Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations

The following discussion and analysis of our financial condition and results of operations should be read in conjunction with our consolidated financial statements and the related notes to those statements included elsewhere in this Annual Report on Form 10-K. In addition to historical financial information, the following discussion and analysis contains forward-looking statements that involve risks, uncertainties and assumptions. Some of the numbers included herein have been rounded for the convenience of presentation. Our actual results may differ materially from those anticipated in these forward-looking statements as a result of many factors, including those discussed under Item 1A, Risk factors, in this Annual Report on Form 10-K.

Overview

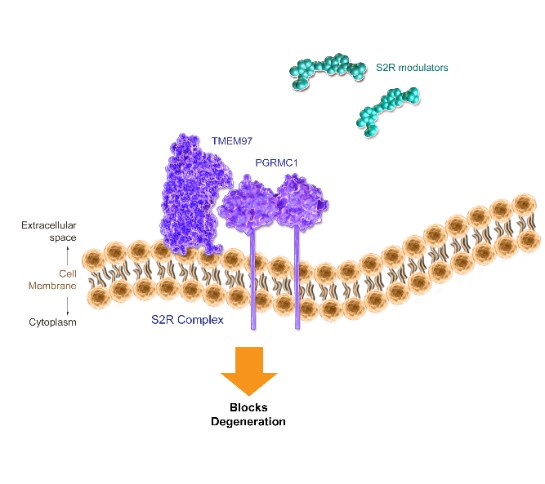

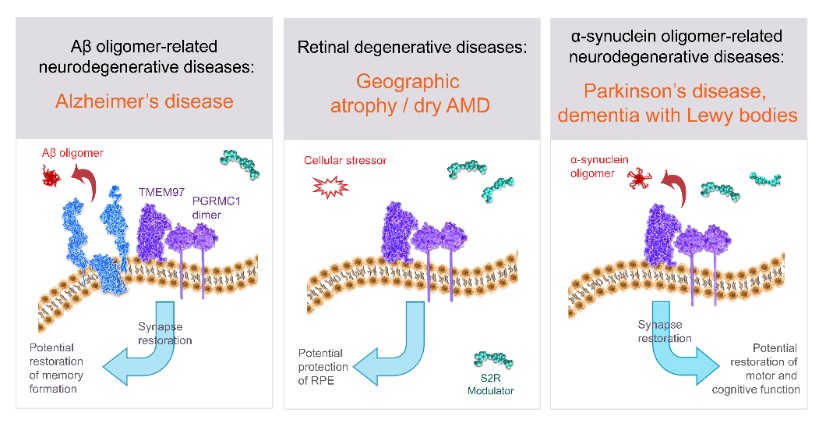

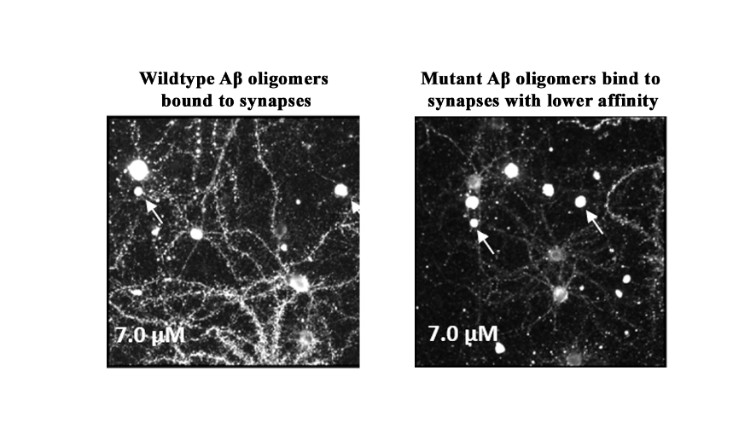

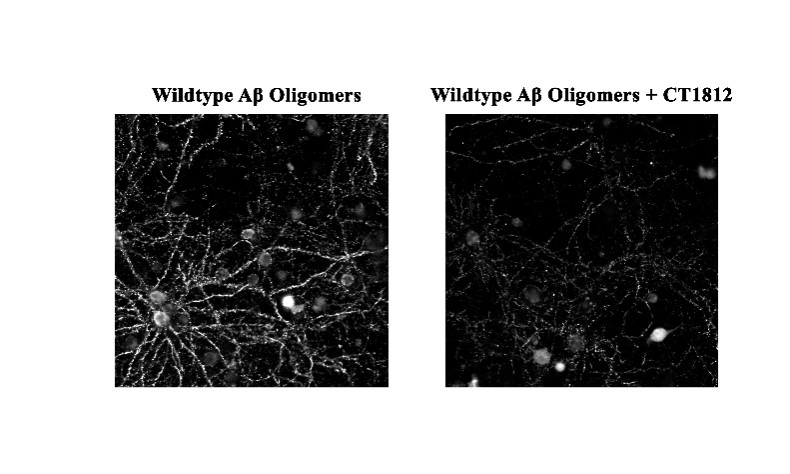

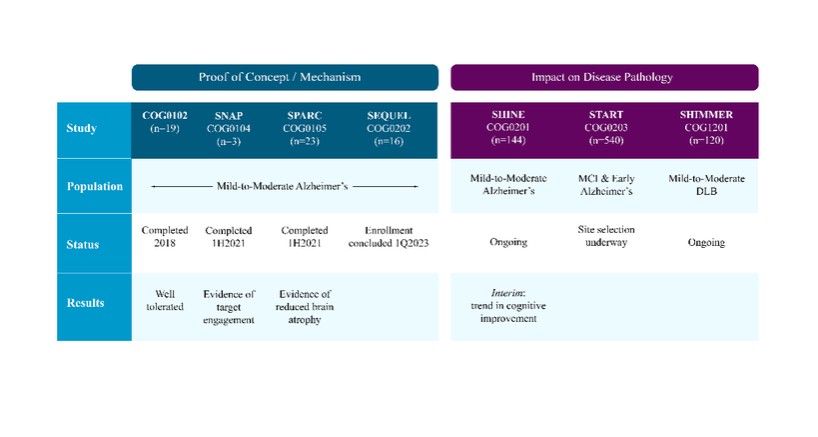

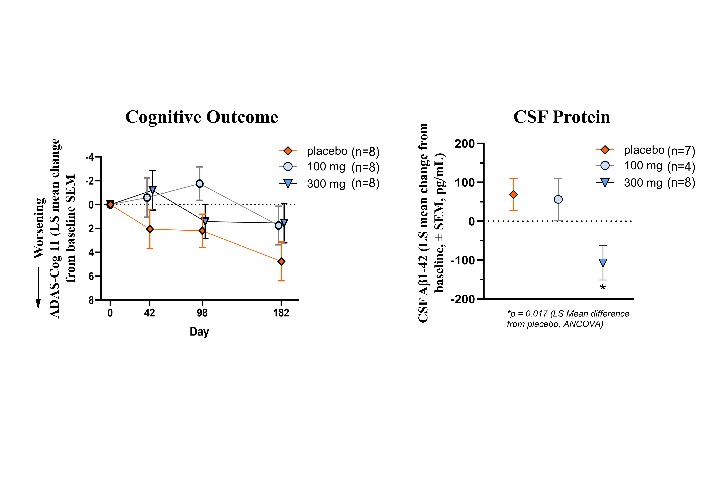

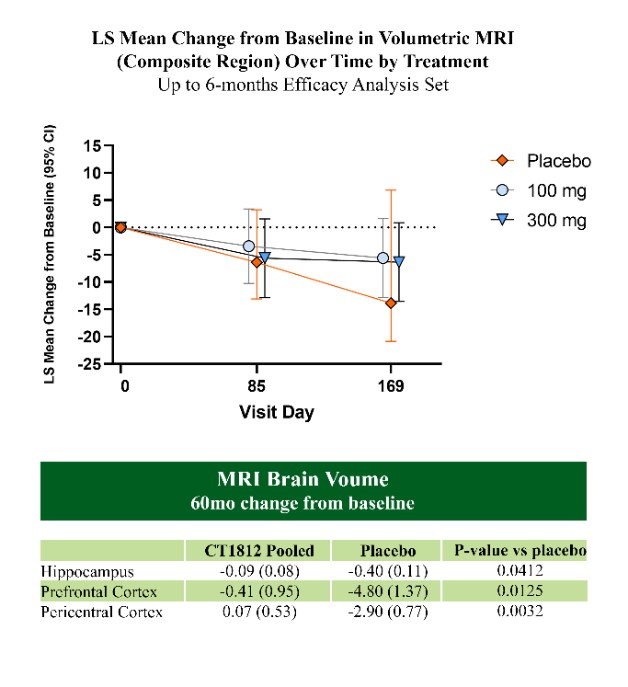

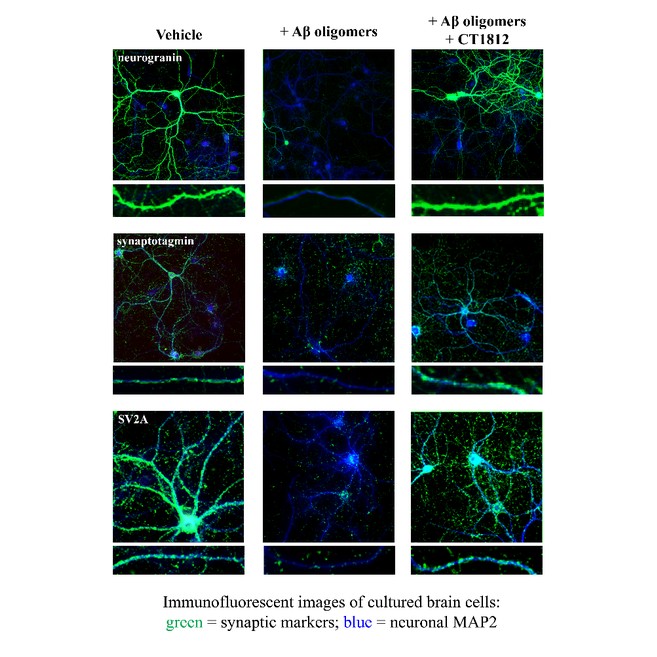

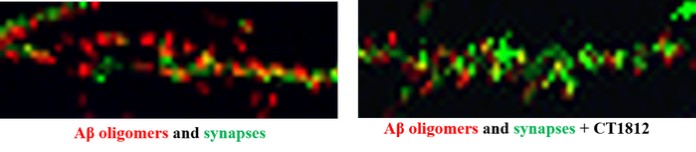

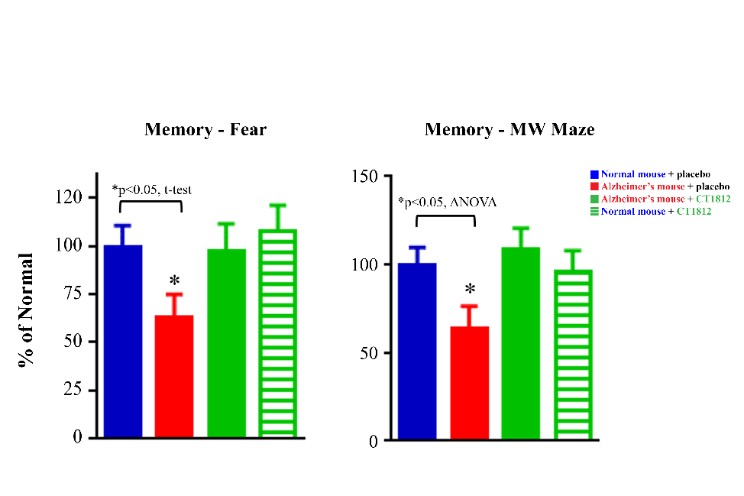

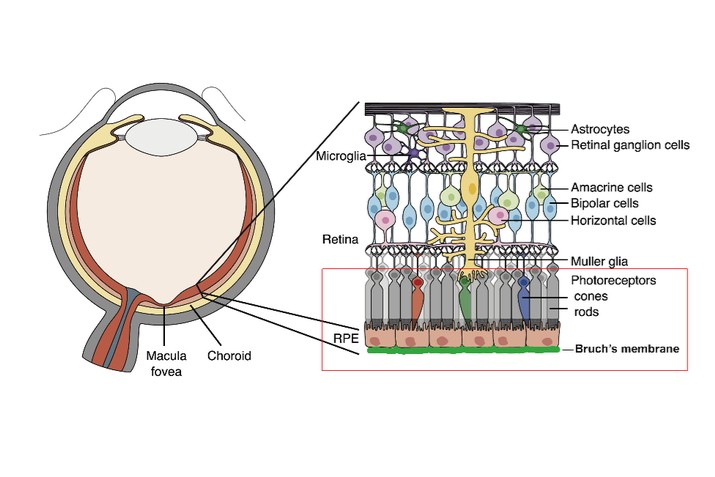

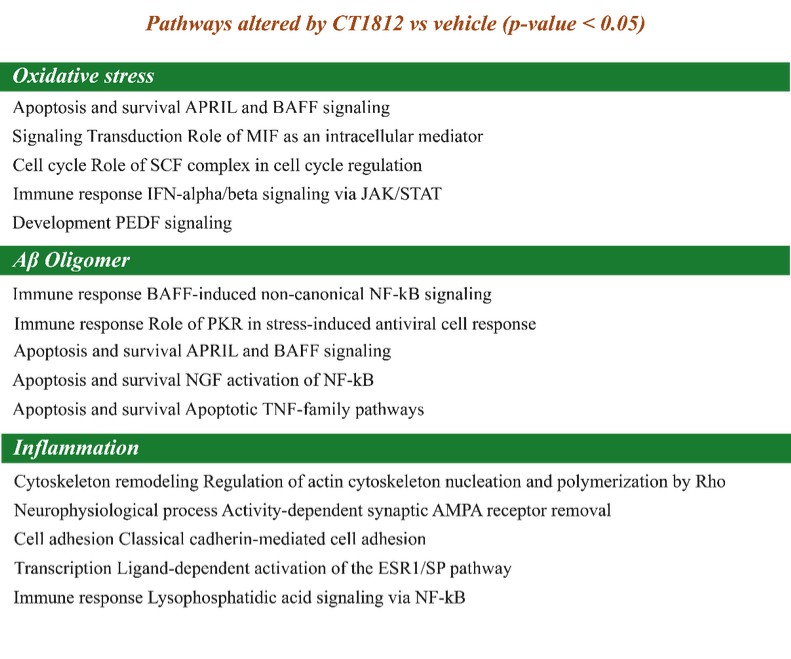

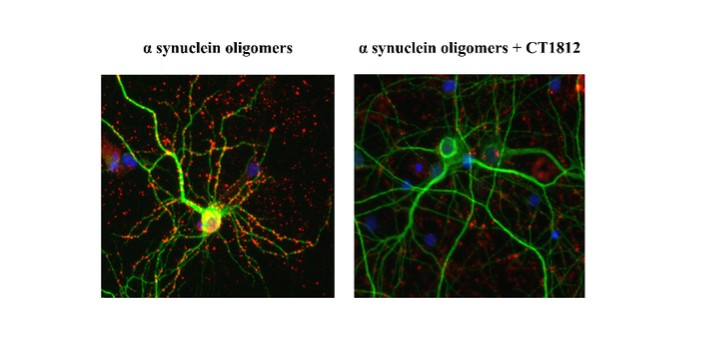

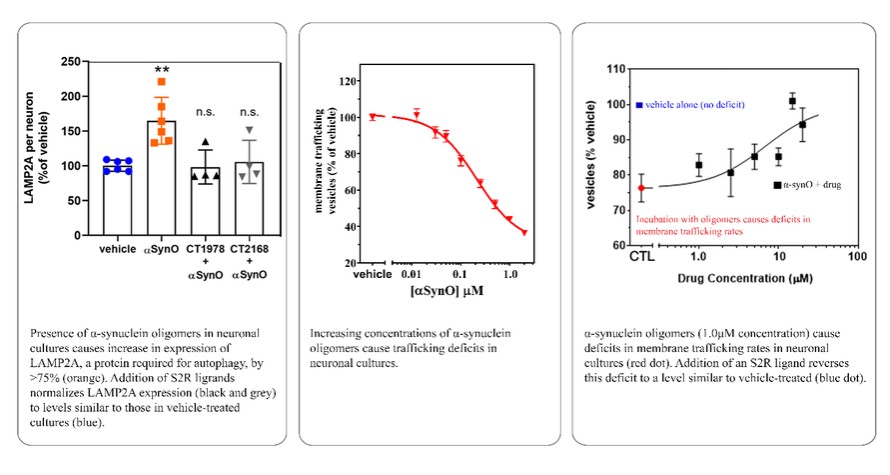

We are a clinical-stage biopharmaceutical company engaged in the discovery and development of innovative, small molecule therapeutics targeting age-related degenerative diseases and disorders of the central nervous system, or CNS, and retina. Currently available therapies for these diseases are limited, with many diseases having no approved therapies or treatments. Our goal is to develop disease modifying treatments for patients with these degenerative disorders by initially leveraging our expertise in the σ-2 (sigma-2) receptor, or S2R, which is expressed by multiple cell types, including neuronal synapses, and acts as a key regulator of cellular damage commonly associated with certain age-related degenerative diseases of the CNS and retina. We believe that targeting the S2R complex represents a mechanism that is functionally distinct from other current approaches in clinical development for the treatment of degenerative diseases.

Since our inception in 2007, we have incurred significant operating losses and devoted substantially all of our time and resources to developing our lead product candidate, CT1812, building our intellectual property portfolio, raising capital and recruiting management and technical staff to support these operations. As of December 31, 2022, we had an accumulated deficit of $115.4 million. We incurred net losses of $21.4 million and $11.7 million for the years ended December 31, 2022 and 2021, respectively.

To date, we have funded our operations primarily with proceeds from grants awarded by the National Institute of Aging, or NIA, a division of the National Institutes of Health, or NIH, and proceeds from our initial public offering, or IPO, completed in October 2021, proceeds from our follow-on public offering in November 2022, and the sales of our convertible promissory notes, convertible preferred stock, simple agreements for future equity, or SAFE, and stock option exercises. Since our inception, we have received approximately $171.0 million in cumulative grant awards to fund our clinical trials, primarily from the NIA, and we have raised approximately $108.8 million in net proceeds from sales of our equity securities, convertible notes, SAFE, stock option exercises, our IPO and follow-on public offering. As of December 31, 2022, we had cash and cash equivalents of $41.6 million.

On October 13, 2021, we completed our IPO, pursuant to which we issued and sold 3,768,116 shares of our common stock at a public offering price of $12.00 per share. Additionally, on November 12, 2021, the underwriters exercise of their over-allotment option in full to purchase 565,217 shares of our common stock closed. In connection with the IPO, we received net proceeds of approximately $44.2 million, after deducting underwriting discounts and commissions and other offering related expenses payable by us, which includes net proceeds of approximately $6.3 million from the exercise of the over-allotment option.

On November 15, 2022, we completed our follow-on public offering, pursuant to which we issued and sold 5,000,000 shares of our common stock at a public offering price of $1.20 per share. In connection with the follow-on public offering, we received net proceeds of approximately $5.2 million, after deducting underwriting discounts and commissions and other offering related expenses.

On December 23, 2022, we entered into a sales agreement with Cantor Fitzgerald & Co. and B. Riley Securities, Inc., or the Sales Agents, providing for the offering, issuance and sale by us of up to $40 million of our common stock from time to time in “at-the-market” offerings (the “ATM”). For the year ended December 31, 2022, we have not sold any shares of common stock under the ATM.