Exhibit 99.2

Execution Copy

PURCHASE AND SALE AGREEMENT

(GOLD AND SILVER)

FRANCO-NEVADA CORPORATION

— and —

FRANCO-NEVADA (BARBADOS) CORPORATION

— and —

LUNDIN MINING CORPORATION

— and —

LMC BERMUDA LTD.

October 6, 2014

TABLE OF CONTENTS

| | Page |

| |

ARTICLE 1 INTERPRETATION | 2 |

| |

1.1 | Definitions | 2 |

1.2 | Certain Rules of Interpretation | 19 |

| | |

ARTICLE 2 PURCHASE AND SALE | 20 |

| |

2.1 | Purchase and Sale of Refined Gold and Refined Silver | 20 |

2.2 | Delivery Obligations | 21 |

2.3 | Invoicing | 23 |

2.4 | Gold Purchase Price | 24 |

2.5 | Silver Purchase Price | 24 |

2.6 | Payment | 24 |

2.7 | Gold Recovery Collar | 25 |

2.8 | Silver Recovery Collar | 25 |

| | |

ARTICLE 2A ACQUISITION OF THE SUMITOMO INTEREST | 26 |

| |

2A.1 | Acquisition of the Sumitomo Interest | 26 |

| | |

ARTICLE 2B ADJUSTMENT TO DEPOSIT | 27 |

| |

ARTICLE 3 DEPOSIT PAYMENT | 27 |

| |

3.1 | Deposit | 27 |

3.2 | Conditions Precedent to Deposit in Favour of the Purchaser | 28 |

3.3 | Use of Deposit | 31 |

3.4 | Conditions Precedent in Favour of the Seller | 31 |

3.5 | Satisfaction of Conditions Precedent | 31 |

3.6 | Closing Deliveries of the Purchaser | 31 |

3.7 | Additional Deposit - Notice of Acquisition of Area of Interest Properties | 32 |

3.8 | Additional Deposit - Option Exercise | 33 |

| | |

ARTICLE 4 TERM | 34 |

| |

4.1 | Term | 34 |

| | |

ARTICLE 5 REPORTING; BOOKS AND RECORDS; INSPECTIONS | 35 |

| |

5.1 | Monthly Reporting | 35 |

5.2 | Annual Reporting | 35 |

5.3 | Books and Records | 36 |

5.4 | Inspections | 37 |

| | |

ARTICLE 6 COVENANTS | 37 |

| |

6.1 | Conduct of Operations | 37 |

6.2 | Preservation of Corporate Existence | 38 |

6.3 | Processing/Commingling | 38 |

6.4 | Offtake Agreements | 39 |

i

TABLE OF CONTENTS

(continued)

| | Page |

| | |

6.5 | Insurance | 40 |

6.6 | Confidentiality | 41 |

6.7 | Notice of Adverse Impact | 42 |

6.8 | Expropriation | 43 |

6.9 | Restrictions on Business | 43 |

6.10 | Non-Arm’s Length Transactions | 44 |

6.11 | Other Covenant | 44 |

| | |

ARTICLE 7 TRANSFERS OF INTERESTS | 45 |

| |

7.1 | Prohibition on Sale of Mineral Interests | 45 |

7.2 | Owner of Project Assets | 46 |

7.3 | Prohibited Transfers and Changes of Control | 46 |

7.4 | Permitted Transfers and Changes of Control | 47 |

| | |

ARTICLE 8 SECURITY | 53 |

| |

8.1 | Indebtedness and Encumbrances | 53 |

8.2 | Security | 53 |

8.3 | Stockpiling | 54 |

| | |

ARTICLE 9 GUARANTEES | 55 |

| |

9.1 | FNC Guarantee and Indemnity | 55 |

9.2 | LMC Guarantee and Indemnity | 58 |

| | |

ARTICLE 10 REPRESENTATIONS AND WARRANTIES | 61 |

| |

10.1 | Representations and Warranties of LMC and the Seller | 61 |

10.2 | Representations and Warranties of the Purchaser | 61 |

10.3 | Representations and Warranties of FNC | 61 |

10.4 | Survival of Representations and Warranties | 61 |

10.5 | Knowledge | 61 |

| | |

ARTICLE 11 LUNDIN EVENTS OF DEFAULT | 61 |

| |

11.1 | Lundin Events of Default | 61 |

11.2 | Remedies | 63 |

11.3 | Exceptions | 63 |

| | |

ARTICLE 12 PURCHASER EVENTS OF DEFAULT | 64 |

| |

12.1 | Purchaser Events of Default | 64 |

12.2 | Remedies | 64 |

| | |

ARTICLE 13 ADDITIONAL PAYMENT TERMS | 65 |

| |

13.1 | Payments | 65 |

13.2 | Taxes | 65 |

13.3 | Overdue Payments | 66 |

ii

TABLE OF CONTENTS

(continued)

| | Page |

| | |

13.4 | Set-Off | 66 |

| | |

ARTICLE 14 GENERAL | 67 |

| |

14.1 | Disputes and Arbitration | 67 |

14.2 | Further Assurances | 67 |

14.3 | Survival | 67 |

14.4 | No Joint Venture | 68 |

14.5 | Governing Law | 68 |

14.6 | Notices | 68 |

14.7 | Press Releases | 69 |

14.8 | Amendments | 70 |

14.9 | Beneficiaries | 70 |

14.10 | Entire Agreement | 70 |

14.11 | Waivers | 70 |

14.12 | Assignment | 70 |

14.13 | Severability | 71 |

14.14 | Costs and Expenses | 71 |

14.15 | Counterparts | 71 |

iii

THIS PURCHASE AND SALE AGREEMENT dated as of October 6, 2014.

BETWEEN:

FRANCO-NEVADA CORPORATION, a corporation incorporated under the laws of Canada

(“FNC”)

— and —

FRANCO-NEVADA (BARBADOS) CORPORATION, a corporation incorporated under the laws of Barbados

(the “Purchaser”)

— and —

LUNDIN MINING CORPORATION, a corporation incorporated under the laws of Canada

(“LMC”)

— and —

LMC BERMUDA LTD., a corporation incorporated under the laws of Bermuda

(the “Seller”)

WITNESSES THAT:

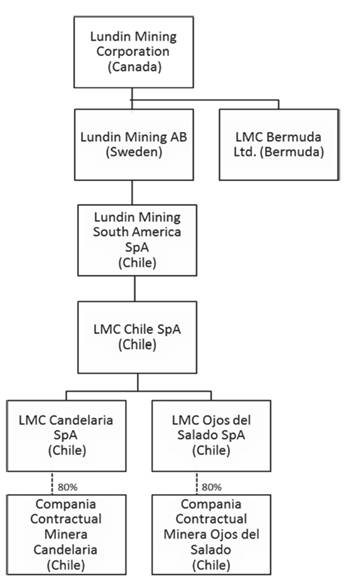

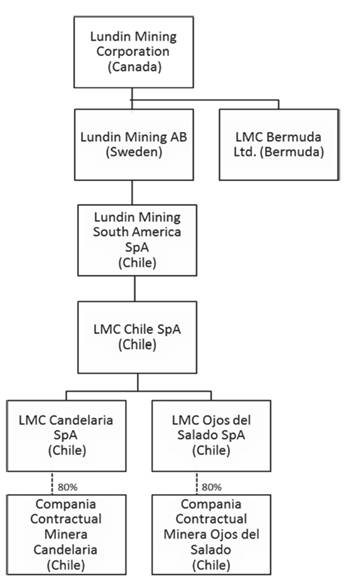

WHEREAS LMC Candelaria SpA (“CCM AcqCo”) and LMC Ojos del Salado SpA (“Ojos AcqCo”), indirect wholly owned subsidiaries of LMC (the “Holdcos”), have agreed to acquire from Freeport Minerals Corporation (“FMC”) all the outstanding Series A Stock and Series C Stock of Compania Contractual Minera Candelaria (“CCMC”) and all the outstanding Series A Stock and Series C Stock of Compania Contractual Minera Ojos del Salado (“CCMO”, and together with CCMC, the “Owners”), the owners and operators of the Candelaria and Ojos del Salado properties, which are producing mines located in Atacama province, Region III, Chile;

AND WHEREAS SMMA Candelaria, Inc., Sumitomo Metal Mining Co., Ltd. and Sumitomo Corporation (collectively, “Sumitomo”), at the date of this Agreement, hold all the outstanding Series B Stock of CCMC and CCMO and have determined to continue to hold those shares and not exercise their rights to sell them to the Holdcos;

AND WHEREAS the Seller, a direct subsidiary of LMC, has agreed to sell to the Purchaser, and the Purchaser has agreed to purchase from the Seller, an amount of Refined Gold and Refined Silver as determined in this Agreement, all subject to and in accordance with the terms and conditions of this Agreement;

AND WHEREAS capitalized terms when used in these recitals shall have the respective meanings set forth in Article 1;

NOW THEREFORE in consideration of the mutual covenants and agreements herein contained and for other good and valuable consideration, the receipt and sufficiency of which are hereby acknowledged by the Parties hereto, the Parties mutually agree as follows:

ARTICLE 1

INTERPRETATION

1.1 Definitions

In this Agreement, including in the recitals and schedules hereto:

“Abandonment Property” has the meaning set out in the paragraph below Section 7.4(e).

“Acquisition” means the acquisition by the Holdcos of the Series A Stock and Series C Stock of each of CCMC and CCMO pursuant to the Acquisition Agreement.

“Acquisition Agreement” means the Stock Purchase Agreement dated October 6, 2014 between CCM AcqCo, Ojos AcqCo and FMC.

“Acquisition Financing” means the Notes and/or the Bridge Facility in an aggregate principal amount not to exceed $1 billion.

“Actual Reserve Amount” has the meaning set out in Section 2B.2(a)(i).

“Additional Deposit” means the additional deposit to be paid by the Purchaser to the Seller which shall be the net present value of the Refined Gold and Refined Silver from the applicable Area of Interest Properties, based on:

(a) 40% of the number of ounces of gold and silver in Mineral Reserves set forth in the Feasibility Study for such Area of Interest Properties;

(b) the projected production and revenue relating to the development, construction and operation, as applicable, of such Area of Interest Properties, including the methodology used in making such projections and related prudent assumptions and contingencies set out in such Feasibility Study;

(c) an [Amount redacted — Commercially sensitive information]% discount rate; and

(d) the published Selected Commodity Analysts consensus annual future prices for gold and silver.

“Additional Term” has the meaning set out in Section 4.1(a).

2

“Affiliate” means, in relation to any person, any other person who is, directly or indirectly, through one or more intermediaries, controlling, controlled by or under common control with such first mentioned person. For the purposes of this Agreement, including this definition and the definitions of “Change of Control” and “subsidiary”, “control” (including, with correlative meanings, the terms “controlled by” and “under common control with”), as applied to any person, means the possession, directly or indirectly, of the power to direct or cause the direction of the management and policies of that person, whether through the ownership of voting securities, by contract or otherwise.

“Agreement” means this purchase and sale agreement and all attached schedules, in each case as the same may be amended, restated, amended and restated, supplemented, modified or superseded from time to time in accordance with the terms hereof.

“Applicable Laws” means any international, federal, state, provincial, territorial, local or municipal law, regulation, ordinance, code, order or other requirement or rule of law or the rules, policies, orders or regulations of any Governmental Authority or stock exchange, including any judicial or administrative interpretation thereof, applicable to a person or any of its properties, assets, business or operations.

“Applicable Percentage” has the meaning set out in Sections 6.5(b), 6.5(d) and 6.8(b).

“Approvals” means all authorizations, clearances, consents, orders and other approvals required to be obtained from any person, including any Governmental Authority, in connection with the transactions contemplated by this Agreement.

“Arbitration Rules” means the International Commercial Arbitration Act (Ontario).

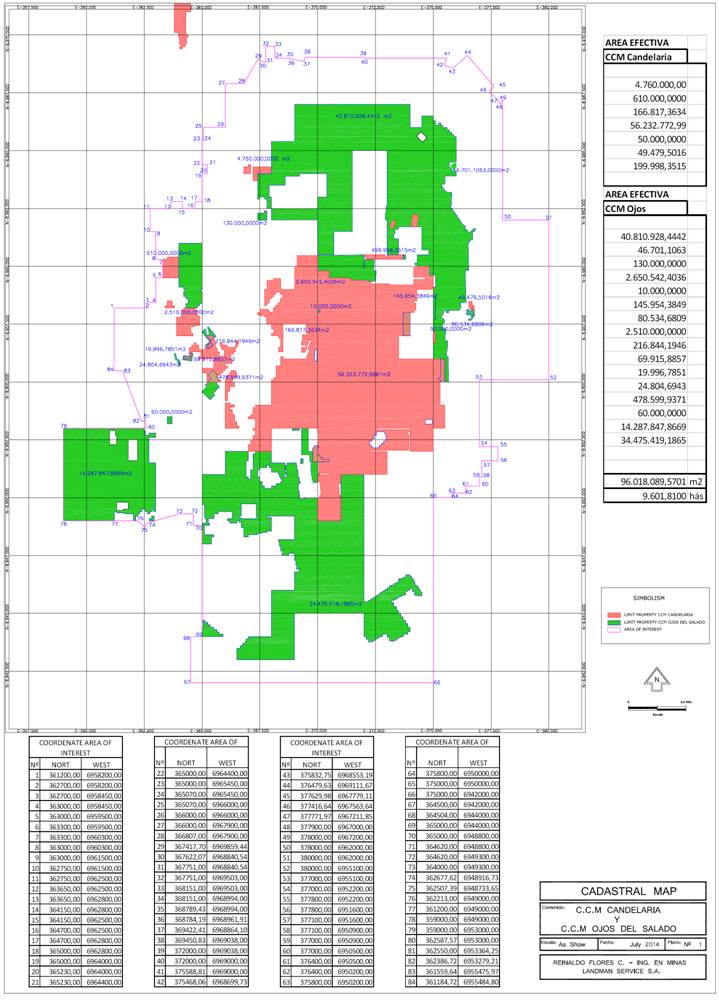

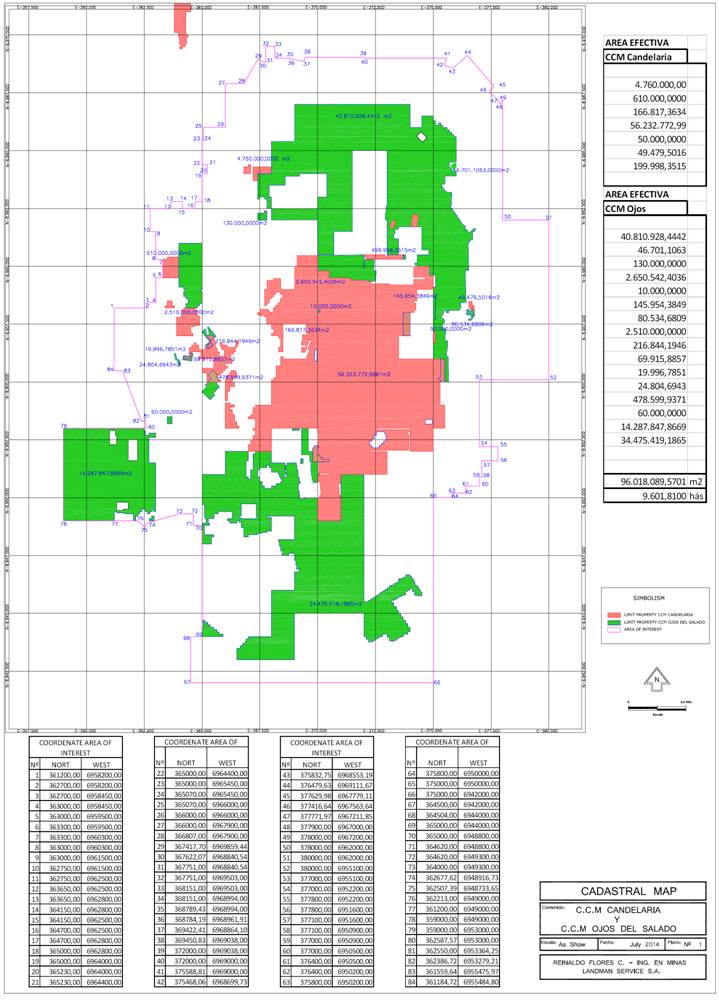

“Area of Interest Properties” means the properties or any portion thereof (or any direct or indirect interests therein) that are located within the boundary indicated on the map included as part of Schedule A attached hereto.

“Bridge Facility” means one or more bridge credit facilities in an aggregate principal amount of up to $1 billion to be entered into pursuant to the commitment letter between Bank of America, N.A., Merrill Lynch, Pierce, Fenner & Smith Incorporated, The Bank of Nova Scotia and LMC dated October 6, 2014, forming part of the Acquisition Financing.

“Business Day” means any day other than a Saturday or Sunday or a day that is a statutory holiday under the laws of any of the Province of Ontario, Barbados, Bermuda or Chile.

“Candelaria Shareholders Agreement” means the agreement dated September 21, 1992 between SMMA Candelaria, Inc., PD Candelaria, Inc. and CCMC, as amended May 24, 1993.

“CCMC” has the meaning set out in the Recitals.

“CCMO” has the meaning set out in the Recitals.

3

“Change of Control” of a person (the “Subject Person”) means the consummation of any transaction, including any consolidation, arrangement, amalgamation or merger or any issue, Transfer or acquisition of voting securities, the result of which is that any other person or group of other persons acting jointly or in concert for purposes of such transaction (1) becomes the beneficial owner, directly or indirectly, of more than 50% of the voting securities of the Subject Person or (2) acquires control, directly or indirectly, of the Subject Person; provided that a Change of Control with respect to any Lundin Group Entity shall not include: (a) a change in the beneficial ownership of voting securities of LMC, or acquisition of control of LMC, if a majority of LMC’s voting securities were listed on a public securities exchange immediately prior to the completion of such transaction and, for greater certainty, shall not include a change in the beneficial ownership of voting securities, or acquisition of control, of a person that directly or indirectly controls LMC if a majority of that controlling person’s voting securities were listed on a public securities exchange immediately prior to the completion of such transaction; or (b) any transaction that results in the Subject Person, other than LMC, continuing to be, directly or indirectly, wholly-owned and controlled by LMC provided that, at the time of such transaction, a majority of LMC’s voting securities are listed on a public securities exchange.

“Closing Date” means the date (which must be a business day) on which the Acquisition under the Acquisition Agreement is scheduled to be completed, which shall be at least three Business Days following the date on which the Seller has provided notice to the Purchaser of such scheduled date, or such other date as the Parties may agree.

“CCM AcqCo” has the meaning set out in the Recitals.

“Collateral” has the meaning set out in Section 8.2(a).

“Commingling Plan” has the meaning set out in Section 6.3.

“Confidential Information” has the meaning set out in Section 6.6(a).

“Date of Delivery” has the meaning set out in Section 2.2(c).

“Definitive Agreement” has the meaning set out in Section 7.1(c).

“Delivery Date” has the meaning set out in Section 2.1(d).

“Deposit” means, subject to adjustment in accordance with Article 2B, $648,000,000 plus the amount of any Additional Deposit paid to the Seller.

“Deposit Reduction Date” means the date on which the Deposit is reduced to nil in accordance with this Agreement.

“Determination Date” has the meaning set out in Section 2B.1(b).

“Designated Jurisdictions” means the United Kingdom and Switzerland.

4

“Designated Percentage of Payable Gold” means, (i) until 720,000 ounces of Refined Gold have been delivered to the Purchaser pursuant to this Agreement, 68% of the number of ounces of Payable Gold in respect of any Minerals from the Properties for which any Lundin Group Entity receives an Offtaker Settlement, as determined in accordance with Section 2.1(b), (ii) after 720,000 ounces of Refined Gold have been so delivered, 40% of the number of ounces of Payable Gold in respect of any Minerals from the Properties for which any Lundin Group Entity receives an Offtaker Settlement, as determined in accordance with Section 2.1(b), and (iii) 40% of the number of ounces of Payable Gold in respect of any Minerals from the Other Properties for which any Lundin Group Entity receives an Offtaker Settlement, as determined in accordance with Section 2.1(b).

“Designated Percentage of Payable Silver” means, (i) until 12 million ounces of Refined Silver have been delivered to the Purchaser pursuant to this Agreement, 68% of the number of ounces of Payable Silver in respect of any Minerals from the Properties for which any Lundin Group Entity receives an Offtaker Settlement, as determined in accordance with Section 2.1(b), (ii) after 12 million ounces of Refined Silver have been so delivered, 40% of the number of ounces of Payable Silver in respect of any Minerals from the Properties for which any Lundin Group Entity receives an Offtaker Settlement, as determined in accordance with Section 2.1(b), and (iii) 40% of the number of ounces of Payable Silver in respect of any Minerals from the Other Properties for which any Lundin Group Entity receives an Offtaker Settlement, as determined in accordance with Section 2.1(b).

“Dispute Notice” has the meaning set out in Section 2B.1(b).

“Dissolution”, for the purpose of Article 9 means, in respect of any person, the bankruptcy, insolvency, winding-up, administration or liquidation of that person and any equivalent or analogous procedure.

“Distribution” means, with respect to any person:

(i) the retirement, redemption, retraction, purchase or other acquisition by such person of any securities of such person;

(ii) the declaration or payment of any dividend, return of capital or other distribution (in cash, securities or other property or otherwise) of, on or in respect of, any securities of such person;

(iii) any payment, repurchase or other acquisition by such person of, or on account of, any Subordinated Debt, including in respect of principal, interest, bonus, premium or otherwise; and

(iv) any other payment or distribution (in cash, securities or other property, or otherwise) by such person of, on or in respect of its securities.

“Encumbrances” means any and all mortgages, charges, assignments, hypothecs, pledges, security interests, liens and other encumbrances of every nature and kind,

5

whether contingent or absolute and any agreement, option or privilege capable of becoming any of the foregoing (whether consensual, arising by law or otherwise) that secures the payment of any Indebtedness or liability or the observance or performance of any obligation.

“Excluded Taxes” has the meaning set out in Section 13.2(b).

“Expert” has the meaning set out in Section 2B.1(b).

“Feasibility Study” means (i) a feasibility study (as such term is defined and incorporated in NI 43-101) relating to the applicable Area of Interest Properties that includes a Reserve Statement, where the number of ounces of gold and silver constituting Mineral Reserves with respect to such Area of Interest Properties is equal to or greater than [Amount redacted — Commercially sensitive information] gold equivalent ounces, or (ii) an appropriate economic study relating to the applicable Area of Interest Properties, where the number of ounces of gold and silver constituting Mineral Reserves with respect to such Area of Interest Properties is less than [Amount redacted — Commercially sensitive information] gold equivalent ounces. For the purposes of this definition, gold equivalent ounces shall be determined with reference to the published Selected Commodity Analysts consensus annual future prices for gold and silver.

“Fixed Gold Price” means, (i) with respect to the Properties, per ounce, $400.00, subject to increase by 1% per annum (on a compounded basis) starting on the third anniversary of the date of this Agreement, and (ii) with respect to the Other Properties, 30% of the Gold Market Price at the Time of Delivery.

“Fixed Silver Price” means, (i) with respect to the Properties, per ounce, $4.00, subject to increase by 1% per annum (on a compounded basis) starting on the third anniversary of the date of this Agreement, and (ii) with respect to the Other Properties, 30% of the Silver Market Price at the Time of Delivery.

“FMC” has the meaning set out in the Recitals.

“Gold Cap Amount” has the meaning set out in Section 2.7(a).

“Gold Deficiency Amount” has the meaning set out in Section 2.7(a).

“Gold Excess Amount” has the meaning set out in Section 2.7(a).

“Gold Excess Payment Amount” has the meaning set out in Section 2.7(b).

“Gold Floor Amount” has the meaning set out in Section 2.7(a).

“Gold Market Price” means, with respect to any day, the afternoon per ounce gold fixing price in U.S. dollars quoted by the London Bullion Market Association for Refined Gold on such day or, if such day is not a trading day, the immediately preceding trading day; provided that if, for any reason, the London Bullion Market Association is no longer in operation or the price of Refined Gold is not confirmed, acknowledged by or quoted by

6

the London Bullion Market Association, the Gold Market Price shall be determined by reference to the price of Refined Gold in the manner endorsed by the London Bullion Market Association and World Gold Council, failing which the Gold Market Price will be determined by reference to the price of Refined Gold on a commodity exchange mutually acceptable to the Parties, acting reasonably.

“Gold Purchase Price” has the meaning set out in Section 2.4.

“Governmental Authority” means any international, federal, state, provincial, territorial, municipal or local government, agency, department, ministry, authority, board, tribunal, commission or official, including any such entity with power to tax, or exercise regulatory or administrative functions, or any court, arbitrator (public or private), stock exchange or securities commission.

“Guarantee” means a guarantee of the Guarantors in form and substance reasonably acceptable to the Purchaser and the Seller.

“Guarantors” means New ChileCo, New ChileCo 2 and each of the Holdcos and any other person from time to time party to the Guarantee.

“Holdcos” has the meaning set out in the Recitals.

“Indebtedness” of any person means, without duplication:

(i) all obligations of such person for borrowed money and all obligations of such person evidenced by bonds, debentures, notes, bills or other similar instruments;

(ii) all obligations, contingent or otherwise, relative to the face amount of all letters of credit, whether or not drawn, and banker’s acceptances issued for such person’s account;

(iii) all obligations of such person under any lease that is required to be classified and accounted for as a capital or financed lease for financial accounting purposes or under any synthetic lease, tax retention, operating lease or other lease having substantially the same economic effect as a conditional sale, title retention agreement or similar arrangement;

(iv) all obligations of such person in respect of the deferred purchase price of property or services (excluding current accounts payable incurred in the ordinary course of business);

(v) all indebtedness of another person secured by (or for which the holder of such obligations has an existing right, contingent or otherwise, to be secured by) any Encumbrance, upon or in property owned by such person, even if such person has not assumed or become liable for the payment of such obligations or such obligations are limited in recourse;

7

(vi) all obligations of such person created or arising under any conditional sale or other title retention agreement with respect to property acquired by such person (even if the rights and remedies of the seller or lender under such agreement in the event of default are limited to repossession or sale of such property);

(vii) all guarantees, indemnities and other obligations (contingent or otherwise) of such person in respect of Indebtedness of another person; and

(viii) all obligations of such person to purchase, redeem, retire, defease or otherwise acquire for value any equity, ownership or profit interests in such person within ten years from the date of issuance thereof.

“Initial Term” has the meaning set out in Section 4.1(a).

“Insolvency Event” means, in relation to any person, any one or more of the following events or circumstances:

(i) proceedings are commenced for the winding-up, liquidation or dissolution of it, unless it in good faith actively and diligently contests such proceedings resulting in a dismissal or stay thereof within 30 days of the commencement of such proceedings;

(ii) a decree or order of a court of competent jurisdiction is entered adjudging it to be bankrupt or insolvent (unless vacated), or a petition seeking reorganization, arrangement or adjustment of or in respect of it is approved under applicable laws relating to bankruptcy, insolvency or relief of debtors;

(iii) it makes an assignment for the benefit of its creditors, or petitions or applies to any court or tribunal for the appointment of a receiver or trustee for itself or any substantial part of its assets or property, or commences for itself or acquiesces in or approves or has filed or commenced against it any proceeding under any Applicable Law relating to bankruptcy, insolvency, reorganization, arrangement or readjustment of debt or any proceeding for the appointment of a receiver or trustee for itself or any substantial part of its assets or property, or has a liquidator, administrator, receiver, trustee, conservator or similar person appointed with respect to it or any substantial portion of its property or assets unless such proceeding, assignment or appointment is involuntary and dismissed, vacated or stayed within 30 days of commencement of such proceeding; or

(iv) a resolution of its board of directors is passed for the receivership or winding-up or liquidation of it.

“Intercreditor Agreement” means an agreement between the Purchaser, the Lenders, LMC and the applicable PSA Entities that recognizes this Agreement as a pre-paid

8

forward sale of gold and silver and includes terms consistent with the principles set out in Schedule B.

“Lenders” means the lenders, indenture trustees, administrative agents and collateral agents, as applicable, from time to time under the Acquisition Financing or any Refinancing Facility.

“LMAB” means Lundin Mining AB, a Swedish company.

“Lot” means the applicable quantity of Minerals delivered to an Offtaker.

“Lundin Event of Default” has the meaning set out in Section 11.1.

“Lundin Group Entity” means LMC and any Affiliate of LMC, including the PSA Entities, from time to time.

“Material Adverse Effect” means any event, occurrence, change or effect that, when taken individually or together with all other events, occurrences, changes or effects:

(i) materially limits, restricts or impairs or is reasonably likely to materially limit, restrict or impair the ability of (1) LMC or any PSA Entity to perform its obligations under this Agreement, the Guarantee or any Security Pledge Agreement, as applicable, or (2) the Owners to operate the Project substantially in accordance with the Operating Plan in effect at the time of the occurrence of the Material Adverse Effect; or

(ii) causes or is reasonably likely to cause any significant decrease to expected gold or silver production from the Project based on the Operating Plan in effect at the time of the occurrence of the Material Adverse Effect.

“Mineral Interest” has the meaning set out in Section 7.1(b).

“Mineral Reserves” means proven mineral reserves and probable mineral reserves as defined and incorporated under NI 43-101.

“Minerals” means any and all marketable metal bearing material in whatever form or state that is mined, produced, extracted or otherwise recovered from the Properties or the Other Properties, and including any such material derived from any processing or reprocessing of any tailings, waste rock or other waste products originally derived from the Properties or the Other Properties, and including ore and any other products resulting from the further milling, processing or other beneficiation of Minerals, including concentrates or doré; provided however, that “Minerals” shall not include tailings resulting from Mineral bearing material that has been processed, including for the recovery of gold and silver, through the processing facilities related to the Project and subsequently processed by or sold to Compania Minera del Pacifico S.A. or other parties for the purpose of recovering magnetite.

9

“Monthly Report” means a written report in relation to a calendar month with respect to the Project that contains, for such month:

(i) types, tonnes and grades of mined copper, gold and silver;

(ii) types, tonnes and grades of stockpiled copper, gold and silver;

(iii) tonnes of Minerals processed by and resulting concentrates from the processing facilities related to the Project in total and separately with respect to the Properties and the Other Properties, and similar information with respect to any other processing facilities;

(iv) the number of tonnes of copper and ounces of gold and silver contained in Minerals processed during such month, but not delivered to an Offtaker by the end of such month;

(v) a summary of deliveries made to Offtakers during such month showing, among other things, provisional Refined Gold and Produced Gold amounts and related Offtaker Settlements and provisional Refined Silver and Produced Silver amounts and related Offtaker Settlements and any final settlement adjustments made during such month;

(vi) copies of available Offtaker Settlement Sheets and other Offtaker statements, invoices or receipts, or if the sharing of such documents is restricted by applicable confidentiality restrictions or Applicable Laws, such other information that will allow the Purchaser to verify all aspects of the deliveries of Refined Gold and Refined Silver and compliance with other provisions of this Agreement;

(vii) the aggregate number of ounces of Refined Gold and Refined Silver delivered to the Purchaser under this Agreement up to the end of such month;

(viii) a detailed calculation of the Uncredited Balance as of the end of such month; and

(ix) such other information regarding the calculation of the amount of Refined Gold and/or Refined Silver delivered to the Purchaser as the Purchaser may reasonably request.

“Net Present Value of the Remaining Stream” means the net present value of the Purchaser’s rights under this Agreement based on [Calculation methodology redacted — Commercially sensitive information].

“Net Proceeds” means, with respect to the receipt of proceeds under Sections 6.5(b), 6.5(d) and 6.8(b), the aggregate amount received by the Lundin Group Entities less the fees, costs and other out-of-pocket expenses (as evidenced by supporting documentation provided to the Purchaser upon request) incurred or paid to a third party by any Lundin

10

Group Entity in connection with the claim giving rise to such proceeds, without deduction for any insurance premiums or similar payments.

“New ChileCo” means Lundin Mining South America SpA, a company incorporated under Chilean law.

“New ChileCo 2” means LMC Chile SpA, a company incorporated under Chilean law.

“New Owner” has the meaning set out in Section 7.4(a)(ii).

“NI 43-101” means National Instrument 43-101 — Standards of Disclosure for Mineral Projects of the Canadian Securities Administrators, as it may be amended from time to time, or any successor instrument, rule or policy.

“Notes” means the senior secured notes of LMC in an aggregate principal amount of up to $1 billion forming part of the Acquisition Financing.

“Offtake Agreement” means any agreement entered into by any Lundin Group Entity with any person (including spot sales) (i) for the sale of Minerals to such person (other than an intra-company sale between Lundin Group Entities that precedes the sale of Minerals to an arm’s length third party), or (ii) for the smelting, refining or other beneficiation of Minerals by such person for the benefit of any Lundin Group Entity, as may be amended, restated, amended and restated, supplemented, modified or superseded from time to time.

“Offtaker” means any person that enters into an Offtake Agreement with a Lundin Group Entity.

“Offtaker Settlement” means (i) with respect to Minerals purchased by an Offtaker from a Lundin Group Entity, the receipt by a Lundin Group Entity of payment, or other consideration from the Offtaker, whether provisional or final, and (ii) with respect to Minerals refined, smelted or otherwise beneficiated by an Offtaker on behalf of a Lundin Group Entity, the receipt by the Lundin Group Entity of Refined Gold or Refined Silver or other materials or payments derived from or relating to Produced Gold or Produced Silver in accordance with the applicable Offtake Agreement.

“Offtaker Settlement Sheets” means the final documents from the Offtaker (or if such final documents are not available in the case of a provisional payment, the relevant documents on which such provisional payment has been determined) or such other relevant documents, in each case evidencing at least the amount of Minerals, including Produced Gold and Produced Silver, in each Lot.

“Ojos AcqCo” has the meaning set out in the Recitals.

“Ojos Shareholders Agreement” means the agreement dated December 22, 2005 between SMMA Candelaria, Inc., Sumitomo Metal Mining Arizona, Inc., Sumitomo Metal Mining Co., Ltd., Sumitomo Corporation, PD Ojos Del Salado, Inc., Phelps Dodge Corporation and CCMO.

11

“Operating Plan” means the life of mine operating plans for the Project as provided by the Seller to the Purchaser on the date hereof, as amended from time to time.

“Option” means the option granted by the Seller to the Purchaser pursuant to Sections 3.7 and 3.8.

“Other Minerals” means any and all marketable metal bearing material in whatever form or state (including ore) that is mined, produced, extracted or otherwise recovered from any location that is not within the Properties or the Other Properties.

“Other Properties” means any of the Area of Interest Properties that (i) are acquired by a Lundin Group Entity and (ii) (x) the Minerals from such Area of Interest Properties are processed through the processing facilities in respect of the Project prior to the last day for the Purchaser to exercise the Option with respect to such Area of Interest Properties in accordance with the provisions of Sections 3.7 and 3.8, or (y) form part of this Agreement pursuant to an exercise of the Option with respect to such Area of Interest Properties by the Purchaser in accordance with the provisions of Sections 3.7 and 3.8.

“Owners” has the meaning set out in the Recitals, and following any merger permitted under this Agreement, references to the Owners will be to their applicable successors.

“Parties” means the parties to this Agreement.

“Payable Gold” means 93% of the Produced Gold contained in a Lot in respect of which Lot any Lundin Group Entity receives an Offtaker Settlement during the Term, as determined in accordance with Section 2.1(b).

“Payable Silver” means 90% of the Produced Silver contained in a Lot in respect of which Lot any Lundin Group Entity receives an Offtaker Settlement during the Term, as determined in accordance with Section 2.1(b).

“Permits” means all material licenses, permits, approvals (including environmental approvals) authorizations, rights (including surface and access rights), privileges, concessions or franchises necessary for the development and operation of the Project, including any contemplated by the Operating Plan.

“Permitted Encumbrances” means any Encumbrance in respect of the Project Assets constituted by the following:

(i) inchoate or statutory liens for taxes, assessments, royalties, rents or charges not at the time due or payable, or being contested in good faith through appropriate proceedings;

(ii) any reservations, or exceptions contained in the original grants of land or by applicable statute or the terms of any lease in respect of any Properties or the Other Properties, or comprising the Properties or the Other Properties;

12

(iii) minor discrepancies in the legal description or acreage of or associated with the Properties or the Other Properties, or any adjoining properties which would be disclosed in an up to date survey, and any registered easements and registered restrictions or covenants that run with the land, in either case which do not materially detract from the value of, or materially impair the use of, the Properties or the Other Properties, for the purpose of conducting and carrying out mining operations thereon;

(iv) rights of way for or reservations or rights of others for, sewers, water lines, gas lines, electric lines, telegraph and telephone lines, and other similar utilities, or zoning by-laws, ordinances, surface access rights or other restrictions as to the use of the Properties or the Other Properties, which do not in the aggregate materially detract from the use of the Properties or the Other Properties, for the purpose of conducting and carrying out mining operations thereon;

(v) liens or other rights granted by either Owner to secure performance of statutory obligations or regulatory requirements (including reclamation obligations) in connection with the Project;

(vi) a right of title retention in connection with the acquisition by either Owner of goods in the ordinary course of business;

(vii) security deposits with any Governmental Authority and utilities in the ordinary course of business of a PSA Entity;

(viii) the Security Pledge Agreements;

(ix) liens granted by either Owner solely to secure Indebtedness permitted under clauses (a) and (b) in item (ii) of the definition of Permitted Indebtedness; and

(x) an Encumbrance created with the Purchaser’s prior written consent.

“Permitted Indebtedness” means:

(i) Indebtedness incurred and available to be drawn under the Acquisition Financing or a Refinancing Facility;

(ii) Indebtedness incurred by the Owners constituting (a) equipment financing that is secured only by the underlying equipment, (b) receivable financing that is secured only by the underlying receivables, and (c) Indebtedness solely for working capital purposes in connection with the Project in an aggregate amount not to exceed $[Amount redacted — Commercially sensitive information] and that is unsecured;

(iii) Subordinated Debt;

13

(iv) Indebtedness incurred under this Agreement, the Guarantee and the Security Pledge Agreements;

(v) Indebtedness in respect of surety or completion bonds, standby letters of credit or letters of guarantee securing mine closure, asset retirement and environmental reclamation obligations of the Owners to the extent required by Applicable Laws or Governmental Authority; and

(vi) any other Indebtedness with the Purchaser’s prior written consent.

“person” includes an individual, corporation, body corporate, limited or general partnership, joint stock company, limited liability corporation, joint venture, association, company, trust, bank, trust company, Governmental Authority or any other type of organization or entity, whether or not a legal entity.

“Pledged Shares” means (i) the Series A Stock of CCMC, the Series A Stock and Series C Stock of CCMO, the Shares of New ChileCo 2, and the Shares of the Seller, (ii) the Shares of the companies resulting from the merger of any PSA Entities with one another, (iii) if and when the requisite consents of Sumitomo have been obtained, the Series C Stock of CCMC and the Shares of CCM AcqCo and Ojos AcqCo, and (iv) the Shares of any other person that becomes a PSA Entity (for greater certainty excluding New ChileCo as long as it, or its successor, remains a subsidiary of LMAB or another Swedish corporation that is also a direct subsidiary of LMC).

“Principals Agreement” means the agreement dated September 18, 1992 between Phelps Dodge Corporation, Sumitomo Metals Mining Co., Ltd., Sumitomo Corporation and Sumitomo Metal Mining Arizona, Inc., as amended June 1, 1993.

“Produced Gold” means (i) any and all gold in whatever form or state that is contained in Minerals recovered from the Properties, and (ii) any and all gold in whatever form or state that is contained in Minerals recovered from the Other Properties.

“Produced Silver” means (i) any and all silver in whatever form or state that is contained in Minerals recovered from the Properties, and (ii) any and all silver in whatever form or state that is contained in Minerals recovered from the Other Properties.

“Project” means the Properties and the Other Properties, the mining, exploration and development operations conducted thereon, and the mines, infrastructure, processing facilities and other facilities constructed and operated at or in respect of the Properties or the Other Properties.

“Project Assets” means the Properties and the Other Properties and all other present and after acquired real or personal property or other assets and rights (including water rights and surface rights) used or acquired for use by any Lundin Group Entity in connection with the Project, including the Punta Padrones port and desalination plant facilities, and any mining, production, processing or extraction of Minerals from the Properties and the Other Properties. For the avoidance of doubt, Project Assets shall not include the Pledged Shares or any other shares of any Lundin Group Entity.

14

“Project Net Present Value” means the net present value of the Project based on [Calculation methodology redacted — Commercially sensitive information].

“Properties” means all real property interests, mineral claims, mineral leases and other rights, concessions and interests held by the Owners as of the Closing Date, including those listed in Schedule A, including all buildings, structures, improvements, appurtenances and fixtures thereon or attached thereto, whether created privately or by the action of any Governmental Authority. “Properties” shall also include any term extension, renewal, replacement, conversion or substitution of any such real property interests, mineral claims, mineral leases, and any related rights, concessions or interests, owned or in respect of which an interest is held, directly or indirectly, by any Lundin Group Entity at any time during the Term, whether or not such ownership or interest is held continuously. Certain of the Properties are depicted in the map attached at Schedule A.

“PSA Entity” means from time to time any Party to this Agreement (other than LMC, FNC and the Purchaser), the Owners, CCM AcqCo, Ojos AcqCo, New ChileCo, New ChileCo 2 and any other person (now or hereafter formed or acquired) that acquires directly or indirectly all or part of the Project Assets (other than a Transfer of which is not restricted by Sections 7.2 and 7.3), but excluding LMAB and any other person that directly or indirectly holds any interest in New ChileCo, provided that LMAB or such other person does not otherwise directly or indirectly hold any interest in the Project Assets. Notwithstanding the foregoing, LMC shall become a PSA Entity if it at any time directly holds any Project Assets.

“PSA Security” means the charges and security interests granted in favour of the Purchaser pursuant to the Security Pledge Agreements.

“Purchaser Event of Default” has the meaning set out in Section 12.1.

“Purchaser Guaranteed Obligations” has the meaning set out in Section 9.1(a).

“Purchaser Termination Event” has the meaning set out in Section 12.1(b).

“Receiving Party” has the meaning set out in Section 6.6(a).

“Recovery Protocol” has the meaning set out in Section 2.7.

“Refinancing Facility” means any credit facility, bonds, debentures, notes or other similar instruments, the net proceeds of which are used to replace, refinance, defease or discharge the Acquisition Financing (or any other Refinancing Facility) or that are entered into or issued at any time following the defeasance or discharge of all or part of the Acquisition Financing (or any other Refinancing Facility), provided that (i) the principal amount of such Indebtedness available under such Refinancing Facility, together with any remaining Indebtedness outstanding and available to be drawn under the Acquisition Financing (or any other Refinancing Facility), does not exceed in the aggregate $1 billion (plus the amount of all fees, and expenses and premiums incurred in connection therewith), (ii) such Refinancing Facility has a maturity date which is after the

15

maturity date of the Indebtedness under the Acquisition Financing, and (iii) such Refinancing Facility is not secured against the Project Assets, and if secured against the Pledged Shares, the lenders or holders thereunder have agreed to be bound by an intercreditor agreement with the Purchaser which is (x) substantially on the same terms and conditions as the Intercreditor Agreement (without regard to the Designated Percentage) or (y) otherwise at least as favourable to the Purchaser (as determined by it, acting reasonably) as the Intercreditor Agreement (without regard to the Designated Percentage), and in each case such intercreditor agreement provides for a “Designated Percentage” (as defined in Schedule B) in favour of the Purchaser that is equal to at least, but need not be greater than (A) two times the Uncredited Balance at the time the Refinancing Facility is entered into, divided by (B) the Project Net Present Value (less outstanding Indebtedness, other than Subordinated Debt, of the Owners) at such time.

“Refined Gold” means marketable metal bearing material in the form of gold bars or coins that is refined to standards meeting or exceeding 995 parts per 1,000 fine gold.

“Refined Silver” means marketable metal bearing material in the form of silver bars or coins that is refined to standards meeting or exceeding 999 parts per 1,000 fine silver.

“Reserve Statement” means a statement prepared by a qualified person (as such term is defined in NI 43-101) on behalf of the Lundin Group Entities setting out the number of tonnes of ore and metal grades of Mineral Reserves.

“Restricted Person” means any person that:

(i) is named, identified, described in or on or included in or on any of:

(1) the lists maintained by the Office of the Superintendent of Financial Institutions (Canada) with respect to terrorism financing, including the lists made under subsection 83.05(1) of the Criminal Code, under the Regulations Implementing the United Nations Resolutions on the Suppression of Terrorism and under the United Nations Al-Qaida and Taliban Regulations;

(2) the Denied Persons List, the Entity List or the Unverified List, compiled by the Bureau of Industry and Security, U.S. Department of Commerce;

(3) the List of Statutorily Debarred Parties compiled by the U.S. Department of State;

(4) the Specially Designated Nationals Blocked Persons List compiled by the U.S. Office of Foreign Assets Control;

(5) the annex to, or is otherwise subject to the provisions of, U.S. Executive Order No. 13324; or

16

(6) any other Applicable Law relating to anti-terrorism or anti-money laundering matters;

(ii) is subject to trade restrictions under any Applicable Laws, including, but not limited to:

(1) the United Nations Act (Canada), the Special Economic Measures Act (Canada) and the Freezing of Assets of Corrupt Foreign Officials Act (Canada);

(2) the International Emergency Economic Powers Act, 50 U.S.C.; and

(3) the Trading with the Enemy Act, 50 U.S.C. App. 1.1 et seq.; or any other enabling legislation or executive order relating thereto, including the Uniting and Strengthening America by Providing Appropriate Tools Required to Intercept and Obstruct Terrorism Act of 2001, Title III of Pub. L. 107 56; or

(iii) is a person or entity who is an Affiliate of a person or entity listed above.

“Review Period” has the meaning set out in Section 7.1(c).

“S&D Reserve Statement” has the meaning set out in Section 2B.1(a).

“S&D Review Period” has the meaning set out in Section 2B.1(b).

“Security Pledge Agreements” has the meaning set out in Section 8.2(a).

“Selected Commodity Analysts” means the respective division, group or entity of each of the following, which is responsible for forecasting metal prices for gold and silver and other applicable metals: [Specific entities redacted — Commercially sensitive information], provided that any of the foregoing that has not published forecasts for the applicable metal(s) prior to end of the last calendar quarter shall be excluded with respect to such metal(s) and the foregoing list may be updated by the Parties, acting reasonably, in writing from time to time in order to remove and replace any institution that ceases to publish the relevant information. Where such term is used herein, the reference to consensus prices shall be determined based on the most recent forecast published by such persons.

“Seller Guaranteed Obligations” means all present and future debts, liabilities and obligations of the Seller to the Purchaser under or in connection with this Agreement, including its obligations under Article 2 and to pay any amounts under this Agreement, including an award of the arbitrators under Schedule F.

“Seller Offer” has the meaning set out in Section 7.1(b).

“Share Transfer” has the meaning set out in Section 7.4.

17

“Shares”, in the case of a body corporate, means shares (voting or otherwise) in the body corporate, and in the case of any other person, means shares, partnership or member interests, or voting, equity, participating or other ownership interests in that person, and includes any option or other right to acquire Shares and any security convertible into or exchangeable for Shares.

“Silver Cap Amount” has the meaning set out in Section 2.8(a).

“Silver Deficiency Amount” has the meaning set out in Section 2.8(a).

“Silver Excess Amount” has the meaning set out in Section 2.8(a).

“Silver Excess Payment Amount” has the meaning set out in Section 2.8(b).

“Silver Floor Amount” has the meaning set out in Section 2.8(a).

“Silver Market Price” means, with respect to any day, the daily per ounce LBMA Silver Price in U.S. dollars quoted by the London Bullion Market Association (currently in partnership with CME Group and Thomson Reuters) for Refined Silver on such day or, if such day is not a trading day, the immediately preceding trading day; provided that if, for any reason, the LBMA Silver Price is no longer confirmed, acknowledged or quoted by the London Bullion Market Association, the Silver Market Price shall be determined by reference to the price of Refined Silver on a commodity exchange mutually acceptable to the Parties, acting reasonably.

“Silver Purchase Price” has the meaning set out in Section 2.5.

“Subscription Agreement” means the subscription agreement dated December 5, 2005 between Sumitomo Metal Mining Co., Ltd., Sumitomo Corporation, Sumitomo Metal Mining Arizona, Inc., SMMA Candelaria, Inc., Phelps Dodge Corporation and PD Ojos del Salado, Inc. and CCMC.

“Subordinated Debt” means any debts, liabilities or obligations owing by a PSA Entity to (i) any other PSA Entity, (ii) LMC, or (iii) any Affiliate of LMC, on any account and in any capacity, subordinated in accordance with the provisions of the Subordination and Postponement of Claims.

“Subordination and Postponement of Claims” has the meaning set out in Section 8.2(b).

“subsidiary” means, with respect to any person, any other person which is, directly or indirectly, controlled and wholly-owned by that person.

“Sumitomo” has the meaning set out in the Recitals.

“Target Reserve Amount” has the meaning set out in Section 2B.2(a)(ii).

18

“Taxes” means all taxes, surtaxes, duties, levies, imposts, tariffs, fees, assessments, reassessments, withholdings, dues and other charges of any nature, whether disputed or not, by a Governmental Authority, and instalments in respect thereof, including such amounts imposed or collected on the basis of: income; capital, real or personal property; payments, deliveries or transfers of property of any kind to residents or non-residents; purchases, consumption, sales, use, import, export of goods and services; mining; distributions; equity; together with penalties, fines, additions to tax and interest thereon; and “Tax” shall have a corresponding meaning.

“Term” has the meaning set out in Section 4.1(a).

“Third Party” has the meaning set out in Section 6.6(a)(i).

“Time of Delivery” has the meaning set out in Section 2.2(c).

“Transfer” means to, directly or indirectly, sell, transfer, assign, convey, dispose or otherwise grant a right, title or interest (including expropriation or other transfer required or imposed by law or any Governmental Authority), whether voluntary or involuntary.

“Uncredited Balance” at any time means the uncredited balance of the Deposit determined in accordance with this Agreement.

1.2 Certain Rules of Interpretation

Except as may be otherwise specifically provided in this Agreement and unless the context otherwise requires:

(a) The terms “Agreement”, “this Agreement”, “the Agreement”, “hereto”, “hereof”, “herein”, “hereby”, “hereunder” and similar expressions refer to this Agreement in its entirety and not to any particular provision hereof.

(b) References to an “Article”, “Section” or “Schedule” followed by a number or letter refer to the specified Article or Section of or Schedule to this Agreement.

(c) Headings of Articles and Sections are inserted for convenience of reference only and shall not affect the construction or interpretation of this Agreement.

(d) Where the word “including” or “includes” is used in this Agreement, it means “including without limitation” or “includes without limitation”.

(e) The language used in this Agreement is the language chosen by the Parties to express their mutual intent, and no rule of strict construction shall be applied against any Party.

(f) Unless the context otherwise requires, words importing the singular include the plural and vice versa and words importing gender include all genders.

19

(g) A reference to a statute includes all regulations made pursuant to and rules promulgated under such statute and, unless otherwise specified, any reference to a statute or regulation includes the provisions of any statute or regulation which amends, supplements or supersedes any such statute or any such regulation from time to time.

(h) Time is of the essence in the performance of the Parties’ respective obligations under this Agreement.

(i) Unless specified otherwise, in this Agreement a period of days shall be deemed to begin on the first day after the event which began the period and to end at 5:00 p.m. (Toronto time) on the last day of the period. If, however, the last day of the period does not fall on a Business Day, the period shall terminate at 5:00 p.m. (Toronto time) on the next Business Day.

(j) Unless specified otherwise in this Agreement, all statements or references to dollar amounts in this Agreement are to United States of America dollars.

(k) The following schedules are attached to and form part of this Agreement:

Schedule A | - | | Description of Properties and Area of Interest (with Map) |

Schedule B | - | | Principles of the Intercreditor Agreement |

Schedule C | - | | LMC and Seller Representations and Warranties |

Schedule D | - | | Purchaser Representations and Warranties |

Schedule E | - | | FNC Representations and Warranties |

Schedule F | - | | Dispute Resolution |

Schedule G | - | | Susana and Damiana Mineralization Zones |

ARTICLE 2

PURCHASE AND SALE

2.1 Purchase and Sale of Refined Gold and Refined Silver

(a) Subject to and in accordance with the terms of this Agreement, during the Term, the Seller hereby agrees to sell to the Purchaser, and the Purchaser hereby agrees to purchase from the Seller, in respect of each Lot:

(i) an amount of Refined Gold equal to the Designated Percentage of Payable Gold, free and clear of all Encumbrances; and

(ii) an amount of Refined Silver equal to the Designated Percentage of Payable Silver, free and clear of all Encumbrances.

(b) The amount of Produced Gold and Produced Silver shall be measured by the amount of contained gold and silver in the Minerals received by the Offtaker as

20

determined by the Offtaker Settlement Sheets. Produced Gold and Produced Silver shall not be reduced for, and the Purchaser shall not be responsible for, any refining charges, treatment charges, penalties, insurance charges, transportation charges, settlement charges, financing charges or price participation charges, or other similar charges or deductions, regardless of whether such charges or deductions are expressed as a specific metal deduction, as any recovery rate or otherwise, in any case, pursuant to the terms of the applicable Offtake Agreement or otherwise.

(c) The Refined Gold and Refined Silver delivered pursuant to this Agreement need not come from gold or silver physically produced at the Project, provided that the Seller shall not sell or deliver to the Purchaser (for purposes of this Agreement and at any time during the Term) any Refined Gold or Refined Silver that has been directly or indirectly purchased on a commodity exchange.

(d) The provisions of Article 2 shall also apply to any settlements from offtakers received by or on behalf of the Owners in respect of Produced Gold and Produced Silver sold during the period from and including July 1, 2014 to and excluding the Closing Date (where the related offtaker settlement is received prior to the Closing Date), provided that the Seller shall have no obligation to make such deliveries of Refined Gold or Refined Silver to the extent that the aggregate amount of such deliveries in respect of such period exceeds an amount equal to [Amount redacted — Commercially sensitive information] in the case of Refined Gold and [Amount redacted — Commercially sensitive information] in the case of Refined Silver, multiplied by the number of days during the period from and including July 1, 2014 to and excluding the Closing Date. The Seller shall use its reasonable commercial efforts to determine the amount of Refined Gold and Refined Silver to be delivered pursuant to this clause (d) and to make such deliveries to the Purchaser as soon as practicable after the Closing Date and no later than (i) 14 days after the Closing Date if the Closing Date occurs on or before December 12, 2014, or (ii) on the Closing Date, if the Closing Date occurs after December 12, 2014 (as applicable, the “Delivery Date”), provided that if the Seller is unable to make such determination prior to the Delivery Date, the Seller shall deliver on the Delivery Date an amount of Refined Gold and Refined Silver equal to 80% of the estimated amounts to be delivered under this clause (d) as agreed by the Purchaser and Seller, acting in good faith, and the Seller shall determine and deliver the final balance of such amount no later than 30 days after the Delivery Date.

2.2 Delivery Obligations

(a) Subject to Section 2.2(b), within five Business Days after the date of each Offtaker Settlement on or following the Closing Date (for greater certainty, including with respect to any sales of Produced Gold and Produced Silver occurring on or after July 1, 2014, and prior to the Closing Date), the Seller shall sell and deliver to the Purchaser Refined Gold in an amount equal to the Designated Percentage of Payable Gold and Refined Silver in an amount equal to

21

the Designated Percentage of Payable Silver in respect of the Lot to which such Offtaker Settlement relates.

(b) If an Offtaker Settlement consists of a provisional payment that may be adjusted upon final settlement of a Lot, then:

(i) within five Business Days after the date of such provisional Offtaker Settlement, the Seller shall sell and deliver to the Purchaser (A) Refined Gold in an amount equal to the Designated Percentage of Payable Gold, and (B) Refined Silver in an amount equal to the Designated Percentage of Payable Silver, in each case in respect of such Lot for which the Seller received a provisional Offtaker Settlement (provided that, for this calculation of Refined Gold and Refined Silver, as applicable, the amount of gold and silver in the Lot which the Offtaker uses in the calculation of its provisional payment shall be used to determine the amount of Produced Gold and Produced Silver in the Lot) under the applicable Offtake Agreement, as supported by the documentation required pursuant to Section 2.3 and in the applicable Monthly Report; and

(ii) within five Business Days after the date of final settlement of the Lot with the Offtaker, the Seller shall sell and deliver to the Purchaser (A) Refined Gold in an amount equal to the amount by which the actual Designated Percentage of Payable Gold exceeds the amount of Refined Gold previously delivered to the Purchaser in respect of such Lot pursuant to Section 2.2(b)(i), and (B) Refined Silver in an amount equal to the amount by which the actual Designated Percentage of Payable Silver exceeds the amount of Refined Silver previously delivered to the Purchaser in respect of such Lot pursuant to Section 2.2(b)(i), in each case as supported by the documentation required pursuant to Section 2.3 and the applicable Monthly Report; provided, however, if the Refined Gold or Refined Silver delivered pursuant to Section 2.2(b)(i) exceeds the actual Designated Percentage of Payable Gold or the actual Designated Percentage of Payable Silver, respectively, then the Seller shall be entitled to set off and deduct such excess amount of either or both of Refined Gold or Refined Silver, as applicable, from the next required deliveries by the Seller under this Agreement until it has been fully offset against deliveries to the Purchaser of either or both of Refined Gold or Refined Silver, if any, pursuant to this Section 2.2(b).

(c) The Seller shall sell and deliver to the Purchaser all Refined Gold and Refined Silver to be sold or delivered under this Agreement by way of (i) credit (in metal) or physical allocation to (ii) the metal account or accounts in a Designated Jurisdiction designated by the Purchaser, with both (i) and (ii) to be specified by the Purchaser by electronic communication prior to the Closing Date and thereafter, if there is any change to such information, at least 30 days in advance of any sale or delivery of Refined Gold or Refined Silver. If the Purchaser wishes to designate a metal account in a jurisdiction other than a Designated Jurisdiction,

22

such designation will be subject to the prior written consent of the Seller, such consent not to be unreasonably withheld. The Purchaser hereby confirms that at the Closing Date its metal account will be in the United Kingdom. Delivery of Refined Gold and Refined Silver to the Purchaser shall be deemed to have been made at the time and on the date Refined Gold and Refined Silver are respectively credited or physically allocated to a designated metal account of the Purchaser (the “Time of Delivery” on the “Date of Delivery”).

(d) Title to, and risk of loss of, Refined Gold and Refined Silver shall pass from the Seller to the Purchaser at the Time of Delivery.

(e) All costs and expenses pertaining to each delivery of Refined Gold and Refined Silver to the Purchaser shall be borne by the Seller so long as the Purchaser’s metal accounts are in a Designated Jurisdiction. If the Purchaser specifies delivery to a jurisdiction other than a Designated Jurisdiction, then it will be responsible for any additional costs and expenses resulting therefrom over the costs and expenses that would have applied in the previous Designated Jurisdiction.

(f) The Seller hereby represents and warrants to and covenants with the Purchaser that, immediately prior to the Time of Delivery (i) the Seller will be the sole legal and beneficial owner of the Refined Gold and Refined Silver credited or physically allocated to a metal account of the Purchaser, (ii) the Seller will have good, valid and marketable title to such Refined Gold and Refined Silver, and (iii) such Refined Gold and Refined Silver will be free and clear of all Encumbrances.

2.3 Invoicing

The Seller shall notify the Purchaser in writing, within three Business Days after each delivery and credit to the account of the Purchaser, by delivery of an invoice to the Purchaser that shall include:

(a) the calculation of the number of ounces of Refined Gold and Refined Silver credited or physically allocated;

(b) the Offtaker Settlement Sheets on which the calculation is based, or if the sharing of such Offtaker Settlement Sheets is restricted by applicable confidentiality restrictions or Applicable Laws, such other information that will allow the Purchaser to verify all aspects of the delivery of Refined Gold and Refined Silver reflected in such invoice;

(c) the Date of Delivery and Time of Delivery;

(d) the Gold Purchase Price for Refined Gold and Silver Purchase Price for Refined Silver credited or physically allocated; and

(e) reference to the Offtake Agreement under which such delivery was made.

23

2.4 Gold Purchase Price

The Purchaser shall pay to the Seller a purchase price for each ounce of Refined Gold sold and delivered by the Seller to the Purchaser under this Agreement (the “Gold Purchase Price”) equal to:

(a) until the Deposit Reduction Date, the Gold Market Price on the Date of Delivery of such Refined Gold, payable (i) in cash or by wire transfer equal to the amount of the lesser of the Fixed Gold Price and the Gold Market Price on the Date of Delivery, and (ii) if such Gold Market Price is greater than the Fixed Gold Price, the balance will be payable by crediting an amount equal to the difference between such Gold Market Price and the Fixed Gold Price against the Deposit in order to reduce the Uncredited Balance until it has been credited and reduced to nil; and

(b) after the Deposit Reduction Date, the lesser of the Fixed Gold Price and the Gold Market Price on the Date of Delivery of such Refined Gold, payable in cash or by wire transfer.

2.5 Silver Purchase Price

The Purchaser shall pay to the Seller a purchase price for each ounce of Refined Silver sold and delivered by the Seller to the Purchaser under this Agreement (the “Silver Purchase Price”) equal to:

(a) until the Deposit Reduction Date, the Silver Market Price on the Date of Delivery of such Refined Silver, payable (i) in cash or by wire transfer equal to the amount of the lesser of the Fixed Silver Price and the Silver Market Price on the Date of Delivery, and (ii) if such Silver Market Price is greater than the Fixed Silver Price, the balance will be payable by crediting an amount equal to the difference between such Silver Market Price and the Fixed Silver Price against the Deposit in order to reduce the Uncredited Balance until it has been credited and reduced to nil; and

(b) after the Deposit Reduction Date, the lesser of the Fixed Silver Price and the Silver Market Price on the Date of Delivery of such Refined Silver, payable in cash or by wire transfer.

2.6 Payment

Payment by the Purchaser for each delivery of Refined Gold and Refined Silver shall be made (i) no later than five Business Days after the receipt of the Refined Gold or Refined Silver, as applicable, in the Purchaser’s metal account, and (ii) to a bank account of the Seller designated in accordance with Section 13.1.

24

2.7 Gold Recovery Collar

Within 20 days after the end of each calendar year, the Purchaser and the Seller will determine the “gold recovery” and “silver recovery” from Minerals for the year just ended in accordance with a protocol to be agreed prior to the Closing Date (the “Recovery Protocol”). If that determination results in a recovery ratio of gold in concentrate to gold in preprocessed ore (expressed as a percentage) of (i) more than 73%, the Purchaser shall make an additional payment to the Seller in accordance with clauses (a), (b) and (c) below, or (ii) less than 68%, the Seller shall deliver additional Refined Gold to the Purchaser in accordance with clauses (a) and (b) below:

(a) in accordance with the Recovery Protocol the Purchaser and Seller shall determine (i) the number of ounces of Refined Gold that would have been delivered to the Purchaser pursuant to this Agreement during the prior calendar year if the recovery ratio was 73% (the “Gold Cap Amount”), and (ii) the number of ounces of Refined Gold that would have been delivered to the Purchaser pursuant to this Agreement during the prior calendar year if the recovery ratio was 68% (the “Gold Floor Amount”). The excess, if any, of the total number of ounces of Refined Gold delivered to the Purchaser pursuant to this Agreement during the prior calendar year over the Gold Cap Amount is referred to herein as the “Gold Excess Amount”. The deficiency, if any, of the total number of ounces of Refined Gold delivered to the Purchaser pursuant to this Agreement during the prior calendar year below the Gold Floor Amount is referred to herein as the “Gold Deficiency Amount”.

(b) within 15 days after the determination, (i) in the case where there is a Gold Excess Amount, the Purchaser will make a payment to the Seller in an amount equal to the Gold Excess Amount multiplied by the difference (if positive) between the Gold Market Price as of the date of payment and the Fixed Gold Price for the prior calendar year (such amount the “Gold Excess Payment Amount”), and until the Deposit Reduction Date, the Uncredited Balance shall be increased by the amount of such payment, and (ii) in the case where there is a Gold Deficiency Amount, the Seller will deliver to the Purchaser an amount of Refined Gold equal to the Gold Deficiency Amount, such delivery and the payment therefor to be in accordance with the applicable provisions of Article 2; and

(c) in the case where there is a Gold Excess Amount, the payment of the Gold Excess Payment Amount shall be paid in cash to a bank account of the Seller designated in accordance with Section 13.1.

2.8 Silver Recovery Collar

Within 20 days after the end of each calendar year, the Purchaser and the Seller will determine the “gold recovery” and “silver recovery” from Minerals for the year just ended in accordance with the Recovery Protocol. If that determination results in a recovery ratio of silver in concentrate to silver in preprocessed ore (expressed as a percentage) of (i) more than 81%, the Purchaser shall make an additional payment to the Seller in accordance with clauses (a), (b) and

25

(c) below, or (ii) less than 75%, the Seller shall deliver additional Refined Silver to the Purchaser in accordance with clauses (a) and (b) below:

(a) in accordance with the Recovery Protocol the Purchaser and Seller shall determine (i) the number of ounces of Refined Silver that would have been delivered to the Purchaser pursuant to this Agreement during the prior calendar year if the recovery ratio was 81% (the “Silver Cap Amount”), and (ii) the number of ounces of Refined Silver that would have been delivered to the Purchaser pursuant to this Agreement during the prior calendar year if the recovery ratio was 75% (the “Silver Floor Amount”). The excess, if any, of the total number of ounces of Refined Silver delivered to the Purchaser pursuant to this Agreement during the prior calendar year over the Silver Cap Amount is referred to herein as the “Silver Excess Amount”. The deficiency, if any, of the total number of ounces of Refined Silver delivered to the Purchaser pursuant to this Agreement during the prior calendar year below the Silver Floor Amount is referred to herein as the “Silver Deficiency Amount”.

(b) within 15 days after the determination, (i) in the case where there is a Silver Excess Amount, the Purchaser will make a payment to the Seller in an amount equal to the Silver Excess Amount multiplied by the difference (if positive) between the Silver Market Price as of the date of payment and the Fixed Silver Price for the prior calendar year (such amount the “Silver Excess Payment Amount”), and until the Deposit Reduction Date, the Uncredited Balance shall be increased by the amount of such payment, and (ii) in the case where there is a Silver Deficiency Amount, the Seller will deliver to the Purchaser an amount of Refined Silver equal to the Silver Deficiency Amount, such delivery and the payment therefor to be in accordance with the applicable provisions of Article 2; and

(c) in the case where there is a Silver Excess Amount, the payment of the Silver Excess Payment Amount shall be paid in cash to a bank account of the Seller designated in accordance with Section 13.1.

ARTICLE 2A

ACQUISITION OF THE SUMITOMO INTEREST

2A.1 Acquisition of the Sumitomo Interest

If at any time during the Initial Term or any Additional Term any Lundin Group Entity acquires the Series B Stock of CCMC and CCMO, then the Seller shall promptly thereafter ensure:

(a) New ChileCo 2 shall have executed and delivered a Security Pledge Agreement to the Purchaser covering all the outstanding shares of the Holdcos, such Security Pledge Agreement to be in form and substance satisfactory to the Purchaser, acting reasonably, and shall have executed and delivered or agreed to become bound by the Intercreditor Agreement;

26

(b) the Security Pledge Agreement of CCM AcqCo required to be delivered pursuant to Section 3.2(c) shall also include as part of the pledge all the Series B Stock and the Series C Stock of CCMC;

(c)�� the Security Pledge Agreement of Ojos AcqCo required to be delivered pursuant to Section 3.2(c) shall also include as part of the pledge all the Series B Stock of CCMO;

(d) that the Security Pledge Agreements shall have been registered, filed or recorded in all offices, and all actions shall have been taken, that may be prudent or necessary to preserve, protect or perfect the security interest of the Purchaser under the Security Pledge Agreements; and

(e) the delivery to the Purchaser of favourable opinions, in form and substance satisfactory to the Purchaser, acting reasonably, dated as of the date of completion, from external legal counsel to the applicable PSA Entities substantially to the effect of the applicable opinions described in Section 3.2(d), with any applicable modifications,

and thereafter, the definition of “Pledged Shares” shall be as follows: “Pledged Shares” means (i) all the Shares of CCMC, CCMO, the Seller, CCM AcqCo, Ojos AcqCo, and New ChileCo 2, (ii) the Shares of any person resulting from a merger of any PSA Entities with one another, and (iii) the Shares of any other person that becomes a PSA Entity (for greater certainty excluding New ChileCo as long as it, or its successor, remains a subsidiary of LMAB or another Swedish corporation that is also a direct subsidiary of LMC).

ARTICLE 2B

ADJUSTMENT TO DEPOSIT

[Commercially sensitive provisions relating to the adjustment to the Deposit redacted. The maximum adjustment and related payment obligation will not exceed $40 million for either Purchaser or Seller.]

ARTICLE 3

DEPOSIT PAYMENT

3.1 Deposit

In consideration for the respective promises and covenants of the Seller contained herein, including the sale and delivery by the Seller to the Purchaser of Refined Gold and Refined Silver, the Purchaser hereby agrees to pay, and the Seller hereby agrees to accept, the Deposit on the Closing Date in cash against, and as a prepayment of, the Gold Purchase Price and the Silver Purchase Price, subject to the conditions in Section 3.2. The Seller will provide wire transfer instructions and bank account information for the Deposit to the Purchaser at least three Business Days in advance of the Closing Date.

No interest will be payable by the Seller on or in respect of the Deposit except as expressly provided in this Agreement.

27

If by the expiry of the Initial Term or any Additional Term the Seller has not sold and delivered to the Purchaser an amount of Refined Gold or Refined Silver sufficient to reduce the Uncredited Balance of the Deposit to nil, as calculated in accordance with Sections 2.4(a) and 2.5(a), then the Seller will not have any obligation to pay such Uncredited Balance of the Deposit to the Purchaser.

3.2 Conditions Precedent to Deposit in Favour of the Purchaser

The Purchaser shall pay the Deposit to or to the order of the Seller on the Closing Date once each of the following conditions has been satisfied in full:

(a) LMC and each PSA Entity shall have delivered to the Purchaser a certificate of status, good standing or compliance (or equivalent) for LMC and each PSA Entity, issued by the relevant Governmental Authority dated no earlier than five Business Days prior to the Closing Date;

(b) LMC and each applicable PSA Entity shall have executed and delivered to the Purchaser a certificate of a senior officer of each, in form and substance satisfactory to the Purchaser, acting reasonably, dated as of the Closing Date, as to the constating documents of each; the resolutions of the board of directors or other comparable authority of each authorizing the execution, delivery and performance of this Agreement, the Guarantee, the Security Pledge Agreements and the Intercreditor Agreement, as applicable, and the transactions contemplated hereby and thereby; the names, positions and true signatures of the persons authorized to sign this Agreement, the Guarantee, the Security Pledge Agreements and the Intercreditor Agreement, as applicable, and such other matters pertaining to the transactions contemplated hereby as the Purchaser may reasonably require;

(c) LMC (as applicable) and each applicable PSA Entity shall have executed and delivered, as security for the performance of its obligations to the Purchaser under this Agreement, the Guarantee and the Security Pledge Agreements (such Security Pledge Agreements covering the Shares of the Seller, the Shares of New ChileCo 2 and the Series A Stock of CCMC and the Series A Stock and Series C Stock of CCMO and in a form and substance satisfactory to the Purchaser, acting reasonably) and the Security Pledge Agreements shall have been registered, filed or recorded in all offices, and all actions shall have been taken, that may be prudent or necessary to preserve, protect or perfect the security interest of the Purchaser under the Security Pledge Agreements (it being understood that, to the extent any security interest in any Collateral cannot be perfected on or before the Closing Date as a result of applicable registration procedures, the perfection of such security interests in such Collateral shall not constitute a condition precedent to the availability of the Deposit on the Closing Date but shall be satisfied as soon as practicable after the Closing Date);

(d) LMC and the applicable PSA Entities shall have delivered to the Purchaser favourable opinions, in form and substance satisfactory to the Purchaser, acting reasonably, dated as of the Closing Date, from external legal counsel to LMC and

28