UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

| Investment Company Act file number | 811-22284 |

| Hatteras Ramius Advantage Institutional Fund |

| (Exact name of registrant as specified in charter) |

| |

| 8540 Colonnade Center Drive, Suite 401 |

| Raleigh, North Carolina 27615 |

| (Address of principal executive offices) (Zip code) |

| |

| David B. Perkins |

| 8540 Colonnade Center Drive, Suite 401 |

| Raleigh, North Carolina 27615 |

| (Name and address of agent for service) |

| Registrant's telephone number, including area code: | (919) 846-2324 |

| Date of fiscal year end: | March 31 |

| Date of reporting period: | March 31, 2011 |

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget (“OMB”) control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 450 Fifth Street, NW, Washington, DC 20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. § 3507.

ITEM 1. REPORTS TO STOCKHOLDERS.

The Report to Shareholders is attached herewith.

Hatteras Ramius Advantage Fund

(a Delaware Statutory Trust)

Financial Statements

(Liquidation Basis)

As of and for the Year Ended March 31, 2011

Hatteras Ramius Advantage Fund

(a Delaware Statutory Trust)

(Liquidation Basis)

As of and for the Year Ended March 31, 2011

Table of Contents

| Report of Independent Registered Public Accounting Firm | | 1 |

| Statement of Assets and Liabilities | | 2 |

| Statement of Operations | | 3 |

| Statement of Changes in Net Assets | | 4 |

| Statement of Cash Flows | | 5 |

| Notes to Financial Statements | | 6 - 11 |

| Board of Trustees | | 12 |

| Fund Management | | 13 |

| Other Information | | 14 |

| Deloitte & Touche LLP 1700 Market Street Philadelphia, PA 19103-3984 USA Tel: +1 215 246 2300 Fax: +1 215 569 2441 www.deloitte.com |

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

To the Board of Trustees and Shareholders of Hatteras Ramius Advantage Fund:

We have audited the accompanying statement of assets and liabilities (liquidation basis) of Hatteras Ramius Advantage Fund (a Delaware Statutory Trust) (the "Fund") as of March 31, 2011, and the related statements of operations (liquidation basis) and cash flows (liquidation basis) for the year then ended, the statement of changes in net assets (liquidation basis) for the year ended March 31, 2011 and the statement of changes in net assets for the period from November 1, 2009 (commencement of operations) to March 31, 2010. These financial statements are the responsibility of the Fund's management. Our responsibility is to express an opinion on these financial statements and based on our audits.

We conducted our audits in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement. The Fund is not required to have, nor were we engaged to perform, an audit of its internal control over financial reporting. Our audits included consideration of internal control over financial reporting as a basis for designing audit procedures that are appropriate in the circumstances, but not for the purpose of expressing an opinion on the effectiveness of the Fund's internal control over financial reporting. Accordingly, we express no such opinion. An audit also includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements, assessing the accounting principles used and significant estimates made by management, as well as evaluating the overall financial statement presentation. We believe that our audits provide a reasonable basis for our opinion.

As discussed in Note 1 to the financial statements, on January 6, 2011, the Board of Trustees approved a plan of to discontinue operations of the Fund and begin liquidation proceedings. As a result the Fund changed its basis of accounting from going concern to the liquidation basis.

In our opinion, the financial statements referred to above present fairly, in all material respects, the financial position of the Hatteras Ramius Advantage Fund as of March 31, 2011, the results of its operations and its cash flows for the year then ended and changes in its net assets for each of the periods presented, in conformity with accounting principles generally accepted in the United States of America applied on the basis described in the preceding paragraph.

May xx, 2011

HATTERAS RAMIUS ADVANTAGE FUND

(a Delaware Statutory Trust)

STATEMENT OF ASSETS AND LIABILITIES

(Liquidation Basis)

March 31, 2011

| Assets | �� | | |

| Investment in Hatteras Ramius Advantage Institutional Fund, at fair value (cost $4,682,575) | | $ | 4,638,024 | |

| Cash | | | 18,092 | |

| Receivable for redemption from Master Fund | | | 4,677,702 | |

| Expense waiver receivable from Investment Manager | | | 71,388 | |

| Prepaid assets | | | 3 | |

| Total assets | | | 9,405,209 | |

| Liabilities | | | | |

| Capital withdrawal | | | 4,677,702 | |

| Professional fees payable | | | 10,500 | |

| Servicing fee payable | | | 8,245 | |

| Accounting and administration fees payable | | | 4,500 | |

| Custodian fees payable | | | 350 | |

| Other expenses payable | | | 2,675 | |

| Total liabilities | | | 4,703,972 | |

| Net Assets | | $ | 4,701,237 | |

| | | | | |

| Components of Net Assets: | | | | |

| Shares of beneficial interest | | | 4,597,799 | |

| Accumulated net investment loss | | | - | |

| Accumulated net realized loss on investments | | | (36,773 | ) |

| Net unrealized appreciation on investments | | | 140,211 | |

Total Net Assets | | $ | 4,701,237 | |

| | | | | |

| Net asset value per share | | $ | 99.03 | |

| Number of authorized shares | | | 1,500,000.00 | |

| Number of outstanding shares | | | 47,472.33 | |

See notes to financial statements.

HATTERAS RAMIUS ADVANTAGE FUND

(a Delaware Statutory Trust)

STATEMENT OF OPERATIONS

(Liquidation Basis)

For the Year Ended March 31, 2011

| Net investment loss allocated from Hatteras Ramius Advantage Institutional Fund | | | |

| Interest | | $ | 4,014 | |

| Expenses | | | (577,417 | ) |

| Expense reimbursement by Investment Manager | | | 301,951 | |

| Net investment loss allocated from Hatteras Ramius Advantage Institutional Fund | | | (271,452 | ) |

| | | | | |

| Fund investment income | | | | |

| Interest | | | 33 | |

| Total Fund investment income | | | 33 | |

| | | | | |

| Fund expenses | | | | |

| Accounting and administration fees | | | 58,231 | |

| Registration and blue sky fees | | | 46,711 | |

| Servicing fee | | | 32,625 | |

| Professional fees | | | 15,917 | |

| Insurance fees | | | 2,177 | |

| Custodian fees | | | 1,997 | |

| Other expenses | | | 11,394 | |

| Total Fund expenses before reimbursement | | | 169,052 | |

| Expense reimbursement | | | (132,385 | ) |

| Net Fund expenses | | | 36,667 | |

| Net investment loss | | | (308,086 | ) |

| | | | | |

| Net realized gain and change in unrealized depreciation on investments allocated from Hatteras Ramius Advantage Institutional Fund | | | | |

| Net realized gain from investments allocated from Hatteras Ramius Advantage Institutional Fund | | | 358,548 | |

| Net unrealized depreciation on investments allocated From Hatteras Ramius Advantage Institutional Fund | | | (118,144 | ) |

| Net realized gain and change in unrealized depreciation on investments allocated from Hatteras Ramius Advantage Institutional Fund | | | 240,404 | |

| Net decrease in net assets resulting from operations | | $ | (67,682 | ) |

See notes to financial statements.

HATTERAS RAMIUS ADVANTAGE FUND

(a Delaware Statutory Trust)

STATEMENT OF CHANGES IN NET ASSETS

| | | For the Year Ended March 31, 2011 (Liquidation Basis) | | | For the period from November 1, 2009 (commencement of operations) to March 31, 2010 | |

| Operations: | | | | | | |

| Net investment loss | | $ | (308,086 | ) | | $ | (127,010 | ) |

| Net realized gain on investments allocated from Hatteras Ramius Advantage Institutional Fund | | | 358,548 | | | | 4,629 | |

| Net change in unrealized appreciation(depreciation) on investments allocated from Hatteras Ramius Advantage Institutional Fund | | | (118,144 | ) | | | 258,355 | |

| | | | | | | | | |

| Net change in net assets resulting from operations | | | (67,682 | ) | | | 135,974 | |

| | | | | | | | | |

| Capital Share Transactions | | | | | | | | |

| Capital withdrawals | | | (4,677,702 | ) | | | − | |

| Distribution | | | (167,150 | ) | | | − | |

| Reinvestment of distribution | | | 167,150 | | | | − | |

| Proceeds from shares issued | | | 214,604 | | | | 9,096,043 | |

| | | | | | | | | |

| Net change in net assets from capital share transactions | | | (4,463,098 | ) | | | 9,096,043 | |

| | | | | | | | | |

| Total change in net assets | | | (4,530,780 | ) | | | 9,232,017 | |

| | | | | | | | | |

| Net Assets: | | | | | | | | |

| Beginning of year/period | | | 9,232,017 | | | | − | |

| End of year/period | | $ | 4,701,237 | ** | | $ | 9,232,017 | * |

* Including accumulated net investment loss of $121,207.

**Including accumulated net investment loss of $0.

See notes to financial statements.

HATTERAS RAMIUS ADVANTAGE FUND

(a Delaware Statutory Trust)

STATEMENT OF CASH FLOWS

(Liquidation Basis)

For the Year Ended March 31, 2011

| Cash flows from operating activities: | | | |

| Net decrease in net assets resulting from operations | | $ | (67,682 | ) |

| Adjustments to reconcile net decrease in net assets resulting from operations to net cash used in operating activities: | | | | |

| Purchases of shares in Hatteras Ramius Advantage Institutional Fund | | | (401,000 | ) |

| Proceeds from sales of shares in Hatteras Ramius Advantage Institutional Fund | | | 4,878,419 | |

| Decrease in receivable from redemption from Hatteras Ramius Advantage Institutional Fund | | | (4,677,702 | ) |

| Net investment loss allocated from Hatteras Ramius Advantage Institutional Fund | | | 271,452 | |

| Net realized gain from investments | | | (358,548 | ) |

| Net change in unrealized depreciation on investments allocated from Hatteras Ramius Advantage Institutional Fund | | | 118,144 | |

| Decrease in prepaid assets | | | 22,047 | |

| Increase in expense waiver receivable | | | (52,174 | ) |

| Decrease in professional fees payable | | | (2,083 | ) |

| Decrease in accounting and administration fees payable | | | (7,900 | ) |

| Increase in servicing fees payable | | | 5,557 | |

| Decrease in custodian fees payable | | | (1,108 | ) |

| Increase in other expenses payable | | | 2,630 | |

| Net cash used in operating activities | | | (269,948 | ) |

| Cash flows from financing activities: | | | | |

| Proceeds from shares issued | | | 214,604 | |

| Net cash provided by financing activities | | | 214,604 | |

| Net change in cash and cash equivalents | | | (55,344 | ) |

| | | | | |

| Cash and cash equivalents at beginning of year | | | 73,436 | |

| Cash and cash equivalents at end of year | | $ | 18,092 | |

| | | | | |

| Supplemental Disclosure of Reinvestment of Distribution amount | | $ | 167,150 | |

See notes to financial statements.

HATTERAS RAMIUS ADVANTAGE FUND

(a Delaware Statutory Trust)

NOTES TO FINANCIAL STATEMENTS

(Liquidation Basis)

For the Year Ended March 31, 2011

Hatteras Ramius Advantage Fund (the “Fund”) is a Delaware statutory trust registered under the Investment Company Act of 1940, as amended (the “1940 Act”), as a non-diversified, closed-end management investment company. Hatteras Capital Investment Management, LLC (“HCIM”), an investment adviser registered with the Securities and Exchange Commission (the “SEC”) under the Investment Advisers Act of 1940, as amended (the “Advisers Act”), serves as the investment manager to the Master Fund (as defined below) (in such capacity, the “Investment Manager”). Ramius Alternative Solutions LLC (“Ramius”), an investment adviser registered with the SEC under the Advisers Act, serves as sub-adviser to the Master Fund (in such capacity, the “Sub-Adviser”).

On January 6, 2011, the Board of Trustees (the “Board”) of the Fund determined to discontinue investment operations and repurchase all outstanding shares from Shareholders, as soon as practicable. This decision was made after careful consideration of the Fund’s asset size and current expenses. In connection with the pending close and repurchases, the Fund discontinued accepting orders for the purchase of Fund shares, effective immediately. On January 6, 2011, the Board of the Master Fund, a registered closed-end investment company in which the Fund invests substantially all of its assets, has also determined to discontinue investment operations and repurchase all of its outstanding shares from its shareholders as soon as practicable. The Board, and the Board of the Master Fund, approved two tender offers to Shareholders, with valuation dates of March 31, 2011 and June 30, 2011, as an appropriate method for the Fund (and Master Fund) to make cash available to Shareholders (and shareholders of the Master Fund, including the Fund). The tender offers are described in more detail below.

The percentage of the Master Fund’s shares owned by the Fund at March 31, 2011 was 85.22%.

| 2. | SIGNIFICANT ACCOUNTING POLICIES |

The financial statements have been prepared in accordance with accounting principles generally accepted in the United States of America (“U.S. GAAP”), applied on the liquidation basis.�� The liquidation basis of accounting is appropriate when liquidation is considered imminent and the Fund is not considered a going concern. Under this method of accounting assets are stated at their net realizable value and liabilities at their anticipated settlement amounts.

The Fund does not make direct investments in securities or financial instruments, and invests substantially all of its assets in the Master Fund. The Fund records its investment in the Master Fund at fair value. The Fund’s investment in the Master Fund would be considered level 3 as defined under fair valuation accounting standards. Valuation of securities held by the Master Fund, including the Master Fund’s disclosure of investments under the three-tier hierarchy, is discussed in the notes to the Master Fund’s financial statements included elsewhere in this report.

As the Fund discontinues investment operations, the net proceeds from the Master Fund’s liquidation of portfolio securities will be invested in cash equivalent securities. During this time, the Master Fund will hold more cash or cash equivalents than normal, which will likely prevent the Fund from meeting its stated investment objective.

| b. | Allocations from the Master Fund |

The Fund records its allocated portion of income, expense, realized gains and losses and unrealized appreciation and depreciation from the Master Fund.

| c. | Fund Level Income and Expenses |

Interest income on any cash or cash equivalents held by the Fund will be recognized on an accrual basis. Expenses that are specifically attributed to the Fund are charged to the Fund and recorded on an accrual basis. Because the Fund bears its proportionate share of the management fees of the Master Fund, the Fund pays no direct management fee to the Investment Manager.

HATTERAS RAMIUS ADVANTAGE FUND

(a Delaware Statutory Trust)

NOTES TO FINANCIAL STATEMENTS

(Liquidation Basis)

For the Year Ended March 31, 2011 (continued)

| 2. | SIGNIFICANT ACCOUNTING POLICIES (continued) |

| d. | Income Tax Information and Distributions to Shareholders |

The offers to repurchase shares for March 31, 2011 and June 30, 2011 (together, the “Combined Offers”), is expected to result in all Shareholders redeeming 100% of their shares in the Fund. For federal income tax purposes, it is expected that the Combined Offers will be considered as being made pursuant to a plan of complete liquidation. In that case, the cash receive from tendering shares in response to the Combined Offers will constitute a nontaxable return of capital to the extent of the tax basis in all shares, and any excess will be taxable to as capital gain. If shares are held as capital assets, any gain will be capital gain. If the shares have been held for more than twelve months, any such capital gain will be long-term capital gain, taxable to individual U.S. Shareholders at a maximum federal rate of 15%. Capital gain on shares held for twelve months or less will be treated as short-term capital gain.

Each year, the Fund intends to qualify as a regulated investment company by distributing substantially all of its taxable income and realized gains under Subchapter M of the Internal Revenue Code and filing its U.S. federal tax return. As a result, no provision for income taxes is required. As of March 31, 2011, the Fund did not have any unrecognized tax benefits in the accompanying financial statements. The Fund is not aware of any tax positions for which it is reasonably possible that the total amounts of unrecognized tax benefits will significantly change in the next twelve months. The Fund’s federal tax return is subject to examination by the Internal Revenue Service (IRS) for the period ended December 31, 2009 and the year ended December 31, 2010. Foreign taxes are provided for based on the Fund’s understanding of the tax rules and rates that exist in the foreign markets in which it invests.

Distributions are recorded on the ex-dividend date. Income dividends and capital gain distributions are declared separately. Income and capital gain distributions are determined in accordance with income tax regulations, which may differ from generally accepted accounting principles. For the year ended March 31, 2011, the Fund paid an ordinary income distribution of $167,150.

Capital accounts within the financial statements are adjusted for permanent book-tax differences. These adjustments have no impact on net assets or the results of operations. Temporary book-tax differences will reverse in a subsequent period.

Additionally, U.S. GAAP requires certain components of net assets relating to permanent differences be reclassified between financial and tax reporting. Permanent differences between book and tax basis are attributable to certain non-deductible expenses for tax purposes, including certain offering, organizational, and registration expenses. These reclassifications have no effect on net assets or net asset value per share. For the year ended, March 31, 2011, the following was reclassified:

| Shares of beneficial interest | | $ | (196,492 | ) |

| Accumulated net investment loss | | | 596,442 | |

| Accumulated net realized gain on investments | | | (399,950 | ) |

At March 31, 2011, the federal tax cost of investment securities and unrealized appreciation (depreciation) were as follows:

| Gross unrealized appreciation | | $ | 80 | |

| Gross unrealized depreciation | | | (44,631 | ) |

| Net unrealized appreciation (depreciation) | | $ | (44,551 | ) |

| Tax cost | | $ | 4,682,575 | |

HATTERAS RAMIUS ADVANTAGE FUND

(a Delaware Statutory Trust)

NOTES TO FINANCIAL STATEMENTS

(Liquidation Basis)

For the Year Ended March 31, 2011 (continued)

| 2. | SIGNIFICANT ACCOUNTING POLICIES (continued) |

| d. | Income Tax Information and Distributions to Shareholders (continued) |

At December 31, 2010 the tax-based components of distributable earnings as of period end were as follows:

| Undistributed ordinary income | | $ | - | |

| Undistributed long-term capital gains | | | - | |

| | | $ | - | |

| Accumulated Capital and Other Losses | | | (36,773 | ) |

| Unrealized Appreciation / (Depreciation) | | | (44,551 | ) |

| Total Accumulated Earnings (Deficit) | | $ | (81,324 | ) |

Cash includes amounts held in interest bearing demand deposit accounts. Such amounts, at times, may exceed federally insured limits. The Fund has not experienced any losses in such accounts and does not believe it is exposed to any significant credit risk on such accounts.

The preparation of financial statements in conformity with U.S. GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements, and the reported amounts of increases and decreases in net assets from operations during the reporting period. Actual results could differ from those estimates.

| g. | Recently Issued Accounting Pronouncements |

On December 22, 2010, The U.S. government passed the Regulated Investment Company Modernization Act of 2010 (the “Modernization Act”). The Modernization Act is the first major piece of legislation affecting Regulated Investment Companies (“RICs”) since 1986 and it modernizes several of the federal income and excise tax provisions related to RICs. One of the provisions allows a RIC to carry forward capital losses indefinitely, and retain the character of the original loss. Under pre-enactment law, capital losses could be carried forward for eight years, and carried forward as short-term capital, irrespective of the character of the original loss. Except for the simplification provisions related to RIC qualification, the Modernization Act is effective for taxable years beginning after December 22, 2010. The provisions related to RIC qualification are effective for taxable years for which the extended due date of the tax return is after December 22, 2010

| 3. | RELATED PARTY TRANSACTIONS AND OTHER |

In consideration for fund services, the Fund pays the Investment Manager (in such capacity, the "Servicing Agent") a fund servicing fee at the annual rate of 0.35% of the month-end net asset value of the Fund. The servicing fees payable to the Servicing Agent will be borne by all Shareholders on a pro-rata basis before giving effect to any repurchase of shares in the Master Fund effective as of that date, and will decrease the net profits or increase the net losses of the Master Fund that are credited to shareholders.

The Servicing Agent may waive (to all investors on a pro-rata basis) or pay to third parties all or a portion of any such fees in its sole discretion. The Servicing Agent did not waive any of the servicing fees for the year ended March 31, 2011.

The Investment Manager and Sub-Adviser have contractually agreed to reimburse certain expenses through October 31, 2012, so that the total annual expenses of the Fund (which excludes taxes, interest, brokerage commissions, other transaction-related expenses, any extraordinary expenses of the Fund and Master Fund and any acquired fund fees and expenses of the Fund and Master Fund but includes the fund servicing fee and indirect fees and expenses of the Master Fund) for this period will not exceed 3.35% of the net assets of the Fund on an annualized basis (the “Expense Limitation”). The agreement automatically renews for one-year terms after the initial period.

HATTERAS RAMIUS ADVANTAGE FUND

(a Delaware Statutory Trust)

NOTES TO FINANCIAL STATEMENTS

(Liquidation Basis)

For the Year Ended March 31, 2011 (continued)

| 3. | RELATED PARTY TRANSACTIONS AND OTHER (continued) |

The agreement may be terminated by the Investment Manager, the Sub-Adviser or the Fund on sixty (60) days’ written notice to the other parties. The Fund will carry forward, for a period not to exceed (3) three years from the date on which a reimbursement is made by the Investment Manager and/or Sub-Adviser, any expenses in excess of the Expense Limitation and repay the Investment Manager and/or Sub-Adviser such amounts, provided the Fund is able to effect such reimbursement and remain in compliance with the Expense Limitation disclosed in the Fund’s then effective prospectus.

For the year ending March 31, 2011, the Investment Manager reimbursed the Fund $132,385 for amounts in excess of the Expense Limitation, all of which will be available for potential future repayment until October 31, 2012.

Hatteras Capital Distributors LLC (“HCD”), an affiliate of the Investment Manager, serves as the Fund’s distributor. HCD receives a monthly distribution fee from the Investment Manager equal to 0.0083% (0.10% on an annualized basis) of the net assets of the Master Fund as of the last day of the month (before giving effect to any repurchase of Master Fund shares).

At March 31, 2011, Shareholders who are affiliated with the Investment Manager owned $100,791 (2.14% of Net Assets) of the Fund. UMB Bank, N.A. serves as custodian of the Fund’s cash balances and provides custodial services for the Fund. J.D. Clark & Company, a division of UMB Fund Services, Inc. serves as administrator and accounting agent to the Fund and provides certain accounting, record keeping and investor related services. The Fund pays a monthly fee to the custodian and administrator based upon average net assets, subject to certain minimums.

An investment in the Fund involves significant risks that should be carefully considered prior to investment and should only be considered by persons financially able to maintain their investment and who can afford a loss of a substantial part or all of such investment. The Master Fund intends to invest substantially all of its available capital in securities of private investment companies. These investments will generally be restricted securities that are subject to substantial holding periods or are not traded in public markets at all, so that the Master Fund may not be able to resell some of its investments for extended periods, which may be several years. Shareholders should refer to the Fund’s prospectus and corresponding statement of additional information for a more complete list of risk factors. No guarantee or representation is made that the investment objective will be met.

| 5. | CAPITAL SHARE TRANSACTIONS |

Transactions in shares were as follows:

Shares outstanding, November 1, 2009 (commencement of operations) | | | − | |

| Shares issued | | | 90,964.79 | |

| Shares redeemed | | | − | |

| Shares outstanding, April 1, 2010 | | | 90,964.79 | |

| Shares issued | | | 2,088.79 | |

| Shares reinvested | | | 1,654.30 | |

| Shares redeemed | | | ( 47,235.55 | ) |

| Shares outstanding, March 31, 2011 | | | 47,472.33 | |

HATTERAS RAMIUS ADVANTAGE FUND

(a Delaware Statutory Trust)

NOTES TO FINANCIAL STATEMENTS

(Liquidation Basis)

For the Year Ended March 31, 2011 (continued)

The Board has approved the Combined Offers as an appropriate method for the Fund to make cash available to Shareholders for the closing of the Fund. The Fund will make an initial tender offer to Shareholders (in an amount up to approximately 50% of the Fund’s net assets) to purchase shares at their net asset value calculated as of March 31, 2011 (the “March Tender”), and will make a final tender offer to Shareholders to purchase all then-outstanding shares of the Fund at their net asset value calculated as of June 30, 2011 (the “June Tender”). HCIM does not intend to tender all of its shares and may, despite the fact that the Fund will no longer be accepting subscriptions from outside investors, purchase additional shares, the proceeds of which may be used by the Fund to make payments in connection with the Combined Offers. Following completion of the June Tender, it is anticipated that HCIM will be the sole shareholder of the Master Fund during the completion of the Master Fund’s liquidation.

In the normal course of business, the Fund enters into contracts that provide general indemnifications. The Fund’s maximum exposure under these agreements is dependent on future claims that may be made against the Fund, and therefore cannot be established; however, based on experience, the risk of loss from such claims is considered remote.

The financial highlights are intended to help an investor understand the Fund’s financial performance. The total returns in the table represent the rate that a Shareholder would be expected to have earned or lost on an investment in the Fund. An individual Shareholder’s ratio or return may vary from the table below based on the timing of capital transactions.

The ratios are calculated by dividing total dollars of income or expenses as applicable by the average of total monthly net assets and are annualized (except for total return and portfolio turnover ratio) for periods less than a year. The ratios include the Fund’s proportionate share of the Master Fund’s income and expenses and expense reimbursement.

Total return is not annualized and is calculated based on changes in net asset value. A Shareholder’s individual return may vary from this return based on the timing of share purchases. The portfolio turnover rate is calculated based on the Master Fund’s investment activity, as turnover occurs at the Master Fund level, and the Fund is typically invested 100% in the Master Fund.

Net Asset Value, November 1, 2009 (commencement of operations) | | $ | 100.00 | |

| Income from investment operations: | | | | |

| Net investment loss | | | (1.40 | ) |

| Net realized and unrealized gain on investment transactions | | | 2.89 | |

| Total from investment operations | | | 1.49 | |

| Net Asset Value, April 1, 2010 | | $ | 101.49 | |

| Income from investment operations: | | | | |

| Net investment loss | | | (2.85 | ) |

| Net realized and unrealized gain on investment transactions | | | 2.19 | |

| Total from investment operations | | | (0.66 | ) |

| Distributions | | | (1.80 | ) |

| Net Asset Value, March 31, 2011 | | $ | 99.03 | |

HATTERAS RAMIUS ADVANTAGE FUND

(a Delaware Statutory Trust)

NOTES TO FINANCIAL STATEMENTS

(Liquidation Basis)

For the Year Ended March 31, 2011 (Concluded)

| 8. | FINANCIAL HIGHLIGHTS (continued) |

| | | For the Year Ended March 31, 2011 | | | For the period from November 1, 2009 (commencement of operations) to March 31, 2010 | |

| Total return | | | (0.62 | )% | | | 1.49 | %3 |

| Net investment loss | | | (1.15 | )% | | | (3.33 | )% |

| Operating expenses, excluding reimbursement from Investment Manager | | | 1.81 | % | | | 12.22 | %1 |

| Reimbursement from Investment Manager | | | (1.42 | )% | | | (8.87 | )% |

| Net expenses | | | 0.39 | % | | | 3.35 | %2 |

| Net assets, end of period (000’s) | | $ | 4,701 | | | $ | 9,232 | |

| Portfolio Turnover Rate (Master Fund) | | | 9.52 | % | | | 3.93 | %3 |

| 1 | Offering costs and organizational expenses, included in operating expenses, are not annualized. |

| 2 | Ratios calculated based on total expenses and average net assets and are annualized, except for organizational costs. |

Management has evaluated the events and transactions through the date the financial statements were issued and determined there were no subsequent events that required adjustment to our disclosure in the financial statements except the Board accepted approximately $4,700,000 worth of tender requests which will be effective as of June 30, 2011.

*****

HATTERAS RAMIUS ADVANTAGE FUND

(a Delaware Statutory Trust)

BOARD OF TRUSTEES

(unaudited)

The identity of the Board members (each a “Trustee”) and brief biographical information, as of March 31, 2011, is set forth below. The business address of each Trustee is care of Hatteras Funds, 8540 Colonnade Center Drive, Suite 401, Raleigh, NC 27615. The Fund’s statement of additional information includes information about the Trustees and may be obtained without charge by calling the Fund at 1-888-363-2324.

Name & Date of Birth | | Position(s) Held with the Fund | | Length of Time Served | | Principal Occupation(s) During Past 5 Years and Other Directorships Held by Trustee | | Number of Portfolios in Fund Complex’ Overseen by Trustee |

| INTERESTED TRUSTEE | | | | |

David B. Perkins* July 18, 1962 | | President and Chairman of the Board of Trustees of the Fund | | Since Inception | | Mr. Perkins has been Chairman of the Board of Trustees and President of the Fund since inception. Mr. Perkins is the Chief Executive Officer of Hatteras and its affiliated entities. He founded the firm in September 2003. Prior to that, he was the co-founder and Managing Partner of CapFinancial Partners, LLC. | | 15 |

| INDEPENDENT TRUSTEES | | | | |

H. Alexander Holmes May 4, 1942 | | Trustee; Audit Committee Member of the Fund | | Since Inception | | Mr. Holmes founded Holmes Advisory Services, LLC, a financial consultation firm, in 1993. | | 15 |

Steve E. Moss February 18, 1953 | | Trustee; Audit Committee Member of the Fund | | Since Inception | | Mr. Moss is a principal of Holden, Moss, Knott, Clark, Copley & Hoyle, P.A. and has been a member manager of HMKCT Properties, LLC since January 1996. | | 15 |

Gregory S. Sellers May 5, 1959 | | Trustee; Audit Committee Member of the Fund | | Since Inception | | Mr. Sellers has been the Chief Financial Officer of Imagemark Business Services, Inc., a strategic communications provider of marketing and print communications solutions, since June 2009. From 2003 to June 2009, Mr. Sellers was the Chief Financial Officer and a director of Kings Plush, Inc., a fabric manufacturer. | | 15 |

Daniel K. Wilson June 22, 1948 | | Trustee; Audit Committee Member of the Fund | | Since Inception | | Mr. Wilson was Executive Vice President and Chief Financial Officer of Parksdale Mills, Inc. from 2004 - 2008. Mr. Wilson currently is in private practice as a Certified Public Accountant. | | 9 |

*Mr. Perkins is deemed to be an “interested” Trustee of the Fund because of his affiliations with the Investment Manager.

HATTERAS RAMIUS ADVANTAGE FUND

(a Delaware Statutory Trust)

FUND MANAGEMENT

(unaudited)

Set forth below is the name, date of birth, position with the Fund, length of term of office, and the principal occupation for the last five years, as of March 31, 2011, of each of the persons currently serving as Executive Officers. The business address of each officer is care of Hatteras Funds, 8540 Colonnade Center Drive, Suite 401, Raleigh, NC 27615.

Name & Date of Birth | | Position(s) Held with the Fund | | Length of Time Served | | Principal Occupation(s) During Past 5 years and Other Directorships Held by Officer | | Number of Portfolios in Fund Complex Overseen by Officer |

| OFFICERS | | | | | | |

| J. Michael Fields, July 14, 1973 | | Secretary of the Fund | | Since inception | | Prior to becoming Secretary of each of the Funds in the Fund Complex in 2008, Mr. Fields was the Treasurer of each of the Funds in the Fund Complex. Mr. Fields is Chief Operating Officer of Hatteras and its affiliates and has been employed by the Hatteras firm since its inception in September 2003. | | N/A |

| Andrew P. Chica September 7, 1975 | | Chief Compliance Officer of the Fund | | Since inception | | Mr. Chica joined Hatteras in November 2007 and became Chief Compliance Officer of each of the funds in the Fund Complex and the Investment Manager as of January 2008. Prior to joining Hatteras, Mr. Chica was the Compliance Manager for UMB Fund Services, Inc. from December 2004 to November 2007. From April 2000 to December 2004, Mr. Chica served as an Assistant Vice President and Compliance Officer with U.S. Bancorp Fund Services, LLC. | | N/A |

| Robert Lance Baker September 17, 1971 | | Treasurer of the Fund | | Since inception | | Mr. Baker joined Hatteras in March 2008 and became Treasurer of each of the funds in the Fund Complex in December 2008. Mr. Baker serves as the Chief Financial Officer of the Investment Manager and its affiliates. Prior to joining Hatteras, Mr. Baker worked for Smith Breeden Associates, an investment advisor located in Durham, NC. At Smith Breeden, Mr. Baker served as Vice President of Portfolio Accounting, Performance Reporting, and Fund Administration. | | N/A |

HATTERAS RAMIUS ADVANTAGE FUND

(a Delaware Statutory Trust)

OTHER INFORMATION

(unaudited)

Proxy Voting

A description of the policies and procedures that the Master Fund uses to determine how to vote proxies relating to portfolio securities and the Master Fund’s record of actual proxy votes cast is available at www.sec.gov and by calling 1-800-504-9070 and may be obtained at no additional charge.

Availability of Quarterly Portfolio Schedules

The Fund files its complete schedule of portfolio holdings, which includes securities held by the Master Fund, with the SEC for the first and third quarters of each fiscal year on Form N-Q. The Fund’s Form N-Q is available, without charge and upon request, on the SEC’s website at http://www.sec.gov or may be reviewed and copied at the SEC’s Public Reference Room in Washington, DC. Information on the Public Reference Room may be obtained by calling 1-800-SEC-0330.

ITEM 1. REPORTS TO STOCKHOLDERS.

The Report to Shareholders is attached herewith.

Hatteras Ramius Advantage Institutional Fund

(a Delaware Statutory Trust)

Financial Statements

(Liquidation Basis)

As of and for the Year Ended March 31, 2011

Hatteras Ramius Advantage Institutional Fund

(a Delaware Statutory Trust)

(Liquidation Basis)

As of and for the Year Ended March 31, 2011

Table of Contents

| Report of Independent Registered Public Accounting Firm | 1 |

| Schedule of Investments | 2-3 |

| Statement of Assets and Liabilities | 4 |

| Statement of Operations | 5 |

| Statement of Changes in Net Assets | 6 |

| Statement of Cash Flows | 7 |

| Notes to Financial Statements | 8-17 |

| Board of Trustees | 18 |

| Fund Management | 19 |

| Other Information | 20 |

| | Deloitte & Touche LLP |

| | 1700 Market Street |

| | Philadelphia, PA 19103-3984 |

| | USA |

| | |

| | Tel: +1 215 246 2300 |

| | Fax: +1 215 569 2441 |

| | www.deloitte.com |

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

To the Board of Trustees and Shareholders of

Hatteras Ramius Advantage Institutional Fund:

We have audited the accompanying statement of assets and liabilities (liquidation basis) of Hatteras Ramius Advantage Institutional Fund (a Delaware Statutory Trust) (the " Master Fund"), including the schedule of investments (liquidation basis), as of March 31, 2011, and the related statements of operations (liquidation basis), and cash flows (liquidation basis) for the year then ended, the statement of changes in net assets (liquidation basis) for the year ended March 31, 2011 and the statement of changes in net assets for the period from November 1, 2009 (commencement of operations) to March 31, 2010. These financial statements are the responsibility of the Master Fund's management. Our responsibility is to express an opinion on these financial statements based on our audits.

We conducted our audits in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement. The Master Fund is not required to have, nor were we engaged to perform, an audit of its internal control over financial reporting. Our audits included consideration of internal control over financial reporting as a basis for designing audit procedures that are appropriate in the circumstances, but not for the purpose of expressing an opinion on the effectiveness of the Master Fund's internal control over financial reporting. Accordingly, we express no such opinion. An audit also includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements, assessing the accounting principles used and significant estimates made by management, as well as evaluating the overall financial statement presentation. Our procedures included confirmation of investments owned as of March 31, 2011, by correspondence with the underlying Sub-Managers. We believe that our audits provide a reasonable basis for our opinion.

As discussed in Note 1 to the financial statements, on January 6, 2011, the Board of Trustees approved a plan of to discontinue operations of the Master Fund and begin liquidation proceedings. As a result the Master Fund changed its basis of accounting from going concern to the liquidation basis.

In our opinion, the financial statements referred to above present fairly, in all material respects, the financial position of Hatteras Ramius Advantage Institutional Fund as of March 31, 2011, the results of its operations and its cash flows for the year then ended and changes in its net assets for each of the periods presented, in conformity with accounting principles generally accepted in the United States of America applied on the basis described in the preceding paragraph.

As discussed in Note 2 to the financial statements, the financial statements include investments valued at $1,041,770 (19.14% of net assets) as of March 31, 2011, whose fair value have been estimated by management in the absence of readily determinable fair values. Management’s estimates are based primarily on information provided by the underlying Sub-Managers.

May xx, 2011

HATTERAS RAMIUS ADVANTAGE INSTITUTIONAL FUND

(a Delaware Statutory Trust)

SCHEDULE OF INVESTMENTS

(Liquidation Basis)

March 31, 2011

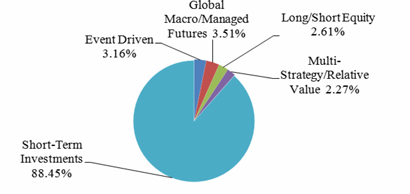

| Investments in Sub-Manager Funds (19.14%) | | Cost | | | Fair Value | |

| Event Driven (5.24%) | | | | | | |

Pershing Square International, Ltd. a,b | | $ | 207,000 | | | $ | 285,250 | |

| Total Event Driven | | | | | | | 285,250 | |

| | | | | | | | | |

| Global Macro/Managed Futures (5.81%) | | | | | | | | |

Wexford Offshore Spectrum Fund a,b | | | 300,000 | | | | 316,451 | |

| Total Global Macro/Managed Futures | | | | | | | 316,451 | |

| | | | | | | | | |

| Long/Short Equity (4.33%) | | | | | | | | |

SAC Capital International, Ltd. a,b | | | 206,770 | | | | 235,612 | |

| Total Long/Short Equity | | | | | | | 235,612 | |

| | | | | | | | | |

| Multi-Strategy/Relative Value (3.76%) | | | | | | | | |

Goldman Sachs Investment Partners Offshore, L.P. a,b | | | 184,000 | | | | 204,457 | |

| Total Multi-Strategy/Relative Value | | | | | | | 204,457 | |

| | | | | | | | | |

| Total Investments in Sub-Manager Funds | | $ | 897,770 | | | $ | 1,041,770 | |

See notes to financial statements.

HATTERAS RAMIUS ADVANTAGE INSTITUTIONAL FUND

(a Delaware Statutory Trust)

SCHEDULE OF INVESTMENTS

(Liquidation Basis)

March 31, 2011

| Short-Term Investments (146.55%) | | | | | | |

| | | | | | | |

Federated Prime Obligations Fund #10, 0.15% c | | $ | 7,975,913 | | | $ | 7,975,913 | |

| | | | | | | | | |

| Total Short-Term Investments (Cost $7,975,913) | | | | | | | 7,975,913 | |

| | | | | | | | | |

| Total Investments (Cost $8,873,683) (165.69%) | | | | | | | 9,017,683 | |

| | | | | | | | | |

| Liabilities in excess of other assets (-65.69%) | | | | | | | (3,575,309 | ) |

| | | | | | | | | |

| Net assets – 100.00% | | | | | | $ | 5,442,374 | |

a Non-income producing.

b Sub-Manager Funds are issued in private placement transactions and as such are restricted as to resale.

c The rate shown is the annualized 7-day yield as of March 31, 2011.

See notes to financial statements.

HATTERAS RAMIUS ADVANTAGE INSTITUTIONAL FUND

(a Delaware Statutory Trust)

STATEMENT OF ASSETS AND LIABILITIES

(Liquidation Basis)

March 31, 2011

| Assets | | | |

| Investments in Sub-Manager Funds, at fair value (cost $897,770) | | $ | 1,041,770 | |

| Investments in Short-Term Investments, at fair value (cost $7,975,913) | | | 7,975,913 | |

| Receivable from redemption from Sub-Manager Funds | | | 1,846,008 | |

| Due from Investment Manager | | | 153,577 | |

| Prepaid assets | | | 1,082 | |

| Total assets | | | 11,018,350 | |

| Liabilities | | | | |

| Redemption payable | | | 5,490,997 | |

| Management fee payable | | | 41,225 | |

| Professional fees payable | | | 20,000 | |

| Servicing fee payable | | | 10,979 | |

| Accounting and administration fees payable | | | 9,775 | |

| Custodian fees payable | | | 1,000 | |

| Other expense payable | | | 2,000 | |

| Total liabilities | | | 5,575,976 | |

| Net Assets | | $ | 5,442,374 | |

| | | | | |

| Components of Net Assets: | | | | |

| Shares of beneficial interest | | $ | 5,456,668 | |

| Accumulated net investment loss | | | (37,003 | ) |

| Accumulated net realized loss on investments | | | (121,291 | ) |

| Accumulated net unrealized appreciation on investments | | | 144,000 | |

| Total Net Assets | | $ | 5,442,374 | |

| | | | | |

| Net asset value per share | | $ | 99.22 | |

| Number of authorized shares | | | 3,000,000.00 | |

| Number of outstanding shares | | | 54,851.58 | |

See notes to financial statements.

HATTERAS RAMIUS ADVANTAGE INSTITUTIONAL FUND

(a Delaware Statutory Trust)

STATEMENT OF OPERATIONS

(Liquidation Basis)

For the Year Ended March 31, 2011

| Investment income | | | |

| Dividend | | $ | 4,674 | |

| Total investment income | | | 4,674 | |

| | | | | |

| Operating expenses | | | | |

| Management fee | | | 158,867 | |

| Professional fees | | | 114,018 | |

| Offering cost | | | 112,328 | |

| Accounting and administration fees | | | 92,594 | |

| Registration and blue sky fees | | | 46,711 | |

| Servicing fee | | | 42,313 | |

| Board of Trustees’ fees | | | 37,500 | |

| Insurance expense | | | 33,537 | |

| Custodian fees | | | 2,930 | |

| Other expenses | | | 17,379 | |

| Total expenses before reimbursement | | | 658,177 | |

| Expense reimbursement | | | (342,448 | ) |

| Net expenses | | | 315,729 | |

| Net investment loss | | | (311,055 | ) |

| | | | | |

| Net realized gain and change in unrealized depreciation on investments in Sub-Manager Funds | | | | |

| Net realized gain from investment in Sub-Manager Funds | | | 420,360 | |

| Net change in unrealized depreciation on investments in Sub-Manager Funds | | | (122,397 | ) |

| Net realized gain and change in unrealized depreciation on investments in Sub-Manager Funds | | | 297,963 | |

| Net decrease in net assets resulting from operations | | $ | (13,092 | ) |

See notes to financial statements.

HATTERAS RAMIUS ADVANTAGE INSTITUTIONAL FUND

(a Delaware Statutory Trust)

STATEMENT OF CHANGES IN NET ASSETS

| | | For the Year Ended March 31, 2011 (Liquidation Basis) | | | For the period from November 1, 2009 (commencement of operations) to March 31, 2010 | |

| Operations: | | | | | | |

| Net investment loss | | $ | (311,055 | ) | | $ | (116,039 | ) |

| Net realized gain from investments in Sub-Manager Funds | | | 420,360 | | | | 4,773 | |

| Net change in unrealized appreciation(depreciation) on investments in Sub-Manager Funds | | | (122,397 | ) | | | 266,397 | |

| | | | | | | | | |

| Net change in net assets resulting from operations | | | (13,092 | ) | | | 155,131 | |

| | | | | | | | | |

| Capital Share Transactions | | | | | | | | |

| Proceeds from shares issued | | | 1,515,289 | | | | 9,276,043 | |

| Distribution | | | (235,572 | ) | | | - | |

| Reinvestment of distribution | | | 235,572 | | | | - | |

| Capital shares redeemed | | | (5,490,997 | ) | | | - | |

| | | | | | | | | |

| Net change in net assets from capital share transactions | | | (3,975,708 | ) | | | 9,276,043 | |

| | | | | | | | | |

| Total change in net assets | | | (3,988,800 | ) | | | 9,431,174 | |

| | | | | | | | | |

| Net Assets: | | | | | | | | |

| Beginning of year/period | | | 9,431,174 | | | | - | |

| End of year/period | | $ | 5,442,374 | ** | | $ | 9,431,174 | * |

*Including accumulated net investment loss of $101,982.

**Including accumulated net investment loss of $37,003.

See notes to financial statements.

HATTERAS RAMIUS ADVANTAGE INSTITUTIONAL FUND

(a Delaware Statutory Trust)

STATEMENT OF CASH FLOWS

(Liquidation Basis)

For the Year Ended March 31, 2011

| Cash flows from operating activities: | | | |

| Net decrease in net assets resulting from operations | | $ | (13,092 | ) |

| Adjustments to reconcile net decrease in net assets resulting from operations to net cash used in operating activities: | | | | |

| Purchases of Sub-Manager Funds | | | (700,000 | ) |

| Proceeds from redemption of Sub-Manager Funds | | | 8,643,590 | |

| Net realized gain from investments in Sub-Manager Funds | | | (420,360 | ) |

| Net change in unrealized depreciation on investments in Sub-Manager Funds | | | 122,397 | |

| Net purchases of Short-Term Investments | | | (7,288,798 | ) |

| Increase in receivable from redemption of Sub-Manager Funds | | | (1,541,235 | ) |

| Increase in due from Investment Manager | | | (91,357 | ) |

| Decrease in prepaid assets | | | 54,356 | |

| Decrease in other assets | | | 112,328 | |

| Decrease in professional fees payable | | | (20,000 | ) |

| Decrease in accounting and administration fees payable | | | (8,475 | ) |

| Increase in management fee payable | | | 29,495 | |

| Decrease in custodian fees payable | | | (3,840 | ) |

| Increase in servicing fee payable | | | 7,855 | |

| Increase in other expense payable | | | 1,847 | |

| Net cash used in operating activities | | | (1,115,289 | ) |

| | | | | |

| Cash flows from financing activities: | | | | |

| Proceeds from shares issued | | | 1,115,289 | |

| Net cash provided by financing activities | | | 1,115,289 | |

| Net change in cash and cash equivalents | | | - | |

| | | | | |

| Cash at beginning of year | | | - | |

| Cash at end of year | | $ | - | |

| | | | | |

| Supplemental Disclosure of Reinvestment of Distribution amount | | $ | 235,572 | |

See notes to financial statements.

HATTERAS RAMIUS ADVANTAGE INSTITUTIONAL FUND

(a Delaware Statutory Trust)

NOTES TO FINANCIAL STATEMENTS

(Liquidation Basis)

For the Year Ended March 31, 2011

Hatteras Ramius Advantage Institutional Fund (the “Master Fund”) is a Delaware statutory trust registered under the Investment Company Act of 1940, as amended (the “1940 Act”), as a non-diversified, closed-end management investment company. Hatteras Capital Investment Management, LLC (“HCIM”), an investment adviser registered with the Securities and Exchange Commission (the “SEC”) under the Investment Advisers Act of 1940, as amended (the “Advisers Act”), serves as the investment manager to the Master Fund (in such capacity, the “Investment Manager”). Ramius Alternative Solutions LLC (“Ramius”), an investment adviser registered with the SEC under the Advisers Act, serves as sub-adviser to the Master Fund (in such capacity, the “Sub-Adviser”).

On January 6, 2011, the Board of Trustees (the “Board”) of the Master Fund, determined to discontinue investment operations and repurchase all outstanding shares from Shareholders, as soon as practicable. This decision was made after careful consideration of the Master Fund’s asset size and current expenses. In connection with the pending close and repurchases, effective immediately, the Master Fund discontinued accepting orders for the purchase of Master Fund shares, effective immediately. The Board approved two tender offers to Shareholders, with valuation dates of March 31, 2011 and June 30, 2011, as an appropriate method for the Fund to make cash available to Shareholders. The tender offers are described in more detail below.

| 2. | SIGNIFICANT ACCOUNTING POLICIES |

The following is a summary of significant accounting and reporting policies used in preparing the financial statements.

The financial statements have been prepared in accordance with accounting principles generally accepted in the United States of America (“U.S. GAAP”), applied on the liquidation basis. The liquidation basis of accounting is appropriate when liquidation is considered imminent and the Fund is not considered a going concern. Under this method of accounting assets are stated at their net realizable value and liabilities at their anticipated settlement amounts.

Cash includes a short-term interest bearing deposit account. At times, such deposits may be in excess of federally insured limits. The Master Fund has not experienced any losses in such accounts and does not believe it is exposed to any significant credit risk on such accounts.

| c. | Valuation of Investments |

As the Master Fund discontinues investment operations, the net proceeds from the liquidation of portfolio securities will be invested in cash equivalent securities or Short-Term Investments. During this time, the Master Fund will hold more cash or cash equivalents than normal, which will likely prevent the Master Fund from meeting its stated investment objective.

Investments held by the Master Fund include:

| | · | Investments in Sub-Manager Funds – The Master Fund values interests in the Sub-Manager Funds at fair value, which ordinarily will be the value determined by their respective investment managers, in accordance with procedures established by the Board. Investments in Sub-Manager Funds are subject to the terms of the Sub-Managers’ offering documents. Valuations of the Sub-Manager Funds may be subject to estimates and are net of management and performance incentive fees or allocations payable to the Sub-Managers Funds’ investment advisers as required by the Sub-Manager Funds’ offering documents. If the Investment Manager determines that the most recent value reported by the Sub-Manager Fund does not represent fair value or if the Sub-Manager Fund fails to report a value to the Master Fund, a fair value determination is made under procedures established by and under the general supervision of the Board. Because of the inherent uncertainty in valuation, the estimated values may differ from the values that would have been used had a ready market for the securities existed, and the differences could be material. |

HATTERAS RAMIUS ADVANTAGE INSTITUTIONAL FUND

(a Delaware Statutory Trust)

NOTES TO FINANCIAL STATEMENTS

(Liquidation Basis)

For the Year Ended March 31, 2011 (continued)

| 2. | SIGNIFICANT ACCOUNTING POLICIES (continued) |

| c. | Valuation of Investments (continued) |

The interests of some Sub-Manager Funds may be valued less frequently than the calculation of the Master Fund’s net asset value. Therefore, the reported performance of the Sub-Manager Fund may lag the reporting period of the Master Fund. The Investment Manager has established procedures for reviewing the effect on the Master Fund’s net asset value due to this lag in reported performance of the Sub-Manager Funds.

| | · | Investments in Short-Term Investments - Short-Term investment consists of Federated Prime Obligation Fund, an open ended money market fund (“MMF”) incorporated in the United States of America. The MMF’s objective is to seek and provide current income consistent with the stability of principal. The MMF invests in a portfolio of short term, high quality, fixed income securities issued by banks, corporations and the U.S. Government. Short term investments having a maturity of 60 days or less are valued at amortized cost, which approximates market value. |

The Master Fund classifies its assets and liabilities into three levels based on the lowest level of input that is significant to the fair value measurement. Estimated values may differ from the values that would have been used if a ready market existed or if the investments were liquidated at the valuation date.

The three-tier hierarchy distinguishes between (1) inputs that reflect the assumptions market participants would use in pricing an asset or liability developed based on market data obtained from sources independent of the reporting entity (observable inputs) and (2) inputs that reflect the reporting entity’s own assumptions about the assumptions market participants would use in pricing an asset or liability developed based on the best information available in the circumstances (unobservable inputs) and to establish classification of fair value measurements for disclosure purposes. Various inputs are used in determining the value of the Master Fund’s investments. The inputs are summarized in the three broad levels listed below:

| | · | Level 1 - quoted prices (unadjusted) in active markets for identical assets and liabilities |

| | · | Level 2 – other significant observable inputs (including quoted prices for similar investments, interest rates, prepayment speeds, credit risk, ability to redeem in the near term for Sub-Manager Funds, etc.) |

| | · | Level 3 - significant unobservable inputs (including the Master Fund’s own assumptions in determining the fair value of investments) |

| | | Level 1 | | | Level 2 | | | Level 3 | | | Total | |

| Event Driven | | $ | − | | | $ | − | | | $ | 285,250 | | | $ | 285,250 | |

| Global Macro/Managed Futures | | | − | | | | − | | | | 316,451 | | | | 316,451 | |

| Long/Short Equity | | | − | | | | − | | | | 235,612 | | | | 235,612 | |

| Multi-Strategy/Relative Value | | | − | | | | − | | | | 204,457 | | | | 204,457 | |

| Short-Term Investments | | | 7,975,913 | | | | − | | | | − | | | | 7,975,913 | |

| Total | | $ | 7,975,913 | | | $ | − | | | $ | 1,041,770 | | | $ | 9,017,683 | |

The following is a reconciliation of investments in which significant unobservable inputs (Level 3) were used in determining value on a reoccurring basis:

HATTERAS RAMIUS ADVANTAGE INSTITUTIONAL FUND

(a Delaware Statutory Trust)

NOTES TO FINANCIAL STATEMENTS

(Liquidation Basis)

For the Year Ended March 31, 2011 (continued)

| 2. | SIGNIFICANT ACCOUNTING POLICIES (continued) |

c. Valuation of Investments (continued)

| | | | | | | | | | | | Global | | | | | | | |

| | | Credit | | | Event | | | Long/Short | | | Macro/Managed | | | Multi- | | | | |

| Investments | | Based | | | Driven | | | Equity | | | Futures | | | Strategy | | | Total | |

| Balance as of March 31, 2010 | | $ | 374,631 | | | $ | 691,245 | | | $ | - | | | $ | - | | | $ | 379,163 | | | $ | 1,445,039 | |

| Net Realized Gain (Loss) | | | 14,737 | | | | 95,048 | | | | 10,128 | | | | - | | | | 64,866 | | | | 184,779 | |

| Change in Unrealized Appreciation (Depreciation) | | | 13,513 | | | | (39,444 | ) | | | 17,552 | | | | 16,451 | | | | (3,102 | ) | | | 4,970 | |

| Gross Purchases | | | | | | | - | | | | - | | | | 300,000 | | | | - | | | | 300,000 | |

| Gross Sales | | | (402,881 | ) | | | (791,987 | ) | | | (106,270 | ) | | | - | | | | (531,866 | ) | | | (1,833,004 | ) |

| Net Transfers in from Level 3* | | | | | | | 330,388 | | | | 314,202 | | | | - | | | | 295,396 | | | | 939,986 | |

| Balance as of March 31, 2011 | | $ | - | | | $ | 285,250 | | | $ | 235,612 | | | $ | 316,451 | | | $ | 204,457 | | | $ | 1,041,770 | |

* Transfers into or out of Level 3 are represented by the investments’ market value as of January 31, 2011.

**Transfers into Level 3 usually result from Adviser Funds imposing gates or suspending redemptions; transfers out of Level 3 generally occur when lock-up periods on investments in Adviser Funds are lifted.

A listing of the investments held by the Master Fund and their attributes as of March 31, 2011, are shown in the table below.

| Investment Category | Event Driven (a) | Global Macro/Managed Futures (b) | Long/Short Equity (c) | Multi- Strategy/Relative Value (d) |

| Investment | Pershing Square International, Ltd. | Wexford Offshore Spectrum Fund | SAC Capital International, Ltd. | Goldman Sachs Investment Partners Offshore, L.P. |

| Investment Strategy | Investments in equities and debt, and may include distressed securities | Investments in a global markets across all security types, and may include futures, currencies, and commodities | Investments with exposure to global equity markets | Investments in long and short positions in equity and debt securities |

| Fair Value (in 000’s) | $285 | $316 | $236 | $204 |

| Unfunded Commitments (in 000’s) | N/A | N/A | N/A | N/A |

| Remaining Life * | N/A | N/A | N/A | N/A |

| Redemption Frequency * | Monthly-Annually | Monthly-Quarterly | Monthly-Quarterly | Annually |

| Notice Period (in Days) * | 30-90 | 30-90 | 30-65 | 90 |

| Redemption Restrictions and Terms * | Quarterly limits between 12.5 – 25% | None | Quarterly limits up to 25% | None |

| * | The information summarized in the table above represents the general terms for the specified asset class. Individual Sub-Manager Funds may have terms that are more or less restrictive than those terms indicated for the asset class as a whole. In addition, most Sub-Manager Funds have the flexibility, as provided for in their constituent documents, to modify and waive such terms. |

The Master Fund’s investments reflect their estimated fair value, which for marketable securities would generally be the last sales price on the primary exchange for such security and for Sub-Manager Funds, would generally be the net asset value as provided by the Sub-Manager Fund or its administrator. For each of the categories below, the fair value of the Sub-Manager Funds has been estimated using the net asset value of the Sub-Manager Funds.

HATTERAS RAMIUS ADVANTAGE INSTITUTIONAL FUND

(a Delaware Statutory Trust)

NOTES TO FINANCIAL STATEMENTS

(Liquidation Basis)

For the Year Ended March 31, 2011 (continued)

| 2. | SIGNIFICANT ACCOUNTING POLICIES (continued) |

| c. | Valuation of Investments (continued) |

| (a) | This category includes Pershing Square International, Ltd. which invests using Event-Driven strategies. Event-Driven strategies typically will include investments in common and preferred equities and various types of debt (often based on the probability that a particular event will occur). These may include distressed or Special Situations investments (securities of companies that are experiencing difficult business situations). Pershing Square International, Ltd. will be redeemed quarterly through September 30, 2012. |

| (b) | This category includes Wexford Offshore Spectrum Fund which invests in all global markets and across all security types including equities, fixed income, commodities, currencies, futures, and exchange-traded funds. Sub-Manager Funds in this category may include global macro funds and commodity trading advisors. Wexford Offshore Spectrum Fund will have a full redemption on June 30, 2011. |

| (c) | This category includes SAC Capital International, Ltd. which invests primarily in global equity markets and equity market derivatives, but may also include other security types including but not limited to currencies and fixed income. SAC Capital International, Ltd. will be redeemed quarterly through September 30, 2011. |

| (d) | This category includes Goldman Sachs Investment Partners Offshore, L.P. which may invest across a range of strategies and long and short positions in common and preferred equity, convertible securities, and various forms of senior and junior (typically unsecured) debt. Goldman Sachs Investment Partners Offshore, L.P. will be redeemed quarterly through September 30, 2011. |

| d. | Derivatives and Hedging |

Authoritative accounting guidance requires disclosures about the reporting entity’s derivative instruments and hedging activities, by providing for qualitative disclosures about the objectives and strategies for using derivatives, quantitative data about the fair value of and gains and losses on derivative contracts, and details of credit-risk-related contingent features in their hedged positions. As of and for the year ended March 31, 2011, the Master Fund had not entered into any derivative instruments.

Interest income is recorded when earned. Dividend income is recorded on the ex-dividend date, except that certain dividends from private equity investments are recorded as soon as the information is available to the Master Fund.

The Sub-Manager Funds generally do not make regular cash distributions of income and gains and are therefore considered non-income producing securities. Disbursements received from Sub-Manager Funds are accounted for as a reduction to cost.

The Master Fund will bear all expenses incurred, on an accrual basis, in the business of the Master Fund, including, but not limited to, the following: all costs and expenses related to portfolio transactions and positions for the Master Fund’s account; legal fees; accounting, auditing, and tax preparation fees; custodial fees; fees for data and software providers; costs of insurance; registration expenses; trustees’ fees; interest expenses and commitment fees on credit facilities; and expenses of meetings of the Board.

The preparation of financial statements in conformity with U.S. GAAP requires the Master Fund to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of increases and decreases in net assets from operations during the reporting period. Actual results could differ from those estimates.

HATTERAS RAMIUS ADVANTAGE INSTITUTIONAL FUND

(a Delaware Statutory Trust)

NOTES TO FINANCIAL STATEMENTS

(Liquidation Basis)

For the Year Ended March 31, 2011 (continued)

| 2. | SIGNIFICANT ACCOUNTING POLICIES (continued) |

| h. | Income Tax Information and Distributions to Shareholders |

The offers to repurchase shares for March 31, 2011 and June 30, 2011 (together, the “Combined Offers”), is expected to result in all Shareholders, except HCIM, redeeming 100% of their shares in the Master Fund. HCIM does not intend to tender all of its shares in the Combined Offers, and may, despite the fact that the Master Fund will no longer be accepting subscriptions from outside investors, purchase additional shares, the proceeds of which may be used by the Master Fund to make payments in connection with the Combined Offers. For federal income tax purposes, it is expected that the Combined Offers will be considered as being made pursuant to a plan of complete liquidation. In that case, the cash receive from tendering shares in response to the Combined Offers will constitute a nontaxable return of capital to the extent of the tax basis in all shares, and any excess, will be taxable as capital gain. If shares are held as capital assets, any gain will be capital gain. If the shares have been held for more than twelve months, any such capital gain will be long-term capital gain, taxable to individual U.S. Shareholders at a maximum federal rate of 15%. Capital gain on shares held for twelve months or less will be treated as short-term capital gain.

Each year, the Master Fund intends to qualify as a regulated investment company by distributing substantially all of its taxable income and realized gains under Subchapter M of the Internal Revenue Code and filing its U.S. federal tax return. As a result, no provision for income taxes is required. As of March 31, 2011, the Master Fund did not have any unrecognized tax benefits in the accompanying financial statements. The Master Fund is not aware of any tax positions for which it is reasonably possible that the total amounts of unrecognized tax benefits will significantly change in the next twelve months. The Master Fund’s federal tax return is subject to examination by the Internal Revenue Service (IRS) for the period ended December 31, 2009 and the year ended December 31, 2010. Foreign taxes are provided for based on the Master Fund’s understanding of the tax rules and rates that exist in the foreign markets in which it invests.

Distributions are recorded on the ex-dividend date. Income dividends and capital gain distributions are declared separately. Income and capital gain distributions are determined in accordance with income tax regulations, which may differ from generally accepted accounting principles. For the year ended March 31, 2011, the Fund paid an ordinary income distribution of $235,572.

Capital accounts within the financial statements are adjusted for permanent book-tax differences. These adjustments have no impact on net assets or the results of operations. Temporary book-tax differences will reverse in a subsequent period.

Additionally, U.S. GAAP requires certain components of net assets relating to permanent differences be reclassified between financial and tax reporting. Permanent differences between book and tax basis are attributable to certain non-deductible expenses for tax purposes, including certain offering, organizational, and registration expenses. These reclassifications have no effect on net assets or net asset value per share. For the year ended March 31, 2011, the following was reclassified:

| Shares of beneficial interest | | $ | (65,182 | ) |

| Accumulated net investment loss | | | 611,606 | |

| Accumulated net realized gain on investments | | | (546,424 | ) |

At March 31, 2011, the federal tax cost of investment securities and unrealized appreciation (depreciation) as of year end were as follows:

| Gross unrealized appreciation | | $ | 144,000 | |

| Gross unrealized depreciation | | | - | |

| Net unrealized appreciation (depreciation) | | $ | 144,000 | |

| Tax cost | | $ | 8,873,683 | |

HATTERAS RAMIUS ADVANTAGE INSTITUTIONAL FUND

(a Delaware Statutory Trust)

NOTES TO FINANCIAL STATEMENTS

(Liquidation Basis)

For the Year Ended March 31, 2011 (continued)

| 2. | SIGNIFICANT ACCOUNTING POLICIES (continued) |

h. Income Tax Information and Distributions to Shareholders (continued)

At December 31, 2010, the tax-based components of distributable earnings as of period end were as follows:

| Undistributed ordinary income | | $ | 128,444 | |

| Undistributed long-term capital gains | | | - | |

| | | $ | 128,444 | |

| Accumulated Capital and Other Losses | | | (116,412 | ) |

| Unrealized Appreciation / (Depreciation) | | | - | |

| Total Accumulated Earnings (Deficit) | | $ | 12,032 | |

| i. | Recently Issued Accounting Pronouncements |

On December 22, 2010, The U.S. government passed the Regulated Investment Company Modernization Act of 2010 (the “Modernization Act”). The Modernization Act is the first major piece of legislation affecting Regulated Investment Companies (“RICs”) since 1986 and it modernizes several of the federal income and excise tax provisions related to RICs. One of the provisions allows a RIC to carry forward capital losses indefinitely, and retain the character of the original loss. Under pre-enactment law, capital losses could be carried forward for eight years, and carried forward as short-term capital, irrespective of the character of the original loss. Except for the simplification provisions related to RIC qualification, the Modernization Act is effective for taxable years beginning after December 22, 2010. The provisions related to RIC qualification are effective for taxable years for which the extended due date of the tax return is after December 22, 2010.

| 3. | INVESTMENT TRANSACTIONS |

Total purchases of Sub-Manager Funds for the year ended March 31, 2011 amounted to $700,000. Total redemptions of Sub-Manager Funds for the year ended March 31, 2011 amounted to $8,643,590. The cost of investments in Sub-Manager Funds for U.S. federal income tax purposes is adjusted for items of taxable income allocated to the Master Fund from the Sub-Manager Funds. The Master Fund relies upon actual and estimated tax information provided by the Sub-Manager Funds as to the amounts of taxable income allocated to the Master Fund as of March 31, 2011.

The Master Fund invests substantially all of its available capital in securities of private investment companies. These investments will generally be restricted securities that are subject to substantial holding periods or are not traded in public markets at all, so that the Master Fund may not be able to resell some of its securities holdings for extended periods.

| 4. | MANAGEMENT FEES, RELATED PARTY TRANSACTIONS, AND OTHER |

The Investment Manager is responsible for providing day-to-day investment management services to the Master Fund, subject to the ultimate supervision of and subject to any policies established by the Board, pursuant to the terms of an investment management agreement with the Master Fund (the "Investment Management Agreement"). Pursuant to its authority under the Investment Management Agreement, the Investment Manager has delegated its responsibility to develop and implement the Master Fund's investment program to the Sub-Adviser.

In consideration for such services, the Master Fund pays the Investment Manager a monthly management fee equal to 0.125% (1.50% on an annualized basis) of the net assets of the Master Fund as of the last day of the month (before giving effect to any repurchase of shares in the Master Fund).

HATTERAS RAMIUS ADVANTAGE INSTITUTIONAL FUND

(a Delaware Statutory Trust)

NOTES TO FINANCIAL STATEMENTS

(Liquidation Basis)

For the Year Ended March 31, 2011 (continued)

4. MANAGEMENT FEES, RELATED PARTY TRANSACTIONS, AND OTHER (continued)

Effective with the commencement of operations, the Investment Manager and Sub-Adviser entered into a sub-advisory agreement. Ramius is paid a monthly sub-advisory fee by the Investment Manager equal to 0.0625% (0.75% on an annualized basis) of the net assets of the Master Fund as of the last day of the month (before giving effect to any repurchase of shares in the Master Fund).

Hatteras Capital Distributors LLC (“HCD”), an affiliate of the Investment Manager, serves as the Master Fund’s distributor. HCD receives a monthly distribution fee from the Investment Manager equal to 0.0083% (0.10% on an annualized basis) of the net assets of the Master Fund as of the last day of the month (before giving effect to any repurchase of shares in the Master Fund).

Each member of the Board who is not an “interested person” of the Master Fund (each an “Independent Trustee”), as defined by the 1940 Act, receives an annual retainer of $10,000. All Board members are reimbursed by the Master Fund for all reasonable out-of-pocket expenses incurred by them in performing their duties.

In consideration for fund services, the Master Fund pays HCIM (in such capacity, the "Servicing Agent") a fund servicing fee at the annual rate of 0.40% of the month-end net asset value of the Master Fund. The servicing fees payable to the Servicing Agent will be borne by all Shareholders of the Master Fund on a pro-rata basis before giving effect to any repurchase of shares in the Master Fund effective as of that date, and will decrease the net profits or increase the net losses of the Master Fund that are credited to Shareholders.

The Servicing Agent may waive (to all investors on a pro-rata basis) or pay to third parties all or a portion of any such fees in its sole discretion. The Servicing Agent did not waive any of the servicing fees for the year ended March 31, 2011.