Q3 2024 EARNINGS INVESTOR PRESENTATION October 22, 2024

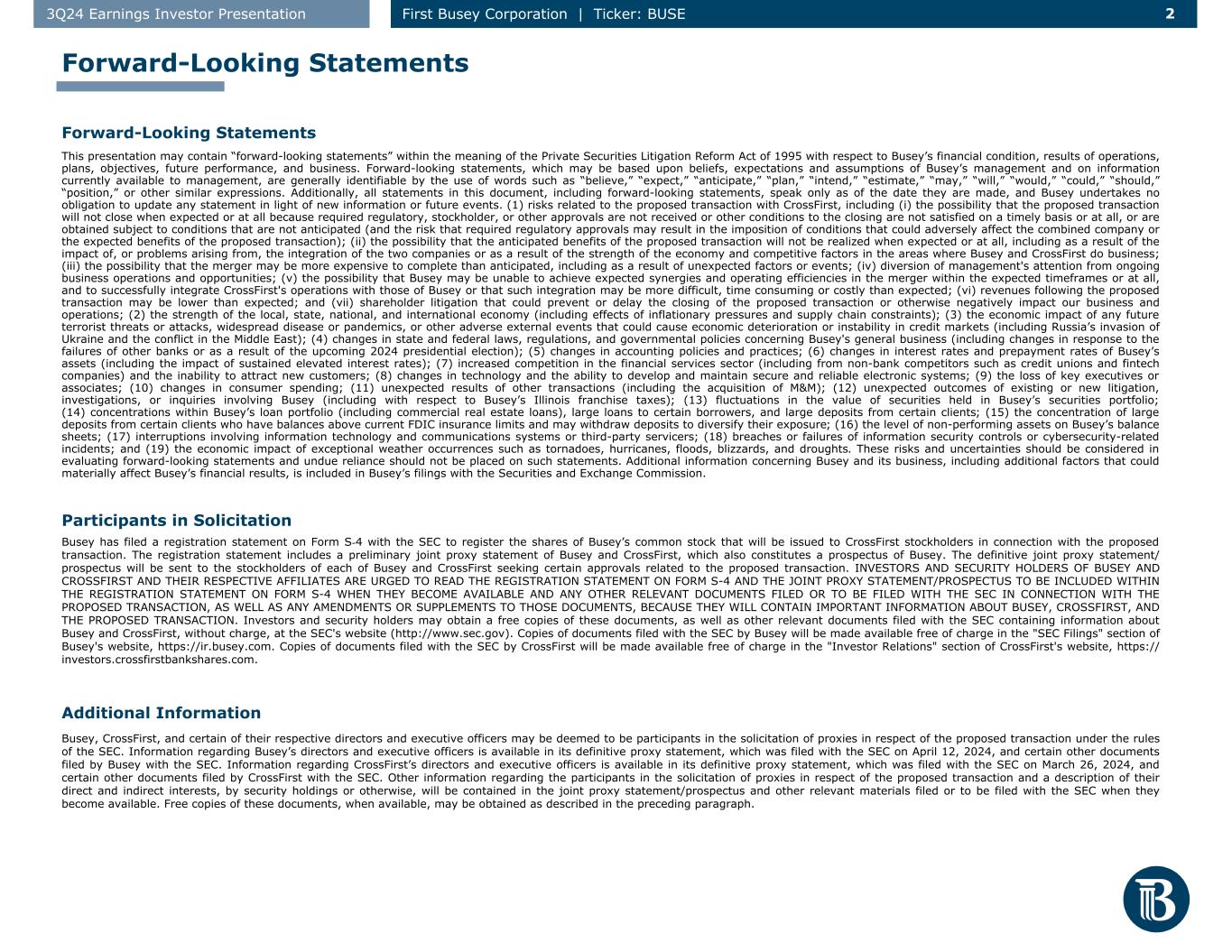

2 23Q24 Earnings Investor Presentation First Busey Corporation | Ticker: BUSE This presentation may contain “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995 with respect to Busey’s financial condition, results of operations, plans, objectives, future performance, and business. Forward-looking statements, which may be based upon beliefs, expectations and assumptions of Busey’s management and on information currently available to management, are generally identifiable by the use of words such as “believe,” “expect,” “anticipate,” “plan,” “intend,” “estimate,” “may,” “will,” “would,” “could,” “should,” “position,” or other similar expressions. Additionally, all statements in this document, including forward-looking statements, speak only as of the date they are made, and Busey undertakes no obligation to update any statement in light of new information or future events. (1) risks related to the proposed transaction with CrossFirst, including (i) the possibility that the proposed transaction will not close when expected or at all because required regulatory, stockholder, or other approvals are not received or other conditions to the closing are not satisfied on a timely basis or at all, or are obtained subject to conditions that are not anticipated (and the risk that required regulatory approvals may result in the imposition of conditions that could adversely affect the combined company or the expected benefits of the proposed transaction); (ii) the possibility that the anticipated benefits of the proposed transaction will not be realized when expected or at all, including as a result of the impact of, or problems arising from, the integration of the two companies or as a result of the strength of the economy and competitive factors in the areas where Busey and CrossFirst do business; (iii) the possibility that the merger may be more expensive to complete than anticipated, including as a result of unexpected factors or events; (iv) diversion of management's attention from ongoing business operations and opportunities; (v) the possibility that Busey may be unable to achieve expected synergies and operating efficiencies in the merger within the expected timeframes or at all, and to successfully integrate CrossFirst's operations with those of Busey or that such integration may be more difficult, time consuming or costly than expected; (vi) revenues following the proposed transaction may be lower than expected; and (vii) shareholder litigation that could prevent or delay the closing of the proposed transaction or otherwise negatively impact our business and operations; (2) the strength of the local, state, national, and international economy (including effects of inflationary pressures and supply chain constraints); (3) the economic impact of any future terrorist threats or attacks, widespread disease or pandemics, or other adverse external events that could cause economic deterioration or instability in credit markets (including Russia’s invasion of Ukraine and the conflict in the Middle East); (4) changes in state and federal laws, regulations, and governmental policies concerning Busey's general business (including changes in response to the failures of other banks or as a result of the upcoming 2024 presidential election); (5) changes in accounting policies and practices; (6) changes in interest rates and prepayment rates of Busey’s assets (including the impact of sustained elevated interest rates); (7) increased competition in the financial services sector (including from non-bank competitors such as credit unions and fintech companies) and the inability to attract new customers; (8) changes in technology and the ability to develop and maintain secure and reliable electronic systems; (9) the loss of key executives or associates; (10) changes in consumer spending; (11) unexpected results of other transactions (including the acquisition of M&M); (12) unexpected outcomes of existing or new litigation, investigations, or inquiries involving Busey (including with respect to Busey’s Illinois franchise taxes); (13) fluctuations in the value of securities held in Busey’s securities portfolio; (14) concentrations within Busey’s loan portfolio (including commercial real estate loans), large loans to certain borrowers, and large deposits from certain clients; (15) the concentration of large deposits from certain clients who have balances above current FDIC insurance limits and may withdraw deposits to diversify their exposure; (16) the level of non-performing assets on Busey’s balance sheets; (17) interruptions involving information technology and communications systems or third-party servicers; (18) breaches or failures of information security controls or cybersecurity-related incidents; and (19) the economic impact of exceptional weather occurrences such as tornadoes, hurricanes, floods, blizzards, and droughts. These risks and uncertainties should be considered in evaluating forward-looking statements and undue reliance should not be placed on such statements. Additional information concerning Busey and its business, including additional factors that could materially affect Busey’s financial results, is included in Busey’s filings with the Securities and Exchange Commission. Forward-Looking Statements Forward-Looking Statements Participants in Solicitation Additional Information Busey has filed a registration statement on Form S-4 with the SEC to register the shares of Busey’s common stock that will be issued to CrossFirst stockholders in connection with the proposed transaction. The registration statement includes a preliminary joint proxy statement of Busey and CrossFirst, which also constitutes a prospectus of Busey. The definitive joint proxy statement/ prospectus will be sent to the stockholders of each of Busey and CrossFirst seeking certain approvals related to the proposed transaction. INVESTORS AND SECURITY HOLDERS OF BUSEY AND CROSSFIRST AND THEIR RESPECTIVE AFFILIATES ARE URGED TO READ THE REGISTRATION STATEMENT ON FORM S-4 AND THE JOINT PROXY STATEMENT/PROSPECTUS TO BE INCLUDED WITHIN THE REGISTRATION STATEMENT ON FORM S-4 WHEN THEY BECOME AVAILABLE AND ANY OTHER RELEVANT DOCUMENTS FILED OR TO BE FILED WITH THE SEC IN CONNECTION WITH THE PROPOSED TRANSACTION, AS WELL AS ANY AMENDMENTS OR SUPPLEMENTS TO THOSE DOCUMENTS, BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT BUSEY, CROSSFIRST, AND THE PROPOSED TRANSACTION. Investors and security holders may obtain a free copies of these documents, as well as other relevant documents filed with the SEC containing information about Busey and CrossFirst, without charge, at the SEC's website (http://www.sec.gov). Copies of documents filed with the SEC by Busey will be made available free of charge in the "SEC Filings" section of Busey's website, https://ir.busey.com. Copies of documents filed with the SEC by CrossFirst will be made available free of charge in the "Investor Relations" section of CrossFirst's website, https:// investors.crossfirstbankshares.com. Busey, CrossFirst, and certain of their respective directors and executive officers may be deemed to be participants in the solicitation of proxies in respect of the proposed transaction under the rules of the SEC. Information regarding Busey’s directors and executive officers is available in its definitive proxy statement, which was filed with the SEC on April 12, 2024, and certain other documents filed by Busey with the SEC. Information regarding CrossFirst’s directors and executive officers is available in its definitive proxy statement, which was filed with the SEC on March 26, 2024, and certain other documents filed by CrossFirst with the SEC. Other information regarding the participants in the solicitation of proxies in respect of the proposed transaction and a description of their direct and indirect interests, by security holdings or otherwise, will be contained in the joint proxy statement/prospectus and other relevant materials filed or to be filed with the SEC when they become available. Free copies of these documents, when available, may be obtained as described in the preceding paragraph.

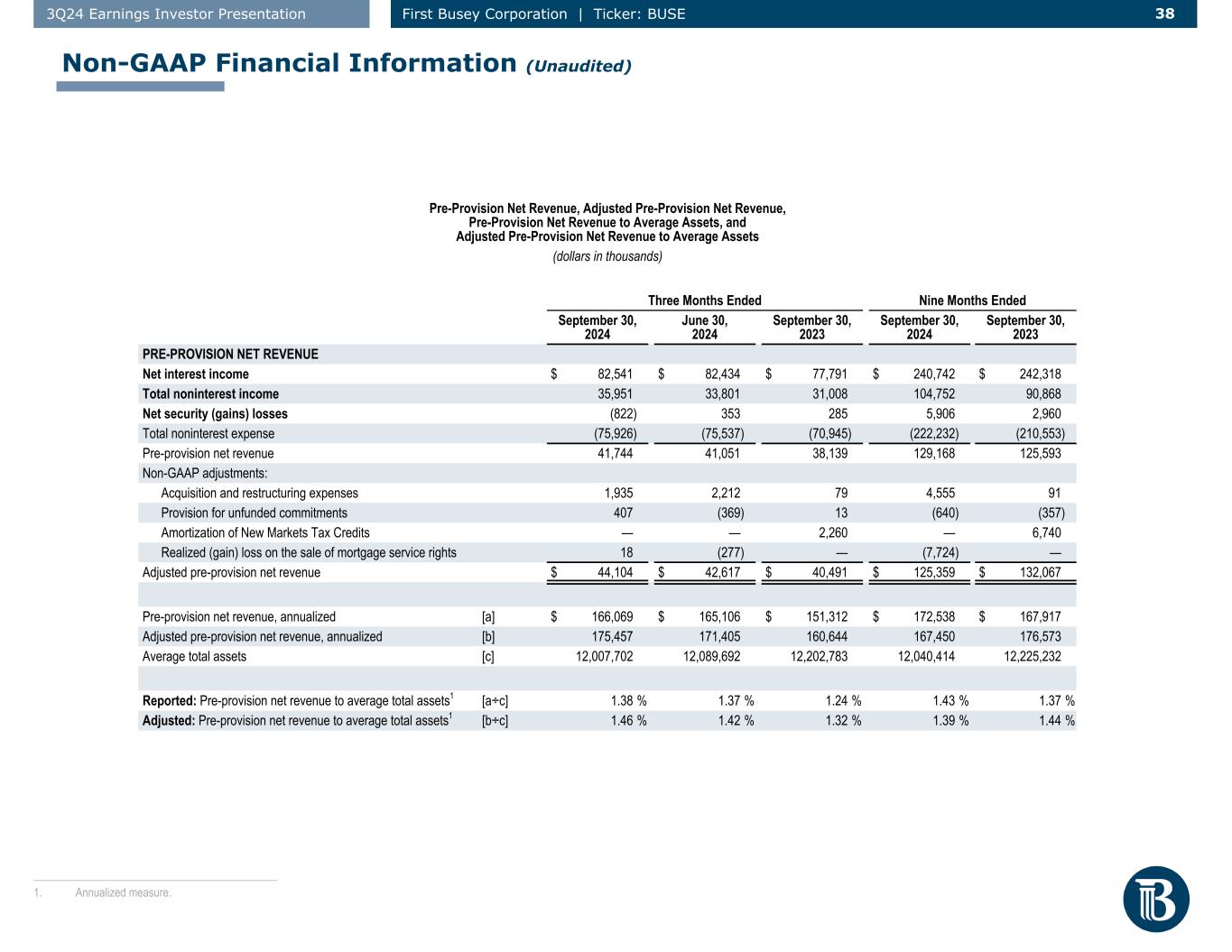

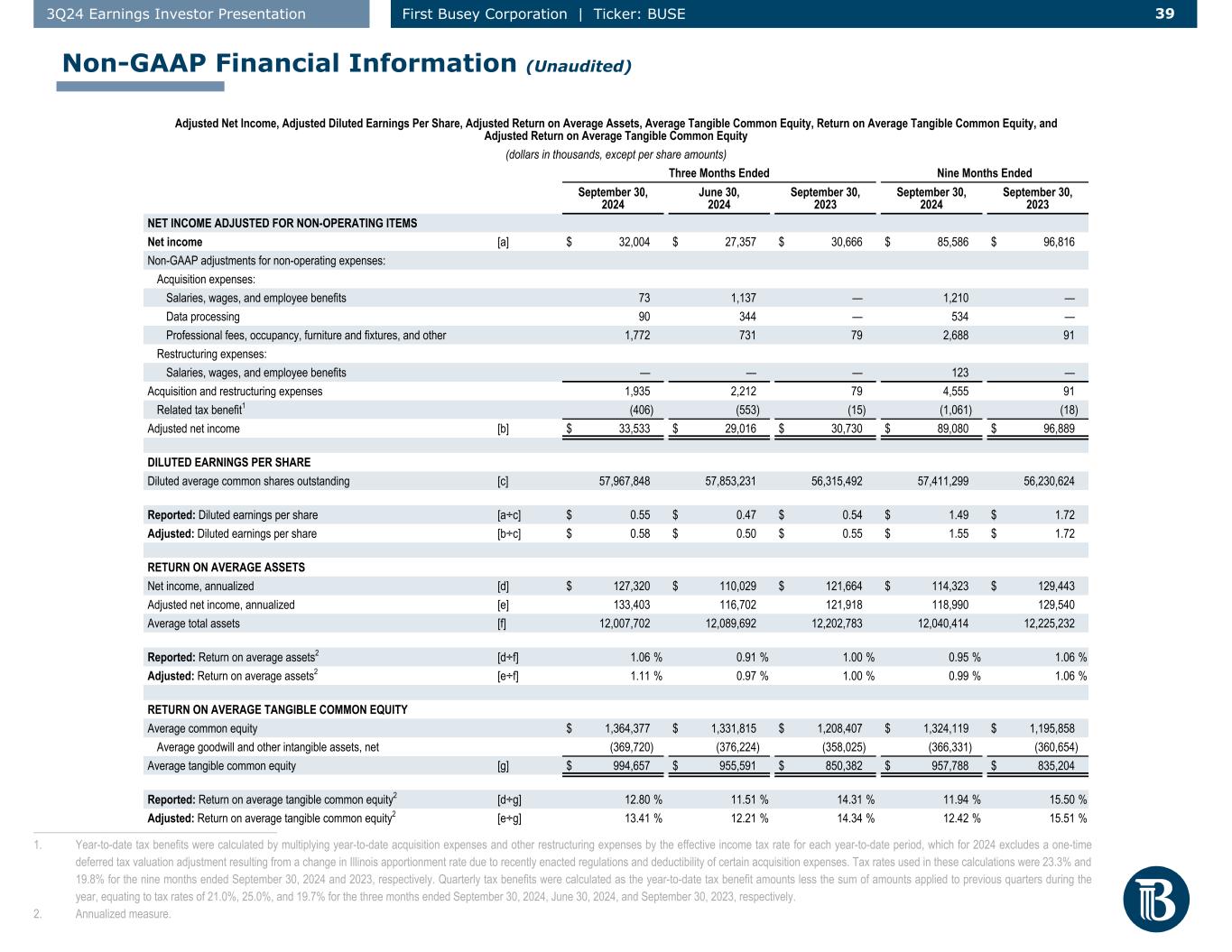

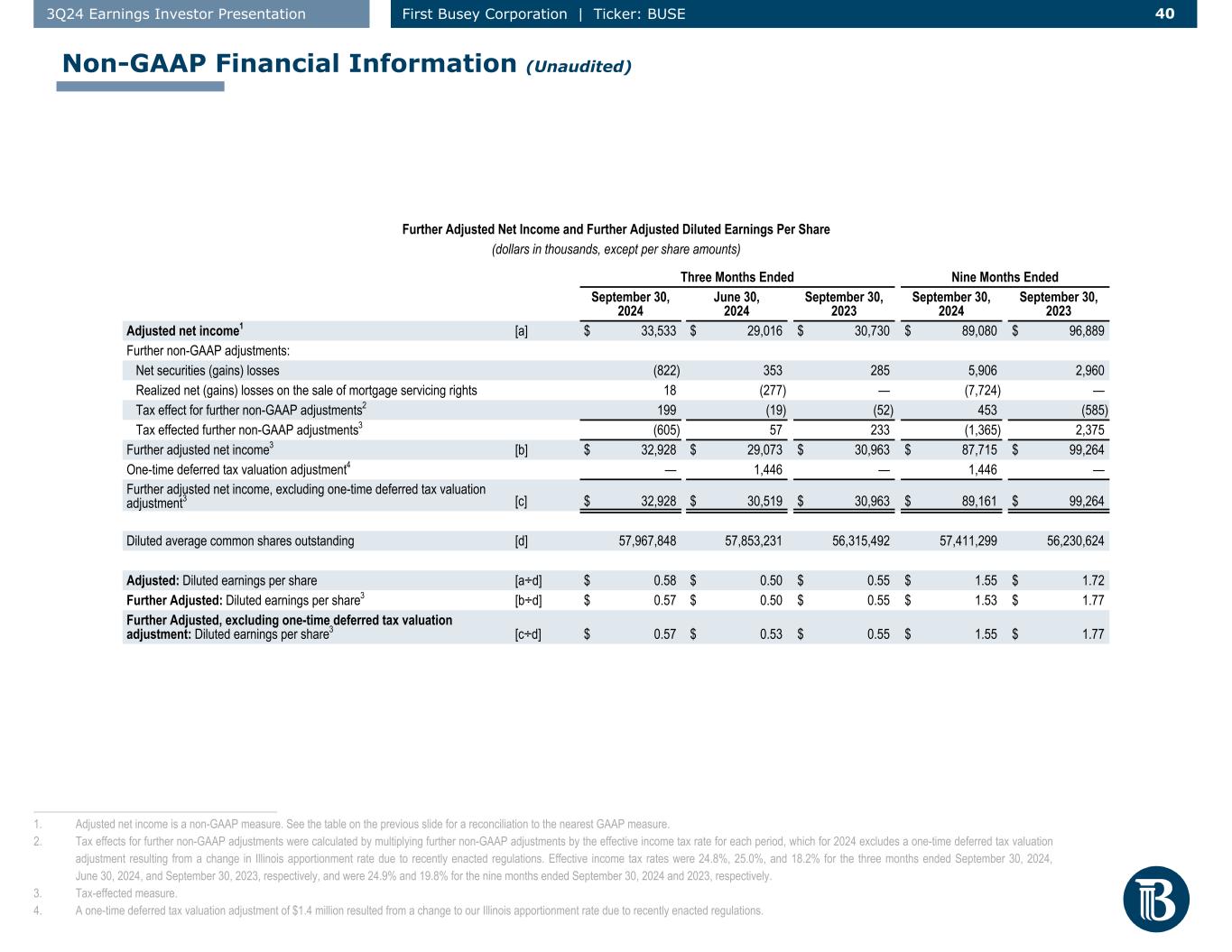

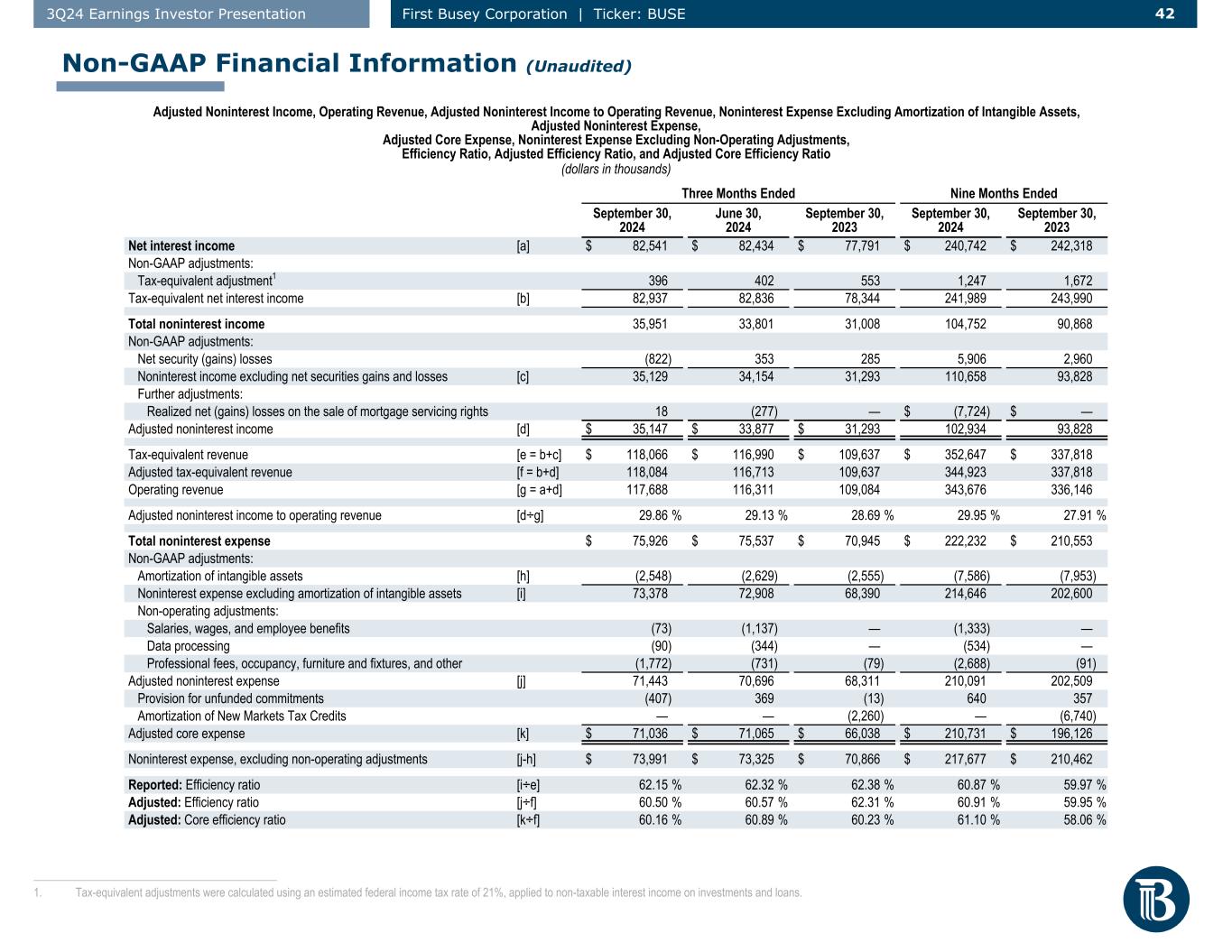

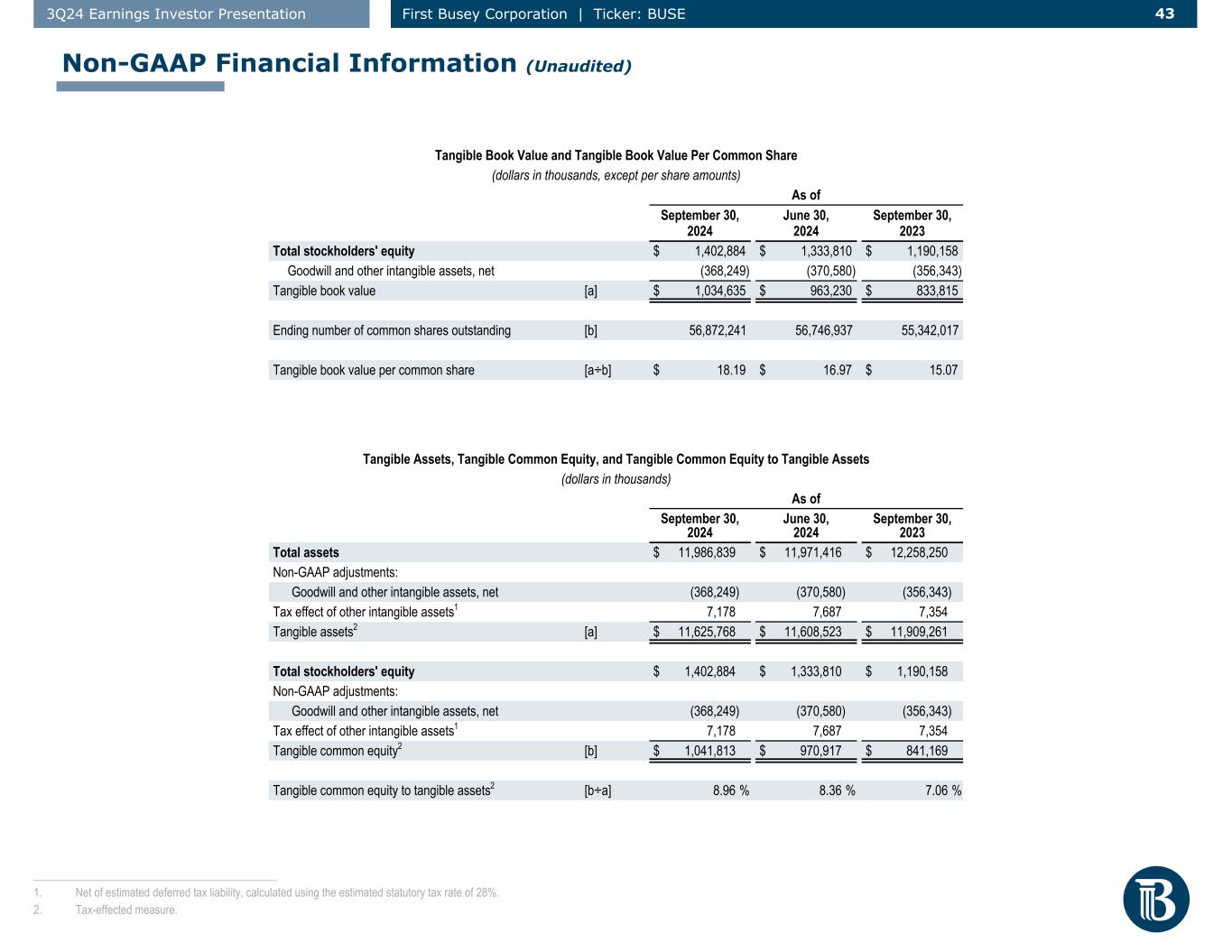

3 33Q24 Earnings Investor Presentation First Busey Corporation | Ticker: BUSE Non-GAAP Financial Information This presentation contains certain financial information determined by methods other than U.S. Generally Accepted Accounting Principles (“GAAP”). Management uses these non-GAAP measures, together with the related GAAP measures, in analysis of Busey’s performance and in making business decisions, as well as for comparison to Busey’s peers. Busey believes the adjusted measures are useful for investors and management to understand the effects of certain non-core and non-recurring noninterest items and provide additional perspective on Busey’s performance over time. Included in the Appendix are reconciliations to what management believes to be the most directly comparable GAAP financial measures—specifically, net interest income, total noninterest income, net security gains and losses, and total noninterest expense in the case of pre-provision net revenue, adjusted pre-provision net revenue, pre-provision net revenue to average assets, and adjusted pre- provision net revenue to average assets; net income in the case of adjusted net income, adjusted diluted earnings per share, adjusted return on average assets, average tangible common equity, return on average tangible common equity, adjusted return on average tangible common equity; net income and net security gains and losses in the case of further adjusted net income and further adjusted diluted earnings per share; net interest income in the case of adjusted net interest income and adjusted net interest margin; net interest income, total noninterest income, and total noninterest expense in the case of adjusted noninterest income, adjusted noninterest expense, noninterest expense excluding non-operating adjustments, adjusted core expense, efficiency ratio, adjusted efficiency ratio, and adjusted core efficiency ratio; net interest income, total noninterest income, net securities gains and losses, and net gains and losses on the sale of mortgage servicing rights in the case of operating revenue and adjusted noninterest income to operating revenue; total assets and goodwill and other intangible assets in the case of tangible assets; total stockholders’ equity in the case of tangible book value per common share; total assets and total stockholders’ equity in the case of tangible common equity and tangible common equity to tangible assets; and total deposits in the case of core deposits and core deposits to total deposits. These non-GAAP disclosures have inherent limitations and are not audited. They should not be considered in isolation or as a substitute for operating results reported in accordance with GAAP, nor are they necessarily comparable to non-GAAP performance measures that may be presented by other companies. Tax effected numbers included in these non-GAAP disclosures are based on estimated statutory rates, estimated federal income tax rates, or effective tax rates, as noted with the tables below. Non-GAAP Financial Information

4 43Q24 Earnings Investor Presentation First Busey Corporation | Ticker: BUSE Table of Contents Overview of First Busey Corporation (BUSE) 5 Diversified Company with Comprehensive & Innovative Financial Solutions 6 Appendix: 32 Compelling Regional Operating Model 7 Experienced Management Team 33 Investment Highlights 8 Fully Integrated Wealth Platform 34 Fortress Balance Sheet 9 FirsTech, A Uniquely Positioned Payment Technology Company 35 Transformational Partnership with CrossFirst Bankshares 10 Busey Impact 37 Track Record of Successful Integrations 12 Non-GAAP Financial Information 38 High Quality Loan Portfolio 13 High Quality Portfolio: CRE 14 Office Investor Owned CRE Portfolio 15 High Quality Portfolio: C&I 16 Pristine Credit Quality 17 Credit Profile Bolstered by Strong Reserves 18 Top Tier Core Deposit Franchise 19 Granular, Stable Deposit Base 20 Deposit Cost Trends 21 Net Interest Margin 22 Diversified and Significant Sources of Fee Income 23 Wealth Management 24 FirsTech 25 Balanced, Low-Risk, Short-Duration Investment Portfolio 26 Actively Managing Well-Positioned Balance Sheet 27 Focused Control on Expenses 28 Robust Capital Foundation 29 3Q24 Earnings Review 30 Earnings Performance 31

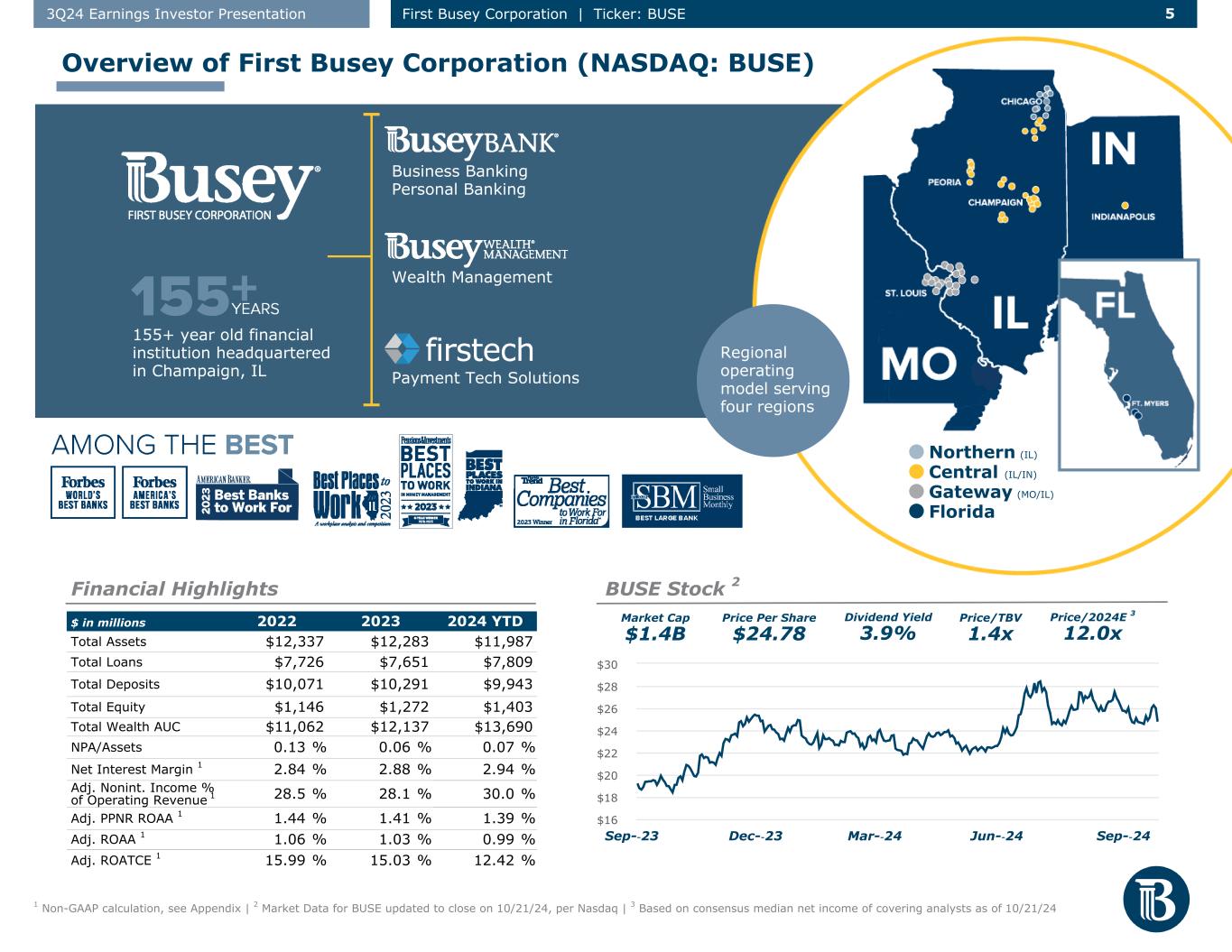

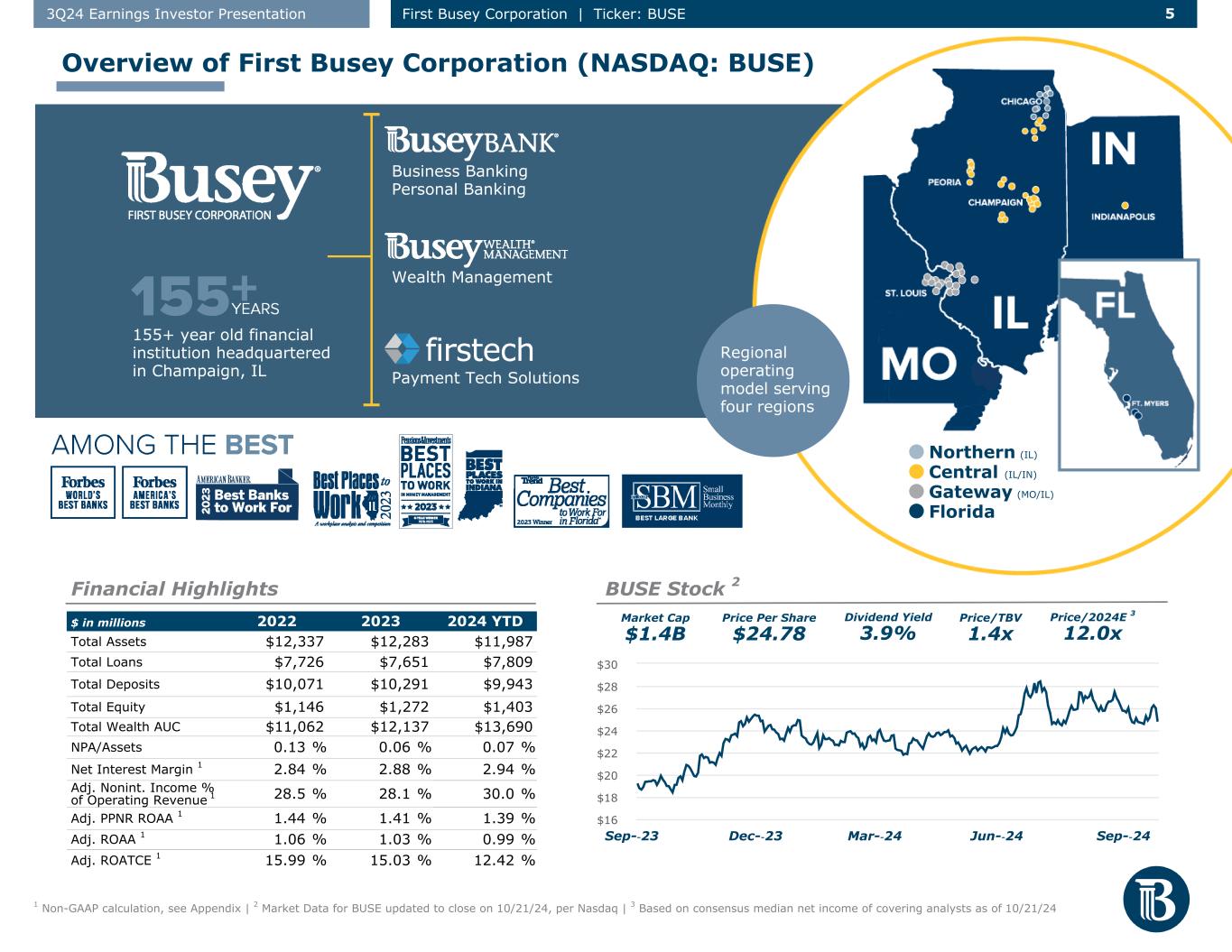

5 53Q24 Earnings Investor Presentation First Busey Corporation | Ticker: BUSE Overview of First Busey Corporation (NASDAQ: BUSE) Price Per Share $24.78 Market Cap $1.4B Dividend Yield 3.9% Price/TBV 1.4x Price/2024E 3 12.0x Sep--23 Dec--23 Mar--24 Jun--24 Sep--24 $16 $18 $20 $22 $24 $26 $28 $30 $ in millions 2022 2023 2024 YTD Total Assets $12,337 $12,283 $11,987 Total Loans $7,726 $7,651 $7,809 Total Deposits $10,071 $10,291 $9,943 Total Equity $1,146 $1,272 $1,403 Total Wealth AUC $11,062 $12,137 $13,690 NPA/Assets 0.13 % 0.06 % 0.07 % Net Interest Margin 1 2.84 % 2.88 % 2.94 % Adj. Nonint. Income % of Operating Revenue 1 28.5 % 28.1 % 30.0 % Adj. PPNR ROAA 1 1.44 % 1.41 % 1.39 % Adj. ROAA 1 1.06 % 1.03 % 0.99 % Adj. ROATCE 1 15.99 % 15.03 % 12.42 % 1 Non-GAAP calculation, see Appendix | 2 Market Data for BUSE updated to close on 10/21/24, per Nasdaq | 3 Based on consensus median net income of covering analysts as of 10/21/24 Northern (IL) Central (IL/IN) Gateway (MO/IL) Florida 155+ year old financial institution headquartered in Champaign, IL Business Banking Personal Banking Wealth Management Payment Tech Solutions Regional operating model serving four regions BUSE Stock 2Financial Highlights

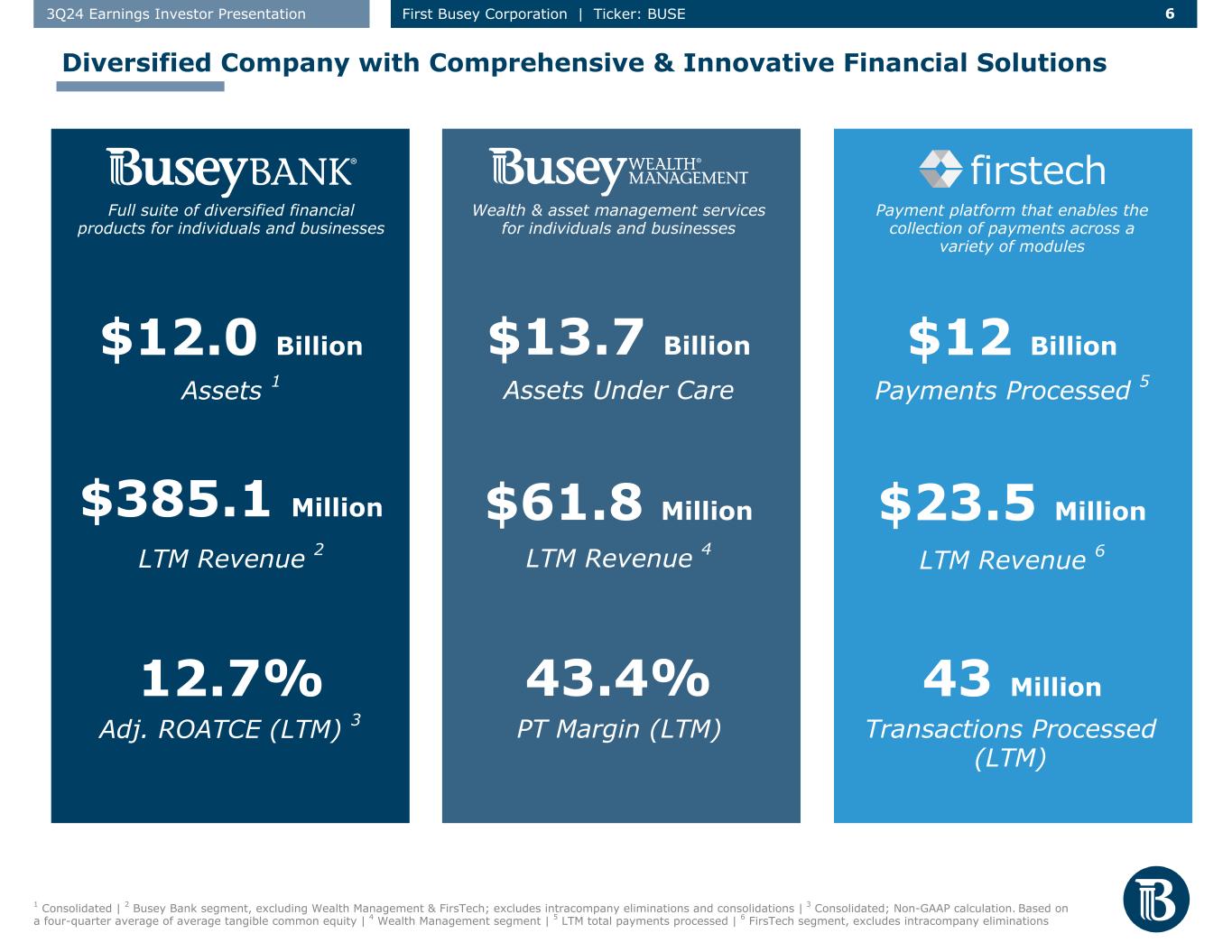

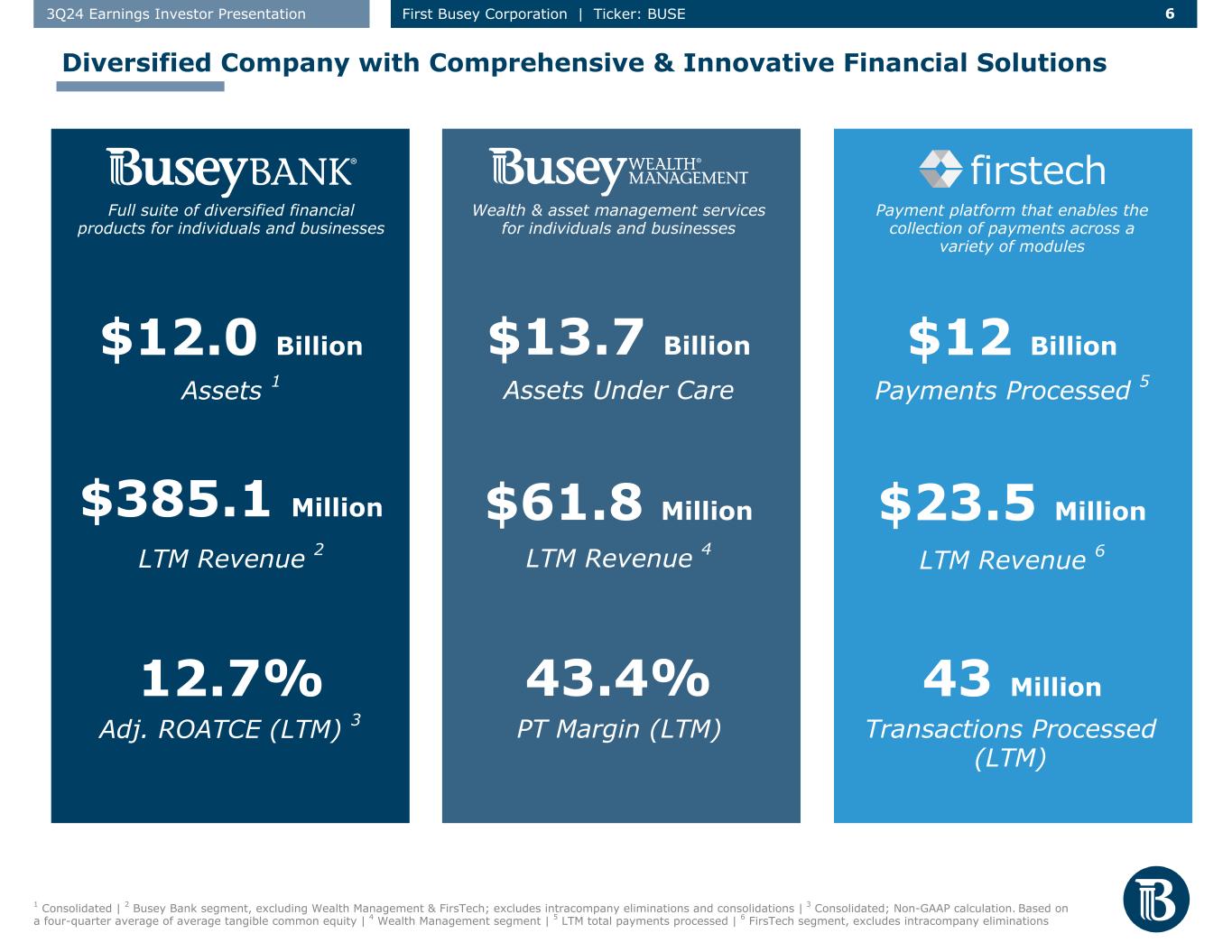

6 63Q24 Earnings Investor Presentation First Busey Corporation | Ticker: BUSE 1 Consolidated | 2 Busey Bank segment, excluding Wealth Management & FirsTech; excludes intracompany eliminations and consolidations | 3 Consolidated; Non-GAAP calculation. Based on a four-quarter average of average tangible common equity | 4 Wealth Management segment | 5 LTM total payments processed | 6 FirsTech segment, excludes intracompany eliminations $12 Billion 43 Million Payments Processed 5 Transactions Processed (LTM) Full suite of diversified financial products for individuals and businesses Wealth & asset management services for individuals and businesses Payment platform that enables the collection of payments across a variety of modules $12.0 Billion Assets 1 12.7% Adj. ROATCE (LTM) 3 $13.7 Billion Assets Under Care 43.4% PT Margin (LTM) $385.1 Million LTM Revenue 2 $61.8 Million LTM Revenue 4 $23.5 Million LTM Revenue 6 Diversified Company with Comprehensive & Innovative Financial Solutions

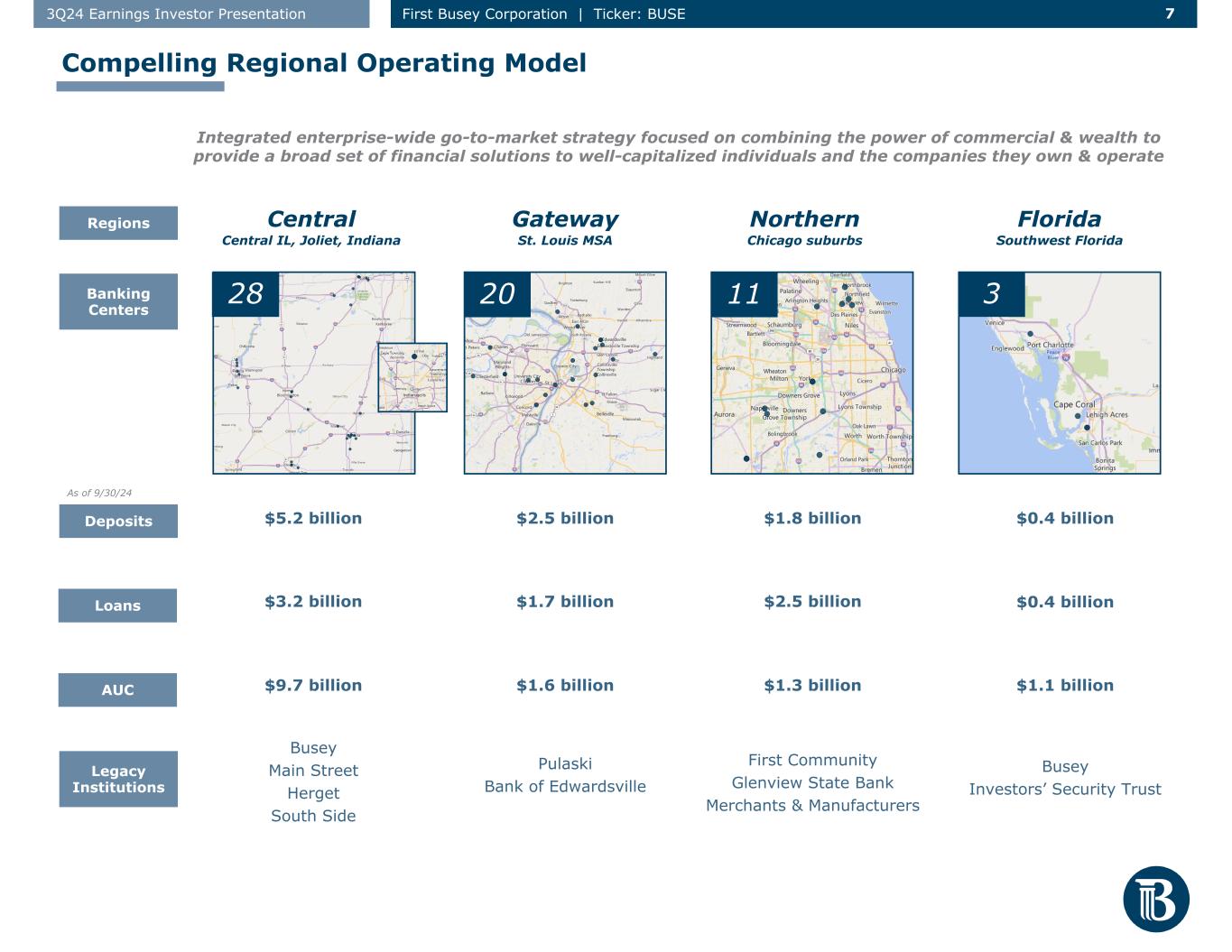

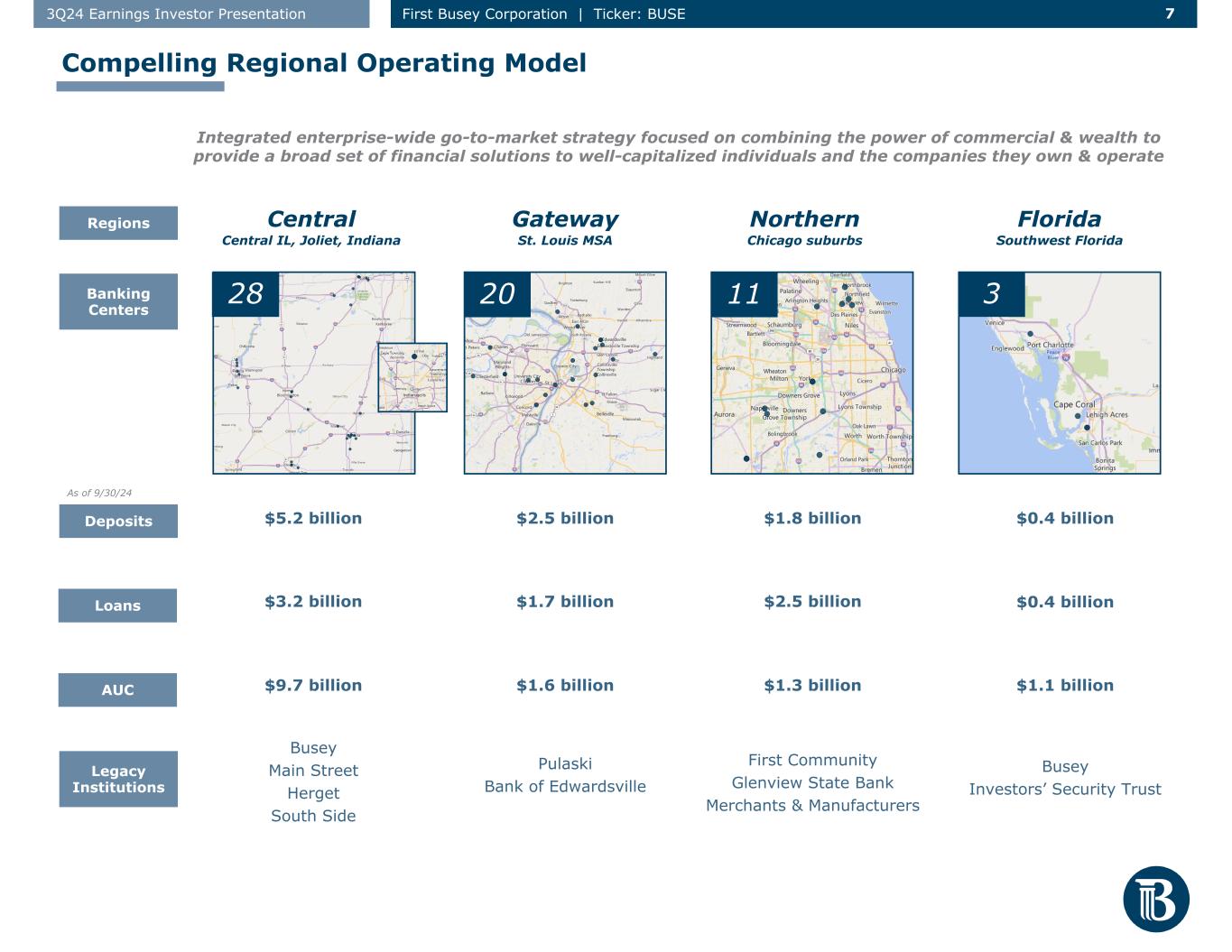

7 73Q24 Earnings Investor Presentation First Busey Corporation | Ticker: BUSE Compelling Regional Operating Model Loans Banking Centers Legacy Institutions Deposits Northern Chicago suburbs Gateway St. Louis MSA Central Central IL, Joliet, Indiana Florida Southwest Florida 1128 20 3 $5.2 billion $1.8 billion$2.5 billion $0.4 billion $3.2 billion Busey Main Street Herget South Side As of 9/30/24 AUC $9.7 billion $1.3 billion$1.6 billion $1.1 billion $1.7 billion $2.5 billion $0.4 billion Pulaski Bank of Edwardsville First Community Glenview State Bank Merchants & Manufacturers Busey Investors’ Security Trust Regions Integrated enterprise-wide go-to-market strategy focused on combining the power of commercial & wealth to provide a broad set of financial solutions to well-capitalized individuals and the companies they own & operate

8 83Q24 Earnings Investor Presentation First Busey Corporation | Ticker: BUSE ▪ 62 branches across four states: Illinois, Missouri, Indiana, and Florida ▪ Premier commercial bank, wealth management, and payment technology solutions for individuals and businesses ▪ Attractive core deposit to total deposit ratio (96.5%)1, low cost non-time deposits (150 bps) in 3Q24, and low level of uninsured & uncollateralized deposits2 (29%) at 9/30/24 ▪ Substantial investments in technology enterprise-wide, deep leadership bench, and risk management infrastructure Attractive Franchise that Provides Innovative Financial Solutions Attractive Profitability and Returns ▪ Adjusted ROAA of 1.11%1 and Adjusted ROATCE of 13.41%1 for 3Q24 ▪ 3Q24 NIM of 3.02%1, a decrease of 1 basis point from 2Q24 ▪ Adjusted core efficiency ratio of 60.2%1 for 3Q24 ▪ Adjusted diluted EPS of $0.581 for 3Q24 ▪ Quarterly dividend of $0.24 (3.9% yield)3 Disciplined Growth Strategy Driven by Regional Operating Model ▪ Organic growth across key business lines driven by regional operating model that aligns commercial, wealth and FirsTech operations ▪ Efficient and right-sized branch network (average deposits per branch of $160 million) ▪ Leverage track record as proven successful acquirer to expand operations through disciplined M&A; announced partnership with CrossFirst Bankshares on 8/27/24 Powerful Combination of Three Business Lines Drives Strong Noninterest Income ▪ Significant revenue derived from diverse and complementary fee income sources ▪ Noninterest income represented 29.9% of total revenue for 3Q24 (excluding net securities gains) ▪ Noninterest income generated from the Wealth Management and FirsTech operating segments comprised 60.4% of total noninterest income in 3Q24 ▪ Sizable business lines provide for a full suite of solutions for our clients across their lifecycle 1 Non-GAAP calculation, see Appendix | 2 Estimated uninsured & uncollateralized deposits consists of the excess of accounts over $250K FDIC insurance limit, less internal accounts and fully-collateralized accounts (incl. preferred deposits) | 3 Based on BUSE closing stock price on 10/21/24 Investment Highlights BUILT ON A FORTRESS BALANCE SHEET Pristine asset quality, highly diversified loan portfolio, & capital levels significantly in excess of well-capitalized minimums

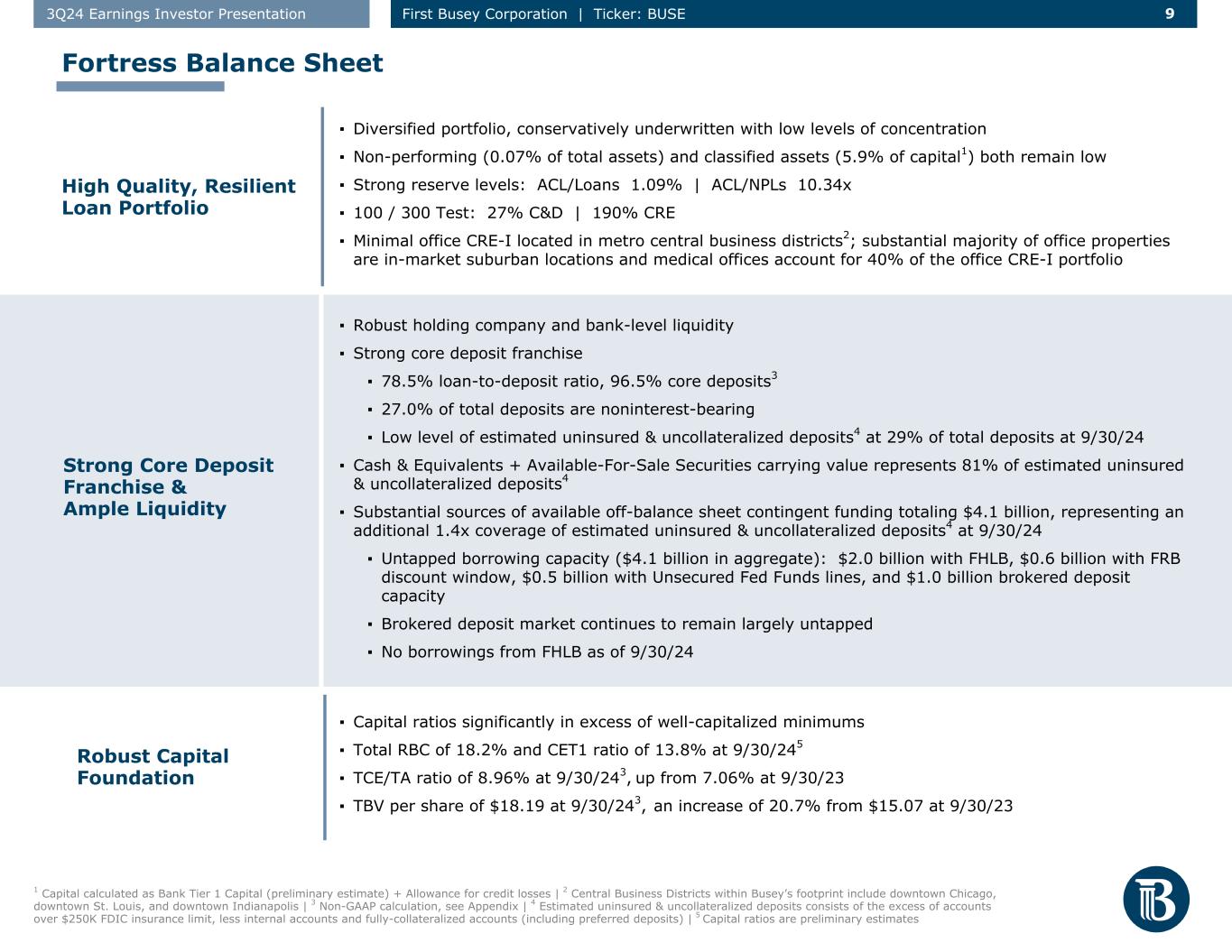

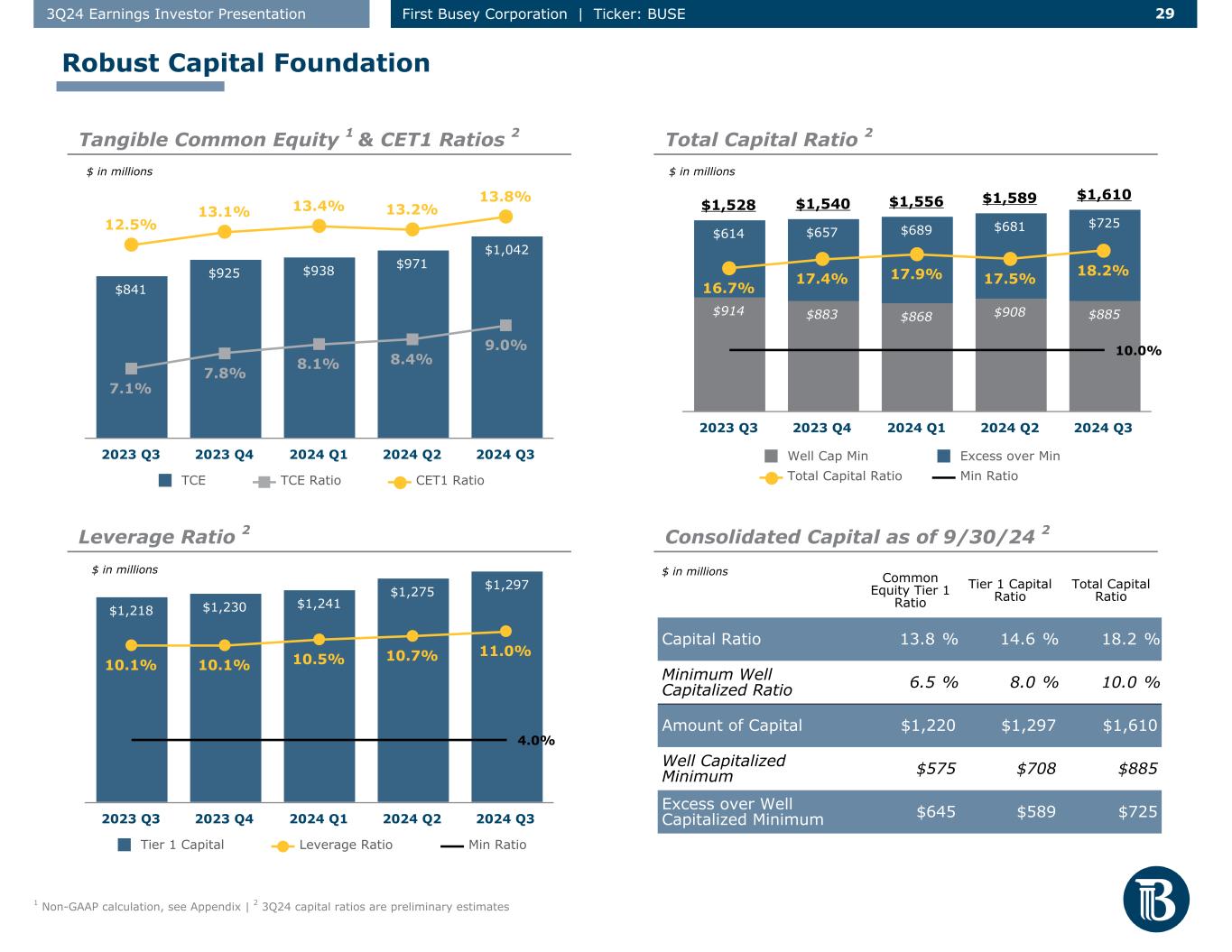

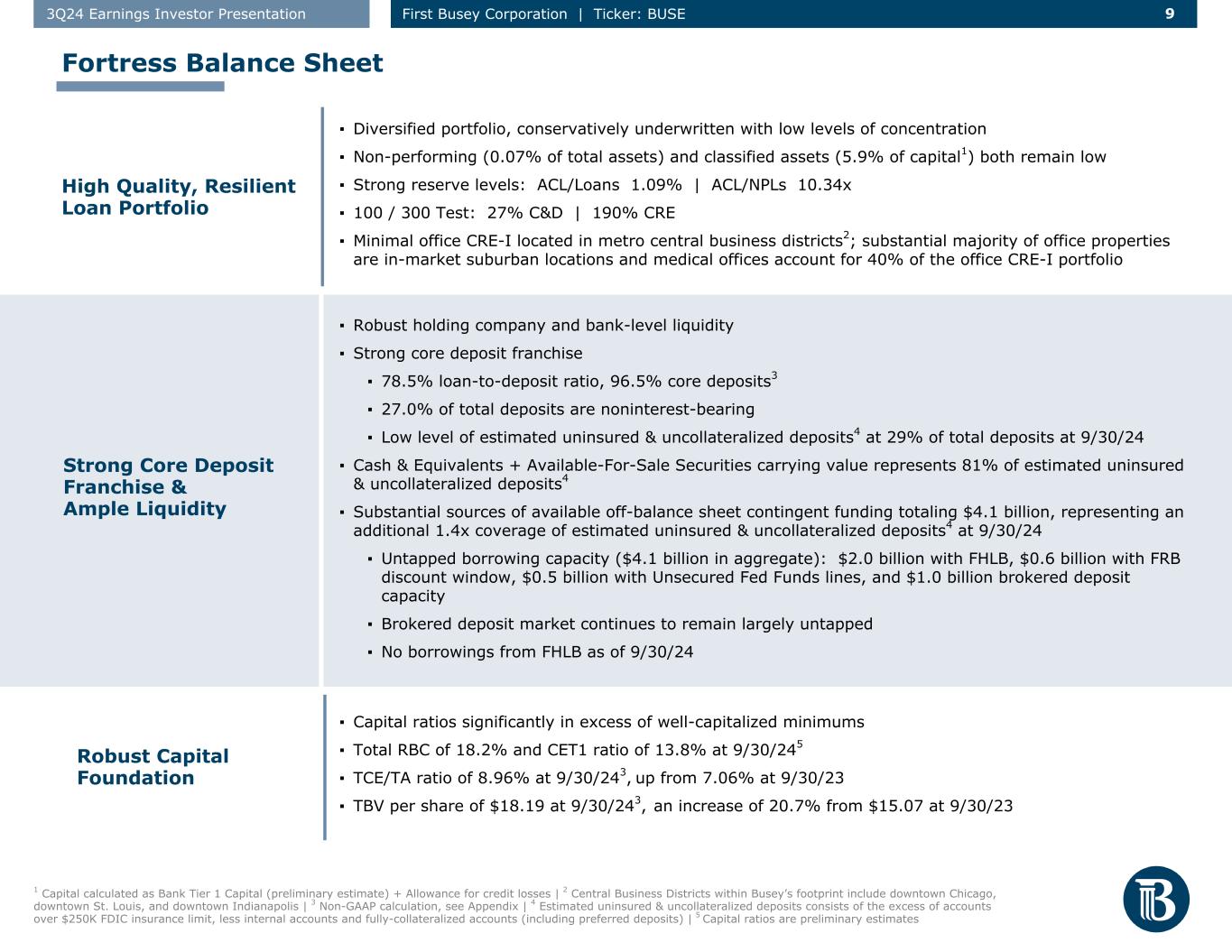

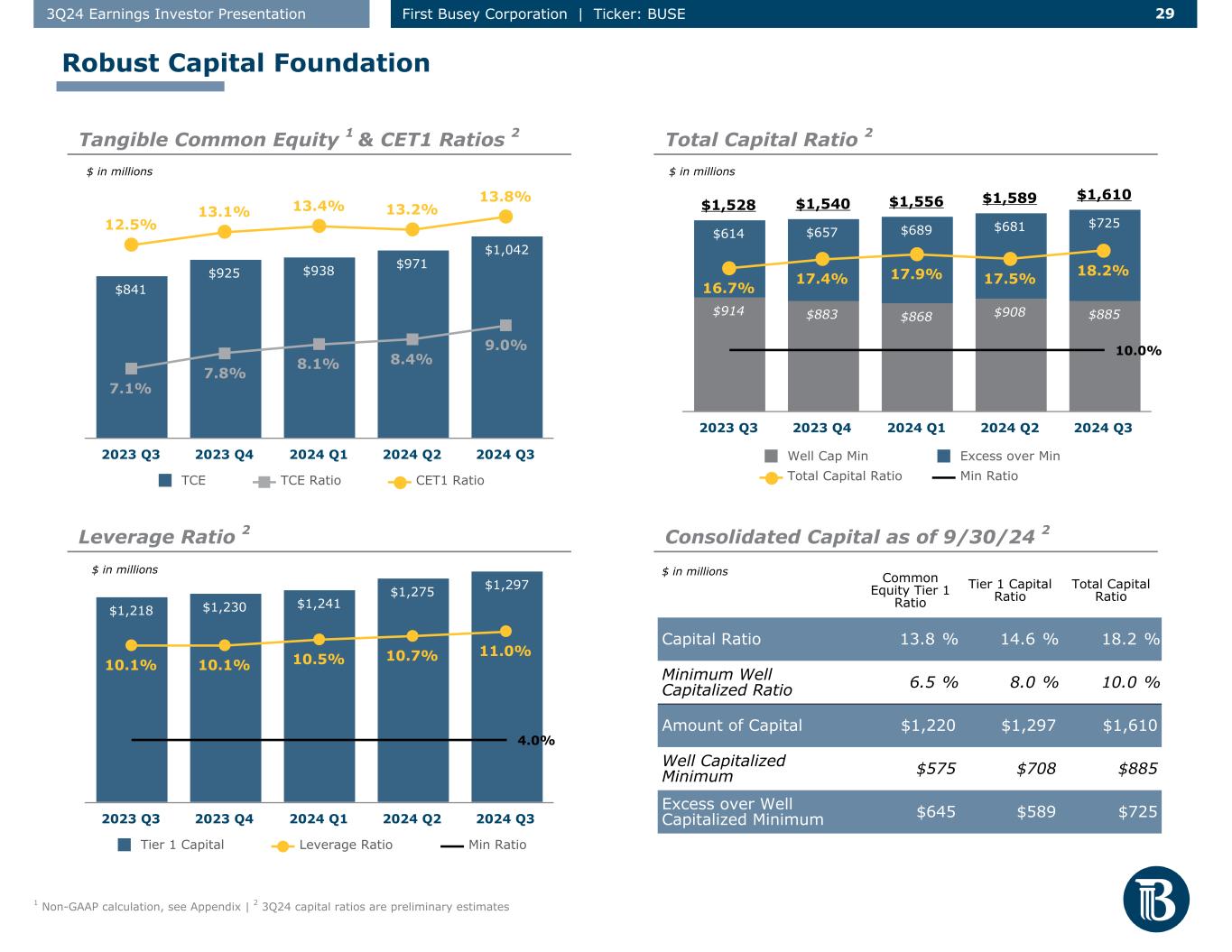

9 93Q24 Earnings Investor Presentation First Busey Corporation | Ticker: BUSE ▪ Capital ratios significantly in excess of well-capitalized minimums ▪ Total RBC of 18.2% and CET1 ratio of 13.8% at 9/30/245 ▪ TCE/TA ratio of 8.96% at 9/30/243, up from 7.06% at 9/30/23 ▪ TBV per share of $18.19 at 9/30/243, an increase of 20.7% from $15.07 at 9/30/23 Robust Capital Foundation High Quality, Resilient Loan Portfolio ▪ Diversified portfolio, conservatively underwritten with low levels of concentration ▪ Non-performing (0.07% of total assets) and classified assets (5.9% of capital1) both remain low ▪ Strong reserve levels: ACL/Loans 1.09% | ACL/NPLs 10.34x ▪ 100 / 300 Test: 27% C&D | 190% CRE ▪ Minimal office CRE-I located in metro central business districts2; substantial majority of office properties are in-market suburban locations and medical offices account for 40% of the office CRE-I portfolio ▪ Robust holding company and bank-level liquidity ▪ Strong core deposit franchise ▪ 78.5% loan-to-deposit ratio, 96.5% core deposits3 ▪ 27.0% of total deposits are noninterest-bearing ▪ Low level of estimated uninsured & uncollateralized deposits4 at 29% of total deposits at 9/30/24 ▪ Cash & Equivalents + Available-For-Sale Securities carrying value represents 81% of estimated uninsured & uncollateralized deposits4 ▪ Substantial sources of available off-balance sheet contingent funding totaling $4.1 billion, representing an additional 1.4x coverage of estimated uninsured & uncollateralized deposits4 at 9/30/24 ▪ Untapped borrowing capacity ($4.1 billion in aggregate): $2.0 billion with FHLB, $0.6 billion with FRB discount window, $0.5 billion with Unsecured Fed Funds lines, and $1.0 billion brokered deposit capacity ▪ Brokered deposit market continues to remain largely untapped ▪ No borrowings from FHLB as of 9/30/24 Strong Core Deposit Franchise & Ample Liquidity 1 Capital calculated as Bank Tier 1 Capital (preliminary estimate) + Allowance for credit losses | 2 Central Business Districts within Busey’s footprint include downtown Chicago, downtown St. Louis, and downtown Indianapolis | 3 Non-GAAP calculation, see Appendix | 4 Estimated uninsured & uncollateralized deposits consists of the excess of accounts over $250K FDIC insurance limit, less internal accounts and fully-collateralized accounts (including preferred deposits) | 5 Capital ratios are preliminary estimates Fortress Balance Sheet

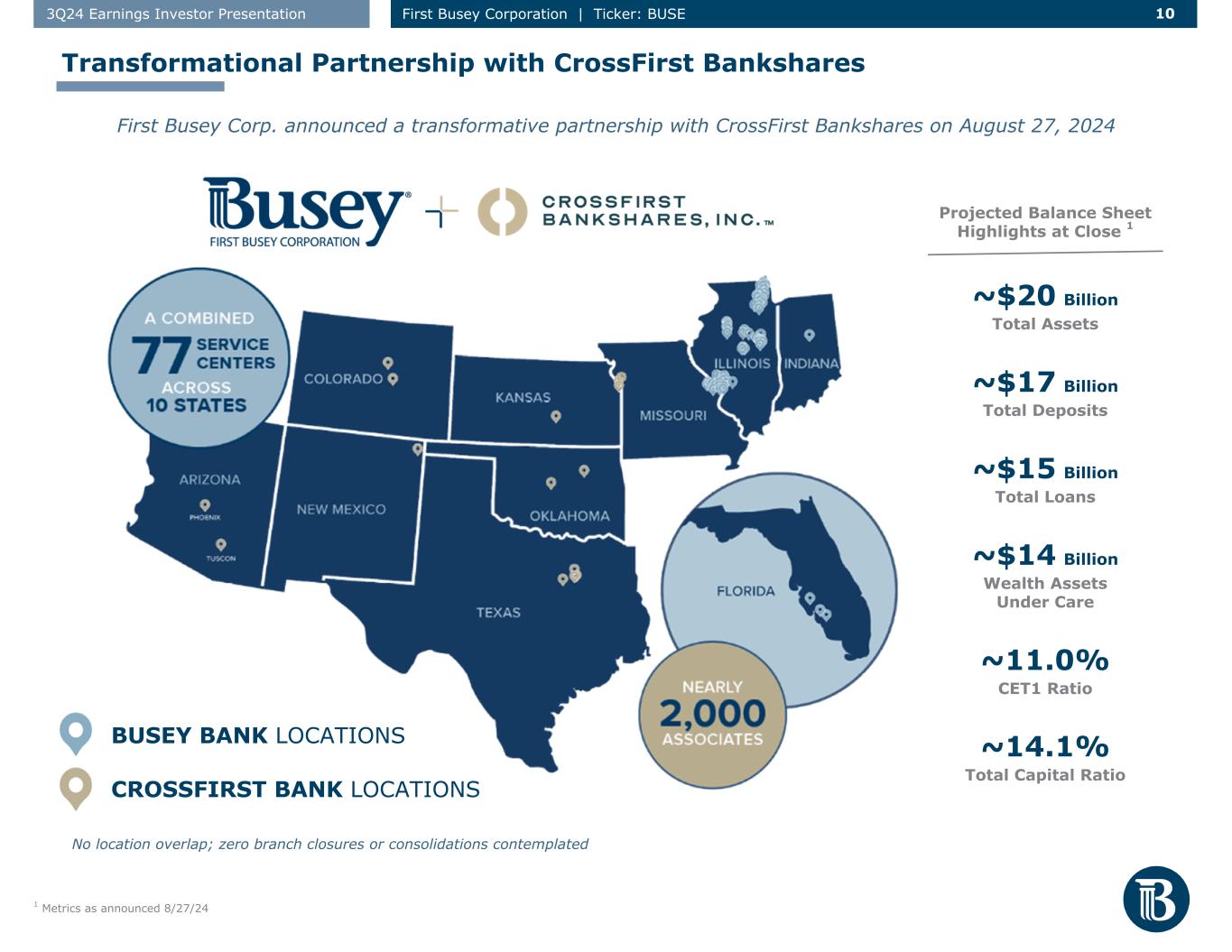

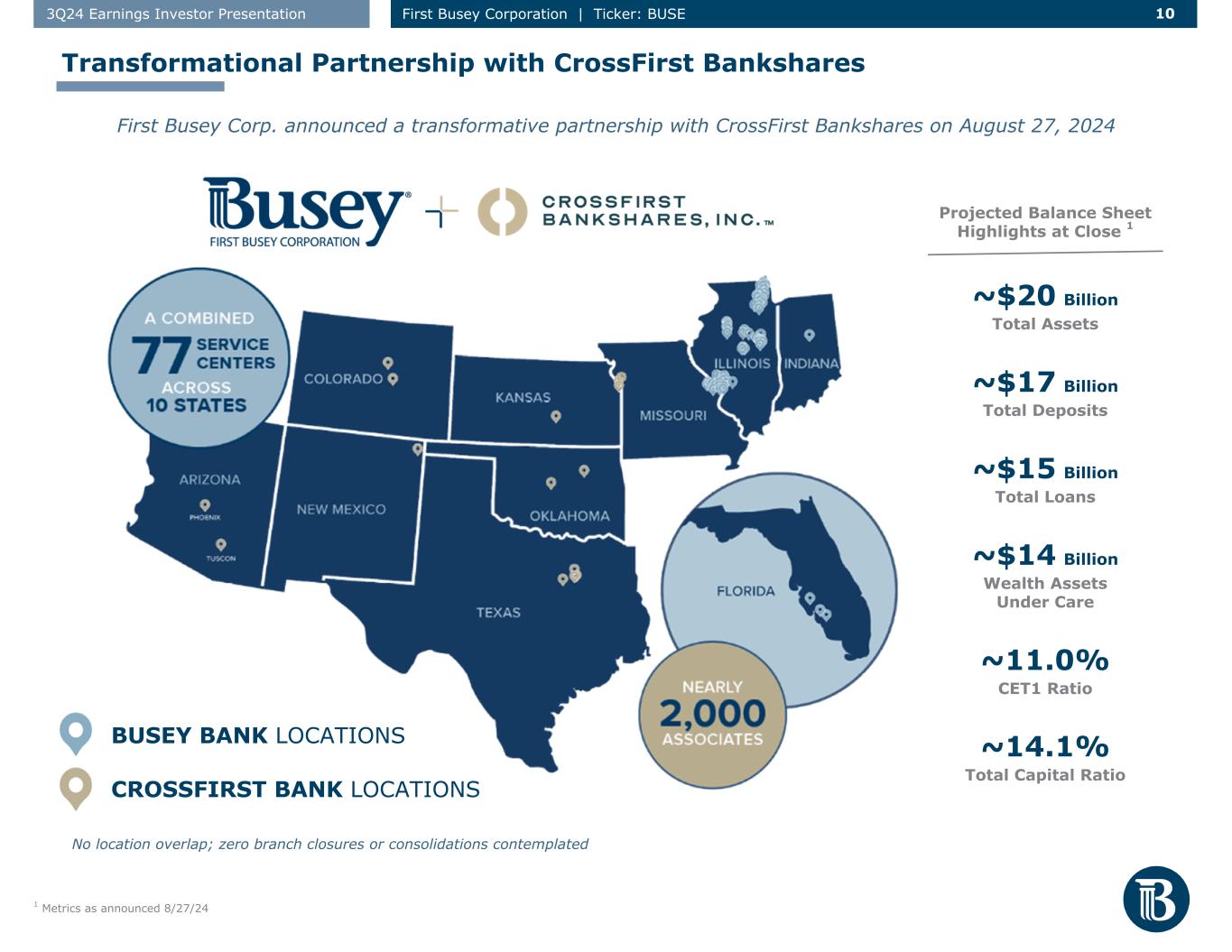

10 103Q24 Earnings Investor Presentation First Busey Corporation | Ticker: BUSE Transformational Partnership with CrossFirst Bankshares 1 Metrics as announced 8/27/24 BUSEY BANK LOCATIONS CROSSFIRST BANK LOCATIONS First Busey Corp. announced a transformative partnership with CrossFirst Bankshares on August 27, 2024 Projected Balance Sheet Highlights at Close 1 ~$20 Billion Total Assets ~$17 Billion Total Deposits ~$15 Billion Total Loans ~$14 Billion Wealth Assets Under Care ~11.0% CET1 Ratio ~14.1% Total Capital Ratio No location overlap; zero branch closures or consolidations contemplated

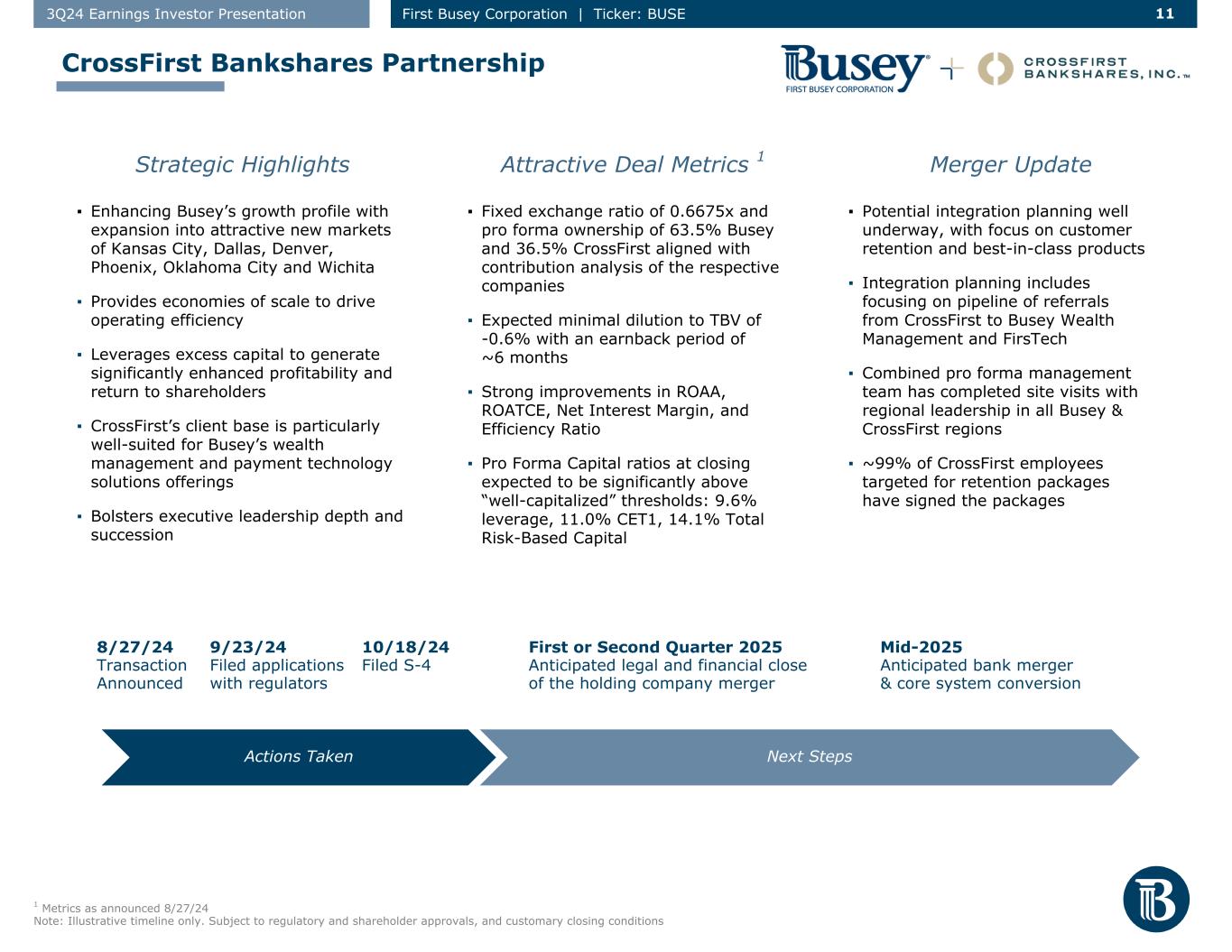

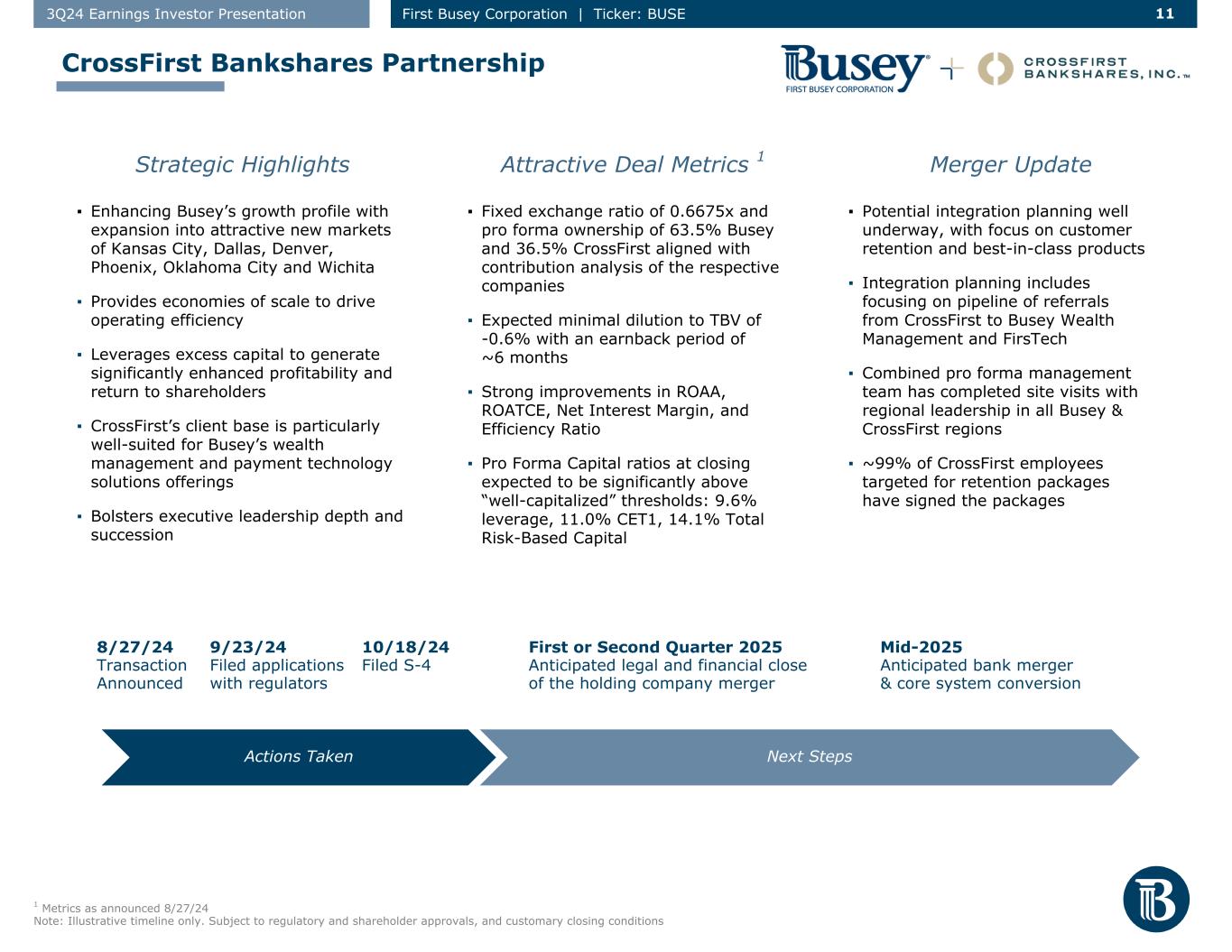

11 113Q24 Earnings Investor Presentation First Busey Corporation | Ticker: BUSE ▪ Potential integration planning well underway, with focus on customer retention and best-in-class products ▪ Integration planning includes focusing on pipeline of referrals from CrossFirst to Busey Wealth Management and FirsTech ▪ Combined pro forma management team has completed site visits with regional leadership in all Busey & CrossFirst regions ▪ ~99% of CrossFirst employees targeted for retention packages have signed the packages Merger Update ▪ Fixed exchange ratio of 0.6675x and pro forma ownership of 63.5% Busey and 36.5% CrossFirst aligned with contribution analysis of the respective companies ▪ Expected minimal dilution to TBV of -0.6% with an earnback period of ~6 months ▪ Strong improvements in ROAA, ROATCE, Net Interest Margin, and Efficiency Ratio ▪ Pro Forma Capital ratios at closing expected to be significantly above “well-capitalized” thresholds: 9.6% leverage, 11.0% CET1, 14.1% Total Risk-Based Capital Attractive Deal Metrics 1Strategic Highlights ▪ Enhancing Busey’s growth profile with expansion into attractive new markets of Kansas City, Dallas, Denver, Phoenix, Oklahoma City and Wichita ▪ Provides economies of scale to drive operating efficiency ▪ Leverages excess capital to generate significantly enhanced profitability and return to shareholders ▪ CrossFirst’s client base is particularly well-suited for Busey’s wealth management and payment technology solutions offerings ▪ Bolsters executive leadership depth and succession Next StepsActions Taken 8/27/24 Transaction Announced 9/23/24 Filed applications with regulators First or Second Quarter 2025 Anticipated legal and financial close of the holding company merger Mid-2025 Anticipated bank merger & core system conversion CrossFirst Bankshares Partnership 1 Metrics as announced 8/27/24 Note: Illustrative timeline only. Subject to regulatory and shareholder approvals, and customary closing conditions 10/18/24 Filed S-4

12 123Q24 Earnings Investor Presentation First Busey Corporation | Ticker: BUSE ▪ Integrating CrossFirst’s efficient operating model, branch-lite footprint, and commercial-focused customer base has the potential to be less arduous than challenging integrations successfully managed in the past that included more retail (customers & locations) and wealth operations ▪ Combined pro forma management team leverages strengths of both Busey and CrossFirst to provide continuity of leadership during and beyond integration ▪ Busey successfully integrated seven whole bank mergers aggregating $7B+ in total assets and one wealth management firm since 2015; most recent integration in 2Q24 Track Record of Successful Integrations ▪ An integral component of the regional operating model is bringing together associates from many different organizational backgrounds and with different expertise (Lending, Wealth, Payment Technology) to deliver comprehensive client solutions through an integrated sales culture

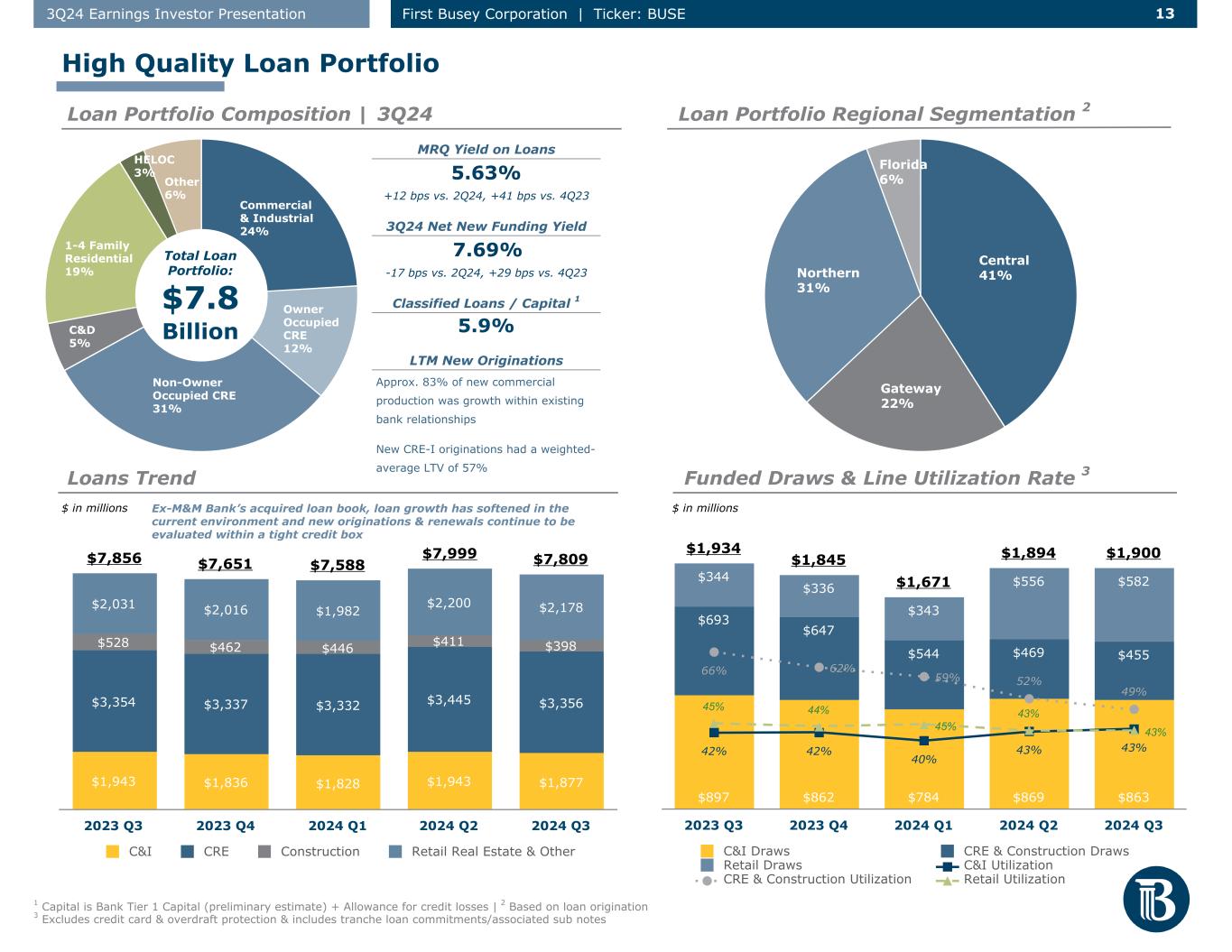

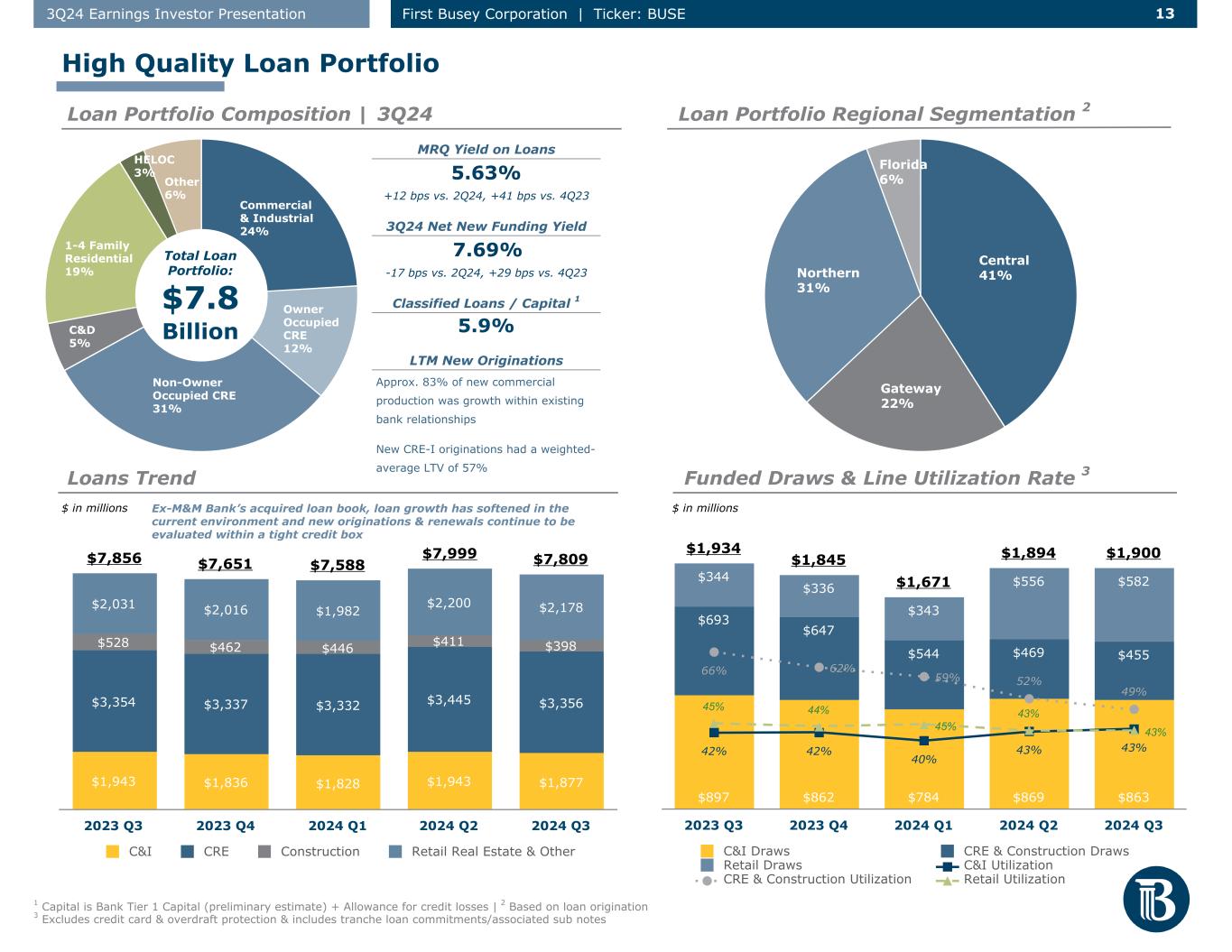

13 133Q24 Earnings Investor Presentation First Busey Corporation | Ticker: BUSE $1,934 $1,845 $1,671 $1,894 $1,900 $897 $862 $784 $869 $863 $693 $647 $544 $469 $455 $344 $336 $343 $556 $582 42% 42% 40% 43% 43% 66% 62% 59% 52% 49% 45% 44% 45% 43% 43% C&I Draws CRE & Construction Draws Retail Draws C&I Utilization CRE & Construction Utilization Retail Utilization 2023 Q3 2023 Q4 2024 Q1 2024 Q2 2024 Q3 Commercial & Industrial 24% Owner Occupied CRE 12% Non-Owner Occupied CRE 31% C&D 5% 1-4 Family Residential 19% HELOC 3% Other 6% 1 Capital is Bank Tier 1 Capital (preliminary estimate) + Allowance for credit losses | 2 Based on loan origination 3 Excludes credit card & overdraft protection & includes tranche loan commitments/associated sub notes Central 41% Gateway 22% Northern 31% Florida 6% $7,856 $7,651 $7,588 $7,999 $7,809 $1,943 $1,836 $1,828 $1,943 $1,877 $3,354 $3,337 $3,332 $3,445 $3,356 $528 $462 $446 $411 $398 $2,031 $2,016 $1,982 $2,200 $2,178 C&I CRE Construction Retail Real Estate & Other 2023 Q3 2023 Q4 2024 Q1 2024 Q2 2024 Q3 $ in millions$ in millionsLTM Core Growth 3 LTM Commercial Growth 3 -0.6% -3.3% Total Loan Portfolio: $7.8 Billion MRQ Yield on Loans 5.63% +12 bps vs. 2Q24, +41 bps vs. 4Q23 3Q24 Net New Funding Yield 7.69% -17 bps vs. 2Q24, +29 bps vs. 4Q23 Classified Loans / Capital 1 5.9% LTM New Originations ▪ Approx. 83% of new commercial production was growth within existing bank relationships ▪ New CRE-I originations had a weighted- average LTV of 57% High Quality Loan Portfolio Funded Draws & Line Utilization Rate 3Loans Trend Loan Portfolio Regional Segmentation 2Loan Portfolio Composition | 3Q24 LTM Growth -0.6% Ex-M&M Bank’s acquired loan book, loan growth has softened in the current environment and new originations & renewals continue to be evaluated within a tight credit box

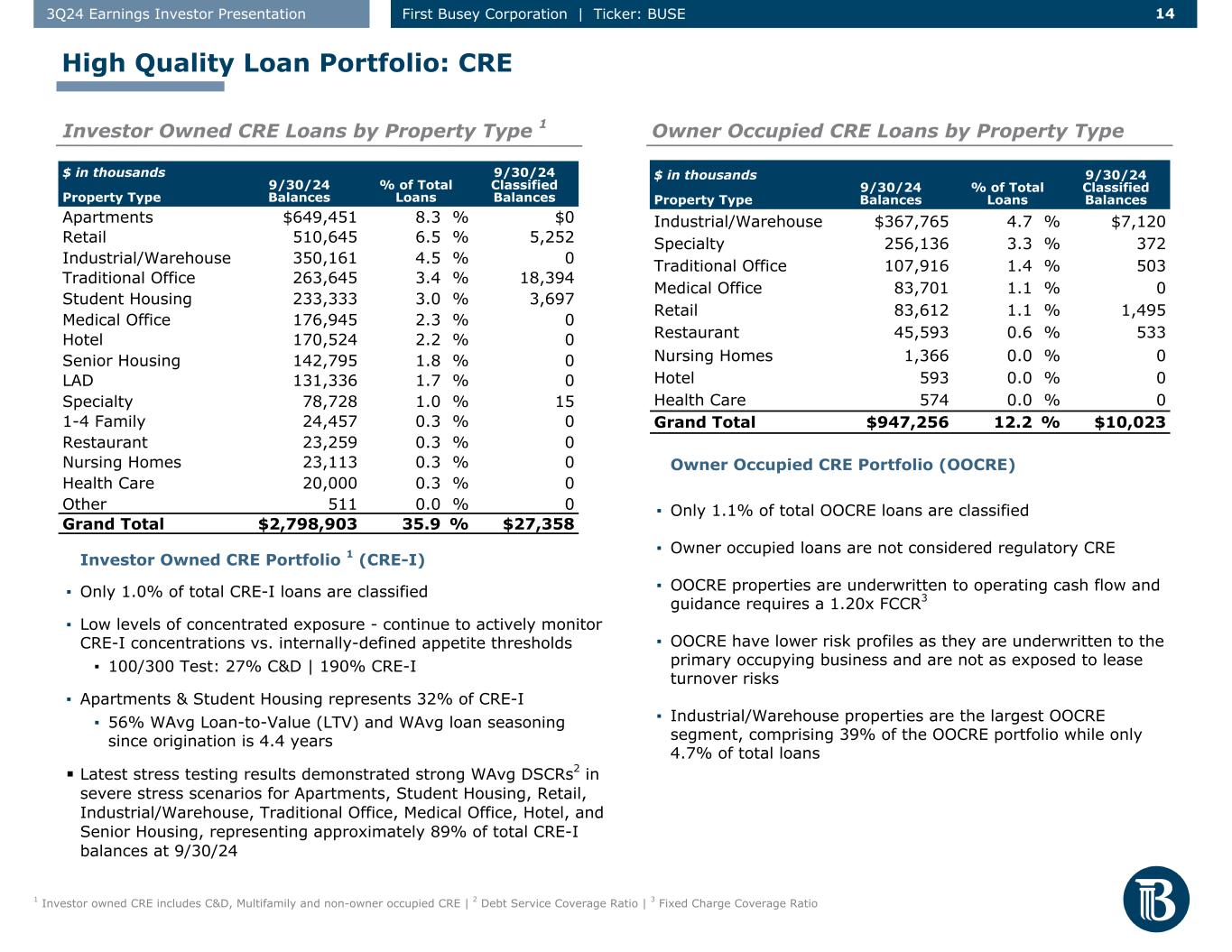

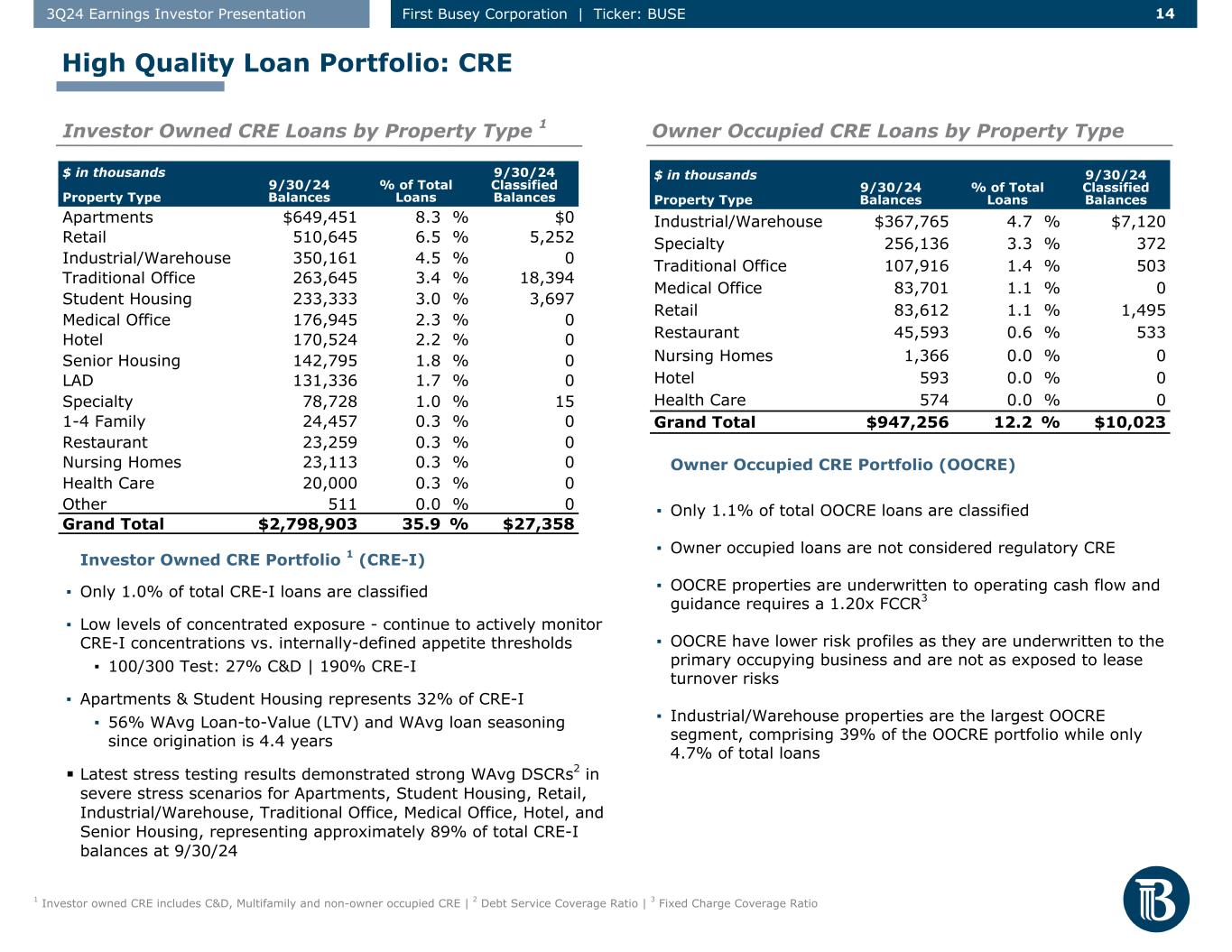

14 143Q24 Earnings Investor Presentation First Busey Corporation | Ticker: BUSE 1 Investor owned CRE includes C&D, Multifamily and non-owner occupied CRE | 2 Debt Service Coverage Ratio | 3 Fixed Charge Coverage Ratio $ in thousands Property Type 9/30/24 Balances % of Total Loans 9/30/24 Classified Balances Apartments $649,451 8.3 % $0 Retail 510,645 6.5 % 5,252 Industrial/Warehouse 350,161 4.5 % 0 Traditional Office 263,645 3.4 % 18,394 Student Housing 233,333 3.0 % 3,697 Medical Office 176,945 2.3 % 0 Hotel 170,524 2.2 % 0 Senior Housing 142,795 1.8 % 0 LAD 131,336 1.7 % 0 Specialty 78,728 1.0 % 15 1-4 Family 24,457 0.3 % 0 Restaurant 23,259 0.3 % 0 Nursing Homes 23,113 0.3 % 0 Health Care 20,000 0.3 % 0 Other 511 0.0 % 0 Grand Total $2,798,903 35.9 % $27,358 Investor Owned CRE Portfolio 1 (CRE-I) ▪ Only 1.0% of total CRE-I loans are classified ▪ Low levels of concentrated exposure - continue to actively monitor CRE-I concentrations vs. internally-defined appetite thresholds ▪ 100/300 Test: 27% C&D | 190% CRE-I ▪ Apartments & Student Housing represents 32% of CRE-I ▪ 56% WAvg Loan-to-Value (LTV) and WAvg loan seasoning since origination is 4.4 years ▪ Latest stress testing results demonstrated strong WAvg DSCRs2 in severe stress scenarios for Apartments, Student Housing, Retail, Industrial/Warehouse, Traditional Office, Medical Office, Hotel, and Senior Housing, representing approximately 89% of total CRE-I balances at 9/30/24 $ in thousands Property Type 9/30/24 Balances % of Total Loans 9/30/24 Classified Balances Industrial/Warehouse $367,765 4.7 % $7,120 Specialty 256,136 3.3 % 372 Traditional Office 107,916 1.4 % 503 Medical Office 83,701 1.1 % 0 Retail 83,612 1.1 % 1,495 Restaurant 45,593 0.6 % 533 Nursing Homes 1,366 0.0 % 0 Hotel 593 0.0 % 0 Health Care 574 0.0 % 0 Grand Total $947,256 12.2 % $10,023 Owner Occupied CRE Portfolio (OOCRE) ▪ Only 1.1% of total OOCRE loans are classified ▪ Owner occupied loans are not considered regulatory CRE ▪ OOCRE properties are underwritten to operating cash flow and guidance requires a 1.20x FCCR3 ▪ OOCRE have lower risk profiles as they are underwritten to the primary occupying business and are not as exposed to lease turnover risks ▪ Industrial/Warehouse properties are the largest OOCRE segment, comprising 39% of the OOCRE portfolio while only 4.7% of total loans Owner Occupied CRE Loans by Property Type High Quality Loan Portfolio: CRE Investor Owned CRE Loans by Property Type 1

15 153Q24 Earnings Investor Presentation First Busey Corporation | Ticker: BUSE Weighted Average DSCR: Weighted Average Debt Yield: WAvg 1-Year Lease Rollover: WAvg 2-Year Lease Rollover: Top Ten Largest Office Loans 1.49 12.5% 2.4% 5.9% Downtown St. Louis 1 Property with $1.8 million in balances Limited Metro Central Business District Exposure Downtown Chicago No outstanding Office CRE-I in Downtown Chicago Downtown Indy 1 Property with $0.3 million in balances All data as of 9/30/24 $ in thousands Metric Traditional Office Medical Office Top Ten Largest Office Loans CBD Office Exposure Total Balances $263,645 $176,945 $137,183 $2,101 % of Total CRE-I 9.4 % 6.3 % 4.9 % 0.1 % % of Total Office CRE-I 59.8 % 40.2 % 31.1 % 0.5 % # of Loans 183 65 10 2 Average Loan Size $1,441 $2,722 $13,718 $1,051 Total Classified Balances $18,394 $0 $17,999 $0 Weighted Avg Current LTV 58 % 64 % 66% 63% Office Investor Owned CRE Portfolio

16 163Q24 Earnings Investor Presentation First Busey Corporation | Ticker: BUSE ▪ 23.8% of total loan portfolio ▪ 65% of C&I borrowers have been Busey customers for 5+ years ▪ C&I loans are underwritten to a 1.20x FCCR requirement and RLOCs greater than $1 million require a monthly borrowing base ▪ C&I lines of credits have an overall utilization of 43%, demonstrating substantial borrowing capacity and appropriate revolving of most lines ▪ Diversified portfolio results in low levels of concentrated exposure ▪ Top concentration in one industry - Finance & Insurance - is 17% of C&I loans, or 4% of total loans; the majority of the Finance & Insurance portfolio is secured by marketable securities ▪ 2.4% of C&I loans are classified, compared to 2.5% in 2Q24 and 1.8% in 3Q23 1 Minor difference in C&I balances from chart and those reported elsewhere as consolidated C&I loan balances is attributable to purchase accounting, deferred fees & costs, and overdrafts High Quality Loan Portfolio: C&I C&I Loans by Sector $ in thousands NAICS Sector 9/30/24 Balances % of Total Loans 9/30/24 Classified Balances Finance and Insurance $316,077 4.0 % $0 Manufacturing 258,590 3.3 % 23,204 Real Estate Rental & Leasing 240,895 3.1 % 2,338 Wholesale Trade 191,241 2.4 % 6,968 Transportation 137,718 1.8 % 1,538 Construction 123,311 1.6 % 651 Educational Services 120,071 1.5 % 72 Agriculture, Forestry, Fishing, Hunting 87,556 1.1 % 980 Food Services and Drinking Places 72,839 0.9 % 0 Retail Trade 66,677 0.9 % 199 Public Administration 56,301 0.7 % 0 Other Services (except Public Admin.) 55,800 0.7 % 274 Health Care and Social Assistance 54,274 0.7 % 5,587 Arts, Entertainment, and Recreation 34,510 0.4 % 424 Professional, Scientific, Technical Svcs. 34,043 0.4 % 1,357 Administrative and Support Services 12,113 0.2 % 417 Mining, Quarrying, Oil, Gas Extraction 7,174 0.1 % 0 Information 3,080 0.0 % 1,625 Waste Management Services 2,616 0.0 % 0 Utilities 586 0.0 % 0 Warehousing and Storage 52 0.0 % 0 Other 20 0.0 % 0 Grand Total1 $1,875,544 23.8 % $45,634

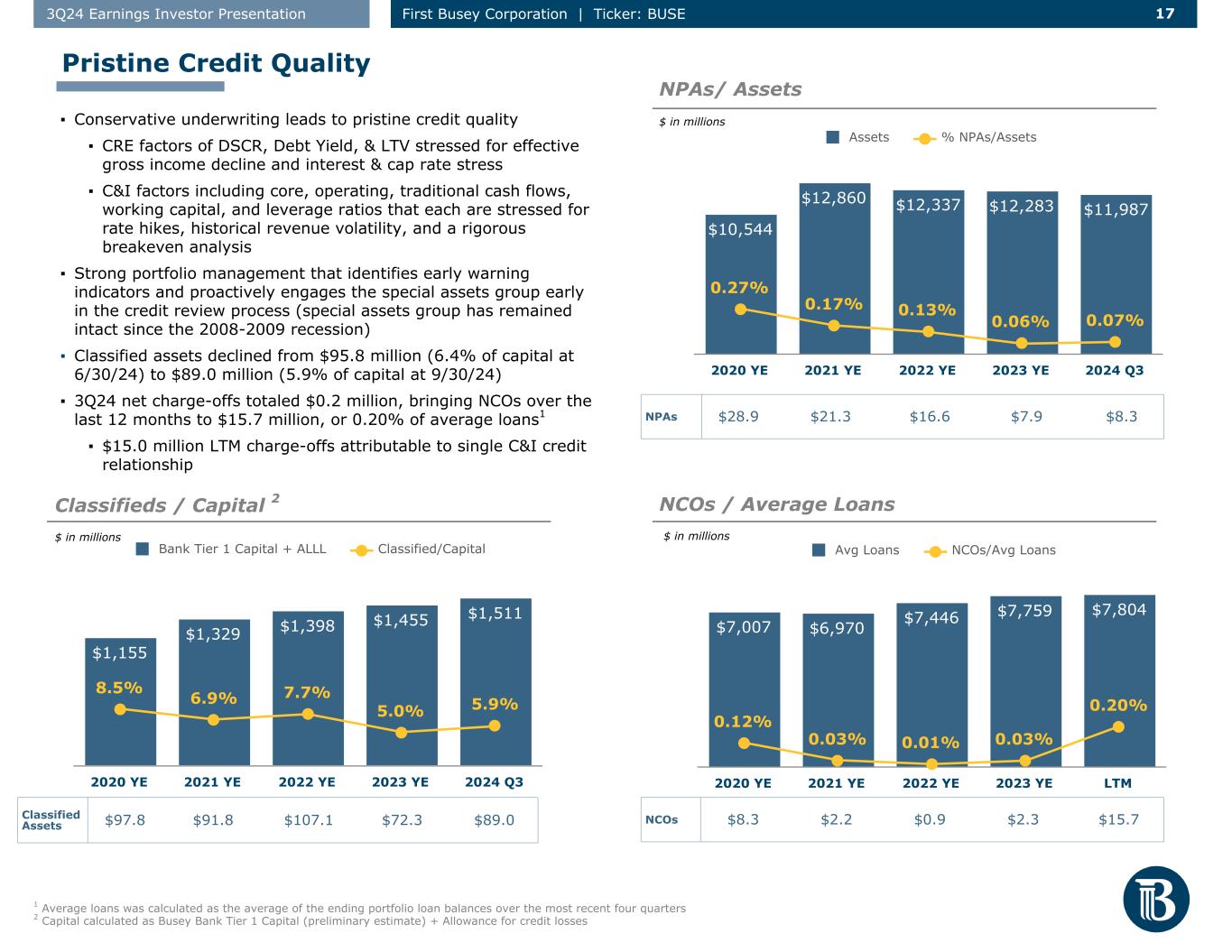

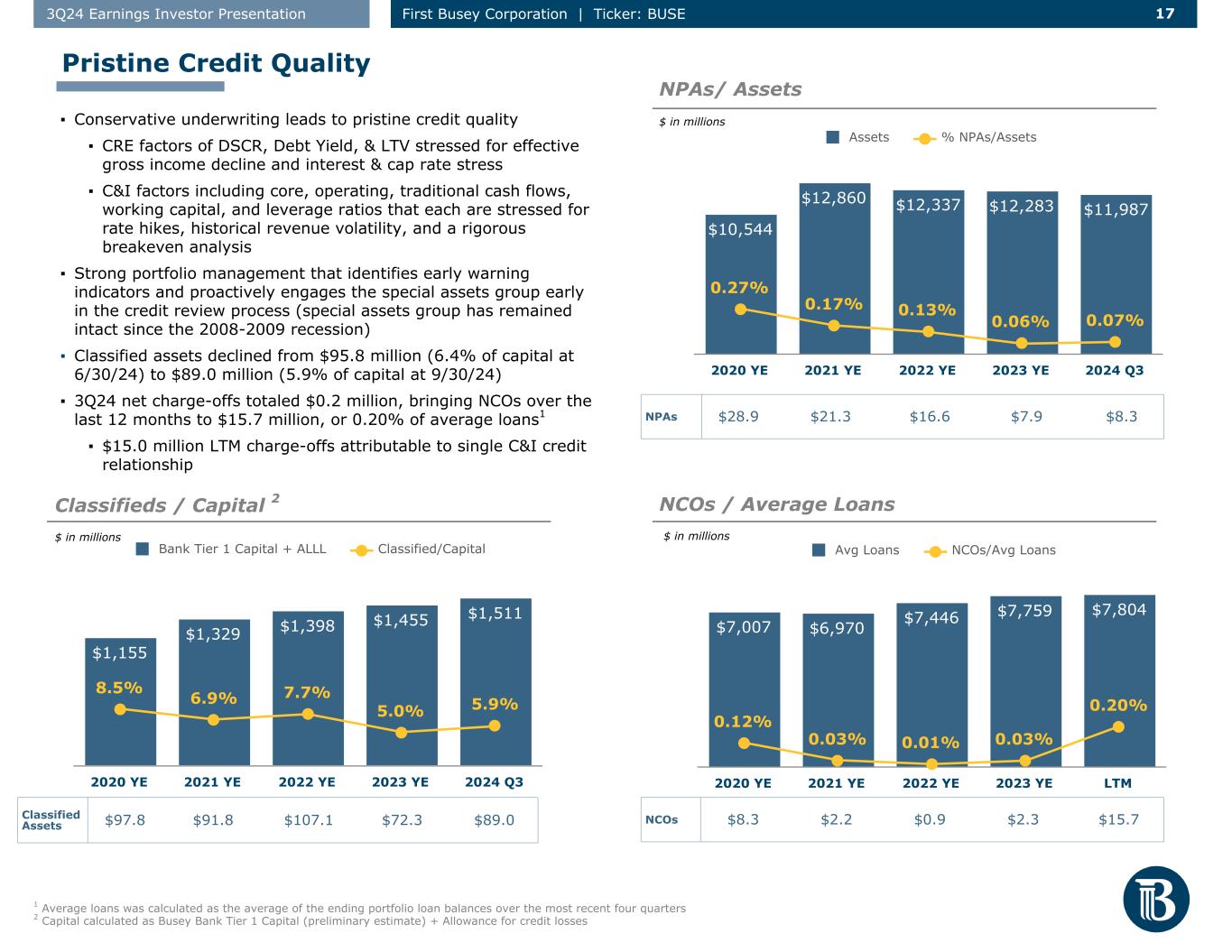

17 173Q24 Earnings Investor Presentation First Busey Corporation | Ticker: BUSE $7,007 $6,970 $7,446 $7,759 $7,804 0.12% 0.03% 0.01% 0.03% 0.20% Avg Loans NCOs/Avg Loans 2020 YE 2021 YE 2022 YE 2023 YE LTM $1,155 $1,329 $1,398 $1,455 $1,511 8.5% 6.9% 7.7% 5.0% 5.9% Bank Tier 1 Capital + ALLL Classified/Capital 2020 YE 2021 YE 2022 YE 2023 YE 2024 Q3 ▪ Conservative underwriting leads to pristine credit quality ▪ CRE factors of DSCR, Debt Yield, & LTV stressed for effective gross income decline and interest & cap rate stress ▪ C&I factors including core, operating, traditional cash flows, working capital, and leverage ratios that each are stressed for rate hikes, historical revenue volatility, and a rigorous breakeven analysis ▪ Strong portfolio management that identifies early warning indicators and proactively engages the special assets group early in the credit review process (special assets group has remained intact since the 2008-2009 recession) ▪ Classified assets declined from $95.8 million (6.4% of capital at 6/30/24) to $89.0 million (5.9% of capital at 9/30/24) ▪ 3Q24 net charge-offs totaled $0.2 million, bringing NCOs over the last 12 months to $15.7 million, or 0.20% of average loans1 ▪ $15.0 million LTM charge-offs attributable to single C&I credit relationship 1 Average loans was calculated as the average of the ending portfolio loan balances over the most recent four quarters 2 Capital calculated as Busey Bank Tier 1 Capital (preliminary estimate) + Allowance for credit losses Pristine Credit Quality NPAs/ Assets Classifieds / Capital 2 NCOs / Average Loans $10,544 $12,860 $12,337 $12,283 $11,987 0.27% 0.17% 0.13% 0.06% 0.07% Assets % NPAs/Assets 2020 YE 2021 YE 2022 YE 2023 YE 2024 Q3 $ in millions $ in millions $ in millions NPAs $28.9 $21.3 $16.6 $7.9 $8.3 NCOs $8.3 $2.2 $0.9 $2.3 $15.7Classified Assets $97.8 $91.8 $107.1 $72.3 $89.0

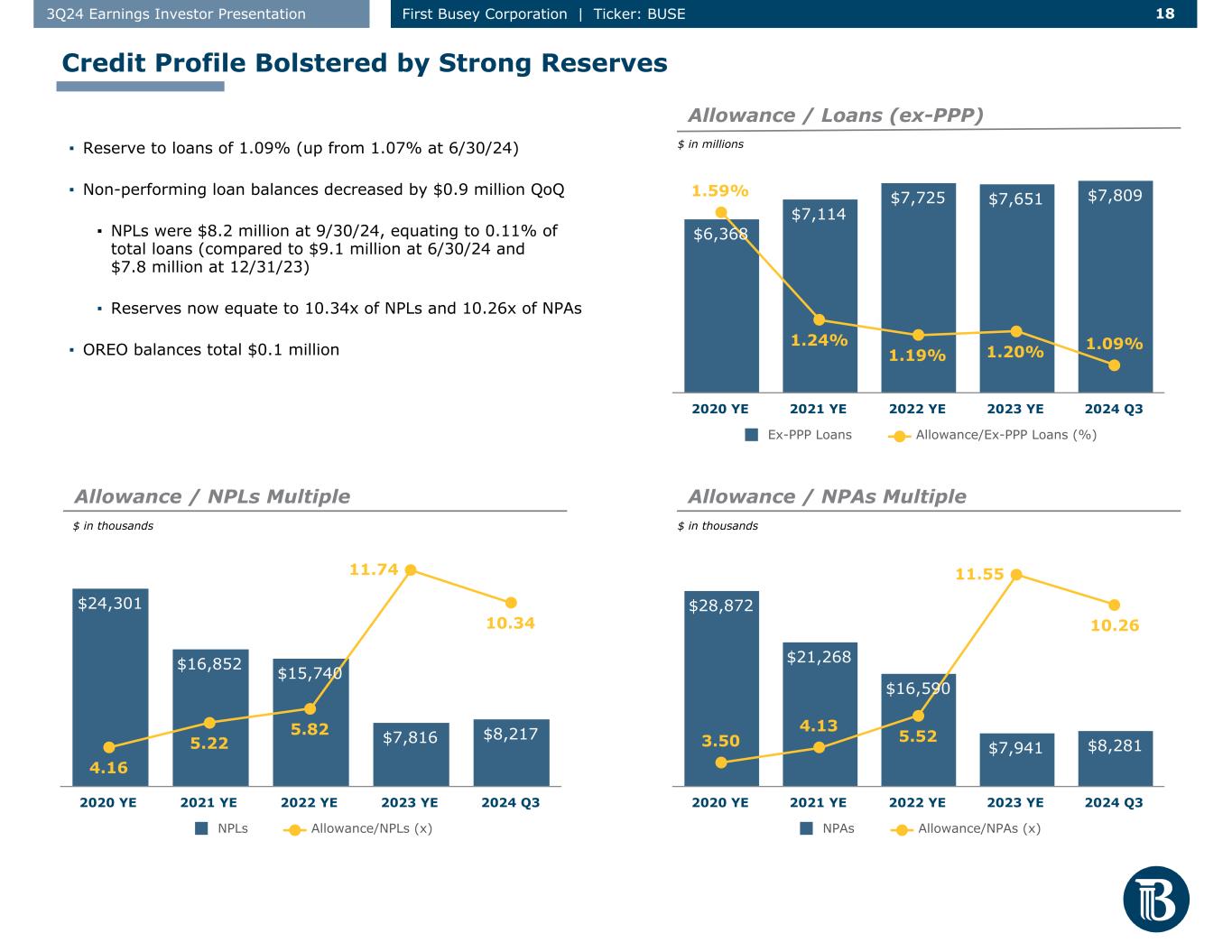

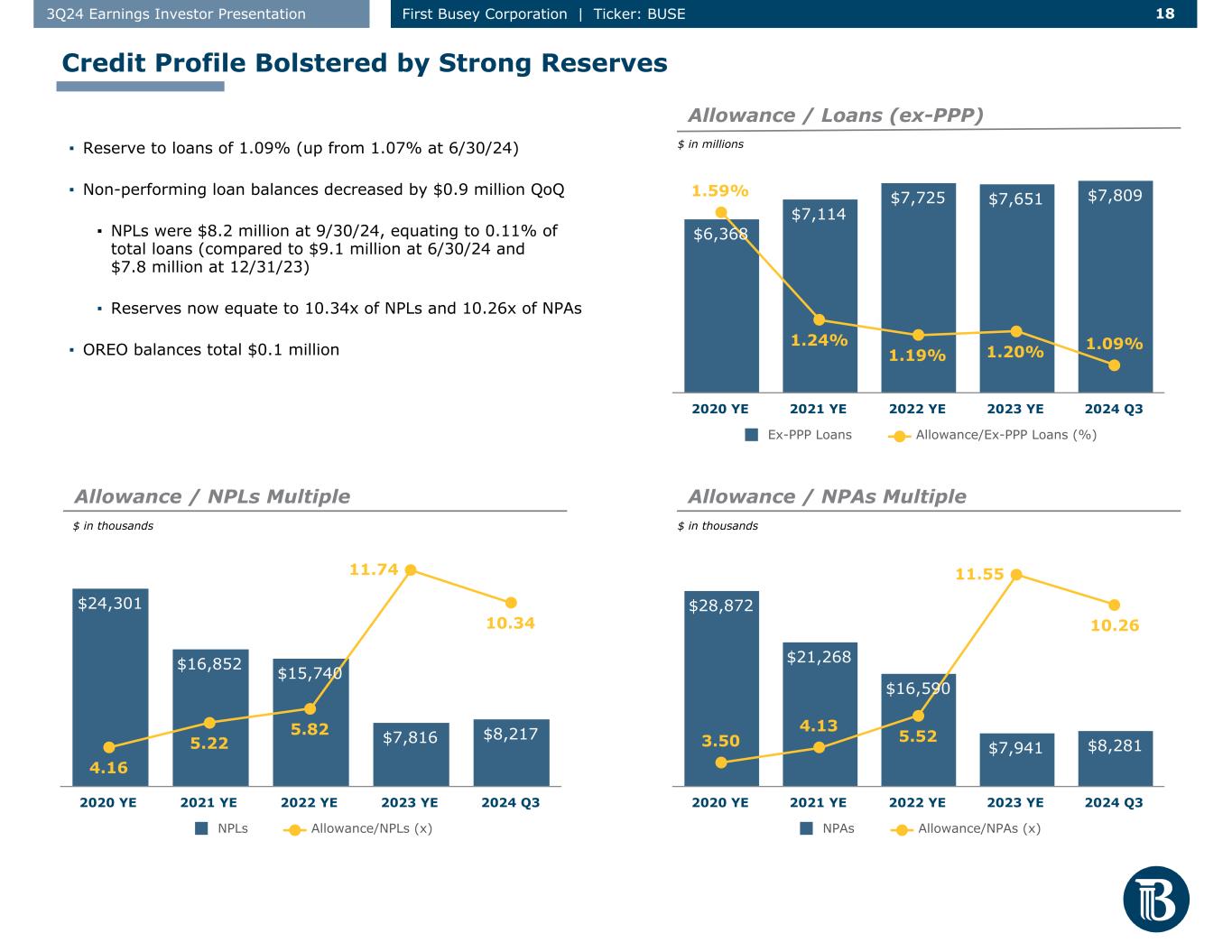

18 183Q24 Earnings Investor Presentation First Busey Corporation | Ticker: BUSE $6,368 $7,114 $7,725 $7,651 $7,8091.59% 1.24% 1.19% 1.20% 1.09% Ex-PPP Loans Allowance/Ex-PPP Loans (%) 2020 YE 2021 YE 2022 YE 2023 YE 2024 Q3 $24,301 $16,852 $15,740 $7,816 $8,217 4.16 5.22 5.82 11.74 10.34 NPLs Allowance/NPLs (x) 2020 YE 2021 YE 2022 YE 2023 YE 2024 Q3 $28,872 $21,268 $16,590 $7,941 $8,2813.50 4.13 5.52 11.55 10.26 NPAs Allowance/NPAs (x) 2020 YE 2021 YE 2022 YE 2023 YE 2024 Q3 ▪ Reserve to loans of 1.09% (up from 1.07% at 6/30/24) ▪ Non-performing loan balances decreased by $0.9 million QoQ ▪ NPLs were $8.2 million at 9/30/24, equating to 0.11% of total loans (compared to $9.1 million at 6/30/24 and $7.8 million at 12/31/23) ▪ Reserves now equate to 10.34x of NPLs and 10.26x of NPAs ▪ OREO balances total $0.1 million Credit Profile Bolstered by Strong Reserves Allowance / Loans (ex-PPP) Allowance / NPLs Multiple Allowance / NPAs Multiple $ in millions $ in thousands$ in thousands

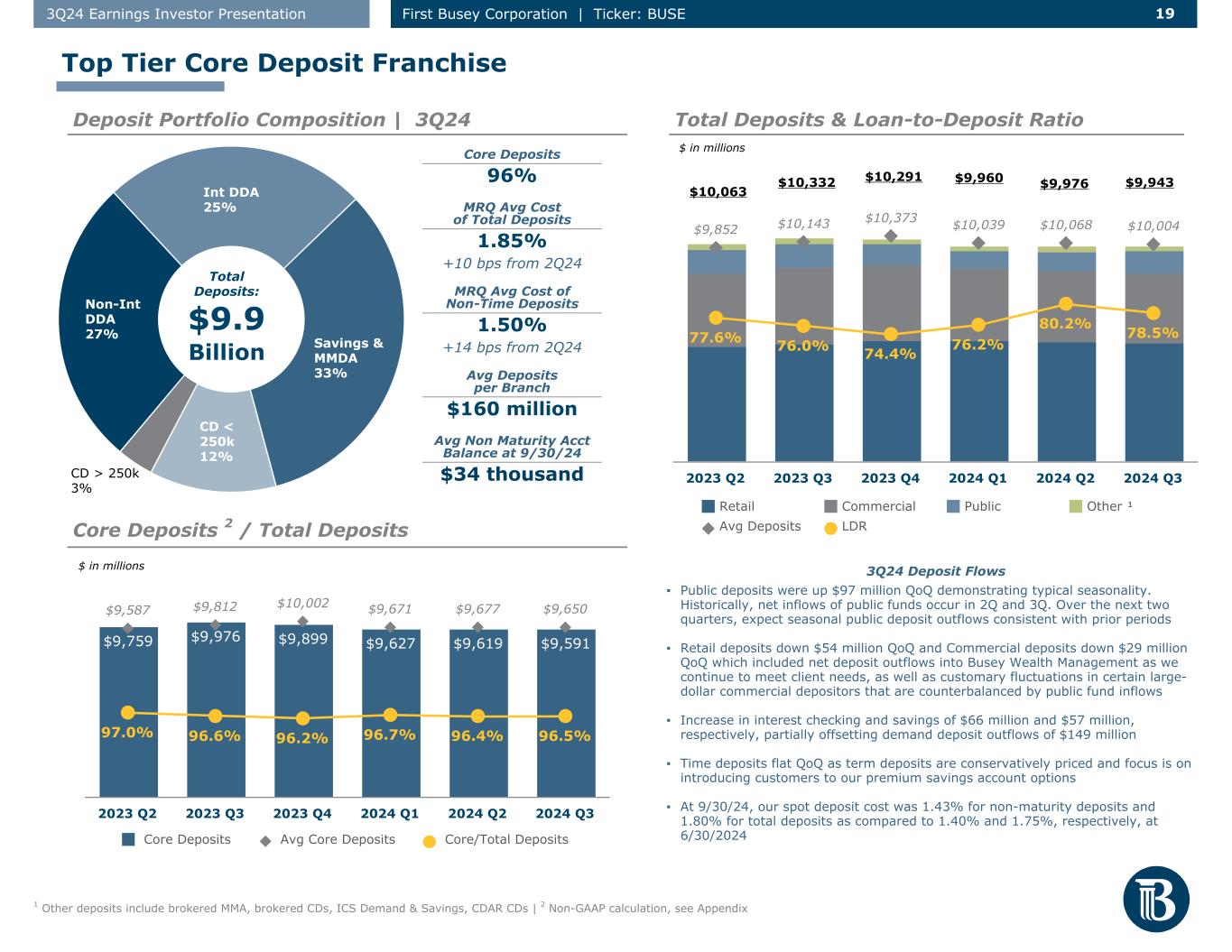

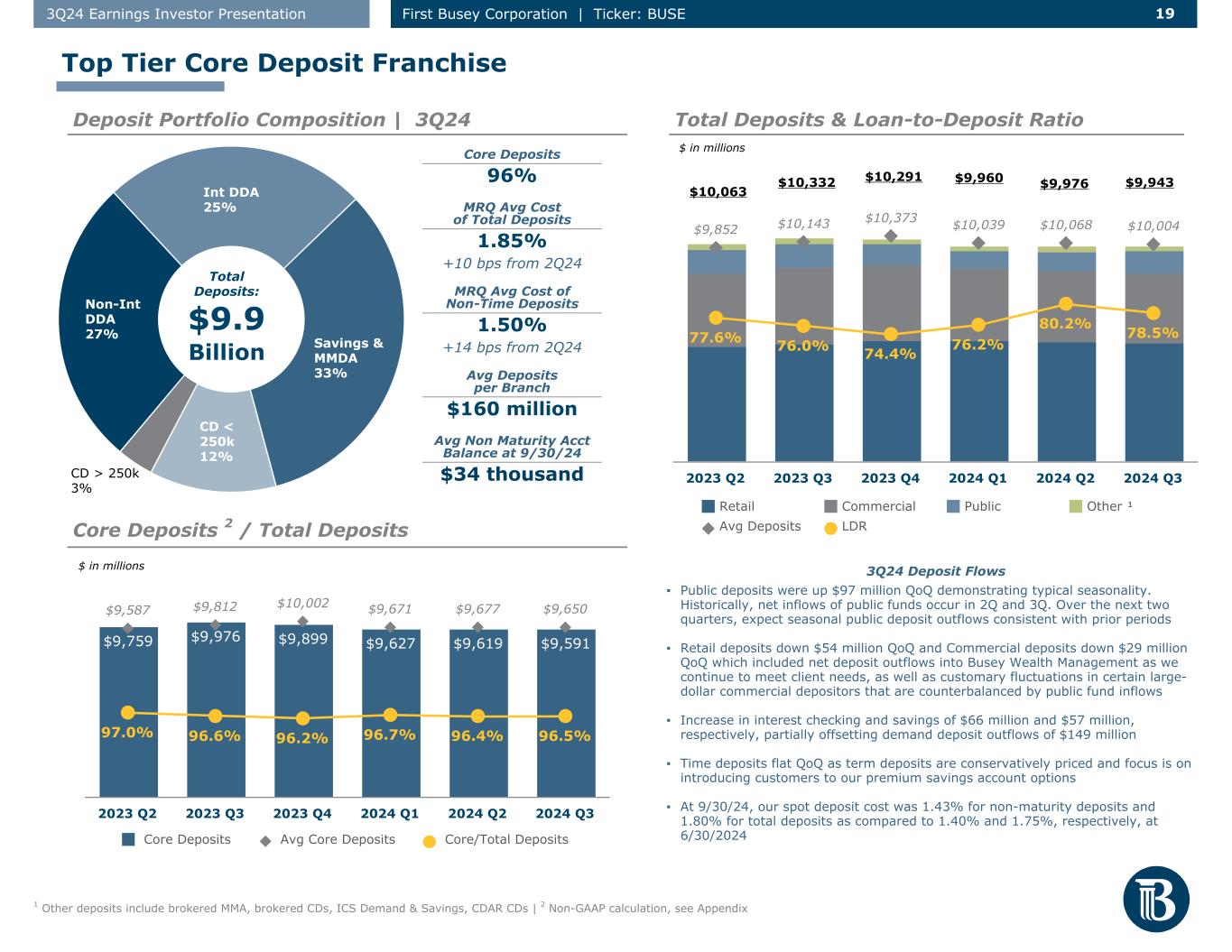

19 193Q24 Earnings Investor Presentation First Busey Corporation | Ticker: BUSE 1 Other deposits include brokered MMA, brokered CDs, ICS Demand & Savings, CDAR CDs | 2 Non-GAAP calculation, see Appendix 3Q24 Deposit Flows ▪ Public deposits were up $97 million QoQ demonstrating typical seasonality. Historically, net inflows of public funds occur in 2Q and 3Q. Over the next two quarters, expect seasonal public deposit outflows consistent with prior periods ▪ Retail deposits down $54 million QoQ and Commercial deposits down $29 million QoQ which included net deposit outflows into Busey Wealth Management as we continue to meet client needs, as well as customary fluctuations in certain large- dollar commercial depositors that are counterbalanced by public fund inflows ▪ Increase in interest checking and savings of $66 million and $57 million, respectively, partially offsetting demand deposit outflows of $149 million ▪ Time deposits flat QoQ as term deposits are conservatively priced and focus is on introducing customers to our premium savings account options ▪ At 9/30/24, our spot deposit cost was 1.43% for non-maturity deposits and 1.80% for total deposits as compared to 1.40% and 1.75%, respectively, at 6/30/2024 Non-Int DDA 27% Int DDA 25% Savings & MMDA 33% CD < 250k 12% CD > 250k 3% Core Deposits 96% MRQ Avg Cost of Total Deposits 1.85% +10 bps from 2Q24 MRQ Avg Cost of Non-Time Deposits 1.50% +14 bps from 2Q24 Avg Deposits per Branch $160 million Avg Non Maturity Acct Balance at 9/30/24 $34 thousand Total Deposits: $9.9 Billion $9,852 $10,143 $10,373 $10,039 $10,068 $10,004 77.6% 76.0% 74.4% 76.2% 80.2% 78.5% Retail Commercial Public Other ¹ Avg Deposits LDR 2023 Q2 2023 Q3 2023 Q4 2024 Q1 2024 Q2 2024 Q3 $9,759 $9,976 $9,899 $9,627 $9,619 $9,591 $9,587 $9,812 $10,002 $9,671 $9,677 $9,650 97.0% 96.6% 96.2% 96.7% 96.4% 96.5% Core Deposits Avg Core Deposits Core/Total Deposits 2023 Q2 2023 Q3 2023 Q4 2024 Q1 2024 Q2 2024 Q3 $ in millions Top Tier Core Deposit Franchise Deposit Portfolio Composition | 3Q24 Total Deposits & Loan-to-Deposit Ratio Core Deposits 2 / Total Deposits $10,063 $10,332 $10,291 $9,960 $9,976 $9,943 $ in millions

20 203Q24 Earnings Investor Presentation First Busey Corporation | Ticker: BUSE $5,410 $3,584 $1,091 $247 $5,602 $3,482 $971 $236 $5,599 $3,333 $798 $230 $5,531 $3,288 $886 $271 $5,477 $3,259 $983 $223 9/30/23 12/31/23 3/31/24 6/30/24 9/30/24 Retail Commercial Public Other² 1 Estimated uninsured & uncollateralized deposits consists of the excess of accounts over $250K FDIC insurance limit, less internal accounts and fully-collateralized accounts (including preferred deposits) | 2 Other deposits include brokered MMA, brokered CDs, ICS Demand & Savings, CDAR CDs Customers with Account Balances totaling $250K+ Since 3/31/23, total deposits up -$389 million, or (3.8)% 2024 Q3 Number of customers 5,828 Median account balance $405 thousand Median customer tenure 14.2 years 2024 Q3 Estimated Uninsured & Uncollateralized Deposits1 $2.9 billion Estimated Uninsured & Uncollateralized Deposits1 / Total Deposits 29% As of 9/30/24 Retail Commercial Number of Accounts 253,000+ 33,000+ Avg Balance per Account $22 thousand $97 thousand Avg Customer Tenure 16.7 years 12.6 years Granular, Stable Deposit Base Long-tenured Deposit Relationships that are very granular Deposit Flows by Type

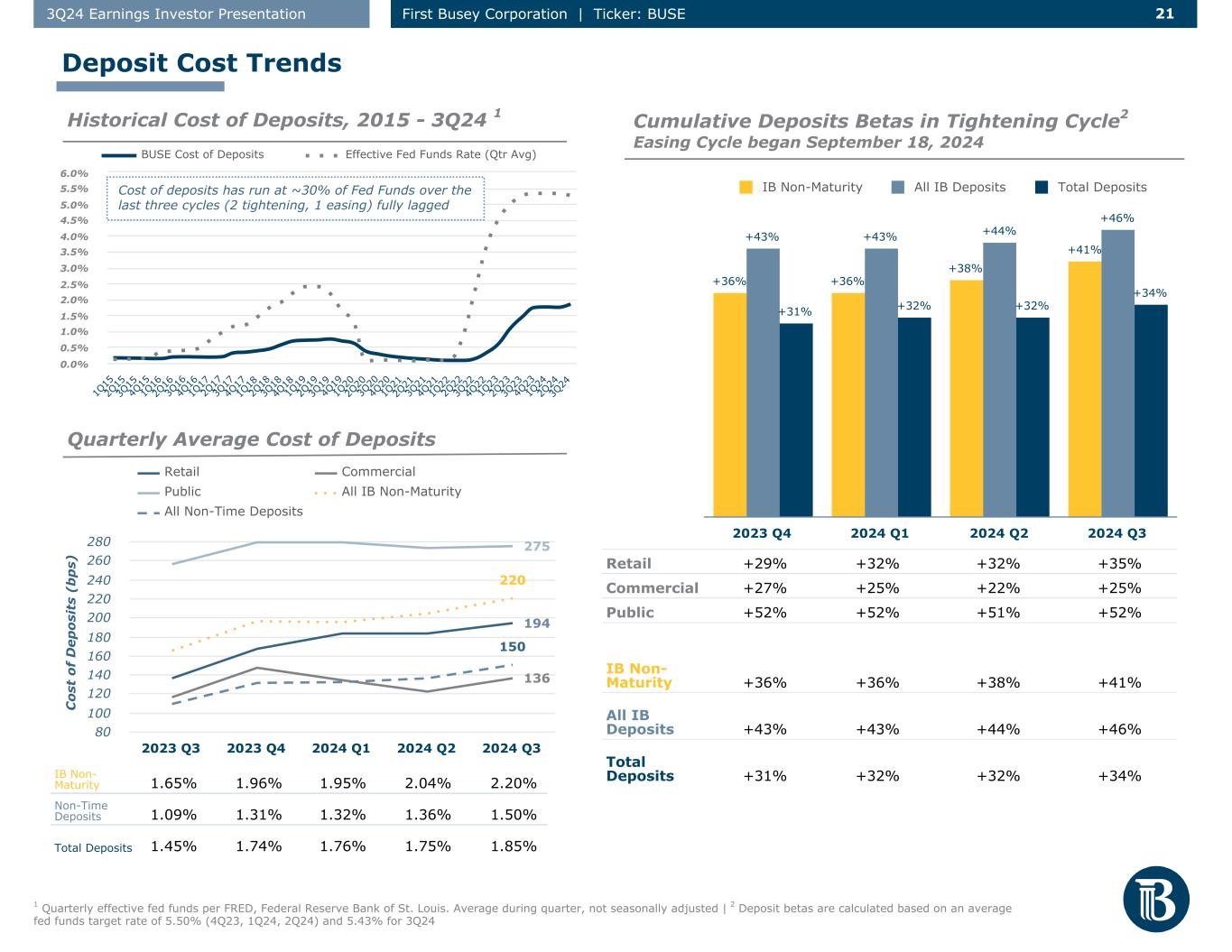

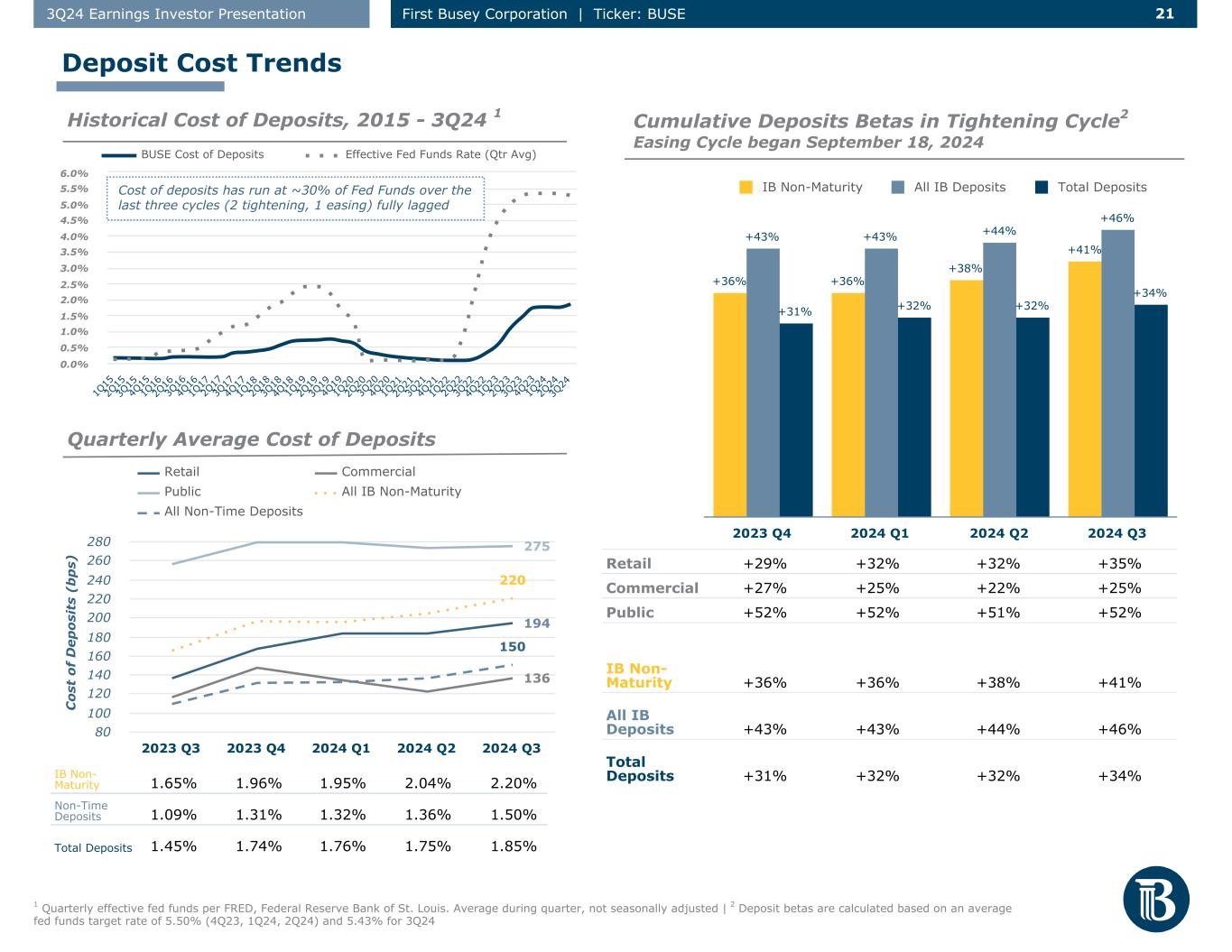

21 213Q24 Earnings Investor Presentation First Busey Corporation | Ticker: BUSE 1 Quarterly effective fed funds per FRED, Federal Reserve Bank of St. Louis. Average during quarter, not seasonally adjusted | 2 Deposit betas are calculated based on an average fed funds target rate of 5.50% (4Q23, 1Q24, 2Q24) and 5.43% for 3Q24 BUSE Cost of Deposits Effective Fed Funds Rate (Qtr Avg) 1Q 15 2Q 15 3Q 15 4Q 15 1Q 16 2Q 16 3Q 16 4Q 16 1Q 17 2Q 17 3Q 17 4Q 17 1Q 18 2Q 18 3Q 18 4Q 18 1Q 19 2Q 19 3Q 19 4Q 19 1Q 20 2Q 20 3Q 20 4Q 20 1Q 21 2Q 21 3Q 21 4Q 21 1Q 22 2Q 22 3Q 22 4Q 22 1Q 23 2Q 23 3Q 23 4Q 23 1Q 24 2Q 24 3Q 24 0.0% 0.5% 1.0% 1.5% 2.0% 2.5% 3.0% 3.5% 4.0% 4.5% 5.0% 5.5% 6.0% C os t of D ep os it s (b p s) 194 136 275 220 150 Retail Commercial Public All IB Non-Maturity All Non-Time Deposits 2023 Q3 2023 Q4 2024 Q1 2024 Q2 2024 Q3 80 100 120 140 160 180 200 220 240 260 280 +36% +36% +38% +41% +43% +43% +44% +46% +31% +32% +32% +34% IB Non-Maturity All IB Deposits Total Deposits 2023 Q4 2024 Q1 2024 Q2 2024 Q3 Retail +29% +32% +32% +35% Commercial +27% +25% +22% +25% Public +52% +52% +51% +52% IB Non- Maturity +36% +36% +38% +41% All IB Deposits +43% +43% +44% +46% Total Deposits +31% +32% +32% +34% Historical Cost of Deposits, 2015 - 3Q24 1 Cumulative Deposits Betas in Tightening Cycle2 Easing Cycle began September 18, 2024 Quarterly Average Cost of Deposits Deposit Cost Trends IB Non- Maturity 1.65% 1.96% 1.95% 2.04% 2.20% Non-Time Deposits 1.09% 1.31% 1.32% 1.36% 1.50% Total Deposits 1.45% 1.74% 1.76% 1.75% 1.85% Cost of deposits has run at ~30% of Fed Funds over the last three cycles (2 tightening, 1 easing) fully lagged

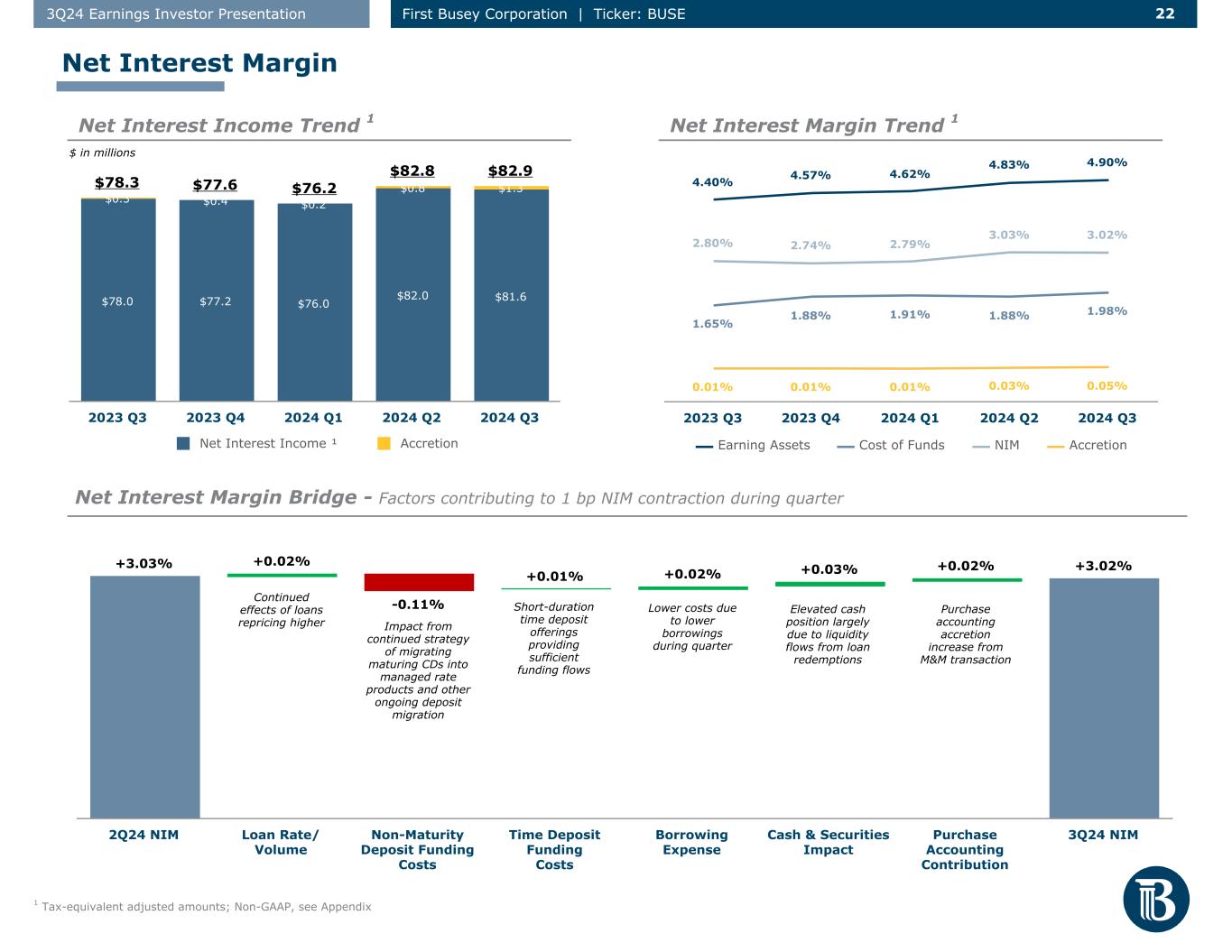

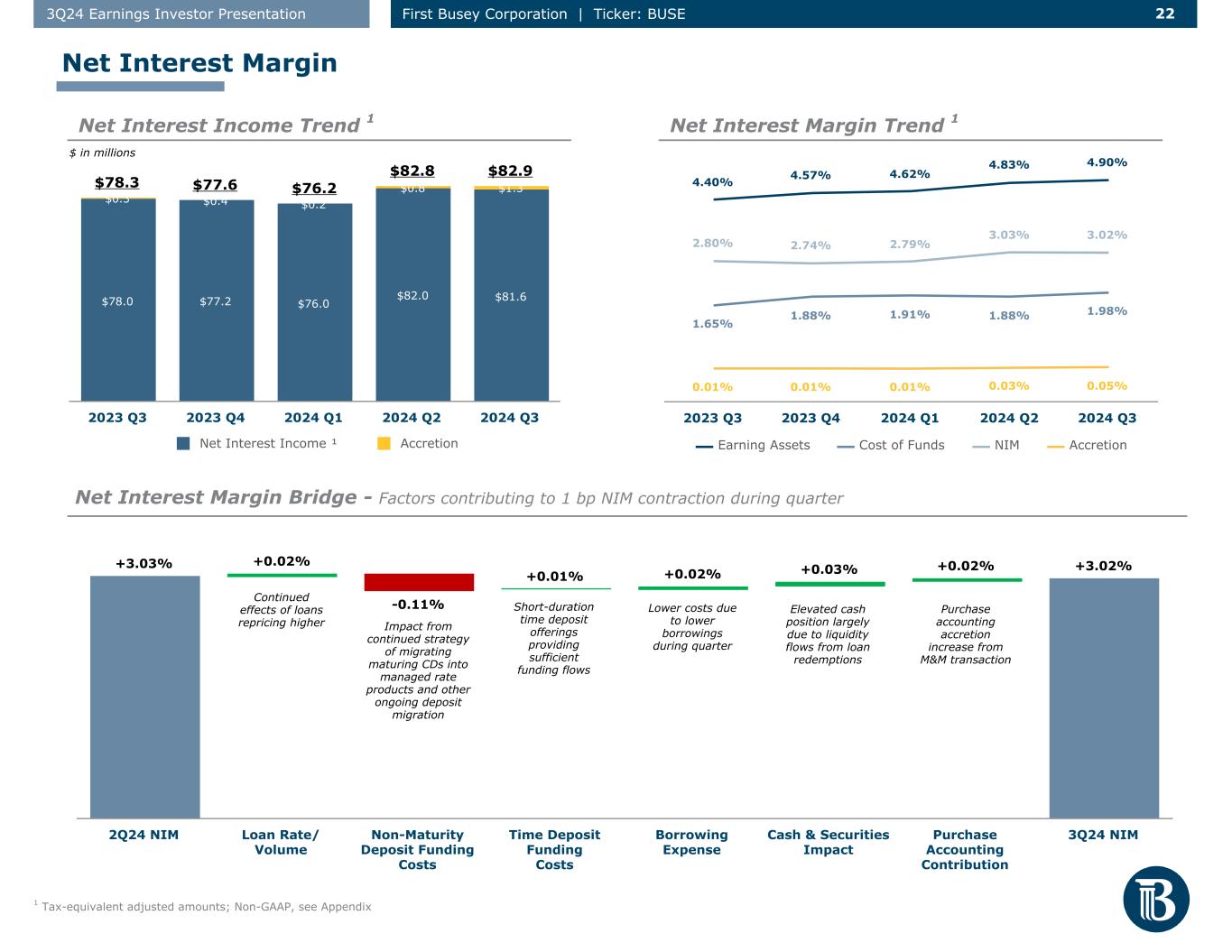

22 223Q24 Earnings Investor Presentation First Busey Corporation | Ticker: BUSE $78.3 $77.6 $76.2 $82.8 $82.9 $78.0 $77.2 $76.0 $82.0 $81.6 $0.3 $0.4 $0.2 $0.8 $1.3 Net Interest Income ¹ Accretion 2023 Q3 2023 Q4 2024 Q1 2024 Q2 2024 Q3 4.40% 4.57% 4.62% 4.83% 4.90% 1.65% 1.88% 1.91% 1.88% 1.98% 2.80% 2.74% 2.79% 3.03% 3.02% 0.01% 0.01% 0.01% 0.03% 0.05% Earning Assets Cost of Funds NIM Accretion 2023 Q3 2023 Q4 2024 Q1 2024 Q2 2024 Q3 +3.03% +0.02% -0.11% +0.01% +0.02% +0.03% +0.02% +3.02% 2Q24 NIM Loan Rate/ Volume Non-Maturity Deposit Funding Costs Time Deposit Funding Costs Borrowing Expense Cash & Securities Impact Purchase Accounting Contribution 3Q24 NIM 1 Tax-equivalent adjusted amounts; Non-GAAP, see Appendix $ in millions Continued effects of loans repricing higher Impact from continued strategy of migrating maturing CDs into managed rate products and other ongoing deposit migration Short-duration time deposit offerings providing sufficient funding flows Net Interest Margin Bridge - Factors contributing to 1 bp NIM contraction during quarter Net Interest Margin Trend 1Net Interest Income Trend 1 Net Interest Margin Elevated cash position largely due to liquidity flows from loan redemptions Purchase accounting accretion increase from M&M transaction Lower costs due to lower borrowings during quarter

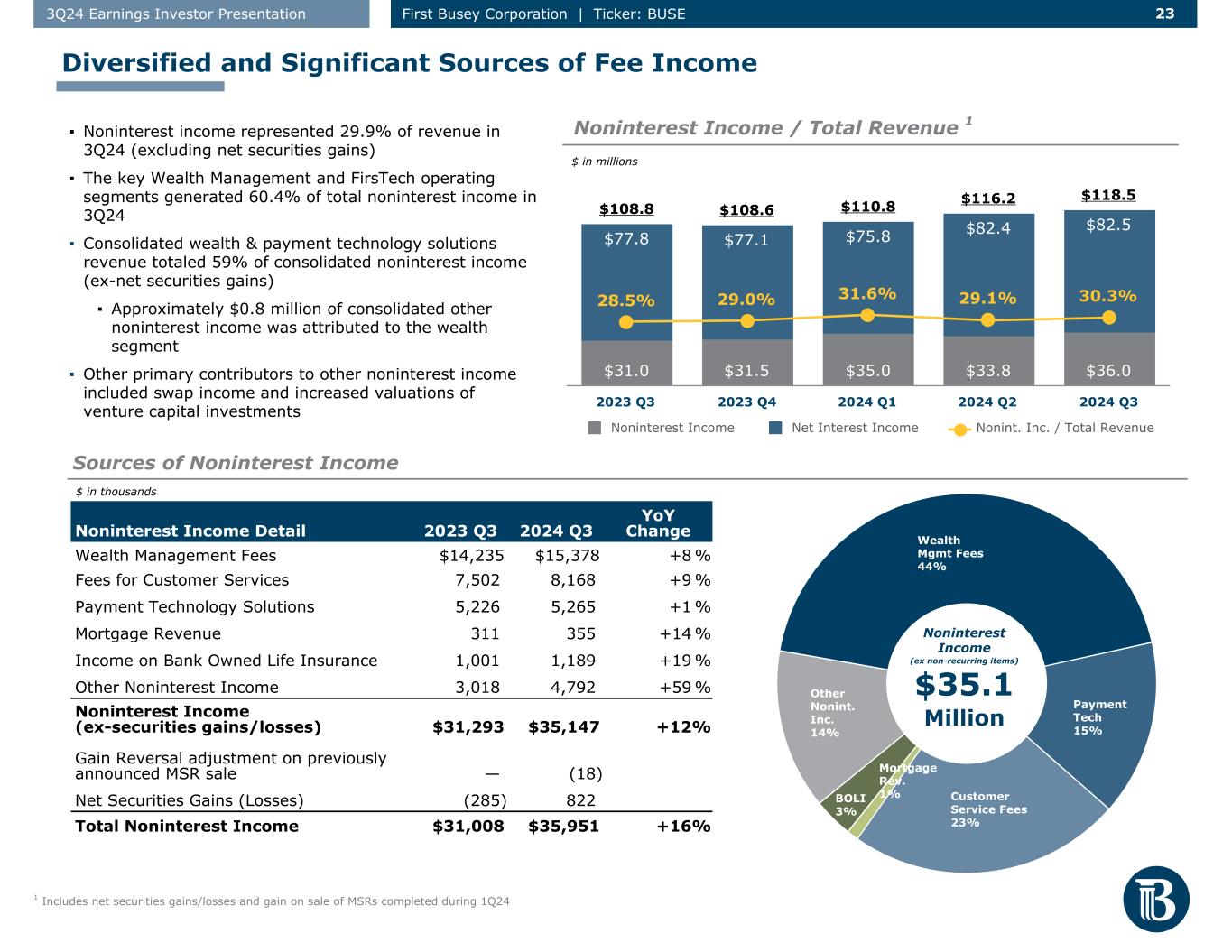

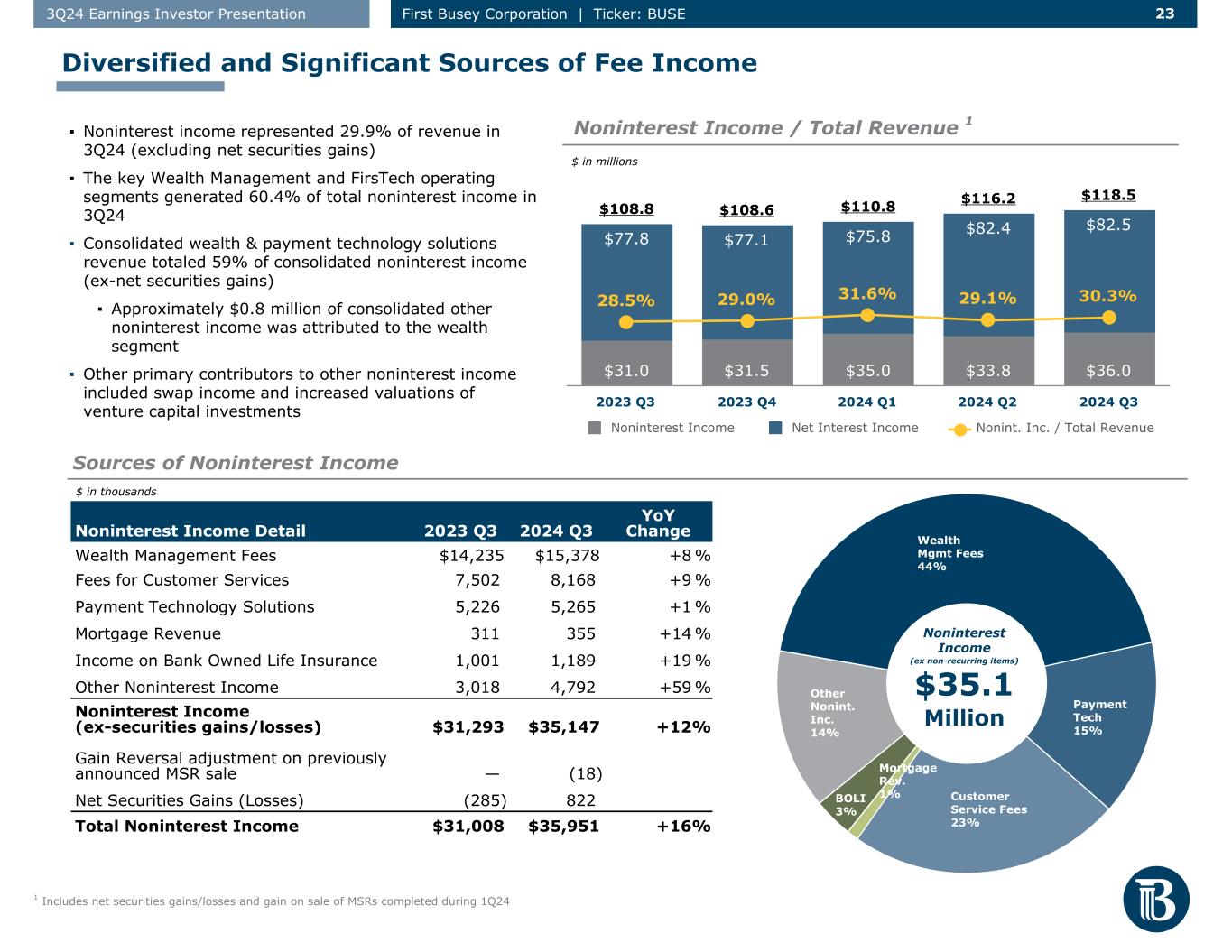

23 233Q24 Earnings Investor Presentation First Busey Corporation | Ticker: BUSE ▪ Noninterest income represented 29.9% of revenue in 3Q24 (excluding net securities gains) ▪ The key Wealth Management and FirsTech operating segments generated 60.4% of total noninterest income in 3Q24 ▪ Consolidated wealth & payment technology solutions revenue totaled 59% of consolidated noninterest income (ex-net securities gains) ▪ Approximately $0.8 million of consolidated other noninterest income was attributed to the wealth segment ▪ Other primary contributors to other noninterest income included swap income and increased valuations of venture capital investments 1 Includes net securities gains/losses and gain on sale of MSRs completed during 1Q24 $108.8 $108.6 $110.8 $116.2 $118.5 $31.0 $31.5 $35.0 $33.8 $36.0 $77.8 $77.1 $75.8 $82.4 $82.5 28.5% 29.0% 31.6% 29.1% 30.3% Noninterest Income Net Interest Income Nonint. Inc. / Total Revenue 2023 Q3 2023 Q4 2024 Q1 2024 Q2 2024 Q3 $ in millions Noninterest Income Detail 2023 Q3 2024 Q3 YoY Change Wealth Management Fees $14,235 $15,378 +8 % Fees for Customer Services 7,502 8,168 +9 % Payment Technology Solutions 5,226 5,265 +1 % Mortgage Revenue 311 355 +14 % Income on Bank Owned Life Insurance 1,001 1,189 +19 % Other Noninterest Income 3,018 4,792 +59 % Noninterest Income (ex-securities gains/losses) $31,293 $35,147 +12 % Gain Reversal adjustment on previously announced MSR sale — (18) Net Securities Gains (Losses) (285) 822 Total Noninterest Income $31,008 $35,951 +16 % $ in thousands Wealth Mgmt Fees 44% Payment Tech 15% Customer Service Fees 23% Mortgage Rev. 1%BOLI 3% Other Nonint. Inc. 14% Noninterest Income (ex non-recurring items) $35.1 Million Noninterest Income / Total Revenue 1 Sources of Noninterest Income Diversified and Significant Sources of Fee Income

24 243Q24 Earnings Investor Presentation First Busey Corporation | Ticker: BUSE $14.4 $13.8 $15.7 $16.1 $16.2 $6.3 $5.6 $6.6 $7.3 $7.4 43.8% 40.3% 41.9% 45.4% 45.7% Revenue Pre-Tax Net Income Pre-Tax Profit Margin 2023 Q3 2023 Q4 2024 Q1 2024 Q2 2024 Q3 $11,548 $12,137 $12,763 $13,020 $13,690 2023 Q3 2023 Q4 2024 Q1 2024 Q2 2024 Q3 ▪ Assets Under Care (AUC) of $13.7 billion, a QoQ increase of $0.7 billion and a YoY increase of $2.1 billion, or +18.6% ▪ 3Q24 Wealth segment revenue of $16.2 million, representing record quarterly revenue in company history, a YoY increase of +12.7% ▪ Pre-tax net income of $7.4 million, a YoY increase of +17.5% ▪ Pre-tax profit margin of 45.7% in 3Q24 and 43.4% over the last twelve months ▪ Our fully internalized investment team continues to produce excellent returns, focused on long-term outperformance of benchmarks ▪ The team’s blended portfolio has outperformed the blended benchmark2 over the last 3 years and over the last 5 years ▪ Bank + Wealth partnership allows us to better keep customer funds inside our overall ecosystem depending on client needs 1 Wealth Management segment | 2 Blended benchmark consists of 60% MSCI All-Country World Index / 40% Bloomberg Intermediate Govt/Credit Index $ in millions $ in millions Wealth Management Assets Under Care Wealth - Revenue and Pre-tax Income 1 $14.4 $13.8 $15.7 $16.1 $16.2 Trust Brokerage Tax Planning Estate Settlement Ag Services Other 2023 Q3 2023 Q4 2024 Q1 2024 Q2 2024 Q3 Wealth Revenue Composition 1 $ in millions

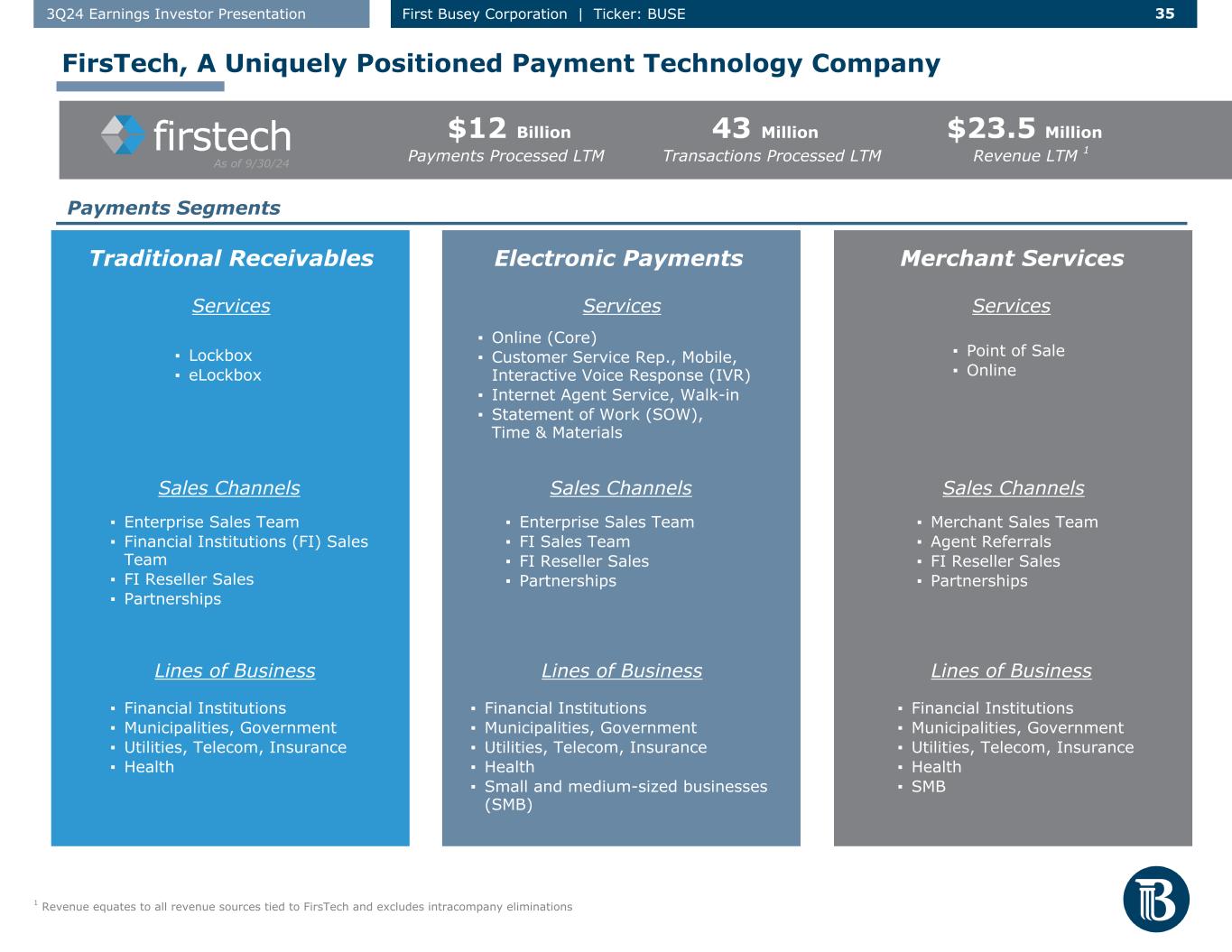

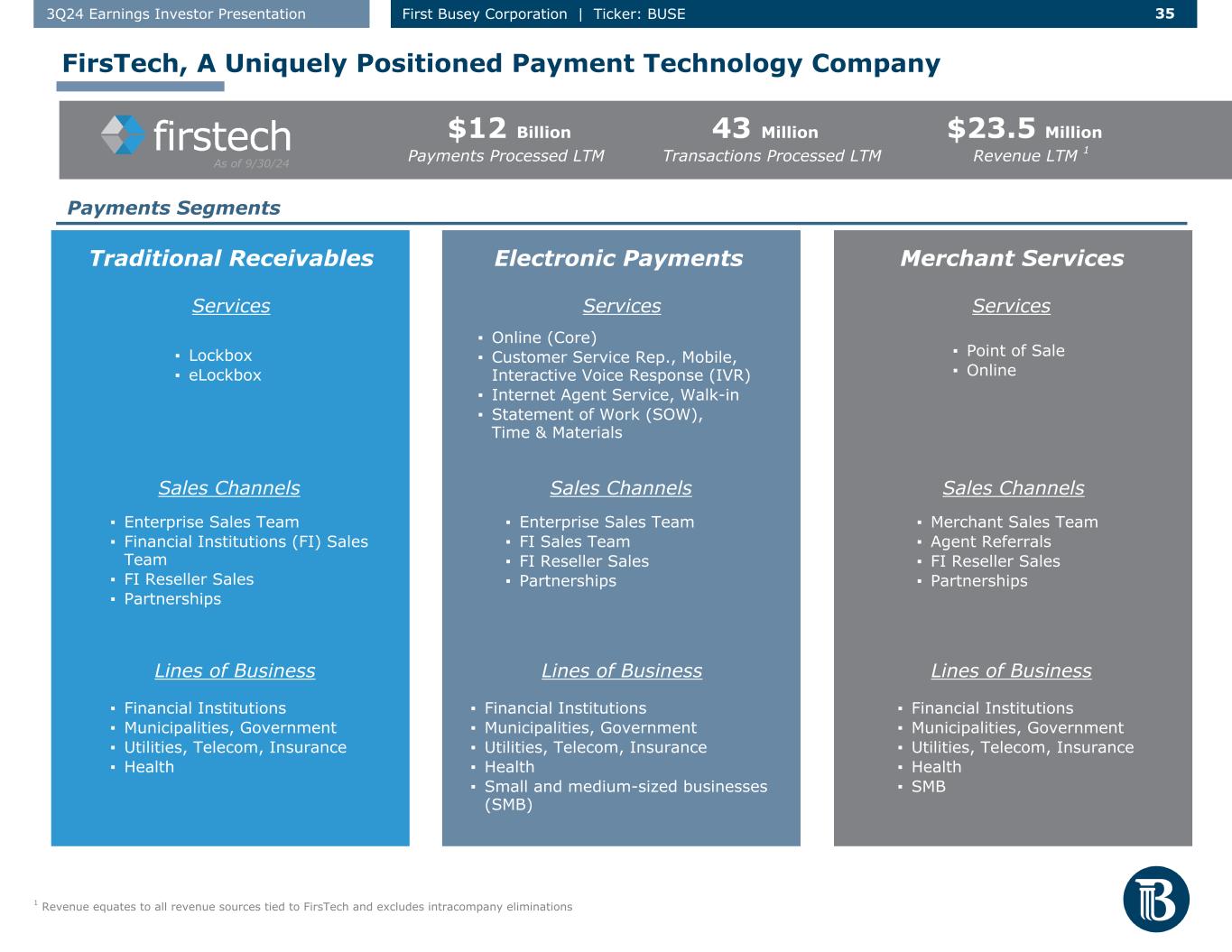

25 253Q24 Earnings Investor Presentation First Busey Corporation | Ticker: BUSE ▪ LTM segment revenue of $23.5 million, an increase of 5% over the prior twelve-month period ▪ 3Q24 segment revenue of $5.6 million ▪ 3Q24 revenue down 2% vs. 3Q23 ▪ Decrease primarily due to the deconversion of online payment services with one client that was anticipated ▪ Key competencies of traditional receivables, merchant services, and online payments will continue to be key drivers of growth Revenue Growth 1 $23.5 million LTM 9/30/24 +5.1%$22.4 million LTM 9/30/23 Transactions processed in last twelve months 43 million $12 billion Payments processed in last twelve months Average Revenue Per Processing Day Trend $78.5K $78.2K $87.5K $84.0K $87.2K $88.3K $91.5K $89.1K $89.9K $93.4K $96.3K $98.1K $86.7K 2021 Q3 2021 Q4 2022 Q1 2022 Q2 2022 Q3 2022 Q4 2023 Q1 2023 Q2 2023 Q3 2023 Q4 2024 Q1 2024 Q2 2024 Q3 +3% 3-Year CAGR FirsTech 1 Revenue equates to all revenue sources tied to FirsTech and excludes intracompany eliminations ▪ Two largest deals in FirsTech history signed within the past year (including one client which will start generating revenue during 4Q24) ▪ During 3Q24, opened processing site in Glenview, IL to support scale in Chicagoland ▪ 41% revenue growth from 3Q23 to 3Q24 ▪ Serving over 1,000 merchant accounts ▪ High referral rate from Busey Bank and successful partnerships closed with existing commercial customers ▪ Recent launch of new consumer focused payment platform has driven refreshed client interest ▪ Sales team rebuilt during 2024 has been seeing recent contract signing success along with an increasing pipeline for 2025 Traditional Receivables Merchant Processing Online Payments

26 263Q24 Earnings Investor Presentation First Busey Corporation | Ticker: BUSE $3,409 $3,217 $3,018 $2,937 $2,859 $2,526 $2,344 $2,156 $2,086 $2,020 $883 $873 $862 $851 $839 2.67% 2.71% 2.75% 2.73% 2.70% Amortized Cost AFS Amortized Cost HTM Tax Equivalent Yield 2023 Q3 2023 Q4 2024 Q1 2024 Q2 2024 Q3 ▪ Carrying value of investment portfolio is 24% of total assets ▪ BUSE carried $839 million in held-to-maturity (HTM) securities as of 9/30/24 (HTM AOCI of -$23 million at 9/30/24) ▪ The duration of the securities portfolio including HTM is 3.9 years and our fair value duration, which excludes the HTM portfolio, is 3.6 years ▪ After-tax net AFS unrealized loss position of $137 million and accumulated loss position of $11 million on cash flow hedges (captured in total AOCI) ▪ Projected roll off cash flow (based on static rates) of $97 million at ~2.18% yield for the remainder of 2024 and $374 million at ~1.65% yield for 2025 ▪ Over the last four quarters, the size of the investment portfolio has decreased by $550 million due to strategic restructuring actions and principal roll off Balanced, Low-Risk, Short Duration Investment Portfolio Securities Portfolio - Amortized Cost vs. TE Yield Investment Portfolio Composition | 3Q24 ■All Mortgage-Backed Securities & Collateralized Mortgage Obligations are Agency ■92% of Municipal holdings rated AA or better and 8% rated A ■99% of Corporate holdings are investment grade ■Collateralized Loan Obligation portfolio consists of 86% rated AAA and 14% rated AA Municipals 6% CMOs 33% Residential MBS 22% Commercial MBS 19% CLOs 14% Corporate 6% Total Securities (Amortized Cost): $2.9 Billion $ in millions AFS % of Amortized Cost 71% HTM % of Amortized Cost 29%

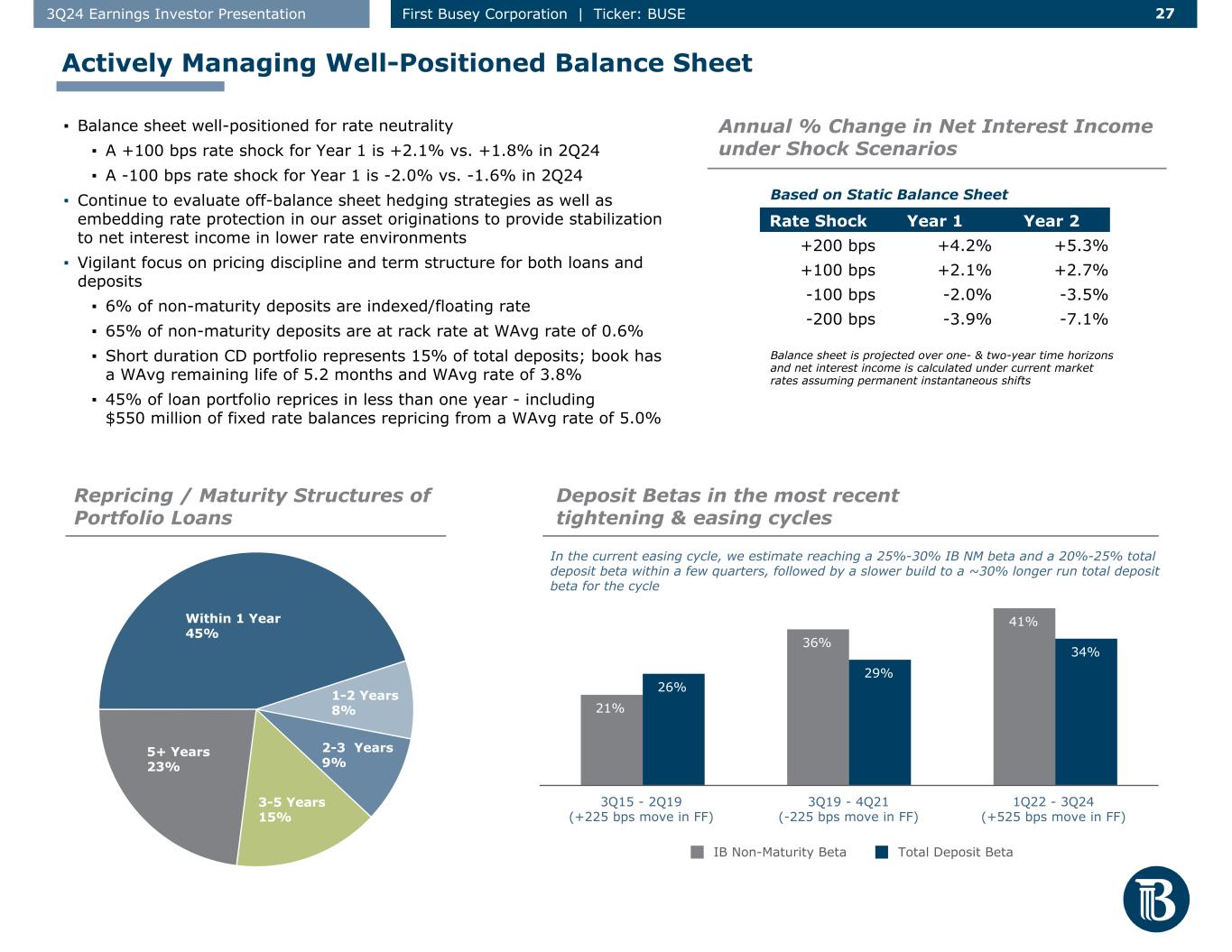

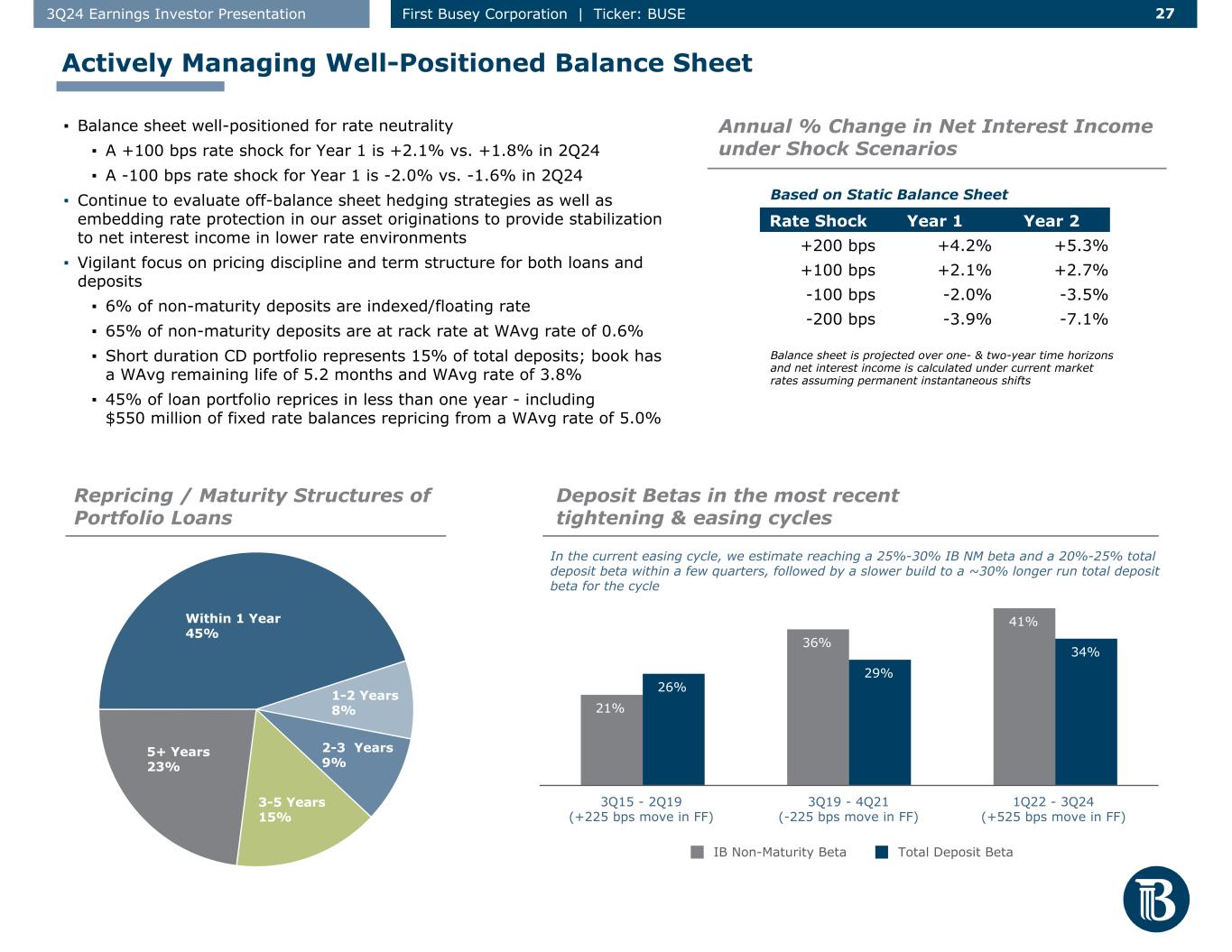

27 273Q24 Earnings Investor Presentation First Busey Corporation | Ticker: BUSE ▪ Balance sheet well-positioned for rate neutrality ▪ A +100 bps rate shock for Year 1 is +2.1% vs. +1.8% in 2Q24 ▪ A -100 bps rate shock for Year 1 is -2.0% vs. -1.6% in 2Q24 ▪ Continue to evaluate off-balance sheet hedging strategies as well as embedding rate protection in our asset originations to provide stabilization to net interest income in lower rate environments ▪ Vigilant focus on pricing discipline and term structure for both loans and deposits ▪ 6% of non-maturity deposits are indexed/floating rate ▪ 65% of non-maturity deposits are at rack rate at WAvg rate of 0.6% ▪ Short duration CD portfolio represents 15% of total deposits; book has a WAvg remaining life of 5.2 months and WAvg rate of 3.8% ▪ 45% of loan portfolio reprices in less than one year - including $550 million of fixed rate balances repricing from a WAvg rate of 5.0% Balance sheet is projected over one- & two-year time horizons and net interest income is calculated under current market rates assuming permanent instantaneous shifts Actively Managing Well-Positioned Balance Sheet Annual % Change in Net Interest Income under Shock Scenarios Repricing / Maturity Structures of Portfolio Loans Deposit Betas in the most recent tightening & easing cycles Rate Shock Year 1 Year 2 +200 bps +4.2 % +5.3 % +100 bps +2.1 % +2.7 % -100 bps -2.0 % -3.5 % -200 bps -3.9 % -7.1 % Within 1 Year 45% 1-2 Years 8% 2-3 Years 9% 3-5 Years 15% 5+ Years 23% 21% 36% 41% 26% 29% 34% IB Non-Maturity Beta Total Deposit Beta 3Q15 - 2Q19 (+225 bps move in FF) 3Q19 - 4Q21 (-225 bps move in FF) 1Q22 - 3Q24 (+525 bps move in FF) ALCO Model Forecast - Peak NM Deposits Beta, 46% ALCO Model Forecast - Peak Total Deposits Beta, 35% Based on Static Balance Sheet In the current easing cycle, we estimate reaching a 25%-30% IB NM beta and a 20%-25% total deposit beta within a few quarters, followed by a slower build to a ~30% longer run total deposit beta for the cycle Easing Cycle Beta

28 283Q24 Earnings Investor Presentation First Busey Corporation | Ticker: BUSE Note: Certain totals above may not tie exactly due to rounding. Detail amounts can be found in Non-GAAP table within Appendix 1 Non-GAAP, see Appendix ▪ Adjusted core expenses1 of $71.0 million in 3Q24 ▪ Non-operating other expenses during 3Q24 were comprised of $1.9 million related to acquisition & restructuring related expenses (announced CrossFirst Bankshares transaction on 8/27/24 and M&M Bank was merged into Busey Bank on 6/21/24) ▪ Quarterly pre-tax expense synergies from the M&M acquisition are anticipated to be $1.6 to $1.7 million per quarter when fully realized. Full quarterly run-rate savings are projected to be achieved by 1Q25. During 3Q24, we achieved approximately 79% of the full quarterly savings ▪ Continue to be mindful and diligent on expenses, restricting new hires by targeting critical replacements and selective adds ▪ Adopted accounting standard update 2023-02 on 1/1/24 and began recording amortization of New Markets Tax Credits as income tax expense instead of other operating expense, which resulted in a decrease to other operating expenses of $2.3 million compared to 4Q23 ▪ $7.2 million of average earning assets per employee for 3Q24 Full-Time Equivalents (FTE) $70.9 $75.0 $70.8 $75.5 $75.9 62.3% 63.0% 61.7% 60.6% 60.5%60.2% 60.1% 62.3% 60.9% 60.2% Expenses ex-Acq. Acq./Restructuring Exp. Adj. Efficiency Ratio¹ Adj. Core Efficiency Ratio¹ 2023 Q3 2023 Q4 2024 Q1 2024 Q2 2024 Q3 $ in millions 1,346 1,463 1,497 1,479 1,510 2020 YE 2021 YE 2022 YE 2023 YE 2024 Q3 Noninterest Exp. $70.9 $75.0 $70.8 $75.5 $75.9 Intangible Amort. $2.6 $2.5 $2.4 $2.6 $2.5 Acq./Restructuring Exp. $0.1 $4.2 $0.4 $2.2 $1.9 Adj. Exp. 1 $68.3 $68.3 $68.0 $70.7 $71.4 Unfunded Provision $0.0 $0.8 -$0.7 -$0.4 $0.4 NMTC Amort. $2.3 $2.3 $0.0 $0.0 $0.0 Adj. Core Exp. 1 $66.0 $65.2 $68.6 $71.1 $71.0 Noninterest Expense Focused Control on Expenses

29 293Q24 Earnings Investor Presentation First Busey Corporation | Ticker: BUSE Tangible Common Equity 1 & CET1 Ratios 2 1 Non-GAAP calculation, see Appendix | 2 3Q24 capital ratios are preliminary estimates $841 $925 $938 $971 $1,042 7.1% 7.8% 8.1% 8.4% 9.0% 12.5% 13.1% 13.4% 13.2% 13.8% TCE TCE Ratio CET1 Ratio 2023 Q3 2023 Q4 2024 Q1 2024 Q2 2024 Q3 $1,528 $1,540 $1,556 $1,589 $1,610 $914 $883 $868 $908 $885 $614 $657 $689 $681 $725 16.7% 17.4% 17.9% 17.5% 18.2% 10.0% Well Cap Min Excess over Min Total Capital Ratio Min Ratio 2023 Q3 2023 Q4 2024 Q1 2024 Q2 2024 Q3 $1,218 $1,230 $1,241 $1,275 $1,297 10.1% 10.1% 10.5% 10.7% 11.0% 4.0% Tier 1 Capital Leverage Ratio Min Ratio 2023 Q3 2023 Q4 2024 Q1 2024 Q2 2024 Q3 $ in millions Common Equity Tier 1 Ratio Tier 1 Capital Ratio Total Capital Ratio Capital Ratio 13.8 % 14.6 % 18.2 % Minimum Well Capitalized Ratio 6.5 % 8.0 % 10.0 % Amount of Capital $1,220 $1,297 $1,610 Well Capitalized Minimum $575 $708 $885 Excess over Well Capitalized Minimum $645 $589 $725 $ in millions $ in millions $ in millions Robust Capital Foundation Total Capital Ratio 2 Leverage Ratio 2 Consolidated Capital as of 9/30/24 2

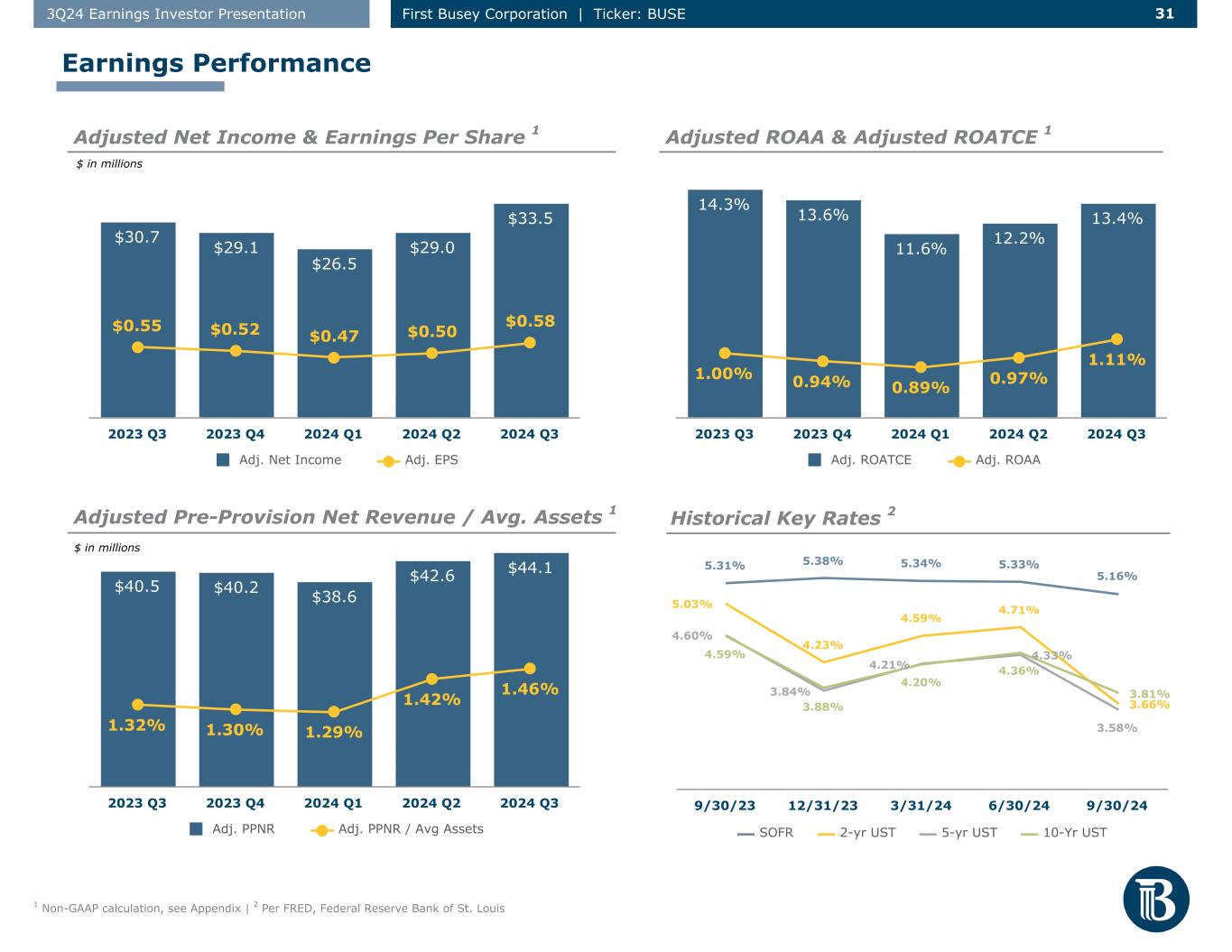

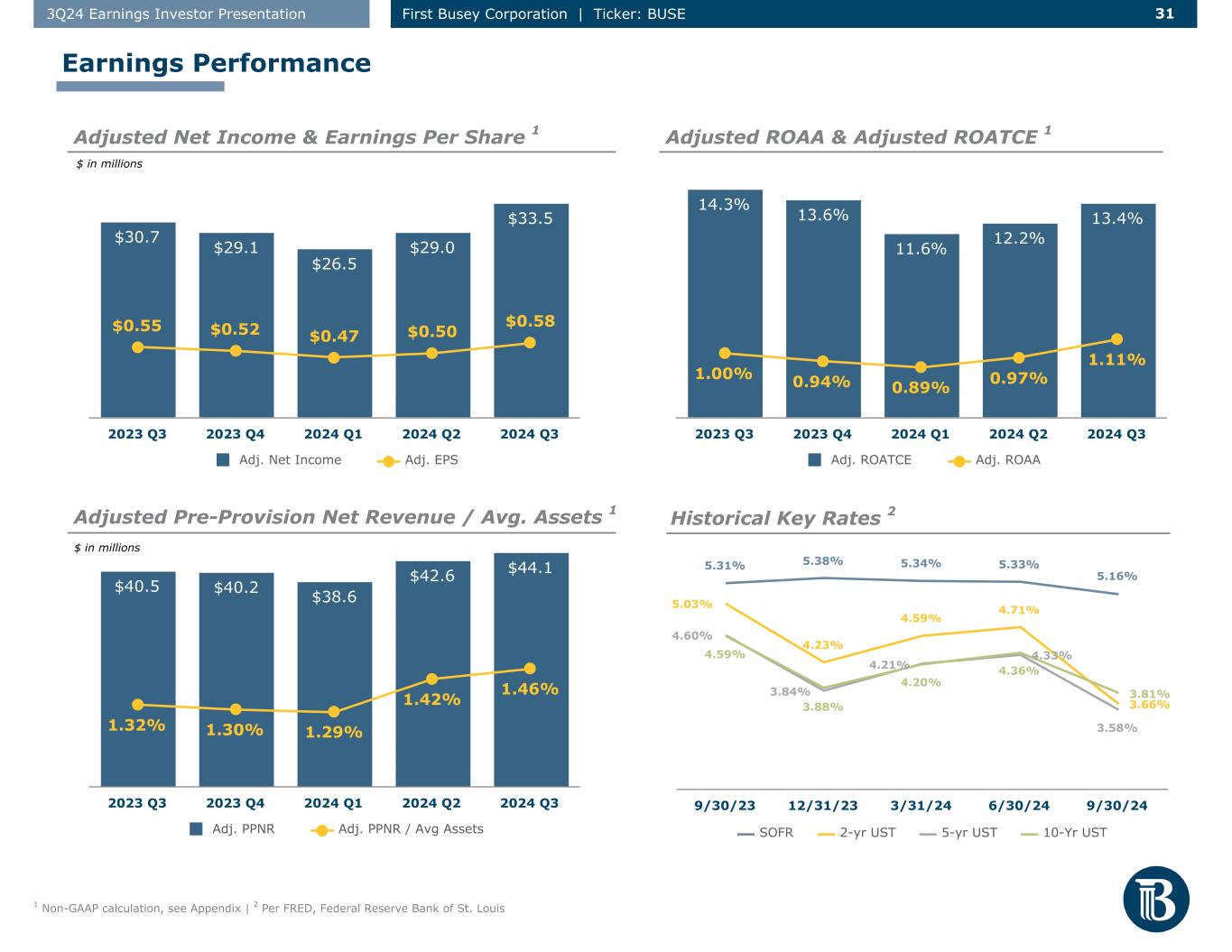

30 303Q24 Earnings Investor Presentation First Busey Corporation | Ticker: BUSE ▪ Net interest income was $82.5 million in 3Q24 vs. $82.4 million in 2Q24 and $77.8 million in 3Q23 ▪ Net interest margin1 was 3.02% in 3Q24, a decrease of 1 bp vs. 3.03% in 2Q24 ▪ The primary factors contributing to the quarter’s NIM contraction were non-maturity deposit costs pressures (11 bps decrease) partially offset by improved loan yields on new volume (2 bps increase), cash & securities impacts (3 bps increase), and purchase accounting accretion (2 bps increase) Net Interest Income Noninterest Income ▪ Adjusted noninterest income1 of $35.1 million in 3Q24, representing 29.9% of operating revenue ▪ Consolidated wealth management fees of $15.4 million in 3Q24, a decline from $15.9 million in 2Q24 but +8% YoY ▪ Payment tech solutions revenue of $5.3 million in 3Q24, a decrease from $5.9 million in 2Q24 and +1% YoY ▪ Fees for customer services of $8.2 million in 3Q24, a increase from $7.8 million in 2Q24 and +9% YoY ▪ Adjusted noninterest expense1 (ex-amortization of intangibles, one-time acquisition & restructuring related items) of $71.4 million in 3Q24, resulting in a 60.5% adjusted efficiency ratio1 ▪ Adjusted core expense1 of $71.0 million (ex-amortization of intangible assets, one-time items, and unfunded commitment provision) in 3Q24, equating to 60.2% adjusted core efficiency ratio1 Noninterest Expense Provision ▪ Insignificant loan loss provision expense ▪ Net charge offs of $0.2 million in 3Q24 ▪ $0.4 million provision for unfunded commitments (captured in other noninterest expense) ▪ Adjusted net income of $33.5 million or $0.58 per diluted share1 ▪ Adjusted pre-provision net revenue of $44.1 million (1.46% PPNR ROAA) in 3Q24 1 ▪ 1.11% Adjusted ROAA and 13.41% Adjusted ROATCE in 3Q24 1 Earnings 1 Non-GAAP, see Appendix Taxes ▪ 3Q24 effective tax rate of 24.8% 3Q24 Earnings Review

31 313Q24 Earnings Investor Presentation First Busey Corporation | Ticker: BUSE $30.7 $29.1 $26.5 $29.0 $33.5 $0.55 $0.52 $0.47 $0.50 $0.58 Adj. Net Income Adj. EPS 2023 Q3 2023 Q4 2024 Q1 2024 Q2 2024 Q3 $40.5 $40.2 $38.6 $42.6 $44.1 1.32% 1.30% 1.29% 1.42% 1.46% Adj. PPNR Adj. PPNR / Avg Assets 2023 Q3 2023 Q4 2024 Q1 2024 Q2 2024 Q3 14.3% 13.6% 11.6% 12.2% 13.4% 1.00% 0.94% 0.89% 0.97% 1.11% Adj. ROATCE Adj. ROAA 2023 Q3 2023 Q4 2024 Q1 2024 Q2 2024 Q3 1 Non-GAAP calculation, see Appendix | 2 Per FRED, Federal Reserve Bank of St. Louis Earnings Performance Adjusted Net Income & Earnings Per Share 1 Adjusted ROAA & Adjusted ROATCE 1 Adjusted Pre-Provision Net Revenue / Avg. Assets 1 Historical Key Rates 2 $ in millions $ in millions 5.31% 5.38% 5.34% 5.33% 5.16% 5.03% 4.23% 4.59% 4.71% 3.66% 4.60% 3.84% 4.21% 4.33% 3.58% 4.59% 3.88% 4.20% 4.36% 3.81% SOFR 2-yr UST 5-yr UST 10-Yr UST 9/30/23 12/31/23 3/31/24 6/30/24 9/30/24

Appendix

32 323Q24 Earnings Investor Presentation First Busey Corporation | Ticker: BUSE Has served as Chairman & CEO of First Busey since 2007 and became Chairman of the Board effective July 2020. Also serves as Chairman & CEO of Busey Bank, along with a director of FirsTech. Offers 40 years of diverse financial services experience and extensive board involvement with a conservative operating philosophy and management style that focuses on Busey’s associates, customers, communities and shareholders. He also serves on the board of directors for Desert Mountain Club and the Champaign Illinois Kennel Club. Joined Busey in January 2020 with nearly 25 years of financial leadership experience. Previously, Ms. Bowe served as Senior Director of Operational Risk Program Management at KeyBank. Ms. Bowe offers experience in M&A due diligence, effective navigation of key risk areas and dedication to continuous improvement towards enterprise-wide risk management strategies. She also serves on the board of directors for ProSight Financial Association, Cleveland Hearing & Speech Center and the iPower Booster Club. Monica L. Bowe EVP & Chief Risk Officer Joined Busey in December 2011 and has over 40 years of legal experience. Prior to joining Busey, he was a partner in the law firm of Meyer Capel, where he specialized in serving the financial services industry. He also serves on the board of trustees for Holy Cross Church and the board of directors for St. Thomas More High School in Champaign, IL. John J. Powers EVP & General Counsel Joined Busey in 2008 and now leads many areas, including: human resources, marketing, corporate communications and the overall Busey experience, consumer & digital banking, executive administration, as well as all technology and business services & systems. Additionally, she serves as Chairperson and oversees FirsTech. Prior to Busey, Mrs. Randolph worked for 10+ years with CliftonLarsonAllen LLP. She also serves on the board of directors for the Illinois Bankers Association and Illinois Bankers Business Services. Amy L. Randolph EVP & COO Joined Busey in 1984, serving in the role of Vice Chairman of Credit, Chief Banking Officer or Chief Credit Officer since 2010 and chairing all Credit Committees. Mr. Plecki previously served as COO, President & CEO of Busey Wealth Management, and EVP of the Florida and Champaign markets. Prior to the 2007 merger with First Busey, he served in various management roles at Main Street Trust. He also serves on the board of directors for the Don Moyer Boys & Girls Club, OSF Community Council and St. Thomas More High School in Champaign, IL. Joined Busey in 2011 and has over 15 years of experience in the banking industry. Before being named President of Credit and Bank Administration in 2022, he served as Co- Chief Banking Officer for two years. Mr. Jorstad has also held the role of Regional President for Commercial Banking – overseeing business banking efforts, including Agricultural, Commercial, Construction and Real Estate financing. He also serves on the board of directors for Intersect Illinois and the St. Matthew Education Commission in Champaign, IL. Chip Jorstad EVP & President of Credit and Bank Admin. Joined Busey in 2021, leading the team that provides asset management, investment and fiduciary services to individuals, businesses and foundations. Mr. Burgess formerly served as President of Commerce Brokerage Services, Inc., and was Director of Business Development for the east region of Commerce Trust Company. He also serves on the board of directors for Social Venture Partners and Community School in St. Louis, MO. Jeff D. Burgess EVP & President of Busey Wealth Management Joined Busey in August 2019, bringing nearly 20 years of investment banking and financial services experience. Also serves as a board member of FirsTech. Previously served as Managing Director and Co-Head of Financial Institutions at Stephens Inc. Mr. Jones began his career in the Banking Supervision and Regulation division of the Federal Reserve. He also serves on the board of directors for Academy High in Champaign, IL, and the D Jones Family Charitable Foundation. Jeffrey D. Jones EVP & CFO Joined Busey in June 2022 to lead the Consumer, Community, Mortgage and Digital Banking teams. Mr. Sheils’ nearly 25 years of banking experience includes serving as the Head of Retail Banking at MB Financial. Prior to his shift to retail, he led teams in Commercial Banking at MB Financial and LaSalle Bank. He also serves on the board of directors for the Loyola University Chicago Alumni Association and the Union League Club of Chicago. Joseph A. Sheils EVP & President of Consumer and Digital Banking Van A. Dukeman Chairman & CEO Experienced Management Team Robert F. Plecki, Jr. EVP & Vice Chairman of Credit Joined Busey in 2014 as a Commercial Relationship Manager before taking on increasing leadership responsibilities and becoming Regional President of Busey’s Central Illinois Region in May of 2020. He then took on the Indianapolis Region in Q4 2023. He also serves on the board of trustees for Carle Health – East Region and the board of directors for the Champaign County Economic Development Corporation. Joined FirsTech and Busey in 2020, leading the organization’s Products & Technology efforts. In 2023, he moved into the role of President and CEO with FirsTech and EVP of Technology at Busey. Mr. Ghauri is a proven executive leader with 20-plus years of experience building and leading high growth products and technology organizations. Tenure includes working with CareerBuilder, ADP, Skillsoft and Oracle. Humair Ghauri EVP of Technology, Busey Bank President & CEO, FirsTech Joined Busey in 2016 with the First Community Financial Bank partnership. His career in banking spans 30 years, previously working at LaSalle Bank, First Chicago Bank & Trust, and Inland Bank & Trust prior to moving to First Community. Mr. Gallagher served as Commercial Market President for Busey until moving to Regional President of the Northern Region in 2020. He took on leadership of the Gateway and Florida Regions in Q4 2023, while also assuming responsibility for Busey’s Treasury Management division. He also serves on the board of directors for American Heart Association CycleNation. Sean Gallagher EVP & Regional President for Northern Illinois, Gateway and Florida Regions Martin O’Donnell EVP & Regional President for Central Illinois and Indiana Regions

34 343Q24 Earnings Investor Presentation First Busey Corporation | Ticker: BUSE $13.7 Billion Assets Under Care LTM Revenue $61.8 Million PT Margin LTM 43.4% Core Principles I. Client-Focused Strategy Trusted fiduciaries that identify prudent financial solutions to meet client-specific needs and objectives and help clients make better decisions about their wealth II. Team-Based Approach Collaborative team of experienced, credentialed professionals with broad resources that excels in developing unique solutions for clients III. Comprehensive Wealth Management Fully internalized investment office and an investment philosophy that uses a tailored approach to provide proactive advice, empowering clients to make appropriate financial choices to meet their goals in every aspect of their financial health INVESTMENT MANAGEMENT ▪ Preserving and growing wealth with enhanced asset allocation & tax efficient strategies As of 9/30/24 Fully Integrated Wealth Platform PERSONAL SERVICES ▪ Family Office ▪ High Net Worth ▪ Mass Affluent and Emerging Wealth INSTITUTIONAL SERVICES ▪ Retirement Plans ▪ Corporations & Municipalities ▪ Foundations and Endowments ▪ Not-for-Profit Organizations Wealth Client Segments TAX PLANNING & PREPARATION ▪ Deduction maximization, capital event planning, tax-advantaged savings & investment strategies FIDUCIARY ADMINISTRATION ▪ Trust services, estate planning, and philanthropic advisory PRIVATE CLIENT ▪ Concierge banking with one point of contact that coordinates all banking needs AG SERVICES ▪ Farm management and brokerage RETIREMENT PLANNING ▪ Goal-based advisory including life insurance, long-term care, executive stock option strategies Integrated Core Capabilities to Service Personal & Institutional Clients

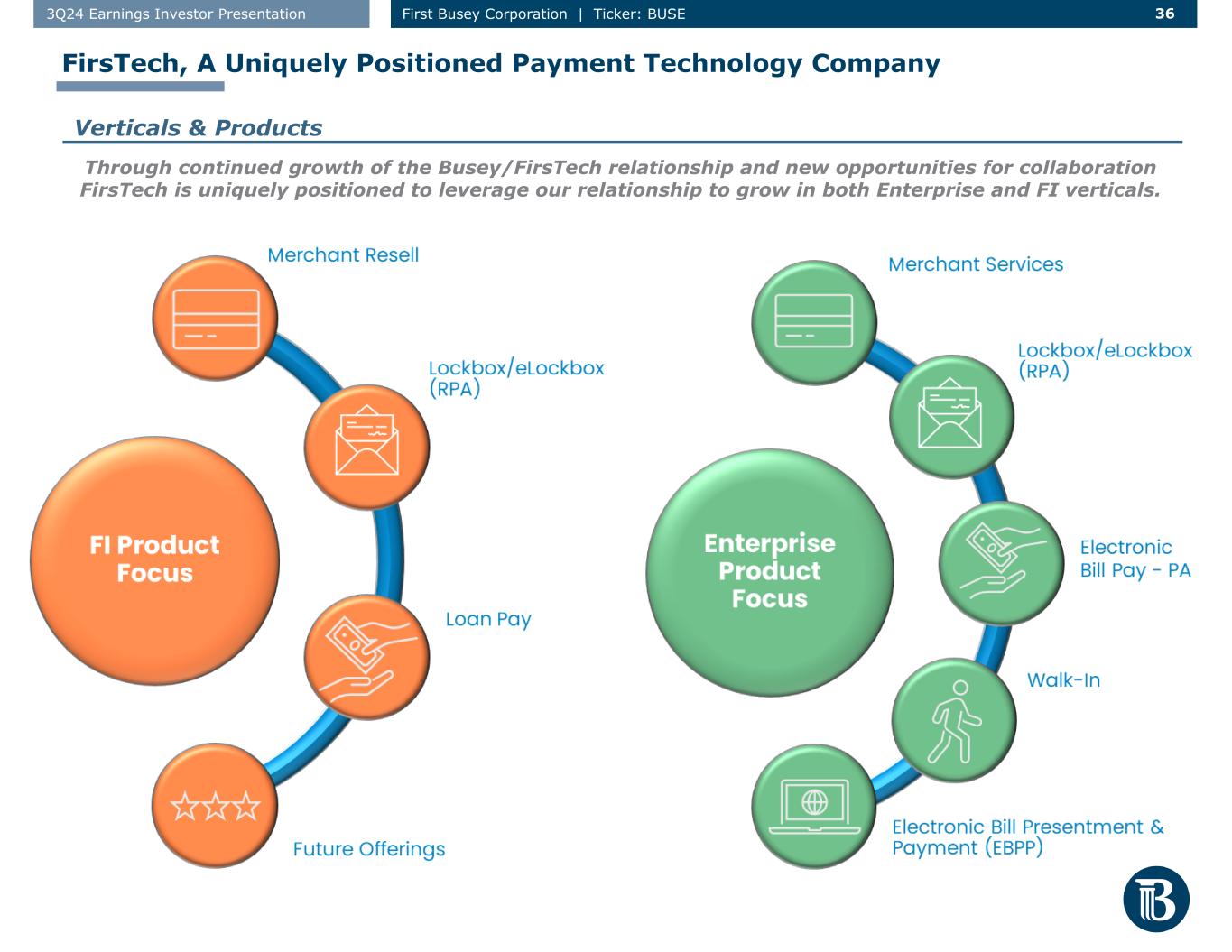

35 353Q24 Earnings Investor Presentation First Busey Corporation | Ticker: BUSE FirsTech, A Uniquely Positioned Payment Technology Company Traditional Receivables Electronic Payments Merchant Services Services Services Services Sales Channels Sales Channels Sales Channels Lines of Business Lines of BusinessLines of Business ▪ Lockbox ▪ eLockbox ▪ Online (Core) ▪ Customer Service Rep., Mobile, Interactive Voice Response (IVR) ▪ Internet Agent Service, Walk-in ▪ Statement of Work (SOW), Time & Materials ▪ Point of Sale ▪ Online ▪ Enterprise Sales Team ▪ Financial Institutions (FI) Sales Team ▪ FI Reseller Sales ▪ Partnerships ▪ Enterprise Sales Team ▪ FI Sales Team ▪ FI Reseller Sales ▪ Partnerships ▪ Merchant Sales Team ▪ Agent Referrals ▪ FI Reseller Sales ▪ Partnerships ▪ Financial Institutions ▪ Municipalities, Government ▪ Utilities, Telecom, Insurance ▪ Health ▪ Financial Institutions ▪ Municipalities, Government ▪ Utilities, Telecom, Insurance ▪ Health ▪ Small and medium-sized businesses (SMB) ▪ Financial Institutions ▪ Municipalities, Government ▪ Utilities, Telecom, Insurance ▪ Health ▪ SMB Payments Segments $12 Billion Payments Processed LTM Transactions Processed LTM 43 Million Revenue LTM 1 $23.5 Million As of 9/30/24 1 Revenue equates to all revenue sources tied to FirsTech and excludes intracompany eliminations

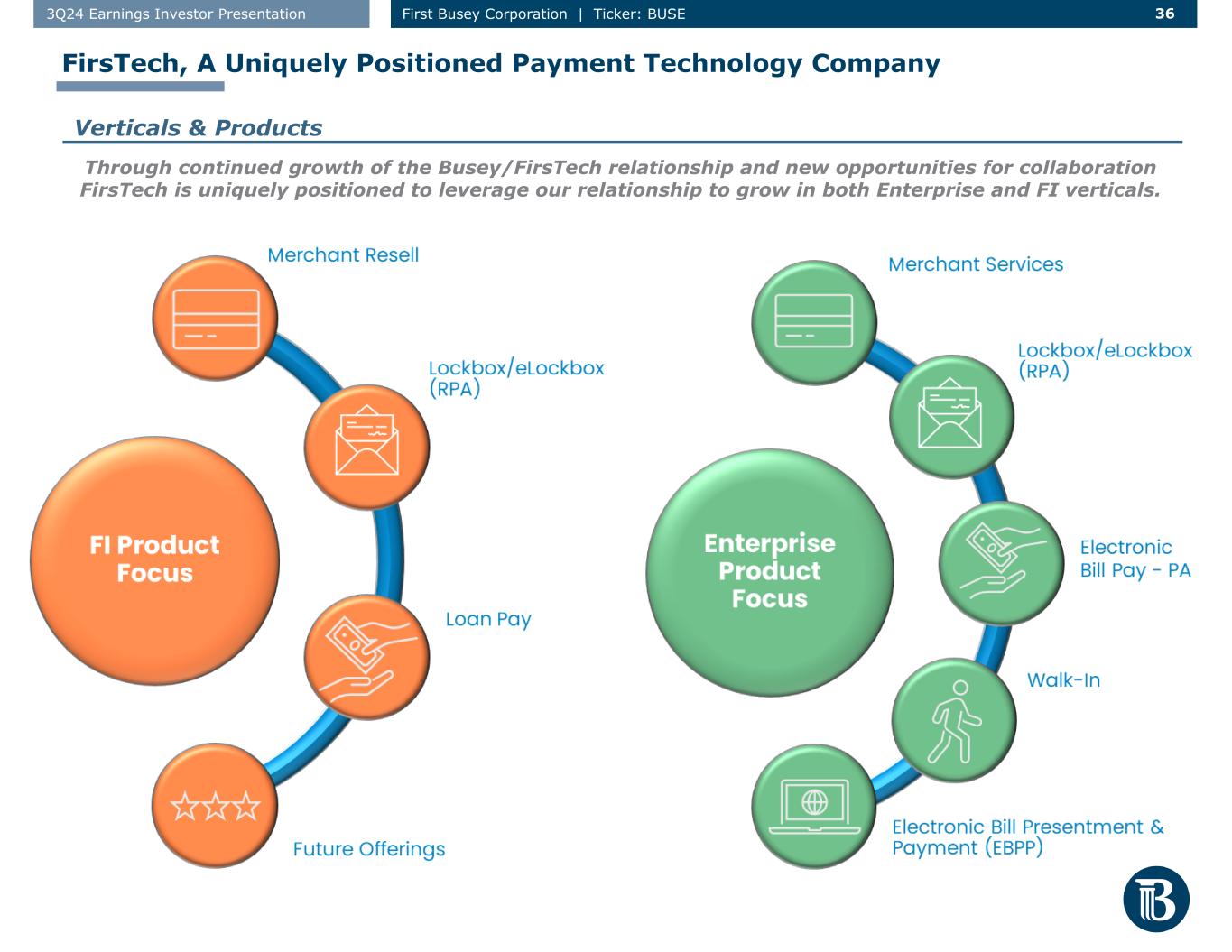

36 363Q24 Earnings Investor Presentation First Busey Corporation | Ticker: BUSE FirsTech, A Uniquely Positioned Payment Technology Company Through continued growth of the Busey/FirsTech relationship and new opportunities for collaboration FirsTech is uniquely positioned to leverage our relationship to grow in both Enterprise and FI verticals. Verticals & Products

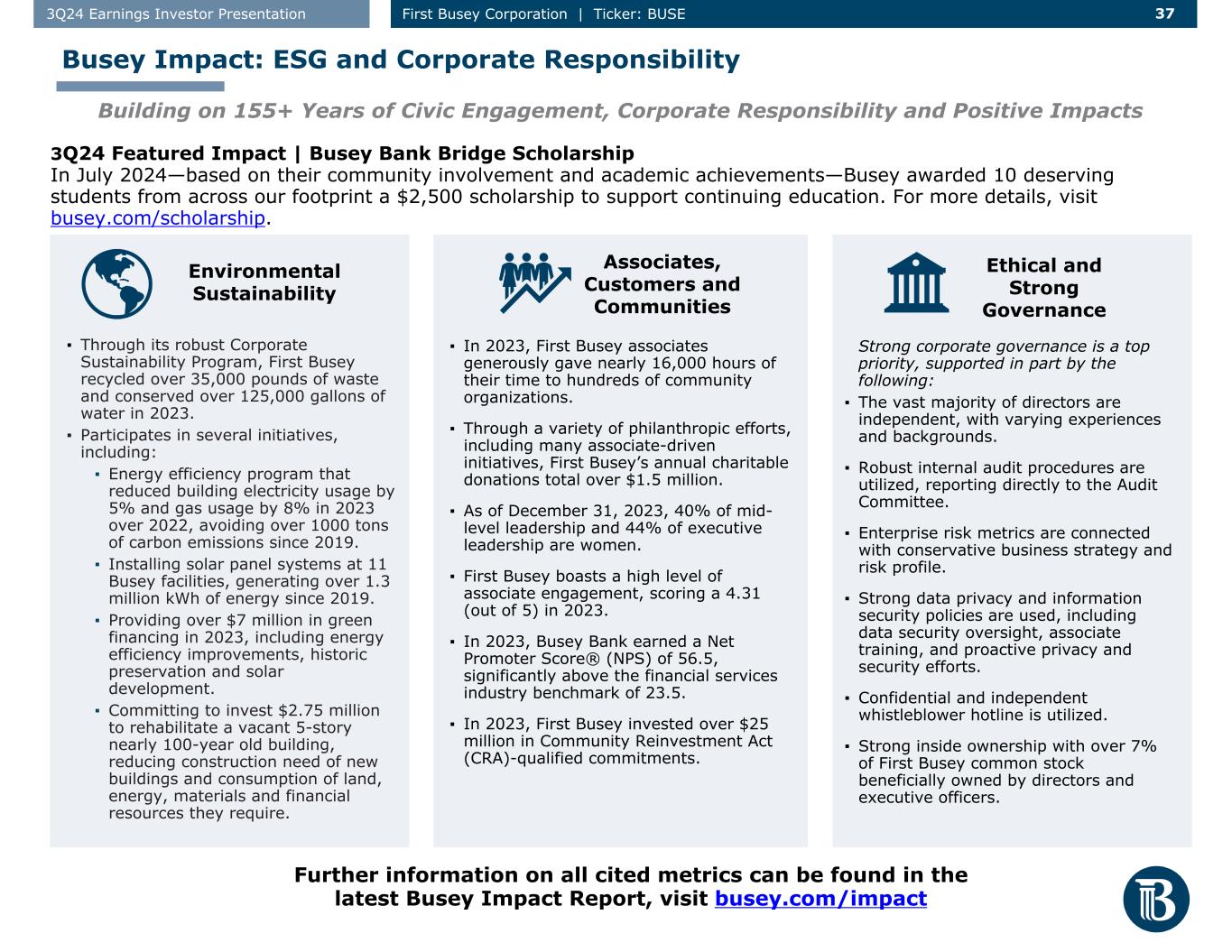

37 373Q24 Earnings Investor Presentation First Busey Corporation | Ticker: BUSE ▪ Through its robust Corporate Sustainability Program, First Busey recycled over 35,000 pounds of waste and conserved over 125,000 gallons of water in 2023. ▪ Participates in several initiatives, including: ▪ Energy efficiency program that reduced building electricity usage by 5% and gas usage by 8% in 2023 over 2022, avoiding over 1000 tons of carbon emissions since 2019. ▪ Installing solar panel systems at 11 Busey facilities, generating over 1.3 million kWh of energy since 2019. ▪ Providing over $7 million in green financing in 2023, including energy efficiency improvements, historic preservation and solar development. ▪ Committing to invest $2.75 million to rehabilitate a vacant 5-story nearly 100-year old building, reducing construction need of new buildings and consumption of land, energy, materials and financial resources they require. ▪ In 2023, First Busey associates generously gave nearly 16,000 hours of their time to hundreds of community organizations. ▪ Through a variety of philanthropic efforts, including many associate-driven initiatives, First Busey’s annual charitable donations total over $1.5 million. ▪ As of December 31, 2023, 40% of mid- level leadership and 44% of executive leadership are women. ▪ First Busey boasts a high level of associate engagement, scoring a 4.31 (out of 5) in 2023. ▪ In 2023, Busey Bank earned a Net Promoter Score® (NPS) of 56.5, significantly above the financial services industry benchmark of 23.5. ▪ In 2023, First Busey invested over $25 million in Community Reinvestment Act (CRA)-qualified commitments. Strong corporate governance is a top priority, supported in part by the following: ▪ The vast majority of directors are independent, with varying experiences and backgrounds. ▪ Robust internal audit procedures are utilized, reporting directly to the Audit Committee. ▪ Enterprise risk metrics are connected with conservative business strategy and risk profile. ▪ Strong data privacy and information security policies are used, including data security oversight, associate training, and proactive privacy and security efforts. ▪ Confidential and independent whistleblower hotline is utilized. ▪ Strong inside ownership with over 7% of First Busey common stock beneficially owned by directors and executive officers. Further information on all cited metrics can be found in the latest Busey Impact Report, visit busey.com/impact Building on 155+ Years of Civic Engagement, Corporate Responsibility and Positive Impacts 3Q24 Featured Impact | Busey Bank Bridge Scholarship In July 2024—based on their community involvement and academic achievements—Busey awarded 10 deserving students from across our footprint a $2,500 scholarship to support continuing education. For more details, visit busey.com/scholarship. Environmental Sustainability Associates, Customers and Communities Ethical and Strong Governance Busey Impact: ESG and Corporate Responsibility

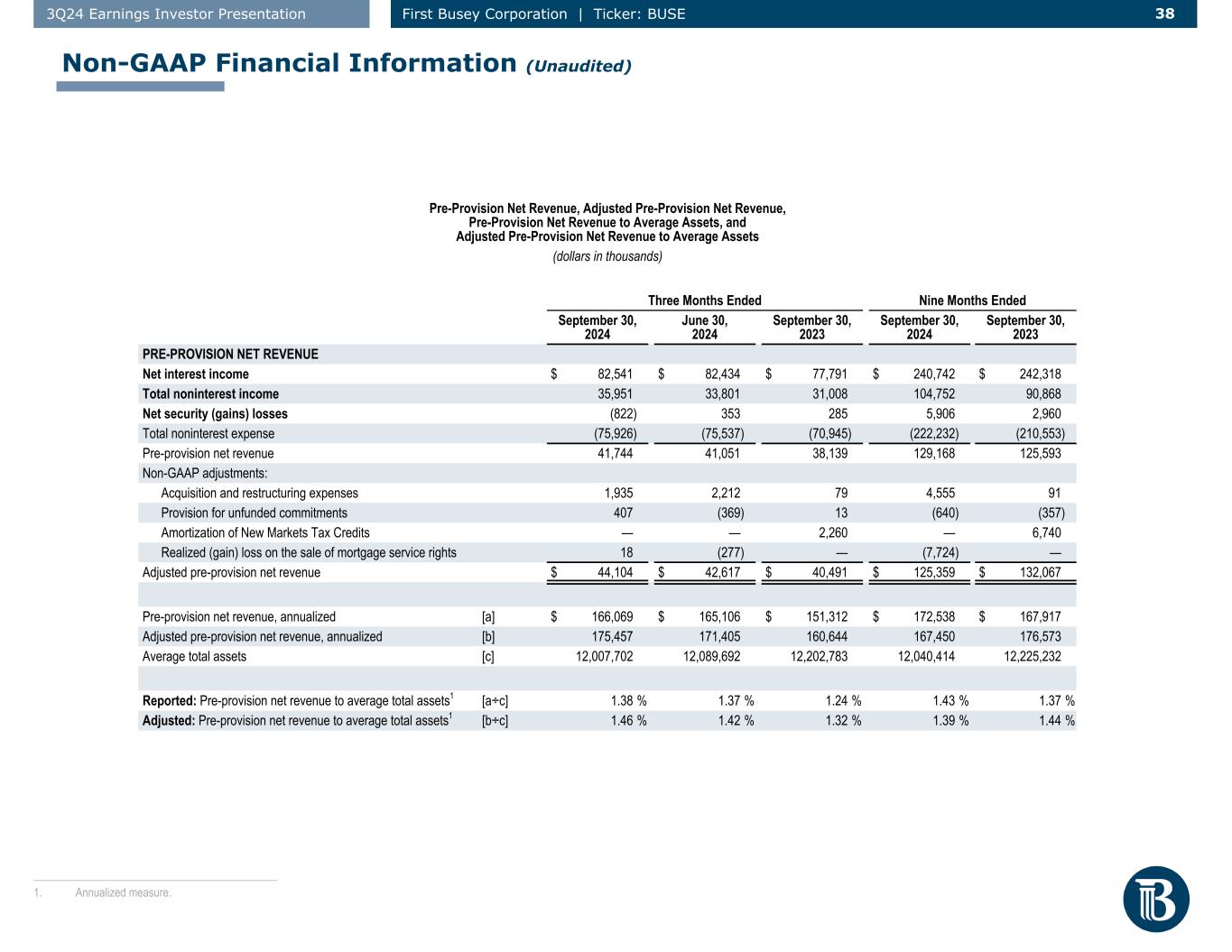

38 383Q24 Earnings Investor Presentation First Busey Corporation | Ticker: BUSE Pre-Provision Net Revenue, Adjusted Pre-Provision Net Revenue, Pre-Provision Net Revenue to Average Assets, and Adjusted Pre-Provision Net Revenue to Average Assets (dollars in thousands) Three Months Ended Nine Months Ended September 30, 2024 June 30, 2024 September 30, 2023 September 30, 2024 September 30, 2023 PRE-PROVISION NET REVENUE Net interest income $ 82,541 $ 82,434 $ 77,791 $ 240,742 $ 242,318 Total noninterest income 35,951 33,801 31,008 104,752 90,868 Net security (gains) losses (822) 353 285 5,906 2,960 Total noninterest expense (75,926) (75,537) (70,945) (222,232) (210,553) Pre-provision net revenue 41,744 41,051 38,139 129,168 125,593 Non-GAAP adjustments: Acquisition and restructuring expenses 1,935 2,212 79 4,555 91 Provision for unfunded commitments 407 (369) 13 (640) (357) Amortization of New Markets Tax Credits — — 2,260 — 6,740 Realized (gain) loss on the sale of mortgage service rights 18 (277) — (7,724) — Adjusted pre-provision net revenue $ 44,104 $ 42,617 $ 40,491 $ 125,359 $ 132,067 Pre-provision net revenue, annualized [a] $ 166,069 $ 165,106 $ 151,312 $ 172,538 $ 167,917 Adjusted pre-provision net revenue, annualized [b] 175,457 171,405 160,644 167,450 176,573 Average total assets [c] 12,007,702 12,089,692 12,202,783 12,040,414 12,225,232 Reported: Pre-provision net revenue to average total assets1 [a÷c] 1.38 % 1.37 % 1.24 % 1.43 % 1.37 % Adjusted: Pre-provision net revenue to average total assets1 [b÷c] 1.46 % 1.42 % 1.32 % 1.39 % 1.44 % ___________________________________________ 1. Annualized measure. Non-GAAP Financial Information (Unaudited)

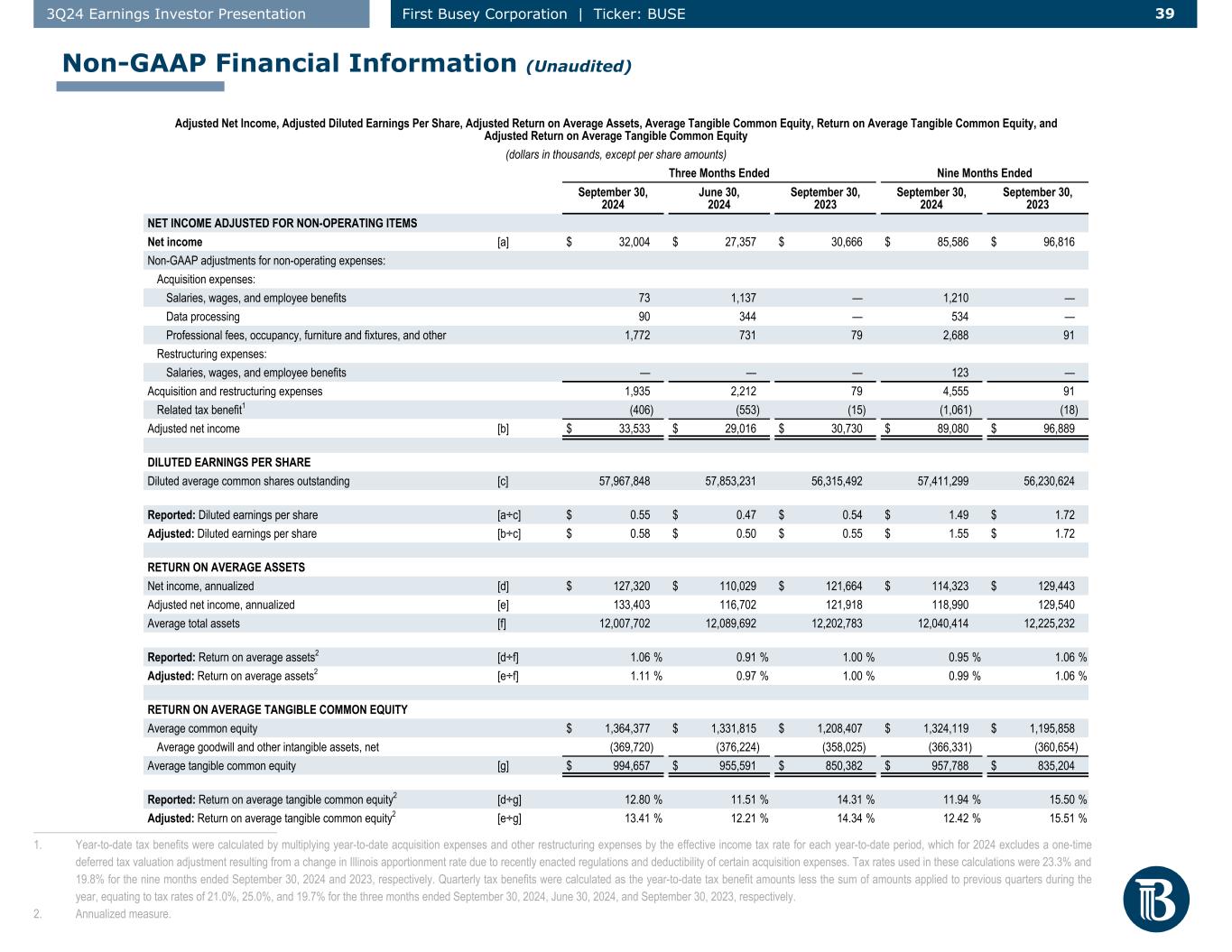

39 393Q24 Earnings Investor Presentation First Busey Corporation | Ticker: BUSE Adjusted Net Income, Adjusted Diluted Earnings Per Share, Adjusted Return on Average Assets, Average Tangible Common Equity, Return on Average Tangible Common Equity, and Adjusted Return on Average Tangible Common Equity (dollars in thousands, except per share amounts) Three Months Ended Nine Months Ended September 30, 2024 June 30, 2024 September 30, 2023 September 30, 2024 September 30, 2023 NET INCOME ADJUSTED FOR NON-OPERATING ITEMS Net income [a] $ 32,004 $ 27,357 $ 30,666 $ 85,586 $ 96,816 Non-GAAP adjustments for non-operating expenses: Acquisition expenses: Salaries, wages, and employee benefits 73 1,137 — 1,210 — Data processing 90 344 — 534 — Professional fees, occupancy, furniture and fixtures, and other 1,772 731 79 2,688 91 Restructuring expenses: Salaries, wages, and employee benefits — — — 123 — Acquisition and restructuring expenses 1,935 2,212 79 4,555 91 Related tax benefit1 (406) (553) (15) (1,061) (18) Adjusted net income [b] $ 33,533 $ 29,016 $ 30,730 $ 89,080 $ 96,889 DILUTED EARNINGS PER SHARE Diluted average common shares outstanding [c] 57,967,848 57,853,231 56,315,492 57,411,299 56,230,624 Reported: Diluted earnings per share [a÷c] $ 0.55 $ 0.47 $ 0.54 $ 1.49 $ 1.72 Adjusted: Diluted earnings per share [b÷c] $ 0.58 $ 0.50 $ 0.55 $ 1.55 $ 1.72 RETURN ON AVERAGE ASSETS Net income, annualized [d] $ 127,320 $ 110,029 $ 121,664 $ 114,323 $ 129,443 Adjusted net income, annualized [e] 133,403 116,702 121,918 118,990 129,540 Average total assets [f] 12,007,702 12,089,692 12,202,783 12,040,414 12,225,232 Reported: Return on average assets2 [d÷f] 1.06 % 0.91 % 1.00 % 0.95 % 1.06 % Adjusted: Return on average assets2 [e÷f] 1.11 % 0.97 % 1.00 % 0.99 % 1.06 % RETURN ON AVERAGE TANGIBLE COMMON EQUITY Average common equity $ 1,364,377 $ 1,331,815 $ 1,208,407 $ 1,324,119 $ 1,195,858 Average goodwill and other intangible assets, net (369,720) (376,224) (358,025) (366,331) (360,654) Average tangible common equity [g] $ 994,657 $ 955,591 $ 850,382 $ 957,788 $ 835,204 Reported: Return on average tangible common equity2 [d÷g] 12.80 % 11.51 % 14.31 % 11.94 % 15.50 % Adjusted: Return on average tangible common equity2 [e÷g] 13.41 % 12.21 % 14.34 % 12.42 % 15.51 % ___________________________________________ 1. Year-to-date tax benefits were calculated by multiplying year-to-date acquisition expenses and other restructuring expenses by the effective income tax rate for each year-to-date period, which for 2024 excludes a one-time deferred tax valuation adjustment resulting from a change in Illinois apportionment rate due to recently enacted regulations and deductibility of certain acquisition expenses. Tax rates used in these calculations were 23.3% and 19.8% for the nine months ended September 30, 2024 and 2023, respectively. Quarterly tax benefits were calculated as the year-to-date tax benefit amounts less the sum of amounts applied to previous quarters during the year, equating to tax rates of 21.0%, 25.0%, and 19.7% for the three months ended September 30, 2024, June 30, 2024, and September 30, 2023, respectively. 2. Annualized measure. Non-GAAP Financial Information (Unaudited)

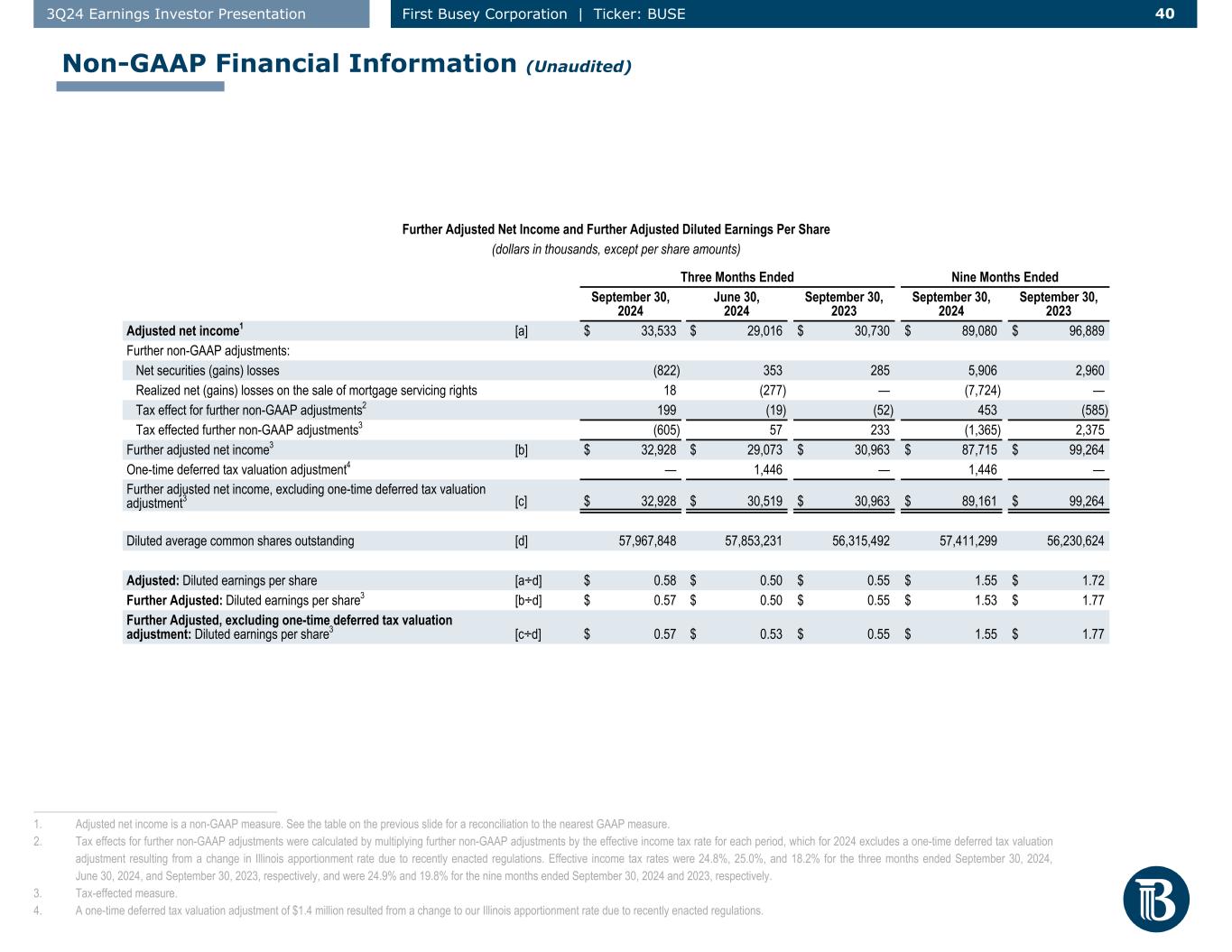

40 403Q24 Earnings Investor Presentation First Busey Corporation | Ticker: BUSE Non-GAAP Financial Information (Unaudited) Further Adjusted Net Income and Further Adjusted Diluted Earnings Per Share (dollars in thousands, except per share amounts) Three Months Ended Nine Months Ended September 30, 2024 June 30, 2024 September 30, 2023 September 30, 2024 September 30, 2023 Adjusted net income1 [a] $ 33,533 $ 29,016 $ 30,730 $ 89,080 $ 96,889 Further non-GAAP adjustments: Net securities (gains) losses (822) 353 285 5,906 2,960 Realized net (gains) losses on the sale of mortgage servicing rights 18 (277) — (7,724) — Tax effect for further non-GAAP adjustments2 199 (19) (52) 453 (585) Tax effected further non-GAAP adjustments3 (605) 57 233 (1,365) 2,375 Further adjusted net income3 [b] $ 32,928 $ 29,073 $ 30,963 $ 87,715 $ 99,264 One-time deferred tax valuation adjustment4 — 1,446 — 1,446 — Further adjusted net income, excluding one-time deferred tax valuation adjustment3 [c] $ 32,928 $ 30,519 $ 30,963 $ 89,161 $ 99,264 Diluted average common shares outstanding [d] 57,967,848 57,853,231 56,315,492 57,411,299 56,230,624 Adjusted: Diluted earnings per share [a÷d] $ 0.58 $ 0.50 $ 0.55 $ 1.55 $ 1.72 Further Adjusted: Diluted earnings per share3 [b÷d] $ 0.57 $ 0.50 $ 0.55 $ 1.53 $ 1.77 Further Adjusted, excluding one-time deferred tax valuation adjustment: Diluted earnings per share3 [c÷d] $ 0.57 $ 0.53 $ 0.55 $ 1.55 $ 1.77 ___________________________________________ 1. Adjusted net income is a non-GAAP measure. See the table on the previous slide for a reconciliation to the nearest GAAP measure. 2. Tax effects for further non-GAAP adjustments were calculated by multiplying further non-GAAP adjustments by the effective income tax rate for each period, which for 2024 excludes a one-time deferred tax valuation adjustment resulting from a change in Illinois apportionment rate due to recently enacted regulations. Effective income tax rates were 24.8%, 25.0%, and 18.2% for the three months ended September 30, 2024, June 30, 2024, and September 30, 2023, respectively, and were 24.9% and 19.8% for the nine months ended September 30, 2024 and 2023, respectively. 3. Tax-effected measure. 4. A one-time deferred tax valuation adjustment of $1.4 million resulted from a change to our Illinois apportionment rate due to recently enacted regulations.

41 413Q24 Earnings Investor Presentation First Busey Corporation | Ticker: BUSE Non-GAAP Financial Information (Unaudited) ___________________________________________ 1. Tax-equivalent adjustments were calculated using an estimated federal income tax rate of 21%, applied to non-taxable interest income on investments and loans. 2. Tax-effected measure. Adjusted Net Interest Income and Adjusted Net Interest Margin (dollars in thousands) Three Months Ended Nine Months Ended September 30, 2024 June 30, 2024 September 30, 2023 September 30, 2024 September 30, 2023 Net interest income $ 82,541 $ 82,434 $ 77,791 $ 240,742 $ 242,318 Non-GAAP adjustments: Tax-equivalent adjustment1 396 402 553 1,247 1,672 Tax-equivalent net interest income 82,937 82,836 78,344 241,989 243,990 Purchase accounting accretion related to business combinations (1,338) (812) (277) (2,354) (1,093) Adjusted net interest income $ 81,599 $ 82,024 $ 78,067 $ 239,635 $ 242,897 Tax-equivalent net interest income, annualized [a] $ 329,945 $ 333,165 $ 310,821 $ 323,241 $ 326,214 Adjusted net interest income, annualized [b] 324,622 329,899 309,722 320,096 324,752 Average interest-earning assets [c] 10,936,611 10,993,907 11,118,167 10,976,660 11,142,780 Reported: Net interest margin2 [a÷c] 3.02 % 3.03 % 2.80 % 2.94 % 2.93 % Adjusted: Net interest margin2 [b÷c] 2.97 % 3.00 % 2.79 % 2.92 % 2.91 %

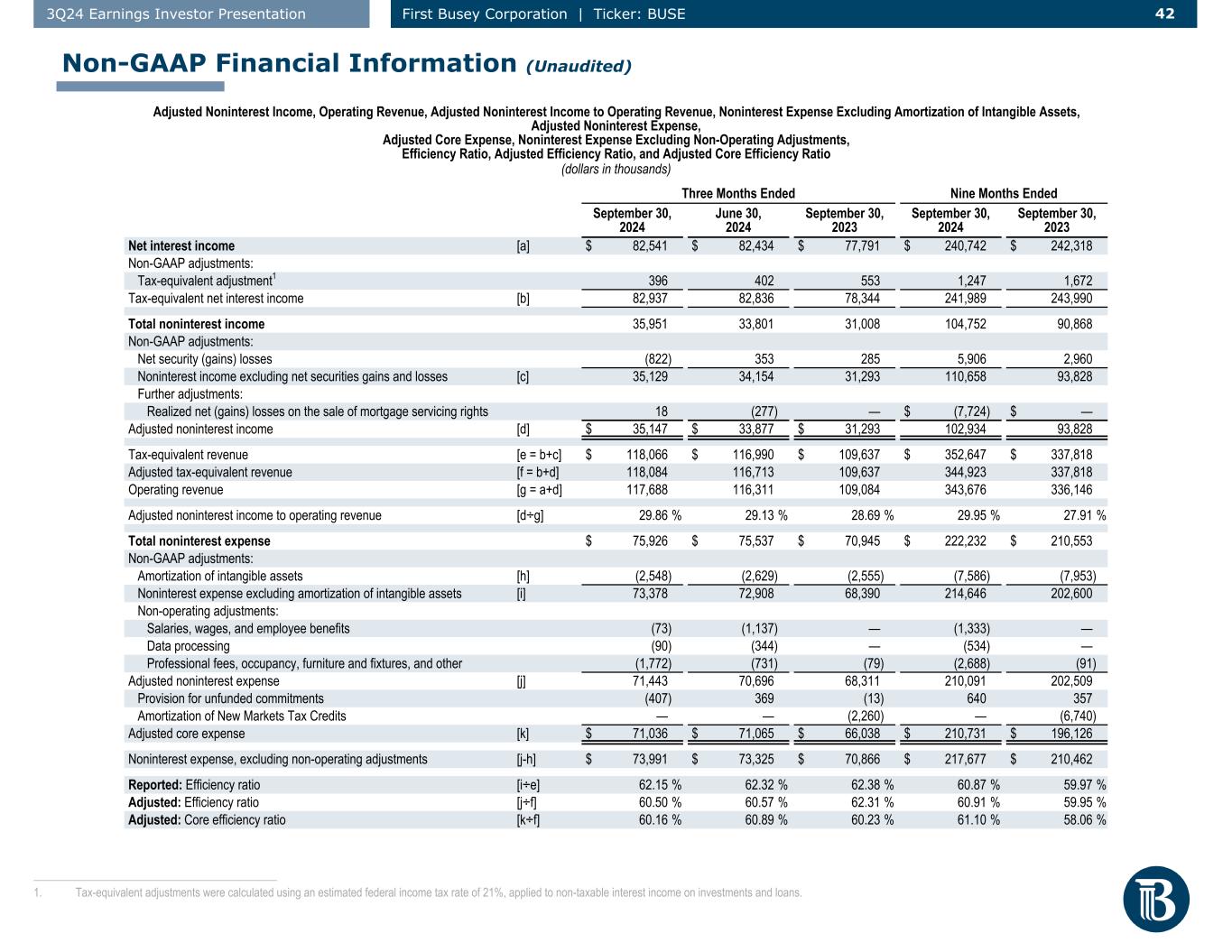

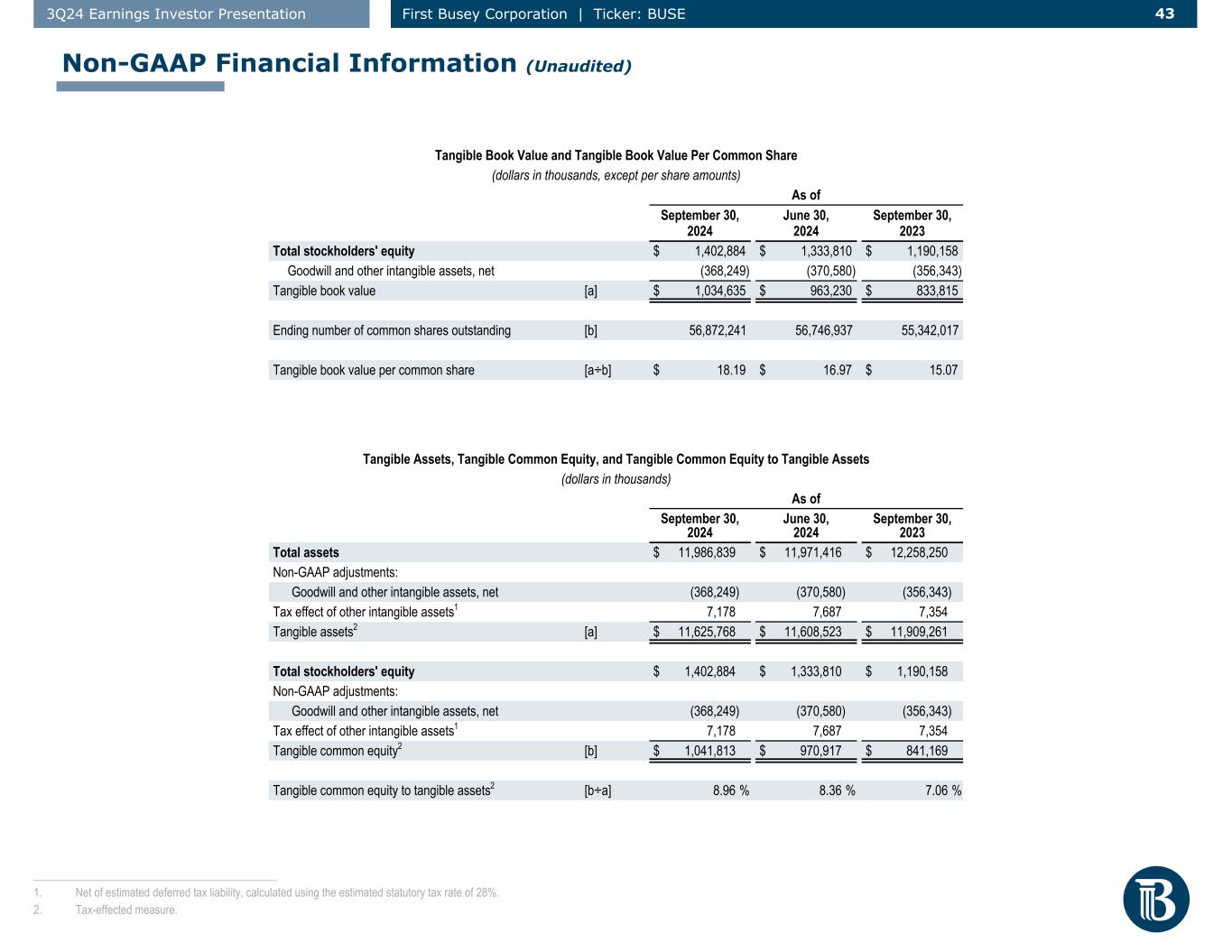

42 423Q24 Earnings Investor Presentation First Busey Corporation | Ticker: BUSE Adjusted Noninterest Income, Operating Revenue, Adjusted Noninterest Income to Operating Revenue, Noninterest Expense Excluding Amortization of Intangible Assets, Adjusted Noninterest Expense, Adjusted Core Expense, Noninterest Expense Excluding Non-Operating Adjustments, Efficiency Ratio, Adjusted Efficiency Ratio, and Adjusted Core Efficiency Ratio (dollars in thousands) Three Months Ended Nine Months Ended September 30, 2024 June 30, 2024 September 30, 2023 September 30, 2024 September 30, 2023 Net interest income [a] $ 82,541 $ 82,434 $ 77,791 $ 240,742 $ 242,318 Non-GAAP adjustments: Tax-equivalent adjustment1 396 402 553 1,247 1,672 Tax-equivalent net interest income [b] 82,937 82,836 78,344 241,989 243,990 Total noninterest income 35,951 33,801 31,008 104,752 90,868 Non-GAAP adjustments: Net security (gains) losses (822) 353 285 5,906 2,960 Noninterest income excluding net securities gains and losses [c] 35,129 34,154 31,293 110,658 93,828 Further adjustments: Realized net (gains) losses on the sale of mortgage servicing rights 18 (277) — $ (7,724) $ — Adjusted noninterest income [d] $ 35,147 $ 33,877 $ 31,293 102,934 93,828 Tax-equivalent revenue [e = b+c] $ 118,066 $ 116,990 $ 109,637 $ 352,647 $ 337,818 Adjusted tax-equivalent revenue [f = b+d] 118,084 116,713 109,637 344,923 337,818 Operating revenue [g = a+d] 117,688 116,311 109,084 343,676 336,146 Adjusted noninterest income to operating revenue [d÷g] 29.86 % 29.13 % 28.69 % 29.95 % 27.91 % Total noninterest expense $ 75,926 $ 75,537 $ 70,945 $ 222,232 $ 210,553 Non-GAAP adjustments: Amortization of intangible assets [h] (2,548) (2,629) (2,555) (7,586) (7,953) Noninterest expense excluding amortization of intangible assets [i] 73,378 72,908 68,390 214,646 202,600 Non-operating adjustments: Salaries, wages, and employee benefits (73) (1,137) — (1,333) — Data processing (90) (344) — (534) — Professional fees, occupancy, furniture and fixtures, and other (1,772) (731) (79) (2,688) (91) Adjusted noninterest expense [j] 71,443 70,696 68,311 210,091 202,509 Provision for unfunded commitments (407) 369 (13) 640 357 Amortization of New Markets Tax Credits — — (2,260) — (6,740) Adjusted core expense [k] $ 71,036 $ 71,065 $ 66,038 $ 210,731 $ 196,126 Noninterest expense, excluding non-operating adjustments [j-h] $ 73,991 $ 73,325 $ 70,866 $ 217,677 $ 210,462 Reported: Efficiency ratio [i÷e] 62.15 % 62.32 % 62.38 % 60.87 % 59.97 % Adjusted: Efficiency ratio [j÷f] 60.50 % 60.57 % 62.31 % 60.91 % 59.95 % Adjusted: Core efficiency ratio [k÷f] 60.16 % 60.89 % 60.23 % 61.10 % 58.06 % Non-GAAP Financial Information (Unaudited) ___________________________________________ 1. Tax-equivalent adjustments were calculated using an estimated federal income tax rate of 21%, applied to non-taxable interest income on investments and loans.