Acquisition of U.S. Oil & Gas Royalty Rights with Continental Resources, Inc. – SCOOP and STACK, Oklahoma, U.S.A.

Franco-Nevada recorded contributions to the Royalty Acquisition Venture of $2.5 million and $19.3 million in Q2/2020 and H1/2020, respectively (Q2/2019 and H1/2019 - $35.1 million and $86.5 million, respectively). Of this, $0.5 million was funded after quarter-end. As at June 30, 2020, the total cumulative investment in the Royalty Acquisition Venture by the Company totalled $395.5 million and Franco-Nevada has remaining commitments of up to $124.5 million to be funded in future periods. In the first half of the year, in order to account for weakness in the commodity price environment, Franco-Nevada and Continental Resources, Inc. (“Continental”) collectively agreed to reduce their capital funding commitments to the Royalty Acquisition Venture by approximately half for the 2020 fiscal year. Since that time, the pace of acquisition has been slower than anticipated and capital contributions for 2020 are now expected to total approximately $30 million to $40 million, with $19.3 million expensed in the first half of 2020. The reduced funding level will target lower prices for acquiring acreage, which will allow the Royalty Acquisition Venture to bolster the land base and provide a stronger platform for a potential future rebound in commodity prices and a resumption of development activity by Continental.

Financing

Credit Facilities

As at June 30, 2020, the Company had no amounts outstanding against its $1.0 billion unsecured revolving term credit facility (the “Corporate Revolver”). However, the Company has posted security in the form of standby letters of credit in the amount of $17.0 million (C$23.1 million) in connection with the audit by the Canada Revenue Agency (“CRA”) of its 2013–2015 taxation years. The standby letters of credit reduce the available balance under the Corporate Revolver.

On March 10, 2020, Franco-Nevada (Barbados) Corporation amended its $100.0 million unsecured revolving credit facility (the “FNBC Revolver”) to extend the term by an additional year to March 20, 2021. The amendment also provided a reduction in the applicable margins and standby fees, which depend on the Company’s leverage ratio. As at June 30, 2020, the Company had no amounts outstanding against the FNBC Revolver.

On February 14, 2020, the Company made full repayment of the $80.0 million it had outstanding at December 31, 2019 under its non-revolving credit facility (the “Corporate Term Loan”). The Corporate Term Loan is a non-revolving facility, and is therefore no longer available to draw.

At-the-Market Equity Program

On May 11, 2020, the Company established an at-the-market equity program (the “ATM Program”) permitting the Company to issue up to an aggregate of $300 million worth of common shares from treasury at prevailing market prices to the public through the Toronto Stock Exchange, the New York Stock Exchange or any other marketplace on which the common shares are listed, quoted or otherwise trade. The Company’s previous at-the-market equity program established on July 19, 2019 that allowed the Company to issue up to $200 million worth of common shares was terminated on April 28, 2020.

In Q2/2020, the Company issued 474,900 common shares under the ATM Program at an average price per common share of $143.58. The gross proceeds from these issuances were $68.2 million, and the net proceeds were $66.8 million after deducting agent commission costs of $0.7 million and other share issuance costs of $0.7 million.

For H1/2020, the Company issued 909,900 common shares under the ATM Program as defined and the previous ATM program at an average price per common share of $125.54. The gross proceeds from these issuances were $114.2 million, and the net proceeds were $112.3 million after deducting agent commission costs of $1.1 million and other share issuance costs of $0.8 million.

Dividend Declaration

In Q2/2020, Franco-Nevada declared a quarterly dividend of $0.26 per share. The total dividend declared was $49.9 million, of which $39.8 million was paid in cash and $10.1 million was paid in common shares issued under the Company’s Dividend Reinvestment Plan (the “DRIP”). For H1/2020, dividends declared totaled $0.51 per share, or $97.0 million, of which $76.0 million was paid in cash and $21.0 million was paid in common shares under the DRIP.

Guidance

The following contains forward-looking statements. Reference should be made to the “Cautionary Statement on Forward-Looking Information” section at the end of this MD&A. For a description of material factors that could cause our actual results to differ materially from the forward-looking statements below, please see the “Cautionary Statement” and the “Risk Factors” section of our most recent Annual Information Form filed with the Canadian securities regulatory authorities on www.sedar.com and our most recent Form 40-F filed with the United States Securities and Exchange Commission on www.sec.gov.

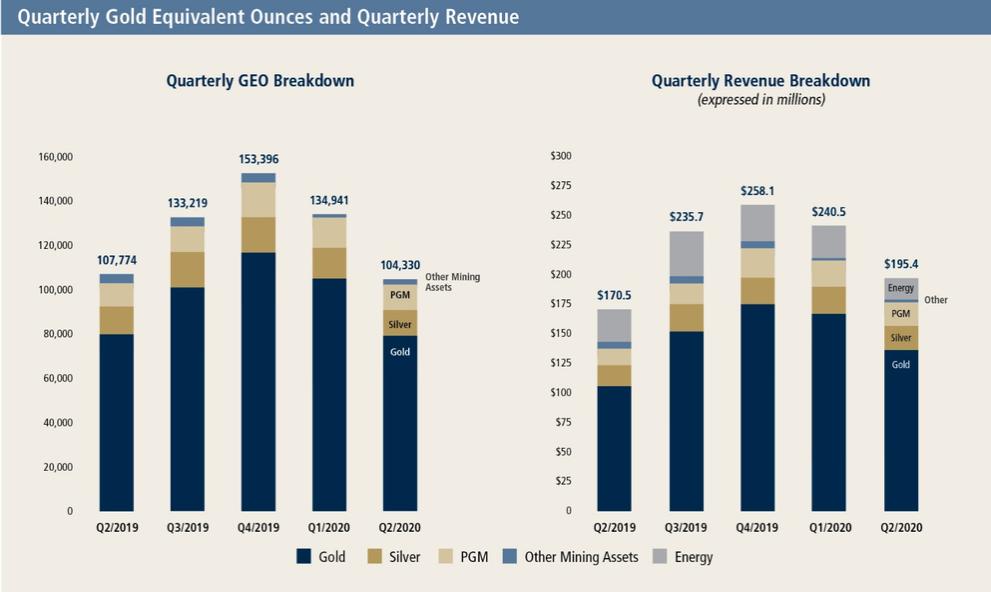

Franco-Nevada now expects attributable royalty and stream sales to total 475,000 to 505,000 GEOs from its mining assets and revenue of $60 to $75 million from its energy assets in 2020. For this updated guidance, silver, platinum and palladium metals have been converted to GEOs using assumed commodity prices of $1,800/oz Au, $20.00/oz Ag, $900/oz Pt and $2,200/oz Pd. The WTI oil price and Henry Hub natural gas price are assumed to average $40 per barrel and $2.00 per mcf, respectively. The 2020 guidance is based on public forecasts and other disclosures by the third-party owners and operators of our assets or our assessment thereof.