Exhibit (a)(1)(A)

LETTER OF TRANSMITTAL

REIT EXCHANGE FUND, INC.

OFFER TO EXCHANGE COMMON SHARES

FOR

UP TO [ ] [ ] OF [ ] IN

[Selected REIT]

at

an Exchange Ratio of [ ]

Pursuant to the Prospectus, dated , 2013

(“Prospectus”)

THE EXCHANGE OFFER WILL EXPIRE AT MIDNIGHT,

NEW YORK CITY TIME, ON THE EXPIRATION DATE, UNLESS THE EXCHANGE OFFER IS EXTENDED.

Delivery To:

U.S. Bancorp Fund Services, LLC

By Mail: |

| By Hand or Overnight Delivery Service: |

|

|

|

U.S. Bancorp Fund Services, LLC |

| U.S. Bancorp Fund Services, LLC |

By Facsimile Transmission: 1-866-350-5206

The Information Agent for the Exchange Offer is:

D.F. King & Co., Inc.

48 Wall Street

New York, NY 10005

Shareholders, call toll-free: 1-800-290-6424

Banks and brokers, call collect: (212) 269-5550

Email: rxfinfo@dfking.com

Delivery of this Letter of Transmittal to an address other than as set forth above, or transmission of instructions via facsimile other than as set forth above, will not constitute a valid delivery. You must sign this Letter of Transmittal in the appropriate space provided therefor below, with signature guaranteed, if required, and complete the IRS Form W-9 included in this Letter of Transmittal, or an applicable IRS Form W-8, if required. The instructions set forth in this Letter of Transmittal should be read carefully before this Letter of Transmittal is completed.

DESCRIPTION OF COMPANY SHARES TENDERED

|

| Company Shares Tendered | ||||

Name(s) and Address(es) of Registered Holder(s) |

| Certificate |

| Total Number of |

| Total Number of |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total Company Shares |

|

|

|

|

(1) If shares are held in book-entry form you must indicate the number of Company Shares you are tendering.

(2) Unless otherwise indicated, all Company Shares represented by Share Certificates or book-entry position delivered to the Exchange Agent will be deemed to have been tendered. See Instruction 4.

The Offer (as defined below) is not being made to (nor will tender of Company Shares (as defined below) be accepted from or on behalf of) shareholders in any jurisdiction where it would be illegal to do so.

This Letter of Transmittal is to be used by shareholders of [ (the “Company”)] if certificates of Company Shares (“Share Certificates”) are to be forwarded herewith or if Company Shares are held in book-entry form on the records of the Depositary (pursuant to the procedures set forth in the section: “Terms of the Exchange Offer — How to Tender” of the Prospectus).

Shareholders whose Share Certificates are not immediately available, or who cannot complete the procedure for book-entry transfer on a timely basis, or who cannot deliver all other required documents to the Information Agent prior to the Expiration Date (as defined in the summary section of the Prospectus), must tender their Company Shares according to the guaranteed delivery procedure set forth in the section: “Terms of the Exchange Offer — How to Tender.” See Instruction 2.

THE INSTRUCTIONS ACCOMPANYING THIS LETTER OF TRANSMITTAL SHOULD BE READ CAREFULLY BEFORE THIS LETTER OF TRANSMITTAL IS COMPLETED. REQUESTS FOR ASSISTANCE MAY BE MADE TO OR OBTAINED FROM THE INFORMATION AGENT AT THE ADDRESS OR TELEPHONE NUMBERS SET FORTH BELOW.

Ladies and Gentlemen:

The undersigned hereby tenders to the REIT Exchange Fund, Inc., a Maryland corporation (the “Fund” or “RXF”), the above described shares of common stock, par value $[ ] per share (“Company Shares”), of [ ] (the “Company”), pursuant to RXF’s offer to exchange Company Shares for RXF common shares (“RXF Common Shares”), upon the terms and subject to the conditions set forth in RXF’s prospectus which forms part of a registration statement on Form N-2, dated April 9, 2013 (as it may be amended or supplemented from time to time, the “Prospectus”), and in this Letter of Transmittal (as it may be amended or supplemented from time to time, this “Letter of Transmittal” and, together with the Prospectus, the “Exchange Offer”).

Upon the terms and subject to the conditions of the Exchange Offer (and if the Exchange Offer is extended or amended, the terms and conditions of any such extension or amendment) and subject to, and effective upon, acceptance for payment of Company Shares validly tendered herewith and not properly withdrawn prior to the Expiration Date in accordance with the terms of the Exchange Offer, the undersigned hereby sells, assigns and transfers to or upon the order of RXF all right, title and interest in and to all Company Shares that are being tendered hereby (and any and all dividends, distributions, rights, other Company Shares or other securities issued or issuable in respect thereof on or after [ ], 2013 (collectively, “Distributions”)) and irrevocably constitutes and appoints U.S. Bancorp Fund Services, LLC (the “Exchange Agent” ) the true and lawful agent and attorney-in-fact of the undersigned with respect to such Company Shares (and any and all Distributions), with full power of substitution (such power of attorney being deemed to be an irrevocable power coupled with an interest in the Company Shares tendered by this Letter of Transmittal), to (i) deliver Share Certificates for such Company Shares (and any and all Distributions) or transfer ownership of such Company Shares (and any and all Distributions) on the account books maintained by the Depositary Trust Company (“DTC”) or on the books of any other registrar that the Company may have designated (“Registrar”), together, in any such case, with all accompanying evidences of transfer and authenticity, to or upon the order of RXF, (ii) present such Company Shares (and any and all Distributions) for transfer on the books of the Company and (iii) receive all benefits and otherwise exercise all rights of beneficial ownership of such Company Shares (and any and all Distributions), all in accordance with the terms and subject to the conditions of the Exchange Offer.

By executing this Letter of Transmittal, the undersigned hereby irrevocably appoints Nathan D. Leight and Guy M. Barudin, and any other designees of RXF, and each of them, as attorneys-in-fact and proxies of the undersigned, each with full power of substitution, (i) to vote at any annual or special meeting of the Company’s shareholders or any adjournment or postponement thereof or otherwise in such manner as each such attorney-in-fact and proxy or its, his or her substitute shall in its, his or her sole discretion deem proper with respect to, (ii) to execute any written consent concerning any matter as each such attorney-in-fact and proxy or its, his or her substitute shall in its, his or her sole discretion deem proper with respect to, and (iii) to otherwise act as each such attorney-in-fact and proxy or its, his or her substitute shall in its, his or her sole discretion deem proper with respect to, all Company Shares (and any and all Distributions) tendered hereby and accepted by RXF pursuant to the terms of the Exchange Offer. This appointment will be effective if and when, and only to the extent that, RXF accepts such Company Shares pursuant to the Exchange Offer. This power of attorney and proxy are irrevocable and are granted in consideration of the acceptance for and exchange of such Company Shares in accordance with the terms of the Exchange Offer. Such acceptance for payment shall, without further action, revoke any prior powers of attorney and proxies granted by the undersigned at any time with respect to such Company Shares (and any and all Distributions), and no subsequent powers of attorney, proxies, consents or revocations may be given by the undersigned with respect thereto (and, if given, will be deemed ineffective). RXF reserves the right to require that, in order for Company Shares to be deemed validly tendered, immediately upon RXF’s acceptance of such Company Shares, RXF or its designees must be able to exercise full voting, consent and other rights with respect to such Company Shares (and any and all Distributions), including voting at any meeting of the Company’s shareholders.

The undersigned hereby represents and warrants that the undersigned has full power and authority to tender, sell, assign and transfer any and all Company Shares tendered hereby (and any and all Distributions) and that, when the same are accepted for exchange by RXF, RXF will acquire good, marketable and unencumbered title to such Company Shares (and any and all Distributions), free and clear of all liens, restrictions, charges and encumbrances, and the same will not be subject to any adverse claims. The undersigned hereby represents and warrants that the undersigned is the registered owner of the Company Shares, or the Share Certificate(s) have been endorsed to the undersigned in blank, or the undersigned is a participant in DTC or at the Registrar whose name appears on a security position listing as the owner of the Company Shares. The undersigned will, upon request, execute and deliver any additional documents deemed by the Information Agent or RXF to be necessary or desirable to complete the sale, assignment and transfer of any and all Company Shares tendered hereby (and any and all Distributions). In addition, the undersigned shall promptly remit and transfer to Exchange Agent for the account of RXF all Distributions in respect of any and all Company Shares tendered hereby, accompanied by appropriate documentation of transfer, and, pending such remittance and transfer or appropriate assurance thereof, RXF shall be entitled to all rights and privileges as owner of each such Distribution.

All authority herein conferred or agreed to be conferred shall not be affected by, and shall survive, the death or incapacity of the undersigned, and any obligation of the undersigned hereunder shall be binding upon the heirs, executors, administrators, personal representatives, trustees in bankruptcy, successors and assigns of the undersigned. Except as stated in the Prospectus, this tender is irrevocable.

The undersigned hereby acknowledges that delivery of any Share Certificate shall be effected, and risk of loss and title to such Share Certificate shall pass only upon the proper delivery of such Share Certificate to the Exchange Agent.

The undersigned understands that the valid tender of Company Shares pursuant to any of the procedures described in the Prospectus and in the Instructions hereto will constitute the undersigned’s acceptance of the terms and conditions of the Exchange Offer. RXF’s acceptance of such Company Shares will constitute a binding agreement between the undersigned and RXF upon the terms and subject to the conditions of the Exchange Offer (and if the Exchange Offer is extended or amended, the terms of or the conditions of any such extension or amendment).

Unless otherwise indicated herein, in the box entitled “Special Issuance Instructions” below, please deliver RXF Common Shares in the name of the undersigned or, in the case of book-entry delivery of RXF Common Shares, please credit the account indicated above maintained with the Exchange Agent for book-entry transfer (the “Book-Entry Transfer Facility”). Similarly, unless otherwise indicated under the box entitled “Special Delivery Instructions” below, please send RXF Common Shares to the address shown above in the box entitled “Description of Company Shares Tendered.”

THE UNDERSIGNED, BY COMPLETING THE BOX ENTITLED “DESCRIPTION OF COMPANY SHARES” ABOVE AND SIGNING THIS LETTER OF TRANSMITTAL, WILL BE DEEMED TO HAVE TENDERED THEIR COMMON SHARES AS SET FORTH IN SUCH BOX ABOVE.

IMPORTANT: THIS LETTER OF TRANSMITTAL OR A FACSIMILE HEREOF, TOGETHER WITH THE SHARE CERTIFICATES OR A BOOK-ENTRY CONFIRMATION AND ALL OTHER REQUIRED DOCUMENTS (OR THE NOTICE OF

GUARANTEED DELIVERY) MUST BE RECEIVED BY THE EXCHANGE AGENT PRIOR TO MIDNIGHT, NEW YORK CITY TIME, ON THE EXPIRAITON DATE.

PLEASE READ THIS ENTIRE LETTER OF TRANSMITTAL CAREFULLY BEFORE COMPLETION.

LOST CERTIFICATES: PLEASE CONTACT SHAREHOLDER SERVICES AT THE COMPANY TO OBTAIN NECESSARY DOCUMENTS TO REPLACE YOUR LOST SHARE CERTIFICATES.

SPECIAL ISSUANCE INSTRUCTIONS

To be completed ONLY if certificates for RXF Common Shares are to be issued in the name of and sent to someone other than the person or persons whose signature(s) appear(s) below on this Letter of Transmittal, or if Common Shares delivered by book-entry transfer which are not accepted for exchange are to be returned by credit to an account maintained at the book-entry transfer facility other than that indicated above:

Issue RXF Common Shares to:

Name |

|

| (Please Type or Print) |

|

|

Address |

|

|

|

|

|

|

|

|

|

(Also Complete IRS Form W-9 | |

SPECIAL DELIVERY INSTRUCTIONS

To be completed ONLY if the certificates for RXF Common Shares not exchanged and/or RXF Common Shares are to be sent to someone other than the person or persons whose signature(s) appear(s) below on this Letter of Transmittal or to such person or persons at an address other than shown above in the box entitled “Description of Company Shares Tendered” on this Letter of Transmittal.

Mail RXF Common Shares to:

Name |

|

| (Please Print) |

|

|

Address |

|

|

|

|

|

|

|

|

|

(Also Complete IRS Form W-9 | |

IMPORTANT

STOCKHOLDER: SIGN HERE

(Please complete and return the IRS Form W-9 included in this Letter of Transmittal

or an applicable IRS Form W-8)

| ||||

Signature(s) of Holder(s) of Company Shares | ||||

| ||||

Dated: , 2013 | ||||

| ||||

Name(s) |

| |||

(Please Print) | ||||

| ||||

Capacity (full title) |

| |||

(See Instruction 5) |

| |||

(Include Zip Code) | ||||

| ||||

| ||||

Address |

| |||

|

| |||

|

| |||

Area Code and Telephone No. |

| |||

|

| |||

Must be signed by registered holder(s) exactly as name(s) appear(s) on Share Certificate(s) or on a security position listing or by person(s) authorized to become registered holder(s) by Share Certificate(s) and documents transmitted herewith. If signature is by a trustee, executor, administrator, guardian, attorney-in-fact, agent, officer of a corporation or other person acting in a fiduciary or representative capacity, please set forth full title and see Instruction 5.

Guarantee of Signature(s)

(If Required– See Instructions 1 and 5.)

APPLY MEDALLION GUARANTEE STAMP BELOW

INSTRUCTIONS

FORMING PART OF THE TERMS AND CONDITIONS OF THE EXCHANGE OFFER

1. Guarantee of Signatures. No medallion signature guarantee is required on this Letter of Transmittal if: (i) the Letter of Transmittal is signed by the registered holder(s) of Company Shares tendered herewith, or (ii) the Common Shares are tendered for the account of a financial institution (including most commercial banks, savings and loan associations and brokerage houses) that is a member of or participant in a recognized “Medallion Program” approved by the Securities Transfer Association Inc., including the Security Transfer Agents Medallion Program (STAMP), the Stock Exchange Medallion Program (SEMP) and the New York Stock Exchange Medallion Signature Program (MSP), or any other “eligible guarantor institution,” as such term is defined in Rule 17Ad—15 of the Securities Exchange Act of 1933, as amended (each, an “Eligible Institution”). In all other cases, all signatures on a Letter of Transmittal must be guaranteed by an Eligible Institution. See Instruction 5.

2. Requirements of Tender. This Letter of Transmittal is to be completed by shareholders if certificates are to be forwarded herewith or, if Company Shares are held in book-entry form on the records of DTC or the Registrar, unless an agent’s message is utilized. Share certificates evidencing tendered Company Shares, as well as this Letter of Transmittal (or a manually signed facsimile hereof), properly completed and duly executed, with any required medallion signature guarantees, and any other documents required by this Letter of Transmittal, must be received by the Exchange Agent at one of its addresses set forth herein prior to the Expiration Date. If Share Certificates are forwarded separately to the Eligible Institution, a properly completed and duly executed Letter of Transmittal must accompany each such delivery.

The method of delivery of this Letter of Transmittal, Share Certificates and all other required documents, including delivery through the Exchange Agent, is at the election and the risk of the tendering shareholder and the delivery of all such documents will be deemed made (and the risk of loss and title to Share Certificates will pass) only when actually received by the Exchange Agent (including, in the case of book-entry transfer, by book-entry confirmation). If delivery is by mail, registered mail with return receipt requested, properly insured, is recommended. In all cases, sufficient time should be allowed to ensure timely delivery prior to the expiration of the Exchange Offer.

LETTERS OF TRANSMITTAL MUST BE RECEIVED IN THE OFFICE OF THE EXCHANGE AGENT BY MIDNIGHT, NEW YORK CITY TIME, ON THE EXPIRATION DATE OF THE EXCHANGE OFFER. DELIVERY OF THESE DOCUMENTS TO THE EXCHANGE AGENT’S P.O. BOX ON THE EXPIRATION DATE DOES NOT CONSTITUTE RECEIPT BY THE EXCHANGE AGENT. GUARANTEED DELIVERIES WILL BE ACCEPTED VIA FAX UNTIL THE EXPIRATION TIME OF THE OFFER ON THE EXPIRATION DATE.

3. Inadequate Space. If the space provided herein is inadequate, Share Certificate numbers, the number of Company Shares represented by such Share Certificates and/or the number of Company Shares tendered should be listed on a signed separate schedule attached hereto.

4. Partial Tenders. If fewer than all of the Company Shares evidenced by any Share Certificate or book-entry position are to be tendered, fill in the number of Company Shares that are to be tendered in the box entitled Number of Company Shares Tendered. In this case, new Share Certificates or a new book-entry position for the Company Shares that were evidenced by your old Share Certificates or book-entry position, but were not tendered by you, will be sent to you or established for you, as applicable, unless otherwise provided in the appropriate box on this Letter of Transmittal, as soon as practicable after the Expiration Date. All Company Shares represented by Share Certificates or book-entry position delivered to the Exchange Agent will be deemed to have been tendered unless otherwise indicated.

5. Signatures on Letter of Transmittal; Stock Powers and Endorsements.

(a) Exact Signatures. If this Letter of Transmittal is signed by the registered holder(s) of Company Shares tendered hereby, then the signature(s) must correspond with the name(s) as written on the face of such Share Certificates for such Company Shares without alteration, enlargement or any change whatsoever.

(b) Holders. If any Company Shares tendered hereby are held of record by two or more persons, then all such persons must sign this Letter of Transmittal.

(c) Different Names on Share Certificates or book-entry positions. If any Company Shares tendered hereby are registered in different names on different Share Certificates or book-entry positions, then it will be necessary to complete, sign and submit as many separate Letters of Transmittal as there are different registrations of Share Certificates or book-entry positions.

(d) Endorsements. If this Letter of Transmittal is signed by the registered holder(s) of Company Shares tendered hereby, then no endorsements of Share Certificates for such Company Shares or separate stock powers are required unless RXF Common Shares are to be issued, in the name of any person other than the registered holder(s). Signatures on any such Share Certificates or stock powers must be guaranteed by an Eligible Institution.

If this Letter of Transmittal is signed by a person other than the registered holder(s) of Company Shares tendered hereby, then such Share Certificates for such Company Shares must be endorsed or accompanied by appropriate stock powers, in either case, signed exactly as the name(s) of the registered holder(s) appear(s) on such Share Certificates for such Company Shares. Signature(s) on any such Share Certificates or stock powers must be guaranteed by an Eligible Institution. See Instruction 1.

If this Letter of Transmittal or any Share Certificate or stock power is signed by a trustee, executor, administrator, guardian, attorney-in-fact, officer of a corporation or other legal entity or other person acting in a fiduciary or representative capacity, then such person should so indicate when signing, and proper evidence satisfactory to the Exchange Agent of the authority of such person so to act must be submitted.

6. Stock Transfer Taxes. Except as otherwise provided in this Instruction 6, RXF or any successor entity thereto will pay all stock transfer taxes with respect to the transfer and sale of any Company Shares to it or its successor pursuant to the Exchange Offer (for the avoidance of doubt, stock transfer taxes do not include United States federal income tax or backup withholding taxes). If, however, Company Shares not tendered or not accepted for payment are to be registered in the name of, any person(s) other than the registered holder(s), or if tendered Company Shares are registered in the name of any person(s) other than the person(s) signing this Letter of Transmittal, then the amount of any stock transfer taxes or other taxes required by reason of the payment to a person other than the registered holder(s) of such Company Shares (in each case whether imposed on the registered holder(s) or such other person(s)) payable on account of the transfer to such other person(s) will be billed to such tendering holder.

Except as provided in this Instruction 6, it will not be necessary for transfer tax stamps to be affixed to Share Certificate(s) evidencing the Company Shares tendered hereby.

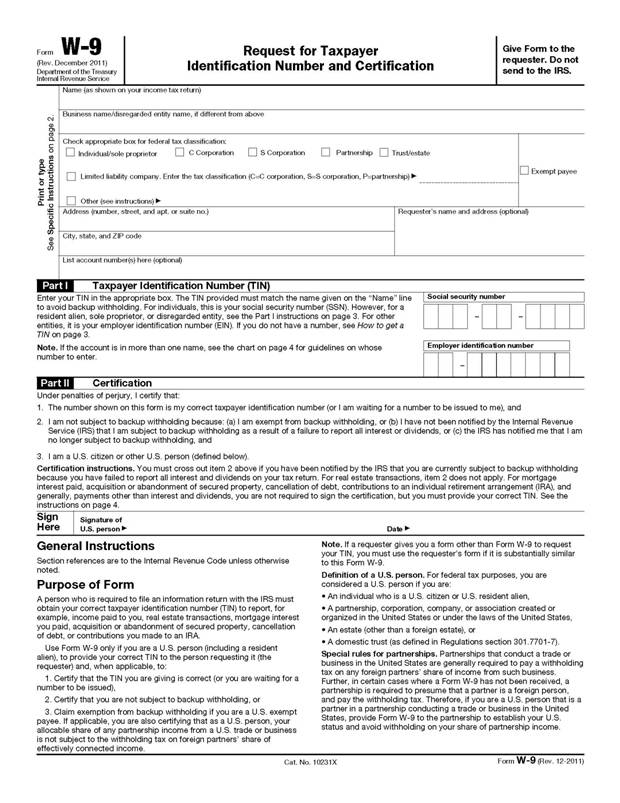

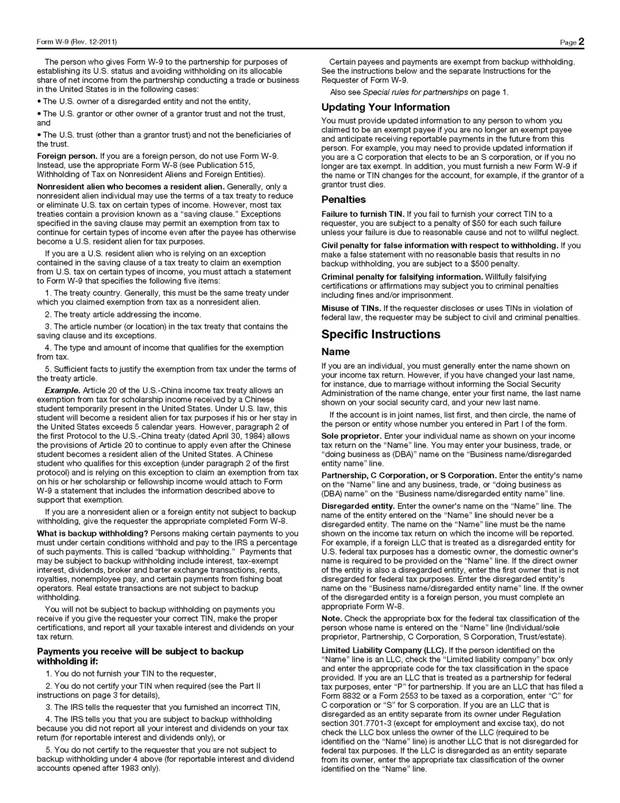

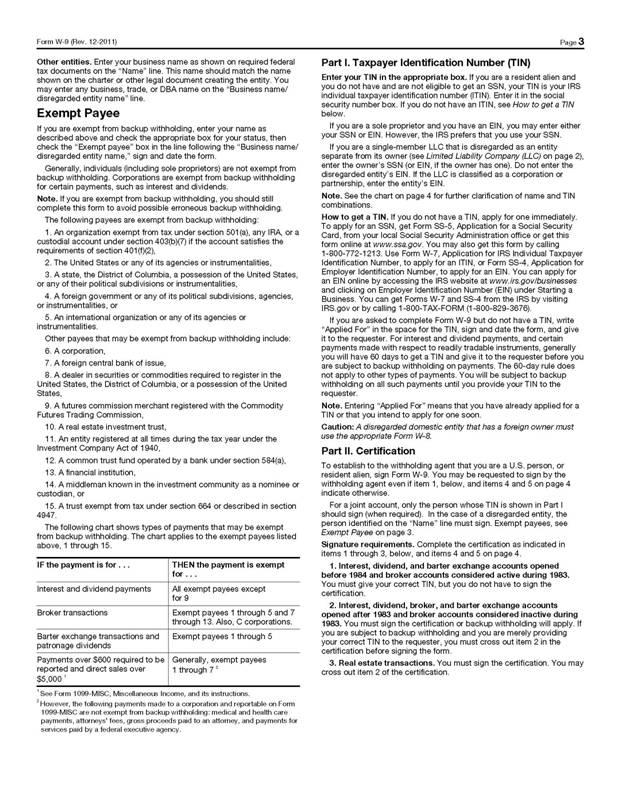

7. IRS Form W-9: Backup Withholding; Taxpayer Identification Number. To avoid backup withholding, currently at a rate of 28%, a tendering shareholder that is a United States person (as defined for United States federal income tax purposes) is required to provide the Exchange Agent with a correct Taxpayer Identification Number (“TIN”) on a properly completed internal revenue service (“IRS”) Form W-9, which is included herein following “Important Tax Information” below, and to certify, under penalties of perjury, that such number is correct and that such shareholder is not subject to backup withholding of federal income tax, and that such stockholder is a United States person (as defined for United States federal income tax purposes). If the tendering shareholder has been notified by the Internal Revenue Service (“IRS”) that such shareholder is subject to backup withholding, such stockholder must cross out item (2) of the Certification section of the IRS Form W-9, and place a check mark on the line under the heading “Notification of Backup Withholding,” unless such shareholder has since been notified by the IRS that such shareholder is no longer subject to backup withholding.

Certain shareholders (including, among others, all corporations and certain foreign individuals and entities) may not be subject to backup withholding. Exempt foreign shareholders should submit an appropriate and properly completed applicable IRS Form W-8, a copy of which may be obtained from the Depositary or from the IRS at its website: www.irs.gov, in order to avoid backup withholding. Such shareholders should consult a tax adviser to determine which Form W-8 is appropriate.

Backup withholding is not an additional tax. A tendering shareholder may credit any amount withheld against its, his or her regular United States federal income tax liability or, if backup withholding results in an overpayment of taxes, claim a refund from the IRS.

If a tendering shareholder fails to furnish its, his or her correct TIN to the Exchange Agent, such shareholder will be subject to a penalty of $50.00 for each such failure unless the failure is due to reasonable cause and not to willful neglect. If a tendering shareholder makes a false statement with no reasonable basis that results in no backup withholding, such shareholder is subject to a $500.00 penalty. Willfully falsifying certifications or affirmations may subject a shareholder to criminal penalties, including fines and/or imprisonment.

See the instructions enclosed with the IRS Form W-9 included in this Letter of Transmittal for more instructions.

9. Irregularities. All questions as to the validity, form and eligibility (including, without limitation, time of receipt) and acceptance for payment of any tender of Company Shares will be determined by RXF in its reasonable discretion. RXF reserves the absolute right to reject any or all tenders of Company Shares it determines not to be in proper form or the acceptance for payment of which may, in the opinion of its counsel, be unlawful. RXF also reserves the absolute right to waive any of the conditions of the Exchange Offer other than the Minimum Condition (as defined in the Prospectus) and any defect or irregularity in the tender of any particular Company Shares, and RXF’s interpretation of the terms of the Exchange Offer (including, without limitation, these instructions). No tender of Company Shares will be deemed to have been validly made until all defects and irregularities have been cured or waived. Unless waived, any defects or irregularities in connection with the tenders must be cured within such time as RXF shall determine. None of RXF, the Exchange Agent, the Information Agent (as the foregoing are defined herein) or any other person is or will be obligated to give notice of any defects or irregularities in tenders and none of them will incur any liability for failure to give any such notice.

10. Requests for Additional Copies. Questions or requests for assistance may be directed to the Information Agent at its address and telephone number set forth below or to your broker, dealer, commercial bank or trust company. Additional copies of the Prospectus, this Letter of Transmittal, the Notice of Guaranteed Delivery and other tender offer materials may be obtained from the Information Agent as set forth below, and will be furnished at RXF’s expense.

11. Lost, Destroyed or Stolen Certificates. If any Share Certificate representing Company Shares has been mutilated, lost, destroyed or stolen, then the shareholder should promptly notify the Company’s Exchange Agent at ( ). The shareholder will then be instructed as to the steps that must be taken in order to replace such Share Certificate(s). This Letter of Transmittal and related documents cannot be processed until the procedures for replacing lost, destroyed or stolen Share Certificates have been followed.

This Letter of Transmittal, properly completed and duly executed, together with Share Certificates representing Company Shares being tendered (if applicable) and all other required documents, must be received before midnight, New York City time, on the Expiration Date, or the tendering shareholder must comply with the procedures for guaranteed delivery.

IMPORTANT TAX INFORMATION

CIRCULAR 230

TO ENSURE COMPLIANCE WITH REQUIREMENTS IMPOSED BY THE IRS, WE INFORM YOU THAT ANY U.S. TAX ADVICE CONTAINED IN THIS COMMUNICATION (INCLUDING ANY ATTACHMENTS) IS NOT INTENDED OR WRITTEN TO BE USED, AND CANNOT BE USED, FOR THE PURPOSE OF (I) AVOIDING PENALTIES UNDER THE INTERNAL REVENUE CODE OR (II) PROMOTING, MARKETING OR RECOMMENDING TO ANOTHER PARTY ANY TRANSACTION OR MATTER ADDRESSED HEREIN.

Under United States federal income tax law, a shareholder who is a United States person (as defined for United States federal income tax purposes) surrendering Company Shares must, unless an exemption applies, provide the Exchange Agent with the shareholder’s correct TIN on IRS Form W-9, a copy of which is included in this Letter of Transmittal. If the shareholder is an individual, then the shareholder’s TIN is such shareholder’s Social Security number. If the correct TIN is not provided, then the shareholder may be subject to a $50.00 penalty imposed by the IRS.

Certain shareholders may not be subject to backup withholding and reporting requirements. In order for an exempt shareholder who is not a United States person to avoid backup withholding, such person should complete, sign and submit an appropriate IRS Form W-8, signed under penalties of perjury, attesting to his, her or its exempt status. An IRS Form W-8 can be obtained from the Exchange Agent or from the IRS at its website (www.irs.gov). Such shareholders should consult a tax adviser to determine which IRS Form W-8 is appropriate. Exempt shareholders who are United States persons should furnish their TIN, check the “Exempt payee” box of the IRS Form W-9 and sign, date and return the IRS Form W-9 to the Exchange Agent in order to avoid erroneous backup withholding. A shareholder should consult its, his or her tax adviser as to such shareholder’s qualification for an exemption from backup withholding and the procedure for such exemption.

Backup withholding is not an additional tax. Rather, the United States federal income tax liability of persons subject to backup withholding will be reduced by the amount of tax withheld. If backup withholding results in an overpayment of taxes, a refund may be obtained from the IRS if required information is timely furnished to the IRS.

Purpose of IRS Form W-9

To prevent backup withholding to a shareholder that is a United States person with respect to Company Shares, the shareholder is required to notify the Exchange Agent of the shareholder’s correct TIN by completing the IRS Form W-9 included in this Letter of Transmittal and certifying, under penalties of perjury, that (1) the TIN provided on the IRS Form W-9 is correct (or that such shareholder is awaiting a TIN), (2) the shareholder is not subject to backup withholding because (i) the shareholder is exempt from backup withholding, (ii) the shareholder has not been notified by the IRS that the shareholder is subject to backup withholding as a result of a failure to report all interest and dividends or (iii) the IRS has notified the shareholder that the shareholder is no longer subject to backup withholding, and (3) the shareholder is a United States person.

The following section, entitled “What Number to Give the Exchange Agent,” is applicable only to shareholders that are United States persons.

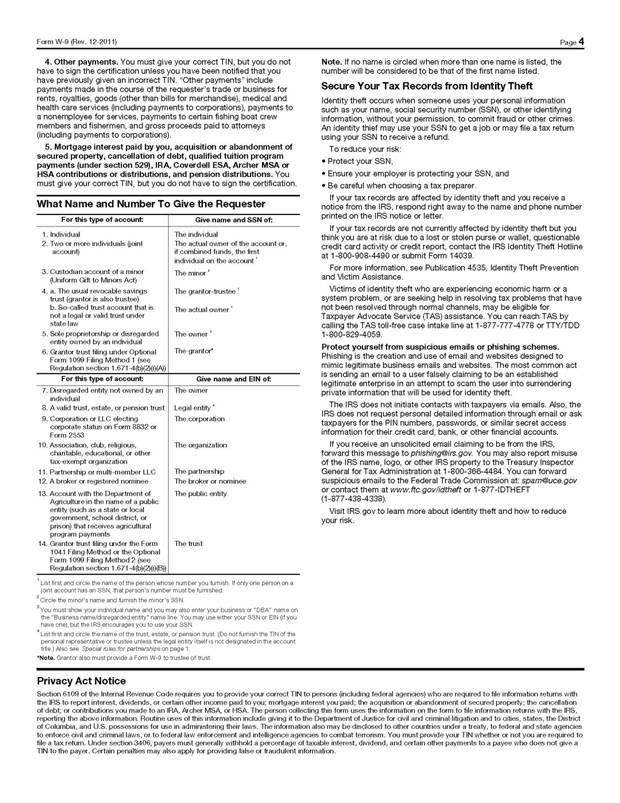

What Number to Give the Exchange Agent

The tendering shareholder is required to give the Exchange Agent the TIN, generally the Social Security number or employer identification number, of the record holder of all Company Shares tendered hereby. If such Company Shares are in more than one name or are not in the name of the actual owner, consult the instructions enclosed with the IRS Form W-9 included in this Letter of Transmittal for additional guidance on which number to report. If the tendering shareholder has not been issued a TIN and has applied for one or intends to apply for one in the near future, such shareholder should sign and date the IRS Form W-9 and sign and date the Certificate of Awaiting Taxpayer Identification Number. If the tendering shareholder completes the Certificate of Awaiting Taxpayer Identification Number and the Exchange Agent is not provided with a TIN by the time of payment, the Exchange Agent will withhold on all reportable Distributions, which will be refunded if a TIN is provided to the Exchange Agent within sixty (60) days of the Exchange Agent’s receipt of the Certificate of Awaiting Taxpayer Identification Number. If the Exchange Agent is provided with an incorrect TIN in connection with such payments, then the shareholder may be subject to a $50.00 penalty imposed by the IRS.

SHAREHOLDERS are urged to consult with their tax advisors regarding the applicability and refund of backup withholding tax.

The Exchange Agent for the Exchange Offer is:

U.S. Bancorp Fund Services, LLC

By Mail: |

| By Hand or Overnight Delivery Service: |

|

|

|

U.S. Bancorp Fund Services, LLC PO BOX 701 Milwaukee, Wisconsin 53201 |

| U.S. Bancorp Fund Services, LLC 615 East Michigan Street Milwaukee, Wisconsin 53202 |

By Facsimile Transmission: 1-866-350-5206

Questions or requests for assistance may be directed to the Information Agent at the address and telephone numbers set forth below. Questions or requests for assistance or additional copies of the Prospectus, this Letter of Transmittal and the Notice of Guaranteed Delivery may be directed to the Information Agent at the address and telephone numbers set forth below. Shareholders may also contact their broker, dealer, commercial bank or trust company for assistance concerning the Exchange Offer.

The Information Agent for the Exchange Offer is:

D.F. King & Co., Inc.

48 Wall Street

New York, NY 10005

Shareholders, call toll-free: 1-800-290-6424

Banks and brokers, call collect: (212) 269-5550

Email: rxfinfo@dfking.com