Exhibit 99.2

PALMAREJO PROJECT

SW Chihuahua State, Mexico

YE 2012 - TECHNICAL REPORT

Prepared for Franco-Nevada Corporation

January 1, 2013

Prepared by or under the Supervision of:

Donald J. Birak, Senior Vice President - Exploration, Coeur d’Alene Mines Corporation, a Qualified Person under NI 43-101, Fellow AusIMM, Member SME.

Keith Blair, Manager, Applied Geoscience LLC, a Qualified Person under NI 43-101, Member AIPG (CPG).

Klaus Triebel, Senior Corporate Resource Geologist, Coeur d’Alene Mines Corporation, a Qualified Person under NI 43-101, Member AIPG (CPG).

1

TABLE OF CONTENTS

SECTION | | PAGE |

| |

SECTION 1 - SUMMARY | 13 |

1.1 Property Description and Location | 13 |

1.2 Exploration | 14 |

1.3 Status of Development and Mine Operations | 14 |

1.4 Mineral Resource and Mineral Reserve Estimates | 15 |

1.5 Economic Analysis | 18 |

1.6 Conclusions and Recommendations | 22 |

SECTION 2 - INTRODUCTION | 23 |

SECTION 3 - RELIANCE ON OTHER EXPERTS | 24 |

SECTION 4 - PROPERTY DESCRIPTION AND LOCATION | 25 |

4.1 Property Description and Location | 25 |

4.2 Land Tenure | 26 |

4.2.1 Mining Concession Agreements | 29 |

4.2.2 Ejido Agreements | 33 |

4.2.3 Royalty Agreement | 35 |

SECTION 5 - ACCESSIBILITY, CLIMATE, LOCAL RESOURCES, INFRASTRUCTURE AND PHYSIOGRAPHY | 36 |

5.1 Accessibility | 36 |

5.2 Climate | 36 |

5.3 Local Resources and Infrastructure | 36 |

5.4 Physiography and Vegetation | 37 |

SECTION 6 - HISTORY | 40 |

6.1 Exploration and Mining History | 40 |

6.2 Historic Resource Estimates | 42 |

6.2.1 NI 43-101 Compliant Mineral Resource Estimates | 42 |

6.3 Palmarejo Mine - Coeur Mexicana Production | 51 |

SECTION 7 - GEOLOGIC SETTING and MINERALIZATION | 52 |

7.1 Regional Geology | 52 |

7.2 Regional Mineralization | 54 |

7.3 Palmarejo Area | 56 |

7.4 Guadalupe Area | 60 |

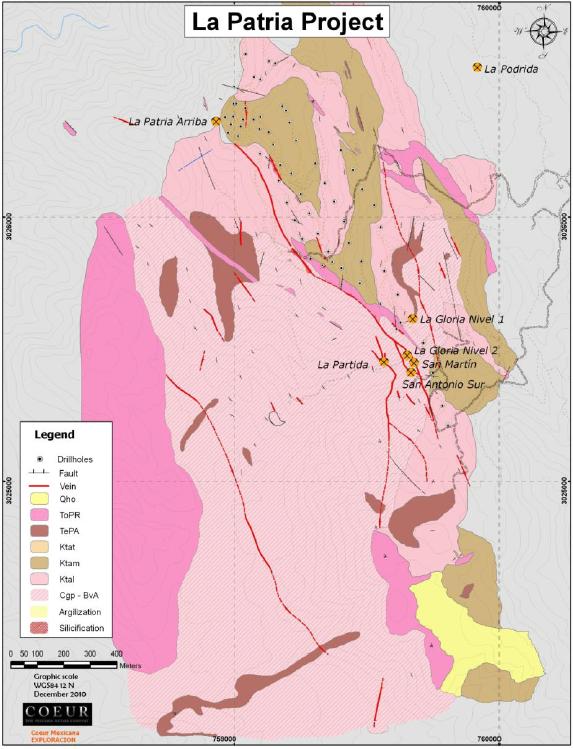

7.5 La Patria Area | 66 |

7.6 Other Areas of Mineralization | 69 |

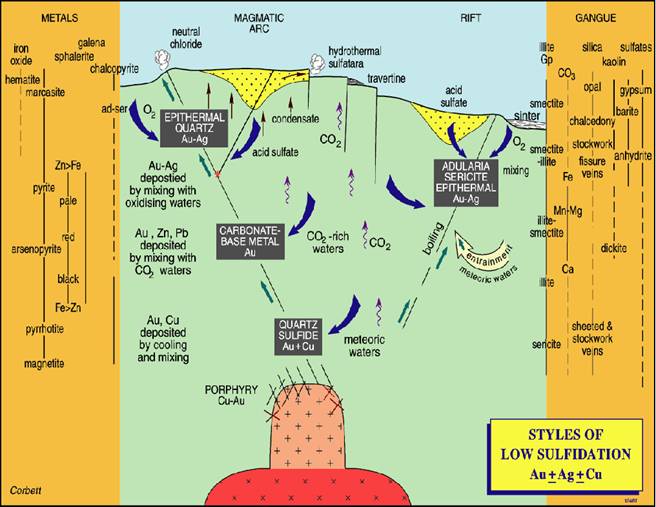

SECTION 8 - DEPOSIT TYPES | 71 |

SECTION 9 - EXPLORATION | 73 |

9.1 Planet Gold Exploration, 2003-2007 | 73 |

9.2 Coeur Mexicana Exploration 2008-Present | 75 |

SECTION 10 - DRILLING | 76 |

10.1 Pre-Coeur Mexicana Drilling - Planet Gold Drilling (2003-2007) | 76 |

10.2 Coeur Mexicana Drilling | 77 |

10.3 Core Drilling and Logging | 77 |

10.4 Reverse Circulation Drilling and Logging | 78 |

10.5 Sampling Method and Approach Summary | 78 |

10.6 Diamond Drilling Sampling | 79 |

2

10.7 Reverse Circulation Drilling Sampling | 79 |

SECTION 11 - SAMPLE PREPARATION, ANALYSIS, AND SECURITY | 81 |

11.1 Historic QA/QC and Third Party Reviews | 81 |

11.1.1 Historic Palmarejo QA/QC Program Review by Applied Geoscience, LLC | 81 |

11.1.2 AMEC’s 2008 Review of Palmarejo QA/QC | 83 |

11.1.3 Guadalupe Project Historic QA/QC and Third Party Reviews | 84 |

11.1.4 La Patria Project QA/QC Review | 84 |

11.1.5 Third Party Reviews of Historic QA/QC - Discussion and Recommendations | 85 |

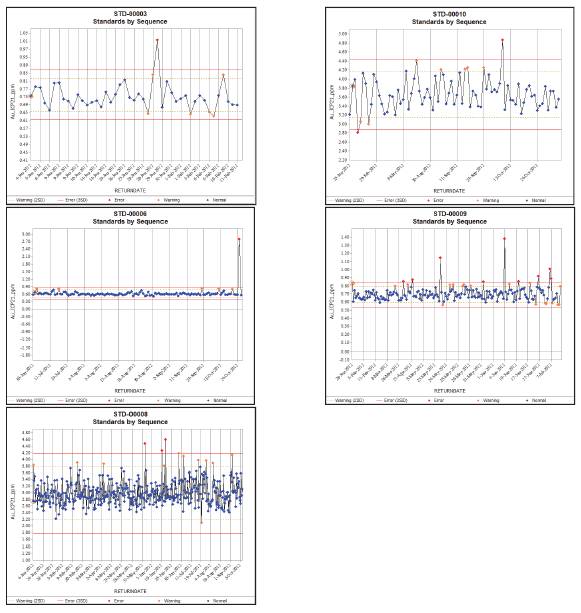

11.2 Coeur QA/QC Programs | 86 |

11.2.1 Coeur QA/QC Summary - Palmarejo Deposit | 86 |

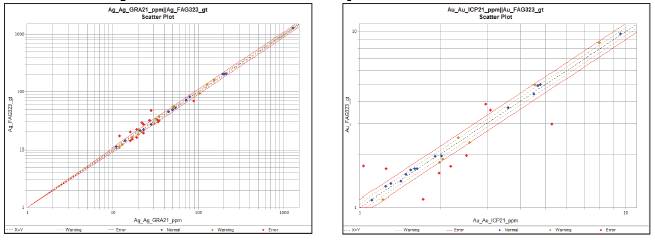

11.2.1.1 QAQC Results Palmarejo Exploration and Production Sampling 2012 | 86 |

11.2.1.2 2012 QA/QC Palmarejo Mine Area Exploration and Production | 87 |

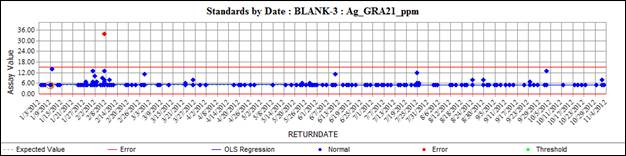

11.2.2 Coeur QA/QC Summary - Guadalupe, La Patria and District Exploration Targets | 100 |

11.2.2.1 Earlier QA/QC Programs | 100 |

11.2.2.2 NCL Audit | 100 |

11.2.2.3 Palmarejo District QA/QC (excluding Palmarejo mine area) QA/QC Discussion and Recommendations | 101 |

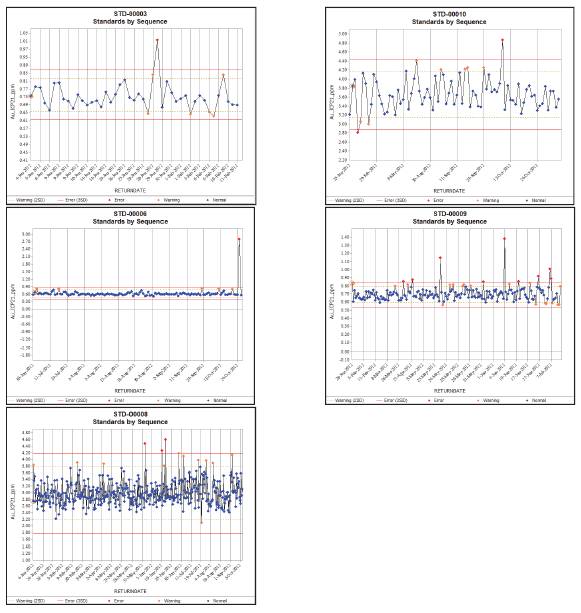

11.2.2.4 QAQC Results Guadalupe, La Patria and Other Exploration Sampling 2012 | 102 |

SECTION 12 - DATA VERIFICATION | 115 |

12.1 Assays | 115 |

12.1.1 External Audit of Assays in AcQuire | 115 |

12.1.2 Internal Assay Validation | 116 |

12.2 Palmarejo | 116 |

12.3 Guadalupe | 116 |

12.4 La Patria | 117 |

12.4.1 Internal Geology Validation | 118 |

12.5 Site Visit | 118 |

SECTION 13 - MINERAL PROCESSING AND METALLURGICAL TESTING | 119 |

13.1 Historic Third Party Test Programs Summary | 119 |

13.2 Palmarejo Metallurgical Test work Summary | 121 |

13.3 Guadalupe Metallurgical Test work Summary | 133 |

13.4 La Patria Metallurgical Test work Summary | 137 |

SECTION 14 - MINERAL RESOURCES | 142 |

14.1 Mineral Resource Estimation Methodology Palmarejo Deposit | 142 |

14.1.1 Assay Data | 142 |

14.1.2 Material Density | 143 |

14.1.3 Geology Modeling | 144 |

14.1.4 Exploratory Data Analysis (EDA) | 150 |

14.1.5 Block Model Validation | 165 |

14.1.6 Resource Classification | 174 |

14.1.7 Statement of Mineral Resources Palmarejo Deposit | 174 |

14.2 Mineral Resource Estimation Methodology Guadalupe Deposit | 176 |

14.2.1 Data | 176 |

14.2.2 Density | 177 |

14.2.3 Deposit Geology Pertinent to Resource Modeling | 178 |

14.2.4 Exploratory Data Analysis (EDA) | 181 |

14.2.5 Block Model Estimation Methodology Guadalupe | 185 |

14.2.6 Block Model Validation | 187 |

14.2.7 Classification Scheme | 192 |

3

14.2.8 Statement of Mineral Resources Guadalupe Deposit | 193 |

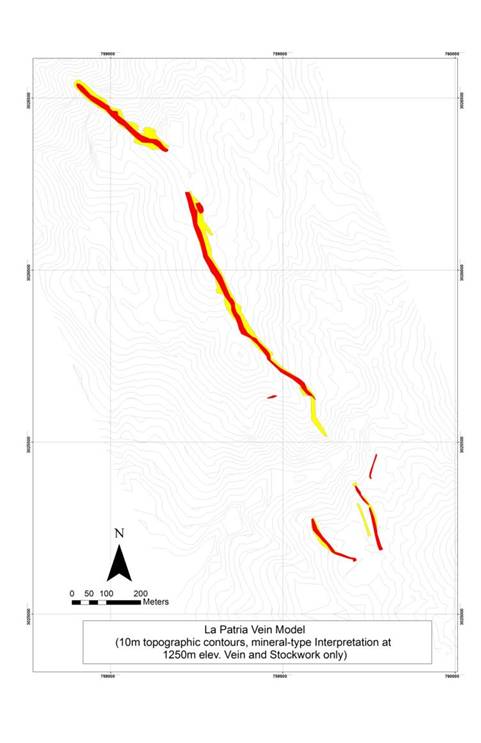

14.3 Mineral Resource Estimation Methodology La Patria | 195 |

14.3.1 Data | 195 |

14.3.2 Material Density | 196 |

14.3.3 Geological Model | 197 |

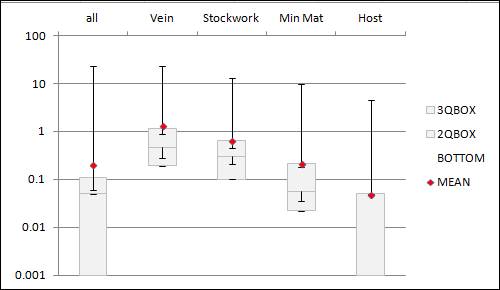

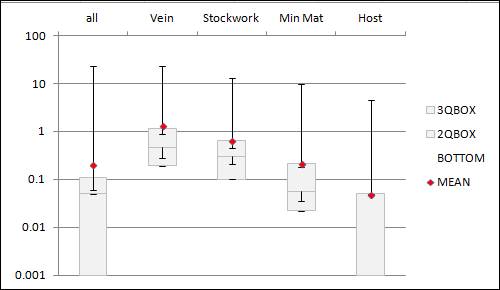

14.3.4 Exploratory Data Analysis (EDA) | 200 |

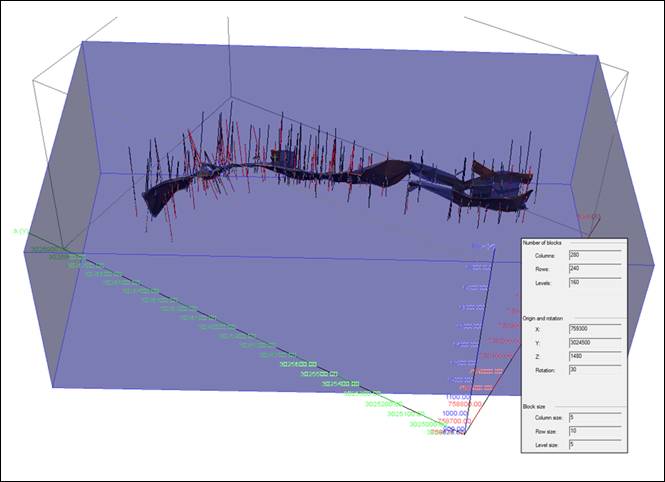

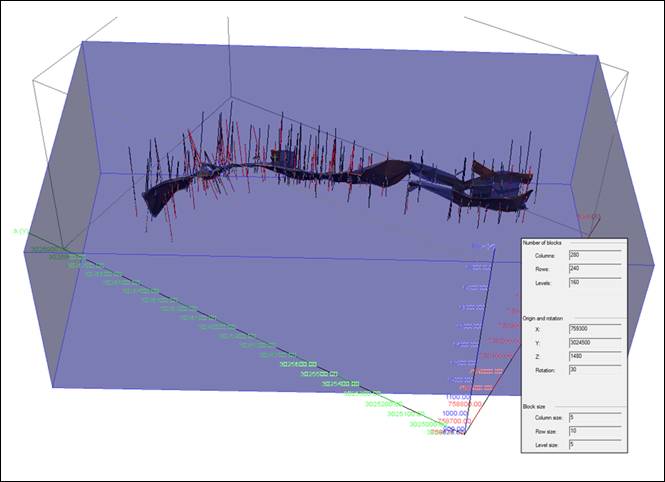

14.3.5 Block Model Estimation Methodology La Patria | 204 |

14.3.6 Block Model Estimation Methodology La Patria | 207 |

14.3.7 Classification Scheme | 208 |

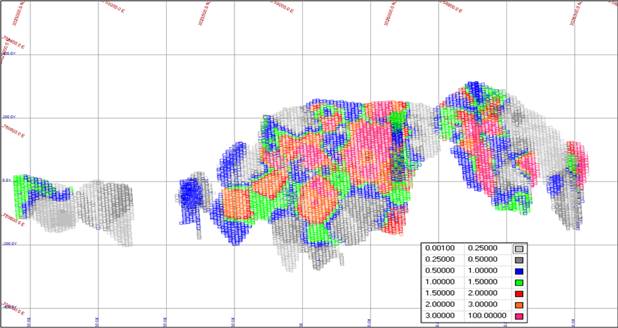

14.3.8 Block Model Validation | 208 |

14.3.9 Visual Validation | 208 |

14.3.10 Statement of Mineral Resources La Patria | 216 |

14.4 Summary of Mineral Resources Palmarejo District | 217 |

SECTION 15 - MINERAL RESERVE ESTIMATES | 219 |

15.1 Palmarejo Deposit Mineral Reserves | 219 |

15.1.1 Palmarejo Underground Reserve Methodology | 219 |

15.1.2 Palmarejo Open Pit Reserve Methodology | 220 |

15.2 Guadalupe Deposit Mineral Reserves | 220 |

15.2.1 Guadalupe Underground Reserve Methodology | 221 |

15.2.2 Guadalupe Open Pit Reserve Methodology | 221 |

15.3 Summary of Mineral Reserves Palmarejo District | 222 |

15.4 Equivalent Factor | 222 |

SECTION 16 - MINING METHODS | 223 |

16.1 Palmarejo Operations | 224 |

16.2 Guadalupe Operations | 227 |

SECTION 17 - RECOVERY METHODS | 230 |

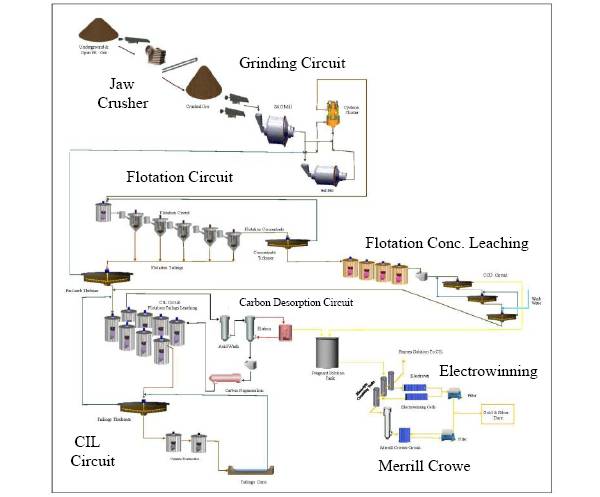

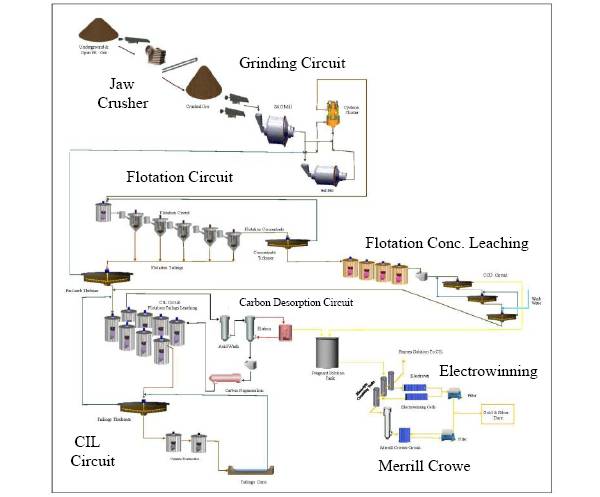

17.1 Mineral Processing | 230 |

17.2 Crushing | 230 |

17.3 Grinding | 230 |

17.4 Flotation | 230 |

17.5 Flotation Concentrate Leaching | 232 |

17.6 Flotation Tailings Leaching | 232 |

17.7 Carbon Desorption | 232 |

17.8 Carbon Regeneration | 233 |

17.9 Electrowinning, Merrill Crowe and Smelting | 233 |

17.10 Cyanide Detoxification | 233 |

17.11 Metallurgical Performance | 235 |

SECTION 18 - PROJECT INFRASTRUCTURE | 236 |

SECTION 19 - MARKET STUDIES AND CONTRACTS | 237 |

SECTION 20 - ENVIRONMENTAL STUDIES, PERMITTING AND SOCIAL OR COMMUNITY IMPACT | 238 |

SECTION 21 - CAPITAL AND OPERATING COSTS | 241 |

21.1 Capital Cost Estimate Palmarejo and Guadalupe | 241 |

21.2 Operating Cost Estimate Palmarejo | 241 |

21.3 Operating Cost Estimate Guadalupe | 241 |

SECTION 22 - ECONOMIC ANALYSIS | 243 |

SECTION 23 - ADJACENT PROPERTIES | 248 |

SECTION 24 - OTHER RELEVANT DATA AND INFORMATION | 249 |

4

SECTION 25 - INTERPRETATION AND CONCLUSIONS | 250 |

SECTION 26 - RECOMMENDATIONS | 251 |

26.1 Sampling | 251 |

26.2 Resource modeling | 251 |

26.3 Processing | 252 |

SECTION 27 - REFERENCES | 254 |

5

LIST OF TABLES | | PAGE |

| | |

Table 1.1: Total Palmarejo District Resource Inclusive of Mineral Reserves | 17 |

Table 1.2: Total Palmarejo District Mineral Reserves | 18 |

Table 1.3: Total Palmarejo District Mineral Resource Exclusive of Mineral Reserves | 18 |

Table 1.4: Palmarejo Operating Cost Estimates | 19 |

Table 1.5: Guadalupe Mine Operating Cost Estimates | 20 |

Table 1.6: Life-Of-Mine Economic Analysis | 21 |

Table 4.1: Mining Concessions Owned by Coeur Mexicana | 27 |

Table 4.2: Mining Concessions Partially Owned by Coeur Mexicana | 28 |

Table 4.3: CMP Agreement Concessions | 30 |

Table 4.4: Carmen Breach Valenzuela Agreement Concessions | 31 |

Table 4.5: Ricardo Rodriguez Lugo and Joaquin Rodriguez Lugo Agreement Concessions | 31 |

Table 4.6: Eva Alicia Fontes Manriquez, Et vir Agreement Concessions | 32 |

Table 4.7: Minera Azteca de Oro y Plata Agreement Concessions | 33 |

Table 6.1: Minas Huruapa S.A. de C.V. Production at Palmarejo Mine: 1979 to 1992 | 41 |

Table 6.2: Pre-Planet Gold Estimates of “Reserves” for the Palmarejo Mine | 42 |

Table 6.3: Palmarejo 2004 Silver and Gold Resources | 42 |

Table 6.4: Palmarejo 2005 Silver and Gold Resources | 43 |

Table 6.5: Palmarejo 2006 Silver and Gold Resources | 44 |

Table 6.6: Palmarejo 2007 Silver and Gold Resources; September 2007 | 45 |

Table 6.7: Guadalupe Inferred Resources; October 2006 | 46 |

Table 6.7a: Guadalupe Indicated Resources; September 2007 | 46 |

Table 6.7b: Guadalupe Inferred Resources; September 2007 | 47 |

Table 6.8: La Patria Inferred Resources: September 2007 | 47 |

Table 6.9: Total Palmarejo District Mineral Resources, January 1, 2009 | 48 |

Table 6.10: Total Palmarejo District Mineral Reserves, January 1, 2009 | 48 |

Table 6.11: Remaining Palmarejo District Mineral Resources, January 1, 2009 | 48 |

Table 6.12: Total Palmarejo District Mineral Resources, January 1, 2010 | 49 |

Table 6.13: Total Palmarejo District Mineral Reserves, January 1, 2010 | 49 |

Table 6.14: Remaining Palmarejo District Mineral Resources, January 1, 2010 | 49 |

Table 6.15: Total Palmarejo District Mineral Reserves, January 1, 2011 | 49 |

Table 6.16: Remaining Palmarejo District Mineral Resource, January 1, 2011 | 50 |

Table 6.17: Total Palmarejo District Mineral Reserves, January 1, 2012 | 50 |

Table 6.18: Remaining Palmarejo District Mineral Resource, January 1, 2012 | 50 |

Table 6.19: Coeur Palmarejo Mine Ore Production - Inception to December 31, 2012 | 51 |

Table 9.1: Planet Gold Palmarejo Underground Channel Sample Database Statistics | 73 |

Table 10.1: Palmarejo Drilling Summary - Planet Gold | 76 |

Table 10.2: Guadalupe Drilling Summary - Planet Gold 2005 - 2007 | 76 |

Table 10.3: Total Drilling at La Patria, 2005-2007 | 76 |

Table 11.1: Drilling Report Activity 2012 | 87 |

Table 11.2: Field and QA/QC Sample Activity 2012 | 88 |

Table 11.3: QAQC Failure Rate for 2012 Sampling Program | 88 |

Table 11.4: Standards Used in 2012 | 89 |

Table 11.5: Pulp Duplicate Failure for Resource Definition Drilling (ALS Chemex) | 94 |

6

Table 11.6: Sample Split Duplicate Failure for Resource Definition Drilling (ALS Chemex) | 94 |

Table 11.7: Sample Split Duplicate Failure for Development Drilling (PAL Site Lab) | 95 |

Table 11.8: Check Sample Results Guadalupe and La Patria Exploration Programs | 99 |

Table 11.9: Exploration QAQC Summary Palmarejo District - 2012 | 102 |

Table 11.10: Standards Used in 2012 Exploration Program | 103 |

Table 11.11: QAQC Failure Rate for 2012 Quality Control Standards and Blanks | 103 |

Table 11.12: Pulp Duplicate Failure for Resource Definition Drilling (ALS Chemex) | 109 |

Table 11.13: Check Sample Results Guadalupe and La Patria Exploration Programs | 112 |

Table 12.1: MDA Assay Certificate Audit Results | 115 |

Table 12.2: Guadalupe Laboratory Certificates Selected for Verification | 116 |

Table 12.3: Guadalupe Drillholes Selected for Collar Verification | 117 |

Table 12.4: La Patria Drillholes Selected for Collar Verification | 117 |

Table 13.1: Samples Tested | 122 |

Table 13.2: Comminution Test work Summary | 123 |

Table 13.3: Different Process Route Test work Summary | 124 |

Table 13.4: Flotation Test work Summary | 125 |

Table 13.5: Leaching Test work Summary | 126 |

Table 13.6: Cyanide Destruction Test work Summary | 127 |

Table 13.7: Settling Test work Summary | 129 |

Table 13.8: Oxygen Uptake Test work Summary | 130 |

PTable 13.9: Merrill Crowe Zinc Precipitation Test work Summary | 131 |

Table 13.10: Guadalupe Metallurgical Samples Selected | 133 |

Table 13.11: Guadalupe Metallurgical Test Results | 135 |

Table 13.12: Mineral Species at Guadalupe and Palmarejo | 136 |

Table 13.13: La Patria Metallurgical Test Drill Holes | 138 |

Table 14.1: Palmarejo Mine Area Drill and Other Data - YE2012 Mineral Resources Model | 142 |

Table 14.2: Palmarejo Specific-Gravity Statistics by Geology | 144 |

Table 14.3: Palmarejo Specific-Gravity by Geology | 144 |

Table 14.4: Palmarejo Lithological Unit Descriptions and Codes | 146 |

Table 14.5: Minas Huruapa Production 1979 to 1992 | 148 |

Table 14.6: Palmarejo Project – Mineral-Type Model Solid Description | 150 |

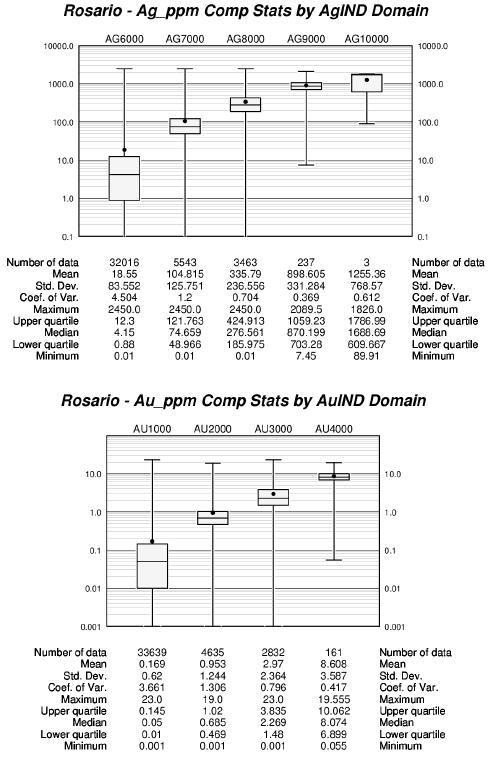

Table 14.7: Sample Statistics – Rosario Area | 151 |

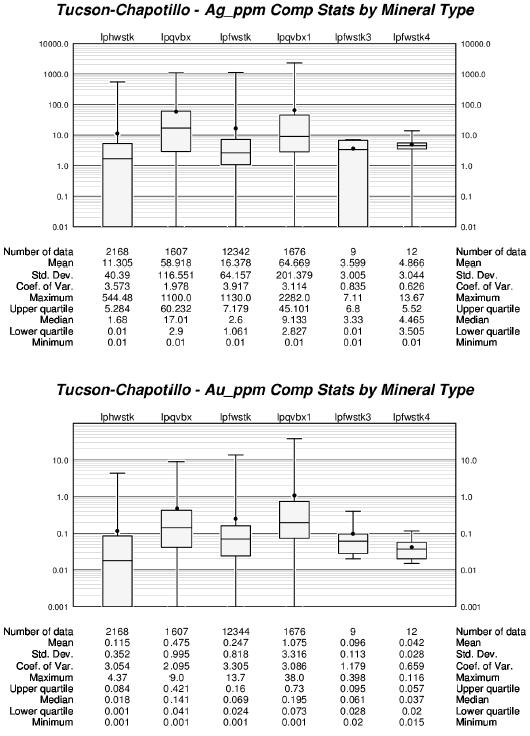

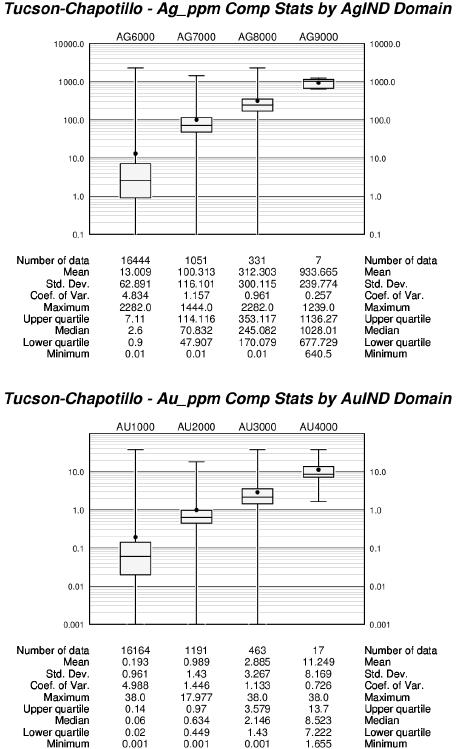

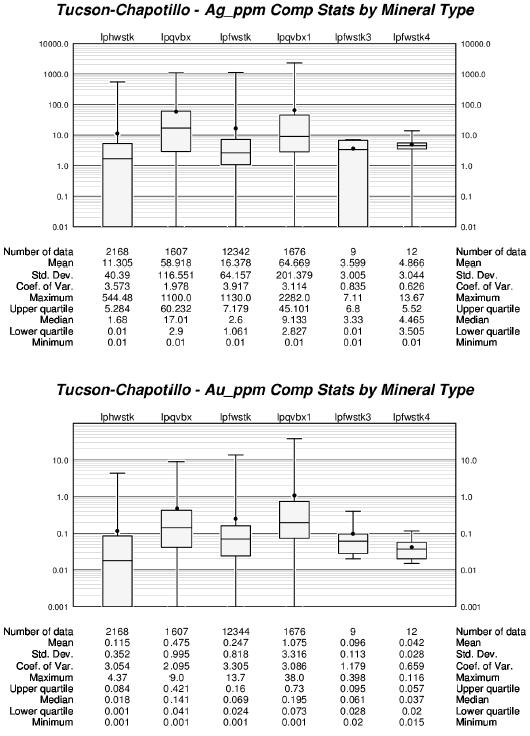

Table 14.8: Sample Statistics – Tucson-Chapotillo Area | 152 |

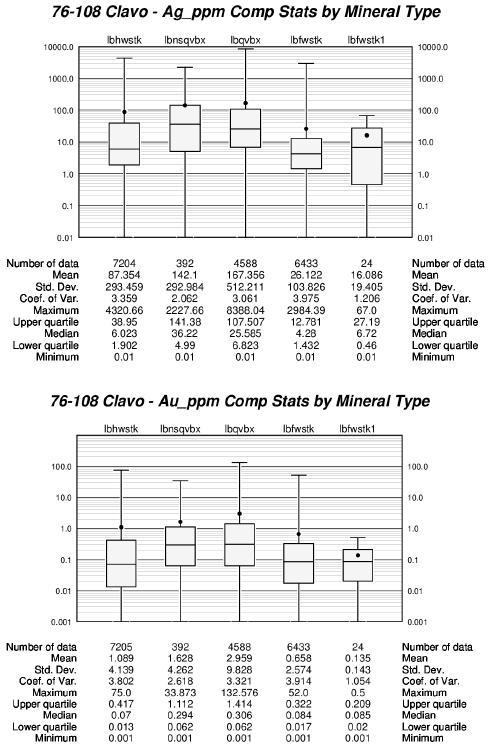

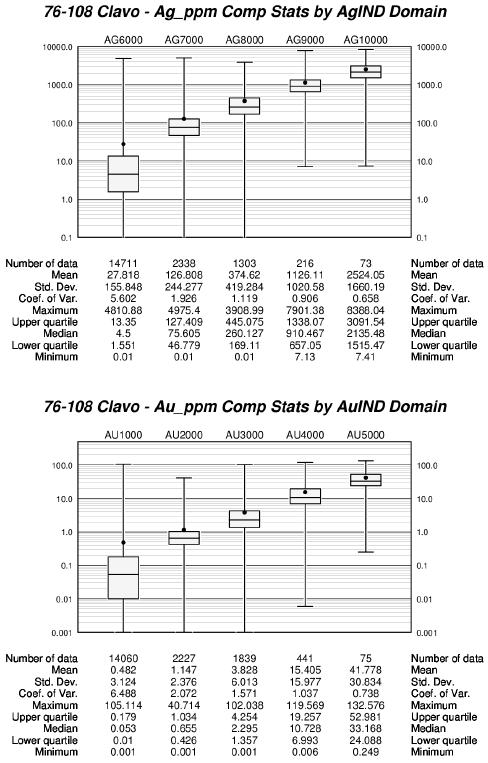

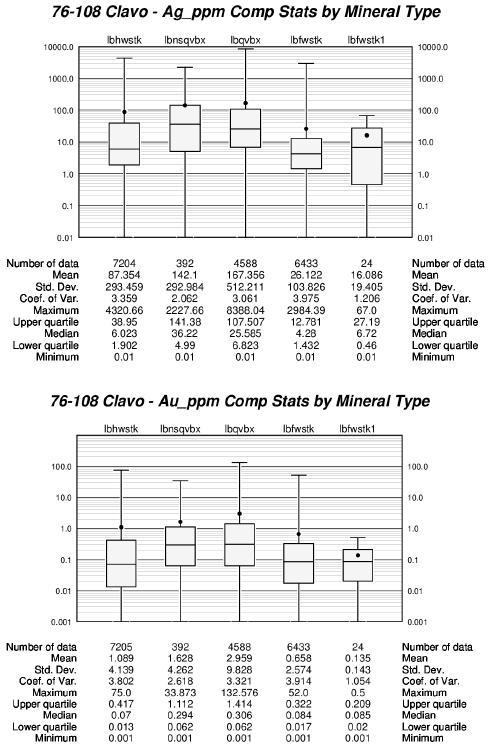

Table 14.9: Sample Statistics – 76-108 Clavo Area | 152 |

Table 14.10: Trimming Levels by Area and Mineral Type | 153 |

Table 14.11: Trimmed Sample Statistics – Rosario Area | 153 |

Table 14.12: Trimmed Sample Statistics – Tucson-Chapotillo Area | 154 |

Table 14.13: Trimmed Sample Statistics – 76-108 Clavo Area | 154 |

Table 14.14: Indicator Grade Levels – Ag_ppm, Au_ppm | 158 |

Table 14.15: Vein/Structure Orientations by Area | 163 |

Table 14.16: Variogram Models by Indicator Domain and Metal– Rosario Area | 164 |

Table 14.17: Block Model Geometry | 164 |

Table 14.18: ID3 vs. NN Block Grades a: Gold and Silver Statistics | 171 |

Table 14.19: ID3 Model and Mean Composite Grade Comparison: Gold and Silver Statistics (xval: composite mean) | 173 |

7

Table 14.20: Resource Classification Parameters | 174 |

Table 14.21: Total Palmarejo Deposit Total Mineral Resource- Inclusive of Mineral Reserves | 175 |

Table 14.22: Palmarejo Deposit Remaining Mineral Resource- Exclusive of Reserves | 176 |

Table 14.23: Guadalupe Resource Drill Data - YE2012 Model | 177 |

Table 14.24: Guadalupe Specific - Gravity Statistics: Mineralized Core Samples | 178 |

Table 14.25: Guadalupe Mineral - Type Domain Codes | 180 |

Table 14.26: Guadalupe – Assay Sample Statistics by Mineral Type | 182 |

Table 14.27: Composite Statistics for each Lithological Domain for Gold and Silver | 183 |

Table 14.28: Guadalupe - Pair-Wise Variography Models by Metal,, Structural Domain, and Lithology Type | 185 |

Table 14.29: Structural Domain Definitions | 187 |

Table 14.30: Block Grades and Composite Grades Comparison by Rock Type: Gold and Silver Statistics) | 192 |

Table 14.31: Classification Criteria | 193 |

Table 14.32: Guadalupe Deposit Mineral Resource Inclusive of Mineral Reserves | 194 |

Table 14.33: Guadalupe Deposit Remaining Mineral Resource- Exclusive of Reserves | 195 |

Table 14.34: Coeur Mexicana La Patria Drill-Hole Database | 196 |

Table 14.35: La Patria – Specific - Gravity Statistics: Mineralized Core Samples | 197 |

Table 14.36: La Patria – Mineral Type Domain Coding | 198 |

Table 14.37: La Patria - Sample Statistics by Mineral Type | 200 |

Table 14.38: La Patria - Trimming Levels by Mineral Type | 201 |

Table 14.39: La Patria – Trimmed Sample Statistics by Mineral Type | 202 |

Table 14.40: La Patria – Composite Statistics by Mineral Type | 203 |

Table 14.41: La Patria - Vein/Structure Orientations by Area | 205 |

Table 14.42: La Patria – Exponential Variogram Models Parameters | 206 |

Table 14.43: La Patria – Search Parameters | 207 |

Table 14.44: La Patria - Block Model Geometry | 207 |

Table 14.45: La Patria – Block Classification Scheme | 208 |

Table 14.46: La Patria – Block Model Statistics | 214 |

Table 14.47: La Patria - Deposit Mineral Resources | 217 |

Table 14.48: Total Palmarejo District Mineral Resource Inclusive of Mineral Reserves | 217 |

Table 14.49: Total Palmarejo District Mineral Resource Exclusive of Mineral Reserves | 218 |

Table 15.1: Proven and Probable Mineral Reserves – Palmarejo Deposit | 219 |

Table 15.2: Proven and Probable Mineral Reserves – Guadalupe Deposit | 221 |

Table 15.3: Total Palmarejo District Mineral Reserves | 222 |

Table 16.1: Remaining Life-of-Mine Production Summary with Development | 223 |

Table 16.2: Palmarejo Underground Mining Methods and Stope Design Parameters | 225 |

Table 16.3: Palmarejo Open Pit Design and Operational Parameters | 226 |

Table 16.4: Guadalupe Underground Mining Methods, Design Parameters and Major Equipment | 228 |

Table 16.5: Guadalupe Basis For Open Pit Design and Operational Parameters | 229 |

Table 21.1: Palmarejo Operating Cost, Recovery and Cut-Off Grade Estimate | 241 |

Table 21.2: Guadalupe Operating Cost, Recovery and Cut-Off Grade Estimate | 242 |

Table 22.1: Life-Of-Mine Economic Analysis | 243 |

Table 22.2: Yearly Production and Cash Flows | 244 |

8

Table 22.3: Sensitivity of Project Performance to Gold and Silver Price | 244 |

Table 22.4: Sensitivity of Project Performance to a 10% Increase in Gold and Silver Grade | 245 |

Table 22.5: Sensitivity of Project Performance to a 10% Decrease in Gold and Silver Grade | 245 |

Table 22.6: Sensitivity of Project Performance to a 10% Increase in Operating Cost | 245 |

Table 22.7: Sensitivity of Project Performance to a 10% Decrease in Operating Cost | 245 |

Table 22.8: Sensitivity of Project Performance to a 10% Increase in Capital Costs | 246 |

Table 22.9: Sensitivity of Project Performance to a 10% Decrease in Capital Costs | 246 |

Table 22.10: Tax Rates | 247 |

9

LIST OF FIGURES | | PAGE |

| | |

Figure 1.1: Regional Map Showing Project Location | 13 |

Figure 1.2: Localized Map Showing Project Location | 14 |

Figure 1.3: Locations of Palmarejo District Mineral Deposits | 16 |

Figure 4.1: General Project Location | 25 |

Figure 4.2: Property Map of the Palmarejo District | 29 |

Figure 5.1: Overview of the Palmarejo Area | 38 |

Figure 5.2: Overview of the Guadalupe Area | 39 |

Figure 7.1: Palmarejo Location at the Boundary between the Western Mexican Basin and Range Province and the Sierra Madre Occidental (Earthscope, 2012) | 52 |

Figure 7.2: Regional Geology of the Palmarejo Area | 55 |

Figure 7.3: Geologic Map of the Palmarejo Area | 57 |

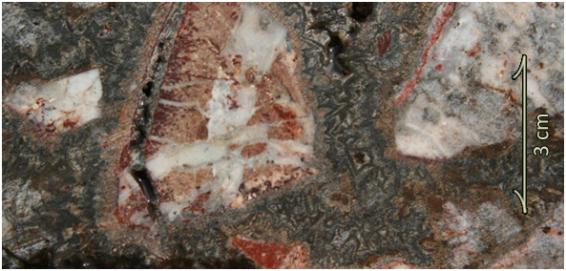

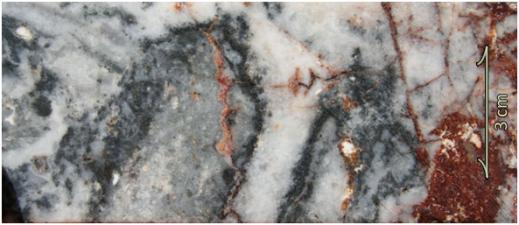

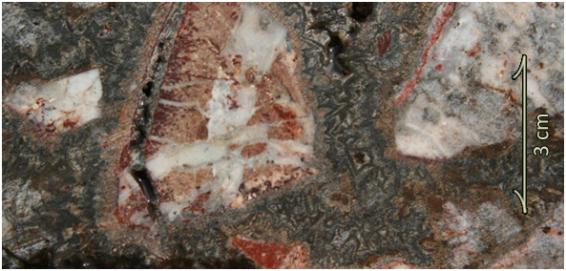

Figure 7.4: Four Breccia Types of the Palmarejo Mineralized Veins | 59 |

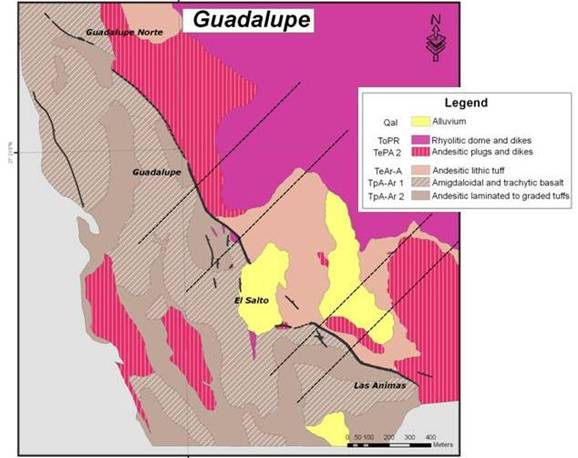

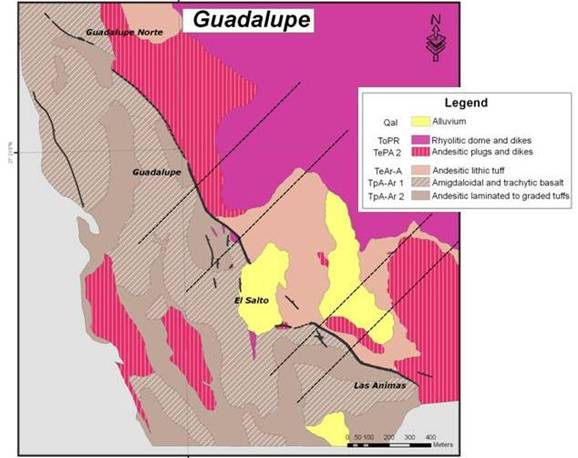

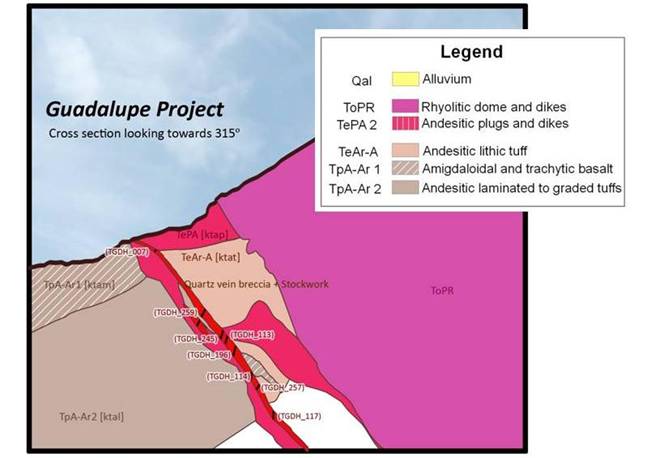

Figure 7.5: Geologic Map of the Guadalupe Area | 61 |

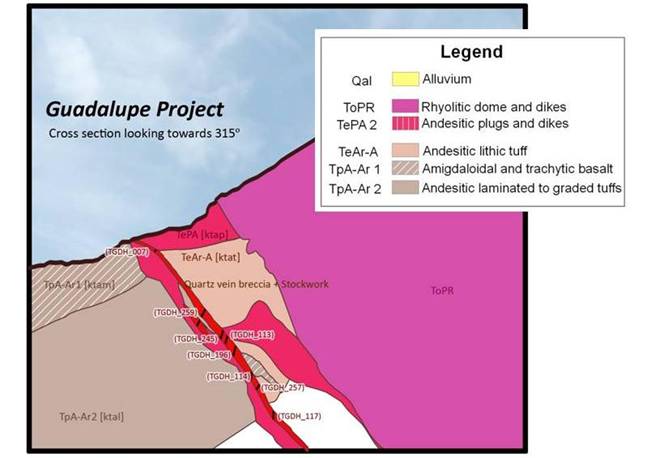

Figure 7.6: Cross Section of the Guadalupe Structure | 62 |

Figure 7.7: Photo Showing the Guadalupe Norte Clay Alteration (Looking ENE) | 63 |

Figure 7.8: Photo Showing Sulfide Mineralization | 63 |

Figure 7.9: Photo Showing Mineralized Rhodochrosite | 64 |

Figure 7.10: Photo Showing Late - Deposited Carbonates | 65 |

Figure 7.11: Poorly Mineralized Structure at Surface and Clay Alteration at Guadalupe Norte. | 66 |

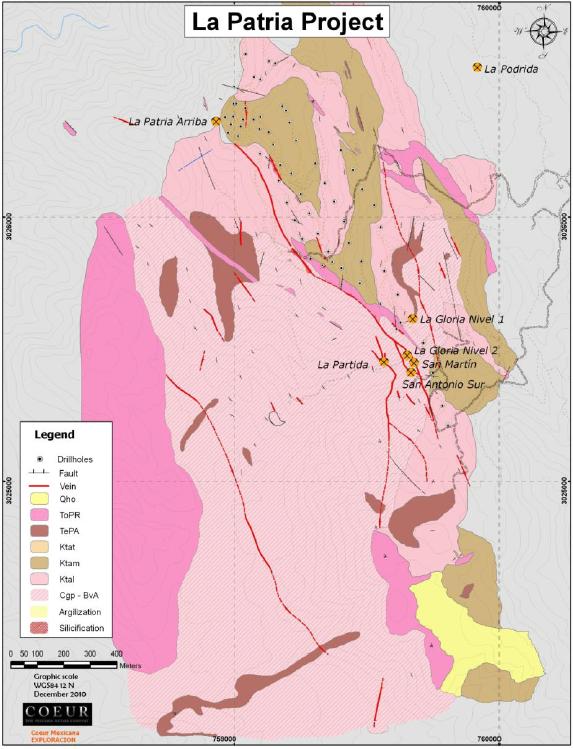

Figure 7.12: Geologic Map of the La Patria Area | 68 |

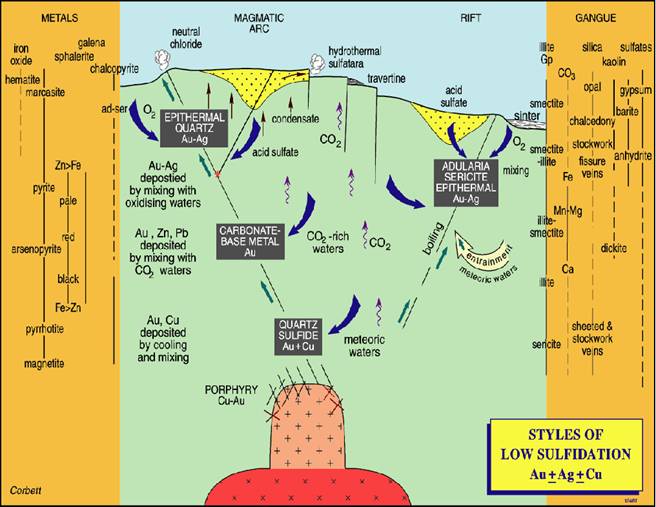

Figure 8.1: Low Sulfidation Polymetallic Silver-Gold Mineralization | 72 |

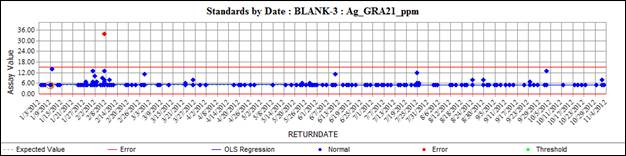

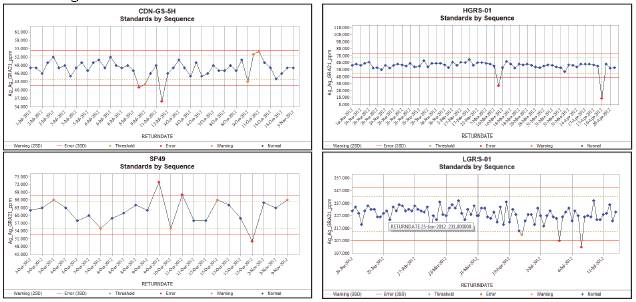

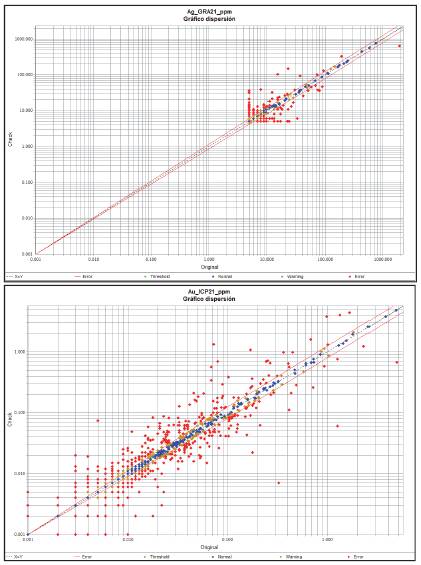

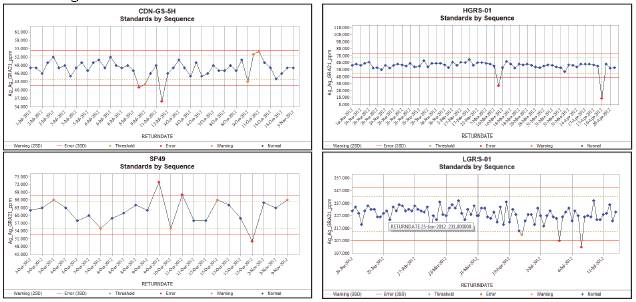

Figure 11.1: Standard Results for Category 3 Drilling Silver Gravimetric Results | 90 |

Figure 11.2: Standard Results for Categgory 3 Drilling Gold ICP Results | 91 |

Figure 11.3: Standard Results for Development Drilling Silver Gravimetric Results | 92 |

Figure 11.4: Standard Results for Development Drilling Gold AA Results | 92 |

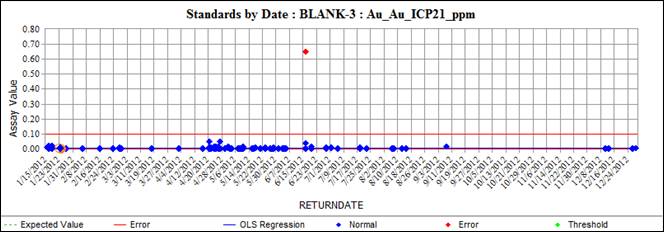

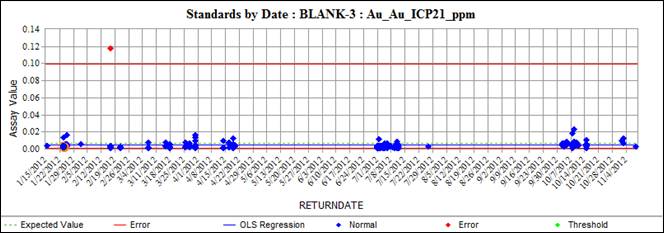

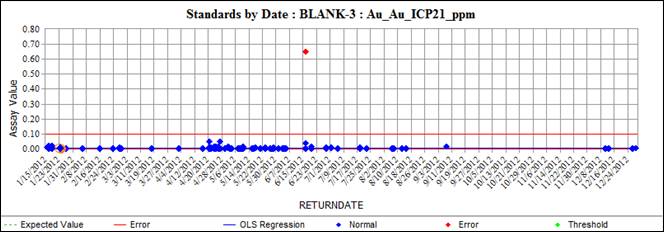

Figure 11.5: Blank Results for Development Drilling | 93 |

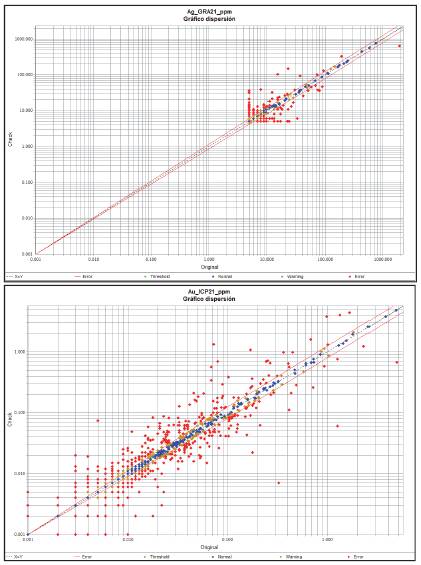

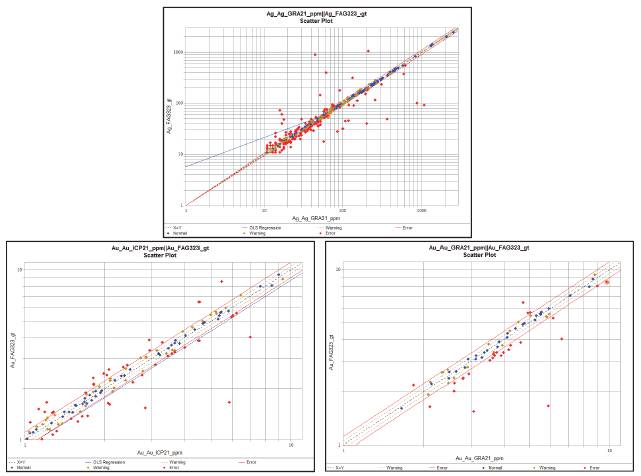

Figure 11.6: Sample Duplicate Results for Category 3 Drilling | 96 |

Figure 11.7: Pulp Duplicate Results for Category 3 Drilling | 97 |

Figure 11.8: Sample Duplicate Results for Development Drilling | 98 |

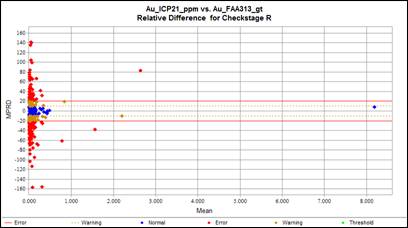

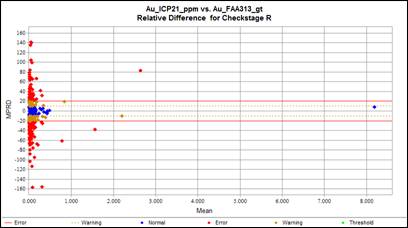

Figure 11.9: Check Sample Results Palmarejo Gold Analysis | 99 |

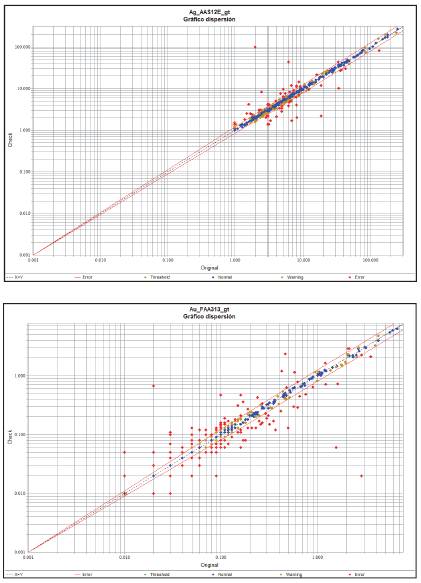

Figure 11.10: Guadalupe Standards ALS Chemex Silver Gravimetric Results | 104 |

Figure 11.11: Guadalupe Standards ALS Chemex Gold Gravimetric Results | 104 |

Figure 11.12: Guadalupe Standards ALS Chemex Gold ICP Results | 105 |

Figure 11.13: La Patria Standards ALS Chemex Silver Gravimetric Results | 105 |

Figure 11.14: La Patria Standards ALS Chemex Gold Gravimetric Results | 106 |

Figure 11.15: La Patria Standards ALS Chemex Gold ICP Results | 106 |

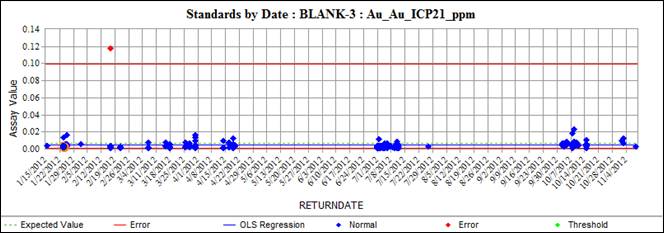

Figure 11.16: Guadalupe Blanks ALS Chemex Silver and Gold | 107 |

Figure 11.17: La Patria Blanks ALS Chemex Silver and Gold | 108 |

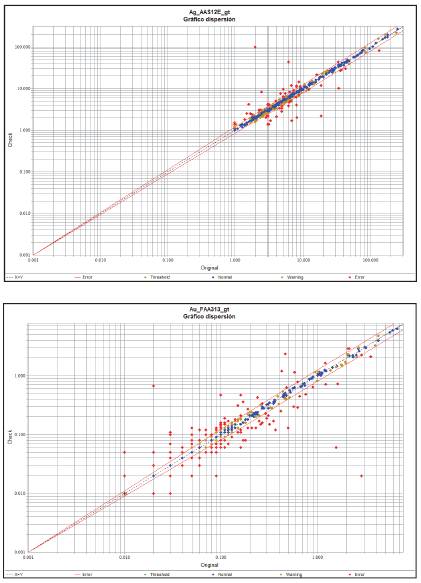

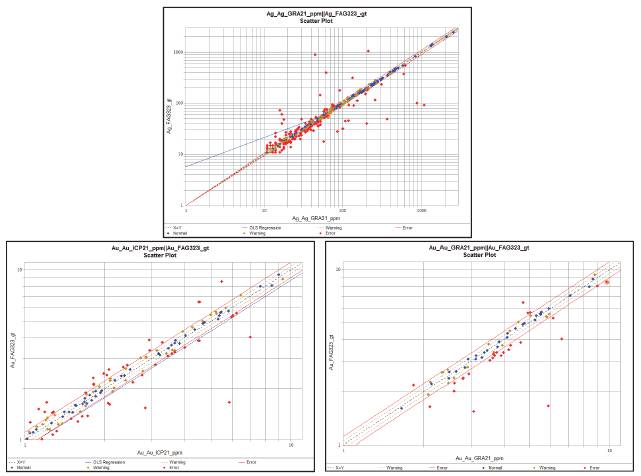

Figure 11.18: Guadalupe Pulp Duplicates ALS Chemex Silver and Gold | 110 |

Figure 11.19: La Patria Pulp Duplicates ALS Chemex Silver and Gold | 111 |

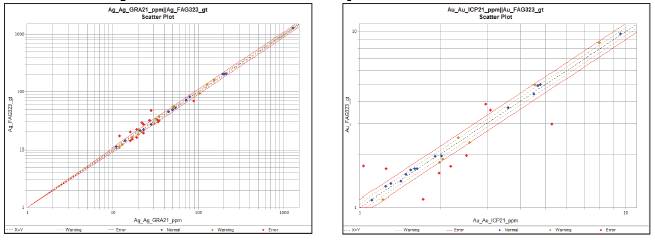

Figure 11.20: Gaudalupe Check Samples ALS Chemex vs. SGS | 113 |

Figure 11.21: La Patria Check Samples ALS Chemex vs. SGS | 113 |

Figure 13.1: Location of Samples for Metallurgical Testing | 133 |

10

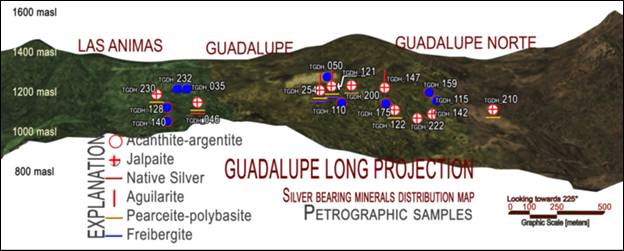

Figure 13.2: Location of Samples for Mineralogical Studies | 134 |

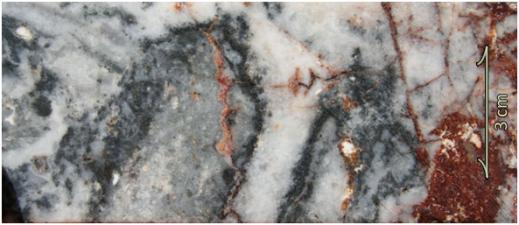

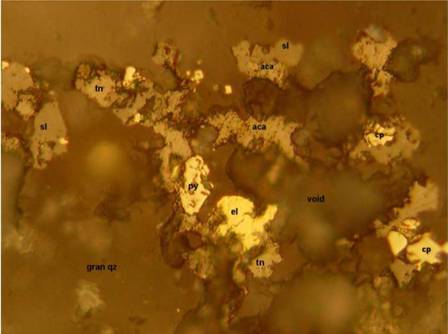

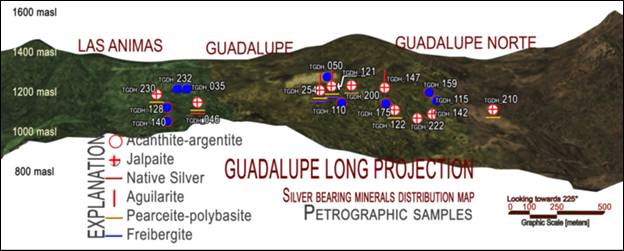

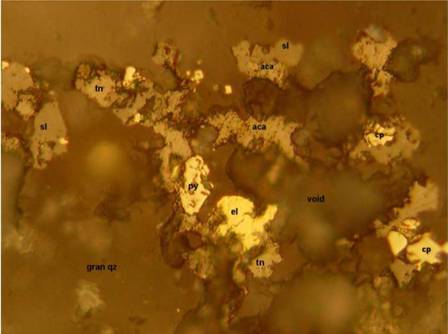

Figure 13.3: Photomicrograph of Drill Hole TGDH-254 | 137 |

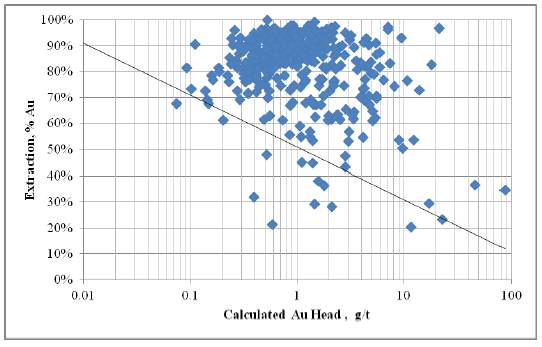

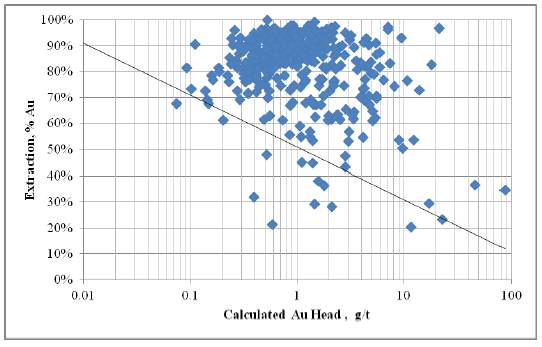

Figure 13.4: La Patria; Gold Extraction (%) vs. Calculated Head (g/t) | 139 |

Figure 13.5: La Patria; Silver Extraction (%) vs. Calculated Head (g/t) | 139 |

Figure 13.6: La Patria; Gold Extraction (%) vs. Calculated Head (gr/mt) | 140 |

Figure 13.7: La Patria; Silver Extraction (%) vs. Calculated Head (g/t) | 140 |

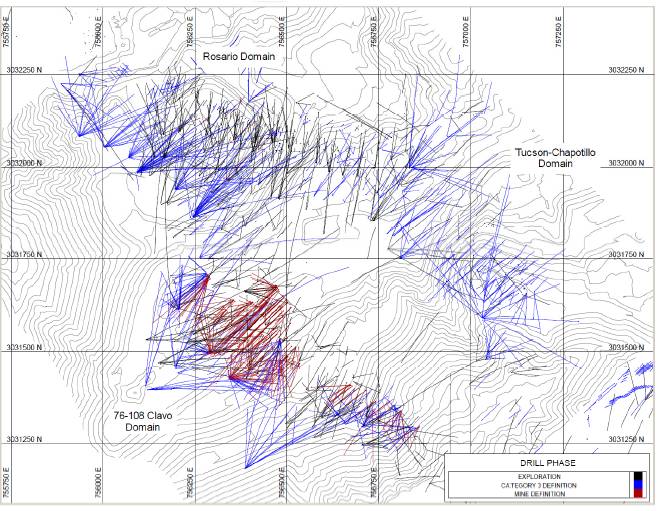

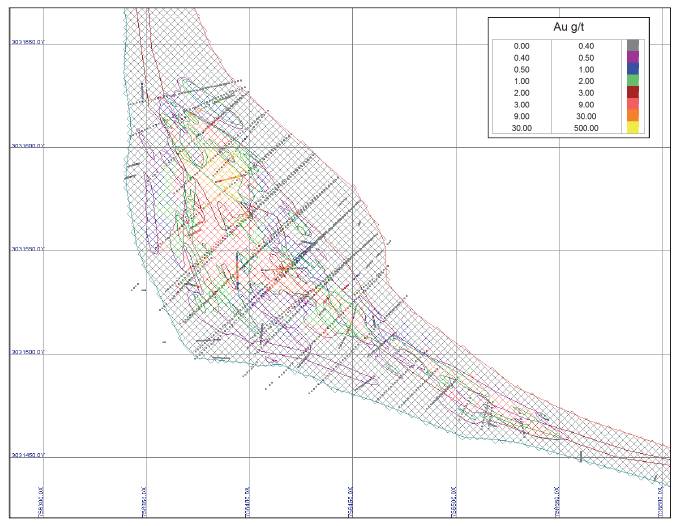

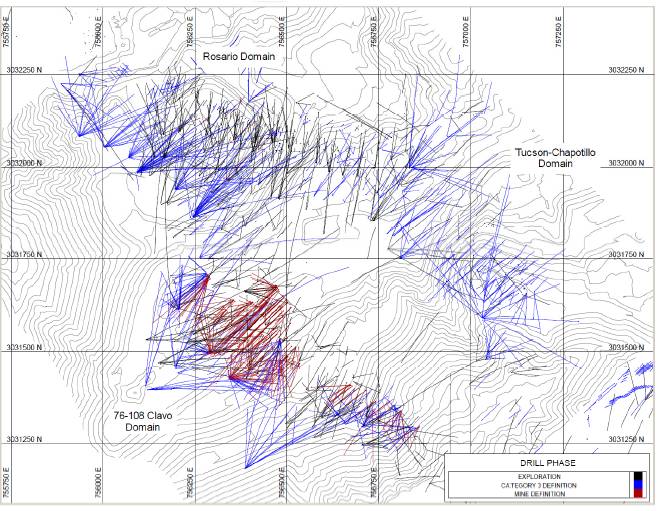

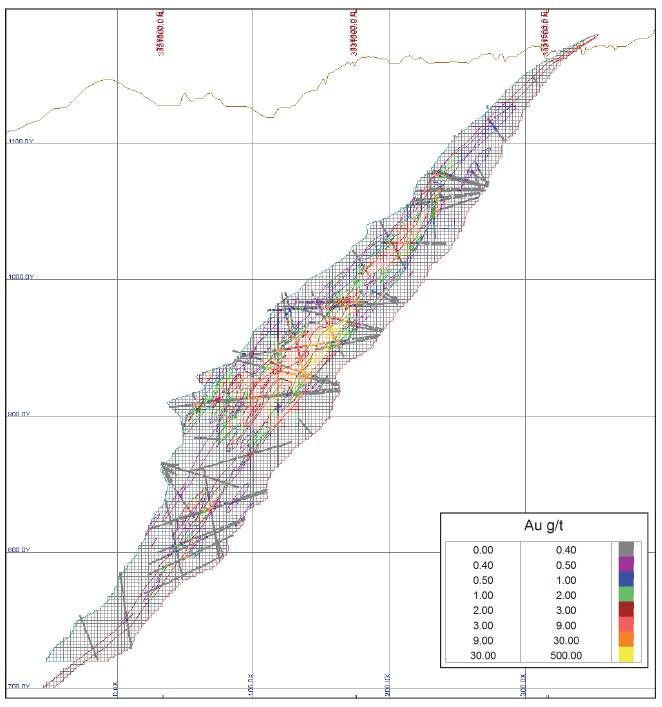

Figure 14.1 Palmarejo Project – Exploration and Definition Drill Holes | 143 |

Figure 14.2 Palmarejo Project – Model Domain Areas, Mineral-Type Model Coding | 145 |

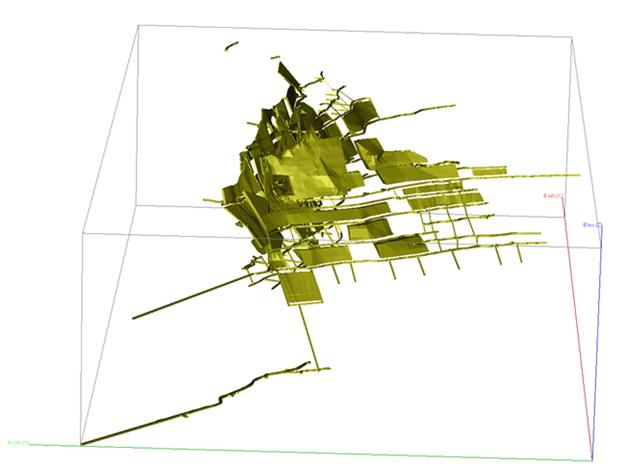

Figure 14.3: AMEC/Coeur 2007 Void Model – 3-D view | 149 |

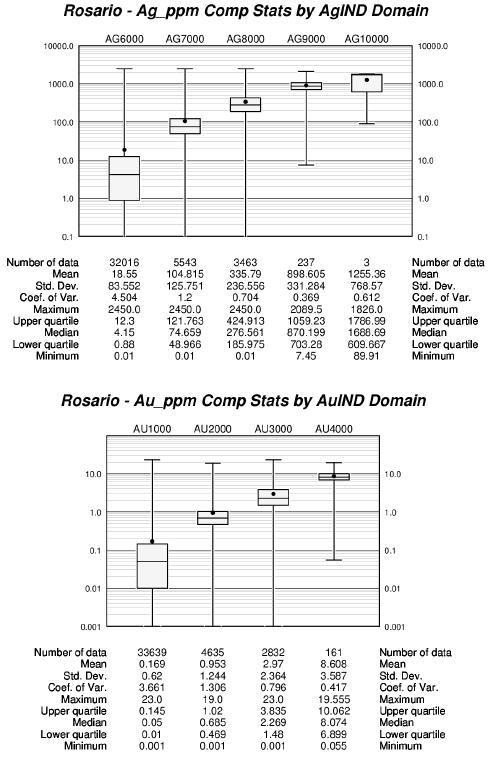

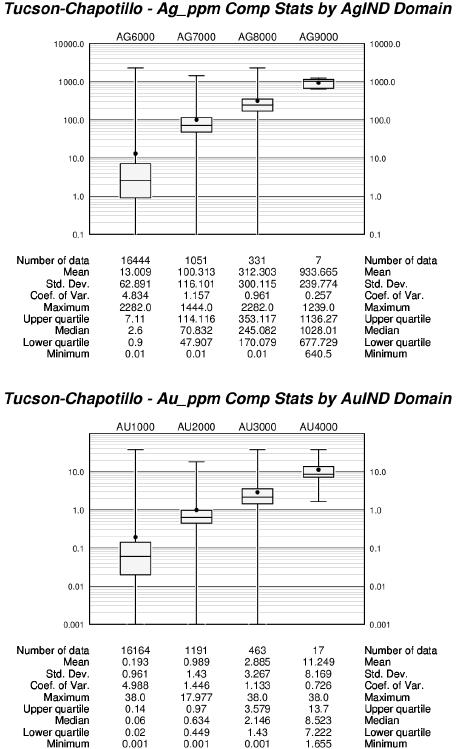

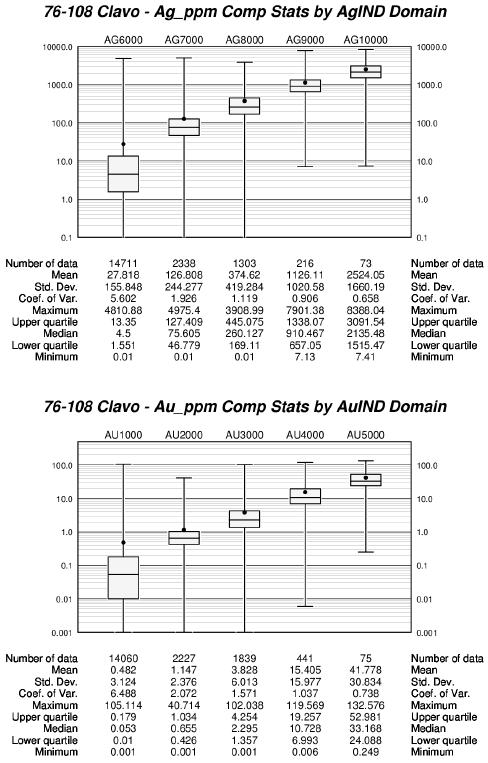

Figure 14.4: Composite Statistics by Mineral Type – Rosario Area | 155 |

Figure 14.5: Composite Statistics by Mineral Type – Tucson-Chapotillo Area | 156 |

Figure 14.6: Composite Statistics by Mineral Type – 76-108 Clavo Area | 157 |

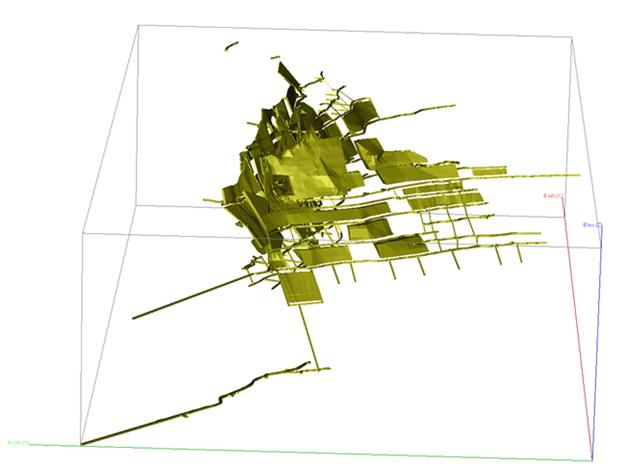

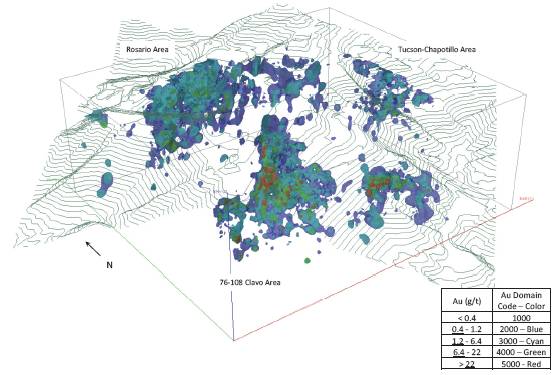

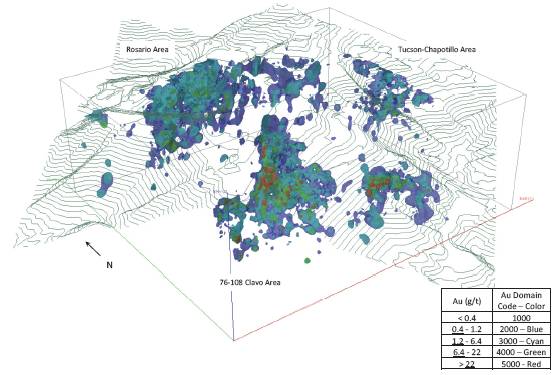

Figure 14.7: Ag Indicator-Probability Domain Models – 3D View Looking Northeast | 159 |

Figure 14.8: Au Indicator-Probability Domain Models – 3D View Looking Northeast | 159 |

Figure 14.9: Composite Statistics by Indicator Domain – Rosario Area | 160 |

Figure 14.10: Composite Statistics by Indicator Domain – Tucson-Chapotillo Area | 161 |

Figure 14.11: Composite Statistics by Indicator Domain – 76-108 Clavo Area | 162 |

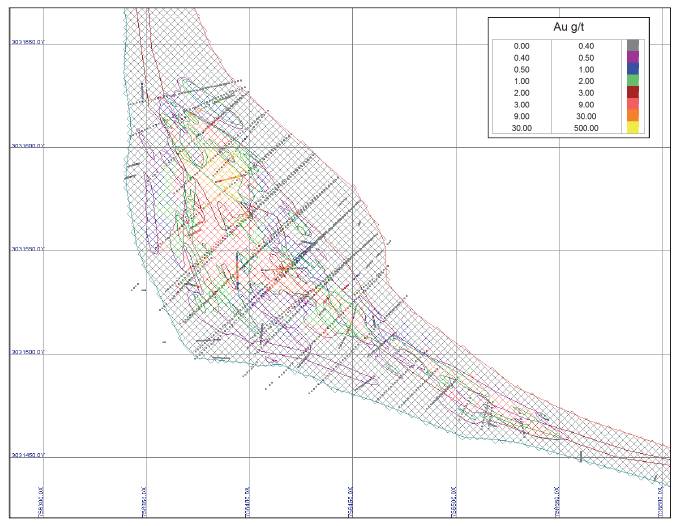

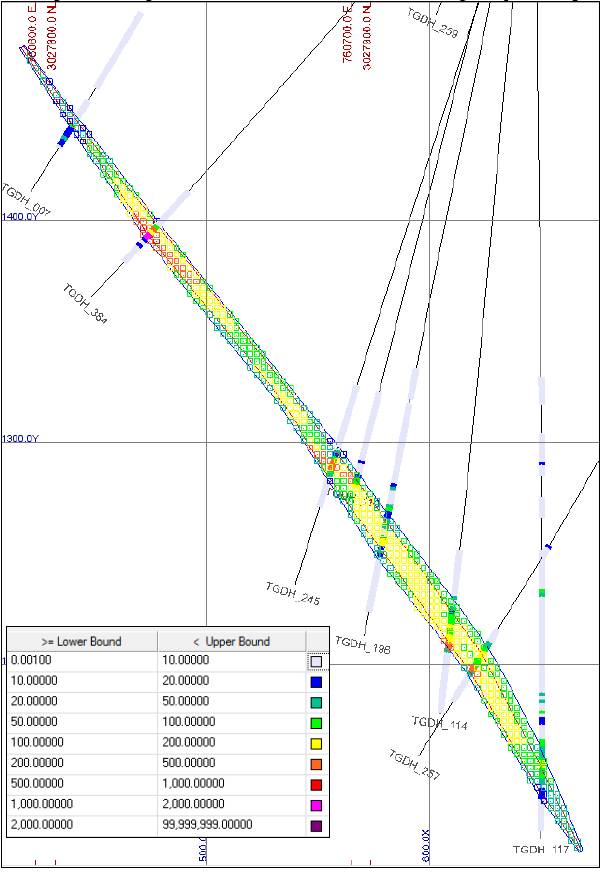

Figure 14.12: 76-108 Clavo Blocks and Composites Colored by Silver Grade | 166 |

Figure 14.13: 76-108 Clavo Blocks and Composites Colored by Gold Grade | 167 |

Figure 14.14: 76 Clavo Blocks and Composites Colored by Silver Grade | 168 |

Figure 14.15: 76 Clavo Blocks and Composites Colored by Gold Grade | 169 |

Figure 14.16: Guadalupe Project – Structural Domain Areas, Mineral-Type Model Coding | 181 |

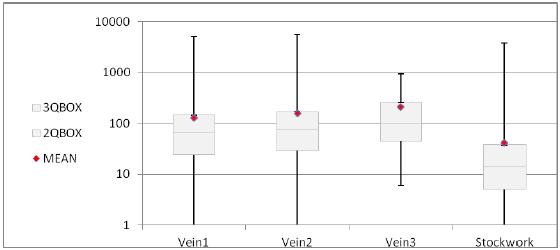

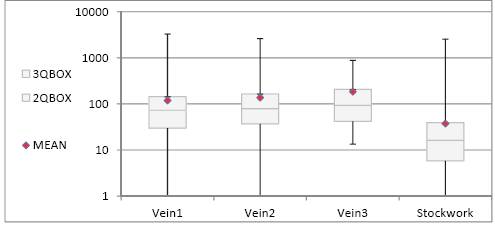

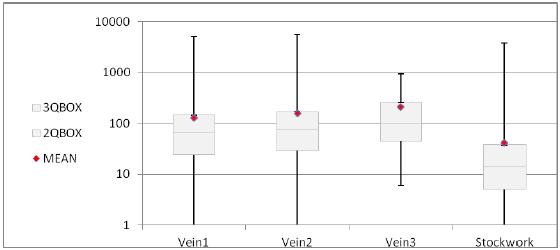

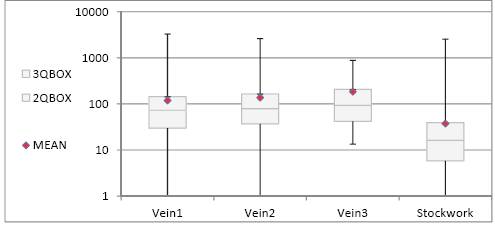

Figure 14.17: Box Plots of Assay Silver grades in the four Lithology Domains | 182 |

Figure 14.18: Assay Length Distribution | 183 |

Figure 14.19: Box Plots of Composite Silver grades in the four Lithology Domains | 184 |

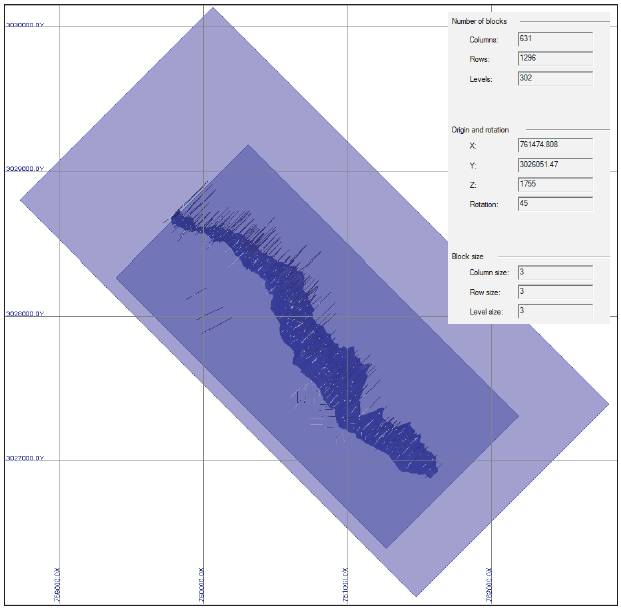

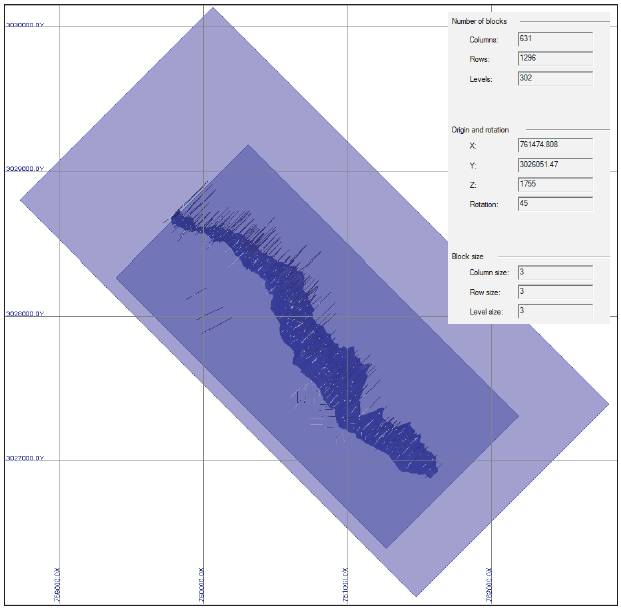

Figure 14.20: Block Model Geometry | 186 |

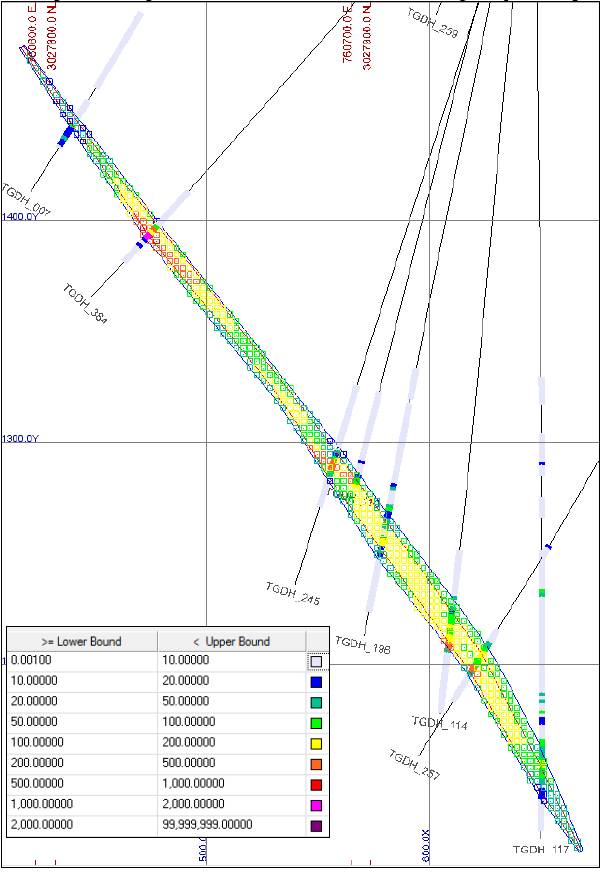

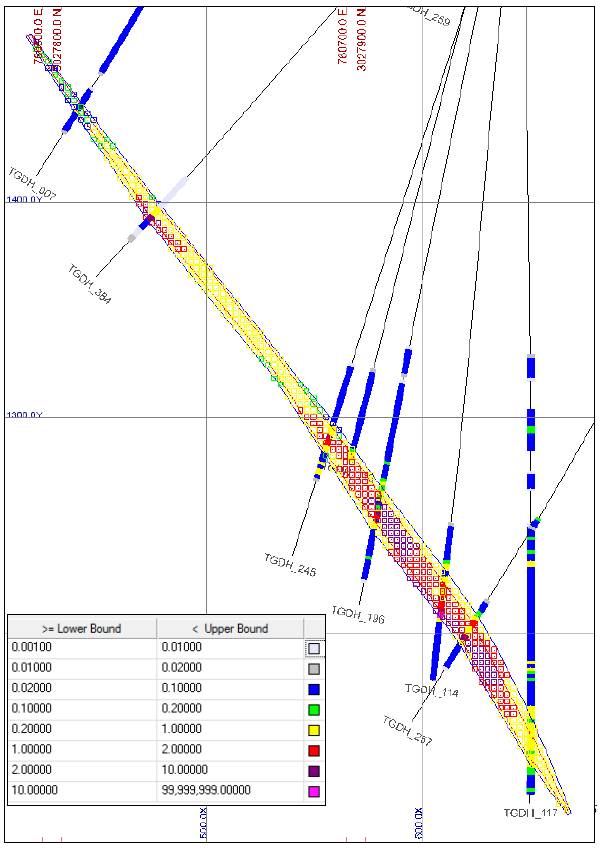

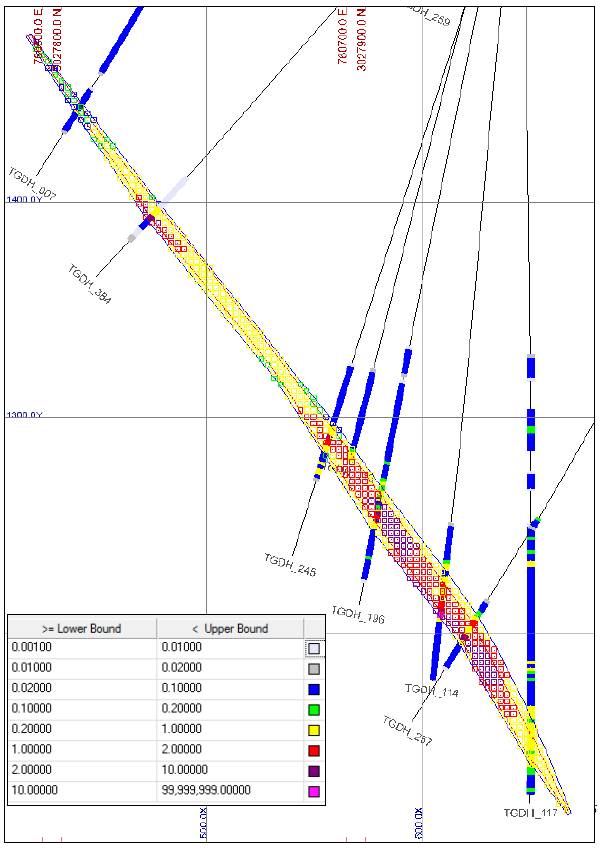

Figure 14.21: Ag Consolidated Block Model ID2 Grades vs. Ag Composites in g/t | 188 |

Figure 14.22: Au Consolidated Block Model ID2 Grades vs. Au Composites in g/t | 189 |

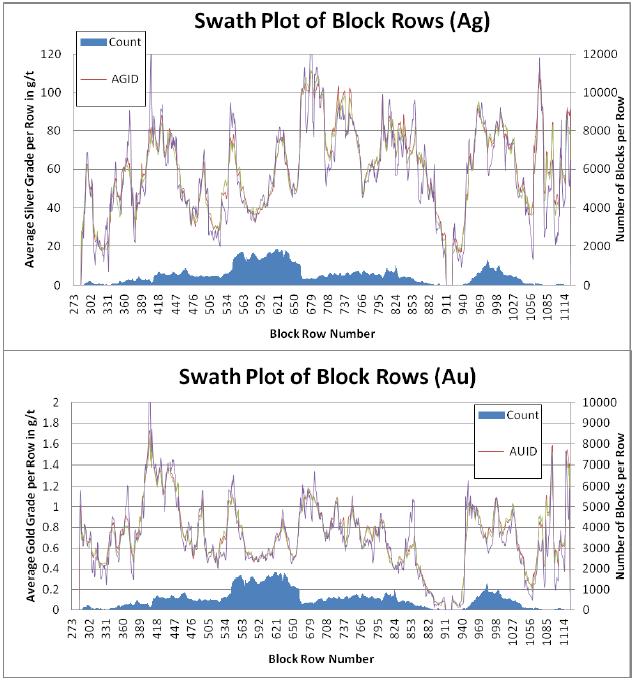

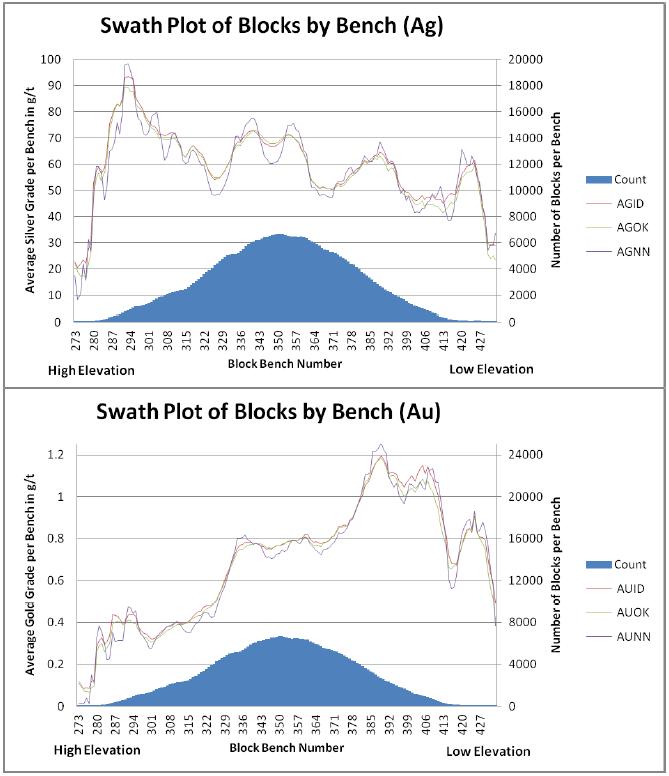

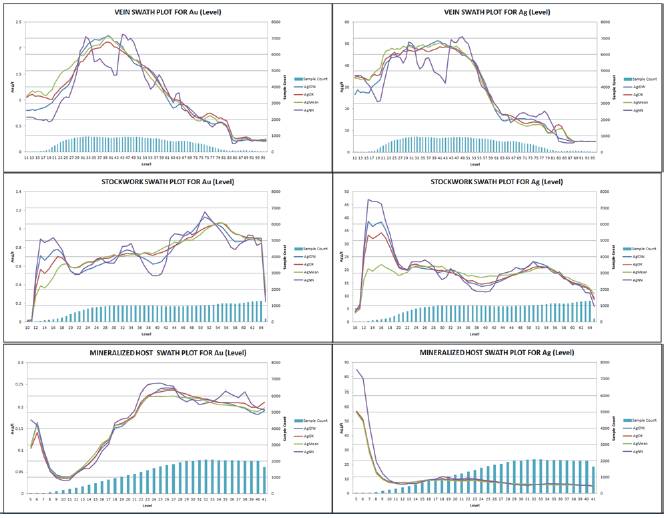

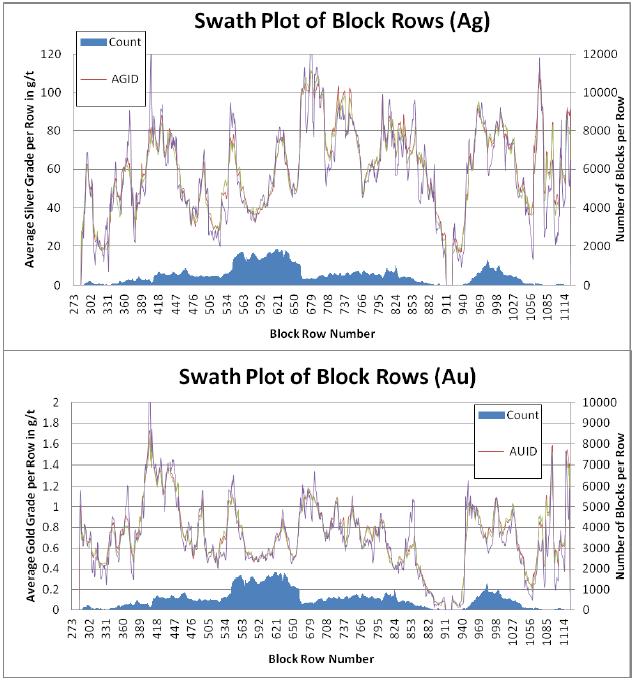

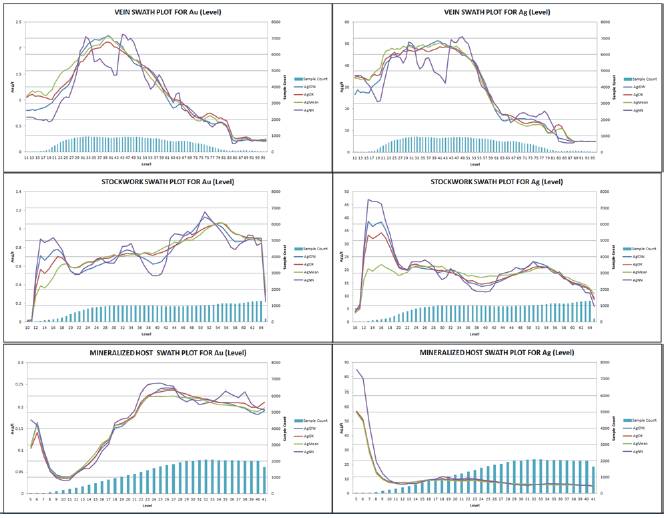

Figure 14.23: Guadalupe YE2012 Vein Domains -Swath Plots by Row—MI Blocks | 190 |

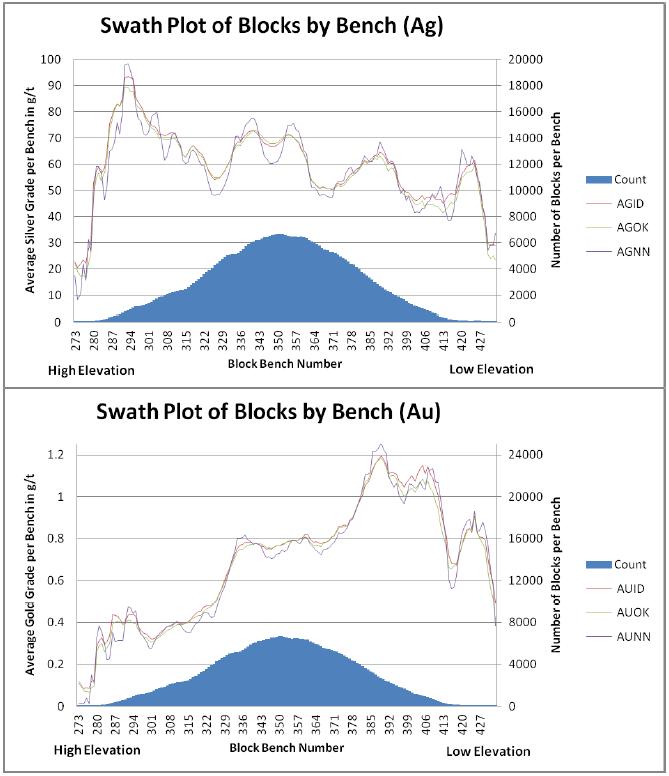

Figure 14.24: Guadalupe YE2012 Vein Domains - Swath Plots by Bench — MI Blocks | 191 |

Figure 14.25: La Patria – Drillhole – Vein Intersection Separation Distance | 196 |

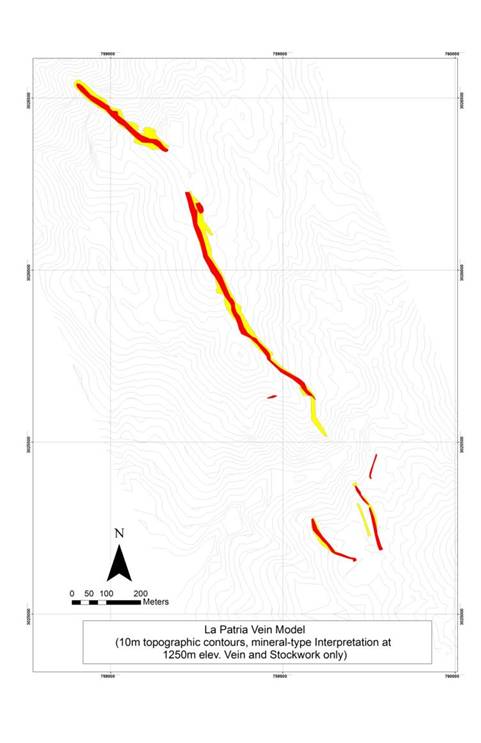

Figure 14.26: La Patria – Structural Domain Areas, Vein Model | 199 |

Figure 14.27: La Patria - Sample Statistics Au Raw Assays | 200 |

Figure 14.28: La Patria - Sample Statistics Ag Raw Assays | 201 |

Figure 14.29: La Patria – Sample Length Frequency | 202 |

Figure 14.30: La Patria – Composite Statistics Ag | 203 |

Figure 14.31: La Patria – Composite Statistics Au | 204 |

Figure 14.32: Block Model Geometry | 205 |

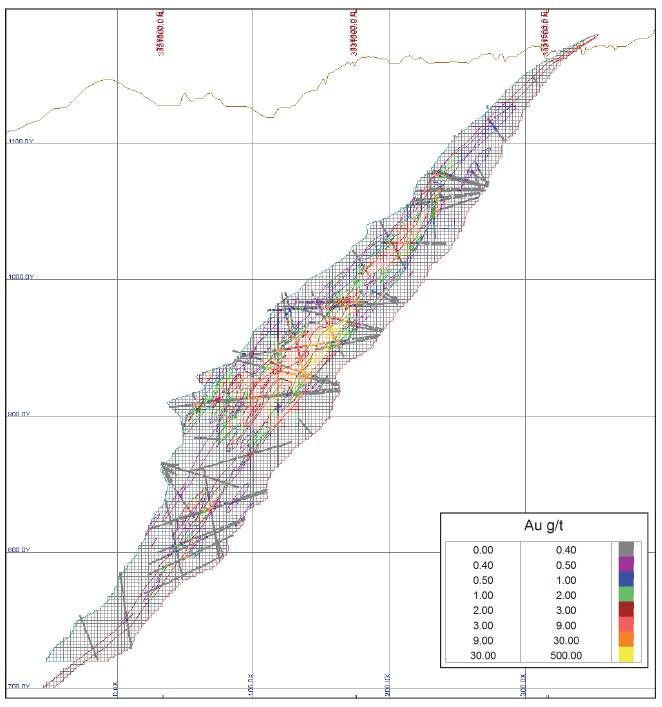

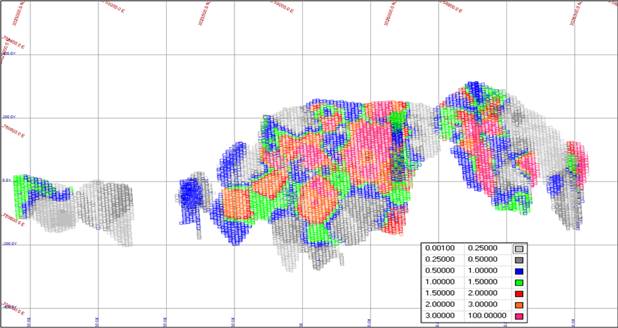

Figure 14.33: La Patria – Inclined Long Section – Gold Model for Vein (100) | 209 |

Figure 14.34: La Patria – Inclined Long Section – Silver Model for Vein (100) | 209 |

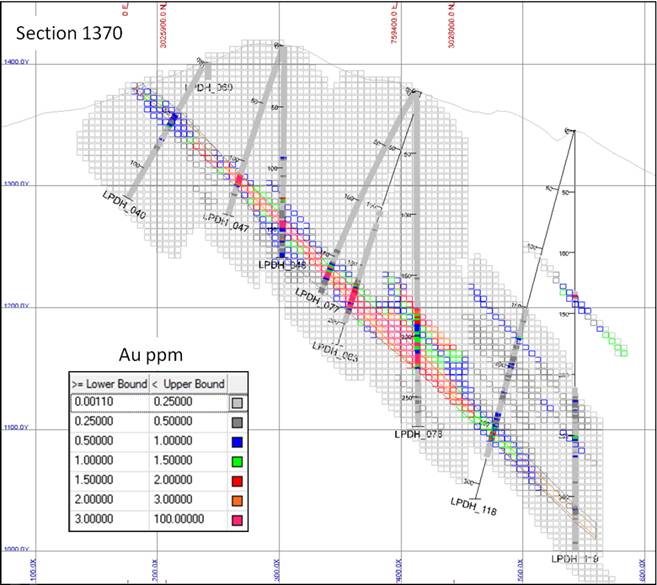

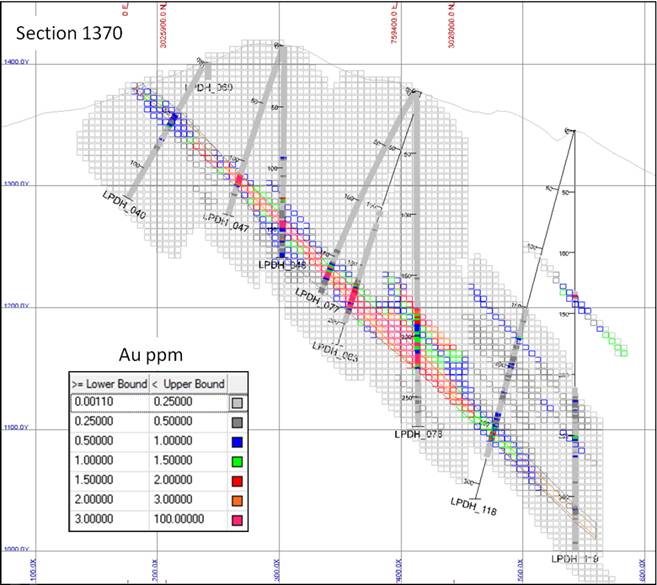

Figure 14.35: La Patria – Vertical Section 1370 – Gold (looking northwest) | 210 |

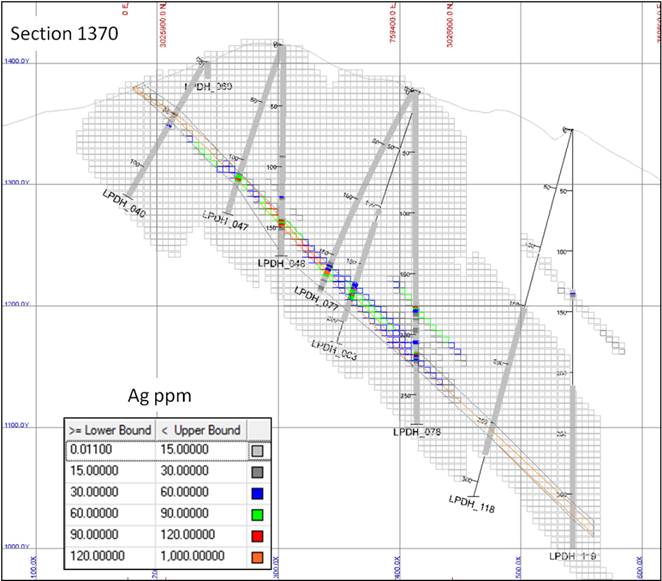

Figure 14.36: La Patria – Vertical Section 1370 – Silver (looking northwest) | 211 |

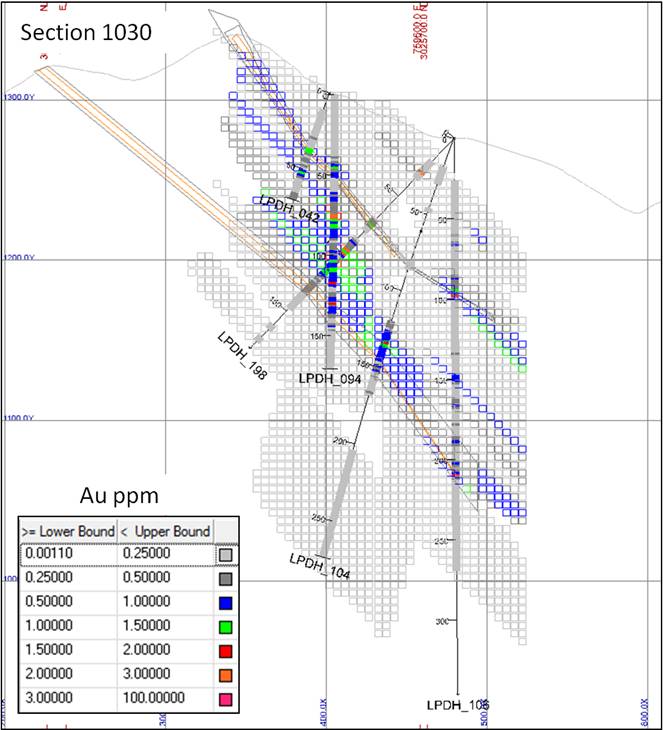

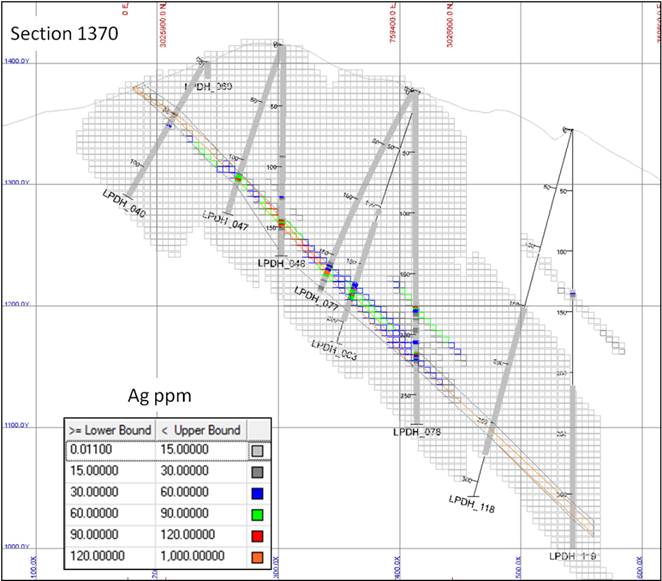

Figure 14.37: La Patria – Vertical Section 1030 – Gold (looking northwest) | 212 |

Figure 14.38: La Patria – Vertical Section 1030 – Silver (looking northwest) | 213 |

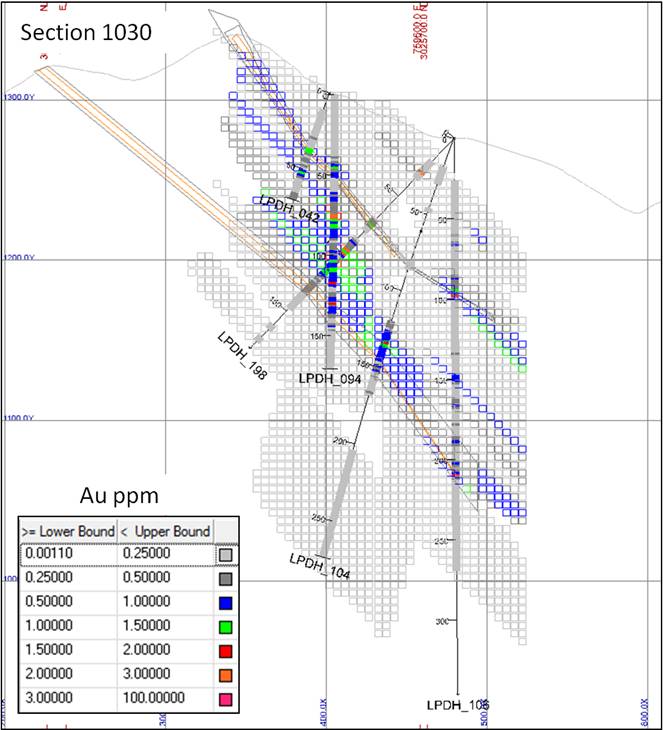

Figure 14.39: La Patria YE2012 Geologic Domains - Swath Plots by Column – All Blocks | 215 |

11

Figure 14.40: La Patria YE2012 Geologic Domains - Swath Plots by Level – All Blocks | 216 |

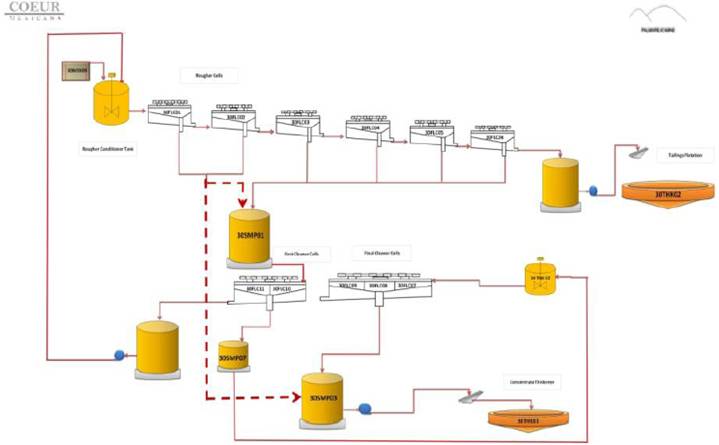

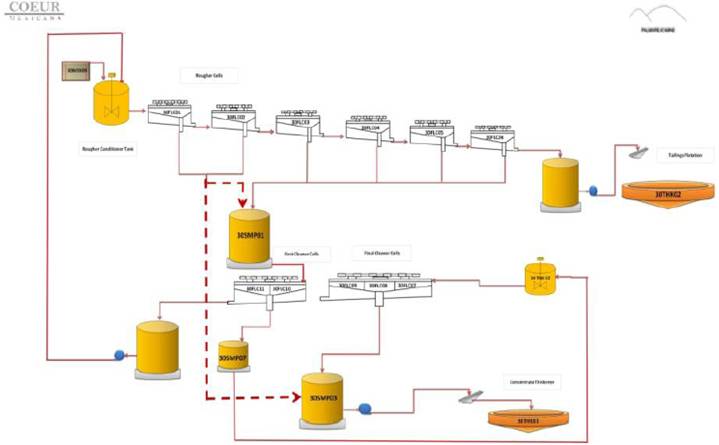

Figure 17.1: Palmarejo Flotation Circuit Flow | 231 |

Figure 17.2: Palmarejo Process Flow Sheet | 234 |

12

SECTION 1 - SUMMARY

This Technical Report concerns the Palmarejo silver and gold project located in the Sierra Madre mountain range in the western portion of the state of Chihuahua, Mexico. The data presented in this report are related to the Palmarejo, Guadalupe, and La Patria deposits and their Mineral Resource and Reserve estimates. The information in this Technical Report is effective as of January 1, 2013, unless otherwise stated. All currency is expressed as US dollars unless otherwise noted.

1.1 Property Description and Location

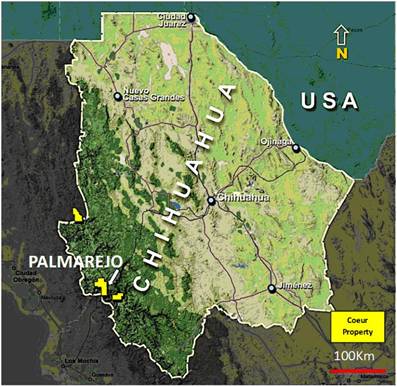

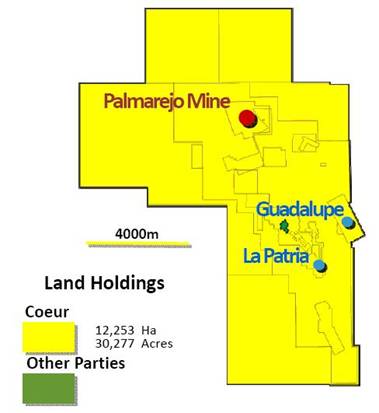

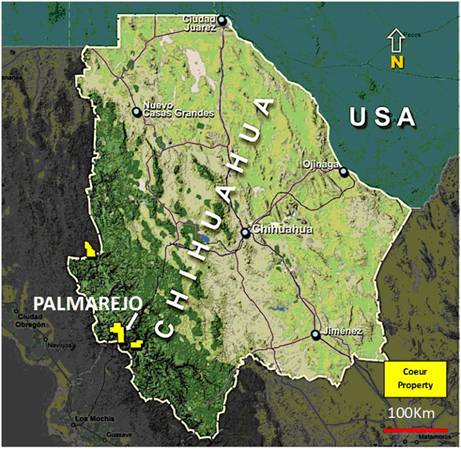

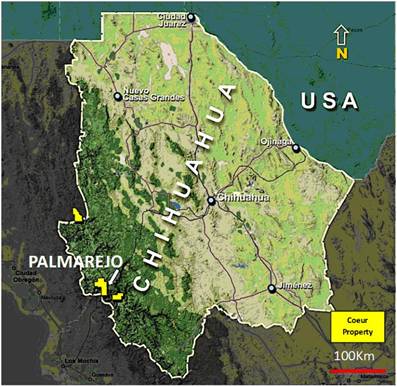

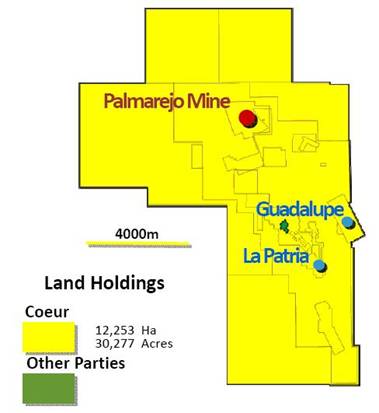

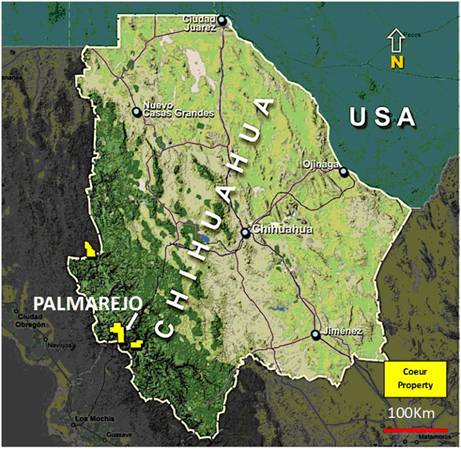

The Palmarejo Project is located about 420 kilometers by road southwest of the city of Chihuahua in the state of Chihuahua in northern Mexico and on the western edge of the Sierra Madre Occidental in the Témoris mining district (Figure 1.1). The project consists of the current Palmarejo surface and underground mine and mill complex, the Guadalupe deposit, located about 7 kilometers southeast of the Palmarejo mine and the La Patria deposit, located located southwest of Guadalupe (Figure 1.2). The terms “Palmarejo Project” or “Palmarejo District” used in this document refer to all three of the above mentioned deposits and consist of approximately 12,253 hectares covered by mining concessions. Coeur Mexicana owns or controls a 100% interest in 32 concessions totaling 12,204.10 hectares, a 50% interest in one concession of 43.77 hectares and 60% interest in two concessions totaling 5 additional hectares. (see Section 4).

Figure 1.1: Regional Map Showing Project Location

13

Figure 1.2: Localized Map Showing Project Location

1.2 Exploration

During the 2012 Exploration Year Coeur Mexicana drilled 103,873 meters of surface and underground core in 285 holes. This compares to the budgeted meterage of 84,000. Additional AFE’s extended the original budgeted funds from $15.8M USD to $21.0M USD expended at Palmarejo. Late in 2012 a new study indicated that potential for surface mineral deposits existed in the Animas (south) and Guadalupe North sections of the Guadalupe deposit. Drilling in early 2013 will further evaluate these areas. New mineralization was also cut in the Independencia clavo. Additional drilling during 2013 will seek to expand this deposit area. The Total Exploration Budget for 2013 at Palmarejo is $15 million.

1.3 Status of Development and Mine Operations

The Palmarejo Mine experienced its first complete year of operation in 2010 and recovered over 5.9 million ounces of silver and 102,000 ounces of gold. In 2011, 9.0 million ounces of silver and 125,000 ounces of gold were recovered in doré. Recovered precious metals for 2012 were 8.2 millon ounces of silver and 106,000 ounces for gold. The final tailings dam began receiving

14

tails during 2010 and continues to be constructed in stages to the final design crest elevation of 825 meters above sea level to be completed by 2014.

Ore at Palmarjo is mined by both conventional open pit techniques and by long hole underground techniques. Open pit mining operations are at full capacity. Haulage access to the process plant run-of-mine (ROM) stockpile and all waste dump areas are complete. Underground operation began stoping in mid-2010 with both transverse and longitudinal long hole stopes. During 2010 the Cement Rock Fill (CRF) backfill plant was completed and has been in full operation since the first quarter of 2011.

Current Mineral Reserves at the Palmarejo Mine include the “Rosario”, “Tucson”, and “Chapotillo” areas, mined by open pit methods and the “Rosario”, “76” and “108” areas, mined by underground methods.

The Guadalupe mine operation will operate as a satellite to the Palmarejo Mine. Haul road construction, geotechnical model development, and north portal pad construction were initiated in 2011. Collaring of the north portal took place in in 2012, with ore production scheduled to begin during third quarter 2013. The Palmarejo Mine will provide processing, tailings and administrative support for the Guadalupe Mine. Ore will be mined by long hole underground techniques (see Section 16). The ore material mined from Guadalupe to be hauled to the Palmarejo Mine site for processing at the existing Palmarejo mill and has been confirmed to have similar metallurgical characteristics as the existing Palmarejo underground operations.

1.4 Mineral Resource and Mineral Reserve Estimates

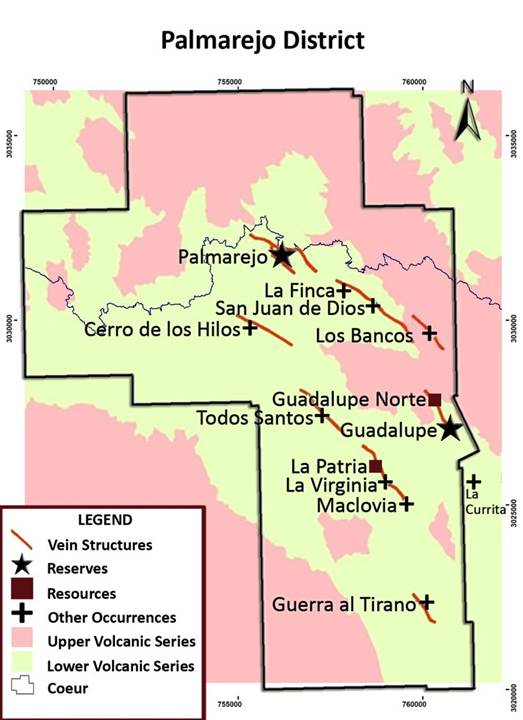

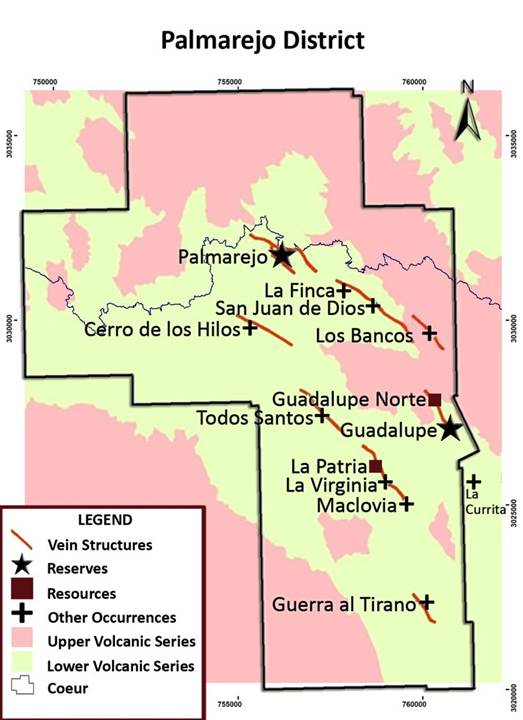

The silver and gold mineral deposits in the Palmarejo district are zoned epithermal occurrences hosted in quartz veins and quartz-rich breccias within a package of volcanic and volcano-sedimentary rocks known to host similar occurrences in the Sierra Madre Occidental of northern Mexico. The style of mineralization is typical of other epithermal precious metal deposits in the range as well as other parts of the world. Three deposits comprise the Mineral Resources and Reserves cited in this report —Guadalupe, Palmarejo, and La Patria (there are other mineralized targets on the property). The locations of mineralized structures are shown in red on the map below (Figure 1.3). The Palmarejo deposit includes the La Blanca and La Prieta veins that form a wishbone shown to the north. The Guadalupe and La Patria structures are shown to the south of the Palmarejo project.

15

Figure 1.3: Locations of Palmarejo District Mineral Deposits

16

The Mineral Resources and Mineral Reserves for the Palmarejo District stated in tables 1.1, 1.2 and 1.3 are effective January 1, 2013, and include the Palmarejo, Guadalupe, and La Patria silver and gold deposits. Palmarejo Mineral Resources are comprised of open pit resources above a cutoff grade of 0.98 g/t AuEq within a Whittle™ optimized pit and underground resources above a cutoff grade of 2.09 g/t AuEq. Guadalupe Mineral Resources are comprised of an open pit resources above a cutoff grade of 1.03 g/t and an underground resources above a cutoff grade of 2.14 g/t AuEq. La Patria Mineral Resources were calculated using a cutoff grade of 0.47 g/t AuEq. All resource cutoff grades were calculated using metal prices of US$1,700/oz gold and US$33.00/oz silver. The Au equivalent factor for Palmarejo and Guadalupe Mineral Resources were 58.96 and for LaPatria 56.49 (see Section 15). Rounding of tonnes, average grades and contained ounces may result in apparent discrepancies with total rounded tonnes, average grades and total contained ounces.

Table 1.1: Total Palmarejo District Resource Inclusive of Mineral Reserves

| | | | Average Grade

(g/t) | | Contained Ounces | |

Category | | Tonnes | | Au | | Ag | | Au | | Ag | |

Measured | | 8,103,000 | | 2.55 | | 190.3 | | 663,000 | | 49,578,000 | |

Indicated | | 25,067,000 | | 1.20 | | 61.1 | | 966,000 | | 49,272,000 | |

Meas. and Ind. | | 33,170,000 | | 1.53 | | 92.7 | | 1,629,000 | | 98,851,000 | |

Inferred | | 10,798,000 | | 1.32 | | 63.7 | | 457,000 | | 22,104,000 | |

Total Mineral Resource includes Proven and Probable Reserves

Cut-off grade for Palmarejo deposit: open pit 0.98 g/tAuEq, underground 2.09 g/tAuEq

Cut-off grade for Guadalupe deposit: open pit 1.03 g/tAuEq, underground 2.14 g/tAuEq

Cut-off grade for La Patria deposit 0.47 g/tAuEq

The Proven and Probable Mineral Reserves, effective January 1, 2013 (Table 1.2), are based on Measured and Indicated Mineral Resources only. The total Mineral Reserves for the Palmarejo District include the Palmarejo and Guadalupe deposits only. There are no Mineral Reserves defined for the La Patria deposit at this time. The separate Mineral Reserves for each deposit are detailed in Section 15 of this report. Each ore body has been evaluated using the appropriate mining method and corresponding cut-off grades using metal prices of US$27.50/oz silver and US$1,450/oz gold. Palmarejo Deposit Mineral Reserves were calculated using an open pit cutoff grade of 1.15 g/t AuEq and an underground cutoff grade of 2.45 g/t AuEq. Guadalupe Mineral Reserves were calculated using an open pit cutoff grade of 1.21 g/t AuEq and an underground cutoff grade of 2.51 g/t AuEq.

17

Table 1.2: Total Palmarejo District Mineral Reserves

| | | | Average Grade

(g/t) | | Contained Ouncespol; | |

Category | | Tonnes | | Au | | Ag | | Au | | Ag | |

Proven | | 5,213,000 | | 2.08 | | 160.2 | | 348,000 | | 26,858,000 | |

Probable | | 6,446,000 | | 1.53 | | 126.7 | | 317,000 | | 26,251,000 | |

Total | | 11,659,000 | | 1.77 | | 141.7 | | 665,000 | | 53,110,000 | |

Metal prices used were $1,450 USD per Au ounce, $27.50 US per Ag ounce

Includes Mineral Reserves for Palmarejo and Guadalupe deposits

Table 1.3 shows the remaining Mineral Resource for the Palmarejo District (including the Palmarejo, Guadalupe and La Patria deposits) exclusive of the Mineral Reserves and have not demonstrated economic viability.

Table 1.3: Total Palmarejo District Mineral Resource Exclusive of Mineral Reserves

| | | | Average Grade

(g/t) | | Contained Ounces | |

Category | | Tonnes | | Au | | Ag | | Au | | Ag | |

Measured | | 2,890,000 | | 3.39 | | 244.5 | | 315,000 | | 22,720,000 | |

Indicated | | 18,621,000 | | 1.08 | | 38.5 | | 649,000 | | 23,021,000 | |

Meas. and Ind. | | 21,511,000 | | 1.39 | | 66.1 | | 964,000 | | 45,741,000 | |

Inferred | | 10,798,000 | | 1.32 | | 63.7 | | 457,000 | | 22,104,000 | |

Mineral Resources are in addition to Mineral Reserves and have not demonstrated economic viability

Cut-off grade for Palmarejo deposit: open pit 1.03 g/tAuEq, underground 1.92 g/tAuEq

Cut-off grade for Guadalupe deposit: underground only 1.98 g/tAuEq

Cut-off grade for La Patria deposit 1.12 g/tAuEq

1.5 Economic Analysis

The economic analysis for Palmarejo District was based on a cash flow model which included the following inputs:

· Mineral Reserves as of January 1, 2013;

· Silver and gold prices of $1,450/oz Au and $27.50/oz Ag;

· Metallurgical recovery for silver and gold based on actual process plant results obtained to date and reasonable assumptions for continuous process improvement over time;

· Smelting and refining costs based on site information;

· Underground and open-pit mine production plans and schedules for Palmarejo and Guadalupe;

· Underground and open pit mining, ore processing and general and administration (G and A) Operating costs derived from previous actuals and LOM budget for Palmarejo and Guadalupe;

18

· Capital cost inputs including remaining construction, operating, sustaining and underground development capital for Palmarejo and Guadalupe; and

· Royalty payments to Franco Nevada Corporation according to the royalty agreement described in section 22;

Input parameters for ore and metal production, metallurgical recovery, capital and operating costs, and project schedule are based on current mine planning, detailed engineering, capital and operating cost updates and construction progress to date. The operating cost assumptions, metal prices, and process plant recoveries used for estimating open pit and underground reserves at Palmarejo and Guadalupe are summarized in Tables 1.4 and 1.5 (see Sections 21 and 22 for detailed costs and economic analysis).

Table 1.4: Palmarejo Operating Cost Estimates

Item | | Unit | | Value | |

Open Pit Mining | | $/tonne mined | | 1.92 | |

Underground Mining | | $/tonne mined | | 57.02 | |

Ore Processing | | $/tonne ore | | 32.47 | |

G & A - Open Pit and Underground | | $/tonne ore | | 17.66 | |

Reclamation – Open Pit | | $/tonne ore | | 0.20 | |

Cut-off Grade - Open Pit - Internal | | g/t AuEq | | 1.15 | |

Cut-off Grade - Underground | | g/t AuEq | | 2.45 | |

Gold Price | | $/oz | | 1450.00 | |

Silver Price | | $/oz | | 27.50 | |

Mill Recovery - Gold | | % | | 94 | % |

Mill Recovery - Silver | | % | | 82.5 | % |

Payable Metal - Gold | | % | | 99.90 | % |

Payable Metal - Silver | | % | | 99.70 | % |

19

Table 1.5: Guadalupe Mine Operating Cost Estimates

Item | | Unit | | Value | |

Open Pit Mining | | $/tonne mined | | 1.92 | |

Underground Mining | | $/tonne mined | | 57.02 | |

Ore Processing | | $/tonne ore | | 32.47 | |

Ore Transport — Guadalupe to Palmarejo Mill | | $/tonne ore | | 2.56 | |

G & A - Open Pit and Underground | | $/tonne ore | | 17.66 | |

Reclamation — Open Pit | | $/tonne ore | | 0.20 | |

Cut-off Grade - Open Pit — Internal | | g/t AuEq | | 1.21 | |

Cut-off Grade — Underground | | g/t AuEq | | 2.51 | |

Gold Price | | $/oz | | 1450.00 | |

Silver Price | | $/oz | | 27.50 | |

Mill Recovery — Gold | | % | | 94 | % |

Mill Recovery — Silver | | % | | 82.5 | % |

Payable Metal — Gold | | % | | 99.90 | % |

Payable Metal — Silver | | % | | 99.70 | % |

A summary of the economic analysis is shown in Table 1.6. The production schedule is based on concurrent mining of the Palmarejo open pit and underground Mineral Reserves and the Guadalupe underground Mineral Reserves.

20

Table 1.6: Life-Of-Mine Economic Analysis

Item | | Unit | | Palmarejo | | Guadalupe | |

Mine Production | | | | | | | |

Open Pit Tonnes | | tonnes ore | | 1,930,795 | | 563,102 | |

Ore Au Grade | | g/t Au | | 1.04 | | 1.42 | |

Ore Ag Grade | | g/t Ag | | 154.2 | | 156.1 | |

Underground Tonnes | | tonnes ore | | 2,508,240 | | 6,577,604 | |

Ore Au Grade | | g/t Au | | 3.14 | | 1.51 | |

Ore Ag Grade | | g/t Ag | | 183.6 | | 121.6 | |

Stockpile | | tonnes ore | | 79,391 | | | |

Ore Au Grade | | g/t Au | | 0.55 | | | |

Ore Ag Grade | | g/t Ag | | 77.0 | | | |

Mill Throughput | | | | | | | |

Total Ore Processed | | tonnes ore | | 11,659,133 | |

Ore Grade Au | | g/t Au | | 1.77 | |

Ore Grade Ag | | g/t Ag | | 141.7 | |

Metallurgical Recovery Au | | % | | 94% | |

Metallurgical Recovery Ag | | % | | 82.5% | |

Payable Au | | Oz Au | | 99.90% | |

Payable Ag | | Oz Ag | | 99.70% | |

Revenue | | | | | |

Gold Price | | $/oz | | $1,450 | |

Silver Price | | $/oz | | $27.50 | |

Gross Revenue | | $M | | $2,110.8 | |

Operating Costs | | | | | |

Open Pit Mining | | $M | | $(105.4) | |

Underground Mining | | $M | | $(253.0) | |

Milling/Processing | | $M | | $(378.6) | |

Smelting and Refining | | $M | | $(22.2) | |

G & A | | $M | | $(205.9) | |

Corporate Management Fee | | $M | | $(35.3) | |

Royalty(1) | | $M | | $(138.1) | |

Total Operating Cost | | $M | | $(1,138.5) | |

Cash Flow | | | | | |

Operating Cash Flow | | $M | | $936.5 | |

Capital | | $M | | $(171.3) | |

Royalty1 | | $M | | $(189.8) | |

Total Cash Flow (Net Cash Flow) | | $M | | $575.3 | |

Project NPV (8% discount rate) | | $M | | $431.4 | |

As of January 1, 2013, the Mineral Reserves are estimated to return an NPV of $431.4M at 8% discount rate, and generate a pre-tax net cash flow of $575.3M over the remaining life of the

21

project as illustrated in Table 1.6 above. The stated Mineral Reserves yield an estimated mine life of approximately eight years.

1.6 Conclusions and Recommendations

Palmarejo is an operating mining venture that has demonstrated positive cash flow. The financial analysis and associated assumptions conducted for this report support the conclusion that the Palmarejo mine will continue to be profitable and generate acceptable returns over the life of the mine.

It is recommended, based on the Guadalupe Mineral Reserves and joint economic analysis with the Palmarejo Mine, that Coeur continue to advance the Guadalupe project. Further work on Guadalupe will focus on optimization of mine designs and plans to maximize economic benefit of this addition to Palmarejo simultaneously as mine development work advances.

The Qualified Persons have visited the project sites and have reviewed all information regarding their relevant scopes of work (see Section 2). Data and assumptions used in the estimation of Mineral Resources and Mineral Reserves summarized in this report have been reviewed by the Qualified Persons, with reliance on other experts where appropriate (see Section 3), and they believe that the data are an accurate and reasonable representation of the Palmarejo silver-gold project.

It is the opinion of the Qualified Persons for this report that the Mineral Resource and Reserve estimates are based on valid data and are reasonably estimated using standard engineering practices. There are no known environmental, permitting, legal, title, socio-economic, marketing, or political issues that could materially affect the Palmarejo and Guadalupe Mineral Reserves.

22

SECTION 2 - INTRODUCTION

This Technical Report was prepared by or under the supervision of the Qualified Persons, for Coeur d’Alene Mines Corporation (Coeur), a publically-traded silver and gold mining company listed on the New York Stock Exchange as CDE, the Toronto Stock Exchange as CDM. The report has been prepared to provide scientific and technical information on the continuing operations, development and exploration of the Palmarejo Mine and surrounding concessions controlled by Coeur Mexicana (Palmarejo District) in a manner that is in accordance with Canadian National Instrument 43-101 disclosure and reporting requirements.

Mine Development Associates (MDA) authored previous Technical Reports (Gustin, M, 2004, 2005, 2006, 2007) pertaining to the Palmarejo District for the prior owners, Bolnisi Gold NL (BSG) and Palmarejo Silver and Gold Co (PJO). On December 21, 2007, Coeur acquired all of the outstanding stock of BSG, an Australian company listed on the Australian Stock Exchange, and PJO, a Canadian company listed on the TSX Venture Exchange. The principal asset of BSG was its ownership of 72.8% of the outstanding common shares of PJO. PJO, through its operating company Planet Gold S.A.de C.V., was engaged in the exploration and development of silver and gold properties located in Mexico. Among those was the Palmarejo Project. Section 27 details the sources of information used in the preparation of this report.

The Qualified Persons and contributors to this Technical Report are either senior members of Coeur’s corporate and technical staff or consultants retained to assist in preparing certain portions of the Technical Report. The contributors are or have been involved with the mineral exploration and extraction activities conducted by Coeur in the Palmarejo District.

The Qualified Persons for this Technical Report are

· Donald J. Birak, Coeur’s Senior Vice President— Exploration. Mr. Birak last visited the property from November 17th to November 19th, 2012.

· Keith R. Blair, Manager, Applied Geoscience LLC, Qualified Person per NI43-101. Mr. Blair (CPG) is a consulting geologist who was contracted to prepare the Mineral Resource estimates for the Palmarejo and La Patria deposits. He is a Qualified Person for the resource estimates of those properties.

· Klaus Triebel, Coeur’s Corporate Resource Geologist. Mr. Triebel (CPG) generated the resource estimate for the Guadalupe deposit and acts as a Qualified Person on that propery.

· Mr. Birak is the Qualified Person for all other aspects of this report.

The information contained in this Technical Report is current as of January 1, 2013 unless otherwise noted.

23

SECTION 3 - RELIANCE ON OTHER EXPERTS

The authors of this report state that they are the Qualified Persons for those areas identified in the appropriate “Certificate of Qualified Person” attached to this report. The authors may have relied upon, and believe there is a sound basis for reliance upon, the following experts and reports.

Open pit and underground mine designs, plans and schedules were prepared by mining engineers at the Palmarejo mine and at Coeur’s corporate office in Coeur d’Alene, Idaho. Such planning is generally subject to internal checks and verification but no exhaustive verification process was conducted by the Qualified Person for this report.

Economic analysis and associated financial model inputs were calculated, chosen and used by planning and accounting staff at the Palmarejo mine and at Coeur’s corporate office in Coeur d’Alene, Idaho. Such work is generally subject to internal checks and verification but no exhaustive verification process was conducted by the qualified person for this report.

Coeur has also relied on the drilling, interpretations, and results conducted by other experts (including AMEC and MDA). The Qualified Person has not personally verified the work performed by AMEC to create a model of the historic mining at Palmarejo and relies on their expertise, noting that the volume of the void model is reasonable for depletion of the Palmarejo resource model. The Qualified Persons have reviewed this information and drilling and sampling methods conducted by Coeur Mexicana and believe that the methods employed are sound and that the results and interpretations are accurate and within industry standards.

AMEC International (Chile) S.A., “Palmarejo Resource Modeling, Chihuahua, Mexico,” a private report for Coeur d’Alene Mines Corporation, February, 2008.

Outokumpu Pty Ltd., “Supaflo® Thickener Test Data Report S559TA”, private report for Intermet Engineering Technologies for the Palmarejo Project, July, 2005.

SGS, “Batch and Pilot Flotation on a Sample of Palmarejo Silver/Gold Ore, Lakefield Oretest Job Number 9632”; a private report for Bolnisi Gold NL, May, 2005.

SGS, “Pruebas Metalúrgicas Para Determinar la Susceptibilidad de Dos Muestras de Mineral a los Procesos de Lixiviación, Flotación y Concentración Gravimétrica”, Report No. SGS-49-08; a private report for Planet Gold, S.A. de C.V., November 11, 2008.

SGS, “Pruebas Metalúrgicas Para Determinar la Susceptibilidad de Cuatro Compositos de Mineral a los Procesos de Lixiviación, Flotación y Concentración Gravimétrica”, Report No. SGS-04-09; a prívate report for Coeur Mexicana, S.A. de C.V., March 06, 2009.

Pincock Allen & Holt PAH Consultants, “Mine Planning Exercise at the Coeur Palmarejo Mine, Mexico” PAH Project No. DE-00179, May, 2011.

24

SECTION 4 - PROPERTY DESCRIPTION AND LOCATION

4.1 Property Description and Location

The Palmarejo District is located in the state of Chihuahua in northern Mexico, 420 kilometers by road southwest of the city of Chihuahua, the state capital (Figures 1.1 and 4.1). The project lies in the Témoris mining district, part of the gold-silver belt of the Sierra Madre Occidental, about 15 kilometers northwest of the town of Témoris.

The project can be found on the Instituto de Nacional de Estadística, Geografía e Informática (“INEGI”) Ciudad Obregon geological sheet and the INEGI Chinipas de Almada topographic map and is centered on coordinates 27°23’ Longitude and 108°26’ Latitude. The coordinate system used for all maps and sections in this report is the Universal Transverse Mercator (WGS 84) Zone 12 (Northern Hemisphere).

The Dirección General de Minas (“General Bureau of Mines”) administers Mining Concessions in Mexico. A legal survey (“Trabajos Periciales”) of the property was completed as part of the process of obtaining the original Concessions.

Figure 4.1: General Project Location

25

4.2 Land Tenure

The Palmarejo Mine area consists of approximately 12,253 hectares covered by Mining Concessions (Figure 4.2). The Guadalupe project area is located entirely within this area of Mining Concessions and is contained within the San Carlos Concession, which consists of 160.0000 hectares, and is 100% owned by Coeur Mexicana S.A. de C.V. (“Coeur Mexicana”).

Mining Concessions totaling 32 and consisting of 12,204.1118 hectares are 100% owned and registered by Coeur Mexicana, formerly known as Planet Gold S.A. de C.V. (“Planet Gold”) are listed in Table 4.1 and include:

(1) 3,852.5095 hectares in the Trogan and Trogan Fracción Mining Concessions, the first tenements staked by Planet Gold to envelope all of the existing Concessions in the immediate project area (the “original Trogan Concessions”);

(2) The Ampliación Trogan, Ampliación Trogan Oeste, Trogan Norte 1, Trogan Norte 2, and Trogan Oeste Mining Concessions totaling 7,145.5227 hectares that are contiguous to the original Trogan Concessions on the north, northeast, and west;

(3) The La Buena Fe Norte Mining Concession covers 98.0878 hectares and was acquired by means of a lottery when the prior tenement holder defaulted on payment of Mining Duties; and

(4) 1,013.51 hectares in 21 concessions purchased by Planet Gold within the original Trogan Concessions that include the Palmarejo Resources described in following sections.

(5) 94.4844 hectares in three Concessions purchased by Coeur Mexicana in 2011 from Minera Azteca de Oro y Plata S.A. de C.V. (Minera Azteca). The acquisition is described below as the Guerra al Tirano agreement.

As shown in Table 4.2, three Concessions totaling 48.7717 hectares are partially owned by Coeur Mexicana (formerly Planet Gold), including 50% of the Camila Concession of 43.7717 hectares, and 60% of the Carrizo Concessions.

26

Table 4.1: Mining Concessions Owned by Coeur Mexicana

Concession | | Title Number | | Area (has.) | | Expiration Date | |

Trogan | | 221490 | | 3844.5413 | | Feb 18, 2054 | |

Trogan Fracción | | 221491 | | 7.9682 | | Feb 18, 2054 | |

Ampliación Trogan | | 224118 | | 703.2318 | | Apr 07, 2055 | |

Ampliación Trogan Oeste | | 225223 | | 1699.9939 | | Aug 04, 2055 | |

Trogan Norte 1 | | 225278 | | 1024.0000 | | Aug 11, 2055 | |

Trogan Norte 2 | | 225279 | | 1019.2222 | | Aug 11, 2055 | |

Trogan Oeste | | 225308 | | 2699.0748 | | Aug 15, 2055 | |

La Buena Fe Norte | | 226201 | | 98.0878 | | Nov 28, 2055 | |

Caballero Azteca | | 209975 | | 5.0510 | | Aug 30, 2049 | |

Carmelita | | 209976 | | 5.3430 | | Aug 30, 2049 | |

El Risco | | 210163 | | 24.0000 | | Sep 09, 2049 | |

La Aurelia | | 209541 | | 10.0000 | | Aug 02, 2049 | |

La Mexicana | | 212281 | | 142.1410 | | Sep 28, 2050 | |

Lezcura | | 210479 | | 14.5465 | | Oct 07, 2049 | |

Palmarejo | | 164465 | | 52.0737 | | May 08, 2029 | |

San Carlos | | 188817 | | 160.0000 | | Nov 28, 2040 | |

Santo Domingo | | 194678 | | 15.3737 | | May 06, 2042 | |

Unificación Huruapa | | 195487 | | 213.7755 | | Sep 13, 2039 | |

La Moderna | | 225574 | | 75.8635 | | Sep 22, 2055 | |

Los Tajos | | 186009 | | 2.7043 | | Dec 13, 2039 | |

La Estrella | | 189692 | | 59.5863 | | Dec 4, 2040 | |

Virginia | | 214101 | | 12.0906 | | Aug 9, 2051 | |

La Buena Fe | | 188820 | | 60.0000 | | Nov 28, 2040 | |

Ampliación La Buena Fe | | 209648 | | 40.8700 | | Aug 2, 2049 | |

La Victoria | | 210320 | | 76.0883 | | Sep 23, 2049 | |

Patria Vieja | | 167323 | | 4.0000 | | Nov 2, 2030 | |

Nueva Patria | | 167281 | | 11.0000 | | Oct 29, 2030 | |

Maclovia | | 167282 | | 6.0000 | | Oct 29, 2030 | |

San Juan de Dios | | 167322 | | 23.0000 | (1) | Nov 2, 2030 | |

Unificación Guerra al Tirano | | 170588 | | 27.4471 | | Jun 1, 2032 | |

Reyna de Oro | | 198543 | | 27.1791 | | Nov 29, 2043 | |

Tres de Mayo | | 187906 | | 39.8582 | | Nov 21, 2040 | |

Total | | | | 12,204.1118 | | | |

(1) The Title at the General Bureau of Mines (the “Bureau”) erroneously states Mining Concession is 5.2300 Ha. Coeur Mexicana is filing Writ to petition the Bureau, to have the Title accurately reflect the true size of San Juan de Dios Mining Concession, which is 23.0000 Ha.

27

Table 4.2: Mining Concessions Partially Owned by Coeur Mexicana

Concession | | Title Number | | Area (has.) | | Expiration Date | | Ownership | |

Camila | | 220801 | | 43.7717 | | Oct 7, 2053 | | 50 | % |

Carrizo Anexas | | 167284 | | 1.0000 | | Oct 29, 2030 | | 60 | % |

El Carrizo Anexas | | 167283 | | 4.0000 | | Oct 29, 2030 | | 60 | % |

Total | | | | 48.7717 | | | | | |

Types of Concession

Pursuant to an amendment of the Mexican Mining Law (the “Law”), by Congressional Decree of February 22, 2005, which was published in the Federal Official Gazette April 28, 2005, there is no longer any distinction between an Exploration Concession and an Exploitation Concession. Consequently, all Concessions are “Mining Concessions” (Exploration and Exploitation), and as a result, all Exploration and Exploitation Concessions have been converted into Mining Concessions, expiring fifty years from the date they were originally granted.

28

Figure 4.2: Property Map of the Palmarejo District

4.2.1 Mining Concession Agreements

Corporación Minera de Palmarejo S.A. de C.V. Agreement

A Lease and Option to Purchase Agreement (the “Agreement”) between Planet Gold and Corporación Minera de Palmarejo, S.A. de C.V. (“CMP”) represented by Mr. Ruben Rodriguez Villegas, for Concessions totaling 642.3262 hectares (Table 4.3) was signed on June 26, 2003. The Concessions correspond to the core of the Palmarejo and Guadalupe projects. The Agreement, which could have been terminated with 30 days notice by Planet Gold, granted Planet Gold an exclusive five-year exploration right over the project in exchange for cash payments, including $20,000 on signing and nine escalating semi-annual payments totaling $385,000. When these obligations were fulfilled (or before if convenient for the company), Planet Gold could acquire a 100% interest in the concessions by making a payment of $115,000 by the end of five years from the effective date of the agreement. Planet Gold exercised the option on April 6, 2005 and all the Concessions were transferred to Planet Gold.

29

Table 4.3: CMP Agreement Concessions

Concession | | Title Number | | Area (has.) | | Expiration Date | |

Caballero Azteca | | 209975 | | 5.0510 | | Aug 30, 2049 | |

Carmelita | | 209976 | | 5.3430 | | Aug 30, 2049 | |

El Risco | | 210163 | | 24.0000 | | Sep 09, 2049 | |

La Aurelia | | 209541 | | 10.0000 | | Aug 02, 2049 | |

La Mexicana | | 212281 | | 142.1410 | | Sep 28, 2050 | |

Lezcura | | 210479 | | 14.5565 | | Oct 07, 2049 | |

Palmarejo | | 164465 | | 52.0855 | | May 08, 2029 | |

San Carlos | | 188817 | | 160.0000 | | Nov 28, 2040 | |

Santo Domingo | | 194678 | | 15.3737 | | May 06, 2042 | |

Unificación Huruapa | | 195487 | | 213.7755 | | Sep 13, 2039 | |

Total | | | | 642.3262 | | | |

Aldo Arturo Aguayo Dozal Agreement

On July 7, 2003, an application for the Trogan Concession was filed in Chihuahua with the Informe Pericial. This application was configured to surround the Palmarejo District area and other properties of interest along major northwest and west-northwest trending structures; the initial application covered about 16km in a northwest-southeast direction and three to five kilometers in a northeast-southwest direction. From the application, the Trogan and Trogan Fracción Mining Concessions (Table 4.1) were granted in the name of Aldo Arturo Aguayo Dozal, a Mexican employee of Planet Gold, on February 19, 2004. On October 15, 2004, Aldo Arturo Aguayo Dozal transferred all rights to the Trogan and Trogan Fracción Mining Concessions to Planet Gold S.A. de C.V. for a nominal sum.

Carmen Breach Valenzuela Agreement

A Lease and Option to Purchase Agreement (the “Agreement”) between Planet Gold and Carmen Breach Russo Viuda de Valenzuela (“Mrs. Breach Valenzuela”), the heir of the late Sr. Francisco Jacobo Valenzuela (“Mr. Valenzuela Breach”), for Concessions totaling 49.0000 hectares (Table 4.4) was signed on October 9, 2003. The Concessions lie in three discrete areas within the broader project region. The Agreement, which could have been terminated with 30 days notice by Planet Gold, granted Planet Gold an exclusive four-year exploration right over the project in exchange for cash payments, including $25,000 on signing and seven escalating semi-annual payments totaling $205,000. When these obligations were fulfilled, Planet Gold could acquire a 100% interest in the Concessions by making a payment of $70,000 by the end of four years from the effective date of the Agreement.

All contractual obligations and cash payments have been completed and the transfer of rights to Coeur Mexicana for Concessions Patria Vieja, Nueva Patria, Maclovia, and San Juan de Dios has been accomplished.

30

Table 4.4: Carmen Breach Valenzuela Agreement Concessions

Concession | | Title Number | | Area (has.) | | Expiration Date | |

Patria Vieja | | 167323 | | 4.0000 | | Nov 2, 2030 | |

Nueva Patria | | 167281 | | 11.0000 | | Oct 29, 2030 | |

Maclovia | | 167282 | | 6.0000 | | Oct 29, 2030 | |

San Juan de Dios | | 167322 | | 23.0000 | (2) | Nov 2, 2030 | |

Carrizo Anexas | | 167284 | | 1.0000 | | Oct 29, 2030 | |

El Carrizo Anexas | | 167283 | | 4.0000 | | Oct 29, 2030 | |

Total | | | | 49.00 | | | |

Mrs. Breach Valenzuela currently is the registered owner of 60% of the El Carrizo Anexas and Carrizo Anexas Concessions; Mrs. Breach Valenzuela needs to complete a transfer of rights to the remaining 40% ownership before Coeur Mexicana can hold an option on 100% of the two Concessions.

Ricardo Rodriguez Lugo and Joaquin Rodriguez Lugo Agreement

A Lease and Option to Purchase Agreement (the “Agreement”) between Planet Gold and Messrs. Ricardo Rodriguez Lugo and Joaquin Rodriguez Lugo for Concessions totaling 100.8701 hectares (Table 4.5) was signed on April 20, 2004. The Agreement, which could have been terminated with 30 days notice by Planet Gold, granted Planet Gold an exclusive four-year exploration right over the Concessions in exchange for cash payments, including $12,800 on signing and seven escalating semi-annual payments totaling $102,800. When these obligations were fulfilled, Planet Gold could acquire a 100% interest in the Concessions by making a payment of $80,000 by the end of 4.5 years from the effective date of the Agreement.

All of the contractual obligations and cash payments have been completed and the La Buena Fe Concession was transferred to Planet Gold, while an administrative mistake by the Dirección General de Minas, concerning the Ampliación La Buena Fe Concession is being corrected, so this Concessions will be valid, in good standing and correctly identified as being owned by Coeur Mexican S.A. de C.V., formerly known as Planet Gold.

Table 4.5: Ricardo Rodriguez Lugo and Joaquin Rodriguez Lugo Agreement Concessions

Concession | | Title Number | | Area (has.) | | Expiration Date | |

La Buena Fe | | 188820 | | 60.0000 | | Nov 28, 2040 | |

Ampliación La Buena Fe | | 209648 | | 40.8701 | | Aug 2, 2049 | |

Total | | | | 100.8701 | | | |

(2) The Title at the General Bureau of Mines (the “Bureau”) erroneously states Mining Concession is 5.2300 Ha. Coeur Mexicana is filing Writ to petition the Bureau, to have the Title accurately reflect the true size of San Juan de Dios Mining Concession, which is 23.0000 Ha.

31

Francisco Yanez Medina Agreement

Under the terms of a Purchase Agreement (the “Agreement”) between Planet Gold and Francisco Yanez Medina, signed on September 14, 2004, Planet Gold purchased the La Moderna Exploration Concession (Table 4.1) for $12,000. The Exploration Concession was scheduled to expire on September 29, 2004, but Planet Gold filed an application to convert it to an Exploitation Concession; the application was granted on September 23, 2005.

Arturo Perea Saenz Agreement

Planet Gold acquired a 100% interest in the Los Tajos Mining Concession (Table 4.1) from Arturo Perea Saenz for $25,000 on April 21, 2005.

Eva Alicia Fontes Manriquez and James Max Patterson Campbell Agreement

On May 5, 2005, Planet Gold signed a Lease and Purchase Option Agreement (the “Agreement”) with Eva Alicia Fontes Manriquez and husband, James Max Patterson Campbell, concerning the Victoria Mining Concession (Table 4.6). Under this Agreement, Planet Gold held a three-year exploration right for escalating semi-annual payments totaling USD$180,000. On or before the conclusion of the three-year period, Planet Gold retained the right to purchase 100% ownership of the Concession for an additional USD$120,000.

All of the contractual obligations and cash payments were completed and the Victoria Concession was transferred to Coeur Mexicana.

Table 4.6: Eva Alicia Fontes Manriquez, Et vir Agreement Concessions

Concession | | Title Number | | Area (has.) | | Expiration Date | |

Victoria | | 210320 | | 76.0883 | | Sep 23 2049 | |

Total | | | | 76.0883 | | | |

Ruben Walterio Rascon Tapia Agreement

Planet Gold signed a Purchase Agreement (the “Agreement”) with Mr. Ruben Walterio Rascon Tapia for the La Estrella Mining Concession on February 17, 2004. The purchase price was $500,000, including a $150,000 payment in May 2006, five $25,000 payments every four months thereafter, and a final payment of $225,000, 24 months after the May 2006 payment.

All of the contractual obligations were fully satisfied and the La Estrella Concession was transferred to Planet Gold.

Maritza Rascon Serrano Agreement

On May 16, 2006, Planet Gold signed a Purchase Agreement (the “Agreement”) with Mrs.

32

Maritza Rascon Serrano for the Virginia Mining Concession. The purchase price was $625,000, including $300,000 upon execution of the Agreement, five payments of $25,000 every 4 months thereafter, and a final payment of $200,000, 24 months after the initial payment.

All of the contractual obligations were fully satisfied and the Virginia Concession was transferred to Planet Gold.

Mr. Francisco Hernandez Rochin Agreement

On December 6, 2005, Planet Gold signed a Transfer Agreement (the “Agreement”) with Mr. Francisco Hernandez Rochin for 50% of the Camila Concession, which comprises 43.7717 ha. This Concession is located outside of any areas of active exploration or operations being conducted by Coeur Mexicana. Mr. Simon Trejo Rascon owns the remaining 50% interest in and to Camila.

Minera Azteca de Oro y Plata S.A. de C.V. Agreement

A Purchase Agreement between Coeur Mexicana and Minera Azteca de Oro y Plata S.A. de C.V. (“Minera Azteca”), for Concessions totaling 94.4844 hectares (Table 4.7) was signed on October 10, 2011. The Concessions constitute the core of the Guerra al Tirano project, which is located at the south central area within the Trogan block. The Agreement transferred 100% of the mining rights in exchange for a cash payment of $1,200,000 on signing, plus a royalty of 2% NSR. Coeur Mexicana may acquire, at any time, up to 1.5% of the NSR, at a fixed price of $750,000.

The contractual obligations and cash payment were completed and the transfer of rights to Coeur Mexicana for Concessions Unificación Guerra al Tirano, Reyna de Oro, and Tres de Mayo was accomplished.

Table 4.7: Minera Azteca de Oro y Plata Agreement Concessions

Name | | Title Number | | Area (has.) | | Expiration date | |

Unificación Guerra al Tirano | | 170588 | | 27.4471 | | Jun 2, 2032 | |

Reyna de Oro | | 198554 | | 27.1791 | | Nov 25, 2043 | |

Tres de Mayo | | 187906 | | 39.8582 | | Nov 22, 2040 | |

Total | | | | 94.4844 | | | |

4.2.2 Ejido Agreements

Exploration Ejido Agreements

In addition to the Lease and Option to Purchase Agreements described above, Coeur Mexicana obtained initial Exploration Agreements (the “Agreement(s)”) that allow surface disturbance for

33

the purpose of conducting exploration activities from four ejidos, or surface-owner councils, that covered the Coeur Mexicana land holdings. The project area is under the jurisdiction of each of these four ejidos, which include the Palmarejo, Guazapares, Guerra al Tirano, and Agua Salada ejidos. Agreements with the Palmarejo, Guazapares, and Guerra al Tirano ejidos were effective through November 2009, while the Agua Salada Agreement was effective through September 2010. These Agreements allowed Coeur Mexicana to carry out exploration on the ejido grounds in exchange for paying nominal sums determined by the areas of disturbance associated with the construction of new roads, drill pads, etc. As part of its public relations program with the local inhabitants, Coeur Mexicana also granted certain specific requests by the ejidos above those commitments contained in the Agreements.

Surface Use Ejido Agreements

Subsequent to the Exploration Agreements described above, Coeur Mexicana executed Agreements with the Guazapares, Palmarejo and Agua Salada ejidos covering surface activities involved with the exploration, exploitation, and processing of mineral deposits, the construction of all necessary mining and processing facilities, and the undertaking of mining operations, in return for annual rental payments.

The annual rental payment to the Guazapares ejido is $17,500 and annual rent to the Palmarejo ejido is $25,000. The Agreements were signed on October 16, 2005 and October 30, 2005, respectively, and are effective for 15 years with an option for the company to extend the terms for an additional 15 years. The Palmarejo ejido agreement was modified in 2010 to include additional right-of-way authorizations. As a result, the annual rent was increased to about $45,000. Planet Gold also negotiated a similar agreement with the Agua Salada ejido on November 20, 2005, in return for annual rent of $3,560.

These Agreements are registered with the Registro Agrario Nacional (“Agrarian National Registry”).

Further Exploration Area Ejido Agreements

In October 2008, Planet Gold entered into an agreement with Guazaparez ejido for land use in the Guadalupe/Los Bancos area. An annual rent of $50,000 is paid to the ejido for the use of 372.8 hectares during a renewable 4-year term. In 2009, a contract modification with the Guazapares ejido was finalized assuring Coeur Mexicana the use of 643.7 hectares for the planned mining activities at Guadalupe as outlined in this report. This mining agreement has a six-year term, is renewable, and raised the annual rent to $85,000. Coeur Mexicana has also obtained complete control of part of the rented area by paying compensation to some land-holding ejidatarios(3).

On August 16, 2010, Coeur Mexicana signed a 4-year Exploration Agreement with the Guerra al Tirano ejido, covering 69.7 hectares in the La Patria project.

(3) Individual members of an ejido.

34

In October 2011, Coeur Mexicana acquired the Guerra al Tirano Project from Minera Azteca. Included, was an agreement Minera Azteca executed with the Guerra al Tirano ejido, for the use of the surface land. This agreement was originally executed in February 2007, and provides for an annual rent payable to the ejido during the exploration phase, for the use of 94.48 hectares for approximately USD$8,000. After the exploration phase, the annual rent will increase in several stages, up to a maximum of approximately USD$80,000 per year, after the 6th year of production. There is no expiration date.

4.2.3 Royalty Agreement

On January 20, 2009, Coeur Mexicana, S.A. de C.V. (“Coeur Mexicana”) entered into a gold production royalty transaction (the “Royalty Agreement”) with Franco-Nevada Mexico Corporation, S.A. de C.V. (“Franco-Nevada”) under which Franco-Nevada purchased a royalty covering 50% of the life of mine gold to be produced from the Palmarejo Mine. Coeur Mexicana received $75 million in cash plus a warrant to acquire Franco-Nevada Common Shares, which was valued at $3 million at closing of the transaction. The Royalty Agreement provides for a minimum obligation to be paid monthly on a total of 400,000 troy ounces of gold, or 4,167 troy ounces per month, over an initial eight year period. Each monthly payment is an amount equal to the greater of 4,167 troy ounces of gold or 50% of actual gold production multiplied by the excess of the monthly average market price of gold above $400 per troy ounces (which $400 floor is subject to a 1% inflation compounding adjustment beginning on January 21, 2013). After payments have been made on a total of 400,000 troy ounces of gold, the royalty obligation is payable in the amount of 50% of actual gold production per month multiplied by the excess of the monthly average market price of gold above $400 per troy ounce, adjusted as described above. Payments under the Royalty Agreement are to be made in cash or gold bullion.

Please refer to Section 20 for discussion regarding environmental and permitting factors related to the property.

35

SECTION 5 - ACCESSIBILITY, CLIMATE, LOCAL RESOURCES, INFRASTRUCTURE AND PHYSIOGRAPHY

5.1 Accessibility

Access to Palmarejo from the city of Chihuahua, in the state of Chihuahua, Mexico is via paved Highways 16 and 127 to the town of San Rafael. From San Rafael travel is by gravel road to Témoris, and finally to Palmarejo. Approximate total driving time is 7 hours from Chihuahua. Construction of 40 km of additional paved road is currently being carried out by the Chihuahua State Government between San Rafael and Bahuichivo, as part of the Chihuahua-Sinaloa road project. The Chihuahua-Pacifico rail service operates between Chihuahua and Los Mochis (Topolobampo seaport) on the southwest coast of Mexico. Two passenger trains and one freight train operate daily between these cities. Estación Témoris rail station is located 10 km south from the town of Témoris. Access from Témoris to Palmarejo is along 35 km of company-maintained gravel road, an extension of Highway 127, that continues on through to Chinipas (Gustin and Prenn, 2007).

5.2 Climate

The climate of the area is moderate. Average maximum temperature is about 34°C, with an average minimum temperature of about 5°C. Rainfall occurs mainly in the summer months, with an average annual precipitation of about 800 mm (Gustin and Prenn, 2007). The climate poses no significant impediments to current work in the area and all anticipated exploration and operations activities can be conducted year round.

5.3 Local Resources and Infrastructure

The Palmarejo area has moderately well developed infrastructure and a local work force familiar with mining operations. Approximately four to five thousand inhabitants reside within a one-hour drive, on all-weather compacted dirt roads, of the project (Skeet, 2004). Chinipas and Temoris are the two nearest towns, both with an estimated population of approximately 1,600 inhabitants (according to 2005 census data). The small village of Palmarejo lies immediately northwest of the Palmarejo District area and, according to the 2010 census, has a population of about 430 (census data from www.inegi.org.mx, viewed January, 2011). Many of the workers are employees at the mine and live in these three, nearby communities.

The Chihuahua-Pacifico railway connects Chihuahua with Los Mochis, located on Mexico’s western coast in the state of Sinaloa. Passenger and freight trains pass along this railway daily. The Estación Témoris rail station is about 45 km from Palmarejo by gravel road. Light aircraft airstrips are located in both Témoris and Chinipas, and in 2011 an airstrip was built in Palmarejo to service the mine.

The Palmarejo Mine site was serviced with a 33,000-volt power line supplied by the Comisión Federal Electricidad (CFE), the Mexican federal power authority. An additional 115-kV high voltage line was constructed from the Divisadero substation to the Palmarejo Mine site during

36

2009, and the Palmarejo mine, plant and all other electrical load is now connected to this grid. The same 115-kV high voltage line is within 7 kilometers of the Guadalupe project and excess capacity exists on this line to supply the estimated 2.5 MW of power needed for Guadalupe.

The state road between San Rafael and Palmarejo was initially upgraded in late 2007 for the mobilization of equipment and construction materials. This is an on-going activity as Coeur has permanent maintenance crews working on the road. A joint project between the Chihuahua and Sinaloa State Governments to build a paved road between San Rafael (Chihuahua) and Choix (Sinaloa) is currently underway.

Water for the Palmarejo mine is obtained from a variety of sources. As of 2011 the primary water for milling is recycled from the tailings dam and from the Fresh Water Diversion Dam (FWDD). When needed, additional make-up water, is either pumped from the Chinipas river infiltration gallery, from a shallow water well located in Agua Salada, or from the FWDD and piped to site via a 17 km pipeline. Water for domestic use is also obtained from the FWDD and hauled to the camps by truck load (10,000 L tanks on flatbed trucks) Water from the FWDD is also pumped to the underground mine for drilling and dust suppression, or to the plant for make-up water.

Fresh water for the Guadalupe Mine is planned to come from a combination of sources which includes surface water in nearby arroyos and the FWDD. Water will also be collected in sumps constructed in the underground mines and clarified for recycling in the underground system.

The infrastructure for the Palmarejo mine is complete and the mine is operating and processing ore 24 hours per day 7 days per week. The Guadalupe project will be run as a satellite operation of the Palmarejo mine and much of the existing infrastructure at Palmarejo will support the Guadalupe mine and material processing.

The first phase of the Palmarejo Final Tailings Dam (FTD) was completed in 2010 to the 790 meter elevation and started accepting tailings since the fourth quarter of 2010. The second phase of the Final Tailings Dam was completed in August of 2011 to the 800 meter elevation. Phase three, build-up to 810 meters was completed in 2012. Currently, the engineering department is working on the fourth phase that will go to the 825 meter elevation and is expected to be completed by July of 2014. The FTD crest will be continued to be built up over a three year period to the final design crest elevation 825 meters above sea level in 2014. The construction of the Environmental Control Dam (ECD) which is directly below the FTD and the construction of the FWDD were completed in 2009 and are currently in use.

5.4 Physiography and Vegetation

The Palmarejo District is located on the western flank of the Sierra Madre Occidental, a mountain range that comprises the central spine of northern Mexico. The Sierra Madre Occidental trends north-northwest and is composed of a relatively flat-lying sequence of Tertiary volcanic rocks that forms a volcanic plateau. This volcanic plateau is deeply incised in the Palmarejo-Trogan project area, locally forming steep-walled canyons. The Sierra Madre

37

Occidental gives way in the west to an extensional terrain that represents the southward continuation of the Basin and Range Province of the western United States, and then to the coastal plain of western Mexico. The property lies at the boundary of the volcanic plateau and Mexican Basin and Range Province (Gustin and Prenn, 2007).

The elevation of the current Palmarejo mining area is about 1,150m above sea level, and the area is hilly to mountainous (Figure 5.1), with densely vegetated, steep-sided slopes with local stands of cacti. Conifers occur at high elevations, while oak trees, cacti, and thorny shrubs dominate the vegetation at low levels. Local ranchers and farmers graze cattle and grow corn and other vegetables on small-scale plots.

Figure 5.1: Overview of the Palmarejo Area

(Looking North-Northwest - October, 2010)

The elevation of the Guadalupe development project is about 1,300m above sea level. The area is hilly to mountainous (Figure 5.2), with densely vegetated, steep-sided slopes with local stands of cacti. Conifers occur at high elevations, while oak trees, cacti, and thorny shrubs dominate the vegetation at low levels. Local ranchers and farmers graze cattle and grow corn and other vegetables on small-scale plots.

38

Figure 5.2: Overview of the Guadalupe Area

(Looking North)

Surface rights controlled by Coeur Mexicana are sufficient to support current and anticipated mining, ore processing and exploration activities in the Palmarejo property. Adequate power, water and personnel exist for all current and planned activities.

39

SECTION 6 - HISTORY

6.1 Exploration and Mining History

The Palmarejo District area lies within the Témoris Mining District. Silver and gold production from the district, though poorly documented, has a long, intermittent history dating from Spanish colonial exploitation in the 1620’s. Although local miners claim that mines such as Todos Santos, La Patria, Carmelite, and Guadalupe have been worked for over 100 years, there are no known detailed records of their past production, and they are now abandoned. Many small adits and superficial workings along the district’s two main mineralized structural trends, the Virginia and Guadalupe trends, attest to past mining activity.