UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14C INFORMATION

Amendment No. 2

Information Statement Pursuant to Section 14(c) of the Securities Exchange Act of 1934

Check the appropriate box:

[X ] Preliminary Information Statement

[ ] Confidential, for Use of the Commission Only (as permitted by Rule 14c-5(d)(2))

[ ] Definitive Information Statement

ECO ENERGY PUMPS, INC.

(Name of Registrant As Specified in Charter)

Payment of Filing Fee (Check the appropriate box):

[X] No Fee required.

[ ] Fee computed on table below per Exchange Act Rules 14c-5(g) and 0-11.

(1) Title of each class of securities to which transaction applies:

(2) Aggregate number of securities to which transaction applies:

(3) Per unit price or other underlying value of transaction computed pursuant to Exchange

Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

(4) Proposed maximum aggregate value of transaction:

(5) Total fee paid:

[ ] Fee paid previously with preliminary materials

[ ] Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing.

(1) Amount Previously Paid:

(2) Form, Schedule or Registration Statement No.:

(3) Filing Party:

(4) Date Filed:

Copies to:

Peter Campitiello, Esq.

Tarter Krinsky & Drogin LLP

1350 Broadway

New York, New York 10018

Tel: 212-216-8085

Fax: 212-216-8001

ECO ENERGY PUMPS, INC.

112 North Curry Street

Carson City, Nevada 89703

Dear Shareholders:

We are writing to advise you that on October 18, 2010, John David Palmer, formerly the sole member of our Board of Directors and majority shareholder, authorized the form of the attached Certificate of Amendment of the Articles of Incorporation of Eco Energy Pumps, Inc. (the “Company”) to amend the Company’s Articles of Incorporation to: (i) change the name of the Company to “DLT International, Ltd.” (the “Name Change”) (ii) increase the number of the Company’s authorized shares of capital stock from 75,000,000 shares to 310,000,000 of which 300,000,000 shares will be common stock par value $0.001 per share (the “Common Stock”) and 10,000,000 shares will be preferred stock par value $0.001 per share (the ̶ 0;Preferred Stock”) (the “Authorized Stock Increase”); (iii) effectuate a forward stock split of our issued and outstanding Common Stock by changing and reclassifying each 1 share of our issued and outstanding Common Stock into fourteen 14 and 29/100 (14.29) fully paid and non-assessable shares of Common Stock (“Forward Split”); and (iv) authorize the Board of Directors to provide for the issuance of shares of preferred stock in series and, by filing a certificate pursuant to the Nevada Revised Statutes (hereinafter, along with any similar designation relating to any other class of stock that may hereafter be authorized, referred to as a “Preferred Stock Designation”), to establish from time to time the number of shares to be included in each such series, and to fix the designation, power, preferences and rights of the shares of each such series and the qualifications, limitations and restrictions thereof (the “Blank Check Preferred Stock”) (the Name Chan ge, Authorized Stock Increase, Forward Split and creation of Blank Check Preferred Stock are collectively referred to as the “Amendments”).

Pursuant to a Securities Exchange Agreement (the “Exchange Agreement”) with DLT International Limited, a privately held corporation organized under the laws of the British Virgin Islands (“DLT”) dated October 25, 2010, the Company agreed to file the Amendments as soon as practicable following the closing. Pursuant to the terms of the Exchange Agreement, the Company acquired DLT in exchange for an aggregate of 2,267,320 newly issued shares (the “Exchange”) of the Company’s common stock, par value $0.001 per share issued to DLT Shareholders in accordance with their pro rata ownership of DLT equity. As a result of the Exchange, DLT became a wholly-owned subsidiary of the Company. A copy of the Exchange is attached as Exhibit B to the accompanying information statemen t.

These actions were approved by written consent on October 18, 2010 by our sole Director and majority shareholder as of that date in accordance with Section 78.315 and 78.320 of the Nevada Revised Statutes. Our Director and majority shareholder owning 97% of our outstanding Common Stock, has approved this amendment after carefully considering it and concluding that it was in the best interests of our Company and our shareholders.

No action is required by you. While Rule 14c-2 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), requires us to distribute the final Information Statement at least twenty (20) days prior to the date that the actions are to be taken, the Company erroneously filed a Certificate of Amendment to its Articles of Incorporation containing the Amendments on October 19, 2010. Accordingly, we have failed to comply with the provisions of Rule 14c-2. We are unsure whether such omission will subject the Company, its officers and directors to any liability under Rule 14c-2.

WE ARE NOT ASKING YOU FOR A PROXY, AND YOU ARE REQUESTED NOT TO SEND US A PROXY.

This Information Statement is first mailed to you on or about February ___, 2011.

Please feel free to call us at (775) 284-3713 should you have any questions on the enclosed Information Statement.

| | For the Board of Directors of ECO ENERGY PUMPS, INC. | |

| | | | |

| | By: | /s/ Jun Liu | |

| | | Name: Jun Liu Title: Chief Executive Officer | |

ECO ENERGY PUMPS, INC.

112 North Curry Street

Carson City, Nevada 89703

INFORMATION STATEMENT REGARDING

ACTION TO BE TAKEN BY WRITTEN CONSENT OF

MAJORITY SHAREHOLDER

IN LIEU OF A SPECIAL MEETING

PURSUANT TO SECTION 14(C) OF THE SECURITIES EXCHANGE ACT OF 1934

WE ARE NOT ASKING YOU FOR A PROXY,

AND YOU ARE REQUESTED NOT TO SEND US A PROXY.

GENERAL

This Information Statement is being furnished to the shareholders of Eco Energy Pumps, Inc. (the “Company”) in connection with the proposed amendments to the Articles of Incorporation of the Company to (i) change the name of the Company to “DLT International, Ltd.” (the “Name Change”) (ii) increase the number of the Company’s authorized shares of capital stock from 75,000,000 shares to 310,000,000 of which 300,000,000 shares will be common stock par value $0.001 per share (the “Common Stock”) and 10,000,000 shares will be preferred stock par value $0.001 per share (the “Preferred Stock”) (the “Authorized Stock Increase”); (iii) effectuate a forward stock split of our issued and outstanding Co mmon Stock by changing and reclassifying each 1 share of our issued and outstanding Common Stock into fourteen 14 and 29/100 (14.29) fully paid and non-assessable shares of Common Stock (“Forward Split”); and (iv) authorize the Board of Directors to provide for the issuance of shares of preferred stock in series and, by filing a certificate pursuant to the Nevada Revised Statutes (hereinafter, along with any similar designation relating to any other class of stock that may hereafter be authorized, referred to as a “Preferred Stock Designation”), to establish from time to time the number of shares to be included in each such series, and to fix the designation, power, preferences and rights of the shares of each such series and the qualifications, limitations and restrictions thereof (the “Blank Check Preferred Stock”, and together with the Authorized Stock Increase and the Forward Split, the “Amendments”).

Pursuant to a Securities Exchange Agreement (the “Exchange Agreement”) with DLT International Limited, a privately held corporation organized under the laws of the British Virgin Islands (“DLT”) dated October 25, 2010, the Company agreed to file the Amendments as soon as practicable following the closing. Pursuant to the terms of the Exchange Agreement, the Company acquired DLT in exchange for an aggregate of 2,267,320 newly issued shares (the “Exchange”) of the Company’s common stock, par value $0.001 per share issued to DLT Shareholders in accordance with their pro rata ownership of DLT equity. As a result of the Exchange, DLT became a wholly-owned subsidiary of the Company. A copy of the Exchange is attached as Exhibit B to the accompanying information statemen t.

These actions were approved by John David Palmer, formerly our majority shareholder and sole member of our Board of Directors. This Information Statement has been prepared by our management.

"We," "us," "our," the “Registrant” and the "Company" refers to Eco Energy Pumps, Inc., a Nevada corporation. The amendments to the Company’s Articles of Incorporation is sometimes referred to as the “Amendments”.

While Rule 14c-2 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), requires us to distribute the final Information Statement at least twenty (20) days prior to the date that the actions are to be taken, the Company erroneously filed a Certificate of Amendment to its Articles of Incorporation containing the Amendments on October 19, 2010. Accordingly, we have failed to comply with the provisions of Rule 14c-2. We are unsure whether such omission will subject the Company, its officers and directors to any liability under Rule 14c-2. No further vote of our shareholders is required.

THE AMENDMENTS HAVE NOT BEEN APPROVED OR DISAPPROVED BY THE SECURITIES AND EXCHANGE COMMISSION, NOR HAS THE SECURITIES AND EXCHANGE COMMISSION PASSED UPON THE FAIRNESS OR MERIT OF THE CHARTER AMENDMENT NOR UPON THE ACCURACY OR ADEQUACY OF THE INFORMATION CONTAINED IN THIS INFORMATION STATEMENT ANY REPRESENTATION TO THE CONTRARY IS UNLAWFUL.

PLEASE NOTE THAT THIS IS NEITHER A REQUEST FOR YOUR VOTE NOR A PROXY STATEMENT, BUT RATHER AN INFORMATION STATEMENT DESIGNED TO INFORM YOU OF THE AMENDMENT THAT WILL OCCUR IF THE AMENDMENTS ARE COMPLETED AND TO PROVIDE YOU WITH INFORMATION ABOUT THE AMENDMENT AND THE BACKGROUND OF THESE TRANSACTIONS.

The entire cost of furnishing this Information Statement will be borne by the Company. We will request brokerage houses, nominees, custodians, fiduciaries and other like parties to forward this Information Statement to the beneficial owners of our voting securities held of record by them and we will reimburse such persons for out-of-pocket expenses incurred in forwarding such material.

QUESTIONS AND ANSWERS ABOUT THE AMENDMENTS AND THE EXCHANGE

Q. Why did I receive this Information Statement?

A. Applicable laws require us to provide you information regarding the Amendments and the Exchange even though your vote is neither required nor requested for the Amendments or the Exchange to become effective.

Q. Why am I not being asked to vote on the Amendments?

A. The holder of a majority of the issued and outstanding shares of Common Stock has already approved the Amendments pursuant to a written consent in lieu of a meeting. Such approval, together with the approval of the Company's Board of Directors, is sufficient under Nevada law, and no further approval by our shareholders is required.

Q. Why am I not being asked to vote on the Exchange?

A. The adoption of the Exchange does not require the affirmative vote or written consent of holders of a majority of the outstanding shares of Common Stock of the Company. Our sole Director unanimously voted, approved and recommended the adoption of the Exchange Agreement and determined that the Exchange was advisable to and in the best interests of the Company and its shareholders. Therefore, your vote is not required and is not being sought. We are not asking you for a proxy and you are requested not to send us a proxy.

Q. What is the Exchange?

A. The transaction is by and among Eco Energy Pumps, Inc. (the “Company”), DLT International Ltd., a British Virgin Islands company (“DLT”), and the shareholders of DLT (the “DLT Shareholders”) in accordance with a Securities Exchange Agreement (the “Exchange Agreement”) dated October 25, 2010, whereby the Company acquired all of the issued and outstanding capital stock of DLT in exchange for 2,267,320 newly issued shares of the Company’s Common Stock (the “Exchange Shares”). Pursuant to the Exchange Agreement, the Company’s former principal shareholder and sole director, John David Palmer, agreed to retire 9,300,000 shares of Common Stock. Following the issua nce of the Exchange Shares and the retirement of our principal shareholder shares, DLT’s sole shareholder, KME Investments Group Limited, became the Company’s principal shareholder, owning approximately eighty-nine percent (89%) of the Company’s outstanding Common Stock. Accordingly, the Exchange represents a change in control.

Q. Once the Exchange is completed, what will I receive for my shares of DLT Common Stock?

A. Nothing. The Exchange Shares were issued solely to shareholders of DLT. However, the Company’s Board of Directors believes the Exchange is in the best interests of the Company and its shareholders.

Q. What will I receive if the Amendments are completed?

A. Shareholders who held shares of our Common Stock on the Record Date will receive Fourteen and 29/100 (14.29) shares of Common Stock as a dividend for each share of Common Stock held on the Record. These shares will be mailed directly to shareholders.

Q. What do I need to do now?

A. Nothing. This information statement is purely for your information and does not require or request you to do anything.

SUMMARY

The following summary highlights selected information from this information statement and may not contain all of the information that is important to you. Accordingly, we encourage you to read carefully this entire information statement, its annexes and the documents referred to in this information statement.

Unless we otherwise indicate or unless the context requires otherwise, all references in this information statement to "Company," "Eco Energy," “Registrant,” "we," "our" and "us" refer to Eco Energy Pumps, Inc., a Nevada corporation.

THE AMENDMENTS

Required Approval of the Amendments

On October 18, 2010, our then sole Director and shareholder holding approximately 97% of the Company’s Common Stock (the “Majority Shareholder”), approved the amendments to the Company’s Certificate of Amendment of the Articles of Incorporation (the “Amendments”). The Amendments were approved by written consent of the Majority Shareholder. Pursuant to the Nevada Revised Statutes, the Amendments are required to be approved by a majority of our shareholders. This approval could be obtained either by the written consent of the holders of a majority of our issued and outstanding voting securities, or it could be considered by our shareholders at a special shareholders' meeting convened for the specific pu rpose of approving the Amendments. The Company’s voting securities consist of Common Stock. Each share of Common Stock is entitled to one vote per share on any matter requiring shareholder vote. In order to eliminate the costs and management time involved in holding a special meeting, our Board of Directors voted to utilize the written consent of the Majority Shareholder. The elimination of the need for a meeting of shareholders to approve this action is made possible by Section 78.320 of the Nevada Revised Statutes, as may be amended, which provides that the written consent of the holders of a majority of the outstanding shares of voting capital stock, having no less than the minimum number of votes which would be necessary to authorize or take such action at a meeting at which all shares entitled to vote thereon were present.

As of October 18, 2010, there were 9,552,500 issued and outstanding shares of our Common Stock. As of October 25, 2010, following the Exchange and the retirement of the Majority Shareholder’s 9,300,000 shares of Common Stock, the Company had 2,519,320 shares of Common Stock issued and outstanding.

The date on which this Information Statement was first sent to shareholders is on or about February __, 2011 (the “Mailing Date”). Inasmuch as we will have provided this Information Statement to our shareholders of record as of the record date of October 18, 2010 (“Record Date”) no additional action will be undertaken pursuant to such written consent. Shareholders of record on the Record Date who did not consent to the Amendments are not entitled to dissenter's rights under Nevada law.

Reasons for the Amendments

Pursuant to the Exchange, the Company agreed to effectuate the Amendments as soon as practicable following the Exchange. After careful consideration, our sole Director and Majority Shareholder (i) approved and declared advisable the Amendments and the other transactions contemplated by the Exchange, (ii) resolved that it was in the best interests of Eco Energy’s shareholders that Eco Energy enter into the Exchange and consummate the Exchange and the other transactions contemplated by the Exchange, (iii) directed that the Amendments be submitted for adoption by Eco Energy’s shareholders and (iv) recommended to Eco Energy’s shareholders that they adopt the Amendments. The adoption of the Exchange did not require the affirmative vote or written consent of a majority of the shareholders of the Company.

AMENDMENT TO OUR ARTICLES OF INCORPORATION TO CHANGE THE NAME OF THE CORPORATION

The change of the Company’s name to “DLT International, Ltd.” will better reflect the Company’s business plan following its reverse acquisition of DLT International Limited on October 25, 2010, pursuant to the Agreement and Plan of Share Exchange.

AMENDMENT TO OUR ARTICLES OF INCORPORATION TO INCREASE OUR AUTHORIZED SHARES OF COMMON STOCK FROM 75,000,000 TO 300,000,000

The Amendment authorizes the increase of the number of the Company’s authorized shares of Common Stock, par value $0.001 per share, from 75,000,000 to 300,000,000. Our Board of Directors believes it is in the Company’s best interests and the best interests of our shareholders to increase the number of authorized shares of our Common Stock to allow for the issuance of shares of our Common Stock or other securities in connection with such potential issuances and such other purposes as our Board of Directors determines.

The increase in the authorized number of shares of our Common Stock will permit our Board of Directors to issue additional shares of our Common Stock without further approval of our shareholders, and our Board of Directors does not intend to seek shareholder approval prior to any issuance of the authorized capital stock unless shareholder approval is required by applicable law or stock market or exchange requirements. Although from time to time we review various transactions that could result in the issuance of shares of our Common Stock, we have not reviewed any transaction to date.

Possible Anti-Takeover Effects.

Release No. 34-15230 of the staff of the Securities and Exchange Commission requires disclosure and discussion of the effects of any shareholder proposal that may be used as an anti-takeover device. The actions are not intended to construct or enable any anti-takeover defense or mechanism on behalf of the Company. The purpose of the increase in authorized capital is to increase the number of shares available for future issuance while, the increase of our authorized capital stock could, under certain circumstances, have an anti-takeover effect. We do not have in place provisions which may have an anti-takeover effect. The increase in the authorized number of shares of our Common Stock did not result from our knowledge of any specific effort to accumulate our securities or t o obtain control of us by means of a merger, tender offer, proxy solicitation in opposition to management or otherwise, and we did not take such action to increase the authorized shares of our Common Stock to enable us to frustrate any efforts by another party to acquire a controlling interest or to seek representation on our Board of Directors.

The issuance of additional shares of our Common Stock may have a dilutive effect on earnings per share and on the equity and voting power of existing security holders of our Common Stock, and such issuance may not require shareholder approval. It may also adversely affect the market price of our Common Stock. However, if additional shares are issued in transactions whereby favorable business opportunities are provided which allow us to pursue our business plans, the market price of our Common Stock may increase.

AMENDMENT TO OUR CERTIFICATE OF INCORPORATION TO EFFECTUATE A 14.29-FOR-1 FORWARD STOCK SPLIT

Our Board of Directors has determined that the current number of shares of the Company in the public float is limited and that an expansion of such shares would be more conducive to the establishment of an orderly market. The total number of Common Stock outstanding is 2,519,320. Our Board of Directors believes that this number of outstanding shares impairs our marketability to and acceptance by institutional investors and other members of the investing public and creates a negative impression of our Company.

Theoretically, increasing the number of shares of Common Stock outstanding should not, by itself, affect the marketability of the shares, the type of investor who would be interested in acquiring them, or our reputation in the financial community. Our expectation is that the increase in the number of shares of our outstanding common stock resulting from the Forward Split will encourage greater interest in our Common Stock among members of the financial community and the investing public and possibly create a more liquid market for our shareholders with respect to those shares presently held by them.

It is possible that the Forward Split will not achieve any of the desired results. There also can be no assurance that the price per share of our Common Stock immediately after the Forward Split will increase proportionately with the Forward Split, or that such increase, if any, will be sustained for any period of time.

Possible Anti-Takeover Effects

Release No. 34-15230 of the staff of the Securities and Exchange Commission requires disclosure and discussion of the effects of any shareholder proposal that may be used as an anti-takeover device. The actions are not intended to construct or enable any anti-takeover defense or mechanism on behalf of the Company. As indicated above, the purpose of the Forward Split is to increase the number of issued and outstanding shares.

Procedure for Implementing the Forward Stock Split

In connection with the Forward Split, every 1 share of our pre-split outstanding Common Stock will be exchanged for 14.29 shares of Common Stock. The Forward Split will not affect the par value of the Common Stock. Post-split shares of our Common Stock may be obtained by surrendering certificates representing shares of pre-split Common Stock to our transfer agent. To determine the number of shares of our Common Stock issuable to any record holder, the total number of shares represented by all of the certificates issued in the name of that record holder held in each account as set forth on the records of the transfer agent on the date upon which the split becomes effective will be multiplied by 14.29.

We will not issue any certificates representing fractional shares of our Common Stock in the transaction. Any resulting fractional shares shall be rounded up to the nearest whole number. Upon surrender to the transfer agent of the share certificate(s) representing shares of pre-split Common Stock, the holder will receive a share certificate representing the appropriate number of shares of Common Stock.

Federal Income Tax Consequences

The following discussion generally describes certain federal income tax consequences of the Forward Split to our shareholders. The following does not address any foreign, state, local tax or alternative minimum income tax, or other federal tax consequences of the proposed Forward Split. The actual consequences for each shareholder will be governed by the specific facts and circumstances pertaining to such shareholder’s acquisition and ownership of the Common Stock. Each shareholder should consult his or her accountant or tax advisor for more information in this regard.

We believe that the Forward Split will qualify as a “recapitalization” under Section 368(a)(1)(E) of the Code or as a stock-for-stock exchange under Section 1036(a) of the Code. As a result, no gain or loss should be recognized by us or our shareholders in connection with the Forward Split. A shareholder’s aggregate tax basis in his or her shares of post-Forward Split Common Stock received from us will be the same as his or her aggregate tax basis in the pre-Forward Split Common Stock exchanged therefor. The holding period of the post-Forward Split Common Stock surrendered in exchange therefor will include the period for which the shares of pre-Forward Split Common Stock were held, provided all such Common Stock was held as a capital asset on the date of the exchange.

This summary is provided for general information only and does not purport to address all aspects of the possible federal income tax consequences of the Forward Split and is not intended as tax advice to any person. In particular, and without limiting the foregoing, this summary does not consider the federal income tax consequences to our shareholders in light of their individual investment circumstances or to holders subject to special treatment under the federal income tax laws (such as life insurance companies, regulated investment companies and foreign taxpayers).

No ruling from the Internal Revenue Service or opinion of counsel has been or will be obtained regarding the federal income tax consequences to our shareholders as a result of the Forward Split. Accordingly, each shareholder is encouraged to consult his or her tax advisor regarding the specific tax consequences of the proposed transaction to such shareholder, including the application and effect of state, local and foreign income and other tax laws.

Effects of Forward Stock Split

Following the Forward Split, our capital structure will be as follows:

(i) 36,001,083 shares of Common Stock, $0.001 par value per share, outstanding;

(ii) 263,998.917 shares of Common Stock reserved for issuance; and

(iii) 10,000,000 shares of Preferred Stock reserved for issuance

There are currently no proposals or arrangements, written or otherwise, to issue additional shares of our Common Stock at this time. However, should we issue additional shares of stock in the future, this could have the effect of diluting the earnings per share and book value per share of existing shares of Common Stock.

AMENDMENT TO OUR ARTICLES OF INCORPORATION TO EFFECTUATE THE CREATION OF BLANK CHECK PREFERRED STOCK

The Board of Directors believes that it is prudent to have a class of 10,000,000 shares Preferred Stock for general corporate purposes, including acquisitions, equity financings, stock dividends, stock splits or other recapitalizations, and grants of stock options. The Company currently has no arrangements or understandings for the issuance of shares of preferred stock, although opportunities for acquisitions and equity financings could arise at any time. If the Board of Directors deems it to be in the best interests of the Company and the shareholders to designate the rights to be associated with the issuance of additional shares of Common Stock in the future, and to issue shares from the authorized shares, the Board of Directors generally will not seek further author ization by vote of the shareholders, unless such authorization is otherwise required by law or regulations.

Preferred Stock may be issued from time to time in one or more series. The Board of Directors is hereby authorized to provide for the issuance of shares of preferred stock in series and, by filing a Preferred Stock Designation, to establish from time to time the number of shares to be included in each such series, and to fix the designation, power, preferences and rights of the shares of each such series and the qualifications, limitations and restrictions thereof. The authority of the Board of Directors with respect to each series shall include, but not be limited to, determination of the following:

(i) The designation of the series, which may be by distinguishing number, letter or title;

(ii) The number of shares of the series, which number the Board of Directors may thereafter (except where otherwise provided in the Preferred Stock Designation) increase or decrease (but not below the number of shares thereof then outstanding);

(iii) The amounts payable on, and the preferences, if any, of shares of the series in respect of dividends, and whether such dividends, if any, shall be cumulative or noncumulative;

(iv) Dates on which dividends, if any, shall be payable

(v) The redemption rights and price or prices, if any, for shares of the series;

(vi) The terms and amount of any sinking fund provided for the purchase or redemption of shares of the series;

(vii) The amounts payable on and the preference, if any, of shares of the series in the event of any voluntary or involuntary liquidation, dissolution or winding up of the affairs of the Corporation;

(viii) Whether the shares of the series shall be convertible into or exchangeable for shares of any other class or series, or any other security, of the Corporation or any other corporation, and, if so, the specification of such other class or series of such other security, the conversion or exchange price or prices or rate or rates, any adjustments thereof, the date or dates at which such shares shall be convertible or exchangeable and all other terms and conditions upon which such conversion or exchange may be made;

(ix) Restrictions on the issuance of shares of the same series or of any other class or series;

(x) The voting rights, if any, of the holders of shares of the series.

(xi) The restrictions and conditions, if any, upon the issuance or reissuance of any Additional preferred stock ranking or a part with or prior to such shares as to dividends or upon distribution; and

(xii) Any other preferences, limitations or relative rights of shares of such class or series consistent with this Article Sixth, the general corporation law of the State of Nevada, and applicable law.

The Common Stock shall be subject to the express terms of the preferred stock and any series thereof. Each share of Common Stock shall be equal to each other share of Common Stock. Except as may be provided in the Certificate of Amendment of the Articles of Incorporation or in a Preferred Stock Designation, the holders of shares of Common Stock shall be entitled to one vote for each such share upon all questions presented to the shareholders.

Effects of Blank Check Preferred Stock

Possible Anti-Takeover Effects.

The issuance of Blank Check Preferred Stock may have a dilutive effect on holders of shares of our Common Stock since the blank check preferred stock may convert into shares of our Common Stock. For example, in a liquidation, the holders of the preferred stock may be entitled to receive a certain amount per share of preferred stock before the holders of the common stock receive any distribution. In addition, the holders of preferred stock may be entitled to a certain number of votes per share of preferred stock and such votes may dilute the voting rights of the holders of Common Stock when the Company seeks to take corporate action. Furthermore, preferred stock may be issued with certain preferences over the holders of common stock with respect to dividends or the power to approve the declarati on of a dividend. These are only examples of how shares of preferred stock, if issued, may dilute the interests of the holders of common stock. The Company has no present intention to issue any shares of preferred stock, we cannot assure you that we will not do so in the future. Furthermore, additional issuances of common stock could also have a dilutive effect on holders of shares of our Common Stock.

This new class of Preferred Stock could have an anti-takeover effect. The issuance of preferred stock may discourage, delay or prevent a takeover of the Company. When, in the judgment of the Board of Directors, this action will be in the best interest of the shareholders and the Company, such shares may be used to create voting or other impediments or to discourage persons seeking to gain control of the Company. The ability of the Company to issue such shares of preferred stock may, under certain circumstances, make it more difficult for a third party to gain control of the Company (e.g., by means of a tender offer), prevent or substantially delay such a change of control, discourage bids for the Common Stock at a premium, or otherwise adversely affect the m arket price of the Common Stock. Such shares also could be privately sold to purchasers favorable to the Board of Directors in opposing such action. In addition, the Board of Directors may authorize holders of a series of common or preferred stock to vote either separately as a class or with the holders of the Company's Common Stock, on any merger, sale or exchange of assets by the Company or any other extraordinary corporate transaction. The existence of the additional authorized shares may have the effect of discouraging unsolicited takeover attempts. The issuance of new shares also may be used to dilute the stock ownership of a person or entity seeking to obtain control of the Company should the Board of Directors consider the action of such entity or person not to be in the best interest of the shareholders of the Company. The issuance of new shares also may be used to entrench current management or deter an attempt to replace the Board of Directors by diluting the number or rights of shares held by individuals seeking to control the Company by obtaining a certain number of seats on the Board of Directors.

The creation of the preferred stock may afford the Company greater flexibility in seeking capital and potential acquisition targets. The Company's Articles of Incorporation currently only permits the Company to issue shares of Common Stock. This, the Company believes, has limited the Company's flexibility in seeking additional working capital. The Board of Directors has recommended that the Articles of Incorporation be amended to authorize one or more series of blank check preferred stock and to allow the Board of Directors of the Company the widest possible flexibility in setting the terms of preferred stock that may be issued in the future. The Company will, therefore, be afforded the greatest flexibility possible in seeking additional financing, as the Bo ard of Directors deems appropriate in the exercise of its reasonable business judgment. The Company currently has no commitments or plans for the issuance of any shares of preferred stock.

While the amendment may have anti-takeover ramifications, the Board of Directors believes that the financial flexibility offered by the creation of one or more series of preferred stock outweighs any disadvantages. To the extent that the creation of one or more series of preferred stock may have anti-takeover effects, it may encourage persons seeking to acquire the Company to negotiate directly with the Board of Directors enabling the Board of Directors to consider the proposed transaction in a manner that best serves the shareholders' interests.

THE EXCHANGE

Explanatory Note Regarding the Exchange Agreement

The Exchange Agreement has been included to provide investors and our shareholders with information regarding its terms. It is not intended to provide to any person not a party thereto any other factual information about the Company. The Exchange Agreement contains representations and warranties of the Company and DLT, negotiated between the parties and made as of specific dates solely for purposes of the Exchange, including setting forth the respective rights of the parties with respect to their obligations to complete the Exchange. This description of the representations and warranties is not intended to provide any other factual information about the Company. The representations, warranties and covenants contained in the E xchange Agreement were made only for purposes of such agreement and as of specific dates, were solely for the benefit of the parties to such agreement, and may be subject to limitations agreed upon by the contracting parties, including being qualified by confidential disclosures exchanged between the parties in connection with the execution of the Exchange Agreement. The representations and warranties may have been made for the purposes of allocating contractual risk between the parties to the agreement instead of establishing these matters as facts, and may be subject to standards of materiality applicable to the contracting parties that differ from those applicable to investors. Moreover, information concerning the subject matter of the representations and warranties may change after the date of the Exchange, which subsequent information may or may not be fully reflected in the Company's public disclosures. As a result, no person should rely on the representations, warranti es, covenants and agreements or any descriptions thereof as characterizations of the actual state of facts or condition of the Company, DLT or any of their respective subsidiaries or affiliates.

Required Approval of the Exchange

Our sole Director (i) determined that the Exchange and the other transactions contemplated by the Exchange are in the best interests of the shareholders of the Company and (ii) approved the Exchange and other transactions contemplated by the Exchange.

The Parties to the Securities Exchange Agreement

Eco Energy Pumps, Inc., a Nevada corporation, was incorporated as a for-profit company in the State of Nevada on October 14, 2008 and established a fiscal year end of October 31. The Company is a development-stage company that intended to develop an efficient water pumps powered by solar energy. As a result of the Exchange with DLT International Limited (“DLT”), Eco Energy adopted the business plan of DLT.

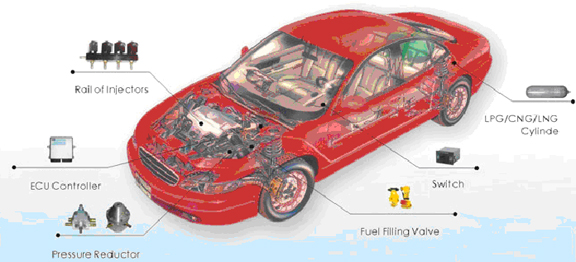

DLT International Limited, a corporation organized under the laws of the British Virgin Islands in March 18, 2010, through its wholly-owned Chinese subsidiary, Dalei Vehicle Inspecting Technology (Shen Zhen) Co., Ltd. (“Dalei”), is a manufacturer and supplier of automotive emissions testing equipment and software control systems and a provider of comprehensive inspection station management services. Such services include the establishment of systems, standards and equipment supply, create inspection service market rules and formulate market rules with the government together in order to constitute a complete set of industry management methods and m anagement measures, which include staff training, equipment access, inspection technology standards, management content and specific requirements. The initial goal of Dalei is to construct a chain of inspection stations in China. DLT has established a joint venture of two vehicle inspection stations, and has commenced operations. At present, the company's main business is motor vehicle testing equipment and software control systems. The main target clients are the comprehensive testing centers owned by the Ministry of Transportation and the Safety Testing Centers owned by the Ministry of Public Security, military, garage workshops, motor vehicle manufacturers, public transport companies and motor vehicle exhaust gas emission testing centers owned by Ministry of Environmental Protection.

On October 25, 2010, Eco Energy acquired DLT, in accordance with the Exchange. DLT is a holding company whose principal operating company develops, manufactures and distributes automotive testing equipment in the People's Republic of China. Upon consummation of the Exchange, the Registrant adopted the business plan of DLT.

Pursuant to the terms of the Exchange, the Company acquired DLT in exchange for an aggregate of 2,267,320 newly issued shares (the “Exchange Shares”) of the Company’s common stock, par value $0.001 per share (the “Common Stock”) issued to DLT Shareholders in accordance with their pro rata ownership of DLT equity. As a result of the Exchange, DLT became a wholly-owned subsidiary of the Company. In addition, our principal shareholder agreed to retire his 9,300,000 shares of Common Stock. Following the Exchange, and upon giving effect to the Forward Split, the Company had an aggregate of approximately 36,001,083 shares issued and outstanding.

On October 18, 2010, pursuant to the terms of the Exchange Agreement, John David Palmer, formerly our sole Director and Majority Shareholder authorized the following: (i) change the name of the Company to “DLT International, Ltd.” (the “Name Change”) (ii) increase the number of the Company’s authorized shares of capital stock from 75,000,000 shares to 310,000,000 of which 300,000,000 shares will be common stock par value $0.001 per share (the “Common Stock”) and 10,000,000 shares will be preferred stock par value $0.001 per share (the “Preferred Stock”) (the “Authorized Stock Increase”); (iii) effectuate a forward stock split of our issued and outstanding Common Stock by changing and reclassifying each 1 share of our issued and outstanding Common Stock into fourteen and 29/100 (14.29) fully paid and non-assessable shares of Common Stock (the “Forward Split”); and (iv) authorize the Board of Directors to provide for the issuance of shares of preferred stock in series and, by filing a certificate pursuant to the Nevada Revised Statutes (hereinafter, along with any similar designation relating to any other class of stock that may hereafter be authorized, referred to as a “Preferred Stock Designation”), to establish from time to time the number of shares to be included in each such series, and to fix the designation, power, preferences and rights of the shares of each such series and the qualifications, limitations and restrictions thereof (the “Blank Check Preferred Stock” and together with the Authorized Stock Increase, the “Amendments”).

At the effective time of the Exchange, our Board of Directors was reconstituted by the resignation of John David Palmer and Jeannette Aparecida da Silva from their role as the Company’s officers and director, and the appointment of Xiu Liang Zhang as the Company’s Chairman and President; Jun Liu as a Director and Chief Executive Officer; and Zhengying Li as a Director and Chief Financial Officer. For more information, please refer to the Form 8-K filed on October 26, 2010, as amended.

The parties have taken the actions necessary to provide that the Exchange is treated as a “tax free exchange” under Section 368 of the Internal Revenue Code of 1986, as amended.

Pro Forma Ownership

Following the issuance of the Exchange Shares and the retirement of our principal share holder’s 9,300,000 shares of our Common Stock, DLT’s sole shareholder, KME Investments Group Limited, became the Registrant’s principal shareholder, owning approximately eighty-nine percent (89%) of the Registrant’s outstanding Common Stock. Accordingly, the Exchange represents a change in control. As of January 26, 2011, and upon giving effect to the Forward Split, there are 36,001,083 shares of Common Stock issued and outstanding. For financial accounting purposes, the acquisition was a reverse acquisition of the Company by DLT under the purchase method of accounting, and was treated as a recapitalization with DLT as the acquirer. Upon consummation of the Exchange, the Co mpany adopted the business plan of DLT.

Change of Control

Following the issuance of the Exchange Shares and the retirement of our principal shareholder shares, DLT became the Registrant’s principal shareholder, owning approximately eighty-nine percent (89%) of the Registrant’s outstanding Common Stock. Accordingly, the Exchange represents a change in control.

At the effective time of the Exchange, our Board of Directors was reconstituted by the resignation of John David Palmer and Jeannette Aparecida da Silva from their role as the Company’s officers and director, and the appointment of Xiu Liang Zhang as the Company’s Chairman and President; Jun Liu as a Director and Chief Executive Officer; and Zhengying Li as a Director and Chief Financial Officer.

Regulatory Approvals Required for the Exchange

Other than the approval by the Company’s Board of Directors of the Company to enter into the Exchange, there are no material federal, state or foreign regulatory requirements, approvals or filings required for the completion of the Exchange that have not been obtained.

Effects of the Exchange

Upon the completion of the Exchange, DLT became a wholly owned subsidiary of the Company, and the Exchange Shares represented approximately eighty-nine percent (89%) of the total outstanding shares of Common Stock of the Company on a fully diluted basis following the forward-split of the Company’s Common Stock on a 14.29 for 1 basis. The Company's common stock is currently quoted on the OTC Bulletin Board under the symbol EEPU.OB. The Company intends to apply to change its name and stock symbol on the Over the Counter Bulletin Board.

Representations and Warranties

The Exchange Agreement contains a number of representations and warranties made by the Company and DLT. The statements embodied in those representations and warranties were made for purposes of the contract among the parties and are subject to qualifications and limitations agreed to by the parties in connection with negotiating the terms of that contract. Certain representations and warranties were made as of the date of the Exchange Agreement (or other date specified in the Exchange Agreement), may be subject to contractual standards of materiality different from those generally applicable to shareholders or may have been used for the purpose of allocating risk by the parties rather than establishing matters of fact. In addition, the representations and warranties are qualified by information in the Company disclo sure letter. Accordingly, you should not rely on the representations and warranties as characterizations of the actual state of facts because they are qualified as described above. Moreover, information concerning the subject matter of the representations and warranties may have changed since the date of the Exchange, and these changes may or may not be fully reflected in our public disclosures. The Exchange should not be read alone, but should instead be read in conjunction with the other information regarding the Company and DLT and the Exchange that is contained in this information statement, as well as in the filings that the Company will make and have made with the SEC. The representations and warranties contained in the Exchange may or may not have been accurate as of the date they were made and we make no assertion herein that they are accurate as of the date of this information statement.

In the Exchange Agreement, the Company and DLT have made customary representations and warranties that are subject, in some cases, to specified exceptions and qualifications, to the Company and DLT, including representations relating to:

• organization, good standing and authorization and qualification to do business;

• capitalization, including the particular number of outstanding shares of common stock , stock options, warrants, convertible debt and other equity-based interests;

• the accuracy of the Company's organizational documents and information disclosed in the Exchange;

• financial statements and internal accounting controls;

• consents required in connection with the Exchange, other than specifically identified consents;

• the absence of any violation or conflicts with any organizational documents, applicable law or certain contracts as a result of the Exchange;

• the timely filing and furnishing of SEC reports;

• the absence of undisclosed liabilities;

• the absence of any changes in the conduct of the business;

• the absence of investigations and legal proceedings;

• material contracts;

• absence of related party transactions;

• tax matters;

• title matters;

• governmental permits and authorizations; and

• permit and compliance with laws matters.

The representations and warranties of the Company and DLT survive after of the Exchange.

Conditions to the Exchange

The Company and DLT’s obligations to complete the Exchange Agreement are subject to the satisfaction or waiver of the following conditions:

• the Company's and DLT’s representations and warranties in the Exchange Agreement being true and correct;

• the Company's and DLT’s performance in all material respects of their respective obligations required to be performed at or prior to the effective time of the Exchange;

• the absence of litigation and material adverse effects on the Company and DLT;

• the receipt of all required consents to the Exchange and the transactions contemplated by the Exchange;

• the receipt of good standing certificates from the appropriate agencies of the Company and DLT; and

• DLT’s receipt of the Company’s shareholder list certified by an executive officer of the Company as being true, complete, and accurate by the Company’s transfer agent.

Termination of the Exchange Agreement

The Exchange Agreement could be terminated at any time prior to the closing of the Exchange by the board of directors of the Company or DLT upon failure to comply in any material respect with any of its covenants or agreements contained in the Exchange or if any of the representations or warranties of the breaching party contained herein shall be inaccurate in any material respect, and, in either case if such failure is reasonably subject to cure, it remains uncured for seven days after notice of such failure is provided to the non-breaching party.

The Exchange Agreement could also be terminated at any time prior to the closing of the Exchange by the board of directors of the Company or DLT if: (i) there were any actual or threatened action or proceeding before any court or any governmental body which shall seek to restrain, prohibit, or invalidate the transactions contemplated by this Agreement and which, in the judgment of such board of directors, made in good faith and based on the advice of its legal counsel, makes it inadvisable to proceed with the exchange contemplated by this Agreement; (ii) any of the transactions contemplated hereby are disapproved by any regulatory authority whose approval is required to consummate such transactions or in the judgment of such board of directors, made in good faith and based on the advice of counsel, there is substantial likelihood that any such approval will not be obtained or will be obtained only on a condition or conditions which would be unduly burdensome, making it inadvisable to proceed with the exchange; (iii) there shall have been any change after the date of the latest balance sheets of DLT and the Company, respectively, in the assets, properties, business, or financial condition of DLT and the Company, which could have a materially adverse affect on the value of the business of DLT and the Company respectively, except any changes disclosed in the DLT and Company Schedules, as the case may be, dated as of the date of execution of this Agreement. In the event of termination, no obligation, right, or liability shall arise hereunder, and each party would bear all of the expenses incurred by it in connection with the negotiation, drafting, and execution of the Agreement and the transactions herein contemplated; (iv) the closing did not occur by December 31, 2010; or (v) if the Company shall no t have provided responses satisfactory in DLT’s reasonable judgment to DLT’s request for due diligence materials.

Material United States Federal Income Tax Consequences of the Exchange to Our Shareholders

The parties have taken the actions necessary to provide that the Exchange is treated as a “tax free exchange” under Section 368 of the Internal Revenue Code of 1986, as amended.

Risks

The Board of Directors identified and considered a variety of risks and other countervailing factors related to entering into the Exchange Agreement and the transactions contemplated by the Exchange Agreement (which are not intended to be exhaustive and are not in relative order of importance), including:

• that, before the closing of the Exchange, there were no assurances that all conditions to the parties' obligations to complete the Exchange would be satisfied or waived, and, as a result, it was possible that the Exchange may not have been completed; and

• that the Company’s executive officers and directors, may have interests, directly or indirectly, in the Exchange that are different from, or in addition to, those of the Company’s other shareholders.

The foregoing discussion of the factors considered by the Board of Directors of the Company is not intended to be exhaustive, but does set forth the material factors considered by the Board.

Interests of Directors and Officers in the Merger

You should be aware that our sole Director who approved the Exchange Agreement and the related transactions, John David Palmer, was also our principal executive and accounting officer as well as our majority shareholder. Accordingly, Mr. Palmer may have had interests, either directly or indirectly, in the Exchange that may be different from, or in addition to, your interests as a shareholder and that may present actual or potential conflicts of interest.

Director and Officer Exculpation, Indemnification

Nevada Revised Statutes (“NRS”) Sections 78.7502 and 78.751 provide the Company with the power to indemnify any of our directors and officers. The director or officer must have conducted himself/herself in good faith and reasonably believe that his/her conduct was in, or not opposed to our best interests. In a criminal action, the director, officer, employee or agent must not have had reasonable cause to believe his/her conduct was unlawful.

Under NRS Section 78.751, advances for expenses may be made by agreement if the director or officer affirms in writing that he/she believes he/she has met the standards and will personally repay the expenses if it is determined such officer or director did not meet the standards.

Pursuant to the Company’s Articles of Incorporation and bylaws, we may indemnify an officer or director who is made a party to any proceeding, because of his position as such, to the fullest extent authorized by Nevada Revised Statutes, as the same exists or may hereafter be amended. In certain cases, we may advance expenses incurred in defending any such proceeding.

To the extent that indemnification for liabilities arising under the Securities Act may be permitted to directors, officers or persons controlling our company pursuant to the foregoing provisions, we have been informed that, in the opinion of the SEC, such indemnification is against public policy as expressed in the Securities Act and is therefore unenforceable. If a claim for indemnification against such liabilities (other than the payment by us of expenses incurred or paid by a director, officer or controlling person of our company in the successful defense of any action, suit or proceeding) is asserted by any of our directors, officers or controlling persons in connection with the securities being registered, we will, unless in the opinion of our counsel the matter has been settled by controlling precedent, submit to a court of appropriate jurisdiction the question whether such indemnification by us is against public policy as expressed in the Securities Act and will be governed by the final adjudication of that issue.

Anti-Takeover Effects of Provisions of Nevada State Law

We may be or in the future we may become subject to Nevada's control share law. A corporation is subject to Nevada's control share law if it has more than 200 shareholders, at least 100 of whom are shareholders of record and residents of Nevada, and if the corporation does business in Nevada or through an affiliated corporation.

The law focuses on the acquisition of a “controlling interest” which means the ownership of outstanding voting shares is sufficient, but for the control share law, to enable the acquiring person to exercise the following proportions of the voting power of the corporation in the election of directors: (1) one-fifth or more but less than one-third, (2) one-third or more but less than a majority, or (3) a majority or more. The ability to exercise such voting power may be direct or indirect, as well as individual or in association with others.

The effect of the control share law is that the acquiring person, and those acting in association with that person, obtain only such voting rights in the control shares as are conferred by a resolution of the shareholders of the corporation, approved at a special or annual meeting of shareholders. The control share law contemplates that voting rights will be considered only once by the other shareholders. Thus, there is no authority to take away voting rights from the control shares of an acquiring person once those rights have been approved. If the shareholders do not grant voting rights to the control shares acquired by an acquiring person, those shares do not become permanent non-voting shares. The acquiring person is free to sell its shares to others. If the buyers of those shares themselves do not acquire a con trolling interest, their shares do not become governed by the control share law.

If control shares are accorded full voting rights and the acquiring person has acquired control shares with a majority or more of the voting power, any shareholder of record, other than an acquiring person, who has not voted in favor of approval of voting rights, is entitled to demand fair value for such shareholder's shares.

Nevada's control share law may have the effect of discouraging corporate takeovers.

In addition to the control share law, Nevada has a business combination law, which prohibits certain business combinations between Nevada corporations and "interested shareholders" for three years after the "interested shareholder" first becomes an "interested shareholder" unless the corporation's board of directors approves the combination in advance. For purposes of Nevada law, an "interested shareholder" is any person who is (1) the beneficial owner, directly or indirectly, of ten percent or more of the voting power of the outstanding voting shares of the corporation, or (2) an affiliate or associate of the corporation and at any time within the three previous years was the beneficial owner, directly or indirectly, of ten percent or more of the voting power of the then outstanding shares of the corporation. The d efinition of the term "business combination" is sufficiently broad to cover virtually any kind of transaction that would allow a potential acquirer to use the corporation's assets to finance the acquisition or otherwise to benefit its own interests rather than the interests of the corporation and its other shareholders.

The effect of Nevada's business combination law is to potentially discourage parties interested in taking control of the Company from doing so if it cannot obtain the approval of our Board of Directors.

ACTIONS BY THE BOARD OF DIRECTORS

AND

CONSENTING SHAREHOLDERS

In accordance with Section 78.315 and 78.320 of the Nevada Revised Statutes, the following actions were taken based upon the unanimous recommendation and approval by the Company's Board of Directors and the written consent of the Majority Shareholder.

AMENDMENT TO THE CERTIFICATE OF AMENDMENT OF THE ARTICLES OF INCORPORATION

On October 18, 2010, our Board of Directors, believing it to be in the best interests of the Company and its shareholders approved, and recommended that the shareholders of the Company approve the Amendments. The Amendments are reflected in the Form of Amendment to the Certificate of Amendment of the Articles of Incorporation, which is attached hereto as Exhibit A, and incorporated herein by reference.

Authorization of Name Change

On October 18, 2010, our Board of Directors adopted a resolution declaring it advisable to amend our Articles of Incorporation to effect the Name Change. Our Board of Directors further directed that the Certificate of Amendment of the Articles of Incorporation be submitted for consideration by our shareholders. By written consent dated as of October 18, 2010, the Board of Directors and the Majority Shareholder approved and adopted resolutions to amend the Company’s Articles of Incorporation to reflect the Name Change.

Authorization of Increase in Number of Common Stock

On October 18, 2010, our Board of Directors adopted a resolution declaring it advisable to amend our Articles of Incorporation to effect the Authorized Share Increase. Our Board of Directors further directed that the Certificate of Amendment of the Articles of Incorporation be submitted for consideration by our shareholders. By written consent dated as of October 18, 2010, the Board of Directors and the Majority Shareholder approved and adopted resolutions to amend the Company’s Articles of Incorporation to reflect the Authorized Share Increase.

Authorization of Forward Stock Split

On October 18, 2010, our Board of Directors unanimously adopted a resolution declaring it advisable to amend our Certificate of Incorporation to effect a Forward Split. Our Board of Directors further directed that the Certificate of Amendment of the Certificate of Incorporation be submitted for consideration by our shareholders. By written consent dated as of October 18, 2010, of all the Board of Directors and the Majority Shareholder approved and adopted resolutions to amend the Company’s Certificate of Incorporation to approve the Forward Split.

Authorization of Class of Blank Check Preferred Stock

On October 18, 2010, our Board of Directors adopted a resolution declaring it advisable to amend our Articles of Incorporation to create a series of Blank Check Preferred Stock. Our Board of Directors further directed that the Certificate of Amendment of the Articles of Incorporation be submitted for consideration by our shareholders. By written consent dated as of October 18, 2010, the Board of Directors and the Majority Shareholder approved and adopted resolutions to amend the Company’s Articles of Incorporation to approve the creation of Blank Check Preferred Stock.

Effective Time of the Amendments

While Rule 14c-2 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), requires us to distribute the final Information Statement at least twenty (20) days prior to the date that the actions are to be taken, the Company erroneously filed the Amendment on October 19, 2010. A copy of the Certificate of Amendment of the Articles of Incorporation is attached to this Information Statement as Appendix A.

No Appraisal Rights for the Amendments

Under Nevada law, the Company’s shareholders are not entitled to appraisal rights with respect to the Amendments and the Company will not independently provide shareholders with any such right.

DESCRIPTION OF SECURITIES

Description of Common Stock

Number of Authorized and Outstanding Shares. The Company's Articles of Incorporation authorizes the issuance of 75,000,000 shares of Common Stock, $0.001 par value per share, of which 9,552,500 shares were outstanding on October 18, 2010 and 2,519,320 shares of Common Stock issued and outstanding following the Exchange and the retirement of the Majority Shareholder’s 9,300,000 shares of Common Stock. All of the outstanding shares of Common Stock are fully paid and non-assessable.

Voting Rights. Holders of shares of Common Stock are entitled to one vote for each share held of record on all matters to be voted on by the shareholders. Accordingly, the holders of in excess of 50% of the aggregate number of shares of Common Stock outstanding will be able to elect all of the directors of the Company and to approve or disapprove any other matter submitted to a vote of all shareholders. The holders of our Common Stock are entitled to receive ratably such dividends, if any, as may be declared by the Board of Directors out of funds legally available. We have not paid any dividends since our inception, and we presently anticipate that all earnings, if any, will be retained for d evelopment of our business. Any future disposition of dividends will be at the discretion of our Board of Directors and will depend upon, among other things, our future earnings, operating and financial condition, capital requirements, and other factors.

Other. Holders of Common Stock have no cumulative voting rights. Holders of Common Stock have no preemptive rights to purchase the Company's Common Stock. There are no conversion rights or redemption or sinking fund provisions with respect to the Common Stock.

Transfer Agent. Shares of Common Stock are registered at the transfer agent and are transferable at such office by the registered holder (or duly authorized attorney) upon surrender of the Common Stock certificate, properly endorsed. No transfer shall be registered unless the Company is satisfied that such transfer will not result in a violation of any applicable federal or state security laws. The Company’s transfer agent for its Common Stock is West Coast Stock Transfer located at 2010 Hancock Street, Ste A, San Diego, California 92110, (619) 664-4780.

SECURITIES OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The following table sets forth certain information, as of January 25, 2011 with respect to any person (including any "group", as that term is used in Section 13(d)(3) of the Securities Exchange Act of 1934, as amended (the "Exchange Act") who is known to the Company to be the beneficial owner of more than five percent of any class of the Company's voting securities, and as to those shares of the Company's equity securities beneficially owned by each its directors, the executive officers of the Company and all of its directors and executive officers of the Company and all of its directors and executive officers as a group. Unless otherwise specified in the table below, such information, other than information with respect to the directors and officers of the Company, is based on a review of statements filed, with the Securities and Exchange commission (the "Commission") pursuant to Sections 13 (d), 13 (f), and 13 (g) of the Exchange Act with respect to the Company's Common Stock.

The table also shows the number of shares beneficially owned as of January 25, 2011 by each of the individual directors and executive officers and by all directors and executive officers as a group.

Name of Beneficial Owner (1) | Common Stock Beneficially Owned | Percentage of Common Stock |

John David Palmer (2) | 0 | 0% |

| | | |

| DLT International, Ltd (2)(3) | 2,267,320 | 90% |

| | | | |

| Xiu Liang Zhang, Chairman, President (3)(4) | 2,267,320 | 90% |

| | | | |

| Jun Liu, Director, Chief Executive Officer (4) | 0 | 0% |

| | | | |

| Zheng Yin Li, Director, Chief Financial Officer (4) | 0 | 0% |

| | | | |

| All Directors and Executive Officers as a Group (3 persons) (3) | 2,267,320 | 90% |

| | (1) | The persons named in the above table have sole voting and investment power with respect to all shares of Common Stock shown as beneficially owned by them. |

| | | |

| | (2) | On the Record Date of October 18, 2010, Mr. Palmer, our former sole Director and Executive Officer held 9,300,000 shares of Common Stock |

| | | |

| | (3) | Pursuant to the Company’s Securities Exchange Agreement with DLT International Limited, KME Investments Group Limited was issued 2,267,320 shares of the Company’s Common Stock. Xiu Liang Zhang holds voting and dispositive power with respect to the shares held by KME Investments Group Limited. |

| | | |

| | (4) | Appointed on October 25, 2010. |

ANNUAL AND QUARTERLY REPORTS AND WHERE YOU CAN OBTAIN ADDITIONAL INFORMATION

The Company is required to file annual, quarterly and special reports, and other information with the Securities and Exchange Commission (“SEC”). We are attaching as exhibits to this Information Statement the following documents which have been filed by the Company with the Securities and Exchange Commission (SEC File Number 333-144228) and contain important information about DLT, the Company and their respective finances:

• Our Annual Report on Form 10-K/A for the fiscal year ended October 31, 2009 as filed with the Commission on January 5, 2011.

• Our Quarterly Reports on Form 10-Q/A filed for the quarters ending January 31, 2010, April 30, 2010 and July 31, 2010 as filed with the Commission on November 29, 2010.

Our Current Report on Form 8-K/A reporting the Exchange with DLT International, Ltd. as filed as filed with the Commission on January 7, 2011.

You may read and copy any document the Company filed at the SEC's public reference rooms at 100 F Street, NE, Washington, D.C. 20549. Please call the SEC at (202) 942-8088 for more information on the operation of the public reference rooms. Copies of the Company’s SEC filings are also available to the public from the SEC's web site at www.sec.gov.

APPENDIX INDEX

A Certificate of Amendment to Articles of Incorporation of Eco Energy Pumps, Inc.

B Securities Exchange Agreement among Eco Energy Pumps, Inc., DLT International Ltd. and the shareholders of DLT International Ltd.

C Annual Report on Form 10-K/A for the fiscal year ended October 31, 2009

D Quarterly Report on Form 10-Q/A filed for the quarters ending January 31, 2010,

E Quarterly Reports on Form 10-Q/A filed for the quarters ending April 30, 2010,

F Quarterly Reports on Form 10-Q/A filed for the quarters ending July 31, 2010,

G Current Report on Form 8-K/A

H Unaudited Pro Forma Consolidated Financial Statements

| | ECO ENERGY PUMPS, INC. |

| |

| | By: | /s/ Jun Liu | |

| | Name: Jun Liu Title: Chief Executive Officer |

| | |

APPENDIX A

CERTIFICATE OF AMENDMENT TO ARTICLES OF INCORPORATION OF

ECO ENERGY PUMPS, INC.

PURSUANT TO SECTIONS 78.380 AND 78.390 OF THE NEVADA

REVISED STATUTES

Eco Energy Pumps, Inc., a corporation organized and existing under the laws of the State of Nevada (the "Corporation"), hereby certifies as follows:

1. The name of the Corporation is Eco Energy Pumps, Inc.

2. The articles have been amended as follows:

ARTICLE I

The name of the corporation (hereinafter referred to as the “Corporation") is:

“DLT International, Ltd.”

ARTICLE II

The purpose of the Corporation shall be to engage in any lawful act or activity for which corporations may be organized and incorporated under the Nevada Revised Statutes (the "N.R.S.").

ARTICLE III

(a) Authorized Capital Stock.

(i) The total number of shares of stock that the Corporation shall have authority to issue is 310,000,000, consisting of (i) 300,000,000 shares of Common Stock, par value $0.001 per share ("Common Stock") and (ii) 10,000,000 shares of Preferred Stock, par value $0.001 per share ("Preferred Stock").

(b) Effective upon the filing of these Articles of Incorporation (the "Effective Time"), a fourteen and 29/100 (14.29) for one (1) stock split of the Common Stock will be effectuated. As of the Effective Time, every one (1) share of Common Stock issued and outstanding immediately prior to the Effective Time (the "Old Common Stock") will be automatically and without any action on the part of the holder thereof reclassified as and converted into fourteen and 29/100 shares of Common Stock (the "New Common Stock"), subject to the treatment of fractional share interests as described below. Each stock certificate that, immediately prior to the Effective Time, represented shares of Old Common Stock shall, from a nd after the Effective Time, automatically and without the necessity of presenting the same for exchange, represent that the number of whole shares of New Common Stock into which the shares of Old Common Stock represented by such certificate shall have been reclassified. All fractional shares of Common Stock shall be rounded to the next higher whole number of shares of Common Stock. If more than one Old Certificate shall be surrendered at one time for the account of the same stockholder, the number of full shares of New Common Stock for which New Certificates shall be issued shall be computed on the basis of the aggregate number of shares represented by the Old Certificates so surrendered. If any New Certificate is to be issued in a name other than that in which the Old Certificates surrendered for exchange are issued, the Old Certificates so surrendered shall be properly endorsed and otherwise in proper form for transfer, and the person or persons requesting the exchange shall affix any requisite stock transfer tax stamps to the Old Certificates surrendered, or provide funds for their purchase, or establish to the satisfaction of the transfer agent that the taxes are not payable. From and after the Effective Time the amount of capital represented by the shares of the New Common Stock into which and for which the shares of the Old Common Stock are reclassified under the terms hereof shall be the same as the amount of capital represented by the shares of Old Common Stock so reclassified, until thereafter reduced or increased in accordance with applicable law.”

(c) Preferred Stock. Preferred Stock may be issued from time to time in one or more series. The Board of Directors is hereby authorized to provide for the issuance of shares of Preferred Stock in series and, by filing a certificate pursuant to the N.R.S. (hereinafter, along with any similar designation relating to any other class of stock that may hereafter be authorized, referred to as a "Preferred Stock Designation"), to establish from time to time one or more classes of Preferred Stock or one or more series of Preferred Stock, by fixing and determining the number of shares to be included in each such class or series, and to fix the designation, powers, preferences and rights of the shares of each such series and the qualifications, limita tions and restrictions thereof. The authority of the Board of Directors with respect to each series, is hereby expressly vested in it and shall include, without limiting the generality of the foregoing, determination of the following:

(i) the designation of such class or series, which may be by distinguishing number, letter or title;

(ii) the number of shares of the series, which number the Board of Directors may thereafter (except where otherwise provided in the Preferred Stock Designation) increase or decrease (but not below the number of shares thereof then outstanding);

(iii) the amounts payable on, and the preferences, if any, of shares of the series in respect of dividends payable and any other class or classes of capital stock of the Corporation, and whether such dividends, if any, shall be cumulative or noncumulative;

(iv) dates on which dividends, if any, shall be payable;

(v) whether the shares of such class or series shall be subject to redemption by the Corporation, and if made subject to redemption, the redemption rights and price or prices, if any, for shares of the class or series;

(vi) The terms and amount of any sinking fund provided for the purchase or redemption of shares of the series;

(vii) the amounts payable on and the preferences, if any, of shares of the series in the event of any voluntary or involuntary liquidation, dissolution or winding up of the affairs of the Corporation;

(viii) whether the shares of the series shall be convertible into or exchangeable for shares of any other class or series, or any other security, of the Corporation or any other corporation, and, if so, the specification of such other class or series of such other security, the conversion or exchange price or prices or rate or rates, any adjustments thereof, the date or dates at which such shares shall be convertible or exchangeable and all other terms and conditions upon which such conversion or exchange may be made;

(ix) Restrictions on the issuance of shares of the same class or series or of any other class or series;

(x) whether the holders of the shares of such class or series shall be entitle to vote, as a class, series or otherwise, any and all matters of the corporation to which holders of Capital Stock are entitled to vote;

(xi) the restrictions and conditions, if any, upon the issuance or reissuance of any Additional Preferred Stock ranking or a party with or prior to such shares as to dividends or upon distribution; and

(xii) any other preferences, limitations or relative rights of shares of such class or series consistent with this Article IIII, the N.R.S. and applicable law.

(c) Common Stock. The Common Stock shall be subject to the express terms of the Preferred Stock and any series thereof. Each share of Common Stock shall be equal to each other share of Common Stock. Except as may be provided in these Articles of Incorporation or in a Preferred Stock Designation, the holders of shares of Common Stock shall be entitled to one vote for each such share upon all questions presented to the stockholders.

ARTICLE IV

The Board of Directors is hereby authorized to create and issue, whether or not in connection with the issuance and sale of any of stock or other securities or property of the Corporation, rights entitling the holders thereof to purchase from the Corporation shares of stock or other securities of the Corporation or any other corporation. The times at which and the terms upon which such rights are to be issued will be determined by the Board of Directors and set forth in the contracts or instruments that evidence such rights. The authority of the Board of Directors with respect to such rights shall include, but not be limited to, determination of the following: