Exhibit 99.1

[Translation]

Note: This document has been translated from the Japanese original for reference purposes only. In the event of any discrepancy between this translated document and the Japanese original, the original shall prevail.

Local code: 8755

December 2009

Notice to Shareholders

Sompo Japan Insurance Inc.

1-26-1 Nishi-Shinjuku, Shinjuku-ku, Tokyo

Masatoshi Sato, President

Notice of Calling of the Extraordinary Shareholders’ Meeting

Thank you all for your continued patronage.

The Extraordinary Shareholders’ Meeting will be held as follows and your attendance is cordially requested.

Please fill out and submit the enclosed Voting Form at the reception when you attend the meeting.

If you are unable to attend on this date, you may exercise your voting rights either in writing or through the Internet. In this case, please review the “Shareholders’ Meeting Reference Documents” (which follow this notice), and exercise your voting rights by either one of the methods detailed below.

[Exercising voting rights in writing]

Please mark your approval or disapproval with respect to each proposal on the enclosed Voting Form, and return it so that it is received by us by 5 p.m. on December 21, 2009 (Monday).

[Exercising voting rights via the Internet]

Please refer to the “Instructions on the Exercise of Voting Rights via the Internet” on pages 3 and 4 for details and indicate your approval or disapproval with respect to each proposal by 5 p.m. on December 21, 2009 (Monday).

(Note)

If amendments are made to Shareholders’ Meeting Reference Documents, the amended contents will be accessible immediately on our website at the URL given below.

Our Website:http://www.sompo-japan.co.jp

Details of the Meeting

| | | | |

| 1. | | Date and Time: | | December 22, 2009 (Tuesday) at 10 a.m. |

| | |

| 2. | | Location: | | 1-26-1 Nishi-Shinjuku, Shinjuku-ku, Tokyo Head office, 2nd floor conference room |

| | | | (See the “Extraordinary Shareholders’ Meeting Venue Details” on the last page) |

3. Purpose of the Shareholders’ Meeting:

Matters to be Resolved

| | |

| Proposal No. 1 | | Approval of the Share Exchange Plan (kyodo-kabushiki-iten-keikaku) of the Company and NIPPONKOA Insurance Company, Limited |

| |

| Proposal No. 2 | | Changes to the Articles of Incorporation |

4. Matters related to the Exercising of Voting Rights:

| | (1) | In the case where a shareholder exercises his/her voting rights using the Voting Form and does not indicate his/her approval or disapproval (or abstention) of each proposal, the absence of such indication shall be treated as a vote for approval. |

| | (2) | If any shareholder casts duplicate or multiple votes via the Internet, the last vote cast shall be treated as the effective vote. |

| | (3) | If duplicate votes are exercised by using both the enclosed Voting Form and the Internet, the vote cast using the Internet shall be treated as the effective vote. |

| | (4) | In the event a proxy attends the meeting, the proxy shall submit a letter of proxy together with the Voting Form to the reception counter at the meeting. Proxy eligibility shall be limited to one (1) of the shareholders having voting rights of the Company. |

2

Instructions on the Exercising of Voting Rights via the Internet

Voting rights can only be exercised via the Internet by using the Company’s designated websites for the exercise of voting rights (please refer to the URLs below). You may also access the Internet using your mobile phone.

When exercising your voting rights via the Internet, the vote exercise code and the password indicated on the enclosed Voting Form are required.

| 1. | The vote exercise code and the password provided this time are only valid for this shareholders’ meeting. A new vote exercise code and password will be issued for the next shareholders’ meeting. |

| 2. | How to exercise your voting rights via the Internet. |

http://www.it-soukai.com/ or https://daiko.mizuho-tb.co.jp/

(These URLs cannot be accessed between the hours of 3 a.m. and 5 a.m. during the voting period)

| | * | The voting sites may be accessed by using a mobile phone with a barcode reading function and reading the "QR code®." Please refer to the user manual for your mobile phone for detailed instructions on how to use your phone. |

| | (2) | Enter the vote exercise code and the password and press the “login” button. The vote exercise code and the password are indicated on the lower right hand side of the enclosed Voting Form. |

| | (3) | Follow the instructions on the screen to complete the process. |

| | (1) | Using a personal computer |

| | • | | Personal computer: Windows® (Not compatible with PDA or game machines) |

| | • | | Browser: Microsoft® Internet Explorer 5.5 or later version |

| | • | | An Internet accessible environment such as that provided by contract with an Internet Service Provider. |

| | • | | Screen resolution: 1024 x 768 or better is recommended. |

| | • | | Mobile telephone: A mobile phone model capable of 128 bit SSL transmission (encoding). |

Allows for the use of at least one of the following services: iMode, EZweb or Yahoo! Keitai (Some models are not compatible).

| | * | Microsoft and Windows are registered trademarks or trademarks of Microsoft Corporation of USA in USA and other countries. |

| | * | “iMode” is a registered trademark of NTT DoCoMo, Inc. |

| | * | “EZweb” is a registered trademark of KDDI Corporation. |

| | * | “Yahoo!” is a registered trademark or trademark of Yahoo! Inc., of USA. |

| | * | “QR code®” is a registered trademark of Denso Wave Incorporated. |

3

| 4. | Costs for using the Internet, including connection and transmission charges to an Internet Service Provider, shall be borne by the shareholder. |

SSL 128 bit encryption technology is used to ensure that information is not tampered with or stolen so that users may use the websites safely.

The voting rights exercise code and the password indicated on your Voting Form are important information that verify your identity as a shareholder. Do not disclose this information to anyone. The Company will not make inquiries regarding their passwords to individual shareholders.

[Further Inquiries]

| | 1) | Further inquiries concerning how to use a personal computer or mobile phone to exercise voting rights via the Internet should be directed to: |

Internet Help Dial, Securities & Custody Business Department, Mizuho Trust & Banking Co., Ltd.

Telephone: 0120-768-524 (Toll Free)

(Reception hours: 9:00-21:00 except Saturdays, Sundays and public holidays)

| | 2) | For inquiries other than the above (address changes, etc.) |

Securities & Custody Business Department, Mizuho Trust & Banking Co., Ltd.

Telephone: 0120-288-324 (Toll Free)

(Reception hours: 9:00-17:00 except Saturdays, Sundays and public holidays)

[To Corporate Investors]

Corporate investors may use the “Electronic Voting Platform” operated by Inventor Communications Japan, Inc. as a means to exercise your voting rights.

4

Proposal No. 1 Approval of Share Exchange Plan (kyodo-kabushiki-iten-keikaku) of

the Company and NIPPONKOA Insurance Company, Limited

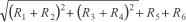

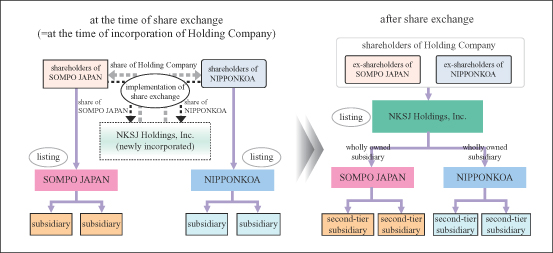

The Company plans to implement, jointly with NIPPONKOA Insurance Company, Limited (hereinafter “NIPPONKOA” and, together with the Company, “Both Companies”), a business integration (hereinafter the “Integration”) in which Both Companies will incorporate as of April 1, 2010, through a share exchange (kyodo-kabushiki-iten) (hereinafter the “Share Exchange”), a holding company called NKSJ Holdings, Inc. (hereinafter the “Holding Company”) that shall be the wholly owning parent company of Both Companies, and Both Companies shall become the Holding Company’s wholly-owned subsidiaries.

This Proposal requests approval of the share exchange plan (kyodo-kabushiki-iten-keikaku) prepared by Both Companies (contents of which are specified in pages 30 through 194 hereof (Note: pages 27 through 183 of English translation) (hereinafter the “Exchange Plan”) in order to implement the Integration.

The application procedures to have shares in the Holding Company listed on the First Section of the Tokyo Stock Exchange as well as the First Section of the Osaka Securities Exchange are scheduled to be taken promptly in association with the Integration. The shares in the Holding Company that will be listed on both of these Exchanges will be distributed to our shareholders in exchange for shares in the Company, at the prescribed Share Exchange Ratio.

| 1. | Reasons for the Share Exchange |

Companies are under strong pressure to take appropriate action and to contribute to the safety of society as well as the sense of security on the part of customers, in the face of a declining birthrate as well as an aging and depopulating society, which are serious problems in Japan over the medium and long term, as well as in conjunction with increasing risks as a result of climate change on a global level as well as global warming, and the diversification of needs associated with changes in lifestyles.

Based on this shared perspective, the Company and NIPPONKOA have decided to create a “new solution service group that will provide customers with security and service of the highest quality and will contribute to the social welfare,” while sharing as a single group the strengths nurtured over their respective 120-year histories.

| 2. | Outline of the Exchange Plan |

Contents of the Exchange Plan shall be as set forth in the share exchange plan (kyodo-kabushiki-iten-keikakusho) attached hereto (pages 30 through 194) (Note: pages 27 through 183 of English translation).

| 3. | Matters concerning the reasonability of the provisions relating to the matters prescribed by Article 773, Paragraph 1 (v) and (vi) of the Corporation Law |

| (1) | Both Companies which will become wholly owned subsidiaries of the Holding Company through the Share Exchange have determined the allocation ratio of shares of common stock of the Holding Company to be delivered to their respective shareholders upon incorporation of the Holding Company which is the wholly owning parent company (the “Share Exchange Ratio”) as follows. |

| (i) | The Share Exchange Ratio is as set out below. |

One share of common stock of the Holding Company will be allotted for one share of common stock of the Company and 0.9 shares of common stock of the Holding Company will be allotted for one share of common stock of NIPPONKOA.

The number of shares per unit of shares of the Holding Company shall be 1,000 (at the present time in Both Companies the number of shares per unit of shares in the respective company is 1,000). It is however possible that the Share Exchange Ratio referred to above may be changed through mutual consultation of Both Companies if a material change occurs in any of the conditions upon which the ratio was determined.

5

(ii) Basis of calculation etc. in relation to the Share Exchange Ratio are as set out below.

In order to ensure the fairness of Both Companies’ respective calculation of the share exchange ratio to be used in the Share Exchange, the Company requested Nomura Securities Co., Ltd. (“Nomura Securities”), Mizuho Securities Co., Ltd. (“Mizuho Securities”) and Goldman Sachs Japan Co., Ltd. (“Goldman Sachs”), and NIPPONKOA requested Merrill Lynch Japan Securities Co., Ltd. (“Merrill Lynch”) and Mitsubishi UFJ Securities Co., Ltd. (“Mitsubishi UFJ Securities”), to perform fairness analyses relating to the calculation of the share exchange ratio in connection with the business integration.

Because the common stock of each of Both Companies has a market price, Nomura Securities has adopted the average market price method, as well as the comparable peer company method, the dividend discount model analysis method (the “DDM Method”) and contribution analysis, for calculating the share exchange ratio. The calculation results based on each method are as follows. The calculation range of the share exchange ratio shows the range of the number of shares of the Holding Company’s common stock that are to be allotted for each share of common stock of NIPPONKOA, assuming that one share of common stock of the Holding Company will be allotted for each share of the Company’s common stock.

| | | | |

| | | Adopted Method | | Calculation Range of

Share Exchange Ratio |

(1) | | Average Market Price Method | | 0.85 ~ 0.92 |

(2) | | Comparable Peer Company Method | | 0.53 ~ 0.69 |

(3) | | DDM Method | | 0.74 ~ 1.05 |

(4) | | Contribution Analysis | | 0.54 ~ 1.26 |

In the average market price method, the calculation range of the share exchange ratio is based on (1) the closing stock price on July 28, 2009 (the “Record Date”); (2) the average closing stock price during the week before the Record Date; (3) the average closing stock price during the month before the Record Date; (4) the average closing stock price between May 21, 2009 (one business day after the date of the disclosure of the financial results for the fiscal year ended March 31, 2009) and the Record Date; (5) the average closing stock price during the three months before the Record Date and (6) the average closing stock price between March 16, 2009 (one business day after the Memorandum of Understanding was announced) and the Record Date.

Nomura Securities has used the information provided by Both Companies, in addition to publicly available information, to conduct its analysis. Nomura Securities has not conducted any independent verification of the accuracy and completeness of this information, but rather has assumed that all such materials and information are accurate and complete. In addition, Nomura Securities has not made any independent evaluation, appraisal or assessment of the assets or liabilities (including contingent liabilities) of either of Both Companies or their affiliates, nor has Nomura Securities independently analyzed or assessed each individual asset and liability. Nomura Securities has not appointed any third party for appraisal or assessment. Nomura Securities calculated the share exchange ratio based on information and economic conditions as of July 28, 2009, and Nomura Securities assumes that the financial projections (including the profit plan and other information) reported by Both Companies have been rationally prepared on the basis of the best possible estimates and judgment available at that time from the management of each of Both Companies.

Because the common stock of each of Both Companies has a market price, Mizuho Securities has adopted the average market price method, as well as the comparable peer company method and the dividend discount model analysis method (the “DDM Method”), for calculating the share exchange ratio. The calculation results based on each method are as follows. The calculation range of the share exchange ratio shows the range of the number of shares of the Holding Company’s common stock to be allotted for each share of common stock of NIPPONKOA, assuming that one share of common stock of the Holding Company will be allotted for each share of the Company’s common stock.

6

| | | | |

| | | Adopted Method | | Calculation Range of

Share Exchange Ratio |

(1) | | Average Market Price Method | | 0.851 ~ 0.942 |

(2) | | Comparable Peer Company Method | | 0.485 ~ 0.927 |

(3) | | Dividend Discount Model Analysis (DDM Method) | | 0.453 ~ 1.020 |

In the average market price method, the calculation range of the share exchange ratio is based on (1) the closing stock price on July 24, 2009 (one business day before July 25, 2009, when there were press reports about the share exchange ratio) (the “Record Date”); (2) the average closing stock price during the week before the Record Date; (3) the average closing stock price during the month before the Record Date; and (4) the average closing stock price during the three months before the Record Date.

Mizuho Securities has used the information provided by Both Companies, in addition to publicly available information, to conduct its analysis. Mizuho Securities has not conducted any independent verification of the accuracy and completeness of this information, but rather has assumed that all such materials and information are accurate and complete. In addition, Mizuho Securities has not made any independent evaluation, appraisal or assessment of the assets or liabilities (including contingent liabilities) or reserves of either party, their subsidiaries or their affiliates, nor has Mizuho Securities independently analyzed or assessed each individual asset or liability or reserve. Mizuho Securities has not appointed any third party for appraisal or assessment. Mizuho Securities calculated the share exchange ratio based on information and economic conditions up to and as of July 28, 2009, and Mizuho Securities assumes that the financial projections (including the profit plan and other information) reported by Both Companies have been rationally prepared on the basis of the best possible estimates and judgment available at that time from the management of each of Both Companies.

Goldman Sachs performed a stock price analysis and a comparable companies analysis based on publicly available information, and a DDM analysis based on financial projections prepared by management of Both Companies, as approved for Goldman Sachs’ use by the Company. The results of respective analyses are shown below. The below ranges of the share exchange ratio are for a number of shares of the Holding Company to be issued in exchange for one share of NIPPONKOA common stock assuming that one share of the Holding Company stock will be issued in exchange for one share of the Company common stock. In performing the stock price analysis, Goldman Sachs used July 24, 2009 as the base date, and reviewed the closing market prices of Both Companies on the base date and the closing market prices of Both Companies during the one-month, three-month and six-month period ending on the base date as a basis for the analysis. In addition, no company used in this analysis as a comparison is directly comparable to the Company and NIPPONKOA. Goldman Sachs delivered to the Company a written opinion, approved by the fairness committee of Goldman Sachs & Co., that, as of July 29, 2009, and based upon and subject to certain conditions, including the below assumptions, the share exchange ratio of one share of common stock of the Holding Company to be issued in exchange for one share of common stock of the Company agreed to pursuant to the Agreement was fair to the shareholders of the Company from a financial point of view. Goldman Sachs provided its advisory services and the opinion for the information and assistance of the Board of Directors of the Company in connection with its consideration of the share exchange and such opinion does not constitute a recommendation as to how any shareholder of the Company should vote with respect to such Share Exchange or any other matter. Goldman Sachs did not recommend any specific share exchange ratio to the Company or its Board of Directors or that any specific share exchange ratio constituted the only appropriate share exchange ratio. Please refer to Note 1 below for a more detailed description.

| | | | |

| | | Analysis Method | | Range of Share Exchange Ratio |

(1) | | Stock Price Analysis | | 0.77 ~ 1.57 |

(2) | | Comparable Companies Analysis | | 0.53 ~ 2.74 |

(3) | | DDM Analysis | | 0.51 ~ 1.24 |

7

Goldman Sachs’ analyses and opinion are necessarily based on economic, monetary, market and other conditions as in effect on, and the information made available to Goldman Sachs as of, July 29, 2009, and Goldman Sachs assumes no responsibility for updating, revising or reaffirming this opinion based on circumstances, developments or events occurring after the date thereof. Goldman Sachs assumed with the Company’s consent that the financial forecasts for Both Companies, including synergies, have been reasonably prepared on the basis of the best possible estimates and judgment available at that time from the management of each of Both Companies.

Merrill Lynch, considering the trends of the market share prices, forecasts and other aspects of the performance of NIPPONKOA and the Company, conducted its valuation using a market price analysis, a comparable companies analysis and a discounted cash flow (“DCF”) analysis, and the Board of Directors of NIPPONKOA received a valuation report from Merrill Lynch on July 29, 2009. (Furthermore, the Board of Directors of NIPPONKOA received a written opinion on July 29, 2009, to the effect that, based on the assumptions set forth below and other conditions set forth in such written opinion, the Share Exchange Ratio to be used in the Share Exchange is fair, from a financial point of view, to the holders of common stock of NIPPONKOA, other than the Company and its affiliates. Both the valuation report and the written opinion were submitted by Merrill Lynch to the Board of Directors of NIPPONKOA on the condition that they were prepared solely for use by the Board of Directors of NIPPONKOA in connection with its evaluation of the share exchange ratio for the Share Exchange, and that they may not be used or relied upon for any other purpose. Moreover, the Board of Directors of NIPPONKOA has received further supplementary explanation from Merrill Lynch concerning the assumptions and disclaimers related to its analyses and opinions in evaluating the stockholder value of each company. Please see Note 2 below for details.) The market price analysis was based (1) on the closing price of each company on July 24, 2009 (the “Record Date (i)”) and the average closing prices of each company for the one-month, three-month and six-month periods up to and including the Record Date (i) and (2) on the closing prices of each company on March 11, 2009 (the “Record Date (ii)”), the business day immediately prior to the day on which the Share Exchange of NIPPONKOA and the Company was reported by newspapers, and the average closing prices for the one-month, three-month and six-month periods up to and including the Record Date (ii). The table below sets forth the primary methodologies that Merrill Lynch used in its valuations of NIPPONKOA and the Company, along with the ranges of share exchange ratios obtained as a result of such valuations are set forth below. (The following ranges represent the number of shares of NIPPONKOA to be transferred for one share of the Holding Company, assuming that each share of the Company is to be transferred for one share of the Holding Company.)

| | | | |

| | | Methodology | | Range of Share Exchange Ratios |

(1)-1 | | Market Price Analysis (Record Date (i)) | | 0.85 ~ 1.01 |

(1)-2 | | Market Price Analysis (Record Date (ii)) | | 1.01 ~ 1.44 |

(2) | | Comparable Companies Analysis | | 0.62 ~ 0.96 |

(3) | | DCF Analysis | | 0.72 ~ 1.29 |

Merrill Lynch, in preparing its written opinion and the valuations set forth in its valuation report, which were the basis for the written opinion, has assumed and relied on the accuracy and completeness of all information supplied to it by NIPPONKOA and the Company or otherwise made available to Merrill Lynch, discussed with or reviewed by Merrill Lynch, or publicly available, and has not assumed any responsibility for independently verifying such information or undertaken an independent evaluation or appraisal of any of the assets, liabilities or facilities of NIPPONKOA or the Company. Moreover, with respect to the prospects for business, profits, cash flow, assets, liabilities, new business plans, and other matters furnished to or discussed with Merrill Lynch, in addition to any information concerning cost savings expected to arise from the Share Exchange or the expenses related to the execution of the Share Exchange including the amount and timing of such cost savings and related expenses and synergies, Merrill Lynch assumed that they were reasonably prepared and reflected the best possible estimates and judgment of NIPPONKOA’s or the Company’s management available at that time. The written opinion and valuation report provided by Merrill Lynch are necessarily based on the information available to it and economic conditions as they

8

existed on July 29, 2009, and Merrill Lynch assumes no responsibility to update, revise, or reconfirm either its opinion or analyses based on any circumstances, changes, or for any other cause arising after such date.

Merrill Lynch is acting as financial advisor to NIPPONKOA and will receive a fee from NIPPONKOA for its services, a significant portion of which is contingent on the consummation of the Share Exchange.

Because the common stock of each of Both Companies has a market price, Mitsubishi UFJ Securities has adopted the average market price method, as well as the comparable peer company method based on the revised net assets and the dividend discount model analysis method (the ���DDM Method”), for calculating the share exchange ratio. The calculation results based on each method are as follows. The calculation range of the share exchange ratio shows the range of the number of shares of the Holding Company’s common stock to be allotted for each share of common stock of NIPPONKOA, assuming that one share of common stock of the Holding Company will be allotted for each share of the Company’s common stock.

| | | | |

| | | Adopted Method | | Calculation Range of

Share Exchange Ratio |

(1) | | Average Market Price Method (Record Date (i)) | | 0.773 ~ 1.121 |

(2) | | Average Market Price Method (Record Date (ii)) | | 0.613 ~ 1.571 |

(3) | | Comparable Peer Company Method | | 0.710 ~ 0.862 |

(4) | | DDM Method | | 0.773 ~ 1.114 |

In the average market price method, the closing stock price has been applied for the periods of one month and three months on and until the record date of July 27, 2009 (the “Record Date” (i)) and for any day after March 16, 2009 (one business day after the announcement on the Memorandum of Understanding), as well as for the period of one month, three months and six months on and until the record date of March 11, 2009 (the “Record Date” (ii)) (one business day before March 12, 2009, when there were press reports speculating about the business integration).

Mitsubishi UFJ Securities has used the information provided by Both Companies, in addition to publicly available information, to conduct its analysis. Mitsubishi UFJ Securities has not conducted any independent verification of the accuracy and completeness of this information, but rather has assumed that all such materials and information are accurate and complete. In addition, Mitsubishi UFJ Securities has not made any independent evaluation, appraisal or assessment of the assets or liabilities (including contingent liabilities) of either of Both Companies or their affiliates, nor has Mitsubishi UFJ Securities independently analyzed or assessed each individual asset and liability. Mitsubishi UFJ Securities has not appointed any third party for appraisal or assessment. Mitsubishi UFJ Securities calculated the share exchange ratio based on information and economic conditions up to and as of July 27, 2009, and Mitsubishi UFJ Securities assumes that the financial projections (including the profit plan and other information) reported by Both Companies have been rationally prepared on the basis of the best possible estimates and judgment available at that time from the management of each of Both Companies.

| 2) | Determination of the Share Exchange Ratio |

The Company and NIPPONKOA considered various factors, including the financial conditions, asset conditions and future outlook of Both Companies, and engaged in careful deliberation concerning the share exchange ratio, and in the process, the Company referred to the results of analyses of Nomura Securities, Mizuho Securities and Goldman Sachs, and NIPPONKOA referred to the results of analyses of Merrill Lynch and Mitsubishi UFJ Securities. On July 29, 2009, Both Companies concluded that the share exchange ratio mentioned above is appropriate, and agreed on the ratio.

Furthermore, the Company obtained opinions from Nomura Securities and Mizuho Securities, dated July 29, 2009, stating that from a financial point of view, the agreed share exchange ratio is fair to the shareholders of the Company, subject to the conditions set forth hereunder and certain other conditions. The Company has also received an opinion from Goldman Sachs, dated July 29, 2009, stating that from a financial point of view, the agreed share exchange ratio of one share of common stock of the Holding Company to be issued in exchange for each share of common stock of the Company is fair to the shareholders of the Company,

9

subject to the conditions set forth hereunder and certain other conditions. Also, NIPPONKOA obtained an opinion from Merrill Lynch and Mitsubishi UFJ Securities dated July 29, 2009, stating that from a financial point of view, the agreed share exchange ratio is fair to the shareholders of NIPPONKOA, subject to the conditions set forth hereunder and certain other conditions.

| 3) | Relationship with entities that performed fairness analyses |

None of Nomura Securities, Mizuho Securities nor Goldman Sachs, the institutions that performed fairness analyses relating to the calculation of the share exchange ratio for the Company, is a related party of the Company, and none of them has a material interest in the reorganization contemplated in this document.

Furthermore, neither Merrill Lynch nor Mitsubishi UFJ Securities, the institutions that performed fairness analyses relating to the calculation of the share exchange ratio for NIPPONKOA, constitutes a related party with respect to NIPPONKOA, and none of them has a material interest in the reorganization.

(Note 1)

Goldman Sachs and its affiliates are engaged in investment banking and financial advisory services, commercial banking, securities trading, investment management, principal investment, financial planning, benefits counseling, risk management, hedging, financing, brokerage activities and other financial and non-financial activities and services for various persons and entities. In the ordinary course of these activities and services, Goldman Sachs and its affiliates may at any time make or hold long or short positions and investments, as well as actively trade or effect transactions, in the equity, debt and other securities (or related derivative securities) and financial instruments (including bank loans and other obligations) of third parties, the Company, NIPPONKOA and any of their respective affiliates or any currency or commodity that may be involved in the transaction contemplated by the Agreement (the “Transaction”) for their own account and for the accounts of their customers. Goldman Sachs has acted as financial advisor to the Company in connection with, and has participated in certain of the negotiations leading to, the Transaction. Goldman Sachs expects to receive fees for its services in connection with the Transaction, a portion of which is contingent upon consummation of the Transaction, and the Company has agreed to reimburse certain of Goldman Sachs’ expenses arising, and indemnify Goldman Sachs against certain liabilities that may arise, out of its engagement. In addition, Goldman Sachs has provided and is currently providing certain investment banking and other financial services to the Company and its affiliates. Goldman Sachs also may provide investment banking and other financial services to the Company, NIPPONKOA and their respective affiliates in the future. In connection with the above-described services, Goldman Sachs has received, and may receive, compensation.

In connection with its analyses and opinion, Goldman Sachs has reviewed, among other things, the Agreement; the Annual Securities Reports (Yuka Shoken Houkoku-Sho) of the Company and NIPPONKOA for the five fiscal years ended March 31, 2009; certain other communications from the Company and NIPPONKOA to their respective stockholders; certain internal financial analyses and forecasts for the Company prepared by its management and certain internal analyses and forecasts for NIPPONKOA prepared by its management and reviewed by the management of the Company, in each case as approved for Goldman Sachs’ use by the Company (the “Forecasts”), including certain cost savings projected by the managements of the Company and NIPPONKOA to result from the Transaction, as prepared by the managements of the Company and NIPPONKOA and approved for Goldman Sachs’ use by the Company (the “Synergies”). Goldman Sachs also has held discussions with members of the senior managements of the Company and NIPPONKOA regarding their assessment of the past and current business operations, financial condition and future prospects of NIPPONKOA and with the members of senior management of the Company and NIPPONKOA regarding their assessment of the past and current business operations, financial condition and future prospects of the Company and the strategic rationale for, and the potential benefits of, the Transaction. In addition, Goldman Sachs has reviewed the reported price and trading activity for the common shares of the Company and NIPPONKOA, compared certain financial and stock market information for the

10

Company and NIPPONKOA with similar information for certain other companies the securities of which are publicly traded, considered the relative exposure of the Company and NIPPONKOA to losses from financial guarantee insurance on CDO securities, and performed such other studies and analyses, and considered such other factors, as Goldman Sachs considered appropriate.

For purposes of rendering its opinion, Goldman Sachs has relied upon and assumed, without assuming any responsibility for independent verification, the accuracy and completeness of all of the financial, legal, regulatory, tax, accounting and other information provided to, discussed with or reviewed by Goldman Sachs and Goldman Sachs does not assume any liability for any such information. In that regard, Goldman Sachs has assumed with the consent of the Company that the Forecasts, including the Synergies, have been reasonably prepared on a basis reflecting the best estimates and judgments of the management of the Company available at that time. In addition, Goldman Sachs has not made an independent evaluation or appraisal of the assets and liabilities (including any contingent, derivative or off-balance-sheet assets and liabilities) of the Company or NIPPONKOA, or any of their respective subsidiaries, and Goldman Sachs has not been furnished with any such evaluation or appraisal. Goldman Sachs also has assumed that all governmental, regulatory or other consents and approvals necessary for the consummation of the Transaction will be obtained without any adverse effect on the Holding Company, the Company or NIPPONKOA or on the expected benefits of the Transaction in any way meaningful to its analysis. Goldman Sachs also assumed that the Transaction will be consummated on the terms set forth in the Agreement, without the waiver or modification of any term or condition the effect of which would be in any way meaningful to its analysis. Goldman Sachs is not an actuary and its services did not include any actuarial determination or evaluation by Goldman Sachs or any attempt to evaluate actuarial assumptions. In that regard, Goldman Sachs has made no analysis of, and expresses no opinion as to, the adequacy of the reserves of the Company, or NIPPONKOA. In addition, Goldman Sachs is not expressing any opinion as to the impact of the Transaction on the solvency or viability of the Company, NIPPONKOA or the Holding Company or the ability of the Company, NIPPONKOA or the Holding Company to pay its obligations when they come due, and its opinion does not address any legal, regulatory, tax or accounting matters. Goldman Sachs’ opinion does not address the underlying business decision of the Company to engage in the Transaction, or the relative merits of the Transaction as compared to any strategic alternatives that may be available to the Company. The opinion addresses only the fairness from a financial point of view to the common shareholders of the Company, as of July 29, 2009, of the share exchange ratio of one share of common stock of the Holding Company to be issued in exchange for each share of common stock of the Company pursuant to the Agreement. Goldman Sachs does not express any view on, and its opinion does not address, any other term or aspect of the Agreement or Transaction, including, without limitation, the fairness of the Transaction to, or any consideration received in connection therewith by, NIPPONKOA or the common shareholders of NIPPONKOA or any other class of securities, creditors, or other constituencies of the Company or NIPPONKOA; nor as to the fairness of the amount or nature of any compensation to be paid or payable to any of the officers, directors or employees of the Company or NIPPONKOA, or class of such persons in connection with the Transaction, whether relative to the share exchange ratio pursuant to the Agreement or otherwise. Goldman Sachs is not expressing any opinion as to the prices at which shares of the Company, the Holding Company, or NIPPONKOA will trade at any time.

The preparation of a fairness opinion is a complex process and is not necessarily susceptible to partial analysis or summary description. Selecting portions of the analyses or of the summary set forth above, without considering the analyses as a whole, could create an incomplete view of the processes underlying Goldman Sachs’ opinion. In arriving at its fairness determination, Goldman Sachs considered the results of all of its analyses and did not attribute any particular weight to any factor or analysis considered by it. Rather, Goldman Sachs made its determination as to fairness on the basis of its experience and professional judgment after considering the results of all of its analyses.

11

(Note 2)

Merrill Lynch has made qualitative judgments as to the significance and relevance of each analysis and each factor considered in the course of preparing these documents. Accordingly, Merrill Lynch believes that its analysis must be considered as a whole and that selecting portions of its analysis and factors, without considering all analyses and factors, could create an incomplete view of the processes underlying such analysis and opinion. In its analysis, Merrill Lynch made numerous assumptions with respect to NIPPONKOA, the Company, industry performance and regulatory environment, general business, economic, market and financial conditions, as well as other matters, many of which are beyond the control of NIPPONKOA and involve the application of complex methodologies and educated judgment. No company, business or transaction used in any analysis as a comparison is identical to NIPPONKOA, the Company, or the Share Exchange. Analyses relating to the value of businesses or securities are not appraisals and may not reflect the present or future prices at which businesses, companies or securities may actually be sold, which may be significantly different from those suggested by those analysis. Accordingly, these analyses and estimates are inherently subject to substantial uncertainty.

Merrill Lynch has not undertaken an independent evaluation of the solvency or fair value of NIPPONKOA or of the Company, and has assumed, with the consent of NIPPONKOA, that certain accounting and tax-related procedures will be followed in connection with this transaction. Merrill Lynch has assumed that in the course of obtaining the necessary regulatory consents or approvals for this transaction, no restrictions, including any divestiture requirements or amendments or modifications, will be imposed by the relevant authorities that will have a material adverse affect on the contemplated benefits of this transaction.

In connection with the preparation of the written opinion, Merrill Lynch has not been authorized by NIPPONKOA or its Board of Directors to solicit, nor has it solicited, third-party indications of interest for the acquisition of all or any part of NIPPONKOA.

NIPPONKOA has agreed to indemnify Merrill Lynch for certain liabilities arising out of its engagement. Merrill Lynch has, in the past, provided financial advisory and financial services to NIPPONKOA and the Company and has received, and may receive, fees for the rendering of such services. Further, in the ordinary course of business, Merrill Lynch or its affiliates may actively trade the common stock or other securities of NIPPONKOA, as well as the common stock or other securities of the Company for its own account and for the accounts of its customers and, accordingly, may at any time hold a long or short position in such securities.

Neither the valuation report nor the written opinion delivered by Merrill Lynch address the merits of the underlying decision by NIPPONKOA to engage in this transaction or constitutes a recommendation to any stockholder of NIPPONKOA as to how such stockholder should vote on (or whether any opposing stockholder should exercise its statutory opposition rights of appraisal in respect of) this transaction or any matter related thereto. In addition, Merrill Lynch has not been asked to address, nor do the valuation report or the written opinion address, the fairness to, or any other consideration of, the holders of any class of securities, creditors or other constituencies of NIPPONKOA other than the holders of the common stock of NIPPONKOA. Merrill Lynch does not express any opinion herein as to the prices at which shares of NIPPONKOA, the Company or the Holding Company will trade following the announcement or consummation of this transaction, or as to the appropriateness of the trade of any such shares.

12

| (2) | Both Companies have determined that at the time of the incorporation of the Holding Company by way of the Share Exchange, the amounts of capital and capital reserve etc. of the Holding Company shall be as set out below. |

| | (i) | The amounts of capital and capital reserve etc. of the Holding Company shall be as follows. |

| | |

Amount of Capital: | | 100 billion yen |

Amount of Capital Reserve: | | 25 billion yen |

Amount of Retained Earnings Reserve: | | 0 yen |

| | (ii) | The amounts of capital and capital reserve etc. of the Holding Company set forth above have been determined by Both Companies through consultation, taking into comprehensive consideration the capital policy of the Holding Company after its incorporation and other factors and within the limits set forth in Article 52 of the Ordinance for Company Accounting. |

| 4. | Matters concerning the reasonability of the provisions concerning the matters prescribed by Article 773, Paragraph 1 (ix) and (x) of the Corporation Law pertaining to the share options issued by Both Companies set forth in Article 808, Paragraph 3 (iii) of the Corporation Law. |

Both Companies have decided, with respect to the share options respectively issued by Both Companies set forth in Column (1) of rows 1 through 22 of the table below, that the share options of the Holding Company set forth correspondingly in Column (2) of the table below shall be delivered to the holders of the share options stated or registered in the respective final share option registries of Both Companies as of the end of the day immediately preceding the effective date of the Share Exchange, in exchange for and in the same number as, the relevant share options issued by Both Companies.

Thus each holder of a share option in either of Both Companies will receive allotment of a share option of the Holding Company which is effectively of the same content and in the same quantity as the share option owned by such holder prior to the effective date of the Share Exchange, which allotment is to be made with a view towards equal protection of the rights of shareholders of Both Companies and holders of share options of Both Companies taking into consideration the terms of each share option and the Share Exchange Ratio.

| | | | | | | | |

| | | Column (1) | | Column (2) |

| | Share Options issued by Both Companies | | Share Option of the Holding Company to be delivered |

| | Name | | Terms | | Name | | Terms |

| (1) | | Sompo Japan Insurance Inc. First Share Options | | Set forth in Exhibit 2 | | NKSJ HOLDINGS, INC. First Share Options | | Set forth in Exhibit 3 |

| | | | |

| (2) | | Sompo Japan Insurance Inc. Second Issue Share Options | | Set forth in Exhibit 4 | | NKSJ HOLDINGS, INC. Second Issue Share Options | | Set forth in Exhibit 5 |

| | | | |

| (3) | | Sompo Japan Insurance Inc. Fourth Issue Share Options | | Set forth in Exhibit 6 | | NKSJ HOLDINGS, INC. Third Issue Share Options | | Set forth in Exhibit 7 |

| | | | |

| (4) | | Sompo Japan Insurance Inc. Fifth Issue Share Options | | Set forth in Exhibit 8 | | NKSJ HOLDINGS, INC. Fourth Issue Share Options | | Set forth in Exhibit 9 |

| | | | |

| (5) | | Sompo Japan Insurance Inc. Sixth Issue Share Options | | Set forth in Exhibit 10 | | NKSJ HOLDINGS, INC. Fifth Issue Share Options | | Set forth in Exhibit 11 |

| | | | |

| (6) | | Sompo Japan Insurance Inc. Seventh Issue Share Options | | Set forth in Exhibit 12 | | NKSJ HOLDINGS, INC. Sixth Issue Share Options | | Set forth in Exhibit 13 |

| | | | |

| (7) | | Sompo Japan Insurance Inc. Eighth Issue Share Options | | Set forth in Exhibit 14 | | NKSJ HOLDINGS, INC. Seventh Issue Share Options | | Set forth in Exhibit 15 |

| | | | |

| (8) | | Sompo Japan Insurance Inc. Ninth Issue Share Options | | Set forth in Exhibit 16 | | NKSJ HOLDINGS, INC. Eighth Issue Share Options | | Set forth in Exhibit 17 |

13

| | | | | | | | |

| | | Column (1) | | Column (2) |

| | Share Options issued by Both Companies | | Share Option of the Holding Company to be delivered |

| | Name | | Terms | | Name | | Terms |

| (9) | | Sompo Japan Insurance Inc. Tenth Issue Share Options | | Set forth in Exhibit 18 | | NKSJ HOLDINGS, INC. Ninth Issue Share Options | | Set forth in Exhibit 19 |

| | | | |

| (10) | | Sompo Japan Insurance Inc. Eleventh Issue Share Options | | Set forth in Exhibit 20 | | NKSJ HOLDINGS, INC. Tenth Issue Share Options | | Set forth in Exhibit 21 |

| | | | |

| (11) | | Sompo Japan Insurance Inc. Twelfth Issue Share Options | | Set forth in Exhibit 22 | | NKSJ HOLDINGS, INC. Eleventh Issue Share Options | | Set forth in Exhibit 23 |

| | | | |

| (12) | | Sompo Japan Insurance Inc. Thirteenth Issue Share Options | | Set forth in Exhibit 24 | | NKSJ HOLDINGS, INC. Twelfth Issue Share Options | | Set forth in Exhibit 25 |

| | | | |

| (13) | | Sompo Japan Insurance Inc. Fourteenth Issue Share Options | | Set forth in Exhibit 26 | | NKSJ HOLDINGS, INC. Thirteenth Issue Share Options | | Set forth in Exhibit 27 |

| | | | |

| (14) | | Sompo Japan Insurance Inc. Fifteenth Issue Share Options | | Set forth in Exhibit 28 | | NKSJ HOLDINGS, INC. Fourteenth Issue Share Options | | Set forth in Exhibit 29 |

| | | | |

| (15) | | Sompo Japan Insurance Inc. Sixteenth Issue Share Options | | Set forth in Exhibit 30 | | NKSJ HOLDINGS, INC. Fifteenth Issue Share Options | | Set forth in Exhibit 31 |

| | | | |

| (16) | | Sompo Japan Insurance Inc. Seventeenth Issue Share Options | | Set forth in Exhibit 32 | | NKSJ HOLDINGS, INC. Sixteenth Issue Share Options | | Set forth in Exhibit 33 |

| | | | |

| (17) | | NIPPONKOA Insurance Co., Ltd. March 2005 Issue Share Options (Stock Compensation-Type Stock Option) | | Set forth in Exhibits 34 and 46 | | NKSJ HOLDINGS, INC. Seventeenth Issue Share Options | | Set forth in Exhibits 35 and 47 |

| | | | |

| (18) | | NIPPONKOA Insurance Co., Ltd. March 2006 Issue Share Options (Stock Compensation-Type Stock Option) | | Set forth in Exhibits 36 and 46 | | NKSJ HOLDINGS, INC. Eighteenth Issue Share Options | | Set forth in Exhibits 37 and 47 |

| | | | |

| (19) | | NIPPONKOA Insurance Co., Ltd. March 2007 Issue Share Options (Stock Compensation-Type Stock Option) | | Set forth in Exhibits 38 and 48 | | NKSJ HOLDINGS, INC. Nineteenth Issue Share Options | | Set forth in Exhibits 39 and 49 |

| | | | |

| (20) | | NIPPONKOA Insurance Co., Ltd. March 2008 Issue Share Options (Stock Compensation-Type Stock Option) | | Set forth in Exhibits 40 and 48 | | NKSJ HOLDINGS, INC. Twentieth Issue Share Options | | Set forth in Exhibits 41 and 49 |

| | | | |

| (21) | | NIPPONKOA Insurance Co., Ltd. March 2009 Issue Share Options (Stock Compensation-Type Stock Option) | | Set forth in Exhibits 42 and 48 | | NKSJ HOLDINGS, INC. Twenty-First Issue Share Options | | Set forth in Exhibits 43 and 49 |

| | | | |

| (22) | | NIPPONKOA Insurance Co., Ltd. October 2009 Issue Share Options (Stock Compensation-Type Stock Option) | | Set forth in Exhibits 44 and 48 | | NKSJ HOLDINGS, INC. Twenty-Second Issue Share Options | | Set forth in Exhibits 45 and 49 |

Note: Exhibits specified in the columns corresponding to “Terms” shall mean Exhibits to the Exchange Plan, a copy of which is attached hereto.

14

| 5. | Matters pertaining to NIPPONKOA |

| (1) | Contents of Financial Statements etc. relating to the latest business year (business year ended on March 31, 2009) of NIPPONKOA |

The contents of Financial Statements etc. relating to the latest business year (business year ended on March 31, 2009) of NIPPONKOA shall be as set out in pages 195 through 248 hereof (Note: pages 184 through 243 of English translation).

| (2) | Contents of events materially affecting the status of assets of NIPPONKOA which have occurred since the end of the latest business year |

Not applicable

| 6. | Contents of events materially affecting the assets of the Company which have occurred on the part of the Company since the end of the latest business year |

Not applicable

| 7. | Matters concerning Director of the Holding Company prescribed in Article 74 of Ordinance for Enforcement of Corporation Law |

The directors of the Holding Company will be the following persons.

| | | | | | |

Name and Date of Birth | | Summarized Resume; Representative Status at Other Juridical Entities and Position and Responsibilities in the Company or NIPPONKOA | | (1) Number of Shares of

the Company Owned (2) Number of Shares of

NIPPONKOA Owned

(3) Number of Shares of

the Holding Company to be Allotted |

Makoto Hyodo (Jan. 25, 1945) | | Apr. 1967 | | Joined The Nippon Fire & Marine Insurance Co., Ltd. | | (1) 0 shares (2) 49,000 shares (3) 44,100 shares |

| | | | (“NFMI”) (Currently NIPPONKOA) | |

| | Jun. 1991 | | General Manager of First Metropolitan Production Dept. of NFMI | |

| | Jun. 1993 | | General Manager of Fukushima Branch of NFMI | |

| | Jun. 1995 | | General Manager of Hiroshima Branch of NFMI | |

| | Apr. 1998 | | General Manager of Fourth Corporate Production Dept. of NFMI | |

| | Jun. 1999 | | Executive Officer and General Manager of Fourth Corporate Production Dept. of NFMI | |

| | Jun. 2000 | | Executive Officer and Executive General Manager of Tohoku Headquarters of NFMI | |

| | Apr. 2001 | | Executive Officer and Executive General Manager of Tohoku Headquarters of NIPPONKOA | |

| | Dec. 2001 | | Executive Officer and Executive General Manager of Tohoku Headquarters and General Manager of Iwate Branch of NIPPONKOA | |

| | Mar. 2002 | | Managing Executive Officer and General Manager of Fifth Production Dept. of NIPPONKOA | |

| | Apr. 2002 | | Managing Executive Officer of NIPPONKOA | |

| | Jun. 2004 | | Senior Managing Executive Officer of NIPPONKOA | |

| | Jun. 2005 | | Representative Director & Executive Deputy President of NIPPONKOA | |

| | Apr. 2007 | | President & Chief Executive Officer of NIPPONKOA | |

| | to present | | |

| | Representative status at other juridical entities: | | |

| | Chairman of NIPPONKOA Welfare Foundation | | |

| | | | | |

15

| | | | | | |

Name and Date of Birth | | Summarized Resume; Representative Status at Other Juridical Entities and Position and Responsibilities in the Company or NIPPONKOA | | (1) Number of Shares of

the Company Owned (2) Number of Shares of

NIPPONKOA Owned

(3) Number of Shares of

the Holding Company to be Allotted |

Masatoshi Sato (Mar. 2, 1949) | | Apr. 1972 | | Joined the Company | | (1) 47,693 shares (2) 0 shares (3) 47,693 shares |

| | Apr. 1994 | | Branch Manager, Yamanashi Branch of the Company | |

| | Apr. 1996 | | Manager, System Planning Department of the Company | |

| | Apr. 1997 | | Manager, Information Systems Department of the Company | |

| | Apr. 1999 | | Office Manager, Presidential Staff Office, Manager, New Business Development Office of the Company | |

| | Jul. 1999 | | Office Manager, Presidential Staff Office of the Company | |

| | Jun. 2000 | | Director, Office Manager, Presidential Staff Office of the Company | |

| | Jun. 2001 | | Director, Executive Officer, Manager, Information Systems Department of the Company | |

| | Apr. 2002 | | Director, Managing Executive Officer of the Company | |

| | Jul. 2004 | | Director, Managing Executive Officer, Manager, Corporate Business Planning Department of the Company | |

| | Dec. 2004 | | Director, Managing Executive Officer, Manager, Commercial Risk Solutions Department, Manager, Corporate Business Planning Department of the Company | |

| | Jan. 2005 | | Director, Managing Executive Officer, Manager, Corporate Business Planning Department of the Company | |

| | Apr. 2005 | | Director, Managing Executive Officer of the Company | |

| | Jun. 2006 | | President and Chief Executive Officer, President and Senior Managing Executive Officer of the Company | | |

| | to present | | |

| | Representative status at other juridical entities: | | |

| | • Chairman, Sompo Fine Art Foundation, | | |

| | • Chairman, Sompo Japan Foundation | | |

| | • Chairman, Sompo Japan Environment Foundation | | |

| | Responsibilities in the Company | | |

| | Overall management | | |

| | | | | |

16

| | | | | | |

Name and Date of Birth | | Summarized Resume; Representative Status at Other Juridical Entities and Position and Responsibilities in the Company or NIPPONKOA | | (1) Number of Shares of

the Company Owned (2) Number of Shares of

NIPPONKOA Owned

(3) Number of Shares of

the Holding Company to be Allotted |

Akira Genma (Aug. 1, 1934) | | Apr. 1959 | | Joined Shiseido Company, Limited | | (1) 0 shares (2) 0 shares (3) 0 shares |

| | Feb. 1987 | | Director, General Manager of Chainstore Business Department of Shiseido Company, Limited | |

| | Feb. 1988 | | Director, General Manager of Chainstore Business Department, Chainstore Business Division of Shiseido Company, Limited | |

| | Jun. 1990 | | Executive Director, Deputy Chief Officer of Cosmetic Division of Shiseido Company, Limited | |

| | Jun. 1992 | | Senior Executive Director, Chief Officer of Cosmetic Division of Shiseido Company, Limited | |

| | Jun. 1995 | | Senior Executive Director of Shiseido Company, Limited | |

| | Jun. 1996 | | Executive Vice President of Shiseido Company, Limited | |

| | Jun. 1997 | | Representative Director and President of Shiseido Company, Limited | |

| | Jun. 2001 | | Representative Director and Chairman of Shiseido Company, Limited | |

| | Jun. 2003 | | Senior Adviser of Shiseido Company, Limited (current position) | |

| | Jun. 2004 | | Outside Director of KONAMI CORPORATION (current position) | |

| | Mar. 2006 | | Outside Director of Kirin Holdings Company, Limited (current position) | |

| | to present | | |

| | | | | |

| | | |

Tsunehisa Katsumata (Mar. 29, 1940) | | Apr. 1963 | | Joined Tokyo Electric Power Company, Incorporated | | (1) 0 shares (2) 0 shares (3) 0 shares |

| | Jun. 1993 | | General Manager of Corporate Planning Department of Tokyo Electric Power Company, Incorporated | |

| | Jun. 1996 | | Director, General Manager of Corporate Planning Department of Tokyo Electric Power Company, Incorporated | |

| | Jun. 1997 | | Director in charge of Corporate Planning Department, Business Management Department and Corporate Affairs Department of Tokyo Electric Power Company, Incorporated | |

| | Jun. 1998 | | Managing Director of Tokyo Electric Power Company, Incorporated | |

| | Jun. 1999 | | Executive Vice President of Tokyo Electric Power Company, Incorporated | |

| | Jun. 2001 | | Executive Vice President, General Manager of Business Development Department of Tokyo Electric Power Company, Incorporated | |

| | Oct. 2002 | | President of Tokyo Electric Power Company, Incorporated | |

| | Jun. 2006 | | Outside Director of KDDI CORPORATION (current position) | |

| | Jun. 2008 | | Representative Director and Chairman of Tokyo Electric Power Company, Incorporated (current position) | |

| | to present | | |

| | Representative status at other juridical entities: | | |

| | Representative Director and Chairman of Tokyo Electric Power Company, Incorporated | | |

| | | | | |

17

| | | | | | |

Name and Date of Birth | | Summarized Resume; Representative Status at Other Juridical Entities and Position and Responsibilities in the Company or NIPPONKOA | | (1) Number of Shares of

the Company Owned (2) Number of Shares of

NIPPONKOA Owned

(3) Number of Shares of

the Holding Company to be Allotted |

Seiichi Asaka (Dec. 24, 1942) | | Apr. 1965 | | Joined NSK Ltd. | | (1) 0 shares (2) 0 shares (3) 0 shares |

| | Oct. 1990 | | Head of Business Department of Business Development Division HQ of NSK Ltd. | |

| | Jun. 1994 | | Director & Vice Head of Precision Machinery Business Division HQ of NSK Ltd. | |

| | Jun. 1997 | | Senior Vice President & Head of Bearing Business Division HQ of NSK Ltd. | |

| | Jun. 1998 | | Senior Vice President & General Manager for Europe of NSK Ltd. | |

| | Jun. 1999 | | Senior Vice President (shikko yakuin jomu) & General Manager for Europe of NSK Ltd. | |

| | Jun. 2000 | | Representative Director & Executive Vice President, General Manager for Europe of NSK Ltd. | |

| | Jun. 2002 | | President and Chief Executive Officer of NSK Ltd. | |

| | Jun. 2004 | | President & Chief Executive Officer, Chairman of Nomination Committee of NSK Ltd. | |

| | Jun. 2009 | | Chairman of NSK Ltd. (current position) | |

| | to present | | |

| | | | | |

| | | |

Sumitaka Fujita (Dec. 24, 1942) | | Apr. 1965 | | Joined ITOCHU Corporation | | (1) 0 shares (2) 0 shares (3) 0 shares |

| | Oct. 1994 | | General Manager of Corporate Planning & Administration Division of ITOCHU Corporation | |

| | Jun. 1995 | | Executive Director of ITOCHU Corporation | |

| | Apr. 1997 | | Senior Executive Director of ITOCHU Corporation | |

| | Jul. 1998 | | Senior Executive Director, Representative Director of ITOCHU Corporation | |

| | Apr. 1999 | | Chief Executive Director, Representative Director of ITOCHU Corporation | |

| | Apr. 2001 | | Vice President, Representative Director of ITOCHU Corporation | |

| | Apr. 2006 | | Vice Chairman, Representative Director of ITOCHU Corporation | |

| | Jun. 2006 | | Vice Chairman of ITOCHU Corporation | |

| | Jun. 2007 | | Director of Orient Corporation (current position) | |

| | Jun. 2008 | | Special Advisor of ITOCHU Corporation (current position) Outside Auditor of NIPPONKOA Insurance Company, Limited (current position) Outside Director of The Furukawa Electric Co., Ltd. (current position) | |

| | Jun. 2009 | | Outside Director of Nippon Sheet Glass Co., Ltd. (current position) | |

| | to present | | |

| | | | | |

18

| | | | | | |

Name and Date of Birth | | Summarized Resume; Representative Status at Other Juridical Entities and Position and Responsibilities in the Company or NIPPONKOA | | (1) Number of Shares of

the Company Owned

(2) Number of Shares of

NIPPONKOA Owned

(3) Number of Shares of

the Holding Company to be Allotted |

Yoshiharu Kawabata (Dec. 6, 1945) | | Apr. 1970 | | Admitted to the Japanese Bar | | (1) 0 shares (2) 0 shares (3) 0 shares |

| | Apr. 1980 | | Established Kasumigaseki-Sogo Law Offices | |

| | Apr. 1988 | | Executive Vice President of Daini Tokyo Bar Association | |

| | | | Executive Governor of Kanto Federation of Bar Associations | |

| | Apr. 1989 | | Executive Governor of Japan Federation of Bar Associations | |

| | Apr. 2000 | | President of Daini Tokyo Bar Association | |

| | | | Vice President of Japan Federation of Bar Associations | |

| | Sep. 2005 | | Professor of Omiya Law School (current position) | |

| | Sep. 2006 | | Chairman of the Nomination and Compensation Committee of the Company (current position) | |

| | to present | | |

| | | | | |

| | | |

Yasuhide Fujii (Dec. 10, 1951) | | Apr. 1974 | | Joined The Nippon Fire & Marine Insurance Co., Ltd. (“NFMI”) (currently NIPPONKOA) | | (1) 0 shares (2) 36,150 shares (3) 32,535 shares |

| | Jun. 1998 | | General Manager of Reinsurance Dept. of NFMI | |

| | Apr. 2003 | | General Manager of Accounting Dept. of NIPPONKOA | |

| | Apr. 2005 | | Executive Officer of NIPPONKOA | |

| | Apr. 2006 | | Managing Executive Officer of NIPPONKOA | |

| | Jun. 2007 | | Director and Managing Executive Officer of NIPPONKOA | |

| | to present | |

| | | | | |

Yuichi Yamaguchi (Apr. 8, 1952) | | Responsibilities in NIPPONKOA | | (1) 0 shares (2) 18,000 shares (3) 16,200 shares |

| | Risk Management, General Affairs, Accounting | |

| | Apr. 1976 | | Joined The Nippon Fire & Marine Insurance Co., Ltd. (“NFMI”) (currently NIPPONKOA) | |

| | Apr. 2001 | | General Manager of Okayama Branch of NIPPONKOA | |

| | Oct. 2001 | | General Manager of Osaka Minami Branch of NIPPONKOA | |

| | Mar. 2004 | | General Manager of Nagoya Branch of NIPPONKOA | |

| | Jun. 2005 | | General Manager of Claims Management Dept. of NIPPONKOA | |

| | Jun. 2006 | | Executive Officer and General Manager of Claims Management Dept. of NIPPONKOA | |

| | Jun. 2008 | | Managing Executive Officer and General Manager of Claims | |

| | | | Management Dept. of NIPPONKOA | |

| | Aug. 2008 | | Managing Executive Officer of NIPPONKOA | |

| | Jun. 2009 | | Director, Managing Executive Officer of NIPPONKOA | |

| | to present | |

| | Responsibilities in NIPPONKOA | |

| | Quality Control, Corporate Planning (other than IR), Business Integration Planning | |

| | | | | |

19

| | | | | | |

Name and Date of Birth | | Summarized Resume; Representative Status at Other Juridical Entities and Position and Responsibilities in the Company or NIPPONKOA | | (1) Number of Shares of

the Company Owned

(2) Number of Shares of

NIPPONKOA Owned

(3) Number of Shares of

the Holding Company to be Allotted |

George C. Olcott (May 7, 1955) | | Jul. 1986 | | Joined S.G. Warburg & Co., Ltd | | (1) 0 shares (2) 0 shares (3) 0 shares |

| | Nov. 1991 | | Director of S.G. Warburg & Co., Ltd | |

| | Sep. 1993 | | Executive Director, Equity Capital Market Group, S.G. | |

| | | | Warburg Securities London | |

| | Apr. 1997 | | Head of Tokyo branch, SBC Warburg | |

| | Apr. 1998 | | Vice President, LTCB-UBS-Brinson Asset Management | |

| | Feb. 1999 | | President, UBS Asset management (Japan) | |

| | | | President, Japan UBS Brinson | |

| | Jun. 2000 | | Managing Director, Equity Capital Market, UBS Warburg Tokyo | |

| | Sep. 2001 | | Cambridge Judge Business School | |

| | Mar. 2005 | | FME Teaching Fellow of Cambridge Judge Business School | |

| | Mar. 2008 | | Senior Fellow of Cambridge Judge Business School (current position) | |

| | Jun. 2008 | | Outside Director of Nippon Sheet Glass Co., Ltd. (current position) | |

| | to present | | |

| | | | | |

| | | |

Kengo Sakurada (Feb. 11, 1956) | | Apr. 1978 | | Joined the Company | | (1) 15,365 shares (2) 0 shares (3) 15,365 shares |

| | Dec. 2000 | | Manager, Consolidated Planning Department of the Company | |

| | Apr. 2001 | | Manager, Consolidated Planning Department, Manager, DAI-ICHI LIFE Office Integration Planning Department of the Company | |

| | Apr. 2002 | | Manager, Business Strategy Planning Department of the Company | |

| | Jun. 2002 | | Manager, Corporate Planning Department of the Company | |

| | Jul. 2005 | | Executive Officer, Manager, Financial Institutions Department of the Company | |

| | Apr. 2007 | | Managing Executive Officer of the Company | |

| | Jun. 2007 | | Director, Managing Executive Officer of the Company | |

| | to present | |

| | Responsibilities in the Company | |

| | BusinessProcess & IT Integration Department, Renovation Planning Department, Automobile Underwriting Department, Personal Lines Underwriting Department, Personal Lines Underwriting Department Accident & Health Insurance Office, Special Fire Insurance Department, Marketing & Contact Center Planning Department, Saga Call Center Office, Sapporo Call Center Office, Business Process Planning Department, and IT Strategy Planning Department | | |

| | | | | |

20

| | | | | | |

Name and Date of Birth | | Summarized Resume; Representative Status at Other Juridical Entities and Position and Responsibilities in the Company or NIPPONKOA | | (1) Number of Shares of

the Company Owned

(2) Number of Shares of

NIPPONKOA Owned

(3) Number of Shares of

the Holding Company to be Allotted |

Hiroyuki Yamaguchi (Feb.13, 1956) | | Apr. 1979 | | Joined the Company | | (1) 14,050 shares (2) 0 shares (3) 14,050 shares |

| | Jul. 2002 | | Manager, Accounting Department of the Company | |

| | Oct. 2002 | | Manager, Accounting Department, and International Accounting Office of the Company | |

| | Dec. 2002 | | Manager, Accounting Department of the Company | |

| | Jan. 2005 | | Manager, Accounting Department, and Commercial Risk Solutions Department of the Company | |

| | Apr. 2005 | | Manager, Commercial Risk Solutions Department of the Company | |

| | Apr. 2007 | | Executive Officer, Manager, Corporate Planning Department of the Company | |

| | Apr. 2009 | | Managing Executive Officer of the Company | |

| | Jun. 2009 | | Director, Managing Executive Officer of the Company | |

| | to present | |

| | Responsibilities in the Company | |

| | Corporate Planning Department, Integration Planning Department, Accounting Department, Accounting Processing Department | | |

Notes:

| 1. | Mr. Makoto Hyodo is Chairman of NIPPONKOA Welfare Foundation. NIPPONKOA has made donation to NIPPONKOA Welfare Foundation for the purpose of supporting research activities etc. |

| 2. | Mr. Masatoshi Sato is Chairman of each of Sompo Fine Art Foundation, Sompo Japan Foundation and Sompo Japan Environment Foundation. The Company has made donation to each of said foundations for the purpose of supporting research activities etc. |

| 3. | Each of other candidates has no special interests in the Company or NIPPONKOA. |

| 4. | Messrs. Akira Genma, Tsunehisa Katsumata, Seiichi Asaka, Sumitaka Fujita, Yoshiharu Kawabata and George C. Olcott are candidates for outside director. |

| 5. | The reasons for which Messrs. Akira Genma, Tsunehisa Katsumata, Seiichi Asaka, Sumitaka Fujita, Yoshiharu Kawabata and George C. Olcott were selected as candidates for outside director are as set forth below, as well as the matters to be specially mentioned concerning candidates for outside director. |

| | (1) | The motion was made to elect Mr. Akira Genma as an outside director because he is expected to make use of his abundant experience as a manager and his broad insight in the management of the Holding Company. |

| | (2) | The motion was made to elect Mr. Tsunehisa Katsumata as an outside director because he is expected to make use of his abundant experience as a manager and his broad insight in the management of the Holding Company. |

Tokyo Electric Power Company, Limited, where Mr. Katsumata serves as Director, received an administrative disposition from the Ministry of Economy, Trade and Industry (METI) pursuant to the Act on the Regulation of Nuclear Source Material, Nuclear Fuel Material and Reactors and Electricity Business Act in May 2007 and further received an administrative disposition from each of relevant city and regional development bureaus of the Ministry of Land, Infrastructure, Transport and Tourism pursuant to the River Act on the grounds that the data falsification and defective procedures occurred at its electricity generation facilities. Mr. Katsumata was not involved in either incident and repeatedly called attention to the importance of strengthening of compliance at meetings of the board of directors etc. and following the occurrence of the above incidents, he has issued instructions to take thorough measures to prevent recurrence of similar incidents.

21

| | (3) | The motion was made to elect Mr. Seiichi Asaka as an outside director because he is expected to make use of his abundant experience as a manager and his broad insight in the management of the Holding Company. |

| | (4) | The motion was made to elect Mr. Sumitaka Fujita as an outside director because he is expected to make use of his abundant experience as a manager and his broad insight in the management of the Holding Company. |

Itochu Corporation, where Mr. Fujita served as Director until June 2008, made public in March 2008 that inappropriate accounting treatment had occurred concerning transactions by an ex-employee which involved ethanol used for foreign-made drinks, and in October 2008 that inappropriate accounting treatment had occurred concerning tri-nation trade transactions by Itochu Corporation which involved heavy machinery and mechanical equipment and materials. Mr. Fujita was not involved in either incident and repeatedly gave instructions to strengthen compliance and internal control at meetings of the board of directors etc., and following the identification of the above incidents, he issued instructions to take thorough measures to prevent recurrence of similar incidents.

Further, Furukawa Electric Co., Ltd., where Mr. Fujita serves as Outside Director, received in August 2008 a cancellation of JIS Mark Certification by Japan Quality Assurance Organization. This cancellation was issued on the grounds that the performance values that relate to quality with respect to a part of its products were calculated based on the tests conducted in ways that differed from the JIS standards (said JIS MARK Certification was re-acquired in April 9, 2009). In March 2009 this company received from the Japan Fair Trade Commission cease and desist order and an order to pay an administrative fine based on the violation of Antimonopoly Act concerning the transactions related to the cross-linked highly foamed polyethylene sheets Mr. Fujita was not involved in either incident, and at meetings of the board of directors etc., repeatedly called attention to the importance of strengthening of compliance. Following the occurrence of the above incidents, he has issued instructions to take thorough measures to prevent recurrence of similar incidents.

Moreover, NIPPONKOA, where he serves as outside corporate auditor, received an order for business improvement under the Insurance Business Act from the Financial Services Agency in October 2009 on the basis that there was a delay in payment of insurance moneys due to insufficient or inappropriate response, although not intentionally. At meetings of the Board of Directors etc., Mr. Fujita repeatedly called attention to procuring proper operation on the execution of business and following the identification of the above incident, he has demanded that thorough action be taken to prevent recurrence of similar incidents.

| | (5) | The motion was made to elect Mr. Yoshiharu Kawabata as an outside director because he is expected to appropriately carry out the duties of an outside director based on his professional knowledge and experience as an attorney, despite his lack of experience in corporate management. |

| | (6) | The motion was made to elect Mr. George C. Olcott as an outside director because he is expected to make use of his abundant experience as an erudite scholar and a manager and his broad insight in the management of the Holding Company. |

| 6. | Contract for limitation of liability with each candidate for outside director |

If Messrs. Akira Genma, Tsunehisa Katsumata, Seiichi Asaka, Sumitaka Fujita, Yoshiharu Kawabata and George C. Olcott are elected as outside directors, the Holding Company intends to execute a contract for limitation of liability with each of them that limits his liability to the Minimum Liability Amount which is provided for in Article 425, Paragraph 1 of the Corporation Law regarding liability under Article 423, Paragraph 1 of the Corporation Law in accordance with the Articles of Incorporation of the Holding Company.

NIPPONKOA has entered into contracts for limitation of liability with Mr. Sumitaka Fujita, an outside corporate auditor of NIPPONKOA, that limit his liability to the higher of 10,000,000 yen and the Minimum Liability Amount which is provided for in Article 425, Paragraph 1 of the Corporation Law regarding liability under Article 423, Paragraph 1 of the Corporation Law.

22

| 8. | Matters concerning Corporate Auditor of the Holding Company prescribed in Article 76 of Ordinance for Enforcement of Corporation Law |

Corporate Auditors of the Holding Company will be the following persons.

| | | | | | |

Name and Date of Birth | | Summarized Resume; Representative Status at Other Juridical Entities and Position and Responsibilities in the Company or NIPPONKOA | | (1) Number of Shares of the Company Owned (2) Number of Shares of NIPPONKOA Owned (3) Number of Shares of

the Holding Company

to be Allotted |

Koichi Masuda (Jan. 23, 1944) | | Sep. 1978 | | Partner of Shinwa audit corporation | | (1) 0 shares (2) 0 shares (3) 0 shares |

| | Jul. 1992 | | Managing Partner of Asahi Shinwa audit corporation | |

| | Oct. 1993 | | Asahi Shinwa audit corporation changed its name to Asahi & Co., Managing Director of Asahi & Co. | |

| | Jul. 1995 | | Chief Executive of the Japanese Institute of Certified Public Accountants | |

| | Jul. 2001 | | Deputy President of the Japanese Institute of Certified Public Accountants | |

| | Jan. 2004 | | Asahi & Co. changed its name to KPMG AZSA & Co., Managing Partner of KPMG AZSA & Co. | |

| | Jul. 2004 | | Deputy President of the Japanese Institute of Certified Public Accountants | |

| | Jun. 2007 | | Retired from KPMG AZSA & Co. | |

| | Jul. 2007 | | Chairman and President of the Japanese Institute of Certified Public Accountants (current position) | |

| | to present | | |

| | | | | |

| | | |

Makiko Yasuda (Mar. 10, 1944) | | Apr. 1973 | | Admitted to the Japanese Bar | | (1) 0 shares (2) 0 shares (3) 0 shares |

| | | | Registered as Patent Attorney | |

| | | | Joined Kyowa Patent and Law Office | |

| | May 1980 | | Established Yasuda Law and Patent Office | |

| | Apr. 1997 | | Executive Vice President of the Daiichi Tokyo Bar Association | |

| | | | Executive Managing Director of Kanto Federation of Bar Associations | |

| | Mar. 2000 | | Statutory Auditor of The Long-Term Credit Bank of Japan, Ltd. (currently called Shinsei Bank, Limited) | |

| | Jun. 2006 | | Statutory Auditor of Shinsei Trust & Banking Co., Ltd. (current position) | |

| | to present | | |

| | | | | |

| | | |

Motoyoshi Nishikawa (Jan. 1, 1946) | | Apr. 1968 | | Joined Yawata Iron & Steel Co., Ltd. (currently called Nippon Steel Corporation) | | (1) 0 shares (2) 0 shares (3) 0 shares |

| | Jul. 1986 | | Head of General Administration Division of Nippon Steel Corporation | |

| | Jun. 1987 | | Head of Legal Section of Nippon Steel Corporation | |

| | Jun. 1993 | | General Manager of Legal Affairs Department of Nippon Steel Corporation | |

| | Jun. 1997 | | Director of Nippon Steel Corporation | |

| | Apr. 2001 | | Managing Director of Nippon Steel Corporation | |

| | Apr. 2003 | | Director of Nippon Steel Corporation | |

| | Jun. 2003 | | Executive Adviser (Chief Legal Counsel) of Nippon Steel Corporation | |

| | Sep. 2006 | | Chairman of Business Audit and Compliance Committee of the Company (current position) | |

| | Jul. 2007 | | Adviser of Nippon Steel Corporation (current position) | |

| | Jun. 2009 | | Corporate Auditor of NITTETSU-ELEX Co., Ltd. (current position) | |

| | to present | | |

| | | | | |

23

| | | | | | |

Name and Date of Birth | | Summarized Resume; Representative Status at Other Juridical Entities and Position and Responsibilities in the Company or NIPPONKOA | | (1) Number of Shares of

the Company Owned (2) Number of Shares of

NIPPONKOA Owned (3) Number of Shares of

the Holding Company

to be Allotted |

Atau Kadokawa (Jun. 28, 1947) | | Apr. 1970 | | Joined The Nippon Fire & Marine Insurance Co., Ltd. (“NFMI”) (currently NIPPONKOA) | | (1) 0 shares (2) 104,050 shares (3) 93,645 shares |

| | Apr. 1994 | | General Manager of the Americas Dept. of NFMI | |

| | Apr. 1997 | | General Manager of Risk Management Mission, General Affairs Dept. of NFMI | |

| | Jun. 1998 | | General Manager of General Affairs Dept. of NFMI | |

| | Apr. 2000 | | General Manager of General Affairs Dept. & IR Office of NFMI | |