Exhibit 99.2

Q3 2024 Earnings Call November 7, 2024

Legal Disclaimer 2 This presentation contains forward - looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended (the Exchange Act). All statements other than statements of historical facts contained in this presentation, including statements regarding our future results of operations and financial position, business strategy and plans and objectives of management for future operations, are forward - looking statements. In many cases, you can identify forward - looking statements by terms such as “may,” “should,” “expects,” “plans,” “anticipates,” “could,” “intends,” “targets,” “projects,” “contemplates,” “believes,” “estimates,” “predicts,” “potential” or “continue” or the negative of these terms or other similar words. Forward - looking statements contained in this release include, but are not limited to, statements about: i. competition from other wind blade and wind blade turbine manufacturers; ii. the discovery of defects in our products and our ability to estimate the future cost of warranty campaigns; iii. the current status of the wind energy market and our addressable market; iv. our ability to absorb or mitigate the impact of price increases in resin, carbon reinforcements (or fiber), other raw materials and related logistics costs that we use to produce our products; v. our ability to absorb or mitigate the impact of wage inflation in the countries in which we operate; vi. our ability to procure adequate supplies of raw materials and components to fulfill our wind blade volume commitments to our customers; vii. the potential impact of the increasing prevalence of auction - based tenders in the wind energy market and increased competition from solar energy on our gross margins and overall financial performance; viii. our future financial performance, including our net sales, cost of goods sold, gross profit or gross margin, operating expenses, ability to generate positive cash flow and ability to achieve or maintain profitability; ix. changes in domestic or international government or regulatory policy, including without limitation, changes in trade policy and energy policy; x. changes in global economic trends and uncertainty, geopolitical risks, and demand or supply disruptions from global events; xi. changes in macroeconomic and market conditions, including the potential impact of any pandemic, risk of recession, rising interest rates and inflation, supply chain constraints, commodity prices and exchange rates, and the impact of such changes on our business and results of operations; xii. the sufficiency of our cash and cash equivalents to meet our liquidity needs; xiii. the increasing cost and availability of additional capital, should such capital be needed; xiv. our ability to attract and retain customers for our products, and to optimize product pricing; xv. our ability to effectively manage our growth strategy and future expenses, including our startup and transition costs; xvi. our ability to successfully expand in our existing wind energy markets and into new international wind energy markets, including our ability to expand our field service inspection and repair services business; xvii. our ability to keep up with market changes and innovations; xviii. our ability to successfully open new manufacturing facilities and expand existing facilities on time and on budget; xix. the impact of the pace of new product and wind blade model introductions on our business and our results of operations; xx. Our projected sales and costs, including materials costs and capital expenditures, during the current fiscal year; xxi. our ability to maintain, protect and enhance our intellectual property; xxii. our ability to comply with existing, modified, or new laws and regulations applying to our business, including the imposition of new taxes, duties, or similar assessments on our products; xxiii. the attraction and retention of qualified associates and key personnel; xxiv. our ability to maintain good working relationships with our associates, and avoid labor disruptions, strikes and other disputes with labor unions that represent certain of our associates; xxv. the potential impact of one or more of our customers becoming bankrupt or insolvent or experiencing other financial problems; xxvi. our projected business model during the current fiscal year, including with respect to the number of wind blade manufacturing lines we anticipate; and xxvii. our ability to service our current debt and comply with any covenants related to such debt. These forward - looking statements are only predictions. These statements relate to future events or our future financial performance and involve known and unknown risks, uncertainties and other important factors that may cause our actual results, levels of activity, performance or achievements to materially differ from any future results, levels of activity, performance or achievements expressed or implied by these forward - looking statements. Because forward - looking statements are inherently subject to risks and uncertainties, some of which cannot be predicted or quantified, you should not rely on these forward - looking statements as guarantees of future events. Further information on the factors, risks and uncertainties that could affect our financial results and the forward - looking statements in this presentation are included in our filings with the Securities and Exchange Commission and will be included in subsequent periodic and current reports we make with the Securities and Exchange Commission from time to time, including in our Annual Report on Form 10 - K for the year ended December 31, 2023, filed with the Securities and Exchange Commission. The forward - looking statements in this presentation represent our views as of the date of this presentation. We anticipate that subsequent events and developments will cause our views to change. However, while we may elect to update these forward - looking statements at some point in the future, we undertake no obligation to update any forward - looking statement to reflect events or developments after the date on which the statement is made or to reflect the occurrence of unanticipated events except to the extent required by applicable law. You should, therefore, not rely on these forward - looking statements as representing our views as of any date after the date of this presentation. Our forward - looking statements do not reflect the potential impact of any future acquisitions, mergers, dispositions, joint ventures, or investments we may make. This presentation includes unaudited non - GAAP financial measures including EBITDA, adjusted EBITDA, net cash (debt) and free cash flow. We define EBITDA, a non - GAAP financial measure, as net income or loss from continuing operations plus interest expense net, income taxes, depreciation and amortization, preferred stock dividends and accretion less gain on extinguishment on series A preferred stock. We define adjusted EBITDA as EBITDA plus any share - based compensation expense, plus or minus any foreign currency losses or income, plus or minus any losses or gains from the sale of assets and asset impairments, plus any restructuring charges. We define net cash (debt) as total unrestricted cash and cash equivalents less the total principal amount of debt outstanding. We define free cash flow as net cash flow from operating activities less capital expenditures. We present non - GAAP measures when we believe that the additional information is useful and meaningful to investors. Non - GAAP financial measures do not have any standardized meaning and are therefore unlikely to be comparable to similar measures presented by other companies. The presentation of non - GAAP financial measures is not intended to be a substitute for, and should not be considered in isolation from, the financial measures reported in accordance with GAAP. See the Appendix for the reconciliations of certain non - GAAP financial measures to the comparable GAAP measures. This presentation also contains estimates and other information concerning our industry that are based on industry publications, surveys and forecasts. This information involves a number of assumptions and limitations, and we have not independently verified the accuracy or completeness of the information Q3 2024

Agenda ⎮ Q3 2024 Highlights and Business Update ⎮ Q3 2024 Financial Highlights and 2024 Guidance ⎮ Wrap Up ⎮ Q&A 3 Q3 2024

Q3 2024 Highlights and Business Update Q3 2024 4

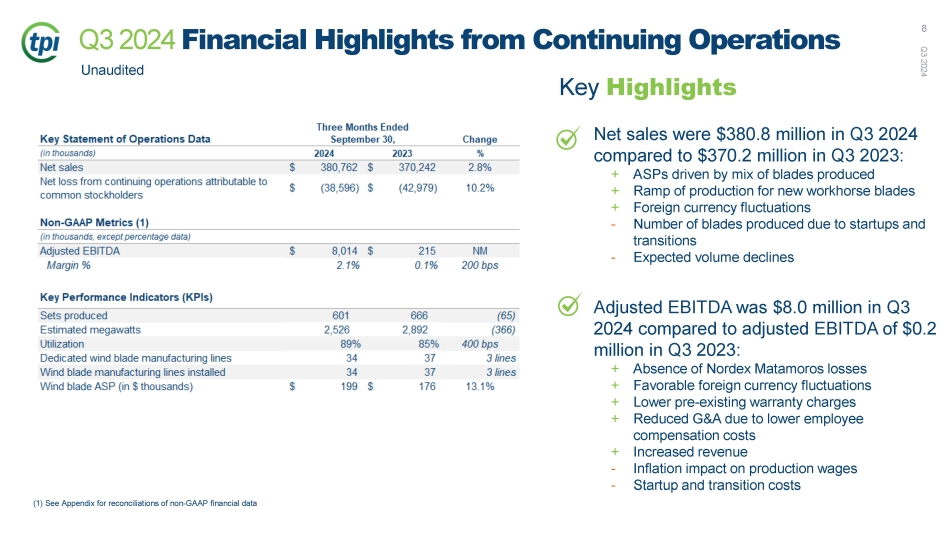

$370 $381 $- $250 $500 3Q23 3Q24 $0 $8 $- $5 $10 $15 3Q23 3Q24 Q3 2024 Continuing Operations 5 Q3 2024 operating results and year - over - year comparisons to Q3 2023: Highlights: x Net sales up 2.8% to $381 million x Net loss from continuing operations attributable to common stockholders was $38.6 million compared to a loss of $43.0 million in Q3 2023 x Adjusted EBITDA of $8 million compared to $0.2 million in Q3 2023 x Sales up 23% sequentially from Q2 x Positive AEBITDA and cash flows from operations x Seven of ten lines in startup or transition achieved full rate production in the quarter x Portfolio re - shaping nearing completion x Agreement with GEV to re - open Newton IA plant mid - 2025 x Expect Q4 to be our strongest free cash flow quarter (1) See Appendix for reconciliations of non - GAAP financial data Adjusted EBITDA (1) ($ in millions) Net Sales ($ in millions) Q3 2024

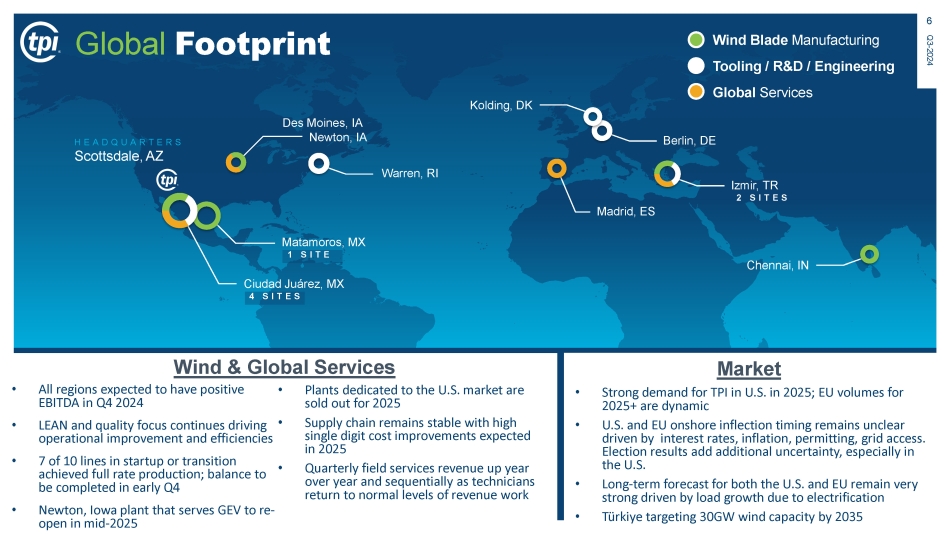

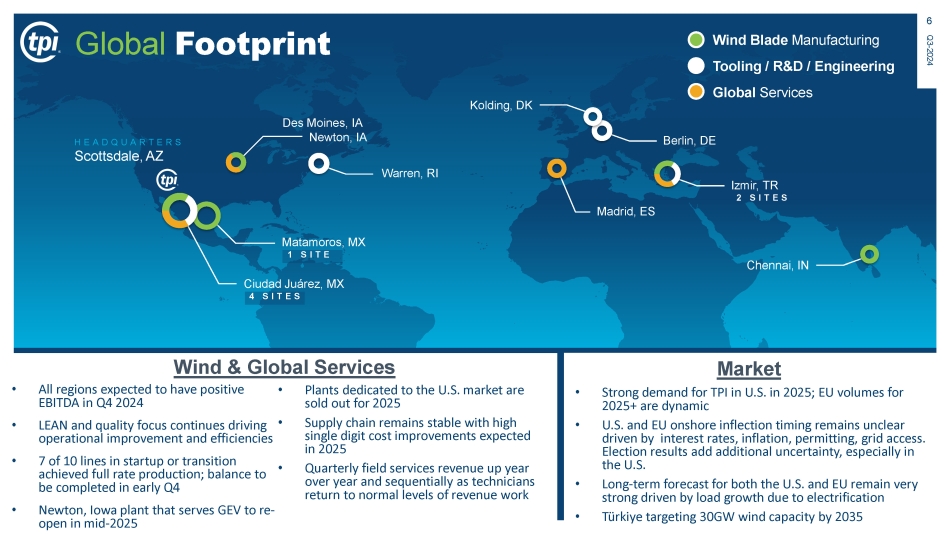

Global Footprint HEADQUARTERS Scottsdale, AZ Ciudad Juárez, MX 4 SITES Matamoros, MX 1 SITE Warren, RI Madrid, ES Berlin, DE Kolding, DK Izmir, TR 2 SITES Chennai, IN Wind Blade Manufacturing Global Services Tooling / R&D / Engineering 6 Q3 - 2024 Des Moines, IA Newton, IA Wind & Global Services • All regions expected to have positive EBITDA in Q4 2024 • LEAN and quality focus continues driving operational improvement and efficiencies • 7 of 10 lines in startup or transition achieved full rate production; balance to be completed in early Q4 • Newton, Iowa plant that serves GEV to re - open in mid - 2025 Market • Strong demand for TPI in U.S. in 2025; EU volumes for 2025+ are dynamic • U.S. and EU onshore inflection timing remains unclear driven by interest rates, inflation, permitting, grid access . Election results add additional uncertainty, especially in the U.S. • Long - term forecast for both the U.S. and EU remain very strong driven by load growth due to electrification • Türkiye targeting 30GW wind capacity by 2035 • Plants dedicated to the U.S. market are sold out for 2025 • Supply chain remains stable with high single digit cost improvements expected in 2025 • Quarterly field services revenue up year over year and sequentially as technicians return to normal levels of revenue work

Q3 2024 Financial Highlights and 2024 Guidance Q3 2024 7

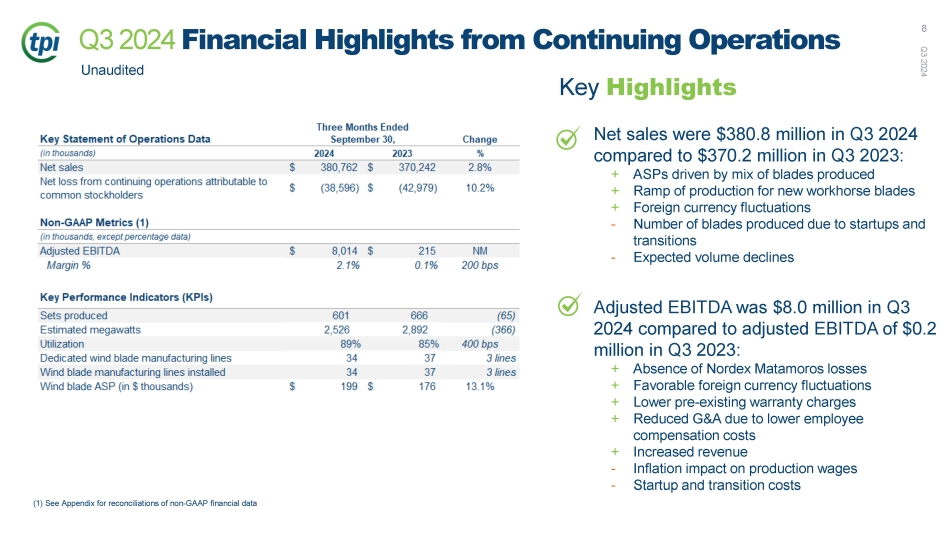

Net sales were $380.8 million in Q3 2024 compared to $370.2 million in Q3 2023: + ASPs driven by mix of blades produced + Ramp of production for new workhorse blades + Foreign currency fluctuations - Number of blades produced due to startups and transitions - Expected volume declines Adjusted EBITDA was $8.0 million in Q3 2024 compared to adjusted EBITDA of $0.2 million in Q3 2023: + Absence of Nordex Matamoros losses + Favorable foreign currency fluctuations + Lower pre - existing warranty charges + Reduced G&A due to lower employee compensation costs + Increased revenue - Inflation impact on production wages - Startup and transition costs Key Highlights Unaudited Q3 2024 Financial Highlights from Continuing Operations (1) See Appendix for reconciliations of non - GAAP financial data Q3 2024 8

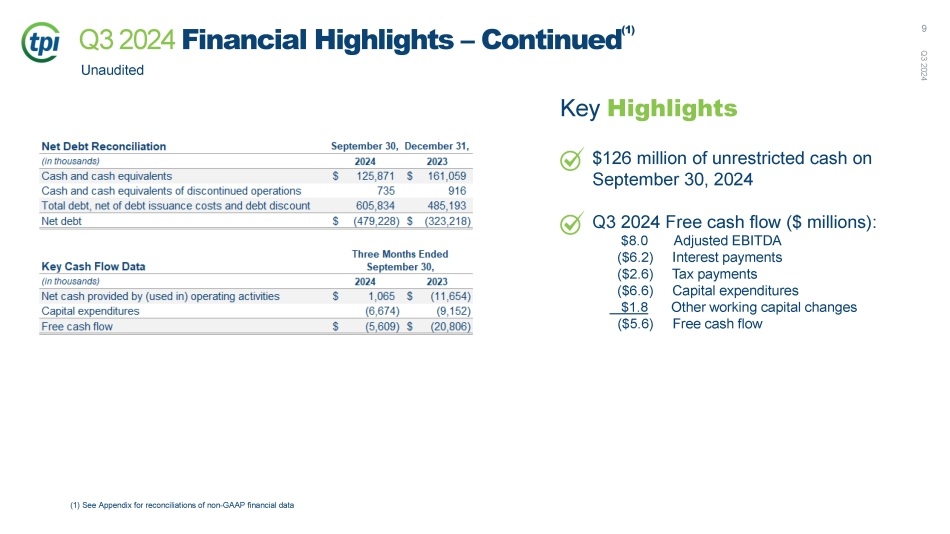

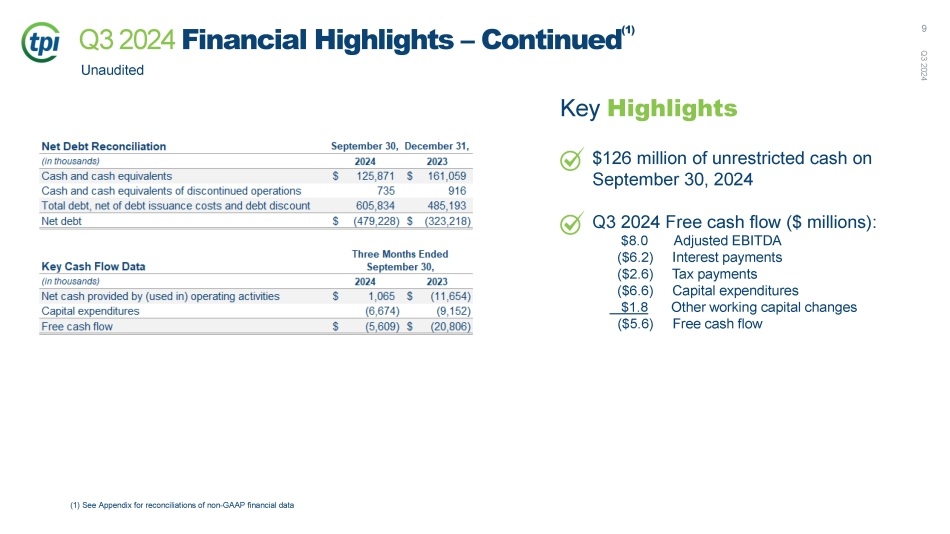

Key Highlights $126 million of unrestricted cash on September 30, 2024 Q3 2024 Free cash flow ($ millions): $8.0 Adjusted EBITDA ($6.2) Interest payments ($2.6) Tax payments ($6.6) Capital expenditures $1.8 Other working capital changes ($5.6) Free cash flow Unaudited Q3 2024 Financial Highlights – Continued (1) (1) See Appendix for reconciliations of non - GAAP financial data Q3 2024 9

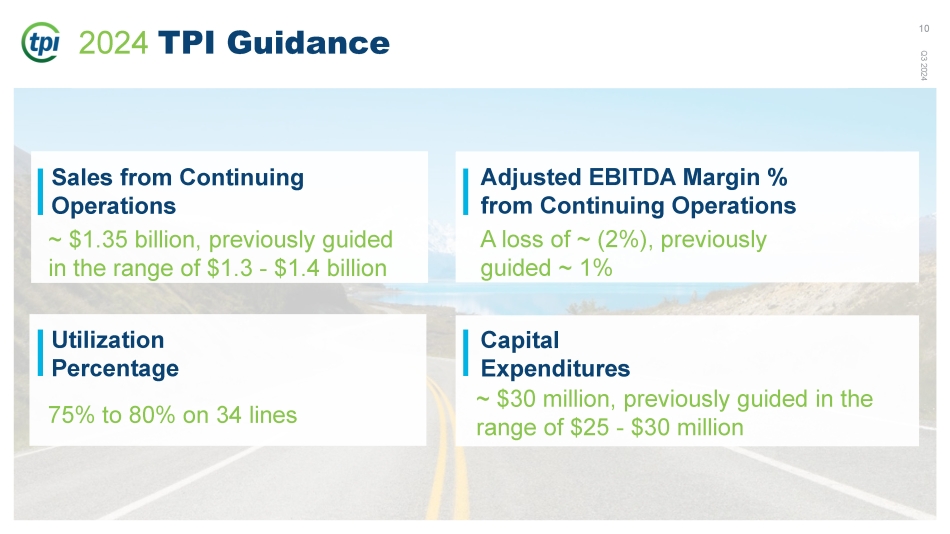

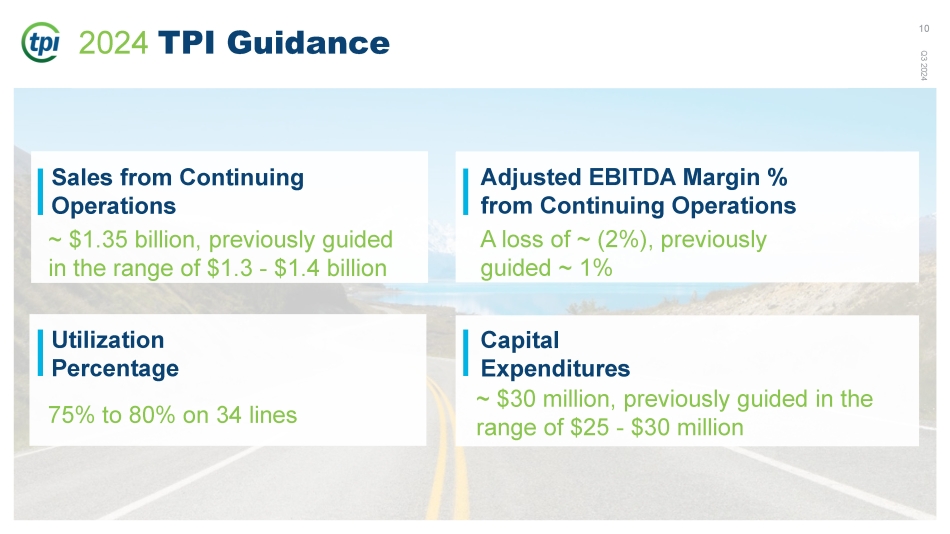

Adjusted EBITDA Margin % from Continuing Operations A loss of ~ (2%), previously guided ~ 1% Capital Expenditures ~ $30 million, previously guided in the range of $25 - $30 million Utilization Percentage 75% to 80% on 34 lines Sales from Continuing Operations ~ $1.35 billion, previously guided in the range of $1.3 - $1.4 billion 2024 TPI Guidance 10 Q3 2024

Wrap Up Q3 2024 11

Q3 2024 12 Wrap Up Market: • Long term prospects continue to be exciting • Structural foundation for sustained onshore growth is in place and robust • Market inflection point remains uncertain, but likely pushed right • Interest rates, permitting, grid access and election results may impact project timelines Operational: • 7 of 10 lines in startup or transition achieved serial production; remaining expected to be completed in early Q4 • Agreement with GEV to re - open Newton, IA plant by mid - 2025 • Field services returning to normal levels of revenue generating work • Continued focus on LEAN to enable waste reduction across the business • Deliberate focus on quality continues to yield benefits Financial: • Q3 delivered sequential and year over year revenue growth and positive AEBITDA • Expect Q4 will be our strongest free cash flow quarter • Will provide 2025 guidance on Q4 2024 earnings call People: • Thanks to our associates for their commitment and dedication to TPI and our mission to decarbonize and electrify the world • Jennifer Lowry joining Board of Directors effective November 13, 2024

Q&A Q3 2024 13

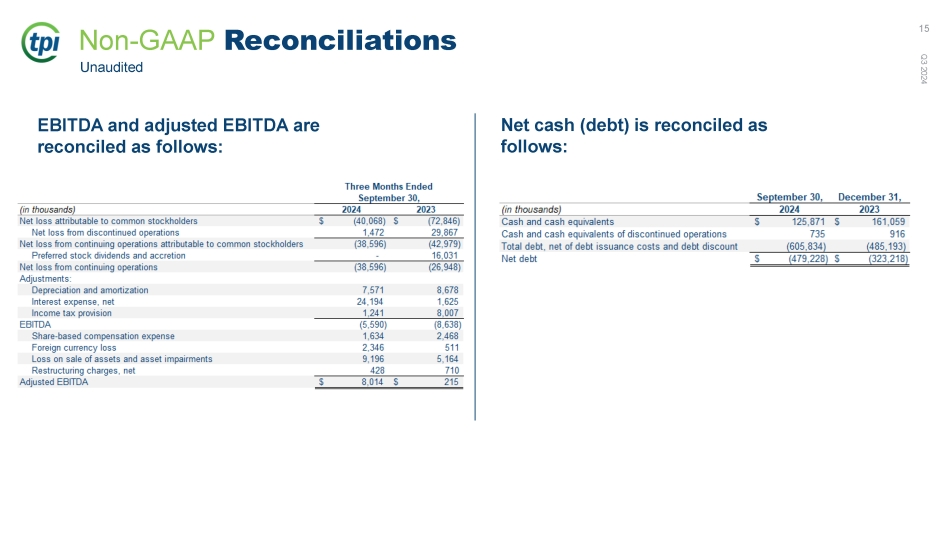

14 Appendix – Non - GAAP Financial Information This presentation includes unaudited non - GAAP financial measures including EBITDA, adjusted EBITDA, net cash (debt) and free cas h flow. We define EBITDA, a non - GAAP financial measure, as net income or loss from continuing operations plus interest expense net, income taxes, depreciati on and amortization, preferred stock dividends and accretion less gain on extinguishment on series A preferred stock. We define adjusted EBITDA as EBITDA plus any sh are - based compensation expense, plus or minus any foreign currency losses or income, plus or minus any losses or gains from the sale of assets and a sse t impairments, plus any restructuring charges. We define net cash (debt) as total unrestricted cash and cash equivalents less the total principal amount of debt ou tst anding. We define free cash flow as net cash flow from operating activities less capital expenditures. We present non - GAAP measures when we believe that the additional information is useful and meaningful to investors. Non - GAAP financial measures do not have any standardized meaning and are therefore unlikely to be comparable to si milar measures presented by other companies. The presentation of non - GAAP financial measures is not intended to be a substitute for, and should not be considered in isolation from, the financial measures reported in accordance with GAAP. We provide forward - looking statements in the form of guidance in our quarterly earnings releases and during our quarterly earnin gs conference calls. This guidance is provided on a non - GAAP basis and cannot be reconciled to the closest GAAP measures without unreasonable effort because of the un predictability of the amounts and timing of events affecting the items we exclude from non - GAAP measures. For example, stock - based compensation is unpredictable f or our performance - based awards, which can fluctuate significantly based on current expectations of future achievement of performance - based targets. Amor tization of intangible assets and restructuring costs are all impacted by the timing and size of potential future actions, which are difficult to predict. In a ddi tion, from time to time, we exclude certain items that occur infrequently, which are also inherently difficult to predict and estimate. It is also difficult to predict the tax ef fect of the items we exclude and to estimate certain discrete tax items, like the resolution of tax audits or changes to tax laws. As such, the costs that are being exclu ded from non - GAAP guidance are difficult to predict and a reconciliation or a range of results could lead to disclosure that would be imprecise or potentially misleading . M aterial changes to any one of the exclusions could have a significant effect on our guidance and future GAAP results. See below for a reconciliation of certain non - GAAP financial measures to the comparable GAAP measures. Q3 2024

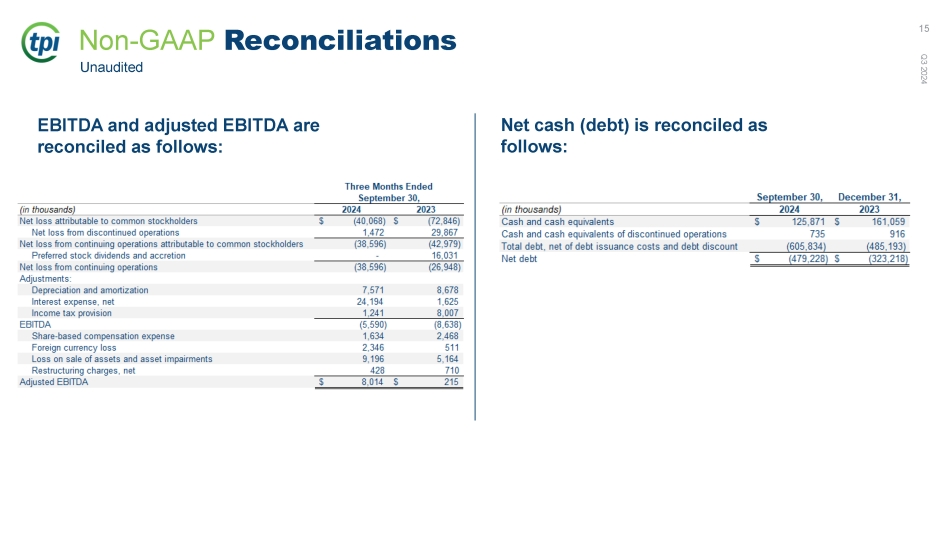

Non - GAAP Reconciliations EBITDA and adjusted EBITDA are reconciled as follows: Unaudited Net cash (debt) is reconciled as follows: Q3 2024 15