UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934

|

| | |

Filed by the Registrant ý |

Filed by a Party other than the Registrant o |

| Check the appropriate box: |

| o | | Preliminary Proxy Statement |

| o | | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ý | | Definitive Proxy Statement |

| o | | Definitive Additional Materials |

| o | | Soliciting Material under §240.14a-12 |

| | | |

| Genocea Biosciences, Inc. |

| (Name of Registrant as Specified In Its Charter) |

| | | |

| (Name of Person(s) Filing Proxy Statement, if other than the Registrant) |

| |

| Payment of Filing Fee (Check the appropriate box): |

| ý | | No fee required. |

| o | | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | (1) | Title of each class of securities to which transaction applies: |

| | (2) | Aggregate number of securities to which transaction applies: |

| | (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | (4) | Proposed maximum aggregate value of transaction: |

| | (5) | Total fee paid: |

| o | | Fee paid previously with preliminary materials. |

| o | | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | (1) | Amount Previously Paid: |

| | (2) | Form, Schedule or Registration Statement No.: |

| | (3) | Filing Party: |

| | (4) | Date Filed: |

Genocea Biosciences, Inc.

100 Acorn Park Drive,

Cambridge, MA 02140

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

The 2020 Annual Meeting of Stockholders of Genocea Biosciences, Inc. (the "Company" or "Genocea") will be held on June 1, 2020, at 9:00 a.m. EST. We have adopted a virtual format for our Annual Meeting to provide a consistent experience to all stockholders regardless of location. We will provide a live webcast of the Annual Meeting at www.virtualshareholdermeeting.com/GNCA2020. The meeting will be held for the following purposes:

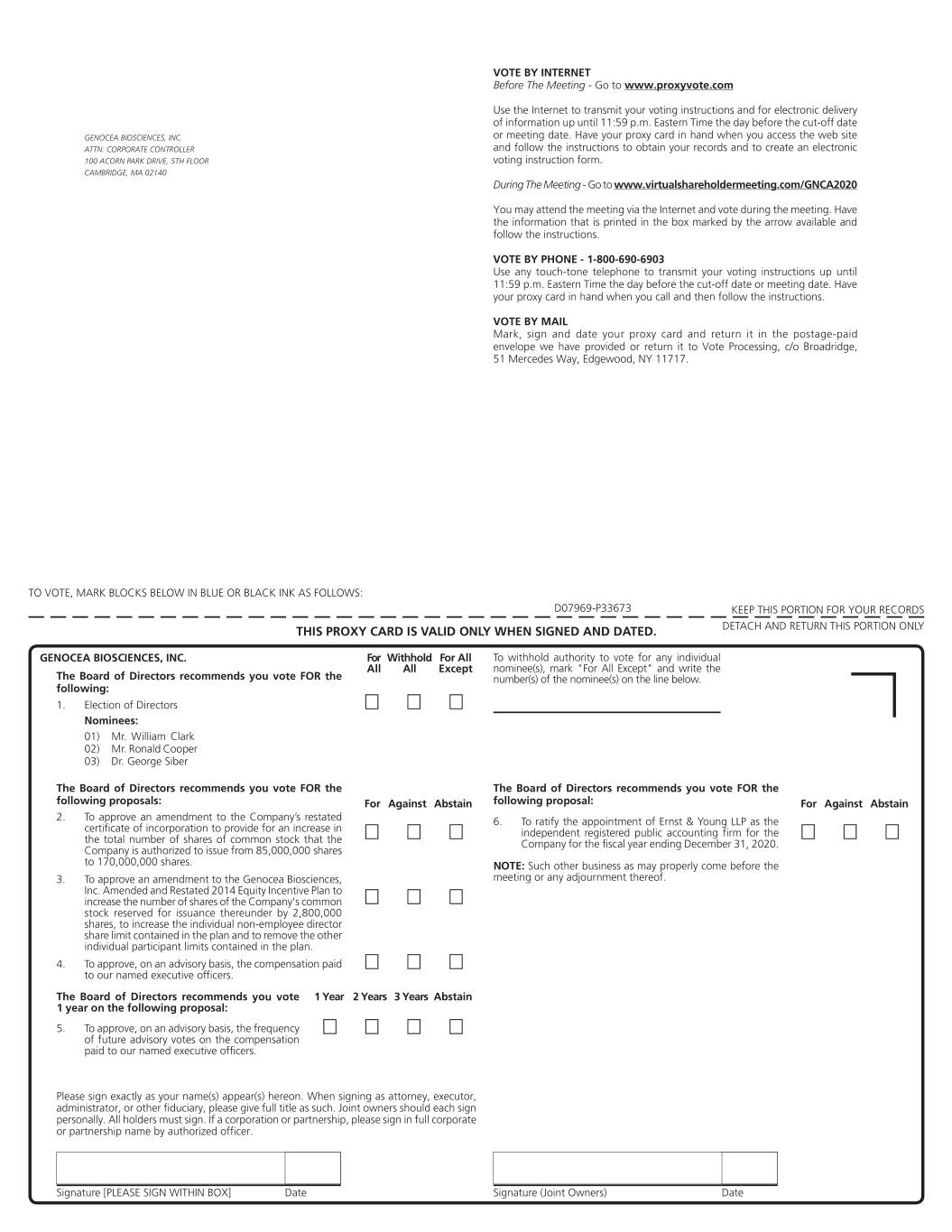

1. To elect Mr. William Clark, Mr. Ronald Cooper and Dr. George Siber as Class III directors, each for a three-year term;

2. To approve an amendment to the Company’s restated certificate of incorporation to provide for an increase in the total number of shares of common stock that the Company is authorized to issue from 85,000,000 shares to 170,000,000 shares;

3. To approve an amendment to the Genocea Biosciences, Inc. Amended and Restated 2014 Equity Incentive Plan to increase the number of shares of the Company's common stock reserved for issuance thereunder by 2,800,000 shares, to increase the individual non-employee director share limit contained in the plan and to remove the other individual participant limits contained in the plan;

4. To approve, on an advisory basis, the compensation paid to our named executive officers;

5. To approve, on an advisory basis, the frequency of future advisory votes on the compensation paid to our named executive officers;

6. To ratify the appointment of Ernst & Young LLP as the independent registered public accounting firm for the Company for the fiscal year ending December 31, 2020; and

7. To consider and act upon any other matters that properly come before the Annual Meeting or any adjournment or postponement thereof.

Each outstanding share of the Company's common stock (Nasdaq: GNCA) entitles the holder of record at the close of business on April 6, 2020, to receive notice of and to vote at the Annual Meeting or any adjournment or postponement of the Annual Meeting.

Due to the ongoing public health impact of the coronavirus outbreak (COVID-19) and to support the health and well-being of our directors, employees and stockholders, our Annual Meeting will be a completely virtual meeting of stockholders, which will be conducted via live webcast. You will be able to attend the Annual Meeting online and submit your questions during the meeting by visiting www.virtualshareholdermeeting.com/GNCA2020. You will also be able to vote your shares electronically at the Annual Meeting. Details regarding how to attend the meeting online are more fully described in the Notice of Meeting and proxy statement.

WHETHER OR NOT YOU EXPECT TO ATTEND THE ANNUAL MEETING, WE URGE YOU TO VOTE YOUR SHARES BY FOLLOWING THE INSTRUCTIONS TO THE IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS THAT YOU PREVIOUSLY RECEIVED AND SUBMIT YOUR PROXY BY INTERNET, TELEPHONE, OR BY SIGNING, DATING AND RETURNING THE PROXY CARD INCLUDED IN THESE MATERIALS. IF YOU CHOOSE TO ATTEND THE ANNUAL MEETING, YOU MAY STILL VOTE YOUR SHARES, EVEN THOUGH YOU HAVE PREVIOUSLY VOTED OR RETURNED YOUR PROXY BY ANY OF THE METHODS DESCRIBED IN OUR PROXY STATEMENT. IF YOUR SHARES ARE HELD IN A BANK OR BROKERAGE ACCOUNT, PLEASE REFER TO THE MATERIALS PROVIDED BY YOUR BANK OR BROKER FOR VOTING INSTRUCTIONS.

ALL STOCKHOLDERS ARE EXTENDED AN INVITATION TO ATTEND THE ANNUAL MEETING.

|

| | |

| | | By Order of the Board of Directors |

| | | |

| | | William Clark |

| | | President and Chief Executive Officer |

| | | April 20, 2020 |

Genocea Biosciences, Inc.

100 Acorn Park Drive,

Cambridge, MA 02140

PROXY STATEMENT FOR ANNUAL MEETING OF STOCKHOLDERS

To Be Held On June 1, 2020 at 9:00 am EST

This proxy statement (the “Proxy Statement”), along with the accompanying Notice of 2020 Annual Meeting of Stockholders, contains information about the Annual Meeting, including any adjournments or postponements of the Annual Meeting. We are holding the Annual Meeting as a virtual meeting at 9:00 a.m. EST, at www.virtualshareholdermeeting.com/GNCA2020.

On or about April 20, 2020, we made available this Proxy Statement and the attached Notice of 2020 Annual Meeting of Stockholders to all stockholders entitled to vote at the Annual Meeting, and we began sending the proxy card and the Important Notice Regarding the Availability of Proxy Materials to all stockholders entitled to vote at the Annual Meeting. Although not part of this Proxy Statement, we have also made available with this Proxy Statement our Annual Report on Form 10-K for the fiscal year ended December 31, 2019 (the “Annual Report”), which includes our financial statements for the fiscal year ended December 31, 2019.

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE STOCKHOLDER MEETING TO BE HELD ON JUNE 1, 2020

This Proxy Statement and our Annual Report are available for viewing, printing and downloading at www.proxyvote.com. To view these materials, please have your 16-digit control number(s) available that appears on your proxy card.

Additionally, you can find a copy of our Annual Report on the website of the Securities and Exchange Commission (“SEC”) at www.sec.gov, or in the “Financials & Filings - Annual Reports and Proxies” tab of the “Investors” section of our website at www.genocea.com. You may also obtain a printed copy of our Annual Report, free of charge, by sending a written request to: Genocea Biosciences, Inc., 100 Acorn Park Drive, Cambridge, Massachusetts 02140, Attention: Secretary. Exhibits, if any, will be provided upon written request and payment of an appropriate processing fee.

GENERAL INFORMATION

When are this Proxy Statement and the accompanying material scheduled to be sent to stockholders?

On or about April 20, 2020, we began sending the Important Notice Regarding the Availability of Proxy Materials to all stockholders entitled to vote at the Annual Meeting.

Who is soliciting my vote?

The Board of Directors of the Company is soliciting your vote for the 2020 Annual Meeting of Stockholders.

When is the record date for the Annual Meeting?

The Company's Board of Directors has fixed the record date for the Annual Meeting as of the close of business on April 6, 2020.

Meeting Information

We will hold the Annual Meeting exclusively online via a live audio webcast at www.virtualshareholdermeeting.com/GNCA2020 at 9:00 a.m. EST on June 1, 2020, unless adjourned or postponed. There is no physical location for the Annual Meeting. Directions for accessing the virtual Annual Meeting can be found under the Investors section of our website at www.genocea.com.

Why a virtual Annual Meeting?

Due to the ongoing public health impact of the coronavirus outbreak (COVID-19) and to support the health and well-being of our directors, employees and stockholders, we are relying on the latest technology to host a virtual Annual Meeting. Stockholders will be able to attend the Annual Meeting online and submit questions by visiting www.virtualshareholdermeeting.com/GNCA2020. Stockholders will also be able to vote their shares electronically during the Annual Meeting.

How do I attend the Annual Meeting?

Our Annual Meeting will begin promptly at 9:00 a.m. EST in a virtual meeting format at www.virtualshareholdermeeting.com/GNCA2020. To participate in the Annual Meeting, you will need the 16-digit control number included in your Notice or on the instructions that accompanied your proxy materials. The meeting webcast will begin promptly at 9:00 a.m. EST. We encourage you to access the meeting prior to the start time. Online check-in will start shortly before the meeting, and you should allow ample time for the check-in procedures. Instructions should also be provided on the voting instruction card provided by your bank or brokerage firm. If you lose your 16-digit control number, you may join the Annual Meeting as a “Guest,” but you will not be able to vote, ask questions or access the list of stockholders as of the Record Date.

What if During the Check-In Time or During the Annual Meeting I have Technical Difficulties or Trouble Accessing the Virtual Meeting Website?

We will have technicians ready to assist you with any technical difficulties you may have accessing the virtual meeting website. If you encounter any difficulties accessing the virtual meeting website during the check-in or meeting time, please call the technical support number that will be posted on the Annual Meeting log-in page.

How many votes can be cast by all stockholders?

A total of 27,643,773 shares of common stock of the Company were outstanding on April 6, 2020 and are entitled to be voted at the Annual Meeting. Each share of common stock is entitled to one vote on each matter.

How do I vote?

If you are a stockholder of record and your shares are registered directly in your name, you may vote:

| |

| • | By Internet. Access the website at www.proxyvote.com and follow the instructions provided on the Important Notice Regarding Availability of Proxy Materials on the proxy card. Your shares will be voted in accordance with your instructions. You must specify how you want your shares voted, or your Internet vote cannot be completed and you will receive an error message. |

| |

| • | By Telephone. Call 1-800-690-6903 toll-free and follow the instructions on the enclosed proxy card. Your shares will be voted in accordance with your instructions. You must specify how you want your shares voted, or your telephone vote cannot be completed. |

| |

| • | By Mail. Complete and mail the enclosed proxy card to Vote Processing, c/o Broadridge, 51 Mercedes Way, Edgewood, NY, 11717 in the enclosed postage prepaid envelope. Your proxy will be voted in accordance with your instructions. If you sign and return the enclosed proxy but do not specify how you want your shares voted, they will be voted (i) FOR the election as directors of the nominees named herein to the Company's Board of Directors, (ii) FOR approval of the amendment to our restated certificate of incorporation to increase the number of shares of common stock authorized for issuance from 85,000,000 shares to 170,000,000 shares; (iii) FOR approval of the amendment to the Genocea Biosciences, Inc. Amended and Restated 2014 Equity Incentive Plan to increase the number of shares reserved for issuance thereunder by 2,800,000 shares, to increase the individual non-employee director share limit contained in the plan and to remove the other individual participant limits contained in this plan; (iv) FOR approval of the advisory vote on the compensation paid to our named executive officers; (v) FOR approval of the advisory vote on an annual frequency for future advisory votes on the compensation paid to our named executive officers; (vi) FOR the ratification of Ernst & Young LLP as the Company's independent registered public accounting firm for the fiscal year ending December 31, 2020, and (vii) will be voted according to the discretion of the proxy holder named in the proxy card upon any other business that may properly be brought before the Annual Meeting and at all adjournments and postponements thereof. |

| |

| • | At the Annual Meeting. The Annual Meeting will be held entirely online. To participate in the Annual Meeting, you will need the 16-digit control number included in your Notice or on the instructions that accompanied your proxy materials. The meeting webcast will being promptly at 9:00 a.m. EST. We encourage you to access the meeting prior to the start time. Online check-in will start shortly before the meeting, and you should allow ample time for the check-in procedures. Instructions should also be provided on the voting instruction form provided by your bank, broker or other nominee. If you lose your 16-digit control number, you may join the Annual Meeting as a “Guest,” but you will not be able to vote, ask questions or access the list of stockholders as of the Record Date. |

If your shares of common stock are held in street name (held for your account by a broker or other nominee):

| |

| • | By Internet or By Telephone. You will receive instructions from your broker or other nominee if you are permitted to vote by Internet or telephone. |

| |

| • | By Mail. You will receive instructions from your broker or other nominee explaining how to vote your shares. |

| |

| • | At the Annual Meeting. The Annual Meeting will be held entirely online. To participate in the Annual Meeting, you will need the 16-digit control number included in your Notice or on the instructions that accompanied your proxy materials. The meeting webcast will begin promptly at 9:00 a.m. EST. We encourage you to access the meeting prior to the start time. Online check-in will start shortly before the meeting, and you should allow ample time for the check-in procedures. Instructions should also be provided on the voting instruction form provided by your bank, broker or other nominee. If you lose your 16-digit control number, you may join the Annual Meeting as a “Guest,” but you will not be able to vote, ask questions or access the list of stockholders as of the Record Date. |

Management, members of our board and representatives of Ernst & Young LLP are expected to attend the Annual Meeting and be available to respond to questions from shareholders.

What are the Board's recommendations on how to vote my shares?

The Board of Directors recommends a vote:

Proposal 1: FOR ALL election of the three Class III directors.

Proposal 2: FOR approving the amendment to our restated certificate of incorporation to provide for an increase in the total number of shares of common stock that the Company is authorized to issue from 85,000,000 shares to 170,000,000 shares.

Proposal 3: FOR approving the amendment to the Genocea Biosciences, Inc. Amended and Restated 2014 Equity Incentive Plan to increase the number of shares reserved for issuance thereunder by 2,800,000 shares, to increase the individual non-employee director share limit contained in the plan and to remove the other individual participant limits contained in this plan.

Proposal 4: FOR approving, on an advisory basis, the compensation paid to our named executive officers.

Proposal 5: FOR approving, on an advisory basis, an annual frequency for the advisory vote on the compensation paid to our named executive officers.

Proposal 6: FOR ratification of the appointment of Ernst & Young LLP as the Company's independent registered public accounting firm for the fiscal year 2020.

Who pays the cost for soliciting proxies?

Genocea will bear the cost of solicitation of proxies. This includes the charges and expenses of brokerage firms and others for forwarding solicitation material to beneficial owners of our outstanding common stock as well as support for hosting of the virtual Annual Meeting. Genocea may solicit proxies by mail, personal interview, telephone, or via the Internet through its officers, directors and other management employees, who will receive no additional compensation for their services.

Can I change my vote?

You may revoke your proxy at any time before it is voted by notifying the Secretary in writing, by returning a signed proxy with a later date, by transmitting a subsequent vote over the Internet or by telephone prior to the close of the Internet voting facility or the telephone voting facility, or by attending the Annual Meeting online. If your stock is held in street name, you must contact your broker or nominee for instructions as to how to change your vote.

How is a quorum reached?

The presence, online or by proxy, of holders of at least a majority of the total number of outstanding shares entitled to vote is necessary to constitute a quorum for the transaction of business at the Annual Meeting. Abstentions and "broker non-votes" (i.e., shares represented at the Annual Meeting held by brokers, bankers or other nominees as to which instructions have not been received from the beneficial owners or persons entitled to vote such shares and, with respect to one or more but not all issues,

such brokers or nominees do not have discretionary voting power to vote such shares), if any, will be counted for purposes of determining whether a quorum is present for the transaction of business at the Annual Meeting.

What vote is required to approve each item?

Directors are elected by a plurality of votes cast (Proposal 1). A vote to withhold or a broker non-vote will have no direct effect on the outcome. The affirmative vote of a majority of the shares of common stock outstanding and entitled to vote is necessary for the approval of the amendment to our restated certificate of incorporation (Proposal 2). A majority of votes cast is necessary for the approval of the amendment to the Genocea Biosciences, Inc. Amended and Restated 2014 Equity Incentive Plan (Proposal 3). Because approval of the compensation paid to our named executive officers (Proposal 4) and the frequency of future advisory votes on the compensation paid to our named executive officers (Proposal 5) are advisory votes there is no “required” vote. We will consider a majority of votes cast to be approval for each of these proposals. A majority of votes cast is necessary for ratification of the selection of Ernst & Young LLP as the Company's independent registered public accounting firm for the fiscal year ending December 31, 2020 (Proposal 6). A vote to abstain will have no direct effect on the outcome.

If there are insufficient votes to approve these proposals, your proxy may be voted by the persons named in the proxy card to adjourn the Annual Meeting in order to solicit additional proxies in favor of the approval of such proposals. If the Annual Meeting is adjourned or postponed for any purpose, at any subsequent reconvening of the Annual Meeting, your proxy will be voted in the same manner as it would have been voted at the original convening of the Annual Meeting unless you withdraw or revoke your proxy.

Could other matters be decided at the Annual Meeting?

Genocea does not know of any other matters that may be presented for action at the Annual Meeting. Should any other business come before the Annual Meeting, the persons named on the enclosed proxy will have discretionary authority to vote the shares represented by such proxies in accordance with their best judgment. If you hold shares through a broker, bank or other nominee as described above, they will not be able to vote your shares on any other business that comes before the Annual Meeting unless they receive instructions from you with respect to such matter.

What happens if the Annual Meeting is postponed or adjourned?

Your proxy may be voted at the postponed or adjourned Annual Meeting. You will still be able to change your proxy until it is voted.

What does it mean if I receive more than one proxy card or voting instruction form?

It means that you have multiple accounts at the transfer agent or with brokers. Please complete and return all proxy cards or voting instruction forms to ensure that all of your shares are voted.

Who should I call if I have any additional questions?

If you hold your shares directly, please call Diantha Duvall, Secretary, at 617-876-8191. If your shares are held in street name, please contact the telephone number provided on your voting instruction form or contact your broker or nominee holder directly.

PROPOSAL NO. 1—ELECTION OF DIRECTORS

In accordance with the Company's restated certificate of incorporation and amended and restated by-laws, the Board of Directors is divided into three classes of approximately equal size. The members of each class are elected to serve a three-year term with the term of office of each class ending in successive years. William Clark, Ronald Cooper and George Siber are the Class III directors whose terms expire at the Annual Meeting. Mr. Clark, Mr. Cooper and Dr. Siber have all been nominated for and have agreed to stand for re-election to the Board of Directors to serve as a Class III director of the Company until the 2023 annual meeting of stockholders and until his successor is duly elected.

It is intended that, unless you give contrary instructions, shares represented by proxies will be voted for the election of the three nominees listed above as director nominees. Genocea has no reason to believe that any nominee will be unable to serve. In the event that one or more nominees is unexpectedly not available to serve, proxies may be voted for another person nominated as a substitute by the Board of Directors, or the Board of Directors may reduce the number of directors to be elected at the Annual Meeting. Information relating to each nominee for election as director and for each continuing director, including his or her period of service as a director of Genocea, principal occupation and other biographical material, is shown below.

THE BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS THAT YOU VOTE

FOR

ALL OF THESE NOMINEES FOR CLASS III DIRECTOR

(PROPOSAL 1 ON YOUR PROXY CARD)

DIRECTOR BIOGRAPHIES

Below sets forth information concerning our directors as of March 1, 2020. The biographical description of each director includes the specific experience, qualifications, attributes and skills that the Board of Directors would expect to consider if it were making a conclusion currently as to whether such person should serve as a director.

CLASS III DIRECTOR NOMINEES

William "Chip" Clark, age 51, is a Class III director who has served on our Board of Directors and as our President and Chief Executive Officer since February 2011. Previously, he served as our Chief Business Officer from August 2010 to February 2011. Mr. Clark has served on our Board of Directors since February 2011. Prior to joining our Company, he served as Chief Business Officer at Vanda Pharmaceuticals, Inc. ("Vanda"), a biopharmaceutical company that he co-founded in 2004. While at Vanda, he led the company’s strategic and business development activities, and played a central role in multiple public and private financings. Prior to Vanda, Mr. Clark was a principal at Care Capital, LLC, a venture capital firm investing in biopharmaceutical companies, after serving in a variety of strategic and commercial roles at SmithKline Beecham (now GlaxoSmithKline). Mr. Clark holds a B.A. from Harvard University and an M.B.A. from The Wharton School at the University of Pennsylvania. We believe that Mr. Clark’s operational and historical experience with our Company gained from serving as our Chief Executive Officer, President and member of our Board of Directors, combined with his prior experience at Vanda and in the venture capital industry focusing on biopharmaceutical companies, qualifies him to serve as a member of our Board of Directors.

Ronald Cooper, age 57, is a Class III director who has served as a member of our Board of Directors since June 2016. Mr. Cooper is President and CEO of Albireo Pharma ("Albireo"), a position that he was appointed to in June 2015. Mr. Cooper is a life sciences leader with a track record of growing and rejuvenating businesses, brands and organizations in the U.S. and Europe, ranging from entrepreneurial and resource-constrained, up to sales exceeding $4.5 billion. Prior to Albireo, Mr. Cooper was with Bristol-Myers Squibb ("BMS") for over 25 years working in five different countries and holding positions of increasing responsibility in sales, marketing and general management, culminating in President of Europe. In Europe, Mr. Cooper was responsible for over 30 countries with sales exceeding $4.5 billion. While at BMS, Mr. Cooper was directly associated with several product successes, including Abilify®, Avapro®, Atripla®, Eliquis®, Orencia®, Pravachol®, Plavix®, Reyataz®, Sustiva®, Sprycel® and Yervoy®. Mr. Cooper has successfully completed over a dozen business development deals including the creation of the first single tablet HIV/AIDS regimen partnership. Mr. Cooper is a graduate of St. Francis Xavier University in Canada. We believe that Mr. Cooper’s experience in the pharmaceutical industry, along with his background as an executive officer of a public company, qualifies him to serve as a member of our Board of Directors.

George Siber, M.D., age 75, is a Class III director who has served as a member of our Board of Directors since 2007. From 1996 to 2007, Dr. Siber served as Executive Vice President and Chief Scientific Officer of Wyeth Vaccines ("Wyeth"). While at Wyeth, Dr. Siber oversaw the development and approval of multiple widely-used childhood vaccines, including: Prevnar, a pneumococcal vaccine which has achieved multibillion dollar revenues; Acel-Imune, an acellular pertussis vaccine; and Meningitec, a meningococcal meningitis vaccine. Prior to Wyeth, Dr. Siber was Director of the Massachusetts Public Health Biologic Laboratories

and a Harvard Medical School Associate Professor of Medicine at Dana Farber Cancer Institute. During this time, Dr. Siber led the research and manufacturing of multiple vaccines and immune globulins including Respigam, a human immune globulin against respiratory syncytial virus. Since 2007, Dr. Siber has served on the boards of directors of several vaccine companies, including Crucell, Selecta Biosciences, Vedantra Pharmaceuticals and Affinivax Inc., and as a consultant or scientific advisory board member of ClearPath Vaccines Company, of which he is currently the Chief Scientific Officer, PaxVax, Vaxess Technologies, Inc., the Bill & Melinda Gates Foundation, PATH, the Wellcome Trust, the European Commission (on vaccinations), the National Institutes of Health, or NIH, and the Korean FDA. Dr. Siber serves as a member of the Board of Trustees of the International Vaccine Institute. Dr. Siber holds an M.D. degree from McGill University in Canada, received post-doctoral training in Internal Medicine at Rush-Presbyterian Hospital in Chicago and Beth Israel Hospital in Boston and Infectious Disease and vaccinology training at Children’s Hospital and Beth Israel Hospital, Harvard Medical School Boston. We believe that Dr. Siber’s experience in life sciences, vaccine industries and his experience overseeing the development of multiple vaccines qualifies him to serve as a member of our Board of Directors.

DIRECTORS NOT STANDING FOR ELECTION AT THE ANNUAL MEETING

Kenneth Bate, age 69, is a Class I director who has served as a member of our Board of Directors since September 2014 and our chair since December 2018. Mr. Bate has served as an independent consultant in the biotechnology field since 2012. From 2009 to 2012, Mr. Bate served as President and Chief Executive Officer of Archemix, Inc., a privately-held biotechnology company. From 2006 to 2009, Mr. Bate served in various positions at NitroMed, Inc., a pharmaceutical company, most recently as President and Chief Executive Officer. From 2002 to 2005, Mr. Bate served as Chief Financial Officer of Millennium Pharmaceuticals Inc., where he headed the commercial organization. Prior to joining Millennium Pharmaceuticals Inc., Mr. Bate co-founded JSB Partners, LLC, a banking and advisory services firm for biopharmaceutical and life sciences companies. From 1990 to 1996, he was with Biogen Inc., a biotechnology company, first as their Chief Financial Officer, and then as head of the commercial organization responsible for launching the multiple sclerosis business. Mr. Bate is currently a director of AVEO Pharmaceuticals, Catabasis Pharmaceuticals, Epizyme Inc., and Madrigal Pharmaceuticals. He holds a B.A. from Williams College and an M.B.A. from The Wharton School of the University of Pennsylvania. We believe that Mr. Bate’s experience as a chief executive officer of multiple biotechnology companies, as well as his experience as a director of other companies, qualifies him to serve as a member of our Board of Directors.

Ali Behbahani, M.D., age 43, is a Class I director who has served as a member of our Board of Directors since February 2018. Since 2007, Dr. Behbahani has served in various positions on the healthcare team at New England Associates, most recently as General Partner. The healthcare team specializes in investments in the biopharmaceutical and medical device sectors. He is also currently a member of the board of directors of CRISPR Therapeutics, Adaptimmune and Nevro Corp. He has previously worked as a consultant in business development at The Medicines Company and held positions as a Venture Associate at Morgan Stanley Venture Partners from 2000 to 2002 and as a Healthcare Investment Banking Analyst at Lehman Brothers from 1998 to 2000. Dr. Behbahani conducted basic science research in the fields of viral fusion inhibition and structural proteomics at the National Institutes of Health and at Duke University. He holds an M.D. degree from The University of Pennsylvania School of Medicine and an M.B.A. from The University of Pennsylvania Wharton School. We believe Dr. Behbahani’s experience in the biopharmaceutical industry, as well as his experience as a member on the boards of directors of multiple companies in the industry, qualifies him to serve as a member of our Board of Directors.

Katrine Bosley, age 51, is a Class II director who has served as a member of our Board of Directors since March 2013 and as our chair from August 2013 until December 2018. Ms. Bosley served as the Chief Executive Officer of Editas Medicine Inc. ("Editas") from June 2014 through February 2019. Prior to Editas, Ms. Bosley was the Entrepreneur-in-Residence at The Broad Institute from September 2013 to May 2014. She served as Chief Executive Officer of Avila Therapeutics Inc. ("Avila"), from May 2009 to March 2012, when Avila was acquired by Celgene Corporation. Before Avila, she was Vice President, Strategic Operations at Adnexus Therapeutics Inc. ("Adnexus"), a BMS Company, and was Vice President, Business Development at Adnexus before that. She joined Adnexus from Biogen Idec where she held roles in business development, commercial operations, and portfolio strategy in the United States and Europe. In addition to serving as a director of our Company, Ms. Bosley currently serves as a director of Galapagos NV and Massachusetts Eye and Ear. She also is a member of the BIO Governing Board and Chair of the Emerging Companies Section of the Board. Ms. Bosley graduated from Cornell University with a B.A. in Biology. We believe that Ms. Bosley’s experience as a chief executive officer of a biotechnology company and her breadth of experience in creating strategic and business development value qualifies her to serve as a member of our Board of Directors.

Michael Higgins, age 57, is a Class II director who has served as a member of our Board of Directors since February 2015. In January 2015, Mr. Higgins joined Polaris Partners as an Entrepreneur-in-Residence. Prior to joining Polaris Partners, Mr. Higgins served as Chief Operating Officer and Chief Financial Officer at Ironwood Pharmaceuticals ("Ironwood") from 2003 through 2014, playing a key role in Ironwood’s evolution from a privately-funded discovery organization through its initial public offering and the launch of its first commercial product. Under his leadership, Ironwood was able to raise more than one billion

dollars to help support the development of the business during that period. Prior to his work at Ironwood, from 1997 through 2003, Mr. Higgins worked at Genzyme Corporation ("Genzyme") in a variety of leadership roles including Vice President, Corporate Finance and Vice President, Business Development. While at Genzyme, he was involved with multiple businesses including the Cell Therapy, Gene Therapy, and Orphan Disease business units. Previously, Mr. Higgins served as Chief Financial Officer of Procept, Inc., from 1992 to 1997, and led the company through its initial public offering. Mr. Higgins currently serves as a director of Pulmatrix, Inc. and Voyager Therapeutics. Mr. Higgins began his pharmaceutical career as a sales representative for Schering-Plough Corporation in 1986. Mr. Higgins earned his B.S. from Cornell University and holds an M.B.A. from the Amos Tuck School of Business at Dartmouth College. We believe that Mr. Higgins' financial and business expertise, including his diversified background as an executive officer in public pharmaceutical companies, qualifies him to serve as a member of our Board of Directors.

Howard Mayer, M.D., age 57, is a Class I director who has served as a member of our Board of Directors since March 2017. Dr. Mayer is Executive Vice President, Head of R&D at Ipsen since December 2019. Previous to that, Dr. Mayer was Senior Vice President and Chief Medical Officer at Shire Plc ("Shire"). Dr. Mayer joined Shire in 2012 and was responsible for global clinical development across hematology, immunology, oncology, genetic diseases, GI/metabolic, neuroscience and ophthalmology therapeutic areas. From 2009 to 2012 he served as Chief Medical Officer at EMD Serono, a division of Merck KGaA. Prior to that, he held a variety of global roles at Pfizer Inc. ("Pfizer"), including Head of Clinical Development and Medical Affairs for Virology/Infectious Diseases. Prior to joining Pfizer, he served as Director of Infectious Diseases Clinical Research at BMS for five years. Dr. Mayer obtained his B.A. from the University of Pennsylvania and his M.D. from Albert Einstein College of Medicine in New York, which was followed by an internship and residency at Mount Sinai Hospital and an Infectious Diseases fellowship at Harvard Medical School. Since 2011 he has served on the board of Autism Speaks in New England. In 2011 and 2017, he was honored by PharmaVoice as one of the 100 Most Inspiring People in the Life Sciences Industry. We believe that Dr. Mayer's scientific expertise, which includes clinical development experiences in both infectious disease and oncology, qualifies him to serve as a member of our Board of Directors.

Gisela Schwab, M.D., age 63, is a Class II director who was appointed to serve as a member of our Board of Directors in February 2020. Dr. Schwab has served as President, Product Development and Medical Affairs and Chief Medical Officer of Exelixis, Inc. (“Exelixis”) since February 2016. Previously, she served as Executive Vice President and Chief Medical Officer of Exelixis from January 2008 to February 2016 and as Senior Vice President and Chief Medical Officer of Exelixis from September 2006 to January 2008. From 2002 to 2006, she held the position of Senior Vice President and Chief Medical Officer at Abgenix, Inc. (“Abgenix”), a human antibody-based drug development company. She also served as Vice President, Clinical Development, at Abgenix from 1999 to 2001. Prior to working at Abgenix, from 1992 to 1999, she held positions of increasing responsibility at Amgen Inc., most recently as Director of Clinical Research and Hematology/Oncology Therapeutic Area Team Leader. From August 2011 through July 2014, Dr. Schwab served as a member of the board of directors of Topotarget A/S, a publicly-held biopharmaceutical company. Since June 2012 she has served as a member of the board of directors of Cellerant Therapeutics, Inc. a privately-held biopharmaceutical company and since March 2015, she has served as a member of the board of directors of Nordic Nanovector A.S., a Norwegian biotechnology company. She received her Doctor of Medicine degree from the University of Heidelberg, trained at the University of Erlangen-Nuremberg and the National Cancer Institute and is board certified in internal medicine and hematology and oncology. We believe that Dr. Schwab’s scientific expertise, which includes advancing product candidates through development and regulatory approval to commercial launch, qualifies her to serve as a member of our Board of Directors.

BOARD OF DIRECTORS AND ITS COMMITTEES

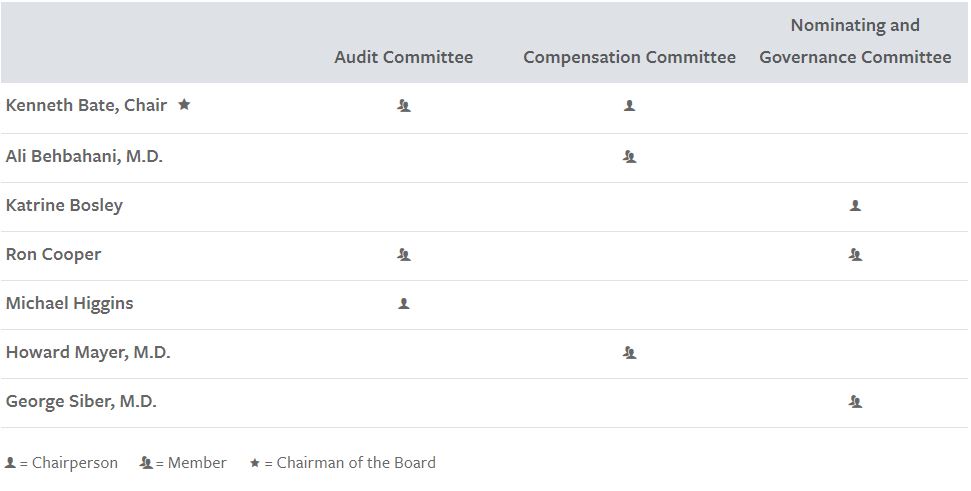

The following table describes which directors serve on each of the committees of the Board of Directors as of March 1, 2020.

THE BOARD OF DIRECTORS AND ITS COMMITTEES

Director Independence

As required by the listing standards of The Nasdaq Capital Market ("Nasdaq"), the Board of Directors has affirmatively determined, upon the recommendation of the Nominating and Corporate Governance Committee, that each of our directors (other than William Clark, our President and Chief Executive Officer) is independent. To make this determination, our Board of Directors reviews all relevant transactions or relationships between each director and Genocea, its senior management and its independent registered public accounting firm. During this review, the Board of Directors considers whether there are any transactions or relationships between directors or any member of their immediate family (or any entity of which a director or an immediate family member is an executive officer, general partner or significant equity holder) and members of our senior management or their affiliates. The Board of Directors consults with Genocea's outside corporate counsel to ensure that the Board of Directors' determinations are consistent with all relevant securities and other laws and regulations regarding the definition of "independent," including those set forth in pertinent Nasdaq listing standards, as in effect from time to time.

Board Meetings and Attendance

The Board of Directors held nine meetings during the year ended December 31, 2019. Each of the directors attended at least 75% of the meetings of the Board of Directors and the committees of the Board of Directors on which he or she served during the year ended December 31, 2019 (in each case, which were held during the period for which he or she was a director and/or a member of the applicable committee). Each director who is up for election at an annual meeting of stockholders or who has a term that continues after such annual meeting is expected to attend the Annual Meeting. All but one of our then existing directors on the Board of Directors attended our 2019 annual meeting.

Board Committees

The Board of Directors has standing Audit, Compensation and Nominating and Corporate Governance Committees, each of which is comprised solely of independent directors, and is described more fully below. The charters for the Audit, Compensation and Nominating and Corporate Governance Committees are all available on our website (http://ir.genocea.com/) under "Investors" at "Governance".

Audit Committee

Our Audit Committee is composed of Mr. Bate, Mr. Cooper, and Mr. Higgins, with Mr. Higgins serving as chair of the committee. Our Board of Directors has determined, upon the recommendation of the Nominating and Corporate Governance Committee, that each member of the Audit Committee meets the independence requirements of Rule 10A-3 under the Exchange Act of 1934, as amended (the “Exchange Act”) and the applicable listing standards of Nasdaq. Our Board of Directors has determined that each of Mr. Bate, Mr. Cooper, and Mr. Higgins is an “audit committee financial expert” within the meaning of the SEC regulations and applicable listing standards of Nasdaq. Our Audit Committee operates pursuant to a written charter and it reviews and assesses the adequacy of its charter annually.

The Audit Committee’s responsibilities include:

| |

| • | appointing, approving the compensation of, and assessing the qualifications, performance and independence of our independent registered public accounting firm by considering (i) evaluations of our independent registered public accounting firm by our management and internal auditors, (ii) our independent registered public accounting firm’s effectiveness of communications and working with the Audit Committee and our management and internal auditors, (iii) the length of time our independent registered public accounting firm has served as our independent auditors, (iv) the quality and depth of our independent registered public accounting firm’s expertise and experience in the biotech and life sciences industries in light of the breadth, complexity and global reach of our business and (v) the advisability and potential impact of selecting a different independent registered public accounting firm; |

| |

| • | pre-approving audit and permissible non-audit services, and the terms of such services, to be provided by our independent registered public accounting firm; |

| |

| • | reviewing the internal audit plan with the independent registered public accounting firm and members of management responsible for preparing our financial statements; |

| |

| • | reviewing and discussing with management and the independent registered public accounting firm our annual and quarterly financial statements and related disclosures as well as critical accounting policies and practices used by us; |

| |

| • | reviewing the adequacy of our internal control over financial reporting; |

| |

| • | establishing policies and procedures for the receipt and retention of accounting-related complaints and concerns; |

| |

| • | recommending, based upon the Audit Committee’s review and discussions with management and the Company's independent registered public accounting firm, whether our audited financial statements shall be included in our Annual Report; |

| |

| • | monitoring our compliance with legal and regulatory requirements as they relate to our financial statements and accounting matters; |

| |

| • | preparing the Audit Committee report required by the rules of the SEC to be included in our annual proxy statement; |

| |

| • | viewing all related party transactions for potential conflict of interest situations and approving all such transactions; and |

| |

| • | reviewing and discussing with management and our independent registered public accounting firm our earnings releases and scripts. |

All audit and non-audit services to be provided to us by our independent registered public accounting firm must be approved in advance by the Audit Committee. During the year ended December 31, 2019, the Audit Committee met four times. The report of the Audit Committee is included in this Proxy Statement under "Audit Committee Report".

Compensation Committee

Our Compensation Committee is composed of Mr. Bate, Dr. Behbahani, and Dr. Mayer, with Mr. Bate serving as chair of the committee. The Board of Directors has determined, upon the recommendation of the Nominating and Corporate Governance Committee, that each member of the Compensation Committee is "independent" within the meaning of the rules and regulations of Nasdaq and the SEC. In addition, each member is a "non-employee director" within the meaning of the SEC rules. Our Compensation Committee operates pursuant to a written charter and it reviews and assesses the adequacy of its charter periodically.

The Compensation Committee’s responsibilities include:

| |

| • | annually reviewing and recommending to the Board of Directors for approval the corporate goals and objectives relevant to the compensation of our Chief Executive Officer; |

| |

| • | evaluating the performance of our Chief Executive Officer in light of such corporate goals and objectives and recommending to the Board of Directors for approval the compensation of our Chief Executive Officer; |

| |

| • | reviewing and approving the compensation of our other executive officers; |

| |

| • | appointing, compensating and overseeing the work of any compensation consultant, legal counsel or other advisor retained by the Compensation Committee; |

| |

| • | conducting the independence assessment outlined in Nasdaq rules with respect to any compensation consultant, legal counsel or other advisor retained by the Compensation Committee; |

| |

| • | annually reviewing and reassessing the adequacy of the committee charter in accordance with the listing requirements of Nasdaq; |

| |

| • | reviewing and establishing our overall management compensation philosophy and policy; |

| |

| • | overseeing and administering our equity compensation and other incentive compensation programs; |

| |

| • | reviewing and approving our equity and incentive policies and procedures for the grant of equity-based awards and approving the grant of such equity-based awards; |

| |

| • | reviewing and making recommendations to the Board of Directors with respect to director compensation; and |

| |

| • | if applicable, producing the compensation committee report to be included in our annual proxy statement and/or Annual Report. |

During the year ended December 31, 2019, the Compensation Committee met three times.

Nominating and Corporate Governance Committee

Our Nominating and Corporate Governance Committee is composed of Ms. Bosley, Mr. Cooper, and Dr. Siber, with Ms. Bosley serving as chair of the committee. Our Board of Directors has determined that each member of the Nominating and Corporate Governance Committee is "independent" within the meaning of the rules and regulations of Nasdaq. Our Nominating and Corporate Governance Committee operates pursuant to a written charter and it reviews and assesses the adequacy of its charter periodically.

The Nominating and Corporate Governance Committee’s responsibilities include:

| |

| • | developing and recommending to the Board of Directors criteria for board and committee membership; |

| |

| • | establishing procedures for identifying and evaluating Board of Director candidates, including nominees recommended by stockholders; |

| |

| • | identifying individuals qualified to become members of the Board of Directors; |

| |

| • | recommending to the Board of Directors the persons to be nominated for election as directors and to each of the Board of Directors’ committees; |

| |

| • | developing and recommending to the Board of Directors a set of corporate governance principles; |

| |

| • | articulating to each director what is expected, including reference to the corporate governance principles and directors’ duties and responsibilities; |

| |

| • | reviewing and recommending to the Board of Directors practices and policies with respect to directors; |

| |

| • | reviewing and recommending to the Board of Directors the functions, duties and compositions of the committees of the Board of Directors; |

| |

| • | reviewing and assessing the adequacy of the committee charter and submitting any changes to the Board of Directors for approval; |

| |

| • | considering and reporting to the Board of Directors any questions of possible conflicts of interest of Board of Directors members; |

| |

| • | providing for new director orientation and continuing education for existing directors on a periodic basis; |

| |

| • | performing an evaluation of the performance of the committee; and |

| |

| • | overseeing the evaluation of the Board of Directors and management. |

The Nominating and Corporate Governance Committee does not set specific, minimum qualifications that nominees must meet in order to be recommended to the Board of Directors, but rather believes that each nominee should be evaluated based on his or her individual merits, taking into account the needs of Genocea and the composition of the Board of Directors. Additionally, neither the Nominating and Corporate Governance Committee nor the Board of Directors has a specific policy with regard to the consideration of diversity in identifying director nominees; however, both may consider the diversity of background and experience of a director nominee in the context of the overall composition of the Board of Directors at that time, such as diversity of knowledge, skills, experience, geographic location, age, gender, and ethnicity. Members of the Nominating and Corporate Governance Committee discuss and evaluate possible candidates in detail and suggest individuals to explore in more depth.

The Nominating and Corporate Governance Committee will consider candidates recommended by stockholders. Candidates recommended by stockholders are given appropriate consideration in the same manner as other candidates.

During the year ended December 31, 2019, the Nominating and Corporate Governance Committee met five times.

Board of Directors Leadership Structure

Mr. Bate has served as the chair of our Board of Directors since December 2018. The independent members of the Board of Directors have periodically reviewed the Board of Directors' leadership structure and have determined that Genocea and our stockholders are well served with this structure.

The chair of the Board of Directors provides leadership to the Board of Directors and works with the Board of Directors to define its activities and the calendar for fulfillment of its responsibilities. The chair of the Board of Directors approves the meeting agendas after input from the Board of Directors and management, facilitates communication among directors and presides at meetings of our Board of Directors and stockholders.

The Board of Directors' Role in Risk Oversight

The Board of Directors plays an important role in risk oversight through direct decision-making authority with respect to significant matters as well as through the oversight of management by the Board of Directors and its committees. In particular, the Board of Directors administers its risk oversight function through (1) the review and discussion of regular periodic reports by the Board of Directors and its committees on topics relating to the risks that we face, (2) the required approval by the Board of Directors (or a committee of the Board of Directors) of significant transactions and other decisions, (3) the direct oversight of specific areas of our business by the Audit, Compensation and Nominating and Corporate Governance Committees, and (4) regular periodic reports from our independent registered public accounting firm and other outside consultants regarding various areas of potential risk, including, among others, those relating to our internal control over financial reporting and executive compensation. The Board of Directors also relies on management to bring significant matters impacting our Company to the attention of the Board of Directors.

Pursuant to the Audit Committee's charter, the Audit Committee is responsible for reviewing and discussing with management and the independent registered public accounting firm our system of internal controls, our critical accounting practices, and policies relating to risk assessment and management. As part of this process, the Audit Committee discusses our major financial risk exposures and steps that management has taken to monitor and control such exposure. In addition, the Audit Committee has established procedures for the receipt, retention and treatment of complaints received by the Company regarding accounting, internal accounting controls or auditing matters, and the confidential, anonymous submissions by employees of concerns regarding questionable accounting or accounting matters.

Because of the role of the Board of Directors and the Audit Committee in risk oversight, the Board of Directors believes that any leadership structure that it adopts must allow it to effectively oversee the management of the risks relating to our operations. The Board of Directors acknowledges that there are different leadership structures that could allow it to effectively oversee the management of the risks relating to the Company's operations and believes its current leadership structure enables it to effectively provide oversight with respect to such risks.

Compensation Consultant

As a part of determining compensation for our named executive officers, the Compensation Committee engaged Pay Governance LLC (“Pay Governance”) as its independent compensation consultant for 2019. As its independent compensation consultant, Pay Governance provided analysis and recommendations to the Compensation Committee regarding:

| |

| • | trends with respect to executive and director compensation; |

| |

| • | the development of a peer group used for compensation-related purposes; |

| |

| • | forms and levels of compensation for executive officers and directors; |

| |

| • | stock utilization and related metrics; |

| |

| • | employment and separation agreements with our executive officers; and |

| |

| • | the risk profile of our compensation programs. |

When requested, consultants from Pay Governance attended meetings of the Compensation Committee, including executive sessions in which executive compensation matters were discussed. During 2019, Pay Governance reported to the Compensation Committee and not to management, although Pay Governance met with management for purposes of gathering information for its analyses and recommendations.

Although the Board of Directors and the Compensation Committee considers the advice and recommendations of Pay Governance (or any other compensation consultant it might engage in the future) as related to our executive compensation program, the Board of Directors and the Compensation Committee ultimately make their own decisions about the compensation arrangements for our executive officers.

In determining whether to engage Pay Governance, the Compensation Committee considered the independence of Pay Governance, taking into consideration relevant factors, including the absence of other services provided to the Company by Pay Governance, the amount of fees the Company paid to Pay Governance as a percentage of Pay Governance's total revenues, the policies and procedures of Pay Governance that are designed to prevent conflicts of interest, any business or personal relationship of the individual compensation advisors employed by Pay Governance with any executive officer of the Company, any business or personal relationship of the individual compensation advisors employed by Pay Governance with any member of the Compensation Committee, and any stock of the Company owned by Pay Governance or the individual compensation advisors employed by Pay Governance (the “Independence Factors”). The Compensation Committee has determined, based on its analysis in light of all relevant factors, including the Independence Factors listed above, that the work of Pay Governance and the individual compensation advisors employed by Pay Governance as compensation consultants to the Compensation Committee did not create any conflicts of interest, and that Pay Governance was independent under the independence standards set forth in the Nasdaq listing standards promulgated pursuant to Section 10C of the Exchange Act.

Non-Employee Director Compensation Policy

Our Board of Directors adopted a non-employee director compensation policy that is designed to enable us to attract and retain, on a long-term basis, highly-qualified non-employee directors. Under the policy, as it may be amended from time to time, all non-employee directors will be paid cash compensation as set forth in the table below. Cash fees are prorated for partial years of service. In addition, we reimburse our non-employee directors for reasonable travel expenses in connection with their service.

|

| | | |

| | Annual Cash Fees |

| Board of Directors: | |

| All non-employee members | $ | 35,000 |

|

| Additional retainer for chair | $ | 40,000 |

|

| Audit Committee: | |

| Members | $ | 7,500 |

|

| Additional retainer for chair | $ | 7,500 |

|

| Compensation Committee: | |

| Members | $ | 5,000 |

|

| Additional retainer for chair | $ | 5,000 |

|

| Nominating and Corporate Governance Committee: | |

| Members | $ | 3,500 |

|

| Additional retainer for chair | $ | 3,500 |

|

Under our non-employee director compensation policy, each non-employee director who is initially appointed or elected to our Board of Directors is eligible to be granted options to purchase 9,375 shares of our common stock under the Genocea Biosciences Inc. Amended and Restated 2014 Equity Incentive Plan ("2014 Equity Plan") at the time of his or her initial appointment or election to our Board of Directors. These options vest annually in equal installments over a three-year period, generally subject to the non-employee director's continued service. In addition, each continuing non-employee director is eligible to be granted options to purchase 5,625 shares of our common stock under our 2014 Equity Plan on an annual basis, which vest in full on the first anniversary of the grant date, generally subject to the non-employee director's continued service through such date. These annual option grants are made on the date of the Company’s annual meeting of stockholders for the relevant year or as soon thereafter as is reasonably practicable.

We did not make any changes to our non-employee director compensation policy for 2019, except the number of shares of our common stock subject to option grants was proportionately adjusted to reflect our eight-to-one reverse stock split in May 2019.

Director Agreements

Dr. Siber

The Company was previously party to a consulting agreement with Dr. Siber that provided for a monthly consulting fee of $9,833 per month for consulting services performed by Dr. Siber related to strategic scientific and business development.

The term of the consulting agreement expired on July 17, 2019. Under the consulting agreement, Dr. Siber agreed not to solicit our employees, contractors and customers for a period of 12 months following the termination of the consulting agreement and is subject to covenants relating to the use and disclosure of confidential information and the assignment of inventions.

Director Compensation

The following table sets forth information concerning the compensation earned by our non-employee directors during 2019. All of our non-employee directors were compensated for service on our Board of Directors under our non-employee director compensation policy. Dr. Siber received additional compensation under his consulting agreement, as described above, prior to its expiration. Mr. Clark receives no additional compensation for his service as a director, and, consequently, is not included in this table. The compensation received by Mr. Clark as our President and Chief Executive Officer for 2019 is set forth in the “Summary Compensation Table” under the section “Executive Compensation”.

|

| | | | | | | | | |

| Name | | Fees earned or paid in cash ($)(1) | | Option awards ($)(2)(3) | | Total ($) |

| Kenneth Bate | | 92,500 |

| | 20,588 |

| | 113,088 |

|

| Ali Behbahani, M.D. (4) | | 42,637 |

| | 20,588 |

| | 63,225 |

|

| Katrine Bosley | | 42,000 |

| | 20,588 |

| | 62,588 |

|

| Ronald Cooper | | 46,000 |

| | 20,588 |

| | 66,588 |

|

| Michael Higgins | | 50,000 |

| | 20,588 |

| | 70,588 |

|

| Howard Mayer, M.D. | | 40,000 |

| | 20,588 |

| | 60,588 |

|

| George Siber, M.D. (4) | | 109,179 |

| | 20,588 |

| | 129,767 |

|

_________________________

| |

| (1) | Amounts represent annual director fees and, in the case of Dr. Siber, include consulting fees, for services rendered, as described above. Consulting fees paid to Dr. Siber were paid in equal monthly installments through July 2019, totaling $68,333. All other director fees were paid quarterly in arrears. |

| |

| (2) | As of December 31, 2019, our directors held the following aggregate number of options to purchase shares of our common stock: Mr. Bate held options to purchase 16,892 shares of our common stock, Dr. Behbahani held options to purchase 15,000 shares of our common stock, Ms. Bosley held options to purchase 20,252 shares of our common stock, Mr. Cooper held options to purchase 16,250 shares of our common stock, Mr. Higgins held options to purchase 16,261 shares of our common stock, Dr. Mayer held options to purchase 14,375 shares of our common stock, and Dr. Siber held options to purchase 25,676 shares of our common stock. |

| |

| (3) | Amounts in the table represent the aggregate grant date fair value of options to purchase shares of our common stock granted during 2019. All of our non-employee directors were granted options to purchase 5,625 shares of our common stock in 2019, which options will vest in full on the one-year anniversary of their respective date of grant, generally subject to the non-employee director's continued service. These grant date fair value amounts were computed in accordance with Financial Accounting Standards Board Accounting Standards Codification Topic 718, Compensation — Stock Compensation (“ASC 718”), excluding the effect of estimated forfeitures. Assumptions used in the calculation of these amounts are included in Note 10 to our financial statements included in our Annual Report. |

| |

| (4) | In addition to annual director fees paid with respect to 2019 services, amounts include payments related to director services rendered in 2018 for which payment was not made until 2019. |

AUDIT COMMITTEE REPORT

The Audit Committee reviewed the Genocea audited financial statements for the year ended December 31, 2019 and discussed these statements with management and Ernst & Young LLP, the Company's independent registered public accounting firm. Genocea management is responsible for the preparation of the Company's financial statements and for maintaining an adequate system of disclosure controls and procedures and internal control over financial reporting for that purpose. Ernst & Young LLP is responsible for expressing an opinion on the conformity of the audited financial statements with generally accepted accounting principles, discussing their judgments as to the quality, not just the acceptability, of the Company's accounting principles and such other matters as are required to be discussed with the Audit Committee under generally accepted auditing standards. The Audit Committee is responsible for providing independent, objective oversight of the Company's accounting functions and internal controls.

The Audit Committee also received from, and discussed with, Ernst & Young LLP all communications required under the standards of the Public Company Accounting Oversight Board (the "PCAOB"), including the matters required to be discussed by Ernst & Young LLP with the Audit Committee, including the matters to be discussed by the PCAOB and the SEC.

Ernst & Young LLP also provided the Audit Committee with the written disclosures and the letter required under the PCAOB, which requires that independent registered public accounting firms annually disclose in writing all relationships that in their professional opinion may reasonably be thought to bear on independence, to confirm their perceived independence and engage in a discussion of independence. The Audit Committee reviewed this disclosure and discussed with Ernst & Young LLP their independence from Genocea.

Based on its discussions with management and our independent registered public accounting firm, and its review of the representations and information provided by management and our independent registered public accounting firm, the Audit Committee recommended to the Board of Directors that the audited financial statements be included in the Genocea Annual Report on Form 10-K for the year ended December 31, 2019, for filing with the SEC.

Respectfully submitted by the

Audit Committee,

Michael Higgins, Chair

Kenneth Bate

Ronald Cooper

PROPOSAL NO. 2—TO APPROVE AN AMENDMENT TO OUR RESTATED CERTIFICATE OF INCORPORATION TO PROVIDE FOR AN INCREASE IN THE TOTAL NUMBER OF SHARES OF COMMON STOCK THAT THE COMPANY IS AUTHORIZED TO ISSUE FROM 85,000,000 SHARES TO 170,000,000 SHARES

General

Stockholders are being asked to approve an amendment to our restated certificate of incorporation, in the form attached hereto as Appendix A (the “Charter Amendment”). The Charter Amendment increases the number of authorized shares of common stock from eighty-five million (85,000,000) shares to one hundred and seventy million (170,000,000) shares. On April 2, 2020, the Board of Directors approved the Charter Amendment, subject to stockholder approval, and directed that the Charter Amendment be submitted to a vote of the Company’s stockholders at this Annual Meeting. The Board of Directors has determined that the Charter Amendment is in the best interests of the Company and its stockholders and recommends approval by the stockholders.

The current restated certificate of incorporation, as amended (the “Current Charter”) authorizes the issuance of up to 85,000,000 shares of common stock, par value of $0.001 per share. As of the close of business on March 31, 2020, 27,643,773 shares of common stock were outstanding. In addition, as of the close of business on March 31, 2020, the Company had 1,289,995 shares of common stock subject to outstanding awards granted under our 2014 Equity Plan, 1,251,700 shares of common stock reserved for issuance under our 2014 Equity Plan (determined without giving effect to the increase in shares contemplated by Proposal No. 3 below and without giving effect to the plan's evergreen provision), 100,032 shares of common stock subject to outstanding stock options granted under the Company’s Amended and Restated 2007 Equity Incentive Plan ("2007 Equity Plan"), 217,966 shares of common stock reserved for issuance under the Company’s 2014 Employee Stock Purchase Plan ("2014 ESPP"), 25,000 shares of common stock subject to outstanding stock options granted as inducement awards, 5,122,183 shares reserved for issuance upon the exercise of outstanding warrants (with a weighted average exercise price of $7.66 as of March 31, 2020), and 204,375 shares reserved for issuance upon conversion of Series A preferred stock. This means that as of March 31, 2020, the Company had just 1,251,635 shares of common stock available for corporate purposes, including, among other things, the issuance of stock options and stock splits by way of dividend. The Current Charter also authorizes the issuance of 25,000,000 shares of preferred stock, with only 1,635 shares of preferred stock issued and outstanding as of March 31, 2020. The Charter Amendment will not increase or otherwise affect the Company’s authorized preferred stock or otherwise affect any other provisions of the Current Charter.

Purpose of the Charter Amendment

The Board of Directors believes it is in the best interest of the Company to increase the number of authorized shares of common stock in order to give the Company greater flexibility in considering and planning for future potential business needs.

With the exception of the Company’s routine practice of granting stock options to employees and directors, the Company has no current specific plan, commitment, arrangement, understanding, or agreement regarding the issuance of the additional shares of common stock resulting from the proposed increase in authorized shares. The additional shares of common stock will be available for issuance by the Board of Directors for various corporate purposes, including but not limited to, grants under employee stock plans, financings, potential strategic transactions, including mergers, acquisitions, strategic partnerships, joint ventures, divestitures, business combinations, stock splits, stock dividends, as well as other general corporate transactions.

Having this additional authorized common stock available for future use will allow the Company to issue additional shares of common stock without the expense and delay of arranging a special meeting of stockholders.

Possible Effects of the Charter Amendment and Additional Anti-takeover Consideration

If the Charter Amendment is approved, the additional authorized shares would be available for issuance at the discretion of the Board of Directors and without further stockholder approval, except as may be required by law or the rules of Nasdaq. The additional shares of authorized common stock would have the same rights and privileges as the shares of common stock currently issued and outstanding. The adoption of the Charter Amendment would not have any immediate dilutive effect on the proportionate voting power or other rights of existing stockholders. Shares of common stock issued otherwise than for a stock split may decrease existing stockholders’ percentage equity ownership and, depending on the price at which they are issued, could be dilutive to the voting rights of existing stockholders and have a negative effect on the market price of the common stock. The common stock carries no preemptive rights to purchase additional shares of common stock.

The Company cannot provide assurances that any such transactions will be consummated on favorable terms or at all, that they will enhance stockholder value or that they will not adversely affect the Company’s business or the trading price of our stock.

The Company has not proposed the increase in the number of authorized shares of common stock with the intention of using the additional authorized shares for anti-takeover purposes, but the Company would be able to use the additional shares to oppose a hostile takeover attempt or delay or prevent changes in control or management of the Company. For example, without further stockholder approval, the Board of Directors could sell shares of common stock in a private transaction to purchasers who would oppose a takeover or favor the current Board of Directors. Although this proposal to increase the authorized number of shares of common stock has been prompted by business and financial considerations and not by the threat of any known or threatened hostile takeover attempt, stockholders should be aware that approval of this proposal could facilitate future efforts by the Company to oppose changes in control of the Company and perpetuate the Company’s management, including transactions in which the stockholders might otherwise receive a premium for their shares over then current market prices.

If the Company’s stockholders approve the Charter Amendment, the Board of directors will have authority to file with the Secretary of State of Delaware the Charter Amendment. The Charter Amendment will become effective on the date it is filed. The Board of Directors reserves the right to abandon or delay the filing of the Charter Amendment even if it is approved by our stockholders. The Charter Amendment is attached to this proxy statement as Appendix A.

Neither Delaware law, the Current Charter, nor the Company’s amended and restated by-laws provides for appraisal or other similar rights for dissenting stockholders in connection with this proposal. Accordingly, the Company’s stockholders will have no right to dissent and obtain payment for their shares.

The affirmative vote of a majority of the outstanding shares of common stock is required to approve the Amended Charter. Accordingly, abstentions and broker non-votes will have the effect of a negative vote.

THE BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS THAT YOU VOTE

FOR

THE APPROVAL OF THE AMENDMENT TO OUR RESTATED CERTIFICATE OF INCORPORATION TO PROVIDE FOR AN INCREASE IN THE TOTAL NUMBER OF SHARES OF COMMON STOCK THAT THE COMPANY IS AUTHORIZED TO ISSUE FROM 85,000,000 SHARES TO 170,000,000 SHARES

(PROPOSAL 2 ON YOUR PROXY CARD)

PROPOSAL NO. 3—TO APPROVE AN AMENDMENT TO THE GENOCEA BIOSCIENCES, INC. AMENDED AND RESTATED 2014 EQUITY INCENTIVE PLAN TO INCREASE THE NUMBER OF SHARES RESERVED FOR ISSUANCE BY 2,800,000 SHARES, TO INCREASE THE INDIVIDUAL NON-EMPLOYEE DIRECTOR SHARE LIMIT AND TO REMOVE THE INDIVIDUAL OTHER PARTICIPANT LIMITS CONTAINED IN THIS PLAN

Our 2014 Equity Plan was originally approved by our Board of Directors and our stockholders prior to the effectiveness of our IPO in 2014 and was subsequently amended and restated in 2018. Our Board of Directors is asking our stockholders to approve an amendment to our 2014 Equity Plan to (i) increase by 2,800,000 shares the number of shares of our common stock reserved for issuance thereunder, (ii) increase the maximum number of shares of our common stock subject to awards that may be granted to our non-employee directors in any calendar year (subject to an aggregate dollar cap that has not been amended) and (iii) eliminate the limits on the maximum number of shares of our common stock subject to awards that may be granted to our employees in any calendar year. Other than these proposed changes, the amendment does not make any other changes to our 2014 Equity Plan.

Our Board of Directors approved the amendment to our 2014 Equity Plan, subject to stockholder approval, to replenish the shares available to us for the grant of equity awards. We have historically granted equity awards to our employees, including our executive officers, almost exclusively in the form of stock options. Nearly all of our outstanding stock options are significantly underwater, with a weighted average exercise price of $11.28 per share. The closing price of our common stock on the Nasdaq was $1.72 per share on March 31, 2020. As a result, our Board of Directors believes that our currently outstanding equity awards are not an effective tool to retain and motivate our employees, including our executive officers, and, with the significant decrease in our stock price since the share pool was determined, the shares remaining available for issuance are not sufficient to permit us to deliver the value necessary to do so. Our Board of Directors believes that the effective use of long-term equity compensation is vital to our ability to achieve strong performance in the future and that our continued success depends, in large part, on our ability to attract, retain and motivate key employees with relevant experience and critical skills in the highly-competitive market for employee talent in which we operate. Further, the use of long-term equity compensation allows us to preserve our cash resources, which is especially important in light of the challenging global economic conditions and uncertainty that we and other companies are currently facing.

For the reasons stated above, our Board of Directors has determined that it is in the best interests of the Company and its stockholders to approve this proposal. Our Board of Directors has approved the amendment to our 2014 Equity Plan, subject to stockholder approval, and recommends that stockholders vote in favor of this proposal at the Annual Meeting. Stockholder approval of this proposal requires the affirmative vote of a majority of the outstanding shares of common stock that are present in person or by proxy and entitled to vote on the proposal at the Annual Meeting.

If stockholders approve this proposal, the amendment to our 2014 Equity Plan will become effective as of the date of stockholder approval. If stockholders do not approve this proposal, the amendment to our 2014 Equity Plan will not become effective and our 2014 Equity Plan will continue to be administered in its current form. In addition, if stockholders do not approve this proposal, certain awards that were granted contingent upon obtaining stockholder approval of this proposal, as described in more detail under "New Plan Benefits" below, will be automatically forfeited.

Reasons for Voting for the Proposal

Long-Term Equity is a Key Component of our Compensation Programs

| |

| • | Delivering competitive equity compensation to our management team and our other key employees is essential to attracting and retaining the quality of talent required for us to achieve our operating and strategic objectives. We compete for this talent with a significant number of biotechnology, pharmaceutical and other life sciences companies in Massachusetts that offer generous equity compensation programs. Attracting and retaining key talent is very much in the interest of our stockholders. |

| |

| • | Equity awards incentivize our employees to manage our business as owners, aligning their interests with those of our stockholders. Equity awards, the value of which depends on our stock performance and which generally require continued service over time before any value can be realized, help achieve these objectives and are a key element of our compensation programs. |

| |