Corporate Developments

Acquisition of Vale Royalty Debentures – Brazil

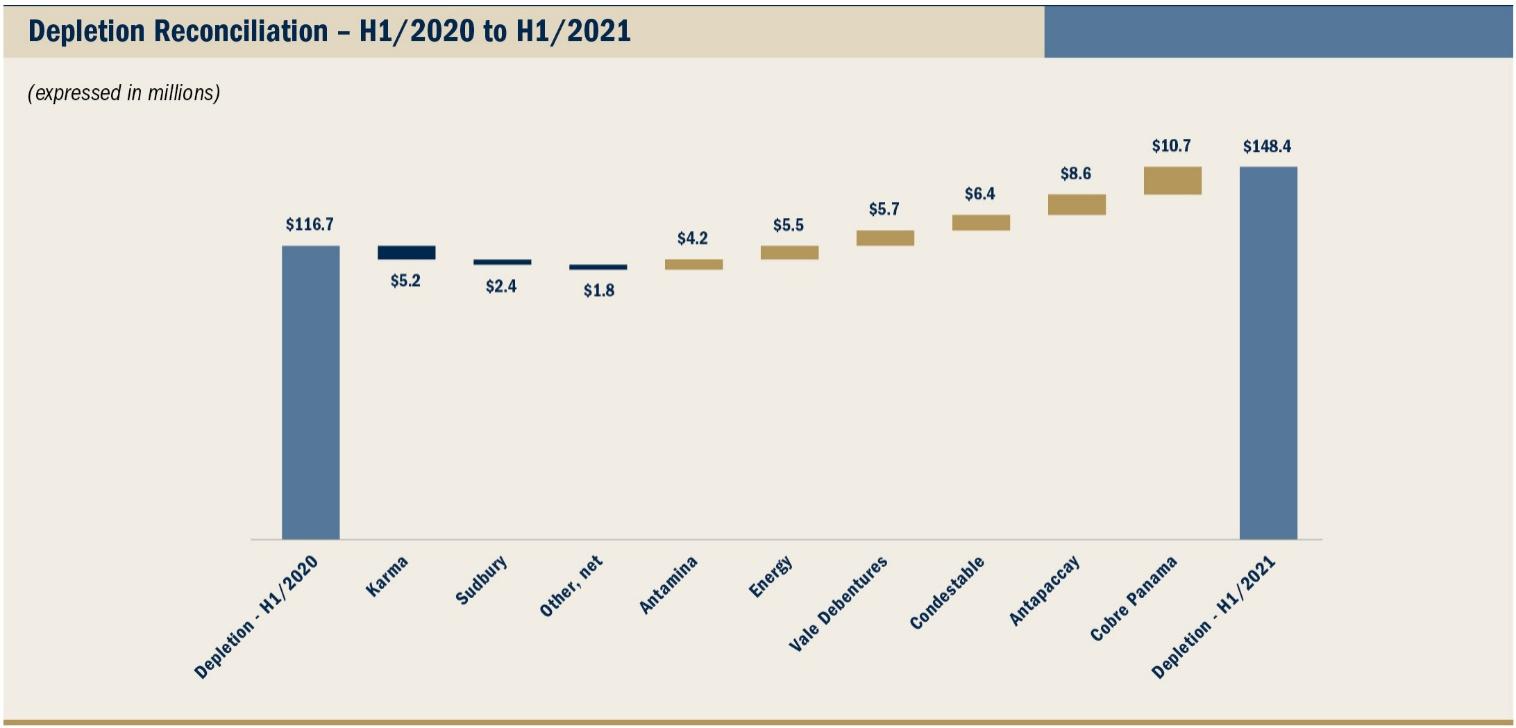

On April 16, 2021, the Company acquired 57 million of Vale S.A.’s (“Vale”) outstanding participating debentures (“Royalty Debentures”) for $538 million. The Royalty Debenture terms, on a 100% basis, provide for a 1.8% (0.264% attributable) net sales royalty on (i) iron ore sales from Vale’s Northern System, including the Serra Norte, Serra Sul and Serra Leste operations, and (ii) an estimated 70% of iron ore sales from Vale’s Southeastern System, in the medium term, including from the Itabira, Minas Centrais (Brucutu) and Mariana (Fazendão) mining complexes. The Southeastern System will start contributions under the Royalty Debentures once a cumulative sales threshold of 1.7 Bt of iron ore has been reached, forecast by Vale to be achieved during 2024. The Royalty Debentures also provide for a 2.5% (0.367% attributable) net sales royalty on certain copper and gold assets. The Royalty Debentures apply on a 50% basis (i.e. 1.25% of net sales, 0.183% attributable) to the Sossego mine. Additionally, the Royalty Debentures provide for a 1% (0.147% attributable) net sales royalty on all other minerals (covered mining rights include prospective deposits for other minerals including zinc and manganese, amongst others), subject to certain thresholds. The 1% royalty (0.147% attributable) also applies to proceeds in the event of an underlying asset sale.

Royalty payments are made on a semi-annual basis on March 31st and September 30th of each year reflecting sales in the preceding half calendar year period. Franco-Nevada has estimated its attributable royalty payment for the six-month period from January 1, 2021 to June 30, 2021 to be $28.0 million. This amount represents our accrual estimate for two quarters’ worth of royalty payments The first payment for the H1/2021 period will be payable to the Company on September 30, 2021.

The transaction was financed with a combination of cash on hand and a draw of $150.0 million on the Company’s $1 billion corporate revolving credit facility. Amounts borrowed were repaid as of June 30, 2021.

Investment in Labrador Iron Ore Royalty Corporation - Canada

Franco-Nevada has accumulated a 9.9% equity investment in Labrador Iron Ore Royalty Corporation (“LIORC”). The position was acquired over a number of years for a total investment of $74.2 million (C$93 million), representing an average cost of $11.72 (C$14.72) per share. The investment in LIORC functions similar to a royalty given the flow through of revenue generated from LIORC’s underlying 7% gross overriding royalty interest, C$0.10 per tonne commission, and 15.1% equity interest in Iron Ore Company of Canada’s (“IOC”) Carol Lake mine, operated by Rio Tinto. LIORC normally pays cash dividends from net income derived from IOC to the maximum extent possible, while maintaining appropriate levels of working capital. Dividends from LIORC received by Franco-Nevada are reflected in revenue from Other Mining Assets and included in the calculation of GEOs sold.

Acquisition of Séguéla Royalty – Côte d'Ivoire

On March 30, 2021, the Company acquired a 1.2% NSR on Roxgold Inc.’s (“Roxgold”) Séguéla gold project in Côte d'Ivoire for $15.2 million (A$20.0 million). The royalty agreement is subject to a buy-back at the option of Roxgold of up to 50% of the royalty at a pro rata portion of the purchase price for a period of up to three years after closing. In July 2021, Roxgold completed its business combination with Fortuna Silver Mines Inc.

Acquisition of Condestable Gold and Silver Stream – Peru

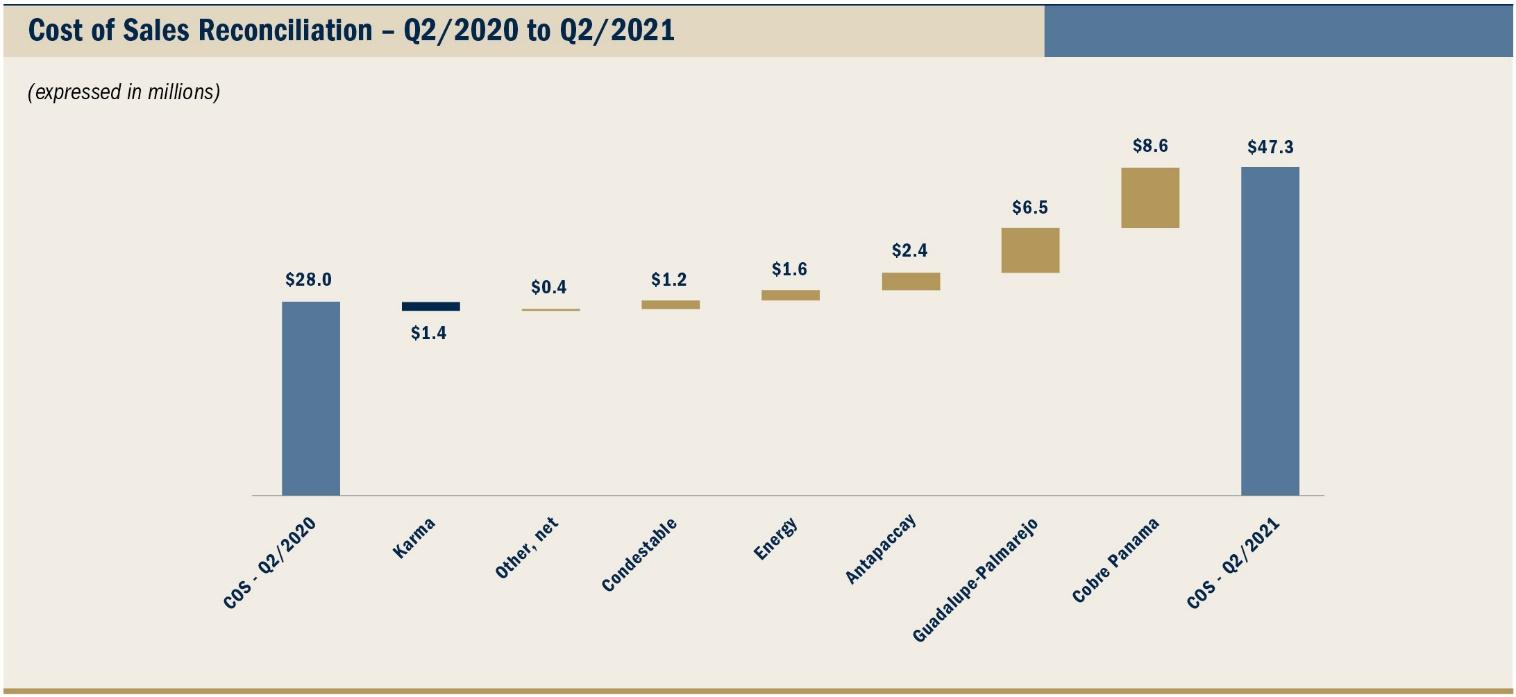

On March 8, 2021, the Company, through a wholly-owned subsidiary, closed a precious metals stream agreement with reference to the gold and silver production from the Condestable mine in Peru, for an up-front deposit of $165.0 million. The Condestable mine is located approximately 90 kilometers south of Lima, Peru and is owned and operated by a subsidiary of Southern Peaks Mining LP (“SPM”), a private company. Commencing on January 1, 2021 and ending December 31, 2025, Franco-Nevada will receive 8,760 ounces of gold and 291,000 ounces of silver annually until a total of 43,800 ounces of gold and 1,455,000 ounces of silver have been delivered (the “Fixed Deliveries”). Thereafter, Franco-Nevada will receive 63% of the contained gold and contained silver produced until a cumulative total of 87,600 ounces of gold and 2,910,000 ounces of silver have been delivered (the “Variable Phase 1 Deliveries”). The stream then reduces to 25% of gold and silver produced in concentrate over the remaining life of mine (the “Variable Phase 2 Deliveries”). Franco-Nevada will pay 20% of the spot price for gold and silver for each ounce delivered under the stream (the “Ongoing Payment”). The stream has an effective date of January 1, 2021, with the first quarterly delivery received March 15, 2021.

Until March 8, 2025, subject to certain restrictions, a subsidiary of SPM may, at its option, make a one-time special delivery comprising the number of ounces of refined gold equal to $118.8 million at the then current spot price subject to the Ongoing Payment, to achieve the early payment of the Fixed Deliveries and Variable Phase 1 Deliveries. The Variable Phase 2 Deliveries would commence immediately thereafter.

Acquisition of U.S. Oil & Gas Royalty Rights with Continental Resources, Inc.

The Company, through a wholly-owned subsidiary, has a strategic relationship with Continental Resources Inc. (“Continental”) to acquire, through a jointly-owned entity (the “Royalty Acquisition Venture”), royalty rights within Continental’s areas of operation. Franco-Nevada recorded contributions to the Royalty Acquisition Venture of $2.8 million and $4.1 million in Q2/2021 and H1/2021, respectively (Q2/2020 and H1/2020 – $2.5 million and $19.3 million, respectively). As at June 30, 2021, the cumulative investment in the Royalty Acquisition Venture by the Company totaled $410.1 million and Franco-Nevada has remaining commitments of up to $109.9 million, less than half of which is expected to be deployed in the remainder of 2021.