Exhibit 99.2

![C:\Users\Chayden\AppData\Local\Microsoft\Windows\Temporary Internet Files\Content.Word\v1[6]_cover_MIC'18_18.02.07.jpg](https://capedge.com/proxy/6-K/0001558370-18-002827/fnv20180406ex99278303d002.jpg)

Dear Shareholders:

March 22, 2018

March 22, 2018

This letter marks the completion of our 10th full year since Franco-Nevada was reborn as a public company with our Initial Public Offering (“IPO”) in late 2007. Over those 10 years, our business model has created true shareholder value. Franco-Nevada’s share price has outperformed both gold and all the relevant comparable gold equity benchmarks. Over those 10 years, our shareholders have realized a compounded annual total return of 19.5%. In 2017, we increased dividends for the tenth consecutive year and dividends reached US$168 million. This is the largest payout in the gold industry and speaks to the strength of our business model and quality of our portfolio. Our year-end market capitalization of over US$14 billion ranks us among the largest global gold companies. We are proud to continue to showcase Franco-Nevada as the gold investment that works.

During the bull commodity market, many mining companies financed growth projects and acquisitions with debt. In the downturn, they were forced to retrench and sell assets. Even though we believe the gold price will trade higher in the longer term, this will always be a cyclical business with periods of consolidation. We have created a great deal of value over the years by being counter-cyclical and making investments when others could not.

Our portfolio became stronger and more diversified with the addition of streams over major long-life and low-cost mines during the 2014-2016 commodity downturn. In 2017 and early this year we increased our gold & silver from the Cobre Panama project. We expect this investment will generate further growth for Franco-Nevada as production ramps up starting in 2019. We have also added to our oil & gas royalties both in Canada and in the Permian and Anadarko shale basins in the U.S. In the past 18 months, Franco-Nevada has invested over US$1 billion to expand its portfolio using available cash on-hand and its strong free cash-flow. Franco-Nevada remains debt free.

Our aspiration is to make Franco-Nevada the “go to” gold stock for any generalist investor. We believe that our emphasis on paying dividends, avoiding debt, minimizing risk through a diversified royalty and stream portfolio and maintaining high governance standards is what generalist investors want. In a world confronted by political volatility and financial market instability, making Franco-Nevada a low risk gold investment, with a dividend and leverage to gold, is the right strategy.

Franco-Nevada operates with a small team of highly dedicated professionals. Even though we have experienced substantial growth in the number of our assets and revenues, our overheads have remained low. Franco-Nevada’s success is a reflection of the hard work of the team guided by an experienced and engaged board of directors. All of them have a material stake in the company and act as owners.

Graham Farquharson has served as a director for over 10 years and will not be standing for reelection at the upcoming annual meeting. He has been an outstanding director, and happily, he has agreed to take on the role of “honorary director”. We look forward to the ongoing benefit of his wise counsel.

To our shareholders, we thank you for your continuing support and investment with us. Please consider the resolutions in this circular for our upcoming shareholders’ meeting. We look forward to meeting many of you personally on May 9th.

|

|

“Pierre Lassonde” “David Harquail” Chair President & CEO

|

TMX 10th Anniversary bell ringing – December 20, 2017 |

|

|

Notice of Annual and Special meeting of shareholders

Annual and Special Meeting (the “Meeting”) of the shareholders of Franco-Nevada Corporation (the “Corporation”)

|

|

|

|

|

|

|

|

| |

Date: |

|

| Wednesday, May 9, 2018 | |

|

|

|

| |

|

|

|

| |

Time: |

|

| 4:00 p.m. (Toronto time) | |

|

|

|

| |

|

|

|

| |

Place: |

|

| The TMX Broadcast Centre, The Exchange Tower | |

|

|

|

| |

|

|

|

|

|

Items of Business: |

|

| √ | to receive the audited consolidated financial statements of the Corporation for the year ended December 31, 2017, together with the auditors’ report thereon; |

|

|

|

|

|

|

|

| √ | to elect the directors of the Corporation; |

|

|

|

|

|

|

|

| √ | to appoint PricewaterhouseCoopers LLP, Chartered Professional Accountants, as auditors of the Corporation for the ensuing year and to authorize the directors to fix the remuneration to be paid to the auditors; |

|

|

|

|

|

|

|

| √ | to consider and, if thought appropriate, pass, with or without variation, an advisory resolution on the Corporation’s approach to executive compensation; |

|

|

|

|

|

|

|

| √ | to consider and, if thought appropriate, pass, with or without variation, resolutions approving certain amendments to the Corporation's share compensation plan; and |

|

|

|

|

|

|

|

| √ | to transact such other business as may properly come before the Meeting or any adjournment thereof. |

|

|

|

|

|

The accompanying management information circular dated March 22, 2018 provides additional information relating to the matters to be dealt with at the Meeting and forms part of this notice.

Shareholders are encouraged to vote. Registered shareholders as of the close of business on March 16, 2018 will be entitled to receive notice of, and vote at, the Meeting and any adjournment thereof.

Registered shareholders who are unable to be present at the Meeting in person, may vote their shares by proxy. Instructions on how to complete and return the proxy are provided with the form of proxy. To be valid, proxies must be deposited with Computershare Investor Services Inc. at 100 University Avenue, 8th Floor, Toronto, Ontario M5J 2Y1, no later than 5:00 p.m. (Toronto time) on May 7, 2018 or on the second business day preceding the date of any adjournment of the Meeting.

Non-registered beneficial shareholders should follow the instructions of their intermediaries in order to vote their shares.

By order of the Board of Directors

“Lloyd Hong”

Chief Legal Officer & Corporate Secretary

Dated at Toronto, the 22nd day of March, 2018.

|

|

TABLE OF CONTENTS

|

|

| 1 | |

| 3 | |

| 4 | |

| 4 | |

| 4 | |

| 4 | |

| 5 | |

| 5 | |

| 7 | |

| 7 | |

| 12 | |

| 12 | |

| 16 | |

| 19 | |

| 19 | |

| 21 | |

| 23 | |

| 24 | |

| 25 | |

| 26 | |

| 26 | |

| 27 | |

| 29 | |

| 30 | |

| 31 | |

| 31 | |

| 32 | |

| 32 | |

| 32 | |

| 33 | |

| 36 | |

Named Executive Officers: Accomplishments and Incentive Awards | 39 |

| 42 | |

| 43 | |

| 45 | |

| 46 | |

| 48 | |

| 53 | |

Securities Authorized for Issuance Under Equity Compensation Plans | 53 |

| 53 | |

| 54 | |

| 57 | |

| 58 | |

| 58 | |

| 58 | |

| 58 | |

| 58 | |

Schedule “A” FRANCO-NEVADA CORPORATION AMENDED AND RESTATED SHARE COMPENSATION PLAN | 59 |

Schedule “B” FRANCO-NEVADA CORPORATION MANDATE OF THE BOARD OF DIRECTORS | 71 |

|

|

This management information circular (this “Circular”) is furnished in connection with the solicitation by the management of Franco-Nevada Corporation (the “Corporation” or “Franco-Nevada”) of proxies to be used at the annual and special meeting (the “Meeting”) of shareholders of the Corporation to be held at the TMX Broadcast Centre, The Exchange Tower, 130 King Street West, Toronto, Ontario M5X 1J2 on Wednesday, May 9, 2018, at 4:00 p.m. (Toronto time), and at all adjournments thereof, for the purposes set forth in the notice of the Meeting that accompanies this Circular (the “Notice of Meeting”).

Who can vote?

The directors have fixed March 16, 2018 as the record date for the determination of shareholders entitled to receive notice of the Meeting. Shareholders of record on such date are entitled to vote at the Meeting.

Who is soliciting my proxy?

Management of the Corporation is soliciting your proxy. It is expected that the solicitation will be made primarily by mail but proxies may also be solicited personally by directors, officers or employees of the Corporation. Such persons will not receive any extra compensation for such activities. The Corporation may also retain, and pay a fee to, one or more proxy solicitation firms to solicit proxies from the shareholders of the Corporation in favour of the matters set forth in the Notice of Meeting. The Corporation may pay brokers or other persons holding common shares of the Corporation in their own names, or in the names of nominees, for their reasonable expenses for sending proxies and the Circular to beneficial owners of common shares and obtaining proxies therefor. The total cost of the solicitation will be borne directly by the Corporation.

Who votes my shares and can I appoint someone else?

The persons named in the enclosed form of proxy are officers or directors of the Corporation. A shareholder has the right to appoint a person (who need not be a shareholder of the Corporation) other than the persons specified in such form of proxy to attend and act on behalf of such shareholder at the Meeting. Such right may be exercised by striking out the names of the persons specified in the form of proxy, inserting the name of the person to be appointed in the blank space provided in the form of proxy, signing the form of proxy and returning it in the manner set forth in the form of proxy.

A shareholder who has given a proxy may revoke it:

(i) by depositing an instrument in writing, including another completed form of proxy, executed by such shareholder or shareholder’s attorney authorized in writing either:

a. at the registered office of the Corporation at any time up to and including the last business day preceding the date of the Meeting or any adjournment thereof; or

b. with the Chair of the Meeting prior to the commencement of the Meeting on the day of the Meeting or any adjournment thereof; or

(ii) in any other manner permitted by law.

How will my shares be voted?

The persons named in the enclosed form of proxy will vote the shares in respect of which they are appointed by proxy on any ballot that may be called for in accordance with the instructions contained therein. If the shareholder specifies a choice with respect to any matter to be acted upon, the shares will be voted accordingly. In the absence of such specifications, such shares will be voted FOR each of the matters referred to herein.

How do I vote if I am not a registered shareholder?

The information set forth in this section is of significant importance to many holders of common shares, as a substantial number of shareholders do not hold common shares in their own name. Shareholders who do not hold

|

|

1 |

|

their common shares in their own name (referred to herein as “Beneficial Shareholders”) should note that only proxies deposited by shareholders whose names appear on the records of the Corporation as the registered holders of common shares can be recognized and acted upon at the Meeting. If common shares are listed in an account statement provided to a shareholder by a broker, then, in almost all cases, those common shares will not be registered in the shareholder’s name on the records of the Corporation. Such shares will more likely be registered under the name of the shareholder’s broker or an agent of that broker. More particularly, a person is a Beneficial Shareholder in respect of common shares which are held on behalf of that person but which are registered either: (a) in the name of an intermediary that the Beneficial Shareholder deals with in respect of the common shares (intermediaries include, among others, banks, trust companies, securities dealers or brokers and trustees or administrators of self-administered RRSPs, RRIFs, RESPs and similar plans); or (b) in the name of a clearing agency (such as The Canadian Depository for Securities Limited (“CDS”) or the Depository Trust Company (“DTC”)), of which the intermediary is a participant. The vast majority of such shares are registered under the name of CDS or DTC, which act as nominee for many brokerage firms. Common shares held by brokers or their nominees can only be voted upon the instructions of the Beneficial Shareholder. Without specific voting instructions, brokers and their nominees are prohibited from voting common shares held for Beneficial Shareholders. Therefore, Beneficial Shareholders should ensure that instructions respecting the voting of their common shares are communicated to the appropriate person or that the common shares are duly registered in their name.

Applicable securities regulatory policy requires intermediaries/brokers to seek voting instructions from Beneficial Shareholders in advance of shareholders’ meetings. Every intermediary/broker has its own mailing procedures and provides its own return instructions to clients, which should be carefully followed by Beneficial Shareholders in order to ensure that their common shares are voted at the Meeting.

The majority of brokers now delegate responsibility for obtaining voting instructions from Beneficial Shareholders to Broadridge Investor Communication Solutions (“Broadridge”). Broadridge supplies a voting instruction form (“VIF”) and asks Beneficial Shareholders to complete and return the VIF to Broadridge in accordance with the instructions set out in the VIF. Broadridge then tabulates the results of all instructions received and provides appropriate instructions respecting the voting of common shares to be represented at the Meeting. The Corporation does intend to pay for an intermediary to deliver the proxy-related materials and related forms to Beneficial Shareholders.

Can I vote by phone or online?

Both our transfer agent, Computershare Investor Services Inc. (the “Transfer Agent”) and Broadridge provide telephone voting and Internet voting instructions on the form of proxy for registered shareholders and the VIF for Beneficial Shareholders, respectively.

What if I wish to attend and vote at the Meeting in person?

If you are a registered shareholder, please do not complete your form of proxy and instead register with the Transfer Agent when you arrive at the Meeting.

If you are a Beneficial Shareholder, and wish to attend the Meeting in person or appoint some other person or company, who need not be a shareholder, to attend and act on your behalf at the Meeting or any adjournment or postponement thereof, please follow the instructions contained in the VIF.

|

|

| 2 |

MANAGEMENT INFORMATION CIRCULAR

Except where otherwise indicated, this Circular contains information as of the close of business on March 22, 2018.

Voting Securities and Principal Holders Thereof

As at March 22, 2018, there were 185,930,331 common shares of the Corporation issued and outstanding. Each common share has the right to one vote on each matter at the Meeting.

To the knowledge of the directors and officers of the Corporation, there are no persons or companies beneficially owning, or exercising control or direction over, directly or indirectly, 10% or more of the issued and outstanding common shares of the Corporation.

Interests of Certain Persons or Companies in Matters to be Acted Upon

Except as otherwise disclosed below, management of the Corporation is not aware of a material interest, direct or indirect, by way of beneficial ownership of common shares or otherwise, of any director or officer of the Corporation at any time since the beginning of the Corporation’s last financial year, of any proposed nominee for election as a director of the Corporation, or of any associate or affiliate of any such person, in any matter to be acted upon at the Meeting other than the election of directors or the appointment of auditors.

Change in Reporting Currency

Please note that all dollar amounts reported in this Circular are reported in Canadian dollars and the symbol $ refers to the Canadian dollar, unless otherwise indicated. In previous years, the Corporation reported in U.S. dollars as this is the currency the Corporation uses for its financial statements. The Corporation has determined to report in Canadian dollars in this Circular as all amounts paid to the directors and the Named Executive Officers (as defined herein) are paid in Canadian dollars. By eliminating foreign exchange conversions, the Corporation hopes to facilitate readers’ understanding of the compensation discussion in this Circular.

|

|

3 |

|

The audited consolidated financial statements of the Corporation for the year ended December 31, 2017 and the auditors’ report thereon will be placed before the shareholders at the Meeting. The audited consolidated financial statements are available from the Corporation upon request or they can be found on SEDAR at www.sedar.com, on EDGAR at www.sec.gov and on the Corporation’s website at www.franco-nevada.com.

Item 2 – Election of Directors

At the Meeting, it is proposed that eight directors be elected to the board of directors of the Corporation (the “Board”). Each director’s term of office will expire at the next annual meeting of shareholders of the Corporation or when his or her successor is duly elected or appointed, unless his or her term ends earlier in accordance with the articles or by-laws of the Corporation, he or she resigns from office or becomes disqualified to act as a director of the Corporation.

For further information, on the director nominees, director compensation and our corporate governance practices, please refer to pages 7 to 29 of this Circular.

Unless the shareholder has specified in the enclosed form of proxy that the common shares represented by such proxy are to be withheld from voting in the election of directors, the persons named in the enclosed form of proxy intend to vote FOR the election of the nominees whose names are set forth below. |

The Board has adopted a policy on majority voting. If, with respect to any particular nominee, such nominee is not elected by a majority (50% + 1 vote) of the votes cast with respect to his or her election, then for purposes of the policy the nominee shall be considered not to have received the support of the shareholders, even though duly elected as a matter of corporate law. A person elected as a director who is considered under this test not to have the confidence of the shareholders must immediately submit to the Board his or her resignation, to take effect upon acceptance by the Board. The Board will refer the resignation to the Compensation and Corporate Governance Committee (the “CCGC”) for consideration. A nominee who tenders a resignation pursuant to the policy will not participate in any meeting of the Board or the CCGC at which the resignation is considered. The Board will promptly accept the resignation unless the CCGC determines that there are exceptional circumstances (for example, relating to the composition of the Board or the voting results) that should delay the acceptance of the resignation or justify rejecting it. In any event, it is expected that the resignation will be accepted (or in rare cases rejected) and the Board will promptly announce its decision in a press release within 90 days of the meeting, including reasons for rejecting the resignation, if applicable. This policy does not apply to a contested meeting.

Item 3 – Appointment of Auditors

The auditors of the Corporation are PricewaterhouseCoopers LLP, who were first appointed as auditors of the Corporation on November 29, 2007.

Unless the shareholder has specified in the enclosed form of proxy that the common shares represented by such proxy are to be withheld from voting in the appointment of auditors, the persons named in the enclosed form of proxy intend to vote FOR the appointment of PricewaterhouseCoopers LLP, as auditors of the Corporation to hold office until the next annual meeting of shareholders, and to authorize the directors to fix the remuneration of the auditors. |

Fees

For the years ended December 31, 2017 and 2016, PricewaterhouseCoopers LLP was paid fees in Canadian dollars from the Corporation as detailed below:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Dec 31, 2017 |

|

| Dec 31, 2016 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Audit Fees |

|

| $857,800 | (1) |

| $470,845 | (1) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Audit-Related Fees |

|

| $70,000 |

|

| $243,000 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Tax Fees |

|

| Nil |

|

| Nil |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Other Fees |

|

| Nil |

|

| Nil |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total Fees |

|

| $927,800 |

|

| $713,845 |

|

|

|

|

|

|

|

|

|

|

Note

(1) | Fees are reported on a cash basis and fees paid in 2017 include payment of certain invoices issued in respect of 2016. |

|

|

| 4 |

For the year ended December 31, 2017, “Audit-Related Fees” noted above included $55,000 and $15,000 for services related to: (i) the French translation of documents, and (ii) ESTMA reporting, respectively. For the year ended December 31, 2016, “Audit-Related Fees” noted above included $175,000 and $68,000 for services related to: (i) the Corporation’s shelf prospectus and equity issue, and (ii) the French translation of documents, respectively.

Policies and Procedures Regarding Services Provided by External Auditors

The Board, upon the recommendation of the Audit and Risk Committee (“ARC”), has adopted policies and procedures regarding services provided by external auditors (collectively, the “Auditor Independence Policy”). Under the Auditor Independence Policy, specific proposals for audit services and permitted non-audit services must be pre-approved by the ARC. The ARC may delegate to any one or more of its members pre-approval authority (other than pre-approval of the annual audit service engagement). Any approvals granted under this delegated authority must be presented to the ARC at its next meeting. The Auditor Independence Policy also provides that the ARC may pre-approve services (other than the annual audit service engagement) without the requirement for a specific proposal where the scope and parameters of such services and their attendant fees are clearly defined. The ARC must be informed in writing at its next scheduled meeting of any engagement of the external auditor to provide services in such circumstances. The Auditor Independence Policy deems de minimus non-audit services to have been pre-approved by the ARC in limited circumstances and subject to certain conditions being met.

The Auditor Independence Policy prohibits the external auditors from providing any of the following types of non-audit services: (a) bookkeeping or other services related to the accounting records or financial statements; (b) financial information systems design and implementation; (c) appraisal or valuation services, fairness opinions, or contribution-in-kind reports; (d) actuarial services; (e) internal audit outsourcing services; (f) management functions or human resources services; (g) corporate finance or other services; (h) broker-dealer, investment advisor or investment banking services; (i) legal services; and (j) any other service that under applicable law and generally accepted auditing standards cannot be provided by an external auditor.

The Auditor Independence Policy provides that the external auditor should not be precluded from providing tax or advisory services that do not fall within any of the categories described above, unless the provision of those services would reasonably be expected to compromise the independence of the external auditor.

Item 4 – “Say-on-Pay” Advisory Resolution

Shareholders of the Corporation are being given the opportunity to vote on an advisory basis “for” or “against” the Corporation’s approach to executive compensation through the following resolution (the “Say-on-Pay Advisory Resolution”):

BE IT RESOLVED THAT, on an advisory basis and not to diminish the role and responsibilities of the board of directors of the Corporation, the shareholders accept the approach to executive compensation as disclosed in the Corporation’s management information circular dated March 22, 2018.

|

The Board recommends to shareholders of the Corporation that they vote FOR the Say-on-Pay Advisory Resolution. Unless the shareholder has specified in the enclosed form of proxy that the common shares represented by such proxy are to be voted against the Say-on-Pay Advisory Resolution, the persons named in the enclosed form of proxy intend to vote FOR the Say-on-Pay Advisory Resolution. |

Since the vote is advisory, it will not be binding on the Board or the CCGC. However, the Board and, in particular, the CCGC, will consider the outcome of the vote as part of its ongoing review of executive compensation. The Corporation’s approach to executive compensation was accepted at the previous shareholder meeting in 2017. This advisory vote indicated “for” 75,402,453 (89.57%) and “against” 8,782,247 (10.43%). For further information on the Corporation’s approach to executive compensation, please refer to pages 30 to 52 of this Circular.

Item 5 – Amended and Restated Share Compensation Plan

Shareholders of the Corporation are being asked to vote “for” or “against” certain amendments to the Corporation’s share compensation plan (the “Amended and Restated Share Compensation Plan”) through the following resolution (the “Share Compensation Plan Resolution”):

|

|

5 |

|

BE IT RESOLVED THAT:

1. | The increase to the maximum number of common shares issuable under such Amended and Restated Share Compensation Plan as described in the Circular is hereby approved, ratified and confirmed; |

2. | The amendments to the participation limits for non-employee directors under the Amended and Restated Share Compensation Plan as described in the Circular, are hereby approved, ratified and confirmed; and |

3. | Any one director or officer of the Corporation is hereby authorized and directed for and on behalf of the Corporation to execute or cause to be executed and to deliver or cause to be delivered all such documents, and to do or cause to be done all such acts and things, as such director or officer may deem necessary or desirable in connection with the foregoing resolution. |

|

The Board recommends to shareholders of the Corporation that they vote FOR the Share Compensation Plan Resolution. Unless the shareholder has specified in the enclosed form of proxy that the common shares represented by such proxy are to be voted against the Share Compensation Plan Resolution, the persons named in the enclosed form of proxy intend to vote FOR the Share Compensation Plan Resolution. |

Shareholders approved the Corporation’s share compensation plan (the “2010 Share Compensation Plan”) at its 2010 annual meeting. On March 7, 2018, the Board adopted the Amended and Restated Share Compensation Plan, subject to receiving shareholder approval at the meeting for those amendments set out in the Share Compensation Plan Resolution. For a summary of the Amended and Restated Share Compensation Plan including the amendments to the 2010 Share Compensation Plan, please refer to pages 53 to 57 of this Circular. Such summary is qualified in its entirety by the full text of the Amended and Restated Share Compensation Plan, which is set out in Schedule “A” to this Circular. Shareholders are encouraged to read the full text of the Amended and Restated Share Compensation Plan before voting on this resolution.

If shareholders of the Corporation do not approve the Share Compensation Plan Resolution, the Amended and Restated Share Compensation Plan will terminate and the 2010 Share Compensation Plan will continue in force but without giving effect to the amendments. Options and restricted share units granted under the 2010 Share Compensation Plan will continue unaffected.

|

|

| 6 |

The following table sets forth for each of the persons proposed to be nominated for election as directors their name, age, city, province/state, and country of residence; their principal occupations or employment; a brief biographical description; the date on which they became directors of the Corporation; their independence; their memberships on the ARC or CCGC, as applicable; their attendance at Board meetings; their attendance at ARC and CCGC meetings, as applicable; the number of common shares of the Corporation beneficially owned or over which control or direction is exercised, directly or indirectly; the number of stock options held; the number of deferred share units (“DSUs”) or restricted share units (“RSUs”) held; the “at-risk” values thereof; their voting results at previous shareholder meetings; and current other board and committee memberships (including interlocks), all as at March 22, 2018.

For additional information regarding compensation, options and minimum ownership requirements, please see “Director Compensation” in this section.

|

|

|

|

|

|

|

|

Pierre Lassonde(1) | Pierre Lassonde is the independent Chair of the Board. In this capacity, Mr. Lassonde provides leadership to the Board of Directors in discharging their duties but is not actively involved in the day-to-day operations of the Corporation. For further details, please see “Statement of Governance Practices – Chair of the Board”. Mr. Lassonde formerly served as President of Newmont Mining Corporation (“Newmont”) from 2002 to 2006 and as a director and Vice-Chair of Newmont until November 30, 2007. Previously, Mr. Lassonde served as a director and President (1982 to 2002) and Co-CEO (1999 to 2002) of Franco-Nevada Mining Corporation Limited (“Old Franco-Nevada”). Mr. Lassonde also served as President and CEO of Euro-Nevada Mining Corporation Limited from 1985 to 1999, prior to its amalgamation with Old Franco-Nevada. Mr. Lassonde served as a director of Normandy Mining Limited from 2001 to 2002 and of New Gold Inc. from 2008 to 2016. Mr. Lassonde is past Chair and a past director of the World Gold Council, past Chair of the Quebec National Art Museum and a director of Enghouse Systems Limited. Mr. Lassonde received his Chartered Financial Analyst designation from the CFA Institute in 1984, a P. Eng (Association of Professional Engineers of Ontario) in 1976, a Master of Business Administration from the University of Utah in 1973, a B.Sc. (Electrical Engineering) from Ecole Polytechnique in 1971 and a B.A. from Seminaire de St. Hyacinthe/Université de Montréal in 1967. Mr. Lassonde was appointed a Member of the Order of Canada in 2002, was inducted into the Canadian Mining Hall of Fame in 2013 and was appointed Chair of the Canadian Council for the Arts in July 2015. | ||||||

|

|

|

|

|

|

|

|

Toronto, Ontario, Canada | Securities Held | ||||||

Director Since: Nov 12, 2007 |

|

| At-Risk Value of |

| At-Risk Value of | ||

Age: 70 | Common |

| Common Shares and |

| Common Shares, | ||

| Shares(2) | DSUs(3) | DSUs(4) | Options(5) | DSUs and Options(6) | ||

| 1,999,247 | 9,843 | C$176,759,738 | Nil | C$176,759,738 | ||

Board and Committee Positions | Membership and Attendance | ||||||

Independent Member of the Board (Chair) | Board Meetings Attended 2017: 6 of 6 - 100% | ||||||

Committee Memberships: None | Mr. Lassonde regularly attends meetings of the committees of which he is not a member | ||||||

Annual and Special Meeting Voting Results | Votes in Favour | Votes Withheld | |||||

2017 | 81,938,822 | (97.33%) | 2,245,884 | (2.67%) | |||

2016 | 88,428,940 | (96.59%) | 3,117,212 | (3.41%) | |||

Current Other Public Board Memberships | Current Other Committee Memberships | ||||||

Enghouse Systems Limited | Compensation (Chair) | ||||||

|

|

|

|

|

|

|

|

|

|

7 |

|

(1)

|

|

David Harquail(1) | David Harquail is President & CEO and is a director of Franco-Nevada. He is Chair of the World Gold Council. He served as Executive Vice President of Newmont (2006 to 2007) and previously served as President and Managing Director of Newmont Capital, the merchant banking division of Newmont (2002 to 2006). Prior to the acquisition by Newmont of Old Franco-Nevada in 2002, Mr. Harquail was with Old Franco-Nevada for a period of 15 years with the final position of Senior Vice President responsible for the metals royalty division and corporate development. He has also held roles as President and CEO of Redstone Resources Inc., as a director of Inco Limited, Echo Bay Mines Limited, Kinross Gold Corporation and the Prospectors and Developers Association of Canada and as a task force advisor to the Toronto Stock Exchange. Mr. Harquail holds a B.A.Sc. in Geological Engineering from the University of Toronto, an MBA from McGill University and is a registered Professional Engineer in Ontario. He is also a major benefactor of the School of Earth Sciences and its Mineral Exploration Research Centre (MERC) at Laurentian University in Sudbury as well as the Centre for Neuromodulation at Sunnybrook Health Sciences in Toronto. |

|

|

|

|

|

| |

Toronto, Ontario, Canada | Securities Held | |||||

Director Since: Nov 13, 2007 |

|

| At-Risk Value of |

| At-Risk Value of | |

Age: 61 | Common |

| Common Shares and |

| Common Shares, | |

| Shares(2) | RSUs(7) | RSUs(4) | Options(5) | RSUs and Options(6) | |

| 1,142,205 | 48,758 | Aggregate of C$104,780,925 comprised of C$100,491,196 (1,142,205 Common Shares) and C$2,665,059 (29,837 Performance-based RSUs) and C$1,664,670 (18,921 Time-based RSUs) | 175,480 | C$107,612,804 | |

Board and Committee Positions | Membership and Attendance | |||||

Non-Independent Member of the Board (President & CEO) | Board Meetings Attended 2017: 6 of 6 - 100% | |||||

Committee Memberships: None | Mr. Harquail regularly attends meetings of the committees of which he is not a member. | |||||

Annual and Special Meeting Voting Results | Votes in Favour | Votes Withheld | ||||

2017 | 83,993,055 | (99.77%) | 191,651 | (0.23%) | ||

2016 | 91,486,198 | (99.93%) | 59,954 | (0.07%) | ||

Current Other Public Board Memberships | Current Other Committee Memberships | |||||

None | None | |||||

(1)

|

|

Tom Albanese(1) | Tom Albanese is a director of Franco-Nevada. He served as CEO of Vedanta Resources plc (2014 to 2017), CEO of Vedanta Limited (2014 to 2017) and was CEO of Rio Tinto plc (2007 to 2013). Mr. Albanese presently serves as a member of the Advisory Board of Nevada Copper Corp. and previously served on the boards of Vedanta Resources plc, Vedanta Limited, Rio Tinto plc, Ivanhoe Mines Limited, Palabora Mining Company and Turquoise Hill Resources Limited. Mr. Albanese holds a Master’s of Science degree in Mining Engineering and a Bachelor of Science degree in Mineral Economics both from the University of Alaska Fairbanks. |

|

|

|

|

|

| |

Hillsborough, NJ, USA | Securities Held | |||||

Director Since: Aug 8, 2013 |

|

| At-Risk Value of |

| At-Risk Value of | |

Age: 60 | Common |

| Common Shares and |

| Common Shares, | |

| Shares(2) | DSUs(3) | DSUs(4) | Options(5) | DSUs and Options(6) | |

| 11,235 | 6,411 | C$1,552,495 | 75,000 | C$4,688,245 | |

Board and Committee Positions | Membership and Attendance | |||||

Independent Member of the Board | Board Meetings Attended 2017: 6 of 6 - 100% | |||||

Committee Memberships: ARC | ARC Meetings Attended 2017: 5 of 5 - 100% | |||||

| Mr. Albanese regularly attends CCGC meetings. | |||||

Annual and Special Meeting Voting Results | Votes in Favour | Votes Withheld | ||||

2017 | 83,308,321 | (98.96%) | 876,385 | (1.04%) | ||

2016 | 89,926,851 | (98.23%) | 1,619,301 | (1.77%) | ||

Current Other Public Board Memberships | Current Other Committee Memberships | |||||

None | None | |||||

|

|

| 8 |

(1)

|

|

Derek W. Evans(1) | Derek Evans is a director of Franco-Nevada. He served as President and CEO and a director of Pengrowth Energy Corporation (an oil and natural gas company) from 2009 until March 15, 2018. From May to September 2009, Mr. Evans was President and Chief Operating Officer of Pengrowth Energy Trust. Mr. Evans served as President and CEO of Focus Energy Trust from May 2002 until March 2008. Mr. Evans has over 30 years of experience in a variety of operational and senior management positions in the oil and gas business in Western Canada. Mr. Evans holds a Bachelor of Science degree in Mining Engineering from Queen’s University and is a registered Professional Engineer in Alberta. Mr. Evans is also a member of the Institute of Corporate Directors. |

|

|

|

|

|

| |

Calgary, Alberta, Canada | Securities Held | |||||

Director Since: Aug 8, 2008 |

|

| At-Risk Value of |

| At-Risk Value of | |

Age: 61 | Common |

| Common Shares and |

| Common Shares, | |

| Shares(2) | DSUs(3) | DSUs(4) | Options(5) | DSUs and Options(6) | |

| 14,054 | 14,090 | C$2,476,109 | Nil | C$2,476,109 | |

Board and Committee Positions | Membership and Attendance | |||||

Independent Member of the Board | Board Meetings Attended 2017: 6 of 6 - 100% | |||||

Committee Memberships: ARC | ARC Meetings Attended 2017: 5 of 5 - 100% | |||||

| Mr. Evans regularly attends CCGC meetings. | |||||

Annual and Special Meeting Voting Results | Votes in Favour | Votes Withheld | ||||

2017 | 84,000,366 | (99.78%) | 184,340 | (0.22%) | ||

2016 | 91,477,030 | (99.92%) | 69,122 | (0.08%) | ||

Current Other Public Board Memberships | Current Other Committee Memberships | |||||

None | None | |||||

(1)

|

|

Catharine Farrow(1) | Dr. Catharine Farrow is a director of Franco-Nevada and President of FarExGeoMine Ltd. (a private consultancy). Dr. Farrow previously served as founding Chief Executive Officer and a Director of TMAC Resources Inc. and Chief Operating Officer of KGHM International Ltd. (formerly FNX Mining Company Inc.). Dr. Farrow is also a member of the Advisory Committee of the Goodman School of Mines and is an Adjunct Professor at Laurentian University, and also has been a member of several non-profit boards and steering committees. Dr. Farrow is a member of the Association of Professional Geoscientists of Ontario, the Canadian Institute of Mining, Metallurgy & Petroleum, and a Fellow of the Society of Economic Geologists. She holds a Doctorate in Earth Sciences from Carleton University, a Master’s degree in Geology from Acadia University, and a Bachelor of Science degree in Geology from Mount Allison University. |

|

|

|

|

|

|

|

|

Sudbury, Ontario, Canada | Securities Held | ||||||

Director Since: May 6, 2015 |

|

| At-Risk Value of |

| At-Risk Value of | ||

Age: 53 | Common |

| Common Shares and |

| Common Shares, | ||

| Shares(2) | DSUs(3) | DSUs(4) | Options(5) | DSUs and Options(6) | ||

| Nil | 6,576 | C$578,556 | 65,000 | C$2,483,706 | ||

Board and Committee Positions | Membership and Attendance | ||||||

Independent Member of the Board | Board Meetings Attended 2017: 5 of 6 - 83.3% (Dr. Farrow was unable | ||||||

Committee Memberships: CCGC | to attend due to a scheduling conflict. She was consulted prior to the | ||||||

|

|

|

| meeting and approved all matters discussed at the meeting.) | |||

|

|

|

|

|

|

|

|

|

|

|

| CCGC Meetings Attended 2017: 4 of 4 - 100% | |||

| Dr. Farrow regularly attends ARC meetings. | ||||||

Annual and Special Meeting Voting Results | Votes in Favour | Votes Withheld | |||||

2017 | 83,622,349 | (99.33%) | 562,357 | (0.67%) | |||

2016 | 90,193,580 | (98.52%) | 1,352,572 | (1.48%) | |||

Current Other Public Board Memberships | Current Other Committee Memberships | ||||||

None | None | ||||||

|

|

9 |

|

(1)

|

|

Louis Gignac(1) | Louis Gignac is Chair of G Mining Services Inc. (a private consultancy) and is a director of Franco-Nevada. Mr. Gignac previously served as President, CEO and a director of Cambior Inc. from its creation in 1986 until its acquisition by IAMGOLD Corporation in 2006. Mr. Gignac previously held management positions with Falconbridge Copper Company and Exxon Minerals Company and has served as a director of several companies including Domtar Corporation, St Andrew Goldfields Ltd., Marengo Mining Limited and Gaz Métro Inc. Mr. Gignac also served as a professor in mining engineering at Laval University from 1979 to 1981. Mr. Gignac is a member of the Ordre des ingénieurs du Québec. Mr. Gignac holds a Doctorate of Engineering in Mining Engineering from the University of Missouri Rolla, a Master’s degree in Mineral Engineering from the University of Minnesota, and a Bachelor of Science degree in Mining Engineering from Laval University. Mr. Gignac was inducted into the Canadian Mining Hall of Fame in 2016. |

|

|

|

|

|

| |

Brossard, Québec, Canada | Securities Held | |||||

Director Since: Nov 12, 2007 |

|

| At-Risk Value of |

| At-Risk Value of | |

Age: 67 | Common |

| Common Shares and |

| Common Shares, | |

| Shares(2) | DSUs(3) | DSUs(4) | Options(5) | DSUs and Options(6) | |

| 10,000 | 10,484 | C$1,802,182 | Nil | C$1,802,182 | |

Board and Committee Positions | Membership and Attendance | |||||

Independent Member of the Board | Board Meetings Attended 2017: 6 of 6 - 100% | |||||

Committee Memberships: CCGC | CCGC Meetings Attended 2017: 4 of 4 - 100% | |||||

| Mr. Gignac regularly attends ARC meetings. | |||||

Annual and Special Meeting Voting Results | Votes in Favour | Votes Withheld | ||||

2017 | 83,671,419 | (99.39%) | 513,287 | (0.61%) | ||

2016 | 91,195,005 | (99.62%) | 351,147 | (0.38%) | ||

Current Other Public Board Memberships | Current Other Committee Memberships | |||||

None | None | |||||

(1)

|

|

Randall Oliphant(1) | Randall Oliphant has worked in natural resources in many capacities for over 30 years. From 1999 to 2003, Mr. Oliphant was the President and Chief Executive Officer of Barrick Gold Corporation, and since that time he has served on the boards of numerous public companies and not-for-profit organizations. Mr. Oliphant was the Chairman of Western Goldfields Inc. from 2006 until its business combination with New Gold in 2009. Mr. Oliphant served as the Executive Chairman of New Gold from the time of the business combination to January 2017. Mr. Oliphant presently serves on the advisory board of Metalmark Capital LLC, a leading private equity firm, and the boards of directors of New Gold Inc. and Franco-Nevada Corporation. In addition, Mr. Oliphant served as Chairman of the World Gold Council from 2013 to 2017. Mr. Oliphant is a CPA, CA and was granted the designation of FCPA in 2016 in recognition of his outstanding contribution to his profession. |

|

|

|

|

|

| |

Toronto, Ontario, Canada | Securities Held | |||||

Director Since: Nov 12, 2007 |

|

| At-Risk Value of |

| At-Risk Value of | |

Age: 58 | Common |

| Common Shares and |

| Common Shares, | |

| Shares(2) | DSUs(3) | DSUs(4) | Options(5) | DSUs and Options(6) | |

| 75,000 | 5,074 | C$7,044,911 | Nil | C$7,044,911 | |

Board and Committee Positions | Membership and Attendance | |||||

Independent Member of the Board | Board Meetings Attended 2017: 6 of 6 - 100% | |||||

Committee Memberships: ARC (Chair) | ARC Meetings Attended 2017: 5 of 5 - 100% | |||||

| Mr. Oliphant regularly attends CCGC meetings. | |||||

Annual and Special Meeting Voting Results | Votes in Favour | Votes Withheld | ||||

2017 | 82,680,963 | (98.21%) | 1,503,743 | (1.79%) | ||

2016 | 85,871,592 | (93.80%) | 5,674,561 | (6.20%) | ||

Current Other Public Board Memberships | Current Other Committee Memberships | |||||

New Gold Inc. | None | |||||

|

|

| 10 |

David Peterson is Chairman Emeritus at the law firm Cassels Brock & Blackwell LLP and is a director of Franco-Nevada. He was the Premier of the Province of Ontario from 1985 to 1990. He was the founding Chair of the Toronto Raptors of the National Basketball Association and was the Chair of the successful Toronto Bid for the 2015 Pan Am Games and was the Chair of the 2015 Pan American and Parapan American Games Organizing Committee. Mr. Peterson also serves as a director of Rogers Communications Inc. Mr. Peterson is Chancellor Emeritus of the University of Toronto and a director of St. Michael’s Hospital Foundation. Mr. Peterson holds an LL.B. from the University of Toronto, was called to the Bar of Ontario in 1969, appointed Queen’s Counsel in 1980 and summoned by Her Majesty to the Privy Council in 1992. (1)

|

|

Hon. David R. Peterson(1) | David Peterson is Chairman Emeritus at the law firm Cassels Brock & Blackwell LLP and is a director of Franco-Nevada. He was the Premier of the Province of Ontario from 1985 to 1990. He was the founding Chair of the Toronto Raptors of the National Basketball Association and was the Chair of the successful Toronto Bid for the 2015 Pan Am Games and was the Chair of the 2015 Pan American and Parapan American Games Organizing Committee. Mr. Peterson also serves as a director of Rogers Communications Inc. Mr. Peterson is Chancellor Emeritus of the University of Toronto and a director of St. Michael’s Hospital Foundation. Mr. Peterson holds an LL.B. from the University of Toronto, was called to the Bar of Ontario in 1969, appointed Queen’s Counsel in 1980 and summoned by Her Majesty to the Privy Council in 1992. |

|

|

|

|

|

| |

Toronto, Ontario, Canada | Securities Held | |||||

Director Since: Nov 12, 2007 |

|

| At-Risk Value of |

| At-Risk Value of | |

Age: 74 | Common |

| Common Shares and |

| Common Shares, | |

| Shares (2) | DSUs(3) | DSUs(4) | Options(5) | DSUs and Options(6) | |

| 15,401 | 16,332 | C$2,791,869 | Nil | C$2,791,869 | |

Board and Committee Positions | Membership and Attendance | |||||

Independent Member of the Board | Board Meetings Attended 2017: 6 of 6 - 100% | |||||

Committee Memberships: CCGC (Chair) | CCGC Meetings Attended 2017: 4 of 4 - 100% | |||||

| Mr. Peterson regularly attends ARC meetings. | |||||

Annual and Special Meeting Voting Results | Votes in Favour | Votes Withheld | ||||

2017 | 81,970,991 | (97.37%) | 2,213,715 | (2.63%) | ||

2016 | 88,912,446 | (97.12%) | 2,633,706 | (2.88%) | ||

Current Other Public Board Memberships | Current Other Committee Memberships | |||||

Rogers Communications Inc. | Pension and Nominating | |||||

|

| |||||

Notes

(1) | Additional information is provided in the “Statement of Governance Practices – Nomination of Directors” section of this Circular, which contains a “skills matrix” highlighting individual director skills. |

(2) | The information as to the number of common shares of the Corporation and any of its subsidiaries beneficially owned, or over which control or direction is exercised, directly or indirectly, by each proposed director, including those which are not registered in the name of such director and not being within the knowledge of the Corporation, has been furnished by the respective director. |

(3) | Non-employee directors are eligible to participate in the Corporation’s deferred share unit plan to receive DSUs. The President & CEO, as an employee director, is eligible to participate in the Corporation’s share compensation plan to receive RSUs. For additional information regarding these plans, please see “Deferred Share Unit Plan” in this section and “Other Information – Amended and Restated Share Compensation Plan”. Fractional DSUs have been rounded. |

(4) | Calculated as of March 22, 2018 using the closing price of the common shares on the TSX of C$87.98 per share. |

(5) | For additional information regarding options held by directors, please see “Director Compensation” below. |

(6) | Calculated as of March 22, 2018 using the closing price of the common shares on the TSX of C$87.98 per share, less the applicable exercise price for options. |

(7) | Comprised of 29,837 performance-based RSUs and 18,921 time-based RSUs. See “Statement of Executive Compensation”. |

Securities laws require the Corporation to disclose whether a proposed director has within the past 10 years: (i) been a director or an executive officer of a company that has been subject to a cease trade or other order or become bankrupt; (ii) been bankrupt; (iii) been subject to any penalties or sanctions relating to securities legislation or entered into a settlement agreement with a securities regulatory authority; and (iv) been subject to any other penalties or sanctions that would likely be considered important to a reasonable shareholder in deciding whether to vote for a proposed director. To the Corporation’s knowledge (based on information furnished by the proposed directors), no disclosure is required in respect of the proposed directors, other than as follows:

Derek Evans was a director (until his resignation in January 2016) of a private oil and gas company that sought protection under the Companies’ Creditors Arrangement Act (Canada) in May 2016.

Under a settlement agreement dated November 30, 2017, Mr. Louis Gignac, a director of the Corporation, resolved concerns of the Authorité des marches financiers (“AMF”) regarding a trade in shares of another issuer made in 2015. The AMF and Mr. Gignac agreed in the settlement agreement that Mr. Gignac traded shares in error while in possession of privileged information, as defined in the Securities Act (Quebec) (the “Quebec Act”). The AMF and Mr. Gignac agreed that Mr. Gignac self-reported his trading to the AMF, fully cooperated with the AMF and that Mr. Gignac had no intention of trading with privileged information. Mr. Gignac agreed to pay an administrative fine of $94,369 under section 204 of the Quebec Act to fully resolve the matter.

|

|

11 |

|

Other Disclosed Matters

On October 17, 2017, the U. S. Securities and Exchange Commission (the “SEC”) filed civil charges against each of Rio Tinto plc, Tom Albanese and the former CFO of Rio Tinto plc, alleging, among other things, violations of the anti-fraud, reporting, books and records and internal control provisions of U.S. federal securities laws in connection with conduct at Rio Tinto plc and certain of its subsidiaries while Mr. Albanese was the CEO of Rio Tinto plc and prior to his becoming a director of the Corporation. On March 2, 2018, the Australian Securities and Investments Commission (“ASIC”) commenced proceedings in the Federal Court of Australia against each of Rio Tinto Limited, Tom Albanese and the former CFO of Rio Tinto Limited relating to statements which ASIC alleges were misleading contained in the annual report of Rio Tinto Limited for 2011.

The Corporation is aware of the allegations and will continue to monitor the progress of the situation.

Director Compensation Table

The following table (presented in accordance with Form 51‑102F6 – Statement of Executive Compensation (“Form 51‑102F6”) under National Instrument 51‑102 – Continuous Disclosure Obligations) sets forth in Canadian dollars all amounts of compensation earned by the non-executive directors for the Corporation’s most recently completed financial year.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Name |

|

| Fees |

|

| Share- |

|

| Option- |

|

| Non-equity |

|

| All other |

|

| Total |

| ||||

|

|

|

| earned(1) |

|

| based |

|

| based |

|

| incentive |

|

| compensation(3) |

|

|

|

| ||||

|

|

|

|

|

|

| awards(2) |

|

| awards |

|

| plan |

|

|

|

|

|

|

| ||||

|

|

|

|

|

|

|

|

|

|

|

|

| compensation |

|

|

|

|

|

|

| ||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Pierre Lassonde |

|

|

| $135,000 |

|

|

| $200,600 |

|

|

| Nil |

|

|

| Nil |

|

| $3,000 |

|

| $338,600 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Tom Albanese |

|

|

| $45,000 |

|

|

| $196,266 |

|

|

| Nil |

|

|

| Nil |

|

| $12,000 |

|

| $253,266 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Derek Evans |

|

|

| $45,000 |

|

|

| $205,205 |

|

|

| Nil |

|

|

| Nil |

|

| $12,000 |

|

| $262,205 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Graham Farquharson |

|

|

| $45,000 |

|

|

| $205,519 |

|

|

| Nil |

|

|

| Nil |

|

| $3,000 |

|

| $253,519 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Catharine Farrow |

|

|

| $45,000 |

|

|

| $196,456 |

|

|

| Nil |

|

|

| Nil |

|

| $3,000 |

|

| $244,456 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Louis Gignac |

|

|

| $45,000 |

|

|

| $201,178 |

|

|

| Nil |

|

|

| Nil |

|

| $9,000 |

|

| $255,178 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Randall Oliphant |

|

|

| $70,000 |

|

|

| $195,049 |

|

|

| Nil |

|

|

| Nil |

|

| $3,000 |

|

| $268,049 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| David Peterson |

|

|

| $60,000 |

|

|

| $207,680 |

|

|

| Nil |

|

|

| Nil |

|

| $3,000 |

|

| $270,680 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Notes

(1) | For a breakdown of fees paid in cash versus fees credited in DSUs, see the chart under “Deferred Share Unit Plan” below. Fees paid or payable to the directors were payable in Canadian dollars. The annual retainer paid to each director is $45,000 per year. Messrs. Lassonde, Oliphant and Peterson are also paid additional retainers for serving as the Chair of the Board, the Chair of the ARC and the Chair of the CCGC, respectively. The additional retainers for the Chair of the Board, the Chair of the ARC and the Chair of the CCGC were $90,000 per year, $25,000 per year and $15,000 per year, respectively. See “Discussion of Director Compensation Table” below. |

(2) | Represents the grant date fair value of the: (1) dividend equivalents credited under the DSU Plan and (2) 2,000 DSUs credited to each director See “Discussion of Director Compensation Table” below. |

(3) | Includes travel fees for out-of-town directors and for directors travelling to out-of-town meetings, as applicable, of $1,500 per day to a maximum of two days per meeting. Reimbursement to each of the directors for other expenses and fees was made during the year. These reimbursements were not considered perquisites, as they were integrally and directly related to the performance of each director’s duties. |

Discussion of Director Compensation Table

Significant factors necessary to understand the information disclosed in the Director Compensation Table above include the Board’s fee structure, the Corporation’s deferred share unit plan, and directors’ equity investment requirements.

Board Fees

In 2015, the CCGC conducted an extensive review of non-executive director compensation and concluded that compensation needed to be adjusted to account for (i) the growth of the Corporation, (ii) the increased workload of the directors (including the Chair and the Chairs of the ARC and CCGC), and (iii) the need to recruit new directors in connection with Board renewal as existing directors retire. The CCGC further determined that director compensation

|

|

| 12 |

should largely be linked to the long-term growth of the Corporation’s share price. As such, the CCGC determined that an increase to director compensation should include the grant of DSUs (as defined below) instead of additional cash compensation.

The components of director compensation are as follows:

an annual retainer (the “Annual Retainer”) of $45,000;

an annual retainer (the “Annual Retainer”) of $45,000;

an additional retainer to the Chair of the Board, the Chair of the ARC and the Chair of the CCGC of $90,000, $25,000 and $15,000, respectively;

an additional retainer to the Chair of the Board, the Chair of the ARC and the Chair of the CCGC of $90,000, $25,000 and $15,000, respectively;

the grant of 2,000 DSUs per year payable on a quarterly basis in arrears to each director which vest on the grant date (the “Annual DSU Grant”); and

the grant of 2,000 DSUs per year payable on a quarterly basis in arrears to each director which vest on the grant date (the “Annual DSU Grant”); and

the payment of travel fees (for out-of-town directors) of $1,500 per day to a maximum of two days per meeting.

the payment of travel fees (for out-of-town directors) of $1,500 per day to a maximum of two days per meeting.

Directors are also reimbursed for out-of-pocket expenses for attending Board and committee meetings and in respect of other activities relating to Board service, which include contributing significant additional time and expertise to management for which directors receive no additional compensation. No director compensation is paid to directors who are members of management of the Corporation.

Deferred Share Unit Plan

Effective March 26, 2008, the Board adopted a deferred share unit plan (the “DSU Plan”), which permits directors who are not salaried officers or employees of the Corporation or a related corporation (referred to as “Eligible Directors”) to defer receipt of all or a portion of their Board fees until termination of Board service. The DSU Plan also provides the Board with the flexibility to award deferred share units (“DSUs”) to Eligible Directors as another form of compensation. Only Eligible Directors are permitted to participate in the DSU Plan which is administered by the CCGC.

With respect to conversion of Board fees into DSUs (“Conversion DSUs”), each Eligible Director may elect to be paid a minimum of 20% up to a maximum of 100%, (in 10% increments), of Board fees in the form of Conversion DSUs in lieu of being paid such fees in cash. On the date on which Board fees are payable (on a quarterly basis), the number of Conversion DSUs to be credited to a participating Eligible Director (a “Participant”) is determined by dividing an amount equal to the designated percentage of the Board fees that the Participant has elected to have credited in Conversion DSUs on that fee payment date, by the fair market value of a common share (i.e. weighted average trading price for the last five trading days) on that fee payment date.

The DSU Plan also permits the CCGC to award DSUs to directors as additional compensation. In 2015, on the recommendation of the CCGC, the Board approved the Annual DSU Grant in lieu of increasing cash retainers paid to directors. Under the DSU Plan, the CCGC is authorized to determine when these DSUs will be awarded, the number of DSUs to be awarded, the vesting criteria for each award of these DSUs, if any, and all other terms and conditions of each award. Unless the CCGC determines otherwise (as was done for the Annual DSU Grant as these DSUs are issued in arrears for services rendered), the DSUs awarded under the DSU Plan will be subject to a vesting schedule whereby they will become vested in equal instalments over three years with one-third vesting on the first anniversary of the award and one-third vesting on each of the subsequent anniversaries of the award. The CCGC may consider alternatives for vesting criteria related to the Corporation’s performance and has the flexibility under the DSU Plan to apply such vesting criteria to particular awards of DSUs. The DSU Plan also provides that: (i) where a Participant’s termination of Board service is as a result of death, all unvested DSUs will vest effective on the date of death; and (ii) in a change of control context, all unvested DSUs will vest immediately prior to the change of control.

When dividends are declared by the Corporation, a Participant is also credited with dividend equivalents in the form of additional DSUs based on the number of vested DSUs the Participant holds on the record date for the payment of a dividend.

A Participant is permitted to redeem his or her vested DSUs only following termination of Board service by way of retirement, non-re-election as a director, resignation or death. A Participant (or, in the case of death of the Participant, the Participant’s legal representative) will be entitled, by giving written notice to the Corporation, provided the Participant is not at that time a salaried officer or an employee of the Corporation or a related corporation, to redeem, on one or more dates specified by the Participant (or the Participant’s legal representative, as the case may be)

|

|

13 |

|

occurring on or after the date of such notice, which date(s) shall not, in any event, be prior to the tenth trading day following the release of the Corporation’s quarterly or annual financial results immediately following the Participant’s termination of Board service and shall not be later than December 1st of the first calendar year commencing after the time of such termination of Board service, all or a portion of the vested DSUs. If the Participant (or the Participant’s legal representative, as the case may be) fails to provide written notice to the Corporation in respect of the redemption of all or any portion of the Participant’s vested DSUs, the Participant (or the Participant’s legal representative, as the case may be) will be deemed to have elected to redeem all vested DSUs on December 1st of the calendar year commencing after the date of termination of Board service of the Participant. The DSU Plan has more specific restrictions on redemptions for U.S. Participants.

Upon redemption of DSUs, the Corporation will pay to the Participant a lump sum cash payment equal to the number of DSUs to be redeemed multiplied by a calculation of the fair market value of a common share (i.e. weighted average trading price for the last five trading days) on the redemption date, net of any applicable deductions and withholdings. The DSU Plan does not entitle any Participant to acquire common shares of the Corporation nor does it allow for the issuance of common shares of the Corporation from treasury.

The following table outlines the breakdown of fees paid in cash versus fees credited in DSUs during the year ended December 31, 2017 and the total DSUs accumulated during the year ended December 31, 2017.

Director Fees/DSUs Breakdown

(in C$)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Name |

|

| Fees |

|

| DSU |

|

| Total fees |

|

| Total fees |

|

| Total fees |

|

| Number of |

|

| Dividend |

|

| Grant of |

|

| Total |

| ||

|

|

|

| earned(1) |

|

| election |

|

| paid in |

|

| accrued in |

|

| credited in |

|

| DSUs(3) |

|

| equivalents(3) |

|

| DSUs(4) |

|

| number of |

| ||

|

|

|

|

|

|

| percentage |

|

| cash |

|

| cash(2) |

|

| DSUs |

|

|

|

|

|

|

|

|

|

|

| DSUs(3) |

| ||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Pierre Lassonde |

|

|

| $135,000 |

|

|

| 0% |

|

| $101,250 |

|

| $33,750 |

|

| Nil |

|

| Nil |

|

| 105 |

|

| 2,000 |

|

| 2,105 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Tom Albanese |

|

|

| $45,000 |

|

|

| 100% |

|

| Nil |

|

| Nil |

|

| $45,000 |

|

| 473 |

|

| 59 |

|

| 2,000 |

|

| 2,532 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Derek Evans |

|

|

| $45,000 |

|

|

| 100% |

|

| Nil |

|

| Nil |

|

| $45,000 |

|

| 473 |

|

| 153 |

|

| 2,000 |

|

| 2,626 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Graham Farquharson |

|

|

| $45,000 |

|

|

| 100% |

|

| Nil |

|

| Nil |

|

| $45,000 |

|

| 473 |

|

| 157 |

|

| 2,000 |

|

| 2,630 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Catharine Farrow |

|

|

| $45,000 |

|

|

| 100% |

|

| Nil |

|

| Nil |

|

| $45,000 |

|

| 473 |

|

| 61 |

|

| 2,000 |

|

| 2,534 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Louis Gignac |

|

|

| $45,000 |

|

|

| 50% |

|

| $16,875 |

|

| $5,625 |

|

| $22,500 |

|

| 237 |

|

| 111 |

|

| 2,000 |

|

| 2,348 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Randall Oliphant |

|

|

| $70,000 |

|

|

| 0% |

|

| $52,500 |

|

| $17,500 |

|

| Nil |

|

| Nil |

|

| 47 |

|

| 2,000 |

|

| 2,047 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| David Peterson |

|

|

| $60,000 |

|

|

| 100% |

|

| Nil |

|

| Nil |

|

| $60,000 |

|

| 631 |

|

| 179 |

|

| 2,000 |

|

| 2,810 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Notes

(1) | Fees paid or payable to the directors were payable in Canadian dollars. |

(2) | Represents cash fees payable for the fourth quarter of 2017 which were paid in 2018. |

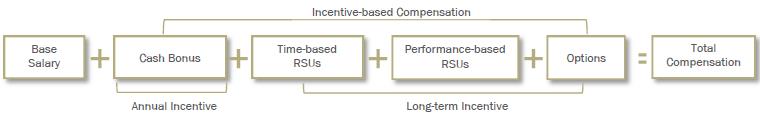

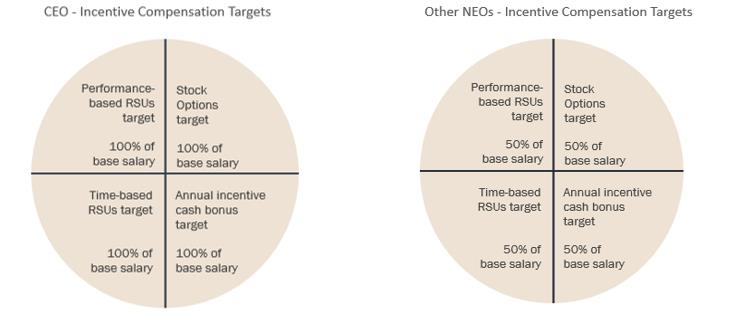

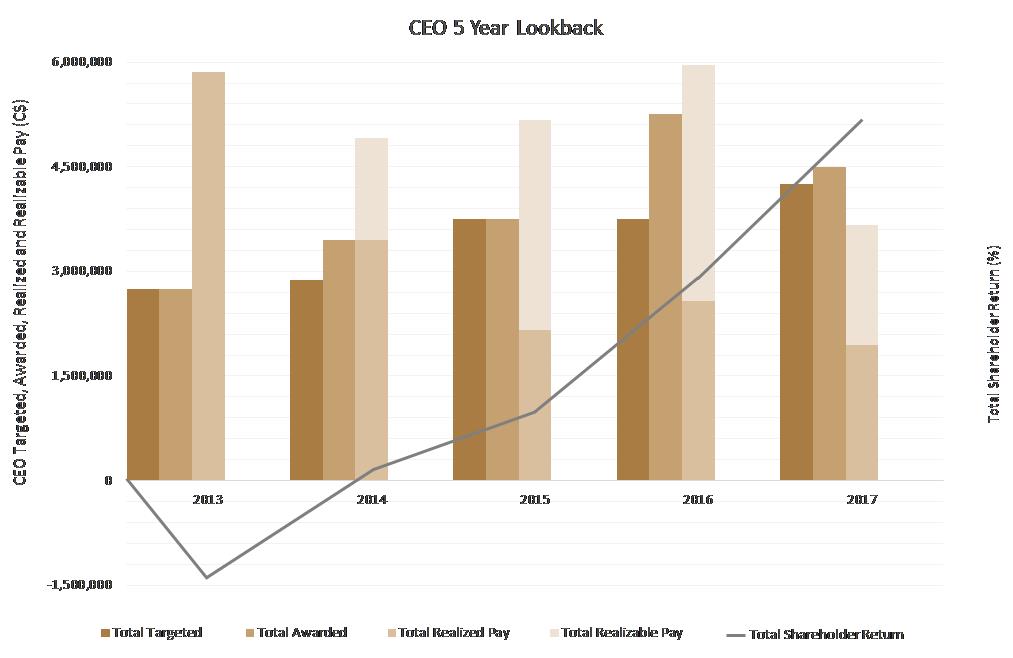

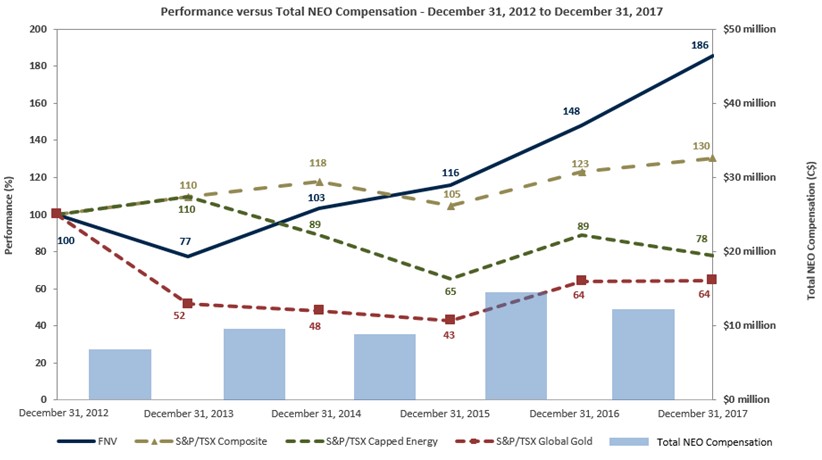

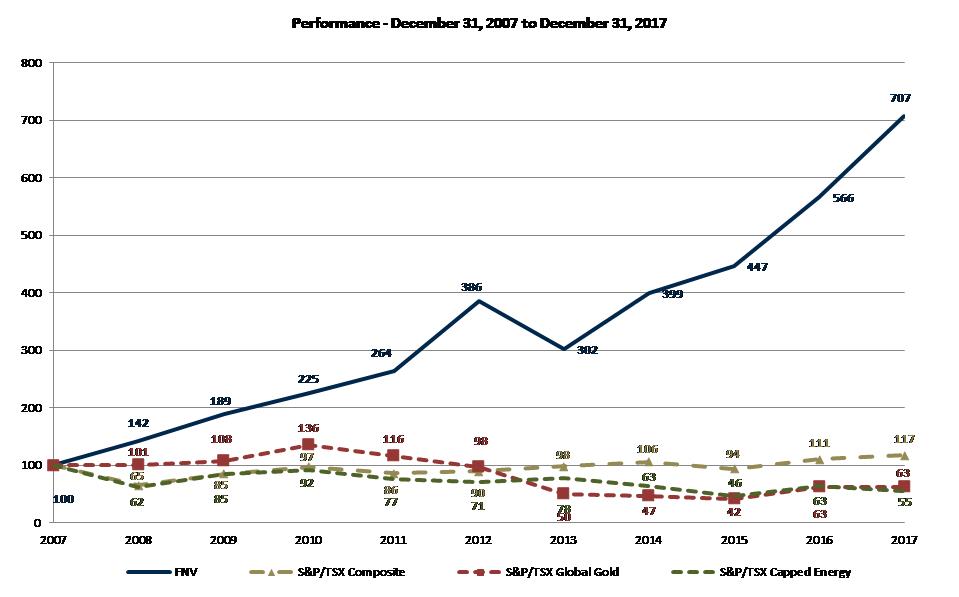

(3) | Fractional DSUs have been rounded. |