FORM 6-K

U.S. SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Report of Foreign Private Issuer

Pursuant to Rule 13a-16 or 15d-16 of

the Securities Exchange Act of 1934

Commission File Number:333-163336

For the month ofMay 2010.

NKSJ Holdings, Inc.

(Translation of registrant’s name into English)

26-1, Nishi-Shinjuku 1-chome

Shinjuku-ku, Tokyo 160-8338

Japan

(Address of principal executive offices)

Indicate by check mark whether the registrant files or will file annual reports under cover Form 20-F or Form 40-F.

Form 20-F X Form 40-F

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b) (1):

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b) (7):

Information furnished on this form:

Table of Contents

Management Plan of NKSJ Group

NKSJ Holdings Announces Details of Share Repurchase

(Share repurchase in accord with articles of incorporation provisions set pursuant to Article 165, paragraph 2, of the Companies Act)

Completion of acquiring of Tenet Insurance Company Ltd., a Singapore Non-life insurance company

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| | | | | | | | |

| | | | NKSJ Holdings, Inc. |

| Date: May 31, 2010 | | | | |

| | | | By: | | /S/ HIROHISA KURUMIDA | | |

| | | | | | Hirohisa Kurumida | | |

| | | | | | Manager of Corporate Legal Department | | |

[English Translation]

Management Plan of NKSJ Group

[English Translation]

May 31, 2010

To whom it may concern:

| | | | |

| | Corporate Name: | | NKSJ Holdings, Inc. |

| | Name of the Representative: | | Makoto Hyodo Chairman and Co-CEO |

| | Name of the Representative: | | Masatoshi Sato President and Co-CEO |

| | (Securities Code: 8630 TSE, OSE) |

Management Plan of NKSJ Group

- Toward the No. 1 Group for “Growth” and “Customers’ Trust” -

The NKSJ Group’s business plan starting FY2010 has been already disclosed in October 2009. In order to ensure the achievement of our numerical target as of FY2014 (five years after the integration), NKSJ Holdings Inc. has established a new management plan reflecting the result of FY2009.

The NKSJ Group, under a slogan of “No. 1 Group for ‘Growth’ and ‘Customers’ Trust’, will provide customers with absolute peace of mind and the highest quality services through our business lines such as property & casualty insurance, life insurance, and overseas insurance businesses.

We will pursue sustainable growth and further improvement of our corporate value by expanding group income through prompt realization of integration synergies and strategic allocation of management resources to growth areas to achieve this plan, through operations premised on building highly transparent governance systems and ensuring effective risk management and compliance.

| 1. | Overview of the group’s business plan |

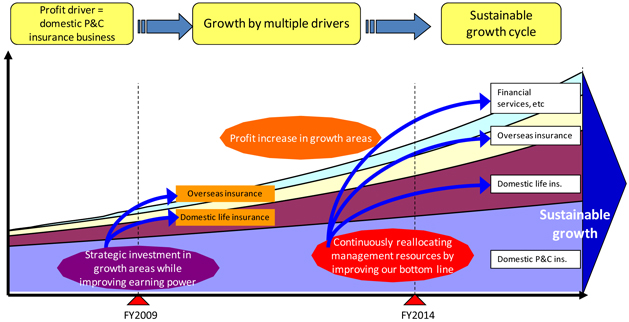

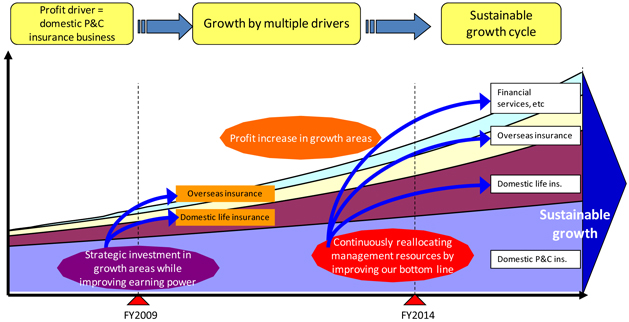

We will further improve our profit-earning capacity in domestic property and casualty (P&C) insurance business, which is a profit driver of the group. Also, we will shift management resources to promising arena such as domestic life insurance and overseas insurance businesses, and will establish more balanced business portfolio. Moreover, we will further invest in growth businesses by utilizing enhanced profit expanded by multiple profit drivers. In this way, NKSJ Group aims to catch on a sustainable growth cycle.

| 2. | Medium-term numerical targets |

NKSJ Group’s medium-term numerical targets (adjusted consolidated profit basis[A]) are as follows*1. Numerical targets as of FY2014 are unchanged from what we have announced on October 30, 2009.

| | | | | | | | | | | | | | | |

| | | (Billions of Yen) | |

| | | FY2009(A) | | | FY2010(E) | | | FY2012(E) | | | FY2014(E) *3 | |

Adjusted consolidated profit | | 89.9 | | | 68.7 | | | 90 | | | 160 | | | (100 | )% |

Domestic P&C insurance | | 46.7 | | | 36.9 | | | 50 | | | 90 | | | (56 | )% |

Domestic life insurance | | 44.6 | | | 30.0 | | | 35 | | | 50 | | | (31 | )% |

Overseas insurance | | 1.5 | | | 4.2 | | | 7+ | a*2 | | 16 | | | (10 | )% |

Financial services, etc | | 2.9 | | | -2.4 | | | -2 | | | 4 | | | (3 | )% |

| | | | | |

Adjusted consolidated ROE[B] | | 5.1 | % | | 3.5 | % | | 4.4 | % | | 7 | % | | | |

| *1 | See “Attachment” for details. |

| *2 | We expect profit increase by mergers and acquisitions in overseas insurance business. However, because it is difficult to predict timing of future transactions at this point, we present overseas insurance profits of FY2012 only from the existing business. |

| *3 | Numbers in parentheses shown in FY2014 column are proportions to the total profit. |

| | [A] | Definition of business and calculation of adjusted profit |

| | |

| <Definition of business> |

| |

• Domestic P&C insurance: | | Sum of Sompo Japan and Nipponkoa (non-consolidated) |

• Domestic life insurance: | | Sum of Sompo Japan Himawari Life and Nipponkoa Life |

• Overseas insurance: | | Overseas subsidiaries |

• Financial services, etc: | | Saison Automobile and Fire, Sonpo 24, Sompo Japan DIY, financial services, healthcare, etc. |

|

| <Calculation of adjusted profit> |

|

• Domestic P&C insurance |

|

Net income + provisions to catastrophe loss reserve (after tax) + provisions to price fluctuation reserve (after tax) - gains/losses on securities sales and securities devaluation losses (after tax) - extraordinary items |

|

• Domestic life insurance (subsidiaries) |

|

Growth in embedded value (EV) net of capital account transactions (e.g., equity issuance) - changes in EV attributable to interest rate movements |

|

• Overseas, financial services, etc |

|

Net income as reported in financial statements |

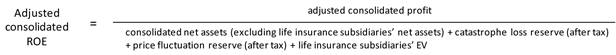

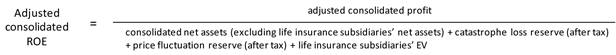

| | [B] | Calculation of adjusted consolidated ROE |

*All values in the denominator are the average of the fiscal-year opening and closing balances

We expect integration benefit (synergies) as much as 30 billion yen p.a. in FY2012 and 50 billion yen in FY2014 (unchanged from what we announced on October 30, 2009).

On the other hand, we expect cumulative one-time costs of 60 billion yen for five years. Although system unification obliges us significant one-time cost in 2012, we expect improvement in expense ratio in 2014 by realizing synergies.

<Expected integration synergies and one-time costs>

| | | | | | |

| | | | | (billions of yen, before tax basis) |

| | | FY2010 | | FY2012 | | FY2014 |

| Integration synergies | | Approx. 10 | | Approx. 30 | | Approx. 50 |

| One-time costs | | Approx. 3 | | Approx. 41 | | Approx. 3 |

| 3. | Strategies of each business area |

Specific plans in each business area are as follows.

| | (1) | Domestic P&C insurance business |

| | • | | By realizing synergy promptly and enhancing earning capacity and management efficiency, we aim to achieve adjusted profit target of 50 billion yen in FY2012, and 90 billion yen in FY2014. |

| | • | | By system integration and thorough review of operations process, we will enhance operating efficiency and reduce expenses. |

| | (2) | Domestic life insurance business |

| | • | | Our life insurance subsidiaries, Sompo Japan Himawari Life and Nipponkoa Life, plan to merge in October 2011. |

| | • | | By strategically allocating our management resources to domestic life insurance business, which we believe is a promising arena, we aim to achieve adjusted EV growth of 50 billion yen in FY2014. |

| | (3) | Overseas insurance business |

| | • | | We set overseas insurance business as a core profit driver following domestic P&C insurance business and domestic life insurance business. We will accelerate mergers and acquisitions overseas, and assume investing as much as 200 billion yen for three years ending FY2012. |

| | • | | As our M&A targets, we mainly focus on sectors which can realize synergies with our business, especially P&C insurance, mainly in growing emerging countries. |

| | (4) | Financial services, etc |

| | • | | In FY2010, we plan to merge/integrate our subsidiaries into a single entity both in asset management business and risk consulting business. |

| | • | | We will promote joint operation in other businesses by utilizing sales network of the group. |

| | • | | We will reduce strategic-holding stocks by 300 billion yen on a mark-to-market basis for three years ending FY2012. Also, we will review our plan with deliberate consideration of future business environment. |

| | • | | In selecting stocks to be sold, we will utilize stock appraisal offered by asset management companies, including our asset management subsidiary. |

| | • | | Part of remuneration of directors and officers is designed to be linked with financial results (NAV per share, adjusted consolidated profit, etc), thereby promoting sound capital management. |

- End -

[Attachment]

<Medium-term numerical targets of NKSJ Group>

| | | | | | | | | | | | |

| | | | | | (Billions of Yen) | |

| | | FY2009(A) | | | FY2010(E) | | | FY2012(E) | | | FY2014(E) | |

Domestic P&C insurance | | | | | | | | | | | | |

Net premiums written | | 1,892.2 | | | 1,903.0 | | | 1,940 | | | 1,950 | |

Excl. CALI*1 | | 1,653.3 | | | 1,664.6 | | | 1,710 | | | 1,720 | |

Loss ratio | | 72.4 | % | | 71.1 | % | | 66.3 | % | | 65.4 | % |

Excl. CALI/Fin. guarantee | | 64.3 | % | | 63.6 | % | | 61.2 | % | | 60.6 | % |

Expense ratio | | 34.6 | % | | 34.0 | % | | 34.9 | % | | 32.4 | % |

Excl. CALI | | 35.9 | % | | 35.2 | % | | 36.1 | % | | 33.4 | % |

Combined ratio | | 107.0 | % | | 105.1 | % | | 101.2 | % | | 97.8 | % |

Excl. CALI/Fin. guarantee | | 100.2 | % | | 98.8 | % | | 97.3 | % | | 94.0 | % |

Adjusted profit | | 46.7 | | | 36.9 | | | 50 | | | 90 | |

Excl. one-time costs | | 46.7 | | | 37.2 | | | 75 | | | 92 | |

Domestic life insurance | | | | | | | | | | | | |

Increase in adjusted EV | | 44.6 | | | 30.0 | | | 35 | | | 50 | |

Overseas insurance | | | | | | | | | | | | |

Net income as reported in financial statements | | 1.5 | | | 4.2 | | | 7+ | a*2 | | 16 | |

Financial service business, etc | | | | | | | | | | | | |

Net income as reported in financial statements | | -2.9 | | | -2.4 | | | -2 | | | 4 | |

Group total | | | | | | | | | | | | |

Adjusted consolidated profit | | 89.9 | | | 68.7 | | | 90 | | | 160 | |

Excl. one-time costs | | 89.9 | | | 69.0 | | | 115 | | | 162 | |

Adjusted consolidated ROE | | 5.1 | % | | 3.5 | % | | 4.4 | % | | 7 | % |

Excl. one-time costs | | 5.1 | % | | 3.5 | % | | 5.6 | % | | 7 | % |

| *1 | CALI: Compulsory automobile liability insurance |

| *2 | We expect profit increase by mergers and acquisitions in overseas insurance business. However, because it is difficult to predict timing of future transactions at this point, we present overseas insurance profits of FY2012 only from the existing business. |

Note Regarding Forward-looking Statements

This document includes “forward-looking statements” that reflect the information in relation to the NKSJ Holdings, Inc. (“NKSJ”). To the extent that statements in this document do not relate to historical or current facts, they constitute forward-looking statements. These forward-looking statements are based on the current assumptions and beliefs of NKSJ in light of the information currently available to NKSJ, and involve known and unknown risks, uncertainties and other factors. Such risks, uncertainties and other factors may cause the actual results, performance, achievements or financial position of NKSJ, as the case may be, to be materially different from any future results, performance, achievements or financial position expressed or implied by these forward-looking statements. NKSJ does not undertake or will not undertake any obligation to publicly update any forward-looking statements after the date of this document. Investors are advised to consult any further disclosures by NKSJ in their subsequent domestic filings in Japan and filings with, or submissions to, the U.S. Securities Exchange Commission pursuant to the U.S. Securities Exchange Act of 1934.

The risks, uncertainties and other factors referred to above include, but are not limited to, those below.

| (1) | Effects of deterioration of economic and business conditions in Japan |

| (2) | Risks associated with non-life insurance business, life insurance business, and other businesses in which NKSJ group participates |

| (3) | Changes to laws, regulations, and systems |

| (4) | Risk of natural disasters |

| (5) | Occurrence of unpredictable damages |

| (7) | Overseas business risk |

| (8) | Effects of declining stock price |

| (9) | Effects of fluctuation in exchange rate |

| (10) | Effects of fluctuation in interest rate |

| (12) | Effects of decline in creditworthiness of investment and/or loan counterparties |

| (13) | Credit rating downgrade |

| (15) | Risk concerning retirement benefit liabilities |

| (16) | Occurrence of personal information leak |

| (17) | Damage on business operations by major disasters |

| (18) | Effects resulting from business integration |

[English Translation]

NKSJ Holdings Announces Details of Share Repurchase

(Share repurchase in accord with articles of incorporation provisions set pursuant to

Article 165, paragraph 2, of the Companies Act)

[English Translation]

May 31, 2010

| | | | |

| | Corporate Name: | | NKSJ Holdings, Inc. |

| | Name of the Representative: | | Makoto Hyodo Chairman and Co-CEO |

| | Name of the Representative: | | Masatoshi Sato President and Co-CEO |

| | (Securities Code: 8630 TSE, OSE) |

NKSJ Holdings Announces Details of Share Repurchase

(Share repurchase in accord with articles of incorporation provisions set pursuant to

Article 165, paragraph 2, of the Companies Act)

NKSJ Holdings announces that its board of directors met today and passed a resolution setting out details of the company’s share repurchase to be conducted in accord with Article 156 of the Companies Act applied pursuant Article 165, paragraph 3, of that Act.

| 1. | Reason for share repurchase |

To obtain treasury stock for delivery upon the exercise of NKSJ Holdings equity warrants

| | |

| (1) Class of shares to be repurchased | | NKSJ Holdings common stock |

| (2) Potential total number of shares repurchased | | 1,000,000 shares (upper limit) (0.06% of issued and outstanding shares (net of treasury stock)) |

| (3) Total purchase price | | 700,000,000 yen (upper limit) |

| (4) Repurchase period | | June 3, 2010 (Thur.) – June 30, 2010 (Wed.) |

For reference: NKSJ Holdings’s treasury stock holdings as of April 30, 2010

| | |

| Number of issued and outstanding shares (net of treasury stock) | | 1,661,368,896 shares |

| Number of shares held in treasury stock | | 40,282 shares |

- End -

Note Regarding Forward-looking Statements

This document includes “forward-looking statements” that reflect the information in relation to the NKSJ Holdings, Inc. (“NKSJ”). To the extent that statements in this document do not relate to historical or current facts, they constitute forward-looking statements. These forward-looking statements are based on the current assumptions and beliefs of NKSJ in light of the information currently available to NKSJ, and involve known and unknown risks, uncertainties and other factors. Such risks, uncertainties and other factors may cause the actual results, performance, achievements or financial position of NKSJ, as the case may be, to be materially different from any future results, performance, achievements or financial position expressed or implied by these forward-looking statements. NKSJ does not undertake or will not undertake any obligation to publicly update any forward-looking statements after the date of this document. Investors are advised to consult any further disclosures by NKSJ in their subsequent domestic filings in Japan and filings with, or submissions to, the U.S. Securities Exchange Commission pursuant to the U.S. Securities Exchange Act of 1934.

The risks, uncertainties and other factors referred to above include, but are not limited to, those below.

| (1) | Effects of deterioration of economic and business conditions in Japan |

| (2) | Risks associated with non-life insurance business, life insurance business, and other businesses in which NKSJ group participates |

| (3) | Changes to laws, regulations, and systems |

| (4) | Risk of natural disasters |

| (5) | Occurrence of unpredictable damages |

| (7) | Overseas business risk |

| (8) | Effects of declining stock price |

| (9) | Effects of fluctuation in exchange rate |

| (10) | Effects of fluctuation in interest rate |

| (12) | Effects of decline in creditworthiness of investment and/or loan counterparties |

| (13) | Credit rating downgrade |

| (15) | Risk concerning retirement benefit liabilities |

| (16) | Occurrence of personal information leak |

| (17) | Damage on business operations by major disasters |

| (18) | Effects resulting from business integration |

[English Translation]

Completion of acquiring of Tenet Insurance Company Ltd., a Singapore Non-life

insurance company

[English Translation]

May 31, 2010

| | | | |

| | Corporate Name: | | NKSJ Holdings, Inc. |

| | Name of the Representative: | | Makoto Hyodo Chairman and Co-CEO |

| | Name of the Representative: | | Masatoshi Sato President and Co-CEO |

| | (Securities Code: 8630 TSE, OSE) |

Completion of acquiring of Tenet Insurance Company Ltd., a Singapore Non-life

insurance company

NKSJ Holdings (“NKSJ”; Masatoshi SATO, President and Co-CEO) is pleased to announce that Sompo Japan Insurance Inc. (“Sompo Japan”; Masatoshi SATO, President and CEO), a wholly owned subsidiary of NKSJ, has acquired on May 31, 2010 shares in Tenet Insurance Company Ltd. (“Tenet”) following the announcement made on March 8, 2010 entitled “Acquisition of Tenet Insurance Company Ltd., a Singapore Non-life insurance company”.

The total consideration paid by Sompo Japan was 95 million Singapore dollars (approx. 6,400 millionYen).

Sompo Japan has acquired 100.0% of Tenet’s common shares and non-voting preferred shares.

In addition to Sompo Japan Singapore’s current business, whose strength lies in the commercial sector, especially in marine insurance, Tenet has achieved steady growth in mid-size commercial and retail markets through innovative marketing expertise. By integrating these two operations in Singapore, Sompo Japan Group plans to further strengthen its solid platform and expand its operations in Singapore and Southeast Asia.

General Information on Tenet

| | |

(1) Corporate Name | | Tenet Insurance Company Limited |

(2) Location of Head Office | | 38 South Bridge Road, Singapore 058672 |

(3) Title and Name of Representative | | Principal Officer: Ms. Tan Yian Hua (Stella) |

(4) Life of Business | | Non-life Insurance |

(5) Capital | | S$44,660,000 |

(6) Date of Incorporation | | May 8, 1957 |

(7) Financial Conditions and Operating Results for the past three years (non-consolidated, S$1,000) |

| | | | | | | | | | |

| | | |

Fiscal Year | | December 2007 | | December 2008 | | December 2009 |

| Net assets | | 72,301 | | 52,284 | | 59,358 |

| Total assets | | 117,667 | | 105,171 | | 121,526 |

| Gross premium written | | 30,859 | | 41,170 | | 45,698 |

| Profit before taxation | | 7,921 | | -5,983 | | 10,736 |

| Net income | | 6,694 | | -4,344 | | 9,474 |

- End –

Note Regarding Forward-looking Statements

This document includes “forward-looking statements” that reflect the information in relation to the NKSJ Holdings, Inc. (“NKSJ”). To the extent that statements in this document do not relate to historical or current facts, they constitute forward-looking statements. These forward-looking statements are based on the current assumptions and beliefs of NKSJ in light of the information currently available to NKSJ, and involve known and unknown risks, uncertainties and other factors. Such risks, uncertainties and other factors may cause the actual results, performance, achievements or financial position of NKSJ, as the case may be, to be materially different from any future results, performance, achievements or financial position expressed or implied by these forward-looking statements. NKSJ does not undertake or will not undertake any obligation to publicly update any forward-looking statements after the date of this document. Investors are advised to consult any further disclosures by NKSJ in their subsequent domestic filings in Japan and filings with, or submissions to, the U.S. Securities Exchange Commission pursuant to the U.S. Securities Exchange Act of 1934.

The risks, uncertainties and other factors referred to above include, but are not limited to, those below.

| (1) | Effects of deterioration of economic and business conditions in Japan |

| (2) | Risks associated with non-life insurance business, life insurance business, and other businesses in which NKSJ group participates |

| (3) | Changes to laws, regulations, and systems |

| (4) | Risk of natural disasters |

| (5) | Occurrence of unpredictable damages |

| (7) | Overseas business risk |

| (8) | Effects of declining stock price |

| (9) | Effects of fluctuation in exchange rate |

| (10) | Effects of fluctuation in interest rate |

| (12) | Effects of decline in creditworthiness of investment and/or loan counterparties |

| (13) | Credit rating downgrade |

| (15) | Risk concerning retirement benefit liabilities |

| (16) | Occurrence of personal information leak |

| (17) | Damage on business operations by major disasters |

| (18) | Effects resulting from business integration |