Exhibit 99.2

MANAGEMENT’S DISCUSSION AND ANALYSIS

This Management’s Discussion and Analysis (“MD&A”) of financial position and results of operations of Franco-Nevada Corporation (“Franco-Nevada”, the “Company”, “we” or “our”) has been prepared based upon information available to the Company as at August 6, 2013 and should be read in conjunction with the Company’s unaudited condensed interim consolidated financial statements and related notes as at and for the three and six months ended June 30, 2013 and 2012. The unaudited interim condensed consolidated statements and MD&A are presented in U.S. dollars and have been prepared in accordance with International Financial Reporting Standards (“IFRS”) as issued by the International Accounting Standards Board applicable to the preparation of interim financial statements in accordance with IAS 34, Interim Financial Reporting.

Readers are cautioned that the MD&A contains forward-looking statements and that actual events may vary from management’s expectations. Readers are encouraged to read the Cautionary Statement on Forward-Looking Information at the end of this MD&A and to consult Franco-Nevada’s audited consolidated financial statements for the year ended December 31, 2012 and the corresponding notes to the financial statements which are available on the Company’s website at www.franco-nevada.com, on SEDAR at www.sedar.com and in our most recent Form 40-F filed with the Securities and Exchange Commission on EDGAR at www.sec.gov.

Additional information related to the Company, including the Company’s Annual Information Form, is available on SEDAR at www.sedar.com, and the Company’s Form 40-F is available on EDGAR at www.sec.gov. These documents contain detailed descriptions and maps of the Company’s producing and advanced royalty and stream assets. For additional information, the Company’s website can be found at www.franco-nevada.com.

TABLE OF CONTENTS | |

| |

Overview | 2 |

Q2 2013 Highlights | 3 |

2013 Guidance | 4 |

Portfolio Additions | 5 |

Selected Financial Information | 6 |

Overview of Financial Performance | 8 |

Non-IFRS Financial Measures | 18 |

Financial Position, Liquidity and Capital Resources | 21 |

Capital Resources | 23 |

Critical Accounting Estimates | 23 |

Outstanding Share Data | 23 |

Risk Factors | 24 |

Internal Control over Financial Reporting and Disclosure Controls and Procedures | 25 |

Cautionary Statement on Forward Looking Information | 26 |

The GOLD Investment that WORKS

1

Overview

Franco-Nevada is a gold royalty and stream company. The Company has a diversified portfolio of cash-flow producing assets and interests in some of the largest gold development and exploration projects in the world. It is the leading gold-focused royalty and stream company by both gold revenues and number of gold assets. The Company’s shares are listed on the Toronto and New York Stock Exchanges under the symbol FNV.

Franco-Nevada’s strategy is to provide its shareholders with superior returns through exposure to upside potential through commodity price appreciation and resource expansion while minimizing operating risks. As a royalty and stream company, Franco-Nevada’s initial investment in a project is its last while the Company continues to benefit from future expansions and exploration discoveries made by the operators or developers.

The Company maintains a lower risk profile by limiting capital and operating risks, seeking secure title and through diversification. For the second quarter of 2013, Franco-Nevada continued to earn its revenue from lower risk jurisdictions with 81% of its revenues from North America and Australia. The Company has a long-term target to earn over 80% of its revenue from precious metals. At June 30, 2013, the Company had over 340 royalty and stream assets, with 45 generating revenue from mineral assets and 137 from oil & gas interests.

The following table outlines Franco-Nevada’s revenue for the three and six months ended June 30, 2013 and 2012 by commodity, geographical location and type of interest and highlights the diversification of the portfolio:

| | Revenue | |

For the three months ended June 30, | | 2013 | | 2012 | |

(expressed in millions) | | $ | | % | | $ | | % | |

| | | | | | | | | |

Commodity | | | | | | | | | |

Gold | | $ | 62.7 | | 67 | % | $ | 81.4 | | 79 | % |

PGMs | | 9.6 | | 10 | % | 11.4 | | 11 | % |

Other Minerals | | 2.8 | | 3 | % | 0.9 | | 1 | % |

Oil &Gas | | 18.2 | | 20 | % | 9.0 | | 9 | % |

| | $ | 93.3 | | 100 | % | $ | 102.7 | | 100 | % |

Geography | | | | | | | | | |

United States | | $ | 19.7 | | 21 | % | $ | 31.7 | | 31 | % |

Canada | | 30.1 | | 33 | % | 25.5 | | 25 | % |

Mexico | | 20.6 | | 22 | % | 29.0 | | 28 | % |

Australia | | 4.9 | | 5 | % | 2.8 | | 3 | % |

Rest of World | | 18.0 | | 19 | % | 13.7 | | 13 | % |

| | $ | 93.3 | | 100 | % | $ | 102.7 | | 100 | % |

Type | | | | | | | | | |

Revenue-based | | $ | 45.1 | | 48 | % | $ | 42.6 | | 42 | % |

Streams | | 35.9 | | 38 | % | 47.7 | | 46 | % |

Profit-based | | 4.4 | | 5 | % | 9.6 | | 9 | % |

Working interests and other | | 7.9 | | 9 | % | 2.8 | | 3 | % |

| | $ | 93.3 | | 100 | % | $ | 102.7 | | 100 | % |

2013 Q2 REPORT Franco-Nevada Corporation

2

| | Revenue | |

For the six months ended June 30, | | 2013 | | 2012 | |

(expressed in millions) | | $ | | % | | $ | | % | |

| | | | | | | | | |

Commodity | | | | | | | | | |

Gold | | $ | 140.1 | | 69 | % | $ | 156.3 | | 75 | % |

PGMs | | 25.1 | | 13 | % | 29.6 | | 14 | % |

Other Minerals | | 4.8 | | 2 | % | 2.3 | | 1 | % |

Oil & Gas | | 32.1 | | 16 | % | 19.5 | | 10 | % |

| | $ | 202.1 | | 100 | % | $ | 207.7 | | 100 | % |

Geography | | | | | | | | | |

United States | | $ | 46.3 | | 23 | % | $ | 55.8 | | 27 | % |

Canada | | 65.5 | | 32 | % | 59.5 | | 29 | % |

Mexico | | 43.2 | | 21 | % | 55.8 | | 27 | % |

Australia | | 9.6 | | 5 | % | 6.8 | | 3 | % |

Rest of World | | 37.5 | | 19 | % | 29.8 | | 14 | % |

| | $ | 202.1 | | 100 | % | $ | 207.7 | | 100 | % |

Type | | | | | | | | | |

Revenue-based | | $ | 86.0 | | 43 | % | $ | 83.9 | | 40 | % |

Streams | | 81.3 | | 40 | % | 102.0 | | 49 | % |

Profit-based | | 21.2 | | 10 | % | 15.5 | | 8 | % |

Working interests and other | | 13.6 | | 7 | % | 6.3 | | 3 | % |

| | $ | 202.1 | | 100 | % | $ | 207.7 | | 100 | % |

Franco-Nevada has a robust balance sheet with assets generating high margins from projects in safe jurisdictions. As at June 30, 2013, the Company had approximately $1.3 billion in available capital comprised of working capital(1) of $835.8 million and an undrawn $500.0 million credit facility from which to fund future acquisitions.

Q2 2013 Highlights

· Revenue of $93.3 million (2012 - $102.7 million);

· 53,292 Gold Equivalent Ounces(2) earned (2012 - 58,344);

· Net income of $21.6 million, or $0.15 per share (2012 - $36.9 million or $0.26 per share);

· Adjusted Net Income(1) of $31.9 million, or $0.22 per share (2012 - $35.1 million or $0.24 per share); and

· Adjusted EBITDA(1) of $75.2 million, or $0.51 per share (2012 - $82.5 million or $0.57 per share).

First Six Months of 2013 Highlights

· Revenue of $202.1 million (2012 - $207.7 million);

· 111,580 Gold Equivalent Ounces(2) earned (2012 - 113,810);

· Net income of $57.0 million, or $0.39 per share (2012 - $83.7 million or $0.59 per share);

· Adjusted Net Income(1) of $72.5 million, or $0.49 per share (2012 - $78.7 million, or $0.55 per share);

· Adjusted EBITDA(1) of $164.3 million, or $1.12 per share (2012 - $167.9 million, or $1.18 per share); and

· Robust Margin(1) of 81.3% (2012 - 80.9%).

(1) Adjusted EBITDA, Adjusted Net Income, working capital and Margin are non-IFRS financial measures with no standardized meaning under IFRS. For further information and a detailed reconciliation, please see pages 18-21 of this MD&A.

(2) For Q2 2013, platinum and palladium metals have been converted to Gold Equivalent Ounces using commodity prices of $1,414/ounce (“oz”) gold (2012 - $1,611/oz), $1,465/oz platinum (2012 - $1,500/oz) and $713/oz palladium (2012 - $628/oz).

3

2013 Guidance

The following contains forward looking statements about our outlook for the second half of 2013 and is qualified in its entirety by the “Cautionary Statement on Forward Looking Information” section at the end of this MD&A.

Royalty and stream production was 53,292 and 111,580 Gold Equivalent Ounces(2) (“GEOs”) and $18.2 million and $32.1 million in revenue from oil & gas assets for the three and six months ended June 30, 2013, respectively, which was in-line with the Company’s expectations for the periods. The Company continues to expect to earn 215,000 to 235,000 GEOs from its mineral assets and $55.0 to $65.0 million in revenue from its oil & gas assets in 2013. Gold equivalent royalty and stream ounces are estimated for gross ounces, and in the case of stream ounces, before the payment of approximately $400 per gold equivalent ounce paid by the Company. For the 2013 guidance, platinum and palladium metals have been converted to GEOs using commodity prices of $1,300/oz Au, $1,425/oz Pt and $750/oz Pd. The WTI oil price is assumed to average $93 per barrel with similar price discounts for Canadian oil as experienced in the first half of 2013.

For the remainder of 2013, the Company expects the following with respect to key producing assets:

· Gold - U.S.: Goldstrike royalty ounces for 2013 are expected to be higher in the second half of 2013 compared to the first half of 2013 as higher production is expected on both the NSR and NPI claims. At Gold Quarry, the Company expects lower royalty ounces for the second half of 2013 compared to the first six months but higher overall ounces for 2013 than 2012. Royalty ounces from Bald Mountain, Hollister and Mesquite are expected to be lower for the remainder of 2013 when compared to the first six months of 2013 due to mining sequencing at Bald Mountain, creditor protection activities at Hollister and mining on lower royalty ground at Mesquite.

· Gold - Canada: Detour Lake poured its first gold in February 2013. Detour Gold Corporation (“Detour”) reduced its guidance, noting that it now expects to produce between 260,000 ounces and 320,000 ounces of gold in 2013 from Detour Lake on which the Company has a 2% net smelter return (“NSR”) royalty. GEOs from Detour are expected to be higher in the second half of 2013 as the operation continues its ramp-up. At Hemlo, the Company’s net profits interest (“NPI”) royalty on the down dip extension of the mine will be lower than initially expected due to the impact of lower commodity prices. At Timmins West, where the Company has a 2.25% NSR, GEOs for the remainder of 2013 are expected to be in-line with the first half of the year.

· Gold - Australia: Duketon gold production is expected to increase with a full year of production from the Garden Well mine. In addition, Regis Resources Ltd. (“Regis”), the operator, has announced plans to add a third operation on the Duketon property, Rosemont, with commissioning expected in September 2013. Regis has also announced plans for a plant expansion at Rosemont which is expected to increase long-term gold production from both Garden Well and Rosemont. Revenue from Bronzewing and Wiluna is expected to be lower in 2013 than 2012, as the operations have been negatively impacted by the lower gold price environment which has resulted in both operators seeking creditor protection.

· Gold - Rest of World: Palmarejo is expected to remain a significant revenue contributor and Coeur Mining, Inc. has maintained its 2013 forecasted gold production of 98,000 to 105,000 ounces. The Company’s 50% gold stream over Palmarejo includes an annual minimum provision of 50,000 ounces, payable monthly. At Mine Waste Solutions (“MWS”), the Company expects to earn stream ounces for the remainder of 2013 that are consistent with the first half of the year. At Tasiast, where the Company has a 2% NSR, the Company expects the rest of 2013 to be consistent with what was earned in the first half of 2013. At Subika, royalty ounces are expected to be higher in 2013 than 2012 as a full year of production will be earned. Subika ounces for the rest of 2013 are expected to be slightly lower than the first part of the year. At Edikan, where the Company has an effective 1.5% NSR, Perseus Mining Limited has announced gold production guidance for the remainder of 2013 to be between 99,000 ounces to 109,000 ounces, which is in-line with gold production of 105,000 ounces for the first half of 2013.

4

· PGMs: Sudbury stream ounces are expected to decline in 2013 as the operator, KGHM International Ltd. (“KGHM”) ceased mining at Podolsky in the first half of 2013 and has put the mine on care and maintenance. In addition, KGHM is expected to continue to focus on mining nickel ore at McCreedy which does not generate payable PGMs attributable to the Company. GEOs earned on the Sudbury stream assets are expected to decline for the remainder of 2013 compared to GEOs earned in the first six months of 2013. At Stillwater, 2013 royalty ounces are expected to be consistent with historical levels.

· Other minerals: At the Peculiar Knob iron-ore project in South Australia, production has begun and the Company expects to receive full-year revenue in 2013.

· Oil & Gas: The Company’s oil & gas assets are expected to generate $55.0 to $65.0 million in revenue for 2013. Production volumes at the Weyburn Unit are expected to increase in the second half of 2013 as fewer CO2 supply disruptions are expected.

Portfolio Additions

Sissingue Royalty

On May 29, 2013, the Company acquired a 0.5% NSR royalty on certain tenements that comprise the Sissingue gold project located in Cote d’Ivoire and operated by Perseus Mining Limited, for Australian $2.0 million in cash.

Brucejack Royalty

On May 13, 2013, the Company acquired an existing 1.2% NSR royalty on Pretium Resources Inc.’s Brucejack gold project located in British Columbia for $45.0 million in cash. The NSR royalty becomes payable following the production of approximately 0.5 million ounces of gold and 17.9 million ounces of silver from the project.

Golden Meadows Royalty

On May 9, 2013, the Company acquired a new 1.7% NSR on Midas Gold Corp.’s (“Midas”) Golden Meadows gold project located in Idaho for $15.0 million in cash subject to an option by Midas to re-acquire one-third of the royalty for $9.0 million. Under the terms of the acquisition, Franco-Nevada also subscribed for 2.0 million Midas warrants which are exerciseable into Midas common shares with each warrant having an exercise price of C$1.23 and a ten-year term.

5

Selected Financial Information

| | For the three | | For the three | | For the six | | For the six | |

| | months ended | | months ended | | months ended | | months ended | |

(expressed in millions, except GEOs | | June 30, | | June 30, | | June 30, | | June 30, | |

and per share amounts) | | 2013 | | 2012 | | 2013 | | 2012 | |

Statement of Income and Comprehensive Income | | | | | | | | | |

Revenue | | $ | 93.3 | | $ | 102.7 | | $ | 202.1 | | $ | 207.7 | |

Operating costs | | 50.8 | | 51.2 | | 106.3 | | 102.5 | |

Operating income | | 42.5 | | 51.5 | | 95.8 | | 105.2 | |

Net income | | 21.6 | | 36.9 | | 57.0 | | 83.7 | |

Basic earnings per share | | $ | 0.15 | | $ | 0.26 | | $ | 0.39 | | $ | 0.59 | |

Diluted earnings per share | | $ | 0.15 | | $ | 0.25 | | $ | 0.39 | | $ | 0.58 | |

Dividends declared per share | | $ | 0.18 | | $ | 0.15 | | $ | 0.36 | | $ | 0.27 | |

| | | | | | | | | |

Non-IFRS Measures | | | | | | | | | |

Gold Equivalent Ounces(1) | | 53,292 | | 58,344 | | 111,580 | | 113,810 | |

Adjusted EBITDA(2) | | 75.2 | | 82.5 | | 164.3 | | 167.9 | |

Adjusted EBITDA(2) per share | | $ | 0.51 | | $ | 0.57 | | $ | 1.12 | | $ | 1.18 | |

Margin(2) | | 80.6 | % | 80.3 | % | 81.3 | % | 80.9 | % |

Adjusted Net Income(2) | | 31.9 | | 35.1 | | 72.5 | | 78.7 | |

Adjusted Net Income(2) per share | | $ | 0.22 | | $ | 0.24 | | $ | 0.49 | | $ | 0.55 | |

| | | | | | | | | |

Statement of Cash flows | | | | | | | | | |

Net cash provided by operating activities, before changes in non-cash assets and liabilities | | 66.2 | | 74.9 | | 143.5 | | 151.8 | |

Net cash (used in)/provided by investing activities | | 1.8 | | 74.2 | | 40.9 | | (128.6 | ) |

Net cash (used in)/provided by financing activities | | (23.9 | ) | (17.1 | ) | (49.7 | ) | 146.4 | |

| | | | | | As at | | As at | |

| | | | | | June 30, | | December 31, | |

| | | | | | 2013 | | 2012 | |

Statement of Financial Position | | | | | | | | | |

Cash and cash equivalents | | | | | | $ | 758.2 | | $ | 631.7 | |

Short-term investments | | | | | | 38.8 | | 148.2 | |

Total assets | | | | | | 3,152.6 | | 3,243.9 | |

Deferred income tax liabilities | | | | | | 38.8 | | 38.0 | |

Total shareholders’ equity | | | | | | 3,070.2 | | 3,149.1 | |

Working capital(2) | | | | | | 835.8 | | 822.4 | |

Debt | | | | | | Nil | | Nil | |

| | | | | | | | | | | |

(1) For Q2 2013, conversion to GEOs using commodity prices of $1,414/oz gold (2012 - $1,611/oz gold), $1,465/oz platinum (2012 - $1,500/oz platinum) and $713/oz palladium (2012 - $628/oz palladium).

(2) Adjusted EBITDA, Margin, Adjusted Net Income and working capital are non-IFRS financial measures with no standardized meaning under IFRS. For further information and a detailed reconciliation, please see pages 18-21 of this MD&A. Working capital is defined by the Company as current assets less current liabilities.

6

The following table outlines GEOs attributable to Franco-Nevada for the three and six months ended June 30, 2013 and 2012 by commodity (excluding oil & gas), geographical location and type of interest:

| | Gold Equivalent Ounces(1) | |

| | | | 2013 | | | | 2012 | |

For the three months ended June 30, | | # | | % | | # | | % | |

| | | | | | | | | |

Commodity | | | | | | | | | |

Gold | | 44,548 | | 84 | % | 50,573 | | 87 | % |

PGMs | | 6,752 | | 13 | % | 7,152 | | 12 | % |

Other Minerals | | 1,992 | | 3 | % | 619 | | 1 | % |

| | 53,292 | | 100 | % | 58,344 | | 100 | % |

Geography | | | | | | | | | |

United States | | 13,915 | | 26 | % | 19,680 | | 34 | % |

Canada | | 8,542 | | 16 | % | 10,450 | | 18 | % |

Mexico | | 14,572 | | 27 | % | 17,975 | | 31 | % |

Australia | | 3,447 | | 7 | % | 1,748 | | 3 | % |

Rest of World | | 12,816 | | 24 | % | 8,491 | | 14 | % |

| | 53,292 | | 100 | % | 58,344 | | 100 | % |

Type | | | | | | | | | |

Revenue-based | | 26,529 | | 50 | % | 22,680 | | 39 | % |

Streams | | 25,490 | | 47 | % | 29,583 | | 51 | % |

Profit-based | | (367 | ) | — | | 6,021 | | 10 | % |

Other | | 1,640 | | 3 | % | 60 | | — | |

| | 53,292 | | 100 | % | 58,344 | | 100 | % |

| | Gold Equivalent Ounces (1) | |

| | | | 2013 | | | | 2012 | |

For the six months ended June 30, | | # | | % | | # | | % | |

| | | | | | | | | |

Commodity | | | | | | | | | |

Gold | | 92,112 | | 82 | % | 94,592 | | 83 | % |

PGMs | | 16,264 | | 15 | % | 17,898 | | 16 | % |

Other Minerals | | 3,204 | | 3 | % | 1,320 | | 1 | % |

| | 111,580 | | 100 | % | 113,810 | | 100 | % |

Geography | | | | | | | | | |

United States | | 30,220 | | 27 | % | 33,651 | | 30 | % |

Canada | | 21,772 | | 20 | % | 24,253 | | 21 | % |

Mexico | | 28,481 | | 26 | % | 33,791 | | 30 | % |

Australia | | 6,354 | | 5 | % | 4,071 | | 3 | % |

Rest of World | | 24,753 | | 22 | % | 18,044 | | 16 | % |

| | 111,580 | | 100 | % | 113,810 | | 100 | % |

Type | | | | | | | | | |

Revenue-based | | 51,082 | | 46 | % | 42,429 | | 38 | % |

Streams | | 53,345 | | 48 | % | 61,766 | | 54 | % |

Profit-based | | 4,665 | | 4 | % | 9,409 | | 8 | % |

Other | | 2,488 | | 2 | % | 206 | | — | |

| | 111,580 | | 100 | % | 113,810 | | 100 | % |

(1) For Q2 2013, conversion to GEOs using commodity prices of $1,414/oz gold (2012 - $1,611/oz gold), $1,465/oz platinum (2012 - $1,500/oz platinum) and $713/oz palladium (2012 - $628/oz palladium).

Oil & gas revenues are not included in the reported GEO numbers above.

7

GEOs were earned from the following asset classes:

| | Gold Equivalent Ounces | |

| | | | 2013 | | | | 2012 | |

For the three months ended June 30, | | # | | % | | # | | % | |

| | | | | | | | | |

Gold - United States | | 9,946 | | 19 | % | 16,600 | | 29 | % |

Gold - Canada | | 5,503 | | 10 | % | 6,182 | | 11 | % |

Gold -Australia | | 1,711 | | 3 | % | 1,325 | | 2 | % |

Gold - Rest of World | | 27,388 | | 52 | % | 26,466 | | 45 | % |

Gold - Total | | 44,548 | | 84 | % | 50,573 | | 87 | % |

PGMs | | 6,752 | | 13 | % | 7,152 | | 12 | % |

Other minerals | | 1,992 | | 3 | % | 619 | | 1 | % |

| | 53,292 | | 100 | % | 58,344 | | 100 | % |

| | Gold Equivalent Ounces | |

| | | | 2013 | | | | 2012 | |

For the six months ended June 30, | | # | | % | | # | | % | |

| | | | | | | | | |

Gold - United States | | 22,889 | | 20 | % | 27,769 | | 24 | % |

Gold - Canada | | 12,409 | | 11 | % | 11,889 | | 10 | % |

Gold -Australia | | 3,575 | �� | 3 | % | 3,118 | | 3 | % |

Gold - Rest of World | | 53,239 | | 48 | % | 51,816 | | 46 | % |

Gold - Total | | 92,112 | | 82 | % | 94,592 | | 83 | % |

PGMs | | 16,264 | | 15 | % | 17,898 | | 16 | % |

Other minerals | | 3,204 | | 3 | % | 1,320 | | 1 | % |

| | 111,580 | | 100 | % | 113,810 | | 100 | % |

The Company’s portfolio continues to deliver robust results with 97% of its GEOs being earned from precious metals assets (84% gold and 13% platinum group metals (“PGMs”)). The portfolio is well-diversified with revenue and GEOs being earned from 45 different mineral interests.

Overview of Financial Performance - Three Months 2013 to Three Months 2012

Net Income

Net income for the quarter was $21.6 million, or $0.15 per share, compared with net income of $36.9 million, or $0.26 per share, for the same period in 2012. The reduction in net income was driven primarily by (i) a weaker average gold price which resulted in lower revenues; (ii) higher mark-to-market losses on warrants held; and (iii) impairment charges on available-for-sale investments.

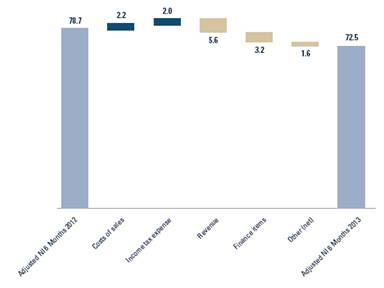

Adjusted Net Income was $31.9 million, or $0.22 per share, compared with $35.1 million, or $0.24 per share, for Q2 2012. The decrease in Adjusted Net Income was driven primarily by lower revenues and finance items, partially offset by lower income tax and depletion expenses.

8

Adjusted Net Income Reconciliation - Q2 2012 to Q2 2013

(expressed in millions)

Revenue

The Company’s revenue is generated from various forms of agreements, ranging from NSR royalties, streams, NPI royalties, NRIs, working interests and other. For definitions of the various types of agreements, please refer to the Company’s Annual Information Form filed on SEDAR at www.sedar.com or the Company’s Form 40-F filed on EDGAR at www.sec.gov. The market prices of gold, PGMs, oil and natural gas are the primary drivers of the Company’s profitability and its ability to generate operating cash flow for shareholders.

9

Revenue for the three and six months ended June 30, 2013 was $93.3 million and $202.1 million, respectively, and was comprised of the following:

| | | | For the three | | For the three | | For the six | | For the six | |

| | | | months ended | | months ended | | months ended | | months ended | |

| | | | June 30, | | June 30, | | June 30, | | June 30, | |

Property | | Interest | | 2013 | | 2012 | | 2013 | | 2012 | |

Gold - United States | | | | | | | | | | | |

Goldstrike | | NSR/NPI 2-4%/2.4-6% | | $ | 3.5 | | $ | 13.2 | | $ | 13.1 | | $ | 21.5 | |

Gold Quarry | | NSR 7.29% | | 5.8 | | 4.8 | | 12.4 | | 9.5 | |

Marigold | | NSR/GR 1.75-5%/0.5-4% | | 2.0 | | 2.5 | | 5.2 | | 5.2 | |

Bald Mountain | | NSR/GR 0.875-5% | | 1.0 | | 4.6 | | 2.0 | | 5.9 | |

Mesquite | | NSR 0.5-2% | | 0.5 | | 1.0 | | 1.2 | | 2.3 | |

Hollister | | NSR 3-5% | | 1.1 | | 0.6 | | 1.1 | | 1.5 | |

Other | | | | — | | 0.1 | | 0.2 | | 0.3 | |

| | | | | | | | | | | |

Gold - Canada | | | | | | | | | | | |

Detour | | NSR 2% | | 1.2 | | — | | 1.4 | | — | |

Sudbury | | Stream 50% | | 2.1 | | 4.0 | | 5.3 | | 7.9 | |

Golden Highway | | NSR 2-15% | | 2.9 | | 3.2 | | 6.7 | | 6.4 | |

Musselwhite | | NPI 5% | | 0.5 | | 1.4 | | 1.3 | | 3.0 | |

Hemlo | | NSR/NPI 3%/50% | | (1.2 | ) | 0.3 | | 0.9 | | 1.0 | |

Timmins West | | NSR 2.25% | | 0.7 | | 0.6 | | 1.4 | | 0.8 | |

Other | | | | 1.7 | | 0.2 | | 1.8 | | 0.3 | |

| | | | | | | | | | | |

Gold - Australia | | | | | | | | | | | |

Duketon | | NSR 2% | | 2.0 | | 0.8 | | 4.2 | | 1.6 | |

Henty | | GR 1/10% | | 0.3 | | 0.7 | | 0.6 | | 2.0 | |

South Kalgoorlie | | NSR/GR 1.75% | | 0.1 | | 0.2 | | 0.3 | | 0.5 | |

Bronzewing | | NSR 2% | | — | | 0.5 | | 0.3 | | 1.0 | |

| | | | | | | | | | | |

Gold - Rest of World | | | | | | | | | | | |

Palmarejo | | Stream 50% | | 19.7 | | 27.5 | | 41.3 | | 52.9 | |

MWS | | Stream 25% | | 9.2 | | 8.1 | | 18.6 | | 18.7 | |

Cooke 4 (Ezulwini) | | Stream 7% | | 0.7 | | 1.2 | | 1.6 | | 2.0 | |

Subika | | NSR 2% | | 3.7 | | — | | 6.8 | | — | |

Tasiast | | NSR 2% | | 1.9 | | 1.3 | | 4.2 | | 3.2 | |

Cerro San Pedro | | GR 1.95% | | 0.9 | | 1.5 | | 1.9 | | 2.9 | |

Edikan | | NSR 1.5-3% | | 1.0 | | 1.5 | | 2.3 | | 2.5 | |

Other | | | | 1.4 | | 1.6 | | 4.0 | | 3.4 | |

| | | | 62.7 | | 81.4 | | 140.1 | | 156.3 | |

PGMs | | | | | | | | | | | |

Stillwater | | NSR 5% | | 5.3 | | 4.6 | | 10.5 | | 9.1 | |

Sudbury | | Stream 50% | | 4.3 | | 6.8 | | 14.6 | | 20.5 | |

| | | | 9.6 | | 11.4 | | 25.1 | | 29.6 | |

Other Minerals | | | | | | | | | | | |

Peculiar Knob | | GR 2% | | 1.9 | | — | | 2.7 | | — | |

Mt. Keith | | NPI/GR 0.25%/0.375% | | 0.4 | | 0.5 | | 0.9 | | 1.4 | |

Other | | | | 0.5 | | 0.4 | | 1.2 | | 0.9 | |

| | | | 2.8 | | 0.9 | | 4.8 | | 2.3 | |

Oil & Gas | | | | | | | | | | | |

Weyburn Unit | | ORR 0.44%, WI 2.26%, 11.7% NRI | | 14.1 | | 5.6 | | 24.2 | | 11.2 | |

Midale Unit | | ORR 1.14%, WI 1.59% | | 1.0 | | 1.1 | | 1.9 | | 2.2 | |

Edson | | ORR 15% | | 1.1 | | 0.8 | | 2.3 | | 2.2 | |

Other | | Various | | 2.0 | | 1.5 | | 3.7 | | 3.9 | |

| | | | 18.2 | | 9.0 | | 32.1 | | 19.5 | |

Revenue | | | | $ | 93.3 | | $ | 102.7 | | $ | 202.1 | | $ | 207.7 | |

10

Gold

Average gold prices continued to decline during the quarter falling to a three-year low of $1,192/oz on June 28 but strengthened into July, averaging $1,287/oz for July 2013. The average gold price for the quarter decreased by 12.2% to $1,414/oz (based on the London PM Fixed quoted prices) from $1,611/oz for the comparable period in 2012. The deterioration of the gold price is attributable to a number of factors, including changes in investor sentiment toward the macroeconomic environment and expected near term interest rate increases.

Overall gold revenue for the quarter decreased to $62.7 million from $81.4 million, a decrease of 22.9%. GEOs earned in the quarter decreased by 11.9% to 44,548 GEOs from 50,573 GEOs earned in the same quarter of 2012. The decreases are attributable to a lower average gold price and lower production from Goldstrike, Palmarejo and Bald Mountain, partially offset by higher production from Subika, Duketon and Gold Quarry.

U.S. assets produced 9,946 GEOs and generated $13.9 million in revenue, a decrease of 6,654 GEOs, or 40.1%, and $12.9 million in revenue, or 48.1%, respectively, over 2012. The largest decrease was attributable to Goldstrike (5,669 GEOs and $9.7 million in revenue) due to lower production on the ground covered by our NSR and higher capital being spent by the operator which impacts our NPI. Lower production at Bald Mountain resulted in decreases of 2,116 GEOs and $3.6 million in revenue due to mine sequencing. These decreases were partially offset by increases at Gold Quarry of 1,087 GEOs and $1.0 million in revenue due to an increase in the minimum royalty provision.

Canadian assets produced 5,503 GEOs and generated $7.9 million in revenue in the period, a decrease of 11.0% and 18.5%, respectively, over 2012 levels. The greatest contributions came from the Company’s Golden Highway assets (2,087 GEOs and $2.9 million in revenue) operated by St Andrew Goldfields Ltd. (“St Andrews”) and Sudbury (1,392 GEOs and $2.1 million in revenue) operated by KGHM. The Company’s Detour NSR contributed 872 GEOs and $1.2 million in revenue in the period. The Detour NSR is expected to become a significant contributor to the Company’s GEOs and revenue in future periods as the project is expected to achieve commercial production in the third quarter of 2013.

Australian GEOs were 1,711 and revenue was $2.4 million for the quarter with growth coming from the Duketon NSR which generated $2.0 million in revenue.

Rest of world gold assets produced 27,388 GEOs and generated $38.5 million in revenue in the period compared to 26,466 GEOs and $42.7 million in revenue in 2012. The increase in GEOs was due to the (i) Subika NSR which surpassed production thresholds in late 2012 (2,618 GEOs); (ii) MWS stream due to higher production (1,564 GEOs); and (iii) Tasiast NSR due to higher production levels (514 GEOs), partially offset by lower production at Palmarejo (3,147 GEOs). Although total GEOs earned was 3.5% higher than 2012, revenue was 9.8% lower due to a 12.2% lower average gold price in the quarter.

PGMs

The average prices for platinum and palladium also experienced significant volatility in Q2 2013 averaging $1,465/oz and $713/oz, respectively, representing a decrease of 2.4% for platinum and an increase of 13.3% for palladium over Q2 2012. Concerns over declining Chinese and Indian demand continue to impact commodity prices.

PGM GEOs produced were 6,752 for the quarter compared to 7,152 GEOs in 2012 and revenue decreased to $9.6 million for the period, down from $11.4 million in 2012. The decrease is attributable to lower production from the Sudbury assets as production at Podolsky ceased and nickel production remains the focus at McCreedy. Production at Stillwater was higher in the period, an increase of 829 GEOs, however the lower average PGM prices resulted in only slightly higher revenue of $0.7 million.

11

Oil & Gas

Oil & gas revenue increased 102.2% to $18.2 million for the quarter (91% oil and 9% gas) compared with $9.0 million for the same period of 2012 (91% oil and 9% gas) due to the addition to the Weyburn Unit net royalty interest (“NRI”) in November 2012.

Oil averaged C$93 per barrel (based on the Canadian Par Average (40 API)) and gas averaged C$3.35/mcf (based on AECO-C), respectively, during the period. The Canadian Par Average oil price traded at a slight discount to the average WTI price of $94 per barrel for the quarter. However the strengthening of the U.S. dollar relative to the Canadian dollar resulted in a $3 price differential to WTI. In addition to the price differential, the oil produced from the Company’s Weyburn interests had a negative quality differential of approximately C$8 per barrel.

The Weyburn Unit generated $14.1 million in the quarter compared with $5.6 million for 2012. The Company acquired an additional 1.15% working interest and 11.7% NRI in February 2012 and November 2012, respectively.

Costs and Expenses

Costs and expenses for the quarter were $50.8 million compared to $51.2 million in 2012. The following table provides a list of the costs and expenses incurred by the Company for the three months ended June 30, 2013 and 2012.

| | Three months ended June 30, | |

(expressed in millions) | | 2013 | | 2012 | | Variance | |

Costs of sales | | $ | 13.9 | | $ | 15.6 | | $ | (1.7 | ) |

Depletion and depreciation | | 28.2 | | 31.0 | | (2.8 | ) |

Corporate administration | | 3.6 | | 3.8 | | (0.2 | ) |

Business development | | 0.6 | | 0.8 | | (0.2 | ) |

Impairment on investments | | 4.5 | | — | | 4.5 | |

| | $ | 50.8 | | $ | 51.2 | | $ | (0.4 | ) |

Costs of sales, which comprises the cost of GEOs purchased under stream agreements, oil & gas production taxes, operating costs on oil & gas working interests and net proceeds taxes on mineral interests, were $13.9 million for the second quarter of 2013 compared with $15.6 million for the second quarter of 2012. The decrease of $1.7 million is attributable to lower (i) cost of stream sales of $0.6 million due to lower production from Palmarejo and the Sudbury assets; (ii) Nevada net proceeds taxes of $0.6 million due to lower revenue being earned from assets in Nevada; and (iii) oil & gas production taxes of $0.5 million due to the reversal of a year-end accrual in the quarter. For the quarter, the Company received 25,490 GEOs under its stream agreements compared to 29,583 GEOs received in 2012.

Depletion and depreciation totaled $28.2 million for the quarter compared to $31.0 million in 2012. The decrease in depletion of $2.8 million is due to lower depletion on the Sudbury assets ($3.5 million), Goldstrike ($2.0 million) and Palmarejo ($1.3 million) all due to lower production, partially offset by higher production on oil & gas assets ($3.0 million) due to higher production and the addition of the Weyburn Unit NRI in late 2012 and Subika ($1.0 million) which started generating revenue in late 2012.

Corporate administration expenses decreased to $3.6 million in the quarter from $3.8 million in 2012. The decrease is due to lower professional fees of $0.6 million partially offset by higher stock-based compensation expense of $0.3 million and filing fees of $0.1 million.

Business development expenses were $0.6 million and $0.8 million for the three months ended June 30, 2013 and 2012, respectively. Timing of incurring these costs will vary depending upon the timing and level of activity of the business development team on completing transactions.

Impairment of investments was $4.5 million (2012 - Nil) in the quarter due to the fair value of certain investments, which had been impaired at December 31, 2012, and continued to decline in value during the second quarter of 2013.

12

Other Income/Expenses

Other income/expenses comprise foreign exchange gains and losses, mark-to-market adjustments on the fair value of warrants held by the Company and gains and losses from the sale of gold where settlement of the royalty/stream obligation is taken in kind from the operators.

Other expenses for the quarter were $9.3 million compared to $2.6 million in 2012. The following table provides a list of the other income/expenses incurred by the Company for the three months ended June 30, 2013 and 2012.

| | Three months ended June 30, | |

(expressed in millions) | | 2013 | | 2012 | | Variance | |

Foreign exchange loss | | $ | (2.7 | ) | $ | (0.5 | ) | $ | (2.2 | ) |

Mark-to-market loss on warrants | | (5.1 | ) | (1.5 | ) | (3.6 | ) |

Loss on sale of gold | | (1.5 | ) | (0.6 | ) | (0.9 | ) |

| | $ | (9.3 | ) | $ | (2.6 | ) | $ | (6.7 | ) |

Foreign exchange losses include foreign exchange movements related to investments in bonds and other debt securities, such as government and corporate bonds, treasury bills and intercompany loans, held in the parent Company, which are denominated in either U.S. dollars or Mexican pesos. The parent Company’s functional currency is the Canadian dollar. Under IFRS, all foreign exchange changes related to the debt securities are recorded in net income as opposed to other comprehensive income.

Foreign exchange loss and other expenses were $9.3 million in the quarter (2012 - $2.6 million) which was comprised of $2.7 million related to foreign exchange losses on intercompany debt securities (2012 - $0.5 million), $5.1 million in mark-to-market losses related to warrants of small to mid-sized publicly listed resource companies (2012 - $1.5 million) and losses on the sale of gold of $1.5 million (2012 - $0.6 million). The Company receives physical gold and silver as settlement for certain royalty obligations which is sold on the open market typically at spot prices within a short time period from the date of receipt. The difference between the spot price realized and the average gold price in the period the gold was recognized is recorded as a gain/loss on the sale of gold.

Finance Costs and Finance Income

Finance income was $0.8 million (2012 - $2.5 million) for the quarter which was earned on the Company’s cash equivalents and/or short-term investments. The decrease in finance income was due to a decrease in the amount of funds invested as the Company acquired the Weyburn Unit NRI for C$400 million at the end of 2012. Finance expenses were $0.4 million (2012 - $0.2 million) and consist of the costs of maintaining the Company’s credit facility in addition to the amortization of the initial set-up costs incurred with respect to the facility. For the quarter, standby fees were $0.3 million (2012 - $0.1 million) and amortization of issuance costs were $0.1 million (2012 - $0.1 million).

Income Taxes

The Company had an income tax expense of $12.0 million (2012 - $14.3 million) for the quarter comprised of a current income tax expense of $9.0 million (2012 - $9.9 million) and a deferred income tax expense of $3.0 million (2012 - $4.4 million) related to the Company’s Canadian entities partially offset by deferred income tax recoveries in Mexico and the U.S.

13

Overview of Financial Performance - Six Months 2013 to Six Months 2012

Net Income

Net income for the six month period was $57.0 million, or $0.39 per share, compared with net income of $83.7 million, or $0.59 per share, for the same period in 2012. The reduction in net income was driven primarily by (i) mark-to market losses recorded on warrants, (ii) impairment charges recorded on publicly-traded equity investments; and (iii) lower revenue due to the weaker average gold price.

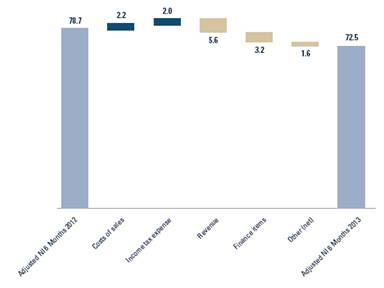

Adjusted Net Income was $72.5 million, or $0.49 per share, for the six months ended June 30, 2013 compared with $78.7 million, or $0.55 per share, for the same period of 2012. The decrease in Adjusted Net Income was driven primarily by lower revenue and finance items, partially offset by lower costs of sales and income tax expense.

Adjusted Net Income Reconciliation - Six Months 2012 to Six Months 2013

(expressed in millions)

Revenue

Gold

Average gold prices for the first six months of 2013 experienced significant volatility with the spot price falling from a high of $1,694/oz in January to a low of $1,192/oz by the end of June. The average gold price for the six months was $1,522/oz compared to $1,651/oz for the same period of 2012 (based on the London PM Fixed quoted prices), a decrease of 7.8%. The deterioration of the gold price is attributable to a number of factors, including changes in investor sentiment toward the macroeconomic environment and expected near term interest rate increases.

Overall gold revenue for the period decreased to $140.1 million from $156.3 million in the first half of 2012, a decrease of 10.4%. GEOs earned in the period decreased by 2.6% to 92,112 GEOs from 94,592 GEOs earned in the same period of 2012. The decreases are attributable to a lower average gold price and lower production from Goldstrike, Palmarejo and Bald Mountain, partially offset by higher production from Subika, Gold Quarry and Duketon.

14

U.S. assets produced 22,889 GEOs and generated $35.2 million in revenue, a decrease of 4,880 GEOs, or 17.6%, and $11.0 million in revenue, or 23.8%, respectively, over the same period of 2012. The largest decrease was attributable to Goldstrike (4,750 GEOs and $8.4 million in revenue) due to lower production on the ground covered by our NSR and higher capital being spent by the operator which impacts our NPI. Lower production at Bald Mountain resulted in decreases of 2,290 GEOs and $3.9 million in revenue due to mine sequencing. These decreases were partially offset by increases at Gold Quarry of 2,328 GEOs and $2.9 million in revenue due to an increase in the minimum royalty provision.

Canadian assets produced 12,409 GEOs and generated $18.8 million in revenue in the six months ended June 30, 2013, an increase of 4.4% and a decrease of 3.1%, respectively, over 2012 levels. The greatest contributions came from the Company’s Golden Highway assets (4,455 GEOs and $6.7 million in revenue) operated by St Andrews and the Sudbury assets (3,368 GEOs and $5.3 million in revenue) operated by KGHM. The Company’s Detour NSR contributed 1,016 GEOs and $1.4 million in revenue in the period. The Detour NSR is expected to become a significant contributor to the Company’s GEOs and revenue in future periods as the project is expected to achieve commercial production in the third quarter of 2013.

Australian GEOs increased to 3,575 for the period from 3,118 in 2012 due to increased production from our Duketon NSR where production from the Garden Well deposit began generating GEOs and revenue in September 2012. Regis has announced plans to construct a third operation on the larger Duketon project area, called Rosemont which is expected to commence gold production in Q3 2013.

Rest of world gold assets produced 53,239 GEOs and generated $80.7 million in revenue in the first six months of 2013 compared to 51,816 GEOs and $85.6 million in revenue in the same period of 2012. The increase in GEOs was due to the (i) Subika NSR which surpassed production thresholds in late 2012 (4,518 GEOs); (ii) MWS stream due to higher production (2,081 GEOs); and (iii) Tasiast NSR due to higher production levels (789 GEOs), partially offset by lower production at Palmarejo (4,893 GEOs).

PGMs

The average prices for platinum and palladium for the first six months of 2013 were $1,549/oz and $726/oz, respectively, which were in line with 2012 levels for platinum and 10.8% higher for palladium.

PGM GEOs produced were 16,264 for the six months compared to 17,898 GEOs in 2012 and revenue decreased to $25.1 million for the period, down from $29.6 million in 2012. The decrease is attributable to lower production from the Sudbury assets as production at Podolsky ceased and nickel production remains the focus at McCreedy. PGM GEO production from Stillwater was 24.9% higher in the period, an increase of 1,378 GEOs with corresponding revenue of $10.5 million.

Oil & Gas

Oil & gas revenue increased 64.6% to $32.1 million for the period (90% oil and 10% gas) compared with $19.5 million for the same period of 2012 (87% oil and 13% gas) due to the addition of the Weyburn Unit NRI in late 2012. Oil averaged C$91 per barrel (based on the Canadian Par Average (40 API)) and gas averaged C$3.19/mcf (based on AECO-C), respectively, during the period. The Canadian Par Average oil price traded at a slight discount to the average WTI price of $94 per barrel for the six-month period. The strengthening of the U.S. dollar relative to the Canadian dollar resulted in a $5/barrel price differential to WTI. In addition to the price differential, the oil produced from the Company’s Weyburn interests had a negative quality differential of approximately C$9 per barrel.

The Weyburn Unit generated $24.2 million compared with $11.2 million for 2012. The Company acquired an additional 1.15% working interest and 11.7% NRI in February 2012 and November 2012, respectively.

15

Costs and expenses

Costs and expenses for the quarter were $106.3 million compared to $102.5 million in 2012. The following table provides a list of the costs and expenses incurred by the Company for the six months ended June 30, 2013 and 2012.

| | Six months ended June 30, | |

(expressed in millions) | | 2013 | | 2012 | | Variance | |

Costs of sales | | $ | 29.0 | | $ | 31.2 | | $ | (2.2 | ) |

Depletion and depreciation | | 62.6 | | 62.7 | | (0.1 | ) |

Corporate administration | | 7.3 | | 7.4 | | (0.1 | ) |

Business development | | 1.5 | | 1.2 | | 0.3 | |

Impairment on investments | | 5.9 | | — | | 5.9 | |

| | $ | 106.3 | | $ | 102.5 | | $ | 3.8 | |

Costs of sales, which comprises the cost of GEOs purchased under stream agreements, oil & gas production taxes, operating costs on oil & gas working interests and net proceeds taxes on mineral interests, were $29.0 million for the first six months of 2013 compared with $31.2 million for the same period of 2012. The decrease of $2.2 million is attributable to lower (i) cost of stream sales of $1.7 million due to lower production from stream assets; and (ii) Nevada net proceeds taxes of $0.5 million as Nevada sourced revenue was lower in the period. For the six month period, the Company received 53,345 GEOs under its stream agreements compared to 61,766 GEOs received for the same period in 2012.

Depletion and depreciation totaled $62.6 million for the quarter compared to $62.7 million a year ago. The decrease in depletion of $0.1 million is due to lower depletion on the Sudbury assets ($4.3 million), Palmarejo ($2.2 million) and Goldstrike ($1.2 million), all due to lower production and other assets ($0.4 million); partially offset by higher depletion on oil & gas assets ($6.4 million) due to higher production and Subika ($1.7 million) as it surpassed production thresholds in the later of part of 2012.

Corporate administration expenses of $7.3 million for the six month period were in-line with 2012.

Business development expenses were $1.5 million and $1.2 million for the six months ended June 30, 2013 and 2012, respectively. Timing of incurring these costs will vary depending upon the timing and level of activity of the business development team on completing transactions.

Impairment of investments was $5.9 million (2012 - Nil) in the period due to the fair value of certain investments, which had been impaired at December 31, 2012, and continued to decline in value over the period.

Other Income/Expenses

Other income/expenses comprise foreign exchange gains and losses, mark-to-market adjustments on the fair value of warrants held by the Company and gains and losses from the sale of gold where settlement of the royalty/stream obligation is taken in kind from the operators.

Other expenses for the six months ended June 30, 2013 were $14.0 million compared to other income of $1.3 million for the same period of 2012. The following table provides a list of the other income/expenses incurred by the Company for the six months ended June 30, 2013 and 2012.

| | Six months ended June 30, | |

(expressed in millions) | | 2013 | | 2012 | | Variance | |

Foreign exchange loss | | $ | (2.9 | ) | $ | (0.7 | ) | $ | (2.2 | ) |

Mark-to-market gain (loss) on warrants | | (9.1 | ) | 2.6 | | (11.7 | ) |

Loss on sale of gold | | (2.0 | ) | (0.6 | ) | (1.4 | ) |

| | $ | (14.0 | ) | $ | 1.3 | | $ | (15.3 | ) |

16

Finance Costs and Finance Income

Finance income was $1.7 million (2012 - $4.7 million) for the six months ended June 30, 2013 which was earned on the Company’s cash equivalents and/or short-term investments. The decrease is attributable to an average lower balance of funds being invested in interest-bearing instruments in 2013 compared with 2012. Finance expenses were $1.1 million (2012 - $0.6 million) and consist of the costs of maintaining the Company’s credit facility in addition to the amortization of the initial set-up costs incurred with respect to the facility. For the period, standby fees were $0.6 million (2012 - $0.1 million) and amortization of issuance costs were $0.2 million (2012 - $0.3 million). In addition, the Company expensed $0.3 million related to the previous credit facility.

Income Taxes

The Company had an income tax expense of $25.4 million (2012 - $26.9 million) for the period. This was comprised of a current income tax expense of $22.2 million (2012 - $21.2 million) and a deferred income tax expense of $3.2 million (2012 - $5.7 million) related to the Company’s Canadian entities partially offset by deferred income tax recoveries in Mexico and the U.S.

Selected quarterly financial information from the Company’s financial statements is set out below:

(expressed in millions, | | Q2 | | Q1 | | Q4 | | Q3 | | Q2 | | Q1 | | Q4 | | Q3 | |

except per share amounts)(1) | | 2013 | | 2013 | | 2012 | | 2012 | | 2012 | | 2012 | | 2011 | | 2011 | |

Revenue | | $ | 93.3 | | $ | 108.8 | | $ | 114.1 | | $ | 105.2 | | $ | 102.7 | | $ | 105.0 | | $ | 118.5 | | $ | 113.3 | |

Cost and expenses | | 50.8 | (2) | 55.5 | (2) | 135.9 | (2) | 50.2 | | 51.2 | | 51.3 | | 226.2 | (2) | 55.8 | |

Operating income (loss) | | 42.5 | | 53.3 | | (21.8 | ) | 55.0 | | 51.5 | | 53.7 | | (107.7 | ) | 57.5 | |

Other income (expenses) | | (8.9 | ) | (4.5 | ) | (0.4 | ) | 11.5 | | (0.3 | ) | 5.7 | | 6.8 | | 6.1 | |

Income tax expense | | 12.0 | | 13.4 | | 10.9 | | 14.5 | | 14.3 | | 12.6 | | 4.5 | | 19.5 | |

Net income (loss) | | 21.6 | | 35.4 | | (33.1 | ) | 52.0 | | 36.9 | | 46.8 | | (105.4 | ) | 44.1 | |

Basic earnings (loss) per share | | $ | 0.15 | | $ | 0.24 | | $ | (0.23 | ) | $ | 0.36 | | $ | 0.26 | | $ | 0.33 | | $ | (0.80 | ) | $ | 0.35 | |

Diluted earnings (loss) per share | | $ | 0.15 | | $ | 0.24 | | $ | (0.23 | ) | $ | 0.35 | | $ | 0.25 | | $ | 0.33 | | $ | (0.80 | ) | $ | 0.34 | |

Adjusted EBITDA(3) | | 75.2 | | 89.1 | | 93.7 | | 86.2 | | 82.5 | | 85.4 | | 94.2 | | 92.2 | |

Adjusted EBITDA(3) per share | | $ | 0.51 | | $ | 0.61 | | $ | 0.65 | | $ | 0.59 | | $ | 0.57 | | $ | 0.61 | | $ | 0.72 | | $ | 0.73 | |

Adjusted Net Income(3) | | 31.9 | | 40.6 | | 47.0 | | 45.3 | | 35.1 | | 43.6 | | 40.8 | | 39.8 | |

Adjusted Net Income(3) per share | | $ | 0.22 | | $ | 0.28 | | $ | 0.32 | | $ | 0.31 | | $ | 0.24 | | $ | 0.31 | | $ | 0.31 | | $ | 0.31 | |

(1) | Due to rounding, amounts may not calculate. |

(2) | Includes impairment charges on royalty, stream, working interests and investments. |

(3) | Adjusted EBITDA and Adjusted Net Income are non-IFRS financial measures with no standardized meaning under IFRS. For further information and a detailed reconciliation, please see pages 18-21 of this MD&A. |

Adjusted EBITDA

Adjusted EBITDA was $75.2 million, or $0.51 per share compared to $82.5 million, or $0.57 per share, for 2012. The decrease in Adjusted EBITDA was primarily due to lower revenue as a result of a decrease in the average gold price and GEOs earned during the quarter.

Adjusted EBITDA for the six months ended June 30, 2013 and 2012 was $164.3 million, or $1.12 per share, and $167.9 million, or $1.18 per share, respectively. The decrease is due to lower revenues from weaker average gold prices and lower GEOs earned in the period.

17

Non-IFRS Financial Measures

Adjusted EBITDA for the three and six months ended June 30, 2013 and 2012 is presented by commodity, location and type of interest below:

| | Adjusted EBITDA | |

For the three months ended June 30, | | | | 2013 | | | | 2012 | |

(expressed in millions) | | $ | | % | | $ | | % | |

Commodity | | | | | | | | | |

Gold | | $ | 50.0 | | 66 | % | $ | 65.9 | | 80 | % |

PGMs | | 6.6 | | 9 | % | 9.2 | | 11 | % |

Other | | 2.7 | | 4 | % | 0.8 | | 1 | % |

Oil &Gas | | 16.0 | | 21 | % | 6.6 | | 8 | % |

| | $ | 75.2 | | 100 | % | $ | 82.5 | | 100 | % |

Geography | | | | | | | | | |

United States | | $ | 17.8 | | 24 | % | $ | 28.5 | | 34 | % |

Canada | | 24.4 | | 32 | % | 19.5 | | 24 | % |

Mexico | | 14.1 | | 19 | % | 2.7 | | 3 | % |

Australia | | 4.7 | | 6 | % | 21.1 | | 26 | % |

Rest of World | | 14.2 | | 19 | % | 10.7 | | 13 | % |

| | $ | 75.2 | | 100 | % | $ | 82.5 | | 100 | % |

Type | | | | | | | | | |

Revenue-based | | $ | 41.1 | | 55 | % | $ | 37.8 | | 46 | % |

Streams | | 22.8 | | 30 | % | 33.8 | | 41 | % |

Profit-based | | 4.2 | | 6 | % | 8.7 | | 11 | % |

Working interests and other | | 7.1 | | 9 | % | 2.2 | | 2 | % |

| | $ | 75.2 | | 100 | % | $ | 82.5 | | 100 | % |

| | Adjusted EBITDA | |

For the six months ended June 30, | | | | 2013 | | | | 2012 | |

(expressed in millions) | | $ | | % | | $ | | % | |

Commodity | | | | | | | | | |

Gold | | $ | 114.5 | | 70 | % | $ | 127.4 | | 75 | % |

PGMs | | 18.3 | | 11 | % | 23.4 | | 14 | % |

Other | | 4.6 | | 3 | % | 2.2 | | 2 | % |

Oil &Gas | | 26.9 | | 16 | % | 14.9 | | 9 | % |

| | $ | 164.3 | | 100 | % | $ | 167.9 | | 100 | % |

Geography | | | | | | | | | |

United States | | $ | 42.0 | | 26 | % | 50.4 | | 30 | % |

Canada | | 52.4 | | 32 | % | 46.4 | | 28 | % |

Mexico | | 30.3 | | 18 | % | 6.5 | | 4 | % |

Australia | | 9.2 | | 6 | % | 41.0 | | 24 | % |

Rest of World | | 30.4 | | 18 | % | 23.6 | | 14 | % |

| | $ | 164.3 | | 100 | % | $ | 167.9 | | 100 | % |

Type | | | | | | | | | |

Revenue-based | | $ | 81.4 | | 50 | % | $ | 75.5 | | 45 | % |

Streams | | 54.7 | | 33 | % | 73.8 | | 44 | % |

Profit-based | | 16.3 | | 10 | % | 14.1 | | 8 | % |

Working interests and other | | 12.0 | | 7 | % | 4.5 | | 3 | % |

| | $ | 164.3 | | 100 | % | $ | 167.9 | | 100 | % |

18

Adjusted EBITDA and Adjusted EBITDA per share

Adjusted EBITDA and Adjusted EBITDA per share are non-IFRS financial measures, which exclude the following from net income and EPS:

· Income tax expense;

· Finance costs;

· Finance income;

· Foreign exchange gains/losses and other expenses;

· Gains and losses on the sale of investments;

· Impairment charges related to royalty, stream and working interests and investments; and

· Depletion and depreciation.

Management uses Adjusted EBITDA and Adjusted EBITDA per share to evaluate the underlying operating performance of the Company as a whole for the reporting periods presented, and to assist with the planning and forecasting of future operating results. Management believes that Adjusted EBITDA and Adjusted EBITDA per share allow investors and analysts to better evaluate the results of the underlying business of the Company. While the adjustments to net income and EPS in these measures include items that are both recurring and non-recurring, management believes that Adjusted EBITDA and Adjusted EBITDA per share are useful measures of the Company’s performance because foreign exchange, gains/losses on sale of investments and impairment charges do not reflect the underlying operating performance of our business and are not necessarily indicative of future operating results. Adjusted EBITDA and Adjusted EBITDA per share are intended to provide additional information to investors and analysts, do not have any standardized meaning under IFRS and should not be considered in isolation or as a substitute for measures of performance prepared in accordance with IFRS.

Reconciliation of Net Income to Adjusted EBITDA:

| | Three months ended June 30, | | Six months ended June 30, | |

(expressed in millions except per share amounts) | | 2013 | | 2012 | | 2013 | | 2012 | |

Net Income | | $ | 21.6 | | $ | 36.9 | | $ | 57.0 | | $ | 83.7 | |

Income tax expense | | 12.0 | | 14.3 | | 25.4 | | 26.9 | |

Finance costs | | 0.4 | | 0.2 | | 1.1 | | 0.6 | |

Finance income | | (0.8 | ) | (2.5 | ) | (1.7 | ) | (4.7 | ) |

Depletion and depreciation | | 28.2 | | 31.0 | | 62.6 | | 62.7 | |

Impairment of investments | | 4.5 | | — | | 5.9 | | — | |

Foreign exchange (gains)/losses and other (income)/expenses | | 9.3 | | 2.6 | | 14.0 | | (1.3 | ) |

Adjusted EBITDA | | $ | 75.2 | | $ | 82.5 | | $ | 164.3 | | $ | 167.9 | |

Basic Weighted Average Shares Outstanding | | 146.8 | | 144.0 | | 146.8 | | 141.9 | |

Adjusted EBITDA per share | | $ | 0.51 | | $ | 0.57 | | $ | 1.12 | | $ | 1.18 | |

Margin

Margin is a non-IFRS financial measure which is defined by the Company as Adjusted EBITDA divided by revenue. Management uses Margin to evaluate the performance of the Company’s portfolio and we believe Margin provides a meaningful measure for investors and analysts to evaluate our overall ability to generate cash flow from our royalty, stream and working interests. Margin is intended to provide additional information, does not have any standardized definition under IFRS and should not be considered in isolation or as a substitute for a measure of performance in accordance with IFRS.

19

Reconciliation of Net Income to Margin:

| | Three months ended June 30, | | Six months ended June 30, | |

(expressed in millions except per share amounts) | | 2013 | | 2012 | | 2013 | | 2012 | |

Net Income | | $ | 21.6 | | $ | 36.9 | | $ | 57.0 | | $ | 83.7 | |

Income tax expense | | 12.0 | | 14.3 | | 25.4 | | 26.9 | |

Finance costs | | 0.4 | | 0.2 | | 1.1 | | 0.6 | |

Finance income | | (0.8 | ) | (2.5 | ) | (1.7 | ) | (4.7 | ) |

Depletion and depreciation | | 28.2 | | 31.0 | | 62.6 | | 62.7 | |

Impairment of investments | | 4.5 | | — | | 5.9 | | — | |

Foreign exchange (gains)/losses and other (income)/expenses | | 9.3 | | 2.6 | | 14.0 | | (1.3 | ) |

Adjusted EBITDA | | $ | 75.2 | | $ | 82.5 | | $ | 164.3 | | $ | 167.9 | |

Revenue | | 93.3 | | 102.7 | | 202.1 | | 207.7 | |

Margin | | 80.6 | % | 80.3 | % | 81.3 | % | 80.8 | % |

Adjusted Net Income and Adjusted Net Income per share

Adjusted Net Income and Adjusted Net Income per share are non-IFRS financial measures, which exclude the following from net income and EPS:

· Foreign exchange gains/losses and other expenses;

· Gains and losses on the sale of investments;

· Impairment charges related to royalty, stream and working interests and investments;

· Unusual non-recurring items; and

· Impact of income taxes on these items.

Management uses Adjusted Net Income and Adjusted Net Income per share to evaluate the underlying operating performance of the Company as a whole for the reporting periods presented, and to assist with the planning and forecasting of future operating results. Management believes that Adjusted Net Income and Adjusted Net Income per share allow investors and analysts to better evaluate the results of the underlying business of the Company. While the adjustments to net income and EPS in these measures include items that are both recurring and non-recurring, management believes that Adjusted Net Income and Adjusted Net Income per share are useful measures of the Company’s performance because foreign exchange, gains/losses on sale of investments and impairment charges do not reflect the underlying operating performance of our business and are not necessarily indicative of future operating results. Adjusted Net Income and Adjusted Net Income per share are intended to provide additional information to investors and analysts, do not have any standardized meaning under IFRS and should not be considered in isolation or as a substitute for measures of performance prepared in accordance with IFRS.

20

Reconciliation of Net Income to Adjusted Net Income:

| | Three months ended June 30, | | Six months ended June 30, | |

(expressed in millions except per share amounts) | | 2013 | | 2012 | | 2013 | | 2012 | |

Net Income | | $ | 21.6 | | $ | 36.9 | | $ | 57.0 | | $ | 83.7 | |

Foreign exchange loss and other expenses, net of income tax | | 1.9 | | 0.4 | | 2.1 | | 0.8 | |

Mark-to-market changes on derivatives, net of income tax | | 4.4 | | 1.3 | | 7.9 | | (2.3 | ) |

Impairment of investments, net of income tax | | 4.0 | | — | | 5.2 | | — | |

Credit facility costs written off, net of income tax | | — | | — | | 0.3 | | — | |

Withholding tax reversal | | — | | (3.5 | ) | — | | (3.5 | ) |

Adjusted Net Income | | $ | 31.9 | | $ | 35.1 | | $ | 72.5 | | $ | 78.7 | |

Basic Weighted Average Shares Outstanding | | 146.8 | | 144.0 | | 146.8 | | 141.9 | |

Basic EPS | | $ | 0.15 | | $ | 0.26 | | $ | 0.39 | | $ | 0.59 | |

Foreign exchange loss and other expenses, net of income tax | | 0.01 | | — | | 0.01 | | — | |

Mark-to-market changes on derivatives, net of income tax | | 0.03 | | — | | 0.05 | | (0.02 | ) |

Impairment of investments, net of income tax | | 0.03 | | — | | 0.04 | | — | |

Withholding tax reversal | | — | | (0.02 | ) | — | | (0.02 | ) |

Adjusted Net Income per share | | $ | 0.22 | | $ | 0.24 | | $ | 0.49 | | $ | 0.55 | |

Financial Position, Liquidity and Capital Resources

Operating Cash Flow

Cash provided by operating activities before changes in non-cash assets and liabilities, relating to operating activities, was $66.3 million and $74.9 million for the three months ended June 30, 2013 and 2012, respectively. The decrease was attributable to lower revenues earned in 2013 compared to 2012.

Cash provided by operating activities before changes in non-cash assets and liabilities, relating to operating activities, was $143.5 million and $151.8 million for the six months ended June 30, 2013 and 2012, respectively. The decrease was attributable to lower revenues earned in 2013 compared to 2012.

Investing Activities

Cash provided by investing activities was $1.8 million for the quarter compared to $74.2 million in 2012. The decrease was due to lower royalty acquisitions in the quarter and partially offset by an increase in investment maturities and purchases.

For the six months ended June 30, 2013, cash provided by investing activities was $40.9 million compared to cash used in investing activities of $128.6 million for the same period of 2012. The increase in cash provided by investing activities was due to fewer short-term investment purchases and working interest acquisitions in 2013 when compared to 2012.

The Company invests its excess funds in various treasury bills of the U.S. government, Canadian federal and provincial governments and high quality corporate bonds. As at June 30, 2013, the investments had various maturities upon acquisition of between 7 and 98 days. Accordingly, as at June 30, 2013, those investments with maturities of three months or less upon acquisition are classified as “cash and cash equivalents” and those with maturities greater than three months upon acquisition are classified as “short-term investments”.

21

Financing Activities

Net cash used in financing activities was $23.9 million for the quarter compared to $17.1 million for 2012. The increase is due to higher dividends being paid in 2013 compared to 2012 as the Company increased its monthly dividend to $0.06 per share effective January 2013 from $0.05 per share in 2012.

Financing activities used $49.8 million in cash in the six months ended June 30, 2013 compared to cash provided by financing activities of $146.4 million due to the higher proceeds from the exercise of warrants in 2012.

Cash Resources and Liquidity

The Company’s performance is impacted by foreign currency fluctuations of the Canadian dollar, Mexican peso and Australian dollar relative to the U.S. dollar. The largest exposure the Company has is with respect to the Canada/U.S. dollar exchange rate as the Company holds a significant amount of its assets in Canada and reports its results in U.S. dollars. The effect of this volatility in these currencies against the U.S. dollar impacts the Company’s corporate administration, business development expenses and depletion on mineral and oil & gas interests incurred in its Canadian and Australian entities due to their respective functional currencies. The Canadian dollar traded in a range of $0.9495 to $1.0532, closing the period at $0.9513. The Mexican peso traded in a range of $0.07454 to $0.08348 and the Australian dollar traded between $0.9167 and $1.0578.

Management’s objectives when managing the Company’s capital are to:

(a) ensure the preservation and availability of capital by investing in low risk investments with high liquidity; and

(b) ensure that the Company maintains the level of capital necessary to meet requirements.

As at June 30, 2013, the Company’s cash, cash equivalents and short-term investments totaled $797.0 million (December 31, 2012 - $779.9 million). In addition, the Company held available-for-sale investments at June 30, 2013 with a combined value of $68.4 million (December 31, 2012 - $108.4 million), of which $35.3 million was held in publicly traded equity instruments (December 31, 2012 - $73.9 million). Working capital as at June 30, 2013 was $835.8 million (December 31, 2012 - $822.4 million). The increase is largely the result of cash generated from normal ongoing operations partially offset by the payment of dividends.

The Company’s near-term cash requirements include funding of the Cobre Panama stream commitment, corporate administration costs, certain costs of operations, declared dividends and income taxes directly related to the recognition of royalty and stream revenues. As a royalty/stream company, there are limited requirements for capital expenditures other than for the acquisition of additional royalties/streams and working interests’ capital commitments. Such acquisitions are entirely discretionary and will be consummated through the use of cash, as available, or through the issuance of common shares or other equity or debt securities or use of the Company’s credit facility. The Company believes that its current cash resources, its available credit facility and future cash flows will be sufficient to cover the cost of its commitments under the Cobre Panama stream agreement, administrative expenses, costs of operations and dividend payments for the foreseeable future.

Ore and refined gold purchase commitments

The Company has certain ore and refined gold purchase commitments related to its stream agreements once the ore is produced from the mining activities.

Cobre Panama Precious Metals Stream

On August 20, 2012, the Company announced the acquisition of a precious metals stream on Inmet’s Cobre Panama copper project in Panama. Franco-Nevada has committed to fund a $1.0 billion deposit for development of the Cobre Panama project, to be drawn down on a 1:3 ratio with Inmet’s funding after Inmet’s aggregate funding for the project has exceeded $1.0 billion. Franco-Nevada expects to fund the $1.0 billion in stages over a three year period with the first draw expected in late 2013.

22

Under the terms of the precious metals stream agreement, Franco-Nevada will pay $400 per ounce for gold and $6 per ounce for silver (subject to an annual adjustment for inflation) for the first 1,341,000 ounces of gold and 21,510,000 ounces of silver, respectively, delivered to Franco-Nevada under the agreement. Thereafter Franco-Nevada will pay the greater of $400 per ounce for gold and $6 per ounce for silver (subject to an annual adjustment for inflation), respectively, and one half of the then prevailing market price. The gold and silver delivered under the precious metals stream agreement is indexed to the copper-in-concentrate produced from the Cobre Panama project.

In March 2013, Inmet was acquired by First Quantum Minerals Ltd.

New Prosperity Gold Stream

Pursuant to a purchase and sale agreement dated May 12, 2010, the Company committed to fund a $350.0 million deposit and acquire 22% of the gold produced pursuant to a gold stream agreement with Taseko Mines Limited (“Taseko”) on Taseko’s New Prosperity copper-gold project located in British Columbia. Franco-Nevada will provide the $350.0 million deposit for the construction of New Prosperity advanced pro-rata with other financing for the project once the project is fully permitted and financed, and has granted Taseko one special warrant. Franco-Nevada’s financing commitment remained available to Taseko provided the project was fully permitted and financed by May 2012 at which point Franco-Nevada was entitled to terminate such commitment. Franco-Nevada has not terminated this option. Once New Prosperity is fully permitted and financed, the special warrant will be exchangeable, without any additional consideration, into two million purchase share warrants. Each purchase share warrant will entitle Taseko to purchase one Franco-Nevada common share at a price of C$75.00 at any time before June 16, 2017. In addition, Franco-Nevada will pay Taseko the lower of $400 per ounce (subject to an inflation adjustment) or the prevailing market price for each ounce of gold delivered under the agreement.

Capital Resources

As of August 6, 2013, the Company has the entire amount of $500.0 million, or its Canadian dollar equivalent, available under its credit facility. Advances under the facility bear interest depending upon the currency of the advance and the Company’s leverage ratio. As of August 6, 2013, U.S. and Canadian dollar advances under the facility would bear interest rates of 4.00% and 3.25%, respectively. The Company can also draw funds using LIBOR 30-day rates plus 125 basis points under its new credit facility.

Standby fees of $0.3 million (2012 - $0.1 million) and $0.6 million (2012 - $0.3 million) were incurred and paid for the three and six months ended June 30, 2013, respectively. In addition, the Company expensed $0.3 million related to the previous credit facility.

Critical Accounting Estimates

The preparation of financial statements in conformity with IFRS requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities, and the disclosure of contingent assets and liabilities at the date of the consolidated financial statements of the Company, and the reported amounts of revenues and expenses during the reporting period. Actual results could be materially different from those estimates.

Our significant accounting policies and estimates are disclosed in notes 2 and 3 of our most recent annual consolidated financial statements.

Outstanding Share Data

The Company is authorized to issue an unlimited number of common and preferred shares. A detailed description of the rights, privileges, restrictions and conditions attached to the authorized shares of the Company is included in the Company’s Annual Information Form for the year ended December 31, 2012, a copy of which can be found on SEDAR at www.sedar.com and in the Company’s 40-F, a copy of which can be found on EDGAR at www.sec.gov.

23

As of August 6, 2013, the number of common shares of the Company outstanding or issuable pursuant to other outstanding securities of the Company is as follows:

Common Shares | | Number | |

Outstanding | | 146,888,818 | |

Issuable upon exercise of Franco-Nevada warrants(1) | | 6,510,769 | |

Issuable upon exercise of Franco-Nevada options(2) | | 1,954,596 | |

Issuable upon exercise of Gold Wheaton (now Franco-Nevada GLW Holdings Corp.) warrants(3) | | 136,150 | |

Issuable upon exercise of Gold Wheaton (now Franco-Nevada GLW Holdings Corp.) options(4) | | 102,307 | |

Issuable upon exercise of special warrant(5) | | 2,000,000 | |

Issuable upon vesting of Franco-Nevada RSUs | | 94,149 | |

Diluted common shares | | 157,686,789 | |

Notes:

(1) | The warrants have an exercise price of C$75.00 per share and an expiry date of June 16, 2017. |

(2) | There were 1,954,596 stock options under the Company’s share compensation plan outstanding to directors, officers, employees and others with exercise prices ranging from C$15.20 to C$57.57 per share. |

(3) | In connection with the acquisition of Gold Wheaton, the Company reserved for issuance 6,126,750 common shares in connection with warrants that were outstanding upon the closing. To-date 1,944,988 Franco-Nevada common shares have been issued upon the exercise of the Gold Wheaton warrants and 25,999,998 warrants (4,045,600 equivalent Franco-Nevada common shares) have expired unexercised. With respect to the warrants, 875,000 warrants (136,150 equivalent Franco-Nevada common shares) have an expiry date of May 26, 2014 and an exercise price of C$5.00 (C$32.13 per share equivalent exercise price). Holders of these warrants, which are now warrants of the Company’s wholly-owned subsidiary Franco-Nevada GLW Holdings Corp., are entitled to receive, at each warrant holder’s election at the time of exercise, either (i) 0.1556 of a Franco-Nevada common share; or (ii) C$5.20 in cash. |

| | | | Number of | | Equivalent | | Equivalent | |

| | | | Gold Wheaton | | Franco-Nevada | | Franco-Nevada | |

Expiry Dates | | Exercise Price | | Warrants | | Exercise Price | | Common Shares | |

May 26, 2014 | | C$ | 5.00 | | 875,000 | | C$ | 32.13 | | 136,150 | |

Total | | | | 875,000 | | | | 136,150 | |

| | | | | | | | | | | |

(4) | In connection with the acquisition of Gold Wheaton, the Company reserved for issuance 730,698 common shares in connection with options that were outstanding upon closing, with exercise prices ranging between C$2.50 and C$6.00 for 0.1556 of a Franco-Nevada common share. To date, 600,071 Gold Wheaton stock options have been exercised and 28,320 Gold Wheaton stock options have expired. |

(5) | In connection with the transaction with Taseko Mines Limited, one special warrant was granted to Taseko which will be exchangeable into 2,000,000 purchase share warrants once the project gets fully permitted and financed. Each warrant will entitle Taseko to purchase one Franco-Nevada common share at a price of C$75.00 per share before June 16, 2017. |

The Company has not issued any preferred shares.

Risk Factors

The following discussion pertains to the outlook and conditions currently known to management which could have a material impact on the financial condition and results of operations of the Company. This discussion, by its nature, is not all-inclusive. It is not a guarantee that other factors will or will not affect the Company in the future. For additional information with respect to risks and uncertainties, please also refer to the “Risk Factors” section of our most recent Annual Information Form filed with the Canadian securities regulatory authorities on SEDAR at www.sedar.com and our most recent Form 40-F filed with the Securities and Exchange Commission on EDGAR at www.sec.gov.

Fluctuation in Commodity Prices

Commodity prices have fluctuated widely in recent years. The marketability and price of metals, minerals, oil & gas on properties for which the Company holds interests will be influenced by numerous factors beyond the control of the Company and which may have a material and adverse effect on the Company’s profitability, results of operations and financial condition.

24

Significance of the Goldstrike Royalties and Palmarejo Gold Stream

The Goldstrike royalties and the Palmarejo gold stream are currently significant to the Company. As a result, any adverse issues associated with financial viability, production and/or the recoverability of reserves from these projects and the associated portions over which the Company has a royalty or stream interest, could have a material and adverse effect on the Company’s profitability, results of operations and financial condition.

Foreign Currency Fluctuations

The Company’s royalty/stream interests are subject to foreign currency fluctuations and inflationary pressures, which may have a material and adverse effect on the Company’s profitability, results of operations and financial condition. There can be no assurance that the steps taken by management to address variations in foreign exchange rates will eliminate the risk of all adverse effects and, accordingly, the Company may suffer losses due to foreign currency rate fluctuations.

The Company operates on an international basis and, therefore, foreign exchange risk and foreign currency translation risk exposures arise from the translation of transactions denominated in a foreign currency. During 2013, the Company’s foreign exchange risk for its Canadian, Australian and Mexican operations arose primarily with respect to the U.S. dollar.

INTERNAL CONTROL OVER FINANCIAL REPORTING AND DISCLOSURE CONTROLS AND PROCEDURES

Our Chief Executive Officer and Chief Financial Officer are responsible for establishing and maintaining the Company’s internal control over financial reporting and other financial disclosure and the Company’s disclosure controls and procedures.

Internal control over financial reporting is a process designed to provide reasonable assurance regarding the reliability of financial reporting and the preparation of financial statements for external purposes in accordance with IFRS. The Company’s internal control over financial reporting includes those policies and procedures that (i) pertain to the maintenance of records that, in reasonable detail, accurately and fairly reflect the transactions and dispositions of the assets of the Company; (ii) provide reasonable assurance that transactions are recorded as necessary to permit preparation of financial statements in accordance with IFRS, and that receipts and expenditures of the Company are being made only in accordance with authorizations of management and directors of the Company; and (iii) provide reasonable assurance regarding prevention or timely detection of unauthorized acquisition, use or disposition of the Company’s assets that could have a material effect on the Company’s financial statements. Internal control over other financial disclosure is a process designed to ensure that other financial information included in this MD&A, fairly represents in all material respects the financial condition, results of operations and cash flows of the Company for the periods presented in this MD&A.