SCHEDULE 14C INFORMATION

INFORMATION STATEMENT PURSUANT TO SECTION 14(C)

OF THE SECURITIES EXCHANGE ACT OF 1934

Check the appropriate box:

| | |

o Preliminary Information Statement | o | Confidential, for use of the Commission | |

| | | Only (as permitted by Rule 14c-d(d)(2)) | |

| | | | |

x Definitive Information Statement | | | |

| | | | |

Evcarco, Inc.

(Name of Registrant as Specified in Its Charter)

Payment of Filing Fee (Check the appropriate box)

x No Fee Required

o Fee computed on table below per Exchange Act Rules 14c-5(g) and 0-11.

(1) Title of each class of securities to which transaction applies:

(2) Aggregate number of securities to which transaction applies:

(3) Per Unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (Set forth the amount on which the filing fee is calculated and state how it was determined):

(4) Proposed maximum aggregate value of transaction:

(5) Total fee paid:

o Fee paid previously with preliminary materials.

o Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing.

(1) Amount Previously Paid:

(2) Form, Schedule or Registration Statement No.:

(3) Filing Party:

(4) Date Filed:

Evcarco, Inc.

7703 Sand Street

Fort Worth, TX 76118

WE ARE NOT ASKING YOU FOR A PROXY AND YOU ARE REQUESTED NOT TO SEND US A PROXY. THE ACTIONS DESCRIBED IN THIS INFORMATION STATEMENT HAVE ALREADY BEEN APPROVED BY THE WRITTEN CONSENT OF SHAREHOLDERS WITH A MAJORITY OF THE VOTING RIGHTS. A VOTE OF THE REMAINING SHAREHOLDERS IS NOT NECESSARY.

NOTICE OF WRITTEN CONSENT OF STOCKHOLDERS IN LIEU OF MEETING

This Information Statement is being furnished to the shareholders of record of Evcarco, Inc. (hereinafter referred to as the “Corporation”) to advise them that the Board of Directors of the Corporation, having more than fifty percent (50%) of the total voting shares of the Corporation, have given their written consent (the “Written Consents”) on February 18, 2013, to change the Corporation’s name to Third Stone Ventures, Inc., which will also result in a change to the stock symbol of the company. The Board of Directors is seeking this approval by the solicitation of written consents. We are not holding a meeting of stockholders in connection with this consent solicitation.

This information statement is being provided to you for information purposes only. Your vote is not required to approve the actions set forth in this Information Statement. This Information Statement does not relate to an annual or special meeting of stockholders.

March 1, 2013

| | By order of the Board of Directors | |

| | | |

| | /s/ Gary Easterwood | |

| | Gary Easterwood | |

| | Director | |

| | | |

| | | |

| | /s/ Walter Speck | |

| | Walter Speck | |

| | Director | |

Evcarco, Inc.

7703 Sand Street

Fort Worth, TX 76118

INFORMATION STATEMENT

ITEM 1. STATEMENT THAT PROXIES ARE NOT SOLICITED

WE ARE NOT ASKING YOU FOR A PROXY AND YOU ARE REQUESTED NOT TO SEND US A PROXY

ITEM 2. INFORMATION REQUIRED BY ITEMS OF SCHEDULE 14C

1. Date, Time and Place Information

This Information Statement, expected to be mailed to stockholders of Evcarco, Inc. (hereinafter referred to as the “Corporation” or “us” or “we”) of record as of February 18, 2013 on or about March 1, 2013, is furnished in connection with actions which were approved by more than fifty (50%) percent of the total voting shares of the Corporation on February 18, 2013.

2. Dissenters Rights of Appraisal

There are no dissenters’ rights of appraisal. Neither the Corporation’s by-laws nor the Nevada Revised Statutes provide for any dissenters’ rights of appraisal in this transaction.

3. Voting Securities and Principals Thereof

| | | |

| Class | Number Outstanding | Total Number of Votes |

| Common Class A Stock | 377,158,021 | 241,576,391 |

| Preferred Class B Stock | 8,000,000 | 8,000,000,000 (1) |

| Total | | 8,241,576,391 (1) |

| | | |

| Gary Easterwood Votes from Common Class A Stock | | 87,923,280 |

| Gary Easterwood Votes from Preferred Class B Stock | | 500,000,000 (1) |

| Gary Easterwood’s Total Votes | | 587,923,280 (1) |

| | | |

| Walter Speck Votes from Common Class A Stock | | 80,925,280 |

| Walter Speck Votes from Preferred Class B Stock | | 7,500,000,000 (1) |

| Walter Speck’s Total Votes | | 7,580,925,280 (1) |

| | | |

| Mack Sanders Votes from Common Class A Stock | | 72,727,831 |

| Mack Sanders’ Total Votes | | 72,727,831 |

(1) Each share of Preferred Class B Stock carries voting rights of 1,000 Common Shares. The Preferred Stock is not required to be converted in order to vote, and results in a total vote of 8,241,576,391, or 98.4% of the Common Shares based on the 8,377,158,021 fully-diluted number of shares of Common Stock outstanding as of February 18, 2013 upon the vote of the above listed Preferred Shares owned by Mr. Easterwood and Mr. Speck.

Record Date for Vote: February 18, 2013.

The following table sets forth certain information with respect to the ownership of the Corporation’s Common Stock by (i) each officer and director, (ii) each person (including any “group” as such term is defined in Section 13(d)(3) of the Exchange Act) known by the Corporation to be the beneficial owner of more than five (5%) percent of any class of the Corporation’s Common Stock and (iii) directors and officers as a group. The information is determined in accordance with Rule 13d-3 promulgated under the Exchange Act. Except as indicated below, the shareholders possess sole voting and investment power with respect to their shares. As of February 18, 2013, we had 377,158,021 shares of Common Stock issued and outstanding.

| Title of Class | | Name & Address of of Beneficial Owner | | Amount & Nature of Beneficial Owner | | | Percent of Class |

| Common Stock | | Gary Easterwood | | | 87,923,280 | | | | 23.3 | % |

| | | 7703 Sand Street Fort Worth, TX 76118 | | | | | | | | |

| | | | | | | | | | | |

| Common Stock | | Walter Speck | | | 80,925,280 | | | | 21.5 | % |

| | | 7703 Sand Street Fort Worth, TX 76118 | | | | | | | | |

| | | | | | | | | | | |

| Common Stock | | Mack Sanders | | | 72,727,831 | | | | 19.3 | % |

| | | 7703 Sand Street Fort Worth, TX 76118 | | | | | | | | |

| | | | | | | | | | | |

Common Stock | | All Directors and Officers | | | | | | | | |

| | | as a Group (consisting of 3 | | | 241,576,391 | | | | 64.1 | % (2) |

| | | persons) | | | | | | | | |

| | | | | | | | | | | |

| Preferred Stock | | Gary Easterwood | | | 500,000 | | | | 6.25 | % |

| | | 7703 Sand Street Fort Worth, TX 76118 | | | | | | | | |

| | | | | | | | | | | |

| Preferred Stock | | Walter Speck | | | 7,500,000 | | | | 93.75 | % |

| | | 7703 Sand Street Fort Worth, TX 76118 | | | | | | | | |

| | | | | | | | | | | |

| | | All Directors and Officers | | | | | | | | |

| Preferred Stock | | as a Group (consisting of 3 | | | 8,000,000 | | | | 100 | % |

| | | persons) | | | | | | | | |

(1) Each share of Preferred Class B Stock carries voting rights of 1,000 Common Shares. The Preferred Stock is not required to be converted in order to vote, and results in a total vote of 8,241,576,391, or 98.4% of the Common Shares based on the 8,377,158,021 fully-diluted number of shares of Common Stock outstanding as of February 18, 2013 upon the vote of the above listed Preferred Shares owned by Mr. Easterwood and Mr. Speck.

(2) Please note that the beneficial ownership of the group is smaller than the sum of the beneficial ownerships of the individual directors. Individual beneficial ownership is calculated under the assumption that only that specific individual exercises his or her warrants and other derivative securities, while group beneficial ownership is calculated under the assumption that all members of the group exercise their warrants and other derivative securities, thus reducing the percentage ownership of each individual member of the group relative to the case where only that individual exercises them.

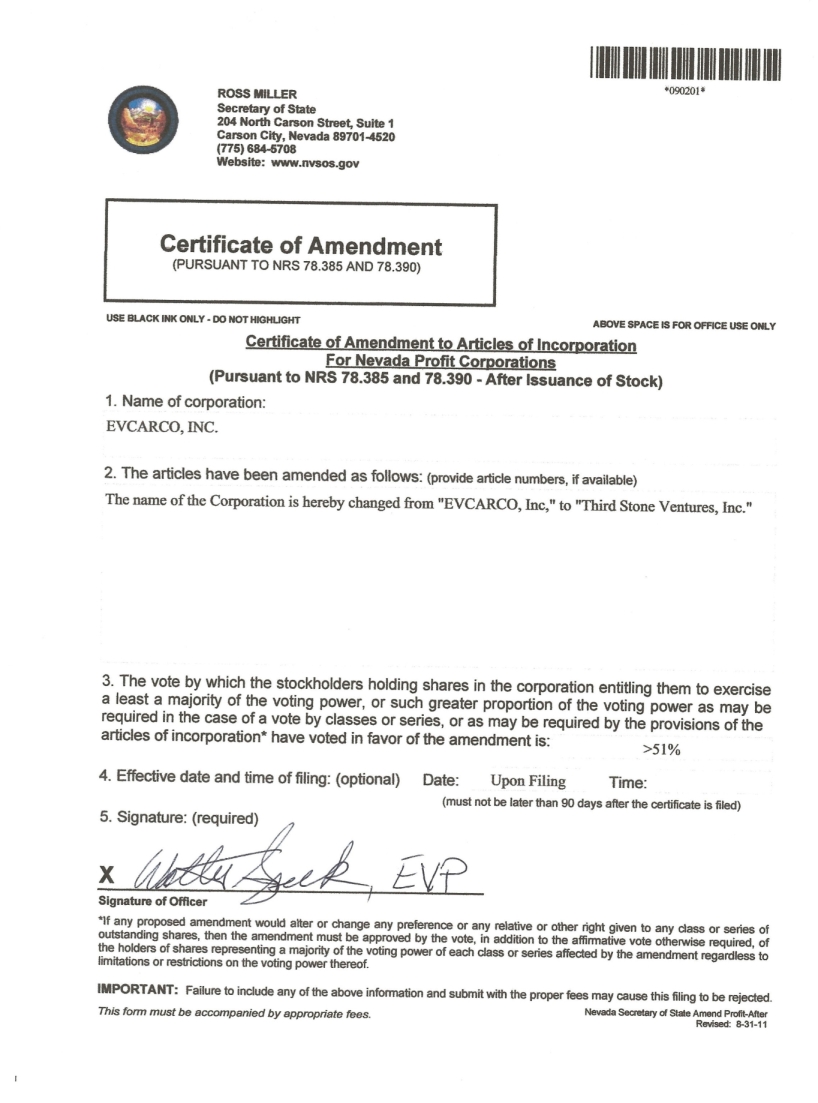

4. Authorization of Corporate Name Change and Stock Symbol Change

Proposal: Amend Evcarco, Inc.’s Articles of Incorporation in order to change the name of the company to Third Stone Ventures, Inc., which will also result in a corporate stock symbol change.

Principal Reasons for Name Change and Symbol Change:

The Corporation’s management believes that it is in the best interest of the Corporation for the name of the Corporation to better reflect the current business plan and operations of the Corporation, and the Corporation’s management believes that the name change will be favorable to the Corporation’s interests. The Corporation is currently acting, and intends to continue to act, as a holding company. The Corporation’s subsidiaries and acquisitions, such as Evcarco, Third Stone Corporation and all future acquisitions, will be more accurately described under one name that is aligned with our current and future business plan.

The voting and other rights that accompany the Company’s securities will not be affected by the change in the Company’s corporate name. The Company’s stock symbol, which is currently “EVCA” and its CUSIP number, will both change as a result of the name change. Stockholders may, but need not, exchange their certificates to reflect the change in corporate name. Your existing certificate will continue to represent shares of the Company’s common stock as if the name had not changed. The Company’s transfer agent will issue stock certificates with the Company’s new name as stock certificates are sent in upon transfers of shares by existing stockholders.

5. Voting Procedures

As of February 18, 2013 there were 377,158,021 shares of Common Class A Stock and 8,000,000 shares of Preferred Class B Stock issued and outstanding, all of which are eligible to vote on any matter which may be voted upon by the stockholders of the Corporation. Section 78.320 of the Nevada Revised Statutes states that any action required to be taken at any annual or special meeting of stockholders of the Corporation, may be taken without a meeting, by the written consent of at least a majority of the voting power, or such different number as would be required to take such action at a meeting. Pursuant to the Corporation’s By-laws, the written consent of a majority of the outstanding and voting shares of the Corporation would be required to authorize, or take, any action at a meeting at which all shares entitled to vote thereon were present and voted, and therefore a majority of the voting power shall be required to approve the written consent. This Information Statement will be mailed to all stockholders of record as of February 18, 2013, and shall be mailed on or about March 1, 2013.

6. Delivery of Documents to Security Holders Sharing an Address.

Only one information statement is being delivered to multiple stockholders sharing an address, unless we have received contrary instructions from one or more of such stockholders. We will undertake to deliver promptly upon written or oral request a separate copy of the information statement to a stockholder at a shared address to which a single copy of the information statement was delivered. You may make a written or oral request by sending a written notification to our principal executive offices stating your name, your shared address, and the address to which we should direct the additional copy of the information statement or by calling our principal executive offices. If multiple stockholders sharing an address have received one copy of this information statement and would prefer us to mail each stockholder a separate copy of future mailings, you may send notification to or call our principal executive offices. Additionally, if current stockholders with a shared address received multiple copies of this information statement and would prefer us to mail one copy of future mailings to stockholders at the shared address, notification of such request may also be made by mail or telephone call to our principal executive offices.

ITEM 3. INTEREST OF CERTAIN PERSONS IN OR OPPOSITION TO MATTERS TO BE ACTED UPON

Not Applicable.

THIS INFORMATION STATEMENT IS PROVIDED TO YOU FOR INFORMATION PURPOSES ONLY. NO ACTION ON YOUR PART IS SOUGHT OR REQUIRED.

March 1, 2013

| | By order of the Board of Directors | |

| | | |

| | /s/ Gary Easterwood | |

| | Gary Easterwood | |

| | President, Chief Executive Officer and Director | |

| | | |

| | | |

| | /s/ Walter Speck | |

| | Walter Speck | |

| | Executive Vice President and Director | |

| | | |

| | | |

| | /s/ Mack Sanders | |

| | Mack Sanders | |

| | Chief Operating Officer | |

SCHEDULE 14C INFORMATION STATEMENT

Pursuant to Regulation 14C of the Securities Exchange Act of 1934 as amended

EVCARCO, INC.

7703 Sand Street

Fort Worth, TX 76118

WE ARE NOT ASKING YOU FOR A PROXY AND

YOU ARE REQUESTED NOT TO SEND US A PROXY

This Information Statement is furnished by the Board of Directors of Evcarco, Inc., a Nevada corporation, to the holders of record at the close of business on the record date, February 18, 2013, of our corporation's outstanding common stock, $0.001 par value per share, pursuant to Rule 14c−2 promulgated under the Securities Exchange Act of 1934, as amended. This Information Statement is being furnished to such stockholders for the purpose of informing the stockholders in regards to:

| | a) | an amendment to our Articles of Incorporation to change the Corporation’s name to Third Stone Ventures, which will also result in a corporate stock symbol change. |

Our Board of Directors approved the Amendments for the name change and symbol change in order to present a corporate name and symbol that more accurately reflect the current and future business plan and operations of the Corporation. The voting and other rights that accompany the Company’s securities will not be affected by the change in the Company’s corporate name. The Company’s stock symbol, which is currently “EVCA” and its CUSIP number, will both change as a result of the name change. Stockholders may, but need not, exchange their certificates to reflect the change in corporate name. Your existing certificate will continue to represent shares of the Company’s common stock as if the name had not changed. The Company’s transfer agent will issue stock certificates with the Company’s new name as stock certificates are sent in upon transfers of shares by existing stockholders.

Our Board of Directors unanimously approved the Amendments to our Articles of Incorporation on February 18, 2013.

Subsequent to our Board of Directors' approval of the Amendments, the holders of the majority of the outstanding shares of our corporation gave us their written consent to the Amendment to our Articles of Incorporation on February 18, 2013. Therefore, following the expiration of the twenty day (20) period mandated by Rule 14c and the provisions of Chapter 78 of the Nevada Revised Statutes, our corporation will file Articles of Amendment to amend our Articles of Incorporation to give effect to the Amendments, and will also file the corporate name change and symbol change application with FINRA. We will not file the Articles of Amendment to our Articles of Incorporation until at least twenty (20) days after the filing and mailing of this Information Statement, which are being mailed to our shareholders on March 1, 2013.

The Articles of Amendment will become effective when they are filed with the Nevada Secretary of State. We anticipate that such filing will occur on March 20, 2013.

The entire cost of furnishing this Information Statement will be borne by our corporation. We will request brokerage houses, nominees, custodians, fiduciaries and other like parties to forward this Information Statement to the beneficial owners of our common stock held of record by them.

Our Board of Directors has fixed the close of business on February 18, 2013, as the record date for the determination of shareholders who are entitled to receive this Information Statement. There were 377,158,021 shares of our common stock issued and outstanding on February 18, 2013. This Information Statement will be mailed on or about March 1, 2013 to all shareholders of record as of the record date.

PLEASE NOTE THAT THIS IS NOT A REQUEST FOR YOUR VOTE OR A PROXY STATEMENT, BUT RATHER AN INFORMATION STATEMENT DESIGNED TO INFORM YOU OF THE AMENDMENTS TO OUR ARTICLES OF INCORPORATION.

WE ARE NOT ASKING YOU FOR A PROXY AND YOU ARE REQUESTED NOT TO SEND US A PROXY.

PLEASE NOTE THAT THIS IS NOT AN OFFER TO PURCHASE YOUR SHARES.

INTEREST OF CERTAIN PERSONS IN OR OPPOSITION TO MATTERS TO BE ACTED UPON

Except as disclosed elsewhere in this Information Statement, since December 31, 2012, being our last completed financial year, none of the following persons has any substantial interest, direct or indirect, by security holdings or otherwise in any matter to be acted upon:

1 any director or officer of our corporation;

2 any proposed nominee for election as a director of our corporation; and

3 any associate or affiliate of any of the foregoing persons.

The shareholdings of our officers are listed below in the section entitled "Principal Shareholders and Security Ownership of Management". To our knowledge, no director has advised that he intends to oppose the Amendments to our authorized capital or to the Sale, as more particularly described herein.

PRINCIPAL SHAREHOLDERS AND SECURITY OWNERSHIP OF MANAGEMENT

As of the record date, February 18, 2013, we had a total of 377,158,021 shares of common stock ($0.001 par value per share) issued and outstanding.

The following table sets forth, as of February 18, 2013, certain information with respect to the beneficial ownership of our common stock by each stockholder known by us to be the beneficial owner of more than 5% of our common stock and by each of our current directors and executive officers. Each person has sole voting and investment power with respect to the shares of common stock, except as otherwise indicated. Beneficial ownership consists of a direct interest in the shares of common stock, except as otherwise indicated.

| Title of Class | | Name & Address of of Beneficial Owner | | Amount & Nature of Beneficial Owner | | | Percent of Class | |

| Common Stock | | Gary Easterwood | | | 87,923,280 | | | | 23.3 | % |

| | | 7703 Sand Street Fort Worth, TX 76118 | | | | | | | | |

| | | | | | | | | | | |

| Common Stock | | Walter Speck | | | 80,925,280 | | | | 21.5 | % |

| | | 7703 Sand Street Fort Worth, TX 76118 | | | | | | | | |

| | | | | | | | | | | |

| Common Stock | | Mack Sanders | | | 72,727,831 | | | | 19.3 | % |

| | | 7703 Sand Street Fort Worth, TX 76118 | | | | | | | | |

| | | | | | | | | | | |

Common Stock | | All Directors and Officers | | | | | | | | |

| | | as a Group (consisting of 3 | | | 241,576,391 | | | | 64.1 | % |

| | | persons) | | | | | | | | |

| | | | | | | | | | | |

| Preferred Stock | | Gary Easterwood | | | 500,000 | | | | 6.25 | % |

| | | 7703 Sand Street Fort Worth, TX 76118 | | | | | | | | |

| | | | | | | | | | | |

| Preferred Stock | | Walter Speck | | | 7,500,000 | | | | 93.75 | % |

| | | 7703 Sand Street Fort Worth, TX 76118 | | | | | | | | |

| | | | | | | | | | | |

| | | All Directors and Officers | | | | | | | | |

| Preferred Stock | | as a Group (consisting of 3 | | | 8,000,000 | | | | 100 | % |

| | | persons) | | | | | | | | |

(1) Each share of Preferred Class B Stock carries voting rights of 1,000 Common Shares. The Preferred Stock is not required to be converted in order to vote, and results in a total vote of 8,241,576,391, or 98.4% of the Common Shares based on the 8,377,158,021 fully-diluted number of shares of Common Stock outstanding as of February 18, 2013 upon the vote of the above listed Preferred Shares owned by Mr. Easterwood and Mr. Speck.

AMENDMENT TO OUR CORPORATION'S ARTICLES

Our Amended Articles of Incorporation (the "Articles") currently lists the Corporation’s name as “Evcarco, Inc.”. On February 18, 2013, our Board of Directors approved the Amendment to our corporation's Articles as it relates to a name change, which will also result in an application to FINRA for a corporate name and stock symbol change, in order to obtain a corporate name that is more accurate with regard to the current and future business plan and operations of the Corporation. We do not currently have any plans, proposals, agreements or understandings, written or otherwise, for any transaction that would require the issuance of additional shares of common stock. The adoption of the amendment to our Articles of Incorporation will not of itself cause any changes in our capital accounts. The amendment to our corporation's Articles to change its corporate name will not have any immediate effect on the rights of existing shareholders.

We do not have any provisions in our Articles, by laws, or employment or credit agreements to which we are party that have anti−takeover consequences. We do not currently have any plans to adopt anti−takeover provisions or enter into any arrangements or understandings that would have anti−takeover consequences. In certain circumstances, our management may issue additional shares to resist a third party takeover transaction, even if done at an above market premium and favored by a majority of independent shareholders.

Shareholder approval for the Amendment to our Articles and our subsequent FINRA application for a corporate name and stock symbol change was obtained by written consent of shareholders owning 241,576,391 shares of our common stock, which represented 64.1% of our outstanding common shares on February 18, 2013, and one hundred percent (100%) of our Preferred Stock, with each share of preferred stock carrying voting rights of 1,000 common shares, for a total vote of 8,241,576,391 common shares, or 98.4% of the 8,377,158,021 fully-diluted shares of common stock outstanding as of February 18, 2013. The changes described herein will not become effective until not less than twenty (20) days after this Information Statement is first mailed to shareholders of our common stock and until the appropriate filings have been made with the Nevada Secretary of State.

DISSENTERS RIGHTS

Under Nevada law, shareholders of our common stock are not entitled to dissenter's rights of appraisal with respect to our proposed Amendments to our Articles of Incorporation.

FINANCIAL AND OTHER INFORMATION

For more detailed information on our Corporation, including financial statements, you may refer to our Form 10−K and other periodic filings made with the SEC from time to time. Additional copies are available on the SEC's EDGAR database at www.sec.gov or by calling our corporate office at 817-595-0710.

Signature

Pursuant to the requirements of the Securities Exchange Act of 1934, Evcarco, Inc. has duly caused this report to be signed by the undersigned hereunto authorized.

March 1, 2013

EVCARCO, INC.

Gary Easterwood

Director

/s/ Walter Speck

Walter Speck

Director