UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

CERTIFIED SHAREHOLDER REPORT OF

REGISTERED MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-22311

Schwab Strategic Trust – Schwab Fixed-Income

ETFs and Schwab Ultra-Short Income ETF

(Exact name of registrant as specified in charter)

211 Main Street, San Francisco, California 94105

(Address of principal executive offices) (Zip code)

Omar Aguilar

Schwab Strategic Trust – Schwab Fixed-Income ETFs and Schwab Ultra-Short Income ETF

211 Main Street, San Francisco, California 94105

(Name and address of agent for service)

Registrant’s telephone number, including area code: (415) 636-7000

Date of fiscal year end: December 31

Date of reporting period: December 31, 2024

Item 1: Report(s) to Shareholders.

Schwab U.S. TIPS ETF

Principal U.S. Listing Exchange:

NYSE Arca, Inc.

This annual shareholder report contains important information about the fund for the period of January 1, 2024, to December 31,

2024.

You can find additional information about the fund at

www.schwabassetmanagement.com/prospectus

. You can also request

this information by calling

or by sending an email request to

orders@mysummaryprospectus.com

.

If you purchase

or hold fund shares through a financial intermediary, the fund’s prospectus, Statement of Additional Information (SAI), reports to

shareholders and other information about the fund are available from your financial intermediary.

This report describes changes to the fund that occurred during the reporting period.

FUND COSTS FOR THE LAST year ENDED December 31, 2024

(BASED ON A HYPOTHETICAL $10,000 INVESTMENT)

MANAGEMENT’S DISCUSSION OF FUND PERFORMANCE

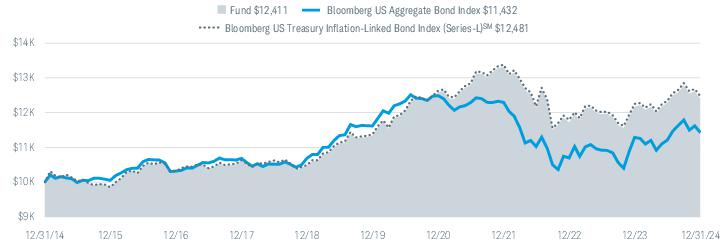

For the 12-month reporting period ended December 31, 2024, the fund’s NAV return was 1.95% (for an explanation of NAV returns,

please refer to footnote 2 on the following page). The Bloomberg US Aggregate Bond Index, which serves as the fund’s regulatory

index and provides a broad measure of market performance, returned 1.25%. The fund generally invests in securities that are

included in the Bloomberg US Treasury Inflation-Linked Bond Index (Series-L)

SM

which returned 1.84%. The fund does not seek to

track the regulatory index.

■

Timing differences between the closing time of prices used for the fund’s NAV and of prices used by the index contributed to

relative performance over the reporting period

●

Timing difference at the beginning of the reporting period contributed to relative performance

●

Timing difference at the end of the reporting period detracted from relative performance but to a lesser degree

●

These deviations are temporary because the two pricing methodologies move back into alignment the following day

■

Coupon income generated by the fund’s holdings contributed to fund performance while negative price returns detracted from

fund performance, although to a smaller degree

Portfolio holdings may have changed since the report da

te.

Schwab U.S. TIPS ETF | Annual Report

The performance data quoted represents past performance. Past performance does not guarantee future results. Investment returns

and principal value of an investment will fluctuate so that an investor’s shares, when sold or redeemed, may be worth more or less than the original cost. Current performance may be lower or higher than the performance data quoted.

To obtain performance information

current to the most recent month end, please visit

www.schwabassetmanagement.com/prospectus

Performance of Hypothetical $10,000 Investment (December 31, 2014 - December 31, 2024)

Average Annual Total Returns

| | | |

Fund: Schwab U.S. TIPS ETF (08/05/2010) 2 | | | |

Bloomberg US Aggregate Bond Index 3 | | | |

Bloomberg US Treasury Inflation-Linked Bond Index (Series-L) SM | | | |

All total returns on this page assume dividends and distributions were reinvested. Index figures do not include trading and management costs, which would lower

performance. Indices are unmanaged and cannot be invested in directly. Performance results less than one year are not annualized.

For index definitions, please see www.schwabassetmanagement.com/glossary.

Shares are bought and sold at market price, which may be higher or lower than the net asset value (NAV). Brokerage commissions will reduce returns.

Index ownership — Bloomberg

®

and Bloomberg US Treasury Inflation-Linked Bond Index (Series-L)

SM

are service marks of Bloomberg Finance L.P. and its affiliates, including

Bloomberg Index Services Limited (BISL), the administrator of the indices (collectively, Bloomberg). Bloomberg is not affiliated with Charles Schwab Investment

Management, Inc., and Bloomberg does not approve, endorse, review, or recommend Schwab U.S. TIPS ETF. Bloomberg does not guarantee the timeliness, accurateness, or

completeness of any data or information relating to Schwab U.S. TIPS ETF.

Performance does not reflect the deduction of taxes that a shareholder would pay on fund distributions or on the redemption or sale of fund shares.

Performance is shown on a NAV basis. The fund’s per share NAV is the value of one share of the fund. NAV is calculated by taking the fund’s total assets (including the fair

value of securities owned), subtracting liabilities, and dividing by the number of shares outstanding. Returns assume that dividends and capital gain distributions have been

reinvested in the fund at NAV.

Due to new regulatory requirements, the fund’s regulatory index has changed from the Bloomberg US Treasury Inflation-Linked Bond Index (Series-L)

SM

to the Bloomberg

US Aggregate Bond Index. The Bloomberg US Aggregate Bond Index provides a broad measure of market performance. The fund generally invests in securities that are

included in the Bloomberg US Treasury Inflation-Linked Bond Index (Series-L)

SM

. The fund does not seek to track the regulatory index.

Schwab U.S. TIPS ETF | Annual Report

| |

| |

(excludes in-kind transactions) | |

Advisory Fees Paid by the Fund | |

Weighted Average Maturity | |

Weighted Average Duration | |

Qualified Interest Income | |

Business Interest Deduction (163j) | |

Portfolio Composition By Security Type % of Investments

Portfolio holdings may have changed since the report date.

Includes the fund’s position in money market mutual funds registered under the Investment Company Act of 1940, as amended.

Schwab U.S. TIPS ETF | Annual Report

This is a summary of certain changes to the fund since

January 1, 2024

. For more complete information, you may review the fund’s

Annual Holdings and Financial Statements at

www.schwabassetmanagement.com/prospectus

or upon request by calling

or by sending an email request to

orders@mysummaryprospectus.com

.

■

On September 25, 2024, the Board of Trustees authorized a 2-for-1 share split for the fund, which applied to shareholders of

record as of the close of U.S. markets on October 9, 2024. Certain of the fund’s financial statements have been adjusted for the

period ended December 31, 2024, and all prior periods, to reflect the share split.

AVAILABILITY OF ADDITIONAL INFORMATION

You can find the fund’s prospectus, Statement of Additional Information (SAI), reports to shareholders, financial information,

holdings, certain tax information, proxy voting information, and other information about the fund online at

www.schwabassetmanagement.com/prospectus

.

Proxy Voting Policies, Procedures and Results

A description of the proxy voting policies and procedures used to determine how to vote proxies on behalf of the funds is available

without charge, upon request, by visiting the Schwab ETFs’ website at

www.schwabassetmanagement.com/prospectus

, the SEC’s

website at

, or by contacting Schwab ETFs at 1-877-824-5615.

Information regarding how a fund voted proxies relating to portfolio securities during the most recent twelve-month period ended

June 30 is available, without charge, by visiting the fund’s website at

www.schwabassetmanagement.com/prospectus

or the SEC’s

website at

, by calling

, or by sending an email request to

orders@mysummaryprospectus.com

.

Schwab U.S. TIPS ETF | Annual Report

Annual Report |

December 31, 2024

Schwab Short-Term U.S. Treasury ETF

Ticker Symbol: SCHO

Principal U.S. Listing Exchange:

NYSE Arca, Inc.

This annual shareholder report contains important information about the fund for the period of January 1, 2024, to December 31,

2024.

You can find additional information about the fund at

www.schwabassetmanagement.com/prospectus

.

You can also request

this information by calling

1-866-414-6349

or by sending an email request to

orders@mysummaryprospectus.com

.

If you purchase

or hold fund shares through a financial intermediary, the fund’s prospectus, Statement of Additional Information (SAI), reports to

shareholders and other information about the fund are available from your financial intermediary.

This report describes changes to the fund that occurred during the reporting period.

FUND COSTS FOR THE LAST year ENDED December 31, 2024

(BASED ON A HYPOTHETICAL $10,000 INVESTMENT)

| | |

Schwab Short-Term U.S. Treasury ETF | | |

MANAGEMENT’S DISCUSSION OF FUND PERFORMANCE

For the 12-month reporting period ended December 31, 2024, the fund’s NAV return was 4.00% (for an explanation of NAV returns,

please refer to footnote 2 on the following page). The Bloomberg US Aggregate Bond Index, which serves as the fund’s regulatory

index and provides a broad measure of market performance, returned 1.25%. The fund generally invests in securities that are

included in the Bloomberg US Treasury 1-3 Year Index which returned 4.03%. The fund does not seek to track the regulatory index.

■

Timing differences between the closing time of prices used for the fund’s NAV and of prices used by the index contributed to

relative performance over the reporting period

●

Timing difference at the beginning of the reporting period contributed to relative performance

●

Timing difference at the end of the reporting period detracted from relative performance but to a lesser degree

●

These deviations are temporary because the two pricing methodologies move back into alignment the following day

■

Most of the fund’s gains c

am

e from coupon income generated by the fund’s holdings though price appreciation also contributed to

fund performance, although to a smaller degree

Portfolio holdings may have changed since the report date.

Schwab Short-Term U.S. Treasury ETF | Annual Report

The performance data quoted represents past performance. Past performance does not guarantee future results. Investment returns

and principal value of an investment will fluctuate so that an investor’s shares, when sold or redeemed, may be worth more or less than the original cost.

Current performance may be lower or higher than the performance data quoted.

To obtain performance information

current to the most recent month end, please visit

www.schwabassetmanagement.com/prospectus

.

Performance of Hypothetical $10,000 Investment (December 31, 2014 - December 31, 2024)

1

Average Annual Total Returns

1

| | | |

Fund: Schwab Short-Term U.S. Treasury ETF (08/05/2010) 2 | | | |

Bloomberg US Aggregate Bond Index 3 | | | |

Bloomberg US Treasury 1-3 Year Index | | | |

All total returns on this page assume dividends and distributions were reinvested. Index figures do not include trading and management costs, which would lower

performance. Indices are unmanaged and cannot be invested in directly. Performance results less than one year are not annualized.

For index definitions, please see www.schwabassetmanagement.com/glossary.

Shares are bought and sold at market price, which may be higher or lower than the net asset value (NAV). Brokerage commissions will reduce returns.

Index ownership — Bloomberg

®

and Bloomberg US Treasury 1-3 Year Index are service marks of Bloomberg Finance L.P. and its affiliates, including Bloomberg Index Services

Limited (BISL), the administrator of the indices (collectively, Bloomberg). Bloomberg is not affiliated with Charles Schwab Investment Management, Inc., and Bloomberg does

not approve, endorse, review, or recommend Schwab Short-Term U.S. Treasury ETF. Bloomberg does not guarantee the timeliness, accurateness, or completeness of any data

or information relating to Schwab Short-Term U.S. Treasury ETF.

Performance does not reflect the deduction of taxes that a shareholder would pay on fund distributions or on the redemption or sale of fund shares.

Performance is shown on a NAV basis. The fund’s per share NAV is the value of one share of the fund. NAV is calculated by taking the fund’s total assets (including the fair

value of securities owned), subtracting liabilities, and dividing by the number of shares outstanding. Returns assume that dividends and capital gain distributions have been

reinvested in the fund at NAV.

Due to new regulatory requirements, the fund’s regulatory index has changed from the Bloomberg US Treasury 1-3 Year Index to the Bloomberg US Aggregate Bond Index.

The Bloomberg US Aggregate Bond Index provides a broad measure of market performance. The fund generally invests in securities that are included in the Bloomberg US

Treasury 1-3 Year Index. The fund does not seek to track the regulatory index.

Schwab Short-Term U.S. Treasury ETF | Annual Report

| |

| |

(excludes in-kind transactions) | |

Advisory Fees Paid by the Fund | |

Weighted Average Maturity | |

Weighted Average Duration | |

Qualified Interest Income | |

Business Interest Deduction (163j) | |

Portfolio Composition By Security Type % of Investments

Portfolio holdings may have changed since the report date.

Includes the fund’s position in money market mutual funds registered under the Investment Company Act of 1940, as amended.

Schwab Short-Term U.S. Treasury ETF | Annual Report

This is a summary of certain changes to the fund since January 1, 2024. For more complete information, you may review the fund’s

Annual Holdings and Financial Statements at

www.schwabassetmanagement.com/prospectus

or upon request by calling

1-866-414-6349

or by sending an email request to

orders@mysummaryprospectus.com

.

■

On September 25, 2024, the Board of Trustees authorized a 2-for-1 share split for the fund, which applied to shareholders of

record as of the close of U.S. markets on October 9, 2024. Certain of the fund’s financial statements have been adjusted for the

period ended December 31, 2024, and all prior periods, to reflect the share split.

AVAILABILITY OF ADDITIONAL INFORMATION

You can find the fund’s prospectus, Statement of Additional Information (SAI), reports to shareholders, financial information,

holdings, certain tax information, proxy voting information, and other information about the fund online at

www.schwabassetmanagement.com/prospectus

.

Proxy Voting Policies, Procedures and Results

A description of the proxy voting policies and procedures used to determine how to vote proxies on behalf of the funds is available

without charge, upon request, by visiting the Schwab ETFs’ website at

www.schwabassetmanagement.com/prospectus

, the SEC’s

website at

www.sec.gov

, or by contacting Schwab ETFs at 1-877-824-5615.

Information regarding how a fund voted proxies relating to portfolio securities during the most recent twelve-month period ended

June 30 is available, without charge, by visiting the fund’s website at

www.schwabassetmanagement.com/prospectus

or the SEC’s

website at

www.sec.gov

, by calling

1-866-414-6349

, or by sending an email request to

orders@mysummaryprospectus.com

.

Schwab Short-Term U.S. Treasury ETF | Annual Report

Annual Report |

December 31, 2024

Schwab Intermediate-Term U.S. Treasury ETF

Ticker Symbol: SCHR

Principal U.S. Listing Exchange:

NYSE Arca, Inc.

This annual shareholder report contains important information about the fund for the period of January 1, 2024, to December 31,

2024.

You can find additional information about the fund at

www.schwabassetmanagement.com/prospectus

.

You can also request

this information by calling

1-866-414-6349

or by sending an email request to

orders@mysummaryprospectus.com

.

If you purchase

or hold fund shares through a financial intermediary, the fund’s prospectus, Statement of Additional Information (SAI), reports to

shareholders and other information about the fund are available from your financial intermediary.

This report describes changes to the fund that occurred during the reporting period.

FUND COSTS FOR THE LAST year ENDED December 31, 2024

(BASED ON A HYPOTHETICAL $10,000 INVESTMENT)

| | |

Schwab Intermediate-Term U.S. Treasury ETF | | |

MANAGEMENT’S DISCUSSION OF FUND PERFORMANCE

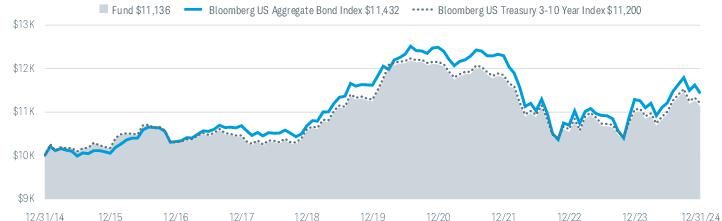

For the 12-month reporting period ended December 31, 2024, the fund’s NAV return was 1.33% (for an explanation of NAV returns,

please refer to footnote 2 on the following page). The Bloomberg US Aggregate Bond Index, which serves as the fund’s regulatory

index and provides a broad measure of market performance, returned 1.25%. The fund generally invests in securities that are

included in the Bloomberg US Treasury 3-10 Year Index which returned 1.26%. The fund does not seek to track the regulatory index.

■

Timing differences between the closing time of prices used for the fund’s NAV and of prices used by the index contributed to

relative performance over the reporting period

●

Timing difference at the beginning of the reporting period contributed to relative performance

●

Timing difference at the end of the reporting period detracted from relative performance but to a lesser degree

●

These deviations are temporary because the two pricing methodologies move back into alignment the following day

■

Coupon income gener

ated

by the fund’s holdings contributed to fund performance while negative price returns detracted from

fund performance, although to a smaller degree

Portfolio holdings may have changed since the report date.

Schwab Intermediate-Term U.S. Treasury ETF | Annual Report

The performance data quoted represents past performance. Past performance does not guarantee future results. Investment returns

and principal value of an investment will fluctuate so that an investor’s shares, when sold or redeemed, may be worth more or less than the original cost.

Current performance may be lower or higher than the performance data quoted.

To obtain performance information

current to the most recent month end, please visit

www.schwabassetmanagement.com/prospectus

.

Performance of Hypothetical $10,000 Investment (December 31, 2014 - December 31, 2024)

1

Average Annual Total Returns

1

| | | |

Fund: Schwab Intermediate-Term U.S. Treasury ETF (08/05/2010) 2 | | | |

Bloomberg US Aggregate Bond Index 3 | | | |

Bloomberg US Treasury 3-10 Year Index | | | |

All total returns on this page assume dividends and distributions were reinvested. Index figures do not include trading and management costs, which would lower

performance. Indices are unmanaged and cannot be invested in directly. Performance results less than one year are not annualized.

For index definitions, please see www.schwabassetmanagement.com/glossary.

Shares are bought and sold at market price, which may be higher or lower than the net asset value (NAV). Brokerage commissions will reduce returns.

Index ownership — Bloomberg

®

and Bloomberg US Treasury 3-10 Year Index are service marks of Bloomberg Finance L.P. and its affiliates, including Bloomberg Index Services

Limited (BISL), the administrator of the indices (collectively, Bloomberg). Bloomberg is not affiliated with Charles Schwab Investment Management, Inc., and Bloomberg does

not approve, endorse, review, or recommend Schwab Intermediate-Term U.S. Treasury ETF. Bloomberg does not guarantee the timeliness, accurateness, or completeness of

any data or information relating to Schwab Intermediate-Term U.S. Treasury ETF.

Performance does not reflect the deduction of taxes that a shareholder would pay on fund distributions or on the redemption or sale of fund shares.

Performance is shown on a NAV basis. The fund’s per share NAV is the value of one share of the fund. NAV is calculated by taking the fund’s total assets (including the fair

value of securities owned), subtracting liabilities, and dividing by the number of shares outstanding. Returns assume that dividends and capital gain distributions have been

reinvested in the fund at NAV.

Due to new regulatory requirements, the fund’s regulatory index has changed from the Bloomberg US Treasury 3-10 Year Index to the Bloomberg US Aggregate Bond Index.

The Bloomberg US Aggregate Bond Index provides a broad measure of market performance. The fund generally invests in securities that are included in the Bloomberg US

Treasury 3-10 Year Index. The fund does not seek to track the regulatory index.

Schwab Intermediate-Term U.S. Treasury ETF | Annual Report

| |

| |

(excludes in-kind transactions) | |

Advisory Fees Paid by the Fund | |

Weighted Average Maturity | |

Weighted Average Duration | |

Qualified Interest Income | |

Business Interest Deduction (163j) | |

Portfolio Composition By Security Type % of Investments

Portfolio holdings may have changed since the report date.

Includes the fund’s position in money market mutual funds registered under the Investment Company Act of 1940, as amended.

Schwab Intermediate-Term U.S. Treasury ETF | Annual Report

This is a summary of certain changes to the fund since January 1, 2024. For more complete information, you may review the fund’s

Annual Holdings and Financial Statements at

www.schwabassetmanagement.com/prospectus

or upon request by calling

1-866-414-6349

or by sending an email request to

orders@mysummaryprospectus.com

.

■

On September 25, 2024, the Board of Trustees authorized a 2-for-1 share split for the fund, which applied to shareholders of

record as of the close of U.S. markets on October 9, 2024. Certain of the fund’s financial statements have been adjusted for the

period ended December 31, 2024, and all prior periods, to reflect the share split.

AVAILABILITY OF ADDITIONAL INFORMATION

You can find the fund’s prospectus, Statement of Additional Information (SAI), reports to shareholders, financial information,

holdings, certain tax information, proxy voting information, and other information about the fund online at

www.schwabassetmanagement.com/prospectus

.

Proxy Voting Policies, Procedures and Results

A description of the proxy voting policies and procedures used to determine how to vote proxies on behalf of the funds is available

without charge, upon request, by visiting the Schwab ETFs’ website at

www.schwabassetmanagement.com/prospectus

, the SEC’s

website at

www.sec.gov

, or by contacting Schwab ETFs at 1-877-824-5615.

Information regarding how a fund voted proxies relating to portfolio securities during the most recent twelve-month period ended

June 30 is available, without charge, by visiting the fund’s website at

www.schwabassetmanagement.com/prospectus

or the SEC’s

website at

www.sec.gov

, by calling

1-866-414-6349

, or by sending an email request to

orders@mysummaryprospectus.com

.

Schwab Intermediate-Term U.S. Treasury ETF | Annual Report

Annual Report |

December 31, 2024

Schwab Long-Term U.S. Treasury ETF

Ticker Symbol: SCHQ

Principal U.S. Listing Exchange:

NYSE Arca, Inc.

This annual shareholder report contains important information about the fund for the period of January 1, 2024, to December 31,

2024.

You can find additional information about the fund at

www.schwabassetmanagement.com/prospectus

.

You can also request

this information by calling

1-866-414-6349

or by sending an email request to

orders@mysummaryprospectus.com

.

If you purchase

or hold fund shares through a financial intermediary, the fund’s prospectus, Statement of Additional Information (SAI), reports to

shareholders and other information about the fund are available from your financial intermediary.

FUND COSTS FOR THE LAST year ENDED December 31, 2024

(BASED ON A HYPOTHETICAL $10,000 INVESTMENT)

| | |

Schwab Long-Term U.S. Treasury ETF | | |

MANAGEMENT’S DISCUSSION OF FUND PERFORMANCE

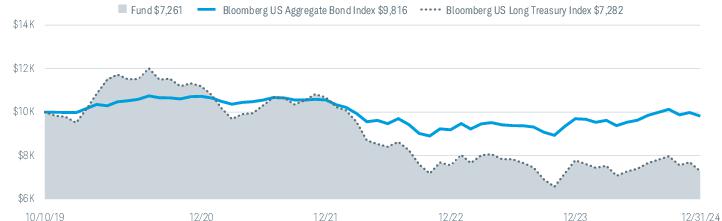

For the 12-month reporting period ended December 31, 2024, the fund’s NAV return was -6.30% (for an explanation of NAV

returns, please refer to footnote 2 on the following page). The Bloomberg US Aggregate Bond Index, which serves as the fund’s

regulatory index and provides a broad measure of market performance, returned 1.25%. The fund generally invests in securities that

are included in the Bloomberg US Long Treasury Index which returned -6.41%. The fund does not seek to track the regulatory index.

■

Timing differences between the closing time of prices used for the fund’s NAV and of prices used by the index contributed to

relative performance over the reporting period

●

Timing difference at the beginning of the reporting period contributed to relative performance

●

Timing difference at the end of the reporting period detracted from relative performance but to a lesser degree

●

These deviations are temporary because the two pricing methodologies move back into alignment the following day

■

Price returns detr

ac

ted from fund performance while coupon income generated by the fund’s holdings contributed to fund

performance, although to a smaller degree

Portfolio holdings may have changed since the report date.

Schwab Long-Term U.S. Treasury ETF | Annual Report

The performance data quoted represents past performance. Past performance does not guarantee future results. Investment returns

and principal value of an investment will fluctuate so that an investor’s shares, when sold or redeemed, may be worth more or less than the original cost.

Current performance may be lower or higher than the performance data quoted.

To obtain performance information

current to the most recent month end, please visit

www.schwabassetmanagement.com/prospectus

.

Performance of Hypothetical $10,000 Investment (October 10, 2019 - December 31, 2024)

1

Average Annual Total Returns

1

| | | |

Fund: Schwab Long-Term U.S. Treasury ETF (10/10/2019) 2 | | | |

Bloomberg US Aggregate Bond Index 3 | | | |

Bloomberg US Long Treasury Index | | | |

All total returns on this page assume dividends and distributions were reinvested. Index figures do not include trading and management costs, which would lower

performance. Indices are unmanaged and cannot be invested in directly. Performance results less than one year are not annualized.

For index definitions, please see www.schwabassetmanagement.com/glossary.

Shares are bought and sold at market price, which may be higher or lower than the net asset value (NAV). Brokerage commissions will reduce returns.

Index ownership — Bloomberg

®

and Bloomberg US Long Treasury Index are service marks of Bloomberg Finance L.P. and its affiliates, including Bloomberg Index Services

Limited (BISL), the administrator of the indices (collectively, Bloomberg). Bloomberg is not affiliated with Charles Schwab Investment Management, Inc., and Bloomberg does

not approve, endorse, review, or recommend Schwab Long-Term U.S. Treasury ETF. Bloomberg does not guarantee the timeliness, accurateness, or completeness of any data

or information relating to Schwab Long-Term U.S. Treasury ETF.

Inception (10/10/2019) represents the date that the shares began trading in the secondary market.

Performance does not reflect the deduction of taxes that a shareholder would pay on fund distributions or on the redemption or sale of fund shares.

Performance is shown on a NAV basis. The fund’s per share NAV is the value of one share of the fund. NAV is calculated by taking the fund’s total assets (including the fair

value of securities owned), subtracting liabilities, and dividing by the number of shares outstanding. Returns assume that dividends and capital gain distributions have been

reinvested in the fund at NAV.

Due to new regulatory requirements, the fund’s regulatory index has changed from the Bloomberg US Long Treasury Index to the Bloomberg US Aggregate Bond Index. The

Bloomberg US Aggregate Bond Index provides a broad measure of market performance. The fund generally invests in securities that are included in the Bloomberg US Long

Treasury Index. The fund does not seek to track the regulatory index.

Schwab Long-Term U.S. Treasury ETF | Annual Report

| |

| |

(excludes in-kind transactions) | |

Advisory Fees Paid by the Fund | |

Weighted Average Maturity | |

Weighted Average Duration | |

Qualified Interest Income | |

Business Interest Deduction (163j) | |

Portfolio Composition By Security Type % of Investments

Portfolio holdings may have changed since the report date.

Includes the fund’s position in money market mutual funds registered under the Investment Company Act of 1940, as amended.

Schwab Long-Term U.S. Treasury ETF | Annual Report

AVAILABILITY OF ADDITIONAL INFORMATION

You can find the fund’s prospectus, Statement of Additional Information (SAI), reports to shareholders, financial information,

holdings, certain tax information, proxy voting information, and other information about the fund online at

www.schwabassetmanagement.com/prospectus

.

Proxy Voting Policies, Procedures and Results

A description of the proxy voting policies and procedures used to determine how to vote proxies on behalf of the funds is available

without charge, upon request, by visiting the Schwab ETFs’ website at

www.schwabassetmanagement.com/prospectus

, the

SEC’s website at

www.sec.gov

, or by contacting Schwab ETFs at 1-877-824-5615.

Information regarding how a fund voted proxies relating to portfolio securities during the most recent twelve-month period ended

June 30 is available, without charge, by visiting the fund’s website at

www.schwabassetmanagement.com/prospectus

or the

SEC’s website at

www.sec.gov

, by calling

1-866-414-6349

, or by sending an email request to

orders@mysummaryprospectus.com

.

Schwab Long-Term U.S. Treasury ETF | Annual Report

Annual Report |

December 31, 2024

Schwab U.S. Aggregate Bond ETF

Ticker Symbol: SCHZ

Principal U.S. Listing Exchange:

NYSE Arca, Inc.

This annual shareholder report contains important information about the fund for the period of January 1, 2024, to December 31,

2024.

You can find additional information about the fund at

www.schwabassetmanagement.com/prospectus

.

You can also request

this information by calling

1-866-414-6349

or by sending an email request to

orders@mysummaryprospectus.com

.

If you purchase

or hold fund shares through a financial intermediary, the fund’s prospectus, Statement of Additional Information (SAI), reports to

shareholders and other information about the fund are available from your financial intermediary.

This report describes changes to the fund that occurred during the reporting period.

FUND COSTS FOR THE LAST year ENDED December 31, 2024

(BASED ON A HYPOTHETICAL $10,000 INVESTMENT)

| | |

Schwab U.S. Aggregate Bond ETF | | |

MANAGEMENT’S DISCUSSION OF FUND PERFORMANCE

For the 12-month reporting period ended December 31, 2024, the fund’s NAV return was 1.26% (for an explanation of NAV returns,

please refer to footnote 2 on the following page). The Bloomberg US Aggregate Bond Index returned 1.25%.

■

Timing differences between the closing time of prices used for the fund’s NAV and of prices used by the index contributed to

relative performance over the reporting period

●

Timing difference at the beginning of the reporting period contributed to relative performance

●

Timing difference at the end of the reporting period detracted from relative performance but to a lesser degree

●

These deviations are temporary because the two pricing methodologies move back into alignment the following day

■

Coupon income generated by the fund’s holdings contributed to fund performance while negative price returns detracted from

fund performance, although to a smaller degree

■

The fund held positions in TBAs, or “to be announced” securities, which are mortgage-backed bonds that settle on a forward date.

The fund’s average month-end position in these securities was 1.4%, with a minimum exposure of 1.0% and a maximum exposure

of 1.9% over the period.

Portfolio holdings may have changed since the report date.

Schwab U.S. Aggregate Bond ETF | Annual Report

The performance data quoted represents past performance. Past performance does not guarantee future results. Investment returns

and principal value of an investment will fluctuate so that an investor’s shares, when sold or redeemed, may be worth more or less than

the original cost.

Current performance may be lower or higher than the performance data quoted.

To obtain performance information

current to the most recent month end, please visit

www.schwabassetmanagement.com/prospectus

.

Performance of Hypothetical $10,000 Investment (December 31, 2014 - December 31, 2024)

1

Average Annual Total Returns

1

| | | |

Fund: Schwab U.S. Aggregate Bond ETF (07/14/2011) 2 | | | |

Bloomberg US Aggregate Bond Index | | | |

All total returns on this page assume dividends and distributions were reinvested. Index figures do not include trading and management costs, which would lower

performance. Indices are unmanaged and cannot be invested in directly. Performance results less than one year are not annualized.

For index definitions, please see www.schwabassetmanagement.com/glossary.

Shares are bought and sold at market price, which may be higher or lower than the net asset value (NAV). Brokerage commissions will reduce returns.

Index ownership — Bloomberg

®

and Bloomberg US Aggregate Bond Index are service marks of Bloomberg Finance L.P. and its affiliates, including Bloomberg Index Services

Limited (BISL), the administrator of the indices (collectively, Bloomberg). Bloomberg is not affiliated with Charles Schwab Investment Management, Inc., and Bloomberg does

not approve, endorse, review, or recommend Schwab U.S. Aggregate Bond ETF. Bloomberg does not guarantee the timeliness, accurateness, or completeness of any data or

information relating to Schwab U.S. Aggregate Bond ETF.

Performance does not reflect the deduction of taxes that a shareholder would pay on fund distributions or on the redemption or sale of fund shares.

Performance is shown on a NAV basis. The fund’s per share NAV is the value of one share of the fund. NAV is calculated by taking the fund’s total assets (including the fair

value of securities owned), subtracting liabilities, and dividing by the number of shares outstanding. Returns assume that dividends and capital gain distributions have been

reinvested in the fund at NAV.

Schwab U.S. Aggregate Bond ETF | Annual Report

| |

| |

(excludes in-kind transactions) | |

Advisory Fees Paid by the Fund | |

Weighted Average Maturity | |

Weighted Average Duration | |

Qualified Interest Income | |

Business Interest Deduction (163j) | |

Portfolio Composition By Security Type % of Investments

Portfolio holdings may have changed since the report date.

Includes the fund’s position in money market mutual funds registered under the Investment Company Act of 1940, as amended.

Schwab U.S. Aggregate Bond ETF | Annual Report

This is a summary of certain changes to the fund since January 1, 2024. For more complete information, you may review the fund’s

Annual Holdings and Financial Statements at

www.schwabassetmanagement.com/prospectus

or upon request by calling

1-866-414-6349

or by sending an email request to

orders@mysummaryprospectus.com

.

■

On September 25, 2024, the Board of Trustees authorized a 2-for-1 share split for the fund, which applied to shareholders of

record as of the close of U.S. markets on October 9, 2024. Certain of the fund’s financial statements have been adjusted for the

period ended December 31, 2024, and all prior periods, to reflect the share split.

AVAILABILITY OF ADDITIONAL INFORMATION

You can find the fund’s prospectus, Statement of Additional Information (SAI), reports to shareholders, financial information,

holdings, certain tax information, proxy voting information, and other information about the fund online at

www.schwabassetmanagement.com/prospectus

.

Proxy Voting Policies, Procedures and Results

A description of the proxy voting policies and procedures used to determine how to vote proxies on behalf of the funds is available

without charge, upon request, by visiting the Schwab ETFs’ website at

www.schwabassetmanagement.com/prospectus

, the SEC’s

website at

www.sec.gov

, or by contacting Schwab ETFs at 1-877-824-5615.

Information regarding how a fund voted proxies relating to portfolio securities during the most recent twelve-month period ended

June 30 is available, without charge, by visiting the fund’s website at

www.schwabassetmanagement.com/prospectus

or the SEC’s

website at

www.sec.gov

, by calling

1-866-414-6349

, or by sending an email request to

orders@mysummaryprospectus.com

.

Schwab U.S. Aggregate Bond ETF | Annual Report

Annual Report |

December 31, 2024

Schwab 1-5 Year Corporate Bond ETF

Principal U.S. Listing Exchange:

NYSE Arca, Inc.

This

annual shareholder report

contains important information about the fund for the period of January 1, 2024, to December 31,

2024.

You can find additional information about the fund at

www.schwabassetmanagement.com/prospectus

.

You can also request

this information by calling

or by sending an email request to

orders@mysummaryprospectus.com

.

If you purchase

or hold fund shares through a financial intermediary, the fund’s prospectus, Statement of Additional Information (SAI), reports to

shareholders and other information about the fund are available from your financial intermediary.

This report describes changes to the fund that occurred during the reporting period.

FUND COSTS FOR THE LAST year ENDED December 31, 2024

(BASED ON A HYPOTHETICAL $10,000 INVESTMENT)

| | |

Schwab 1-5 Year Corporate Bond ETF | | |

MANAGEMENT’S DISCUSSION OF FUND PERFORMANCE

For the 12-month reporting period ended December 31, 2024, the fund’s NAV return was 4.95% (for an explanation of NAV returns,

please refer to footnote 2 on the following page). The Bloomberg US Aggregate Bond Index, which serves as the fund’s regulatory

index and provides a broad measure of market performance, returned 1.25%. The fund generally invests in securities that are

included in the Bloomberg US 1-5 Year Corporate Bond Index which returned 4.95%. The fund does not seek to track the regulatory

index.

■

Timing differences between the closing time of prices used for the fund’s NAV and of prices used by the index contributed to

relative performance over the reporting period

●

Timing difference at the beginning of the reporting period contributed to relative performance

●

Timing difference at the end of the reporting period detracted from relative performance but to a lesser degree

●

These deviations are temporary because the two pricing methodologies move back into alignment the following day

■

Most of the fund’s gains came from coupon income generated by the fund’s holdings though price appreciation also contributed to

fund performance, although to a smaller degree

Portfolio holdings may have changed since the report date.

Schwab 1-5 Year Corporate Bond ETF | Annual Report

The performance data quoted represents past performance. Past performance does not guarantee future results. Investment returns

and principal value of an investment will fluctuate so that an investor’s shares, when sold or redeemed, may be worth more or less than

the original cost.

Current performance may be lower or higher than the performance data quoted.

To obtain performance information

current to the most recent month end, please visit

www.schwabassetmanagement.com/prospectus

.

Performance of Hypothetical $10,000 Investment (October 10, 2019 - December 31, 2024)

1

Average Annual Total Returns

1

| | | |

Fund: Schwab 1-5 Year Corporate Bond ETF (10/10/2019) 2 | | | |

Bloomberg US Aggregate Bond Index 3 | | | |

Bloomberg US 1-5 Year Corporate Bond Index | | | |

All total returns on this page assume dividends and distributions were reinvested. Index figures do not include trading and management costs, which would lower

performance. Indices are unmanaged and cannot be invested in directly. Performance results less than one year are not annualized.

For index definitions, please see www.schwabassetmanagement.com/glossary.

Shares are bought and sold at market price, which may be higher or lower than the net asset value (NAV). Brokerage commissions will reduce returns.

Index ownership — Bloomberg

®

and Bloomberg US 1-5 Year Corporate Bond Index are service marks of Bloomberg Finance L.P. and its affiliates, including Bloomberg Index

Services Limited (BISL), the administrator of the indices (collectively, Bloomberg). Bloomberg is not affiliated with Charles Schwab Investment Management, Inc., and

Bloomberg does not approve, endorse, review, or recommend Schwab 1-5 Year Corporate Bond ETF. Bloomberg does not guarantee the timeliness, accurateness, or

completeness of any data or information relating to Schwab 1-5 Year Corporate Bond ETF.

Inception (10/10/2019) represents the date that the shares began trading in the secondary market.

Performance does not reflect the deduction of taxes that a shareholder would pay on fund distributions or on the redemption or sale of fund shares.

Performance is shown on a NAV basis. The fund’s per share NAV is the value of one share of the fund. NAV is calculated by taking the fund’s total assets (including the fair

value of securities owned), subtracting liabilities, and dividing by the number of shares outstanding. Returns assume that dividends and capital gain distributions have been

reinvested in the fund at NAV.

Due to new regulatory requirements, the fund’s regulatory index has changed from the Bloomberg US 1-5 Year Corporate Bond Index to the Bloomberg US Aggregate Bond

Index. The Bloomberg US Aggregate Bond Index provides a broad measure of market performance. The fund generally invests in securities that are included in the

Bloomberg US 1-5 Year Corporate Bond Index. The fund does not seek to track the regulatory index.

Schwab 1-5 Year Corporate Bond ETF | Annual Report

| |

| |

(excludes in-kind transactions) | |

Advisory Fees Paid by the Fund | |

Weighted Average Maturity | |

Weighted Average Duration | |

Qualified Interest Income | |

Business Interest Deduction (163j) | |

Portfolio Composition By Security Type % of Investments

1

Portfolio holdings may have changed since the report date.

Includes the fund’s position in money market mutual funds registered under the Investment Company Act of 1940, as amended.

Schwab 1-5 Year Corporate Bond ETF | Annual Report

This is a summary of certain changes to the fund since January 1, 2024. For more complete information, you may review the fund’s

Annual Holdings and Financial Statements at

www.schwabassetmanagement.com/prospectus

or upon request by calling

1-866-414-6349

or by sending an email request to

orders@mysummaryprospectus.com

.

■

On September 25, 2024, the Board of Trustees authorized a 2-for-1 share split for the fund, which applied to shareholders of

record as of the close of U.S. markets on October 9, 2024. Certain of the fund’s financial statements have been adjusted for the

period ended December 31, 2024, and all prior periods, to reflect the share split.

AVAILABILITY OF ADDITIONAL INFORMATION

You can find the fund’s prospectus, Statement of Additional Information (SAI), reports to shareholders, financial information,

holdings, certain tax information, proxy voting information, and other information about the fund online at

www.schwabassetmanagement.com/prospectus

.

Proxy Voting Policies, Procedures and Results

A description of the proxy voting policies and procedures used to determine how to vote proxies on behalf of the funds is available

without charge, upon request, by visiting the Schwab ETFs’ website at

www.schwabassetmanagement.com/prospectus

, the SEC’s

website at

www.sec.gov

, or by contacting Schwab ETFs at 1-877-824-5615.

Information regarding how a fund voted proxies relating to portfolio securities during the most recent twelve-month period ended

June 30 is available, without charge, by visiting the fund’s website at

www.schwabassetmanagement.com/prospectus

or the SEC’s

website at

www.sec.gov

, by calling

1-866-414-6349

, or by sending an email request to

orders@mysummaryprospectus.com

.

Schwab 1-5 Year Corporate Bond ETF | Annual Report

Annual Report |

December 31, 2024

Schwab 5-10 Year Corporate Bond ETF

Ticker Symbol: SCHI

Principal U.S. Listing Exchange:

NYSE Arca, Inc.

This annual shareholder report contains important information about the fund for the period of January 1, 2024, to December 31,

2024.

You can find additional information about the fund at

www.schwabassetmanagement.com/prospectus

. You can also request

this information by calling

1-866-414-6349

or by sending an email request to

orders@mysummaryprospectus.com

.

If you purchase

or hold fund shares through a financial intermediary, the fund’s prospectus, Statement of Additional Information (SAI), reports to

shareholders and other information about the fund are available from your financial intermediary.

This report describes changes to the fund that occurred during the reporting period.

FUND COSTS FOR THE LAST year ENDED December 31, 2024

(BASED ON A HYPOTHETICAL $10,000 INVESTMENT)

| | |

Schwab 5-10 Year Corporate Bond ETF | | |

MANAGEMENT’S DISCUSSION OF FUND PERFORMANCE

For the 12-month reporting period ended December 31, 2024, the fund’s NAV return was 3.32% (for an explanation of NAV returns,

please refer to footnote 2 on the following page). The Bloomberg US Aggregate Bond Index, which serves as the fund’s regulatory

index and provides a broad measure of market performance, returned 1.25%. The fund generally invests in securities that are

included in the Bloomberg US 5-10 Year Corporate Bond Index which returned 3.21%. The fund does not seek to track the

regulatory index.

■

Timing differences between the closing time of prices used for the fund’s NAV and of prices used by the index contributed to

relative performance over the reporting period

●

Timing difference at the beginning of the reporting period contributed to relative performance

●

Timing difference at the end of the reporting period detracted from relative performance but to a lesser degree

●

These deviations are temporary because the two pricing methodologies move back into alignment the following day

■

Coupon income generated by the fund’s holdings contributed to fund performance while negative price returns detracted from

fund performance, although to a smaller degree

Portfolio holdings may have changed since the report date.

Schwab 5-10 Year Corporate Bond ETF | Annual Report

The performance data quoted represents past performance. Past performance does not guarantee future results. Investment returns

and principal value of an investment will fluctuate so that an investor’s shares, when sold or redeemed, may be worth more or less than the original cost.

Current performance may be lower or higher than the performance data quoted.

To obtain performance information

current to the most recent month end, please visit

www.schwabassetmanagement.com/prospectus

.

Performance of Hypothetical $10,000 Investment (October 10, 2019 - December 31, 2024)

1

Average Annual Total Returns

1

| | | |

Fund: Schwab 5-10 Year Corporate Bond ETF (10/10/2019) 2 | | | |

Bloomberg US Aggregate Bond Index 3 | | | |

Bloomberg US 5-10 Year Corporate Bond Index | | | |

All total returns on this page assume dividends and distributions were reinvested. Index figures do not include trading and management costs, which would lower

performance. Indices are unmanaged and cannot be invested in directly. Performance results less than one year are not annualized.

For index definitions, please see www.schwabassetmanagement.com/glossary.

Shares are bought and sold at market price, which may be higher or lower than the net asset value (NAV). Brokerage commissions will reduce returns.

Index ownership — Bloomberg

®

and Bloomberg US 5-10 Year Corporate Bond Index are service marks of Bloomberg Finance L.P. and its affiliates, including Bloomberg Index

Services Limited (BISL), the administrator of the indices (collectively, Bloomberg). Bloomberg is not affiliated with Charles Schwab Investment Management, Inc., and

Bloomberg does not approve, endorse, review, or recommend Schwab 5-10 Year Corporate Bond ETF. Bloomberg does not guarantee the timeliness, accurateness, or

completeness of any data or information relating to Schwab 5-10 Year Corporate Bond ETF.

Inception (10/10/2019) represents the date that the shares began trading in the secondary market.

Performance does not reflect the deduction of taxes that a shareholder would pay on fund distributions or on the redemption or sale of fund shares.

Performance is shown on a NAV basis. The fund’s per share NAV is the value of one share of the fund. NAV is calculated by taking the fund’s total assets (including the fair

value of securities owned), subtracting liabilities, and dividing by the number of shares outstanding. Returns assume that dividends and capital gain distributions have been

reinvested in the fund at NAV.

Due to new regulatory requirements, the fund’s regulatory index has changed from the Bloomberg US 5-10 Year Corporate Bond Index to the Bloomberg US Aggregate Bond

Index. The Bloomberg US Aggregate Bond Index provides a broad measure of market performance. The fund generally invests in securities that are included in the

Bloomberg US 5-10 Year Corporate Bond Index. The fund does not seek to track the regulatory index.

Schwab 5-10 Year Corporate Bond ETF | Annual Report

| |

| |

(excludes in-kind transactions) | |

Advisory Fees Paid by the Fund | |

Weighted Average Maturity | |

Weighted Average Duration | |

Qualified Interest Income | |

Business Interest Deduction (163j) | |

Portfolio Composition By Security Type % of Investments

1

Portfolio holdings may have changed since the report date.

Includes the fund’s position in money market mutual funds registered under the Investment Company Act of 1940, as amended.

Schwab 5-10 Year Corporate Bond ETF | Annual Report

This is a summary of certain changes to the fund since January 1, 2024. For more complete information, you may review the fund’s

Annual Holdings and Financial Statements at

www.schwabassetmanagement.com/prospectus

or upon request by calling

1-866-414-6349

or by sending an email request to

orders@mysummaryprospectus.com

.

■

On September 25, 2024, the Board of Trustees authorized a 2-for-1 share split for the fund, which applied to shareholders of

record as of the close of U.S. markets on October 9, 2024. Certain of the fund’s financial statements have been adjusted for the

period ended December 31, 2024, and all prior periods, to reflect the share split.

AVAILABILITY OF ADDITIONAL INFORMATION

You can find the fund’s prospectus, Statement of Additional Information (SAI), reports to shareholders, financial information,

holdings, certain tax information, proxy voting information, and other information about the fund online at

www.schwabassetmanagement.com/prospectus

.

Proxy Voting Policies, Procedures and Results

A description of the proxy voting policies and procedures used to determine how to vote proxies on behalf of the funds is available

without charge, upon request, by visiting the Schwab ETFs’ website at

www.schwabassetmanagement.com/prospectus

, the SEC’s

website at

www.sec.gov

, or by contacting Schwab ETFs at 1-877-824-5615.

Information regarding how a fund voted proxies relating to portfolio securities during the most recent twelve-month period ended

June 30 is available, without charge, by visiting the fund’s website at

www.schwabassetmanagement.com/prospectus

or the SEC’s

website at

www.sec.gov

, by calling

1-866-414-6349

, or by sending an email request to

orders@mysummaryprospectus.com

.

Schwab 5-10 Year Corporate Bond ETF | Annual Report

Schwab Municipal Bond ETF

Principal U.S. Listing Exchange:

NYSE Arca, Inc.

This annual shareholder report contains important information about the fund for the period of January 1, 2024, to December 31,

2024.

You can find additional information about the fund at

www.schwabassetmanagement.com/prospectus

. You can also request this information by calling

or by sending an email request to

orders@mysummaryprospectus.com.

If you purchase

or hold fund shares through a financial intermediary, the fund’s prospectus, Statement of Additional Information (SAI), reports to

shareholders and other information about the fund are available from your financial intermediary.

This report describes changes to the fund that occurred during the reporting period.

FUND COSTS FOR THE LAST year ENDED December 31, 2024

(BASED ON A HYPOTHETICAL $10,000 INVESTMENT)

| | |

Schwab Municipal Bond ETF | | |

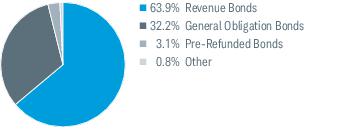

MANAGEMENT’S DISCUSSION OF FUND PERFORMANCE

For the 12-month reporting period ended December 31, 2024, the fund’s NAV return was 1.14% (for an explanation of NAV returns,

please refer to footnote 2 on the following page). The Bloomberg Municipal Bond Index, which serves as the fund’s regulatory index

and provides a broad measure of market performance, returned 1.05%. The fund generally invests in securities that are included in

the ICE AMT-Free Core U.S. National Municipal Index which returned 1.26%. The fund does not seek to track the regulatory index.

■

The fund experienced a significant growth in assets over the period. Variable charges paid to the fund by purchasers and

redeemers of Creation Units (large blocks of shares) for cash contributed to the fund’s performance. These charges offset the

transaction costs to the fund of buying or selling portfolio securities.

■

Coupon income generated by the fund’s holdings contributed to fund performance while negative price returns detracted from

fund performance, although to a smaller degree

Portfolio holdings may have changed since the report date.

Schwab Municipal Bond ETF | Annual Report

The performance data quoted represents past performance. Past performance does not guarantee future results. Investment returns

and principal value of an investment will fluctuate so that an investor’s shares, when sold or redeemed, may be worth more or less than the original cost.

Current performance may be lower or higher than the performance data quoted.

To obtain performance information

current to the most recent month end, please visit

www.schwabassetmanagement.com/prospectus

Performance of Hypothetical $10,000 Investment (October 12, 2022 - December 31, 2024)

Average Annual Total Returns

| | |

Fund: Schwab Municipal Bond ETF (10/12/2022) 2 | | |

Bloomberg Municipal Bond Index 3 | | |

ICE AMT-Free Core U.S. National Municipal Index | | |

All total returns on this page assume dividends and distributions were reinvested. Index figures do not include trading and management costs, which would lower

performance. Indices are unmanaged and cannot be invested in directly. Performance results less than one year are not annualized.

For index definitions, please see www.schwabassetmanagement.com/glossary.

Shares are bought and sold at market price, which may be higher or lower than the net asset value (NAV). Brokerage commissions will reduce returns.

“ICE

®

” is a registered trademark of ICE Data Indices, LLC or its affiliates. This trademark has been licensed, along with the ICE AMT-Free Core U.S. National Municipal Index

(“Index”) for use by Charles Schwab Investment Management, Inc., dba Schwab Asset Management, in connection with the Schwab Municipal Bond ETF. The Schwab

Municipal Bond ETF is not sponsored, endorsed, sold or promoted by ICE Data Indices, LLC, its affiliates or its Third Party Suppliers (“ICE Data and its Suppliers”). ICE Data and

its Suppliers make no representations or warranties regarding the advisability of investing in the Schwab Municipal Bond ETF.

Inception (10/12/2022) represents the date that the shares began trading in the secondary market.

Performance does not reflect the deduction of taxes that a shareholder would pay on fund distributions or on the redemption or sale of fund shares.

Performance is shown on a NAV basis. The fund’s per share NAV is the value of one share of the fund. NAV is calculated by taking the fund’s total assets (including the fair

value of securities owned), subtracting liabilities, and dividing by the number of shares outstanding. Returns assume that dividends and capital gain distributions have been

reinvested in the fund at NAV.

Due to new regulatory requirements, the fund’s regulatory index has changed from the ICE AMT-Free Core U.S. National Municipal Index to the Bloomberg Municipal Bond

Index. The Bloomberg Municipal Bond Index provides a broad measure of market performance. The fund generally invests in securities that are included in the ICE AMT-Free

Core U.S. National Municipal Index. The fund does not seek to track the regulatory index.

Schwab Municipal Bond ETF | Annual Report

| |

| |

(excludes in-kind transactions) | |

Advisory Fees Paid by the Fund | |

Weighted Average Maturity | |

Weighted Average Duration | |

Tax Exempt Income Distribution | |

Portfolio Composition By Security Type % of Investments

Portfolio holdings may have changed since the report date.

Schwab Municipal Bond ETF | Annual Report

This is a summary of certain changes to the fund since

. For more complete information, you may review the fund’s

Annual Holdings and Financial Statements at

www.schwabassetmanagement.com/prospectus

or upon request by calling

or by sending an email request to

orders@mysummaryprospectus.com

.

■

On September 25, 2024, the Board of Trustees authorized a 2-for-1 share split for the fund, which applied to shareholders of

record as of the close of U.S. markets on October 9, 2024. Certain of the fund’s financial statements have been adjusted for the

period ended December 31, 2024, and all prior periods, to reflect the share split.

AVAILABILITY OF ADDITIONAL INFORMATION

You can find the fund’s prospectus, Statement of Additional Information (SAI), reports to shareholders, financial information,

holdings, certain tax information, proxy voting information, and other information about the fund online at

www.schwabassetmanagement.com/prospectus

.

Proxy Voting Policies, Procedures and Results

A description of the proxy voting policies and procedures used to determine how to vote proxies on behalf of the funds is available

without charge, upon request, by visiting the Schwab ETFs’ website at

www.schwabassetmanagement.com/prospectus

, the SEC’s

website at

, or by contacting Schwab ETFs at 1-877-824-5615.

Information regarding how a fund voted proxies relating to portfolio securities during the most recent twelve-month period ended

June 30 is available, without charge, by visiting the fund’s website at

www.schwabassetmanagement.com/prospectus

or the SEC’s

website at

, by calling

, or by sending an email request to

orders@mysummaryprospectus.com

.

Schwab Municipal Bond ETF | Annual Report

Schwab Ultra-Short Income ETF

Principal U.S. Listing Exchange:

NYSE Arca, Inc.

This annual shareholder report contains important information about the fund for the period of August 13, 2024, to December 31,

2024.

You can find additional information about the fund at

www.schwabassetmanagement.com/prospectus

. You can also request

this information by calling

or by sending an email request to

orders@mysummaryprospectus.com

.

If you purchase

or hold fund shares through a financial intermediary, the fund’s prospectus, Statement of Additional Information (SAI), reports to

shareholders and other information about the fund are available from your financial intermediary.

FUND COSTS FOR THE LAST year ENDED December 31, 2024

(BASED ON A HYPOTHETICAL $10,000 INVESTMENT)

| | |

Schwab Ultra-Short Income ETF | | |

For the period from 08/13/2024 (commencement of operations) through 12/31/2024. Expenses for a full reporting period would be higher than the figure shown.

MANAGEMENT’S DISCUSSION OF FUND PERFORMANCE

For the reporting period of August 13, 2024

1

, through December 31, 2024, the fund’s NAV return was 1.96% (for an explanation of

NAV returns, please refer to footnote 2 on the following page). The Bloomberg US Aggregate Bond Index, which serves as the fund’s

regulatory index and provides a broad measure of market performance, returned -1.29%. The ICE BofA US 3-Month Treasury Bill

Index which returned 1.91%, is the fund’s additional index, and is more representative of the fund’s investment universe than the

regulatory index.

■

Though the fund focuses on investment-grade securities with durations of two years or shorter, the fund maintained a duration

between four and six months during the reporting period

■

The fund’s shorter duration positively contributed to performance as yields on the two-year U.S. Treasury rose during the reporting

period

Portfolio holdings may have changed since the report date.

Inception (08/13/2024) represents the date that the shares began trading in the secondary market.

Schwab Ultra-Short Income ETF | Annual Report

The performance data quoted represents past performance. Past performance does not guarantee future results. Investment returns

and principal value of an investment will fluctuate so that an investor’s shares, when sold or redeemed, may be worth more or less than the original cost.

Current performance may be lower or higher than the performance data quoted.

To obtain performance information

current to the most recent month end, please visit

www.schwabassetmanagement.com/prospectus

Performance of Hypothetical $10,000 Investment (August 13, 2024 - December 31, 2024)

Average Annual Total Returns

| |

Fund: Schwab Ultra-Short Income ETF (08/13/2024) 2 | |

Bloomberg US Aggregate Bond Index | |

ICE BofA US 3-Month Treasury Bill Index | |

All total returns on this page assume dividends and distributions were reinvested. Index figures do not include trading and management costs, which would lower

performance. Indices are unmanaged and cannot be invested in directly. Performance results less than one year are not annualized.

For index definitions, please see www.schwabassetmanagement.com/glossary.

Shares are bought and sold at market price, which may be higher or lower than the net asset value (NAV). Brokerage commissions will reduce returns.

Inception (08/13/2024) represents the date that the shares began trading in the secondary market.

Performance does not reflect the deduction of taxes that a shareholder would pay on fund distributions or on the redemption or sale of fund shares.

Performance is shown on a NAV basis. The fund’s per share NAV is the value of one share of the fund. NAV is calculated by taking the fund’s total assets (including the fair

value of securities owned), subtracting liabilities, and dividing by the number of shares outstanding. Returns assume that dividends and capital gain distributions have been

reinvested in the fund at NAV.

Total returns shown are since the fund’s inception date of August 13, 2024.

Schwab Ultra-Short Income ETF | Annual Report

| |

| |

| |

Advisory Fees Paid by the Fund | |

Weighted Average Maturity | |

Weighted Average Duration | |

Qualified Interest Income | |

Business Interest Deduction (163j) | |

Portfolio Composition By Security Type % of Investments

Portfolio holdings may have changed since the report date.

Schwab Ultra-Short Income ETF | Annual Report

AVAILABILITY OF ADDITIONAL INFORMATION

You can find the fund’s prospectus, Statement of Additional Information (SAI), reports to shareholders, financial information,

holdings, certain tax information, proxy voting information, and other information about the fund online at

www.schwabassetmanagement.com/prospectus

.

Proxy Voting Policies, Procedures and Results

A description of the proxy voting policies and procedures used to determine how to vote proxies on behalf of the funds is available

without charge, upon request, by visiting the Schwab ETFs’ website at

www.schwabassetmanagement.com/prospectus

, the

SEC’s website at

, or by contacting Schwab ETFs at 1-877-824-5615.

Information regarding how a fund voted proxies relating to portfolio securities during the most recent twelve-month period ended

June 30 is available, without charge, by visiting the fund’s website at

www.schwabassetmanagement.com/prospectus

or the

SEC’s website at

, by calling

, or by sending an email request to

orders@mysummaryprospectus.com

.

Schwab Ultra-Short Income ETF | Annual Report

Item 2: Code of Ethics.

| (a) | Registrant has adopted a code of ethics that applies to its principal executive officer, principal financial officer, and any other persons who perform a similar function, regardless of whether these individuals are employed by Registrant or a third party. |

| (c) | During the period covered by the report, no amendments were made to the provisions of this code of ethics. |

| (d) | During the period covered by the report, Registrant did not grant any waivers, including implicit waivers, from the provisions of this code of ethics. |

| (f)(1) | Registrant has filed this code of ethics as an exhibit pursuant to Item 19(a)(1) of Form N-CSR. |

Item 3: Audit Committee Financial Expert.

Registrant’s Board of Trustees has determined that Kimberly S. Patmore, Michael J. Beer and J. Derek Penn, each currently serving on its audit, compliance and valuation committee, are each an “audit committee financial expert,” as such term is defined in Item 3 of Form N-CSR. Each member of Registrant’s audit, compliance and valuation committee is “independent” under the standards set forth in Item 3 of Form N-CSR.

The designation of each of Ms. Patmore, Mr. Beer and Mr. Penn as an “audit committee financial expert” pursuant to Item 3 of Form N-CSR does not (i) impose upon such individual any duties, obligations, or liability that are greater than the duties, obligations and liability imposed upon such individual as a member of Registrant’s audit, compliance and valuation committee or Board of Trustees in the absence of such designation; and (ii) affect the duties, obligations or liability of any other member of Registrant’s audit, compliance and valuation committee or Board of Trustees.

Item 4: Principal Accountant Fees and Services.

Registrant is composed of thirty-two operational series. Nine series have a fiscal year-end of December 31, whose annual financial statements are reported in Item 1, seven series have a fiscal year-end of the last day of February, two series have a fiscal year end of March 31, and fourteen series have a fiscal year-end of August 31. Principal accountant fees disclosed in Items 4(a)-(d) and 4(g) include fees billed for services rendered to each of the thirty operational series during 2024/2025 and the thirty operational series during 2023/2024, based on their respective 2024/2025 and 2023/2024 fiscal years, as applicable.

The following table presents fees billed by the principal accountant in each of the last two fiscal years for the services rendered to the funds:

| | | | | | | | | | | | | | |

(a) Audit Fees1 | | (b) Audit-Related Fees | | (c) Tax Fees2 | | (d) All Other Fees |

Fiscal Year

2024/2025 | | Fiscal Year

2023/2024 | | Fiscal Year

2024/2025 | | Fiscal Year

2023/2024 | | Fiscal Year

2024/2025 | | Fiscal Year

2023/2024 | | Fiscal Year

2024/2025 | | Fiscal Year

2023/2024 |

$601,700 | | $558,674 | | $0 | | $0 | | $101,835 | | $98,550 | | $0 | | $0 |

| 1 | The nature of the services includes audit of the registrant’s annual financial statements and normally provided services in connection with regulatory filings for those fiscal years. |

| 2 | The nature of the services includes tax compliance, tax advice and tax planning. |

| (e) | (1) Registrant’s audit, compliance and valuation committee does not have pre-approval policies and procedures as described in paragraph (c)(7) of Rule 2-01 of Regulation S-X. |

| (2) | There were no services described in each of paragraphs (b) through (d) above that were approved by Registrant’s audit, compliance and valuation committee pursuant to paragraph (c)(7)(i)(C) of Rule 2-01 of Regulation S-X. |

(f) Not applicable.

(g) Below are the aggregate non-audit fees billed in each of the last two fiscal years by Registrant’s principal accountant for services rendered to Registrant, to Registrant’s investment adviser, and to any entity controlling, controlled by, or under common control with Registrant’s investment adviser that provides ongoing services to Registrant.

| | | | |

2024: $1,874,341 | | 2023: $ | 3,940,154 | |

(h) During the past fiscal year, all non-audit services provided by Registrant’s principal accountant to either Registrant’s investment adviser or to any entity controlling, controlled by, or under common control with Registrant’s investment adviser that provides ongoing services to Registrant were pre-approved. Included in the audit, compliance and valuation committee’s pre-approval was the review and consideration as to whether the provision of these non-audit services is compatible with maintaining the principal accountant’s independence.

(i) Not applicable.

(j) Not applicable.

Item 5: Audit Committee of Listed Registrants.

The Registrant is a listed issuer as defined in Rule 10A-3 under the Exchange Act and has separately-designated standing audit, compliance and valuation committee established in accordance with Section 3(a)(58)(A) of the Exchange Act. The Registrant’s audit, compliance and valuation committee members are Kimberly S. Patmore, Michael J. Beer and J. Derek Penn.

Item 6: Schedule of Investments.

The schedules of investments are included as part of the report to shareholders filed under Item 7 of this Form.

Item 7: Financial Statements and Financial Highlights for Open-End Management Investment Companies.

Annual Holdings and Financial Statements | December 31, 2024

Schwab Fixed-Income ETFs

| |

Schwab Short-Term U.S. Treasury ETF | |

Schwab Intermediate-Term U.S. Treasury ETF | |

Schwab Long-Term U.S. Treasury ETF | |

Schwab U.S. Aggregate Bond ETF | |

Schwab 1-5 Year Corporate Bond ETF | |

Schwab 5-10 Year Corporate Bond ETF | |

Schwab Municipal Bond ETF | |

Fund investment adviser: Charles Schwab Investment Management, Inc., dba Schwab Asset Management®

Distributor: SEI Investments Distribution Co. (SIDCO)

Schwab Fixed-Income ETFs | Annual Holdings and Financial Statements

1

Financial Statements

| | | | | | |

|

Net asset value at beginning of period | | | | | | |

Income (loss) from investment operations: | | | | | | |

Net investment income (loss)2 | | | | | | |

Net realized and unrealized gains (losses) | | | | | | |

Total from investment operations | | | | | | |

| | | | | | |

Distributions from net investment income | | | | | | |

Net asset value at end of period | | | | | | |

| | | | | | |

|

Ratios to average net assets: | | | | | | |

| | | | | | |

Net investment income (loss) | | | | | | |

| | | | | | |

Net assets, end of period (x 1,000,000) | | | | | | |

| Per-Share Data has been retroactively adjusted to reflect a 2-for-1 share split effective after market close on October 10, 2024 (see financial note 10 for additional information). |

| Calculated based on the average shares outstanding during the period. |

| Effective September 25, 2023, the annual operating expense ratio was reduced to 0.03%. The ratio presented for the period ended December 31, 2023, is a blended ratio. |

| Effective July 1, 2022, the annual operating expense ratio was reduced to 0.04%. The ratio presented for the period ended December 31, 2022, is a blended ratio. |

| Ratio includes less than 0.005% of non-routine proxy expenses. |

| Portfolio turnover rate excludes securities received or delivered from processing of in-kind creations or redemptions. |

2

Schwab Fixed-Income ETFs | Annual Holdings and Financial Statements

Portfolio Holdings as of December 31, 2024

For fixed rate securities, the rate shown is the interest rate (the rate established when the security was issued). The maturity date shown for all the securities is the final legal maturity. Inflation-protected securities are fixed-income securities whose principal value is periodically adjusted by the rate of inflation. The interest rate on these instruments is generally lower at issuance than typical bonds or notes. Over the life of an inflation-indexed instrument interest will be paid based on a principal value, which is adjusted for any inflation or deflation.

SECURITY RATE, MATURITY DATE | | |

TREASURIES 99.6% OF NET ASSETS |

U.S. Treasury Inflation Protected Securities |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

SECURITY RATE, MATURITY DATE | | |

| | |