September 1, 2022

Daniel Crawford, Esq.

Celeste Murphy, Esq.

Vanessa Robertson

Brian Cascio, Esq.

Securities Exchange Commission

Division of Corporation Finance

Office of Life Sciences

U.S. Securities and Exchange Commission

Washington, D. C. 20549

Re: Halberd Corp

Registration Statement on Form 10

Filed May 11, 2022; Amendment No. 1 to Form 10 filed August 15, 2022

File No. 000-56440

Dear Ladies and Gentlemen:

Thank you for your further comments forwarded to us on August 19, 2022 (“Comment Letter No. 2). Per the staff’s request, Halberd Corporation is pleased to respond to this second round of Comments within days of receipt of the staff’s Comment Letter No. 2. Note that our response is comprised of this SEC Response Letter and tracked changes on Amendment No. 3 to the Form 10 being filed concurrently. (This is Amendment No. 3 because we filed Amendment No,.2 on August 23, 2022 to reflect the Exhibit No. 10.5__re the Phoenix Group Agreement inadvertently omitted in Amend-ment No. 1.) We respond as follows:

Amendment No. 1 to Form 10 filed August 15, 2022

Item 1 Business, page 3

1. We note your response to Comment 1 and reissue in part. Your disclosure as drafted on page 4 may create an inference that because you are a government contractor and applied for a development contract that you will prove safety and efficacy to FDA standards. Your status as a government contractor that applied for funding is unrelated to the safety and efficacy of your extracorporeal technology. Please revise to remove any such inference.

Response:

We acknowledge your comment and have revised the Form 10 (via this Amendment No. 3) to eliminate reference to government contractor status in the paragraph in question.

2. We note your response to Comment 3 and reissue. For your advisors and consultants, disclose whether they are an advisor or a consultant and the date you started retaining their services as such.

Response:

We acknowledge your comment and concur. Amendment No. 3 has been revised to include designations of key personnel who are not officers or directors of Halberd Corporation as Advisors and noted consultants as such where appropriate. The point of demarcation is simple: Our advisors are not paid for their services while consultants are paid in cash.

| Page 1 of 10 |

Registration Statement on Form 10, File No. 000-56440

3. We note your response to Comment 4. Please revise to remove the statement that “through Halberd’s extracorporeal treatment, no disease can escape elimination, including diseases previously considered ‘incurable’“ as it is speculative given your extracorporeal treatment has not eliminated a disease in humans. We do not object to statements, if true, that you believe your treatment may be applicable to a wide array of diseases.

Response:

We acknowledge your comment and have revised our amendment to include the phrase “we believe” to remove any inference to a statement of fact. Our objective iis the removal of disease.

4. We note your response to Comment 5 and reissue because the response you provide in the comment letter does not appear to be reflected in your amended filing. Also, we note in your response that you state using extracorporeal treatment Halberd has already developed, you treat bacterial meningitis in 20 minutes. This disclosure appears to be speculative since your extracorporeal treatment has not been cleared by the FDA for any treatment. Revise to remove this statement,or explain why such a statement is not speculative given your early stage of development.

Response:

As requested, we have removed the reference to the elimination of bacterial meningitis in 20 minutes and, while we believe our research supports the proposition, we have not yet had this statement proven in human testing and hereby delete.

We acknowledge your comment regarding this omission and have revised Amendment No. 3 to include information contained in our response to Comment 5 which, through a miscommunication, was originally omitted from Amendment No. 1, namely the following:

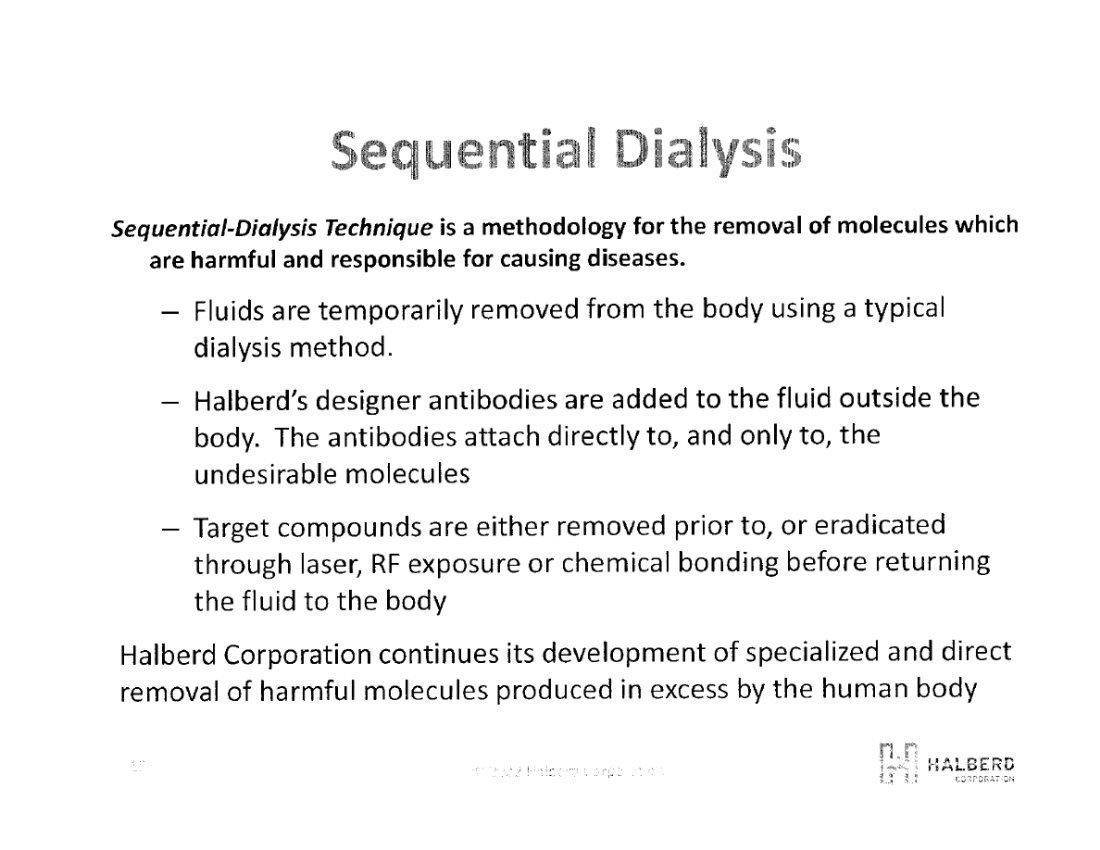

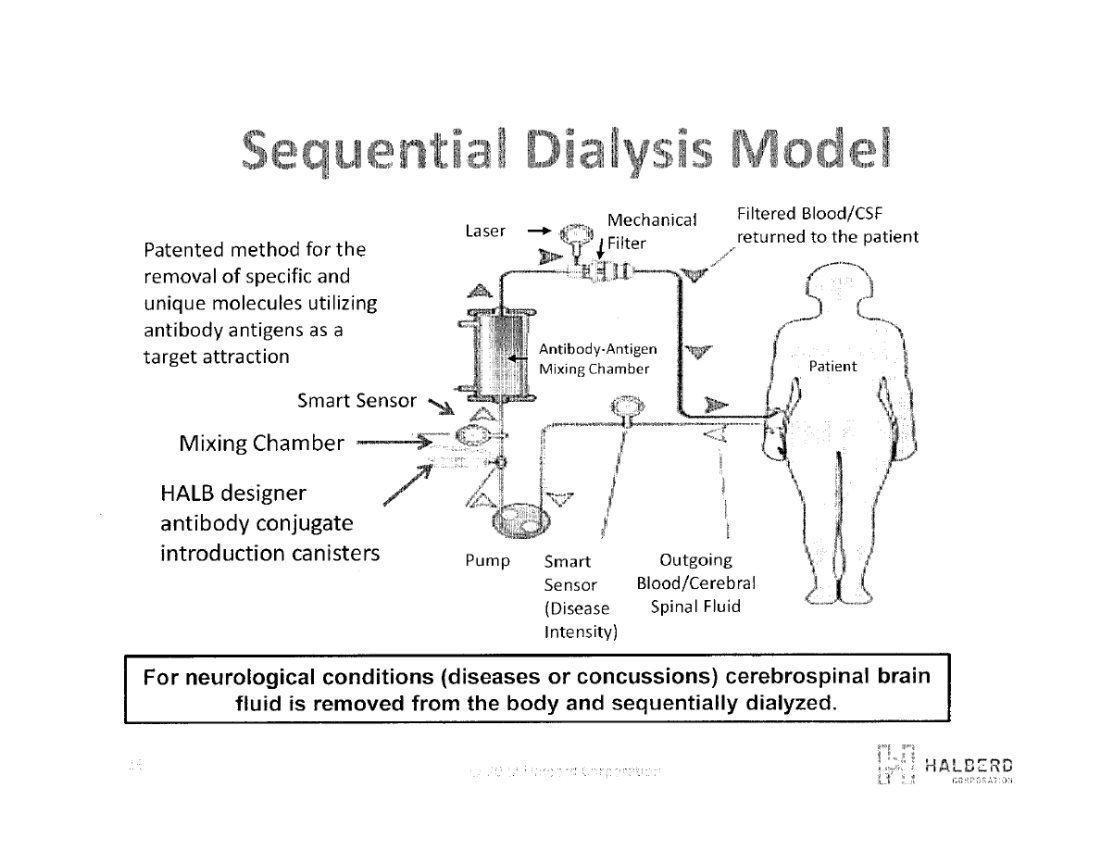

By way of background, other than dialysis and injections, treatment of body fluids outside the body is not common. We are convinced that our extracorporeal treatment is both effective and has no side effects. Traditional medicine typically relies on drugs and/or injections/shots to remove/eliminate the disease at issue. Rather than“adding”to the mix of modalities, extracorporeal treatments seek to remove the disease—i.e., subtract/eliminate, a protocol very different than using drugs/injections.

As requested, we have expanded the Business description to reflect the risks inherent to our business model. Those include funding constraints for the foreseeable future: Because our technology is new, we are fighting an uphill battle to get acceptance of that technology. Our success is/will be largely dependent on ambitious growth and networking relatively near term. Because we are a small fish in a big pond, healthcare reform can be destabilizing. Acquisition and retention of IP is essential as is commercialization—as to which we have no prior substantive experience.

The competitive environment is a challenge, perhaps in an unexpected way. Namely, we have to educate and train our prospective users That is because we expect to encounter considerable resistance to treatments out of the box, in the name of “standard care,” that is ingrained treatment modalities.

5. We note your response to Comment 6 and your disclosure that Youngstown State University is performing research. Please disclose whether there is an agreement between you and the university for its research services. If so, disclose the material terms of the agreement and file it as an exhibit.

Response:

We acknowledge your comment and this oversight and have updated Amendment 3 to include (as Exhibit 10.5.) a copy of the agreement between Halberd Corporation and Youngstown State University and the associated working relationship.

6. Please revise your disclosure on page 5 to provide the basis for your belief that your extracorporeal treatments would increase the efficacy of monoclonal anti-bodies. Disclose whether you have conducted any tests with your extracorporeal treatment in conjunction with monoclonal anti-bodies. To the extent that you have conducted such tests, summarize the results.

Response:

We acknowledge your comment and now realize that the designated language was a mis-statement/misunderstanding by our researchers and, accordingly, has been removed. Among other reasons, we deleted the language because the extra-corporeal treatment is not designed to increase efficacy of commercially available antibodies. The confusion arose due to our research in developing monoclonal antibodies against SARS-COV2 resulted in the creation of antibodies which have been demonstrated in the lab to enhance the binding affinity and neutralization characteristics of a commercially available monoclonal antibody. The Amended t Form 10 unfortunately conflated these two important developments. We submit that these edits have now corrected.

| Page 2 of 10 |

Registration Statement on Form 10, File No. 000-56440

7. We note your response to Comment 21 and reissue. We note you provide in your response letter disclosure that you state is reflected on page 3 of the amended filing, but it does not appear in the business section or anywhere else in the filing. Please revise or otherwise revise.

Response:

We acknowledge your comment and have revised the business section beginning on page 3 to include the response to Comment 21 from Amendment No. 1. Specificallyt we have amended the Business section on page 3 to Amendment No. 3 as follows:

The Company’s research and development activities, along with most of the Company’s operations, have substantially been funded by, Epidemiologic Solutions Corporation (“ESC”), some of which payments were transmitted by Securities Counselors, Inc. on behalf of (“ESC”), as a charitable organization recently approved by the Internal Revenue Service and qualified under Internal Revenue Code section 501(c)(3). ESC has provided the Company a $2,000,000 funding commitment to finance the Company’s research and development endeavors. As of July 31, 2021, $709,465 had been paid on this commitment, beginning with the first payment of $21,782 on, or about, August 31, 2020, as presented as Contributed Capital within the Statement of Stockholders Equity (Deficit). The charitable organization is committed to monthly payments of $50,000 pursuant to its sponsored research agreement with Arizona State University. It has also funded additional collateral payments for supplies and for the Company’s operating expenses. The Company’s relationship to ESC is that of a donor-donee consistent with the provisions of Internal Revenue Code Section 501(c)(3).

8. Please revise to discuss the effect of government regulations on your business. For example, without limitation, discuss how you expect the FDA will regulate your extracorporeal technology and describe the regulatory pathway required to obtain approval.

Response:

We acknowledge your comment and have included the following in the Business sectiononpage3: “Halberd Corporation is unfamiliar with the exact requirements and processes for obtaining FDA certification and as such has retained a consultant company (mdi Consultants) to guide our research and testing efforts to comply with FDA requirements to avoid wasted time and effort.” We also have expanded disclosure to recognize that animal testing could add economic and governmental challenges, further sharpening our distaste to incur unnecessary expensive animal testing. As a result, Halberd felt it needed professional guidance in the area and sought out mdi Consultants for guidance in this specialty area.

9. We note your revised disclose in your Business section on page 3. Regarding your disclosure that your extracorporeal treatment is designed to “remove the root cause of the disease,” revise to disclose what diseases you have tested your technology with and which diseases you eliminated from bodily fluids. Provide summaries of the tests and data relied on for your conclusions. Disclose the diseases you have created “designed antibodies” for. Disclose the data relied on for your statement that your technology is “highly selective and only targets the desired elements for elimination.” Discuss in more detail your treatment methodology which does not even require conjoining of metallic nanoparticles to the body or laser heating of the antibody complex to discuss how it works and your current stage of development. To the extent that you have not conducted such tests or possess such data we request, remove the disclosure, provide your basis for the statement, or otherwise advise.

Response:

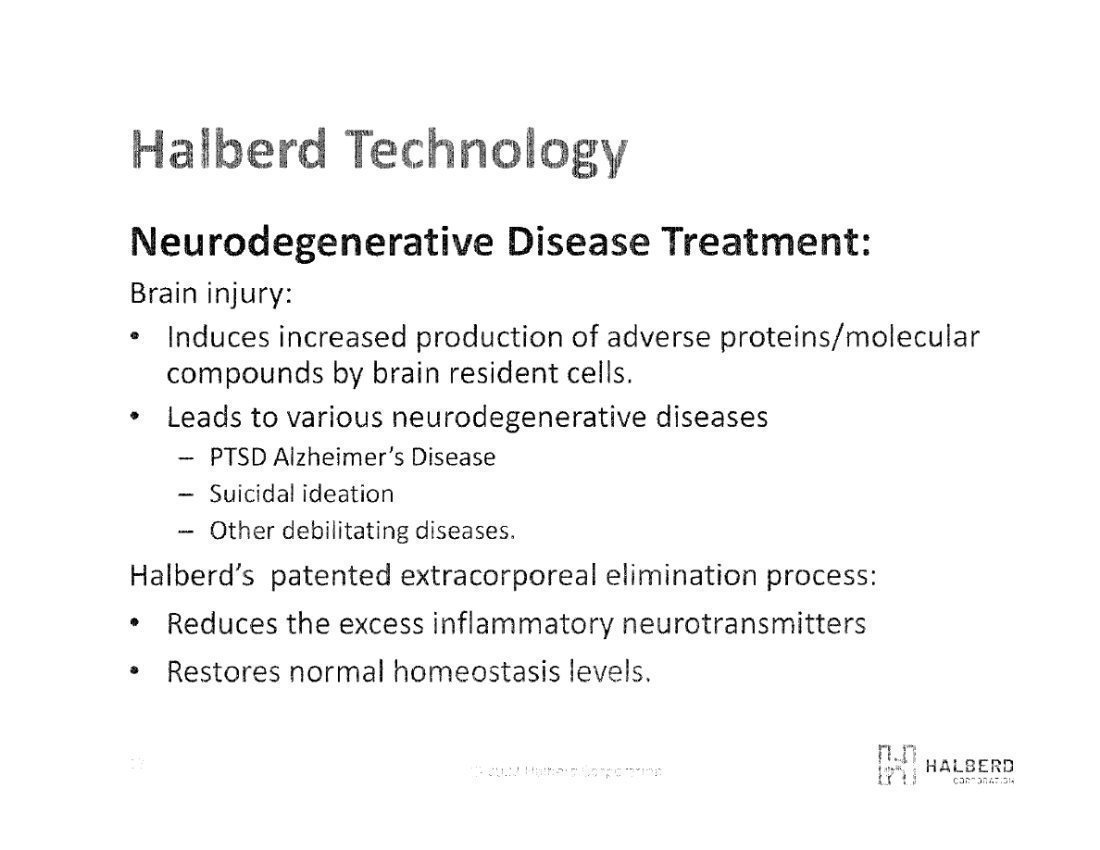

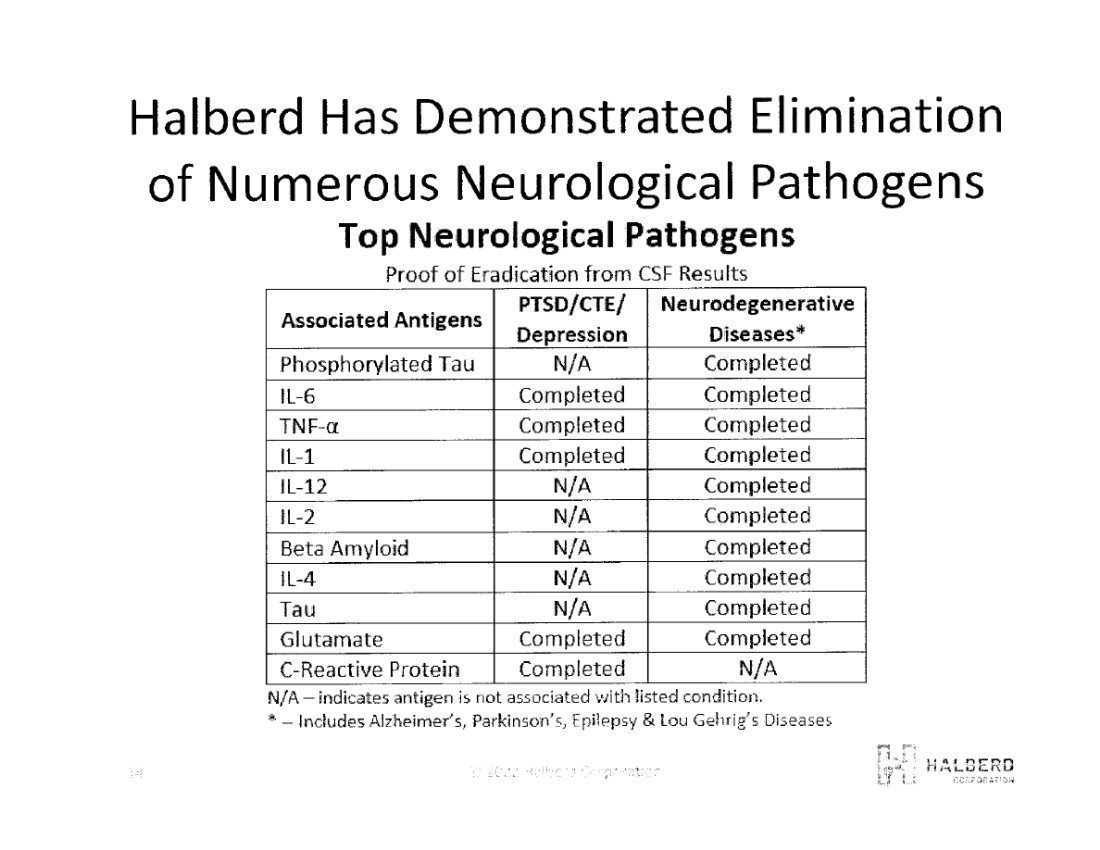

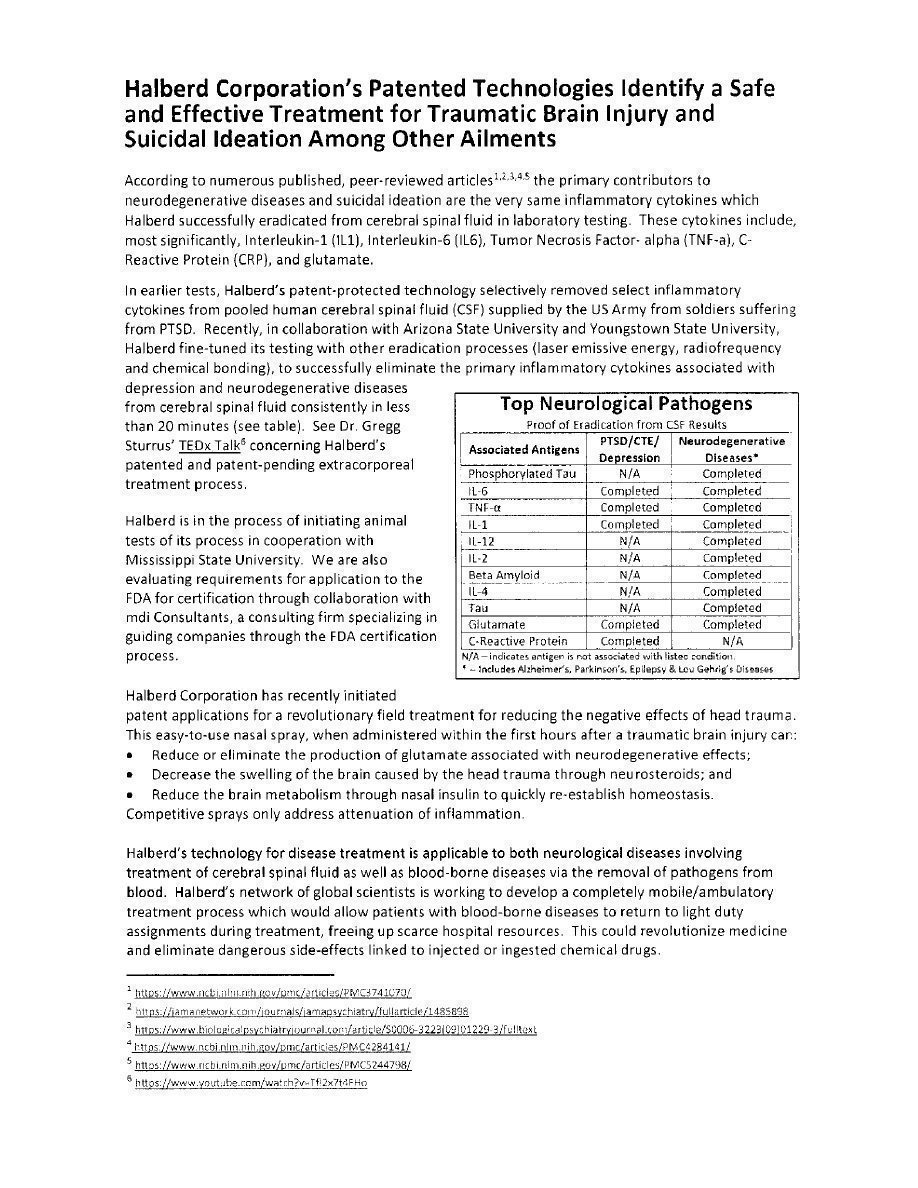

We acknowledge your comment and wish to clarify that Halberd has not eliminated the disease but rather the elements related to the cause of the disease. For instance, we have demonstrated the removal of 11 specific elements (proteins, cytokines, and amino acids) from synthetic cerebrospinal fluid (CSF). These elements have been linked to a variety of neurodegenerative diseases such as Alzheimer’s Disease, epilepsy, Amyotrophic Lateral Sclerosis (“ALS”), PTSD and suicide ideation.

Halberd also demonstrated in the laboratory, the elimination of 12 strains of E.coli from water, some of which have demonstrated antibiotic resistance. E.coli is responsible for meningitis as swell as blood sepsis.

| Page 3 of 10 |

Registration Statement on Form 10, File No. 000-56440

Halberd created designed antibodies against SARS-COV2 which are being tested against existing commercially available monoclonal antibodies (mAb) against SARS-COV2 (Covid-19). Laboratory testing has shown Halberd’s antibody to be the only mAb to show a neutralizing affinity for all four Covid-19 mutations to date. The balance of Halberd’s designed antibodies are not antibodies against specific diseases, but rather against the elements (building blocks) which relate to or enable diseases, such as, neurodegenerative diseases (listed above), E.coli associated bacterial diseases, cancer, etc.

These antibodies are designed to have affinity and binding to a specific target antigen, whether it be in CSF or blood, and will bind only to that target antigen. This allows for the specific elimination through laser irradiation, or tuned radio frequency (RF) exposure of the antibody-nanoparticle-antibody moiety resulting in microheating of the nanoparticle thereby killing the target antigen.

Halberd is also exploring the methodology of elimination of target antigens from bodily fluids through a process referred to as chemical bonding filtration. This process requires an antibody designed to have a strong binding affinity for the target antigen and be able to be chemically bonded to the surfaces of a filter medium, such as medical plastic beads. When the bodily fluid is flowed through the filter media, the target antigen is attracted to, and retained by the antibody. The effluent consists of a pre-determined reduced amount of the target antigen. This reduction can be precisely controlled up to and including virtual 100% elimination, based on concentration, duration and flow rates of the fluid through the filter media. This has been demonstrated in the laboratory through selective reduction of one cytokine (target) vs. an unchanged concentration of another cytokine.Management’s Discussion and Analysis of Financial Condition and Results of Operation, page 32

10. We note your disclosure on page 32 that you have generated very limited revenue to date from the sale of topical CBD pain relief products and a nutraceutical dietary supplement. Please revise your Business section to discuss your CBD pain product and nutraceutical dietary supplement businesses or advise why such disclosure is not warranted.

Response:

We acknowledge your comment and believe that our sales from CBD pain products and nutraceutical dietary supplement business are so minimal that the revenue produced contributes immaterially to the financial position of the Company. We have enhanced our disclosure as follows:

We have generated very limited revenue to date from our sale of topical CBD pain relief products and a nutraceutical dietary supplement and, consequently, intend to focus our future efforts more on our research activities.

| Page 4 of 10 |

Registration Statement on Form 10, File No. 000-56440

Item 7. - Management’s Discussion and Analysis of Financial Condition and Results of Operations

Overview of 2021 Results, page 33

11. Refer to your response to comment 11. It does not appear that the amount of contributed capital has been disclosed in the amendment in the Financial Information or MD&A sections so we reissue the comment. Please disclose the amount of contributed capital you received from Epidemiologic Solutions Corporation to pay expenses for operations during all periods presented.

Response

The Company’s research and development activities, along with most of the Company’s operations, have substantially been funded by, Epidemiologic Solutions Corporation (“ESC”), some of which payments were transmitted by Securities Counselors, Inc. on behalf of ESC as a charitable organization recently approved by the Internal Revenue Service and qualified under Internal Revenue Code section 501(c)(3). ESC has provided the Company a $2,000,000 funding commitment to finance the Company’s research and development endeavors. As of July 31, 2021, $709,465 had been paid on this commitment, beginning with the first payment of $4,500 on, or about, May 1, 2020, represented as Contributed Capital within the Statement of Stockholders Equity (Deficit). The charitable organization is committed to monthly payments of $50,000 pursuant to its sponsored research agreement with Arizona State University. It has also funded additional collateral payments for supplies and for the Company’s operating expenses. The Company’s relationship to ESC is that of a donor-donee, consistent with the provisions of Internal Revenue Code Section 501(c)(3). We have added the following table to the Overview of 2021 results within the MD&A:

Capital contributions consisted of the following at July 31, 2021 and 2020, respectively:

|

| July 31, |

|

| July 31, |

| ||

|

| 2021 |

|

| 2020 |

| ||

|

|

|

|

|

|

| ||

Securities Counselors, Inc.1 |

| $ | 233,033 |

|

| $ | 7,000 |

|

Epidemiologic Solutions Corp.2 |

|

| 421,782 |

|

|

| - |

|

Ronnie J. Godeaux |

|

| 10,000 |

|

|

| 37,650 |

|

Total capital contributions |

| $ | 664,815 |

|

| $ | 44,650 |

|

Results of Operations for the Three and Nine Months Ended April 30, 2022 and 2021 Research and Development, page 39

12. The last sentence of this section states that the costs were not present in the comparative periods which does not appear to be the case. Please revise or advise.

Response

We have revised our disclosure as follows: The increased expenses were due to the research and development costs incurred through our partners, specifically the University of Arizona, incurred during the year ended July 31, 2021 related to the development of our patented, patent pending and trade secret technologies that were minimally present in the comparative period, prior to the commencement of our partnership with the University of Arizona on September 1, 2020.

| Page 5 of 10 |

Registration Statement on Form 10, File No. 000-56440

Consolidated Statements of Operations, page F-4

13. Refer to your response to comment 14. Please explain why you have removed the line item for the fair value adjustment of the judgments payable.

Response

As a result of correcting our accounting treatment to properly account for the judgments at face value, rather than the fair value with mark-to-market adjustments, in accordance with ASC 450, the fair value adjustment of the convertible judgments payable is no longer appropriate, and therefore is no longer included in the statements of operations.

Note 1 - Basis of Presentation and Significant Accounting Policies, page F-7

14. Refer to your response to comment 17. Please revise your disclosure in the notes to financial statements and MD&A to clarify that the cost of merchandise sold consists of the product costs related to the sale of your CBD and nutraceutical products. Also, revise your disclosure in MD&A to explain why costs of sales decreased significantly for the three and nine months ended April 30, 2022.

Response

We have revised our disclosure to add the explanation as follows:

Cost of sales decreased significantly during the three and nine months ended April 30, 2022, as the products we sold had previously been written off as impaired. Therefore, there were no cost of sales related to some of the products sold in those current periods.

The Company’s - Convertible Judgments Payable and Contingent Liabilities, page F-9

15. Refer to your response to comment 19. It does not appear that any revisions have been made to the note. However, we note that you revised the judgments payable amount on the Balance Sheet to $216,400 and $289,165 as of July 31, 2021 and 2020, respectively, from $15,591,498 and $3,603,800. Please explain these changes and whether this was a correction of an error. In addition, please provide us with an expanded analysis of your accounting, including how the amount of the judgement was determined each period, and the literature you relied upon. Disclosure of the accounting treatment should also be clarified in your filing.

Response

We have corrected the error in our accounting treatment and have revised our disclosure to present the face amount of the liabilities on the balance sheet, rather than the underlying fair value of the Company’s common stock.

| Page 6 of 10 |

Registration Statement on Form 10, File No. 000-56440

Note 3 – Convertible Judgments Payable and Contingent Liabilities

On May 7, 2014, the Company entered into a court ordered settlement in Securities Counselors, Inc. v. Halberd Corporation, Case No. 13 L 00000668 for a total of $279,447 that is to be settled with the payment of 441,278,914 shares of common stock to be issued in tranches pursuant to a Section 3(a)(10) exemption from the Securities Act of 1933’s registration requirements. Through July 31, 2021, there were a total of 162,588,671 shares issued in partial extinguishment of this nonmonetary obligation. As of July 31, 2021, there was a balance outstanding of $176,485 on this judgment that could be satisfied by issuing approximately 278,690,243 shares of the Company’s common stock at a rate of approximately $0.00063 per share.

On November 25, 2014, in Securities Counselors, Inc. v. Texas Wyoming Drilling, Inc., Case No. 14 L 825, Halberd Corporation, then named Tykhe Corporation, agreed to a settlement in the amount of $2,822,209, whereby the Company agreed to issue 486,850,070 shares of its common stock at an issuance price of $0.0057969 per-share in exchange for an interest in various cannabis farming operations in accordance with the November 25, 2014 court order. This November 25, 2014 court order covered several different public companies which participated in this initiative, agreeing to issue shares in exchange for interests in such cannabis farming operations. The Texas Wyoming court order further provided that Securities Counselors Inc. was entitled to 19,438,077 shares of common stock in Halberd Corporation in extinguishment of its accrued liability of $112,680.10 for additional legal services rendered, which were in addition to the legal services rendered immediately prior to, and covered by, the Securities Counselors, Inc. v. Halberd Corporation Case No. 13 L 00000668.

That November 25, 2014, Securities Counselors, Inc. v. Texas Wyoming Drilling, Inc. order, however, was later modified in May 2016, effectively extinguishing for Halberd, both the obligation to issue shares as well as any entitlements with respect thereto, except for the share entitlement for legal services. The most relevant provisions relating to this matter of Securities Counselors, Inc. v. Texas Wyoming Drilling, Inc. appear in paragraph 6 stating as follows: “Halberd is hereby relieved of its obligations in accordance with the Securities Counselors, Inc. v. Texas Wyoming Drilling, Inc. 2014 Order, including any obligation to issue the 486,850,070 shares … and …. to receive shares in any of the other Issuers is hereby extinguished. The 19,438,077 shares, which Halberd was obligated to issue SCI shall increase to 321,943,143, to reflect the corresponding decrease in its share price.” Mathematically, the $112,680.10 divided by the 321,943,143 shares is $0.00035 per-share.

As of July 31, 2021, there was a balance outstanding of $39,915 on this judgment that could be satisfied by issuing approximately 114,042,714 shares of the Company’s common stock at a rate of approximately $0.00035 per share. A total of 207,900,429 shares were issued in satisfaction of approximately $72,765 of this obligation over various dates from August 5, 2020 through July 29, 2021.

The Company has accounted for its judgment liability in accordance with ASC 450 - Contingencies, whereby the judgments presented above are carried at the amount of the court ordered judgments, as the losses were both probable and reasonably estimated at the time the judgments were ordered, therefore they have been recognized as liabilities on the balance sheets in the amounts of the court orders. The judgments are to be settled in shares of the Company’s common stock at fixed prices per share, which could result in the issuance of an aggregate 392,732,957 shares of the Company’s common stock.

| Page 7 of 10 |

Registration Statement on Form 10, File No. 000-56440

Note 4 - Fair Value of Financial Instruments, page F-10

16. Refer to your response to comment 20. You state that the change in fair value of the judgments payable resulted in a loss so please explain why you removed the line item for the loss on the mark-to-market fair value adjustment on the convertible judgments payable from your statements of operations. Also, explain why the amounts disclosed as Level 3 for the judgments payable no longer agree to the amounts on the Balance Sheet.

Response

Respectfully, the prior response to comment 20 was not supposed to have said that the change in fair value of the judgments payable resulted in a loss. That was edited out from our responses, but somehow was mistakenly reinserted prior to our submission. Our Convertible judgments payable has been corrected to be reported at the face value of the judgment, which would not have an associated gain or loss on fair value to report in the statement of operations.

The Convertible judgments payable have been measured for fair value disclosure purposes using observable market data (the fair value of the Company’s stock to be issued in satisfaction of the judgments), therefore we have corrected the disclosure to present the amounts as Level 2, rather than Level 3, within the Fair Value of Financial Instruments footnotes.

The amounts in the balance sheet no longer agree to the amounts in Note 4 because the fair value, based on the exit price, or underlying value of the shares for which the judgments are to be issued, has been disclosed, rather than the historical cost, or face value of the judgments, as presented within the balance sheets. We have updated these disclosures in accordance with ASC 820-10-50-2(e), accordingly, as follows:

The fair value of our convertible judgments payable is based on the fair market value of the underlying shares that are to be used to settle the judgments, and are considered Level 3 inputs as defined by ASC Topic 820-10-35. The fair value is based on the exit price using the Company’s common stock at the balance sheet dates. The fair value is greater than the amounts presented on the balance sheets as follows:

|

| July 31, |

|

| July 31, |

| ||

|

| 2021 |

|

| 2020 |

| ||

|

|

|

|

|

|

| ||

Fair value of convertible judgments payable |

| $ | 15,591,498 |

|

| $ | 3,603,800 |

|

Historical value of convertible judgments payable on balance sheets |

|

| 216,400 |

|

|

| 289,165 |

|

|

| $ | 15,375,098 |

|

| $ | 3,314,635 |

|

| Page 8 of 10 |

Registration Statement on Form 10, File No. 000-56440

Index to Financial Statements For the Fiscal Periods Ending January 31, 2022 and 2021, page F- 17

17. Update the title of the financial statements in the index to April 30, 2022 from January 31, 2022.

Response

We have updated the dates and the periods from the three and six months ended to the three and nine months ended, accordingly.

Item 15. Exhibits 23.1, page F-31

18. The consent currently references the report dated May 10, 2022. Please have your auditor revise this to March 10, 2022.

Response

The Auditor Consent has been redated as requested.

Exhibits

19. We note your response to Comment 12 and reissue. Revise to disclose the material terms of your agreement with Arizona State University. Additionally, disclose whether you intend to extend the agreement as it appears it will expire at the end of November 2022. If so, disclose the extent of negotiations with the university and how you expect to finance the agreement.

Response:

We acknowledge your comment and provide a supplemental response to Comment 12.………..Arizona State University (“ASU”) is a leader in molecular sciences, the discipline underlying our extracorporeal treatment. Indeed, ASU’s Dr. Chen (and his team) is viewed as irreplaceable and is fully committed to extending the agreement. We also believe ASU complements the expertise offered by Youngstown State University and, most recently, Mississippi State University. See “Business” for an expanded fuller discussion of this relationship. The associated contract is Exhibit.10.1 to the Form 10 as originally filed on May 11.

The existing Agreement expires by its terms November 30. Halberd has every intention of extending the agreement and is currently in discussions with ASU to extend the existing relationship—at least one year and year to year thereafter. We expect the financial terms as currently in place, including 27 monthly payments of $50,000.at any time through mutual written consent of both parties. We expect the financial commitments being made will be met through continued support from ESC as well as potential capital raises through private investors or public offerings (Reg A).

| Page 9 of 10 |

Registration Statement on Form 10, File No. 000-56440

General

20. We note your response to Comment 23 and reissue because we did not locate any of the referenced attachments. Please supplementally provide us with copies of all written communications, as defined in Rule 405 under the Securities Act, that you, or anyone authorized to do so on your behalf, present to potential investors in reliance on Section 5(d) of the Securities Act, whether or not they retain copies of the communications.

Response:

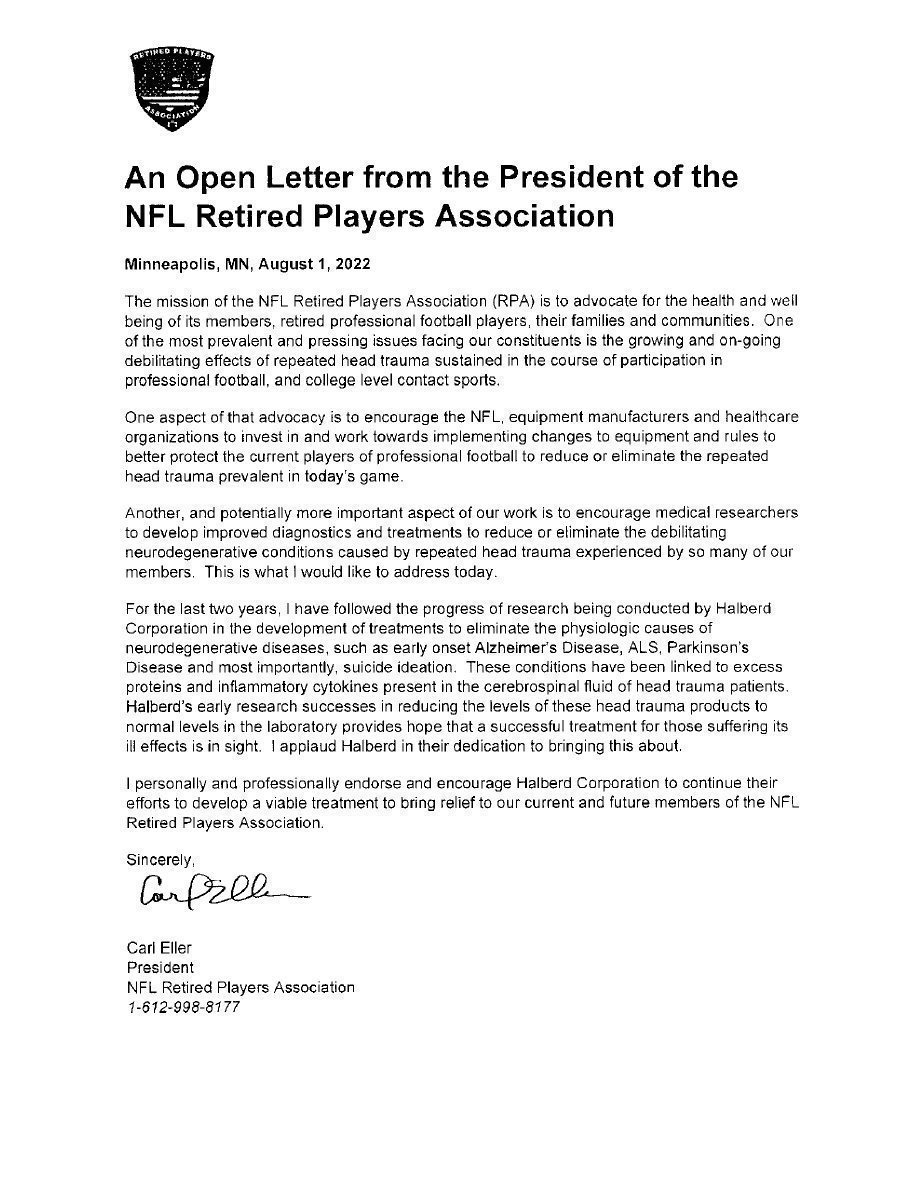

Attached we provide supplementally the requested documentation sought in Comment 23 in the original set of staff comments. We are not convinced that that the docs attached fall within the Rule 405 and Section 5(d) defined terms but have no objection to share with the staff. In conjunction with that attachment (a PDF comprised of five (5) documents), management (i) wanted to keep shareholders advised of progress on execution of its business plan, (ii) address the company’s technological achievements and (iii) convey a sense of the company’s credibility as a potential Joint Venture partner. There most assuredly was no active/formal funds solicitation campaign and we reiterate these observations: Since receiving the funding commitment from Epidemiologic Solutions Corporation (“ESC”), Halberd has not sought capital investors. However, Halberd has responded to the occasional investor inquiry with the attached marketing presentations, press releases, business overview and description of our technology. Please know that these presentations were more commonly used for pharmaceutical company presentations in pursuit of a relationship with a research facility or pharmaceutical company (in other words “big pharma”). (The reason the presentations referring to Premier were included is that those were actually used with an appropriate accompanying explanation.).

_______________________________________________

We acknowledge that the Company and its management are responsible for the accuracy and adequacy of our disclosures, notwithstanding any review, comments, action or absence of action by the staff.

Upon completion of the review of this Amendment No. 3 to the Form 10, we trust all comments will have been satisfied and you can advise us that the Company’s Form 10 Registration Statement has no outstanding comments.

Thank you for your assistance and prompt review of these Form 10 materials as originally filed May 11 and prospectively this Amendment No. 3 to the Form 10.

Should you have any questions during the course of your review, please let me know.

Very truly yours,

___________________

Willliam Hartman. Chief Executive Officer

William Hartman, Chief Financial Officer

Halberd Corporation

Exhibit Collection PDF Relative to Staff Coment Comment 20

| Page 10 of 10 |