- TPIC Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

PRE 14A Filing

TPI Composites (TPIC) PRE 14APreliminary proxy

Filed: 31 Mar 23, 4:02pm

| ☒ | Preliminary Proxy Statement | |

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |

| ☐ | Definitive Proxy Statement | |

| ☐ | Definitive Additional Materials | |

| ☐ | Soliciting Material Pursuant to §240.14a-12 | |

| ☒ | No fee required. | |||

| ☐ | Fee paid previously with preliminary materials. | |||

| ☐ | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and0-11. | |||

| 8501 N. Scottsdale Rd. Gainey Center II Suite 100 Scottsdale, AZ 85253 |

LETTER TO STOCKHOLDERS

Dear TPI Composites, Inc. Stockholder:

I am pleased to invite you to attend the 2023 Annual Meeting of Stockholders (the “Annual Meeting”) of TPI Composites, Inc. (“TPI Composites” or the “Company”) to be held virtually on Wednesday, May 24, 2023 at 1:00 p.m. Arizona time via live audio webcast on the Internet at www.virtualshareholdermeeting.com/TPIC2023.

Enhanced Corporate Governance

In 2022, we implemented several enhancements to our corporate governance standards, including the adoption of a stock ownership policy for our executive officers, the elimination of the plurality voting standard for the election of directors, and the adoption of a majority voting standard for the election of directors, which went into effect on January 1, 2023. This proxy statement seeks your approval of two proposals to further enhance our corporate governance standards: a proposal to declassify the Board of Directors and a proposal to eliminate supermajority voting requirements.

Business Strategy

Our long-term success will be driven by our business strategy. The key elements of our business strategy are as follows:

| • | Capitalize on the long-term, global trends of decarbonization of the electric sector and the electrification of vehicles. |

| • | Grow our existing relationships and develop new relationships with leading industry OEMs. |

| • | Leverage our footprint in large and growing wind markets, capitalize on the continuing outsourcing trend, continue to grow our automotive business and evaluate strategic acquisitions. |

| • | Continue to ensure that wind energy remains competitive with other energy sources. |

| • | Expand our field service inspection and repair business and introduce new ancillary products and services to help our customers better manage the full life cycle of a wind blade. |

| • | Focus on continuing innovation. |

2022 Performance Highlights

For the full year 2022, we:

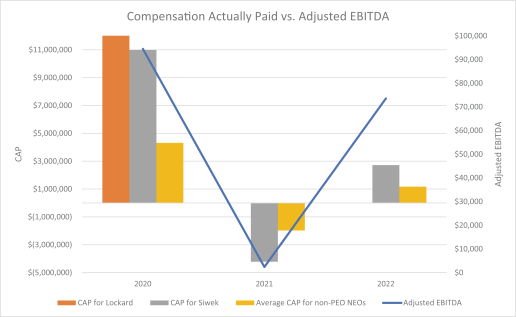

| • | Increased our net sales by 1.5% to $1.76 billion compared to 2021 and achieved adjusted EBITDA of $73.6 million, inclusive of our discontinued operations. |

| • | Grew the automotive business by 17.9% and the global services business by 67.8% compared to 2021. |

| • | Extended contracts with Enercon and GE and entered into an agreement with GE that enabled a long-term lease extension at our manufacturing facility in Newton, Iowa. |

| • | Announced a long-term global framework agreement with Vestas and agreed in principle with Nordex to extend a contract in Türkiye and add two additional lines in India. |

| • | Announced a restructuring plan to optimize our global manufacturing footprint, including ceasing operations at our Yangzhou, China factory. |

Sustainability

We view sustainability as more than a target; it is a principle that guides us to continuously improve our business.. We have embedded sustainability practices into our day-to-day operations to safeguard our people and the environment in which they work. In March 2023, we published our fourth ESG Report.

| Details regarding the Annual Meeting and the business to be conducted are more fully described in the accompanying Notice of 2023 Annual Meeting of Stockholders and Proxy Statement.

Thank you for your ongoing support of and continued interest in TPI Composites. We look forward to your participation at our Annual Meeting.

Sincerely,

William E. Siwek President and Chief Executive Officer |

YOUR VOTE IS IMPORTANT

On or about [April ●, 2023], we expect to mail to our stockholders a Notice of 2023 Annual Meeting of Stockholders (the “Notice”), together with our proxy statement for our 2023 Annual Meeting of Stockholders (the “Proxy Statement”) and our 2022 Annual Report to Stockholders (the “2022 Annual Report”). The Notice provides instructions on how to vote online, by telephone, or by proxy card. The Proxy Statement and our Annual Report can be accessed directly at the Internet address www.proxyvote.com by entering the sixteen-digit control number located on your proxy card.

To ensure your representation at the Annual Meeting, whether or not you plan to attend the Annual Meeting, please vote your shares as promptly as possible. Your participation will help to ensure the presence of a quorum at the Annual Meeting and save TPI Composites the extra expense associated with additional solicitation. If you hold your shares through a broker, your broker is not permitted to vote on your behalf in the election of directors unless you provide specific instructions to the broker by completing and returning any voting instruction form that the broker provides (or following any instructions that allow you to vote your broker-held shares via telephone or the Internet). For your vote to be counted, you will need to communicate your voting decision before the date of the Annual Meeting. Voting your shares in advance will not prevent you from attending the Annual Meeting, revoking your earlier submitted proxy or voting your stock at the Annual Meeting.

NOTICE OF 2023 ANNUAL MEETING

OF STOCKHOLDERS

| DATE: | Wednesday, May 24, 2023 | |

| TIME: | 1:00 p.m. Arizona time | |

| VIRTUAL MEETING: | ||

Agenda of Meeting

| • | To elect three Class I directors Steven C. Lockard, William E. Siwek, and Philip J. Deutch to hold office until the 2026 annual meeting of stockholders or until their successors are duly elected and qualified, subject to their earlier resignation or removal; |

| • | To ratify the appointment of KPMG LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2023; |

| • | To conduct a non-binding advisory vote on the compensation of our named executive officers; |

| • | To approve an amendment to the Company’s Amended and Restated Certificate of Incorporation to declassify the Board of Directors of the Company; |

| • | To approve an amendment to the Company’s Amended and Restated Certificate of Incorporation to eliminate the supermajority voting requirements; and |

| • | To transact any other business that properly comes before the Annual Meeting (including adjournments, continuations and postponements thereof). |

How to Vote

To allow for greater participation by all of our stockholders, regardless of their geographic location, the Board of Directors has determined to hold a live audio webcast in lieu of an in-person meeting. You will be able to listen to the Annual Meeting, vote and submit your questions during the Annual Meeting at www.virtualshareholdermeeting.com/TPIC2023.

On or about April [●], 2023, we expect to mail to our stockholders a Notice of 2023 Annual Meeting of Stockholders, together with our Proxy Statement and our 2022 Annual Report. The Notice provides instructions on how to vote online, by telephone, or by proxy card. This Proxy Statement and our Annual Report can be accessed directly at the Internet address www.proxyvote.com by entering the sixteen-digit control number located on your proxy card.

| INTERNET | TELEPHONE | |||

|  |  | ||

Record Date:

Only stockholders of record at the close of business on March 28, 2023 (the “Record Date”) are entitled to notice of and to vote at the Annual Meeting as set forth in the Proxy Statement. Further information regarding voting rights and the matters to be voted upon is presented in the accompanying Proxy Statement.

If you have any questions regarding this information or the proxy materials, please contact our investor relations department via the methods listed at https://ir.tpicomposites.com/websites/tpicomposites/English/0/investor-relations.html.

By Order of the Board of Directors,

William E. Siwek

President and Chief Executive Officer

Scottsdale, Arizona

April [●], 2023

TABLE OF CONTENTS

i | TPI Composites 2023 Proxy Statement

Table of Contents

| 25 | ||||

| 25 | ||||

| COMPENSATION DISCUSSION AND ANALYSIS | 26 | |||

| 26 | ||||

| 26 | ||||

| 26 | ||||

| 27 | ||||

| 28 | ||||

| 29 | ||||

| 29 | ||||

| 29 | ||||

| 30 | ||||

| 31 | ||||

| 39 | ||||

| 39 | ||||

| 40 | ||||

| 40 | ||||

| 41 | ||||

| 41 | ||||

Policy Prohibiting Hedging and Pledging of Equity Securities | 41 | |||

| 41 | ||||

| EXECUTIVE COMPENSATION | 42 | |||

| 46 | ||||

| 50 | ||||

| 52 | ||||

| 55 | ||||

| 56 | ||||

| 56 | ||||

| SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT | 57 | |||

| 58 | ||||

| RELATED PARTY TRANSACTIONS | 59 | |||

| 59 | ||||

| 61 | ||||

| ADDITIONAL INFORMATION | 62 | |||

| 62 | ||||

| HOUSEHOLDING OF PROXY MATERIALS | 63 | |||

| APPENDIX A – PROPOSED AMENDMENT TO THE AMENDED AND RESTATED CERTIFICATE OF INCORPORATION OF TPI COMPOSITES, INC. | A-1 | |||

| APPENDIX B – NON-GAAP FINANCIAL MEASURES INFORMATION | B-1 | |||

ii | TPI Composites 2023 Proxy Statement

GENERAL INFORMATION

The Board of Directors (the “Board”) solicits your proxy on our behalf for the 2023 Annual Meeting of Stockholders (the “Annual Meeting”) and at any adjournment, continuation or postponement of the Annual Meeting for the purposes set forth in this Proxy Statement for our 2023 Annual Meeting of Stockholders (the “Proxy Statement”) and the accompanying Notice of the 2023 Annual Meeting of Stockholders (the “Notice”). The Annual Meeting will be held virtually at 1:00 p.m. Arizona time on Wednesday, May 24, 2023 via live audio webcast. You will be able to attend the virtual Annual Meeting, vote your shares electronically and submit your questions during the live audio webcast of the Annual Meeting by visiting www.virtualshareholdermeeting.com/TPIC2023 and entering your sixteen-digit control number located on your proxy card. On or about April [●], 2023, we mailed our stockholders a Notice, a Proxy Statement and an Annual Report.

In this Proxy Statement, the terms “TPI Composites,” “the Company,” “we,” “us,” and “our” refer to TPI Composites, Inc. and its subsidiaries. The mailing address of our principal executive offices is TPI Composites, Inc., 8501 N. Scottsdale Rd., Gainey Center II, Suite 100, Scottsdale, AZ 85253.

| Record Date | March 28, 2023 | |

| Quorum | A majority of the shares entitled to vote on the Record Date must be present in person or represented by proxy to constitute a quorum. | |

| Shares Outstanding | 42,996,707 shares of common stock outstanding as of March 28, 2023. | |

| Voting | There are four ways a stockholder of record can vote: | |

(1) by Internet at www.voteproxy.com 24 hours a day, seven days a week, until 11:59 p.m. Eastern Time on May 23, 2023 (have your proxy card in hand when you visit the website);

We encourage you to vote this way as it is the most cost-effective method; | ||

(2) by toll-free telephone at 1-800-690-6903, until 11:59 p.m. Eastern Time on May 23, 2023 (have your proxy card in hand when you call); | ||

(3) by completing and mailing your proxy card; or | ||

(4) by Internet during the Annual Meeting.

Instructions on how to attend and vote at the Annual Meeting are described at www.virtualshareholdermeeting.com/TPIC2023. | ||

| To be counted, proxies submitted by telephone or Internet at www.voteproxy.com must be received by 11:59 p.m. Eastern Time on May 23, 2023. Proxies submitted by U.S. mail must be received before the start of the Annual Meeting. | ||

| If you hold your shares through a bank or broker, please follow their instructions. | ||

| Revoking Your Proxy | Stockholders of record may revoke their proxies by attending the Annual Meeting and voting by Internet during the Annual Meeting, by filing an instrument in writing revoking the proxy, by filing another duly executed proxy bearing a later date with our Secretary before the vote is counted, or by voting again using the telephone or Internet before the cutoff time (your latest telephone or Internet proxy is the one that will be counted). If you hold shares through a bank or broker, you may revoke any prior voting instructions by contacting that firm. | |

Votes Required to Adopt Proposals | Each share of our common stock outstanding on the Record Date is entitled to one vote on any proposal presented at the Annual Meeting: | |

| For Proposal One, the election of directors, each nominee will be elected as a director if they receive a majority of the votes cast with respect to their election. If the votes cast for any nominee do not exceed the votes cast against the nominee, our nominating and corporate governance committee will consider whether to accept or reject such director’s resignation, which is tendered to the Board pursuant to our corporate governance guidelines. | ||

1 | TPI Composites 2023 Proxy Statement

General Information

| For Proposal Two, a majority of the votes properly cast is required to ratify the appointment of KPMG LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2023. | ||

For Proposal Three, the approval of the compensation of our named executive officers, on a non-binding advisory basis, requires a majority of the votes properly cast “for” or “against” such matter. Because your vote is advisory, it will not be binding on the Board or our compensation committee, but the Board and compensation committee will review the voting results and take them into consideration when making future decisions about executive compensation.

For Proposal Four, the affirmative vote of the holders of at least 75% of the outstanding shares of capital stock entitled to vote thereon, voting together as a single class and the affirmative vote of the holders of at least 75% of the outstanding shares of each class of capital stock entitled to vote thereon, as a separate class, is required to approve the proposed amendment to the Company’s Amended and Restated Certificate of Incorporation (the “Certificate of Incorporation”) to declassify the Board of Directors of the Company.

For Proposal Five, the affirmative vote of the holders of at least 75% of the outstanding shares of capital stock entitled to vote thereon, voting together as a single class and the affirmative vote of the holders of at least 75% of the outstanding shares of each class of capital stock entitled to vote thereon, as a separate class, is required to approve the proposed amendment to the Certificate of Incorporation to eliminate the supermajority voting requirements. | ||

Effect of Abstentions and Broker Non-Votes | Abstentions and “broker nonvotes” (i.e., where a broker has not received voting instructions from the beneficial owner and for which the broker does not have discretionary power to vote on a particular matter) are counted as present for purposes of determining the presence of a quorum. Abstentions have no effect on the election of directors, the ratification of the appointment of KPMG LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2023 or approval of the compensation of our named executive officers. Shares voting “abstain” on the proposed amendment of our Certificate of Incorporation to declassify the Board of Directors and the proposed amendment to the Company’s Certificate of Incorporation to eliminate the supermajority voting requirements will have the effect of a vote “against” these proposals. | |

| Under the rules that govern brokers holding shares for their customers, brokers who do not receive voting instructions from their customers have the discretion to vote uninstructed shares on routine matters, but do not have discretion to vote such uninstructed shares on non-routine matters. Only Proposal Two, the ratification of the appointment of KPMG LLP, is considered a routine matter where brokers are permitted to vote shares held by them without instruction. If your shares are held through a broker, those shares will not be voted in the election of directors unless you affirmatively provide the broker instructions on how to vote. Proposals One, Three, Four, and Five are not considered routine matters and brokers are not permitted to vote shares held by them. For Proposals One and Three, broker nonvotes will have no effect. For Proposals Four and Five, broker non-votes will be considered a vote “against” these proposals. | ||

| Voting Instructions | If you complete and submit your proxy voting instructions, the persons named as proxies will follow your instructions. If you submit proxy voting instructions but do not direct how your shares should be voted on each item, the persons named as proxies will vote “FOR” the election of the nominees for director, “FOR” the ratification of the appointment of KPMG LLP as our independent registered public accounting firm, “FOR” the non-binding advisory vote to approve the compensation of our named executive officers, “FOR” the amendment of our Certificate of Incorporation to declassify the Board, and “FOR” the amendment of our Certificate of Incorporation to eliminate supermajority voting. The persons named as proxies will vote on any other matters properly presented at the Annual Meeting in accordance with their best judgment, although we have not received timely notice of any other matters that may be properly presented for voting at the Annual Meeting. | |

| Voting Results | We will announce preliminary results at the Annual Meeting. We will report final results by filing a Form 8-K within four business days after the Annual Meeting. If final results are not available at that time, we will provide preliminary voting results in the Form 8-K and will provide the final results in an amendment to the Form 8-K as soon as they become available. | |

2 | TPI Composites 2023 Proxy Statement

General Information

Additional Solicitation/Costs | We are paying for the distribution of the proxy materials and solicitation of the proxies. As part of this process, we reimburse brokerage houses and other custodians, nominees and fiduciaries for their reasonable out-of-pocket expenses for forwarding proxy and solicitation materials to our stockholders. Proxy solicitation expenses that we will pay include those for preparation, mailing, returning and tabulating the Notice and proxies. Our directors, officers and employees may also solicit proxies on our behalf in person, by telephone, email or facsimile, but they do not receive additional compensation for providing those services. In addition, we have retained Innisfree M&A Incorporated (referred to as “Innisfree”) to solicit stockholder proxies. We have agreed to pay Innisfree a fee of approximately $20,000, plus reasonable expenses, for these services. |

3 | TPI Composites 2023 Proxy Statement

PROPOSAL ONE: ELECTION OF DIRECTORS

Number of Directors; Board Structure

The Board is divided into three staggered classes of directors. One class is elected each year at the annual meeting of stockholders for a term of three years. The term of the Class I directors expires at the Annual Meeting. The term of the Class II directors expires at the 2024 annual meeting of stockholders and the term of the Class III directors expires at the 2025 annual meeting of stockholders. After the initial terms expire, directors are expected to be elected to hold office for a three-year term or until the election and qualification of their successors.

In May 2022, the Board amended our by-laws so that in uncontested elections, a director nominee must receive a majority of the votes cast to be elected, effective on and after January 1, 2023. If the votes cast for any nominee do not exceed the votes cast against the nominee, our nominating and corporate governance committee will consider whether to accept or reject such director’s resignation, which is tendered to the Board pursuant to our corporate governance guidelines. In contested elections, a nominee may be elected by a plurality of the votes properly cast by the stockholders entitled to vote at the election on such election of directors. An election shall be considered contested if, as of the last date on which nominees for director may be submitted in accordance with the by-laws, the nominees for election to the Board exceeds the number of positions on the Board to be filled by election at that meeting.

As discussed in greater detail in Proposal Four, the Board recently approved, subject to stockholder approval, an amendment to our Certificate of Incorporation to provide for the phased declassification of the Board. If Proposal Four is approved by the requisite vote of stockholders at the Annual Meeting, directors will be elected to one-year terms of office beginning at our 2024 annual meeting of stockholders, and, following our 2025 annual meeting of stockholders, the Board of Directors will be completely declassified and all directors will be subject to annual election to one-year terms beginning with our 2026 annual meeting of stockholders.

Nominees

The Board has nominated Steven C. Lockard, William E. Siwek, and Philip J. Deutch for election as Class I directors to hold office until the 2026 annual meeting of stockholders or until their successors are duly elected and qualified, subject to their earlier resignation or removal. Each of Steven C. Lockard, William E. Siwek, and Philip J. Deutch is a current member of the Board and all of the nominees have consented to serve if elected.

Unless you direct otherwise through your proxy voting instructions, the persons named as proxies will vote all proxies received “FOR” the election of each nominee. If any nominee is unable or unwilling to serve at the time of the Annual Meeting, the persons named as proxies may vote for a substitute nominee chosen by the present Board. In the alternative, the proxies may vote only for the remaining nominees, leaving a vacancy on the Board. The Board may fill such vacancy at a later date or reduce the size of the Board. We have no reason to believe that any of the nominees will be unwilling or unable to serve if elected as a director.

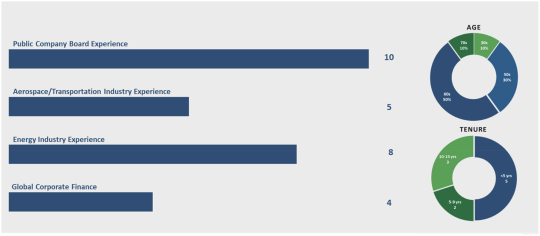

Summary of Director Core Competencies and Board Diversity

| ||

4 | TPI Composites 2023 Proxy Statement

Proposal One: Election of Directors

| Board Diversity Matrix (As of April 4, 2023) | ||

| Total Number of Directors | 10 | |

|

| Female | Male | Non-Binary | Did Not Disclose Gender | ||||

Part I: Gender Identity |

| |||||||

Directors | 3 | 7 |

|

| ||||

Part II: Demographic Background |

| |||||||

African American or Black | 1 | 1 |

|

| ||||

Alaskan Native or Native American |

|

|

|

| ||||

Asian | 1 |

|

|

| ||||

Hispanic or Latinx |

|

|

|

| ||||

Native Hawaiian or Pacific Islander |

|

|

|

| ||||

White | 1 | 6 |

|

| ||||

Two or More Races or Ethnicities |

|

|

|

| ||||

LGBTQ+ |

| |||||||

Did Not Disclose Demographic Background |

| |||||||

Directors who are Military Veterans:-

Directors with Disabilities:-

Directors who identify as Middle Eastern:-

For Proposal One, each nominee will be elected as a director if they receive a majority of the votes cast with respect to their election. If the votes cast for any nominee do not exceed the votes cast against the nominee, our nominating and corporate governance committee will consider whether to accept or reject such director’s resignation, which is tendered to the Board pursuant to our corporate governance guidelines. Broker non-votes and abstentions will have no effect on the election of the nominees.

|

RECOMMENDATION OF THE BOARD

The Board recommends that you vote “FOR” the election of each of the nominees. |

The biographies of each of the nominees and continuing directors below contain information regarding each such person’s service as a director, business experience, director positions held currently or at any time during the last five years and the experiences, qualifications, attributes or skills that caused the Board to determine that the person should serve as a director of the Company. In addition to the information presented below regarding each nominee’s and continuing director’s specific experience, qualifications, attributes and skills that led the Board to the conclusion that he or she should serve as a director, we also believe that each of our directors has a reputation for integrity, honesty and adherence to high ethical standards. Each of our directors has demonstrated business acumen and an ability to exercise sound judgment, as well as a commitment of service to the Company and the Board. Finally, we value our directors’ experience in relevant areas of business management and on other boards of directors and board committees.

Our corporate governance guidelines also dictate that a majority of the Board be comprised of independent directors whom the Board has determined have no material relationship with the Company and who are otherwise “independent” directors under the published listing requirements of the Nasdaq Global Market (“NASDAQ”).

5 | TPI Composites 2023 Proxy Statement

Proposal One: Election of Directors

Directors

The following table sets forth information regarding our directors, including their ages, as of March 28, 2023:

Name | Age | Position | ||

Steven C. Lockard | 61 | Chairman of the Board and Director | ||

Paul G. Giovacchini (1) | 65 | Lead Independent Director | ||

William E. Siwek | 60 | President & Chief Executive Officer, Director | ||

Jayshree S. Desai (2) | 51 | Director | ||

Bavan M. Holloway (1)(2) | 58 | Director | ||

Linda P. Hudson (3) | 72 | Director | ||

James A. Hughes (2) | 60 | Director | ||

Tyrone M. Jordan (1)(3) | 60 | Director | ||

Philip J. Deutch (3) | 58 | Director | ||

Andrew Moir (1) | 35 | Director | ||

| (1) | Member of our compensation committee. |

| (2) | Member of our audit committee. |

| (3) | Member of our nominating and corporate governance committee. |

6 | TPI Composites 2023 Proxy Statement

Proposal One: Election of Directors

| Steven C. Lockard. | ||

Age: 61 | Mr. Lockard has been Chairman of the Board since May 2020. From 2004 to 2020, he was our President and Chief Executive Officer, and has served as a member of the Board since 2004. Prior to joining us in 1999, Mr. Lockard was Vice President of Satloc, Inc., a supplier of precision GPS equipment, from 1997 to 1999. Prior to that, Mr. Lockard was Vice President of marketing and business development and a founding officer of ADFlex Solutions, Inc., a NASDAQ-listed international manufacturer of interconnect products for the electronics industry, from 1993 to 1997. Prior to that, Mr. Lockard held several marketing and management positions at Rogers Corporation from 1982 to 1993. Mr. Lockard is a member of the board of directors of EMSc (UK) Ltd. (aka Powerstar), a supplier of energy storage systems in the United Kingdom. Mr. Lockard previously served as a director of Keystone Towers Systems, a manufacturer of wind turbine towers, and currently serves as an advisor to the company. Mr. Lockard serves as an Operating Partner with Angeleno Group and SCF Partners, equity investment firms that provide growth capital for companies in the energy transition space. Mr. Lockard previously served for ten years as a board member and Chair of the American Wind Energy Association. Mr. Lockard holds a B.S. in Electrical Engineering from Arizona State University. | |

We believe that Mr. Lockard is qualified to serve as a member of the Board based on his deep knowledge of our company gained from his positions as our President and Chief Executive Officer, as well as his experience in the wind energy industry and in high-growth global manufacturing companies. | ||

| William E. Siwek. | ||

Age: 60 | Mr. Siwek was elected to the Board in May 2020 and has been our President and Chief Executive Officer since May 2020. In May 2019, Mr. Siwek was promoted to President and ceased serving as the Chief Financial Officer of the Company, a role he had held since joining the Company in 2013. Prior to joining the Company, Mr. Siwek previously served as the Chief Financial Officer for T.W. Lewis Company, an Arizona-based real estate investment company, from September 2012 to September 2013. From May 2010 until September 2012, he was an independent consultant assisting companies in the real estate, construction, insurance and renewable energy industries. Prior to that, Mr. Siwek was Executive Vice President and Chief Financial Officer of Talisker Mountain, Inc., from January 2009 to April 2010. Prior to that, he was President and Chief Financial Officer of the Lyle Anderson Company from December 2002 to December 2008. Prior to that, Mr. Siwek spent 18 years, from September 1984 to May 2002, with Arthur Andersen where he became a Partner in both Audit and Business Consulting Divisions. Mr. Siwek currently serves on the board of the American Clean Power Association, which represents renewable energy companies in the United States and promotes the growth of clean power. Mr. Siwek holds B.S. degrees in Accounting and Economics from University of Redlands. | |

We believe Mr. Siwek is qualified to serve as a member of the Board because of his extensive knowledge of the Company gained from his positions as our Chief Financial Officer, President, and Chief Executive Officer. | ||

7 | TPI Composites 2023 Proxy Statement

Proposal One: Election of Directors

| Philip J. Deutch. | ||

Age: 58 | Mr. Deutch has served as a member of the Board since 2007. Since January 2021, Philip J. Deutch has been Partner at NGP Energy Capital Management, L.L.C. (“NGP”). Mr. Deutch also has served as the Chief Executive Officer of NGP Energy Technology Partners III, LLC since February 2020 and is a member of NGP’s Executive Committee. Mr. Deutch is also Managing Partner of NGP Energy Technology Partners, which he founded in 2005 with NGP. Mr. Deutch has invested in the energy technology sector since 1997 and his extensive experience includes early to late-stage investments in renewable energy, power quality/reliability, distributed generation, energy management and control, and power electronics. From 2015 to 2018, Mr. Deutch was Partner, COO and President of Social Capital, a $1.8 billion Silicon Valley-based investment firm, where he helped launch SC Public Equity Partners and Social Capital Hedosophia Holdings Corp. From 1997 to 2004, he was Managing Director at Perseus, where he led or co-led the firm’s energy investing activities and was a member of the firm’s Executive Committee. From 1986 to 1988, he was a financial analyst in the Mergers & Acquisition Department of Morgan Stanley & Company. Mr. Deutch is a board member of Anew, Form Energy Inc., Voltus Inc, and Community Energy Inc. He is a former board member of, among other companies, American Wind Capital, Beacon Power, Evergreen Solar, Renewable Energy Group, and SatCon Technologies. Additionally, Phil is a member of the Board of Trustees of the Menlo School. Mr. Deutch previously served on the MIT Future of Solar and Future of Storage Studies and on the boards of the Folger Shakespeare Library, the International Center for Women, the Washington Performing Arts Society and Capital for Children. Mr. Deutch holds a Juris Doctor with distinction from Stanford Law School and a Bachelor of Arts in Economics from Amherst College, where he was elected a member of Phi Beta Kappa. | |

We believe that Mr. Deutch is qualified to serve as a member of the Board because of his substantial experience investing in energy companies in the areas of renewable and alternative energy, energy efficiency, power and oil and gas and serving on the board of directors of both public and private companies. | ||

8 | TPI Composites 2023 Proxy Statement

Proposal One: Election of Directors

Information Concerning Directors Continuing in Office Until the 2024 Annual Meeting

| Paul G. Giovacchini. | ||

Age: 65 | Mr. Giovacchini is the Lead Independent Director and served as Chairman of the Board from 2006 to 2020. He currently serves as the Chair of our Compensation Committee. Mr. Giovacchini has served as an independent consultant to Advantage Capital Management Corporation since October 2021. Mr. Giovacchini also has served as an independent consulting advisor to Landmark Partners, Inc. since 2014. Prior to 2014, he served as a Principal of Landmark Partners, Inc. since 2005. Mr. Giovacchini has been investing in privately held companies on behalf of institutional limited partnerships since 1987. He currently serves as a director of CaLLogix, Inc., a fully integrated contact center providing a full menu of customized outsourced programs. Mr. Giovacchini holds an A.B. in Economics from Stanford University and an M.B.A. from Harvard University. | |

We believe that Mr. Giovacchini is qualified to serve as a member of the Board because of his experience investing in growth companies and serving on their boards of directors, and his extensive knowledge of our business. | ||

| Jayshree S. Desai. | ||

Age: 51 | Ms. Desai has served as a member of the Board since September 2017. Since July 2022, Ms. Desai has served as the Chief Financial Officer of Quanta Services, Inc. (NYSE: PWR), a leading specialty contractor for the electric power, pipeline, industrial and communications industries. From January 2020 to July 2022, Ms. Desai served as the Chief Corporate Development Officer of Quanta Services, Inc. From 2018 to 2019, Ms. Desai served as President of ConnectGen LLC, a company focused on the development of wind, solar and storage projects. From 2010 to 2018, Ms. Desai served as the Chief Operating Officer of Clean Line Energy Partners LLC, a developer of transmission line infrastructure projects that deliver wind energy to communities and cities that lack access to low-cost renewable energy resources. From 2002 to 2010, Ms. Desai served as Chief Financial Officer of EDP Renewables North America f/k/a Horizon Wind Energy, a developer, owner and operator of wind farms. Ms. Desai began her career as a business analyst at McKinsey & Company and also held various positions in the corporate development department of Enron Corporation. Ms. Desai also currently serves on the Executive Board of KIPP Texas, a non-profit organization of public, charter schools for the underserved communities in Texas. Ms. Desai previously served as the Chairperson of the Board of the Wind Energy Foundation, a nonprofit organization dedicated to raising public awareness of wind as a clean, domestic energy source. Ms. Desai holds an M.B.A. from the Wharton School of the University of Pennsylvania and a Bachelor of Business Administration from the University of Texas at Austin. | |

We believe that Ms. Desai is qualified to serve as a member of the Board because of her considerable expertise in energy markets and renewable energy policy, as well as her experience serving in high-level executive roles of wind energy transmission and development companies. | ||

| Bavan M. Holloway. | ||

Age: 58 | Ms. Holloway joined the Board in September 2020. From August 2010 to April 2020, Ms. Holloway served as Vice President of Corporate Audit for The Boeing Company (“Boeing”). Ms. Holloway also served in various senior finance roles for Boeing from May 2002 to August 2010. Prior to joining Boeing, Ms. Holloway worked for KPMG, LLP as a partner and in other roles primarily serving investment services, broker dealer and financial clients. Her internal audit experience has spanned the breadth of enterprise processes, including cybersecurity, supply chain, manufacturing, engineering and overall risk management. Ms. Holloway currently serves on the Boards of Directors of T-Mobile US, Inc. (Nasdaq: TMUS) and Topgolf Callaway Brands, Inc. (NYSE: MODG). Ms. Holloway holds a B.S. degree in Business Administration from the University of Tulsa and a M.S. degree in Financial Markets and Trading from the Illinois Institute of Technology. | |

We believe Ms. Holloway is qualified to serve as a member of the Board because of her 30+ years of broad finance and audit experience in complex and highly regulated global business environments. | ||

9 | TPI Composites 2023 Proxy Statement

Proposal One: Election of Directors

| Linda P. Hudson. | ||

Age: 72 | Ms. Hudson joined the Board in August 2020. From May 2014 to January 2020, Ms. Hudson served as the Chairperson and Chief Executive Officer of The Cardea Group, a management consulting firm that she founded. Ms. Hudson previously served as CEO Emeritus of BAE, a U.S.-based subsidiary of BAE Systems, a global defense, aerospace, and security company headquartered in London, from February 2014 to May 2014, and as President and Chief Executive Officer of BAE from October 2009 until January 2014. Ms. Hudson also served as President of BAE Systems’ Land and Armaments operating group, from October 2006 to October 2009. Prior to joining BAE Systems, Ms. Hudson served as Vice President of General Dynamics Corporation and President of its Armament and Technical Products business, and held various engineering, production operations, program management, and business development positions for defense and aerospace companies. Ms. Hudson holds a B.S. in Systems Engineering from the University of Florida. She also holds an honorary doctorate in engineering from Worcester Polytechnic Institute and an honorary doctorate in science from the University of Florida. In 2019, she was inducted into the National Academy of Engineering. Ms. Hudson currently serves as a director of Bank of America Corporation (NYSE: BAC) and Trane Technologies plc (NYSE: TT), formerly Ingersoll Rand, plc, and previously served as a director of The Southern Company from 2014 to July 2018. Ms. Hudson serves on the non-profit executive board of the University of Florida Foundation. | |

We believe Ms. Hudson is qualified to serve as a member of the Board because of her chief executive officer and public company board experience as well as her global operations expertise which she developed by managing operations in complex and highly regulated business environments for over 35 years. | ||

10 | TPI Composites 2023 Proxy Statement

Proposal One: Election of Directors

Information Concerning Directors Continuing in Office Until the 2025 Annual Meeting

| James A. Hughes. | ||

Age: 60 | Mr. Hughes has served as a member of the Board since October 2015. Since August 2019, Mr. Hughes has served as Managing Partner, Energy Transition at EnCap Investments, a leading provider of equity capital to independent energy companies in the upstream and midstream oil and gas industry and in the energy transition sector of the electric power industry. From December 2017 to August 2019, Mr. Hughes served as CEO and Managing Director of Prisma Energy Capital, a private entity focused on investments in energy storage. Mr. Hughes served as Chief Executive Officer of First Solar, Inc. from May 2012 to July 2016, and served as a member of First Solar, Inc.’s board of directors from May 2012 until September 2016. Prior to serving as the Chief Executive Officer of First Solar, Inc., he served as the company’s Chief Commercial Officer from March 2012 to May 2012. Prior to joining First Solar, Inc., Mr. Hughes served as Chief Executive Officer and Director of AEI Services LLC from October 2007 until April 2011. Mr. Hughes currently serves as a director of PNM Resources Inc. (NYSE: PNM), an energy holding company that generates and provides electricity to homes and businesses in New Mexico and Texas through its regulated utilities. Mr. Hughes also serves as a director of Alcoa Corporation (NYSE: AA), a producer of bauxite, alumina and aluminum products. He is the former chairman and director of the Los Angeles branch of the Federal Reserve Bank of San Francisco. He is also a member of the Energy Advisory Council of the Dallas Federal Reserve Bank. Mr. Hughes holds a J.D. from the University of Texas at Austin School of Law, a Certificate of Completion in international business law from Queen Mary’s College, University of London and a Bachelor’s degree in Business Administration from Southern Methodist University. | |

We believe that Mr. Hughes is qualified to serve as a member of the Board because of his many years of experience in various sections of the energy industry, including renewable energy, as well as his experience serving as the CEO and in other high level executive roles of publicly-traded energy companies. | ||

| Tyrone M. Jordan. | ||

Age: 60 | Mr. Jordan has served as a member of the Board since January 2019. Mr. Jordan served as President and Chief Operating Officer of DURA Automotive Systems, a leading tier one automotive supplier of electric/hybrid systems, advanced driver-assistance systems, mechatronics, lightweight structural systems, and luxury trim systems for premier automotive brands, from October 2015 until his retirement in March 2019. Mr. Jordan joined DURA following a career of more than three decades with General Motors Company and United Technologies Corporation, most recently serving as Executive Vice President, Global Operations and Customer Experience at General Motors. During his 25-year tenure with General Motors, which included living internationally in Brazil, China and Mexico, Mr. Jordan held positions of increasing responsibility in operations, purchasing, technology, business development, strategy, mergers and acquisitions, and engineering. Mr. Jordan served on the board of directors of Cooper Tire & Rubber Company (NYSE: CTB), and currently serves on the board of directors of Oshkosh Corporation (NYSE: OSK), Axalta Coating Systems (NYSE: AXTA), and Trinity Industries, Inc. (NYSE: TRN), and on the Dean’s Advisory Board of the College of Business of Eastern Michigan University. Mr. Jordan received his Executive Aerospace & Defense Master of Business Administration (ADMBA) in Operations, Strategy & Finance from the University of Tennessee, a degree in Pre-law from Eastern Michigan University and a degree in Industrial Engineering Technology from Purdue University. Mr. Jordan is the founder of the Beatrice Cozetta Jordan Scholarship, co-founder of the Henry Elbert Harden Scholarship and the Tyrone M. & Sherri L. Jordan Endowment Fund at Eastern Michigan University. | |

We believe that Mr. Jordan is qualified to serve as a member of the Board because he has substantial experience in advanced automotive and aerospace product development, strategic planning and manufacturing systems. | ||

11 | TPI Composites 2023 Proxy Statement

Proposal One: Election of Directors

| Andrew Moir. | ||

Age: 35 | Mr. Moir joined our Board of Directors as Director in June 2022. Mr. Moir is a senior vice president of Oaktree Capital Management’s Power Opportunities investment strategy since 2013. He is involved in all aspects of the group’s investment activities, including identifying potential investment opportunities, executing transactions and portfolio company oversight. Mr. Moir currently serves as a board observer of Montrose Environmental Group (NYSE: MEG) and Universal Plant Services. He previously served on the boards of Fidelity Building Services Group, Horizon Solar Power, Riggs Distler, Saber Power Services, Ten K Solar, The Kirlin Group, Trench Plate Rental Co. and Vac-One Services. He was also a board observer of GoodCents Holdings and Solomon Corporation. Prior to joining Oaktree in 2013, Mr. Moir was at Moelis & Company, where he focused on executing M&A and capital markets transactions across multiple industries. Mr. Moir graduated cum laude with distinction from Yale University with a B.S. (Intensive) in chemistry and attended Stanford University for graduate studies in physical chemistry where he conducted research on novel solar cell technologies. | |

We believe that Mr. Moir is qualified to serve as a member of the Board because of his substantial experience investing in companies in the energy, professional service and industrials sectors and serving on the board of directors of several private companies. | ||

12 | TPI Composites 2023 Proxy Statement

PROPOSAL TWO: RATIFICATION OF THE APPOINTMENT OF OUR INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

We have appointed KPMG LLP (“KPMG”) as our independent registered public accounting firm to perform the audit of our consolidated financial statements for the fiscal year ending December 31, 2023, and we are asking you and other stockholders to ratify this appointment. During our fiscal year ended December 31, 2022, KPMG served as our independent registered public accounting firm.

The audit committee annually reviews the independent registered public accounting firm’s independence, including reviewing all relationships between the independent registered public accounting firm and us and any disclosed relationships or services that may impact the objectivity and independence of the independent registered public accounting firm, and the independent registered public accounting firm’s performance. As a matter of good corporate governance, the Board is submitting the appointment of KPMG to stockholders for ratification. A majority of the votes properly cast is required to ratify the appointment of KPMG. In the event that a majority of the votes properly cast do not ratify the appointment of KPMG, we will review our future appointment of KPMG.

We expect that a representative of KPMG will attend the Annual Meeting and the representative will have an opportunity to make a statement if he or she so chooses. The representative will also be available to respond to appropriate questions from stockholders.

Policy on Audit Committee Pre-Approval of Audit and Permissible Non-Audit Services of Independent Registered Public Accounting Firm

We have adopted a policy under which the audit committee must pre-approve all audit and permissible non-audit services to be provided by the independent registered public accounting firm. As part of its review, the audit committee also considers whether the categories of pre-approved services are consistent with the rules on accountant independence of the Securities and Exchange Commission (the “SEC”) and the Public Company Accounting Oversight Board. The audit committee pre-approved all services performed since the pre-approval policy was adopted. This policy is set forth in our audit committee’s charter, which is available on our website at https://ir.tpicomposites.com/websites/tpicomposites/English/4300/governance-documents.html.

Audit Fees

The following table sets forth the fees billed by KPMG for audit, audit-related, tax and all other services rendered for fiscal years 2021 and 2022:

| Fee Category | 2021 | 2022 | ||||||

Audit Fees | $2,932,000 | $2,729,500 | ||||||

Audit-Related Fees | $ — | $ 35,000 | ||||||

Tax Fees | $ 595,000 | $ 573,500 | ||||||

All Other Fees | $ — | $ — | ||||||

Total Fees | $3,527,000 | $3,338,000 | ||||||

Audit Fees. Consist of professional services rendered in connection with the audit of our annual consolidated financial statements, including audited financial statements presented in our Annual Report and services that are normally provided by the independent registered public accountants in connection with statutory and regulatory filings or engagements for those fiscal years.

Audit-Related Fees. Consist of aggregate fees for accounting consultations and other services that were reasonably related to the performance of audits or reviews of our consolidated financial statements and were not reported above under “Audit Fees.”

Tax Fees. Consist of aggregate fees for tax compliance, tax advice and tax planning services including the review and preparation of our federal and state income tax returns and were approved by the audit committee.

All Other Fees. Consist of aggregate fees billed for products and services provided by the independent registered public accounting firm other than those disclosed above, of which there were none in 2021 or 2022.

13 | TPI Composites 2023 Proxy Statement

Proposal Two: Ratification of the Appointment of Our Independent Registered Public Accounting Firm

For Proposal Two, a majority of the votes properly cast is required to ratify the appointment of KPMG LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2023. With respect to Proposal Two, you may vote “for,” “against” or “abstain” from voting on this proposal. If you “abstain” from voting with respect to this proposal, your vote will have no effect on this proposal. For Proposal Two, the ratification of the appointment of KPMG LLP, is considered a routine matter where brokers are permitted to vote shares held by them without instruction. Broker non-votes, if any, will have no effect on the vote for this proposal.

|

RECOMMENDATION OF THE BOARD

The Board recommends that you vote “For” the ratification of the appointment of KPMG LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2023. |

Report of the Audit Committee of the Board of Directors

The information contained in this audit committee report shall not be deemed to be (i) “soliciting material,” (ii) “filed” with the SEC, (iii) subject to Regulations 14A or 14C of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or (iv) subject to the liabilities of Section 18 of the Exchange Act. No portion of this audit committee report shall be deemed to be incorporated by reference into any filing under the Securities Act of 1933, as amended, (the “Securities Act”), or the Exchange Act, through any general statement incorporating by reference in its entirety the proxy statement in which this report appears, except to the extent that TPI Composites specifically incorporates this report or a portion of it by reference. In addition, this report shall not be deemed filed under either the Securities Act or the Exchange Act.

This report is submitted by the audit committee of the Board. The audit committee consists of the three directors whose names appear below. None of the members of the audit committee is an officer or employee of TPI Composites, and the Board has determined that each of Mr. Hughes, Ms. Desai, and Ms. Holloway are “independent” for audit committee purposes as that term is defined under Rule 10A-3 of the Exchange Act and the applicable NASDAQ rules. Each member of the audit committee meets the requirements for financial literacy under the applicable rules and regulations of the SEC and NASDAQ.

The audit committee’s general role is to assist the Board in monitoring our financial reporting process and related matters. Its specific responsibilities are set forth in its charter.

The audit committee has reviewed the Company’s consolidated financial statements for the year ended December 31, 2022 and met with management, as well as with representatives of KPMG, the Company’s independent registered public accounting firm, to discuss the consolidated financial statements. The audit committee also discussed with members of KPMG the matters required to be discussed by the applicable requirements of the Public Company Accounting Oversight Board and the SEC.

In addition, the audit committee received the written disclosures and communications from KPMG required by applicable requirements of the Public Company Accounting Oversight Board regarding the independent registered public accounting firm’s communications with the audit committee concerning independence and discussed with members of KPMG its independence.

Based on these discussions, the financial statement review and other matters it deemed relevant, the audit committee recommended to the Board that the Company’s audited consolidated financial statements for the year ended December 31, 2022 be included in its Annual Report on Form 10-K.

Audit Committee

Jayshree S. Desai (Chair)

James A. Hughes

Bavan M. Holloway

14 | TPI Composites 2023 Proxy Statement

PROPOSAL THREE: NON-BINDING ADVISORY VOTE ON NAMED EXECUTIVE OFFICER COMPENSATION

The Board is providing our stockholders with an opportunity to cast a non-binding, advisory vote to approve the compensation of our named executive officers.

The Dodd-Frank Wall Street Reform and Consumer Protection Act of 2010 (the “Dodd-Frank Act”) enables our stockholders to vote to approve, on a non-binding, advisory basis, the compensation of our named executive officers as disclosed in this proxy statement in accordance with the SEC’s rules. As described in the Compensation Discussion and Analysis section, we have developed a compensation program that is designed to motivate employees to achieve short-term and long-term results that we believe are in the best interests of our stockholders. We believe our compensation policy strikes an appropriate balance between the implementation of responsible, measured compensation practices and the effective provision of incentives for our named executive officers to exert their best efforts for our success.

We are asking for stockholder approval, on a non-binding advisory basis, of the compensation of our named executive officers as disclosed in this proxy statement, which includes the disclosures in the Compensation Discussion and Analysis section, and the compensation tables and the narrative discussion following the compensation tables in this proxy statement. This vote is not intended to address any specific item of compensation, but rather the overall compensation of our named executive officers and the policies and practices described in this proxy statement.

The following resolution will be submitted for a stockholder vote at the Annual Meeting:

“BE IT RESOLVED THAT the Company’s stockholders hereby approve, on a non-binding advisory basis, the compensation of the Company’s named executive officers, as disclosed pursuant to Item 402 of Regulation S-K, including the Compensation Discussion and Analysis, the compensation tables and the narrative discussions that accompany the compensation tables.”

As this vote is advisory, it will not be binding upon the Board or compensation committee, and neither the Board nor our compensation committee will be required to take any action as a result of the outcome of this vote. However, our compensation committee will carefully consider the outcome of this vote when considering future executive compensation policies and decisions.

The approval of the compensation of our named executive officers in Proposal Three, on a non-binding advisory basis, requires a majority of the votes properly cast “for” or “against” such matter. With respect to Proposal Three, you may vote “for,” “against” or “abstain” from voting on this proposal. If you “abstain” from voting with respect to this proposal, your vote will have no effect on this proposal. Broker non-votes will have no effect on the vote for this proposal.

|

RECOMMENDATION OF THE BOARD

The Board recommends that you vote “For” the approval, on a non-binding advisory basis, of the compensation of the named executive officers, as disclosed in this proxy statement. |

15 | TPI Composites 2023 Proxy Statement

PROPOSAL FOUR: APPROVAL OF AN AMENDMENT TO OUR AMENDED AND RESTATED CERTIFICATE OF INCORPORATION TO DECLASSIFY THE BOARD OF DIRECTORS OF THE COMPANY

Background

Currently, the Board is divided into three classes, with directors elected to staggered three-year terms. Approximately one-third of our directors stand for election each year. The Board has adopted and declared advisable, and recommends for your approval, an amendment to Article VI of our Certificate of Incorporation to phase out the present three-year, staggered terms of our directors and instead provide for the annual election of directors.

Rationale for Declassifying the Board

The Board regularly reviews our corporate governance practices and current corporate governance trends and, in connection with this review, has discussed the potential declassification of the Board. The Board took into consideration arguments in favor and against continuation of a classified board and determined that it is in the Company’s and its stockholders’ best interests to propose to declassify the Board.

In its review, the Board considered the advantages of maintaining the classified board structure, including, among other reasons, that classified boards provide increased protection in the context of certain abusive takeover tactics because it is more difficult to change a majority of directors on a board in a single year. While the Board continues to believe that this remains an important consideration, the Board also considered the potential advantages of declassification, including the ability of stockholders to evaluate directors annually, which is generally viewed by many institutional stockholders as increasing the accountability of directors to such stockholders, and the fact that many publicly traded companies have declassified their boards in favor of annual elections. After carefully weighing these considerations, the Board determined that it would be in the best interests of the Company and its stockholders to declassify the Board and, accordingly, approved the proposed amendment to our Certificate of Incorporation and recommends that the stockholders adopt this amendment by voting in favor of this proposal.

Proposed Declassification Amendment

If the proposed amendment to our Certificate of Incorporation is approved by stockholders, directors will be elected to one-year terms of office beginning at our 2024 annual meeting of stockholders. Directors who have been elected to three-year terms prior to the effectiveness of the amendment, including directors elected at the Annual Meeting, would complete those three-year terms, and thereafter would be eligible for annual re-election after completion of their current terms. Accordingly, directors who were elected at the 2022 annual meeting of stockholders, whose terms will expire in 2025, and the directors who are elected at the Annual Meeting, whose terms will expire in 2026, will hold office until the end of their terms. If this proposal is approved, following our 2025 annual meeting of stockholders, the Board of Directors will be completely declassified and all directors will be subject to annual election to one-year terms beginning with our 2026 annual meeting of stockholders.

The description of the proposed amendments in this proposal is a summary and is qualified by the full text of the amendment to our Certificate of Incorporation, which is attached to this proxy statement as Appendix A and is incorporated into this proposal by reference. The full text of the amendment to our Certificate of Incorporation attached to this proxy statement as Appendix A includes the amendment to Article VI, Section 3 to which this proposal specifically relates, as well as the amendments discussed in proposal five. If this proposal four is approved by our stockholders at the Annual Meeting, the Company will file with Delaware Secretary of State the amendment to our Certificate of Incorporation set forth in Appendix A including the bracketed language amending Article VI, Section 3. If this proposal four is not approved by our stockholders at the Annual Meeting and proposal five is approved by our stockholders at the Annual Meeting, the Company will file with the Delaware of Secretary of State the amendment to our Certificate of Incorporation set forth in Appendix A including the language inside the braces amending Article VI, Section 4, Article VI, Section 5, Article IX, Section 2 and Article X. If both proposal four and proposal five are approved by our stockholders at the Annual Meeting, the Company will file with the Delaware Secretary of State the full text of the amendment to our Certificate of Incorporation attached to this proxy statement as Appendix A, including the bracketed language and the language in braces. If neither proposal four nor proposal five are approved by our stockholders at the Annual Meeting, the Company will not file the certificate of amendment to our Certificate of Incorporation with the Delaware Secretary of State.

16 | TPI Composites 2023 Proxy Statement

Proposal Four: Approval of an Amendment to Our Amended and Restated Certificate of Incorporation to Declassify the Board of Directors of the Company

If approved by the requisite number of stockholders, the amendment to our Certificate of Incorporation will be effective when the Company files a Certificate of Amendment to our Certificate of Incorporation with the Secretary of State of the State of Delaware.

If the amendment to our Certificate of Incorporation pertaining to the declassification of our Board of Directors is not approved by stockholders, the Board of Directors will remain classified, and directors elected at our future annual meetings of stockholders will serve three-year terms and will hold office until their respective successors are duly elected and qualified or until their earlier resignation or removal.

The approval of the amendment to our Certificate of Incorporation to declassify the Board of Directors requires the affirmative vote of the holders of at least 75% of the outstanding shares of capital stock entitled to vote thereon, voting together as a single class, and the affirmative vote of the holders of at least 75% of the outstanding shares of each class of capital stock entitled to vote thereon, as a separate class. With respect to Proposal Four, you may vote “for,” “against” or “abstain” from voting on this proposal. If you “abstain” from voting with respect to this proposal, your vote will have the effect of a vote “against” this proposal. Broker non-votes will have the effect of a vote “against” this proposal.

|

RECOMMENDATION OF THE BOARD

The Board recommends that you vote “For” the proposed amendment to our Certificate of Incorporation to declassify the Board of Directors. |

17 | TPI Composites 2023 Proxy Statement

PROPOSAL FIVE: APPROVAL OF AN AMENDMENT TO OUR AMENDED AND RESTATED CERTIFICATE OF INCORPORATION TO ELIMINATE THE SUPERMAJORITY VOTING REQUIREMENTS

Background

Our Certificate of Incorporation provides that an amendment to the Certificate of Incorporation, as well as an amendment to our by-laws by stockholders, the removal of Directors, and the election of Directors to fill Board vacancies, require the affirmative vote of stockholders holding at least seventy five percent of the voting power of our then-outstanding shares of capital stock entitled to vote at an election of Directors. The Board has adopted and declared advisable, and recommends for your approval, an Amendment to Articles VI, IX, and X of our Certificate of Incorporation to eliminate the supermajority voting requirements.

Rationale for Eliminating Supermajority Voting Requirements

As part of the Board’s ongoing evaluation of our corporate governance structures and practices, the Board considered the advantages and disadvantages of this supermajority stockholder approval requirement. While this requirement was originally put in place to, among other things, protect our stockholders, including minority stockholders, by ensuring that amendments to our Certificate of Incorporation are not completed without the approval of a substantial majority of our stockholders, the Board believes that this supermajority requirement is no longer necessary in light of prevailing views regarding corporate governance best practices. Accordingly, the Board has determined that it is advisable and in the best interests of the Company and its stockholders to remove this supermajority approval requirement.

Proposed Amendment to Eliminate Supermajority Voting Requirements

If this proposal is adopted by our stockholders, amendments to our Certificate of Incorporation, amendments to the by-laws by our stockholders and removals of Directors will require, in all instances, the affirmative vote of holders of a majority of the voting power of our then-outstanding shares of capital stock entitled to vote at an election of directors.

The description of the proposed amendments in this proposal is a summary and is qualified by the full text of the amendment to our Certificate of Incorporation, which is attached to this proxy statement as Appendix A and is incorporated into this proposal by reference. The full text of the amendment to our Certificate of Incorporation attached to this proxy statement as Appendix A includes the amendments to Article VI, Section 4, Article VI, Section 5, Article IX, Section 2 and Article X to which this proposal specifically relates, as well as the amendments discussed in proposal four. If this proposal five is approved by our stockholders at the Annual Meeting, the Company will file with Delaware Secretary of State the amendment to our Certificate of Incorporation set forth in Appendix A including the language in braces amending Article VI, Section 4, Article VI, Section 5, Article IX, Section 2 and Article X. If this proposal five is not approved by our stockholders at the Annual Meeting and proposal four is approved by our stockholders at the Annual Meeting, the Company will file with the Delaware of Secretary of State the amendment to our Certificate of Incorporation as set forth in Appendix A including the language inside the brackets amending Article VI, Section 3. If both proposal four and proposal five are approved by our stockholders at the Annual Meeting, the Company will file with the Delaware Secretary of State the full text of the amendment to our Certificate of Incorporation attached to this proxy statement as Appendix A, including the bracketed language and the language in braces. If neither proposal four nor proposal five are approved by our stockholders at the Annual Meeting, the Company will not file the certificate of amendment to our Certificate of Incorporation with the Delaware Secretary of State.

If approved by the requisite number of stockholders, the amendment to our Certificate of Incorporation will be effective when the Company files a Certificate of Amendment to our Certificate of Incorporation with the Secretary of State of the State of Delaware.

If the amendment to our Certificate of Incorporation pertaining to the removal of supermajority voting requirements is not approved by stockholders, the supermajority requirements to amend the Certificate of Incorporation and by-laws and remove Directors will remain in place.

The approval of the amendment to our Certificate of Incorporation to eliminate the supermajority voting requirements requires the affirmative vote of the holders of at least 75% of the outstanding shares of capital stock entitled to vote thereon, voting together as a single class, and the affirmative vote of the holders of at least 75% of the outstanding shares of each class of capital stock entitled to vote thereon, as a separate class. With respect to Proposal Five, you may vote “for,” “against” or “abstain” from voting on this proposal.

18 | TPI Composites 2023 Proxy Statement

Proposal Five: approval of an Amendment to our Amended and Restated Certificate of Incorporation to Eliminate the Supermajority Voting Requirements

If you “abstain” from voting with respect to this proposal, your vote will have the effect of a vote “against” this proposal. Broker non-votes will have the effect of a vote “against” this proposal.

|

RECOMMENDATION OF THE BOARD

The Board recommends that you vote “For” the proposed amendment to our Certificate of Incorporation to eliminate the supermajority voting requirements. |

19 | TPI Composites 2023 Proxy Statement

TRANSACTION OF OTHER BUSINESS

The Board knows of no other matters that will be presented for consideration at the Annual Meeting. If any other matters are properly brought before the Annual Meeting, the persons appointed in the accompanying proxy intend to vote the shares represented thereby in accordance with their best judgment on such matters, under applicable laws.

20 | TPI Composites 2023 Proxy Statement

CORPORATE GOVERNANCE

The Board, which is elected by our stockholders, is responsible for directing and overseeing our business and affairs. In carrying out its responsibilities, the Board selects and monitors our top management, provides oversight of our financial reporting processes and determines and implements our corporate governance policies. A copy of our corporate governance guidelines can be found on our website at:

https://ir.tpicomposites.com/websites/tpicomposites/English/4300/governance-documents.html.

The Board and management are committed to good corporate governance to ensure that we are managed for the long-term benefit of our stockholders, and we have a variety of policies and procedures to promote such goals. To that end, during the past year, our management periodically reviewed our corporate governance policies and practices to ensure that they remain consistent with the requirements of the Sarbanes-Oxley Act of 2002 (the “Sarbanes-Oxley Act”), SEC rules and the listing standards of NASDAQ.

Besides verifying the independence of the members of the Board and committees (which is discussed in the section titled “Independence of the Board of Directors”), at the direction of the Board, we also:

| • | Periodically review and make necessary changes to the charters for our audit, compensation, and nominating and corporate governance committees; |

| • | Have established disclosure control policies and procedures in accordance with the requirements of the Sarbanes-Oxley Act and the rules and regulations of the SEC; |

| • | Have a procedure for receipt and treatment of anonymous and confidential complaints or concerns regarding audit or accounting matters in place; and |

| • | Have a code of business conduct and ethics that applies to our officers, directors, and employees. |

In addition, we have adopted a set of corporate governance guidelines. The nominating and corporate governance committee is responsible for reviewing our corporate governance guidelines from time to time and reporting and making recommendations to the Board concerning corporate governance matters. Our corporate governance guidelines address such matters as:

| • | Director Independence – Independent directors must constitute at least a majority of the Board; |

| • | Monitoring Board Effectiveness – The Board, and each committee of the Board, must conduct an annual self-evaluation; |

| • | Review of our Chief Executive Officer – Our compensation committee conducts reviews of the performance of our chief executive officer; |

| • | Board Access to Independent Advisors – The Board as a whole, and each of its committees separately, have authority to retain independent experts, advisors or professionals as each deems necessary or appropriate; and |

| • | Board Committees – All members of the audit, compensation, and nominating and corporate governance committees are independent in accordance with applicable SEC and NASDAQ criteria. |

Meetings of the Board of Directors

In 2022, the Board held seven formal board meetings and also held telephonic update calls with respect to various operational and strategic matters although no formal actions were taken during these calls. Each director attended at least 75% of all meetings of the Board and the committees on which they served that were held during fiscal year 2022, except for Mr. Moir who joined the Board in June 2022. Under our corporate governance guidelines, directors are expected to spend the time needed and meet as frequently as the Board deems necessary or appropriate to discharge their responsibilities. Directors are also expected to make efforts to attend our annual meeting of stockholders, all meetings of the Board and all meetings of the committees on which they serve. All of our directors attended our 2022 Annual Meeting of Stockholders, except for Mr. Moir, who was appointed to our Board in June 2022 after our 2022 Annual Meeting of Stockholders.

Code of Business Conduct and Ethics

The Board has adopted a code of business conduct and ethics that applies to all of our employees, officers, and directors, including our Chief Executive Officer, Chief Financial Officer, and other executive and senior financial officers. A copy of our code of business conduct and ethics is available on our website at https://ir.tpicomposites.com/websites/tpicomposites/English/4300/governance-documents.html and may also be obtained, without charge, by contacting our Secretary at TPI Composites, Inc., 8501 N. Scottsdale Rd., Gainey Center II, Suite 100, Scottsdale, AZ 85253. We intend to disclose any amendments to our code of business conduct and ethics, or waivers of its requirements, on our website or in filings under the Exchange Act, as required by the applicable rules and exchange requirements. During fiscal year 2022, no waivers were granted from any provision of the code of business conduct and ethics.

21 | TPI Composites 2023 Proxy Statement

Corporate Governance

Independence of the Board of Directors

The Board has undertaken a review of the independence of each director. Based on information provided by each director concerning his or her background, employment and affiliations, the Board has determined that Messrs. Giovacchini, Deutch, Hughes, Jordan, Moir, Lockard (as of May 20, 2023), Ms. Desai, Ms. Holloway, and Ms. Hudson do not have a relationship that would interfere with the exercise of independent judgment in carrying out the responsibilities of a director and that each of these directors is “independent” as that term is defined under the applicable rules and regulations of the SEC, and the listing standards of NASDAQ. In making these determinations, the Board considered the current and prior relationships that each non-employee director has with the Company and all other facts and circumstances the Board deemed relevant in determining their independence, including the beneficial ownership of our capital stock by each non-employee director.

Board’s Role in Risk Oversight

The Board’s role in overseeing the management of our risks is conducted primarily through committees of the Board, as disclosed in the descriptions of each of the committees below and in the charters of each of the committees. The full Board (or the appropriate board committee in the case of risks that are under the purview of a particular committee) discusses with management our major risk exposures, their potential impact on the Company, and the steps we take to manage them. When a board committee is responsible for evaluating and overseeing the management of a particular risk or risks, the chairperson of the relevant committee reports on the discussion to the full Board during the committee reports portion of the next Board meeting. This enables the Board and its committees to coordinate the risk oversight role, particularly with respect to risk interrelationships.

Board Leadership Structure

We believe that the structure of the Board and its committees provides strong overall management of the Company. The positions of Chairperson of the Board, Chief Executive Officer and lead independent director roles are held by separate individuals. This structure enables each person to focus on different aspects of company leadership. Our Chief Executive Officer is responsible for setting the strategic direction of the Company, the general management and operation of the business and the guidance and oversight of senior management. By contrast, the Chairperson of the Board oversees Board governance practices, monitors the content, quality and timeliness of information sent to the Board and is available for consultation with the Board regarding the oversight of our business affairs. Mr. Giovacchini has served as our lead independent director since May 2020. As lead independent director, Mr. Giovacchini presides over periodic meetings of our independent directors, will serve as a liaison between our Chairperson of the Board and the independent directors, and will perform such additional duties as the Board may otherwise determine and delegate.

We believe this structure of a separate Chairperson of the Board, Chief Executive Officer and lead independent director, reinforces the independence of our Board as a whole and results in an effective balancing of responsibilities, experience and independent perspective that meets the current corporate governance needs and oversight responsibilities of our Board.

Committees of the Board of Directors

The Board has established an audit committee, a compensation committee, and a nominating and corporate governance committee. The composition and responsibilities of each committee are described below. Members serve on these committees until their resignation or until otherwise determined by the Board. Each of the audit, compensation, and nominating and corporate governance committees operates pursuant to a separate written charter adopted by the Board that is available on our website at https://ir.tpicomposites.com/websites/tpicomposites/English/4300/governance-documents.html.

Audit Committee