UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 (Amendment No. )

|

| |

Filed by the Registrant x |

Filed by a Party other than the Registrant o |

| Check the appropriate box: |

| o | Preliminary Proxy Statement |

| o | Confidential, for Use of the Commission Only (as permitted by Rule 14a‑6(e)(2)) |

| x | Definitive Proxy Statement |

| o | Definitive Additional Materials |

| o | Soliciting Material under §240.14a‑12 |

|

| | |

| NORTHSTAR REAL ESTATE INCOME TRUST, INC. |

| (Name of Registrant as Specified In Its Charter) |

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

|

Payment of Filing Fee (Check the appropriate box): x No fee required. |

| o | Fee computed on table below per Exchange Act Rules 14a‑6(i)(1) and 0-11. |

| | (1) | Title of each class of securities to which transaction applies: |

| | (2) | Aggregate number of securities to which transaction applies: |

| | (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0‑11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | (4) | Proposed maximum aggregate value of transaction: |

| | (5) | Total fee paid: |

| o | Fee paid previously with preliminary materials. |

| o | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | (1) | Amount Previously Paid: |

| | (2) | Form, Schedule or Registration Statement No.: |

| | (3) | Filing Party: |

| | (4) | Date Filed: |

To the Stockholders of NorthStar Real Estate Income Trust, Inc.:

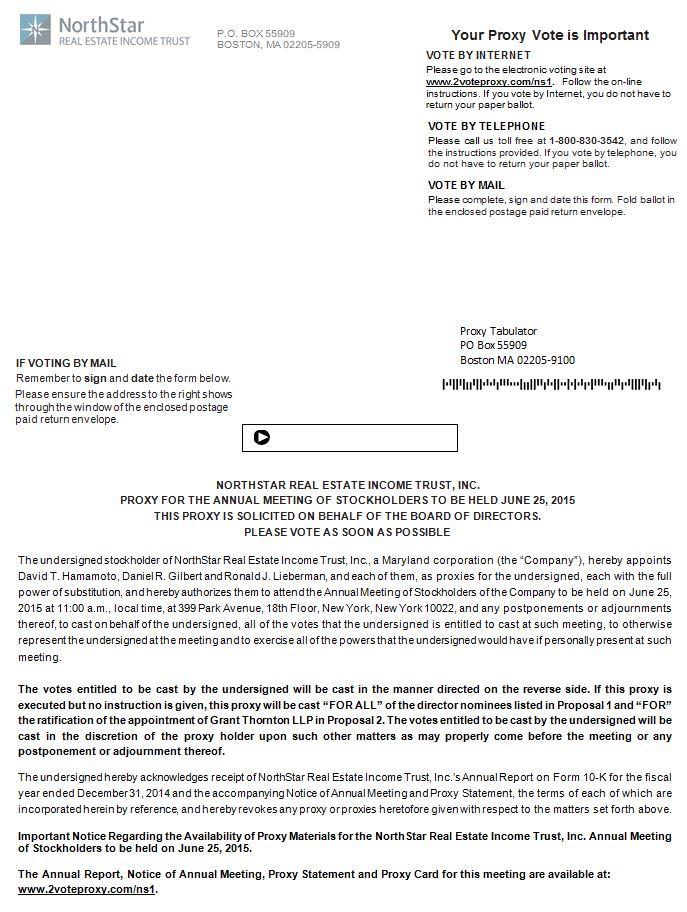

It is our pleasure to invite you to the 2015 annual meeting of stockholders of NorthStar Real Estate Income Trust, Inc., a Maryland corporation. The annual meeting will be held at 399 Park Avenue, 18th Floor, New York, New York 10022 on June 25, 2015, beginning at 11:00 a.m., local time.

The enclosed materials include a notice of meeting, a proxy statement, proxy card, self-addressed envelope and our Annual Report to Stockholders for the fiscal year ended December 31, 2014.

It is important that your shares be represented at the annual meeting regardless of the size of your securities holdings. Whether or not you plan to attend the annual meeting in person, please authorize a proxy to vote your shares as soon as possible. You may authorize a proxy to vote your shares by mail, telephone or Internet. The proxy card materials provide you with details on how to authorize a proxy to vote by these three methods. If you determine to mail us your proxy, please complete, date and sign the proxy card and return it promptly in the envelope provided, which requires no postage if mailed in the United States. If you are the record holder of your shares and you attend the annual meeting, you may withdraw your proxy and vote in person, if you so choose.

We look forward to receiving your proxy and seeing you at the meeting.

|

| |

| Sincerely, | Sincerely, |

| /s/ DAVID T. HAMAMOTO |

/s/ DANIEL R. GILBERT |

| David T. Hamamoto |

Daniel R. Gilbert |

| Chairman | Chief Executive Officer and President |

| April 28, 2015 | |

| New York, New York | |

____________________________

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

To Be Held on June 25, 2015

____________________________

To the Stockholders of NorthStar Real Estate Income Trust, Inc.:

The 2015 annual meeting of stockholders, or the annual meeting, of NorthStar Real Estate Income Trust, Inc., a Maryland corporation, or the Company, will be held at 399 Park Avenue, 18th Floor, New York, New York 10022 on June 25, 2015, beginning at 11:00 a.m., local time. The matters to be considered and voted upon by stockholders at the annual meeting, which are described in detail in the accompanying proxy statement, are:

| |

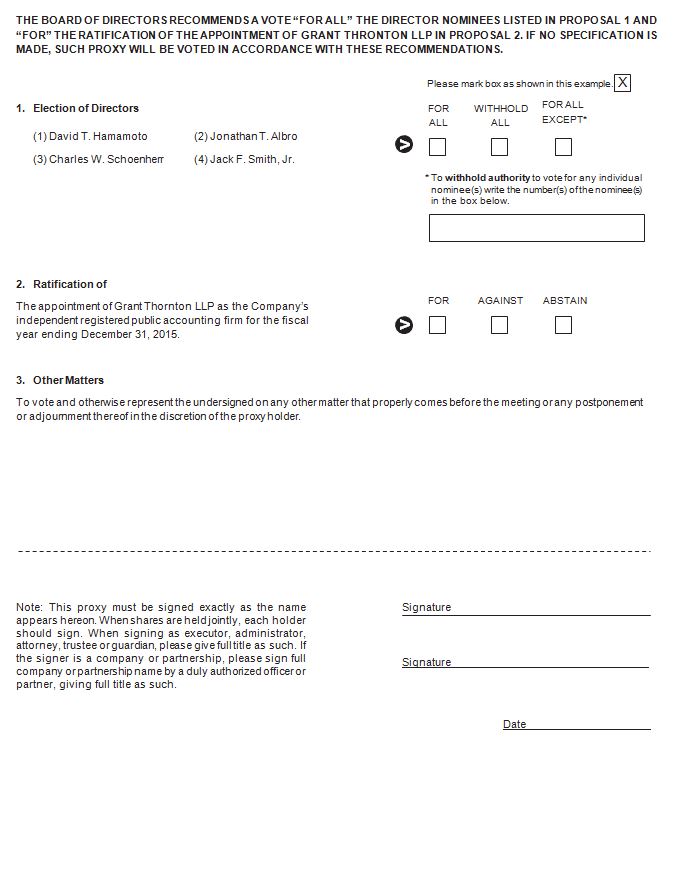

| 1) | a proposal to elect as directors the four individuals nominated by our Board of Directors as set forth in the accompanying proxy statement, each to serve until the 2016 annual meeting of stockholders and until his successor is duly elected and qualified; |

| |

| 2) | a proposal to ratify the appointment of Grant Thornton LLP as the Company’s independent registered public accounting firm for the fiscal year ending December 31, 2015; and |

| |

| 3) | any other business that may properly come before the annual meeting or any postponement or adjournment of the annual meeting. |

This notice is accompanied by the Company’s proxy statement, proxy card, self-addressed envelope and our Annual Report to Stockholders for the fiscal year ended December 31, 2014. This notice is being mailed to you on or about May 1, 2015.

Stockholders of record at the close of business on April 2, 2015 will be entitled to notice of and to vote at the annual meeting and any postponement or adjournment thereof. Whether or not you plan to attend the annual meeting in person, please authorize a proxy to vote your shares as soon as possible. You may authorize a proxy to vote your shares by mail, telephone or Internet. The proxy card materials provide you with details on how to authorize a proxy to vote by these methods. If you determine to mail us your proxy, please complete, date and sign the proxy card as soon as possible, and return it promptly in the envelope provided, which requires no postage if mailed in the United States. Your vote is very important. Your immediate response will help avoid potential delays and may save us significant expenses associated with soliciting stockholder votes. If you are the record holder of your shares and you attend the annual meeting, you may withdraw your proxy and vote in person, if you so choose.

|

| |

| | By Order of the Board of Directors, |

| |

/s/ RONALD J. LIEBERMAN |

| |

Ronald J. Lieberman |

| | Executive Vice President, General Counsel and

Secretary |

| April 28, 2015 | |

| New York, New York | |

NorthStar Real Estate Income Trust, Inc.

399 Park Avenue, 18th Floor

New York, New York 10022

(212) 547-2600

____________________________

PROXY STATEMENT

____________________________

FOR THE 2015 ANNUAL MEETING OF STOCKHOLDERS

To Be Held on June 25, 2015

TABLE OF CONTENTS

GENERAL INFORMATION ABOUT THE MEETING

This proxy statement and the accompanying proxy card and Notice of Annual Meeting of Stockholders are provided in connection with the solicitation of proxies by and on behalf of the board of directors, or our Board, of NorthStar Real Estate Income Trust, Inc., a Maryland corporation, for use at the 2015 annual meeting of stockholders to be held on June 25, 2015, beginning at 11:00 a.m., local time, and any postponements or adjournments thereof. “We,” “our,” “us” and “the Company” each refers to NorthStar Real Estate Income Trust, Inc. We conduct substantially all of our operations and make our investments through our operating partnership, of which we are the sole general partner. References to our operating partnership refer to NorthStar Real Estate Income Trust Operating Partnership, LP.

We were formed to originate, acquire and asset manage a diversified portfolio of commercial real estate, or CRE, debt, select equity and securities investments predominantly in the United States. We are externally managed and have no employees. Prior to June 30, 2014, we were managed by an affiliate of NorthStar Realty Finance Corp. (NYSE: NRF), or NorthStar Realty. Effective June 30, 2014, NorthStar Realty spun-off its asset management business into a separate publicly traded company, NorthStar Asset Management Group Inc. (NYSE: NSAM), our Sponsor. Our Sponsor and its affiliates were organized to provide asset management and other services to us, NorthStar Realty, other sponsored public non-traded companies and any other companies our Sponsor and its affiliates may manage in the future, both in the United States and internationally. Concurrent with the spin-off, an affiliate of our Sponsor, NSAM J-NSI Ltd, or our Advisor, entered into a new advisory agreement with us, pursuant to which our Advisor agreed to manage our day-to-day operations on terms substantially similar to those set forth in our prior advisory agreement with NS Real Estate Income Trust Advisor, LLC, or our prior advisor.

The mailing address of our executive office is 399 Park Avenue, 18th Floor, New York, New York 10022. This proxy statement, the accompanying proxy card and the Notice of Annual Meeting of Stockholders are first being mailed to holders of our common stock on or about May 1, 2015. Stockholders of record at the close of business on April 2, 2015 are entitled to notice of and to vote at the annual meeting. Our common stock is the only security entitled to vote at the annual meeting. In this proxy statement we refer to the shares of our common stock entitled to vote at the annual meeting as our voting securities. Along with this proxy statement, we are also sending our Annual Report to Stockholders for the fiscal year ended December 31, 2014.

When you return the enclosed proxy card, you are authorizing a proxy to vote your shares of common stock at the annual meeting as you instruct, unless you return the proxy with no instruction. In this case, the individuals designated as proxies to vote your shares of common stock at the annual meeting, David T. Hamamoto, Daniel R. Gilbert and Ronald J. Lieberman, will vote FOR the election of each of the four director nominees and FOR the ratification of Grant Thornton LLP, or Grant Thornton, as our independent registered public accounting firm for the fiscal year ending December 31, 2015. As of the date of this proxy statement, management has no knowledge of any business that will be presented for consideration at the annual meeting and that would be required to be set forth in this proxy statement or the related proxy card other than the matters set forth in the Notice of Annual Meeting of Stockholders. If any other matter is properly presented at the annual meeting for consideration, the persons named in the enclosed proxy card and acting thereunder will vote in accordance with their discretion on any such matter.

Grant Thornton, an independent registered public accounting firm, has provided services to us during the past fiscal year, which included the examination of our Annual Report on Form 10-K, review of our quarterly reports and review of registration statements and filings with the Securities and Exchange Commission, or SEC. A representative of Grant Thornton is expected to be present at the annual meeting, will be available to respond to appropriate questions from our stockholders and will be given an opportunity to make a statement if he or she desires to do so.

Matters to be Considered and Voted Upon at the Annual Meeting

At the annual meeting, our stockholders will consider and vote upon:

| |

| 1) | a proposal to elect as directors the four individuals nominated by our Board as set forth in this proxy statement, each to serve until the 2016 annual meeting of stockholders and until his successor is duly elected and qualified; |

| |

| 2) | a proposal to ratify the appointment of Grant Thornton as the Company’s independent registered public accounting firm for the fiscal year ending December 31, 2015; and |

| |

| 3) | any other business that may properly come before the annual meeting or any postponement or adjournment of the annual meeting. |

Solicitation of Proxies

The enclosed proxy is solicited by and on behalf of our Board. The expense of preparing, printing and mailing this proxy statement and the proxies solicited hereby will be borne by us. In addition to the solicitation of proxies by mail, proxies may be solicited by directors and officers, without additional remuneration, by personal interview, telephone, electronic communications or otherwise. We will also request brokerage firms, nominees, custodians and fiduciaries to forward proxy materials to the beneficial owners of shares of our common stock held of record as of the close of business on April 2, 2015 and will reimburse them for their reasonable out‑of‑pocket expenses for forwarding the materials.

We have retained Boston Financial Data Services, Inc., or Boston Financial, to assist us in the distribution of proxy materials and the solicitation of proxies. We estimate that we will pay Boston Financial fees and expenses of approximately $50,000 plus reasonable out‑of‑pocket expenses to solicit proxies incurred in connection with their services which include the review of proxy materials; distribution of proxy materials; operating online and phone voting systems; and receipt of executed proxies.

Stockholders Entitled To Vote

As of the close of business on April 2, 2015, there were 119,079,958 shares of our common stock outstanding and entitled to vote. Each share of our common stock entitles the holder to one vote. Stockholders of record at the close of business on April 2, 2015 are entitled to notice of and to vote at the annual meeting or any postponement or adjournment thereof.

Abstentions and Broker Non-Votes

If you hold your shares in street name and do not provide voting instructions to your bank, broker or other nominee, proxies submitted by a broker for your shares will be considered to be “broker non‑votes” with respect to any proposal on which your bank, broker or other nominee does not have discretionary authority to vote. Your bank, broker or other nominee does not have discretionary authority to vote your shares for Proposal No. 1, the election of directors. Your bank, broker or other nominee does have discretionary authority to vote your shares for Proposal No. 2, the ratification of the selection of Grant Thornton as our independent registered public accounting firm for the fiscal year ending December 31, 2015. Abstentions and broker non‑votes, if any, will be counted as present at the annual meeting for the purpose of determining a quorum.

Required Quorum/Vote

A quorum will be present if stockholders entitled to cast 50% of all the votes entitled to be cast at the annual meeting are present, in person or by proxy. If you hold your shares in your own name as holder of record and return a valid proxy, authorize your proxy by mail, telephone or Internet or attend the annual meeting in person, your shares will be counted for the purpose of determining whether there is a quorum. If a quorum is not present, the annual meeting may be adjourned by the chairman of the annual meeting to a date not more than 120 days after the original record date without notice other than announcement at the annual meeting.

Election of the director nominees named in Proposal No. 1 requires the affirmative vote of the holders of a majority of the shares present in person or by proxy at the annual meeting. Shares represented by executed proxies will be voted, if authority to do so is not withheld, FOR the election of each of the director nominees named in Proposal No. 1. Votes may be cast in favor of or withheld with respect to all of the director nominees, or any one or more of them. A vote “withheld” or a broker non‑vote, if any, will have the same effect as a vote against that nominee.

Ratification of the selection of Grant Thornton as our independent registered public accounting firm for the fiscal year ending December 31, 2015, as specified in Proposal No. 2, requires the affirmative vote of a majority of the votes cast on the proposal at the annual meeting. If this selection is not ratified by holders of our voting securities, our Board’s Audit Committee, or our Audit Committee, may, but need not, reconsider its appointment and endorsement of Grant Thornton as our independent registered public accounting firm for the fiscal year ending December 31, 2015. Abstentions, if any, will not be counted as having been cast and will have no effect on the outcome of the vote for this proposal. Broker non‑votes will not arise in connection with, and will have no effect on the outcome of, Proposal No. 2 because brokers may vote in their discretion on behalf of clients who have not furnished voting instructions. Even if the selection is ratified, our Audit Committee in its discretion may direct the appointment of a different independent registered public accounting firm at any time during the year if it determines that such a change would be in the best interests of the Company.

If the enclosed proxy is properly executed and returned to us in time to be voted at the annual meeting, it will be voted as specified on the proxy unless it is properly revoked prior thereto. If no specification is made on the proxy as to any one or more of the proposals, the shares of our voting securities represented by the proxy will be voted as follows:

| |

| 1) | FOR the election of the four individuals nominated by our Board as set forth in this proxy statement, each to serve until the 2016 annual meeting of stockholders and until his successor is duly elected and qualified; |

| |

| 2) | FOR the ratification of the appointment of Grant Thornton as our independent registered public accounting firm for the fiscal year ending December 31, 2015; and |

| |

| 3) | in the discretion of the proxy holder, on any other business that properly comes before the annual meeting or any postponement or adjournment thereof. |

As of the date of this proxy statement, we are not aware of any other matter to be raised at the annual meeting.

Voting

If you hold your shares of our voting securities in your own name as a holder of record, you may instruct the proxies to vote your shares by signing, dating and mailing the proxy card in the postage‑paid envelope provided. In addition, you may authorize a proxy to vote your shares of our voting securities by either visiting our electronic voting site at www.2voteproxy.com/ns1, by calling our toll‑free voting number at 1-800-830-3542 or you may vote your shares in person at the annual meeting. Your immediate response will help avoid potential delays and may save us significant expenses associated with soliciting stockholder votes.

If your shares of our voting securities are held on your behalf by a broker, bank or other nominee, you will receive instructions from such individual or entity that you must follow in order to have your shares voted at the annual meeting. If your shares are not registered in your own name and you plan to vote your shares in person at the annual meeting, you should contact your broker, bank or other nominee to obtain a legal proxy card and bring it to the annual meeting in order to vote.

Right to Revoke Proxy

If you hold shares of our voting securities in your own name as a holder of record, you may revoke your proxy through any of the following methods:

| |

| • | send written notice of revocation, prior to the date of the annual meeting, to our Secretary, at NorthStar Real Estate Income Trust, Inc., 399 Park Avenue, 18th Floor, New York, New York 10022; |

| |

| • | sign and mail a new, later‑dated proxy card to our Secretary at the address specified above that is received prior to the date of the annual meeting; |

| |

| • | visit our electronic voting site at www.2voteproxy.com/ns1; |

| |

| • | call our toll-free voting number at 1-800-830-3542 and follow the instructions provided; or |

| |

| • | attend the annual meeting and vote your shares in person, although attendance at the annual meeting will not by itself constitute revocation of a proxy. |

Only the most recent proxy vote will be counted and all others will be disregarded notwithstanding the method by which the proxy was authorized. If shares of our voting securities are held on your behalf by a broker, bank or other nominee, you must contact it to receive instructions as to how you may revoke your proxy.

Copies of Annual Report to Stockholders

A copy of our Annual Report to Stockholders for the fiscal year ended December 31, 2014 is being mailed to stockholders entitled to vote at the annual meeting with these proxy materials and is also available without charge to stockholders upon written request to: NorthStar Real Estate Income Trust, Inc., 399 Park Avenue, 18th Floor, New York, New York 10022, Attn: General Counsel.

Annual Report and Quarterly Reports

We make available free of charge through our website at www.northstarreit.com/income under the heading “Investor Relations—SEC Filings” our Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K and all amendments to those reports as soon as reasonably practicable after such material is electronically filed with or furnished to the SEC. Further, we will provide, without charge to each stockholder upon written request, a copy of our Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K and all amendments to those reports. Requests for copies should be addressed to: NorthStar Real Estate Income Trust, Inc., 399 Park Avenue, 18th Floor, New York, New York

10022, Attn: General Counsel. Copies may also be accessed electronically by means of the SEC home page on the Internet, at www.sec.gov. Our SEC filings also are available to the public at the SEC’s Public Reference Room located at 100 F Street, N.E., Washington, D.C. 20549. You also may obtain copies of the documents at prescribed rates by writing to the Public Reference Section of the SEC at 100 F Street, N.E., Room 1580, Washington, D.C. 20549. Please call the SEC at 1-800-SEC-0330 for further information regarding the public reference facilities.

Householding Information

We have adopted a procedure approved by the SEC called “householding.” Under this procedure, we deliver only one copy of our Annual Report to Stockholders for the fiscal year ended December 31, 2014 to multiple stockholders with the same last name and address, or if we reasonably believe they are members of the same family residing at the same address, unless one or more of these stockholders notifies us that they wish to continue receiving individual copies. This procedure will reduce our printing costs and postage fees. Each stockholder will continue to receive a separate proxy card or voting instruction card.

If you participate in householding and wish to receive a separate copy of our Annual Report to Stockholders for the fiscal year ended December 31, 2014, please request a copy in writing from NorthStar Real Estate Income Trust, Inc., 399 Park Avenue, 18th Floor, New York, New York 10022, Attn: General Counsel or by phone by calling 212-547-2600 and a copy will be provided to you promptly.

If you do not wish to continue participating in householding and prefer to receive separate copies of future annual reports to stockholders and other stockholder communications, notify our General Counsel in writing at the following address: NorthStar Real Estate Income Trust, Inc., 399 Park Avenue, 18th Floor, New York, New York 10022, or by phone by calling 212-547-2600.

If you are a stockholder who received multiple copies of our proxy materials or our Annual Report to Stockholders for the fiscal year ended December 31, 2014, you may request householding by contacting us in the same manner as above.

Voting Results

DST Systems, Inc., or DST, our transfer agent, will have a representative present at the annual meeting to count the votes and act as the Inspector of Election. We will publish the voting results in a Current Report on Form 8-K, which we plan to file with the SEC within four business days of the annual meeting.

Confidentiality of Voting

We will keep all proxies, ballots and voting tabulations confidential. We will permit only our Inspector of Election, DST, to examine these documents, except as necessary to meet applicable legal requirements.

Recommendations of our Board

Our Board recommends a vote:

| |

| 1) | FOR the election of the four individuals nominated by our Board as set forth in this proxy statement, each to serve until the 2016 annual meeting of stockholders and until his successor is duly elected and qualified; |

| |

| 2) | FOR the ratification of the appointment of Grant Thornton as the Company’s independent registered public accounting firm for the fiscal year ending December 31, 2015; and |

| |

| 3) | in the discretion of the proxy holder, on any other business that properly comes before the annual meeting or any postponement or adjournment thereof. |

BOARD OF DIRECTORS

General

Our Board presently consists of four members. At the annual meeting, stockholders will vote on the election of Messrs. David T. Hamamoto, Jonathan T. Albro, Charles W. Schoenherr and Jack F. Smith, Jr., for a term ending at the 2016 annual meeting of stockholders and until their successors are duly elected and qualified.

The director nominees listed below are leaders in business and real estate and financial communities because of their intellectual acumen and analytic skills, strategic vision and their records of outstanding accomplishments over a period of

decades. Each has been chosen to stand for re-election in part because of his ability and willingness to understand our unique challenges, and evaluate and implement our strategies.

Set forth below is each director nominee’s name and age as of the date of this proxy statement and biographical information. Each of our director nominees currently serves on our Board and was initially appointed to our Board on January 12, 2010, with the exception of Mr. Hamamoto, who has served as one of our directors since our incorporation on January 26, 2009. Each of our director nominees was elected as a director by the stockholders at the 2014 annual meeting of stockholders.

Current Directors Who are Nominees for Re-election

|

| | |

| Name | | Age |

| David T. Hamamoto | | 55 |

| Jonathan T. Albro | | 52 |

| Charles W. Schoenherr | | 55 |

| Jack F. Smith, Jr. | | 63 |

David T. Hamamoto. David T. Hamamoto has served as our Chairman since February 2009 and served as our Chief Executive Officer from February 2009 until January 2013. Mr. Hamamoto also serves as Chairman and Chief Executive Officer of our Sponsor, a position he has held since January 2014. Mr. Hamamoto has also served as Chairman and Chief Executive Officer of NorthStar Realty since October 2007 and October 2004, respectively, having served as President of NorthStar Realty from October 2004 to April 2011. Mr. Hamamoto has also served as Chairman of NorthStar Real Estate Income II, Inc., or NorthStar Income II, since December 2012. Mr. Hamamoto served as Chairman of NorthStar Healthcare Income, Inc., or NorthStar Healthcare, from January 2013 until January 2014. Mr. Hamamoto has further served as Co-Chairman of NorthStar/RXR New York Metro Income, Inc., or NorthStar/RXR, since March 2014. In July 1997, Mr. Hamamoto co-founded NorthStar Capital Investment Corp., the predecessor to NorthStar Realty, for which he served as Co-Chief Executive Officer until October 2004. From 1983 to 1997, Mr. Hamamoto worked for Goldman, Sachs & Co., or Goldman Sachs, where he was co-head of the Real Estate Principal Investment Area and general partner of the firm between 1994 and 1997. During Mr. Hamamoto’s tenure at Goldman Sachs, he initiated the firm’s effort to build a real estate principal investment business under the auspices of the Whitehall Funds. Additionally, Mr. Hamamoto has served as a member of the advisory committee of RXR Realty LLC, a leading real estate operating and investment management company focused on high-quality real estate investments in the New York Tri-State area, since December 2013. Mr. Hamamoto served as Executive Chairman from March 2011 until November 2012 (having previously served as Chairman from February 2006 until March 2011) of the board of directors of Morgans Hotel Group Co. (NASDAQ: MHGC), a public global hotel management and ownership company focused on the boutique sector. Mr. Hamamoto holds a Bachelor of Science from Stanford University in Palo Alto, California and a Master of Business Administration from the Wharton School of Business at the University of Pennsylvania in Philadelphia, Pennsylvania.

Consideration for Recommendation: Our Board believes that Mr. Hamamoto’s broad and extensive experience in the real estate investment and finance industries and his service as Chairman and Chief Executive Officer of our Sponsor and its predecessor for over 12 years support his nomination to our Board.

Jonathan T. Albro. Jonathan T. Albro is one of our independent directors and a member of our Audit Committee, a position he has held since January 2010. Mr. Albro also serves as a director of NorthStar Income II and as a member of its audit committee. He is Chief Executive Officer and Managing Partner of Penn Square Real Estate Group, LLC, or Penn Square Real Estate Group, which he founded in September 2006. At Penn Square Real Estate Group, he is responsible for strategy, operations, marketing, finance and fundraising. From April 2005 to August 2006, Mr. Albro served as Executive Vice President, National Sales Manager of Cole Capital Markets, Inc., or CCM, and Senior Vice President of Cole Capital Corporation, or CCC. He was responsible for the growth and management of CCM, a distribution company focused on Cole’s suite of real estate offerings in addition to serving on CCC’s executive committee. From September 2001 to April 2005, Mr. Albro served as Executive Vice President and National Sales Manager of MetLife Investors, Inc., a wholly-owned subsidiary of MetLife, Inc., where he was responsible for sales and distribution of MLI Retirement products through financial intermediaries. In all, Mr. Albro has over 26 years of experience in the broker-dealer industry. Mr. Albro holds a Bachelor of Science from State University of New York in Fredonia, New York.

Consideration for Recommendation: Our Board believes that Mr. Albro’s knowledge of the broker‑dealer industry and more than 25 years of experience in the industry support his nomination to our Board.

Charles W. Schoenherr. Charles W. Schoenherr is one of our independent directors and a member of our Audit Committee, a position he has held since January 2010. Mr. Schoenherr has also served as a director and member of the audit

committee of each of NorthStar Income II and NorthStar Realty since December 2012 and June 2014, respectively. Mr. Schoenherr is currently a Managing Director of Waypoint Residential, LLC, or Waypoint Residential, which invests in multifamily properties in the Sunbelt, a position he has held since October 2014, where he is responsible for sourcing acquisition opportunities and raising capital. Mr. Schoenherr previously served as Waypoint Residential’s Chief Investment Officer from October 2011 to September 2014. From June 2009 until January 2011, Mr. Schoenherr served as President of Scout Real Estate Capital, LLC, a full service real estate firm that focuses on acquiring, developing and operating hospitality assets, where he was responsible for managing the company’s properties and originating new acquisition and asset management opportunities. Prior to joining Scout Real Estate Capital, LLC, Mr. Schoenherr was the managing partner of Elevation Capital, LLC, where he advised real estate clients on debt and equity restructuring and performed due diligence and valuation analysis on new acquisitions between November 2008 and June 2009. Between September 1997 and October 2008, Mr. Schoenherr served as Senior Vice President and Managing Director of Lehman Brothers’ Global Real Estate Group, where he was responsible for originating debt, mezzanine and equity transactions on all major property types throughout the United States. During his career he has also held senior management positions with GE Capital Corporation, GE Investments, Inc. and KPMG LLP, where he also practiced as a certified public accountant. Mr. Schoenherr also serves on the Board of Trustees of Iona College and is on its Real Estate Committee and its Investment Committee. Mr. Schoenherr holds a Bachelor of Business Administration in Accounting from Iona College in New Rochelle, New York and a Master of Business Administration in Finance from the University of Connecticut in Stamford, Connecticut.

Consideration for Recommendation: Our Board believes that Mr. Schoenherr’s knowledge of the real estate investment and finance industries, including extensive experience originating debt, mezzanine and equity transactions, support his nomination to our Board.

Jack F. Smith, Jr. Jack F. Smith, Jr. has been one of our independent directors and the chairman and financial expert of our Audit Committee since January 2010. Mr. Smith is also a member of the board of directors and chairman of the audit committee of NorthStar Healthcare, a position he has held since June 2011. Mr. Smith was a partner with Deloitte & Touche LLP, or Deloitte, from June 1984 until August 2009. Subsequent to his retirement in 2009, Mr. Smith has engaged in investing in and management of personal real estate and other assets. During his tenure at Deloitte, he served as the head of the firm’s real estate industry practice for Atlanta, Georgia and the Southeast from June 1996 to June 2007. Mr. Smith began his career as an accountant with Deloitte in 1973, where his responsibilities included audits, due diligence on acquisitions and mergers, business and accounting advice and assistance in problem resolution. During the course of his career, Mr. Smith has served clients of varying sizes in many different industries, including public and private real estate investment trusts, or REITs, real estate developers, merchant builders, real estate investment funds, real estate operating companies and hotels. Mr. Smith is a member of the Tennessee Technological University College of Business Foundation, the American Institute of Certified Public Accountants and the Tennessee and Georgia Societies of Certified Public Accountants. Mr. Smith holds a Bachelor of Science in Accounting from Tennessee Technological University in Cookeville, Tennessee and a Master of Business Administration from Emory University in Atlanta, Georgia.

Consideration for Recommendation: Our Board believes that Mr. Smith’s 25 years of experience as a partner with Deloitte and his service as the head of the firm’s real estate industry practice in Atlanta and the Southeast support his nomination to our Board.

Corporate Governance Profile

We are committed to good corporate governance practices and, as such, we have adopted a code of ethics and corporate governance guidelines discussed below.

Code of Ethics

We have adopted a code of ethics for the purpose of promoting honest and ethical conduct of our business, full disclosure in our filings with the SEC, compliance with applicable laws, governmental rules and regulations, prompt internal reporting of violations of, and accountability for adherence to, our code of ethics. Our code of ethics applies to our Chief Executive Officer, Chief Financial Officer and Treasurer and other senior financial officers performing similar functions and our Board, collectively referred to as our covered persons. We intend to maintain high standards of honest and ethical business practices and compliance with all laws and regulations applicable to our business. Among the areas addressed by our code of ethics are conflicts of interest, including improper benefits, outside financial interests, business arrangements with us, outside employment or activities with competitors, charitable, government and other outside business activities, family members working in the industry, corporate opportunities, offering and receiving entertainment, gifts and gratuities, protection and proper use of our assets, maintaining the our books and records, internal accounting controls, improper influence on audits, record retention, the protection of our confidential information, trademarks, copyrights and other intellectual property, insider trading, fair dealing and interacting with the government. Our code of ethics is available on our website at www.northstarreit.com/income under the heading “Investor Relations—Corporate Governance” and is also available without charge to stockholders upon written request to: NorthStar Real Estate Income Trust, Inc., 399 Park Avenue, 18th Floor, New York, New York 10022, Attn: General Counsel. Within the time period required by the rules of the SEC, we will post on our website any amendment to, or waiver from, our code of ethics.

Corporate Governance Guidelines

We have adopted corporate governance guidelines to assist our Board in the exercise of its responsibilities. The corporate governance guidelines govern, among other things, Board composition, Board member qualifications, responsibilities and education, management succession and self-evaluation. A copy of our corporate governance guidelines may be found on our website at www.northstarreit.com/income under the heading “Investor Relations—Corporate Governance” and is also available without charge to stockholders upon written request to: NorthStar Real Estate Income Trust, Inc., 399 Park Avenue, 18th Floor, New York, New York 10022, Attn: General Counsel.

Our Audit Committee

Our Board has a separately designated standing Audit Committee and its primary function is to engage our independent registered public accounting firm and to assist our Board in fulfilling its oversight responsibilities by reviewing the financial information to be provided to the stockholders and others, the system of internal controls which management has established and the audit and financial reporting process.

Our Audit Committee acts under a written charter adopted by our Board that sets forth the committee’s responsibilities and duties, as well as requirements for the committee’s composition and meetings. Under the Audit Committee charter, our Audit Committee will always be comprised solely of independent directors. A copy of the Audit Committee charter is available on our website at www.northstarreit.com/income under the heading “Investor Relations—Corporate Governance” and is also available without charge to stockholders upon written request to: NorthStar Real Estate Income Trust, Inc., 399 Park Avenue, 18th Floor, New York, New York 10022, Attn: General Counsel.

Our Audit Committee held five meetings in 2014. Each director then serving as a member of our Audit Committee attended at least 75% of the aggregate number of meetings of our Audit Committee. Our Board has determined that each member of our Audit Committee is independent within the meaning of the applicable SEC rules. Even though our shares are not listed on the New York Stock Exchange, or the NYSE, our Board has also determined that each independent member of our Board is independent under the NYSE rules. The members of our Audit Committee are Messrs. Albro, Schoenherr and Smith. Our Board has determined that Mr. Smith, who chairs our Audit Committee, is an “audit committee financial expert,” as that term is defined by the SEC.

Compensation Committee Interlocks and Insider Participation

We currently do not have a compensation committee of our Board because we do not pay any compensation to our officers. Our independent directors participate in the consideration of independent director compensation. There are no interlocks or insider participation as to compensation decisions required to be disclosed pursuant to SEC regulations.

Director Independence

The NYSE standards provide that to qualify as an independent director, in addition to satisfying certain specified criteria, the board of directors must conclude that a director has no material relationship with us (either directly or as a partner, stockholder or officer of an organization that has a relationship with us). Although our shares are not listed on the NYSE or any other national securities exchange, our Board has affirmatively determined that all of the members of our Board, except Mr. Hamamoto, are independent under the NYSE rules.

In addition, we have determined that all of the members of our Board, except Mr. Hamamoto, are independent pursuant to the definition of independence in our charter, which is based on the definition included in the North American Securities Administrators Association, Inc.’s Statement of Policy Regarding Real Estate Investment Trusts, as revised and adopted on May 7, 2007. Our charter is available on our website at www.northstarreit.com/income under the heading “Investor Relations—Corporate Governance” and is also available without charge to stockholders upon written request to: NorthStar Real Estate Income Trust, Inc., 399 Park Avenue, 18th Floor, New York, New York 10022, Attn: General Counsel.

Board Leadership Structure; Meetings of Independent Directors

Our Board believes it is important to select our Chairman and our Chief Executive Officer in the manner it considers to be in our best interests and in the best interests of our stockholders at any given point in time. The members of our Board possess considerable business experience and in-depth knowledge of the issues we face, and are therefore in the best position to evaluate our needs and how best to organize our leadership structure to meet those needs. The Chairman and the Chief Executive Officer positions may be filled by one individual or by two different individuals. Our Board currently operates under a leadership structure with separate roles for our Chairman of the Board and our Chief Executive Officer. Our company’s day‑to‑day operations are conducted by its officers under the direction of Mr. Gilbert, our Chief Executive Officer and President. Our Board has selected Mr. Hamamoto to serve as our Chairman of the Board based on his service with and knowledge of our company and his significant leadership and real estate experience. Mr. Gilbert and Mr. Hamamoto work together to provide consistent communication and coordination for the Company, which our Board believes will result in effective and efficient implementation of our corporate strategy.

Although Mr. Hamamoto is not an independent director, our Board has determined that it is not necessary to appoint a lead independent director. To promote the independence of our Board and appropriate oversight of management, our independent directors meet in executive sessions at which only non-management directors are present. These meetings are held in conjunction with the regularly scheduled quarterly meetings of our Board, but may be called at any time by our independent directors. In 2014, our independent directors met seven times in executive session without management present following Board meetings.

During the year ended December 31, 2014, our Board met on eight occasions. Each director then serving attended at least 75% of the aggregate number of meetings of our Board.

Stockholder Communications with our Board

Our Board has established the following means for stockholders to communicate concerns to our Board. If the concern relates to our financial statements, accounting practices or internal controls, the concerns should be submitted in writing to the chairman of our Audit Committee at NorthStar Real Estate Income Trust, Inc., 399 Park Avenue, 18th Floor, New York, New York 10022, Attn: Secretary. If the concern relates to our governance practices, business ethics or corporate conduct, the concern may be submitted in writing to our Secretary at the above address. If uncertain as to which category a concern relates, a stockholder may communicate the concern to any of our independent directors in care of our Secretary at the address above. Communications received will be distributed by the Secretary to such member or members of our Board as deemed appropriate by the Secretary, depending on the facts and circumstances outlined in the communication received.

Section 16(a) Beneficial Ownership Reporting Compliance

Section 16(a) of the Securities Exchange Act of 1934, as amended, or the Exchange Act, requires our executive officers, directors and persons who own more than 10% of shares of our common stock, to furnish us with and to file reports of beneficial ownership of such securities on Forms 3, 4 and 5 with the SEC. Based solely on our review of the copies of such forms we received or written representations from certain reporting persons, we believe that all such filings required to be made during and with respect to the fiscal year ended December 31, 2014 by Section 16(a) of the Exchange Act were timely made, except that Form 4s were filed late in connection with the grants of shares to Messrs. Albro, Schoenherr and Smith on June 11, 2014 following their re-election to our Board.

Director Nomination Procedures

We do not have a standing nominating committee. Our Board has determined that it is appropriate for us not to have a nominating committee because our Board as currently constituted permits all of our independent directors to consider all matters for which a nominating committee would be ordinarily responsible. Each member of our Board participates in the consideration of nominees. Our charter requires that our directors, other than our independent directors, must have at least three years of relevant experience demonstrating the knowledge and experience required to acquire and manage the type of assets acquired by us and that at least one of our independent directors has three years of relevant real estate experience. While we do not have any other minimum qualifications with respect to nominees, our Board considers many factors in connection with each candidate, including judgment, integrity, diversity, prior experience, the value of the candidate’s experience relative to the experience of other board members and the candidate’s willingness to devote substantial time and effort to board responsibilities. Our Board does not have a formal written policy regarding the consideration of diversity in identifying director nominees. Nevertheless, consideration of diversity will continue to be an important factor in identifying and recruiting new directors.

Our Board will also consider recommendations made by stockholders for director nominees who meet the established director criteria set forth above. In order to be considered by our Board, recommendations made by stockholders must be submitted within the timeframe required for director nominations by stockholders as provided in our bylaws. See “Stockholder Proposals and Director Nominations for 2016” below. In evaluating the persons recommended as potential directors, our Board will consider each candidate without regard to the source of the recommendation and take into account those factors that our Board determines are relevant. Stockholders may directly nominate potential directors (without the recommendation of our Board) by satisfying the procedural requirements for such nomination as provided in Article II, Section 11, of our bylaws.

Risk Oversight

Risk is inherent with every business and how well a business manages risk can ultimately determine its success. Our management team is responsible for our risk exposures on a day‑to‑day basis by identifying the material risks we face, implementing appropriate risk management strategies that are responsive to our risk profile, integrating consideration of risk and risk management into our decision‑making process and, if necessary, promulgating policies and procedures to ensure that information with respect to material risks is communicated to our Board. Our Board has the responsibility to oversee and monitor these risk management processes by informing itself of material risks and evaluating whether management has reasonable controls in place to address the material risks; our Board is not responsible, however, for defining or managing our various risks. Our Board is regularly informed by management of potential material risks and activities related to those risks at Board meetings. Our executive officers generally attend all Board meetings and management is readily available to the Board to address any questions or concerns raised by the Board on risk management and any other matters. Our Board’s oversight of risk has not specifically affected its leadership structure.

Director Attendance at Annual Meeting

Our corporate governance guidelines encourage but do not require our directors to attend the annual meeting of stockholders. No directors attended the 2014 annual meeting of stockholders.

EXECUTIVE OFFICERS

Our executive officers are elected annually by our Board and serve at the discretion of our Board. Set forth below is information, as of the date of this proxy statement, regarding our executive officers:

|

| | | | |

| Name | | Age | | Position |

| Daniel R. Gilbert | | 45 | | Chief Executive Officer and President |

| Debra A. Hess | | 51 | | Chief Financial Officer and Treasurer |

| Ronald J. Lieberman | | 45 | | Executive Vice President, General Counsel and Secretary |

Set forth below is biographical information regarding each of our executive officers.

Daniel R. Gilbert. Daniel R. Gilbert has served as our Chief Executive Officer and President since January 2013 and March 2011, respectively, having previously served as our Chief Investment Officer from our inception in January 2009 through January 2013. Mr. Gilbert has also served as Chief Investment and Operating Officer of NorthStar Asset Management Group, Ltd, a wholly owned subsidiary of our Sponsor and parent company of our Advisor, since June 2014, and of NorthStar Realty since January 2013. Mr. Gilbert has also served as Executive Chairman of the board of directors of NorthStar Healthcare since

January 2014, having previously served as its Chief Executive Officer from August 2012 to January 2014 and as its Chief Investment Officer from October 2010 through February 2012. He has also served as Chief Executive Officer and President of each of NorthStar Income II and NorthStar/RXR since December 2012 and March 2014, respectively. Previously, Mr. Gilbert served as Co-President of NorthStar Realty from April 2011 until January 2013 and in various other senior management positions since its initial public offering in October 2004. Mr. Gilbert served as an Executive Vice President and Managing Director of Mezzanine Lending of NorthStar Capital Investment Corp., a predecessor company of NorthStar Realty. Prior to that role, Mr. Gilbert was with Merrill Lynch & Co., or Merrill Lynch, in its Global Principal Investments and Commercial Real Estate Department and prior to joining Merrill Lynch, held accounting and legal-related positions at Prudential Securities Incorporated. Mr. Gilbert holds a Bachelor of Arts degree from Union College in Schenectady, New York.

Debra A. Hess. Debra A. Hess has been our Chief Financial Officer and Treasurer since October 2011. Ms. Hess currently serves as Chief Financial Officer of our Sponsor and NorthStar Realty, positions she has held since January 2014 and July 2011, respectively. Ms. Hess has also served as Chief Financial Officer and Treasurer of each of NorthStar Healthcare, NorthStar Income II and NorthStar/RXR since March 2012, December 2012 and March 2014, respectively. Ms. Hess has significant financial, accounting and compliance experience at public companies. Prior to joining NorthStar Realty, Ms. Hess served as Chief Financial Officer and Compliance Officer of H/2 Capital Partners, where she was employed from August 2008 to June 2011. From March 2003 to July 2008, Ms. Hess was a managing director at Fortress Investment Group, or Fortress, where she also served as Chief Financial Officer of Newcastle Investment Corp., a Fortress portfolio company and an NYSE-listed alternative investment manager. From 1993 to 2003, Ms. Hess served in various positions at Goldman, Sachs & Co., including as Vice President in its Principal Finance Group and as a Manager of Financial Reporting in its Finance Division. Prior to 1993, Ms. Hess was employed by Chemical Banking Corporation in the corporate credit policy group and by Arthur Andersen & Company as a supervisory senior auditor. Ms. Hess holds a Bachelor of Science in Accounting from the University of Connecticut in Storrs, Connecticut and a Master of Business Administration in Finance from New York University’s Stern School of Business in New York, New York.

Ronald J. Lieberman. Ronald J. Lieberman has been our General Counsel and Secretary since October 2011 and has served as our Executive Vice President since January 2013. Mr. Lieberman currently serves as Executive Vice President, General Counsel and Secretary of our Sponsor, positions he has held since January 2014. He has also served as NorthStar Realty’s Executive Vice President, General Counsel and Secretary since April 2012, April 2011 and January 2013, respectively. Mr. Lieberman previously served as Assistant Secretary of NorthStar Realty from April 2011 until January 2013. Mr. Lieberman has served as Executive Vice President, General Counsel and Secretary of NorthStar Healthcare since January 2013, April 2011 and January 2013, respectively. Mr. Lieberman also serves as NorthStar Income II’s Executive Vice President (a position he has held since March 2013), General Counsel and Secretary (positions he has held since December 2012). Mr. Lieberman further serves as Executive Vice President, General Counsel and Secretary for NorthStar/RXR, positions he has held since March 2014. Mr. Lieberman also currently serves on the Executive Committee of American Healthcare Investors LLC. Prior to joining NorthStar Realty, Mr. Lieberman was a partner in the Real Estate Capital Markets practice at the law firm of Hunton & Williams LLP. Mr. Lieberman practiced at Hunton & Williams from September 2000 until March 2011 where he advised numerous REITs, including mortgage REITs and specialized in capital markets transactions, mergers and acquisitions, securities law compliance, corporate governance and other board advisory matters. Prior to joining Hunton & Williams, Mr. Lieberman was the associate general counsel at Entrade, Inc., during which time Entrade was a public company listed on the NYSE. Mr. Lieberman began his legal career at Skadden, Arps, Slate, Meagher and Flom LLP. Mr. Lieberman holds a Bachelor of Arts, Master of Business Administration and Juris Doctor, each from the University of Michigan in Ann Arbor, Michigan.

EXECUTIVE COMPENSATION

We currently have no employees. Our day‑to‑day management functions are performed by our Advisor and related affiliates. Our executive officers are all employees of our Sponsor or its affiliates and are utilized by our Advisor to provide management, acquisition, advisory and certain administrative services for us. We do not pay any of these individuals for serving in their respective positions. See “Certain Relationships and Related Transactions” below for a discussion of fees paid to our Advisor and other affiliated companies.

DIRECTOR COMPENSATION

Independent Directors

Pursuant to our NorthStar Real Estate Income Trust, Inc. Independent Directors Compensation Plan, or the Independent Directors Plan, each of our independent directors was paid an annual director’s fee of $90,000 in 2014. Mr. Smith, who serves as our Audit Committee chairperson, was paid an additional fee of $10,000 in 2014. Each of our independent directors also

received $35,000 in shares of restricted common stock in June 2014, in connection with such independent director’s re-election to our Board. The restricted common stock generally vests quarterly over two years; provided, however, that the restricted common stock will become fully vested on the earlier occurrence of: (i) the termination of the independent director’s service as a director due to his or her death or disability; or (ii) a change in our control. In addition, we reimburse all directors for reasonable out‑of‑pocket expenses incurred in connection with their services on our Board.

Directors who are our officers, including our Chairman of the Board, do not receive compensation as directors.

In 2015, our Board retained FTI Consulting, Inc., or FTI, a compensation consulting firm, to complete a competitive analysis of, and to provide a recommendation for, our independent director compensation program. On March 3, 2015, our Board approved a revised NorthStar Real Estate Income Trust, Inc. Independent Directors Compensation Plan for 2015, or the 2015 Independent Directors Compensation Plan. Based on the recommendations of FTI, our Board determined that, effective as of January 1, 2015, each of our independent directors will continue to be paid an annual director’s fee of $90,000 pursuant to the 2015 Independent Directors Plan. The independent director who serves as our Audit Committee chairperson will be paid an additional fee of $15,000 per year.

In addition, based on the recommendations of FTI and pursuant to the 2015 Independent Directors Plan, our Board determined that we will automatically grant to any person who becomes an independent director $75,000 in shares of restricted common stock on the date such independent director is initially appointed or elected to our Board. In addition, on the date following an independent director’s re-election to our Board, he or she will receive $50,000 in shares of restricted common stock. The actual number of shares of restricted common stock that we grant is determined by dividing the fixed value by (i) prior to a listing of our shares on a national securities exchange and during an offering, the offering price to the public; (ii) following an offering, the most recently disclosed net asset value, or NAV, or if an NAV has not been disclosed, the most recent offering price; or (iii) following a listing on a national securities exchange, the closing price of the shares on the date of grant. The shares of restricted common stock will generally vest quarterly over two years; provided, however, that the restricted common stock will become fully vested on the earlier occurrence of: (i) the termination of the independent director’s service as a director due to his or her death or disability; or (ii) a change in our control. We reserve the right to modify the nature of the equity grant to our directors from restricted common stock to other forms of stock-based incentive awards, such as units in our operating partnership structured as profit interests, as well as the vesting schedule.

Director Compensation for 2014

The following table provides information concerning the compensation of our independent directors for 2014.

|

| | | | | | | | | | | | |

| Name | | Fees

Earned or

Paid in

Cash(1) | | Stock

Awards(2) | | Total |

| Jonathan T. Albro | | $ | 90,000 |

| | $ | 35,000 |

| | $ | 125,000 |

|

| Charles W. Schoenherr | | 90,000 |

| | 35,000 |

| | 125,000 |

|

| Jack F. Smith, Jr. | | 100,000 |

| | 35,000 |

| | 135,000 |

|

| Total | | $ | 280,000 |

| | $ | 105,000 |

| | $ | 385,000 |

|

________________________

| |

| (1) | Amounts include annual cash retainers. Fees paid to directors are currently incurred by our Advisor on our behalf and are classified as operating costs. See “Certain Relationships and Related Transactions.” |

| |

| (2) | The compensation associated with the restricted common stock issued to the directors was based on a price of $10.00 per share. |

In addition, we reimbursed all directors for reasonable out-of-pocket expenses incurred in connection with their services on our Board in 2014.

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The following table sets forth, as of April 2, 2015, the total number and the percentage of shares of our common stock beneficially owned by:

| |

| • | each of our directors and each nominee for director; |

| |

| • | each of our executive officers; and |

| |

| • | all of our directors and executive officers as a group. |

The following table also sets forth how many shares of our common stock are beneficially owned by each person known to us to be a beneficial owner of more than 5% of the outstanding shares of our common stock. As of April 2, 2015, there were no beneficial owners of more than 5% of our outstanding common stock. The percentages of common stock beneficially owned are based on 119,079,958 shares of our common stock outstanding as of April 2, 2015.

|

| | | | | | |

| | | Amount and Nature of

Beneficial Ownership(1) |

| Name and Address of Beneficial Owner | | Number(1) | | Percentage(1) |

Directors and Executive Officers(2): | | | | |

| David T. Hamamoto | | — |

| | — |

|

Jonathan T. Albro(3) | | 17,000 |

| | * |

|

Charles W. Schoenherr(3) | | 17,000 |

| | * |

|

Jack F. Smith, Jr.(3) | | 17,000 |

| | * |

|

| Daniel R. Gilbert | | — |

| | — |

|

| Debra A. Hess | | — |

| | — |

|

| Ronald J. Lieberman | | — |

| | — |

|

| All directors and executive officers as a group (7 persons) | | 51,000 |

| | * |

|

________________________

| |

| (1) | Under SEC rules, a person is deemed to be a “beneficial owner” of a security if that person has or shares: (i) “voting power,” which includes the power to vote or to direct the voting of such security; or (ii) “investment power,” which includes the power to dispose of or direct the disposition of such security. A person also is deemed to be a beneficial owner of any securities which that person has a right to acquire within 60 days. Under these rules, more than one person may be deemed to be a beneficial owner of securities as to which he or she has no economic or pecuniary interest. |

| |

| (2) | The address of each of the directors and executive officers is 399 Park Avenue, 18th Floor, New York, New York 10022. |

| |

| (3) | Includes 2,375 unvested shares of restricted common stock held by each director. |

EQUITY COMPENSATION PLAN INFORMATION

The following table provides summary information on the securities issuable under our equity compensation plans as of December 31, 2014.

|

| | | | | | | |

| Plan Category | | Number of

Securities to be

Issued Upon

Exercise of

Outstanding

Options, Warrants,

and Rights | | Weighted‑

Average Exercise

Price of

Outstanding

Options,

Warrants, and

Rights | | Number of Securities

Remaining Available

for Future Issuance |

| Equity compensation plans approved by security holders | | — |

| | — | | 1,949,000 |

| Equity compensation plans not approved by security holders | | N/A |

| | N/A | | N/A |

| Total | | — |

| | — | | 1,949,000 |

CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS

The following section describes all transactions and currently proposed transactions between us and any related person since January 1, 2013 and such related person had or will have a direct or indirect material interest. Our independent directors are specifically charged with and have examined the fairness of such transactions to our stockholders and have determined that all such transactions are fair and reasonable to us and on terms and conditions not less favorable to us than those available from unaffiliated third parties.

Ownership Interests

Pursuant to the limited partnership agreement of our operating partnership, an affiliate of our Advisor, or the Special Unit Holder, holds a subordinated participation interest entitling it to receive distributions equal to 15% of our net cash flows, whether from continuing operations, the repayment of loans, the disposition of assets or otherwise, but only after our stockholders have received, in the aggregate, cumulative distributions equal to their invested capital plus an 8.0% cumulative, non-compounded annual pre-tax return on such invested capital. In addition, the Special Unit Holder is entitled to a separate payment if it redeems its special units. The special units may be redeemed upon: (i) the listing of our common stock on a national securities exchange; or (ii) the occurrence of certain events that result in the termination or non‑renewal of our advisory agreement, in each case for

an amount that the Special Unit Holder would have been entitled to receive had our operating partnership disposed of all of its assets at the enterprise valuation as of the date of the event triggering the redemption. If the event triggering the redemption is: (i) a listing of our shares on a national securities exchange, the enterprise valuation will be calculated based on the average share price of our shares for a specified period; or (ii) an underwritten public offering, the enterprise value will be based on the valuation of the shares as determined by the initial public offering price in such offering. If the triggering event is the termination or non-renewal of the advisory agreement other than for cause, the enterprise valuation will be calculated based on an appraisal of our assets.

To date, we have not paid any distributions to the Special Unit Holder pursuant to its subordinated participation interest.

Pursuant to a distribution support agreement, in certain circumstances where our distributions exceed our modified funds from operations, NorthStar Realty, our former sponsor, agreed to purchase up to $10,000,000 of shares of our common stock through July 19, 2013 at $9.00 per share to provide additional cash to support distributions to our stockholders. The distribution support agreement expired with the closing of our offering in July 2013. For the years ended December 31, 2014 and 2013, NorthStar Realty was not required to purchase shares in connection with our distribution support agreement. From inception through the expiration of the distribution support agreement, NorthStar Realty purchased 507,980 shares of our common stock for $4.6 million under such commitment.

Advisor

In connection with the completion of NorthStar Realty’s spin-off of its asset management business into our Sponsor, we entered into a new advisory agreement with our Advisor, an affiliate of our Sponsor, on terms substantially similar to those set forth in the prior advisory agreement and terminated the advisory agreement with our prior advisor on June 30, 2014. For periods prior to June 30, 2014, the information below regarding fees and reimbursements incurred and accrued but not yet paid relates to our prior advisor.

Our Advisor provides management, acquisition, advisory and certain administrative services for us, subject to oversight by our Board. Our Advisor is an indirect subsidiary of our Sponsor. All of our officers are officers of our Sponsor or its affiliates.

We pay our Advisor the following pursuant to the advisory agreement:

| |

| • | We pay our Advisor monthly asset management fees equal to one-twelfth of 1.25% of the sum of the amount funded or allocated for commercial real estate, or CRE, debt investments originated or acquired and the cost of all other investments, including expenses and any financing attributable to such investments, less any principal received on debt and securities investments (or our proportionate share thereof in the case of debt investments through joint ventures). For the years ended December 31, 2014 and 2013, we incurred $22.0 million and $13.6 million, respectively, and paid $23.6 million and $12.6 million, respectively, of asset management fees to our Advisor. |

| |

| • | We pay our Advisor an acquisition fee equal to 1.0% of the amount funded or allocated by us to originate or acquire investments, including any acquisition expenses attributable to such investments (or our proportionate share thereof in the case of an investment made through a joint venture). For the years ended December 31, 2014 and 2013, we incurred $8.2 million and $10.2 million, respectively, and paid 8.2 million and $10.2 million, respectively, of acquisition fees to our Advisor. From inception through December 31, 2014, our Advisor deferred $0.5 million of acquisition fees related to CRE securities. Our Advisor may determine to continue to defer these fees or seek reimbursement, subject to compliance with applicable policies. |

| |

| • | We pay our Advisor a disposition fee equal to 1.0% of the contract sales price of each CRE investment sold. We do not pay a disposition fee upon the maturity, prepayment, workout, modification or extension of a CRE debt investment unless there is a corresponding fee paid by the borrower, in which case the disposition fee is the lesser of: (i) 1.0% of the principal amount of the loan or debt-related investment prior to such transaction; or (ii) the amount of the fee paid by the borrower in connection with such transaction. If we take ownership of a property as a result of a workout or foreclosure of a loan, we will pay a disposition fee upon the sale of such property. For the years ended December 31, 2014 and 2013, we incurred and paid $2.5 and $1.2 million, respectively, of disposition fees to our Advisor. From inception through December 31, 2014, our Advisor deferred $0.4 million of disposition fees related to CRE securities. Our Advisor may determine to continue to defer these fees or seek reimbursement, subject to compliance with applicable policies. |

| |

| • | We reimbursed our advisor and its affiliates for organization and offering costs paid on behalf of the Company in connection with the offering. We were obligated to reimburse our Advisor, or its affiliates, as applicable, for organization and offering costs to the extent the aggregate of selling commissions, dealer manager fees and other organization and offering costs did not exceed 15% of gross proceeds from the primary offering. Our independent directors did not determine that any of the organization and offering costs were unfair or commercially unreasonable. |

The total costs paid by our Advisor and its affiliates in connection with the offering of our securities were approximately $11.0 million in organization and offering costs through December 31, 2014 and we have reimbursed our Advisor and its affiliates all of such costs.

| |

| • | We reimburse our Advisor for direct and indirect operating costs incurred by our Advisor in connection with administrative services provided to us. Indirect operating costs include our allocable share of costs incurred by our Advisor for personnel and other overhead such as rent, technology and utilities. However, there is no reimbursement for personnel costs related to (1) our executive officers and (2) with respect to other personnel, to the extent allocable to activities performed by such personnel for which our Advisor receives an acquisition fee or disposition fee. We reimburse our Advisor quarterly for operating costs (including the asset management fee) subject to a limitation that operating costs for the four preceding fiscal quarters not exceed the greater of: (i) 2.0% of our average invested assets; or (ii) 25.0% of our net income determined without reduction for any additions to reserves for depreciation, loan losses or other similar non-cash reserves and excluding any gain from the sale of assets for that period, or the 2%/25% Guidelines. Notwithstanding the above, we may reimburse our Advisor for expenses in excess of this limitation if a majority of our independent directors determines that such excess expenses are justified based on unusual and non-recurring factors. We calculate the expense reimbursement quarterly based upon the trailing 12‑month period. As a result, for the years ended December 31, 2014 and 2013, we incurred $11.5 million and $7.8 million, respectively, of allocable operating costs and we paid $13.0 million and $6.9 million, respectively, in operating costs to our Advisor. In addition, as of December 31, 2014 and 2013, our Advisor incurred $7.2 million and $8.1 million, respectively, in operating costs on our behalf that are still allocable. |

| |

| • | We reimburse our Advisor for acquisition expenses actually incurred in connection with the selection, origination or acquisition of an investment, whether or not we ultimately originate or acquire the investment. For the year ended December 31, 2014, our Advisor incurred and we reimbursed $2.5 million of acquisition expenses at cost that our Advisor incurred on our behalf. For the year ended December 31, 2013 our Advisor incurred and we reimbursed $2.6 million of acquisition expenses at cost that our Advisor incurred on our behalf. |

Subject to the terms and conditions of the advisory agreement, we also agreed to indemnify our Advisor and its affiliates against losses it incurs in connection with its obligations under the advisory agreement.

Dealer Manager

The dealer manager for our offering of common stock that was completed in July 2013 was NorthStar Realty Securities, LLC, or our Dealer Manager, an indirect subsidiary of our Sponsor. Our Dealer Manager is a licensed broker-dealer registered with the Financial Industry Regulatory Authority, Inc. Pursuant to the dealer manager agreement with our Dealer Manager, we paid our Dealer Manager selling commissions of up to 7.0% of gross proceeds from our primary offering, all of which were reallowed to participating broker-dealers. In addition, we paid our Dealer Manager a dealer manager fee of up to 3.0% of gross proceeds from our primary offering, a portion of which was reallowed to participating broker-dealers. No selling commissions or dealer manager fees are paid for sales pursuant to our distribution reinvestment plan. For the year ended December 31, 2014, we did not incur any selling commissions or dealer manager fees. For the year ended December 31, 2013, we incurred $34.1 million of selling commissions and $15.4 million of dealer manager fees.

Sponsor

Securitization 2013-1 Transaction

In August 2013, we entered into a $531.5 million securitization financing transaction, or Securitization 2013-1. We initially contributed eight CRE debt investments with a $346.1 million aggregate principal amount. Subsequent to the closing of Securitization 2013-1, we contributed three additional CRE debt investments with a $63.7 million aggregate principal balance. NorthStar Realty transferred three senior loans with an aggregate principal amount of $79.1 million at cost to Securitization 2013-1. NorthStar Realty did not retain any interest in such senior loans. A total of $382.7 million of permanent, non-recourse, non-mark-to-market investment-grade securitization bonds were issued, representing an advance rate of 72.0% at a weighted average coupon of LIBOR plus 2.68%. We retained all of the below investment-grade securitization bonds. We used the proceeds to repay $222.7 million of borrowings on our term loan facilities. An affiliate of the Sponsor was named special servicer of Securitization 2013-1.

PE Investments

In December 2012, we invested in a joint venture owning indirect interests in real estate through private equity real estate funds with NorthStar Realty and a third party, or PE Investment I. In February 2013, we completed the initial closing, or the PE I Initial Closing, of PE Investment I, which through a preferred investment, owns a portfolio of limited partnership interests in real estate private equity funds managed by institutional-quality sponsors. Pursuant to the terms of the agreement, at the PE I

Initial Closing, the full purchase price was funded, excluding future capital commitments. Accordingly, we funded $118.0 million and NorthStar Realty, which together with us, we refer to as the NorthStar Entities, funded $282.1 million. The NorthStar Entities have an aggregate ownership interest in PE Investment I of 51.0%, of which we own 29.5% and NorthStar Realty owns 70.5%. As of December 31, 2014, the carrying value of the investment in PE Investment I was $91.5 million. For the year ended December 31, 2014, we recognized $21.4 million of equity in earnings. For the year ended December 31, 2014, we received $40.6 million of cash distributions and made $0.5 million of contributions related to PE Investment I. As of December 31, 2014, the Company’s estimated future capital commitments to the fund interests in PE Investment I would be approximately $3 million.

In June 2013, we, NorthStar Realty and a third party formed a joint venture, or PE Investment II, to acquire a portfolio of limited partnership interests in 24 real estate private equity funds managed by institutional-quality sponsors. We, NorthStar Realty and the third party each have an ownership interest in PE Investment II of 15.0%, 70.0% and 15.0%, respectively. All amounts paid and received by PE Investment II will be based on each partner’s proportionate interest. PE Investment II paid $504.8 million, or the Initial Amount, to the seller for all of the fund interests, or 55.0% of the aggregate reported net asset value, or NAV, of the portfolio as of September 30, 2012, and will pay the remaining $411.4 million, or 45.0% of the September 30, 2012 NAV, or the Deferred Amount, by the fourth year after the first day of the fiscal quarter following the closing date of each fund interest. Our share of the Initial Amount and the Deferred Amount represents $75.7 million and $61.7 million, respectively. We funded our entire proportionate share of the Initial Amount at the initial closing on July 3, 2013. The Deferred Amount is a liability of PE Investment II. Each PE Investment II partner, directly or indirectly, guaranteed its proportionate interest of the Deferred Amount. As of December 31, 2014, the carrying value of the investment in PE Investment II was $49.6 million. For the year ended December 31, 2014, we recognized $11.4 million of equity in earnings. For the year ended December 31, 2014, we received $24.9 million of cash distributions and made $1.3 million of contributions related to PE Investment II. As of December 31, 2014, our estimated future capital commitments to the fund interests in PE Investment II would be approximately $1 million.