SUBJECT TO COMPLETION, Dated February 23 , 2009

PROSPECTUS

Rider Explorations, Inc.

640,000

SHARES OF COMMON STOCK

INITIAL PUBLIC OFFERING

___________________

The selling shareholders named in this prospectus are offering up to 640,000 shares of common stock offered through this prospectus. We will not receive any proceeds from this offering and have not made any arrangements for the sale of these securities. We have, however, set an offering price for these securities of $0.05 per share. We will use our best efforts to maintain the effectiveness of the resale registration statement from the effective date through and until all securities registered under the registration statement have been sold or are otherwise able to be sold pursuant to Rule 144 promulgated under the Securities Act of 1933.

| | Offering Price | Underwriting Discounts and Commissions | Proceeds to Selling Shareholders |

| Per Share | $0.05 | None | $0.05 |

| Total | $32,000 | None | $32,000 |

| | | | |

Our common stock is presently not traded on any market or securities exchange. The sales price to the public is fixed at $0.05 per share until such time as the shares of our common stock are traded on the NASD Over-The-Counter Bulletin Board. Although we intend to apply for quotation of our common stock on the NASD Over-The-Counter Bulletin Board, public trading of our common stock may never materialize. If our common stock becomes traded on the NASD Over-The-Counter Bulletin Board, then the sale price to the public will vary according to prevailing market prices or privately negotiated prices by the selling shareholders.

The purchase of the securities offered through this prospectus involves a high degree of risk. See section of this Prospectus entitled "Risk Factors."

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or passed upon the adequacy or accuracy of this prospectus. Any representation to the contrary is a criminal offense.

The information in this prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. The prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any state where the offer or sale is not permitted.

The Date of This Prospectus Is: February 23 , 2009

Table of Contents

| | Page |

| Summary | 6 |

| Risk Factors | 8 |

| Risks Related To Our Financial Condition and Business Model | 8 |

| If we do not obtain additional financing, our business will fail. | 8 |

| Because we will need additional financing to fund our extensive exploration activities, our auditors believe there is substantial doubt about our ability to continue as a going concern. | 9 |

| Because we have only recently commenced business operations, we face a high risk of business failure. | 9 |

| Because we conduct our business through verbal agreements with consultants and arms-length third parties, there is a substantial risk that such persons may not be readily available to us and the implementation of our business plan could be impaired. | 9 |

| Because of the unique difficulties and uncertainties inherent in the mineral exploration business, we face a high risk of business failure. | 10 |

| Because we anticipate our operating expenses will increase prior to our earning revenues, we may never achieve profitability. | 10 |

| Because access to the Sallus mineral claims may be restricted by inclement weather, we may be delayed in our exploration efforts. | 10 |

| Because our President has only agreed to provide his services on a part-time basis, he may not be able or willing to devote a sufficient amount of time to our business operations, causing our business to fail. | 11 |

| Because our President & CEO, Mr. Steve Friberg and our Treasurer and Secretary, Mr. Dan Decker own an aggregate 70.1% of our outstanding common stock and serves our two directors, investors may find that corporate decisions influenced by Mr. Steve Friberg and Mr. Decker are inconsistent with the best interests of other stockholders. | 11 |

| Because our President & CEO, Mr. Steve Friberg and our Treasurer and Secretary, Mr. Dan Decker own an aggregate 70.1% of our outstanding common stock the market price of our shares would most likely decline if he were to sell a substantial number of shares all at once or in large blocks. | 11 |

| If we are unable to successfully compete within the mineral exploration business, we will not be able to achieve profitable operations. | 11 |

| Because of factors beyond our control which could affect the marketability of any substances found, we may have difficulty selling any substances we discover. | 12 |

| Risks Related To Legal Uncertainty | 12 |

| Because we will be subject to compliance with government regulation which may change, the anticipated costs of our exploration program may increase. | 12 |

| If Native land claims affect the title to our mineral claims, our ability to prospect the mineral claims may be lost. | 12 |

Because the Province of British Columbia owns the land covered by the Sallus mineral claims in the Lillooet Mining District of British Columbia, Canada, our availability to conduct an exploratory program on the Lillooet Mining District mineral claim is subject to the consent of Mr. Murray McClaren and we can be ejected from the land and our interest in the land could be forfeit. | 13 |

| Because new legislation, including the Sarbanes-Oxley Act of 2002, increases the cost of compliance with federal securities regulations as well as the risks of liability to officers and directors, we may find it more difficult for us to retain or attract officers and directors. | 13 |

| Risks Related To This Offering | 14 |

| If a market for our common stock does not develop, shareholders may be unable to sell their shares. | 14 |

| If the selling shareholders sell a large number of shares all at once or in blocks, the market price of our shares would most likely decline. | 14 |

| Because we will subject to the “Penny Stock” rules once our shares are quoted on the over-the-counter bulletin board the level of trading activity in our stock may be reduced. | 14 |

| If our shares are quoted on the over-the-counter bulletin board, we will be required to remain current in our filings with the SEC and our securities will not be eligible for quotation if we are not current in our filings with the SEC. | 15 |

| Forward-Looking Statements | 15 |

| Use of Proceeds | 15 |

| Determination of Offering Price | 15 |

| Dilution | 15 |

| Selling Shareholders | 16 |

| Plan of Distribution | 19 |

| Description of Securities | 20 |

| Interest of Named Experts and Counsel | 21 |

| Description of Business | 23 |

| Description of Property | 24 |

| Legal Proceedings | 31 |

| Market for Common Equity and Related Stockholder Matters | 32 |

| Financial Statements | 34 |

| Plan of Operations | 43 |

| Changes in and Disagreements with Accountants | 46 |

| Directors and Executive Officers | 46 |

| Executive Compensation | 47 |

| Security Ownership of Certain Beneficial Owners and Management | 49 |

| Disclosure of Commission Position on Indemnification for Securities Act Liabilities | 50 |

| Certain Relationships and Related Transactions | 50 |

| Available Information | 51 |

| Dealer Prospectus Delivery Obligation | 52 |

| Other Expenses of Issuance and Distribution | 52 |

| Indemnification of Directors and Officers | 52 |

| Recent Sales of Unregistered Securities | 53 |

| Table of Exhibits | 54 |

| Undertakings | 54 |

| Signatures | 56 |

| Power of Attorney | 57 |

Summary

Rider Explorations, Inc.

The following summary is qualified in its entirety by the more detailed information appearing elsewhere in this Offering Memorandum and the Exhibits attached hereto. Prospective investors are urged to read this Offering Memorandum in its entirety.

The Company

Rider Resources, Inc. was incorporated on May 17, 2007 in Nevada,

Offices and Key Personnel

The Company’s principal office is presently located at: 955 S. Virginia Street, Suite 116, Reno NV 89502-0413, telephone 775-284-0370

Steve Friberg is the Company’s President and Director; Dan Decker is Treasurer, Secretary, and Director.

Plan of Operations Summary

The Company has acquired an exclusive option to obtain a 100% interest in a group of mining claims in the Lillooet Mining District of British Columbia, Canada, subject to 2% Net Smelter Returns royalty.

The Company intends to conduct mineral exploration on the optioned mining claims in an effort to find economically developable deposits of precious metals

We have not commenced our planned exploration program. Our plan of operations is to conduct mineral exploration activities on the Sallus Creek Property mineral claim in order to assess whether this claim possess commercially exploitable mineral deposits. Our exploration program is designed to explore for commercially viable deposits of gold and other metallic minerals. We have not, nor to our knowledge has any predecessor, identified any commercially exploitable reserves of these minerals on the Sallus Creek Property mineral claim. We are an exploration stage company and there is no assurance that a commercially viable mineral deposit exists on the Sallus Creek Property mineral claim.

The mineral exploration program, consisting of geological mapping, sampling, geochemical analyses, and trenching is oriented toward identifying areas of mineralized bedrock within the Sallus Creek Property mineral claim.

Currently, we are uncertain of the number of mineral exploration phases we will conduct before concluding whether there are commercially viable minerals present on the Sallus Creek Property mineral claim. Further phases beyond the current exploration program will be dependent upon a number of factors such as a consulting geologist’s recommendations based upon ongoing exploration program results, and our available funds.

Since we are in the exploration stage of our business plan, we have not yet earned any revenues from our planned operations. As of October 31, 2008, we had $26,553 cash on hand, $5,500 in subscriptions receivable (which have since been deposited) and $441 liabilities. Accordingly, our working capital position as of October 31, 2008 was $26,112. Since our inception through October 31, 2008, we have incurred a net loss of $1,888. We attribute our net loss to having no revenues to offset our expenses and the professional fees related to the creation and operation of our business.

Our fiscal year ended is October 31.

We were incorporated on May 17, 2007, under the laws of the state of Nevada. Our principal offices are located at 955 South Virginia St., Suite 116, Reno, NV 89502-0413.

Our resident agent is Nevada Agency and Trust Company, 50 West Liberty Street, Suite 880, Reno, NV 89501. Our phone number is (775) 284-0370.

The Offering

Securities Being Offered | Up to 640,000 shares of our common stock. |

| Offering Price and Alternative Plan of Distribution | The offering price of the common stock is $0.05 per share. We intend to apply to the NASD over-the-counter bulletin board to allow the trading of our common stock upon our becoming a reporting entity under the Securities Exchange Act of 1934. If our common stock becomes so traded and a market for the stock develops, the actual price of stock will be determined by prevailing market prices at the time of sale or by private transactions negotiated by the selling shareholders. The offering price would thus be determined by market factors and the independent decisions of the selling shareholders. |

| Minimum Number of Shares To Be Sold in This Offering | None |

| Securities Issued and to be Issued | 640,000 shares of our common stock are issued and outstanding as of the date of this prospectus. All of the common stock to be sold under this prospectus will be sold by existing shareholders. There will be no increase in our issued and outstanding shares as a result of this offering. |

| Use of Proceeds | We will not receive any proceeds from the sale of the common stock by the selling shareholders. |

Summary Financial Information

Balance Sheet Data | | From Inception on May 17, 2007 through October 31, 2008 (audited) | |

| Cash | | $ | 26,553 | |

| Total Assets | | | 26,553 | |

| Liabilities | | | 441 | |

| Total Stockholder’s Equity (Deficit) | | | 26,112 | |

Statement of Operations | | | | |

| Revenue | | $ | 0 | |

| Net Loss for Reporting Period | | $ | 1,888 | |

Risk Factors

An investment in our common stock involves a high degree of risk. You should carefully consider the risks described below and the other information in this prospectus before investing in our common stock. If any of the following risks occur, our business, operating results and financial condition could be seriously harmed. Currently, shares of our common stock are not publicly traded. In the event that shares of our common stock become publicly traded, the trading price of our common stock could decline due to any of these risks, and you may lose all or part of your investment.

Risks Related To Our Financial Condition and Business Model

If we do not obtain additional financing, our business will fail.

As of October 31, 2008, we had cash in the amount of $26,553. Our cash on hand, considering the need for some administrative expenses, will allow us to begin but not complete Phase I exploration in 2009. Our Phase I exploration program will require approximately $23,000 to complete, and our Phase II exploration program will require an additional $300,000 to complete. In addition, we are required to pay $5,000 by December 31, 2008 under the option agreement that we entered into. In order for us to complete our Phase I exploration program and begin our Phase II exploration program, and make our option payments, we will need to obtain additional financing. We currently do not have any operations and we have no income. Our business plan calls for significant exploration expenses. We will also require additional financing if further exploration programs are necessary. We will require additional financing to sustain our business operations if we are not successful in earning revenues once exploration is complete. If our exploration programs are successful in discovering reserves of commercial tonnage and grade and we exercise our option, we will require additional funds in order to place the Sallus mineral claim into commercial production. We currently do not have any arrangements for financing and we may not be able to obtain financing when required. Obtaining additional financing would be subject to a number of factors, including the market prices for copper, zinc, molybdenum and other metallic minerals and the costs of exploring for or commercial production of these materials. These factors may make the timing, amount, terms or conditions of additional financing unavailable to us.

Because we will need additional financing to fund our extensive exploration activities, our auditors believe there is substantial doubt about our ability to continue as a going concern.

We have incurred a net loss of $1,888 for the period from our inception, May 17, 2007 to October 31, 2008, and have no sales. Our future is dependent upon our ability to obtain financing and upon future profitable operations from the commercial exploitation of an interest in mineral claims. Our auditors have issued a going concern opinion and raised substantial doubt as to our continuance as a going concern. When an auditor issues a going concern opinion, the auditor has substantial doubt that the company will continue to operate indefinitely and not go out of business and liquidate its assets. This is a significant risk to investors who purchase shares of our common stock because there is an increased risk that we may not be able to generate and/or raise enough resources to remain operational for an indefinite period of time. The auditor’s going concern opinion may inhibit our ability to raise financing because we may not remain operational for an indefinite period of time resulting in potential investors failing to receive any return on their investment.

We have not yet begun the initial stages of exploration on mineral claims for which we have acquired an option. As a result, we have no way to evaluate the likelihood that we will be able to operate the business successfully. We were incorporated on May 17, 2007, and to date have been involved primarily in organizational activities, the acquisition of an option to purchase an interest in mineral claims and obtaining an independent consulting geologist’s report on these mineral claims. We have not earned any revenues as of the date of this prospectus, and thus face a high risk of business failure.

Because we conduct our business through verbal agreements with consultants and arms-length third parties, there is a substantial risk that such persons may not be readily available to us and the implementation of our business plan could be impaired.

We have a verbal agreement with our consulting geologist that requires him to review all of the results from the exploration work performed upon the mineral claims that we have an option to purchase and then make recommendations based upon those results. In addition, we have a verbal agreement with our accountants to perform requested financial accounting services and our outside auditors to perform auditing functions. We have a verbal agreement with a firm that provides us with office space, telephone answering and secretarial services. Each of these functions requires the services of persons in high demand and these persons may not always be available. The implementation of our business plan may be impaired if these parties do not perform in accordance with our verbal agreement. In addition, it may be difficult to enforce a verbal agreement in the event that any of these parties fail to perform.

Because of the unique difficulties and uncertainties inherent in the mineral exploration business, we face a high risk of business failure.

Potential investors should be aware of the difficulties normally encountered by new mineral exploration companies and the high rate of failure of such enterprises. The likelihood of success must be considered in light of the problems, expenses, difficulties, complications and delays encountered in connection with the exploration of the mineral properties that we plan to undertake. These potential problems include, but are not limited to, unanticipated problems relating to exploration, and additional costs and expenses that may exceed current estimates. The search for valuable minerals also involves numerous hazards. As a result, we may become subject to liability for such hazards, including pollution, cave-ins and other hazards against which we cannot insure or against which we may elect not to insure. At the present time, we have no coverage to insure against these hazards. The payment of such liabilities may have a material adverse effect on our financial position. In addition, there is no assurance that the expenditures to be made by us in the exploration of the mineral claims will result in the discovery of mineral deposits. Problems such as unusual or unexpected formations and other conditions are involved in mineral exploration and often result in unsuccessful exploration efforts.

Because we anticipate our operating expenses will increase prior to our earning revenues, we may never achieve profitability.

Prior to completion of our exploration stage, we anticipate that we will incur increased operating expenses without realizing any revenues. We expect to incur continuing and significant losses into the foreseeable future. As a result of continuing losses, we may exhaust all of our resources and be unable to complete the exploration of the Sallus mineral claims. Our accumulated deficit will continue to increase as we continue to incur losses. We may not be able to earn profits or continue operations if we are unable to generate significant revenues from the exploration of the mineral claims if we exercise our option. There is no history upon which to base any assumption as to the likelihood that we will be successful, and we may not be able to generate any operating revenues or ever achieve profitable operations. If we are unsuccessful in addressing these risks, our business will most likely fail.

Because access to the Sallus mineral claims may be restricted by inclement weather, we may be delayed in our exploration efforts.

Access to the Sallus mineral claim may be restricted through some of the year due to weather in the area. The property is located approximately 10 km north of the town of Lillooet in southwest British Columbia, Canada ,and lies north of the Trans Canada Highway, approximately 9 km north of the Salmon Pond access road, and west of the Gander River. The terrain is mountainous and the climate is typical of the southern coast range of British Columbia, with cold winters and significant snow at higher elevations.

Mr. Friberg, our President and Chief Executive Officer, devotes 5 to 10 hours per week to our business affairs. We do not have an employment agreement with Mr. Friberg nor do we maintain a key man life insurance policy for him. Currently, we do not have any full or part-time employees. If the demands of our business require the full business time of Mr. Friberg, it is possible that Mr. Friberg may not be able to devote sufficient time to the management of our business, as and when needed. If our management is unable to devote a sufficient amount of time to manage our operations, our business will fail.

Because our president, Mr. Steven Friberg and our Treasurer and Secretary, Mr. Dan Decker own an aggregate 70.1% of our outstanding common stock, investors may find that corporate decisions influenced by Mr. Friberg and Mr. Decker are inconsistent with the best interests of other stockholders.

Mr. Friberg is our President, Chief Executive Officer and one of two directors. He owns approximately 46.7% of the outstanding shares of our common stock. Mr. Decker is our Treasurer, Secretary and second of two directors. He owns approximately 23.4% of the outstanding shares of our common stock. He owns Accordingly, they will have an overwhelming influence in determining the outcome of all corporate transactions or other matters, including mergers, consolidations and the sale of all or substantially all of our assets, and also the power to prevent or cause a change in control. While we have no current plans with regard to any merger, consolidation or sale of substantially all of its assets, the interests of Mr. Friberg and Mr. Decker may still differ from the interests of the other stockholders.

Because our president, Mr. Steven Friberg and our Treasurer and Secretary, Mr. Dan Decker own an aggregate 70.1% of our outstanding common stock, the market price of our shares would most likely decline if they were to sell a substantial number of shares all at once or in large blocks.

Our President, Mr. Steven Friberg owns 1,000,000 shares of our common stock, which equates to 44.8% of our outstanding common stock. Our Secretary and Treasurer, Mr. Dan Decker owns 500,000 shares of our common stock which equates to 23.4% of our outstanding common stock. There is presently no public market for our common stock and we plan to apply for quotation of our common stock on the NASD over-the-counter bulletin board upon the effectiveness of the registration statement of which this prospectus forms a part. If our shares are publicly traded on the over-the-counter bulletin board, Mr. Friberg and Mr. Decker will be eligible to sell his shares publicly subject to the volume limitations in Rule 144. The offer or sale of a large number of shares at any price may cause the market price to fall. Sales of substantial amounts of common stock or the perception that such transactions could occur may materially and adversely affect prevailing markets prices for our common stock.

If we are unable to successfully compete within the mineral exploration business, we will not be able to achieve profitable operations.

The mineral exploration business is highly competitive. This industry has a multitude of competitors and no small number of competitors dominates this industry with respect to any of the large volume metallic minerals. Our exploration activities will be focused on the large volume metallic minerals of copper, zinc, molybdenum and other metallic minerals. Many of our competitors have greater financial resources than us. As a result, we may experience difficulty competing with other businesses when conducting mineral exploration activities on the Sallus mineral claims. If we are unable to retain qualified personnel to assist us in conducting mineral exploration activities on the Sallus mineral claims if a commercially viable deposit is found to exist, we may be unable to enter into production and achieve profitable operations.

Because of factors beyond our control, which could affect the marketability of any substances found, we may have difficulty selling any substances we discover.

Even if commercial quantities of reserves are discovered, a ready market may not exist for the sale of the reserves. Numerous factors beyond our control may affect the marketability of any substances discovered. These factors include market fluctuations, the proximity and capacity of natural resource markets and processing equipment, government regulations, including regulations relating to prices, taxes, royalties, land tenure, land use, importing and exporting of minerals and environmental protection. These factors could inhibit our ability to sell minerals in the event that commercial amounts of minerals are found.

Risks Related To Legal Uncertainty

Because we will be subject to compliance with government regulation, which may change, the anticipated costs of our exploration program may increase.

There are several governmental regulations that materially restrict mineral exploration or exploitation. We will be subject to the Mining Act of British Columbia as we carry out our exploration program. We may be required to obtain work permits, post bonds and perform remediation work for any physical disturbance to the land in order to comply with these regulations. Currently, we have not experienced any difficulty with compliance of any laws or regulations, which affect our business. While our planned exploration program budgets for regulatory compliance, there is a risk that new regulations could increase our costs of doing business, prevent us from carrying out our exploration program, and make compliance with new regulations unduly burdensome.

If Native land claims affect the title to our mineral claims, our ability to prospect the mineral claims may be lost.

We are unaware of any outstanding native land claims on the Sallus mineral claims. Notwithstanding, it is possible that a native land claim could be made in the future. The federal and provincial government policy at this time is to consult with all potentially affected native bands and other stakeholders in the area of any potential commercial production. In the event that we encounter a situation where a native person or group claims an interest in the Sallus mineral claims, we may be unable to provide compensation to the affected party in order to continue with our exploration work, or if such an option is not available, we may have to relinquish any interest that we may have in these claims. The Supreme Court of Canada recently ruled that both the federal and provincial governments in Canada are now obliged to negotiate these matters in good faith with native groups and at no cost to us. Notwithstanding, the costs and/or losses could be greater than our financial capacity and our business would fail.

Because the Province of British Columbia owns the land covered by the Sallus mineral claims, our availability to conduct an exploratory program on the Sallus mineral claims is subject to the consent of the Province of British Columbia and we can be ejected from the land and M. McClaren’s interest in the land could be forfeit.

The land covered by the Sallus mineral claims is owned by the Province of British Columbia. The availability to conduct an exploratory program on the Sallus mineral claims is subject to the consent of the Province of British Columbia.

In order to keep the Sallus mineral claims in good standing with the Province of British Columbia, the Province of British Columbia requires that before the expiry dates of the mineral claims that exploration work on the mineral claims valued at an amount stipulated by the government be completed together with the payment of a filing fee or payment to the Province of British Columbia in lieu of completing exploration work. In the event that these conditions are not satisfied prior to the expiry dates of the mineral claims, we will lose our interest in the mineral claims and the mineral claims then become available again to any party that wishes to stake an interest in these claims. In the event that either M. McClaren or we are ejected from the land or our mineral claims expire, we will lose all interest that we have in the Sallus mineral claims.

Because new legislation, including the Sarbanes-Oxley Act of 2002, increases the cost of compliance with federal securities regulations as well as the risks of liability to officers and directors, we may find it more difficult for us to retain or attract officers and directors.

The Sarbanes-Oxley Act of 2002 was enacted in response to public concerns regarding corporate accountability in connection with recent accounting scandals. The stated goals of the Sarbanes-Oxley Act are to increase corporate responsibility, to provide for enhanced penalties for accounting and auditing improprieties at publicly traded companies, and to protect investors by improving the accuracy and reliability of corporate disclosures pursuant to the securities laws. The Sarbanes-Oxley Act generally applies to all companies that file or are required to file periodic reports with the SEC, under the Securities Exchange Act of 1934. Upon becoming a public company, we will be required to comply with the Sarbanes-Oxley Act and it is costly to remain in compliance with the federal securities regulations. Additionally, we may be unable to attract and retain qualified officers, directors and members of board committees required to provide for our effective management as a result of Sarbanes-Oxley Act of 2002. The enactment of the Sarbanes-Oxley Act of 2002 has resulted in a series of rules and regulations by the SEC that increase responsibilities and liabilities of directors and executive officers. The perceived increased personal risk associated with these recent changes may make it more costly or deter qualified individuals from accepting these roles. Significant costs incurred as a result of becoming a public company could divert the use of finances from our operations resulting in our inability to achieve profitability.

Risks Related To This Offering

If a market for our common stock does not develop, shareholders may be unable to sell their shares.

A market for our common stock may never develop. We currently plan to apply for quotation of our common stock on the NASD over-the-counter bulletin board upon the effectiveness of the registration statement of which this prospectus forms a part. However, our shares may never be traded on the bulletin board, or, if traded, a public market may not materialize. If our common stock is not traded on the bulletin board or if a public market for our common stock does not develop, investors may not be able to re-sell the shares of our common stock that they have purchased and may lose all of their investment.

If the selling shareholders sell a large number of shares all at once or in blocks, the market price of our shares would most likely decline.

The selling shareholders are offering 640,000 shares of our common stock through this prospectus. Our common stock is presently not traded on any market or securities exchange, but should a market develop, shares sold at a price below the current market price at which the common stock is trading will cause that market price to decline. Moreover, the offer or sale of a large number of shares at any price may cause the market price to fall. The outstanding shares of common stock covered by this prospectus represent approximately 29.9% of the common shares outstanding as of the date of this prospectus.

Because we will be subject to the “Penny Stock” rules once our shares are quoted on the over-the-counter bulletin board, the level of trading activity in our stock may be reduced.

Broker-dealer practices in connection with transactions in "penny stocks" are regulated by penny stock rules adopted by the Securities and Exchange Commission. Penny stocks generally are equity securities with a price of less than $5.00 (other than securities registered on some national securities exchanges or quoted on Nasdaq). The penny stock rules require a broker-dealer, prior to a transaction in a penny stock not otherwise exempt from the rules, to deliver a standardized risk disclosure document that provides information about penny stocks and the nature and level of risks in the penny stock market. The broker-dealer also must provide the customer with current bid and offer quotations for the penny stock, the compensation of the broker-dealer and its salesperson in the transaction, and, if the broker-dealer is the sole market maker, the broker-dealer must disclose this fact and the broker-dealer's presumed control over the market, and monthly account statements showing the market value of each penny stock held in the customer's account. In addition, broker-dealers who sell these securities to persons other than established customers and "accredited investors" must make a special written determination that the penny stock is a suitable investment for the purchaser and receive the purchaser's written agreement to the transaction. Consequently, these requirements may have the effect of reducing the level of trading activity, if any, in the secondary market for a security subject to the penny stock rules, and investors in our common stock may find it difficult to sell their shares.

If our shares are quoted on the over-the-counter bulletin board, we will be required to remain current in our filings with the SEC and our securities will not be eligible for quotation if we are not current in our filings with the SEC.

In the event that our shares are quoted on the over-the-counter bulletin board, we will be required order to remain current in our filings with the SEC in order for shares of our common stock to be eligible for quotation on the over-the-counter bulletin board. In the event that we become delinquent in our required filings with the SEC, quotation of our common stock will be terminated following a 30 or 60 day grace period if we do not make our required filing during that time. If our shares are not eligible for quotation on the over-the-counter bulletin board, investors in our common stock may find it difficult to sell their shares.

This prospectus contains forward-looking statements that involve risks and uncertainties. We use words such as anticipate, believe, plan, expect, future, intend and similar expressions to identify such forward-looking statements. The actual results could differ materially from our forward-looking statements. Our actual results are most likely to differ materially from those anticipated in these forward-looking statements for many reasons, including the risks faced by us described in this Risk Factors section and elsewhere in this prospectus.

We will not receive any proceeds from the sale of the common stock offered through this prospectus by the selling shareholders.

The $0.05 per share offering price of our common stock was arbitrarily chosen using the last sales price of our stock from our most recent private offering of common stock. There is no relationship between this price and our assets, earnings, book value or any other objective criteria of value.

We intend to apply to the NASD over-the-counter bulletin board for the quotation of our common stock upon our becoming a reporting entity under the Securities Exchange Act of 1934. We intend to file a registration statement under the Exchange Act concurrently with the effectiveness of the registration statement of which this prospectus forms a part. If our common stock becomes so traded and a market for the stock develops, the actual price of stock will be determined by prevailing market prices at the time of sale or by private transactions negotiated by the selling shareholders. The offering price would thus be determined by market factors and the independent decisions of the selling shareholders.

The common stock to be sold by the selling shareholders is common stock that is currently issued and outstanding. Accordingly, there will be no dilution to our existing shareholders.

Selling Shareholders

The selling shareholders named in this prospectus are offering all of the 640,000 shares of common stock offered through this prospectus. All of the shares were acquired from us by the selling shareholders in offerings that were exempt from registration pursuant to Rule 504 of Regulation D of the Securities Act of 1933. The selling shareholders purchased their shares in two offerings completed on September 30, 2008 and October 31, 2008.

The following table provides information regarding the beneficial ownership of our common stock held by each of the selling shareholders as of October 31, 2008 including:

1. the number of shares owned by each prior to this offering;

2. the total number of shares that are to be offered by each;

3. the total number of shares that will be owned by each upon completion of the offering;

4. the percentage owned by each upon completion of the offering; and

5. the identity of the beneficial holder of any entity that owns the shares.

The named party beneficially owns and has sole voting and investment power over all shares or rights to the shares, unless otherwise shown in the table. The numbers in this table assume that none of the selling shareholders sells shares of common stock not being offered in this prospectus or purchases additional shares of common stock, and assumes that all shares offered are sold. The Percentages are based on 2,140,000 shares of common stock outstanding on November 30, 2008.

Name of Selling Shareholder | Shares Owned Prior to this Offering | Total Number of Shares to be Offered for Selling Shareholder Account | Total Shares to be Owned Upon Completion of this Offering | Percent Owned Upon Completion of this Offering |

Nancy Abercrombie 3735 Annie Oakley Dr. Las Vegas, NV 89121 | 10,000 | 10,000 | zero | zero |

Emily Arnone 112 Arthur St. Garden City, NY 11530 | 20,000 | 20,000 | zero | zero |

Janet Bergman 6024 W. Pinedale Ave. Fresno, CA 93722 | 20,000 | 20,000 | zero | zero |

George Bierbaum PO Box 13 Cheraw CO 81030 | 10,000 | 10,000 | zero | zero |

Daniel Bishop 3735 Annie Oakley Dr. Las Vegas, NV 89121 | 10,000 | 10,000 | zero | zero |

| | | | | |

Nancy Brignoni 224 Juniata St. Freemansburg, PA. 18017 | 20,000 | 20,000 | zero | zero |

Ruben Brignoni 224 Juniata St. Freemansburg PA. 18017 | 20,000 | 20,000 | zero | zero |

Pam Brown 11961 Madison St. NE Blaine MN 55434 | 20,000 | 20,000 | zero | zero |

Charles DiPinto 3098 Harbor Height Las Vegas, NV 89117 | 10,000 | 10,000 | zero | zero |

Karlyle Fonger 4908 Hildago Way Las Vegas, NV 89121 | 20,000 | 20,000 | zero | zero |

Karen Goedderz 4908 Hildago Way Las Vegas, NV 89121 | 20,000 | 20,000 | zero | zero |

Linda Greenblatt 1753 Honeytree Dr. Las Vegas, NV 89144 | 10,000 | 10,000 | zero | zero |

Jennifer Hafer 3136 Glen Ave. Gaston PA. 18045 | 20,000 | 20,000 | zero | zero |

Patricia Hafer 31 Katta Dr. Cherokee Village, AR 72529 | 20,000 | 20,000 | zero | zero |

Todd Hafer 3136 Glen Ave. Gaston PA. 18045 | 20,000 | 20,000 | zero | zero |

Claudia Hartman 5325 Nellie Bell Las Vegas, NV 89118 | 10,000 | 10,000 | zero | zero |

Erica Howie 1011 W 25th Ave. Spokane WA 99203 | 20,000 | 20,000 | zero | zero |

Richard Howie 1011 W 25th Ave. Spokane WA 99203 | 20,000 | 20,000 | zero | zero |

Victoria Howie 1011 W 25th Ave. Spokane WA 99203 | 20,000 | 20,000 | zero | zero |

Winford E. Jensen Jr. 5773 Bass Circle Fort Myers, FL 33919 | 20,000 | 20,000 | zero | zero |

| | | | | |

Thomas Manganaro 17 Ommulgee Dr. PO Box 847 Cherokee Village, AR 72525 | 20,000 | 20,000 | zero | zero |

Crystal Miller 9108 Driftwood Cove Ct. Las Vegas, NV 89117 | 20,000 | 20,000 | zero | zero |

Greg Miller 9108 Driftwood Cove Ct. Las Vegas, NV 89117 | 20,000 | 20,000 | zero | zero |

Stephen Mullen 2721 Breakers Creek Dr. Las Vegas, NV 89134 | 20,000 | 20,000 | zero | zero |

Thomas Penna 17310 Chameleon St. NW Ramsey, MN 55303 | 20,000 | 20,000 | zero | zero |

Wendy Penna 17310 Chameleon St. NW Ramsey, MN 55303 | 20,000 | 20,000 | zero | zero |

Aaltje L Sampson 7716 W. Rutter Parkway Spokane WA 99208 | 40,000 | 40,000 | zero | zero |

Joshua E. Sampson 6050 Sycamore Lane NE Bremerton WA. 98311 | 20,000 | 20,000 | zero | zero |

Sara L Clements-Sampson 6050 Sycamore Lane NE Bremerton WA. 98311 | 20,000 | 20,000 | zero | zero |

Suganya Sockalingam 2721 Breakers Creek Dr. Las Vegas, NV 89134 | 20,000 | 20,000 | zero | zero |

Cathleen A. Turgeon 7622 Landau Dr. Bloomington, MN 55438 | 20,000 | 20,000 | zero | zero |

Arttours Weeden 5330 Krista Alethea St. Las Vegas, NV 89031 | 10,000 | 10,000 | zero | zero |

Carol JK Williams 9519 Briar Circle Bloomington MN 55437 | 20,000 | 20,000 | zero | zero |

John Williams 9519 Briar Circle Bloomington MN 55437 | 20,000 | 20,000 | zero | zero |

Cynthia Wilson PO Box 13 Cheraw CO 81030 | 10,000 | 10,000 | zero | zero |

| TOTAL | 640,000 | 640,000 | | |

None of the selling shareholders: (1) has had a material relationship with us other than as a shareholder at any time within the past three years; or (2) has ever been one of our officers or directors:

Plan of Distribution

The selling shareholders may sell some or all of their common stock in one or more transactions, including block transactions:

| 1. | on such public markets or exchanges as the common stock may from time to time be trading; |

| 2. | in privately negotiated transactions; |

| 3. | through the writing of options on the common stock; |

| 5. | in any combination of these methods of distribution. |

The sales price to the public is fixed at $0.05 per share until such time as the shares of our common stock become traded on the NASD Over-The-Counter Bulletin Board or another exchange. Although we intend to apply for quotation of our common stock on the NASD Over-The-Counter Bulletin Board, public trading of our common stock may never materialize. If our common stock becomes traded on the NASD Over-The-Counter Bulletin Board, or another exchange, then the sales price to the public will vary according to the selling decisions of each selling shareholder and the market for our stock at the time of resale. In these circumstances, the sales price to the public may be:

1. the market price of our common stock prevailing at the time of sale;

2. a price related to such prevailing market price of our common stock, or;

3. such other price as the selling shareholders determine from time to time.

The shares may also be sold in compliance with the Securities and Exchange Commission's Rule 144.

The selling shareholders may also sell their shares directly to market makers acting as agents in unsolicited brokerage transactions. Any broker or dealer participating in such transactions as an agent may receive a commission from the selling shareholders or from such purchaser if they act as agent for the purchaser. If applicable, the selling shareholders may distribute shares to one or more of their partners who are unaffiliated with us. Such partners may, in turn, distribute such shares as described above.

We are bearing all costs relating to the registration of the common stock. The selling shareholders, however, will pay any commissions or other fees payable to brokers or dealers in connection with any sale of the common stock.

The selling shareholders must comply with the requirements of the Securities Act of 1933 and the Securities Exchange Act in the offer and sale of the common stock. In particular, during such times as the selling shareholders may be deemed to be engaged in a distribution of the common stock, and therefore be considered to be an underwriter, they must comply with applicable law and may, among other things:

1. not engage in any stabilization activities in connection with our common stock;

2. furnish each broker or dealer through which common stock may be offered, such copies of this

prospectus, as amended from time to time, as may be required by such broker or dealer; and;

3. not bid for or purchase any of our securities or attempt to induce any person to purchase any of

our securities other than as permitted under the Securities Exchange Act.

Description of Securities

Common Stock

We have 50,000,000 common shares authorized, with a par value of $0.001 per share, of which 2,140,000 shares were outstanding as of January 31, 2009.

Voting Rights

Holders of common stock have the right to cast one vote for each share of stock in his or her own name on the books of the corporation, whether represented in person or by proxy, on all matters submitted to a vote of holders of common stock, including the election of directors. There is no right to cumulative voting in the election of directors. Except where a greater requirement is provided by statute or by the Articles of Incorporation, or by the Bylaws, the presence, in person or by proxy duly authorized, of the holder or holders of a majority of the outstanding shares of the our common voting stock shall constitute a quorum for the transaction of business. The vote by the holders of a majority of such outstanding shares is also required to effect certain fundamental corporate changes such as liquidation, merger or amendment of the Company's Articles of Incorporation.

Dividends

There are no restrictions in our articles of incorporation or bylaws that prevent us from declaring dividends. The California Statutes, however, do prohibit us from declaring dividends where after giving effect to the distribution of the dividend:

1. We would not be able to pay our debts as they become due in the usual course of business, or;

2. Our total assets would be less than the sum of our total liabilities plus the amount that would be needed to satisfy the rights of shareholders who have preferential rights superior to those receiving the distribution.

We have not declared any dividends and we do not plan to declare any dividends in the foreseeable future.

Pre-emptive Rights

Holders of common stock are not entitled to pre-emptive or subscription or conversion rights, and there are no redemption or sinking fund provisions applicable to the Common Stock. All outstanding shares of common stock are, and the shares of common stock offered hereby will be when issued, fully paid and non-assessable.

Share Purchase Warrants

We have not issued and do not have outstanding any warrants to purchase shares of our common stock.

Options

We have not issued and do not have outstanding any options to purchase shares of our common stock.

Convertible Securities

We have not issued and do not have outstanding any securities convertible into shares of our common stock or any rights convertible or exchangeable into shares of our common stock.

Transfer Agent

Quicksilver Stock Transfer of Las Vegas, Nevada.

Interests of Named Experts and Counsel

No expert or counsel named in this prospectus as having prepared or certified any part of this prospectus or having given an opinion upon the validity of the securities being registered or upon other legal matters in connection with the registration or offering of the common stock was employed on a contingency basis, or had, or is to receive, in connection with the offering, a substantial interest, direct or indirect, in the registrant or any of its parents or subsidiaries. Nor was any such person connected with the registrant or any of its parents or subsidiaries as a promoter, managing or principal underwriter, voting trustee, director, officer, or employee.

Wendy E. Miller our independent legal counsel has provided an opinion on the validity of our common stock.

Moore & Associates, Chtd, Certified Public Accountants, has audited our financial statements included in this prospectus and registration statement to the extent and for the periods set forth in their audit report. Moore & Associates, Chtd. has presented their report with respect to our audited financial statements. The report of Moore & Associates, Chtd. is included in reliance upon their authority as experts in accounting and auditing.

Barry J. Price, Consulting Geologist has provided a geological evaluation report on the “Sallus Creek” mineral property. He was employed on a flat rate consulting fee and he has no interest, nor does he expect any interest in the property or securities of the Sallus Creek Property.

Description of Business

1. Summary

The Company has acquired an exclusive option to obtain a 100% interest in a group of mining claims in the Lillooet Mining District of British Columbia, Canada, subject to 2% Net Smelter Returns royalty.

The terms of the Option Agreement (a copy of which is attached herein as Exhibit 2) are as follows:

The Optionor grants to the Optionee the exclusive right and option, to acquire a 100% undivided interest in the Property free and clear of all charges, encumbrances and claims, save and except for those set out herein.

2.1 Option shall be exercised by the Optionee:

(a) (i) paying to the Optionor $5,000 Cdn. forthwith on or before May 31, 2007;

(ii) paying to the Optionor an additional $5,000 Cdn. on or before December 31, 2008;

(iii) paying to the Optionor an additional $10,000 Cdn. on or before December 31, 2009.

(b) (i) incurring Exploration Expenditures of $10,000 Cdn. on the Property on or before December 31, 2009, or if weather does not allow reasonable access to the property at that time, the work to be completed at such other time as agreed by the parties;

(ii) incurring additional Exploration Expenditures of $50,000 Cdn. on the Property on or before December 31, 2010;

(iii) incurring additional Exploration Expenditures of $100,000 Cdn. on the Property on or before December 31, 2011.

The Option shall be deemed to be exercised upon the Optionee making all payments and

Incurring all Exploration Expenditures in accordance with this Paragraph (a) and (b).

On or before October 31 of each subsequent year and for as long as the Optionor retains a Royalty in the Property either the Optionee or the Owner, as the case may be, shall incur US$250,000 in Exploration Expenditures on the Property.

In the event that the Optionee or the Owner, as the case may be, in any of the above periods incurs more than the specified sum of Exploration Expenditures, the excess shall be carried forward and applied to the Exploration Expenditures to be incurred in succeeding periods.

In the event that the Optionee or the Owner, as the case may be, in any of the above periods incurs less than the specified sum of Exploration Expenditures, it may pay to the Optionor the difference between the amount it actually spent and the specified sum in full satisfaction of the Exploration Expenditures to be incurred.

The Optionee will not be bound to make any payment under subsection 2.2, other than the cash payment under Paragraph 2.2 (a) (i), but the Option will terminate and either the Optionee or the Owner, as the case may be, will forfeit all previous payments if any payment or Exploration Expenditure is not made in accordance with subsections 2.2 and 2.3

The Company intends to conduct mineral exploration on the optioned mining claims in an effort to find economically developable deposits of precious metals.

Employees

The Company currently has two employees, its President, Steve Friberg, and it’s Secretary/Treasurer, Dan Decker who work for the Company on a part-time basis.

We are an exploration stage company that intends to engage in the exploration of mineral properties. We have acquired a mineral claim that we refer to as the Sallus Creek Property mineral claim. Exploration of this mineral claim is required before a final determination as to its viability can be made.

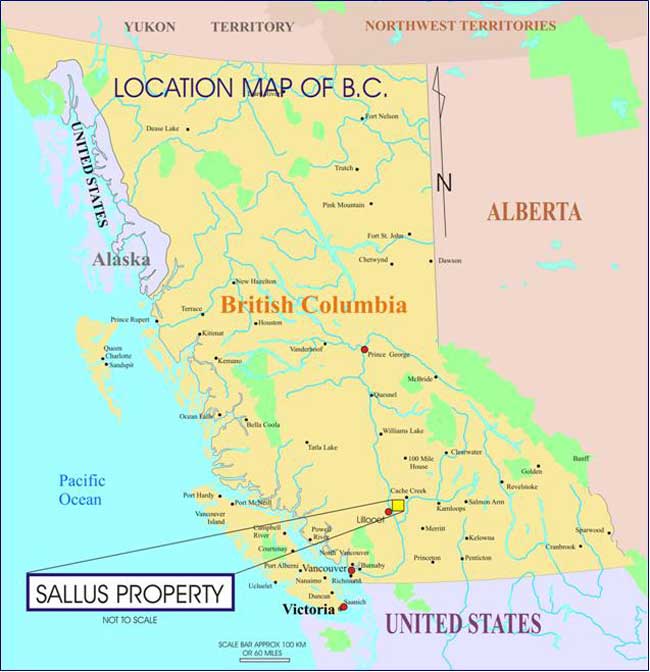

The property is located approximately 10 km north of Lillooet in BC. The property lies north of the Trans Canada Highway, approximately 9 km north of the Salmon Pond access road, and west of the Gander River.

Our plan of operations is to carry out exploration work on this claim in order to ascertain whether it possesses commercially exploitable quantities of copper/molybdenum and other metals. We will not be able to determine whether or not the Sallus Creek Property mineral claim contains a commercially exploitable mineral deposit, or reserve, until appropriate exploratory work is done and an economic evaluation based on that work indicates economic viability.

Phase I of our exploration program will begin in the summer of 2009 and will cost approximately $28,000 Cdn. This phase will consist of an on-site surface preliminary prospecting and mapping program to examine the porphyry style mineralization and to plan a preliminary drill program. Phase II of our program would consist of a 1500 meter drill program which would likely be helicopter supported and geochemical analyses of the various samples gathered. Phase II of our exploration program will cost approximately $400,000 Cdn and will commence in the late summer or early fall of 2009 followed by preparation of a report and data compilation. The existence of commercially exploitable mineral deposits in the Sallus Creek Property mineral claim is unknown at the present time and we will not be able to ascertain such information until we receive and evaluate the results of our exploration program.

Acquisition of the Sallus Creek Property mineral claim

We have acquired an option to purchase a 100% interest in the Sallus Creek Property mineral claim located in British Columbia, Canada. Mr. McClaren’s ownership in the Sallus Creek Property claim was electronically staked and recorded under the electronic mineral claim staking and recording procedures of the Online Mineral Claims Staking System administered by the Department of Natural Resources, Government of British Columbia, Canada. A party is able to stake and record an interest in a particular mineral claim if no other party has an interest in the said claim that is in good standing and on record. There is no formal agreement between us and/or our subsidiary and the Government of British Columbia.

The Sallus Creek Property claim is administered under the Mineral Act of British Columbia. Mr. McClaren’s interest in the Sallus Creek Property mineral claim will continue for up to twenty years provided that the minimum required expenditures toward exploration work on the claim are made in compliance with the Act. The required amount of expenditures toward exploration work is set by the Province of British Columbia and can be altered in its sole discretion. Currently, the amount required to be expended annually for exploration work within the first year that the mineral claim is acquired is $200 per claim. The required expenditures per claim increase gradually each year up to a maximum of $1,200 per claim for the sixteenth year and beyond. Within 60 days following the anniversary date of the claim, an assessment report on the work performed must be submitted to the Mineral Claims Recorder. Every five years, renewal fee of between $25 and $100 per claim is also required.

We selected the Sallus Creek Property mineral property based upon an independent geological report which was commissioned from Barry J. Price, a Consulting Geologist. Mr. Price recommended an exploration program on this claim which could cost us approximately $428,000 Cdn.

DESCRIPTION OF PROPERTY

The “Sallus” mineral claims located within the Lillooet Mining Division of British Columbia:

| 588045 | Mineral | SALLUS | 117354 (100%) | 092I | 2009/Jul/09 | GOOD | Lillooet M.D. |

| | | | | | | | |

| 588046 | Mineral | SALLUS 2 | 117354 (100%) | 092I | 2009/Jul/09 | GOOD | Lillooet M.D. |

Geological Exploration Program in General

We have obtained an independent Geological Report and have an option to acquire a 100% ownership interest in the Sallus Creek Property mineral claim. Barry J. Price, Consulting Geologist, has prepared this Geological Report and reviewed all available exploration data completed on this mineral claim.

Mr. Price is an Independent Consulting Geologist with offices at Ste. 1028 – 470 Granville Street, Vancouver, BC, telephone: (604) 682-1501.

He graduated from the University of British Columbia in Vancouver, BC, in 1965 with a Bachelors Degree in Science (B.Sc) (Honours), in the field of Geology, and received a further degree of Master of Science (M.Sc) in Economic Geology from the same University in 1972.

He has practiced as a Geologist for the past 40 years in the fields of Mining Exploration, Oil and Gas Exploration, and Geological Consulting. He has also been the author of a considerable number of Qualifying Reports, Technical Reports and Opinions of Value for junior companies in the past 35 years.

The property that is the subject of the Sallus Creek Property mineral claim is undeveloped and does not contain any open-pit or underground mines which can be rehabilitated. There is no commercial production plant or equipment located on the property that is the subject of the mineral claim. Currently, there is no power supply to the mineral claims. We have not yet commenced the field work phase of our initial exploration program. Exploration is currently in the planning stages. Our exploration program is exploratory in nature and there is no assurance that mineral reserves will be found. The details of the Geological Report are provided below.

Sallus Creek Property Mineral Claim Geological Report, Dated Aug 15, 2008

A primary purpose of the geological report is to review information, if any, from the previous exploration of the mineral claims and to recommend exploration procedures to establish the feasibility of commercial production project on the mineral claims. The summary report lists results of the history of the exploration of the mineral claims, the regional and local geology of the mineral claims and the mineralization and the geological formations identified as a result of the prior exploration. The summary report also gave conclusions regarding potential mineralization of the mineral claims and recommended a further geological exploration program.

Exploration Potential of the Sallus Creek Property Mineral Claim

Previous sampling by the Johns-Manville Company yielded copper/Molybdenum anomalies on ground currently covered by the Sallus Creek Property claims. The claims are underlain by rocks of similar age and lithology as those in which gold anomalies are currently being developed by Paragon Minerals Corp. on their nearby Appleton Linear and JBP claims.

The Sallus Creek area is underlain by the western contact of the Early Jurassic Mount Martley stock which intrudes the Western belt of the Cache Creek Complex (mainly sedimentary rocks including shales and limestones), the stock is a medium to course grained, massive granodiorite with local secondary silicification and serictization near the contacts. Pervasive quartz veins and aplite dikes are found within the stock near the contact. Intense thermal alteration of the sediments is evident near the contact of the stock and disseminated copper mineralization was seen. Limestone, in part, is totally recrystallized. Intense pyritization of the argillites is observed near the contacts, evidenced on surface by rust colorization and gossans.

Within the claims, a plug of rusty, weathered and altered diorite and quartz diorite intrudes argillite. This plus has a very irregular contact, approximately 914 meters long by 609 meters wide, and is probably genetically related to the Mount Martley stock, 1600 meters to the east. Pyrite is abundantly disseminated and smeared along fracture faces throughout the diorite. Very fine traces of native copper have been recognized in the highly weathered diorite. Malachite stain is evident in the diorite.

The Sallus Creek Claim bock is located 10 miles Northeast of Lillooet, British Columbia (N.T.S 92 I/071 and 072) between Gibbs Creek on the south and Sallus Creek on the north. Access is from Lillooet via a secondary road on the east side of the Fraser River to a logging road about 1.3 miles north of Gibbs Creek, and thence eastward to the claims. Four wheel drive vehicles are recommended. Helicopter access to some sites may be more practical, and a helicopter company is based in Lillooet.

No visit to the property has yet been made by us or our consulting geologists.

Recommendations from Our Consulting Geologist

A preliminary prospecting and mapping program could be done initially to examine the porphyry style mineralization and to plan a preliminary drill program of about 5 diamond core holes of about 200-300 meters each. This would assess the likelihood of substantial copper porphyry on the property. The area of the Mt. Martley stock should be prospected and staked if additional porphyry style mineralization is suspected.

Exploration Budget

| Phase I | Exploration Expenditure |

| Geological supervision | $7,500 |

| Helper | 2,500 |

| Vehicle | 1,250 |

| Food, lodging, or camp costs | 1,250 |

| Field, camp supplies | 500 |

| Helicopter | 6,250 |

| Samples | 1,875 |

| Mob and Demob | 500 |

| Cell Phone/Radio | 100 |

| Reports and Drafting | 2,000 |

| Reclamation Bond | 0 |

| Subtotal (Rounded) | 24,000 |

| GST at 6% | 1,400 |

| Contingency 10% | 2,400 |

| Total Phase I (Rounded) | $28,000 |

In US (at date of prospectus) | $22,400 |

| | |

| | |

| Phase II | |

| This phase would be contingent on favorable results from Phase I | |

| Geological Supervision | $15,000 |

| Helper | 5,000 |

| Vehicle | 2,500 |

| Food, Lodging, or camp costs | 3,000 |

| Field, camp supplies | 5,500 |

| Helicopter | 75,000 |

| Heli Transportable Drill | 187,500 |

| Samples | 15,000 |

| Mob and Demob | 3,000 |

| Cell Phone/Radio | 500 |

| Reports and Drafting | 10,000 |

| Reclamation Bond | 10,000 |

| Subtotal (Rounded) | 330,000 |

| GST at 6% | 20,000 |

| Contingency 15% | 50,000 |

| Total Phase I (Rounded) | $400,000 |

In US (at date of prospectus) | $320,000 |

| | |

While we have not commenced the field work phase of our initial exploration program, we intend to begin the initial exploratory work as recommended. We expect that Phase I will begin in the summer of 2009, with Phase II to follow, depending on the initial results. Upon our review of the results, we will assess whether the results are sufficiently positive to warrant proceeding to Phase II and any additional phases of the exploration program. We will make the decision to proceed with any further programs based upon our consulting geologist’s review of the results and recommendations. In order to complete significant additional exploration beyond the currently planned Phase I, we will need to raise additional capital.

Competition

Competition and unforeseen limited sources of supplies in the industry could result in occasional spot shortages of supplies like dynamite, and equipment like bulldozers and excavators that we might need to conduct exploration. We have not attempted to locate or negotiate with any suppliers of products, equipment or materials. We will attempt to locate products, equipment and materials after this Offering is complete. If we cannot find the products and equipment we need, we will have to suspend our exploration plans until we do find the products and equipment we need.

Compliance with Government Regulation

The main agency that governs the exploration of minerals in the Province of British Columbia is the Department of Natural Resources.

The Department of Natural Resources manages the development of British Columbia’s mineral resources, and implements policies and programs respecting their development while protecting the environment. In addition, the Department regulates and inspects the exploration and mineral production industries in British Columbia to protect workers, the public and the environment.

The material legislation applicable to Rider Exploration, Inc. is the Mineral Act of British Columbia. Any person who intends to conduct an exploration program on a staked or licensed area must submit prior notice with a detailed description of the activity to the Department of Natural Resources. An exploration program that may result in major ground disturbance or disruption to wildlife or wildlife habitat must have an Exploration Approval from the department before the activity can commence.

We will also have to sustain the cost of reclamation and environmental remediation for all exploration work undertaken. Both reclamation and environmental remediation refer to putting disturbed ground back as close to its original state as possible. Other potential pollution or damage must be cleaned-up and renewed along standard guidelines outlined in the usual permits. Reclamation is the process of bringing the land back to its natural state after completion of exploration activities. Environmental remediation refers to the physical activity of taking steps to remediate, or remedy any environmental damage caused such as refilling trenches after sampling or cleaning up fuel spills. Our initial exploration program does not require any reclamation or remediation because of minimal disturbance to the ground. The amount of these costs is not known at this time because we do not know the extent of the exploration program we will undertake, beyond completion of the recommended exploration phase described above, or if we will enter into production on the property. Because there is presently no information on the size, tenor, or quality of any resource or reserve at this time, it is impossible to assess the impact of any capital expenditures on our earnings or competitive position in the event a potentially-economic deposit is discovered.

Research and Development Expenditures

We have not incurred any research or development expenditures since our incorporation.

Subsidiaries

We do not currently have any subsidiaries.

Patents and Trademarks

We do not own, either legally or beneficially, any patent or trademark.