Exhibit 99.2

arch

Management’s Discussion and Analysis |

This Management’s Discussion and Analysis (“MD&A”) of financial position and results of operations of Franco-Nevada Corporation (“Franco-Nevada”, the “Company”, “we” or “our”) has been prepared based upon information available to Franco-Nevada as at November 5, 2018 and should be read in conjunction with Franco-Nevada’s unaudited condensed consolidated interim financial statements and related notes as at and for the three and nine months ended September 30, 2018 and 2017. The unaudited condensed consolidated interim financial statements and MD&A are presented in U.S. dollars and have been prepared in accordance with International Financial Reporting Standards (“IFRS”) as issued by the International Accounting Standards Board (“IASB”) applicable to the preparation of interim financial statements in accordance with IAS 34 Interim Financial Reporting.

Readers are cautioned that the MD&A contains forward-looking statements and that actual events may vary from management’s expectations. Readers are encouraged to read the “Cautionary Statement on Forward-Looking Information” at the end of this MD&A and to consult Franco-Nevada’s audited consolidated financial statements for the years ended December 31, 2017 and 2016 and the corresponding notes to the financial statements which are available on our website at www.franco-nevada.com, on SEDAR at www.sedar.com and in our most recent Form 40-F filed with the United States Securities and Exchange Commission on EDGAR at www.sec.gov. Additional information related to Franco-Nevada, including our Annual Information Form, is available on SEDAR at www.sedar.com, and our Form 40-F is available on EDGAR at www.sec.gov. These documents contain descriptions of certain of Franco-Nevada’s producing and advanced royalty and stream assets, as well as a description of risk factors affecting the Company. For additional information, our website can be found at www.franco-nevada.com.

|

|

4 | |

5 | |

8 | |

8 | |

10 | |

11 | |

12 | |

18 | |

24 | |

25 | |

26 | |

29 | |

32 | |

32 | INTERNAL CONTROL OVER FINANCIAL REPORTING AND DISCLOSURE CONTROLS AND PROCEDURES |

33 | |

36 |

Abbreviations used in this report |

The following abbreviations may be used throughout this MD&A:

|

|

|

|

|

Abbreviated Definitions |

|

|

| |

|

|

|

|

|

Periods under review |

|

|

| |

"YTD/2018" | The nine-month period ended September 30, 2018 | |||

"YTD/2017" | The nine-month period ended September 30, 2017 | |||

"Q3/2018" | The three-month period ended September 30, 2018 | |||

"Q2/2018" | The three-month period ended June 30, 2018 | |||

"Q1/2018" | The three-month period ended March 31, 2018 | |||

"Q4/2017" | The three-month period ended December 31, 2017 | |||

"Q3/2017" | The three-month period ended September 30, 2017 | |||

"Q2/2017" | The three-month period ended June 30, 2017 | |||

"Q1/2017" | The three-month period ended March 31, 2017 | |||

|

|

|

|

|

Places and currencies |

| Measurement | ||

"U.S." | United States |

| "GEO" | Gold equivalent ounces |

"$" or "USD" | United States dollars |

| "PGM" | Platinum group metals |

"C$" or "CAD" | Canadian dollars |

| "oz" | Ounce |

"A$" or "AUD" | Australian dollars |

| "oz Au" | Ounce of gold |

|

|

| "oz Ag" | Ounce of silver |

Interest types |

| "oz Pt" | Ounce of platinum | |

"NSR" | Net smelter return royalty |

| "oz Pd" | Ounce of palladium |

"GR" | Gross royalty |

| "LBMA" | London Bullion Market Association |

"ORR" | Overriding royalty |

| "bbl" | Barrel |

"GORR" | Gross overriding royalty |

| "boe" | Barrels of oil equivalent |

"FH" | Freehold or lessor royalty |

| "WTI" | West Texas Intermediate |

"NPI" | Net profits interest |

|

|

|

"NRI" | Net royalty interest |

|

|

|

"WI" | Working interest |

|

|

|

Business Overview and Strategy

Franco-Nevada is the leading gold-focused royalty and stream company by both gold revenue and number of gold assets. The Company has the largest and most diversified portfolio of royalties and streams by commodity, geography, revenue type and stage of project. The portfolio is actively managed with the aim to maintain over 80% of revenue from precious metals (gold, silver and PGM).

|

|

|

|

|

|

|

|

|

|

Franco-Nevada Asset Count at November 5, 2018 | |||||||||

|

| Precious Metals |

| Other Mining Assets |

| Oil & Gas |

|

| TOTAL |

Producing |

| 44 |

| 7 |

| 58 |

|

| 109 |

Advanced |

| 28 |

| 7 |

| — |

|

| 35 |

Exploration |

| 138 |

| 70 |

| 25 |

|

| 233 |

TOTAL |

| 210 |

| 84 |

| 83 |

|

| 377 |

The Company does not operate mines, develop projects or conduct exploration. Franco-Nevada’s business model is focused on managing and growing its portfolio of royalties and streams. The advantages of this business model are:

· | Exposure to precious metals price optionality; |

· | A perpetual discovery option over large areas of geologically prospective lands. No additional costs other than the initial investment; |

· | Limited exposure to many of the risks associated with operating companies; |

· | A free cash-flow business with limited cash calls; |

· | A high-margin business that can generate cash through the entire commodity cycle; |

· | A scalable and diversified business in which a large number of assets can be managed with a small stable overhead; and |

· | A forward-looking business in which management focuses on growth opportunities rather than operational or development issues. |

Franco-Nevada’s financial results in the short-term are primarily tied to the price of commodities and the amount of production from its portfolio of producing assets. Financial results have also been supplemented by acquisitions of new producing assets. Over the longer-term, results are impacted by the availability of exploration and development capital applied by other companies to expand or extend Franco-Nevada’s producing assets or to advance Franco-Nevada’s advanced and exploration assets into production.

Franco-Nevada has a long-term investment outlook and recognizes the cyclical nature of the industry. Franco-Nevada has historically operated by maintaining a strong balance sheet so that it can make investments during commodity cycle downturns.

Franco-Nevada’s shares are listed on the Toronto and New York stock exchanges under the symbol FNV. An investment in Franco-Nevada’s shares is expected to provide investors with yield and exposure to commodity price and exploration optionality while limiting exposure to many of the risks of operating companies. Since its Initial Public Offering over ten years ago, Franco-Nevada has increased its dividend annually and its share price has outperformed the gold price and all relevant gold equity benchmarks.

Franco-Nevada’s revenue is generated from various forms of agreements, ranging from net smelter return royalties, streams, net profits interests, net royalty interests, working interests and other. For definitions of the various types of agreements, please refer to our most recent Annual Information Form filed on SEDAR at www.sedar.com or our Form 40‑F filed on EDGAR at www.sec.gov.

Financial Update – Q3/2018

· | $134.7 million, or $0.72 per share, of Adjusted EBITDA(2), in line with $134.1 million, or $0.72 per share, in Q3/2017; |

· | $52.1 million, or $0.28 per share, in net income, a decrease of 13.2% from $60.0 million, or $0.32 per share, in Q3/2017; |

· | $54.6 million, or $0.29 per share in Adjusted Net Income(2), a decrease of 1.3% compared to $55.3 million, or $0.30 per share, in Q3/2017; |

· | $128.2 million in net cash provided by operating activities, an increase of 10.5% compared to $116.0 million in Q3/2017; |

· | $1.4 billion in available capital as at September 30, 2018, comprising $149.9 million of working capital, $161.3 million in marketable equity securities, and $1.1 billion available under the Company’s credit facilities. Subsequent to quarter-end, $214.8 million was used to fund the previously announced joint acquisition of mineral rights with Continental Resources, Inc. Franco-Nevada also funded its final contribution towards the Cobre Panama project in October 2018, thereby fulfilling its $1.0 billion capital commitment in its original fixed-payment stream investment in the project. |

1GEOs include our gold, silver, platinum, palladium and other mining assets, and do not include Oil & Gas assets. GEOs are estimated on a gross basis for NSR royalties and, in the case of stream ounces, before the payment of the per ounce contractual price paid by the Company. For NPI royalties, GEOs are calculated taking into account the NPI economics. Silver, platinum, palladium and other mining commodities are converted to GEOs by dividing associated revenue, which includes settlement adjustments, by the relevant gold price. The price used in the computation of GEOs earned from a particular asset varies depending on the royalty or stream agreement, which may make reference to the market price realized by the operator, or the average price for the month, quarter, or year in which the mining commodity was produced or sold. For illustrative purposes, please refer to the average commodity price table on pages 12 and 18 of this MD&A for indicative prices which may be used in the calculation of GEOs for the three and nine months ended September 30, 2018, respectively.

2Adjusted Net Income, Adjusted EBITDA and Margin are non-IFRS financial measures with no standardized meaning under IFRS. For further information and a detailed reconciliation, please see the “Non-IFRS Financial Measures” section of this MD&A.

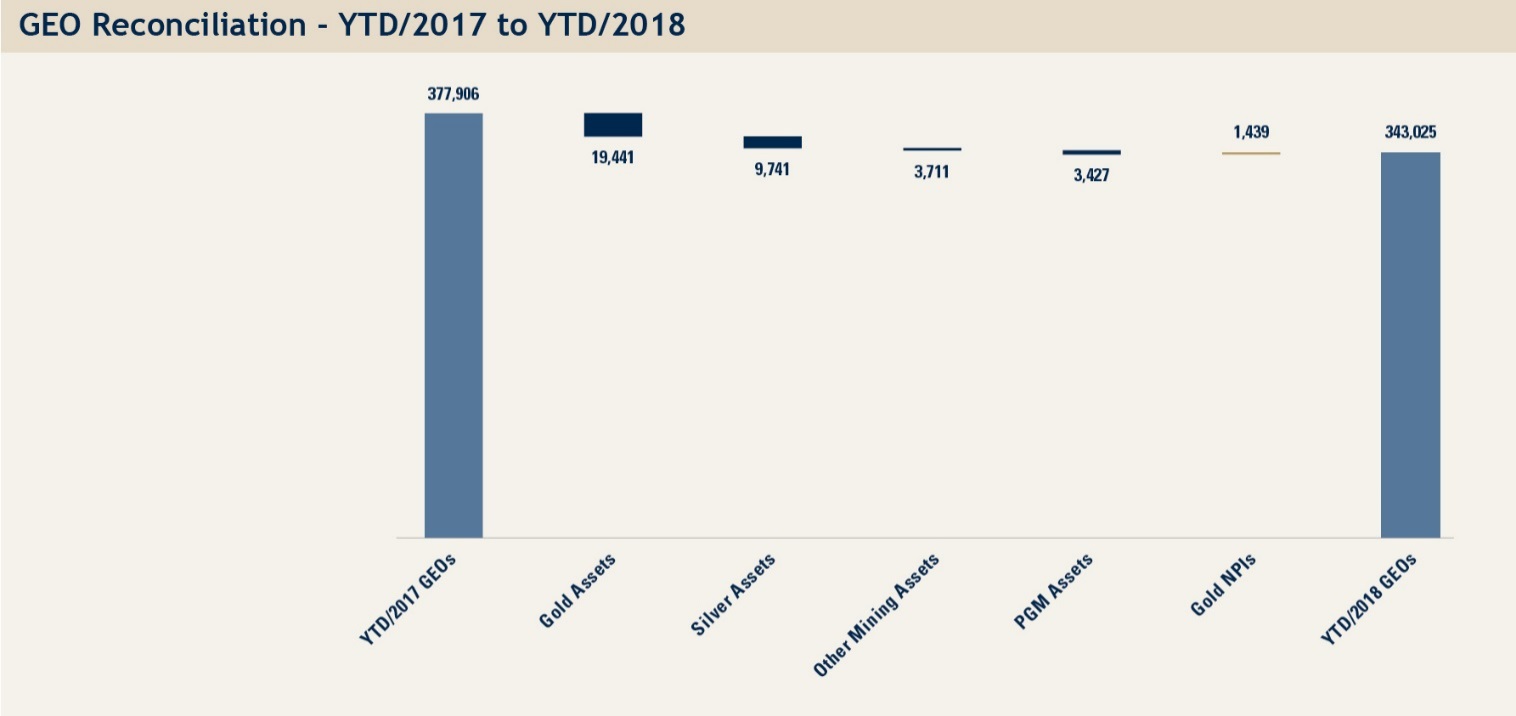

Financial Update – YTD/2018

· | 343,025 GEOs earned, a decrease of 9.2% from 377,906 GEOs in YTD/2017; |

· | $505.0 million in revenue, a slight decrease of 0.6% from revenue of $507.8 million in YTD/2017; |

· | $400.9 million, or $2.15 per share, in Adjusted EBITDA, an increase of 3.3% from $388.1 million, or $2.13 per share, in YTD/2017; |

· | 79.4% in Margin, an increase compared to 76.4% in YTD/2017; |

· | $170.3 million, or $0.92 per share, in net income, an increase of 12.6% compared to $151.2 million, or $0.83 per share, in YTD/2017; |

· | $172.3 million, or $0.93 per share, in Adjusted Net Income, an increase of 17.9% compared to $146.2 million, or $0.80 per share, in YTD/2017; |

· | $377.0 million in net cash provided by operating activities, an increase of 4.1% compared to $362.3 million in YTD/2017. |

Corporate Developments

Acquisition of U.S. Oil & Gas Mineral Rights and Strategic Relationship with Continental Resources, Inc. – SCOOP and STACK, Oklahoma

As previously announced, on August 6, 2018, the Company entered, through a wholly-owned subsidiary, into a strategic relationship with Continental Resources, Inc. (“Continental”) to jointly acquire, through a newly-formed entity (the “Continental Minerals Venture”), mineral rights in the South Central Oklahoma Oil Province (“SCOOP”) and Sooner Trend Anadarko Basin Canadian and Kingfisher Counties (“STACK”) plays of Oklahoma.

On October 23, 2018, the Company closed this transaction, and contributed $218.5 million for its stake in the Continental Minerals Venture. The contribution was funded net of $3.7 million in royalties generated by the acquired assets between March 1, 2018, the effective date of the transaction, and October 23, 2018, the date of closing, for a net disbursement of $214.8 million.

Moving forward, the minerals relationship will capitalize on Continental’s land and exploration expertise and focus predominantly on acquiring minerals under Continental’s drill plan. To grow the Continental Minerals Venture portfolio, Franco-Nevada has committed to spend up to $300 million over the next three years to acquire additional mineral rights through the Continental Minerals Venture, subject to satisfaction of agreed upon development thresholds. Continental has committed to spend up to $75 million over the same period through the Continental Minerals Venture. Acquisition of mineral rights by the Continental Minerals Venture has accelerated and Franco-Nevada now expects to fund additional capital contributions of between $35 million and $55 million in 2018. These accelerated contributions will reduce Franco-Nevada’s commitment in the last of the three years, such that the total commitment remains $300 million.

Revenue distribution from the Continental Minerals Venture will vary depending on production volumes, with Franco‑Nevada entitled to a minimum of 50% of revenue and up to 75% of revenue at certain production volumes. While Franco-Nevada expects to earn revenue starting in Q4/2018, meaningful revenue from the initial contribution is expected to begin in 2019, increasing over time. The assets subject to the investment have an anticipated life of 30+ years from current wells and future development.

Additional Acquisition and Funding of Cobre Panama, Panama

On January 19, 2018, the Company, through a wholly-owned subsidiary, entered into an amended and restated stream agreement with First Quantum Minerals Ltd. (“First Quantum”) and Korea Resources Corp. (“KORES”). The amended and restated stream agreement covers 100% of the Cobre Panama project (“Cobre Panama”). Cobre Panama, which is in the construction phase and is located in Panama, is 90% owned by First Quantum and 10% by KORES.

The amended and restated stream agreement comprises two distinct precious metals streams: the original stream covering First Quantum’s initial 80% interest in the project (the “Fixed Payment Stream”) and a new stream covering (i) First Quantum’s additional 10% interest in the project acquired from LS-Nikko Copper Inc. in Q4/2017 and (ii) KORES’ 10% interest in the project (the “Floating Payment Stream”).

Fixed Payment Stream

Under the terms of the Fixed Payment Stream, Franco-Nevada has funded a deposit of $1.0 billion against future deliveries of gold and silver from Cobre Panama. The deposit was funded on a pro-rata basis of 1:3 to First Quantum’s share of the capital costs for Cobre Panama in excess of $1.0 billion. As at September 30, 2018, the Company funded a cumulative total of $974.4 million towards the Fixed Payment Stream. Franco-Nevada made a final contribution of $25.6 million on October 19, 2018, thereby fulfilling its capital commitment of $1.0 billion.

Under the terms of the amended and restated stream agreement, the fixed price for the Fixed Payment Stream is $418 per ounce of gold and $6.27 per ounce of silver (each increased by a 1.5% annual inflation factor), until 1,341,000 ounces of gold and 21,500,000 ounces of silver have been delivered. Thereafter, the ongoing payment will be the greater of 50% of the fixed price and 50% of the spot price.

Floating Payment Stream

The purchase price of the Floating Payment Stream was $356.0 million and was funded upfront upon closing on March 16, 2018. The terms of the Floating Payment Stream, other than the ongoing price, are similar to the Fixed Payment Stream, including initially linking precious metals deliveries to copper in concentrate shipped. Under the Floating Payment Stream, the ongoing price per ounce for deliveries is 20% of the spot price until 604,000 ounces of gold and 9,618,000 ounces of silver have been delivered. Thereafter, the ongoing payment will be 50% of the spot price.

Project Update

First Quantum continued to progress with the construction of its Cobre Panama project, reporting a completion rate of 81% as at the end of Q3/2018, with project capital expenditure for YTD/2018 totaling $1,120.0 million against full year guidance of $1,330 million. Cobre Panama remains scheduled for phased commissioning during 2018, with continued ramp-up over 2019 and 2020. In the event that ramp-up is slower than expected and the mill does not reach a run-rate of 58 million tonnes per day by January 1, 2019, the stream agreement provides Franco-Nevada downside protection through a discount on the initial ounces purchased pursuant to the agreement. The discount would provide Franco-Nevada an effective 5% return on capital.

On September 25, 2018, First Quantum addressed the announcement of the Supreme Court of Panama ruling in connection with the constitutionality of Law 9 of 1997. According to First Quantum, Law 9 granted the status of national law to the mining concession contract, establishing a statutory legal and fiscal regime for the development of the Cobre Panama project. Minera Panama SA (“MPSA”), the operating subsidiary of First Quantum, understands that the Supreme Court ruling with respect to the constitutionality of Law 9 relates to the enactment of Law 9 and does not affect the legality of the MPSA mining concession contract itself, which remains in effect, and allows continuation of the development of Cobre Panama project by MPSA. Subsequently, MPSA has submitted filings to the Supreme Court for ruling, which it has accepted, prior to the ruling in relation to the constitutionality of Law 9 taking effect. On September 26, 2018 the Government of Panama issued a news release affirming support for the Cobre Panama project. Construction and commissioning are continuing while the First Quantum seeks to clarify the legal position.

Acquisition of Bowen Basin Coal Royalties, Australia

On February 28, 2018, Franco-Nevada, through a wholly-owned subsidiary, acquired a portfolio of metallurgical coal royalties located in the Bowen Basin of Queensland, Australia for a cash consideration of A$4.2 million. The portfolio includes certain claims that comprise the producing Moorvale mine, the Olive Downs project which has filed permitting applications, and another 33 exploration tenements. The Bowen Basin Coal royalties are production payments of A$0.10 per tonne, adjusted for consumer price index changes since December 31, 1997.

Acquisition of U.S. Oil & Gas Royalties – Delaware Basin, Texas

On February 20, 2018, the Company, through a wholly-owned subsidiary, closed the acquisition of a royalty portfolio in the Delaware Basin, which represents the western portion of the Permian Basin, for $101.3 million. The royalties are derived principally from mineral title which provides a perpetual interest in royalty lands. The transaction entitles the Company to royalties effective October 1, 2017. Prior to year-end, the Company advanced $11.0 million into escrow in respect of this transaction which was included in royalty, stream and working interests on the statement of financial position as at December 31, 2017.

Financing

Credit Facilities

As noted earlier, Franco-Nevada closed its transaction with Continental on October 23, 2018 and funded its initial contribution, net of pre-closing royalties, of $214.8 million. The net contribution was funded in part through a draw of $200.0 million on the Company’s $1.0 billion unsecured revolving credit facility (the “Credit Facility”). The funds were drawn as 30-day LIBOR loans with the associated interest rate based on 30-day LIBOR plus 1.10%. The Credit Facility has a maturity date of March 22, 2023. As of the date of this MD&A, the Credit Facility has an outstanding balance of $200.0 million, and $800.0 million remains available.

Franco-Nevada (Barbados) Corporation (“FNBC”) also drew on its credit facility (the “FNBC Credit Facility”) to fund its final contribution towards the Cobre Panama project. The draw of $7.0 million was repaid on October 31, 2018, and incurred interest based on 13-day LIBOR plus 1.35%. As at the date of this MD&A, the full $100.0 million remains available to FNBC. The FNBC Credit Facility has a maturity date of March 20, 2019.

Dividend Declaration

In Q3/2018, Franco-Nevada declared a quarterly dividend of $0.24 per share. The total dividend declared was $45.0 million, of which $33.8 million was paid in cash and $11.2 million was paid in common shares issued under the Company’s Dividend Reinvestment Plan (“DRIP”). For the nine months ended September 30, 2018, dividends declared totaled $132.9 million, of which $104.5 million was paid in cash and $28.4 million was paid in common shares.

The following contains forward-looking statements. Reference should be made to the “Cautionary Statement on Forward-Looking Information” section at the end of this MD&A. For a description of material factors that could cause our actual results to differ materially from the forward-looking statements below, please see the “Cautionary Statement” and the “Risk Factors” section of our most recent Annual Information Form filed with the Canadian securities regulatory authorities on www.sedar.com and our most recent Form 40-F filed with the United States Securities and Exchange Commission on www.sec.gov. 2018 guidance is based on assumptions including the forecasted state of operations from our assets based on the public statements and other disclosures by the third-party owners and operators of the underlying properties (subject to our assessment thereof).

Franco-Nevada had a strong performance in Q3/2018, with its mining assets generating revenue in line with expectations and its recently acquired U.S. Oil & Gas assets performing better than anticipated. With respect to its mining assets, Franco-Nevada reiterates its 2018 revised GEO guidance. To reflect the continued strong performance of its Oil & Gas assets, Franco-Nevada now expects to generate $75 million to $85 million in revenue from Oil & Gas for 2018. This represents a further increase to the updated guidance in August of $65 million to $75 million and the original guidance in March of $50 million to $60 million.

|

|

|

|

|

|

|

|

|

|

| YTD/2018 Actual |

|

| 2018 Guidance(4) |

|

Mining assets - GEO production(1),(2) |

|

| 343,025 GEOs |

|

| 440,000 - 470,000 GEOs |

|

Oil & Gas assets - Revenue(3) |

|

| $67.9 million |

|

| $75 - $85 million |

|

1Of the 440,000 to 470,000 GEOs, Franco-Nevada expects to receive 290,000 to 320,000 GEOs under its various streams. For the nine months ended September 30, 2018, the Company has earned 231,098 GEOs from its streams.

2In forecasting GEOs for 2018, gold, silver, platinum and palladium metals have been converted to GEOs using commodity prices of $1,250/oz Au, $16.00/oz Ag, $850/oz Pt and $950/oz Pd.

3In forecasting revenue from Oil & Gas assets for 2018, the WTI oil price is assumed to average $65 per barrel.

4On August 8, 2018, GEO guidance was revised from 460,000-490,000 GEOs to 440,000-470,000 GEOs, and Oil & Gas guidance was revised from $50-$60 million to $65-$75 million.

In Q3/2018, Franco-Nevada funded $88.4 million towards the Fixed Payment Stream of the Cobre Panama project, for a cumulative total as of September 30, 2018 of $974.4 million. The Company fulfilled its capital commitment of $1.0 billion under the Fixed Payment Stream subsequent to quarter-end, with a final contribution of $25.6 million made in October 2018.

As described in the Corporate Developments section above, the Company is expecting to contribute to the Continental Minerals Venture, subject to satisfaction of agreed upon development thresholds, up to $100 million per year over the next three years, for a total remaining commitment of up to $300 million. Although Franco-Nevada has met its initial capital contribution for 2018, the Company expects to fund an additional $35 million to $55 million in Q4/2018. These accelerated contributions will reduce Franco-Nevada’s commitment in the last of the three years, such that the total commitment remains $300 million.

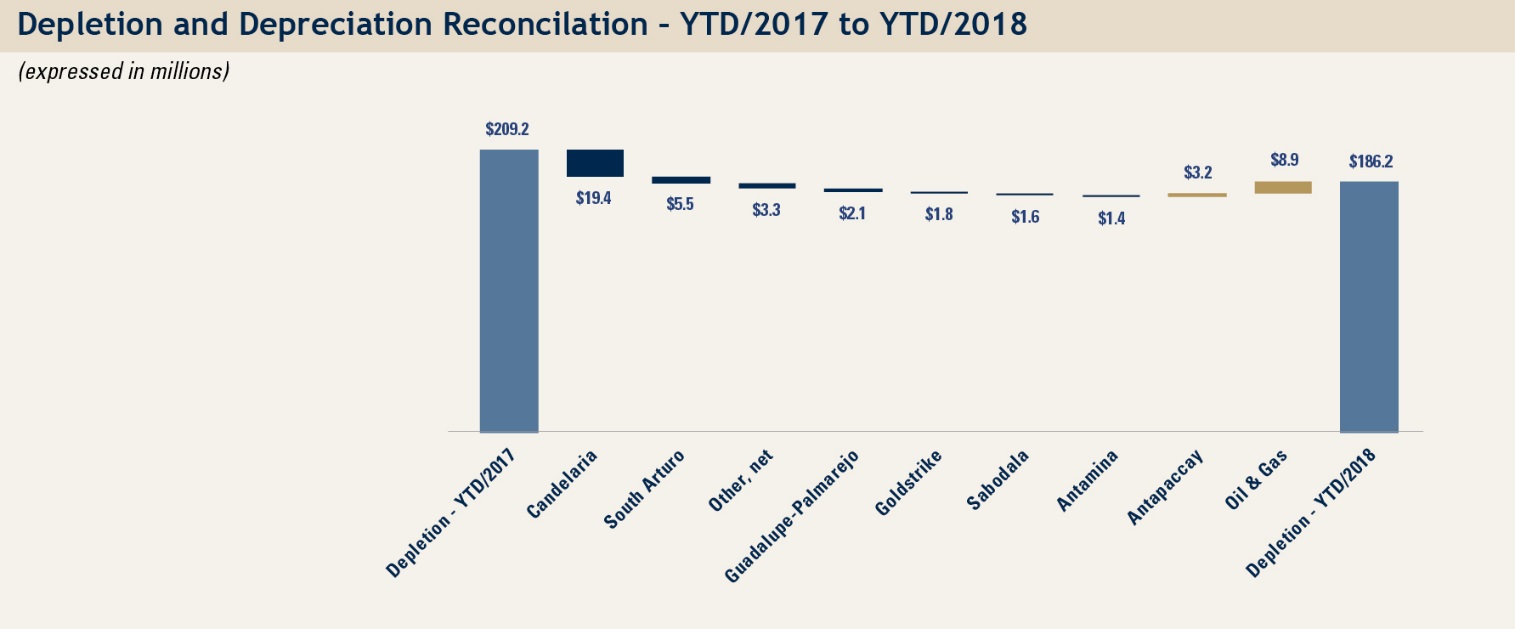

Depletion and depreciation expense totaled $186.2 million YTD/2018. The Company estimates depletion and depreciation expense to be $250.0 million to $270.0 million for the full year 2018.

The prices of precious metals, gold in particular, are the largest factors in determining profitability and cash-flow from operations for Franco-Nevada. Historically, the price of gold has been subject to volatile price movements and is affected by numerous macroeconomic and industry factors that are beyond the Company’s control. Major influences on the gold price include the level of interest rates, inflation expectations, currency exchange rate fluctuations including the relative strength of the U.S. dollar, and the supply of and demand for gold.

Commodity price volatility also impacts the number of GEOs contributed by non-gold mining assets when converting silver, platinum, palladium and other mining commodities to GEOs. Silver, platinum, palladium and other mining commodities are converted to GEOs by dividing associated revenue, which includes settlement adjustments, by the relevant gold price. The price used in the computation of GEOs earned from a particular asset varies depending on the royalty or stream agreement, which may make reference to the market price realized by the operator, or the average price for the month, quarter, or year in which the mining commodity was produced or sold.

During Q3/2018, gold prices averaged $1,213/oz, down 5.1% compared to the Q3/2017 average of $1,278/oz. Gold prices traded between $1,178/oz and $1,262/oz, ending Q3/2018 at $1,187/oz, approximately 5.0% lower than at the end of Q2/2018.

Silver prices averaged $14.99/oz in Q3/2018, a decrease of 10.9% compared to $16.83/oz in Q3/2017. Platinum and palladium prices averaged $814/oz and $953/oz, respectively, in Q3/2018, compared to $953/oz and $901/oz, respectively, for Q3/2017, a decrease of 14.6% and an increase of 5.8% year-over-year, respectively.

One of the strengths of the Franco-Nevada business model is that our business is not generally impacted when producer costs increase as long as the producer continues to operate. Royalty and stream payments/deliveries are based on production levels with no adjustments for the operator’s operating costs, with the exception of NPI and NRI royalties, which are based on the profit of the underlying mining operation. Profit-based royalties accounted for approximately 6.7% of total revenue in Q3/2018.

Another attribute of the Franco-Nevada business model is the diversification of its portfolio across commodities. In Q3/2018, 15.4% of the Company’s revenue was generated from its Oil & Gas assets. During the quarter, Edmonton Light prices averaged C$77.14/bbl, up 34.7% compared to Q3/2017, while the WTI averaged $67.88/bbl, a 44.8% increase from Q3/2017.

Franco-Nevada strives to generate 80% of revenue from precious metals over a long-term horizon which includes gold, silver and PGM. In the short-term, we may diverge from the long-term target based on opportunities available. With 84.7% of revenue earned from precious metals in YTD/2018, the Company has the flexibility to consider diversification opportunities outside of the precious metals’ space and increase its exposure to other commodities while maintaining its long-term target.

Selected Financial Information

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

| For the three months ended |

|

| For the nine months ended |

| ||||||||||

(in millions, except Average Gold Price, |

|

| September 30, |

|

| September 30, |

| ||||||||||

GEOs sold, Margin, per share amounts) |

|

| 2018 |

|

| 2017 |

|

| 2018 |

|

| 2017 |

| ||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Statistical Measures |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Average Gold Price |

|

| $ | 1,213 |

|

| $ | 1,278 |

|

| $ | 1,318 |

|

| $ | 1,251 |

|

GEOs sold(1) |

|

|

| 120,021 |

|

|

| 123,787 |

|

|

| 343,025 |

|

|

| 377,906 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Statement of Income and Comprehensive Income |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Revenue |

|

| $ | 170.6 |

|

| $ | 171.5 |

|

| $ | 505.0 |

|

| $ | 507.8 |

|

Depletion and depreciation |

|

|

| 66.0 |

|

|

| 70.5 |

|

|

| 186.2 |

|

|

| 209.2 |

|

Cost of sales |

|

|

| 33.4 |

|

|

| 33.0 |

|

|

| 93.4 |

|

|

| 106.8 |

|

Operating income |

|

|

| 65.8 |

|

|

| 63.0 |

|

|

| 208.1 |

|

|

| 174.2 |

|

Net income |

|

|

| 52.1 |

|

|

| 60.0 |

|

|

| 170.3 |

|

|

| 151.2 |

|

Basic earnings per share |

|

| $ | 0.28 |

|

| $ | 0.32 |

|

| $ | 0.92 |

|

| $ | 0.83 |

|

Diluted earnings per share |

|

| $ | 0.28 |

|

| $ | 0.32 |

|

| $ | 0.91 |

|

| $ | 0.83 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Dividends declared per share |

|

| $ | 0.24 |

|

| $ | 0.23 |

|

| $ | 0.71 |

|

| $ | 0.68 |

|

Dividends declared (including DRIP) |

|

| $ | 45.0 |

|

| $ | 42.8 |

|

| $ | 132.9 |

|

| $ | 124.7 |

|

Weighted average shares outstanding |

|

|

| 186.1 |

|

|

| 185.5 |

|

|

| 186.1 |

|

|

| 181.9 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Non-IFRS Measures |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Adjusted EBITDA(2) |

|

| $ | 134.7 |

|

| $ | 134.1 |

|

| $ | 400.9 |

|

| $ | 388.1 |

|

Adjusted EBITDA(2) per share |

|

| $ | 0.72 |

|

| $ | 0.72 |

|

| $ | 2.15 |

|

| $ | 2.13 |

|

Margin(2) |

|

|

| 79.0 | % |

|

| 78.2 | % |

|

| 79.4 | % |

|

| 76.4 | % |

Adjusted Net Income(2) |

|

| $ | 54.6 |

|

| $ | 55.3 |

|

| $ | 172.3 |

|

| $ | 146.2 |

|

Adjusted Net Income(2) per share |

|

| $ | 0.29 |

|

| $ | 0.30 |

|

| $ | 0.93 |

|

| $ | 0.80 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Statement of Cash Flows |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net cash provided by operating activities |

|

| $ | 128.2 |

|

| $ | 116.0 |

|

| $ | 377.0 |

|

| $ | 362.3 |

|

Net cash used in investing activities |

|

| $ | (89.4) |

|

| $ | (185.6) |

|

| $ | (703.4) |

|

| $ | (384.7) |

|

Net cash (used in) provided by financing activities |

|

| $ | (33.8) |

|

| $ | (29.3) |

|

| $ | (104.9) |

|

| $ | 271.7 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| As at |

|

| As at |

| ||

|

|

| September 30, |

|

| December 31, |

| ||

|

|

| 2018 |

|

| 2017 |

| ||

Statement of Financial Position |

|

|

|

|

|

|

|

|

|

Cash and cash equivalents |

|

| $ | 76.9 |

|

| $ | 511.1 |

|

Total assets |

|

|

| 4,834.5 |

|

|

| 4,788.4 |

|

Deferred income tax liabilities |

|

|

| 67.0 |

|

|

| 60.3 |

|

Total shareholders’ equity |

|

|

| 4,744.9 |

|

|

| 4,705.5 |

|

Working capital(3) |

|

|

| 149.9 |

|

|

| 593.8 |

|

1 | Refer to Note 1 at the bottom of page 5 of this MD&A for the methodology for calculating GEOs, and, for illustrative purposes, to the average commodity price table on pages 12 and 18 of this MD&A for indicative prices which may be used in the calculations of GEOs for the three and nine months ended September 30, 2018, respectively. |

3 | The Company defines Working Capital as current assets less current liabilities. |

Our portfolio is well-diversified with GEOs and revenue being earned from 51(1) mining assets and 57 Oil & Gas assets in various jurisdictions. The following table details revenue earned from our various royalty, stream and working interests for the three and nine months ended September 30, 2018 and 2017:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| For the three months ended |

|

| For the nine months ended |

| ||||||||||

(expressed in millions) |

|

|

|

| September 30, |

|

| September 30, |

| ||||||||||

Property |

| Interest |

|

| 2018 |

|

| 2017 |

|

| 2018 |

|

| 2017 |

| ||||

PRECIOUS METALS |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Latin America |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Antapaccay |

| Stream (indexed) |

|

| $ | 26.3 |

|

| $ | 24.8 |

|

| $ | 75.6 |

|

| $ | 65.2 |

|

Candelaria |

| Stream 68% |

|

|

| 21.6 |

|

|

| 31.9 |

|

|

| 59.2 |

|

|

| 87.1 |

|

Antamina |

| Stream 22.5% |

|

|

| 12.9 |

|

|

| 16.4 |

|

|

| 40.2 |

|

|

| 46.6 |

|

Guadalupe-Palmarejo |

| Stream 50% |

|

|

| 12.7 |

|

|

| 12.1 |

|

|

| 38.5 |

|

|

| 48.0 |

|

Other |

|

|

|

|

| 1.1 |

|

|

| 0.6 |

|

|

| 2.1 |

|

|

| 1.7 |

|

United States |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Goldstrike |

| NSR 2-4%, NPI 2.4-6% |

|

| $ | 5.0 |

|

| $ | 4.4 |

|

| $ | 12.7 |

|

| $ | 12.4 |

|

Stillwater |

| NSR 5% |

|

|

| 3.7 |

|

|

| 5.7 |

|

|

| 14.7 |

|

|

| 15.4 |

|

Gold Quarry |

| NSR 7.29% |

|

|

| 3.1 |

|

|

| 3.6 |

|

|

| 11.1 |

|

|

| 10.6 |

|

Marigold |

| NSR 1.75-5%, GR 0.5-4% |

|

|

| 3.0 |

|

|

| 2.1 |

|

|

| 7.7 |

|

|

| 7.6 |

|

Fire Creek/Midas |

| Fixed to 2018 / NSR 2.5% (2) |

|

|

| 2.8 |

|

|

| 0.8 |

|

|

| 8.2 |

|

|

| 6.7 |

|

Bald Mountain |

| NSR/GR 0.875-5% |

|

|

| 2.7 |

|

|

| 2.1 |

|

|

| 10.4 |

|

|

| 4.3 |

|

South Arturo |

| GR 4-9% |

|

|

| 0.4 |

|

|

| 1.6 |

|

|

| 4.0 |

|

|

| 9.9 |

|

Other |

|

|

|

|

| 1.0 |

|

|

| 0.8 |

|

|

| 3.3 |

|

|

| 2.3 |

|

Canada |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Sudbury |

| Stream 50% |

|

| $ | 6.4 |

|

| $ | 7.1 |

|

| $ | 17.0 |

|

| $ | 22.4 |

|

Detour Lake |

| NSR 2% |

|

|

| 3.5 |

|

|

| 3.0 |

|

|

| 11.4 |

|

|

| 10.0 |

|

Golden Highway |

| NSR 2-15% |

|

|

| 2.4 |

|

|

| 2.1 |

|

|

| 6.7 |

|

|

| 6.3 |

|

Hemlo |

| NSR 3%, NPI 50% |

|

|

| 0.4 |

|

|

| (0.3) |

|

|

| 5.5 |

|

|

| 3.6 |

|

Musselwhite |

| NPI 5% |

|

|

| 0.9 |

|

|

| 0.9 |

|

|

| 1.6 |

|

|

| 3.0 |

|

Kirkland Lake |

| NSR 1.5-5.5%, NPI 20% |

|

|

| 1.0 |

|

|

| 0.9 |

|

|

| 3.3 |

|

|

| 3.0 |

|

Timmins West |

| NSR 2.25% |

|

|

| 0.6 |

|

|

| 0.8 |

|

|

| 1.9 |

|

|

| 2.7 |

|

Canadian Malartic |

| GR 1.5% |

|

|

| 0.6 |

|

|

| 0.6 |

|

|

| 1.9 |

|

|

| 1.6 |

|

Rest of World |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

MWS |

| Stream 25% |

|

| $ | 7.3 |

|

| $ | 9.4 |

|

| $ | 24.7 |

|

| $ | 26.6 |

|

Sabodala |

| Stream 6%, Fixed to 2019 |

|

|

| 6.8 |

|

|

| 7.2 |

|

|

| 21.6 |

|

|

| 23.4 |

|

Karma |

| Stream 4.875%, Fixed to 80,625 oz |

|

|

| 5.3 |

|

|

| 5.8 |

|

|

| 16.9 |

|

|

| 17.4 |

|

Subika |

| NSR 2% |

|

|

| 2.2 |

|

|

| 1.5 |

|

|

| 6.5 |

|

|

| 4.9 |

|

Tasiast |

| NSR 2% |

|

|

| 1.3 |

|

|

| 1.8 |

|

|

| 4.2 |

|

|

| 4.8 |

|

Duketon |

| NSR 2% |

|

|

| 1.6 |

|

|

| 1.8 |

|

|

| 5.2 |

|

|

| 5.1 |

|

Edikan |

| NSR 1.5% |

|

|

| 1.1 |

|

|

| 1.0 |

|

|

| 3.4 |

|

|

| 2.7 |

|

Other |

|

|

|

|

| 2.4 |

|

|

| 1.8 |

|

|

| 8.0 |

|

|

| 5.3 |

|

|

|

|

|

| $ | 140.1 |

|

| $ | 152.3 |

|

| $ | 427.5 |

|

| $ | 460.6 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

OTHER MINING ASSETS |

|

|

|

| $ | 4.3 |

|

| $ | 6.7 |

|

| $ | 9.6 |

|

| $ | 14.2 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

OIL & GAS |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Weyburn |

| NRI 11.71%, ORR 0.44%, WI 2.56% |

|

| $ | 10.6 |

|

| $ | 8.6 |

|

| $ | 30.9 |

|

| $ | 23.4 |

|

Midale |

| ORR 1.14%, WI 1.59% |

|

|

| 0.5 |

|

|

| 0.4 |

|

|

| 1.5 |

|

|

| 1.2 |

|

Edson |

| ORR 15% |

|

|

| 0.4 |

|

|

| 0.4 |

|

|

| 1.3 |

|

|

| 1.5 |

|

SCOOP/STACK |

| Various Royalty Rates |

|

|

| 5.3 |

|

|

| 0.7 |

|

|

| 10.8 |

|

|

| 2.0 |

|

Midland/Delaware |

| Various Royalty Rates |

|

|

| 6.9 |

|

|

| 0.8 |

|

|

| 16.8 |

|

|

| 1.5 |

|

Orion |

| GORR 4% |

|

|

| 1.4 |

|

|

| 0.3 |

|

|

| 3.1 |

|

|

| 0.3 |

|

Other |

|

|

|

|

| 1.1 |

|

|

| 1.3 |

|

|

| 3.5 |

|

|

| 3.1 |

|

|

|

|

|

| $ | 26.2 |

|

| $ | 12.5 |

|

| $ | 67.9 |

|

| $ | 33.0 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Revenue |

|

|

|

| $ | 170.6 |

|

| $ | 171.5 |

|

| $ | 505.0 |

|

| $ | 507.8 |

|

1 | New revenue-generating assets in 2018 include the Cerro Moro and Sissingué mines, which started contributing revenue to the Company in Q2/2018, as well as the Brucejack mine which is expected to begin generating revenue for the Company by the end of 2018. |

2 | 2.5% NSR commencing in 2019. |

Overview of Financial Performance –Q3/2018 to Q3/2017

The prices of precious metals, oil and gas and the actual production from mining and Oil & Gas assets are the largest factors in determining profitability and cash flow from operations for Franco-Nevada. The following table summarizes average commodity prices and average exchange rates during the periods presented.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| QOQ |

| YOY | |||||

Quarterly average prices and rates |

|

|

|

| Q3/2018 |

|

| Q2/2018 |

| Q3/2017 |

| (Q3/2018-Q2/2018) |

| (Q3/2018-Q3/2017) | |||||

Gold(1) |

| ($/oz) |

|

| $ | 1,213 |

|

| $ | 1,306 |

| $ | 1,278 |

| (7.1) | % |

| (5.1) | % |

Silver(2) |

| ($/oz) |

|

|

| 14.99 |

|

|

| 16.57 |

|

| 16.83 |

| (9.5) | % |

| (10.9) | % |

Platinum(3) |

| ($/oz) |

|

|

| 814 |

|

|

| 904 |

|

| 953 |

| (10.0) | % |

| (14.6) | % |

Palladium(3) |

| ($/oz) |

|

|

| 953 |

|

|

| 979 |

|

| 901 |

| (2.6) | % |

| 5.8 | % |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Edmonton Light |

| (C$/bbl) |

|

|

| 77.14 |

|

|

| 78.41 |

|

| 57.28 |

| (1.6) | % |

| 34.7 | % |

West Texas Intermediate |

| ($/bbl) |

|

|

| 69.67 |

|

|

| 67.88 |

|

| 48.13 |

| 2.6 | % |

| 44.8 | % |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

CAD/USD exchange rate(4) |

|

|

|

|

| 0.7652 |

|

|

| 0.7747 |

|

| 0.8000 |

| (1.2) | % |

| (4.4) | % |

1 | Based on LBMA Gold Price PM Fix. |

2 | Based on LBMA Silver Price. |

3 | Based on London PM Fix. |

4 | Based on Bank of Canada daily average rates. |

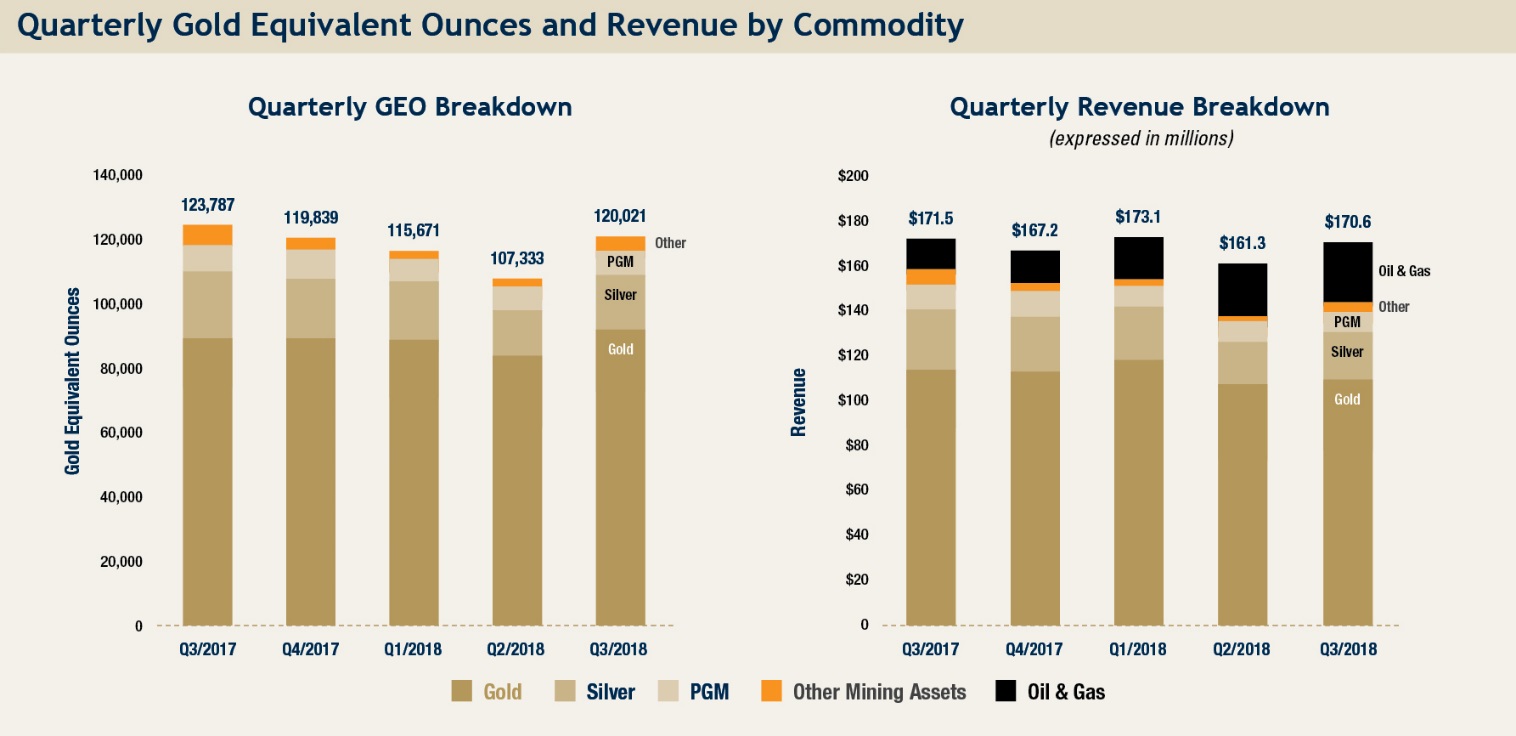

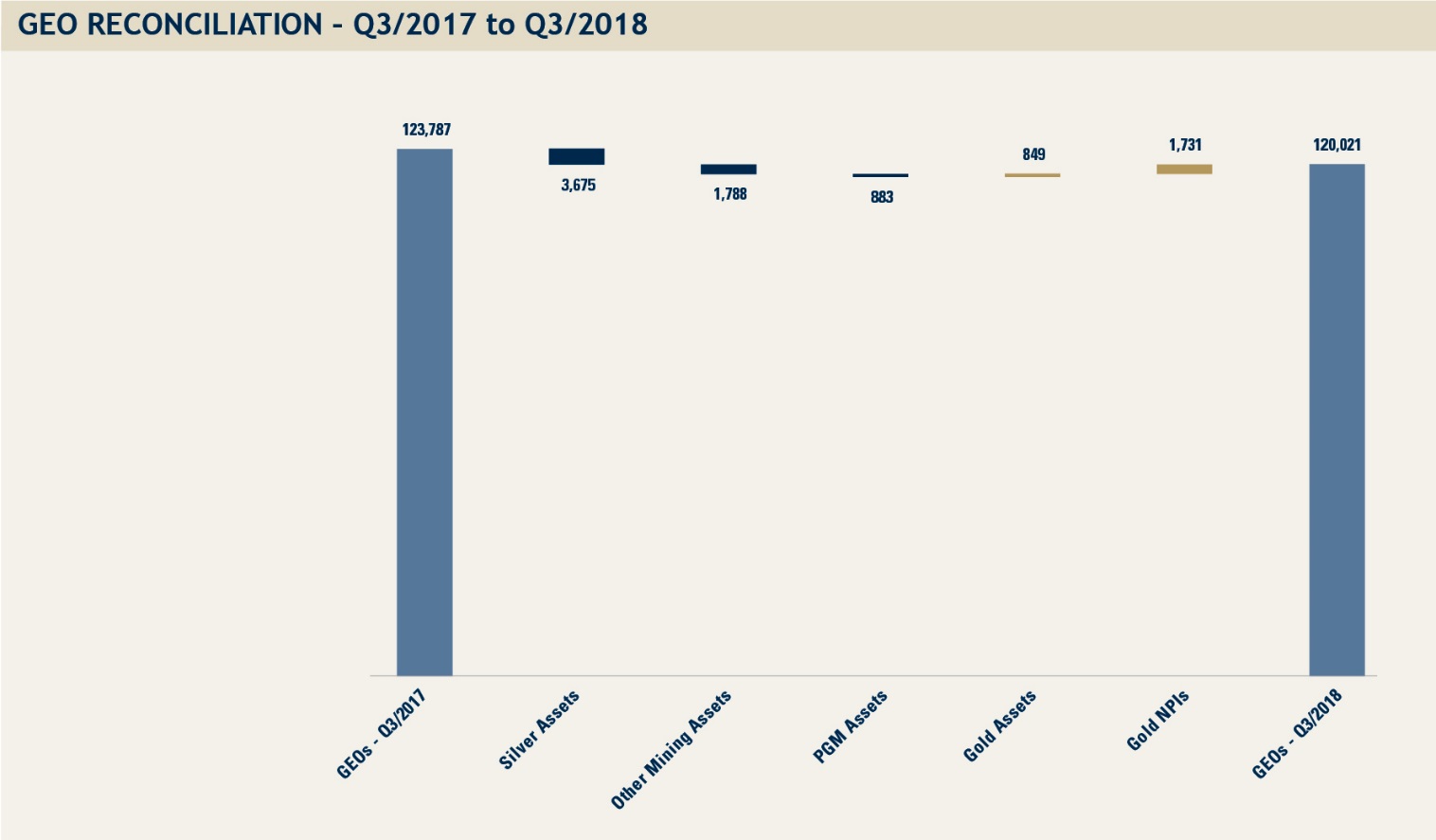

Revenue and Gold Equivalent Ounces

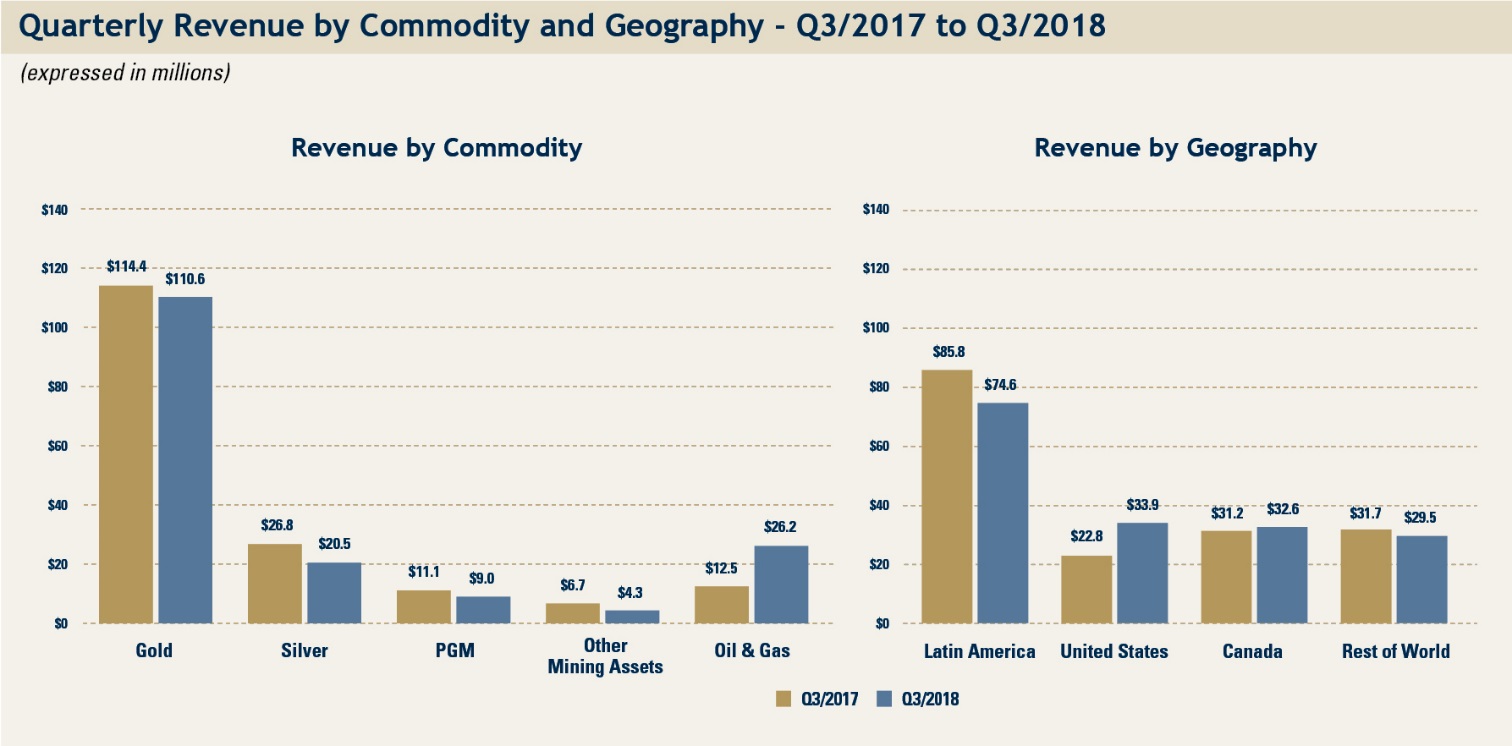

Revenue for Q3/2018 was $170.6 million, a slight decrease from $171.5 million earned in Q3/2017. While revenue from mining assets decreased by 9.2% in Q3/2018, reflecting fewer GEOs earned as well as lower precious metals prices, revenue from Oil & Gas assets more than doubled year-over-year. Recently acquired Oil & Gas assets, namely Delaware, Orion and the second royalty portfolio in the STACK play, which all closed around or subsequent to September 30, 2017, added $6.2 million in incremental revenue compared to Q3/2017. Revenue from existing assets also increased year-over-year, benefitting from higher oil prices.

Precious metals assets contributed 82.1% of the Company’s total revenue in Q3/2018, compared to 88.9% in Q3/2017, reflecting the growth of the Company’s Oil & Gas portfolio of assets over the last two years. The Company remains heavily invested in the Americas, with 82.7% of revenue in Q3/2018, compared to 81.5% in Q3/2017.

The following table outlines GEOs and revenue attributable to Franco-Nevada for the three months ended September 30, 2018 and 2017 by commodity, geographical location and type of interest:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Gold Equivalent Ounces(1) |

|

| Revenue (in millions) |

| |||||||||||||

For the three months ended September 30, |

|

| 2018 |

|

| 2017 |

| Variance |

|

| 2018 |

|

| 2017 |

| Variance |

| |||

Commodity |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Precious Metals |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Gold |

|

| 91,820 |

|

| 89,240 |

| 2,580 |

|

| $ | 110.6 |

|

| $ | 114.4 |

| $ | (3.8) |

|

Silver |

|

| 17,023 |

|

| 20,698 |

| (3,675) |

|

|

| 20.5 |

|

|

| 26.8 |

|

| (6.3) |

|

PGM |

|

| 7,635 |

|

| 8,518 |

| (883) |

|

|

| 9.0 |

|

|

| 11.1 |

|

| (2.1) |

|

Precious Metals - Total |

|

| 116,478 |

|

| 118,456 |

| (1,978) |

|

|

| 140.1 |

|

|

| 152.3 |

|

| (12.2) |

|

Other mining assets |

|

| 3,543 |

|

| 5,331 |

| (1,788) |

|

|

| 4.3 |

|

|

| 6.7 |

|

| (2.4) |

|

Oil & Gas |

|

| - |

|

| - |

| - |

|

|

| 26.2 |

|

|

| 12.5 |

|

| 13.7 |

|

|

|

| 120,021 |

|

| 123,787 |

| (3,766) |

|

| $ | 170.6 |

|

| $ | 171.5 |

| $ | (0.9) |

|

Geography |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Latin America |

|

| 61,967 |

|

| 66,740 |

| (4,773) |

|

| $ | 74.6 |

|

| $ | 85.8 |

| $ | (11.2) |

|

United States |

|

| 17,969 |

|

| 16,652 |

| 1,317 |

|

|

| 33.9 |

|

|

| 22.8 |

|

| 11.1 |

|

Canada |

|

| 15,610 |

|

| 15,643 |

| (33) |

|

|

| 32.6 |

|

|

| 31.2 |

|

| 1.4 |

|

Rest of World |

|

| 24,475 |

|

| 24,752 |

| (277) |

|

|

| 29.5 |

|

|

| 31.7 |

|

| (2.2) |

|

|

|

| 120,021 |

|

| 123,787 |

| (3,766) |

|

| $ | 170.6 |

|

| $ | 171.5 |

| $ | (0.9) |

|

Type |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Revenue-based royalties |

|

| 28,182 |

|

| 27,567 |

| 615 |

|

| $ | 47.5 |

|

| $ | 38.7 |

| $ | 8.8 |

|

Streams |

|

| 82,751 |

|

| 89,053 |

| (6,302) |

|

|

| 99.3 |

|

|

| 114.7 |

|

| (15.4) |

|

Profit-based royalties |

|

| 3,909 |

|

| 2,178 |

| 1,731 |

|

|

| 11.4 |

|

|

| 8.6 |

|

| 2.8 |

|

Other |

|

| 5,179 |

|

| 4,989 |

| 190 |

|

|

| 12.4 |

|

|

| 9.5 |

|

| 2.9 |

|

|

|

| 120,021 |

|

| 123,787 |

| (3,766) |

|

| $ | 170.6 |

|

| $ | 171.5 |

| $ | (0.9) |

|

1 | Refer to Note 1 at the bottom of page 5 of this MD&A for the methodology for calculating GEOs, and, for illustrative purposes, to the average commodity price table on page 12 of this MD&A for indicative prices which may be used in the calculations of GEOs. |

GEOs and revenue from precious metals were earned from the following geographical locations:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Gold Equivalent Ounces(1) |

|

| Revenue (in millions) |

| |||||||||||||

For the three months ended September 30, |

|

| 2018 |

|

| 2017 |

| Variance |

|

| 2018 |

|

| 2017 |

| Variance |

| |||

Geography for Precious Metals |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Precious Metals |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Latin America |

|

| 61,967 |

|

| 66,740 |

| (4,773) |

|

| $ | 74.6 |

|

| $ | 85.8 |

| $ | (11.2) |

|

United States |

|

| 17,866 |

|

| 16,549 |

| 1,317 |

|

|

| 21.7 |

|

|

| 21.1 |

|

| 0.6 |

|

Canada |

|

| 13,391 |

|

| 11,586 |

| 1,805 |

|

|

| 15.8 |

|

|

| 15.1 |

|

| 0.7 |

|

Rest of World |

|

| 23,254 |

|

| 23,581 |

| (327) |

|

|

| 28.0 |

|

|

| 30.3 |

|

| (2.3) |

|

Precious Metals - Total |

|

| 116,478 |

|

| 118,456 |

| (1,978) |

|

| $ | 140.1 |

|

| $ | 152.3 |

| $ | (12.2) |

|

1 | Refer to Note 1 at the bottom of page 5 of this MD&A for the methodology for calculating GEOs, and, for illustrative purposes, to the average commodity price table on page 12 of this MD&A for indicative prices which may be used in the calculations of GEOs. |

Precious Metals

Revenue from precious metals assets was $140.1 million in Q3/2018 compared to $152.3 million in Q3/2017, reflecting lower precious metals prices and a slight decrease of 1.7% of GEOs earned. The decrease in GEOs during the quarter was primarily due to the following assets:

· | Candelaria - The Company earned 17,972 GEOs from its Candelaria stream, compared to 24,961 GEOs in Q3/2017. Precious metals production level from the Candelaria mine are currently lower than in the comparable period due to the temporary processing of lower grade material. |

· | Antamina - The Company earned 10,763 GEOs from its Antamina silver stream in Q3/2018, compared to 12,575 GEOs in Q3/2017, in-line with the 2018 life of mine plan. |

· | Stillwater - Stillwater generated 3,027 GEOs in Q3/2018, down 32.5% from Q3/2017, due to a temporary delay in the payment of royalties. Royalty payments are expected to catch up in Q4/2018. |

The above decreases were partly offset by the following:

· | Antapaccay - Antapaccay delivered 21,725 GEOs in Q3/2018, compared to 19,370 in Q3/2017, an increase of 12.2% year-over-year. |

· | Fire Creek/Midas - The Company sold 2,300 GEOs in Q3/2018, compared to 668 GEOs in the same period in 2017. Although ounce deliveries from Fire Creek/Midas are fixed until the end of 2018, the Company sold fewer ounces in Q3/2017 and maintained the unsold ounces in inventory at September 30, 2017. |

During Q3/2018, 1,379,198 ounces of silver were received from our Antamina, Antapaccay, Candelaria and Cerro San Pedro interests and 1,402,456 ounces were sold in the quarter. Ounces of silver sold were converted to 17,023 GEOs in Q3/2018.

Other Mining Assets

Other mining assets generated 3,543 GEOs and $4.3 million in revenue in Q3/2018, compared to 5,331 GEOs and $6.7 million in revenue in Q3/2017.

Oil & Gas

Revenue from Oil & Gas assets more than doubled year-over-year, generating revenue of $26.2 million for the quarter (97% oil and 3% gas), compared to $12.5 million for Q3/2017 (96% oil and 4% gas). Production volume increased 61.8% year-over-year.

Revenue from the Weyburn Unit for the quarter benefitted from higher average realized prices, increasing by $2.0 million year-over-year, to $10.6 million (Q3/2017 - $8.6 million): $6.8 million earned from the NRI (Q3/2017 - $5.7 million), $3.2 million earned from the WI (Q3/2017 - $2.4 million) and $0.6 million earned from the ORRs (Q3/2017 - $0.5 million). Capital and operating expenditures were 9.5% and 31.2% higher in Q3/2018 than in Q3/2017, respectively. The actual realized price from the NRI was 44.6% higher in Q3/2018, at C$75.69/boe, compared to C$52.35/boe for Q3/2017.

Orion contributed $1.4 million in revenue in Q3/2018 (Q3/2017 - $0.3 million). The acquisition of Orion was closed at the end of Q3/2017, therefore not reflecting a full quarter’s production. Differentials for heavy oil prices in Western Canada widened during the quarter which negatively impacted revenue.

U.S. assets represented 46.6% of Franco-Nevada’s Oil & Gas revenue, and performed well in Q3/2018, with drilling activities ahead of initial expectations. Revenue from the first royalty portfolio in the STACK generated $4.6 million in Q3/2018 (Q3/2017 - $0.7 million), while Midland produced $2.5 million (Q3/2018 - $0.8 million), reflecting higher volumes. Assets acquired over the last year, Delaware and the second portfolio of royalties in the STACK play, contributed an incremental $5.1 million in Q3/2018, for which there is no comparative in the same period in 2017. This included $2.1 million in lease bonus revenue from Delaware, which was not budgeted.

The following table provides a list of operating costs and expenses incurred in the periods presented:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| For the three months ended September 30, |

| ||||||||

(expressed in millions) |

|

| 2018 |

|

| 2017 |

| Variance |

| |||

Costs of sales |

|

| $ | 33.4 |

|

| $ | 33.0 |

| $ | 0.4 |

|

Depletion and depreciation |

|

|

| 66.0 |

|

|

| 70.5 |

|

| (4.5) |

|

General and administrative |

|

|

| 5.2 |

|

|

| 5.2 |

|

| — |

|

Loss (gain) on sale of gold bullion |

|

|

| 0.2 |

|

|

| (0.2) |

|

| 0.4 |

|

|

|

| $ | 104.8 |

|

| $ | 108.5 |

| $ | (3.7) |

|

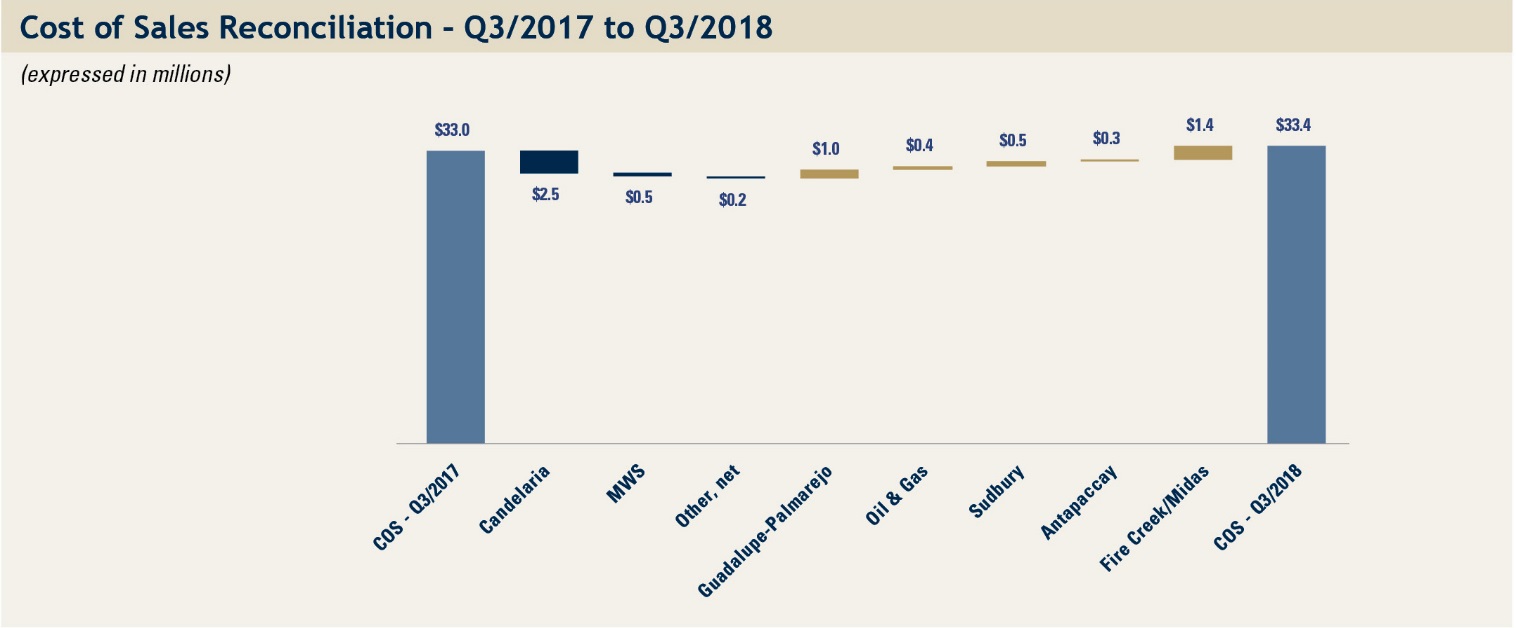

Costs of Sales

The following table provides a breakdown of cost of sales incurred in the periods presented:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| For the three months ended September 30, |

| ||||||||

(expressed in millions) |

|

| 2018 |

|

| 2017 |

| Variance |

| |||

Cost of stream sales |

|

| $ | 29.3 |

|

| $ | 30.8 |

| $ | (1.5) |

|

Cost of prepaid ounces |

|

|

| 2.0 |

|

|

| 0.6 |

|

| 1.4 |

|

Mineral production taxes |

|

|

| 0.6 |

|

|

| 0.5 |

|

| 0.1 |

|

Oil & Gas operating costs |

|

|

| 1.5 |

|

|

| 1.1 |

|

| 0.4 |

|

|

|

| $ | 33.4 |

|

| $ | 33.0 |

| $ | 0.4 |

|

Stream ounces sold decreased 7.1% in Q3/2018 to 82,751 GEOs, compared to 89,053 GEOs in Q3/2017, primarily due to fewer ounces purchased under the Candelaria stream. The reduction in cost of sales from stream ounces decreased to a lesser extent, down 4.9% compared to Q3/2017, as the decrease in cost of sales from the Candelaria ounces was partly offset by the cost of ounces from Guadalupe-Palmarejo, which carries a higher cash payment per ounce.

Cost of prepaid ounces increased by $1.4 million compared to Q3/2017, reflecting 2,300 ounces sold in Q3/2018 compared to 668 ounces in the same period in 2017.

|

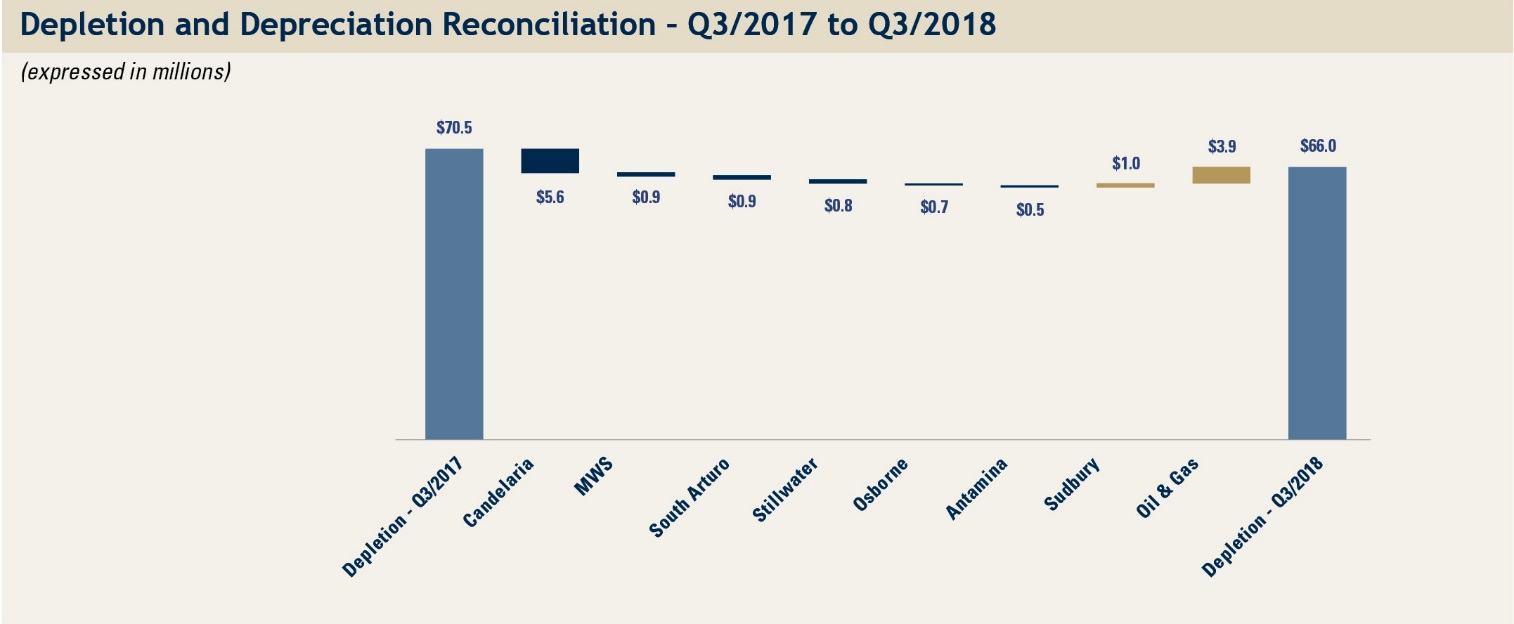

Depletion and Depreciation

Depletion and depreciation expense totaled $66.0 million in Q3/2018 compared to $70.5 million in Q3/2017. The decrease in depletion and depreciation expense reflects fewer GEOs earned from Candelaria and South Arturo, as well as a lower depletion rate per ounce on South Arturo which completed its Phase 2 mining.

General and Administrative Expenses

The following table provides a breakdown of general and administrative expenses incurred for the periods presented:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| For the three months ended September 30, |

| ||||||||

(expressed in millions) |

|

| 2018 |

|

| 2017 |

| Variance |

| |||

Salaries and benefits |

|

| $ | 1.5 |

|

| $ | 1.6 |

| $ | (0.1) |

|

Professional fees |

|

|

| 0.4 |

|

|

| 0.6 |

|

| (0.2) |

|

Office costs |

|

|

| 0.2 |

|

|

| 0.2 |

|

| — |

|

Board of Directors' costs |

|

|

| (0.6) |

|

|

| 0.9 |

|

| (1.5) |

|

Share-based compensation |

|

|

| 1.5 |

|

|

| 0.9 |

|

| 0.6 |

|

Other |

|

|

| 2.2 |

|

|

| 1.0 |

|

| 1.2 |

|

|

|

| $ | 5.2 |

|

| $ | 5.2 |

| $ | — |

|

General and administrative expenses, representing 3.0% of revenue for Q3/2018, remained overall flat compared to Q3/2017. Included in general and administrative expenses in Q3/2018 are $0.9 million in transaction costs incurred in connection to the setup of the Continental Minerals Venture. Offsetting these expenses is a reduction in Board-related fees. Board of Directors’ fees

vary according to the mark-to-market of the value of deferred share units that are granted to the directors of the Company. As the Company’s share price decreased during the quarter, the Company recognized a decrease in the value of the deferred share unit liability. Also included in general and administrative expenses are business development costs, which vary depending upon the level of business development related activity and the timing of completing transactions. Business development expenses related to completed transactions are capitalized to the relevant asset.

Foreign Exchange and Other Income/Expenses

The following table provides a list of foreign exchange and other income/expenses incurred for the periods presented:

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

| For the three months ended September 30, |

| ||||||||

(expressed in millions) |

|

| 2018 |

|

| 2017 |

| Variance |

| |||

Foreign exchange (loss) gain |

|

| $ | — |

|

| $ | (2.0) |

| $ | 2.0 |

|

Other income |

|

|

| 0.1 |

|

|

| 1.1 |

|

| (1.0) |

|

|

|

| $ | 0.1 |

|

| $ | (0.9) |

| $ | 1.0 |

|

Under IFRS, all foreign exchange gains or losses related to monetary assets and liabilities held in a currency other than the functional currency are recorded in net income as opposed to other comprehensive income. The parent company’s functional currency is the Canadian dollar, while the functional currency of certain of the Company’s subsidiaries is the U.S. dollar.

Finance Income and Finance Expenses

The following table provides a breakdown of finance income and expenses incurred for the periods presented:

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

| For the three months ended September 30, |

| ||||||||

(expressed in millions) |

|

| 2018 |

|

| 2017 |

| Variance |

| |||

Finance income |

|

|

|

|

|

|

|

|

|

|

|

|

Interest |

|

| $ | 0.7 |

|

| $ | 1.6 |

| $ | (0.9) |

|

|

|

| $ | 0.7 |

|

| $ | 1.6 |

| $ | (0.9) |

|

Finance expenses |

|

|

|

|

|

|

|

|

|

|

|

|

Standby charges |

|

| $ | 0.5 |

|

| $ | 0.6 |

| $ | (0.1) |

|

Amortization |

|

|

| 0.2 |

|

|

| 0.2 |

|

| — |

|

|

|

| $ | 0.7 |

|

| $ | 0.8 |

| $ | (0.1) |

|

Finance income is earned on our cash equivalents and/or short-term investments. Finance income also includes interest income in the amount of $0.5 million accrued on the Noront Resources Ltd. loan during Q3/2018 (Q3/2017 – $0.5 million). Finance expenses consist of the costs of standby charges, which represent the costs of maintaining our credit facilities and amortization of the costs incurred with respect to the initial set-up or subsequent amendments of the facilities.

Income Taxes

Income tax expense for the quarter was $13.8 million in Q3/2018, compared to $2.9 million Q3/2017. Income tax expense in Q3/2017 was unusually low as it included the recognition of tax benefits realized from deductible permanent differences and the utilization of tax attributes for which no deferred tax asset was previously recognized.

Net income for Q3/2018 was $52.1 million, or $0.28 per share, compared to $60.0 million, or $0.32 per share, for the same period in 2017. Adjusted Net Income was $54.6 million, or $0.29 per share, compared to $55.3 million, or $0.30 per share, earned in Q3/2017. While revenue remained relatively consistent year-over-year due to increased revenue from recently acquired Oil & Gas assets, depletion expense decreased due to the addition of reserves for certain of the Company’s assets over the year. Income tax expense was also higher in Q3/2018 compared to the same period in 2017.

Overview of Financial Performance – YTD/2018 to YTD/2017

The prices of precious metals, oil and gas and the actual production from mining and Oil & Gas assets are the largest factors in determining profitability and cash flow from operations for Franco-Nevada. The following table summarizes average commodity prices and average exchange rates during the periods presented.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Year-to-date average prices and rates |

|

|

|

| YTD/2018 |

|

| YTD/2017 |

| Variance |

| ||

Gold(1) |

| ($/oz) |

|

| $ | 1,318 |

|

| $ | 1,251 |

| 5.4 | % |

Silver(2) |

| ($/oz) |

|

|

| 16.65 |

|

|

| 17.17 |

| (3.0) | % |

Platinum(3) |

| ($/oz) |

|

|

| 941 |

|

|

| 958 |

| (1.8) | % |

Palladium(3) |

| ($/oz) |

|

|

| 1,008 |

|

|

| 829 |

| 21.6 | % |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Edmonton Light |

| (C$/bbl) |

|

|

| 76.00 |

|

|

| 61.27 |

| 24.0 | % |

West Texas Intermediate |

| ($/bbl) |

|

|

| 66.81 |

|

|

| 49.40 |

| 35.2 | % |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

CAD/USD exchange rate(4) |

|

|

|

|

| 0.7828 |

|

|

| 0.7685 |

| 1.9 | % |

1 | Based on LBMA Gold Price PM Fix. |

2 | Based on LBMA Silver Price. |

3 | Based on London PM Fix. |

4 | Based on Bank of Canada noon and daily average rates. |

Revenue and Gold Equivalent Ounces

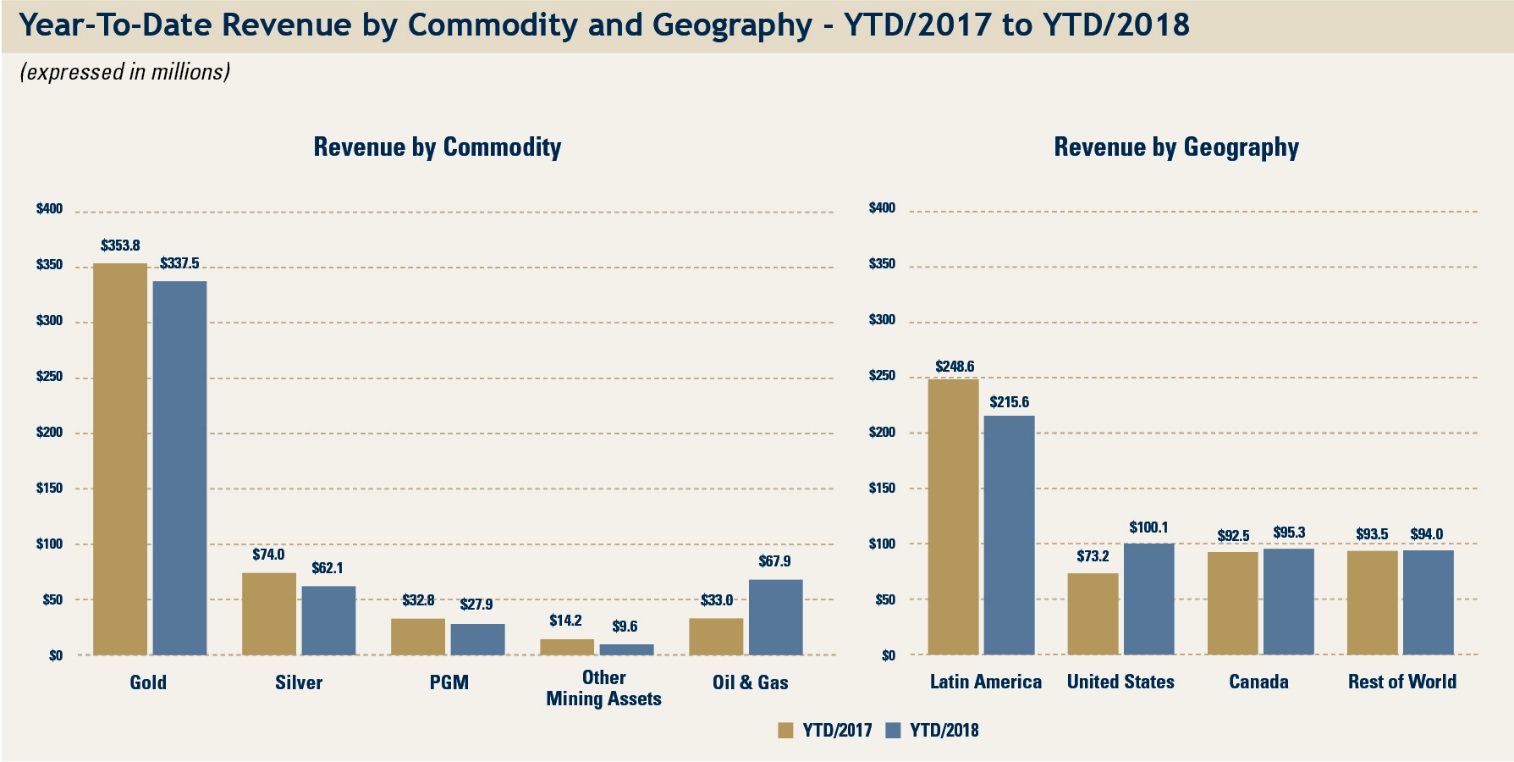

Revenue in YTD/2018 was $505.0 million, which was relatively consistent with revenue earned in the same period in 2017. GEOs earned in YTD/2018 decreased 9.2% to 343,025 GEOs, resulting in a corresponding decrease in revenue from mining assets which was slightly offset by higher gold prices. Revenue from Oil & Gas assets compensated to a large degree for the decrease in revenue from mining assets, reflecting the growth of the Company’s Oil & Gas portfolio over the last two years.

Precious metals revenue comprised 84.7% of total revenue YTD/2018, a decrease from 90.7% in YTD/2017, while revenue from the Americas remained stable year-over-year, at 81.4%, compared to 81.6% in YTD/2017.

The following table outlines GEOs and revenue attributable to Franco-Nevada for the nine months ended September 30, 2018 and 2017 by commodity, geographical location and type of interest:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Gold Equivalent Ounces(1) |

|

| Revenue (in millions) |

| |||||||||||||

For the nine months ended September 30, |

|

| 2018 |

|

| 2017 |

| Variance |

|

| 2018 |

|

| 2017 |

| Variance |

| |||

Commodity |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Precious Metals |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Gold |

|

| 264,484 |

|

| 282,486 |

| (18,002) |

|

| $ | 337.5 |

|

| $ | 353.8 |

| $ | (16.3) |

|

Silver |

|

| 48,842 |

|

| 58,583 |

| (9,741) |

|

|

| 62.1 |

|

|

| 74.0 |

|

| (11.9) |

|

PGM |

|

| 22,116 |

|

| 25,543 |

| (3,427) |

|

|

| 27.9 |

|

|

| 32.8 |

|

| (4.9) |

|

Precious Metals - Total |

|

| 335,442 |

|

| 366,612 |

| (31,170) |

|

|

| 427.5 |

|

|

| 460.6 |

|

| (33.1) |

|

Other mining assets |

|

| 7,583 |

|

| 11,294 |

| (3,711) |

|

|

| 9.6 |

|

|

| 14.2 |

|

| (4.6) |

|

Oil & Gas |

|

| - |

|

| - |

| - |

|

|

| 67.9 |

|

|

| 33.0 |

|

| 34.9 |

|

|

|

| 343,025 |

|

| 377,906 |

| (34,881) |

|

| $ | 505.0 |

|

| $ | 507.8 |

| $ | (2.8) |

|

Geography |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Latin America |

|

| 169,427 |

|

| 197,717 |

| (28,290) |

|

| $ | 215.6 |

|

| $ | 248.6 |

| $ | (33.0) |

|

United States |

|

| 56,532 |

|

| 55,749 |

| 783 |

|

|

| 100.1 |

|

|

| 73.2 |

|

| 26.9 |

|

Canada |

|

| 43,447 |

|

| 49,632 |

| (6,185) |

|

|

| 95.3 |

|

|

| 92.5 |

|

| 2.8 |

|

Rest of World |

|

| 73,619 |

|

| 74,808 |

| (1,189) |

|

|

| 94.0 |

|

|

| 93.5 |

|

| 0.5 |

|

|

|

| 343,025 |

|

| 377,906 |

| (34,881) |

|

| $ | 505.0 |

|

| $ | 507.8 |

| $ | (2.8) |

|

Type |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Revenue-based royalties |

|

| 88,064 |

|

| 85,878 |

| 2,186 |

|

| $ | 146.4 |

|

| $ | 115.9 |

| $ | 30.5 |

|

Streams |

|

| 231,098 |

|

| 267,437 |

| (36,339) |

|

|

| 293.7 |

|

|

| 336.7 |

|

| (43.0) |

|

Profit-based royalties |

|

| 11,570 |

|

| 10,131 |

| 1,439 |

|

|

| 35.1 |

|

|

| 27.6 |

|

| 7.5 |

|

Other |

|

| 12,293 |

|

| 14,460 |

| (2,167) |

|

|

| 29.8 |

|

|

| 27.6 |

|

| 2.2 |

|

|

|

| 343,025 |

|

| 377,906 |

| (34,881) |

|

| $ | 505.0 |

|

| $ | 507.8 |

| $ | (2.8) |

|

1 | Refer to Note 1 at the bottom of page 5 of this MD&A for the methodology for calculating GEOs, and, for illustrative purposes, to the average commodity price table on page 18 of this MD&A for indicative prices which may be used in the calculations of GEOs. |

GEOs and revenue from precious metals were earned from the following geographical locations:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Gold Equivalent Ounces(1) |

|

| Revenue (in millions) |

| |||||||||||||

For the nine months ended September 30, |

|

| 2018 |

|

| 2017 |

| Variance |

|

| 2018 |

|

| 2017 |

| Variance |

| |||

Geography for Precious Metals |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Precious Metals |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Latin America |

|

| 169,427 |

|

| 197,717 |

| (28,290) |

|

| $ | 215.6 |

|

| $ | 248.6 |

| $ | (33.0) |

|

United States |

|

| 56,160 |

|

| 55,428 |

| 732 |

|

|

| 72.1 |

|

|

| 69.2 |

|

| 2.9 |

|

Canada |

|

| 39,015 |

|

| 41,335 |

| (2,320) |

|

|

| 49.3 |

|

|

| 52.6 |

|

| (3.3) |

|

Rest of World |

|

| 70,840 |

|

| 72,132 |

| (1,292) |

|

|

| 90.5 |

|

|

| 90.2 |

|

| 0.3 |

|

Precious Metals - Total |

|

| 335,442 |

|

| 366,612 |

| (31,170) |

|

| $ | 427.5 |

|

| $ | 460.6 |

| $ | (33.1) |

|

1 | Refer to Note 1 at the bottom of page 5 of this MD&A for the methodology for calculating GEOs, and, for illustrative purposes, to the average commodity price table on page 18 of this MD&A for indicative prices which may be used in the calculations of GEOs. |

Precious Metals

Revenue from precious metals assets was $427.5 million in YTD/2018 compared to $460.6 million in YTD/2017, reflecting a decrease of 8.5% in GEOs from precious metals assets, slightly offset by higher average gold prices. The decrease in GEOs during YTD/2018 was primarily due to the following assets:

· | Candelaria - The Company earned 46,519 GEOs from its Candelaria stream in YTD/2018, compared to 69,425 in YTD/2017. Although a decrease in production of precious metals was expected in 2018 based on planned processing of lower grade material, the impact on gold and silver production was greater than expected. YTD/2017 also includes 2,032 GEOs which had been delivered in 2016, but sold in Q1/2017. |

· | Guadalupe - The Guadalupe stream delivered 30,350 GEOs in YTD/2018, compared to 38,383 GEOs under the Palmarejo agreement, with 2017 being an exceptionally strong year of production for Guadalupe-Palmarejo. Production in YTD/2018 was also negatively affected by a temporary suspension of activities in September 2018. |

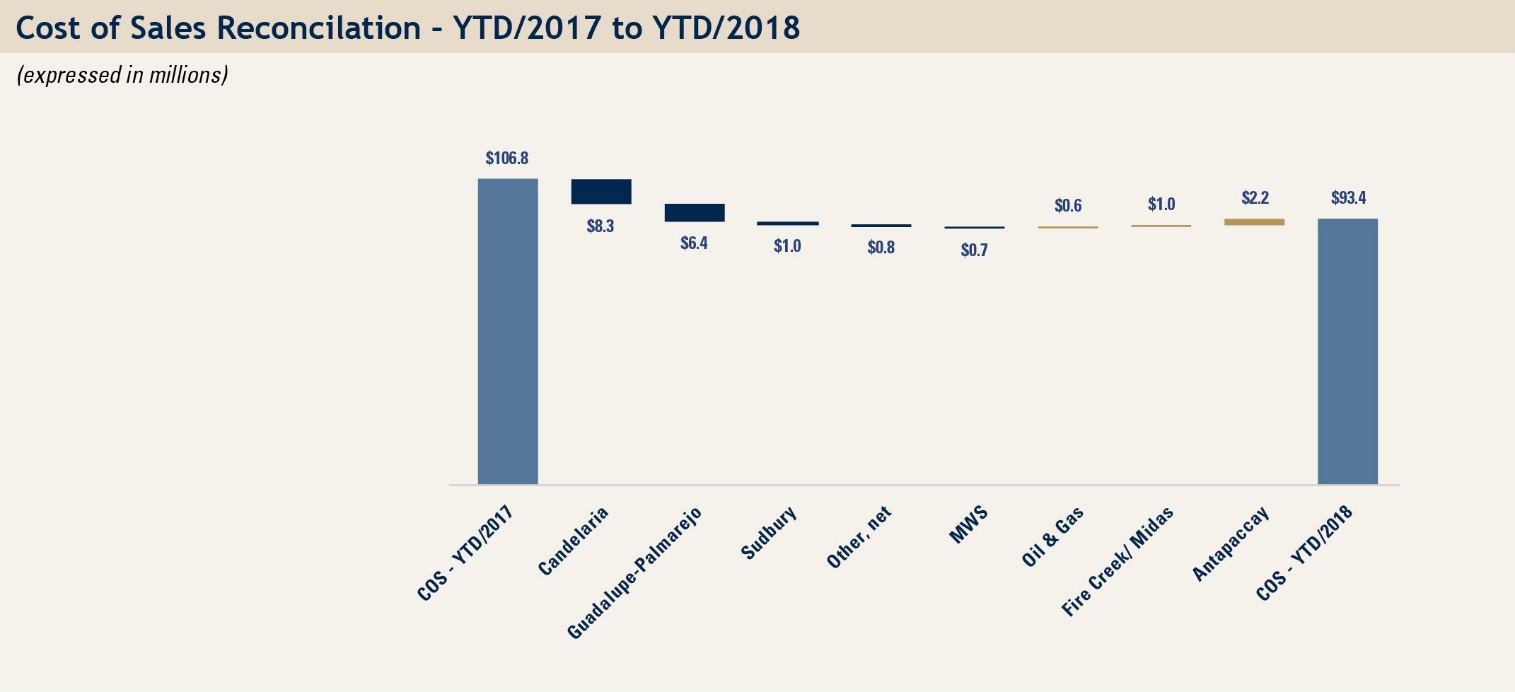

· | Antamina - The Company earned 31,674 GEOs from its Antamina silver stream, compared to 36,786 GEOs in YTD/2017, in-line with the 2018 life of mine plan. |