Exhibit 99.2

MANAGEMENT’S DISCUSSION AND ANALYSIS

This Management’s Discussion and Analysis (“MD&A”) of financial position and results of operations of Franco-Nevada Corporation (“Franco-Nevada”, the “Company”, “we” or “our”) has been prepared based upon information available to Franco-Nevada as at November 11, 2015 and should be read in conjunction with Franco-Nevada’s unaudited condensed interim consolidated financial statements and related notes as at and for the three and nine months ended September 30, 2015 and 2014. The unaudited condensed interim consolidated statements and MD&A are presented in U.S. dollars and have been prepared in accordance with International Financial Reporting Standards (“IFRS”) as issued by the International Accounting Standards Board (“IASB”) applicable to the preparation of interim financial statements in accordance with IAS 34, Interim Financial Reporting.

Readers are cautioned that the MD&A contains forward looking statements and that actual events may vary from management’s expectations. Readers are encouraged to read the “Cautionary Statement on Forward Looking Information” at the end of this MD&A and to consult Franco-Nevada’s audited consolidated financial statements for the year ended December 31, 2014 and the corresponding notes to the financial statements which are available on our website at www.franco-nevada.com, on SEDAR at www.sedar.com and in our most recent Form 40-F filed with the Securities and Exchange Commission on EDGAR at www.sec.gov.

Additional information related to Franco-Nevada, including our Annual Information Form, is available on SEDAR at www.sedar.com, and our Form 40-F is available on EDGAR at www.sec.gov. These documents contain detailed descriptions and maps of certain of Franco-Nevada’s producing and advanced royalty and stream assets. For additional information, our website can be found at www.franco-nevada.com.

Table of Contents

Overview | 3 |

|

|

Highlights | 4 |

|

|

Guidance | 5 |

|

|

Selected Financial Information | 7 |

|

|

Overview of Financial Performance — Q3 2015 to Q3 2014 | 8 |

|

|

Overview of Financial Performance — Nine Months 2015 to Nine Months 2014 | 23 |

|

|

Financial Condition Review | 33 |

|

|

Balance Sheet Review | 33 |

|

|

Financial Position, Liquidity and Capital Resources | 33 |

|

|

Capital Resources | 37 |

|

|

Critical Accounting Estimates | 37 |

|

|

Outstanding Share Data | 37 |

|

|

Risk Factors | 38 |

|

|

Internal Control Over Financial Reporting and Disclosure Controls and Procedures | 39 |

|

|

Non-IFRS Financial Measures | 40 |

|

|

Cautionary Statement on Forward Looking Information | 43 |

Overview

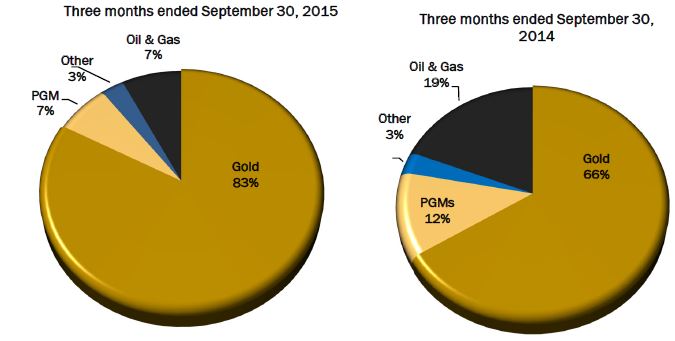

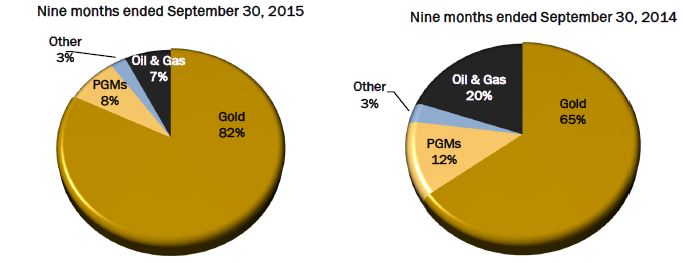

Franco-Nevada is the leading gold royalty and stream company by both gold revenues and number of gold assets. The Company is gold-focused but also has the largest and most diversified portfolio of royalties and streams by commodity, geography, revenue type and stage of project. The portfolio is actively managed with the aim to maintain over 80% of revenue from precious metals (gold, silver & PGM).

The Company does not operate mines, develop projects or conduct exploration. Franco-Nevada’s business model is focused on managing and growing its portfolio of royalties and streams. The advantages of this business model are:

· Exposure to commodity price optionality;

· Limited exposure to many of the risks associated with operating companies;

· A free cash-flow business with limited cash calls;

· A high-margin business that can generate cash through the entire commodity cycle;

· A scalable and diversified business in which a large number of assets can be managed with a small stable overhead;

· A forward-looking business in which management focuses on growth opportunities rather than operational or development issues; and

· A perpetual discovery option over large areas of geologically prospective lands with no cost other than the initial investment.

Franco-Nevada’s financial results in the short-term are primarily tied to the price of commodities and the amount of production from its portfolio of producing assets. From time to time, financial results are also supplemented by acquisitions of new producing assets. Over the longer-term, results are impacted by the availability of exploration and development capital applied by other companies to expand or extend Franco-Nevada’s producing assets or to advance Franco-Nevada’s advanced and exploration assets into production.

Franco-Nevada has a long-term focus in making its investments and recognizes it is in a cyclical industry. Franco-Nevada has historically operated by maintaining a strong balance sheet so that it can make investments during commodity cycle downturns.

Franco-Nevada’s shares are listed on the Toronto and New York stock exchanges under the symbol FNV. An investment in Franco-Nevada’s shares is expected to provide investors with yield and exposure to gold price and exploration optionality while limiting exposure to many of the risks of operating companies. Since its IPO almost eight years ago, Franco-Nevada has increased its dividend annually and its share price has outperformed the gold price and all relevant gold equity benchmarks.

Highlights

Financial — 3 months

· 85,637 Gold Equivalent Ounces (“GEOs”)1 earned (2014 — 70,0711), an increase of 22.2% over Q3 2014;

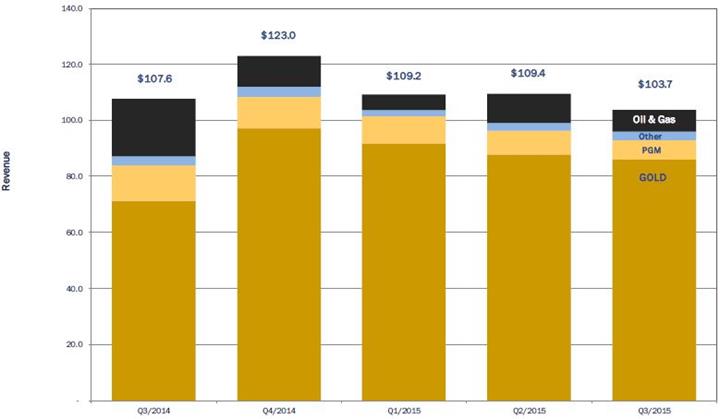

· Revenue of $103.7 million (2014 - $107.6 million);

· Adjusted EBITDA2 of $78.0 million, or $0.50 per share (2014 - $88.7 million or $0.59 per share);

· Margin2 of 75.2% (2014 — 82.4%);

· Net income of $15.2 million, or $0.10 per share (2014 — $33.2 million or $0.22 per share); and

· Adjusted Net Income2 of $19.4 million, or $0.12 per share (2014 - $34.5 million or $0.23 per share).

Financial — 9 months

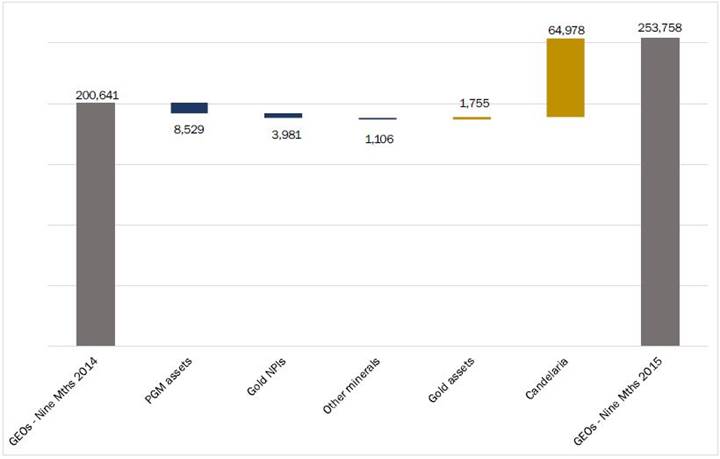

· 253,758 GEOs1 earned (2014 — 200,6411), an increase of 26.5% over 2014;

· Revenue of $322.3 million (2014 - $319.4 million);

· Adjusted EBITDA2 of $243.4 million, or $1.55 per share (2014 - $260.7 million or $1.75 per share);

· Margin2 of 75.5% (2014 — 81.6%);

· Net income of $56.0 million, or $0.36 per share (2014 — $105.5 million or $0.71 per share); and

· Adjusted Net Income2 of $65.2 million, or $0.42 per share (2014 - $104.8 million or $0.71 per share).

Corporate

Antamina

On October 9, 2015, the Company acquired a silver stream from Teck Resources Limited (“Teck”) on production from the Antamina mine located in Peru. In exchange for a $610.0 million advance payment, the Company will purchase all recovered silver from Teck’s attributable 22.5% interest in the Antamina mine, subject to a fixed silver payability of 90%. The Company will pay 5% of the spot silver price for each ounce delivered under the stream agreement. The stream will reduce by one-third after 86 million ounces of silver have been delivered under the stream agreement, which is estimated to occur in 30 years assuming current throughput.

Cobre Panama

On October 7, 2015, the Company announced it had finalized terms of a replacement precious metals stream agreement for First Quantum Minerals Ltd.’s (“First Quantum”) Cobre Panama project located in Panama. The changes from the original agreement relate to streamlining reporting arrangements and providing First Quantum with greater flexibility to finance the project while maintaining the Company’s security package. The principal commercial terms of the replacement agreement remain the same as the original agreement including that the Company will provide a $1.0 billion deposit against future deliveries of gold and silver from Cobre

1 GEOs include our gold, silver, platinum, palladium and other mineral assets. GEOs are estimated on a gross basis for NSR royalties and, in the case of stream ounces, before the payment of the per ounce contractual price paid by the Company. For NPI royalties, GEOs are calculated taking into account the NPI economics. Platinum, palladium and other minerals were converted to GEOs by dividing associated revenue, which includes settlement adjustments, by the average gold price for the period. For average commodity prices used in calculation of GEOs, please refer to average commodity price tables on pages 16 and 27 of this MD&A.

2 Adjusted Net Income, Adjusted EBITDA and Margin are non-IFRS financial measures with no standardized meaning under IFRS. For further information and a detailed reconciliation, please see pages 40-43 of this MD&A.

Panama. The deposit will be funded on a pro-rata basis of 1:3 with First Quantum’s 80% share of the capital costs in excess of $1.0 billion. Initial funding of $337.9 million was made by the Company on November 3, 2015 using existing cash on hand and the use of the Company’s credit facility.

Credit Facility

The Company has drawn $480.0 million in aggregate under its credit facility to fund a portion of the Antamina acquisition and Cobre Panama funding. The Company has entered into an agreement to increase its credit facility to $1.0 billion while maintaining a $250.0 million accordion and extending the maturity to November 2020.

Ring of Fire

On April 28, 2015, the Company acquired royalty rights in the Ring of Fire mining district of Ontario by providing $28.5 million in loan and royalty financing to Noront Resources Ltd.

Dublin Gulch (Eagle)

On January 14, 2015, the Company acquired an existing 1.5% NSR and 2.0% gross royalty on certain claims that comprise the Eagle deposit located in the Yukon, Canada for cash consideration of $7.0 million.

The royalties acquired were accounted for as asset acquisitions.

Candelaria

On July 29, 2015, Franco-Nevada made an additional and final $7.5 million payment to Lundin due to an increase in reserves following resolution of certain post-closing items pursuant to the Candelaria stream agreement. The amount has been recorded as part of the stream interest.

Guidance

The following contains forward looking statements about our guidance for the remainder of 2015. Reference should be made to the “Cautionary Statement on Forward Looking Information” section at the end of this MD&A. For a description of material factors that could cause our actual results to differ materially from the forward looking statements in the following, please see the Cautionary Statement, the “Risk Factors” section of this MD&A and the “Risk Factors” section of our most recent Annual Information Form filed with the Canadian securities regulatory authorities on www.sedar.com and our most recent Form 40-F filed with the Securities and Exchange Commission on www.sec.gov.

For the nine months of 2015, Franco-Nevada realized 253,758 GEOs and $23.6 million in revenue from its oil & gas assets. For fiscal 2015, Franco-Nevada expects to receive GEOs in the lower half of the previously announced 335,000 to 355,000 GEOs guidance range from its existing mineral assets, excluding Antamina. Antamina is expected to contribute between 900,000 and 1,100,000 silver ounces (12,300 to 15,000 GEOs) in the fourth quarter. Of the 335,000 to 355,000 GEOs, Franco-Nevada expects to receive 210,000 to 220,000 GEOs under its various stream agreements. The Company expects revenue from its oil & gas division to be at the higher end of its $20.0 to $30.0 million guidance.

GEOs include our gold, platinum, palladium, silver and other mineral assets. GEOs are estimated on a gross basis for NSR royalties and, in the case of stream ounces, before the payment of the per ounce contractual price paid by Franco-Nevada. For net profit interest (“NPI”) royalties, GEOs are calculated taking into account the NPI economics. Platinum, palladium, silver and other minerals were converted to GEOs by dividing the associated revenue, which includes settlement adjustments, by the average gold price for the period. For the remainder of 2015, platinum, palladium and silver metals have been converted to GEOs using commodity prices of $1,150/oz Au, $950/oz Pt, $700/oz Pd and $16.00/oz Ag. For 2015, the WTI oil price is assumed to average $50 per barrel with a $7.00 per barrel price differential for Canadian oil. 2015 guidance assumes the continued steady state of operations from our assets and is also based on the assumptions set out below.

More specifically, we expect the following with respect to our key asset categories for 2015:

· Gold — U.S.: Overall GEOs from U.S. gold assets are expected to be in-line with 2014. Fire Creek/Midas is expected to deliver 7,500 ounces in 2015 pursuant to the agreement. Gold Quarry is expected to deliver 11,250 royalty ounces in 2015 as payments will be based on the minimum royalty provision.

· Gold — Canada: GEOs earned from Canadian assets in 2015 are expected to be lower than 2014 levels. Detour Lake royalty ounces are expected to be higher as Detour continues to ramp-up production. This increase is expected to be offset by declines in production from other Canadian assets.

· Gold — Latin America: GEOs from Latin America will grow significantly with Franco-Nevada benefitting from a full year of production from Candelaria in 2015 compared to a partial year in 2014. Candelaria is expected to deliver 85,000 GEOs in 2015, a substantial increase over 2014 when Candelaria contributed 20,099 GEOs. Antamina is expected to contribute 12,300 to 15,000 GEOs in the fourth quarter of 2015.

· Gold — Rest of World: Rest of World gold assets are expected to generate lower GEOs in 2015. Sabodala is expected to deliver 22,500 ounces pursuant to the stream agreement. Subika is expected to be lower as a result of the delayed expansion at Ahafo.

· PGM: Sudbury stream ounces are expected to be lower in 2015 and lower PGM ounces are expected from Stillwater.

· Other minerals: GEOs from other minerals are expected to be lower in 2015 as Osborne has lowered its production forecast and Peculiar Knob is scheduled to be put on care and maintenance.

· Oil & Gas: For 2015, oil & gas revenues are projected to be $20.0 million to $30.0 million reflecting significantly lower oil price assumptions compared to last year.

Selected Financial Information

(Expressed in millions, except Average Gold Price, GEOs, |

| For the three |

| For the three |

| For the |

| For the nine |

| ||||

Statement of Income and Comprehensive Income (Loss) |

|

|

|

|

|

|

|

|

| ||||

Revenue |

| $ | 103.7 |

| $ | 107.6 |

| $ | 322.3 |

| $ | 319.4 |

|

Depletion and depreciation |

| 49.7 |

| 38.5 |

| 150.5 |

| 114.2 |

| ||||

Impairments1 |

| 1.9 |

| 0.2 |

| 2.0 |

| 0.2 |

| ||||

Operating income |

| 26.6 |

| 46.6 |

| 87.9 |

| 142.9 |

| ||||

Net income |

| 15.2 |

| 33.2 |

| 56.0 |

| 105.5 |

| ||||

Basic earnings per share |

| $ | 0.10 |

| $ | 0.22 |

| $ | 0.36 |

| $ | 0.71 |

|

Diluted earnings per share |

| $ | 0.10 |

| $ | 0.22 |

| $ | 0.36 |

| $ | 0.71 |

|

Weighted Average Shares Outstanding |

| 156.9 |

| 151.1 |

| 156.8 |

| 148.6 |

| ||||

|

|

|

|

|

|

|

|

|

| ||||

Non-IFRS Measures |

|

|

|

|

|

|

|

|

| ||||

Average Gold Price |

| $ | 1,124 |

| $ | 1,282 |

| $ | 1,179 |

| $ | 1,288 |

|

GEOs 2 |

| 85,637 |

| 70,071 |

| 253,758 |

| 200,641 |

| ||||

Adjusted EBITDA3 |

| $ | 78.0 |

| $ | 88.7 |

| $ | 243.4 |

| $ | 260.7 |

|

Adjusted EBITDA3 per share |

| $ | 0.50 |

| $ | 0.59 |

| $ | 1.55 |

| $ | 1.75 |

|

Margin3 |

| 75.2 | % | 82.4 | % | 75.5 | % | 81.6 | % | ||||

Adjusted Net Income3 |

| $ | 19.4 |

| $ | 34.5 |

| $ | 65.2 |

| $ | 104.8 |

|

Adjusted Net Income3 per share |

| $ | 0.12 |

| $ | 0.23 |

| $ | 0.42 |

| $ | 0.71 |

|

|

|

|

|

|

|

|

|

|

| ||||

Statement of Cash flows |

|

|

|

|

|

|

|

|

| ||||

Net cash provided by operating activities, before changes in non-cash assets and liabilities |

| 72.4 |

| 80.1 |

| 228.3 |

| 238.1 |

| ||||

Net cash used in investing activities |

| (34.9 | ) | (7.0 | ) | (81.8 | ) | (145.1 | ) | ||||

Net cash (used in) provided by financing activities |

| (23.2 | ) | 458.1 |

| (71.1 | ) | 414.7 |

| ||||

|

| As at |

| As at |

| ||

Statement of Financial Position |

|

|

|

|

| ||

Cash and cash equivalents |

| $ | 605.4 |

| $ | 592.5 |

|

Total assets |

| 3,311.7 |

| 3,466.9 |

| ||

Deferred income tax liabilities |

| 43.6 |

| 40.3 |

| ||

Total shareholders’ equity |

| 3,246.9 |

| 3,405.5 |

| ||

|

|

|

|

|

| ||

Working capital |

| $ | 698.1 |

| $ | 677.8 |

|

Debt |

| Nil |

| Nil |

| ||

1 Impairments include impairment charges on investments, royalties, streams and working interests.

2 For average commodity prices used in calculation of GEOs, please refer to average commodity price tables on pages 16 and 27 of this MD&A.

3 Adjusted EBITDA, Margin and Adjusted Net Income are non-IFRS financial measures with no standardized meaning under IFRS. For further information and a detailed reconciliation, please see pages 40-43 of this MD&A.

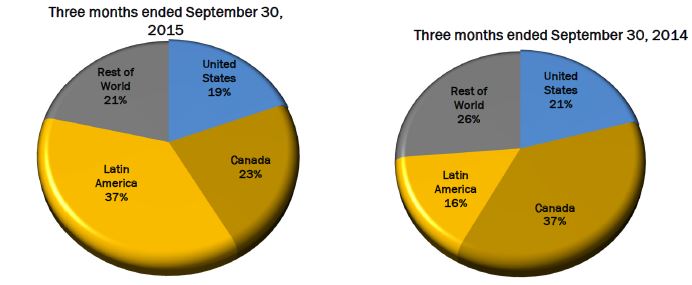

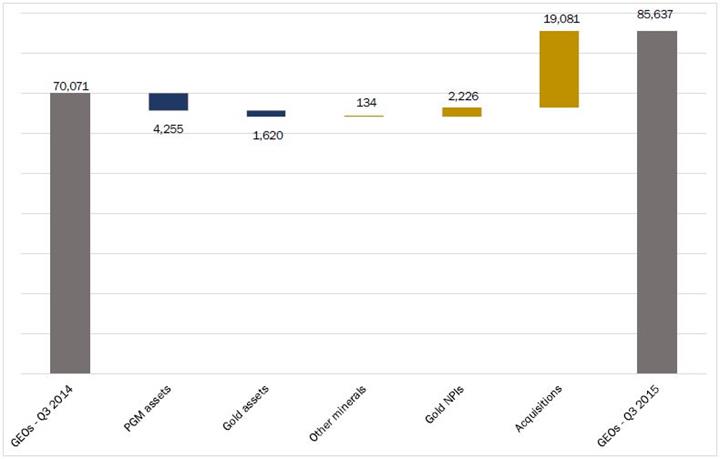

Overview of Financial Performance — Q3 2015 to Q3 2014

Gold Equivalent Ounces

The Company continued to grow its GEOs compared to Q3 2014 with 85,637 GEOs earned in the third quarter of 2015, an increase of 22.2% over the third quarter of 2014. Franco-Nevada continues to grow its portfolio through acquisitions and organic growth.

1 Q4 2014 GEOs included six months of deliveries from Candelaria.

The following table outlines GEOs attributable to Franco-Nevada for the three months ended September 30, 2015 and 2014 by commodity, geographical location and type of interest (excluding oil & gas):

|

| Gold Equivalent Ounces1 |

| ||||||

For the three months ended September 30, |

| 2015 |

| 2014 |

| Variance |

| % |

|

Commodity |

|

|

|

|

|

|

|

|

|

Gold |

| 76,430 |

| 56,743 |

| 19,687 |

| 35 | % |

PGM |

| 6,506 |

| 10,761 |

| (4,255 | ) | (40 | )% |

Other Minerals |

| 2,701 |

| 2,567 |

| 134 |

| 5 | % |

|

| 85,637 |

| 70,071 |

| 15,566 |

| 22 | % |

Geography |

|

|

|

|

|

|

|

|

|

United States |

| 17,715 |

| 18,346 |

| (631 | ) | (3 | )% |

Canada |

| 14,211 |

| 16,088 |

| (1,877 | ) | (12 | )% |

Latin America |

| 34,001 |

| 13,344 |

| 20,657 |

| 155 | % |

Rest of World |

| 19,710 |

| 22,293 |

| (2,583 | ) | (12 | )% |

|

| 85,637 |

| 70,071 |

| 15,566 |

| 22 | % |

Type |

|

|

|

|

|

|

|

|

|

Revenue-based |

| 26,593 |

| 28,195 |

| (1,602 | ) | (6 | )% |

Streams |

| 50,008 |

| 33,276 |

| 16,732 |

| 50 | % |

Profit-based |

| 5,508 |

| 3,253 |

| 2,255 |

| 69 | % |

Other |

| 3,528 |

| 5,347 |

| (1,819 | ) | (34 | )% |

|

| 85,637 |

| 70,071 |

| 15,566 |

| 22 | % |

1 For average commodity prices used in calculation of GEOs, please refer to average commodity price tables on page 16 of this MD&A.

GEOs were earned from the following asset classes (excluding oil & gas):

|

| Gold Equivalent Ounces1 |

| ||||||

For the three months ended September 30, |

| 2015 |

| 2014 |

| Variance |

| % |

|

|

|

|

|

|

|

|

|

|

|

Gold — United States |

| 14,618 |

| 13,442 |

| 1,176 |

| 9 | % |

Gold — Canada |

| 9,701 |

| 10,083 |

| (382 | ) | (4 | )% |

Gold — Latin America |

| 33,999 |

| 13,345 |

| 20,654 |

| 155 | % |

Gold — Rest of World |

| 18,112 |

| 19,873 |

| (1,761 | ) | (9 | )% |

Gold — Total |

| 76,430 |

| 56,743 |

| 19,687 |

| 35 | % |

PGM |

| 6,506 |

| 10,761 |

| (4,255 | ) | (40 | )% |

Other Minerals |

| 2,701 |

| 2,567 |

| 134 |

| 5 | % |

|

| 85,637 |

| 70,071 |

| 15,566 |

| 22 | % |

1 For average commodity prices used in calculation of GEOs, please refer to average commodity price tables on page 16 of this MD&A.

Our portfolio is well-diversified with GEOs being earned from approximately 46 different mineral interests in various jurisdictions.

GEO Reconciliation — Q3 2014 to Q3 2015

Gold GEOs

GEOs earned from gold assets increased by 34.7% to 76,430 GEOs in the third quarter of 2015 from 56,743 GEOs in the third quarter of 2014. The growth in GEOs was mainly attributable to the addition of the Candelaria stream and higher production from gold NPIs. For the quarter, 5,508 GEOs were earned from our gold NPIs compared with 3,282 GEOs earned from gold NPIs in the same period in 2014.

U.S. assets produced 14,618 GEOs, representing an increase of 8.7%, or 1,176 GEOs. The increase is due to:

· higher production and NPI ounces from Goldstrike (3,492 GEOs), Bald Mountain (500 GEOs), Gold Quarry (301 GEOs), Mesquite (244 GEOs) and other gold assets (51 GEOs);

· partially offset by fewer fixed ounces delivered under our Fire Creek/Midas agreement (1,983 GEOs) pursuant to the agreement and lower production at Marigold (1,429 GEOs).

Canadian assets produced 9,701 GEOs in the quarter, a decrease of 382 GEOs, or 3.8%. The largest decreases came from:

· Hemlo (1,086 GEOs), Sudbury (272 GEOs) and Timmins West (35 GEOs), all due to lower production;

· partially offset by higher production at Detour Lake (287 GEOs), Golden Highway (254 GEOs), Musselwhite (187 GEOs), Kirkland Lake (117 GEOs) and other Canadian gold assets (166 GEOs).

Latin American assets, which include the recent Candelaria acquisition, generated 33,999 GEOs with the major contributions as follows:

· Candelaria’s production was 19,081 GEOs, or 56.1%, of total GEOs from Latin America; and

· production from Palmarejo (13,917 GEOs) and Cerro San Pedro (724 GEOs) increased due to higher production levels.

Rest of World assets generated 18,112 GEOs, a decrease of 8.9%, over 2014 levels, attributable to:

· lower production at Subika (1,251 GEOs), MWS (874 GEOs) and other rest of world assets (397 GEOs);

· partially offset by higher production at Edikan (337 GEOs), Duketon (250 GEOs), Cooke 4 (136 GEOs) and Tasiast (38 GEOs).

PGM GEOs

PGM GEOs produced were 6,506 for the quarter compared to 10,761 GEOs in 2014, a decrease of 39.5%. The decrease in GEOs is attributable to:

· lower production from the Sudbury assets (2,432 GEOs) and Stillwater (1,823 GEOs); and

· the impact of a lower palladium to gold ratio.

Overall palladium production was 17.1% lower in the quarter with overall platinum production 20.8% lower over the third quarter of 2014.

Other Mineral GEOs

GEOs generated from other minerals increased to 2,701 GEOs from 2,567 GEOs in the comparable period.

Revenue

Franco-Nevada’s revenue is generated from various forms of agreements, ranging from NSR royalties, streams, NPI royalties, net royalty interests (“NRI”), working interests and other. For definitions of the various types of agreements, please refer to our Annual Information Form filed on SEDAR at www.sedar.com or our Form 40-F filed on EDGAR at www.sec.gov.

The market prices of gold, PGM, oil and natural gas are the primary drivers of our profitability and our ability to generate operating cash flow for shareholders.

Quarterly Revenue Breakdown

(millions of dollars)

The following table outlines Franco-Nevada’s revenue for the three months ended September 30, 2015 and 2014, by commodity, geographical location and type of interest and highlights the diversification of the portfolio:

For the three months ended September 30, |

| Revenue |

| |||||||||

(expressed in millions) |

| 2015 |

| 2014 |

| Variance |

| % |

| |||

|

|

|

|

|

|

|

|

|

| |||

Commodity |

|

|

|

|

|

|

|

|

| |||

Gold |

| $ | 85.9 |

| $ | 71.2 |

| $ | 14.7 |

| 21 | % |

PGM |

| 7.0 |

| 12.7 |

| (5.7 | ) | (45 | )% | |||

Other Minerals |

| 3.0 |

| 3.2 |

| (0.2 | ) | (6 | )% | |||

Oil & Gas |

| 7.8 |

| 20.5 |

| (12.7 | ) | (62 | )% | |||

|

| $ | 103.7 |

| $ | 107.6 |

| $ | (3.9 | ) | (4 | )% |

|

|

|

|

|

|

|

|

|

| |||

Geography |

|

|

|

|

|

|

|

|

| |||

United States |

| $ | 19.9 |

| $ | 22.3 |

| $ | (2.4 | ) | (11 | )% |

Canada |

| 23.4 |

| 39.9 |

| (16.5 | ) | (41 | )% | |||

Latin America |

| 38.3 |

| 17.1 |

| 21.2 |

| 124 | % | |||

Rest of World |

| 22.1 |

| 28.3 |

| (6.2 | ) | (22 | )% | |||

|

| $ | 103.7 |

| $ | 107.6 |

| $ | (3.9 | ) | (4 | )% |

|

|

|

|

|

|

|

|

|

| |||

Type |

|

|

|

|

|

|

|

|

| |||

Revenue-based |

| $ | 31.8 |

| $ | 39.1 |

| $ | (7.3 | ) | (19 | )% |

Streams |

| 56.2 |

| 41.3 |

| 14.9 |

| 36 | % | |||

Profit-based |

| 9.7 |

| 15.7 |

| (6.0 | ) | (38 | )% | |||

Working interests and other |

| 6.0 |

| 11.5 |

| (5.5 | ) | (48 | )% | |||

|

| $ | 103.7 |

| $ | 107.6 |

| $ | (3.9 | ) | (4 | )% |

Revenue for the three and nine months ended September 30, 2015 was $103.7 million (2014 - $107.6 million) and $322.3 million (2014 - $319.4 million), respectively, and was comprised of the following:

(expressed in millions)

|

|

|

| For the three months ended |

| For the nine months ended |

| ||||||||

Property |

| Interest |

| 2015 |

| 2014 |

| 2015 |

| 2014 |

| ||||

Gold - United States |

|

|

|

|

|

|

|

|

|

|

| ||||

Goldstrike |

| NSR 2-4%, NPI 2.4-6% |

| $ | 7.9 |

| $ | 4.5 |

| $ | 13.9 |

| $ | 18.6 |

|

Gold Quarry |

| NSR 7.29% |

| 3.0 |

| 3.0 |

| 10.7 |

| 10.8 |

| ||||

Marigold |

| NSR 1.75-5%, GR 0.5-4% |

| 0.5 |

| 1.3 |

| 3.7 |

| 3.7 |

| ||||

Fire Creek/Midas |

| Fixed to 2018 / NSR 2.5% |

| 2.1 |

| 4.9 |

| 6.6 |

| 4.9 |

| ||||

Bald Mountain |

| NSR/GR 0.875-5% |

| 2.0 |

| 1.7 |

| 6.4 |

| 3.7 |

| ||||

Mesquite |

| NSR 0.5-2% |

| 0.7 |

| 0.4 |

| 1.3 |

| 1.2 |

| ||||

Other |

|

|

| 0.2 |

| 0.1 |

| 0.4 |

| 0.7 |

| ||||

Gold - Canada |

|

|

|

|

|

|

|

|

|

|

| ||||

Detour Lake |

| NSR 2% |

| 2.9 |

| 3.0 |

| 8.4 |

| 8.3 |

| ||||

Golden Highway |

| NSR 2-15% |

| 2.3 |

| 2.3 |

| 7.9 |

| 8.1 |

| ||||

Sudbury |

| Stream 50% |

| 1.1 |

| 1.6 |

| 3.8 |

| 5.5 |

| ||||

Musselwhite |

| NPI 5% |

| 0.7 |

| 0.7 |

| 2.3 |

| 1.6 |

| ||||

Hemlo |

| NSR 3%, NPI 50% |

| 1.2 |

| 2.7 |

| 1.7 |

| 4.9 |

| ||||

Kirkland Lake |

| NSR 2.5-5.5%, NPI 20% |

| 1.2 |

| 1.2 |

| 3.5 |

| 3.5 |

| ||||

Timmins West |

| NSR 2.25% |

| 0.9 |

| 1.0 |

| 2.9 |

| 3.2 |

| ||||

Other |

|

|

| 0.5 |

| 0.3 |

| 1.2 |

| 1.0 |

| ||||

Gold - Latin America |

|

|

|

|

|

|

|

|

|

|

| ||||

Candelaria |

| Stream 68% |

| 21.6 |

| — |

| 77.3 |

| — |

| ||||

Palmarejo |

| Stream 50% |

| 15.7 |

| 16.4 |

| 45.8 |

| 51.6 |

| ||||

Cerro San Pedro |

| GR 1.95% |

| 0.8 |

| 0.3 |

| 2.2 |

| 1.5 |

| ||||

Other |

|

|

| 0.3 |

| 0.3 |

| 0.9 |

| 0.9 |

| ||||

Gold - Rest of World |

|

|

|

|

|

|

|

|

|

|

| ||||

MWS |

| Stream 25% |

| 6.0 |

| 7.9 |

| 19.7 |

| 22.6 |

| ||||

Sabodala |

| Stream 6%, Fixed to 2019 |

| 6.4 |

| 7.1 |

| 22.2 |

| 21.7 |

| ||||

Subika |

| NSR 2% |

| 0.8 |

| 2.6 |

| 3.4 |

| 7.7 |

| ||||

Tasiast |

| NSR 2% |

| 1.3 |

| 1.5 |

| 3.9 |

| 5.6 |

| ||||

Duketon |

| NSR 2% |

| 1.9 |

| 1.9 |

| 5.1 |

| 5.2 |

| ||||

Edikan |

| NSR 1.5% |

| 1.3 |

| 1.0 |

| 2.8 |

| 2.7 |

| ||||

Cooke 4 |

| Stream 7% |

| 1.7 |

| 1.7 |

| 3.5 |

| 3.5 |

| ||||

Other |

|

|

| 0.9 |

| 1.8 |

| 3.8 |

| 4.4 |

| ||||

|

|

|

| $ | 85.9 |

| $ | 71.2 |

| $ | 265.3 |

| $ | 207.1 |

|

PGM |

|

|

|

|

|

|

|

|

|

|

| ||||

Sudbury |

| Stream 50% |

| 3.7 |

| 6.6 |

| 13.0 |

| 21.9 |

| ||||

Stillwater |

| NSR 5% |

| 3.3 |

| 6.1 |

| 12.4 |

| 17.3 |

| ||||

|

|

|

| $ | 7.0 |

| $ | 12.7 |

| $ | 25.4 |

| $ | 39.2 |

|

|

|

|

|

|

|

|

|

|

|

|

| ||||

Other Minerals |

|

|

| $ | 3.0 |

| $ | 3.2 |

| $ | 8.0 |

| $ | 10.2 |

|

|

|

|

|

|

|

|

|

|

|

|

| ||||

Oil & Gas |

|

|

|

|

|

|

|

|

|

|

| ||||

Weyburn |

| NRI 11.71%, ORR 0.44%, WI 2.26% |

| 5.9 |

| 16.6 |

| 17.6 |

| 49.7 |

| ||||

Midale |

| ORR 1.14%, WI 1.59% |

| 0.5 |

| 0.9 |

| 1.5 |

| 2.7 |

| ||||

Edson |

| ORR 15% |

| 0.4 |

| 1.1 |

| 1.3 |

| 3.9 |

| ||||

Other |

|

|

| 1.0 |

| 1.9 |

| 3.2 |

| 6.6 |

| ||||

|

|

|

| $ | 7.8 |

| $ | 20.5 |

| $ | 23.6 |

| $ | 62.9 |

|

|

|

|

|

|

|

|

|

|

|

|

| ||||

Revenue |

|

|

| $ | 103.7 |

| $ | 107.6 |

| $ | 322.3 |

| $ | 319.4 |

|

Average Precious Metal Commodity Prices

Quarterly Averages |

|

|

| Q3 |

| Q2 |

| Variance |

| Q3 |

| Variance |

| |||

Gold1 |

| ($/oz) |

| $ | 1,124 |

| $ | 1,193 |

| (5.8 | )% | $ | 1,282 |

| (12.3 | )% |

Silver1 |

| ($/oz) |

| 14.91 |

| 16.41 |

| (9.1 | )% | 19.63 |

| (24.0 | )% | |||

Platinum2 |

| ($/oz) |

| 988 |

| 1,127 |

| (12.3 | )% | 1,434 |

| (31.1 | )% | |||

Palladium2 |

| ($/oz) |

| 615 |

| 760 |

| (19.1 | )% | 863 |

| (28.7 | )% | |||

Exchange Rates3 |

|

|

|

|

|

|

|

|

|

|

|

|

| |||

CAD |

|

|

| 0.7639 |

| 0.8135 |

| (6.1 | )% | 0.9181 |

| (16.8 | )% | |||

1 Based on London Bullion Market Association (“LBMA”) prices

2 Based on London PM fix

3 Based on Bank of Canada noon rates

Gold Revenue

The price of gold is the largest single factor in determining profitability and cash flow from operations for Franco-Nevada. During Q3 2015, average gold prices traded between $1,081/oz and $1,168/oz with an average price of $1,124/oz. This compares to an average gold price of $1,282/oz for the third quarter of 2014, a decrease of 12.3%. Gold prices continue to be pressured by a strong U.S. dollar and expectations of U.S. interest rate increases starting in 2015.

Overall gold revenue increased to $85.9 million from $71.2 million for the comparable period, an increase of 20.6%. The increase was attributable primarily to:

· production from the recent Candelaria acquisition ($21.6 million) and Goldstrike ($3.4 million);

· partially offset by the lower average gold price.

NPI interests contributed $6.2 million to revenue in the quarter compared to $4.2 million in the third quarter of 2014.

U.S. assets generated $16.4 million in revenue, an increase of 3.1%, mainly driven by:

· higher revenue from Goldstrike from both the NSR and NPI;

· partially offset by lower revenue from Marigold ($0.8 million) and Fire Creek/Midas ($2.8 million) with fewer fixed ounces delivered in 2015 compared to 2014 pursuant to the agreement.

Canadian assets generated $10.8 million in revenue in the quarter, a decrease of $2.0 million, or 15.6%, over 2014. The decrease was attributable to the Hemlo NPI ($1.5 million) and lower production at Sudbury ($0.5 million).

Latin American gold assets generated $38.4 million compared to $17.0 million for the same period in 2014. The increase was mainly due to:

· the acquisition of Candelaria ($21.6 million) and higher revenue from Cerro San Pedro ($0.5 million);

· partially offset by lower revenue from Palmarejo ($0.7 million).

Rest of World gold assets generated $20.3 million in revenue in the quarter compared to $25.5 million in 2014. The 20.4% decrease was due primarily to lower revenue earned from

the Rest of World gold assets due to a combination of lower production and lower average gold prices.

PGM Revenue

The prices for platinum and palladium averaged $988/oz and $615/oz, respectively, representing decreases of 31.1% and 28.7%, respectively, over the third quarter of 2014. PGM revenue for the quarter was $7.0 million compared to $12.7 million for the third quarter of 2014, a decrease of 44.9%. Palladium is a significantly larger portion of Franco-Nevada’s revenue than platinum. Production was lower for both platinum and palladium during the quarter when compared to the same quarter of 2014.

Other Mineral Revenue

Other minerals generated $3.0 million and $3.2 million in revenue for the quarters ended September 30, 2015 and 2014, respectively.

Oil & Gas Revenue

Averages (C$/bbl) |

| Q3 |

| Q2 |

| Variance |

| Q3 |

| Variance |

| |||

Edmonton Light |

| C$ | 55.04 |

| C$ | 69.07 |

| (20.3 | )% | C$ | 96.52 |

| (43.0 | )% |

Quality Differential |

|

| (4.58 | ) | (6.74 | ) | 32.0 | % | (7.72 | ) | 40.7 | % | ||

Realized oil price |

| C$ | 50.46 |

| C$ | 62.33 |

| (19.0 | )% | C$ | 88.80 |

| (43.2 | )% |

Oil & gas revenue was $7.8 million for the quarter (96% oil and 4% gas) compared with $20.5 million for the same period of 2014 (95% oil and 5% gas), a decrease of 62.0%. The decrease is due to lower average commodity prices with production volumes stable when compared with the third quarter of 2014.

Revenue from the Weyburn Unit for the quarter decreased to $5.9 million (2014 - $16.6 million) with $3.5 million earned from the NRI (2014 - $11.5 million), $1.9 million earned from the working interest (2014 - $4.2 million) and $0.5 million earned from the overriding royalties (2014 - $0.9 million). Revenue was impacted by lower average oil prices with production from the Weyburn Unit down 0.5% in the quarter when compared to the third quarter of 2014. Actual realized price from the NRI was C$49.37/boe for the quarter, down 45.1% from the realized price of C$89.88/boe for the third quarter of 2014.

Costs and Expenses

Costs and expenses for the quarter were $77.1 million compared to $61.0 million in 2014. The following table provides a list of the costs and expenses incurred for the three months ended September 30, 2015 and 2014.

|

| Three months ended September 30, |

| |||||||

(expressed in millions) |

| 2015 |

| 2014 |

| Variance |

| |||

Costs of sales |

| $ | 22.4 |

| $ | 18.4 |

| $ | 4.0 |

|

Depletion and depreciation |

| 49.7 |

| 38.5 |

| 11.2 |

| |||

Corporate administration |

| 4.0 |

| 3.3 |

| 0.7 |

| |||

Business development |

| 1.0 |

| 0.6 |

| 0.4 |

| |||

|

| $ | 77.1 |

| $ | 61.0 |

| $ | 16.1 |

|

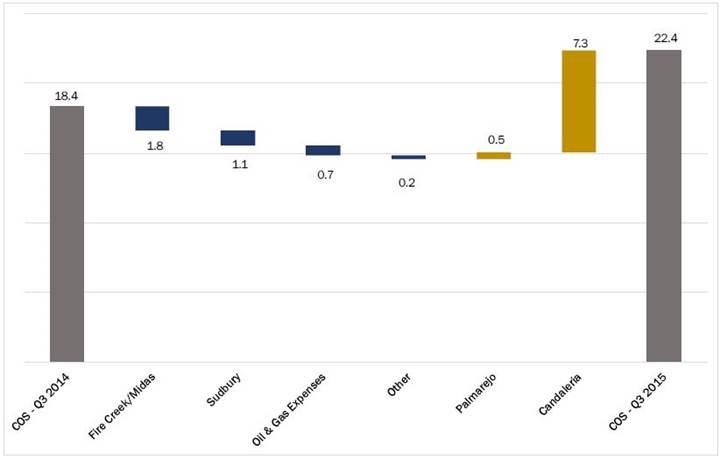

Costs of sales, which are comprised of the cost of GEOs purchased under stream agreements, cost of prepaid gold ounces, oil & gas production taxes, operating costs on oil & gas working interests and net proceeds taxes on mineral interests, were $22.4 million for the third quarter of 2015 compared with $18.4 million for the third quarter of 2014. The increase of $4.0 million is attributable to the higher purchase cost of stream and prepaid ounces ($4.5 million) due to the Candelaria acquisition and higher net proceeds taxes ($0.2 million) due to higher revenue from Goldstrike, partially offset by lower oil & gas operating costs and production taxes ($0.7 million). Upon the sale of the gold ounces delivered under the Fire Creek/Midas transaction, Franco-Nevada will record an amount of $882.71/oz as a non-cash cost of sale. Franco-Nevada received 50,008 GEOs under its stream agreements compared to 33,276 GEOs received in Q3 2014.

Costs of Sales Reconciliation — Q3 2014 to Q3 2015

(expressed in millions)

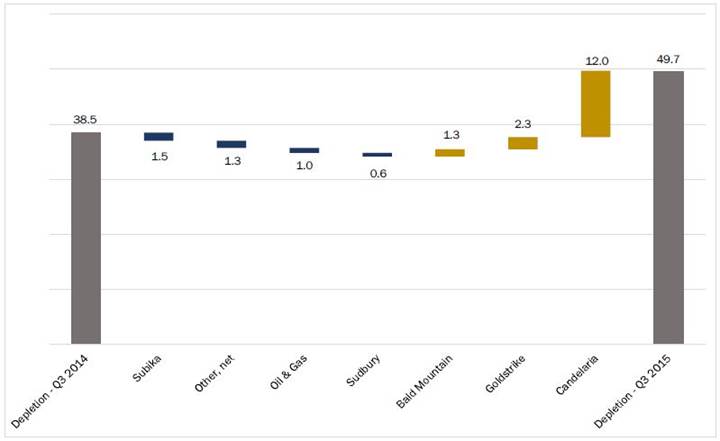

Depletion and depreciation totaled $49.7 million for the quarter compared to $38.5 million in 2014. The increase of $11.2 million is due in part to Candelaria ($12.0 million), a recent acquisition, Goldstrike ($2.3 million) and Bald Mountain ($1.3 million), due to higher production. These increases were partially offset by lower production and associated depletion on Subika, the Sudbury streams and oil & gas assets, as outlined below.

Depletion Reconciliation — Q3 2014 to Q3 2015

(expressed in millions)

Corporate administration expenses increased to $4.0 million in the quarter, representing 3.9% of revenue, from $3.3 million in 2014. The increase is due to the mark-to-market fluctuations related to the Company’s Deferred Share Units and higher stock based compensation expense.

Business development expenses were $1.0 million and $0.6 million for the three months ended September 30, 2015 and 2014, respectively. Timing of incurring these costs typically varies depending upon the level of activity of the business development team and the timing of completing transactions.

Foreign Exchange and Other Income/Expenses

Foreign exchange losses and other expenses for the quarter were $1.7 million compared to $1.2 million in 2014. The following table provides a list of foreign exchange losses and other income incurred for the three months ended September 30, 2015 and 2014.

|

| Three months ended September 30, |

| |||||||

(expressed in millions) |

| 2015 |

| 2014 |

| Variance |

| |||

Foreign exchange loss |

| $ | (1.3 | ) | $ | (0.6 | ) | $ | (0.7 | ) |

Mark-to-market gain (loss) on warrants |

| — |

| (0.8 | ) | 0.8 |

| |||

(Loss) gain on sale of gold |

| (0.4 | ) | 0.2 |

| (0.6 | ) | |||

|

| $ | (1.7 | ) | $ | (1.2 | ) | $ | (0.5 | ) |

Foreign exchange gains and losses include foreign exchange movements related to investments in bonds and other debt securities, such as government and corporate bonds, treasury bills and intercompany loans, held in the parent company, which are denominated in either U.S. dollars or Mexican pesos. The parent company’s functional currency is the Canadian dollar. Under IFRS, all foreign exchange changes related to the debt securities are recorded in net income as opposed to other comprehensive income.

As at September 30, 2015, the fair value of certain available-for-sale investments had decreased which resulted in an impairment charge of $1.9 million being recorded for the quarter.

Finance Costs and Finance Income

Finance income was $1.3 million (2014 - $1.2 million) for the quarter which was earned on our cash equivalents and investments. Finance expenses were $0.6 million (2014 - $0.4 million) and consist of the costs of maintaining our credit facility in addition to the amortization of the initial set-up costs incurred with respect to the facility. Finance expenses were comprised of standby fees of $0.5 million (2014 - $0.3 million) and amortization of issuance costs were $0.1 million (2014 - $0.1 million).

Income Taxes

Franco-Nevada had an income tax expense of $8.5 million (2014 — $13.0 million) for the quarter comprised of a current income tax expense of $7.4 million (2014 - $7.3 million) and a deferred income tax expense of $1.1 million (2014 — $5.7 million) related to our Canadian and Mexican entities.

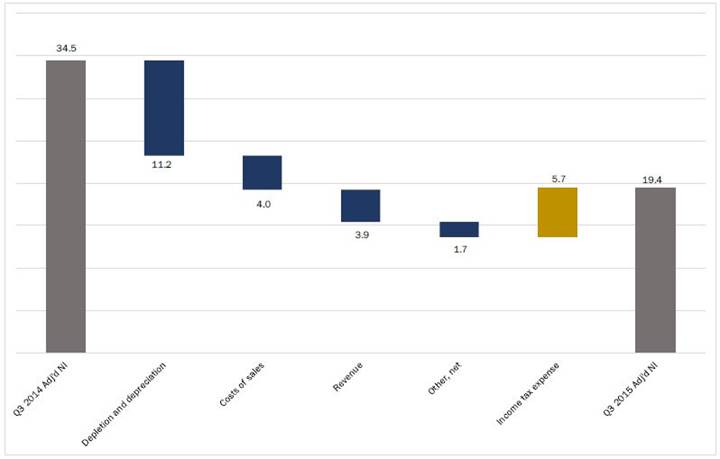

Net Income

Net income for the quarter was $15.2 million, or $0.10 per share, compared with $33.2 million, or $0.22 per share, for the same period in 2014. Adjusted Net Income was $19.4 million, or $0.12 per share, compared with $34.5 million, or $0.23 per share, for Q3 2014.

The decrease in Adjusted Net Income was driven primarily by:

· higher depletion and costs of sales due to the Candelaria and Fire Creek/Midas additions and lower revenue;

· partially offset by lower income tax expense.

Quarterly Financial Information

Selected quarterly financial information from our financial statements is set out below:

(expressed in millions, |

| Q3 |

| Q2 |

| Q1 |

| Q4 |

| Q3 |

| Q2 |

| Q1 |

| Q4 |

| ||||||||

Revenue |

| $ | 103.7 |

| $ | 109.4 |

| $ | 109.2 |

| $ | 123.0 |

| $ | 107.6 |

| $ | 107.7 |

| $ | 104.1 |

| $ | 100.0 |

|

Costs and expenses2 |

| 77.1 |

| 78.5 |

| 78.8 |

| 109.6 |

| 61.0 |

| 60.1 |

| 55.4 |

| 194.8 |

| ||||||||

Operating income (loss) |

| 26.6 |

| 30.9 |

| 30.4 |

| 13.4 |

| 46.6 |

| 47.6 |

| 48.7 |

| (94.8 | ) | ||||||||

Other income (expenses) |

| (2.9 | ) | 2.0 |

| (2.2 | ) | (2.0 | ) | (0.4 | ) | 2.0 |

| 1.1 |

| (2.9 | ) | ||||||||

Income tax expense (recovery) |

| 8.5 |

| 11.3 |

| 9.0 |

| 10.2 |

| 13.0 |

| 12.7 |

| 14.4 |

| (17.1 | ) | ||||||||

Net income (loss) |

| 15.2 |

| 21.1 |

| 19.2 |

| 1.2 |

| 33.2 |

| 36.9 |

| 35.4 |

| (80.6 | ) | ||||||||

Basic earnings (loss) per share |

| $ | 0.10 |

| $ | 0.14 |

| $ | 0.12 |

| $ | 0.00 |

| $ | 0.22 |

| $ | 0.25 |

| $ | 0.24 |

| $ | (0.55 | ) |

Diluted earnings (loss) per share |

| $ | 0.10 |

| $ | 0.14 |

| $ | 0.12 |

| $ | (0.01 | ) | $ | 0.22 |

| $ | 0.25 |

| $ | 0.24 |

| $ | (0.55 | ) |

Average Gold Price |

| $ | 1,124 |

| $ | 1,193 |

| $ | 1,219 |

| $ | 1,200 |

| $ | 1,282 |

| $ | 1,289 |

| $ | 1,294 |

| $ | 1,272 |

|

GEOs3 |

| 85,637 |

| 83,040 |

| 85,081 |

| 92,774 |

| 70,071 |

| 64,734 |

| 92,774 |

| 69,741 |

| ||||||||

Adjusted EBITDA3 |

| $ | 78.0 |

| $ | 82.2 |

| $ | 83.3 |

| $ | 96.2 |

| $ | 88.7 |

| $ | 87.2 |

| $ | 84.8 |

| $ | 77.3 |

|

Adjusted EBITDA3 per share |

| $ | 0.50 |

| $ | 0.53 |

| $ | 0.53 |

| $ | 0.62 |

| $ | 0.59 |

| $ | 0.58 |

| $ | 0.58 |

| $ | 0.53 |

|

Margin3 |

| 75.2 | % | 75.1 | % | 76.3 | % | 78.2 | % | 82.4 | % | 81.0 | % | 81.5 | % | 77.3 | % | ||||||||

Adjusted Net Income3 |

| $ | 19.4 |

| $ | 22.9 |

| $ | 22.9 |

| $ | 31.6 |

| $ | 34.5 |

| $ | 36.0 |

| $ | 35.4 |

| $ | 30.5 |

|

Adjusted Net Income3 per share |

| $ | 0.12 |

| $ | 0.15 |

| $ | 0.15 |

| $ | 0.20 |

| $ | 0.23 |

| $ | 0.24 |

| $ | 0.24 |

| $ | 0.21 |

|

1 Due to rounding, amounts may not calculate.

2 Includes impairment charges on royalty, stream and working interests and investments.

3 GEOs, Adjusted EBITDA, Margin and Adjusted Net Income are non-IFRS measures with no standardized meaning under IFRS. For further information and a detailed reconciliation, please refer to pages 40-43 of this MD&A.

Overview of Financial Performance — Nine Months 2015 to Nine Months 2014

Gold Equivalent Ounces

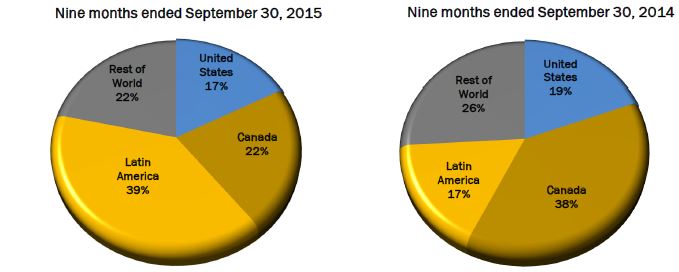

The following table outlines GEOs attributable to Franco-Nevada for the nine months ended September 30, 2015 and 2014 by commodity, geographical location and type of interest (excluding oil & gas):

|

| Gold Equivalent Ounces1 |

| ||||||

For the nine months ended September 30, |

| 2015 |

| 2014 |

| Variance |

| % |

|

Commodity |

|

|

|

|

|

|

|

|

|

Gold |

| 225,036 |

| 162,284 |

| 62,752 |

| 39 | % |

PGM |

| 21,812 |

| 30,341 |

| (8,529 | ) | (28 | )% |

Other Minerals |

| 6,910 |

| 8,016 |

| (1,106 | ) | (14 | )% |

|

| 253,758 |

| 200,641 |

| 53,117 |

| 27 | % |

Geography |

|

|

|

|

|

|

|

|

|

United States |

| 47,665 |

| 49,302 |

| (1,637 | ) | (3 | )% |

Canada |

| 40,462 |

| 45,004 |

| (4,542 | ) | (10 | )% |

Latin America |

| 106,562 |

| 41,986 |

| 64,576 |

| 154 | % |

Rest of World |

| 59,069 |

| 64,349 |

| (5,280 | ) | (8 | )% |

|

| 253,758 |

| 200,641 |

| 53,117 |

| 27 | % |

Type |

|

|

|

|

|

|

|

|

|

Revenue-based |

| 78,872 |

| 81,291 |

| (2,419 | ) | (3 | )% |

Streams |

| 156,848 |

| 98,394 |

| 58,454 |

| 59 | % |

Profit-based |

| 7,715 |

| 11,667 |

| (3,952 | ) | (34 | )% |

Other |

| 10,323 |

| 9,289 |

| 1,034 |

| 11 | % |

|

| 253,758 |

| 200,641 |

| 53,117 |

| 27 | % |

1 For average commodity prices used in calculation of GEOs, please refer to average commodity price tables on page 27 of this MD&A.

Oil & gas revenues are not included in the reported GEO numbers.

GEOs were earned from the following asset classes (excluding oil & gas):

|

| Gold Equivalent Ounces1 |

| ||||||

For the nine months ended September 30, |

| 2015 |

| 2014 |

| Variance |

| % |

|

Gold — United States |

| 36,711 |

| 35,338 |

| 1,373 |

| 4 | % |

Gold — Canada |

| 27,038 |

| 28,173 |

| (1,135 | ) | (4 | )% |

Gold — Latin America |

| 106,561 |

| 41,987 |

| 64,574 |

| 154 | % |

Gold — Rest of World |

| 54,726 |

| 56,786 |

| (2,060 | ) | (4 | )% |

Gold — Total |

| 225,036 |

| 162,284 |

| 62,752 |

| 39 | % |

PGM |

| 21,812 |

| 30,341 |

| (8,529 | ) | (28 | )% |

Other Minerals |

| 6,910 |

| 8,016 |

| (1,106 | ) | (14 | )% |

|

| 253,758 |

| 200,641 |

| 53,117 |

| 27 | % |

1 For average commodity prices used in calculation of GEOs, please refer to average commodity price tables on page 27 of this MD&A.

GEO Reconciliation — Nine Months 2014 to Nine Months 2015

Gold GEOs

GEOs earned from gold assets increased by 38.7% to 225,036 GEOs from 162,284 GEOs in 2014. The increase of 62,752 GEOs is mainly attributable to the recent Candelaria (64,978 GEOs) and Fire Creek/Midas (1,767 GEOs) acquisitions. Gold NPIs were lower in the nine months of 2015 with 7,714 GEOs being earned compared with 11,695 GEOs in 2014.

U.S. assets produced 36,711 GEOs, representing an increase of 3.9% over 2014. The increase was mainly attributable to:

· higher production from Bald Mountain (2,593 GEOs), Gold Quarry (571 GEOs) and Mesquite (109 GEOs). Fire Creek/Midas fixed ounce deliveries included the full nine months of 2015 compared with four months in 2014;

· partially offset by lower production from Goldstrike, both on the NPI and NSR (2,894 GEOs), Marigold (647 GEOs) and other U.S. gold assets (126 GEOs).

Canadian assets produced 27,038 GEOs, a decrease of 1,135 GEOs, or 4.0%, with:

· Hemlo (2,404 GEOs) and Sudbury (1,062 GEOs) contributing fewer GEOs in 2015 than 2014 due to lower production;

· partially offset by higher production at Musselwhite (800 GEOs), Detour (738 GEOs), Kirkland Lake (231 GEOs), Golden Highway (340 GEOs) and other Canadian gold assets (222 GEOs).

Latin American gold assets produced 106,561 GEOs, an increase of 64,574 GEOs, or 153.8%, which was due to:

· the Candelaria acquisition (64,978 GEOs) and higher production from Cerro San Pedro (684 GEOs) and other Latin American assets (59 GEOs);

· partially offset by lower production at Palmarejo (1,147 GEOs).

For the nine months of 2015, 975,919 ounces of silver were converted to GEOs with the majority coming from Candelaria.

Rest of World gold assets produced 54,726 GEOs in the period compared to 56,786 GEOs in 2014, which was due to:

· one additional delivery from the Sabodala stream (1,875 GEOs) and higher production from Duketon (410 GEOs), Edikan (305 GEOs) and Cooke 4 (279 GEOs);

· offset by lower production at Subika (3,044 GEOs), Tasiast (937 GEOs), MWS (934 GEOs) and other assets (14 GEOs).

PGM GEOs

PGM GEOs produced were 21,812 for the period compared to 30,341 GEOs in 2014. The decrease in GEOs is attributable to lower production from the Sudbury assets (5,535 GEOs) and Stillwater (2,994 GEOs). Actual palladium and platinum production subject to the stream and royalties was lower by 14.0% and 18.4%, respectively, in the nine months of 2015 when compared to 2014.

Other Mineral GEOs

GEOs generated from other minerals decreased to 6,910 GEOs substantially due to lower production from Peculiar Knob, an iron-ore operation in Australia, and Osborne, a nickel operation in Australia.

Revenue

The following table outlines Franco-Nevada’s revenue for the nine months ended September 30, 2015 and 2014, by commodity, geographical location and type of interest:

For the nine months ended September 30, |

| Revenue |

| |||||||||

(expressed in millions) |

| 2015 |

| 2014 |

| Variance |

| % |

| |||

Commodity |

|

|

|

|

|

|

|

|

| |||

Gold |

| $ | 265.3 |

| $ | 207.1 |

| $ | 58.2 |

| 28 | % |

PGM |

| 25.4 |

| 39.2 |

| (13.8 | ) | (35 | )% | |||

Other Minerals |

| 8.0 |

| 10.2 |

| (2.2 | ) | (22 | )% | |||

Oil & Gas |

| 23.6 |

| 62.9 |

| (39.3 | ) | (62 | )% | |||

|

| $ | 322.3 |

| $ | 319.4 |

| $ | 2.9 |

| 1 | % |

|

|

|

|

|

|

|

|

|

| |||

Geography |

|

|

|

|

|

|

|

|

| |||

United States |

| $ | 55.9 |

| $ | 61.5 |

| $ | (5.6 | ) | (9 | )% |

Canada |

| 70.8 |

| 121.1 |

| (50.3 | ) | (42 | )% | |||

Latin America |

| 126.1 |

| 54.0 |

| 72.1 |

| 134 | % | |||

Rest of World |

| 69.5 |

| 82.8 |

| (13.3 | ) | (16 | )% | |||

|

| $ | 322.3 |

| $ | 319.4 |

| $ | 2.9 |

| 1 | % |

|

|

|

|

|

|

|

|

|

| |||

Type |

|

|

|

|

|

|

|

|

| |||

Revenue-based |

| $ | 98.8 |

| $ | 117.7 |

| $ | (18.9 | ) | (16 | )% |

Streams |

| 185.3 |

| 126.8 |

| 58.5 |

| 46 | % | |||

Profit-based |

| 19.1 |

| 48.2 |

| (29.1 | ) | (60 | )% | |||

Working interests and other |

| 19.1 |

| 26.7 |

| (7.6 | ) | (28 | )% | |||

|

| $ | 322.3 |

| $ | 319.4 |

| $ | 2.9 |

| 1 | % |

Average Precious Metal Commodity Prices

|

|

|

| For the nine months ended September 30, |

| ||||||

Nine Month Averages |

|

|

| 2015 |

| 2014 |

| Variance |

| ||

Gold1 |

| ($/oz) |

| $ | 1,179 |

| $ | 1,288 |

| (8.5 | )% |

Silver1 |

| ($/oz) |

| 16.02 |

| 19.91 |

| (19.5 | )% | ||

Platinum2 |

| ($/oz) |

| 1,103 |

| 1,437 |

| (23.2 | )% | ||

Palladium2 |

| ($/oz) |

| 720 |

| 808 |

| (10.9 | )% | ||

Exchange Rates3 |

|

|

|

|

|

|

|

|

| ||

CAD |

|

|

| 0.7944 |

| 0.9138 |

| (13.1 | )% | ||

1 Based on LBMA prices

2 Based on London PM Fix

3 Based on Bank of Canada noon rates

Gold Revenue

During the nine months of 2015, gold prices continued to experience significant volatility, trading between $1,100/oz and $1,296/oz with an average price of $1,179/oz. This compares to an average gold price of $1,288/oz in the first nine months of 2014. Despite the 8.5% lower average gold price, overall gold revenue increased 28.1% to $265.3 million from $207.1 million for 2014. The increase was attributable primarily to recent acquisitions, Candelaria ($77.3 million) and Fire Creek/Midas ($1.7 million), offset by the lower average gold price and lower production. NPI interests contributed $8.9 million to revenue in the period compared to $14.3 million in 2014.

U.S. assets generated $43.0 million in revenue from $43.6 million in 2014 attributable to:

· lower revenue recorded at Goldstrike from both the NPI and NSR ($4.7 million);

· partially offset by higher production at Bald Mountain ($2.7 million) and Fire Creek/Midas ($1.7 million), a recent acquisition with lower revenue from other U.S. gold assets ($0.3 million).

Canadian assets generated $31.7 million in revenue in the year, a decrease of $4.4 million, or 12.2% over 2014. The decreases were attributable to:

· lower revenue from the Hemlo NPI and NSR ($3.2 million), Sudbury ($1.7 million) and other Canadian gold assets ($0.2 million);

· partially offset by higher revenue from Musselwhite ($0.7 million).

Latin American gold assets generated $126.2 million up from $54.0 million in 2014 with:

· Candelaria contributing $77.3 million in revenue, or 61.3% of revenue from Latin American gold assets; and

· revenue from Palmarejo being lower due to lower production and average gold prices.

Rest of World gold assets generated $64.4 million in revenue compared to $73.4 million in 2014. The 12.3% decrease was primarily due to the lower average gold price as production levels were 3.6% lower in the period when compared to the 2014.

PGM Revenue

The prices for platinum and palladium averaged $1,103/oz and $720/oz, respectively, in the first nine months of 2015, representing decreases of 23.2% and 10.9%, respectively, compared with the average prices for 2014. PGM price volatility remained high in 2015, similar to the volatility of gold prices.

Revenue from PGM assets was $25.4 million compared to $39.2 million for 2014. The decrease is due to a combination of lower production levels at Sudbury and Stillwater and the lower average commodity prices.

Other Mineral Revenue

Other minerals generated $8.0 million in revenue for the first nine months of 2015 compared with $10.2 million for the comparable period of 2014. The decrease is primarily due to lower production and iron-ore prices realized from Peculiar Knob, an iron-ore project in Australia.

Oil & Gas Revenue

|

| For the nine months ended |

|

|

| ||||

Averages (C$/bbl) |

| 2015 |

| 2014 |

| Variance |

| ||

Edmonton Light |

| C$ | 59.14 |

| C$ | 99.94 |

| (40.8 | )% |

Quality Differential |

| C$ | (7.38 | ) | C$ | (8.61 | ) | 14.3 | % |

Realized oil price |

| C$ | 51.76 |

| C$ | 91.33 |

| (43.3 | )% |

Oil & gas revenue decreased 62.5% to $23.6 million for the first nine months of 2015 (95% oil and 5% gas) compared with $62.9 million for 2014 (94% oil and 6% gas). The decrease was due to the lower average oil prices and a weaker Canadian dollar with production down 2.5% in the period.

Revenue from the Weyburn Unit for the period decreased to $17.6 million (2014 - $49.7 million) with $10.3 million earned from the NRI (2014 - $33.8 million), $6.1 million earned from the working interest (2014 - $13.2 million) and $1.2 million earned from the overriding royalties (2014 - $2.7 million). Actual realized price from the NRI was C$51.45/boe for the period, down 47.6%, from the average price of C$98.20/boe for the first nine months of 2014.

Costs and Expenses

Costs and expenses were $234.4 million for the first nine months of 2015 compared to $176.5 million in 2014. The following table provides a list of the costs and expenses incurred for the nine months ended September 30, 2015 and 2014.

|

| Nine months ended September 30, |

| |||||||

(expressed in millions) |

| 2015 |

| 2014 |

| Variance |

| |||

Costs of sales |

| $ | 68.8 |

| $ | 48.2 |

| $ | 20.6 |

|

Depletion and depreciation |

| 150.5 |

| 114.2 |

| 36.3 |

| |||

Corporate administration |

| 12.2 |

| 12.0 |

| 0.2 |

| |||

Business development |

| 2.8 |

| 1.9 |

| 0.9 |

| |||

Subtotal |

| $ | 234.3 |

| $ | 176.3 |

| $ | 58.0 |

|

Impairment of royalty interests |

| 0.1 |

| 0.2 |

| (0.1 | ) | |||

|

| $ | 234.4 |

| $ | 176.5 |

| $ | 57.9 |

|

Costs of sales, which are comprised of the cost of GEOs purchased under stream agreements, cost of prepaid gold ounces, oil & gas production taxes, operating costs on oil &

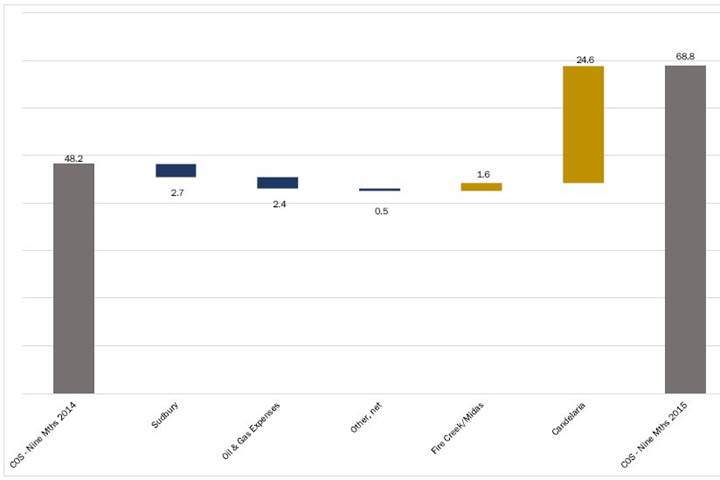

gas working interests and net proceeds taxes on mineral interests, were $68.8 million for the first nine months of 2015 compared with $48.2 million for the same period of 2014. The increase of $20.6 million is attributable to the higher cost of stream and prepaid ounces from Candelaria ($24.6 million) and Fire Creek/Midas ($1.6 million); partially offset by the lower cost of stream ounces purchased from Sudbury ($2.7 million), lower oil & gas production taxes and operating costs ($2.4 million) and other ($0.5 million). For the first nine months of 2015, Franco-Nevada received 156,848 GEOs under its stream agreements compared to 98,394 GEOs received in the same period of 2014.

Costs of Sales Reconciliation — Nine Months 2014 to Nine Months 2015

(expressed in millions)

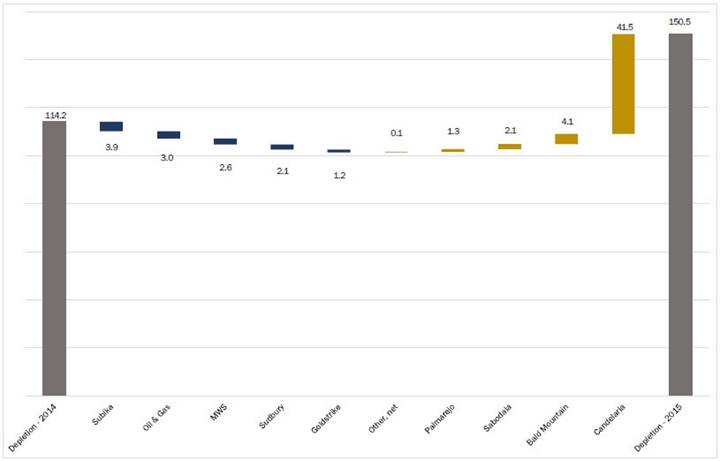

Depletion and depreciation totaled $150.5 million for the period compared to $114.2 million in 2014. The increase of $36.3 million is mostly due to Candelaria ($41.5 million) and Sabodala ($2.1 million), both 2014 acquisitions, as well as higher depletion on Bald Mountain ($4.1 million) due to higher production, and Palmarejo ($1.3 million) due to a change in estimate in late 2014. These increases were partially offset by lower production and the associated depletion on Subika ($3.9 million), oil & gas assets ($3.0 million), MWS ($2.6 million) and Sudbury ($2.1 million).

Depletion Reconciliation — Nine Months 2014 to Nine Months 2015

(expressed in millions)

Corporate administration expenses increased to $12.2 million, representing 3.8% of revenue, from $12.0 million in 2014. Business development expenses were $2.8 million and $1.9 million for the nine months ended September 30, 2015 and 2014, respectively. Timing of incurring these costs typically varies depending upon the level of activity of the business development team and timing of completing transactions.

Foreign Exchange and Other Income/Expenses

Foreign exchange losses and other expenses for the period were $2.9 million compared to other income of $0.9 million in 2014. The following table provides a list of the other income/expenses incurred for the nine months ended September 30, 2015 and 2014.

|

| Nine months ended September 30, |

| |||||||

(expressed in millions) |

| 2015 |

| 2014 |

| Variance |

| |||

Foreign exchange loss |

| $ | (3.1 | ) | $ | (0.5 | ) | $ | (2.6 | ) |

Mark-to-market gain (loss) on warrants |

| (0.3 | ) | 1.5 |

| (1.8 | ) | |||

Loss on sale of gold |

| (0.4 | ) | (0.1 | ) | (0.3 | ) | |||

Gain on sale of available-for-sale investments |

| 0.9 |

| — |

| 0.9 |

| |||

|

| $ | (2.9 | ) | $ | 0.9 |

| $ | (3.8 | ) |

Foreign exchange and other expenses were $2.9 million in the period (2014 — other income of $0.9 million) which was comprised of $3.1 million related to foreign exchange losses on intercompany debt securities and Canadian dollar cash balances (2014 — $0.5 million), $0.3 million in mark-to-market losses related to warrants of small to mid-sized publicly-listed resource companies (2014 — gains of $1.5 million), $0.4 million in losses on the sale of gold bullion (2014 - $0.1 million) and a $0.9 million gain on the sale of available-for-sale investments (2014 — $Nil).

Finance Costs and Finance Income

Finance income was $3.2 million (2014 - $3.0 million) for the period which was earned on our cash equivalents and/or short-term investments. Finance expenses were $1.5 million (2014 - $1.2 million) consisting of the costs of maintaining our credit facility in addition to the amortization of the initial set-up costs incurred with respect to the facility. Finance expenses were in line with 2014 and were comprised of standby fees of $1.2 million (2014 - $0.9 million) and amortization of issuance costs were $0.3 million (2014 - $0.3 million).

Income Taxes

Franco-Nevada had an income tax expense of $28.8 million (2014 — $40.1 million) for the period comprised of a current income tax expense of $20.8 million (2014 - $24.8 million) and a deferred income tax expense of $8.0 million (2014 — $15.3 million) related to our Canadian, U.S. and Mexican entities. The Company’s effective tax rate was 34.0%, an increase from 2014, due a change in current and deferred tax rates.

Net Income

Net income for the first nine months of 2015 was $56.0 million, or $0.36 per share, compared with $105.5 million, or $0.71 per share, for 2014. Adjusted Net Income was $65.2 million, or $0.42 per share, compared with $104.8 million, or $0.71 per share, for 2014.

The decrease in Adjusted Net Income was driven primarily by:

· higher depletion and costs of sales, due to the Candelaria and Fire Creek/Midas acquisitions;

· partially offset by lower income tax expense and higher revenue.

Financial Condition Review

Summary Balance Sheet and Key Financial Metrics

(expressed in millions, except ratios) |

| As at |

| As at |

| ||

Total cash and cash equivalents |

| $ | 605.4 |

| $ | 592.5 |

|

Current assets |

| 719.3 |

| 698.9 |

| ||

Non-current assets |

| 2,592.4 |

| 2,768.0 |

| ||

Total assets |

| $ | 3,311.7 |

| $ | 3,466.9 |

|

Current liabilities |

| 21.2 |

| 21.1 |

| ||

Non-current liabilities |

| 43.6 |

| 40.3 |

| ||

Total liabilities |

| $ | 64.8 |

| $ | 61.4 |

|

Total shareholders’ equity |

| $ | 3,246.9 |

| $ | 3,405.5 |

|

Dividends paid (including DRIP) |

| 96.5 |

| 118.0 |

| ||

Debt |

| — |

| — |

| ||

Total common shares outstanding |

| 157.1 |

| 156.5 |

| ||

Key Financial Ratios |

|

|

|

|

| ||

Working Capital |

| $ | 698.1 |

| $ | 677.8 |

|

Current Ratio |

| 33.9:1 |

| 33.1:1 |

| ||

Debt to equity |

| 0:1 |

| 0:1 |

| ||

Balance Sheet Review

Total assets were $3,311.7 million at September 30, 2015 compared to $3,466.9 million at December 31, 2014 with the reduction due to a stronger U.S. dollar relative to the Canadian and Australian dollars, partially offset by cash generated from operations. Our asset base is primarily comprised of non-current assets such as our royalty, stream and working interests, and cash and cash equivalents, which reflect our business strategy of growing a diversified portfolio and ensuring cash is available for future acquisitions and dividends.

Total liabilities at September 30, 2015 was $64.8 million, comprised primarily of current and deferred income tax liabilities. Franco-Nevada continues to maintain a financially strong balance sheet with no debt and a large cash balance.

Financial Position, Liquidity and Capital Resources

Operating Cash Flow

Cash provided by operating activities before changes in non-cash assets and liabilities relating to operating activities was $72.4 million and $80.1 million for the three months ended September 30, 2015 and 2014, respectively. The decrease was attributable to higher costs of sales attributable to stream ounces paid in the quarter compared to the same quarter in 2014.

Cash provided by operating activities before changes in non-cash assets and liabilities relating to operating activities was $228.3 million and $238.1 million for the nine months ended September 30, 3015 and 2014, respectively. The decrease was attributable to higher costs of sales attributable to stream ounces paid in 2015 when compared to 2014.

Investing Activities

Cash used in investing activities was $34.9 million for the quarter compared to $7.0 million in the same period of 2014. The increase was due to an increase in the acquisition of mineral interests and investments in the third quarter of 2015 compared to 2014.

For the nine months ended September 30, 2015, cash used in investing activities was $81.8 million compared to $145.1 million in 2014. The decrease is due to fewer mineral interests being acquired in 2015 compared to 2014.

Typically Franco-Nevada invests its excess funds in various term deposits, treasury bills of the U.S. government, Canadian federal and provincial governments and high quality corporate bonds. As at September 30, 2015, the majority of funds were held in cash deposits with several financial institutions. As at September 30, 2015, the investments had various maturities upon acquisition of up to 92 days and were classified as “cash and cash equivalents”.

Financing Activities

Net cash used in financing activities was $23.2 million for the quarter compared with net cash generated of $458.1 million for 2014. The decrease is due to an equity financing that was completed in the third quarter of 2014 which generated net cash of $479.8 million.

Financing activities used $71.1 million in cash in the first nine months of 2015 which was used to pay dividends. Net cash generated from financing activities in 2014 was $414.7 million and included the proceeds from an equity financing.

Cash Resources and Liquidity

Our performance is impacted by foreign currency fluctuations of the Canadian dollar, Mexican peso and Australian dollar relative to the U.S. dollar. The largest exposure we have is with respect to the Canada/U.S. dollar exchange rate as we hold a significant amount of our assets in Canada and report our results in U.S. dollars. The effect of this volatility in these currencies against the U.S. dollar impacts our corporate administration, business development expenses and depletion on mineral and oil & gas interests incurred in our Canadian and Australian entities due to their respective functional currencies. For the nine months of 2015, the Canadian dollar traded in a range of $0.7455 to $0.8527, closing the period at $0.7455, the Mexican peso traded in a range of $0.05846 to $0.06866 and the Australian dollar traded between $0.6916 and $0.8211.

Management’s objectives when managing capital are to:

(a) ensure the preservation and availability of capital by investing in low risk investments with high liquidity; and

(b) ensure that adequate levels of capital are maintained to meet requirements.

As at September 30, 2015, our cash, cash equivalents and short-term investments totaled $613.9 million (December 31, 2014 - $592.5 million). In addition, we held investments at September 30, 2015 with a combined value of $112.0 million (December 31, 2014 - $67.1 million), of which $82.2 million was held in publicly traded equity instruments (December 31, 2014 - $62.0 million). Working capital as at September 30, 2015 was $698.1 million (December 31, 2014 - $677.8 million).

Our near-term cash requirements include funding of the Cobre Panama and Karma stream commitments, corporate administration costs, certain costs of operations, declared dividends and income taxes directly related to the recognition of royalty and stream revenues. The funding of Antamina and Cobre Panama used a combination of the Company’s cash on hand and proceeds from a partial drawdown of the Company’s credit facility. As at November 11, 2015, the Company had $480.0 million (plus accrued interest) outstanding under the credit facility with net debt of approximately $330.0 million.

We believe with our remaining cash resources, the increased credit facility and future cash flows will be sufficient to cover the costs of our commitments under the various stream agreements, administrative expenses, costs of operations and dividend payments for the foreseeable future.

Ore and refined gold purchase commitments

The following table summarizes Franco-Nevada’s commitments to pay for gold, silver and PGM to which it has the contractual right pursuant to the associated precious metals agreements:

|

| Attributable Payable |

|

|

|

|

|

|

|

|

|

|

| |||||||

|

| Production to be Purchased |

| Per Ounce Cash Payment 1,2 |

| Term of |

| Date of |

| |||||||||||

Interest |

| Gold |

| Silver |

| PGM |

| Gold |

| Silver |

| PGM |

| Agreement3 |

| Contract |

| |||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |||

Antamina |

| 0 | % | 22.5 | %4 | 0 | % | n/a |

| 5 | %5 | n/a |

| 40 years |

| 7-Oct-15 |

| |||

Candelaria |

| 68 | %6 | 68 | %6 | 0 | % | $ | 400 |

| $ | 4 |

| n/a |

| 40 years |

| 6-Oct-14 |

| |

Cobre Panama |

| — | %7 | — | %8 | 0 | % | $ | 400 |

| $ | 6 |

| n/a |

| 45 years |

| 20-Aug-12 |

| |

Karma |

| 4.875 | %9 | 0 | % | 0 | % | 20 | %10 | n/a |

| n/a |

| 40 years |

| 11-Aug-14 |

| |||

Palmarejo |

| 50 | % | 0 | % | 0 | % | $ | 400 |

| n/a |

| n/a |

| Life-of-Mine11 |

| 20-Jan-09 |

| ||

Guadalupe |

| 50 | % | 0 | % | 0 | % | $ | 800 |

| n/a |

| n/a |

| 40 years |

| 2-Oct-14 |

| ||

Sabodala |

| 6 | %12 | 0 | % | 0 | % | 20 | %13 | n/a |

| n/a |

| 40 years |

| 12-Dec-13 |

| |||

MWS |

| 25 | % | 0 | % | 0 | % | $ | 400 |

| n/a |

| n/a |

| 40 years14 |

| 2-Mar-12 |

| ||

Cooke 4 |

| 7 | % | 0 | % | 0 | % | $ | 400 |

| n/a |

| n/a |

| 40 years |

| 5-Nov-09 |

| ||

Sudbury15 |

| 50 | % | 0 | % | 50 | % | $ | 400 |

| n/a |

| $ | 400 |

| 40 years |

| 15-Jul-08 |

| |

1 - Subject to an annual inflationary adjustment except for Antamina, Karma, Guadalupe and Sabodala.

2 - Should the prevailing market price for gold be lower than this amount, the per ounce cash payment will be reduced to the prevailing market price, with the exception of Palmarejo.

3 - Subject to successive extensions.

4 - Subject to a fixed payability of 90%. Percentage decreases to 15.0% after 86 million ounces of silver has been delivered under the agreement.

5 - Purchase price is 5% of the average silver price at time of delivery.

6 - Percentage decreases to 40% after 720,000 ounces of gold and 12 million ounces of silver has been delivered under the agreement.

7 - Gold deliveries are indexed to copper in concentrate produced from the project. 120 ounces per 1 million pounds of copper until 808,000 ounces of gold delivered, thereafter 81 ounces per 1 million pounds of copper to 1,716,188 ounces of gold delivered, thereafter 63.4% of the gold in concentrate.

8 - Silver deliveries are indexed to copper in concentrate produced from the project. 1,376 ounces per 1 million pounds of copper until 9,842,000 ounces of silver delivered, thereafter 1,776 ounces per 1 million pounds of copper to 29,731,000 ounces of silver delivered, thereafter 62.1% of the silver in concentrate.

9 - Gold deliveries are fixed at 15,000 ounces per annum until February 28, 2021. Thereafter, percentage is 4.875% of gold produced.

10 — Purchase price is 20% of average gold price at time of delivery.

11 - Agreement is capped at 400,000 ounces of gold.

12 — Gold deliveries are fixed at 1,875 ounces per month until December 31, 2019. Thereafter, percentage is 6% of gold produced.

13 - Purchase price is 20% of prevailing market price at the time of delivery.

14 - Agreement is capped at 312,500 ounces of gold.

15 - The Company is committed to purchase 50% of the precious metals contained in ore from the properties. Cash payment is based on gold equivalent ounces.

Antamina Silver Stream

See details of silver agreement in Corporate section above.

Candelaria Gold and Silver Stream

Franco-Nevada made an additional and final $7.5 million payment to Lundin on July 24, 2015 following the resolution of certain post-closing items pursuant to the Candelaria stream agreement. The amount has been recorded as part of the stream interest.

Karma Gold Stream