Office Properties Income Trust Fourth Quarter 2024 Financial Results and Supplemental Information February 13, 2025 Richland, WA Exhibit 99.2

Q4 2024 2 Table of Contents QUARTERLY RESULTS Office Properties Income Trust Announces Fourth Quarter 2024 Financial Results ........................................................ 4 Fourth Quarter 2024 Highlights ................................................................................................................................................. 5 FINANCIALS Key Financial Data ......................................................................................................................................................................... 7 Consolidated Statements of Income (Loss) .............................................................................................................................. 8 Consolidated Balance Sheets ..................................................................................................................................................... 9 Debt Summary ............................................................................................................................................................................... 10 Debt Maturity Schedule ................................................................................................................................................................ 11 Leverage Ratios, Coverage Ratios and Public Debt Covenants ........................................................................................... 12 Capital Expenditures Summary .................................................................................................................................................. 13 Property Dispositions .................................................................................................................................................................... 14 Investment in Unconsolidated Joint Venture ........................................................................................................................... 15 PORTFOLIO INFORMATION Summary Same Property Results ................................................................................................................................................ 17 Occupancy and Leasing Summary ............................................................................................................................................. 18 Tenant Diversity and Credit Characteristics ............................................................................................................................. 19 Tenants Representing 1% or More of Total Annualized Rental Income ............................................................................. 20 Lease Expiration Schedule ........................................................................................................................................................... 21 APPENDIX Company Profile and Governance Information ....................................................................................................................... 23 Calculation and Reconciliation of NOI and Cash Basis NOI .................................................................................................. 24 Reconciliation and Calculation of Same Property NOI and Same Property Cash Basis NOI .......................................... 25 Property Details (by Collateral Pool) .......................................................................................................................................... 26 Calculation of EBITDA, EBITDAre and Adjusted EBITDAre .................................................................................................. 34 Calculation of FFO, Normalized FFO and CAD ....................................................................................................................... 35 Non-GAAP Financial Measures and Certain Definitions ........................................................................................................ 36 WARNING CONCERNING FORWARD-LOOKING STATEMENTS ....................................................................................................... 38 Trading Symbols: Common Shares: OPI Senior Unsecured Notes due 2050: OPINL Investor Relations Contact: Kevin Barry, Senior Director (617) 219-1410 kbarry@opireit.com ir@opireit.com Corporate Headquarters: Two Newton Place 255 Washington Street, Suite 300 Newton, Massachusetts 02458-1634 www.opireit.com All amounts in this presentation are unaudited. Unless otherwise noted, all data presented in this presentation excludes two properties, which are encumbered by a $50.0 million mortgage note, owned by an unconsolidated joint venture in which OPI owns a 51% interest. See page 15 for information regarding this joint venture and its related mortgage note. Please refer to Non-GAAP Financial Measures and Certain Definitions for terms used throughout this presentation.

Q4 2024 3RETURN TO TABLE OF CONTENTS Quarterly Results

Q4 2024 4RETURN TO TABLE OF CONTENTS OFFICE PROPERTIES INCOME TRUST ANNOUNCES FOURTH QUARTER 2024 FINANCIAL RESULTS "To end the year, we advanced our asset disposition and refinancing objectives by selling 17 office properties for approximately $114 million and closing a series of private debt exchanges addressing all of our 2025 debt maturities. During the fourth quarter, we completed 359,000 square feet of new and renewal leasing at a 24.3% roll-up in rent and a weighted average lease term of 7.1 years. Same- property portfolio occupancy grew to 89.4% while same property cash basis NOI increased 4.9% year over year. As we look ahead, we continue to face sector headwinds and pending debt maturities. Accordingly, we remain focused on tenant retention and attracting new tenants to our properties as well as evaluating strategies to address future debt maturities as we navigate liquidity concerns and debt covenant constraints. With respect to our pending debt maturities, we launched a new debt exchange offer last week, which invites participation by our 2026 holders in addition to our 2027 and 2031 debt holders.” Yael Duffy, President and Chief Operating Officer Newton, MA (February 13, 2025). Office Properties Income Trust (Nasdaq: OPI) today announced its financial results for the quarter ended December 31, 2024. Distribution OPI has declared a quarterly distribution on its common shares of $0.01 per share to shareholders of record as of the close of business on January 27, 2025. This distribution will be paid on or about February 20, 2025. Conference Call A conference call discussing OPI's fourth quarter results will be held on Friday, February 14, 2025 at 10:00 a.m. Eastern Time. The conference call may be accessed by dialing (877) 328-1172 or (412) 317-5418 (if calling from outside the United States and Canada); a pass code is not required. A replay will be available for one week by dialing (877) 344-7529; the replay pass code is 2499443. A live audio webcast of the conference call will also be available in a listen only mode on OPI’s website, at www.opireit.com. The archived webcast will be available for replay on OPI’s website after the call. The transcription, recording and retransmission in any way are strictly prohibited without the prior written consent of OPI. About Office Properties Income Trust OPI is a national REIT focused on owning and leasing office properties to high credit quality tenants in markets throughout the United States. As of December 31, 2024, approximately 58% of OPI's revenues were from investment grade rated tenants. OPI owned 128 properties as of December 31, 2024, with approximately 17.8 million square feet located in 29 states and Washington, D.C. In 2024, OPI was named as an Energy Star® Partner of the Year for the seventh consecutive year. OPI is managed by The RMR Group (Nasdaq: RMR), a leading U.S. alternative asset management company with over $40 billion in assets under management as of December 31, 2024, and more than 35 years of institutional experience in buying, selling, financing and operating commercial real estate. OPI is headquartered in Newton, MA. For more information, visit opireit.com.

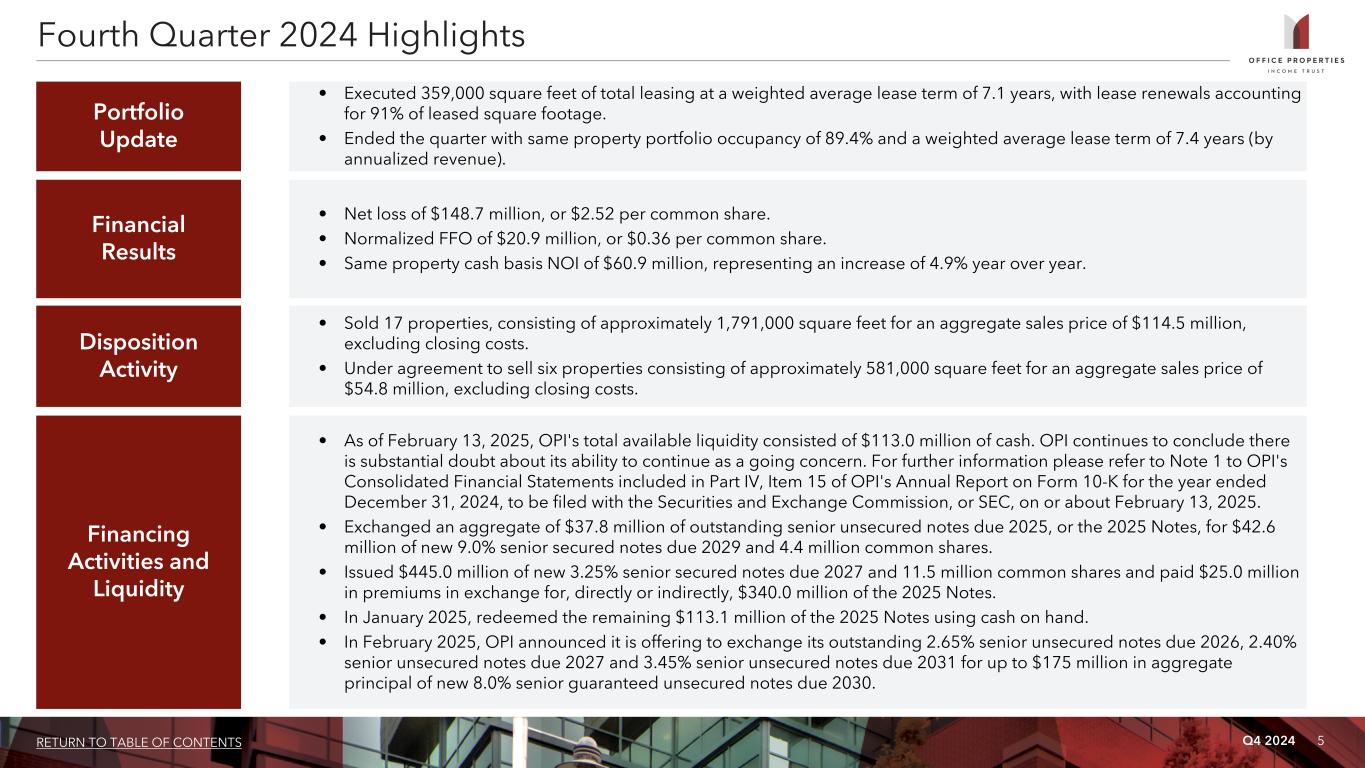

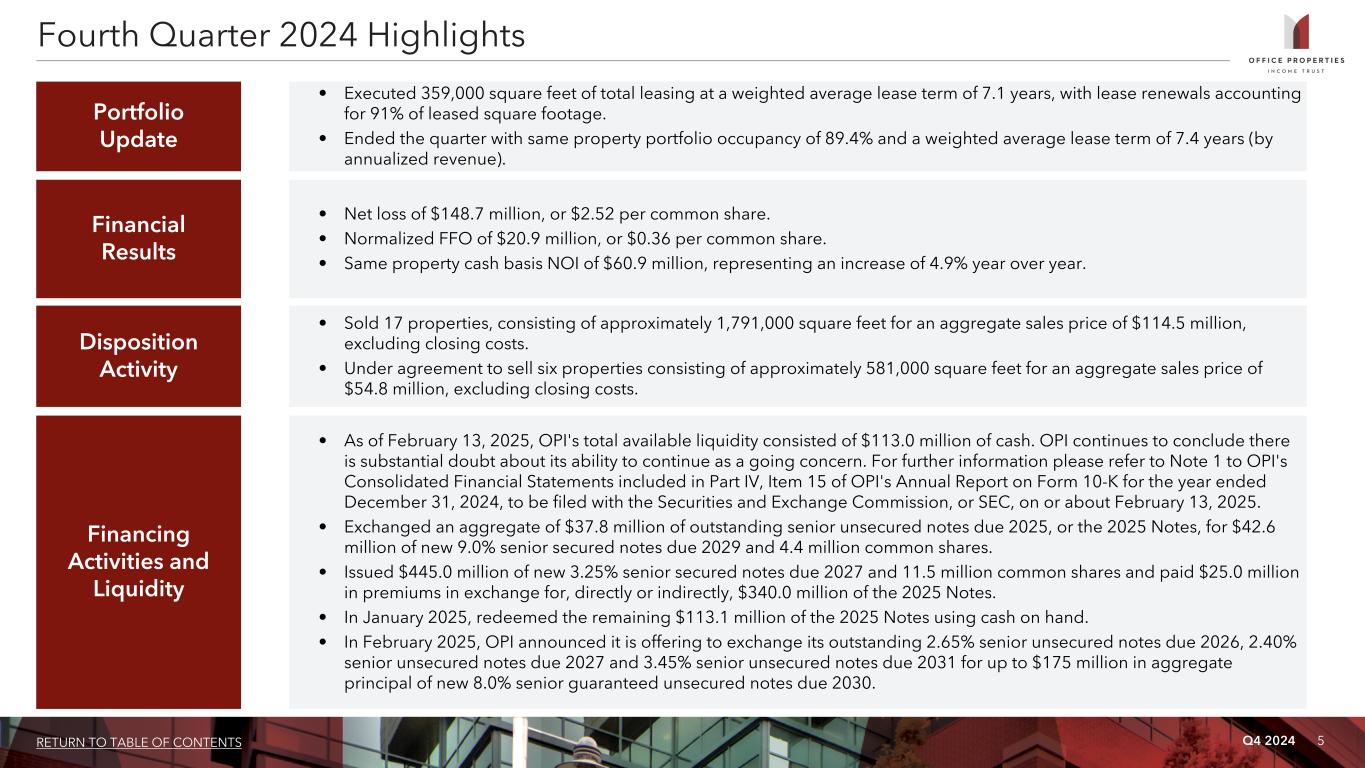

Q4 2024 5RETURN TO TABLE OF CONTENTS Fourth Quarter 2024 Highlights Portfolio Update • Executed 359,000 square feet of total leasing at a weighted average lease term of 7.1 years, with lease renewals accounting for 91% of leased square footage. • Ended the quarter with same property portfolio occupancy of 89.4% and a weighted average lease term of 7.4 years (by annualized revenue). Financial Results • Net loss of $148.7 million, or $2.52 per common share. • Normalized FFO of $20.9 million, or $0.36 per common share. • Same property cash basis NOI of $60.9 million, representing an increase of 4.9% year over year. Disposition Activity • Sold 17 properties, consisting of approximately 1,791,000 square feet for an aggregate sales price of $114.5 million, excluding closing costs. • Under agreement to sell six properties consisting of approximately 581,000 square feet for an aggregate sales price of $54.8 million, excluding closing costs. Financing Activities and Liquidity • As of February 13, 2025, OPI's total available liquidity consisted of $113.0 million of cash. OPI continues to conclude there is substantial doubt about its ability to continue as a going concern. For further information please refer to Note 1 to OPI's Consolidated Financial Statements included in Part IV, Item 15 of OPI's Annual Report on Form 10-K for the year ended December 31, 2024, to be filed with the Securities and Exchange Commission, or SEC, on or about February 13, 2025. • Exchanged an aggregate of $37.8 million of outstanding senior unsecured notes due 2025, or the 2025 Notes, for $42.6 million of new 9.0% senior secured notes due 2029 and 4.4 million common shares. • Issued $445.0 million of new 3.25% senior secured notes due 2027 and 11.5 million common shares and paid $25.0 million in premiums in exchange for, directly or indirectly, $340.0 million of the 2025 Notes. • In January 2025, redeemed the remaining $113.1 million of the 2025 Notes using cash on hand. • In February 2025, OPI announced it is offering to exchange its outstanding 2.65% senior unsecured notes due 2026, 2.40% senior unsecured notes due 2027 and 3.45% senior unsecured notes due 2031 for up to $175 million in aggregate principal of new 8.0% senior guaranteed unsecured notes due 2030.

Q4 2024 6RETURN TO TABLE OF CONTENTS Financials

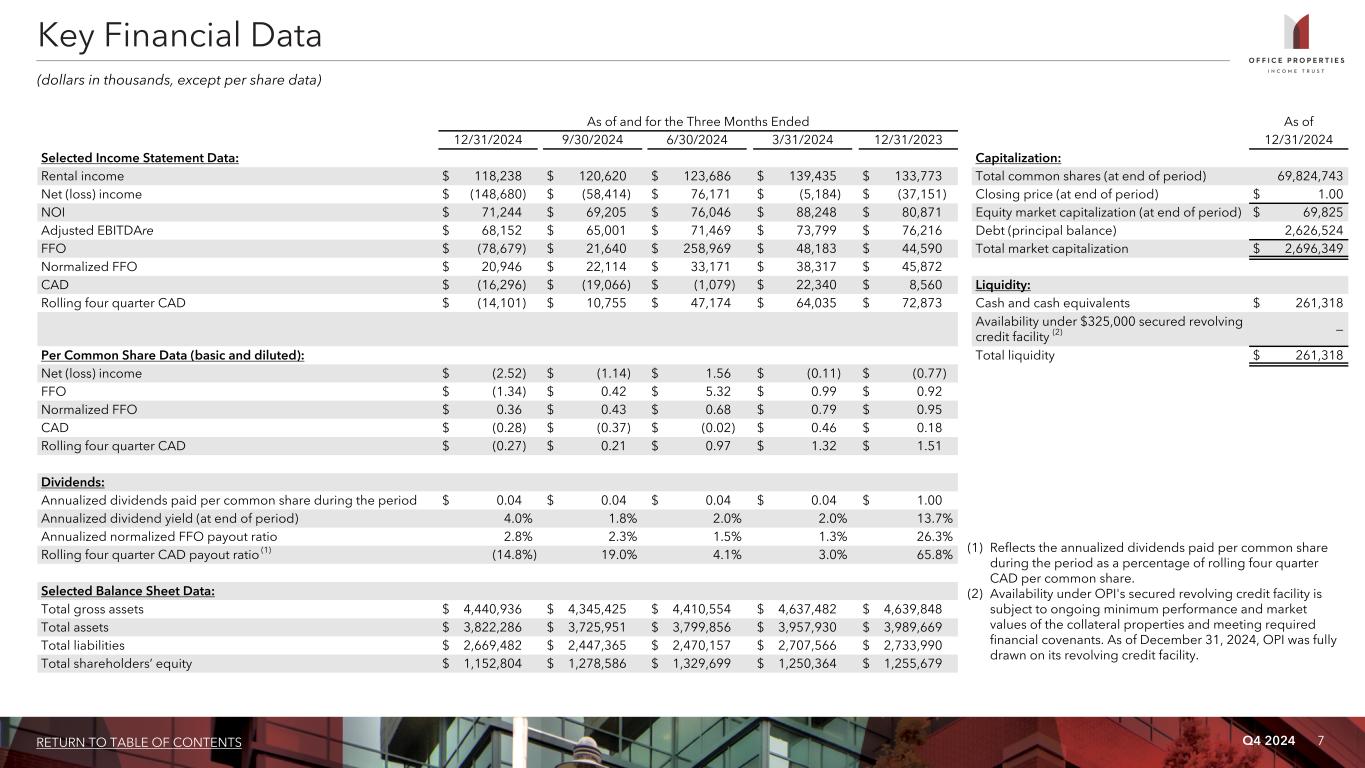

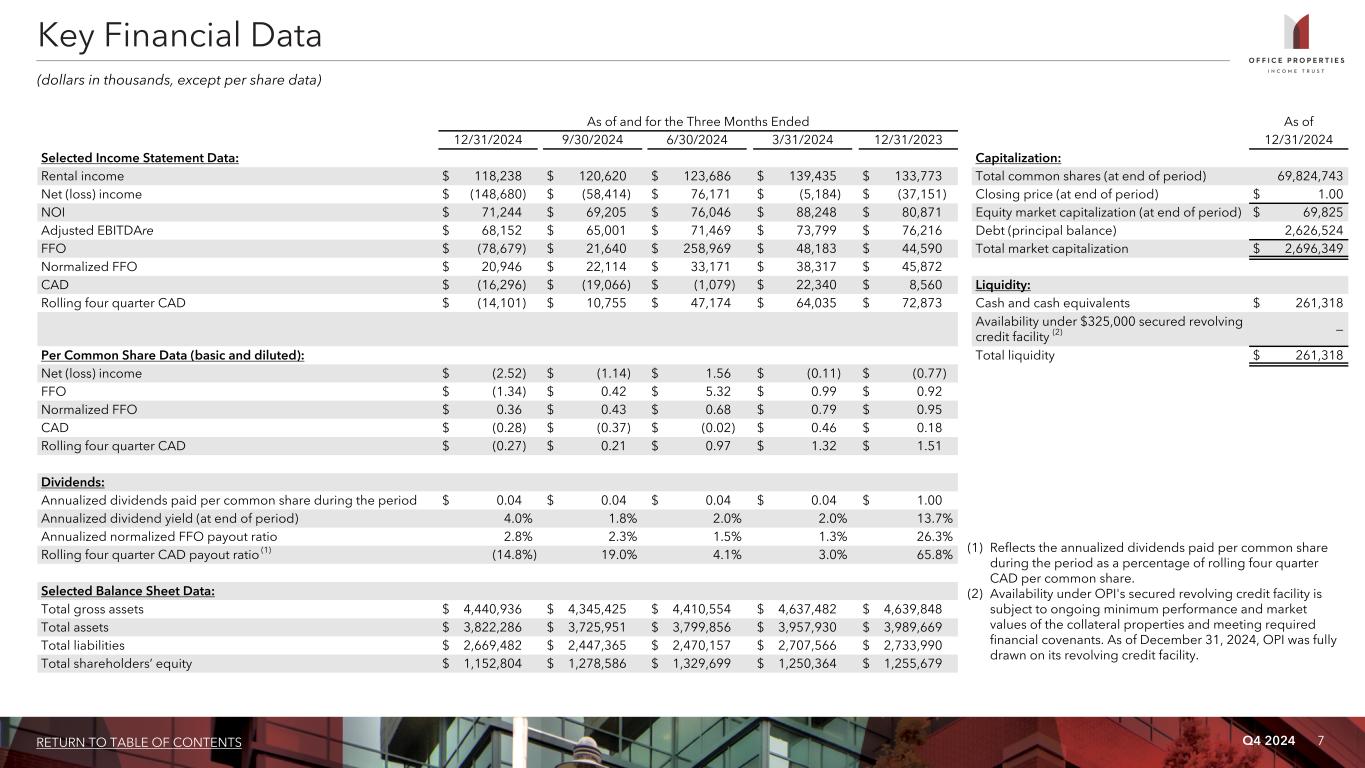

Q4 2024 7RETURN TO TABLE OF CONTENTS As of and for the Three Months Ended As of 12/31/2024 9/30/2024 6/30/2024 3/31/2024 12/31/2023 12/31/2024 Selected Income Statement Data: Capitalization: Rental income $ 118,238 $ 120,620 $ 123,686 $ 139,435 $ 133,773 Total common shares (at end of period) 69,824,743 Net (loss) income $ (148,680) $ (58,414) $ 76,171 $ (5,184) $ (37,151) Closing price (at end of period) $ 1.00 NOI $ 71,244 $ 69,205 $ 76,046 $ 88,248 $ 80,871 Equity market capitalization (at end of period) $ 69,825 Adjusted EBITDAre $ 68,152 $ 65,001 $ 71,469 $ 73,799 $ 76,216 Debt (principal balance) 2,626,524 FFO $ (78,679) $ 21,640 $ 258,969 $ 48,183 $ 44,590 Total market capitalization $ 2,696,349 Normalized FFO $ 20,946 $ 22,114 $ 33,171 $ 38,317 $ 45,872 CAD $ (16,296) $ (19,066) $ (1,079) $ 22,340 $ 8,560 Liquidity: Rolling four quarter CAD $ (14,101) $ 10,755 $ 47,174 $ 64,035 $ 72,873 Cash and cash equivalents $ 261,318 Availability under $325,000 secured revolving credit facility (2) — Per Common Share Data (basic and diluted): Total liquidity $ 261,318 Net (loss) income $ (2.52) $ (1.14) $ 1.56 $ (0.11) $ (0.77) FFO $ (1.34) $ 0.42 $ 5.32 $ 0.99 $ 0.92 Normalized FFO $ 0.36 $ 0.43 $ 0.68 $ 0.79 $ 0.95 CAD $ (0.28) $ (0.37) $ (0.02) $ 0.46 $ 0.18 Rolling four quarter CAD $ (0.27) $ 0.21 $ 0.97 $ 1.32 $ 1.51 Dividends: Annualized dividends paid per common share during the period $ 0.04 $ 0.04 $ 0.04 $ 0.04 $ 1.00 Annualized dividend yield (at end of period) 4.0% 1.8% 2.0% 2.0% 13.7% Annualized normalized FFO payout ratio 2.8% 2.3% 1.5% 1.3% 26.3% Rolling four quarter CAD payout ratio (1) (14.8%) 19.0% 4.1% 3.0% 65.8% Selected Balance Sheet Data: Total gross assets $ 4,440,936 $ 4,345,425 $ 4,410,554 $ 4,637,482 $ 4,639,848 Total assets $ 3,822,286 $ 3,725,951 $ 3,799,856 $ 3,957,930 $ 3,989,669 Total liabilities $ 2,669,482 $ 2,447,365 $ 2,470,157 $ 2,707,566 $ 2,733,990 Total shareholders’ equity $ 1,152,804 $ 1,278,586 $ 1,329,699 $ 1,250,364 $ 1,255,679 (dollars in thousands, except per share data) Key Financial Data (1) Reflects the annualized dividends paid per common share during the period as a percentage of rolling four quarter CAD per common share. (2) Availability under OPI's secured revolving credit facility is subject to ongoing minimum performance and market values of the collateral properties and meeting required financial covenants. As of December 31, 2024, OPI was fully drawn on its revolving credit facility.

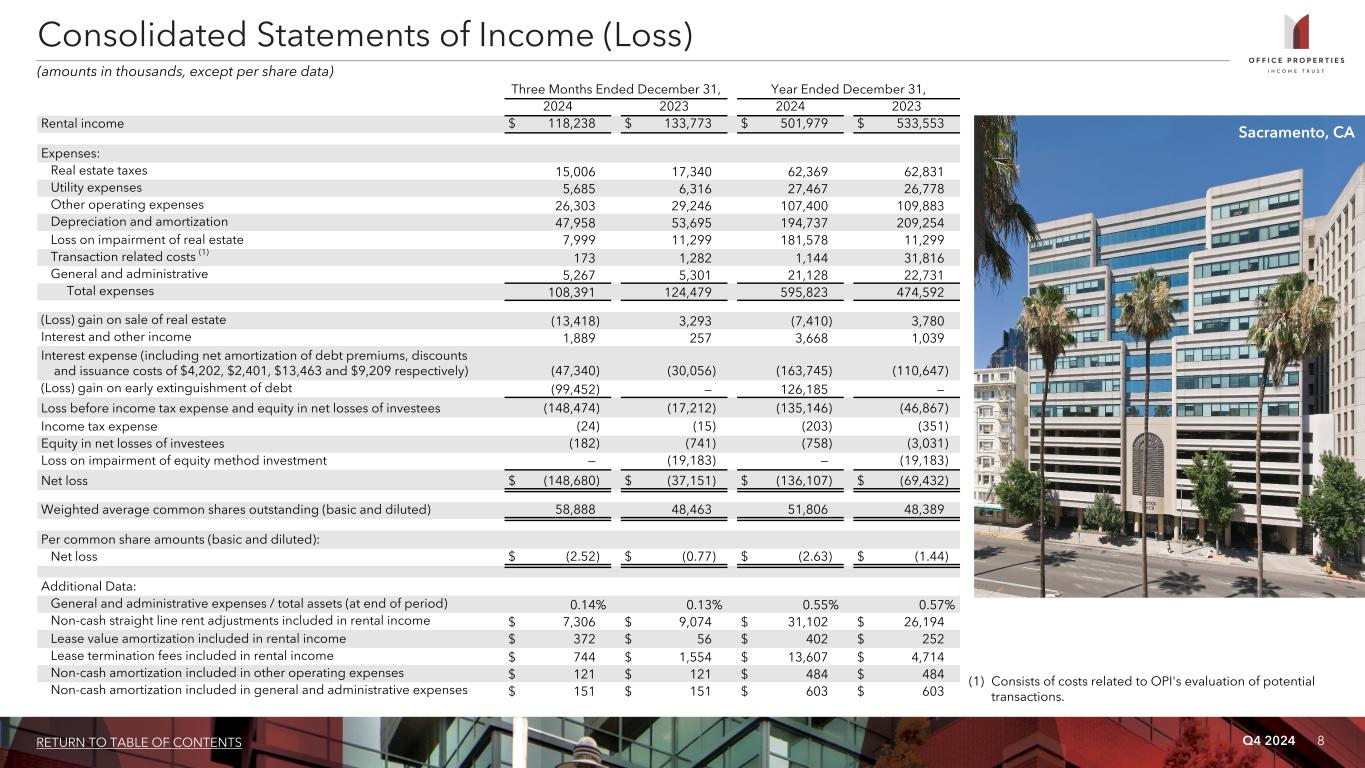

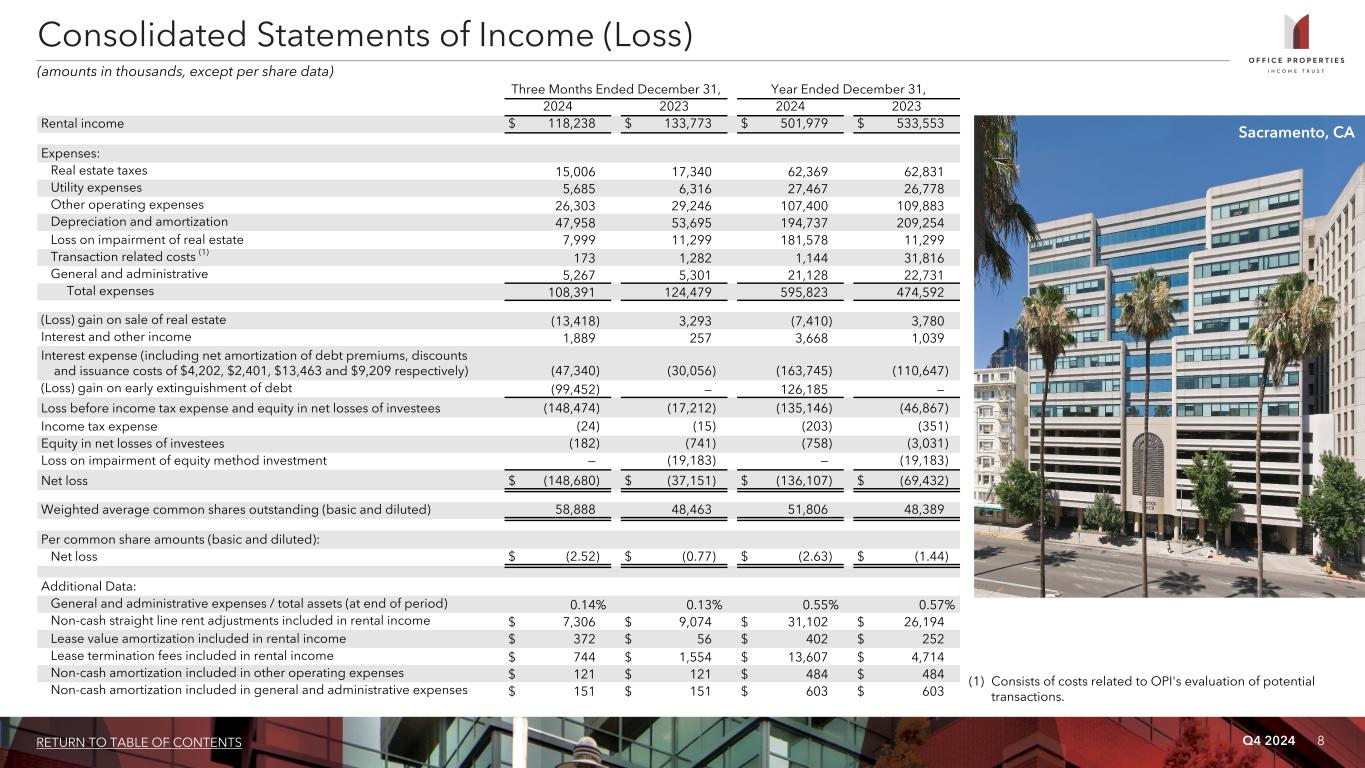

Q4 2024 8RETURN TO TABLE OF CONTENTS Three Months Ended December 31, Year Ended December 31, 2024 2023 2024 2023 Rental income $ 118,238 $ 133,773 $ 501,979 $ 533,553 Expenses: Real estate taxes 15,006 17,340 62,369 62,831 Utility expenses 5,685 6,316 27,467 26,778 Other operating expenses 26,303 29,246 107,400 109,883 Depreciation and amortization 47,958 53,695 194,737 209,254 Loss on impairment of real estate 7,999 11,299 181,578 11,299 Transaction related costs (1) 173 1,282 1,144 31,816 General and administrative 5,267 5,301 21,128 22,731 Total expenses 108,391 124,479 595,823 474,592 (Loss) gain on sale of real estate (13,418) 3,293 (7,410) 3,780 Interest and other income 1,889 257 3,668 1,039 Interest expense (including net amortization of debt premiums, discounts and issuance costs of $4,202, $2,401, $13,463 and $9,209 respectively) (47,340) (30,056) (163,745) (110,647) (Loss) gain on early extinguishment of debt (99,452) — 126,185 — Loss before income tax expense and equity in net losses of investees (148,474) (17,212) (135,146) (46,867) Income tax expense (24) (15) (203) (351) Equity in net losses of investees (182) (741) (758) (3,031) Loss on impairment of equity method investment — (19,183) — (19,183) Net loss $ (148,680) $ (37,151) $ (136,107) $ (69,432) Weighted average common shares outstanding (basic and diluted) 58,888 48,463 51,806 48,389 Per common share amounts (basic and diluted): Net loss $ (2.52) $ (0.77) $ (2.63) $ (1.44) Additional Data: General and administrative expenses / total assets (at end of period) 0.14% 0.13% 0.55% 0.57% Non-cash straight line rent adjustments included in rental income $ 7,306 $ 9,074 $ 31,102 $ 26,194 Lease value amortization included in rental income $ 372 $ 56 $ 402 $ 252 Lease termination fees included in rental income $ 744 $ 1,554 $ 13,607 $ 4,714 Non-cash amortization included in other operating expenses $ 121 $ 121 $ 484 $ 484 Non-cash amortization included in general and administrative expenses $ 151 $ 151 $ 603 $ 603 (amounts in thousands, except per share data) (1) Consists of costs related to OPI's evaluation of potential transactions. Consolidated Statements of Income (Loss) Sacramento, CA

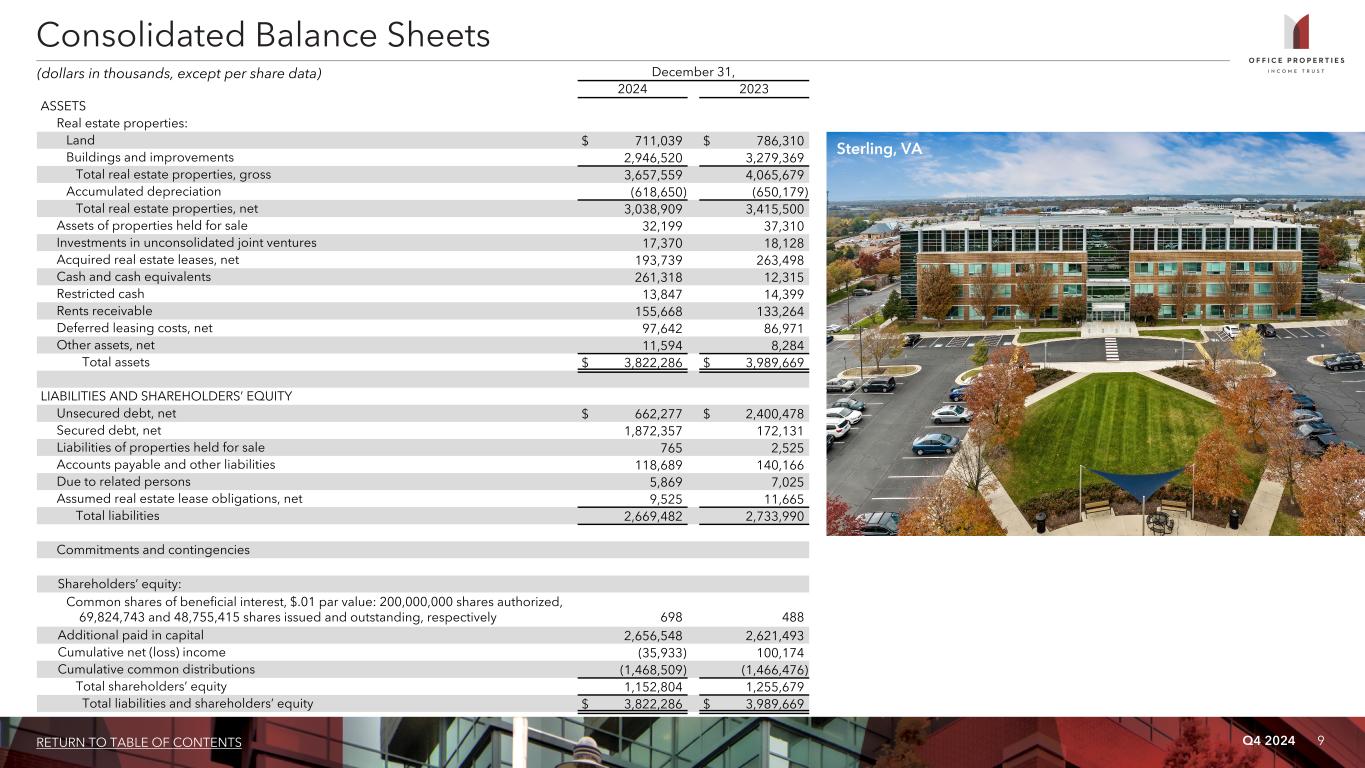

Q4 2024 9RETURN TO TABLE OF CONTENTS December 31, 2024 2023 ASSETS Real estate properties: Land $ 711,039 $ 786,310 Buildings and improvements 2,946,520 3,279,369 Total real estate properties, gross 3,657,559 4,065,679 Accumulated depreciation (618,650) (650,179) Total real estate properties, net 3,038,909 3,415,500 Assets of properties held for sale 32,199 37,310 Investments in unconsolidated joint ventures 17,370 18,128 Acquired real estate leases, net 193,739 263,498 Cash and cash equivalents 261,318 12,315 Restricted cash 13,847 14,399 Rents receivable 155,668 133,264 Deferred leasing costs, net 97,642 86,971 Other assets, net 11,594 8,284 Total assets $ 3,822,286 $ 3,989,669 LIABILITIES AND SHAREHOLDERS’ EQUITY Unsecured debt, net $ 662,277 $ 2,400,478 Secured debt, net 1,872,357 172,131 Liabilities of properties held for sale 765 2,525 Accounts payable and other liabilities 118,689 140,166 Due to related persons 5,869 7,025 Assumed real estate lease obligations, net 9,525 11,665 Total liabilities 2,669,482 2,733,990 Commitments and contingencies Shareholders’ equity: Common shares of beneficial interest, $.01 par value: 200,000,000 shares authorized, 69,824,743 and 48,755,415 shares issued and outstanding, respectively 698 488 Additional paid in capital 2,656,548 2,621,493 Cumulative net (loss) income (35,933) 100,174 Cumulative common distributions (1,468,509) (1,466,476) Total shareholders’ equity 1,152,804 1,255,679 Total liabilities and shareholders’ equity $ 3,822,286 $ 3,989,669 Consolidated Balance Sheets (dollars in thousands, except per share data) Sterling, VA

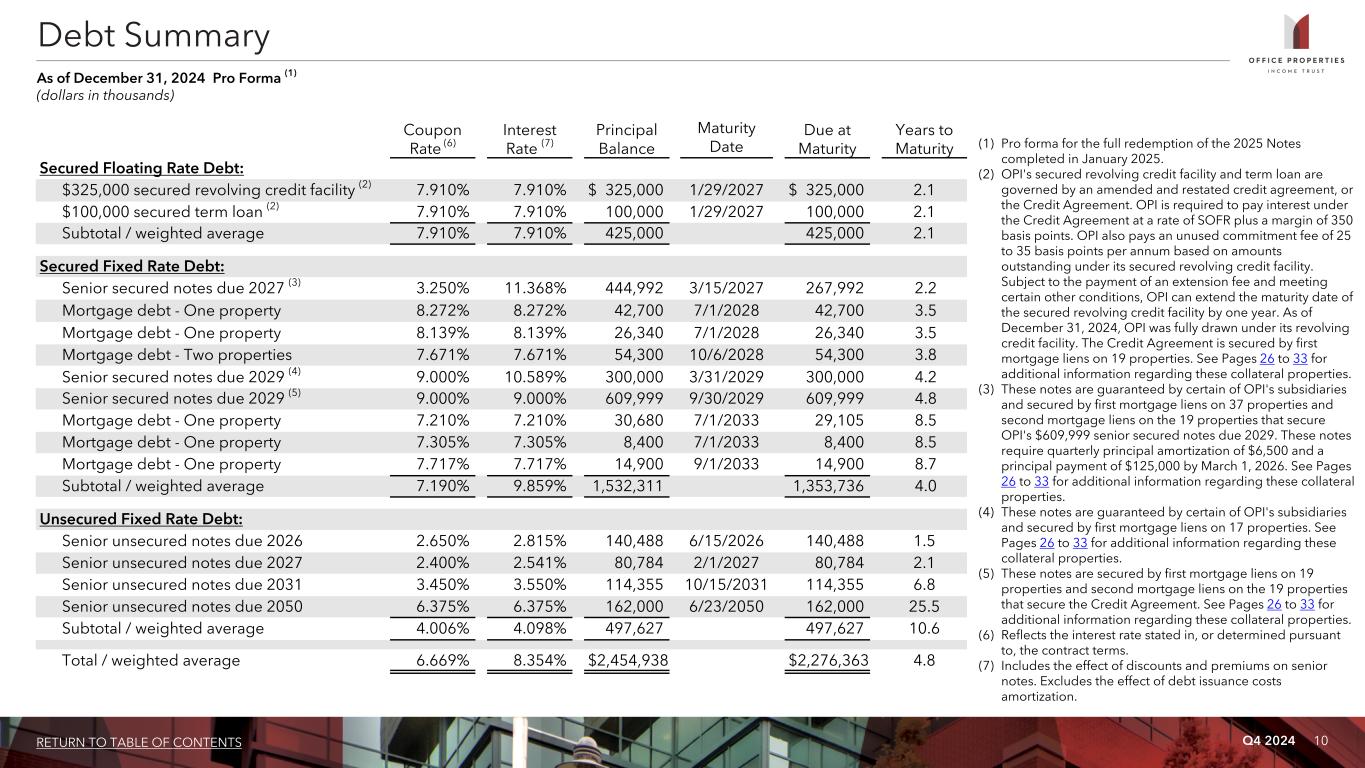

Q4 2024 10RETURN TO TABLE OF CONTENTS Coupon Rate (6) Interest Rate (7) Principal Balance Maturity Date Due at Maturity Years to Maturity Secured Floating Rate Debt: $325,000 secured revolving credit facility (2) 7.910% 7.910% $ 325,000 1/29/2027 $ 325,000 2.1 $100,000 secured term loan (2) 7.910% 7.910% 100,000 1/29/2027 100,000 2.1 Subtotal / weighted average 7.910% 7.910% 425,000 425,000 2.1 Secured Fixed Rate Debt: Senior secured notes due 2027 (3) 3.250% 11.368% 444,992 3/15/2027 267,992 2.2 Mortgage debt - One property 8.272% 8.272% 42,700 7/1/2028 42,700 3.5 Mortgage debt - One property 8.139% 8.139% 26,340 7/1/2028 26,340 3.5 Mortgage debt - Two properties 7.671% 7.671% 54,300 10/6/2028 54,300 3.8 Senior secured notes due 2029 (4) 9.000% 10.589% 300,000 3/31/2029 300,000 4.2 Senior secured notes due 2029 (5) 9.000% 9.000% 609,999 9/30/2029 609,999 4.8 Mortgage debt - One property 7.210% 7.210% 30,680 7/1/2033 29,105 8.5 Mortgage debt - One property 7.305% 7.305% 8,400 7/1/2033 8,400 8.5 Mortgage debt - One property 7.717% 7.717% 14,900 9/1/2033 14,900 8.7 Subtotal / weighted average 7.190% 9.859% 1,532,311 1,353,736 4.0 Unsecured Fixed Rate Debt: Senior unsecured notes due 2026 2.650% 2.815% 140,488 6/15/2026 140,488 1.5 Senior unsecured notes due 2027 2.400% 2.541% 80,784 2/1/2027 80,784 2.1 Senior unsecured notes due 2031 3.450% 3.550% 114,355 10/15/2031 114,355 6.8 Senior unsecured notes due 2050 6.375% 6.375% 162,000 6/23/2050 162,000 25.5 Subtotal / weighted average 4.006% 4.098% 497,627 497,627 10.6 Total / weighted average 6.669% 8.354% $ 2,454,938 $ 2,276,363 4.8 Debt Summary As of December 31, 2024 Pro Forma (1) (dollars in thousands) (1) Pro forma for the full redemption of the 2025 Notes completed in January 2025. (2) OPI's secured revolving credit facility and term loan are governed by an amended and restated credit agreement, or the Credit Agreement. OPI is required to pay interest under the Credit Agreement at a rate of SOFR plus a margin of 350 basis points. OPI also pays an unused commitment fee of 25 to 35 basis points per annum based on amounts outstanding under its secured revolving credit facility. Subject to the payment of an extension fee and meeting certain other conditions, OPI can extend the maturity date of the secured revolving credit facility by one year. As of December 31, 2024, OPI was fully drawn under its revolving credit facility. The Credit Agreement is secured by first mortgage liens on 19 properties. See Pages 26 to 33 for additional information regarding these collateral properties. (3) These notes are guaranteed by certain of OPI's subsidiaries and secured by first mortgage liens on 37 properties and second mortgage liens on the 19 properties that secure OPI's $609,999 senior secured notes due 2029. These notes require quarterly principal amortization of $6,500 and a principal payment of $125,000 by March 1, 2026. See Pages 26 to 33 for additional information regarding these collateral properties. (4) These notes are guaranteed by certain of OPI's subsidiaries and secured by first mortgage liens on 17 properties. See Pages 26 to 33 for additional information regarding these collateral properties. (5) These notes are secured by first mortgage liens on 19 properties and second mortgage liens on the 19 properties that secure the Credit Agreement. See Pages 26 to 33 for additional information regarding these collateral properties. (6) Reflects the interest rate stated in, or determined pursuant to, the contract terms. (7) Includes the effect of discounts and premiums on senior notes. Excludes the effect of debt issuance costs amortization.

Q4 2024 11RETURN TO TABLE OF CONTENTS $140,488 $80,784 $276,355 $425,000 $26,000 $151,000 $267,992 $123,487 $910,278 $53,554 Unsecured Fixed Rate Debt Secured Floating Rate Debt Secured Fixed Rate Debt 2025 2026 2027 2028 2029 2030 and thereafter 0 200,000 400,000 600,000 800,000 1,000,000 Debt Maturity Schedule As of December 31, 2024 Pro Forma (1) (dollars in thousands) Fixed vs. Variable Rate Debt Fixed 82.7% Variable 17.3% Secured vs. Unsecured Debt Unsecured 20.3% Secured 79.7% (1) See accompanying notes on previous page.

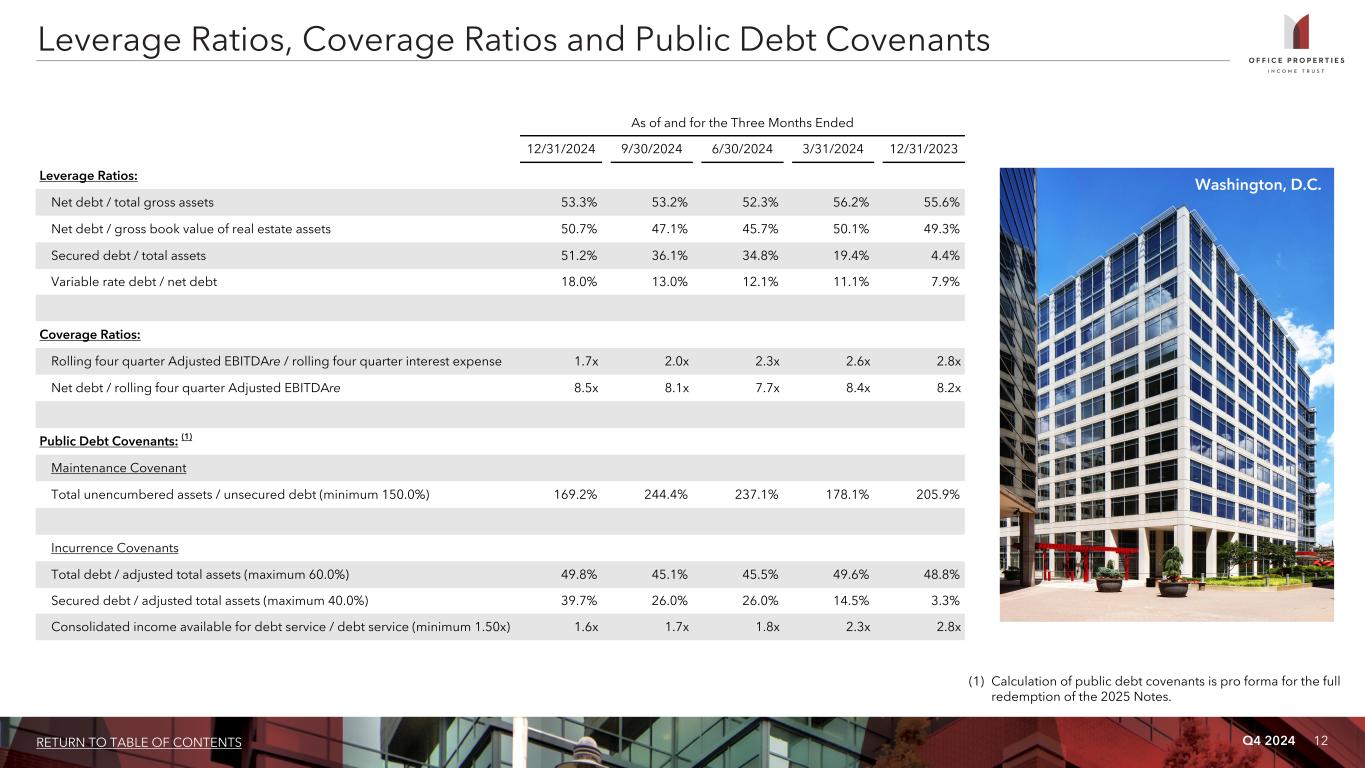

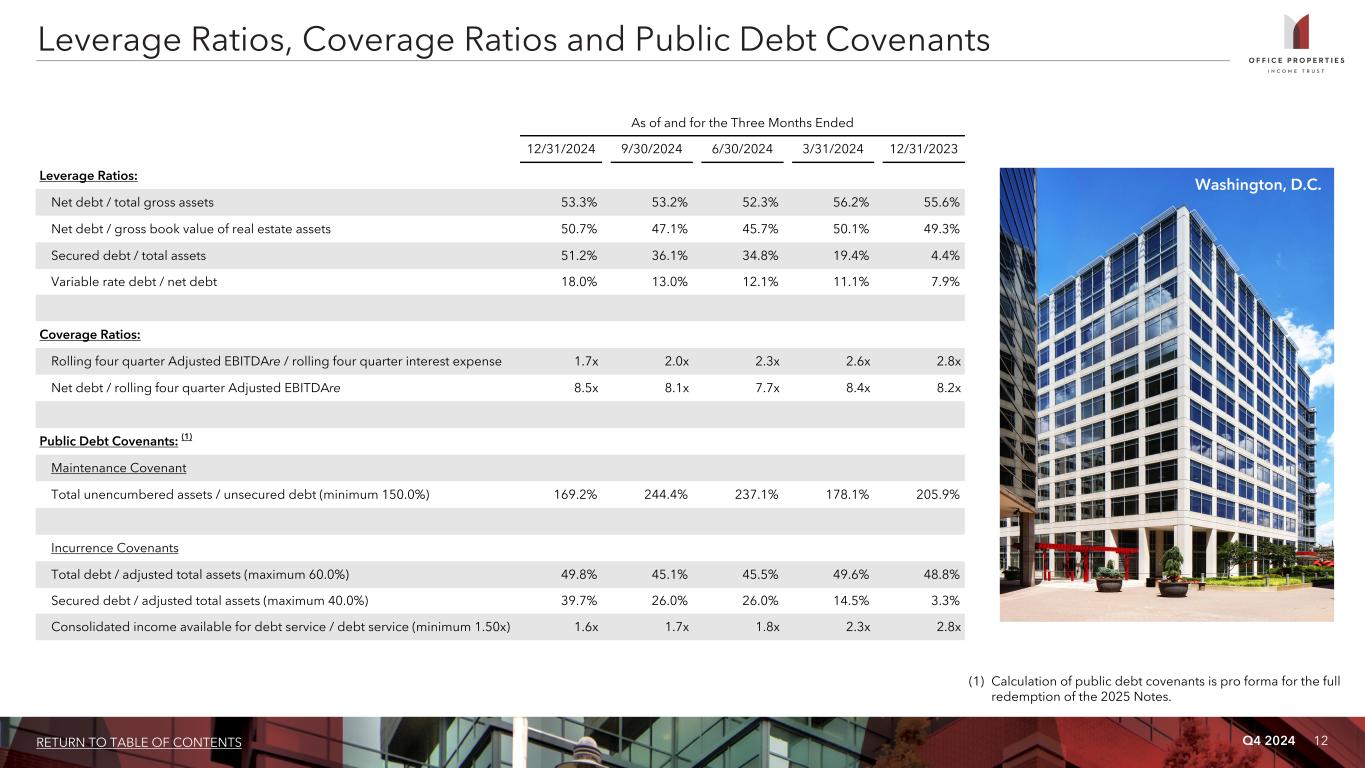

Q4 2024 12RETURN TO TABLE OF CONTENTS Leverage Ratios, Coverage Ratios and Public Debt Covenants As of and for the Three Months Ended 12/31/2024 9/30/2024 6/30/2024 3/31/2024 12/31/2023 Leverage Ratios: Net debt / total gross assets 53.3% 53.2% 52.3% 56.2% 55.6% Net debt / gross book value of real estate assets 50.7% 47.1% 45.7% 50.1% 49.3% Secured debt / total assets 51.2% 36.1% 34.8% 19.4% 4.4% Variable rate debt / net debt 18.0% 13.0% 12.1% 11.1% 7.9% Coverage Ratios: Rolling four quarter Adjusted EBITDAre / rolling four quarter interest expense 1.7x 2.0x 2.3x 2.6x 2.8x Net debt / rolling four quarter Adjusted EBITDAre 8.5x 8.1x 7.7x 8.4x 8.2x Public Debt Covenants: (1) Maintenance Covenant Total unencumbered assets / unsecured debt (minimum 150.0%) 169.2% 244.4% 237.1% 178.1% 205.9% Incurrence Covenants Total debt / adjusted total assets (maximum 60.0%) 49.8% 45.1% 45.5% 49.6% 48.8% Secured debt / adjusted total assets (maximum 40.0%) 39.7% 26.0% 26.0% 14.5% 3.3% Consolidated income available for debt service / debt service (minimum 1.50x) 1.6x 1.7x 1.8x 2.3x 2.8x Washington, D.C. (1) Calculation of public debt covenants is pro forma for the full redemption of the 2025 Notes.

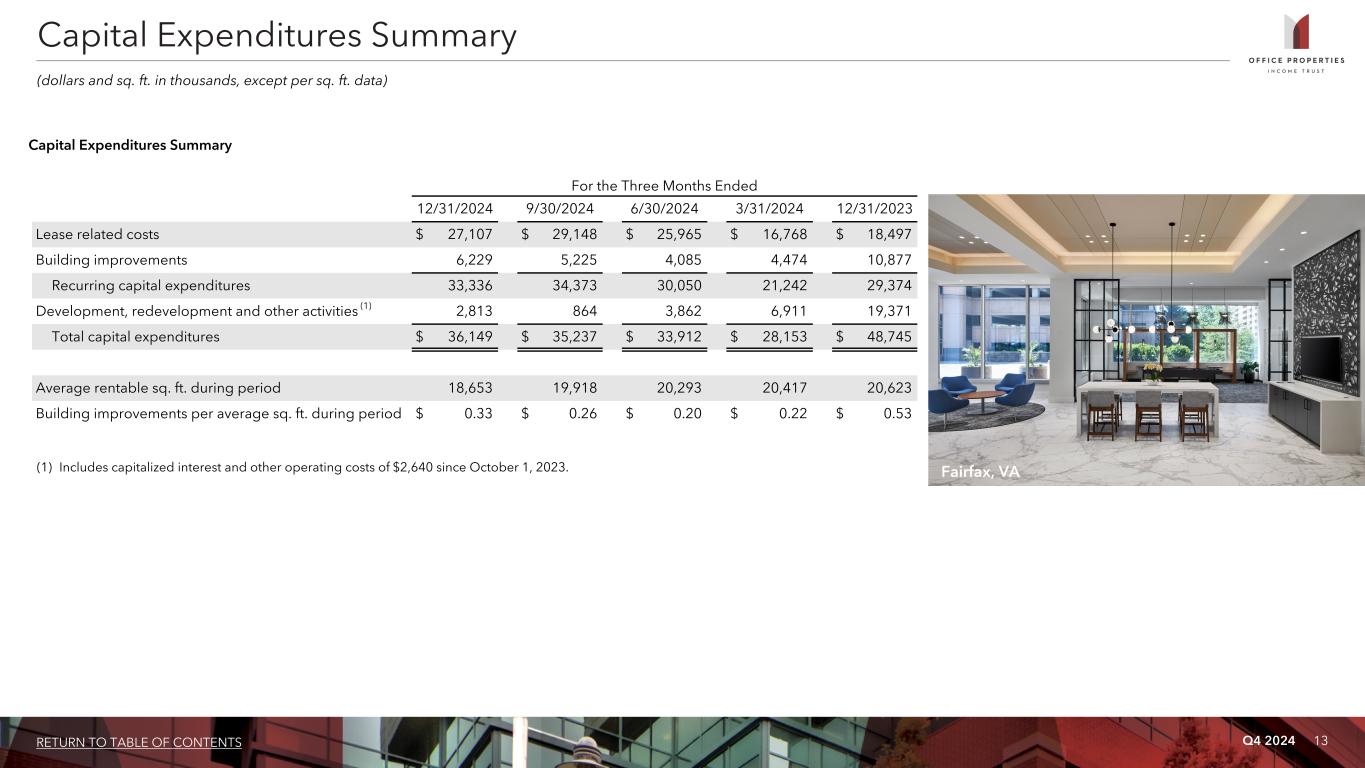

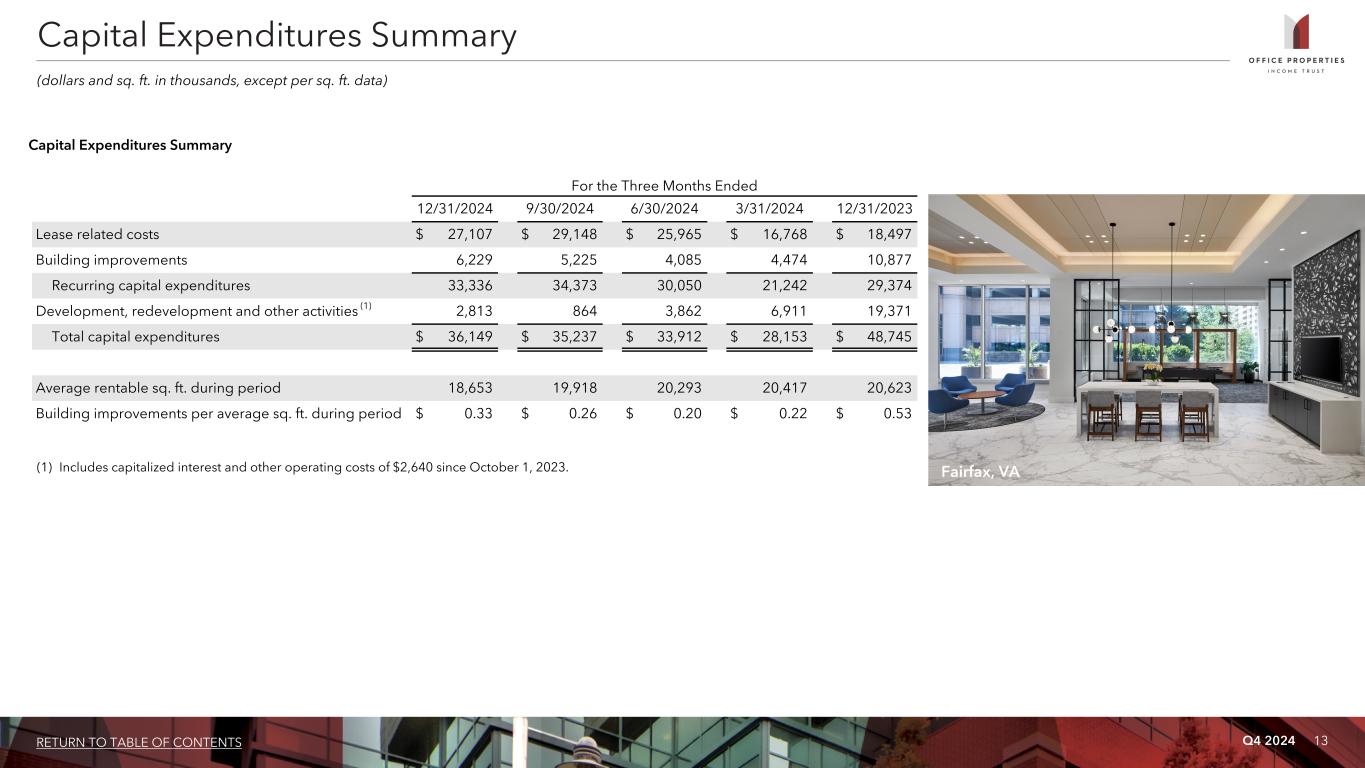

Q4 2024 13RETURN TO TABLE OF CONTENTS For the Three Months Ended 12/31/2024 9/30/2024 6/30/2024 3/31/2024 12/31/2023 Lease related costs $ 27,107 $ 29,148 $ 25,965 $ 16,768 $ 18,497 Building improvements 6,229 5,225 4,085 4,474 10,877 Recurring capital expenditures 33,336 34,373 30,050 21,242 29,374 Development, redevelopment and other activities (1) 2,813 864 3,862 6,911 19,371 Total capital expenditures $ 36,149 $ 35,237 $ 33,912 $ 28,153 $ 48,745 Average rentable sq. ft. during period 18,653 19,918 20,293 20,417 20,623 Building improvements per average sq. ft. during period $ 0.33 $ 0.26 $ 0.20 $ 0.22 $ 0.53 Capital Expenditures Summary (dollars and sq. ft. in thousands, except per sq. ft. data) (1) Includes capitalized interest and other operating costs of $2,640 since October 1, 2023. Capital Expenditures Summary Fairfax, VA

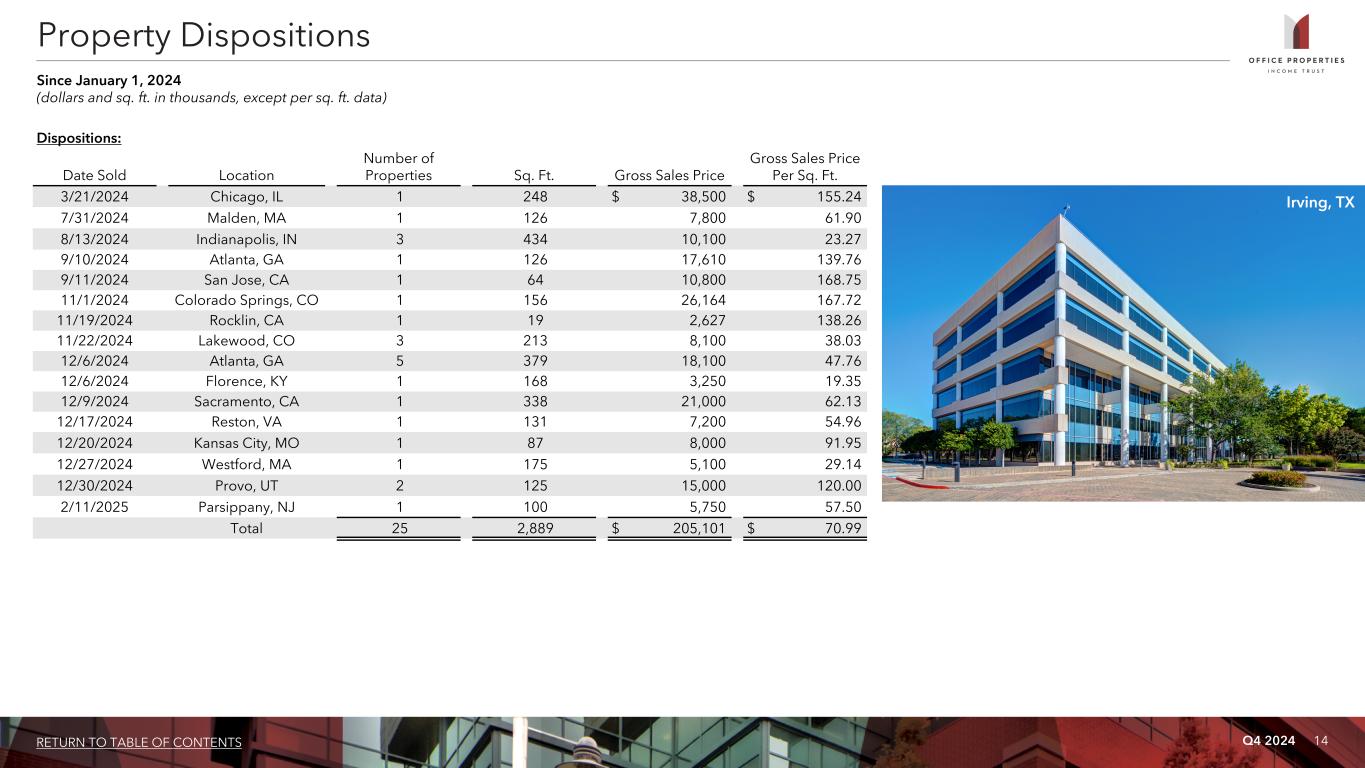

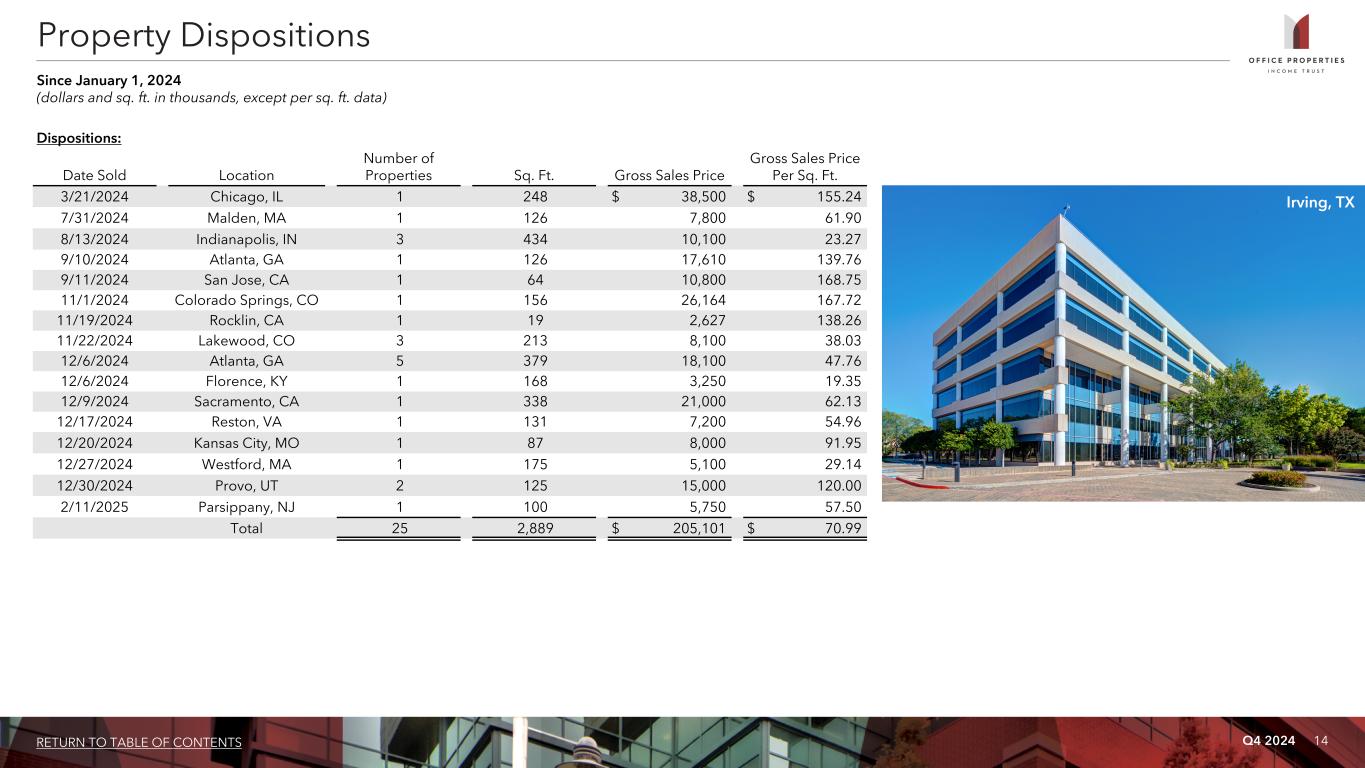

Q4 2024 14RETURN TO TABLE OF CONTENTS Dispositions: Date Sold Location Number of Properties Sq. Ft. Gross Sales Price Gross Sales Price Per Sq. Ft. 3/21/2024 Chicago, IL 1 248 $ 38,500 $ 155.24 7/31/2024 Malden, MA 1 126 7,800 61.90 8/13/2024 Indianapolis, IN 3 434 10,100 23.27 9/10/2024 Atlanta, GA 1 126 17,610 139.76 9/11/2024 San Jose, CA 1 64 10,800 168.75 11/1/2024 Colorado Springs, CO 1 156 26,164 167.72 11/19/2024 Rocklin, CA 1 19 2,627 138.26 11/22/2024 Lakewood, CO 3 213 8,100 38.03 12/6/2024 Atlanta, GA 5 379 18,100 47.76 12/6/2024 Florence, KY 1 168 3,250 19.35 12/9/2024 Sacramento, CA 1 338 21,000 62.13 12/17/2024 Reston, VA 1 131 7,200 54.96 12/20/2024 Kansas City, MO 1 87 8,000 91.95 12/27/2024 Westford, MA 1 175 5,100 29.14 12/30/2024 Provo, UT 2 125 15,000 120.00 2/11/2025 Parsippany, NJ 1 100 5,750 57.50 Total 25 2,889 $ 205,101 $ 70.99 Property Dispositions Since January 1, 2024 (dollars and sq. ft. in thousands, except per sq. ft. data) Irving, TX

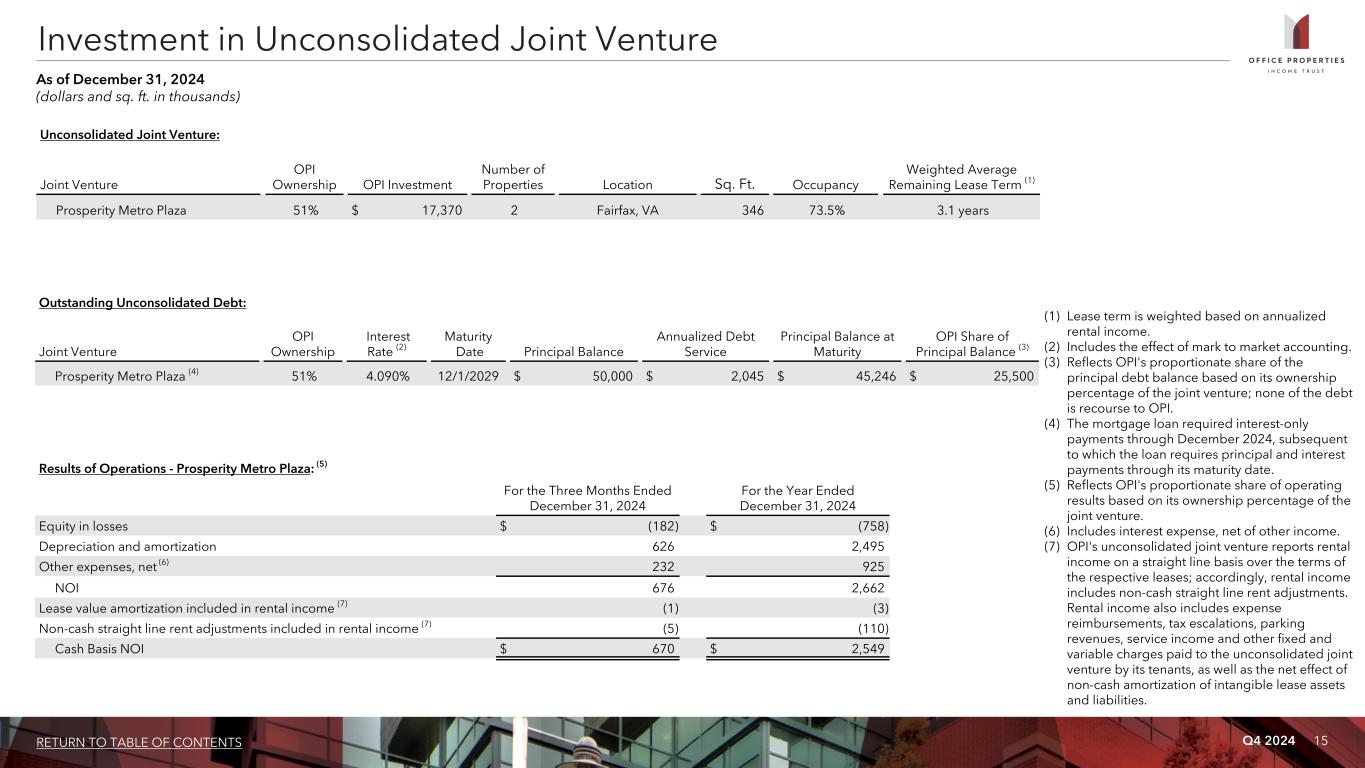

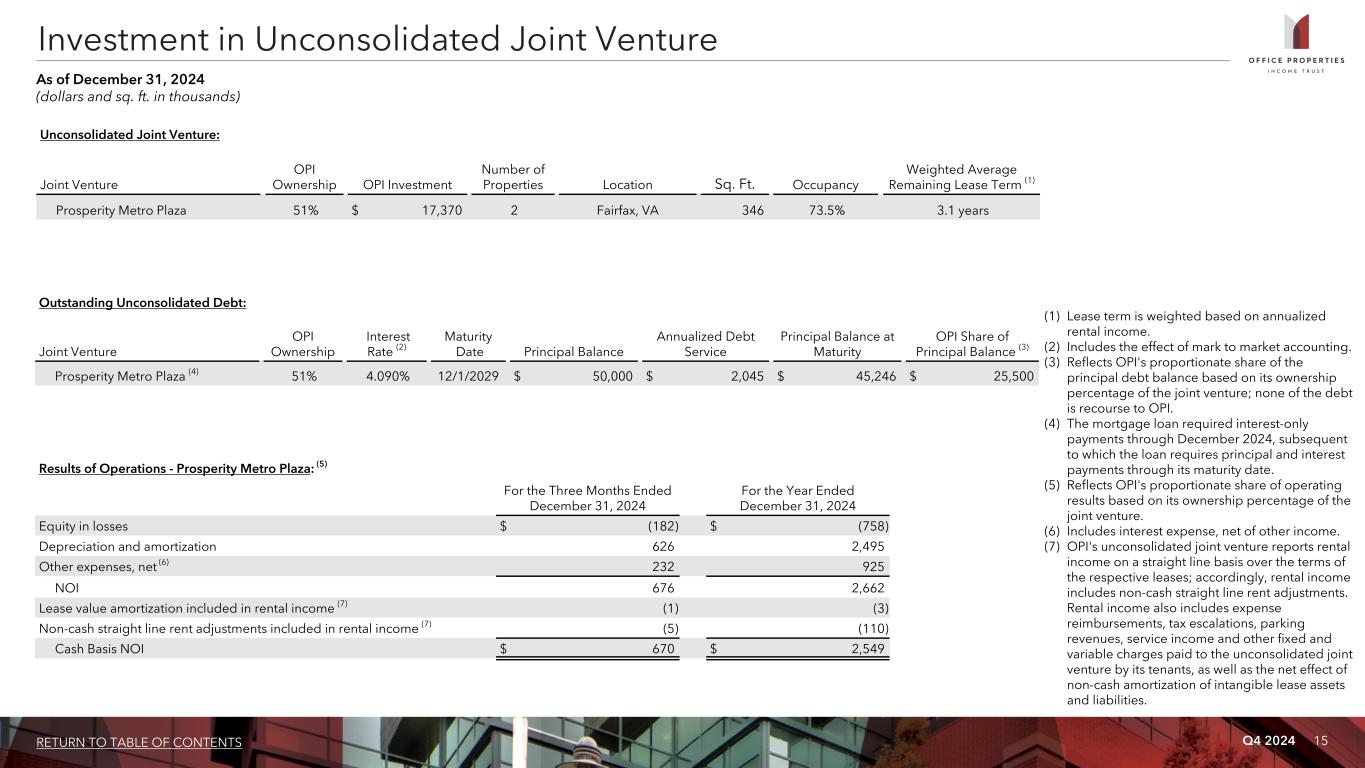

Q4 2024 15RETURN TO TABLE OF CONTENTS Unconsolidated Joint Venture: Joint Venture OPI Ownership OPI Investment Number of Properties Location Sq. Ft. Occupancy Weighted Average Remaining Lease Term (1) Prosperity Metro Plaza 51% $ 17,370 2 Fairfax, VA 346 73.5% 3.1 years (1) Lease term is weighted based on annualized rental income. (2) Includes the effect of mark to market accounting. (3) Reflects OPI's proportionate share of the principal debt balance based on its ownership percentage of the joint venture; none of the debt is recourse to OPI. (4) The mortgage loan required interest-only payments through December 2024, subsequent to which the loan requires principal and interest payments through its maturity date. (5) Reflects OPI's proportionate share of operating results based on its ownership percentage of the joint venture. (6) Includes interest expense, net of other income. (7) OPI's unconsolidated joint venture reports rental income on a straight line basis over the terms of the respective leases; accordingly, rental income includes non-cash straight line rent adjustments. Rental income also includes expense reimbursements, tax escalations, parking revenues, service income and other fixed and variable charges paid to the unconsolidated joint venture by its tenants, as well as the net effect of non-cash amortization of intangible lease assets and liabilities. Investment in Unconsolidated Joint Venture As of December 31, 2024 (dollars and sq. ft. in thousands) Results of Operations - Prosperity Metro Plaza: (5) For the Three Months Ended December 31, 2024 For the Year Ended December 31, 2024 Equity in losses $ (182) $ (758) Depreciation and amortization 626 2,495 Other expenses, net (6) 232 925 NOI 676 2,662 Lease value amortization included in rental income (7) (1) (3) Non-cash straight line rent adjustments included in rental income (7) (5) (110) Cash Basis NOI $ 670 $ 2,549 Outstanding Unconsolidated Debt: Joint Venture OPI Ownership Interest Rate (2) Maturity Date Principal Balance Annualized Debt Service Principal Balance at Maturity OPI Share of Principal Balance (3) Prosperity Metro Plaza (4) 51% 4.090% 12/1/2029 $ 50,000 $ 2,045 $ 45,246 $ 25,500

Q4 2024 16RETURN TO TABLE OF CONTENTS Portfolio Information

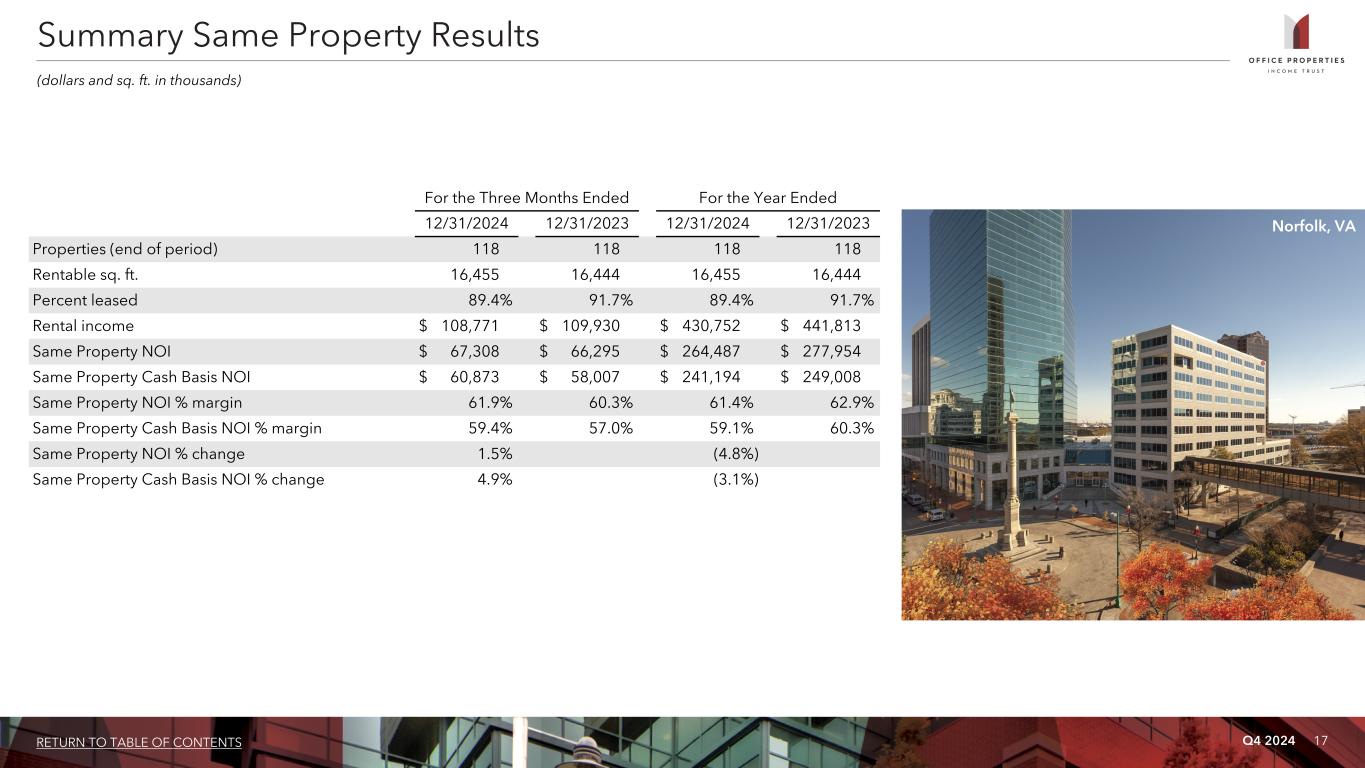

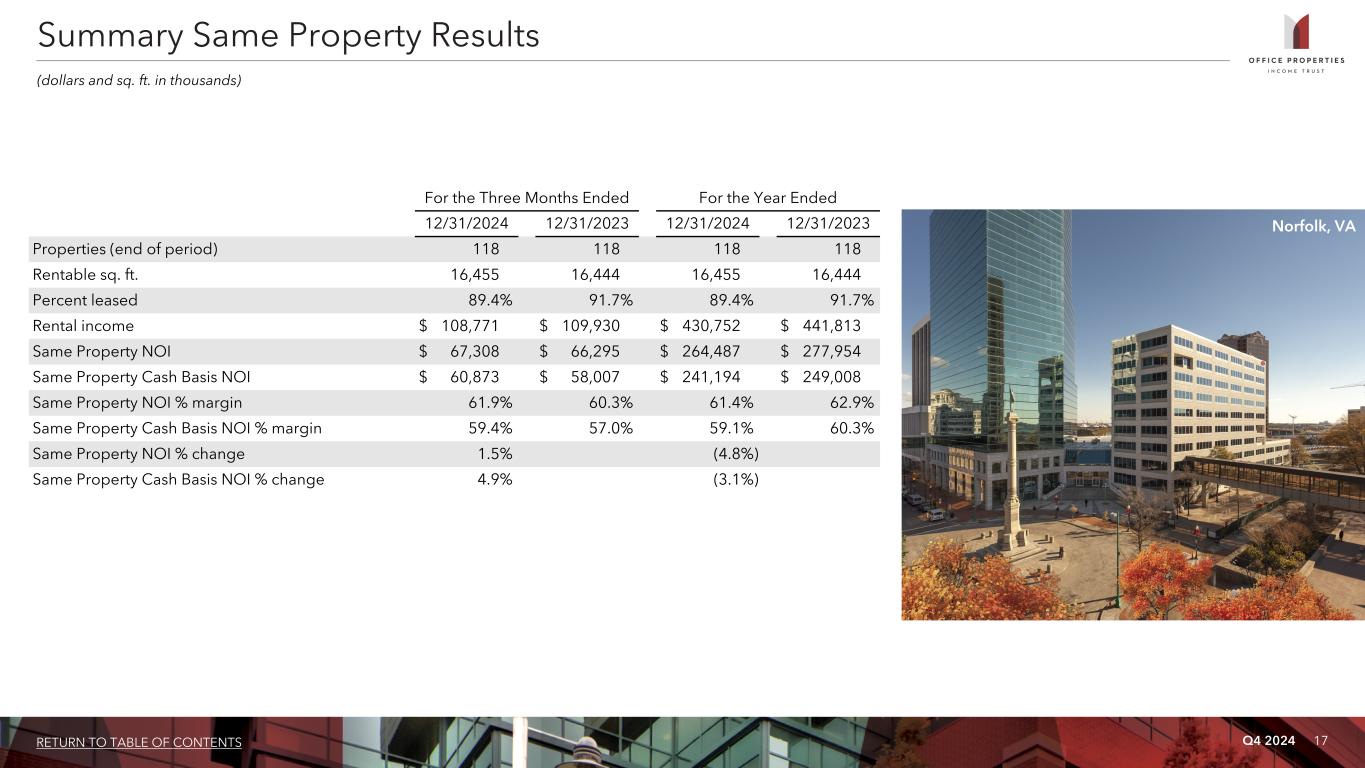

Q4 2024 17RETURN TO TABLE OF CONTENTS For the Three Months Ended For the Year Ended 12/31/2024 12/31/2023 12/31/2024 12/31/2023 Properties (end of period) 118 118 118 118 Rentable sq. ft. 16,455 16,444 16,455 16,444 Percent leased 89.4% 91.7% 89.4% 91.7% Rental income $ 108,771 $ 109,930 $ 430,752 $ 441,813 Same Property NOI $ 67,308 $ 66,295 $ 264,487 $ 277,954 Same Property Cash Basis NOI $ 60,873 $ 58,007 $ 241,194 $ 249,008 Same Property NOI % margin 61.9% 60.3% 61.4% 62.9% Same Property Cash Basis NOI % margin 59.4% 57.0% 59.1% 60.3% Same Property NOI % change 1.5% (4.8%) Same Property Cash Basis NOI % change 4.9% (3.1%) Summary Same Property Results (dollars and sq. ft. in thousands) Norfolk, VA

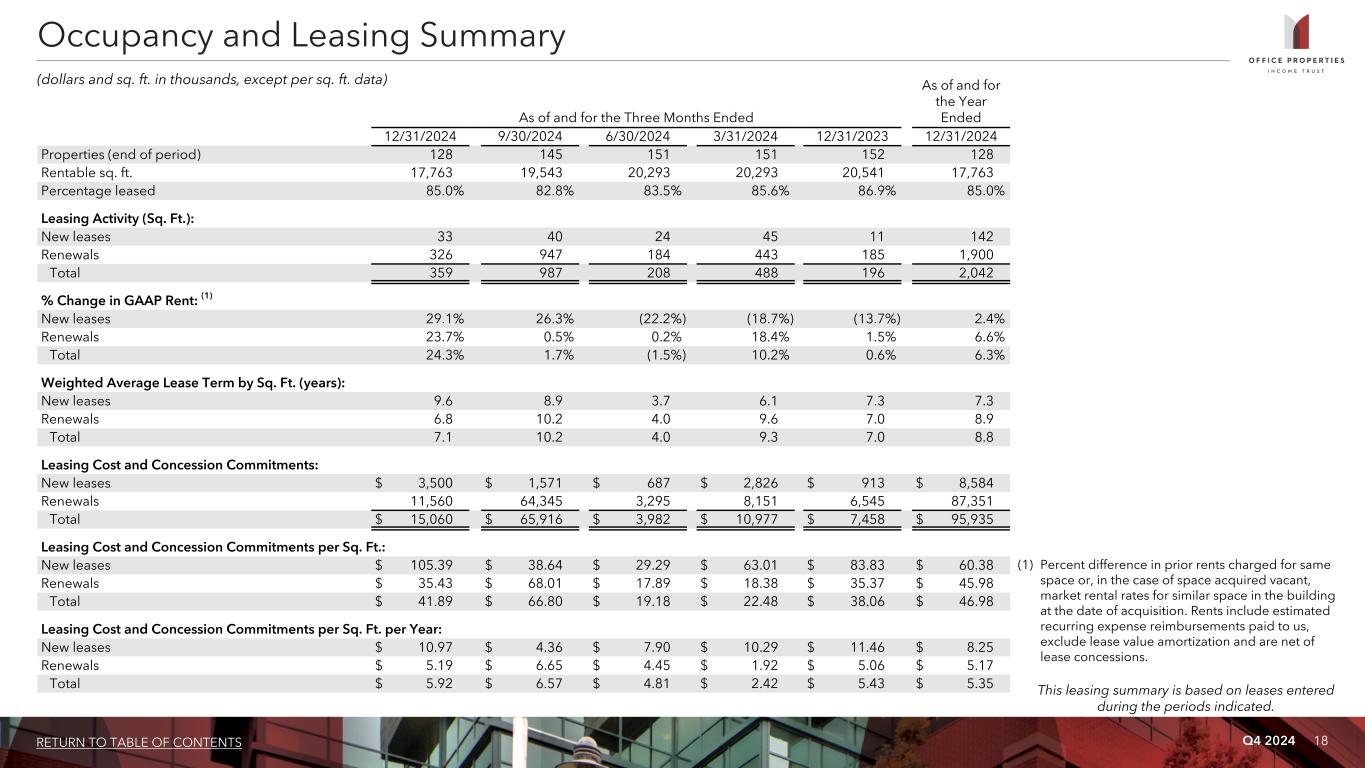

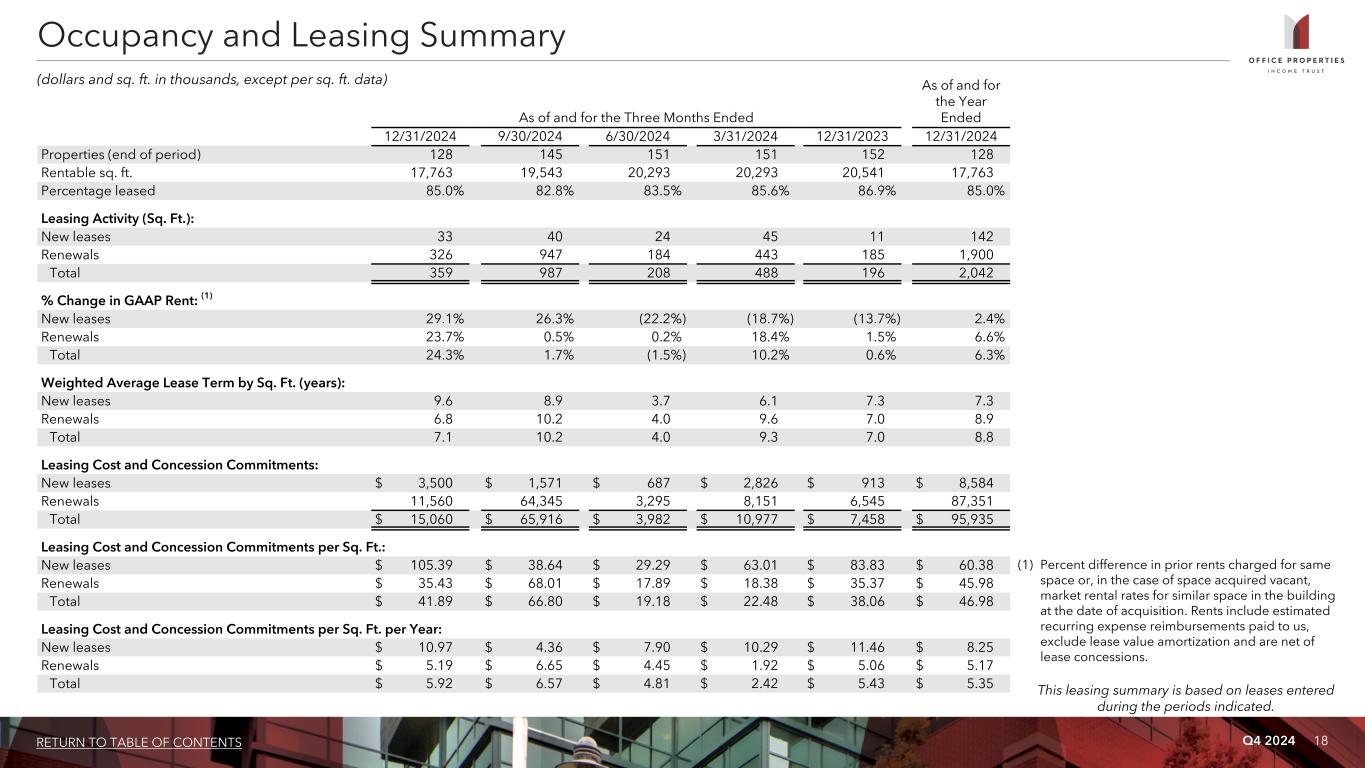

Q4 2024 18RETURN TO TABLE OF CONTENTS As of and for the Three Months Ended As of and for the Year Ended 12/31/2024 9/30/2024 6/30/2024 3/31/2024 12/31/2023 12/31/2024 Properties (end of period) 128 145 151 151 152 128 Rentable sq. ft. 17,763 19,543 20,293 20,293 20,541 17,763 Percentage leased 85.0% 82.8% 83.5% 85.6% 86.9% 85.0% Leasing Activity (Sq. Ft.): New leases 33 40 24 45 11 142 Renewals 326 947 184 443 185 1,900 Total 359 987 208 488 196 2,042 % Change in GAAP Rent: (1) New leases 29.1% 26.3% (22.2%) (18.7%) (13.7%) 2.4% Renewals 23.7% 0.5% 0.2% 18.4% 1.5% 6.6% Total 24.3% 1.7% (1.5%) 10.2% 0.6% 6.3% Weighted Average Lease Term by Sq. Ft. (years): New leases 9.6 8.9 3.7 6.1 7.3 7.3 Renewals 6.8 10.2 4.0 9.6 7.0 8.9 Total 7.1 10.2 4.0 9.3 7.0 8.8 Leasing Cost and Concession Commitments: New leases $ 3,500 $ 1,571 $ 687 $ 2,826 $ 913 $ 8,584 Renewals 11,560 64,345 3,295 8,151 6,545 87,351 Total $ 15,060 $ 65,916 $ 3,982 $ 10,977 $ 7,458 $ 95,935 Leasing Cost and Concession Commitments per Sq. Ft.: New leases $ 105.39 $ 38.64 $ 29.29 $ 63.01 $ 83.83 $ 60.38 Renewals $ 35.43 $ 68.01 $ 17.89 $ 18.38 $ 35.37 $ 45.98 Total $ 41.89 $ 66.80 $ 19.18 $ 22.48 $ 38.06 $ 46.98 Leasing Cost and Concession Commitments per Sq. Ft. per Year: New leases $ 10.97 $ 4.36 $ 7.90 $ 10.29 $ 11.46 $ 8.25 Renewals $ 5.19 $ 6.65 $ 4.45 $ 1.92 $ 5.06 $ 5.17 Total $ 5.92 $ 6.57 $ 4.81 $ 2.42 $ 5.43 $ 5.35 (1) Percent difference in prior rents charged for same space or, in the case of space acquired vacant, market rental rates for similar space in the building at the date of acquisition. Rents include estimated recurring expense reimbursements paid to us, exclude lease value amortization and are net of lease concessions. Occupancy and Leasing Summary (dollars and sq. ft. in thousands, except per sq. ft. data) This leasing summary is based on leases entered during the periods indicated.

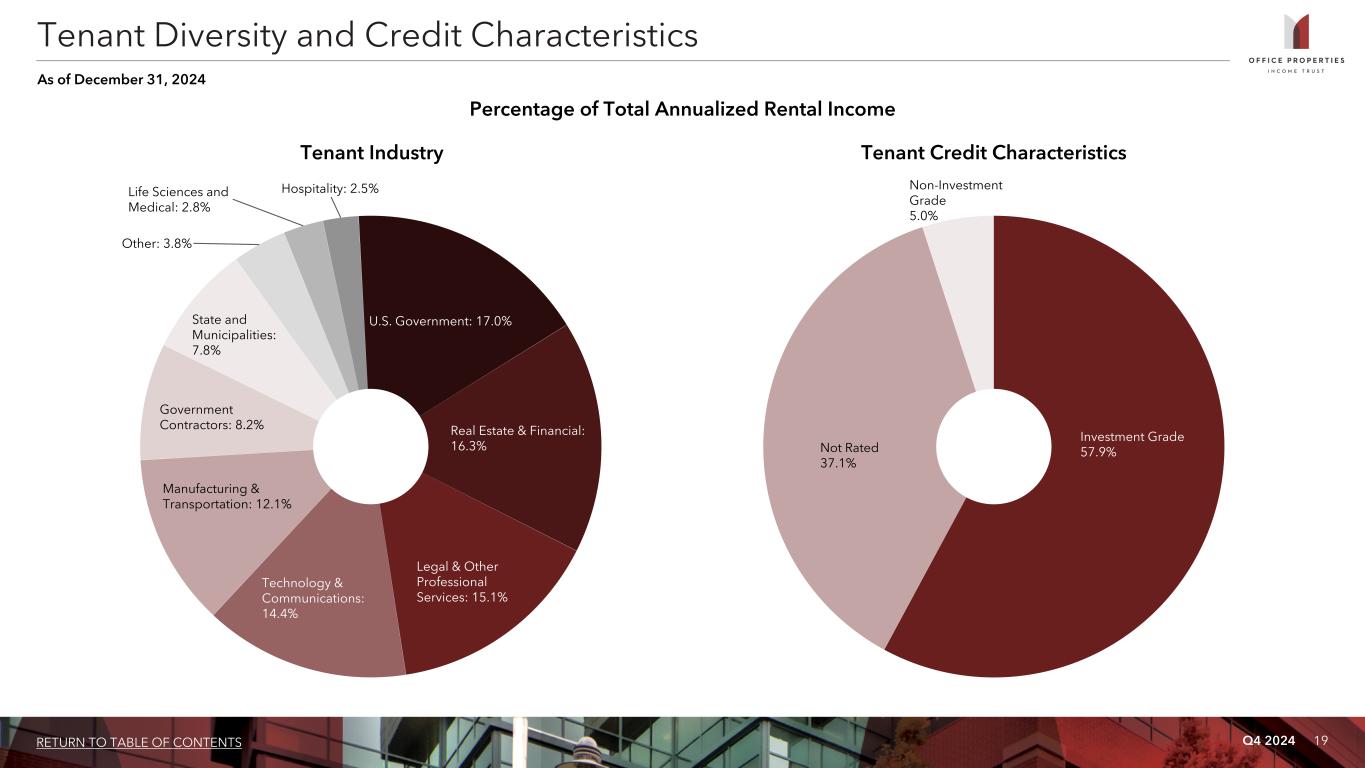

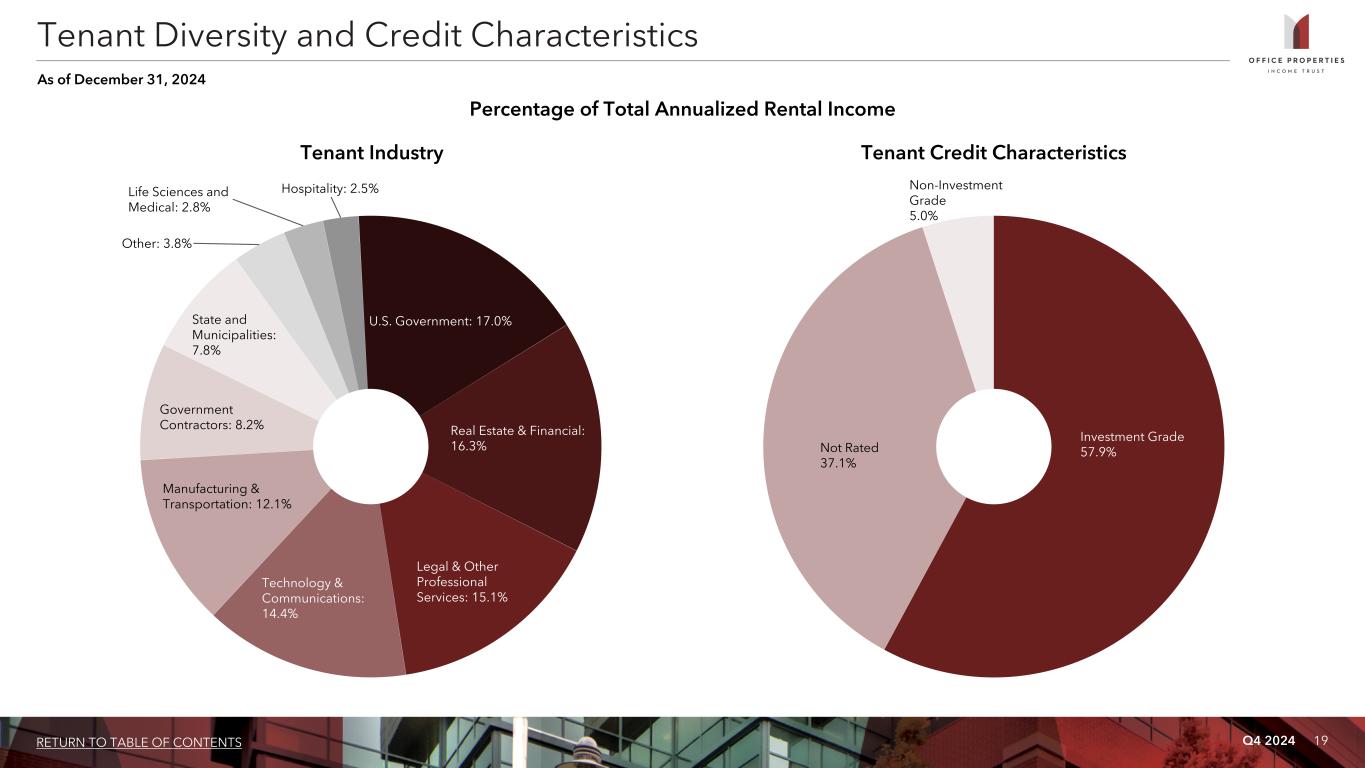

Q4 2024 19RETURN TO TABLE OF CONTENTS Investment Grade 57.9%Not Rated 37.1% Non-Investment Grade 5.0% Percentage of Total Annualized Rental Income Tenant Credit Characteristics ( 4 ) (3) Tenant Industry Tenant Diversity and Credit Characteristics As of December 31, 2024 U.S. Government: 17.0% Real Estate & Financial: 16.3% Legal & Other Professional Services: 15.1% Technology & Communications: 14.4% Manufacturing & Transportation: 12.1% Government Contractors: 8.2% State and Municipalities: 7.8% Other: 3.8% Life Sciences and Medical: 2.8% Hospitality: 2.5%

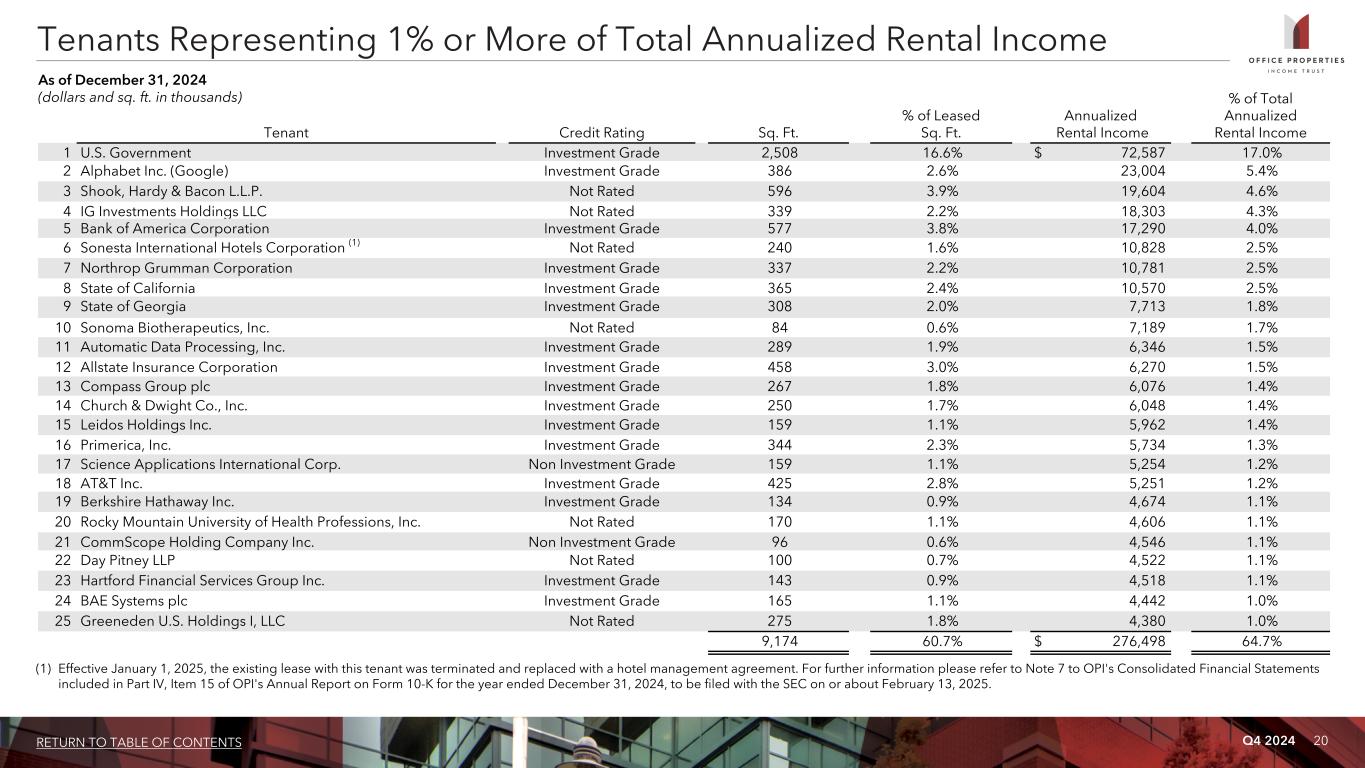

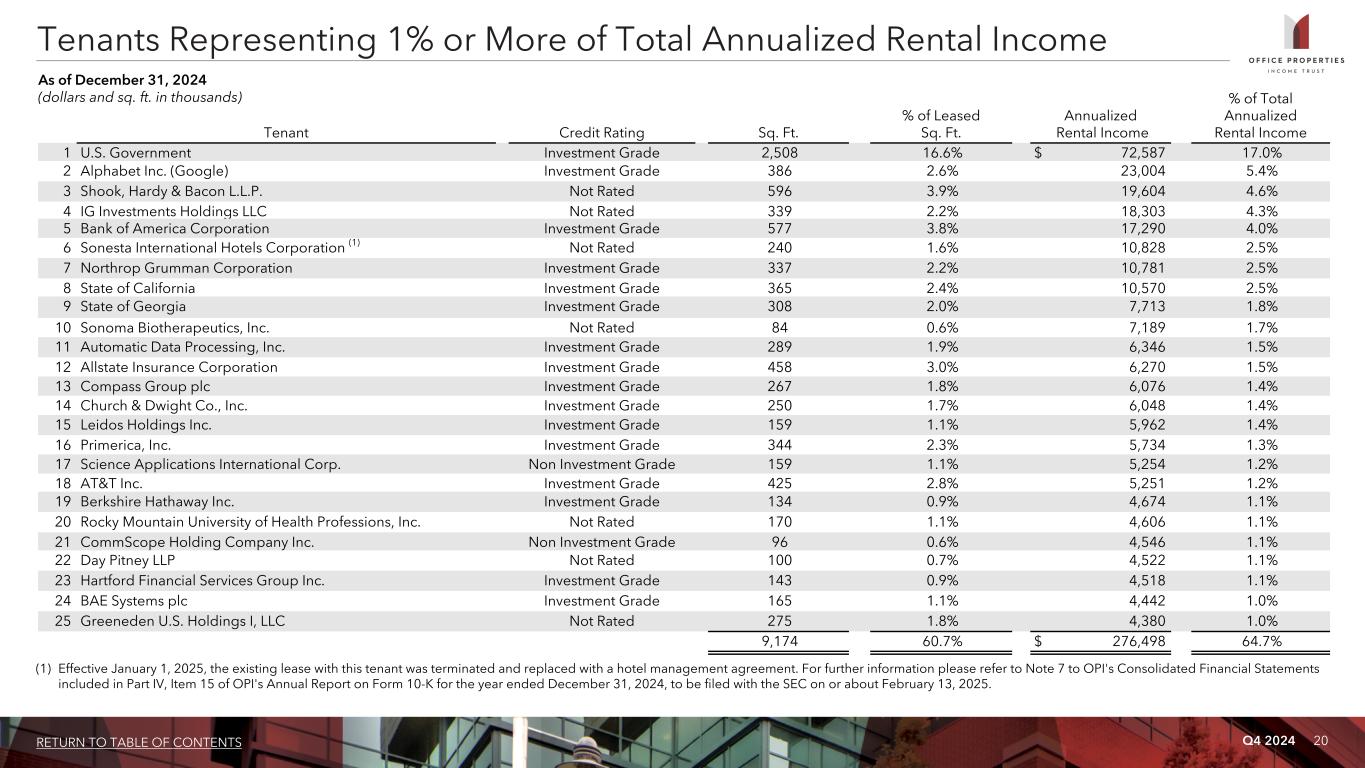

Q4 2024 20RETURN TO TABLE OF CONTENTS Tenant Credit Rating Sq. Ft. % of Leased Sq. Ft. Annualized Rental Income % of Total Annualized Rental Income 1 U.S. Government Investment Grade 2,508 16.6% $ 72,587 17.0% 2 Alphabet Inc. (Google) Investment Grade 386 2.6% 23,004 5.4% 3 Shook, Hardy & Bacon L.L.P. Not Rated 596 3.9% 19,604 4.6% 4 IG Investments Holdings LLC Not Rated 339 2.2% 18,303 4.3% 5 Bank of America Corporation Investment Grade 577 3.8% 17,290 4.0% 6 Sonesta International Hotels Corporation (1) Not Rated 240 1.6% 10,828 2.5% 7 Northrop Grumman Corporation Investment Grade 337 2.2% 10,781 2.5% 8 State of California Investment Grade 365 2.4% 10,570 2.5% 9 State of Georgia Investment Grade 308 2.0% 7,713 1.8% 10 Sonoma Biotherapeutics, Inc. Not Rated 84 0.6% 7,189 1.7% 11 Automatic Data Processing, Inc. Investment Grade 289 1.9% 6,346 1.5% 12 Allstate Insurance Corporation Investment Grade 458 3.0% 6,270 1.5% 13 Compass Group plc Investment Grade 267 1.8% 6,076 1.4% 14 Church & Dwight Co., Inc. Investment Grade 250 1.7% 6,048 1.4% 15 Leidos Holdings Inc. Investment Grade 159 1.1% 5,962 1.4% 16 Primerica, Inc. Investment Grade 344 2.3% 5,734 1.3% 17 Science Applications International Corp. Non Investment Grade 159 1.1% 5,254 1.2% 18 AT&T Inc. Investment Grade 425 2.8% 5,251 1.2% 19 Berkshire Hathaway Inc. Investment Grade 134 0.9% 4,674 1.1% 20 Rocky Mountain University of Health Professions, Inc. Not Rated 170 1.1% 4,606 1.1% 21 CommScope Holding Company Inc. Non Investment Grade 96 0.6% 4,546 1.1% 22 Day Pitney LLP Not Rated 100 0.7% 4,522 1.1% 23 Hartford Financial Services Group Inc. Investment Grade 143 0.9% 4,518 1.1% 24 BAE Systems plc Investment Grade 165 1.1% 4,442 1.0% 25 Greeneden U.S. Holdings I, LLC Not Rated 275 1.8% 4,380 1.0% 9,174 60.7% $ 276,498 64.7% Tenants Representing 1% or More of Total Annualized Rental Income As of December 31, 2024 (dollars and sq. ft. in thousands) (1) Effective January 1, 2025, the existing lease with this tenant was terminated and replaced with a hotel management agreement. For further information please refer to Note 7 to OPI's Consolidated Financial Statements included in Part IV, Item 15 of OPI's Annual Report on Form 10-K for the year ended December 31, 2024, to be filed with the SEC on or about February 13, 2025.

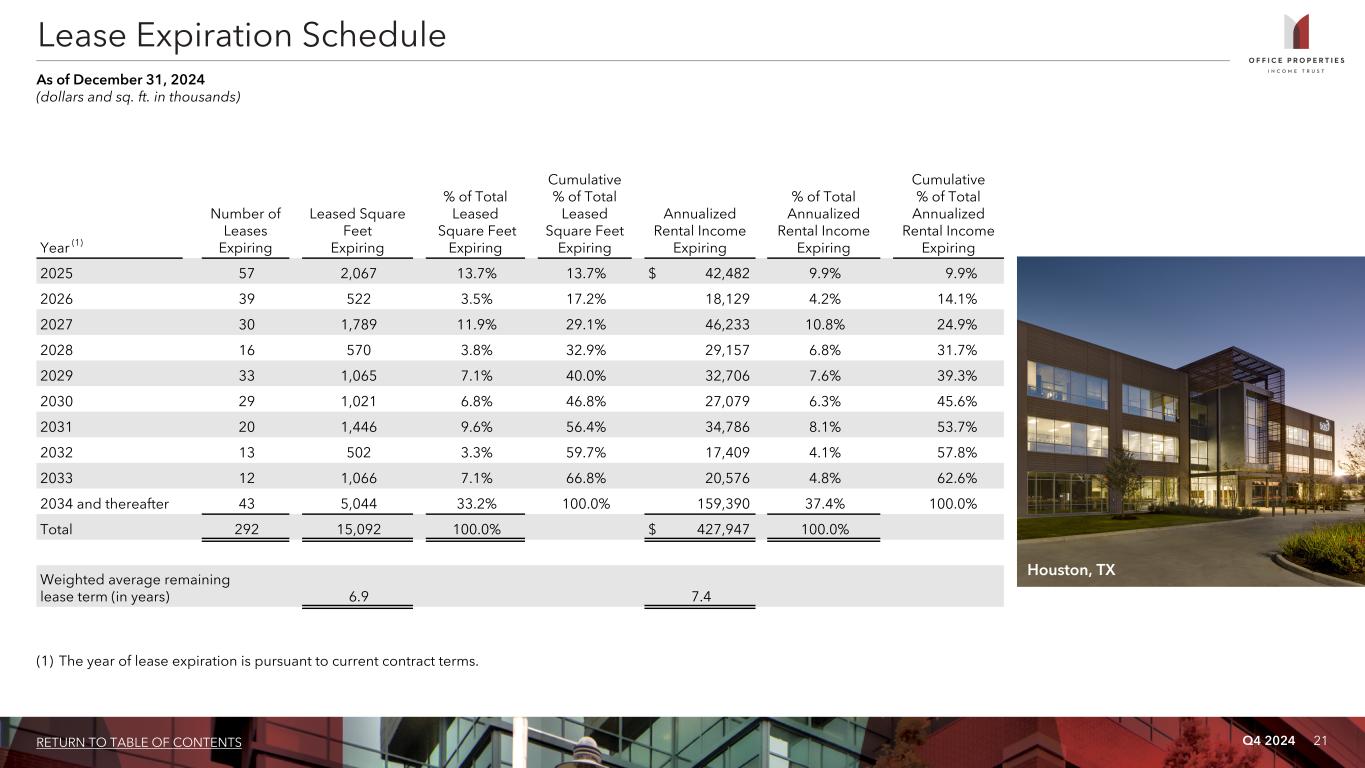

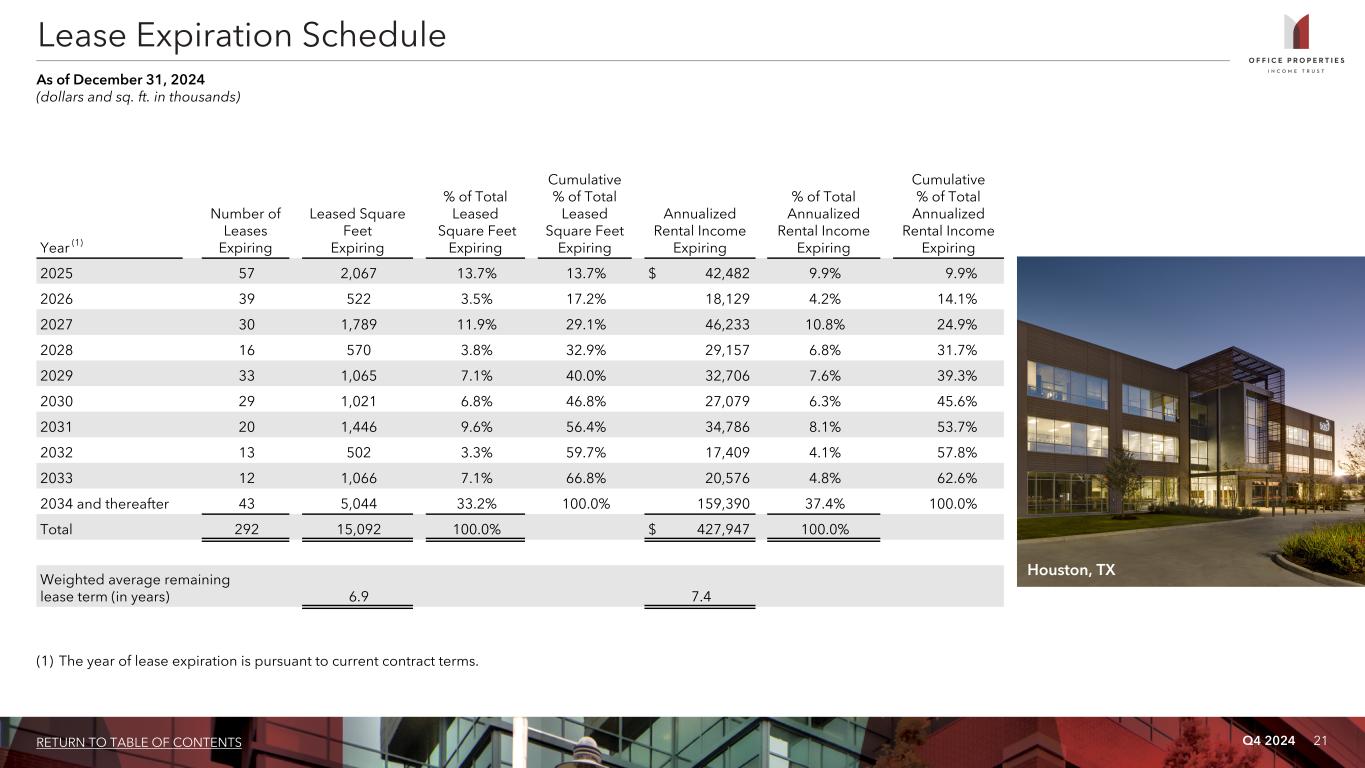

Q4 2024 21RETURN TO TABLE OF CONTENTS Year (1) Number of Leases Expiring Leased Square Feet Expiring % of Total Leased Square Feet Expiring Cumulative % of Total Leased Square Feet Expiring Annualized Rental Income Expiring % of Total Annualized Rental Income Expiring Cumulative % of Total Annualized Rental Income Expiring 2025 57 2,067 13.7% 13.7% $ 42,482 9.9% 9.9% 2026 39 522 3.5% 17.2% 18,129 4.2% 14.1% 2027 30 1,789 11.9% 29.1% 46,233 10.8% 24.9% 2028 16 570 3.8% 32.9% 29,157 6.8% 31.7% 2029 33 1,065 7.1% 40.0% 32,706 7.6% 39.3% 2030 29 1,021 6.8% 46.8% 27,079 6.3% 45.6% 2031 20 1,446 9.6% 56.4% 34,786 8.1% 53.7% 2032 13 502 3.3% 59.7% 17,409 4.1% 57.8% 2033 12 1,066 7.1% 66.8% 20,576 4.8% 62.6% 2034 and thereafter 43 5,044 33.2% 100.0% 159,390 37.4% 100.0% Total 292 15,092 100.0% $ 427,947 100.0% Weighted average remaining lease term (in years) 6.9 7.4 (1) The year of lease expiration is pursuant to current contract terms. Lease Expiration Schedule As of December 31, 2024 (dollars and sq. ft. in thousands) Houston, TX

Q4 2024 22RETURN TO TABLE OF CONTENTS Appendix

Q4 2024 23RETURN TO TABLE OF CONTENTS Management: OPI is managed by The RMR Group (Nasdaq: RMR). RMR is an alternative asset management company that is focused on commercial real estate and related businesses. RMR primarily provides management services to publicly traded real estate companies, privately held real estate funds and real estate related operating businesses. As of December 31, 2024, RMR had over $40 billion of real estate assets under management and the combined RMR managed companies had more than $5 billion of annual revenues, approximately 2,000 properties and over 18,000 employees. OPI believes that being managed by RMR is a competitive advantage for OPI because of RMR’s depth of management and experience in the real estate industry. OPI also believes RMR provides management services to it at costs that are lower than OPI would have to pay for similar quality services if OPI were self managed. Company Profile and Governance Information Rating Agencies Moody's Investors Service S&P Global Christian Azzi Alan Zigman Christian.Azzi@moodys.com alan.zigman@spglobal.com (212) 553-9342 (416) 507-2556 OPI's credit is rated by the rating agencies listed on this page. Please note that any opinions, estimates or forecasts regarding OPI’s performance made by these agencies do not represent opinions, forecasts or predictions of OPI or its management. OPI does not by its reference above imply its endorsement of or concurrence with any information, conclusions or recommendations provided by any of these agencies. Board of Trustees Donna D. Fraiche Barbara D. Gilmore John L. Harrington Independent Trustee Independent Trustee Independent Trustee William A. Lamkin Elena B. Poptodorova Jeffrey P. Somers Independent Trustee Lead Independent Trustee Independent Trustee Mark A. Talley Jennifer B. Clark Adam D. Portnoy Independent Trustee Managing Trustee Chair of the Board & Managing Trustee Executive Officers Yael Duffy Brian E. Donley President and Chief Operating Officer Chief Financial Officer and Treasurer

Q4 2024 24RETURN TO TABLE OF CONTENTS For the Three Months Ended For the Year Ended 12/31/2024 9/30/2024 6/30/2024 3/31/2024 12/31/2023 12/31/2024 12/31/2023 Calculation of NOI and Cash Basis NOI: Rental income $ 118,238 $ 120,620 $ 123,686 $ 139,435 $ 133,773 $ 501,979 $ 533,553 Property operating expenses (46,994) (51,415) (47,640) (51,187) (52,902) (197,236) (199,492) NOI 71,244 69,205 76,046 88,248 80,871 304,743 334,061 Non-cash straight line rent adjustments included in rental income (7,306) (8,854) (7,563) (7,379) (9,074) (31,102) (26,194) Lease value amortization included in rental income (372) 59 (56) (33) (56) (402) (252) Lease termination fees included in rental income (744) (218) (200) (12,445) (1,554) (13,607) (4,714) Non-cash amortization included in other operating expenses (121) (121) (121) (121) (121) (484) (484) Cash Basis NOI $ 62,701 $ 60,071 $ 68,106 $ 68,270 $ 70,066 $ 259,148 $ 302,417 Reconciliation of Net (Loss) Income to NOI and Cash Basis NOI: Net (loss) income $ (148,680) $ (58,414) $ 76,171 $ (5,184) $ (37,151) $ (136,107) $ (69,432) Equity in net losses of investees 182 166 180 230 741 758 3,031 Loss on impairment of equity method investment — — — — 19,183 — 19,183 Income tax expense (benefit) 24 230 (107) 56 15 203 351 (Loss) income before income tax expense (benefit) and equity in net losses of investees (148,474) (58,018) 76,244 (4,898) (17,212) (135,146) (46,867) Loss (gain) on early extinguishment of debt 99,452 (264) (225,798) 425 — (126,185) — Interest expense 47,340 42,580 38,349 35,476 30,056 163,745 110,647 Interest and other income (1,889) (196) (226) (1,357) (257) (3,668) (1,039) Loss (gain) on sale of real estate 13,418 (8,456) 64 2,384 (3,293) 7,410 (3,780) General and administrative 5,267 4,927 5,290 5,644 5,301 21,128 22,731 Transaction related costs 173 738 — 233 1,282 1,144 31,816 Loss on impairment of real estate 7,999 41,847 131,732 — 11,299 181,578 11,299 Depreciation and amortization 47,958 46,047 50,391 50,341 53,695 194,737 209,254 NOI 71,244 69,205 76,046 88,248 80,871 304,743 334,061 Non-cash amortization included in other operating expenses (121) (121) (121) (121) (121) (484) (484) Lease termination fees included in rental income (744) (218) (200) (12,445) (1,554) (13,607) (4,714) Lease value amortization included in rental income (372) 59 (56) (33) (56) (402) (252) Non-cash straight line rent adjustments included in rental income (7,306) (8,854) (7,563) (7,379) (9,074) (31,102) (26,194) Cash Basis NOI $ 62,701 $ 60,071 $ 68,106 $ 68,270 $ 70,066 $ 259,148 $ 302,417 Calculation and Reconciliation of NOI and Cash Basis NOI (dollars in thousands)

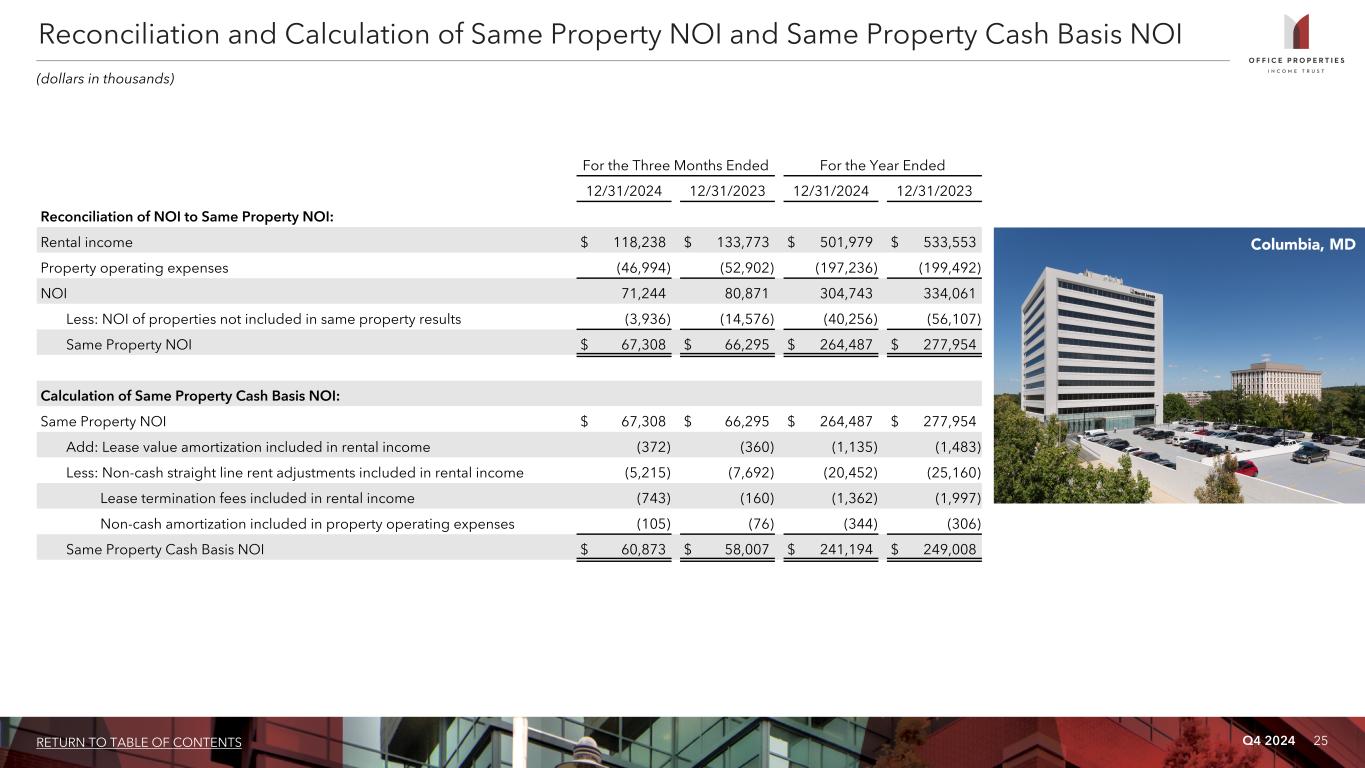

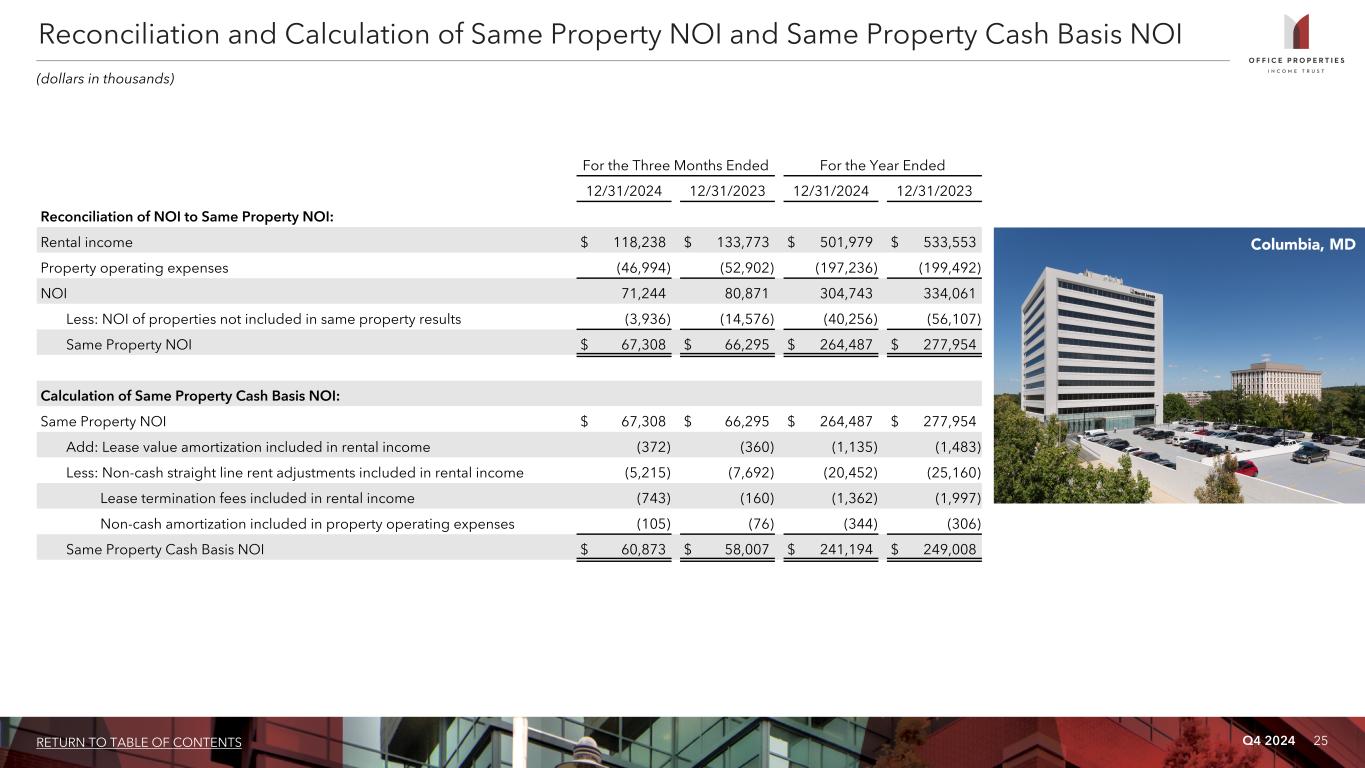

Q4 2024 25RETURN TO TABLE OF CONTENTS For the Three Months Ended For the Year Ended 12/31/2024 12/31/2023 12/31/2024 12/31/2023 Reconciliation of NOI to Same Property NOI: Rental income $ 118,238 $ 133,773 $ 501,979 $ 533,553 Property operating expenses (46,994) (52,902) (197,236) (199,492) NOI 71,244 80,871 304,743 334,061 Less: NOI of properties not included in same property results (3,936) (14,576) (40,256) (56,107) Same Property NOI $ 67,308 $ 66,295 $ 264,487 $ 277,954 Calculation of Same Property Cash Basis NOI: Same Property NOI $ 67,308 $ 66,295 $ 264,487 $ 277,954 Add: Lease value amortization included in rental income (372) (360) (1,135) (1,483) Less: Non-cash straight line rent adjustments included in rental income (5,215) (7,692) (20,452) (25,160) Lease termination fees included in rental income (743) (160) (1,362) (1,997) Non-cash amortization included in property operating expenses (105) (76) (344) (306) Same Property Cash Basis NOI $ 60,873 $ 58,007 $ 241,194 $ 249,008 Reconciliation and Calculation of Same Property NOI and Same Property Cash Basis NOI (dollars in thousands) Columbia, MD

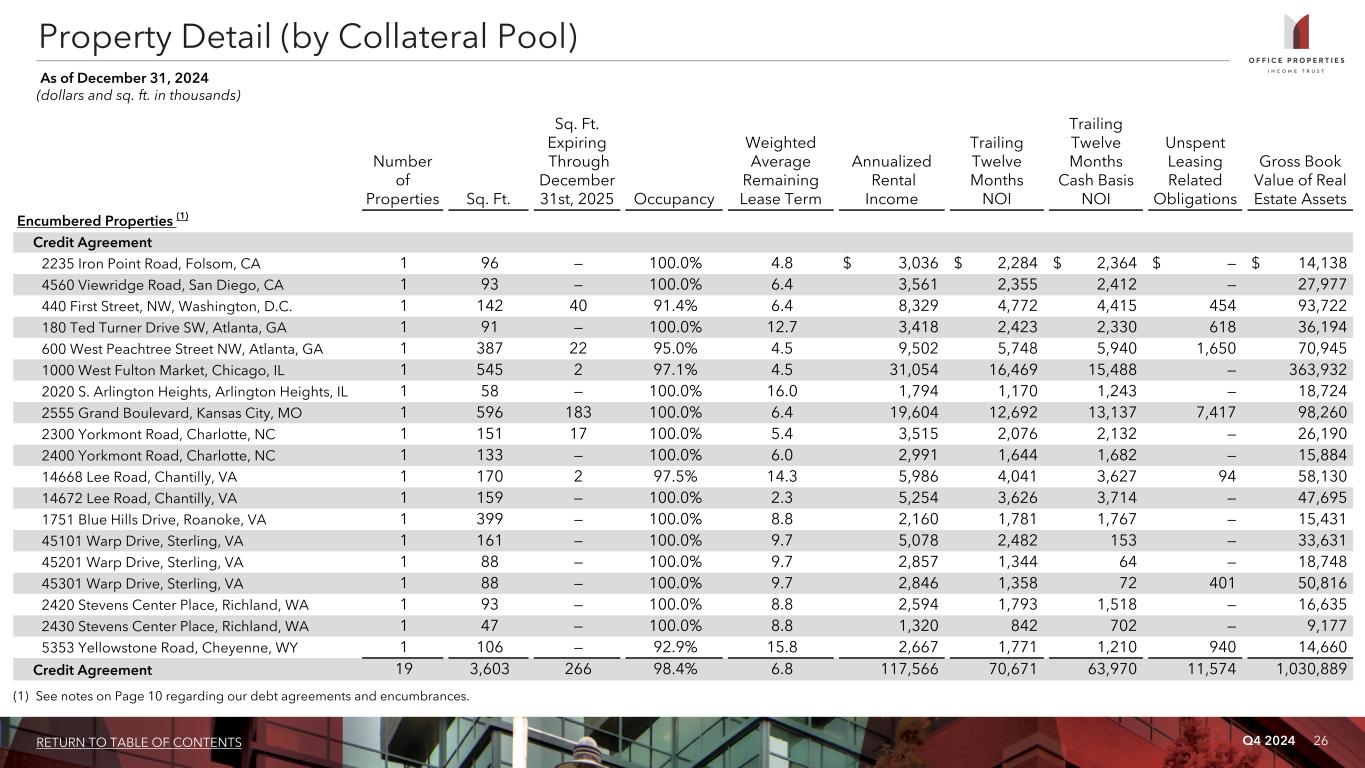

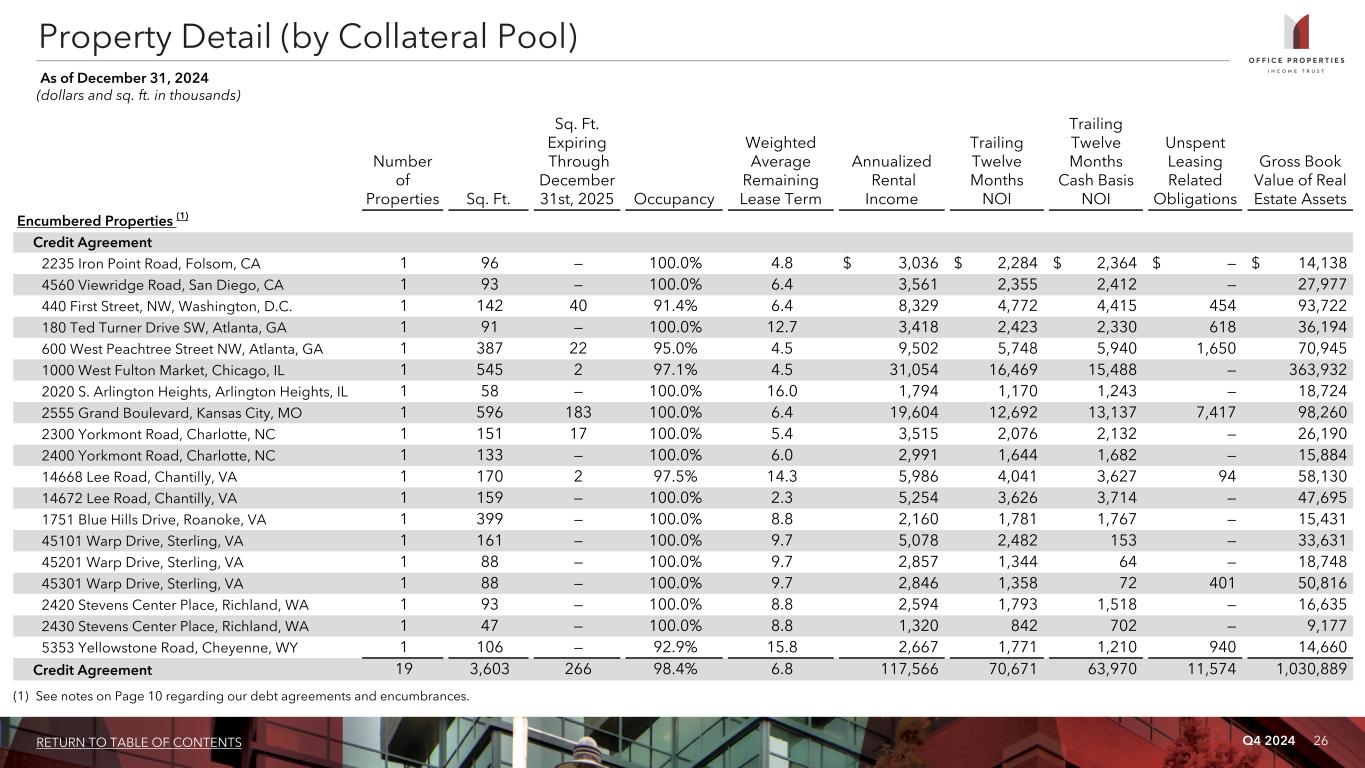

Q4 2024 26RETURN TO TABLE OF CONTENTS Property Detail (by Collateral Pool) As of December 31, 2024 (dollars and sq. ft. in thousands) Number of Properties Sq. Ft. Sq. Ft. Expiring Through December 31st, 2025 Occupancy Weighted Average Remaining Lease Term Annualized Rental Income Trailing Twelve Months NOI Trailing Twelve Months Cash Basis NOI Unspent Leasing Related Obligations Gross Book Value of Real Estate Assets Encumbered Properties (1) Credit Agreement 2235 Iron Point Road, Folsom, CA 1 96 — 100.0% 4.8 $ 3,036 $ 2,284 $ 2,364 $ — $ 14,138 4560 Viewridge Road, San Diego, CA 1 93 — 100.0% 6.4 3,561 2,355 2,412 — 27,977 440 First Street, NW, Washington, D.C. 1 142 40 91.4% 6.4 8,329 4,772 4,415 454 93,722 180 Ted Turner Drive SW, Atlanta, GA 1 91 — 100.0% 12.7 3,418 2,423 2,330 618 36,194 600 West Peachtree Street NW, Atlanta, GA 1 387 22 95.0% 4.5 9,502 5,748 5,940 1,650 70,945 1000 West Fulton Market, Chicago, IL 1 545 2 97.1% 4.5 31,054 16,469 15,488 — 363,932 2020 S. Arlington Heights, Arlington Heights, IL 1 58 — 100.0% 16.0 1,794 1,170 1,243 — 18,724 2555 Grand Boulevard, Kansas City, MO 1 596 183 100.0% 6.4 19,604 12,692 13,137 7,417 98,260 2300 Yorkmont Road, Charlotte, NC 1 151 17 100.0% 5.4 3,515 2,076 2,132 — 26,190 2400 Yorkmont Road, Charlotte, NC 1 133 — 100.0% 6.0 2,991 1,644 1,682 — 15,884 14668 Lee Road, Chantilly, VA 1 170 2 97.5% 14.3 5,986 4,041 3,627 94 58,130 14672 Lee Road, Chantilly, VA 1 159 — 100.0% 2.3 5,254 3,626 3,714 — 47,695 1751 Blue Hills Drive, Roanoke, VA 1 399 — 100.0% 8.8 2,160 1,781 1,767 — 15,431 45101 Warp Drive, Sterling, VA 1 161 — 100.0% 9.7 5,078 2,482 153 — 33,631 45201 Warp Drive, Sterling, VA 1 88 — 100.0% 9.7 2,857 1,344 64 — 18,748 45301 Warp Drive, Sterling, VA 1 88 — 100.0% 9.7 2,846 1,358 72 401 50,816 2420 Stevens Center Place, Richland, WA 1 93 — 100.0% 8.8 2,594 1,793 1,518 — 16,635 2430 Stevens Center Place, Richland, WA 1 47 — 100.0% 8.8 1,320 842 702 — 9,177 5353 Yellowstone Road, Cheyenne, WY 1 106 — 92.9% 15.8 2,667 1,771 1,210 940 14,660 Credit Agreement 19 3,603 266 98.4% 6.8 117,566 70,671 63,970 11,574 1,030,889 (1) See notes on Page 10 regarding our debt agreements and encumbrances.

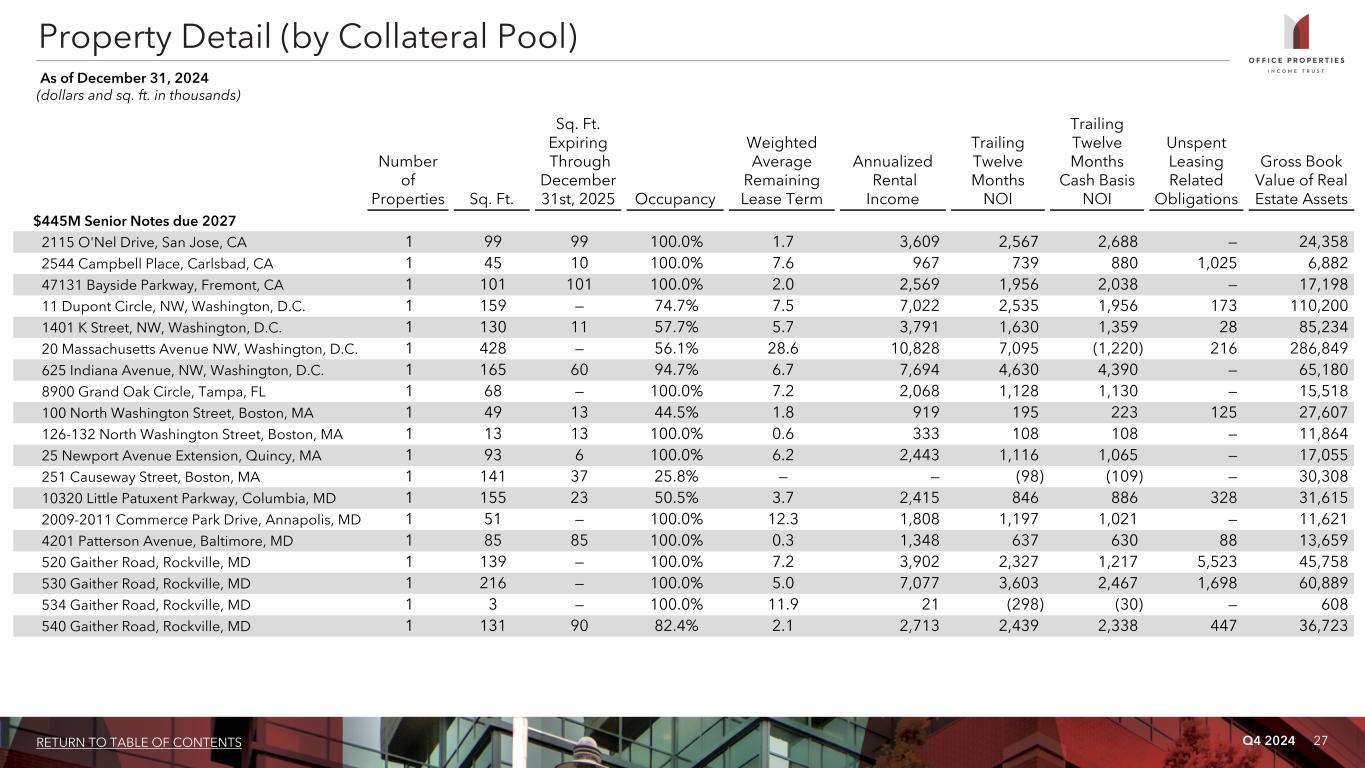

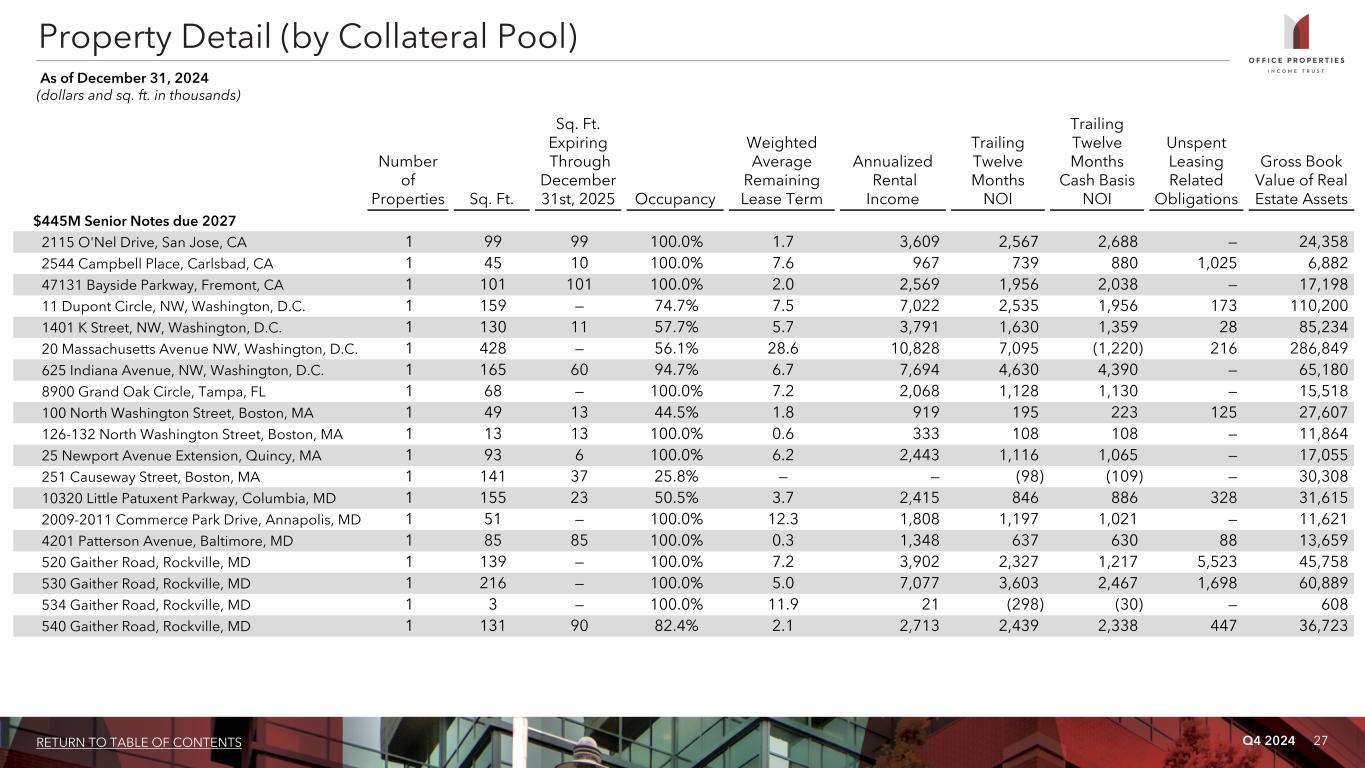

Q4 2024 27RETURN TO TABLE OF CONTENTS Property Detail (by Collateral Pool) As of December 31, 2024 (dollars and sq. ft. in thousands) Number of Properties Sq. Ft. Sq. Ft. Expiring Through December 31st, 2025 Occupancy Weighted Average Remaining Lease Term Annualized Rental Income Trailing Twelve Months NOI Trailing Twelve Months Cash Basis NOI Unspent Leasing Related Obligations Gross Book Value of Real Estate Assets $445M Senior Notes due 2027 2115 O'Nel Drive, San Jose, CA 1 99 99 100.0% 1.7 3,609 2,567 2,688 — 24,358 2544 Campbell Place, Carlsbad, CA 1 45 10 100.0% 7.6 967 739 880 1,025 6,882 47131 Bayside Parkway, Fremont, CA 1 101 101 100.0% 2.0 2,569 1,956 2,038 — 17,198 11 Dupont Circle, NW, Washington, D.C. 1 159 — 74.7% 7.5 7,022 2,535 1,956 173 110,200 1401 K Street, NW, Washington, D.C. 1 130 11 57.7% 5.7 3,791 1,630 1,359 28 85,234 20 Massachusetts Avenue NW, Washington, D.C. 1 428 — 56.1% 28.6 10,828 7,095 (1,220) 216 286,849 625 Indiana Avenue, NW, Washington, D.C. 1 165 60 94.7% 6.7 7,694 4,630 4,390 — 65,180 8900 Grand Oak Circle, Tampa, FL 1 68 — 100.0% 7.2 2,068 1,128 1,130 — 15,518 100 North Washington Street, Boston, MA 1 49 13 44.5% 1.8 919 195 223 125 27,607 126-132 North Washington Street, Boston, MA 1 13 13 100.0% 0.6 333 108 108 — 11,864 25 Newport Avenue Extension, Quincy, MA 1 93 6 100.0% 6.2 2,443 1,116 1,065 — 17,055 251 Causeway Street, Boston, MA 1 141 37 25.8% — — (98) (109) — 30,308 10320 Little Patuxent Parkway, Columbia, MD 1 155 23 50.5% 3.7 2,415 846 886 328 31,615 2009-2011 Commerce Park Drive, Annapolis, MD 1 51 — 100.0% 12.3 1,808 1,197 1,021 — 11,621 4201 Patterson Avenue, Baltimore, MD 1 85 85 100.0% 0.3 1,348 637 630 88 13,659 520 Gaither Road, Rockville, MD 1 139 — 100.0% 7.2 3,902 2,327 1,217 5,523 45,758 530 Gaither Road, Rockville, MD 1 216 — 100.0% 5.0 7,077 3,603 2,467 1,698 60,889 534 Gaither Road, Rockville, MD 1 3 — 100.0% 11.9 21 (298) (30) — 608 540 Gaither Road, Rockville, MD 1 131 90 82.4% 2.1 2,713 2,439 2,338 447 36,723

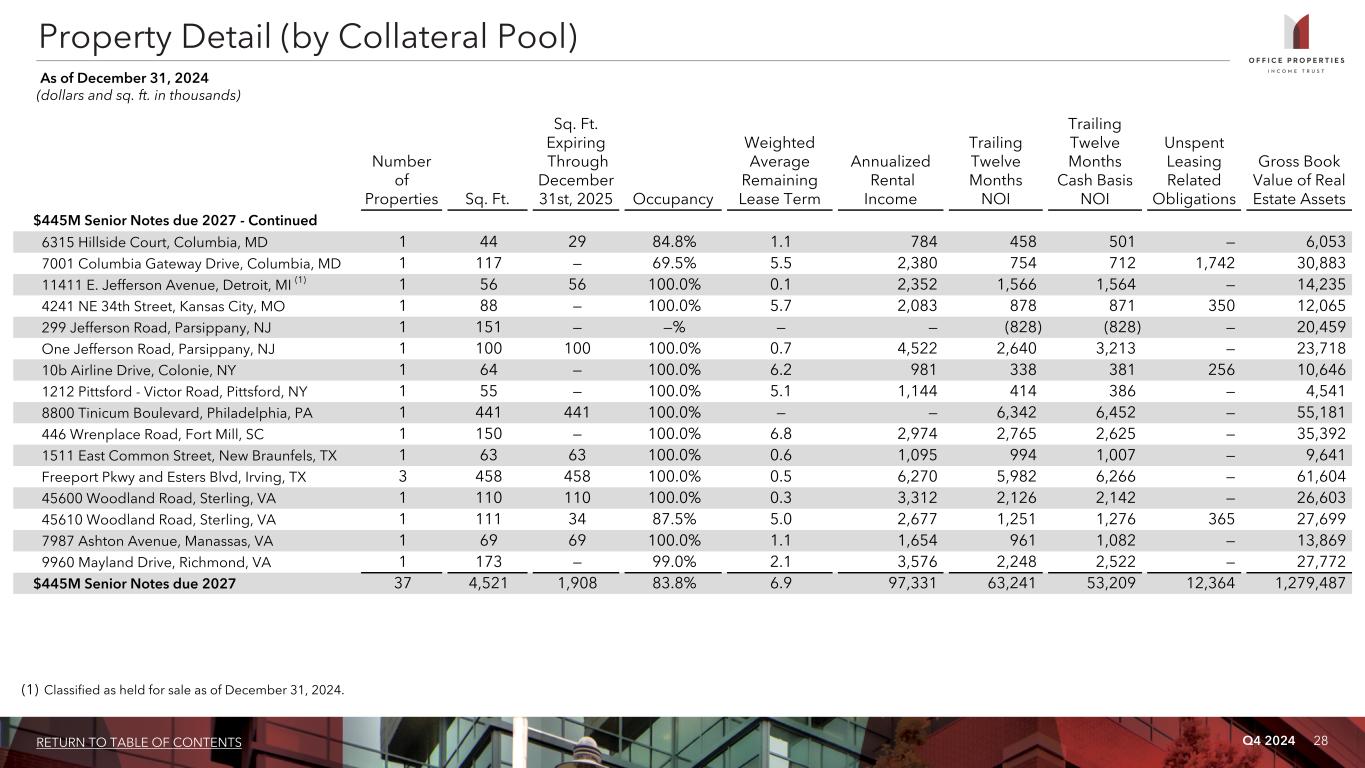

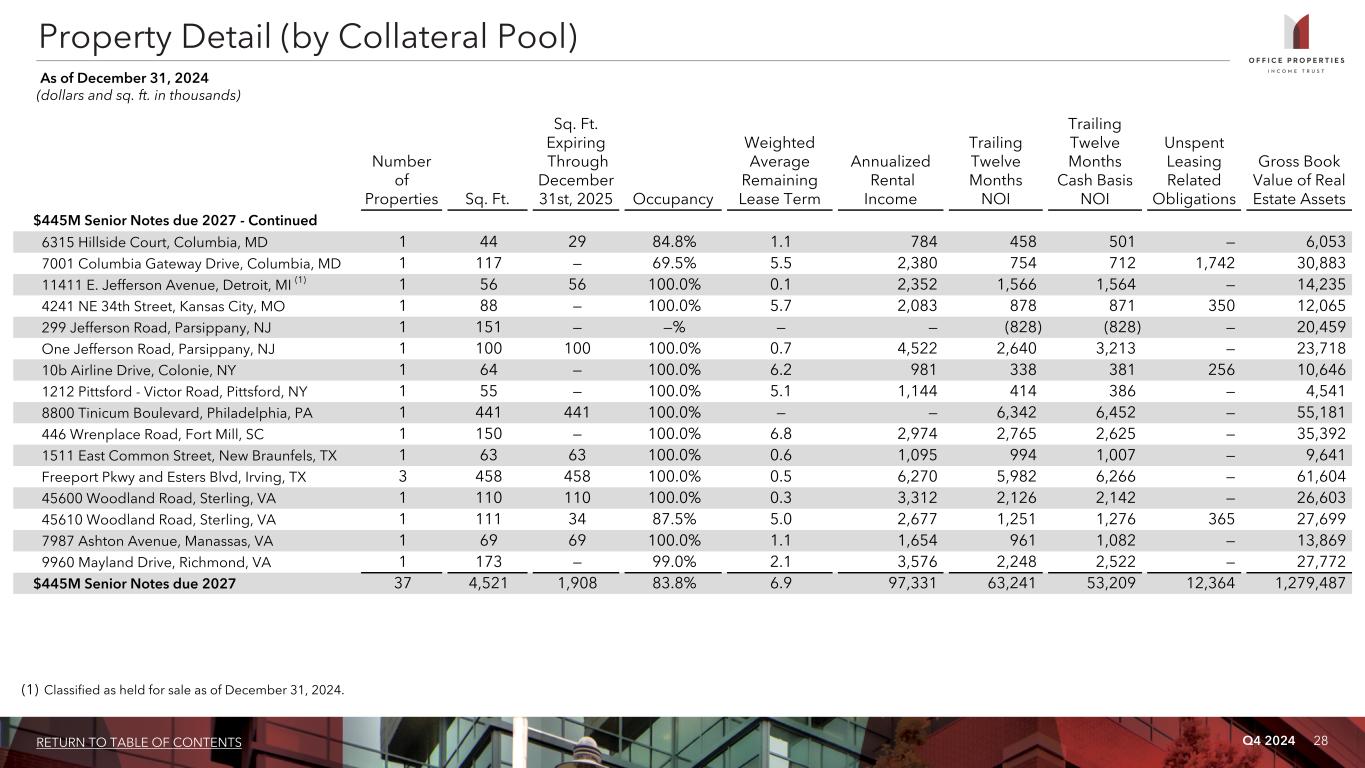

Q4 2024 28RETURN TO TABLE OF CONTENTS Property Detail (by Collateral Pool) As of December 31, 2024 (dollars and sq. ft. in thousands) Number of Properties Sq. Ft. Sq. Ft. Expiring Through December 31st, 2025 Occupancy Weighted Average Remaining Lease Term Annualized Rental Income Trailing Twelve Months NOI Trailing Twelve Months Cash Basis NOI Unspent Leasing Related Obligations Gross Book Value of Real Estate Assets $445M Senior Notes due 2027 - Continued 6315 Hillside Court, Columbia, MD 1 44 29 84.8% 1.1 784 458 501 — 6,053 7001 Columbia Gateway Drive, Columbia, MD 1 117 — 69.5% 5.5 2,380 754 712 1,742 30,883 11411 E. Jefferson Avenue, Detroit, MI (1) 1 56 56 100.0% 0.1 2,352 1,566 1,564 — 14,235 4241 NE 34th Street, Kansas City, MO 1 88 — 100.0% 5.7 2,083 878 871 350 12,065 299 Jefferson Road, Parsippany, NJ 1 151 — —% — — (828) (828) — 20,459 One Jefferson Road, Parsippany, NJ 1 100 100 100.0% 0.7 4,522 2,640 3,213 — 23,718 10b Airline Drive, Colonie, NY 1 64 — 100.0% 6.2 981 338 381 256 10,646 1212 Pittsford - Victor Road, Pittsford, NY 1 55 — 100.0% 5.1 1,144 414 386 — 4,541 8800 Tinicum Boulevard, Philadelphia, PA 1 441 441 100.0% — — 6,342 6,452 — 55,181 446 Wrenplace Road, Fort Mill, SC 1 150 — 100.0% 6.8 2,974 2,765 2,625 — 35,392 1511 East Common Street, New Braunfels, TX 1 63 63 100.0% 0.6 1,095 994 1,007 — 9,641 Freeport Pkwy and Esters Blvd, Irving, TX 3 458 458 100.0% 0.5 6,270 5,982 6,266 — 61,604 45600 Woodland Road, Sterling, VA 1 110 110 100.0% 0.3 3,312 2,126 2,142 — 26,603 45610 Woodland Road, Sterling, VA 1 111 34 87.5% 5.0 2,677 1,251 1,276 365 27,699 7987 Ashton Avenue, Manassas, VA 1 69 69 100.0% 1.1 1,654 961 1,082 — 13,869 9960 Mayland Drive, Richmond, VA 1 173 — 99.0% 2.1 3,576 2,248 2,522 — 27,772 $445M Senior Notes due 2027 37 4,521 1,908 83.8% 6.9 97,331 63,241 53,209 12,364 1,279,487 (1) Classified as held for sale as of December 31, 2024.

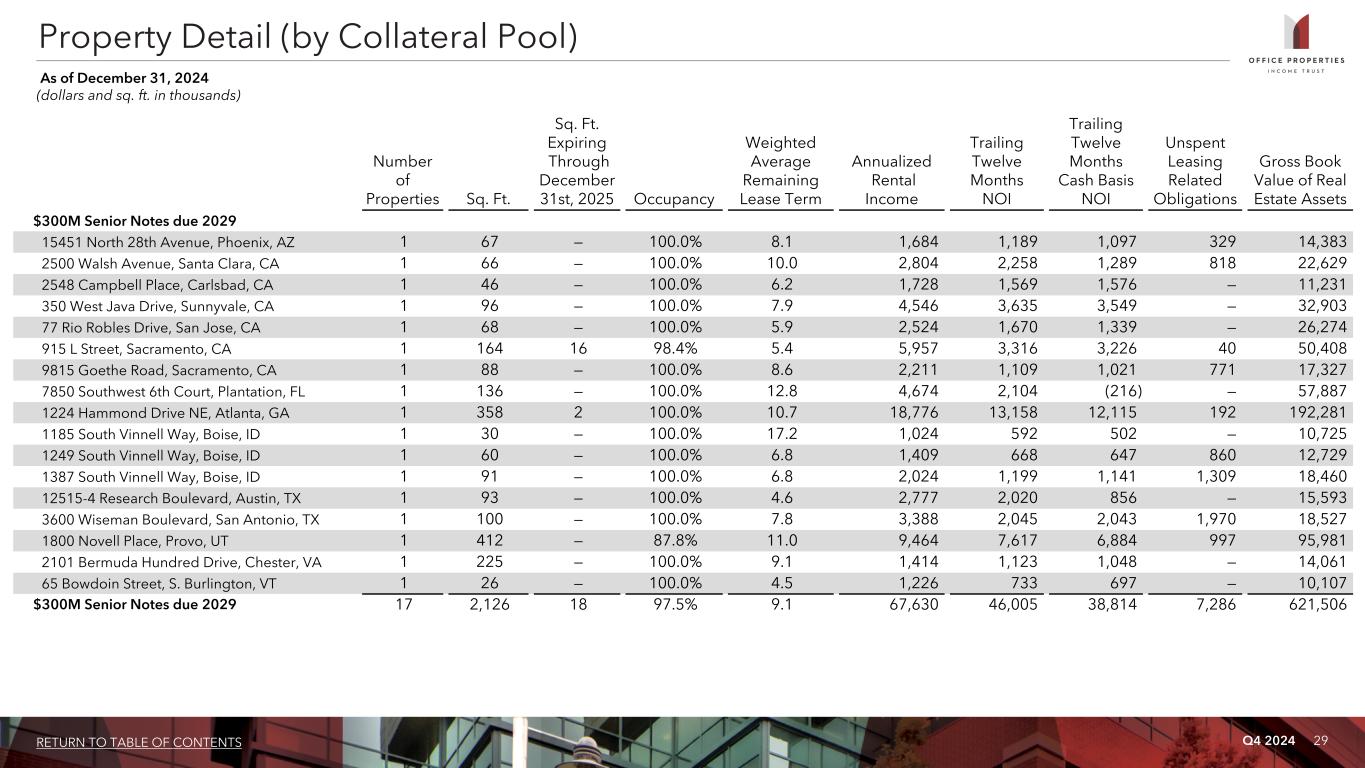

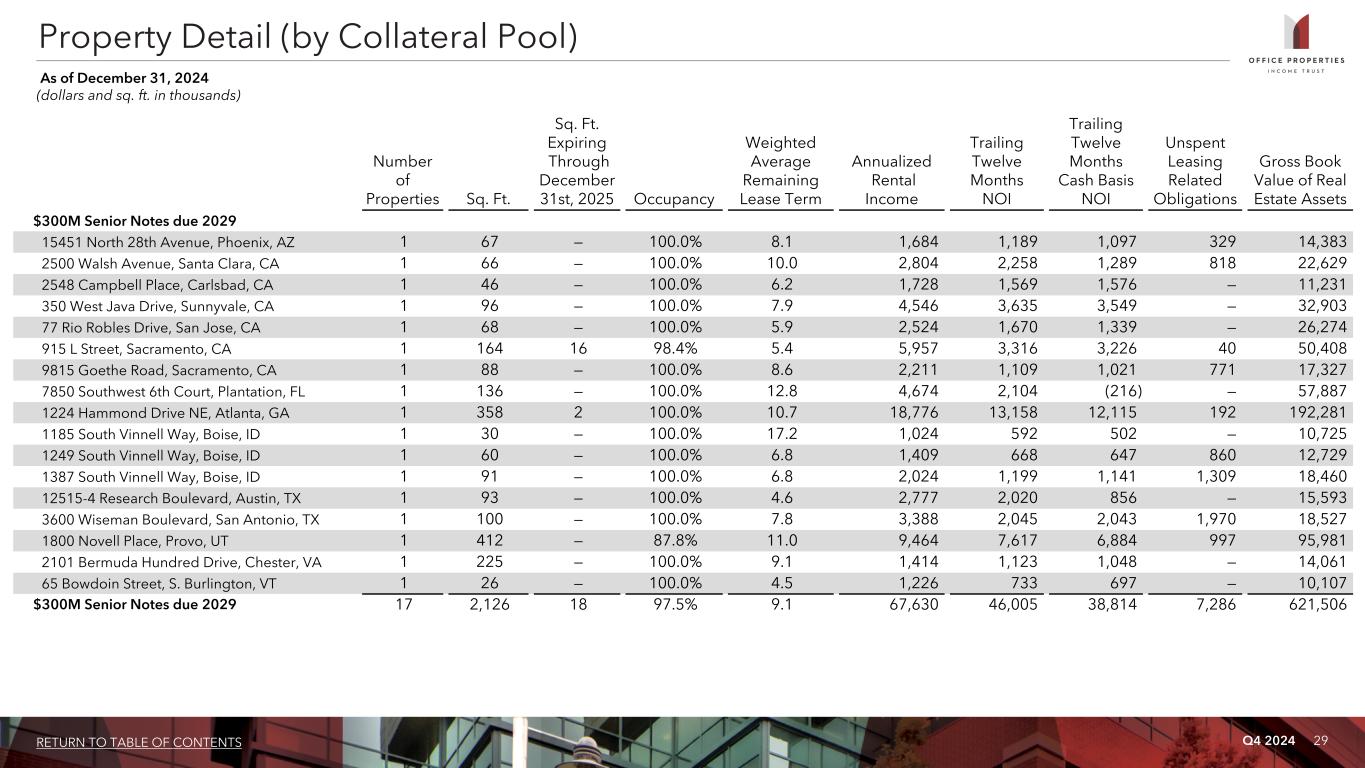

Q4 2024 29RETURN TO TABLE OF CONTENTS Property Detail (by Collateral Pool) As of December 31, 2024 (dollars and sq. ft. in thousands) Number of Properties Sq. Ft. Sq. Ft. Expiring Through December 31st, 2025 Occupancy Weighted Average Remaining Lease Term Annualized Rental Income Trailing Twelve Months NOI Trailing Twelve Months Cash Basis NOI Unspent Leasing Related Obligations Gross Book Value of Real Estate Assets $300M Senior Notes due 2029 15451 North 28th Avenue, Phoenix, AZ 1 67 — 100.0% 8.1 1,684 1,189 1,097 329 14,383 2500 Walsh Avenue, Santa Clara, CA 1 66 — 100.0% 10.0 2,804 2,258 1,289 818 22,629 2548 Campbell Place, Carlsbad, CA 1 46 — 100.0% 6.2 1,728 1,569 1,576 — 11,231 350 West Java Drive, Sunnyvale, CA 1 96 — 100.0% 7.9 4,546 3,635 3,549 — 32,903 77 Rio Robles Drive, San Jose, CA 1 68 — 100.0% 5.9 2,524 1,670 1,339 — 26,274 915 L Street, Sacramento, CA 1 164 16 98.4% 5.4 5,957 3,316 3,226 40 50,408 9815 Goethe Road, Sacramento, CA 1 88 — 100.0% 8.6 2,211 1,109 1,021 771 17,327 7850 Southwest 6th Court, Plantation, FL 1 136 — 100.0% 12.8 4,674 2,104 (216) — 57,887 1224 Hammond Drive NE, Atlanta, GA 1 358 2 100.0% 10.7 18,776 13,158 12,115 192 192,281 1185 South Vinnell Way, Boise, ID 1 30 — 100.0% 17.2 1,024 592 502 — 10,725 1249 South Vinnell Way, Boise, ID 1 60 — 100.0% 6.8 1,409 668 647 860 12,729 1387 South Vinnell Way, Boise, ID 1 91 — 100.0% 6.8 2,024 1,199 1,141 1,309 18,460 12515-4 Research Boulevard, Austin, TX 1 93 — 100.0% 4.6 2,777 2,020 856 — 15,593 3600 Wiseman Boulevard, San Antonio, TX 1 100 — 100.0% 7.8 3,388 2,045 2,043 1,970 18,527 1800 Novell Place, Provo, UT 1 412 — 87.8% 11.0 9,464 7,617 6,884 997 95,981 2101 Bermuda Hundred Drive, Chester, VA 1 225 — 100.0% 9.1 1,414 1,123 1,048 — 14,061 65 Bowdoin Street, S. Burlington, VT 1 26 — 100.0% 4.5 1,226 733 697 — 10,107 $300M Senior Notes due 2029 17 2,126 18 97.5% 9.1 67,630 46,005 38,814 7,286 621,506

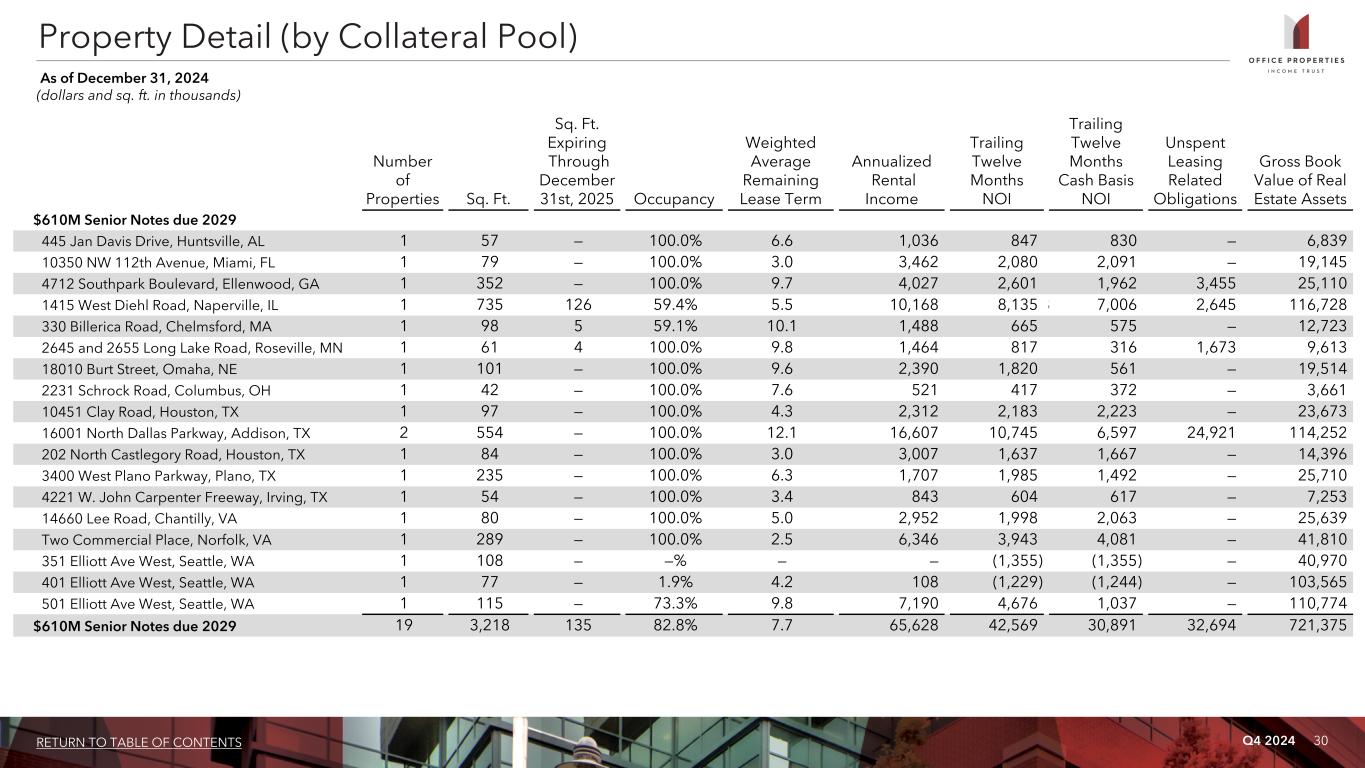

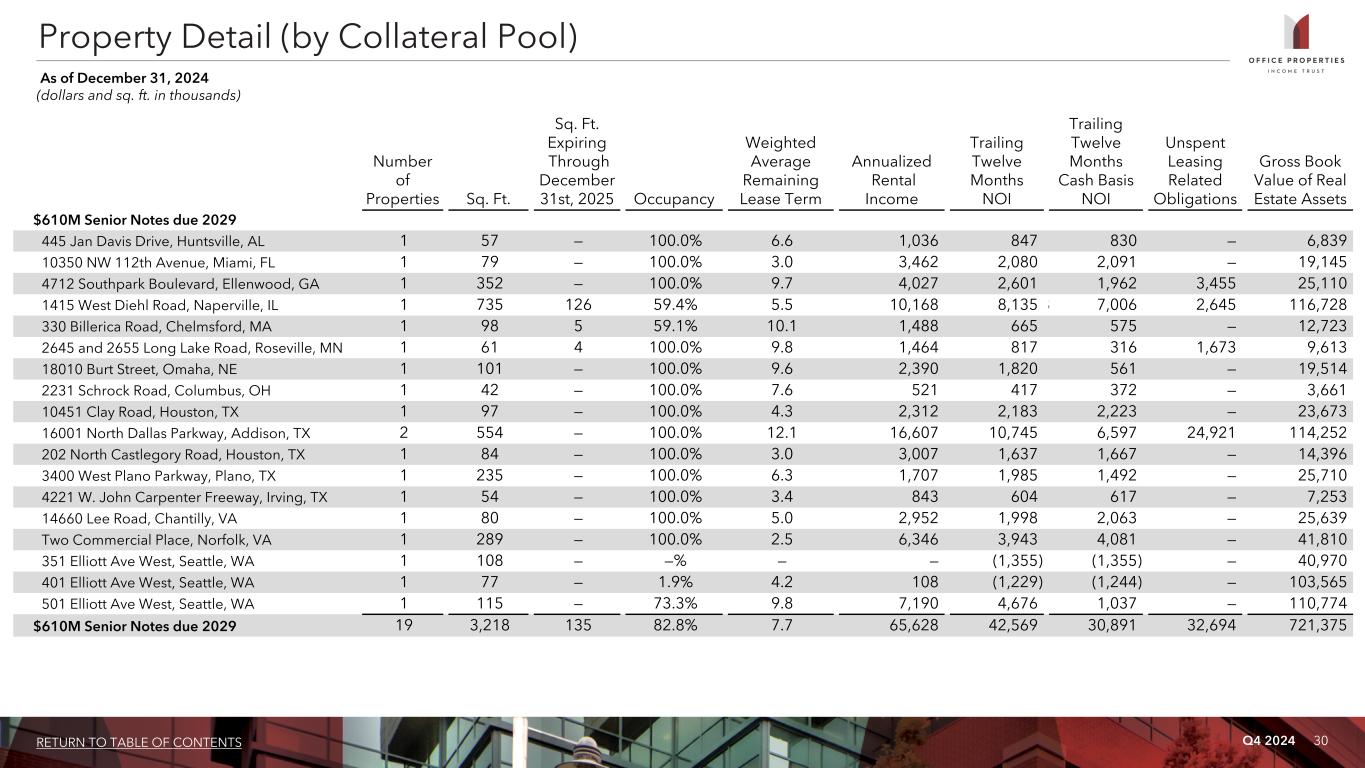

Q4 2024 30RETURN TO TABLE OF CONTENTS Property Detail (by Collateral Pool) As of December 31, 2024 (dollars and sq. ft. in thousands) Number of Properties Sq. Ft. Sq. Ft. Expiring Through December 31st, 2025 Occupancy Weighted Average Remaining Lease Term Annualized Rental Income Trailing Twelve Months NOI Trailing Twelve Months Cash Basis NOI Unspent Leasing Related Obligations Gross Book Value of Real Estate Assets $610M Senior Notes due 2029 445 Jan Davis Drive, Huntsville, AL 1 57 — 100.0% 6.6 1,036 847 830 — 6,839 10350 NW 112th Avenue, Miami, FL 1 79 — 100.0% 3.0 3,462 2,080 2,091 — 19,145 4712 Southpark Boulevard, Ellenwood, GA 1 352 — 100.0% 9.7 4,027 2,601 1,962 3,455 25,110 1415 West Diehl Road, Naperville, IL 1 735 126 59.4% 5.5 10,168 8,135 8,135 7,006 2,645 116,728 330 Billerica Road, Chelmsford, MA 1 98 5 59.1% 10.1 1,488 665 575 — 12,723 2645 and 2655 Long Lake Road, Roseville, MN 1 61 4 100.0% 9.8 1,464 817 316 1,673 9,613 18010 Burt Street, Omaha, NE 1 101 — 100.0% 9.6 2,390 1,820 561 — 19,514 2231 Schrock Road, Columbus, OH 1 42 — 100.0% 7.6 521 417 372 — 3,661 10451 Clay Road, Houston, TX 1 97 — 100.0% 4.3 2,312 2,183 2,223 — 23,673 16001 North Dallas Parkway, Addison, TX 2 554 — 100.0% 12.1 16,607 10,745 6,597 24,921 114,252 202 North Castlegory Road, Houston, TX 1 84 — 100.0% 3.0 3,007 1,637 1,667 — 14,396 3400 West Plano Parkway, Plano, TX 1 235 — 100.0% 6.3 1,707 1,985 1,492 — 25,710 4221 W. John Carpenter Freeway, Irving, TX 1 54 — 100.0% 3.4 843 604 617 — 7,253 14660 Lee Road, Chantilly, VA 1 80 — 100.0% 5.0 2,952 1,998 2,063 — 25,639 Two Commercial Place, Norfolk, VA 1 289 — 100.0% 2.5 6,346 3,943 4,081 — 41,810 351 Elliott Ave West, Seattle, WA 1 108 — —% — — (1,355) (1,355) — 40,970 401 Elliott Ave West, Seattle, WA 1 77 — 1.9% 4.2 108 (1,229) (1,244) — 103,565 501 Elliott Ave West, Seattle, WA 1 115 — 73.3% 9.8 7,190 4,676 1,037 — 110,774 $610M Senior Notes due 2029 19 3,218 135 82.8% 7.7 65,628 42,569 30,891 32,694 721,375

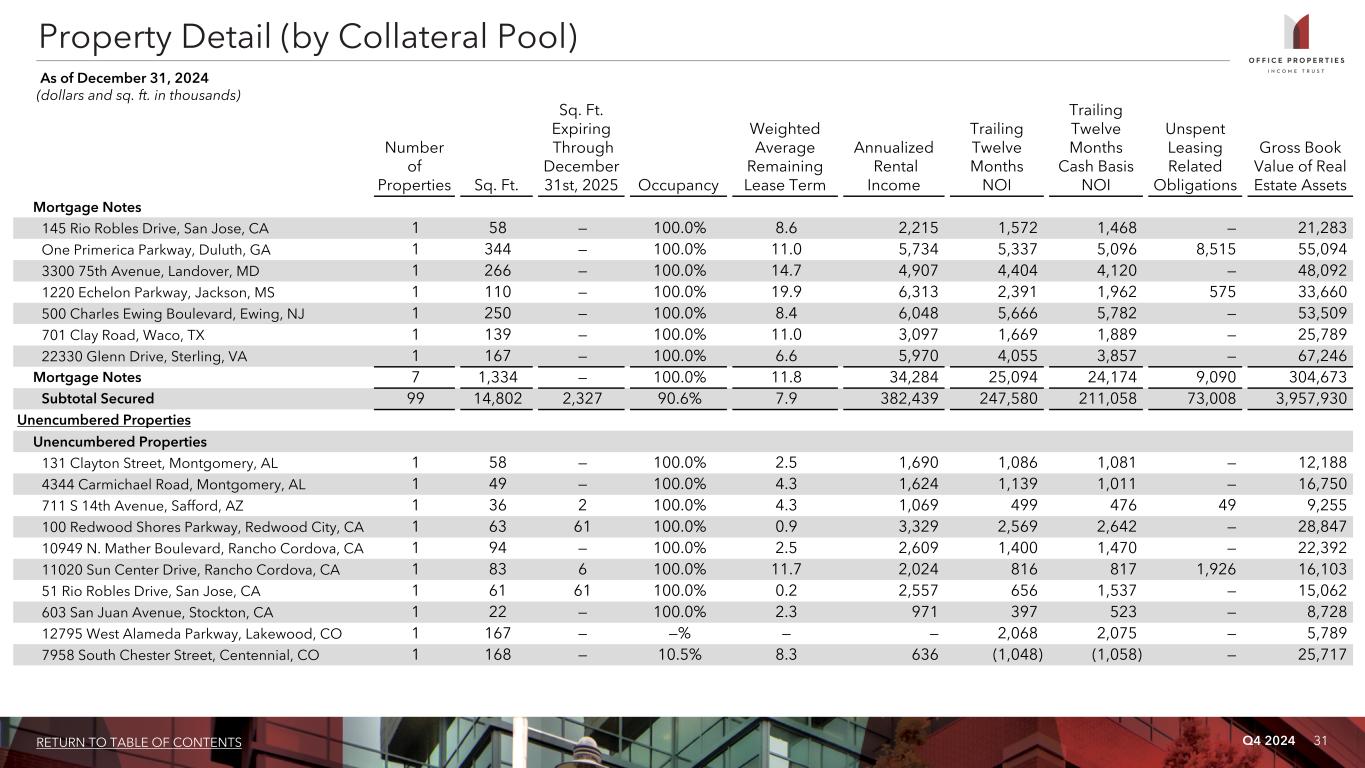

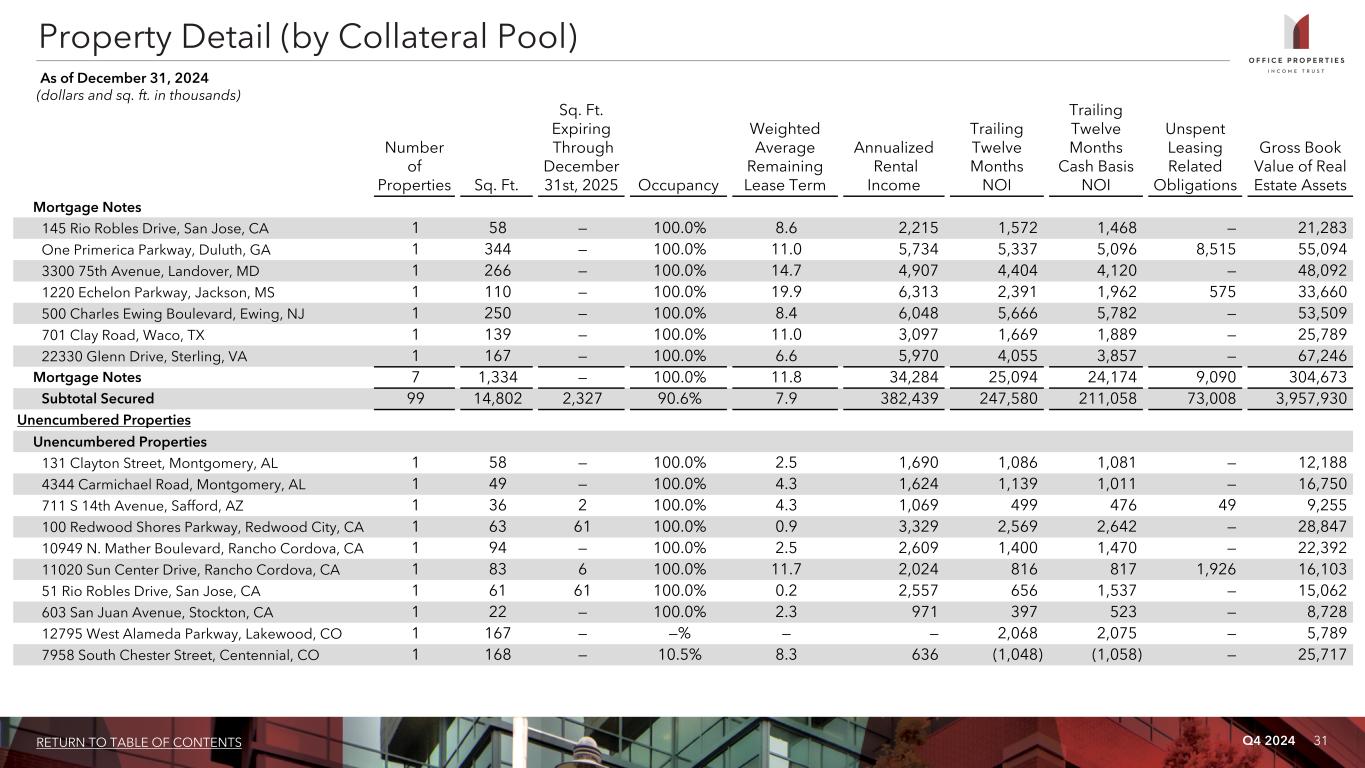

Q4 2024 31RETURN TO TABLE OF CONTENTS Property Detail (by Collateral Pool) As of December 31, 2024 (dollars and sq. ft. in thousands) Number of Properties Sq. Ft. Sq. Ft. Expiring Through December 31st, 2025 Occupancy Weighted Average Remaining Lease Term Annualized Rental Income Trailing Twelve Months NOI Trailing Twelve Months Cash Basis NOI Unspent Leasing Related Obligations Gross Book Value of Real Estate Assets Mortgage Notes 145 Rio Robles Drive, San Jose, CA 1 58 — 100.0% 8.6 2,215 1,572 1,468 — 21,283 One Primerica Parkway, Duluth, GA 1 344 — 100.0% 11.0 5,734 5,337 5,096 8,515 55,094 3300 75th Avenue, Landover, MD 1 266 — 100.0% 14.7 4,907 4,404 4,120 — 48,092 1220 Echelon Parkway, Jackson, MS 1 110 — 100.0% 19.9 6,313 2,391 1,962 575 33,660 500 Charles Ewing Boulevard, Ewing, NJ 1 250 — 100.0% 8.4 6,048 5,666 5,782 — 53,509 701 Clay Road, Waco, TX 1 139 — 100.0% 11.0 3,097 1,669 1,889 — 25,789 22330 Glenn Drive, Sterling, VA 1 167 — 100.0% 6.6 5,970 4,055 3,857 — 67,246 Mortgage Notes 7 1,334 — 100.0% 11.8 34,284 25,094 24,174 9,090 304,673 Subtotal Secured 99 14,802 2,327 90.6% 7.9 382,439 247,580 211,058 73,008 3,957,930 Unencumbered Properties Unencumbered Properties 131 Clayton Street, Montgomery, AL 1 58 — 100.0% 2.5 1,690 1,086 1,081 — 12,188 4344 Carmichael Road, Montgomery, AL 1 49 — 100.0% 4.3 1,624 1,139 1,011 — 16,750 711 S 14th Avenue, Safford, AZ 1 36 2 100.0% 4.3 1,069 499 476 49 9,255 100 Redwood Shores Parkway, Redwood City, CA 1 63 61 100.0% 0.9 3,329 2,569 2,642 — 28,847 10949 N. Mather Boulevard, Rancho Cordova, CA 1 94 — 100.0% 2.5 2,609 1,400 1,470 — 22,392 11020 Sun Center Drive, Rancho Cordova, CA 1 83 6 100.0% 11.7 2,024 816 817 1,926 16,103 51 Rio Robles Drive, San Jose, CA 1 61 61 100.0% 0.2 2,557 656 1,537 — 15,062 603 San Juan Avenue, Stockton, CA 1 22 — 100.0% 2.3 971 397 523 — 8,728 12795 West Alameda Parkway, Lakewood, CO 1 167 — —% — — 2,068 2,075 — 5,789 7958 South Chester Street, Centennial, CO 1 168 — 10.5% 8.3 636 (1,048) (1,058) — 25,717

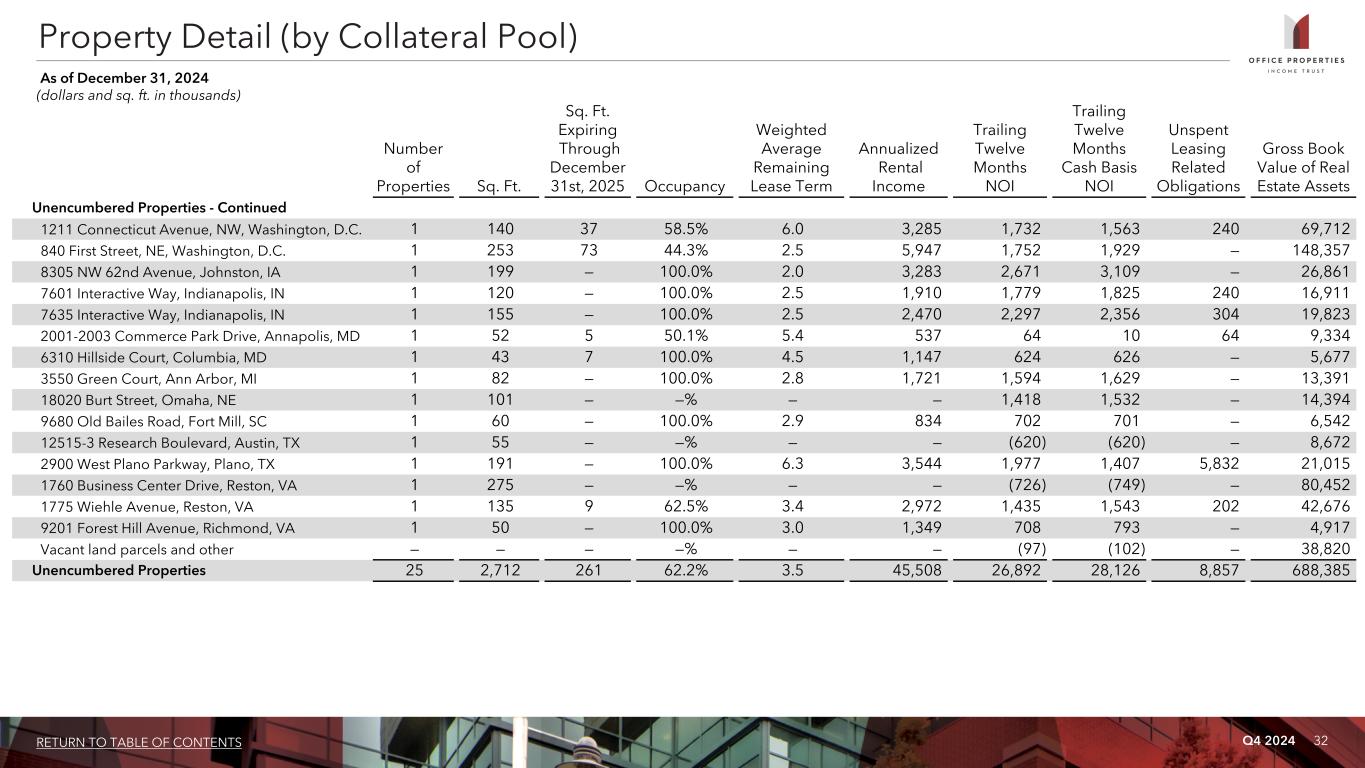

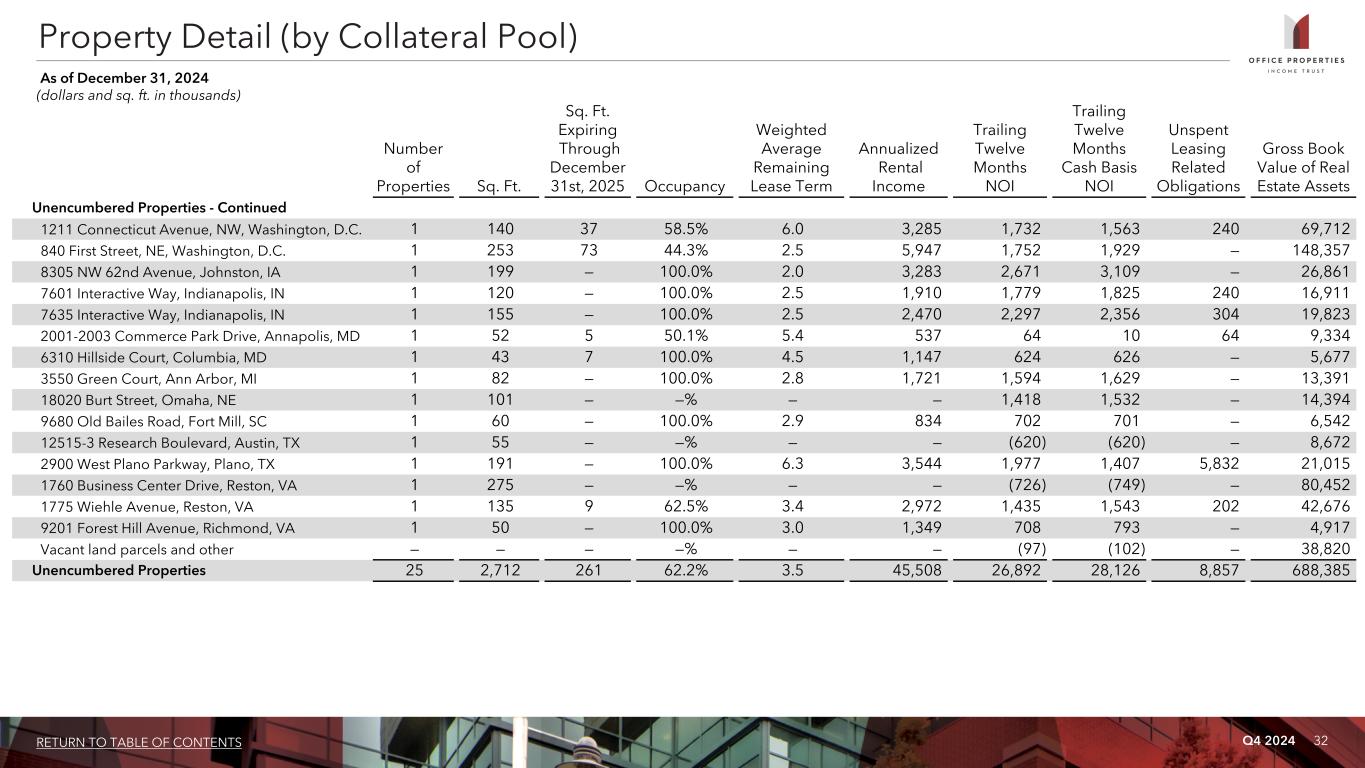

Q4 2024 32RETURN TO TABLE OF CONTENTS Property Detail (by Collateral Pool) As of December 31, 2024 (dollars and sq. ft. in thousands) Number of Properties Sq. Ft. Sq. Ft. Expiring Through December 31st, 2025 Occupancy Weighted Average Remaining Lease Term Annualized Rental Income Trailing Twelve Months NOI Trailing Twelve Months Cash Basis NOI Unspent Leasing Related Obligations Gross Book Value of Real Estate Assets Unencumbered Properties - Continued 1211 Connecticut Avenue, NW, Washington, D.C. 1 140 37 58.5% 6.0 3,285 1,732 1,563 240 69,712 840 First Street, NE, Washington, D.C. 1 253 73 44.3% 2.5 5,947 1,752 1,929 — 148,357 8305 NW 62nd Avenue, Johnston, IA 1 199 — 100.0% 2.0 3,283 2,671 3,109 — 26,861 7601 Interactive Way, Indianapolis, IN 1 120 — 100.0% 2.5 1,910 1,779 1,825 240 16,911 7635 Interactive Way, Indianapolis, IN 1 155 — 100.0% 2.5 2,470 2,297 2,356 304 19,823 2001-2003 Commerce Park Drive, Annapolis, MD 1 52 5 50.1% 5.4 537 64 10 64 9,334 6310 Hillside Court, Columbia, MD 1 43 7 100.0% 4.5 1,147 624 626 — 5,677 3550 Green Court, Ann Arbor, MI 1 82 — 100.0% 2.8 1,721 1,594 1,629 — 13,391 18020 Burt Street, Omaha, NE 1 101 — —% — — 1,418 1,532 — 14,394 9680 Old Bailes Road, Fort Mill, SC 1 60 — 100.0% 2.9 834 702 701 — 6,542 12515-3 Research Boulevard, Austin, TX 1 55 — —% — — (620) (620) — 8,672 2900 West Plano Parkway, Plano, TX 1 191 — 100.0% 6.3 3,544 1,977 1,407 5,832 21,015 1760 Business Center Drive, Reston, VA 1 275 — —% — — (726) (749) — 80,452 1775 Wiehle Avenue, Reston, VA 1 135 9 62.5% 3.4 2,972 1,435 1,543 202 42,676 9201 Forest Hill Avenue, Richmond, VA 1 50 — 100.0% 3.0 1,349 708 793 — 4,917 Vacant land parcels and other — — — —% — — (97) (102) — 38,820 Unencumbered Properties 25 2,712 261 62.2% 3.5 45,508 26,892 28,126 8,857 688,385

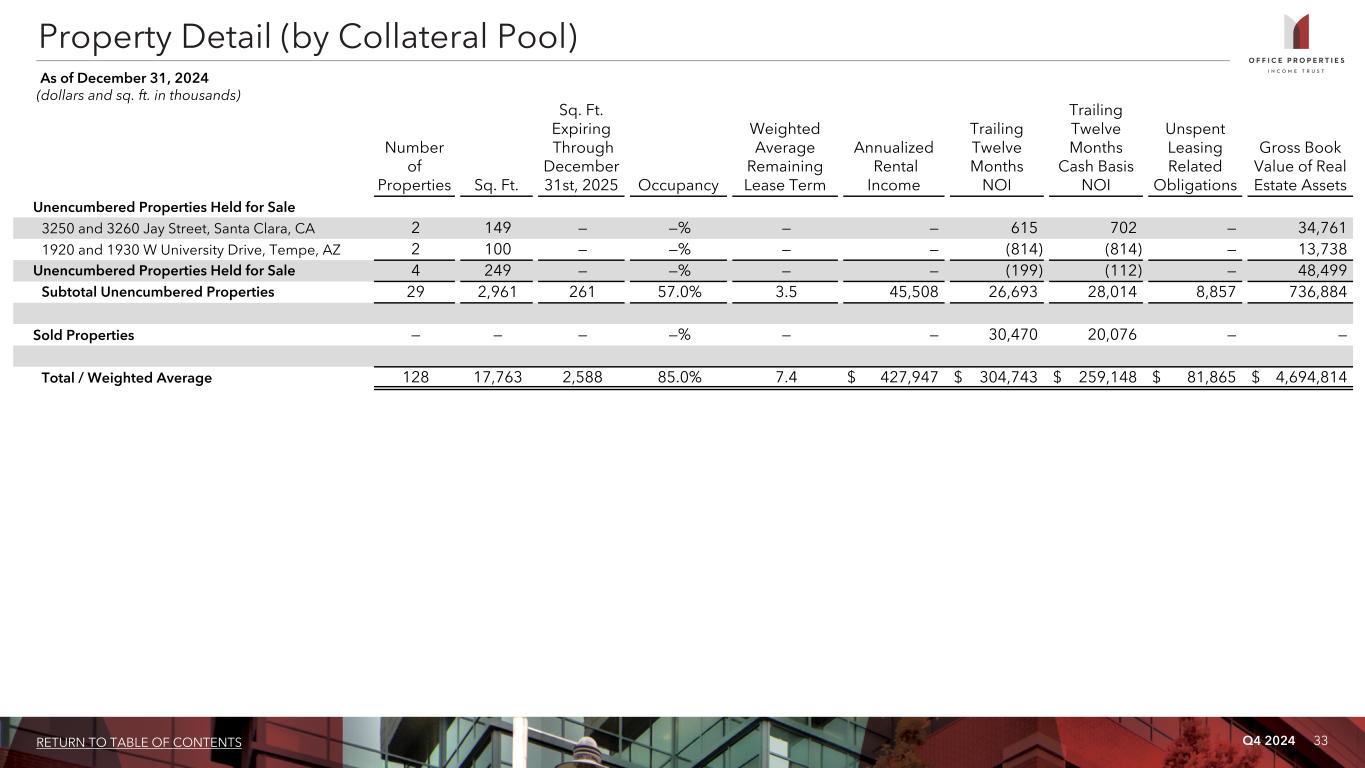

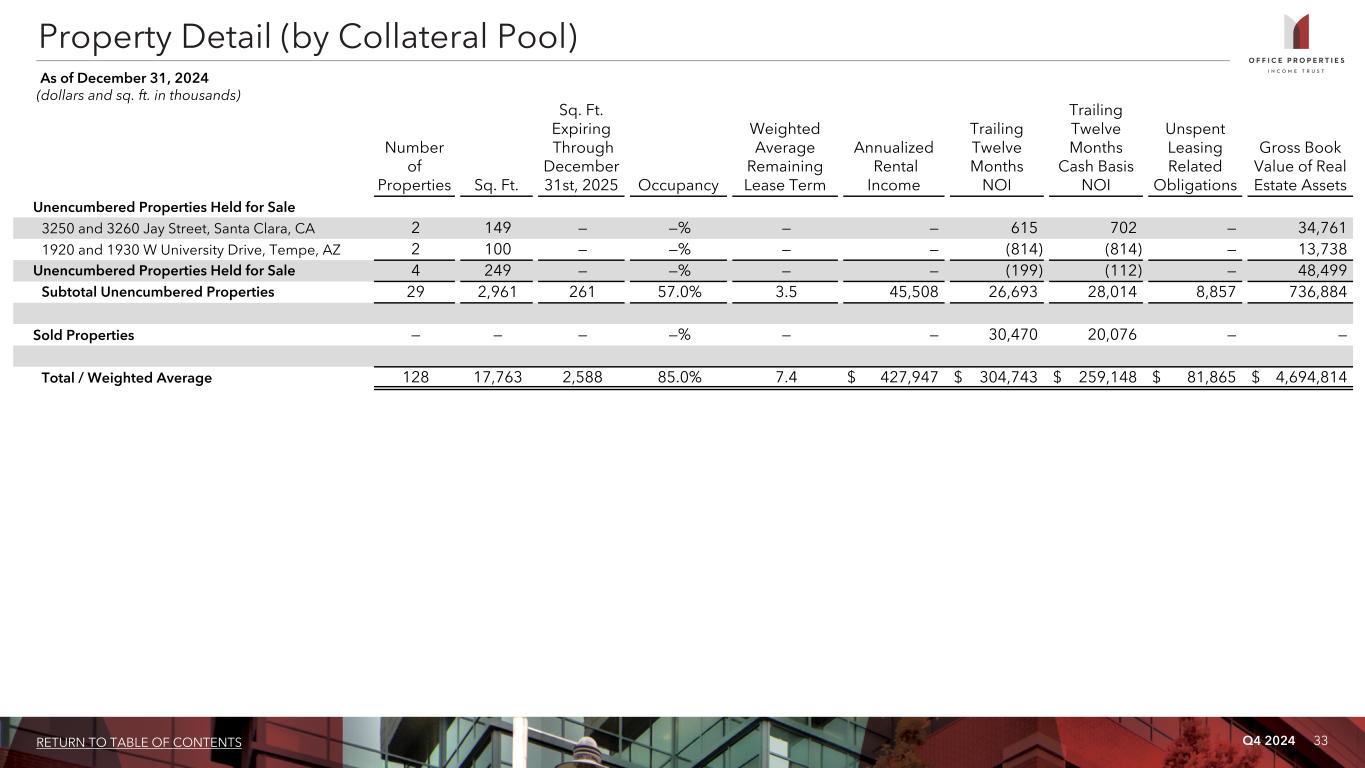

Q4 2024 33RETURN TO TABLE OF CONTENTS Property Detail (by Collateral Pool) As of December 31, 2024 (dollars and sq. ft. in thousands) Number of Properties Sq. Ft. Sq. Ft. Expiring Through December 31st, 2025 Occupancy Weighted Average Remaining Lease Term Annualized Rental Income Trailing Twelve Months NOI Trailing Twelve Months Cash Basis NOI Unspent Leasing Related Obligations Gross Book Value of Real Estate Assets Unencumbered Properties Held for Sale 3250 and 3260 Jay Street, Santa Clara, CA 2 149 — —% — — 615 702 — 34,761 1920 and 1930 W University Drive, Tempe, AZ 2 100 — —% — — (814) (814) — 13,738 Unencumbered Properties Held for Sale 4 249 — —% — — (199) (112) — 48,499 Subtotal Unencumbered Properties 29 2,961 261 57.0% 3.5 45,508 26,693 28,014 8,857 736,884 Sold Properties — — — —% — — 30,470 20,076 — — Total / Weighted Average 128 17,763 2,588 85.0% 7.4 $ 427,947 $ 304,743 $ 259,148 $ 81,865 $ 4,694,814

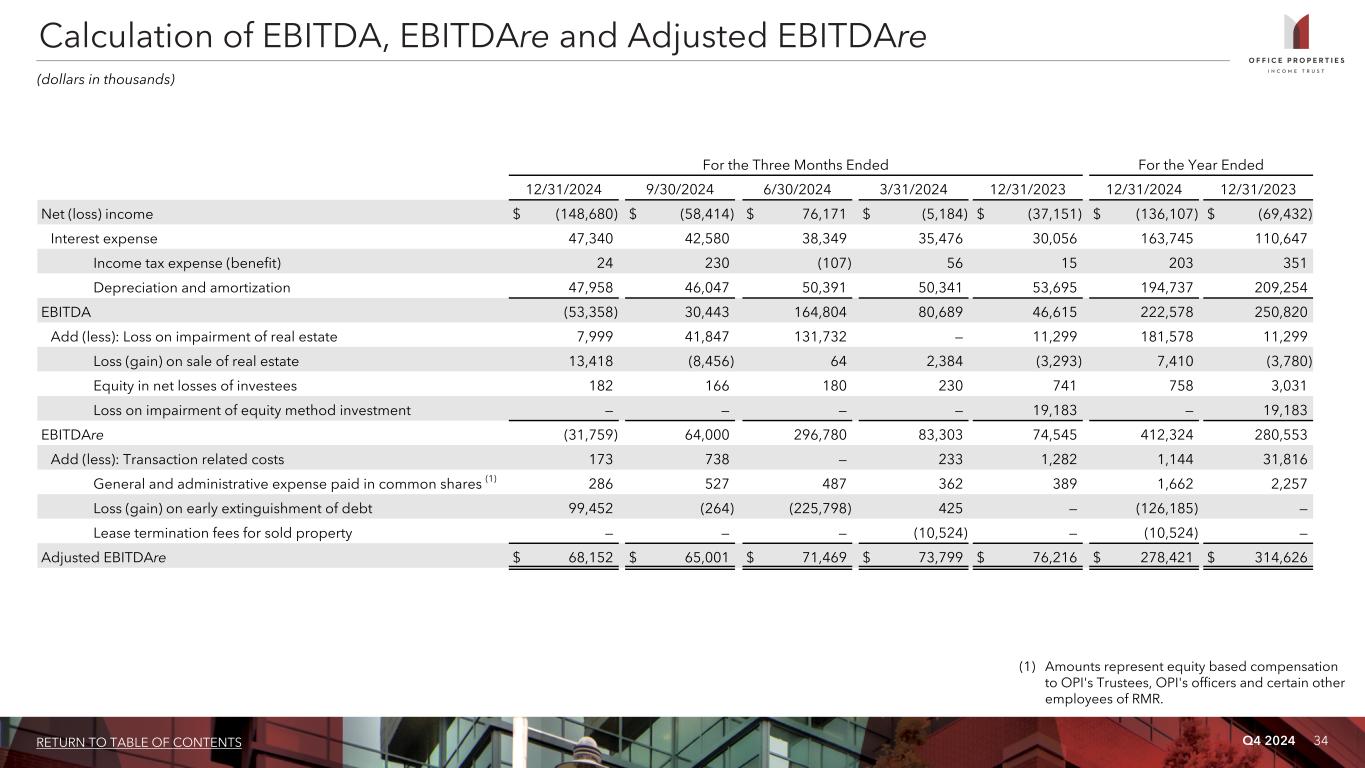

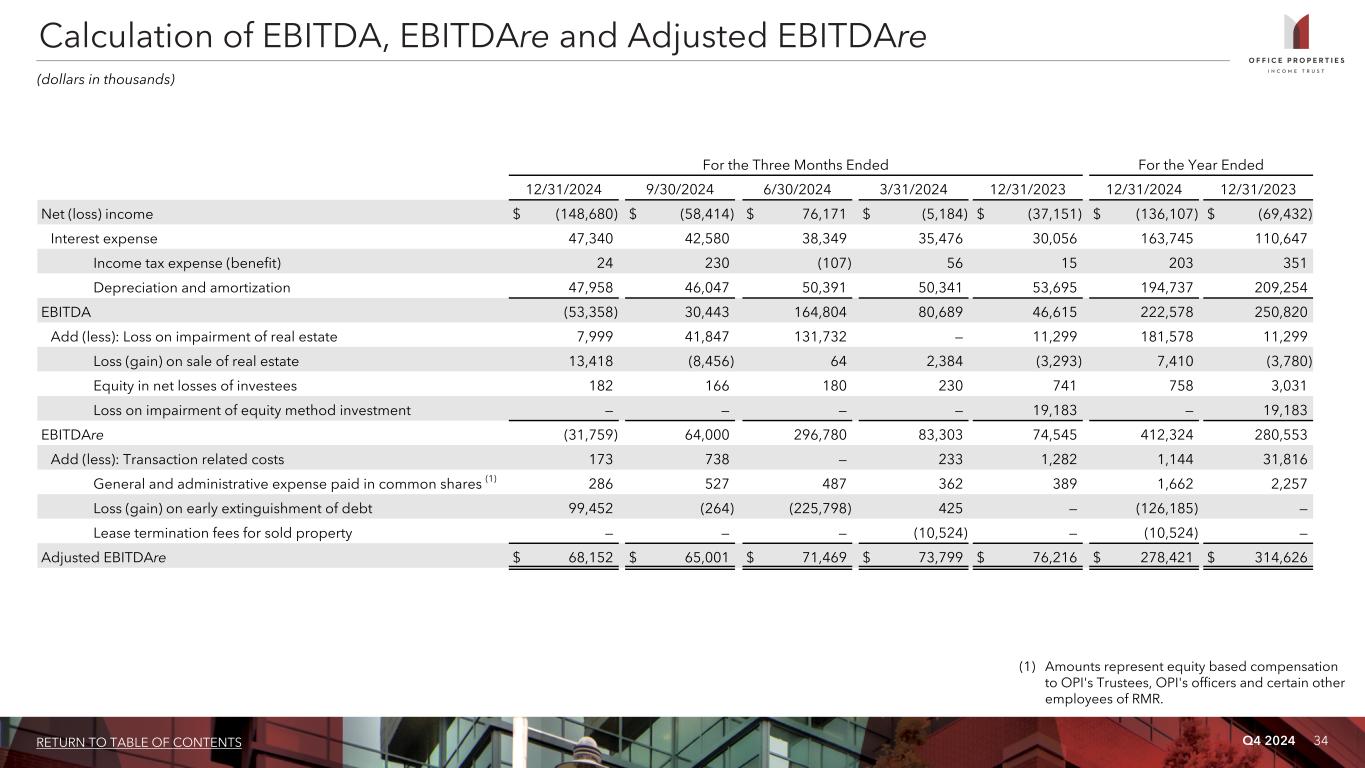

Q4 2024 34RETURN TO TABLE OF CONTENTS For the Three Months Ended For the Year Ended 12/31/2024 9/30/2024 6/30/2024 3/31/2024 12/31/2023 12/31/2024 12/31/2023 Net (loss) income $ (148,680) $ (58,414) $ 76,171 $ (5,184) $ (37,151) $ (136,107) $ (69,432) Interest expense 47,340 42,580 38,349 35,476 30,056 163,745 110,647 Income tax expense (benefit) 24 230 (107) 56 15 203 351 Depreciation and amortization 47,958 46,047 50,391 50,341 53,695 194,737 209,254 EBITDA (53,358) 30,443 164,804 80,689 46,615 222,578 250,820 Add (less): Loss on impairment of real estate 7,999 41,847 131,732 — 11,299 181,578 11,299 Loss (gain) on sale of real estate 13,418 (8,456) 64 2,384 (3,293) 7,410 (3,780) Equity in net losses of investees 182 166 180 230 741 758 3,031 Loss on impairment of equity method investment — — — — 19,183 — 19,183 EBITDAre (31,759) 64,000 296,780 83,303 74,545 412,324 280,553 Add (less): Transaction related costs 173 738 — 233 1,282 1,144 31,816 General and administrative expense paid in common shares (1) 286 527 487 362 389 1,662 2,257 Loss (gain) on early extinguishment of debt 99,452 (264) (225,798) 425 — (126,185) — Lease termination fees for sold property — — — (10,524) — (10,524) — Adjusted EBITDAre $ 68,152 $ 65,001 $ 71,469 $ 73,799 $ 76,216 $ 278,421 $ 314,626 Calculation of EBITDA, EBITDAre and Adjusted EBITDAre (dollars in thousands) (1) Amounts represent equity based compensation to OPI's Trustees, OPI's officers and certain other employees of RMR.

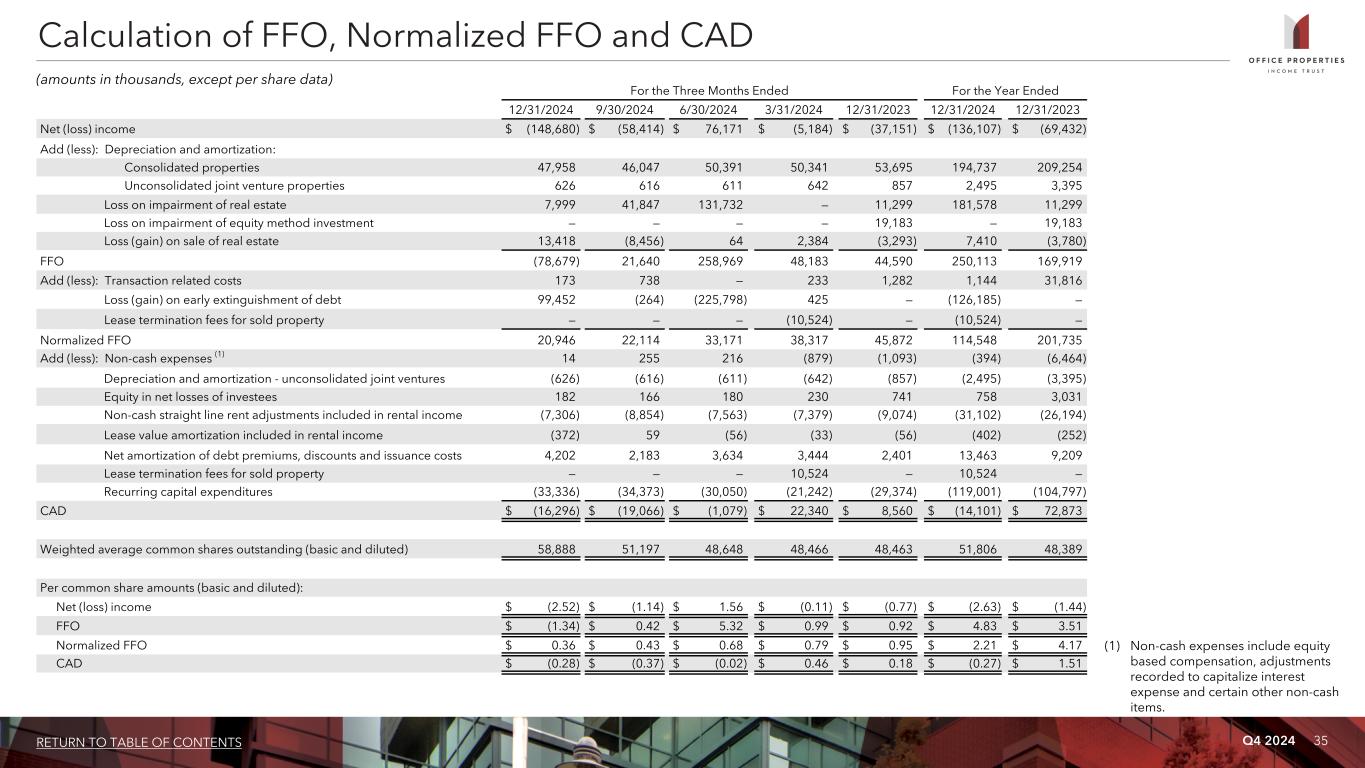

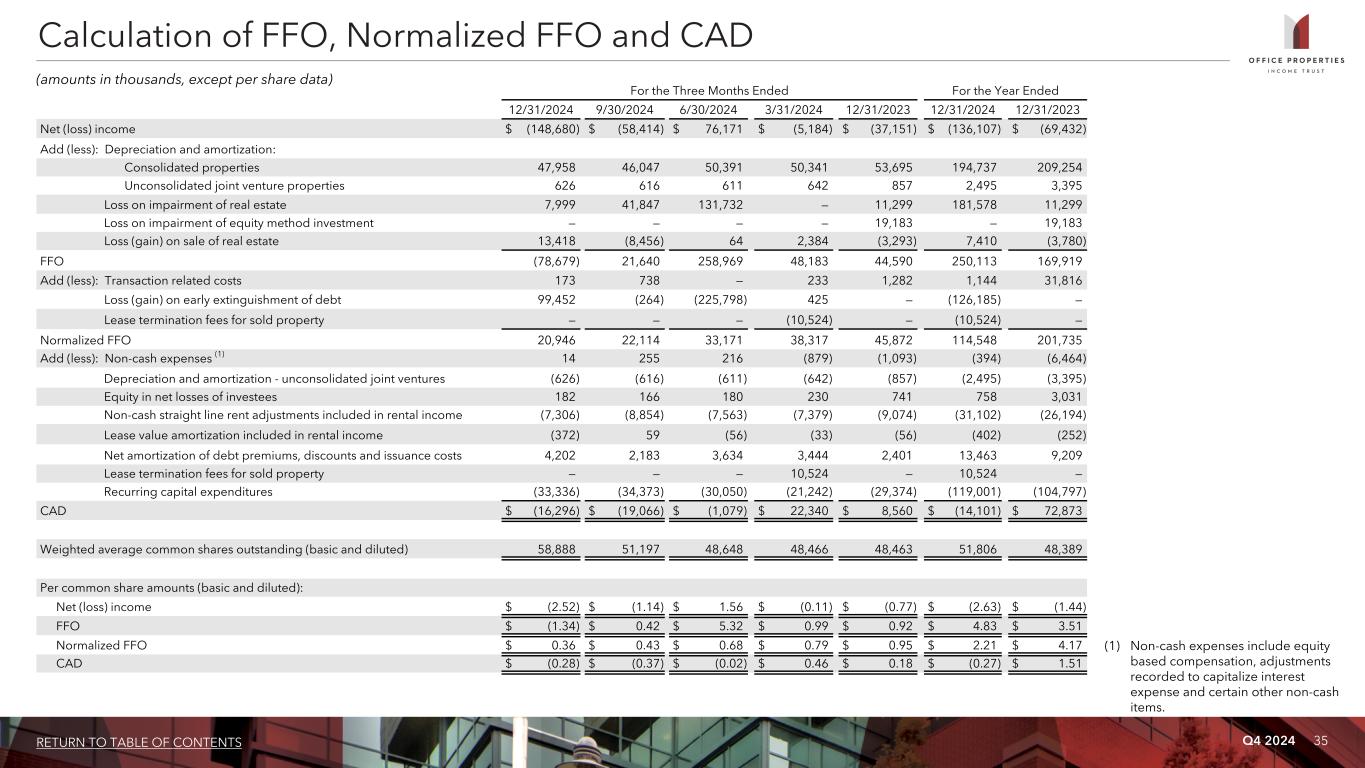

Q4 2024 35RETURN TO TABLE OF CONTENTS For the Three Months Ended For the Year Ended 12/31/2024 9/30/2024 6/30/2024 3/31/2024 12/31/2023 12/31/2024 12/31/2023 Net (loss) income $ (148,680) $ (58,414) $ 76,171 $ (5,184) $ (37,151) $ (136,107) $ (69,432) Add (less): Depreciation and amortization: Consolidated properties 47,958 46,047 50,391 50,341 53,695 194,737 209,254 Unconsolidated joint venture properties 626 616 611 642 857 2,495 3,395 Loss on impairment of real estate 7,999 41,847 131,732 — 11,299 181,578 11,299 Loss on impairment of equity method investment — — — — 19,183 — 19,183 Loss (gain) on sale of real estate 13,418 (8,456) 64 2,384 (3,293) 7,410 (3,780) FFO (78,679) 21,640 258,969 48,183 44,590 250,113 169,919 Add (less): Transaction related costs 173 738 — 233 1,282 1,144 31,816 Loss (gain) on early extinguishment of debt 99,452 (264) (225,798) 425 — (126,185) — Lease termination fees for sold property — — — (10,524) — (10,524) — Normalized FFO 20,946 22,114 33,171 38,317 45,872 114,548 201,735 Add (less): Non-cash expenses (1) 14 255 216 (879) (1,093) (394) (6,464) Depreciation and amortization - unconsolidated joint ventures (626) (616) (611) (642) (857) (2,495) (3,395) Equity in net losses of investees 182 166 180 230 741 758 3,031 Non-cash straight line rent adjustments included in rental income (7,306) (8,854) (7,563) (7,379) (9,074) (31,102) (26,194) Lease value amortization included in rental income (372) 59 (56) (33) (56) (402) (252) Net amortization of debt premiums, discounts and issuance costs 4,202 2,183 3,634 3,444 2,401 13,463 9,209 Lease termination fees for sold property — — — 10,524 — 10,524 — Recurring capital expenditures (33,336) (34,373) (30,050) (21,242) (29,374) (119,001) (104,797) CAD $ (16,296) $ (19,066) $ (1,079) $ 22,340 $ 8,560 $ (14,101) $ 72,873 Weighted average common shares outstanding (basic and diluted) 58,888 51,197 48,648 48,466 48,463 51,806 48,389 Per common share amounts (basic and diluted): Net (loss) income $ (2.52) $ (1.14) $ 1.56 $ (0.11) $ (0.77) $ (2.63) $ (1.44) FFO $ (1.34) $ 0.42 $ 5.32 $ 0.99 $ 0.92 $ 4.83 $ 3.51 Normalized FFO $ 0.36 $ 0.43 $ 0.68 $ 0.79 $ 0.95 $ 2.21 $ 4.17 CAD $ (0.28) $ (0.37) $ (0.02) $ 0.46 $ 0.18 $ (0.27) $ 1.51 (1) Non-cash expenses include equity based compensation, adjustments recorded to capitalize interest expense and certain other non-cash items. Calculation of FFO, Normalized FFO and CAD (amounts in thousands, except per share data)

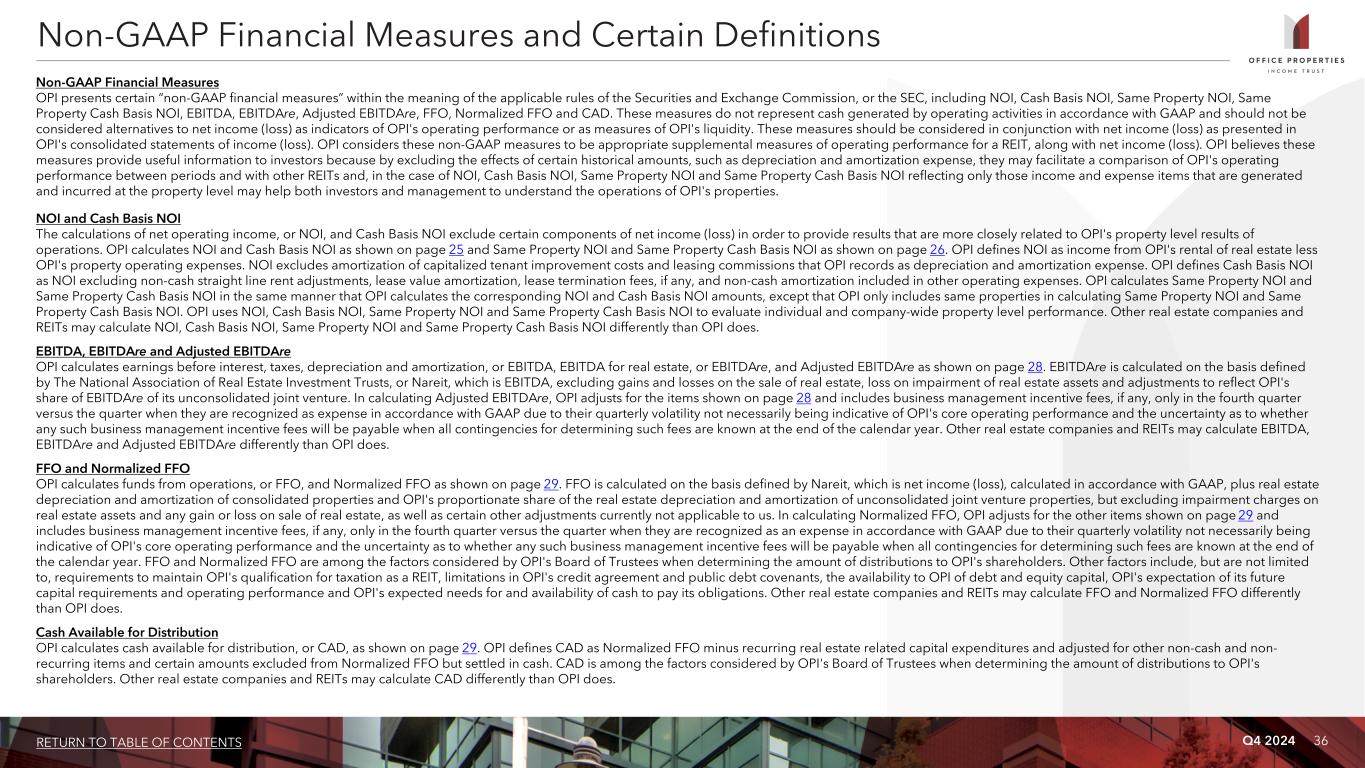

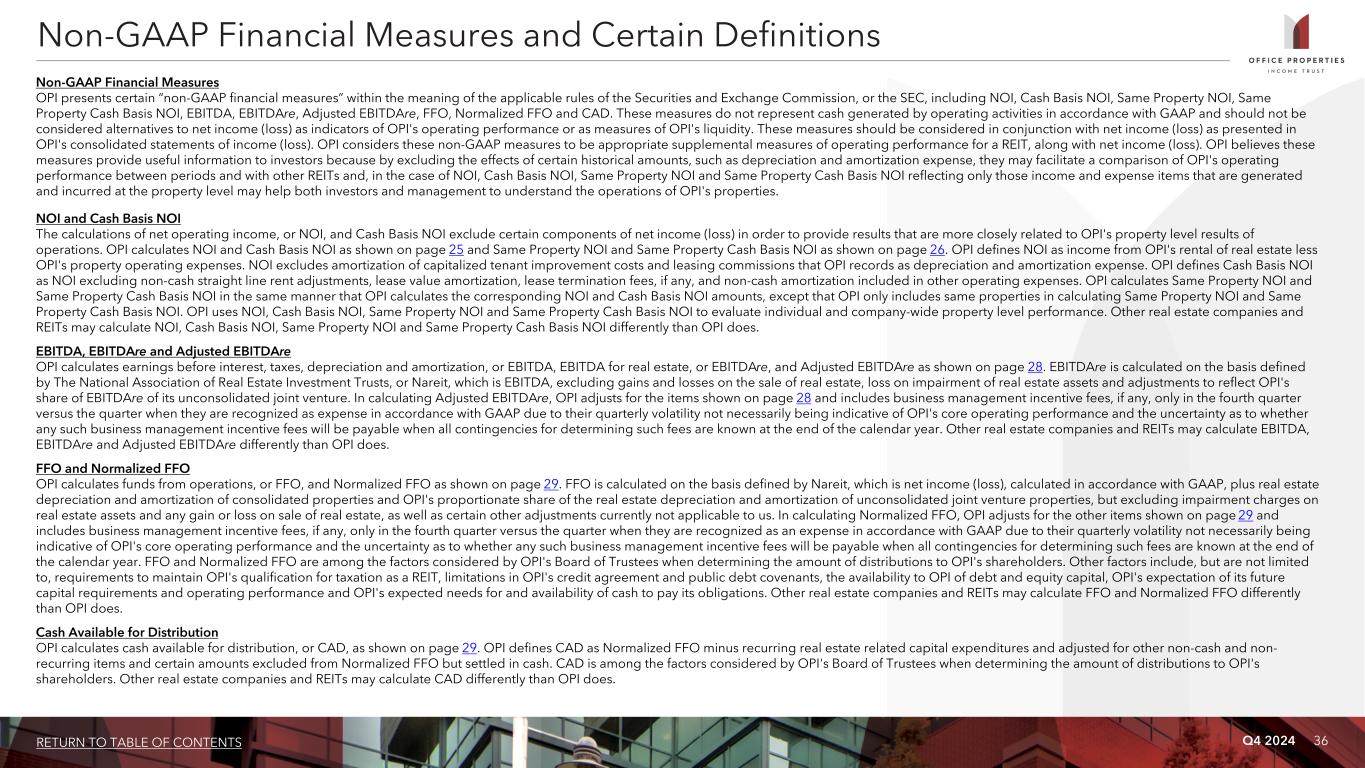

Q4 2024 36RETURN TO TABLE OF CONTENTS Non-GAAP Financial Measures OPI presents certain “non-GAAP financial measures” within the meaning of the applicable rules of the Securities and Exchange Commission, or the SEC, including NOI, Cash Basis NOI, Same Property NOI, Same Property Cash Basis NOI, EBITDA, EBITDAre, Adjusted EBITDAre, FFO, Normalized FFO and CAD. These measures do not represent cash generated by operating activities in accordance with GAAP and should not be considered alternatives to net income (loss) as indicators of OPI's operating performance or as measures of OPI's liquidity. These measures should be considered in conjunction with net income (loss) as presented in OPI's consolidated statements of income (loss). OPI considers these non-GAAP measures to be appropriate supplemental measures of operating performance for a REIT, along with net income (loss). OPI believes these measures provide useful information to investors because by excluding the effects of certain historical amounts, such as depreciation and amortization expense, they may facilitate a comparison of OPI's operating performance between periods and with other REITs and, in the case of NOI, Cash Basis NOI, Same Property NOI and Same Property Cash Basis NOI reflecting only those income and expense items that are generated and incurred at the property level may help both investors and management to understand the operations of OPI's properties. NOI and Cash Basis NOI The calculations of net operating income, or NOI, and Cash Basis NOI exclude certain components of net income (loss) in order to provide results that are more closely related to OPI's property level results of operations. OPI calculates NOI and Cash Basis NOI as shown on page 25 and Same Property NOI and Same Property Cash Basis NOI as shown on page 26. OPI defines NOI as income from OPI's rental of real estate less OPI's property operating expenses. NOI excludes amortization of capitalized tenant improvement costs and leasing commissions that OPI records as depreciation and amortization expense. OPI defines Cash Basis NOI as NOI excluding non-cash straight line rent adjustments, lease value amortization, lease termination fees, if any, and non-cash amortization included in other operating expenses. OPI calculates Same Property NOI and Same Property Cash Basis NOI in the same manner that OPI calculates the corresponding NOI and Cash Basis NOI amounts, except that OPI only includes same properties in calculating Same Property NOI and Same Property Cash Basis NOI. OPI uses NOI, Cash Basis NOI, Same Property NOI and Same Property Cash Basis NOI to evaluate individual and company-wide property level performance. Other real estate companies and REITs may calculate NOI, Cash Basis NOI, Same Property NOI and Same Property Cash Basis NOI differently than OPI does. EBITDA, EBITDAre and Adjusted EBITDAre OPI calculates earnings before interest, taxes, depreciation and amortization, or EBITDA, EBITDA for real estate, or EBITDAre, and Adjusted EBITDAre as shown on page 28. EBITDAre is calculated on the basis defined by The National Association of Real Estate Investment Trusts, or Nareit, which is EBITDA, excluding gains and losses on the sale of real estate, loss on impairment of real estate assets and adjustments to reflect OPI's share of EBITDAre of its unconsolidated joint venture. In calculating Adjusted EBITDAre, OPI adjusts for the items shown on page 28 and includes business management incentive fees, if any, only in the fourth quarter versus the quarter when they are recognized as expense in accordance with GAAP due to their quarterly volatility not necessarily being indicative of OPI's core operating performance and the uncertainty as to whether any such business management incentive fees will be payable when all contingencies for determining such fees are known at the end of the calendar year. Other real estate companies and REITs may calculate EBITDA, EBITDAre and Adjusted EBITDAre differently than OPI does. FFO and Normalized FFO OPI calculates funds from operations, or FFO, and Normalized FFO as shown on page 29. FFO is calculated on the basis defined by Nareit, which is net income (loss), calculated in accordance with GAAP, plus real estate depreciation and amortization of consolidated properties and OPI's proportionate share of the real estate depreciation and amortization of unconsolidated joint venture properties, but excluding impairment charges on real estate assets and any gain or loss on sale of real estate, as well as certain other adjustments currently not applicable to us. In calculating Normalized FFO, OPI adjusts for the other items shown on page 29 and includes business management incentive fees, if any, only in the fourth quarter versus the quarter when they are recognized as an expense in accordance with GAAP due to their quarterly volatility not necessarily being indicative of OPI's core operating performance and the uncertainty as to whether any such business management incentive fees will be payable when all contingencies for determining such fees are known at the end of the calendar year. FFO and Normalized FFO are among the factors considered by OPI's Board of Trustees when determining the amount of distributions to OPI's shareholders. Other factors include, but are not limited to, requirements to maintain OPI's qualification for taxation as a REIT, limitations in OPI's credit agreement and public debt covenants, the availability to OPI of debt and equity capital, OPI's expectation of its future capital requirements and operating performance and OPI's expected needs for and availability of cash to pay its obligations. Other real estate companies and REITs may calculate FFO and Normalized FFO differently than OPI does. Cash Available for Distribution OPI calculates cash available for distribution, or CAD, as shown on page 29. OPI defines CAD as Normalized FFO minus recurring real estate related capital expenditures and adjusted for other non-cash and non- recurring items and certain amounts excluded from Normalized FFO but settled in cash. CAD is among the factors considered by OPI's Board of Trustees when determining the amount of distributions to OPI's shareholders. Other real estate companies and REITs may calculate CAD differently than OPI does. Non-GAAP Financial Measures and Certain Definitions

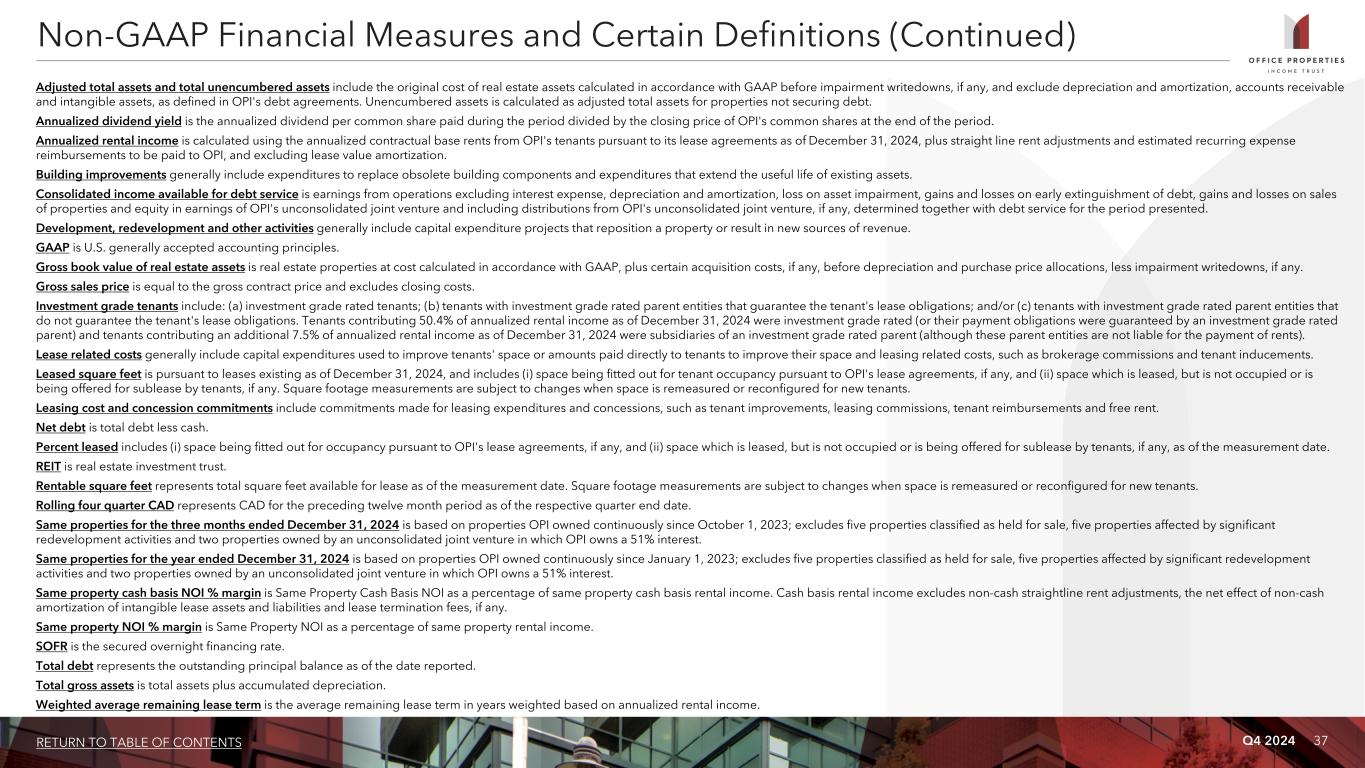

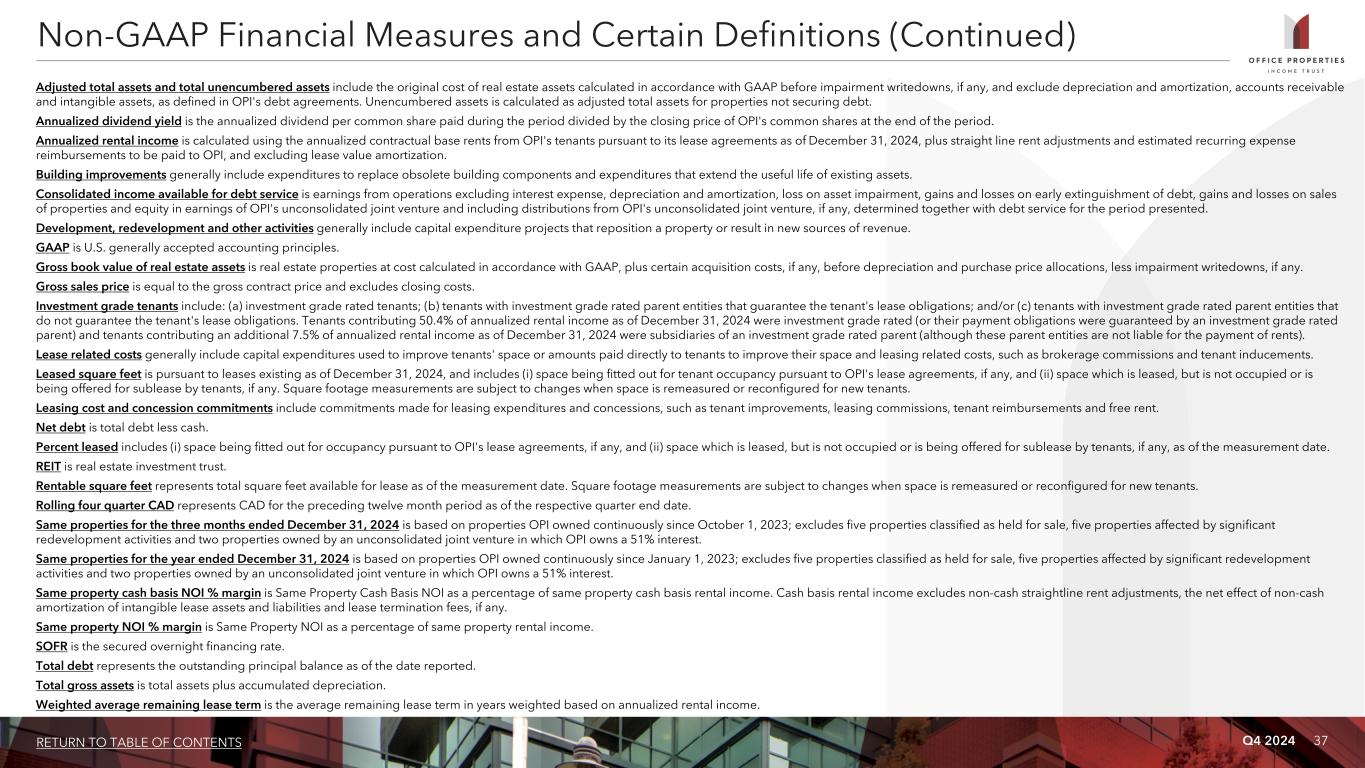

Q4 2024 37RETURN TO TABLE OF CONTENTS Adjusted total assets and total unencumbered assets include the original cost of real estate assets calculated in accordance with GAAP before impairment writedowns, if any, and exclude depreciation and amortization, accounts receivable and intangible assets, as defined in OPI's debt agreements. Unencumbered assets is calculated as adjusted total assets for properties not securing debt. Annualized dividend yield is the annualized dividend per common share paid during the period divided by the closing price of OPI's common shares at the end of the period. Annualized rental income is calculated using the annualized contractual base rents from OPI's tenants pursuant to its lease agreements as of December 31, 2024, plus straight line rent adjustments and estimated recurring expense reimbursements to be paid to OPI, and excluding lease value amortization. Building improvements generally include expenditures to replace obsolete building components and expenditures that extend the useful life of existing assets. Consolidated income available for debt service is earnings from operations excluding interest expense, depreciation and amortization, loss on asset impairment, gains and losses on early extinguishment of debt, gains and losses on sales of properties and equity in earnings of OPI's unconsolidated joint venture and including distributions from OPI's unconsolidated joint venture, if any, determined together with debt service for the period presented. Development, redevelopment and other activities generally include capital expenditure projects that reposition a property or result in new sources of revenue. GAAP is U.S. generally accepted accounting principles. Gross book value of real estate assets is real estate properties at cost calculated in accordance with GAAP, plus certain acquisition costs, if any, before depreciation and purchase price allocations, less impairment writedowns, if any. Gross sales price is equal to the gross contract price and excludes closing costs. Investment grade tenants include: (a) investment grade rated tenants; (b) tenants with investment grade rated parent entities that guarantee the tenant's lease obligations; and/or (c) tenants with investment grade rated parent entities that do not guarantee the tenant's lease obligations. Tenants contributing 50.4% of annualized rental income as of December 31, 2024 were investment grade rated (or their payment obligations were guaranteed by an investment grade rated parent) and tenants contributing an additional 7.5% of annualized rental income as of December 31, 2024 were subsidiaries of an investment grade rated parent (although these parent entities are not liable for the payment of rents). Lease related costs generally include capital expenditures used to improve tenants' space or amounts paid directly to tenants to improve their space and leasing related costs, such as brokerage commissions and tenant inducements. Leased square feet is pursuant to leases existing as of December 31, 2024, and includes (i) space being fitted out for tenant occupancy pursuant to OPI's lease agreements, if any, and (ii) space which is leased, but is not occupied or is being offered for sublease by tenants, if any. Square footage measurements are subject to changes when space is remeasured or reconfigured for new tenants. Leasing cost and concession commitments include commitments made for leasing expenditures and concessions, such as tenant improvements, leasing commissions, tenant reimbursements and free rent. Net debt is total debt less cash. Percent leased includes (i) space being fitted out for occupancy pursuant to OPI's lease agreements, if any, and (ii) space which is leased, but is not occupied or is being offered for sublease by tenants, if any, as of the measurement date. REIT is real estate investment trust. Rentable square feet represents total square feet available for lease as of the measurement date. Square footage measurements are subject to changes when space is remeasured or reconfigured for new tenants. Rolling four quarter CAD represents CAD for the preceding twelve month period as of the respective quarter end date. Same properties for the three months ended December 31, 2024 is based on properties OPI owned continuously since October 1, 2023; excludes five properties classified as held for sale, five properties affected by significant redevelopment activities and two properties owned by an unconsolidated joint venture in which OPI owns a 51% interest. Same properties for the year ended December 31, 2024 is based on properties OPI owned continuously since January 1, 2023; excludes five properties classified as held for sale, five properties affected by significant redevelopment activities and two properties owned by an unconsolidated joint venture in which OPI owns a 51% interest. Same property cash basis NOI % margin is Same Property Cash Basis NOI as a percentage of same property cash basis rental income. Cash basis rental income excludes non-cash straightline rent adjustments, the net effect of non-cash amortization of intangible lease assets and liabilities and lease termination fees, if any. Same property NOI % margin is Same Property NOI as a percentage of same property rental income. SOFR is the secured overnight financing rate. Total debt represents the outstanding principal balance as of the date reported. Total gross assets is total assets plus accumulated depreciation. Weighted average remaining lease term is the average remaining lease term in years weighted based on annualized rental income. Non-GAAP Financial Measures and Certain Definitions (Continued)

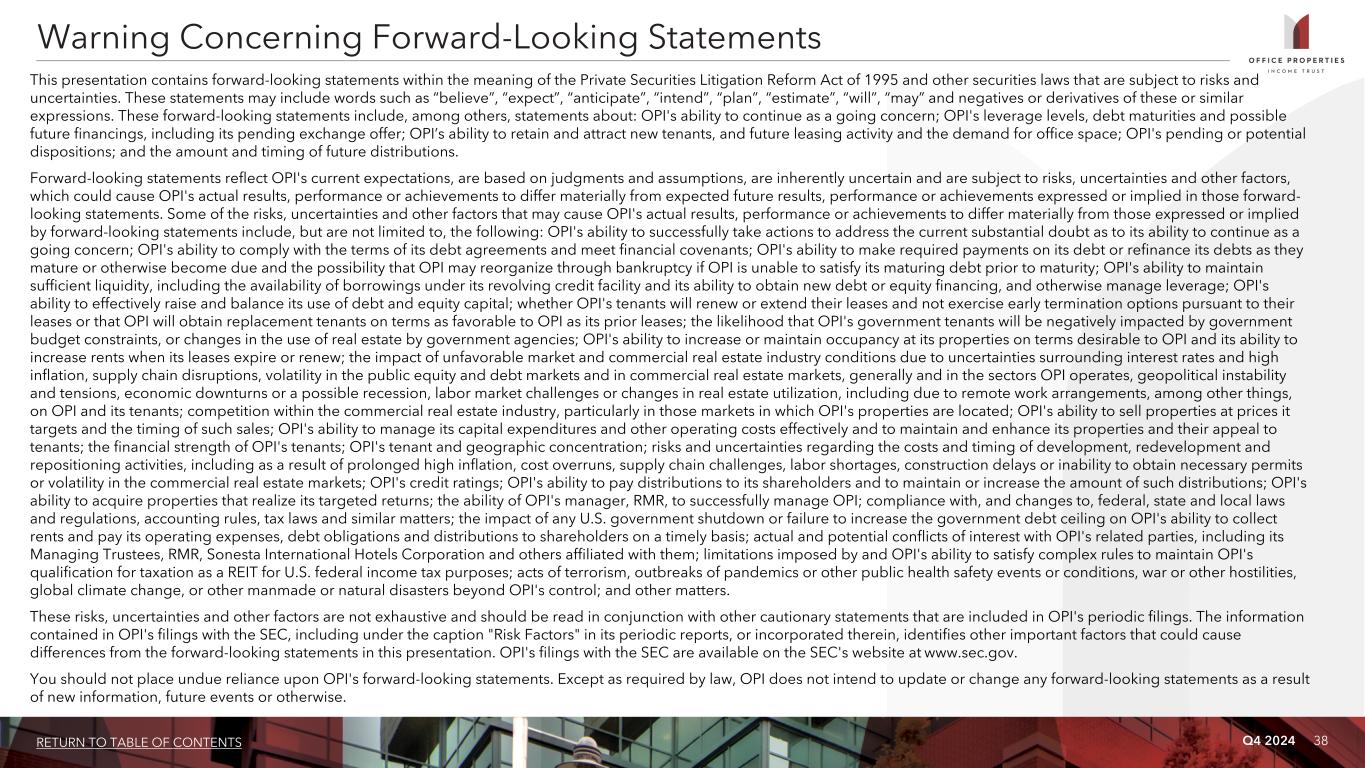

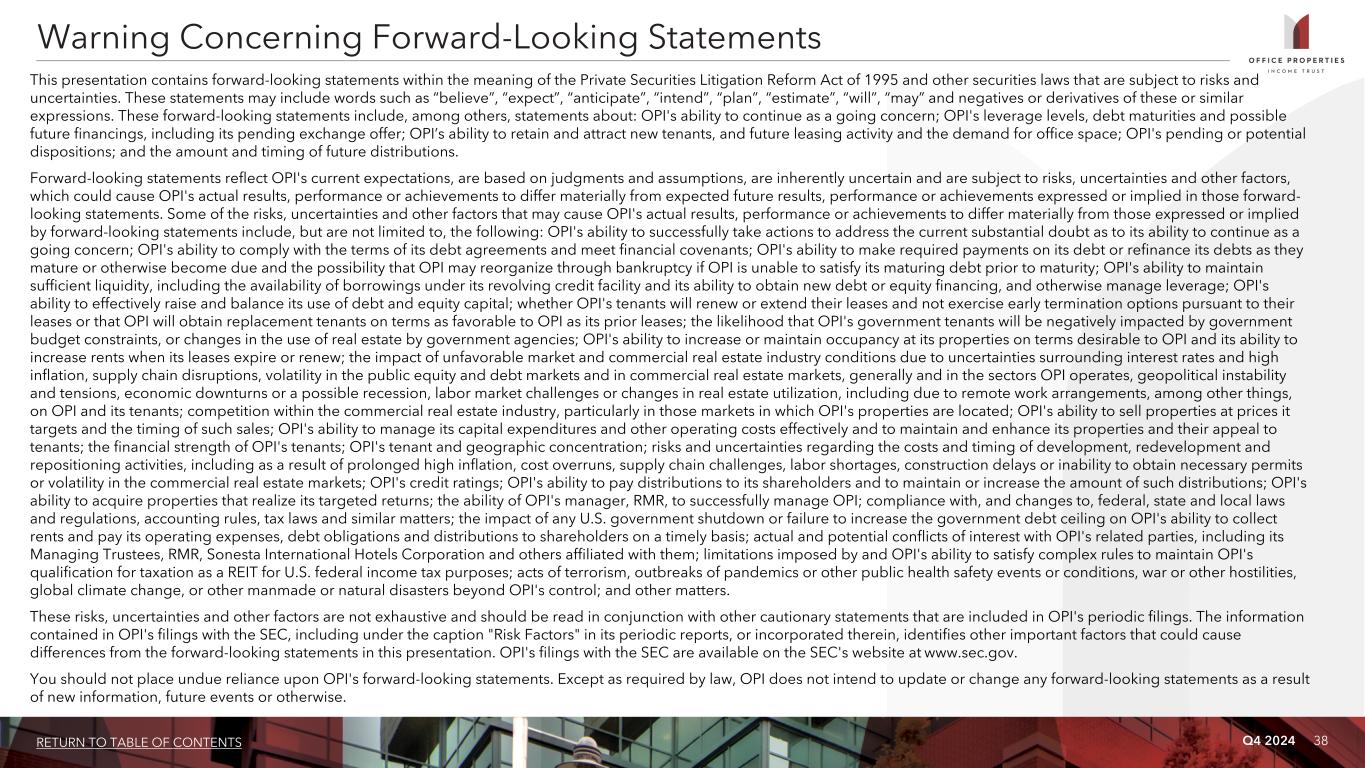

Q4 2024 38RETURN TO TABLE OF CONTENTS Warning Concerning Forward-Looking Statements This presentation contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995 and other securities laws that are subject to risks and uncertainties. These statements may include words such as “believe”, “expect”, “anticipate”, “intend”, “plan”, “estimate”, “will”, “may” and negatives or derivatives of these or similar expressions. These forward-looking statements include, among others, statements about: OPI's ability to continue as a going concern; OPI's leverage levels, debt maturities and possible future financings, including its pending exchange offer; OPI’s ability to retain and attract new tenants, and future leasing activity and the demand for office space; OPI's pending or potential dispositions; and the amount and timing of future distributions. Forward-looking statements reflect OPI's current expectations, are based on judgments and assumptions, are inherently uncertain and are subject to risks, uncertainties and other factors, which could cause OPI's actual results, performance or achievements to differ materially from expected future results, performance or achievements expressed or implied in those forward- looking statements. Some of the risks, uncertainties and other factors that may cause OPI's actual results, performance or achievements to differ materially from those expressed or implied by forward-looking statements include, but are not limited to, the following: OPI's ability to successfully take actions to address the current substantial doubt as to its ability to continue as a going concern; OPI's ability to comply with the terms of its debt agreements and meet financial covenants; OPI's ability to make required payments on its debt or refinance its debts as they mature or otherwise become due and the possibility that OPI may reorganize through bankruptcy if OPI is unable to satisfy its maturing debt prior to maturity; OPI's ability to maintain sufficient liquidity, including the availability of borrowings under its revolving credit facility and its ability to obtain new debt or equity financing, and otherwise manage leverage; OPI's ability to effectively raise and balance its use of debt and equity capital; whether OPI's tenants will renew or extend their leases and not exercise early termination options pursuant to their leases or that OPI will obtain replacement tenants on terms as favorable to OPI as its prior leases; the likelihood that OPI's government tenants will be negatively impacted by government budget constraints, or changes in the use of real estate by government agencies; OPI's ability to increase or maintain occupancy at its properties on terms desirable to OPI and its ability to increase rents when its leases expire or renew; the impact of unfavorable market and commercial real estate industry conditions due to uncertainties surrounding interest rates and high inflation, supply chain disruptions, volatility in the public equity and debt markets and in commercial real estate markets, generally and in the sectors OPI operates, geopolitical instability and tensions, economic downturns or a possible recession, labor market challenges or changes in real estate utilization, including due to remote work arrangements, among other things, on OPI and its tenants; competition within the commercial real estate industry, particularly in those markets in which OPI's properties are located; OPI's ability to sell properties at prices it targets and the timing of such sales; OPI's ability to manage its capital expenditures and other operating costs effectively and to maintain and enhance its properties and their appeal to tenants; the financial strength of OPI's tenants; OPI's tenant and geographic concentration; risks and uncertainties regarding the costs and timing of development, redevelopment and repositioning activities, including as a result of prolonged high inflation, cost overruns, supply chain challenges, labor shortages, construction delays or inability to obtain necessary permits or volatility in the commercial real estate markets; OPI's credit ratings; OPI's ability to pay distributions to its shareholders and to maintain or increase the amount of such distributions; OPI's ability to acquire properties that realize its targeted returns; the ability of OPI's manager, RMR, to successfully manage OPI; compliance with, and changes to, federal, state and local laws and regulations, accounting rules, tax laws and similar matters; the impact of any U.S. government shutdown or failure to increase the government debt ceiling on OPI's ability to collect rents and pay its operating expenses, debt obligations and distributions to shareholders on a timely basis; actual and potential conflicts of interest with OPI's related parties, including its Managing Trustees, RMR, Sonesta International Hotels Corporation and others affiliated with them; limitations imposed by and OPI's ability to satisfy complex rules to maintain OPI's qualification for taxation as a REIT for U.S. federal income tax purposes; acts of terrorism, outbreaks of pandemics or other public health safety events or conditions, war or other hostilities, global climate change, or other manmade or natural disasters beyond OPI's control; and other matters. These risks, uncertainties and other factors are not exhaustive and should be read in conjunction with other cautionary statements that are included in OPI's periodic filings. The information contained in OPI's filings with the SEC, including under the caption "Risk Factors" in its periodic reports, or incorporated therein, identifies other important factors that could cause differences from the forward-looking statements in this presentation. OPI's filings with the SEC are available on the SEC's website at www.sec.gov. You should not place undue reliance upon OPI's forward-looking statements. Except as required by law, OPI does not intend to update or change any forward-looking statements as a result of new information, future events or otherwise.