 0.11% |

All total returns on this page assume dividends and distributions were reinvested. Index figures do not include trading and management costs, which would lower performance. Indices are unmanaged and cannot be invested in directly. Performance results less than one year are not annualized.

For index definitions, please see the Glossary.

Shares are bought and sold at market price, which may be higher or lower than the net asset value (NAV). Brokerage commissions will reduce returns.

International investing may involve risk of capital loss from unfavorable fluctuations in currency values, from differences in generally accepted accounting principles, or from economic or political instability in other nations.

Small-company stocks may be subject to greater volatility than many other asset classes.

Index ownership — FTSE is a trademark of the London Stock Exchange Group companies (LSEG) and is used by the fund under license. The Schwab International Small-Cap Equity ETF is not sponsored, endorsed, sold or promoted by FTSE nor LSEG and neither FTSE nor LSEG makes any representation regarding the advisability of investing in shares of the fund. Fees payable under the license are paid by the investment adviser.

1

Performance does not reflect the deduction of taxes that a shareholder would pay on fund distributions or on the redemption or sale of fund shares.

2

ETF performance must be shown based on both a market price and NAV basis. The fund’s per share NAV is the value of one share of the fund. NAV is calculated by taking the fund’s total assets (including the fair value of securities owned), subtracting liabilities, and dividing by the number of shares outstanding. The NAV Return is based on the NAV of the fund, and the Market Price Return is based on the market price per share of the fund. The price used to calculate market return (Market Price) is determined using the Official Closing Price on the primary stock exchange (generally, 4:00 p.m. Eastern time) and may not represent the returns you would receive if shares were traded at other times. NAV is used as a proxy for purposes of calculating Market Price Return on inception date. Market Price and NAV returns assume that dividends and capital gain distributions have been reinvested in the fund at Market Price and NAV, respectively.

3

The net version of the index reflects reinvested dividends net of withholding taxes but reflects no deductions for expenses or other taxes.

4

In anticipation of new regulatory requirements, the fund’s regulatory index has changed from the FTSE Developed Small Cap ex US Liquid Index (Net) to the MSCI EAFE® Index (Net). The MSCI EAFE® Index (Net) provides a broad measure of market performance. The fund generally invests in securities that are included in the FTSE Developed Small Cap ex US Liquid Index (Net). The fund does not seek to track the regulatory index.

5

Source for category information: Morningstar, Inc. The Morningstar Category return represents all passively- and actively-managed ETFs and mutual funds within the category as of the report date.

6

As stated in the prospectus.

8Schwab International Equity ETFs | Semiannual Report

Schwab International Small-Cap Equity ETF

Performance and Fund Facts as of February 29, 2024

| |

Weighted Average Market Cap (millions) | |

Price/Earnings Ratio (P/E) | |

| |

| |

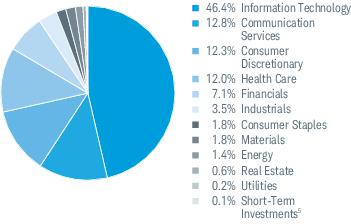

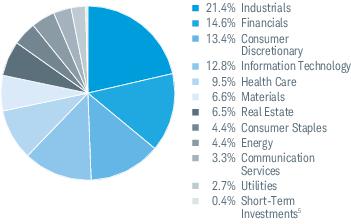

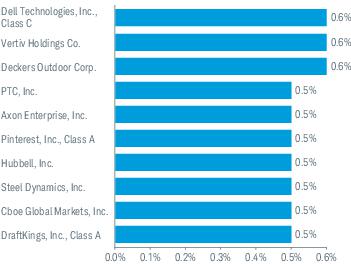

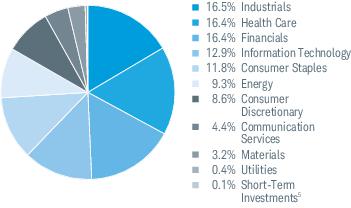

Sector Weightings % of Investments1

Top Equity Holdings % of Net Assets5

Country Weightings % of Investments6

Portfolio holdings may have changed since the report date.

An index is a statistical composite of a specified financial market or sector. Unlike the fund, an index does not actually hold a portfolio of securities and its return is not inclusive of trading and management costs incurred by the fund.

Source of Sector Classification: S&P and MSCI.

3

Portfolio turnover rate excludes securities received or delivered from processing of in-kind creations or redemptions.

4

Includes the fund’s position(s) in money market mutual funds registered under the Investment Company Act of 1940, as amended.

5

This list is not a recommendation of any security by the investment adviser.

6

The percentage may differ from the Portfolio Holdings because the above calculation is based on a percentage of total investments, excluding derivatives, whereas the calculation in the Portfolio Holdings is based on a percentage of net assets.

Schwab International Equity ETFs | Semiannual Report9

Schwab Emerging Markets Equity ETF

The performance data quoted represents past performance. Past performance does not guarantee future results. Investment returns and principal value of an investment will fluctuate so that an investor’s shares, when sold or redeemed, may be worth more or less than the original cost. Current performance may be lower or higher than the performance data quoted. To obtain performance information current to the most recent month end, please visit www.schwabassetmanagement.com/schwabetfs_prospectus.

Average Annual Total Returns1

| | | | |

Fund: Schwab Emerging Markets Equity ETF (1/14/10) | | | | |

| | | | |

| | | | |

MSCI Emerging Markets Index (Net)3,4 | | | | |

FTSE Emerging Index (Net)3 | | | | |

ETF Category: Morningstar Diversified Emerging Markets5 | | | | |

Fund Expense Ratio6: 0.11% |

All total returns on this page assume dividends and distributions were reinvested. Index figures do not include trading and management costs, which would lower performance. Indices are unmanaged and cannot be invested in directly. Performance results less than one year are not annualized.

For index definitions, please see the Glossary.

Shares are bought and sold at market price, which may be higher or lower than the net asset value (NAV). Brokerage commissions will reduce returns.

International investing may involve risk of capital loss from unfavorable fluctuations in currency values, from differences in generally accepted accounting principles, or from economic or political instability in other nations.

Emerging markets involve heightened risks related to the same factors as international investing, as well as increased volatility and lower trading volume.

Index ownership — FTSE is a trademark of the London Stock Exchange Group companies (LSEG) and is used by the fund under license. The Schwab Emerging Markets Equity ETF is not sponsored, endorsed, sold or promoted by FTSE nor LSEG and neither FTSE nor LSEG makes any representation regarding the advisability of investing in shares of the fund. Fees payable under the license are paid by the investment adviser.

1

Performance does not reflect the deduction of taxes that a shareholder would pay on fund distributions or on the redemption or sale of fund shares.

2

ETF performance must be shown based on both a market price and NAV basis. The fund’s per share NAV is the value of one share of the fund. NAV is calculated by taking the fund’s total assets (including the fair value of securities owned), subtracting liabilities, and dividing by the number of shares outstanding. The NAV Return is based on the NAV of the fund, and the Market Price Return is based on the market price per share of the fund. The price used to calculate market return (Market Price) is determined using the Official Closing Price on the primary stock exchange (generally, 4:00 p.m. Eastern time) and may not represent the returns you would receive if shares were traded at other times. NAV is used as a proxy for purposes of calculating Market Price Return on inception date. Market Price and NAV returns assume that dividends and capital gain distributions have been reinvested in the fund at Market Price and NAV, respectively.

3

The net version of the index reflects reinvested dividends net of withholding taxes but reflects no deductions for expenses or other taxes.

4

In anticipation of new regulatory requirements, the fund’s regulatory index has changed from the FTSE Emerging Index (Net) to the MSCI Emerging Markets Index (Net). The MSCI Emerging Markets Index (Net) provides a broad measure of market performance. The fund generally invests in securities that are included in the FTSE Emerging Index (Net). The fund does not seek to track the regulatory index.

5

Source for category information: Morningstar, Inc. The Morningstar Category return represents all passively- and actively-managed ETFs and mutual funds within the category as of the report date.

6

As stated in the prospectus.

10Schwab International Equity ETFs | Semiannual Report

Schwab Emerging Markets Equity ETF

Performance and Fund Facts as of February 29, 2024

| |

Weighted Average Market Cap (millions) | |

Price/Earnings Ratio (P/E) | |

| |

| |

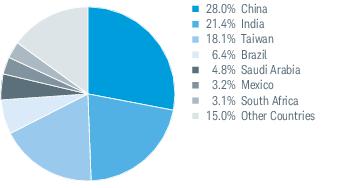

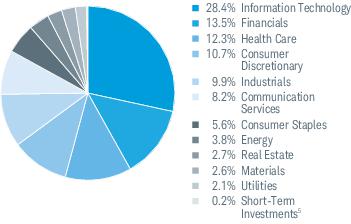

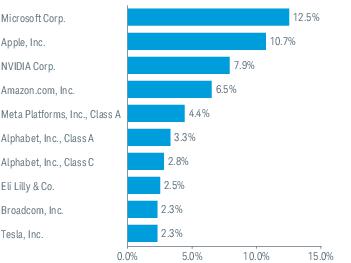

Sector Weightings % of Investments1

Top Equity Holdings % of Net Assets5

Country Weightings % of Investments6

Portfolio holdings may have changed since the report date.

An index is a statistical composite of a specified financial market or sector. Unlike the fund, an index does not actually hold a portfolio of securities and its return is not inclusive of trading and management costs incurred by the fund.

Source of Sector Classification: S&P and MSCI.

3

Portfolio turnover rate excludes securities received or delivered from processing of in-kind creations or redemptions.

4

Includes the fund’s position(s) in money market mutual funds registered under the Investment Company Act of 1940, as amended.

5

This list is not a recommendation of any security by the investment adviser.

6

The percentage may differ from the Portfolio Holdings because the above calculation is based on a percentage of total investments, excluding derivatives, whereas the calculation in the Portfolio Holdings is based on a percentage of net assets.

Schwab International Equity ETFs | Semiannual Report11

Schwab International Equity ETFs

Fund Expenses (Unaudited)

Examples for a $1,000 Investment

As a fund shareholder, you may incur two types of costs: (1) transaction costs, including brokerage commissions on purchases and sales of fund shares; and, (2) ongoing costs, including management fees.

The expense examples below are intended to help you understand your ongoing cost (in dollars) of investing in a fund and to compare this cost with the ongoing cost of investing in other mutual funds. These examples are based on an investment of $1,000 invested for six months beginning September 1, 2023 and held through February 29, 2024.

Actual Return lines in the table below provide information about actual account values and actual expenses. You may use this information, together with the amount you invested, to estimate the expenses that you paid over the period. To do so, simply divide your account value by $1,000 (for example, an $8,600 account value ÷ $1,000 = 8.6), then multiply the result by the number given for your fund under the heading entitled “Expenses Paid During Period.”

Hypothetical Return lines in the table below provide information about hypothetical account values and hypothetical expenses based on a fund’s actual expense ratio and an assumed return of 5% per year before expenses. Because the return used is not an actual return, it may not be used to estimate the actual ending account value or expenses you paid for the period.

You may use this information to compare the ongoing costs of investing in a fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, including any brokerage commissions you may pay when purchasing or selling shares of a fund. Therefore, the hypothetical return lines of the table are useful in comparing ongoing costs only and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

| | BEGINNING

ACCOUNT VALUE

AT 9/1/23 | ENDING

ACCOUNT VALUE

(NET OF EXPENSES)

AT 2/29/24 | EXPENSES PAID

DURING PERIOD

|

Schwab International Dividend Equity ETF | | | | |

| | | | |

| | | | |

Schwab International Equity ETF | | | | |

| | | | |

| | | | |

Schwab International Small-Cap Equity ETF | | | | |

| | | | |

| | | | |

Schwab Emerging Markets Equity ETF | | | | |

| | | | |

| | | | |

| Based on the most recent six-month expense ratio. |

| Expenses for each fund are equal to its annualized expense ratio, multiplied by the average account value over the period, multiplied by 182 days in the period, and divided by 366 days in the fiscal year. |

12Schwab International Equity ETFs | Semiannual Report

Schwab International Dividend Equity ETF

Financial Statements

| | | | | | |

|

Net asset value at beginning of period | | | | | | |

Income (loss) from investment operations: | | | | | | |

Net investment income (loss)2 | | | | | | |

Net realized and unrealized gains (losses) | | | | | | |

Total from investment operations | | | | | | |

| | | | | | |

Distributions from net investment income | | | | | | |

Net asset value at end of period | | | | | | |

| | | | | | |

|

Ratios to average net assets: | | | | | | |

| | | | | | |

Net investment income (loss) | | | | | | |

| | | | | | |

Net assets, end of period (x 1,000) | | | | | | |

| |

| Commencement of operations. |

| Calculated based on the average shares outstanding during the period. |

| |

| |

| Ratio includes less than 0.005% of non-routine proxy expenses. |

| Portfolio turnover rate excludes securities received or delivered from processing of in-kind creations or redemptions. |

Schwab International Equity ETFs | Semiannual Report13

Schwab International Dividend Equity ETF

Portfolio Holdings as of February 29, 2024 (Unaudited)

This section shows all the securities in the fund’s portfolio and their values as of the report date.

The fund files its complete schedule of portfolio holdings with the U.S. Securities and Exchange Commission (SEC) for the first and third quarters of each fiscal year on Form N-PORT Part F. The fund’s Form N-PORT Part F is available on the SEC’s website at www.sec.gov. You can also obtain this information at no cost on the fund’s website at www.schwabassetmanagement.com/schwabetfs_prospectus, by calling 1-866-414-6349, or by sending an email request to orders@mysummaryprospectus.com. The fund also makes available its complete schedule of portfolio holdings on a daily basis on the fund’s website.

| | |

COMMON STOCKS 99.4% OF NET ASSETS |

|

|

| | |

| | |

| | |

Harvey Norman Holdings Ltd. | | |

| | |

| | |

| | |

|

|

| | |

|

|

| | |

| | |

| | |

| | |

| | |

| | |

| | |

|

|

Anhui Conch Cement Co. Ltd., H Shares | | |

China Construction Bank Corp., H Shares | | |

China Life Insurance Co. Ltd., H Shares | | |

China Shenhua Energy Co. Ltd., H Shares | | |

People's Insurance Co. Group of China Ltd., H Shares | | |

PICC Property & Casualty Co. Ltd., H Shares | | |

Tingyi Cayman Islands Holding Corp. | | |

| | |

|

|

| | |

| | |

| | |

| | |

|

|

| | |

| | |

| | |

|

|

Colgate-Palmolive India Ltd. | | |

| | |

| | |

| | |

| | |

| | |

Power Grid Corp. of India Ltd. | | |

| | |

|

|

First International Bank Of Israel Ltd. | | |

|

|

Assicurazioni Generali SpA | | |

| | |

| | |

|

|

Daito Trust Construction Co. Ltd. | | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

|

|

| | |

Petronas Chemicals Group Bhd. | | |

| | |

|

|

Arca Continental SAB de CV | | |

Coca-Cola Femsa SAB de CV | | |

Kimberly-Clark de Mexico SAB de CV, A Shares | | |

| | |

|

|

Koninklijke Ahold Delhaize NV | | |

|

|

| | |

|

|

Gjensidige Forsikring ASA | | |

| | |

| | |

| | |

|

14Schwab International Equity ETFs | Semiannual Report

Schwab International Dividend Equity ETF

Portfolio Holdings as of February 29, 2024 (Unaudited) (continued)

| | |

|

| | |

|

|

| | |

| | |

| | |

|

|

| | |

|

|

| | |

| | |

| | |

| | |

|

|

| | |

Singapore Technologies Engineering Ltd. | | |

| | |

|

|

| | |

|

|

| | |

|

|

| | |

|

|

| | |

Kuehne & Nagel International AG | | |

| | |

| | |

| | |

| | |

|

|

| | |

| | |

| | |

Chicony Electronics Co. Ltd. | | |

Chunghwa Telecom Co. Ltd. | | |

| | |

| | |

Fubon Financial Holding Co. Ltd. | | |

King Slide Works Co. Ltd. | | |

King Yuan Electronics Co. Ltd. | | |

Lite-On Technology Corp., ADR | | |

| | |

| | |

Radiant Opto-Electronics Corp. | | |

Simplo Technology Co. Ltd. | | |

Synnex Technology International Corp. | | |

| | |

| | |

| | |

| | |

|

|

Bangkok Chain Hospital PCL, NVDR | | |

Intouch Holdings PCL NVDR | | |

| | |

Tisco Financial Group PCL NVDR | | |

| | |

|

United Arab Emirates 0.2% |

Abu Dhabi Islamic Bank PJSC | | |

|

|

| | |

British American Tobacco PLC | | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

Total Common Stocks

(Cost $736,533,186) | |

|

PREFERRED STOCKS 0.0% OF NET ASSETS |

|

|

Sberbank of Russia PJSC *(a)(b) | | |

Total Preferred Stocks

(Cost $260,896) | |

| | |

SHORT-TERM INVESTMENTS 0.2% OF NET ASSETS |

|

|

State Street Institutional U.S. Government Money Market Fund, Premier Class 5.28% (c) | | |

Total Short-Term Investments

(Cost $1,791,911) | |

Total Investments in Securities

(Cost $738,585,993) | |

Schwab International Equity ETFs | Semiannual Report15

Schwab International Dividend Equity ETF

Portfolio Holdings as of February 29, 2024 (Unaudited) (continued)

| | | CURRENT VALUE/

UNREALIZED

APPRECIATION

($) |

|

| | | |

MSCI EAFE Index, expires 03/15/24 | | | |

MSCI Emerging Markets Index, expires 03/15/24 | | | |

| | | |

| Non-income producing security. |

| Fair valued using significant unobservable inputs (see financial note 2(a), Securities for which no quoted value is available, for additional information). |

| Trading in Russian securities listed on the Moscow Exchange, Russian ADRs, and Russian GDRs are subject to trade restrictions; and therefore, the ability of the fund to buy these securities is currently not permitted, and the ability of the fund to sell these securities is uncertain. |

| The rate shown is the annualized 7-day yield. |

| American Depositary Receipt |

| Global Depositary Receipt |

| Non-Voting Depositary Receipt |

The following is a summary of the inputs used to value the fund’s investments as of February 29, 2024 (see financial note 2(a) for additional information):

| QUOTED PRICES IN

ACTIVE MARKETS FOR

IDENTICAL ASSETS

(LEVEL 1) | OTHER SIGNIFICANT

OBSERVABLE INPUTS

(LEVEL 2) | SIGNIFICANT

UNOBSERVABLE INPUTS

(LEVEL 3) | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| Level 3 amount shown includes securities determined to have no value at February 29, 2024. |

| As categorized in the Portfolio Holdings. |

| Futures contracts are reported at cumulative unrealized appreciation or depreciation. |

16Schwab International Equity ETFs | Semiannual Report

Schwab International Dividend Equity ETF

Statement of Assets and Liabilities

As of February 29, 2024; unaudited

|

Investments in securities, at value - unaffiliated (cost $738,585,993) | | |

Foreign currency, at value (cost $701,588) | | |

Deposit with broker for futures contracts | | |

| | |

| | |

| | |

Variation margin on future contracts | | |

| | |

|

|

| | |

Foreign capital gains tax | | |

| | |

| | |

| | |

|

|

Capital received from investors | | |

| | |

| | |

Schwab International Equity ETFs | Semiannual Report17

Schwab International Dividend Equity ETF

Statement of Operations

For the period September 1, 2023 through February 29, 2024; unaudited |

|

Dividends received from securities - unaffiliated (net of foreign withholding tax of $883,109) | | |

Income from non-cash dividends - unaffiliated | | |

Interest received from securities - unaffiliated | | |

| | |

| | |

|

|

| | |

| | |

| | |

|

REALIZED AND UNREALIZED GAINS (LOSSES) |

Net realized losses on sales of securities - unaffiliated (net of foreign capital gains tax paid of $118,771) | | |

Net realized gains on sales of in-kind redemptions - unaffiliated | | |

Net realized losses on futures contracts | | |

Net realized losses on foreign currency transactions | | |

| | |

Net change in unrealized appreciation (depreciation) on securities - unaffiliated (net of change in foreign capital gains tax of ($477,413)) | | |

Net change in unrealized appreciation (depreciation) on futures contracts | | |

Net change in unrealized appreciation (depreciation) on foreign currency translations | | |

Net change in unrealized appreciation (depreciation) | | |

Net realized and unrealized gains | | |

Increase in net assets resulting from operations | | |

18Schwab International Equity ETFs | Semiannual Report

Schwab International Dividend Equity ETF

Statement of Changes in Net Assets

For the current and prior report periods

Figures for the current period are unaudited

|

| | |

| | | |

| | | |

Net change in unrealized appreciation (depreciation) | | | |

Increase in net assets resulting from operations | | | |

|

DISTRIBUTIONS TO SHAREHOLDERS |

| | | |

TRANSACTIONS IN FUND SHARES |

| | |

| | | | | |

| | | | | |

| | | | | |

Net transactions in fund shares | | | | | |

|

SHARES OUTSTANDING AND NET ASSETS |

| | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

Schwab International Equity ETFs | Semiannual Report19

Schwab International Equity ETF

Financial Statements

| | | | | | |

|

Net asset value at beginning of period | | | | | | |

Income (loss) from investment operations: | | | | | | |

Net investment income (loss)1 | | | | | | |

Net realized and unrealized gains (losses) | | | | | | |

Total from investment operations | | | | | | |

| | | | | | |

Distributions from net investment income | | | | | | |

Net asset value at end of period | | | | | | |

| | | | | | |

|

Ratios to average net assets: | | | | | | |

| | | | | | |

Net investment income (loss) | | | | | | |

| | | | | | |

Net assets, end of period (x 1,000,000) | | | | | | |

| |

| Calculated based on the average shares outstanding during the period. |

| |

| |

| Ratio includes less than 0.005% of non-routine proxy expenses. |

| Portfolio turnover rate excludes securities received or delivered from processing of in-kind creations or redemptions. |

20Schwab International Equity ETFs | Semiannual Report

Schwab International Equity ETF

Portfolio Holdings as of February 29, 2024 (Unaudited)

This section shows all the securities in the fund’s portfolio and their values as of the report date.

The fund files its complete schedule of portfolio holdings with the U.S. Securities and Exchange Commission (SEC) for the first and third quarters of each fiscal year on Form N-PORT Part F. The fund’s Form N-PORT Part F is available on the SEC’s website at www.sec.gov. You can also obtain this information at no cost on the fund’s website at www.schwabassetmanagement.com/schwabetfs_prospectus, by calling 1-866-414-6349, or by sending an email request to orders@mysummaryprospectus.com. The fund also makes available its complete schedule of portfolio holdings on a daily basis on the fund’s website.

| | |

COMMON STOCKS 98.9% OF NET ASSETS |

|

|

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

Bendigo & Adelaide Bank Ltd. | | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

Cleanaway Waste Management Ltd. | | |

| | |

| | |

Commonwealth Bank of Australia | | |

| | |

| | |

| | |

| | |

| | |

Domain Holdings Australia Ltd. | | |

Domino's Pizza Enterprises Ltd. | | |

| | |

| | |

| | |

Flight Centre Travel Group Ltd. | | |

| | |

| | |

| | |

Harvey Norman Holdings Ltd. | | |

| | |

| | |

| | |

| | |

| | |

Insurance Australia Group Ltd. | | |

James Hardie Industries PLC * | | |

| | |

| | |

| | |

Liontown Resources Ltd. *(a) | | |

| | |

| | |

| | |

Magellan Financial Group Ltd. | | |

| | |

| | |

| | |

| | |

National Australia Bank Ltd. | | |

| | |

| | |

Northern Star Resources Ltd. | | |

| | |

| | |

| | |

| | |

| | |

| | |

Platinum Asset Management Ltd. | | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

Seven Group Holdings Ltd. | | |

| | |

| | |

| | |

Star Entertainment Group Ltd. * | | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

Treasury Wine Estates Ltd. | | |

| | |

Washington H Soul Pattinson & Co. Ltd. | | |

| | |

| | |

| | |

| | |

Woodside Energy Group Ltd. | | |

| | |

| | |

| | |

Schwab International Equity ETFs | Semiannual Report21

Schwab International Equity ETF

Portfolio Holdings as of February 29, 2024 (Unaudited) (continued)

| | |

Yancoal Australia Ltd. (a) | | |

| | |

|

|

| | |

| | |

| | |

| | |

Raiffeisen Bank International AG | | |

| | |

| | |

| | |

| | |

|

|

Ackermans & van Haaren NV | | |

| | |

| | |

| | |

| | |

| | |

Groupe Bruxelles Lambert NV | | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

|

|

| | |

Alimentation Couche-Tard, Inc. | | |

| | |

| | |

| | |

| | |

Brookfield Asset Management Ltd., Class A | | |

| | |

Canadian Imperial Bank of Commerce | | |

Canadian National Railway Co. | | |

Canadian Natural Resources Ltd. | | |

Canadian Pacific Kansas City Ltd. | | |

Canadian Tire Corp. Ltd., Class A | | |

| | |

| | |

Constellation Software, Inc. | | |

| | |

| | |

Fairfax Financial Holdings Ltd. | | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

Magna International, Inc. | | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

Restaurant Brands International, Inc. | | |

| | |

| | |

| | |

| | |

| | |

| | |

Teck Resources Ltd., Class B | | |

| | |

| | |

| | |

| | |

| | |

Wheaton Precious Metals Corp. | | |

| | |

|

|

AP Moller - Maersk AS, Class A | | |

AP Moller - Maersk AS, Class B | | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

|

|

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

|

|

| | |

| | |

| | |

| | |

22Schwab International Equity ETFs | Semiannual Report

Schwab International Equity ETF

Portfolio Holdings as of February 29, 2024 (Unaudited) (continued)

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

Cie Generale des Etablissements Michelin SCA | | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

La Francaise des Jeux SAEM | | |

| | |

| | |

LVMH Moet Hennessy Louis Vuitton SE | | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

Ubisoft Entertainment SA * | | |

Unibail-Rodamco-Westfield * | | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

|

|

| | |

| | |

| | |

| | |

Bayerische Motoren Werke AG | | |

| | |

| | |

| | |

Carl Zeiss Meditec AG, Bearer Shares | | |

| | |

| | |

| | |

CTS Eventim AG & Co. KGaA | | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

DWS Group GmbH & Co. KGaA | | |

| | |

| | |

| | |

Fraport AG Frankfurt Airport Services Worldwide * | | |

Fresenius Medical Care AG | | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

Muenchener Rueckversicherungs-Gesellschaft AG in Muenchen | | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

Siemens Healthineers AG * | | |

| | |

| | |

| | |

Schwab International Equity ETFs | Semiannual Report23

Schwab International Equity ETF

Portfolio Holdings as of February 29, 2024 (Unaudited) (continued)

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

|

|

AAC Technologies Holdings, Inc. | | |

| | |

| | |

| | |

| | |

BOC Hong Kong Holdings Ltd. | | |

Brightoil Petroleum Holdings Ltd. *(b) | | |

Budweiser Brewing Co. APAC Ltd. (a) | | |

Cafe de Coral Holdings Ltd. | | |

Cathay Pacific Airways Ltd. *(a) | | |

| | |

China Travel International Investment Hong Kong Ltd. | | |

Chow Tai Fook Jewellery Group Ltd. | | |

| | |

CK Hutchison Holdings Ltd. | | |

CK Infrastructure Holdings Ltd. | | |

| | |

Dah Sing Banking Group Ltd. | | |

Dah Sing Financial Holdings Ltd. | | |

DFI Retail Group Holdings Ltd. | | |

| | |

| | |

| | |

Galaxy Entertainment Group Ltd. | | |

Guotai Junan International Holdings Ltd. | | |

| | |

Hang Lung Properties Ltd. | | |

| | |

Henderson Land Development Co. Ltd. | | |

Hong Kong & China Gas Co. Ltd. | | |

Hong Kong Exchanges & Clearing Ltd. | | |

Hongkong Land Holdings Ltd. | | |

Huabao International Holdings Ltd. (a) | | |

Hutchison Telecommunications Hong Kong Holdings Ltd. | | |

| | |

Hysan Development Co. Ltd. | | |

Jardine Matheson Holdings Ltd. | | |

Johnson Electric Holdings Ltd. | | |

Kerry Logistics Network Ltd. | | |

| | |

| | |

| | |

L'Occitane International SA | | |

| | |

Melco International Development Ltd. * | | |

MGM China Holdings Ltd. * | | |

| | |

| | |

| | |

New World Development Co. Ltd. (a) | | |

Nexteer Automotive Group Ltd. | | |

| | |

| | |

Orient Overseas International Ltd. | | |

| | |

Power Assets Holdings Ltd. | | |

| | |

Samsonite International SA * | | |

| | |

| | |

| | |

SITC International Holdings Co. Ltd. | | |

| | |

Sun Hung Kai Properties Ltd. | | |

Super Hi International Holding Ltd. * | | |

Swire Pacific Ltd., A Shares | | |

Swire Pacific Ltd., B Shares | | |

| | |

Techtronic Industries Co. Ltd. | | |

United Energy Group Ltd. (a) | | |

Vitasoy International Holdings Ltd. | | |

| | |

| | |

| | |

Wharf Real Estate Investment Co. Ltd. | | |

| | |

Xinyi Glass Holdings Ltd. | | |

Yue Yuen Industrial Holdings Ltd. | | |

| | |

|

|

| | |

Bank of Ireland Group PLC | | |

| | |

| | |

| | |

| | |

|

|

| | |

| | |

| | |

| | |

| | |

Bezeq The Israeli Telecommunication Corp. Ltd. | | |

Big Shopping Centers Ltd. * | | |

| | |

| | |

| | |

Energix-Renewable Energies Ltd. | | |

Enlight Renewable Energy Ltd. * | | |

Fattal Holdings 1998 Ltd. * | | |

First International Bank Of Israel Ltd. | | |

| | |

Harel Insurance Investments & Financial Services Ltd. * | | |

| | |

| | |

Israel Discount Bank Ltd., A Shares | | |

| | |

Mivne Real Estate KD Ltd. | | |

Mizrahi Tefahot Bank Ltd. | | |

| | |

| | |

| | |

| | |

Shapir Engineering & Industry Ltd. | | |

24Schwab International Equity ETFs | Semiannual Report

Schwab International Equity ETF

Portfolio Holdings as of February 29, 2024 (Unaudited) (continued)

| | |

| | |

Teva Pharmaceutical Industries Ltd. * | | |

Tower Semiconductor Ltd. * | | |

| | |

|

|

| | |

| | |

Assicurazioni Generali SpA | | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

FinecoBank Banca Fineco SpA | | |

| | |

Infrastrutture Wireless Italiane SpA | | |

| | |

| | |

| | |

| | |

Mediobanca Banca di Credito Finanziario SpA | | |

| | |

| | |

| | |

| | |

| | |

Recordati Industria Chimica e Farmaceutica SpA | | |

| | |

| | |

| | |

| | |

| | |

Terna - Rete Elettrica Nazionale | | |

| | |

UnipolSai Assicurazioni SpA | | |

| | |

|

|

| | |

| | |

| | |

Advance Residence Investment Corp. | | |

| | |

| | |

AEON Financial Service Co. Ltd. | | |

| | |

AEON REIT Investment Corp. | | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

Asahi Group Holdings Ltd. | | |

| | |

| | |

| | |

| | |

| | |

| | |

AZ-COM MARUWA Holdings, Inc. | | |

Bandai Namco Holdings, Inc. | | |

BayCurrent Consulting, Inc. | | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

Canon Marketing Japan, Inc. | | |

| | |

| | |

| | |

Central Japan Railway Co. | | |

| | |

Chubu Electric Power Co., Inc. | | |

Chugai Pharmaceutical Co. Ltd. | | |

Chugin Financial Group, Inc. | | |

Chugoku Electric Power Co., Inc. | | |

Coca-Cola Bottlers Japan Holdings, Inc. | | |

| | |

Concordia Financial Group Ltd. | | |

Cosmo Energy Holdings Co. Ltd. | | |

Cosmos Pharmaceutical Corp. | | |

| | |

| | |

Dai Nippon Printing Co. Ltd. | | |

| | |

| | |

| | |

Dai-ichi Life Holdings, Inc. | | |

| | |

| | |

| | |

| | |

Daito Trust Construction Co. Ltd. | | |

Daiwa House Industry Co. Ltd. | | |

Daiwa House REIT Investment Corp. | | |

Daiwa Office Investment Corp. | | |

Daiwa Securities Group, Inc. | | |

Daiwa Securities Living Investments Corp. | | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

Electric Power Development Co. Ltd. | | |

Schwab International Equity ETFs | Semiannual Report25

Schwab International Equity ETF

Portfolio Holdings as of February 29, 2024 (Unaudited) (continued)

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

Frontier Real Estate Investment Corp. | | |

| | |

| | |

Fuji Media Holdings, Inc. | | |

| | |

| | |

| | |

| | |

| | |

Fukuoka Financial Group, Inc. | | |

Furukawa Electric Co. Ltd. | | |

Fuyo General Lease Co. Ltd. | | |

| | |

| | |

GMO Payment Gateway, Inc. | | |

| | |

| | |

GungHo Online Entertainment, Inc. | | |

| | |

Hakuhodo DY Holdings, Inc. | | |

| | |

Hankyu Hanshin Holdings, Inc. | | |

Harmonic Drive Systems, Inc. | | |

| | |

| | |

| | |

| | |

| | |

| | |

Hisamitsu Pharmaceutical Co., Inc. | | |

Hitachi Construction Machinery Co. Ltd. | | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

Iida Group Holdings Co. Ltd. | | |

Industrial & Infrastructure Fund Investment Corp. | | |

| | |

| | |

Internet Initiative Japan, Inc. | | |

Invincible Investment Corp. | | |

Isetan Mitsukoshi Holdings Ltd. | | |

| | |

| | |

| | |

Itoham Yonekyu Holdings, Inc. | | |

| | |

| | |

| | |

J Front Retailing Co. Ltd. | | |

| | |

Japan Airport Terminal Co. Ltd. | | |

| | |

Japan Aviation Electronics Industry Ltd. | | |

Japan Exchange Group, Inc. | | |

Japan Hotel REIT Investment Corp. | | |

Japan Logistics Fund, Inc. | | |

Japan Metropolitan Fund Invest | | |

| | |

Japan Post Holdings Co. Ltd. | | |

Japan Post Insurance Co. Ltd. | | |

Japan Prime Realty Investment Corp. | | |

Japan Real Estate Investment Corp. | | |

| | |

| | |

JCR Pharmaceuticals Co. Ltd. | | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

Kansai Electric Power Co., Inc. | | |

| | |

| | |

| | |

Kawasaki Heavy Industries Ltd. | | |

Kawasaki Kisen Kaisha Ltd. | | |

| | |

KDX Realty Investment Corp. | | |

| | |

| | |

| | |

Keisei Electric Railway Co. Ltd. | | |

| | |

| | |

| | |

| | |

Kintetsu Group Holdings Co. Ltd. | | |

| | |

Kobayashi Pharmaceutical Co. Ltd. | | |

| | |

| | |

Koei Tecmo Holdings Co. Ltd. | | |

Koito Manufacturing Co. Ltd. | | |

| | |

| | |

| | |

| | |

| | |

Kotobuki Spirits Co. Ltd. | | |

| | |

| | |

| | |

Kurita Water Industries Ltd. | | |

Kusuri No. Aoki Holdings Co. Ltd. | | |

| | |

Kyoto Financial Group, Inc. | | |

| | |

| | |

Kyushu Electric Power Co., Inc. * | | |

Kyushu Financial Group, Inc. | | |

26Schwab International Equity ETFs | Semiannual Report

Schwab International Equity ETF

Portfolio Holdings as of February 29, 2024 (Unaudited) (continued)

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

Matsui Securities Co. Ltd. | | |

| | |

| | |

McDonald's Holdings Co. Japan Ltd. | | |

Mebuki Financial Group, Inc. | | |

| | |

| | |

| | |

| | |

| | |

| | |

Mitsubishi Chemical Group Corp. | | |

| | |

Mitsubishi Electric Corp. | | |

Mitsubishi Estate Co. Ltd. | | |

Mitsubishi Gas Chemical Co., Inc. | | |

Mitsubishi HC Capital, Inc. | | |

Mitsubishi Heavy Industries Ltd. | | |

Mitsubishi Logistics Corp. | | |

Mitsubishi Materials Corp. | | |

| | |

Mitsubishi UFJ Financial Group, Inc. | | |

| | |

| | |

| | |

Mitsui Fudosan Logistics Park, Inc. | | |

| | |

Mitsui Mining & Smelting Co. Ltd. | | |

| | |

| | |

Mizuho Financial Group, Inc. | | |

| | |

| | |

Mori Hills REIT Investment Corp. | | |

| | |

Morinaga Milk Industry Co. Ltd. | | |

MS&AD Insurance Group Holdings, Inc. | | |

Murata Manufacturing Co. Ltd. | | |

| | |

| | |

| | |

Nankai Electric Railway Co. Ltd. | | |

| | |

NEC Networks & System Integration Corp. | | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

Nihon M&A Center Holdings, Inc. | | |

| | |

| | |

Nippon Accommodations Fund, Inc. | | |

Nippon Building Fund, Inc. | | |

Nippon Electric Glass Co. Ltd. | | |

NIPPON EXPRESS HOLDINGS, Inc. | | |

| | |

Nippon Paint Holdings Co. Ltd. | | |

Nippon Prologis REIT, Inc. | | |

Nippon Sanso Holdings Corp. | | |

| | |

| | |

| | |

Nippon Telegraph & Telephone Corp. | | |

| | |

| | |

Nishi-Nippon Railroad Co. Ltd. | | |

| | |

| | |

Nisshin Seifun Group, Inc. | | |

Nissin Foods Holdings Co. Ltd. | | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

Nomura Real Estate Holdings, Inc. | | |

Nomura Real Estate Master Fund, Inc. | | |

Nomura Research Institute Ltd. | | |

| | |

| | |

| | |

| | |

OBIC Business Consultants Co. Ltd. | | |

| | |

Odakyu Electric Railway Co. Ltd. | | |

| | |

| | |

| | |

| | |

Ono Pharmaceutical Co. Ltd. | | |

Open House Group Co. Ltd. | | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

Pan Pacific International Holdings Corp. | | |

| | |

| | |

Penta-Ocean Construction Co. Ltd. | | |

| | |

| | |

| | |

Pola Orbis Holdings, Inc. | | |

| | |

Schwab International Equity ETFs | Semiannual Report27

Schwab International Equity ETF

Portfolio Holdings as of February 29, 2024 (Unaudited) (continued)

| | |

| | |

| | |

Recruit Holdings Co. Ltd. | | |

| | |

Renesas Electronics Corp. | | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

Rohto Pharmaceutical Co. Ltd. | | |

| | |

| | |

| | |

| | |

| | |

Santen Pharmaceutical Co. Ltd. | | |

| | |

| | |

Sawai Group Holdings Co. Ltd. | | |

| | |

| | |

| | |

| | |

Sega Sammy Holdings, Inc. | | |

| | |

| | |

| | |

Sekisui Chemical Co. Ltd. | | |

| | |

| | |

Seven & i Holdings Co. Ltd. | | |

| | |

| | |

| | |

| | |

Shikoku Electric Power Co., Inc. | | |

| | |

| | |

| | |

| | |

Shin-Etsu Chemical Co. Ltd. | | |

Shinko Electric Industries Co. Ltd. | | |

| | |

Ship Healthcare Holdings, Inc. | | |

| | |

Shizuoka Financial Group, Inc. | | |

SHO-BOND Holdings Co. Ltd. | | |

Skylark Holdings Co. Ltd. | | |

| | |

| | |

| | |

| | |

| | |

Sohgo Security Services Co. Ltd. | | |

| | |

| | |

| | |

| | |

Square Enix Holdings Co. Ltd. | | |

Stanley Electric Co. Ltd. | | |

| | |

| | |

| | |

Sumitomo Bakelite Co. Ltd. | | |

Sumitomo Chemical Co. Ltd. | | |

| | |

| | |

Sumitomo Electric Industries Ltd. | | |

Sumitomo Forestry Co. Ltd. | | |

Sumitomo Heavy Industries Ltd. | | |

Sumitomo Metal Mining Co. Ltd. | | |

Sumitomo Mitsui Financial Group, Inc. | | |

Sumitomo Mitsui Trust Holdings, Inc. | | |

| | |

Sumitomo Realty & Development Co. Ltd. | | |

Sumitomo Rubber Industries Ltd. | | |

| | |

Suntory Beverage & Food Ltd. | | |

| | |

| | |

| | |

| | |

| | |

| | |

Taisho Pharmaceutical Holdings Co. Ltd. | | |

| | |

| | |

| | |

| | |

Takeda Pharmaceutical Co. Ltd. | | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

Toei Animation Co. Ltd. (a) | | |

| | |

| | |

Tohoku Electric Power Co., Inc. | | |

| | |

Tokio Marine Holdings, Inc. | | |

| | |

Tokyo Electric Power Co. Holdings, Inc. * | | |

| | |

| | |

Tokyo Ohka Kogyo Co. Ltd. | | |

| | |

| | |

| | |

Tokyu Fudosan Holdings Corp. | | |

| | |

| | |

| | |

| | |

| | |

Toyo Seikan Group Holdings Ltd. | | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

28Schwab International Equity ETFs | Semiannual Report

Schwab International Equity ETF

Portfolio Holdings as of February 29, 2024 (Unaudited) (continued)

| | |

| | |

| | |

| | |

| | |

United Urban Investment Corp. | | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

Yamaguchi Financial Group, Inc. | | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

|

|

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

BE Semiconductor Industries NV | | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

Koninklijke Ahold Delhaize NV | | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

|

|

| | |

| | |

Auckland International Airport Ltd. | | |

| | |

| | |

| | |

Fisher & Paykel Healthcare Corp. Ltd. | | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

SKYCITY Entertainment Group Ltd. | | |

| | |

| | |

|

|

| | |

| | |

| | |

AutoStore Holdings Ltd. * | | |

| | |

| | |

Gjensidige Forsikring ASA | | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

|

|

| | |

Bank Polska Kasa Opieki SA | | |

| | |

| | |

| | |

| | |

| | |

Powszechna Kasa Oszczednosci Bank Polski SA | | |

Powszechny Zaklad Ubezpieczen SA | | |

| | |

| | |

|

|

EDP - Energias de Portugal SA | | |

| | |

| | |

| | |

| | |

|

|

| | |

| | |

| | |

| | |

BNK Financial Group, Inc. | | |

| | |

| | |

Schwab International Equity ETFs | Semiannual Report29

Schwab International Equity ETF

Portfolio Holdings as of February 29, 2024 (Unaudited) (continued)

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

Daewoo Engineering & Construction Co. Ltd. * | | |

| | |

DGB Financial Group, Inc. | | |

| | |

| | |

| | |

| | |

Doosan Enerbility Co. Ltd. * | | |

| | |

| | |

| | |

| | |

| | |

| | |

GS Engineering & Construction Corp. * | | |

| | |

| | |

Hana Financial Group, Inc. | | |

| | |

Hankook Tire & Technology Co. Ltd. | | |

| | |

| | |

| | |

Hanwha Aerospace Co. Ltd. | | |

| | |

Hanwha Life Insurance Co. Ltd. * | | |

| | |

| | |

| | |

HD Hyundai Heavy Industries Co. Ltd. | | |

HD Hyundai Infracore Co. Ltd. | | |

HD Korea Shipbuilding & Offshore Engineering Co. Ltd. | | |

| | |

| | |

| | |

| | |

| | |

| | |

Hyundai Department Store Co. Ltd. | | |

Hyundai Engineering & Construction Co. Ltd. * | | |

Hyundai Glovis Co. Ltd. * | | |

Hyundai Marine & Fire Insurance Co. Ltd. * | | |

Hyundai Mipo Dockyard Co. Ltd. | | |

| | |

| | |

| | |

| | |

Industrial Bank of Korea * | | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

KEPCO Plant Service & Engineering Co. Ltd. * | | |

| | |

Korea Aerospace Industries Ltd. * | | |

Korea Electric Power Corp. | | |

| | |

Korea Investment Holdings Co. Ltd. * | | |

| | |

Korean Air Lines Co. Ltd. | | |

| | |

| | |

Kumho Petrochemical Co. Ltd. * | | |

| | |

| | |

| | |

| | |

| | |

LG Energy Solution Ltd. * | | |

| | |

| | |

| | |

| | |

Lotte Chilsung Beverage Co. Ltd. | | |

| | |

Lotte Energy Materials Corp. | | |

LOTTE Fine Chemical Co. Ltd. | | |

| | |

| | |

Meritz Financial Group, Inc. | | |

Mirae Asset Securities Co. Ltd. * | | |

| | |

| | |

| | |

NH Investment & Securities Co. Ltd. * | | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

POSCO Future M Co. Ltd. * | | |

| | |

Posco International Corp. * | | |

| | |

Samsung Biologics Co. Ltd. * | | |

| | |

| | |

Samsung Electro-Mechanics Co. Ltd. | | |

Samsung Electronics Co. Ltd. | | |

Samsung Engineering Co. Ltd. * | | |

Samsung Fire & Marine Insurance Co. Ltd. * | | |

Samsung Heavy Industries Co. Ltd. * | | |

Samsung Life Insurance Co. Ltd. | | |

| | |

| | |

Samsung Securities Co. Ltd. | | |

| | |

| | |

Shinhan Financial Group Co. Ltd. | | |

| | |

SK Biopharmaceuticals Co. Ltd. * | | |

| | |

| | |

| | |

SK IE Technology Co. Ltd. * | | |

| | |

30Schwab International Equity ETFs | Semiannual Report

Schwab International Equity ETF

Portfolio Holdings as of February 29, 2024 (Unaudited) (continued)

| | |

| | |

| | |

| | |

| | |

| | |

Solus Advanced Materials Co. Ltd. | | |

| | |

| | |

Woori Financial Group, Inc. | | |

| | |

| | |

|

|

| | |

| | |

CapitaLand Integrated Commercial Trust | | |

CapitaLand Investment Ltd. | | |

| | |

| | |

| | |

Frasers Logistics & Commercial Trust | | |

| | |

Hutchison Port Holdings Trust, Class U | | |

Jardine Cycle & Carriage Ltd. | | |

| | |

| | |

| | |

Mapletree Industrial Trust | | |

Mapletree Logistics Trust | | |

Mapletree Pan Asia Commercial Trust | | |

| | |

| | |

Oversea-Chinese Banking Corp. Ltd. | | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

Singapore Technologies Engineering Ltd. | | |

Singapore Telecommunications Ltd. | | |

| | |

Suntec Real Estate Investment Trust | | |

United Overseas Bank Ltd. | | |

| | |

| | |

Wilmar International Ltd. | | |

| | |

|

|

| | |

ACS Actividades de Construccion y Servicios SA | | |

| | |

| | |

Banco Bilbao Vizcaya Argentaria SA | | |

| | |

| | |

| | |

| | |

| | |

| | |

Corp. ACCIONA Energias Renovables SA (a) | | |

| | |

| | |

| | |

| | |

| | |

Industria de Diseno Textil SA | | |

| | |

Merlin Properties Socimi SA | | |

Naturgy Energy Group SA (a) | | |

| | |

| | |

| | |

| | |

|

|

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

Electrolux AB, B Shares * | | |

| | |

| | |

| | |

| | |

| | |

Fastighets AB Balder, B Shares * | | |

| | |

H & M Hennes & Mauritz AB, B Shares | | |

| | |

| | |

| | |

Industrivarden AB, A Shares | | |