Funding of G Mining Ventures Term Loan for the Tocantinzinho Project – Brazil

On April 19, 2024, we funded a second and final advance of $33.0 million to G Mining Ventures pursuant to our term loan agreement in connection with the Tocantinzinho gold project (the “G Mining Ventures Term Loan”). Together with the initial advance of $42.0 million on January 29, 2024, we have now met our total commitment of $75.0 million under the G Mining Ventures Term Loan.

The G Mining Ventures Term Loan is a 6-year term loan, which bears interest at a rate of 3-Month SOFR +5.75% per annum, reducing to 3-Month SOFR +4.75% per annum after completion tests have been achieved at the Tocantinzinho project. Interest earned on the G Mining Ventures Term Loan is included within interest revenue for the three and six months ended June 30, 2024.

Acquisition of Royalty on Claims in the Stewart Mining Camp and Private Placement with Scottie Resources Corp. – British Columbia, Canada

On April 15, 2024, we acquired a 2.0% gross production royalty on all minerals produced on Scottie Resources Corp.’s (“Scottie”) claims in the Stewart Mining Camp in the Golden Triangle in British Columbia, Canada, for a purchase price of $5.9 million (C$8.1 million).

In addition, we acquired 5,422,994 common shares of Scottie at a price of C$0.18 per common share for an aggregate of $0.7 million (C$1.0 million), comprising the back-end of a non-brokered charity flow-through offering.

Receipt of Séguéla Royalty Buy-Back – Cote d’Ivoire

On March 30, 2024, Fortuna Mining Corp. (“Fortuna”) exercised its option to buy-back 0.6% of our initial 1.2% NSR on the Séguéla mine, such that our NSR on the Séguéla mine is now 0.6%. Fortuna paid Franco-Nevada $6.5 million (A$10 million) on April 1, 2024 for the exercise of the buy-back option.

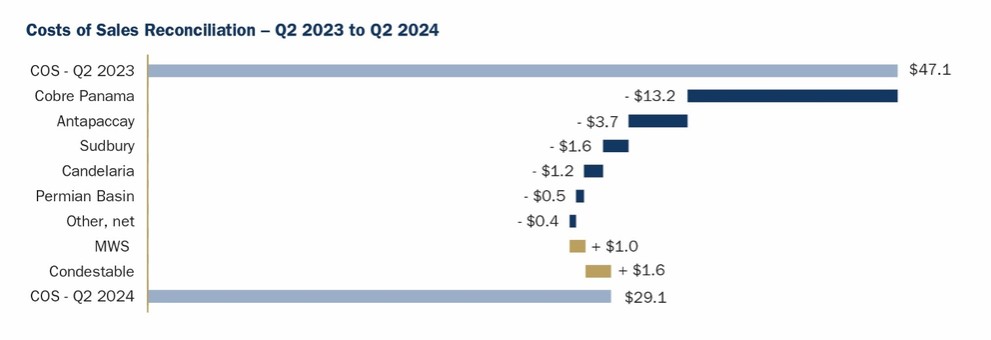

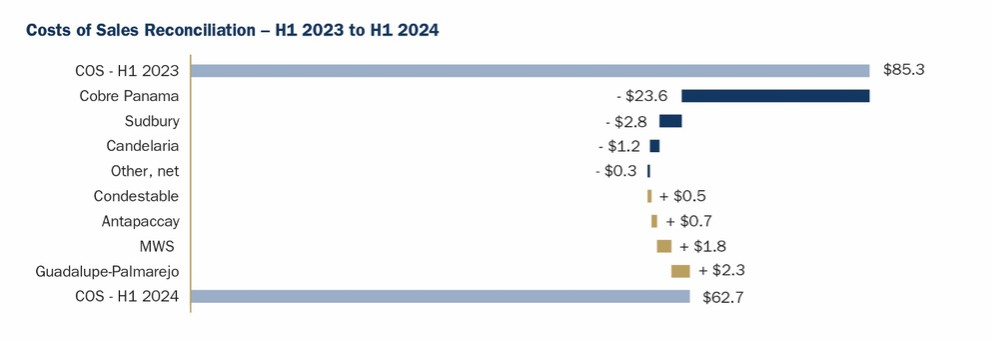

Amendment of Condestable Gold and Silver Stream – Peru

On March 27, 2024, we amended our precious metal stream agreement with reference to the gold and silver production from the Condestable mine in Peru, owned and operated by a subsidiary of Southern Peaks Mining LP, a private company, by advancing, through a wholly-owned subsidiary, an additional up-front deposit of $10.0 million for a total combined deposit of $175.0 million. Under the amended agreement, following the end of the fixed delivery period on December 31, 2025, Franco-Nevada will receive 63% of the gold and silver contained in concentrate until a cumulative total of 87,600 ounces of gold and 2,910,000 ounces of silver have been delivered (the “Variable Phase 1 Deliveries”), then 37.5% over the remaining life of the mine (the “Variable Phase 2 Deliveries”). The March 2024 amendment increased the Variable Phase 2 Deliveries from 25% to 37.5%.

Acquisition of Silver Royalty on Stibnite Gold Project – U.S.

On March 21, 2024, we acquired, through a wholly-owned subsidiary, a NSR interest covering all of the payable silver production from the Stibnite Gold project in Idaho, U.S, for a purchase price of $8.5 million.

Exercise of Option by EMX for an Effective NSR Interest on Caserones – Chile

On January 19, 2024, EMX exercised an option to acquire 0.0531% of our effective NSR on the Caserones mine for a price of $4.7 million, such that our effective NSR on Caserones is now 0.517%.

Acquisition of Royalties on Pascua-Lama Project – Chile

On January 3, 2024, we acquired, through a wholly-owned subsidiary, an additional interest in the Chilean portion of Barrick Gold Corporation’s Pascua-Lama project for a purchase price of $6.7 million. Including the interest we acquired in August 2023, at gold prices exceeding $800/ounce, we now hold a 2.941% NSR (gold) and a 0.588% NSR (copper) on the property.

Acquisition of Additional Natural Gas Royalty Interests in Haynesville – U.S.

On January 2, 2024, we closed, through wholly-owned subsidiaries, the acquisition of a royalty portfolio in the Haynesville gas play in Louisiana and Texas for a total purchase price of $125.0 million. We had funded an initial deposit of $12.5 million in November 2023 when we entered into the agreement. The remainder of the purchase price of $112.5 million was funded upon closing of the transaction in January 2024.

Acquisition of Mineral Rights with Continental Resources, Inc. – U.S.

Through a wholly-owned subsidiary, we have a strategic relationship with Continental Resources, Inc. (“Continental”) to acquire, through a jointly-owned entity (the “Royalty Acquisition Venture”), royalty rights within Continental’s areas of operation. Franco-Nevada recorded contributions to the Royalty Acquisition Venture of $5.3 million and $19.1 million for Q2 2024 and H1 2024, respectively (Q2 2023 and H1 2023 –$3.5 million and $5.9 million, respectively). As at June 30, 2024, Franco-Nevada’s cumulative investment in the Royalty Acquisition Venture totaled $469.3 million and Franco-Nevada has remaining commitments of up to $50.7 million.